UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-05617

SCM Trust

(Exact name of registrant as specified in charter)

1875 Lawrence Street, Suite 300

Denver, CO 80202

(Address of principal executive offices) (Zip code)

Steve Rogers

1875 Lawrence Street, Suite 300

Denver, CO 80202

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 955-9988.

Date of fiscal year end: December 31

Date of reporting period: June 30, 2021

ITEM 1. REPORTS TO STOCKHOLDERS

SEMI-ANNUAL REPORT

June 30, 2021

Shelton BDC Income Fund

Shelton Emerging Markets Fund

Shelton International Select Equity Fund

Shelton Tactical Credit Fund

This report is intended only for the information of shareholders or those who have received the offering prospectus covering shares of beneficial interest of The SCM Trust which contains information about the management fee and other costs. Investments in shares of The SCM Trust are neither insured nor guaranteed by the U.S. Government.

Table of Contents | June 30, 2021 |

| | |

About Your Fund’s Expenses | 2 |

Top Holdings and Sector Breakdown | 3 |

Portfolio of Investments | 5 |

Statements of Assets and Liabilities | 9 |

Statements of Operations | 10 |

Statements of Changes in Net Assets | 11 |

Statement of Cash Flows | 14 |

Financial Highlights | 15 |

Notes to Financial Statements | 23 |

Additional Information | 30 |

Board of Trustees and Executive Officers | 31 |

Board Approval of the Investment Advisory Agreement | 32 |

1

About Your Fund’s Expenses (Unaudited) | June 30, 2021 |

As a shareholder of the Funds, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, reinvested dividends, or other distributions, redemption fees, and exchange fees; and (2) ongoing costs, including management fees, distribution fees and other Fund expenses. Operating expenses, which are deducted from the Funds’ gross income, directly reduce the investment return of the Funds. The Funds’ expenses are expressed as a percentage of its average net assets. This figure is known as the expense ratio. This example is intended to help you understand your ongoing cost (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds. The examples are based on an investment of $1,000 invested at the beginning of the period and held for the entire period from January 1, 2021 to June 30, 2021.

Actual Expenses

The first line of the tables below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses you have paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table provides information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Funds’ actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. The Funds do not charge any sales charges. Please note that the expenses shown in the tables are meant to highlight your ongoing costs only and do not reflect any transactional cost, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second line of the tables are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher. The calculations assume no shares were bought or sold during the period.

| | Beginning

Account Value

January 1, 2021 | Ending

Account Value

June 30,

2021 | Expenses Paid

During Period* | Net Annual

Expense Ratio |

Shelton BDC Income Fund | | | | |

Institutional Shares | | | | |

Based on Actual Fund Return | $ 1,000 | $ 1,205 | $ 6.83 | 1.25% |

Based on Hypothetical 5% Return before expenses | $ 1,000 | $ 1,019 | $ 6.26 | 1.25% |

Investor Shares | | | | |

Based on Actual Fund Return | $ 1,000 | $ 1,204 | $ 8.20 | 1.50% |

Based on Hypothetical 5% Return before expenses | $ 1,000 | $ 1,018 | $ 7.51 | 1.50% |

| | | | | |

Shelton Emerging Markets Fund | | | | |

Institutional Shares | | | | |

Based on Actual Fund Return | $ 1,000 | $ 1,025 | $ 7.73 | 1.54% |

Based on Hypothetical 5% Return before expenses | $ 1,000 | $ 1,017 | $ 7.70 | 1.54% |

Investor Shares | | | | |

Based on Actual Fund Return | $ 1,000 | $ 1,024 | $ 9.03 | 1.80% |

Based on Hypothetical 5% Return before expenses | $ 1,000 | $ 1,016 | $ 9.00 | 1.80% |

| | | | | |

Shelton International Select Equity Fund | | | | |

Institutional Shares | | | | |

Based on Actual Fund Return | $ 1,000 | $ 1,058 | $ 5.10 | 1.00% |

Based on Hypothetical 5% Return before expenses | $ 1,000 | $ 1,020 | $ 5.01 | 1.00% |

Investor Shares | | | | |

Based on Actual Fund Return | $ 1,000 | $ 1,057 | $ 6.32 | 1.24% |

Based on Hypothetical 5% Return before expenses | $ 1,000 | $ 1,019 | $ 6.21 | 1.24% |

| | | | | |

Shelton Tactical Credit Fund | | | | |

Institutional Shares | | | | |

Based on Actual Fund Return | $ 1,000 | $ 1,072 | $ 11.41 | 2.22% |

Based on Hypothetical 5% Return before expenses | $ 1,000 | $ 1,014 | $ 11.09 | 2.22% |

Investor Shares | | | | |

Based on Actual Fund Return | $ 1,000 | $ 1,071 | $ 12.63 | 2.46% |

Based on Hypothetical 5% Return before expenses | $ 1,000 | $ 1,013 | $ 12.28 | 2.46% |

* | Expenses are equal to the Fund’s annualized expense ratio listed in the “Net Annual Expense Ratio” column, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

2

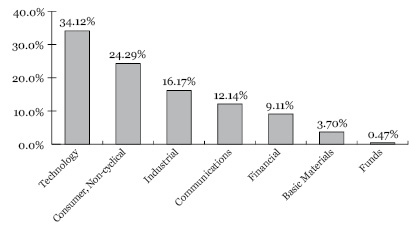

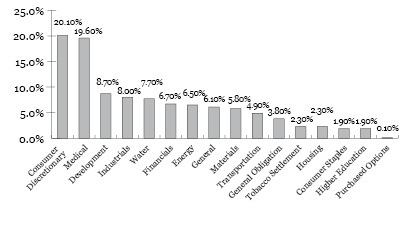

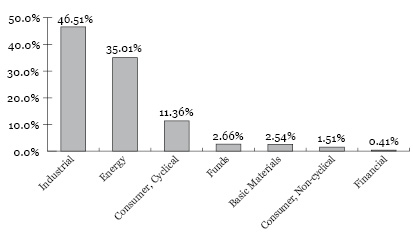

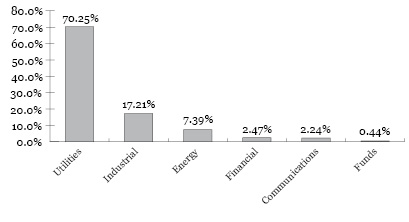

Top Holdings and Sector Breakdown (Unaudited) | June 30, 2021 |

Shelton BDC Income Fund

Security | | Market Value

(in U.S.

Dollars) | | | Percentage

of Total

Investment | |

|

1 | Ares Capital Corp | | | $549,715 | | | | 13.4 | % |

2 | Owl Rock Capital Corp | | | 494,812 | | | | 12.1 | % |

3 | Hercules Capital Inc | | | 379,585 | | | | 9.3 | % |

4 | FS KKR Capital Corp | | | 359,571 | | | | 8.8 | % |

5 | Sixth Street Specialty Lending Inc | | | 308,441 | | | | 7.5 | % |

6 | Main Street Capital Corp | | | 279,412 | | | | 6.8 | % |

7 | Oaktree Specialty Lending Corp | | | 262,703 | | | | 6.4 | % |

8 | Barings BDC Inc | | | 228,096 | | | | 5.6 | % |

9 | Golub Capital BDC Inc | | | 212,025 | | | | 5.2 | % |

10 | SuRo Capital Corp | | | 188,860 | | | | 4.6 | % |

Shelton Emerging Markets Fund

Security | | Market Value

(in U.S.

Dollars) | | | Percentage

of Total

Investment | |

|

1 | Samsung Electronics Co Ltd | | | $2,048,223 | | | | 7.2 | % |

2 | Taiwan Semiconductor Manufacturing Co Ltd | | | 1,966,422 | | | | 6.9 | % |

3 | eMemory Technology Inc | | | 1,280,180 | | | | 4.5 | % |

4 | Accton Technology Corp | | | 1,188,895 | | | | 4.2 | % |

5 | Infosys Ltd | | | 1,185,538 | | | | 4.2 | % |

6 | HDFC Bank Ltd | | | 1,169,554 | | | | 4.1 | % |

7 | Kimberly-Clark de Mexico | | | 1,168,846 | | | | 4.1 | % |

8 | China Meidong Auto Holdings Ltd | | | 1,154,944 | | | | 4.1 | % |

9 | MediaTek Inc | | | 1,151,840 | | | | 4.1 | % |

10 | Haier Smart Home Co Ltd | | | 1,103,472 | | | | 3.9 | % |

| | | | | | | | | | | | | | |

3

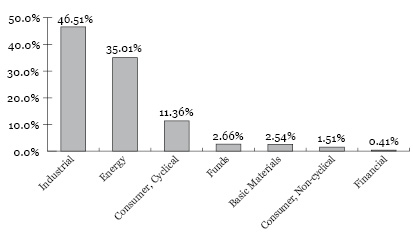

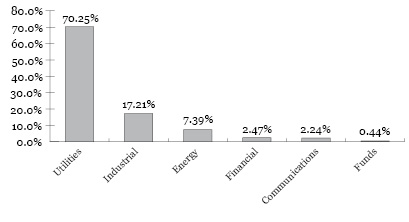

Top Holdings and Sector Breakdown (Unaudited) (Continued) | June 30, 2021 |

Shelton International Select Equity Fund

Security | | Market Value

(in U.S.

Dollars) | | | Percentage

of Total

Investment | |

|

1 | Element Fleet Management Corp | | $ | 8,755,744 | | | | 5.5% | |

2 | CRH PLC | | | 8,421,163 | | | | 5.3% | |

3 | ASML Holding NV | | | 7,286,289 | | | | 4.6% | |

4 | DBS Group Holdings Ltd | | | 6,884,287 | | | | 4.3% | |

5 | Taiwan Semiconductor Manufacturing Co Ltd | | | 6,091,151 | | | | 3.8% | |

6 | Nestle SA | | | 6,034,672 | | | | 3.8% | |

7 | Kimberly-Clark de Mexico SAB de CV | | | 5,862,689 | | | | 3.7% | |

8 | AIA Group Ltd | | | 5,781,911 | | | | 3.6% | |

9 | KBC Group NV | | | 5,762,318 | | | | 3.6% | |

10 | Constellation Software Inc | | | 5,512,608 | | | | 3.5% | |

Shelton Tactical Credit Fund — Long Positions

Security | | Market Value

(in U.S.

Dollars) | | | Percentage

of Total

Investment | |

|

1 | Iron Mountain Inc, 4.875%, 9/15/2029 (144A) | | $ | 2,064,400 | | | | 4.0% | |

2 | Massachusetts Development Finance Agency, 5.000%, 7/1/2044 | | | 2,011,400 | | | | 3.9% | |

3 | Bay Area Toll Authority, 0.010%, 4/1/2053 | | | 2,000,000 | | | | 3.8% | |

4 | City of Murray UT, 0.010%, 5/15/2036 | | | 2,000,000 | | | | 3.8% | |

5 | City of New York NY, 0.010%, 10/1/2046 | | | 2,000,000 | | | | 3.8% | |

6 | Massachusetts Water Resources Authority, 0.030%, 11/1/2026 | | | 2,000,000 | | | | 3.8% | |

7 | New York City Transitional Finance Authority Future Tax Secured Revenue, 0.010%, 11/1/2042 | | | 2,000,000 | | | | 3.8% | |

8 | New York City Water & Sewer System, 0.010%, 6/15/2050 | | | 2,000,000 | | | | 3.8% | |

9 | State of Ohio, 0.020%, 1/1/2052 | | | 2,000,000 | | | | 3.8% | |

10 | Station Casinos LLC, 4.500%, 2/15/2028 (144A) | | | 1,932,386 | | | | 3.7% | |

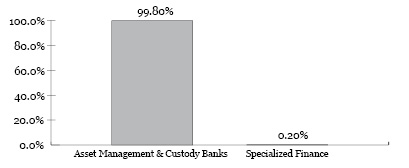

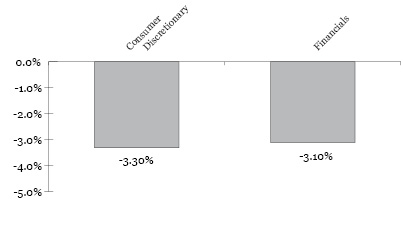

Shelton Tactical Credit Fund — Short Positions

Security | | Market Value

(in U.S.

