UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-05620

Virtus Total Return Fund Inc.

(Exact name of registrant as specified in charter)

101 Munson Street

Greenfield, MA 01301-9683

(Address of principal executive offices) (Zip code)

Kathryn Santoro, Esq.

Vice President, Chief Legal Officer, Counsel and Secretary for Registrant

One Financial Plaza

Hartford, CT 06103-2608

(Name and address of agent for service)

Registrant’s telephone number, including area code: 866-270-7788

Date of fiscal year end: November 30

Date of reporting period: November 30, 2024

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549-1090. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

| | (a) | Include a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Act (17 CFR 270.30e-1). |

The Report to Shareholders is attached herewith.

| Virtus Global Multi-Sector Income Fund |

| Virtus Stone Harbor Emerging Markets Income Fund |

| Virtus Total Return Fund Inc. |

Not FDIC Insured • No Bank Guarantee • May Lose Value

FUND DISTRIBUTIONS AND MANAGED DISTRIBUTION PLAN

The Board of Directors (the “Board,” or the “Directors”) of Virtus Total Return Fund Inc. (the “Fund”) has adopted a Managed Distribution Plan (the “Plan”) which provides for the Fund to make a monthly distribution at the rate of $0.05 per share. Under the terms of the Plan, the Fund seeks to maintain a consistent distribution level that may be paid in part or in full from net investment income, realized capital gains, and a return of capital, or a combination thereof.

If the Fund estimates that it has distributed more than its income and capital gains in a particular period, a portion of your distribution may be a return of capital. A return of capital may occur, for example, when some or all of the money that you invested in the Fund is paid back to you. A return of capital distribution does not necessarily reflect the Fund’s investment performance and should not be confused with “yield” or “income.”

You should not draw any conclusions about the Fund’s investment performance from the amount of the Fund’s distributions or from the terms of the Fund’s Plan.

The amounts and sources of distributions reported in the Fund’s notices issued pursuant to Section 19(a) of the Investment Company Act of 1940 are only estimates and are not being provided for tax reporting purposes. The actual amounts and sources of the amounts for tax reporting purposes will depend upon the Fund’s investment results during its fiscal year and may be subject to changes based on tax regulations. The Fund will send shareholders a Form 1099-DIV for the calendar year that will tell you how to report distributions for federal income tax purposes.

The Board may amend, suspend or terminate the Plan at any time, without prior notice to shareholders, if it deems such action to be in the best interest of the Fund and its shareholders.

Information on the Fund is available through the closed-end fund section on the web at

www.Virtus.com. Section 19(a) notices are posted on the website at:

https://www.virtus.com/ZTR

To Virtus Closed-End Fund Shareholders:

I am pleased to present this annual report, which reviews the performance of your Fund for the 12 months ended November 30, 2024.

The 12-month period saw strong returns across asset classes. Despite several unpredictable global events, markets were fueled by investor optimism about artificial intelligence (AI), as well as continued improvement in inflation data. The Federal Reserve (the “Fed”) began its much-anticipated easing of monetary policy, lowering its benchmark interest rate by a total of 0.75% during the fiscal year. Investors continued to believe that an economic soft landing would be possible, driving markets higher.

Domestic and international equity indexes posted strong returns for the 12 months ended November 30, 2024. U.S. large-capitalization stocks returned 33.89%, as measured by the S&P 500® Index, while small-cap stocks returned 36.43%, as measured by the Russell 2000® Index. Within international equities, developed markets, as measured by the MSCI EAFE® Index (net), returned 11.88%, roughly the same as emerging markets, which were up 11.86% as measured by the MSCI Emerging Markets Index (net).

In fixed income markets, the yield on the 10-year Treasury fell to 4.18% on November 30, 2024, from 4.37% on November 30, 2023. The broader U.S. fixed income market, as represented by the Bloomberg U.S. Aggregate Bond Index, was up 6.88% for the 12-month period, while non-investment grade bonds, as measured by the Bloomberg U.S. Corporate High Yield Bond Index, posted a strong return of 12.71%.

For the fiscal year, the three sectors of emerging markets (EM) debt returned 13.16% for hard currency sovereign debt, as represented by the JPMorgan EMBI Global Diversified Index, 11.54% for hard currency corporate debt, as represented by the JPMorgan CEMBI Broad Diversified Index, and 2.73% for local currency sovereign debt, as represented by the JPMorgan GBI-EM Global Diversified Index.

If you need assistance or have any questions about your Fund, please call our shareholder service team at 1-866-270-7788. We are grateful for your business and committed to your long-term financial success.

Sincerely,

George R. Aylward

President and Chief Executive Officer

Virtus Closed-End Funds

January 2025

Refer to the Fund Summary section for your Fund’s performance. Performance data quoted represents past results. Past performance is no guarantee of future results, and current performance may be higher or lower than the performance shown.

Global Multi-Sector Income Fund

MANAGER’S DISCUSSION OF FUND PERFORMANCE (Unaudited)

November 30, 2024

About the Fund:

Virtus Global Multi-Sector Income Fund’s (NYSE: VGI) (the “Fund”) investment objective is to maximize current income while preserving capital. The Fund seeks to achieve its investment objective by applying extensive credit research to capitalize on opportunities across undervalued areas of the global bond markets. There is no guarantee that the Fund will achieve its investment objective.

The use of leverage allows the Fund to borrow at short-term rates with the expectation to invest at higher yields on its investments. As of November 30, 2024, the Fund’s leverage consisted of $43 million of borrowings made pursuant to margin financing, which represented approximately 30% of the Fund’s total assets.

Manager Comments – Newfleet Asset Management (“Newfleet”)

Newfleet’s multi-sector fixed income strategies team manages the Fund, leveraging the knowledge and skills of investment professionals with expertise in every sector of the bond market, including evolving, specialized, and out-of-favor sectors. The team employs active sector rotation and disciplined risk management for portfolio construction, avoiding interest rate bets and remaining duration neutral. The following commentary is provided by the respective portfolio team at Newfleet and covers the Fund’s portfolio for the fiscal year ended November 30, 2024.

How did the markets perform during the Fund’s fiscal year ended November 30, 2024?

After U.S. economic data from the first half of 2024 kept the Federal Reserve’s (the “Fed”) interest rate activity on hold, continued improvement in inflation data and a rise in the unemployment rate gave the Fed the confidence to adjust monetary policy. The Fed lowered its benchmark interest rate by 0.50% in September, with a subsequent 0.25% cut in November. These were the first reductions since March 2020, during the height of the COVID pandemic, and since the rate hiking cycle began in March 2022 that led to 11 consecutive rate increases for a cumulative 5.25% of monetary policy tightening. U.S. economic performance remained remarkably resilient in the face of higher rates, and at the end of the reporting period, the U.S. still appeared to be headed toward the often-elusive soft landing.

The Fed joined the ranks of other central banks that had already commenced monetary policy easing, including the European Central Bank (“ECB”), the Bank of England, and central banks in Switzerland, Sweden, and Canada. On the other hand, the Bank of Japan stood out with its tightening bias. Global monetary policy remained semi-desynchronized during the fiscal year, with uncertainty about the pace and magnitude of rate cuts. This condition contributed to a stretch of volatility during the period as popular currency trades were adjusted to reflect this reality.

Through the end of the reporting period, the world navigated a year in which political activity was the most active in recent history, including a tumultuous U.S. election cycle that culminated in a win for President-Elect Trump. While the common theme this year was one of several “surprise