Dollars) | | | Percentage

of Total

Investment | |

|

1 | Wynn Las Vegas LLC / Wynn Las Vegas Capital Corp, 5.500%, 03/01/2025 | | $ | (1,722,976 | ) | | | -3.3% | |

2 | Navient Corp, 5.875%, 10/25/2024 | | | (1,618,125 | ) | | | -3.1% | |

| | | | | | | | | | |

4

Shelton BDC Income Fund Portfolio of Investments (Expressed in U.S. Dollars) (Unaudited) June 30, 2021 |

Security Description | | Shares | | | Value | |

Common Stock (99.31%) | | | | | | | | |

| | | | | | | | | |

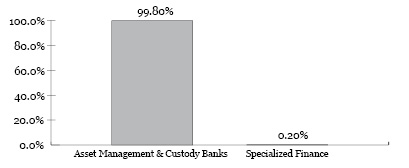

Financial (99.31%) | | | | | | | | |

Diversified Financial Services (0.47%) | | | | | | | | |

Medley Management Inc* | | | 1,863 | | | $ | 11,476 | |

Newstar Financial Inc CVR*,(a) | | | 100,410 | | | | 8,033 | |

| | | | | | | | 19,509 | |

Investment Company (98.84%) | | | | | | | | |

Apollo Investment Corp | | | 5,076 | | | | 69,287 | |

Ares Capital Corp | | | 28,061 | | | | 549,715 | |

Barings BDC Inc | | | 21,600 | | | | 228,096 | |

BlackRock TCP Capital Corp | | | 6,200 | | | | 85,684 | |

Capital Southwest Corp | | | 5,500 | | | | 127,765 | |

FS KKR Capital Corp | | | 16,716 | | | | 359,571 | |

Goldman Sachs BDC Inc | | | 2,580 | | | | 50,568 | |

Golub Capital BDC Inc | | | 13,750 | | | | 212,025 | |

Hercules Capital Inc | | | 22,250 | | | | 379,585 | |

Main Street Capital Corp | | | 6,800 | | | | 279,412 | |

New Mountain Finance Corp | | | 11,900 | | | | 156,723 | |

Oaktree Specialty Lending Corp | | | 39,268 | | | | 262,703 | |

Owl Rock Capital Corp | | | 34,675 | | | | 494,812 | |

Saratoga Investment Corp | | | 6,100 | | | | 163,907 | |

Sixth Street Specialty Lending Inc | | | 13,900 | | | | 308,441 | |

SLR Investment Corp | | | 4,429 | | | | 82,557 | |

SuRo Capital Corp | | | 14,000 | | | | 188,860 | |

TriplePoint Venture Growth BDC Corp | | | 4,728 | | | $ | 71,818 | |

| | | | | | | | 4,071,529 | |

| | | | | | | | | |

Total Common Stock (Cost $3,783,605) | | | | | | | 4,091,038 | |

| | | | | | | | | |

Total Investments (Cost $3,783,605)(b) (99.31%) | | | | | | $ | 4,091,038 | |

Other Net Assets (0.69%) | | | | | | | 28,276 | |

Net Assets (100.00%) | | | | | | $ | 4,119,314 | |

* | Non-income producing security. |

(a) | Level 3 security fair valued under procedures established by the Board of Trustees, represents 0.20% of net assets. The total value of the fair value security is $8,033. |

(b) | Aggregate cost for federal income tax purposes is $3,790,802 |

At June 30, 2021, unrealized appreciation/(depreciation) of securities for federal income tax purposes is as follows:

Unrealized appreciation | | $ | 527,362 | |

Unrealized depreciation | | | (227,126 | ) |

Net unrealized appreciation | | $ | 300,236 | |

Shelton Emerging Markets Fund Portfolio of Investments (Expressed in U.S. Dollars) (Unaudited) June 30, 2021 |

Security Description | | Shares | | | Value | |

Common Stock (93.51%) | | | | | | | | |

| | | | | | | | | |

Argentina (2.60%) | | | | | | | | |

MercadoLibre Inc* | | | 505 | | | $ | 786,684 | |

| | | | | | | | | |

Brazil (7.90%) | | | | | | | | |

Arco Platform Ltd* | | | 33,230 | | | | 1,018,832 | |

Notre Dame Intermedica Participacoes SA | | | 37,400 | | | | 639,901 | |

Sul America SA | | | 105,769 | | | | 737,053 | |

Total Brazil | | | | | | | 2,395,786 | |

| | | | | | | | | |

China (15.37%) | | | | | | | | |

Autohome Inc | | | 6,300 | | | | 402,948 | |

China Meidong Auto Holdings Ltd | | | 212,000 | | | | 1,154,944 | |

Haier Smart Home Co Ltd | | | 316,400 | | | | 1,103,472 | |

New Oriental Education & Technology Group Inc* | | | 57,660 | | | | 473,557 | |

Ping An Insurance Group Co of China Ltd | | | 66,200 | | | | 647,131 | |

Xinyi Solar Holdings Ltd | | | 407,000 | | | | 876,036 | |

Total China | | | | | | | 4,658,088 | |

| | | | | | | | | |

India (7.77%) | | | | | | | | |

HDFC Bank Ltd* | | | 15,995 | | | | 1,169,554 | |

Infosys Ltd | | | 55,948 | | | | 1,185,538 | |

Total India | | | | | | | 2,355,092 | |

| | | | | | | | | |

Indonesia (10.41%) | | | | | | | | |

Ace Hardware Indonesia Tbk PT | | | 7,477,000 | | | | 645,676 | |

Bank Rakyat Indonesia Persero Tbk PT | | | 3,856,000 | | | | 1,048,428 | |

Indofood CBP Sukses Makmur Tbk PT | | | 993,000 | | | | 558,410 | |

Sarana Menara Nusantara Tbk PT | | | 10,537,900 | | | | 901,962 | |

Total Indonesia | | | | | | | 3,154,476 | |

| | | | | | | | | |

Mexico (7.37%) | | | | | | | | |

Kimberly-Clark de Mexico SAB de CV | | | 658,000 | | | | 1,168,846 | |

Regional SAB de CV | | | 180,000 | | | | 1,066,690 | |

Total Mexico | | | | | | | 2,235,536 | |

| | | | | | | | | |

South Korea (12.35%) | | | | | | | | |

Dentium Co Ltd | | | 15,000 | | | | 864,432 | |

Samsung Electronics Co Ltd | | | 28,612 | | | | 2,048,223 | |

Samsung SDI Co Ltd | | | 1,342 | | | | 830,883 | |

Total South Korea | | | | | | | 3,743,538 | |

| | | | | | | | | |

Taiwan (25.47%) | | | | | | | | |

Accton Technology Corp | | | 100,400 | | | | 1,188,895 | |

Chailease Holding Co Ltd | | | 122,000 | | | | 886,676 | |

eMemory Technology Inc | | | 26,700 | | | | 1,280,180 | |

MediaTek Inc | | | 33,400 | | | | 1,151,840 | |

Sporton International Inc | | | 61,000 | | | | 526,095 | |

Taiwan Semiconductor Manufacturing Co Ltd | | | 91,300 | | | | 1,966,422 | |

Voltronic Power Technology Corp | | | 15,000 | | | | 723,602 | |

Total Taiwan | | | | | | | 7,723,710 | |

| | | | | | | | | |

Thailand (4.27%) | | | | | | | | |

Bangkok Bank PCL | | | 223,000 | | | | 786,948 | |

Charoen Pokphand Foods PCL | | | 614,000 | | | | 508,104 | |

Total Thailand | | | | | | | 1,295,052 | |

See accompanying notes to financial statements.

5

Shelton Emerging Markets Fund Portfolio of Investments (Expressed in U.S. Dollars) (Unaudited) (Continued) June 30, 2021 |

Security Description | | Shares | | | Value | |

Total Common Stock (Cost $20,445,726) | | | | | | $ | 28,347,962 | |

| | | | | | | | | |

Total Investments (Cost $20,445,726)(a) (93.51%) | | | | | | $ | 28,347,962 | |

Other Net Assets (6.49%) | | | | | | | 1,966,023 | |

Net Assets (100.00%) | | | | | | $ | 30,313,985 | |

* | Non-income producing security. |

(a) | Aggregate cost for federal income tax purposes is $21,004,661 |

At June 30, 2021, unrealized appreciation/(depreciation) of securities for federal income tax purposes is as follows:

Unrealized appreciation | | $ | 7,982,477 | |

Unrealized depreciation | | | (639,176 | ) |

Net unrealized appreciation | | $ | 7,343,301 | |

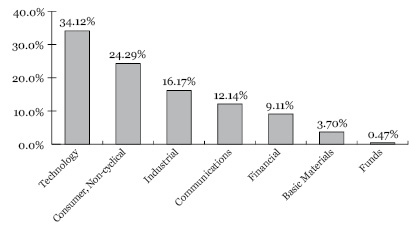

Shelton International Select Equity Fund Portfolio of Investments (Expressed in U.S. Dollars) (Unaudited) June 30, 2021 |

Security Description | | Shares | | | Value | |

Common Stock (91.99%) | | | | | | | | |

| | | | | | | | | |

Belgium (3.32%) | | | | | | | | |

KBC Group NV | | | 75,568 | | | $ | 5,762,318 | |

| | | | | | | | | |

Canada (12.45%) | | | | | | | | |

CAE Inc* | | | 131,311 | | | | 4,048,659 | |

Constellation Software Inc | | | 3,636 | | | | 5,512,608 | |

Element Fleet Management Corp | | | 749,809 | | | | 8,755,744 | |

Linamar Corp | | | 52,000 | | | | 3,264,960 | |

Total Canada | | | | | | | 21,581,971 | |

| | | | | | | | | |

China (5.59%) | | | | | | | | |

China Meidong Auto Holdings Ltd | | | 718,000 | | | | 3,915,515 | |

New Oriental Education & Technology Group Inc* | | | 162,400 | | | | 1,338,372 | |

Ping An Insurance Group Co of China Ltd | | | 453,900 | | | | 4,444,986 | |

Total China | | | | | | | 9,698,873 | |

| | | | | | | | | |

France (9.19%) | | | | | | | | |

BNP Paribas SA | | | 84,387 | | | | 5,290,944 | |

L’Oreal SA | | | 11,937 | | | | 5,319,861 | |

Valeo | | | 176,879 | | | | 5,321,634 | |

Total France | | | | | | | 15,932,439 | |

| | | | | | | | | |

Germany (5.00%) | | | | | | | | |

adidas AG | | | 10,962 | | | | 4,080,650 | |

MTU Aero Engines AG | | | 18,496 | | | | 4,582,100 | |

Total Germany | | | | | | | 8,662,750 | |

| | | | | | | | | |

Great Britain (5.79%) | | | | | | | | |

Intertek Group PLC | | | 68,135 | | | | 5,205,118 | |

Unilever PLC | | | 82,562 | | | | 4,829,877 | |

Total Great Britain | | | | | | | 10,034,995 | |

| | | | | | | | | |

Hong Kong (6.09%) | | | | | | | | |

AIA Group Ltd | | | 465,300 | | | | 5,781,911 | |

Techtronic Industries Co Ltd | | | 273,400 | | | | 4,773,855 | |

Total Hong Kong | | | | | | | 10,555,766 | |

| | | | | | | | | |

India (2.49%) | | | | | | | | |

HDFC Bank Ltd* | | | 59,159 | | | | 4,325,706 | |

| | | | | | | | | |

Indonesia (2.55%) | | | | | | | | |

Bank Rakyat Indonesia Persero Tbk PT | | | 16,268,450 | | | | 4,420,531 | |

| | | | | | | | | |

Ireland (7.65%) | | | | | | | | |

CRH PLC | | | 167,084 | | | | 8,421,163 | |

Smurfit Kappa Group PLC | | | 89,315 | | | | 4,845,781 | |

Total Ireland | | | | | | | 13,266,944 | |

Japan (5.03%) | | | | | | | | |

Daikin Industries Ltd | | | 11,400 | | | | 2,125,110 | |

Nomura Research Institute Ltd | | | 134,700 | | | | 4,460,064 | |

Santen Pharmaceutical Co Ltd | | | 155,500 | | | | 2,143,571 | |

Total Japan | | | | | | | 8,728,745 | |

| | | | | | | | | |

Mexico (3.38%) | | | | | | | | |

Kimberly-Clark de Mexico SAB de CV | | | 3,296,500 | | | | 5,862,689 | |

| | | | | | | | | |

Netherlands (5.54%) | | | | | | | | |

ASML Holding NV | | | 10,547 | | | | 7,286,289 | |

Topicus.com Inc* | | | 31,858 | | | | 2,316,735 | |

Total Netherlands | | | | | | | 9,603,024 | |

| | | | | | | | | |

Singapore (3.97%) | | | | | | | | |

DBS Group Holdings Ltd | | | 310,428 | | | | 6,884,287 | |

| | | | | | | | | |

Switzerland (7.98%) | | | | | | | | |

Givaudan SA | | | 1,004 | | | | 4,673,784 | |

Nestle SA | | | 48,378 | | | | 6,034,672 | |

Straumann Holding AG | | | 1,964 | | | | 3,133,986 | |

Total Switzerland | | | | | | | 13,842,442 | |

| | | | | | | | | |

Taiwan (3.51%) | | | | | | | | |

Taiwan Semiconductor Manufacturing Co Ltd | | | 50,692 | | | | 6,091,151 | |

| | | | | | | | | |

Thailand (2.46%) | | | | | | | | |

Bangkok Bank PCL | | | 1,211,100 | | | | 4,270,025 | |

| | | | | | | | | |

Total Common Stock (Cost $132,078,663) | | | | | | | 159,524,656 | |

| | | | | | | | | |

Total Investments (Cost $132,078,663)(a) (91.99%) | | | | | | $ | 159,524,656 | |

Other Net Assets (8.01%) | | | | | | | 13,897,689 | |

Net Assets (100.00%) | | | | | | $ | 173,422,345 | |

* | Non-income producing security. |

(a) | Aggregate cost for federal income tax purposes is $134,306,434 |

At June 30, 2021, unrealized appreciation/(depreciation) of securities for federal income tax purposes is as follows:

Unrealized appreciation | | $ | 28,578,015 | |

Unrealized depreciation | | | (3,359,793 | ) |

Net unrealized appreciation | | $ | 25,218,222 | |

See accompanying notes to financial statements.

6

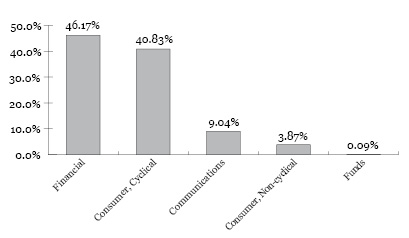

Shelton Tactical Credit Fund Portfolio of Investments (Expressed in U.S. Dollars) (Unaudited) June 30, 2021 |

Security Description /

Long Positions | | Shares | | | Value | |

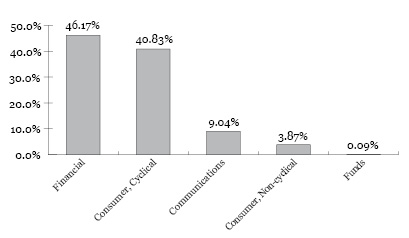

Common Stock (0.84%) | | | | | | | | |

| | | | | | | | | |

Consumer, Cyclical (0.25%) | | | | | | | | |

Copper Earnout Trust(a) | | | 891 | | | $ | 9,133 | |

Propco Earnout Trust(a) | | | 6,682 | | | | 120,276 | |

| | | | | | | | 129,409 | |

| | | | | | | | | |

Consumer, Non-cyclical (0.58%) | | | | | | | | |

Pyxus International Inc* | | | 83,441 | | | | 304,560 | |

| | | | | | | | | |

Energy (0.01%) | | | | | | | | |

CHC Group LLC*,(b) | | | 187,153 | | | | 6,363 | |

| | | | | | | | | |

Total Common Stock (Cost $2,228,812) | | | | | | | 440,332 | |

| | | | | | | | | |

| | Par Value | | | | |

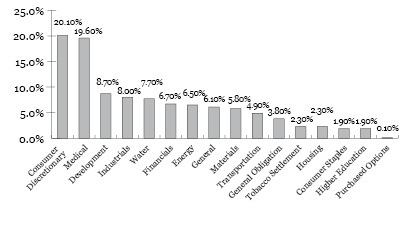

Corporate Debt (46.27%) | | | | | | | | |

| | | | | | | | |

Basic Materials (5.74%) | | | | | | | | |

Cleveland-Cliffs Inc, 9.875%, 10/17/2025 (144A)(c) | | $ | 1,239,000 | | | | 1,452,120 | |

Ferroglobe PLC / Globe Specialty Metals Inc, 9.375%, 3/1/2022 (144A)(c) | | | 1,500,000 | | | | 1,567,500 | |

Total Basic Materials | | | | | | | 3,019,620 | |

| | | | | | | | | |

Consumer, Cyclical (21.53%) | | | | | | | | |

The Bon-Ton Department Stores Inc, 8.000%, 6/15/2021(d) | | | 4,958,932 | | | | 37,192 | |

Boyd Gaming Corp, 4.750%, 6/15/2031 (144A)(c) | | | 500,000 | | | | 519,515 | |

Carnival Corp, 5.750%, 3/1/2027 (144A)(c) | | | 1,750,000 | | | | 1,833,125 | |

Hawaiian Brand Intellectual Property Ltd / HawaiianMiles Loyalty Ltd, 5.750%, 1/20/2026 (144A)(c) | | | 1,750,000 | | | | 1,881,250 | |

JC Penney Corp Inc, 5.875%, 7/1/2023 (144A)(a),(d) | | | 1,400,000 | | | | 3,500 | |

The Michaels Cos Inc, 5.250%, 5/1/2028 (144A)(c) | | | 1,100,000 | | | | 1,128,523 | |

PetSmart Inc / PetSmart Finance Corp, 7.750%, 2/15/2029 (144A)(c) | | | 750,000 | | | | 824,828 | |

Six Flags Entertainment Corp, 4.875%, 7/31/2024 (144A)(c) | | | 1,500,000 | | | | 1,505,625 | |

Spirit Loyalty Cayman Ltd / Spirit IP Cayman Ltd, 8.000%, 9/20/2025 (144A) | | | 538,554 | | | | 609,105 | |

Station Casinos LLC, 4.500%, 2/15/2028 (144A)(c) | | | 1,900,000 | | | | 1,932,386 | |

Titan International Inc, 7.000%, 4/30/2028 (144A)(c) | | | 1,000,000 | | | | 1,046,250 | |

Total Consumer, Cyclical | | | | | | | 11,321,299 | |

| | | | | | | | | |

Consumer, Non-Cyclical (2.01%) | | | | | | | | |

Herc Holdings Inc, 5.500%, 7/15/2027 (144A)(c) | | | 1,000,000 | | | | 1,054,220 | |

| | | | | | | | | |

Energy (6.45%) | | | | | | | | |

Energy Ventures Gom LLC / EnVen Finance Corp, 11.750%, 4/15/2026 (144A)(c) | | | 1,000,000 | | | | 1,042,880 | |

Talos Production Inc, 12.000%, 1/15/2026(c) | | | 1,000,000 | | | | 1,060,000 | |

Transocean Inc, 7.500%, 1/15/2026 (144A)(c) | | | 1,500,000 | | | | 1,290,000 | |

Total Energy | | | | | | | 3,392,880 | |

Financial (6.63%) | | | | | | | | |

CBL & Associates LP, 4.600%, 10/15/2024(d) | | | 1,000,000 | | | | 562,500 | |

CBL & Associates LP, 5.950%, 12/15/2026(d) | | | 1,526,000 | | | | 858,375 | |

Iron Mountain Inc, 4.875%, 9/15/2029 (144A)(c) | | | 2,000,000 | | | | 2,064,400 | |

Total Financial | | | | | | | 3,485,275 | |

| | | | | | | | | |

Industrial (3.91%) | | | | | | | | |

Eletson Holdings Inc / Eletson Finance US LLC / Agathonissos Finance LLC, 9.625%, 1/15/2022 | | | 548,153 | | | | 187,057 | |

Scorpio Tankers Inc, 3.000%, 5/15/2022(c) | | | 1,875,000 | | | | 1,870,025 | |

Total Industrial | | | | | | | 2,057,082 | |

| | | | | | | | | |

Total Corporate Debt (Cost $24,572,618) | | | | | | | 24,330,376 | |

| | | | | | | | | |

Municipal Bonds (56.79%) | | | | | | | | |

| | | | | | | | | |

Development (8.67%) | | | | | | | | |

California Pollution Control Financing Authority, 7.500%, 12/1/2040 (144A)(c) | | | 1,500,000 | | | | 1,641,019 | |

California Pollution Control Financing Authority, 7.500%, 7/1/2032 (144A) | | | 250,000 | | | | 233,727 | |

California Pollution Control Financing Authority, 8.000%, 7/1/2039 (144A)(d) | | | 2,050,000 | | | | 1,332,500 | |

New York Transportation Development Corp, 4.000%, 4/30/2053(c) | | | 325,000 | | | | 378,877 | |

New York Transportation Development Corp, 5.000%, 10/1/2035(c) | | | 750,000 | | | | 972,097 | |

Total Development | | | | | | | 4,558,220 | |

| | | | | | | | | |

General Obligation (9.81%) | | | | | | | | |

City of New York NY, 0.010%, 10/1/2046(e) | | | 2,000,000 | | | | 2,000,000 | |

New York City Transitional Finance Authority Future Tax Secured Revenue, 0.010%, 11/1/2042(e) | | | 2,000,000 | | | | 2,000,000 | |

Puerto Rico Public Finance Corp, 5.500%, 8/1/2031(c),(d) | | | 400,000 | | | | 4,800 | |

Puerto Rico Sales Tax Financing Corp Sales Tax Revenue, 5.000%, 7/1/2058(c) | | | 1,000,000 | | | | 1,152,617 | |

Total General Obligation | | | | | | | 5,157,417 | |

| | | | | | | | | |

Higher Education (1.90%) | | | | | | | | |

Board of Regents of the University of Texas System, 0.010%, 8/1/2034(e) | | | 1,000,000 | | | | 1,000,000 | |

| | | | | | | | | |

Housing (2.27%) | | | | | | | | |

California Municipal Finance Authority, 5.000%, 5/15/2051(c) | | | 1,000,000 | | | | 1,194,757 | |

| | | | | | | | | |

Medical (19.38%) | | | | | | | | |

City of Murray UT, 0.010%, 5/15/2036(e) | | | 2,000,000 | | | | 2,000,000 | |

County of Cuyahoga OH, 5.500%, 2/15/2052(c) | | | 1,300,000 | | | | 1,543,924 | |

County of Cuyahoga OH, 5.500%, 2/15/2057(c) | | | 760,000 | | | | 900,823 | |

Illinois Finance Authority, 0.010%, 8/15/2049(e) | | | 500,000 | | | | 500,000 | |

Massachusetts Development Finance Agency, 5.000%, 7/1/2044(c) | | | 1,765,000 | | | | 2,011,400 | |

New York State Dormitory Authority, 5.000%, 8/1/2035(c) | | | 1,000,000 | | | | 1,231,246 | |

State of Ohio, 0.020%, 1/1/2052(e) | | | 2,000,000 | | | | 2,000,000 | |

Total Medical | | | | | | | 10,187,393 | |

See accompanying notes to financial statements.

7

Shelton Tactical Credit Fund Portfolio of Investments (Expressed in U.S. Dollars) (Unaudited) (Continued) June 30, 2021 |

Security Description /

Long Positions | | Par Value | | | Value | |

Tobacco Settlement (2.26%) | | | | | | | | |

Tobacco Settlement Financing Corp, 5.000%, 6/1/2046(c) | | $ | 1,000,000 | | | $ | 1,188,515 | |

| | | | | | | | | |

Transportation (4.89%) | | | | | | | | |

Bay Area Toll Authority, 0.010%, 4/1/2053(e) | | | 2,000,000 | | | | 2,000,000 | |

Texas Private Activity Bond Surface Transportation Corp, 7.000%, 12/31/2038(c) | | | 500,000 | | | | 569,389 | |

Total Transportation | | | | | | | 2,569,389 | |

| | | | | | | | | |

Water (7.61%) | | | | | | | | |

Massachusetts Water Resources Authority, 0.030%, 11/1/2026(e) | | | 2,000,000 | | | | 2,000,000 | |

New York City Water & Sewer System, 0.010%, 6/15/2050(e) | | | 2,000,000 | | | | 2,000,000 | |

Total Water | | | | | | | 4,000,000 | |

| | | | | | | | | |

Total Municipal Debt (Cost $23,758,297) | | | | | | | 29,855,691 | |

| | | | | | | | | |

Term Loans (1.42%) | | | | | | | | |

JC Penney, Penney Borrower LLC, 3M US LIBOR (floor 1.500%) + 9.500%, 12/07/2026(e) | | | 46,212 | | | | 44,941 | |

Pyxus International Loan, 3M US LIBOR (floor 1.500%) + 9.500%, 2/24/25(e) | | | 722,750 | | | | 704,081 | |

| | | | | | | | | |

Total Term Loans (Cost $2,372,965) | | | | | | | 749,022 | |

| | | | | | | | | |

| | Contracts | | | | |

Purchased Options - Puts (0.02%) | | | | | | | | |

| | | | | | | | | |

Reference Asset | | | | | | | | |

10-Year US Treasury Note Futures | | | | | | | | |

Notional amount $655,000, premiums paid $42,969, exercise price $131, expires 7/26/21* | | | 50 | | | | 5,469 | |

10-Year US Treasury Note Futures | | | | | | | | |

Notional amount $975,000, premiums paid $43,360, exercise price $130, expires 7/26/21* | | | 75 | | | | 2,344 | |

10-Year US Treasury Note Futures | | | | | | | | |

Notional amount $1,290,000, premiums paid $37,500, exercise price $129, expires 7/26/21* | | | 100 | | | | 1,563 | |

| | | | | | | | | |

Total Purchased Options - Puts (Cost $123,828) | | | | | | | 9,376 | |

| | | | | | | | | |

Total Long Positions (Cost $57,364,321)(f) (105.34%) | | | | | | | 55,384,797 | |

Liabilities in Excess of Other Assets (-5.34%) | | | | | | | (2,812,498 | ) |

Net Assets (100.00%) | | | | | | $ | 52,572,299 | |

Security Description /

Short Positions | | Par Value | | | Value | |

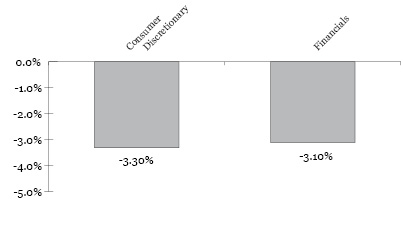

Short Corporate Debt (-6.36%) | | | | | | | | |

| | | | | | | | | |

Consumer, Cyclical (-3.28%) | | | | | | | | |

Wynn Las Vegas LLC / Wynn Las Vegas Capital Corp, 5.500%, 3/1/2025 (144A)(c) | | $ | (1,600,000 | ) | | $ | (1,722,976 | ) |

| | | | | | | | | |

Financial (-3.08%) | | | | | | | | |

Navient Corp, 5.875%, 10/25/2024(c) | | | (1,500,000 | ) | | | (1,618,125 | ) |

| | | | | | | | | |

Total Short Corporate Debt (Proceeds $3,141,425) | | | | | | | (3,341,101 | ) |

(144A) Security was purchased pursuant to Rule 144A or Section 4(a)(2) under the Securities Act of 1933 and may be resold in transactions exempt from registration only to qualified institutional buyers. As of June 30, 2021, these securities had a total aggregate market value of $21,239,497, which represented approximately 40.40% of net assets.

* | Non-income producing security. |

(a) | Level 3 security fair valued under procedures established by the Board of Trustees, represents 0.25% of net assets. The total value of the fair value security is $132,909. |

(c) | All or a portion of this security has been segregated as collateral. |

(e) | Variable rate security. |

(f) | Aggregate cost for federal income tax purposes is $54,441,455 |

At June 30, 2021, unrealized appreciation/(depreciation) of securities for federal income tax purposes is as follows:

Unrealized appreciation | | $ | 2,683,776 | |

Unrealized depreciation | | | (5,081,535 | ) |

Net unrealized depreciation | | $ | (2,397,759 | ) |

See accompanying notes to financial statements.

8

Statements of Assets and Liabilities (Unaudited) June 30, 2021 |

| | | Shelton

BDC Income

Fund | | | Shelton

Emerging

Markets Fund | | | Shelton

International

Select Equity

Fund | | | Shelton

Tactical Credit

Fund | |

Assets | | | | | | | | | | | | | | | | |

Investments in securities | | | | | | | | | | | | | | | | |

Cost of investments | | $ | 3,783,605 | | | $ | 20,445,726 | | | $ | 132,078,663 | | | $ | 57,240,493 | |

Cost of purchased options | | | — | | | | — | | | | — | | | | 123,828 | |

Market value of investments (Note 1) | | | 4,091,038 | | | | 28,347,962 | | | | 159,524,656 | | | | 55,375,421 | |

Market value of purchased options (Note 1) | | | — | | | | — | | | | — | | | | 9,376 | |

Cash | | | 92,567 | | | | 2,599,015 | | | | 13,982,961 | | | | 28,642 | |

Interest receivable | | | — | | | | — | | | | — | | | | 651,113 | |

Dividend receivable | | | 32,327 | | | | 62,320 | | | | 540,019 | | | | — | |

Receivable from investment advisor | | | 484 | | | | 5,769 | | | | 16,893 | | | | 9,402 | |

Receivable for fund shares sold | | | 55,525 | | | | 90,368 | | | | 446,727 | | | | 535,289 | |

Prepaid expenses | | | 636 | | | | 38,869 | | | | 39,942 | | | | 1,799 | |

Total assets | | $ | 4,272,577 | | | $ | 31,144,303 | | | $ | 174,551,198 | | | $ | 56,611,042 | |

| | | | | | | | | | | | | | | | | |

Liabilities | | | | | | | | | | | | | | | | |

Payables and other liabilities | | | | | | | | | | | | | | | | |

Short positions, at value (proceeds $3,141,425) | | | — | | | | — | | | | — | | | | 3,341,101 | |

Interest payable | | | — | | | | — | | | | — | | | | 45,490 | |

Payable for fund shares repurchased | | | 4,033 | | | | 4,383 | | | | 115,494 | | | | 50,450 | |

Payable to investment advisor | | | 558 | | | | 27,738 | | | | 117,679 | | | | 55,114 | |

Distributions payable | | | 116,601 | | | | 824 | | | | 1,065 | | | | 478,273 | |

Payable for securities purchased | | | — | | | | 734,883 | | | | 742,287 | | | | — | |

Accrued 12b-1 fees | | | 920 | | | | 369 | | | | 5,888 | | | | 1,060 | |

Accrued administration fees | | | 356 | | | | 2,506 | | | | 14,376 | | | | 4,258 | |

Accrued CCO fees | | | 348 | | | | 1,192 | | | | 27,388 | | | | 1,976 | |

Accrued custody fees | | | 24 | | | | 3,691 | | | | 11,312 | | | | 1,887 | |

Accrued expenses | | | 10,079 | | | | 22,844 | | | | 41,524 | | | | 31,940 | |

Accrued fund Accounting fees | | | 6,023 | | | | 11,046 | | | | 22,240 | | | | 18,744 | |

Accrued printing fees | | | 2,048 | | | | (1,156 | ) | | | (2,359 | ) | | | 1,298 | |

Accrued registration fees | | | 8,540 | | | | — | | | | — | | | | — | |

Accrued transfer agent fees | | | 2,741 | | | | 21,058 | | | | 29,974 | | | | 5,996 | |

Accrued trustee fees | | | 992 | | | | 940 | | | | 1,985 | | | | 1,156 | |

Total liabilities | | | 153,263 | | | | 830,318 | | | | 1,128,853 | | | | 4,038,743 | |

| | | | | | | | | | | | | | | | | |

Net assets | | $ | 4,119,314 | | | $ | 30,313,985 | | | $ | 173,422,345 | | | $ | 52,572,299 | |

| | | | | | | | | | | | | | | | | |

Net assets at June 30, 2021 consist of | | | | | | | | | | | | | | | | |

Paid-in capital | | | 8,478,217 | | | | 24,475,866 | | | | 189,790,873 | | | | 59,907,524 | |

Distributable earnings/(loss) | | | (4,358,903 | ) | | | 5,838,119 | | | | (16,368,528 | ) | | | (7,335,225 | ) |

Total net assets | | $ | 4,119,314 | | | $ | 30,313,985 | | | $ | 173,422,345 | | | $ | 52,572,299 | |

| | | | | | | | | | | | | | | | | |

Net assets | | | | | | | | | | | | | | | | |

Institutional Shares | | $ | 270,390 | | | $ | 28,667,069 | | | $ | 147,450,949 | | | $ | 47,886,237 | |

Investor Shares | | $ | 3,848,924 | | | $ | 1,646,916 | | | $ | 25,971,396 | | | $ | 4,686,062 | |

| | | | | | | | | | | | | | | | | |

Shares outstanding | | | | | | | | | | | | | | | | |

Institutional Shares (no par value, unlimited shares authorized) | | | 32,505 | | | | 1,391,671 | | | | 5,407,562 | | | | 4,263,677 | |

Investor Shares (no par value, unlimited shares authorized) | | | 458,447 | | | | 80,745 | | | | 959,105 | | | | 417,748 | |

| | | | | | | | | | | | | | | | | |

Net asset value per share | | | | | | | | | | | | | | | | |

Institutional Shares | | $ | 8.32 | | | $ | 20.60 | | | $ | 27.27 | | | $ | 11.23 | |

Investor Shares | | $ | 8.40 | | | $ | 20.40 | | | $ | 27.08 | | | $ | 11.22 | |

See accompanying notes to financial statements.

9

Statements of Operations (Unaudited)

June 30, 2021 |

| | | Shelton

BDC Income

Fund | | | Shelton

Emerging

Markets Fund | | | Shelton

International

Select Equity

Fund | | | Shelton

Tactical

Credit

Fund | |

| | | Period Ended

June 30,

2021 | | | Period Ended

June 30,

2021 | | | Period Ended

June 30,

2021 | | | Period Ended

June 30,

2021 | |

Investment income | | | | | | | | | | | | | | | | |

Interest income | | $ | — | | | $ | 62 | | | $ | 1,464 | | | $ | 1,232,928 | |

Dividend income (net of foreign tax withheld: $—, $35,214, $170,759 and $— respectively) | | | 239,109 | | | | 241,438 | | | | 1,556,532 | | | | 1,945 | |

Total | | $ | 239,109 | | | $ | 241,500 | | | $ | 1,557,996 | | | $ | 1,234,873 | |

| | | | | | | | | | | | | | | | | |

Expenses | | | | | | | | | | | | | | | | |

Interest on short positions | | $ | — | | | $ | — | | | $ | — | | | $ | 109,012 | |

Management fees (Note 2) | | | 19,188 | | | | 144,429 | | | | 581,314 | | | | 280,514 | |

Administration fees (Note 2) | | | 1,937 | | | | 13,145 | | | | 71,407 | | | | 21,785 | |

Transfer agent fees | | | 5,286 | | | | 17,420 | | | | 43,054 | | | | 9,536 | |

Accounting services | | | 10,421 | | | | 14,834 | | | | 28,737 | | | | 25,533 | |

Broker fees | | | — | | | | — | | | | 220 | | | | 91,292 | |

Custodian fees | | | 164 | | | | 10,148 | | | | 17,732 | | | | 3,547 | |

Legal and audit fees | | | 3,052 | | | | 5,835 | | | | 20,026 | | | | 7,537 | |

CCO fees (Note 2) | | | 181 | | | | 1,347 | | | | 8,043 | | | | 2,235 | |

Trustees fees | | | 2,017 | | | | 2,330 | | | | 2,549 | | | | 2,286 | |

Insurance | | | 71 | | | | 558 | | | | 3,295 | | | | 886 | |

Printing | | | 5,975 | | | | 6,306 | | | | 7,205 | | | | 8,674 | |

Registration and dues | | | 11,766 | | | | 15,123 | | | | 31,107 | | | | 14,276 | |

12b-1 fees Investor Shares (Note 2) | | | 4,986 | | | | 2,033 | | | | 27,224 | | | | 6,275 | |

Total expenses | | $ | 65,044 | | | $ | 233,508 | | | $ | 841,913 | | | $ | 583,388 | |

Less reimbursement from manager (Note 2) | | | (33,220 | ) | | | (5,769 | ) | | | (27,810 | ) | | | (41,100 | ) |

Net expenses | | $ | 31,824 | | | $ | 227,739 | | | $ | 814,103 | | | $ | 542,288 | |

Net investment income | | $ | 207,285 | | | $ | 13,761 | | | $ | 743,893 | | | $ | 692,585 | |

| | | | | | | | | | | | | | | | | |

Realized and unrealized gain/(loss) on investments | | | | | | | | | | | | | | | | |

Net realized gain/(loss) from security transactions and foreign currency | | $ | 9,870 | | | $ | 909,215 | | | $ | 8,238,417 | | | $ | 740,215 | |

Net realized gain/(loss) from futures contracts | | | — | | | | — | | | | — | | | | (22,869 | ) |

Net realized gain/(loss) from purchased option contracts | | | — | | | | — | | | | — | | | | (20,585 | ) |

Net realized gain/(loss) from written options contracts | | | — | | | | — | | | | — | | | | 74,599 | |

Total Net Realized gain/(loss) | | | 9,870 | | | | 909,215 | | | | 8,238,417 | | | | 771,360 | |

| | | | | | | | | | | | | | | | | |

Change in unrealized appreciation/(depreciation) of investments | | | 553,820 | | | | (189,637 | ) | | | (558,583 | ) | | | 1,837,264 | |

Change in unrealized appreciation/(depreciation) of purchased option contracts | | | — | | | | — | | | | — | | | | 95,695 | |

Change in unrealized appreciation/(depreciation) of written option contracts | | | — | | | | — | | | | — | | | | (88,726 | ) |

Net realized and unrealized gain/(loss) on investments | | $ | 563,690 | | | $ | 719,578 | | | $ | 7,679,834 | | | $ | 2,615,593 | |

Net increase/(decrease) in net assets resulting from operations | | $ | 770,975 | | | $ | 733,339 | | | $ | 8,423,727 | | | $ | 3,308,178 | |

See accompanying notes to financial statements.

10

Statements of Changes in Net Assets |

| | | Shelton BDC

Income Fund | | | Shelton Emerging Markets Fund | | | Shelton International

Select Equity Fund | |

| | | Period

Ended

June 30,

2021 | | | Year Ended

December 31,

2020 | | | Period

Ended

June 30,

2021 | | | Period

Ended

December 31,

2020 | | | Year Ended

September 30,

2020 | | | Period

Ended

June 30,

2021 | | | Year Ended

December 31,

2020 | |

Operations | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income/(loss) | | $ | 207,285 | | | $ | 417,271 | | | $ | 13,761 | | | $ | (41,404 | ) | | $ | 50,062 | | | $ | 743,893 | | | $ | 425,800 | |

Net realized gain/(loss) from security transactions and foreign currency | | | 9,870 | | | | (683,527 | ) | | | 909,215 | | | | 3,489,313 | | | | (3,886,642 | ) | | | 8,238,417 | | | | 38,555 | |

Change in unrealized appreciation/(depreciation) of investments | | | 553,820 | | | | (598,529 | ) | | | (189,637 | ) | | | 3,281,869 | | | | 4,945,157 | | | | (558,583 | ) | | | 19,176,951 | |

Net increase/(decrease) in net assets resulting from operations | | | 770,975 | | | | (864,785 | ) | | | 733,339 | | | | 6,729,778 | | | | 1,108,577 | | | | 8,423,727 | | | | 19,641,306 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Distributions to shareholders | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Distributions | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Institutional Shares | | | (15,321 | ) | | | (21,443 | ) | | | — | | | | (47,123 | ) | | | (802,092 | ) | | | — | | | | (810,174 | ) |

Investor Shares | | | (212,829 | ) | | | (396,171 | ) | | | — | | | | (2,929 | ) | | | (49,976 | ) | | | — | | | | (75,408 | ) |

Total Distributions | | | (228,150 | ) | | | (417,614 | ) | | | — | | | | (50,052 | ) | | | (852,068 | ) | | | — | | | | (885,582 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Capital share transactions | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Increase/(decrease) in net assets resulting from capital share transactions | | | (466,640 | ) | | | (1,057,698 | ) | | | 2,243,469 | | | | (2,092,602 | ) | | | (21,276,448 | ) | | | 21,242,447 | | | | 64,229,063 | |

Total increase/(decrease) | | | 76,185 | | | | (2,340,097 | ) | | | 2,976,808 | | | | 4,587,124 | | | | (21,019,939 | ) | | | 29,666,174 | | | | 82,984,787 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Beginning of period | | | 4,043,129 | | | | 6,383,226 | | | | 27,337,177 | | | | 22,750,053 | | | | 43,769,992 | | | | 143,756,171 | | | | 60,771,384 | |

End of period | | $ | 4,119,314 | | | $ | 4,043,129 | | | $ | 30,313,985 | | | $ | 27,337,177 | | | $ | 22,750,053 | | | $ | 173,422,345 | | | $ | 143,756,171 | |

| | | Shelton Tactical Credit Fund | |

| | | Period Ended

June 30,

2021 | | | Year Ended

December 31,

2020 | |

Operations | | | | | | | | |

Net investment income/(loss) | | $ | 692,585 | | | $ | 2,304,569 | |

Net realized gain/(loss) from security transactions and foreign currency | | | 740,215 | | | | 786,483 | |

Net realized gain/(loss) from futures contracts | | | (22,869 | ) | | | (1,876,622 | ) |

Net realized gain/(loss) from purchased option contracts | | | (20,585 | ) | | | (1,086,795 | ) |

Net realized gain/(loss) from written options contracts | | | 74,599 | | | | 385,413 | |

Change in unrealized appreciation/(depreciation) of investments | | | 1,837,264 | | | | (1,465,185 | ) |

Change in unrealized appreciation/(depreciation) of futures | | | — | | | | (401,601 | ) |

Change in unrealized appreciation/(depreciation) of purchased option contracts | | | 95,695 | | | | (210,148 | ) |

Change in unrealized appreciation/(depreciation) of written option contracts | | | (88,726 | ) | | | 88,726 | |

Net increase/(decrease) in net assets resulting from operations | | | 3,308,178 | | | | (1,475,160 | ) |

| | | | | | | | | |

Distributions to shareholders | | | | | | | | |

Distributions | | | | | | | | |

Institutional Shares | | | (942,109 | ) | | | (1,860,085 | ) |

Investor Shares | | | (101,293 | ) | | | (443,874 | ) |

Total Distributions | | | (1,043,402 | ) | | | (2,303,959 | ) |

| | | | | | | | | |

Capital share transactions | | | | | | | | |

Increase/(Decrease) in net assets resulting from capital share transactions | | | 3,324,789 | | | | (39,592,702 | ) |

Total increase/(decrease) | | | 5,589,565 | | | | (43,371,821 | ) |

| | | | | | | | | |

Net assets | | | | | | | | |

Beginning of period | | | 46,982,734 | | | | 90,354,555 | |

End of period | | $ | 52,572,299 | | | $ | 46,982,734 | |

See accompanying notes to financial statements.

11

Statements of Changes in Net Assets (Continued) |

Shelton BDC Income Fund | | Institutional Shares | |

| | | Period Ended

June 30, 2021 | | | Year Ended

December 31, 2020 | |

| | | Shares | | | Value | | | Shares | | | Value | |

Shares sold | | | 340 | | | $ | 2,703 | | | | 36,291 | | | $ | 252,509 | |

Shares issued in reinvestment of distributions | | | 639 | | | | 5,227 | | | | 874 | | | | 5,237 | |

Shares repurchased | | | (2,529 | ) | | | (21,936 | ) | | | (37,260 | ) | | | (265,506 | ) |

Net increase/(decrease) | | | (1,550 | ) | | $ | (14,006 | ) | | | (95 | ) | | $ | (7,760 | ) |

| | | Investor Shares | |

| | | Period Ended

June 30, 2021 | | | Year Ended

December 31, 2020 | |

| | | Shares | | | Value | | | Shares | | | Value | |

Shares sold | | | 69,935 | | | $ | 591,440 | | | | 23,280 | | | $ | 160,788 | |

Shares issued in reinvestment of distributions | | | 12,674 | | | | 104,544 | | | | 33,743 | | | | 209,253 | |

Shares repurchased | | | (139,726 | ) | | | (1,148,618 | ) | | | (210,958 | ) | | | (1,419,979 | ) |

Net increase/(decrease) | | | (57,117 | ) | | $ | (452,634 | ) | | | (153,935 | ) | | $ | (1,049,938 | ) |

Shelton Emerging Market Fund | | Institutional Shares | |

| | | Period Ended

June 30, 2021 | | | Period Ended

December 31, 2020 | | | Year Ended

September 30, 2020 | |

| | | Shares | | | Value | | | Shares | | | Value | | | Shares | | | Value | |

Shares sold | | | 320,832 | | | $ | 6,530,525 | | | | 55,023 | | | $ | 972,867 | | | | 361,269 | | | $ | 5,104,041 | |

Shares issued in reinvestment of distributions | | | — | | | | — | | | | 2,309 | | | | 46,398 | | | | 47,764 | | | | 772,818 | |

Shares repurchased | | | (210,522 | ) | | | (4,303,605 | ) | | | (166,946 | ) | | | (2,859,468 | ) | | | (1,842,250 | ) | | | (26,676,989 | ) |

Net increase/(decrease) | | | 110,310 | | | $ | 2,226,920 | | | | (109,614 | ) | | $ | (1,840,203 | ) | | | (1,433,217 | ) | | $ | (20,800,130 | ) |

| | | Investor Shares | |

| | | Period Ended

June 30, 2021 | | | Period Ended

December 31, 2020 | | | Year Ended

September 30, 2020 | |

| | | Shares | | | Value | | | Shares | | | Value | | | Shares | | | Value | |

Shares sold | | | 31,247 | | | $ | 630,892 | | | | 1,032 | | | $ | 18,262 | | | | 14,115 | | | $ | 217,500 | |

Shares issued in reinvestment of distributions | | | — | | | | — | | | | 137 | | | | 2,728 | | | | 2,782 | | | | 44,734 | |

Shares repurchased | | | (30,243 | ) | | | (614,343 | ) | | | (15,622 | ) | | | (273,389 | ) | | | (53,368 | ) | | | (738,552 | ) |

Net increase/(decrease) | | | 1,004 | | | $ | 16,549 | | | | (14,453 | ) | | $ | (252,399 | ) | | | (36,471 | ) | | $ | (476,318 | ) |

Shelton International Select Equity Fund | | Institutional Shares | |

| | | Period Ended

June 30, 2021 | | | Year Ended

December 31, 2020 | |

| | | Shares | | | Value | | | Shares | | | Value | |

Shares sold | | | 1,862,335 | | | $ | 50,005,684 | | | | 2,852,650 | | | $ | 61,496,737 | |

Shares issued in reinvestment of distributions | | | — | | | | — | | | | 33,046 | | | | 794,614 | |

Shares gained with reorganization (Note 5) | | | — | | | | — | | | | 1,027,306 | | | | 21,305,921 | |

Shares repurchased | | | (1,417,464 | ) | | | (37,744,849 | ) | | | (1,475,934 | ) | | | (27,928,354 | ) |

Net increase/(decrease) | | | 444,871 | | | $ | 12,260,835 | | | | 2,437,068 | | | $ | 55,668,918 | |

| | | Investor Shares | |

| | | Period Ended

June 30, 2021 | | | Year Ended

December 31, 2020 | |

| | | Shares | | | Value | | | Shares | | | Value | |

Shares sold | | | 437,449 | | | $ | 11,581,828 | | | | 411,822 | | | $ | 9,231,323 | |

Shares issued in reinvestment of distributions | | | — | | | | — | | | | 2,976 | | | | 71,947 | |

Shares gained with reorganization (Note 5) | | | — | | | | — | | | | 94,062 | | | | 1,938,316 | |

Shares repurchased | | | (97,426 | ) | | | (2,600,216 | ) | | | (124,979 | ) | | | (2,681,441 | ) |

Net increase/(decrease) | | | 340,023 | | | $ | 8,981,612 | | | | 383,881 | | | $ | 8,560,145 | |

See accompanying notes to financial statements.

12

Statements of Changes in Net Assets (Continued) |

Shelton Tactical Credit Fund | | Institutional Shares | |

| | | Period Ended

June 30, 2021 | | | Year Ended

December 31, 2020 | |

| | | Shares | | | Value | | | Shares | | | Value | |

Shares sold | | | 684,802 | | | $ | 7,621,552 | | | | 772,060 | | | $ | 7,819,310 | |

Shares issued in reinvestment of distributions | | | 83,780 | | | | 934,065 | | | | 188,740 | | | | 1,841,491 | |

Shares repurchased | | | (287,397 | ) | | | (3,152,013 | ) | | | (3,803,066 | ) | | | (36,872,793 | ) |

Net increase/(decrease) | | | 481,185 | | | $ | 5,403,604 | | | | (2,842,266 | ) | | $ | (27,211,992 | ) |

| | | Investor Shares | |

| | | Period Ended

June 30, 2021 | | | Year Ended

December 31, 2020 | |

| | | Shares | | | Value | | | Shares | | | Value | |

Shares sold | | | 38,080 | | | $ | 421,581 | | | | 268,050 | | | $ | 2,797,120 | |

Shares issued in reinvestment of distributions | | | 8,984 | | | | 99,998 | | | | 44,314 | | | | 427,078 | |

Shares repurchased | | | (237,353 | ) | | | (2,600,394 | ) | | | (1,644,597 | ) | | | (15,604,908 | ) |

Net increase/(decrease) | | | (190,289 | ) | | $ | (2,078,815 | ) | | | (1,332,233 | ) | | $ | (12,380,710 | ) |

See accompanying notes to financial statements.

13

Shelton Tactical Credit Fund Statement of Cash Flows (Unaudited) For the Period Ended June 30, 2021 |

Increase/(Decrease) in Cash: | | | | |

Cash flows provided by/(used for) operating activities: | | | | |

Net increase in net assets resulting from operations | | $ | 3,308,178 | |

Adjustments to reconcile net decrease in net assets from operations to net cash provided by (used for) operating activities: | | | | |

Purchases of long-term portfolio investments | | | (48,499,108 | ) |

Sales of long-term portfolio investments | | | 53,430,166 | |

Proceeds from securities sold short | | | — | |

Cover short securities | | | (3,236,580 | ) |

Purchases of Options | | | (357,951 | ) |

Written Options | | | 457,037 | |

Sales/(Purchases) of short-term investments, net | | | — | |

Consent payment income received | | | — | |

Return of capital received | | | — | |

Cash used for corporate actions | | | — | |

Decrease/(Increase) in investment securities sold receivable | | | 2,093,906 | |

Increase/(Decrease) in payable for securities purchased | | | (2,730,000 | ) |

Increase/(Decrease) in payable for fund shares repurchased | | | (107,589 | ) |

Decrease/(Increase) in dividends and interest receivable | | | 162,474 | |

Increase/(Decrease) in distributions payable | | | 473,026 | |

Decrease/(Increase) in Fund Shares Sold | | | (487,693 | ) |

Decrease/(Increase) in due from advisor | | | (9,402 | ) |

Decrease/(Increase) in prepaid expenses | | | 2,184 | |

Increase/(Decrease) in advisory fees | | | 5,465 | |

Increase/(Decrease) in short dividends and interest payable | | | (59,857 | ) |

Increase/(Decrease) in accrued expenses | | | 29,456 | |

Net amortization on investments | | | (182,553 | ) |

Net realized loss/(gain) on investments | | | (771,360 | ) |

Net change in unrealized appreciation/depreciation | | | (1,844,233 | ) |

Net cash provided by operating activities | | | 1,675,566 | |

Cash flows provided by (used for) financing activities: | | | | |

Proceeds from shares sold | | | 9,077,196 | |

Cost of shares redeemed | | | (5,752,407 | ) |

Dividends paid to shareholders, net of reinvestments | | | (9,339 | ) |

Net cash provided by financing activities | | | 3,315,450 | |

| | | | | |

Net increase in cash | | | 4,991,015 | |

| | | | | |

Cash and cash equivalents: | | | | |

Beginning cash balance | | | — | |

Beginning cash held at broker | | | (4,962,373 | ) |

Total beginning cash and cash equivalents | | | (4,962,373 | ) |

| | | | | |

Ending cash balance | | | 28,642 | |

Ending cash held at/(due to) broker | | | — | |

Total ending cash and cash equivalents | | $ | 28,642 | |

See accompanying notes to financial statements.

14

Financial Highlights For a Share Outstanding Throughout Each Year or Period

|

Shelton BDC Income Fund | | Institutional Shares | | | Formerly

AR Capital

BDC Income

Fund | |

| | | Period Ended

June 30,

2021

(Unaudited) | | | Year Ended

December 31,

2020 | | | Year Ended

December 31,

2019 | | | Year Ended

December 31,

2018 | | | Year Ended

December 31,

2017 | | | Period Ended

December 31,

2016(a)(b) | | | Year Ended

March 31,

2016(c) | |

Net asset value, beginning of year | | $ | 7.30 | | | $ | 8.96 | | | $ | 7.75 | | | $ | 8.92 | | | $ | 9.11 | | | $ | 8.40 | | | $ | 9.65 | |

INCOME FROM INVESTMENT OPERATIONS | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income/(loss)(d) | | | 0.41 | | | | 0.65 | | | | 0.52 | | | | 0.71 | | | | 0.59 | | | | 0.44 | | | | 0.80 | |

Net gain/(loss) on securities (both realized and unrealized) | | | 1.05 | | | | (1.61 | ) | | | 1.41 | | | | (1.10 | ) | | | (0.22 | ) | | | 0.72 | | | | (1.36 | ) |

Total from investment operations | | | 1.46 | | | | (0.96 | ) | | | 1.93 | | | | (0.39 | ) | | | 0.37 | | | | 1.16 | | | | (0.56 | ) |

LESS DISTRIBUTIONS | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | (0.44 | ) | | | (0.70 | ) | | | (0.65 | ) | | | (0.78 | ) | | | (0.56 | ) | | | (0.45 | ) | | | (0.69 | ) |

Distributions from return of capital | | | — | | | | — | | | | (0.07 | ) | | | — | | | | — | | | | — | | | | — | |

Total distributions | | | (0.44 | ) | | | (0.70 | ) | | | (0.72 | ) | | | (0.78 | ) | | | (0.56 | ) | | | (0.45 | ) | | | (0.69 | ) |

Net asset value, end of year | | $ | 8.32 | | | $ | 7.30 | | | $ | 8.96 | | | $ | 7.75 | | | $ | 8.92 | | | $ | 9.11 | | | $ | 8.40 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total return | | | 20.50 | %(e) | | | (9.00 | )% | | | 25.32 | % | | | (4.80 | )% | | | 3.94 | % | | | 14.07 | %(e) | | | (5.76 | )%(f) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

RATIOS / SUPPLEMENTAL DATA | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of year or period (000s) | | $ | 270 | | | $ | 249 | | | $ | 306 | | | $ | 1,173 | | | $ | 1,610 | | | $ | 420 | | | $ | 443 | |

Ratio of expenses to average net assets:(g) | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Before expense reimbursements | | | 2.14 | %(h) | | | 2.62 | % | | | 1.95 | % | | | 1.78 | % | | | 1.78 | % | | | 2.53 | %(h) | | | 2.47 | % |

After expense reimbursements | | | 1.25 | %(h),(i) | | | 1.26 | %(i) | | | 1.27 | %(i) | | | 1.26 | %(i) | | | 1.25 | % | | | 1.24 | %(h) | | | 1.25 | % |

Ratio of net investment income/(loss) to average net assets(j) | | | | | | | | | | | | | | | | | | | | | | | | | | | 9.30 | % |

Before expense reimbursements | | | 9.16 | %(h) | | | 8.11 | % | | | 5.35 | % | | | 7.56 | % | | | 5.82 | % | | | 5.26 | %(h) | | | | |

After expense reimbursements | | | 10.06 | %(h) | | | 9.47 | % | | | 6.04 | % | | | 8.08 | % | | | 6.34 | % | | | 6.55 | %(h) | | | | |

Portfolio turnover | | | 27 | %(e) | | | 28 | % | | | 37 | % | | | 30 | % | | | 118 | % | | | 38 | %(e) | | | 166 | % |

(a) | For the nine months ended December 31, 2016. |

(b) | Following the acquisition on November 4, 2016, advisor class and class A were renamed Institutional and Investor Class. |

(c) | Audited by other independent registered public accounting firm. |

(d) | Calculated based upon average shares outstanding. |

(f) | Total returns shown exclude the effect of applicable sales loads/redemption fees. If the Adviser did not reimburse/waive a portion of the Fund’s expenses, total return would have been lower. Returns are not annualized |

(g) | Does not include expenses of investment companies in which the Fund invests. |

(i) | CCO Fees are not included in the expense limitation. |

(j) | Recognition of net investment income by the Fund is affected by the timing in which the Fund invests. The ratio does not include the net income of the investment companies in which the Fund invests. |

See accompanying notes to financial statements.

15

Financial Highlights For a Share Outstanding Throughout Each Year or Period

(Continued) |

Shelton BDC Income Fund | | Investor Shares | | | Formerly

AR Capital

BDC Income

Fund | |

| | | Period Ended

June 30,

2021

(Unaudited) | | | Year Ended

December 31,

2020 | | | Year Ended

December 31,

2019 | | | Year Ended

December 31,

2018 | | | Year Ended

December 31,

2017 | | | Period Ended

December 31,

2016(a)(b) | | | Year Ended

March 31,

2016(c) | |

Net asset value, beginning of year | | $ | 7.36 | | | $ | 9.08 | | | $ | 7.83 | | | $ | 9.01 | | | $ | 9.21 | | | $ | 8.51 | | | $ | 9.66 | |

INCOME FROM INVESTMENT OPERATIONS | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income/(loss)(d) | | | 0.39 | | | | 0.68 | | | | 0.60 | | | | 0.68 | | | | 0.54 | | | | 0.44 | | | | 0.70 | |

Net gain/(loss) on securities (both realized and unrealized) | | | 1.12 | | | | (1.68 | ) | | | 1.34 | | | | (1.11 | ) | | | (0.19 | ) | | | 0.71 | | | | (1.17 | ) |

Total from investment operations | | | 1.51 | | | | (1.00 | ) | | | 1.94 | | | | (0.43 | ) | | | 0.35 | | | | 1.15 | | | | (0.47 | ) |

LESS DISTRIBUTIONS | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | (0.47 | ) | | | (0.72 | ) | | | (0.62 | ) | | | (0.75 | ) | | | (0.55 | ) | | | (0.45 | ) | | | (0.68 | ) |

Distributions from return of capital | | | — | | | | — | | | | (0.07 | ) | | | — | | | | — | | | | — | | | | — | |

Total distributions | | | (0.47 | ) | | | (0.72 | ) | | | (0.69 | ) | | | (0.75 | ) | | | (0.55 | ) | | | (0.45 | ) | | | (0.68 | ) |

Net asset value, end of year | | $ | 8.40 | | | $ | 7.36 | | | $ | 9.08 | | | $ | 7.83 | | | $ | 9.01 | | | $ | 9.21 | | | $ | 8.51 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total return | | | 20.43 | %(e) | | | (9.26 | )% | | | 25.31 | % | | | (5.13 | )% | | | 3.73 | % | | | 13.74 | %(e) | | | (4.83 | )%(f) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

RATIOS / SUPPLEMENTAL DATA | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of year or period (000s) | | $ | 3,849 | | | $ | 3,795 | | | $ | 6,077 | | | $ | 8,430 | | | $ | 13,486 | | | $ | 13,614 | | | $ | 12,853 | |

Ratio of expenses to average net assets:(g) | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Before expense reimbursements | | | 2.38 | %(h) | | | 2.87 | % | | | 2.25 | % | | | 2.03 | % | | | 2.04 | % | | | 2.82 | %(h) | | | 2.66 | % |

After expense reimbursements | | | 1.50 | %(h),(i) | | | 1.51 | %(i) | | | 1.52 | %(i) | | | 1.51 | %(i) | | | 1.50 | % | | | 1.50 | %(h) | | | 1.45 | % |

Ratio of net investment income/(loss) to average net assets(j) | | | | | | | | | | | | | | | | | | | | | | | | | | | 7.89 | % |

Before expense reimbursements | | | 8.72 | %(h) | | | 8.36 | % | | | 6.10 | % | | | 7.13 | % | | | 5.21 | % | | | 5.16 | %(h) | | | | |

After expense reimbursements | | | 9.62 | %(h) | | | 9.72 | % | | | 6.83 | % | | | 7.65 | % | | | 5.73 | % | | | 6.48 | %(h) | | | | |

Portfolio turnover | | | 27 | %(e) | | | 28 | % | | | 37 | % | | | 30 | % | | | 118 | % | | | 38 | %(e) | | | 166 | % |

(a) | For the nine months ended December 31, 2016. |

(b) | Following the acquisition on November 4, 2016, advisor class and class A were renamed Institutional and Investor Class. |

(c) | Audited by other independent registered public accounting firm. |

(d) | Calculated based upon average shares outstanding. |

(f) | Total returns shown exclude the effect of applicable sales loads/redemption fees. If the Adviser did not reimburse/waive a portion of the Fund’s expenses, total return would have been lower. Returns are not annualized |

(g) | Does not include expenses of investment companies in which the Fund invests. |

(i) | CCO Fees are not included in the expense limitation. |

(j) | Recognition of net investment income by the Fund is affected by the timing in which the Fund invests. The ratio does not include the net income of the investment companies in which the Fund invests. |

See accompanying notes to financial statements.

16

Financial Highlights For a Share Outstanding Throughout Each Year or Period

(Continued) |

Shelton Emerging

Markets Fund(a)

Institutional Shares(b) | | Period Ended

June 30,

2021

(Unaudited) | | | Period Ended

December 31,

2020(c) | | | Year Ended

September 30,

2020 | | | Year Ended

September 30,

2019(d) | | | Year Ended

September 30,

2018(d) | | | Year Ended

September 30,

2017(d) | | | Year Ended

September 30,

2016(d) | |

Net asset value, beginning of year | | $ | 20.09 | | | $ | 15.33 | | | $ | 14.82 | | | $ | 16.22 | | | $ | 15.90 | | | $ | 14.28 | | | $ | 12.95 | |

INCOME FROM INVESTMENT OPERATIONS | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income/(loss)(e) | | | 0.01 | | | | (0.04 | ) | | | 0.01 | | | | 0.31 | | | | 0.31 | | | | 0.07 | | | | (0.00 | )(f) |

Net gain/(loss) on securities (both realized and unrealized) | | | 0.50 | | | | 4.84 | | | | 0.87 | | | | (1.24 | ) | | | 0.04 | | | | 1.55 | | | | 1.33 | |

Total from investment operations | | | 0.51 | | | | 4.80 | | | | 0.88 | | | | (0.93 | ) | | | 0.35 | | | | 1.62 | | | | 1.33 | |

LESS DISTRIBUTIONS | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | — | | | | (0.04 | ) | | | (0.37 | ) | | | (0.31 | ) | | | (0.03 | ) | | | — | | | | — | |

Distributions from capital gains | | | — | | | | — | | | | — | | | | (0.16 | ) | | | — | | | | — | | | | — | |

Total distributions | | | — | | | | (0.04 | ) | | | (0.37 | ) | | | (0.47 | ) | | | (0.03 | ) | | | — | | | | — | |

Net asset value, end of year or period | | $ | 20.60 | | | $ | 20.09 | | | $ | 15.33 | | | $ | 14.82 | | | $ | 16.22 | | | $ | 15.90 | | | $ | 14.28 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total return | | | 2.54 | %(g) | | | 31.29 | %(g) | | | 5.78 | % | | | (5.60 | )% | | | 2.21 | % | | | 11.34 | % | | | 10.27 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

RATIOS / SUPPLEMENTAL DATA | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of year (000s) | | $ | 28,667 | | | $ | 25,749 | | | $ | 21,354 | | | $ | 41,845 | | | $ | 50,897 | | | $ | 51,833 | | | $ | 45,786 | |

Ratio of expenses to average net assets: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Before expense reimbursements | | | 1.58 | %(h) | | | 1.48 | %(h) | | | 1.89 | % | | | 1.78 | % | | | 1.61 | % | | | 1.72 | % | | | 1.85 | % |

After expense reimbursements(i) | | | 1.54 | %(h) | | | 1.48 | %(h) | | | 1.61 | % | | | 1.56 | % | | | 1.55 | % | | | 1.55 | % | | | 1.55 | % |

Ratio of net investment income/(loss) to average net assets | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Before expense reimbursements | | | 0.08 | %(h) | | | (0.88 | )%(h) | | | (0.20 | )% | | | 1.81 | % | | | 1.83 | % | | | 0.29 | % | | | (0.32 | )% |

After expense reimbursements | | | 0.12 | %(h) | | | (0.88 | )%(h) | | | 0.08 | % | | | 2.03 | % | | | 1.89 | % | | | 0.46 | % | | | (0.32 | )% |

Portfolio turnover | | | 12 | %(g) | | | 27 | %(g) | | | 58 | % | | | 78 | % | | | 63 | % | | | 169 | % | | | 156 | % |

(a) | Formerly named ICON Emerging Markets Fund. |

(b) | Formerly named ICON Emerging Markets Fund - Class S. |

(c) | Fund changed its fiscal year end from September 30 to December 31. |

(d) | Audited by other independent registered public accounting firm. |

(e) | Calculated based upon average shares outstanding. |

(f) | Amount less than $(0.005). |

(i) | Effective for the year ended September 30, 2020 and thereafter, CCO Fees are not included in the expense limitation. For the year ended September 30, 2020, reorganization costs not included. For all years presented, interest expense, when applicable, is not included in the expense limitation. |

See accompanying notes to financial statements.

17

Financial Highlights For a Share Outstanding Throughout Each Year or Period

(Continued) |

Shelton Emerging

Markets Fund(a)

Investor Shares(b) | | Period Ended

June 30,

2021

(Unaudited) | | | Period Ended

December 31,

2020(c) | | | Year Ended

September 30,

2020 | | | Year Ended

September 30,

2019(d) | | | Year Ended

September 30,

2018(d) | | | Year Ended

September 30,

2017(d) | | | Year Ended

September 30,

2016(d) | |

Net asset value, beginning of year | | $ | 19.92 | | | $ | 15.20 | | | $ | 14.73 | | | $ | 16.08 | | | $ | 15.77 | | | $ | 14.20 | | | $ | 12.91 | |

INCOME FROM INVESTMENT OPERATIONS | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income/(loss)(e) | | | (0.02 | ) | | | (0.05 | ) | | | (0.01 | ) | | | 0.14 | | | | 0.24 | | | | 0.06 | | | | (0.01 | ) |

Net gain/(loss) on securities (both realized and unrealized) | | | 0.50 | | | | 4.81 | | | | 0.84 | | | | (1.10 | ) | | | 0.07 | | | | 1.51 | | | | 1.30 | |

Total from investment operations | | | 0.48 | | | | 4.76 | | | | 0.83 | | | | (0.96 | ) | | | 0.31 | | | | 1.57 | | | | 1.29 | |

LESS DISTRIBUTIONS | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | — | | | | (0.04 | ) | | | (0.36 | ) | | | (0.23 | ) | | | (0.00 | )(f) | | | — | | | | — | |

Distributions from capital gains | | | — | | | | — | | | | — | | | | (0.16 | ) | | | — | | | | — | | | | — | |

Total distributions | | | — | | | | (0.04 | ) | | | (0.36 | ) | | | (0.39 | ) | | | (0.00 | ) | | | — | | | | — | |

Net asset value, end of year or period | | $ | 20.40 | | | $ | 19.92 | | | $ | 15.20 | | | $ | 14.73 | | | $ | 16.08 | | | $ | 15.77 | | | $ | 14.20 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total return(g) | | | 2.41 | %(h) | | | 31.29 | %(h) | | | 5.48 | % | | | (5.87 | )% | | | 1.97 | % | | | 11.06 | % | | | 9.99 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

RATIOS / SUPPLEMENTAL DATA | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of year (000s) | | $ | 1,647 | | | $ | 1,588 | | | $ | 1,432 | | | $ | 1,925 | | | $ | 6,436 | | | $ | 12,887 | | | $ | 9,072 | |

Ratio of expenses to average net assets: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Before expense reimbursements | | | 1.84 | %(i) | | | 1.73 | %(i) | | | 2.54 | % | | | 2.26 | % | | | 1.96 | % | | | 2.12 | % | | | 2.16 | % |

After expense reimbursements(j) | | | 1.80 | %(i) | | | 1.73 | %(i) | | | 1.89 | % | | | 1.81 | % | | | 1.80 | % | | | 1.80 | % | | | 1.80 | % |

Ratio of net investment income/(loss) to average net assets | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Before expense reimbursements | | | (0.26 | )%(i) | | | (1.12 | )%(i) | | | (0.74 | )% | | | 0.45 | % | | | 1.32 | % | | | 0.08 | % | | | (0.43 | )% |

After expense reimbursements | | | (0.22 | )%(i) | | | (1.12 | )%(i) | | | (0.08 | )% | | | 0.90 | % | | | 1.48 | % | | | 0.40 | % | | | (0.07 | )% |

Portfolio turnover | | | 12 | %(h) | | | 27 | %(h) | | | 58 | % | | | 78 | % | | | 63 | % | | | 169 | % | | | 156 | % |

(a) | Formerly named ICON Emerging Markets Fund. |

(b) | Formerly named ICON Emerging Markets Fund - Class A. |

(c) | Fund changed its fiscal year end from September 30 to December 31. |

(d) | Audited by other independent registered public accounting firm. |

(e) | Calculated based upon average shares outstanding. |

(f) | Amount less than $(0.005). |

(g) | The total return calculation excludes any sales charges. |

(j) | Effective for the year ended September 30, 2020 and thereafter, CCO Fees are not included in the expense limitation. For the year ended September 30, 2020, reorganization costs not included. For all years presented, interest expense, when applicable, is not included in the expense limitation. |

See accompanying notes to financial statements.

18

Financial Highlights For a Share Outstanding Throughout Each Year

(Continued) |

Shelton International

Select Equity Fund

Institutional Shares(a) | | Period Ended

June 30,

2021

(Unaudited) | | | Year Ended

December 31,

2020 | | | Year Ended

December 31,

2019 | | | Year Ended

December 31,

2018 | | | Period Ended

December 31,

2017(b) | | | Year Ended

April 30,

2017 | | | Year Ended

April 30,

2016 (c) | |

Net asset value, beginning of year | | $ | 25.77 | | | $ | 22.02 | | | $ | 18.35 | | | $ | 21.34 | | | $ | 18.03 | | | $ | 15.90 | | | $ | 21.20 | |

INCOME FROM INVESTMENT OPERATIONS | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income/(loss)(d) | | | 0.13 | | | | 0.12 | | | | 0.29 | | | | 0.19 | | | | 0.10 | | | | 0.22 | | | | 0.25 | |

Net gain/(loss) on securities (both realized and unrealized) | | | 1.37 | | | | 3.84 | | | | 3.84 | | | | (2.97 | ) | | | 3.61 | | | | 2.13 | | | | (5.01 | ) |

Total from investment operations | | | 1.50 | | | | 3.96 | | | | 4.13 | | | | (2.78 | ) | | | 3.71 | | | | 2.35 | | | | (4.76 | ) |

LESS DISTRIBUTIONS | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | — | | | | (0.21 | ) | | | (0.46 | ) | | | (0.21 | ) | | | (0.39 | ) | | | (0.22 | ) | | | (0.54 | ) |

Distributions from return of capital | | | — | | | | — | | | | — | | | | — | | | | (0.01 | ) | | | — | | | | — | |

Distributions from capital gains | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

Total distributions | | | — | | | | (0.21 | ) | | | (0.46 | ) | | | (0.21 | ) | | | (0.40 | ) | | | (0.22 | ) | | | (0.54 | ) |

Redemption Fees | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

Net asset value, end of year | | $ | 27.27 | | | $ | 25.77 | | | $ | 22.02 | | | $ | 18.35 | | | $ | 21.34 | | | $ | 18.03 | | | $ | 15.90 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total return | | | 5.82 | %(e) | | | 18.07 | % | | | 22.53 | % | | | (13.17 | )% | | | 20.74 | % | | | 14.89 | %(e) | | | (22.36 | )%(f) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

RATIOS / SUPPLEMENTAL DATA | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of year or period (000s) | | $ | 147,451 | | | $ | 127,893 | | | $ | 55,619 | | | $ | 41,424 | | | $ | 42,824 | | | $ | 38,737 | | | $ | 44,133 | |

Ratio of expenses to average net assets: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Before expense reimbursements | | | 1.02 | %(g) | | | 1.04 | % | | | 1.12 | % | | | 1.36 | % | | | 1.32 | % | | | 1.76 | %(h) | | | 1.28 | %(h) |

After expense reimbursements | | | 1.00 | %(g) | | | 0.99 | % | | | 1.01 | % | | | 1.17 | % | | | 0.99 | % | | | 0.99 | % | | | 1.23 | % |

Ratio of net investment income/(loss) to average net assets | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Before expense reimbursements | | | 0.92 | %(g) | | | 0.49 | % | | | 1.28 | % | | | 0.73 | % | | | 0.41 | % | | | | | | | | |

After expense reimbursements | | | 0.96 | %(g) | | | 0.54 | % | | | 1.40 | % | | | 0.92 | % | | | 0.74 | % | | | 1.32 | % | | | 1.36 | % |

Portfolio turnover | | | 34 | %(e) | | | 46 | % | | | 49 | % | | | 65 | % | | | 24 | % | | | 41 | % | | | 40 | % |

(a) | As of July 28, 2017 Class A shares and I shares were renamed to Investor shares and Institutional shares, respectively. |

(b) | For the eight month period ended December 31, 2017. |

(c) | Audited by other independent registered public accounting firm. |

(d) | Calculated based upon average shares outstanding. |

(f) | Total investment return is calculated assuming a purchase of shares on the first day and a sale of shares on the last day of each period reported and includes

reinvestment of dividends and distributions, if any. For Investor Shares (Formerly Class A Shares), total investment return does not reflect the impact of the

maximum front-end sales load of 5.75%. If reflected, the return would be lower. |

(h) | During the period, certain fees were waived and/or reimbursed; or recouped, if any. If such fee waivers and/or reimbursements or recoupments had not occurred, the ratios would have been as indicated. |

See accompanying notes to financial statements.

19

Financial Highlights For a Share Outstanding Throughout Each Year or Period

(Continued) |

Shelton International

Select Equity Fund Investor Shares(a) | | Period Ended

June 30,

2021

(Unaudited) | | | Year Ended

December 31,

2020 | | | Year Ended

December 31,

2019 | | | Year Ended

December 31,

2018 | | | Period Ended

December 31,

2017(b) | | | Year Ended

April 30,

2017 | | | Year Ended

April 30,

2016(c) | |

Net asset value, beginning of year | | $ | 25.62 | | | $ | 21.91 | | | $ | 18.29 | | | $ | 21.30 | | | $ | 18.02 | | | $ | 15.88 | | | $ | 21.16 | |

INCOME FROM INVESTMENT OPERATIONS | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income/(loss)(d) | | | 0.11 | | | | 0.05 | | | | 0.24 | | | | 0.11 | | | | 0.08 | | | | 0.17 | | | | 0.19 | |

Net gain/(loss) on securities (both realized and unrealized) | | | 1.35 | | | | 3.80 | | | | 3.83 | | | | (2.94 | ) | | | 3.60 | | | | 2.13 | | | | (4.97 | ) |

Total from investment operations | | | 1.46 | | | | 3.85 | | | | 4.07 | | | | (2.83 | ) | | | 3.68 | | | | 2.30 | | | | (4.78 | ) |

LESS DISTRIBUTIONS | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | — | | | | (0.14 | ) | | | (0.45 | ) | | | (0.18 | ) | | | (0.39 | ) | | | (0.16 | ) | | | (0.50 | ) |

Distributions from return of capital | | | — | | | | — | | | | — | | | | — | | | | (0.01 | ) | | | — | | | | — | |

Distributions from capital gains | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

Total distributions | | | — | | | | (0.14 | ) | | | (0.45 | ) | | | (0.18 | ) | | | (0.40 | ) | | | (0.16 | ) | | | (0.50 | ) |

Redemption Fees | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

Net asset value, end of year | | $ | 27.08 | | | $ | 25.62 | | | $ | 21.91 | | | $ | 18.29 | | | $ | 21.30 | | | $ | 18.02 | | | $ | 15.88 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total return | | | 5.70 | %(e) | | | 17.64 | % | | | 22.25 | % | | | (13.41 | )% | | | 20.53 | % | | | 14.55 | %(e) | | | (22.51 | )%(f) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |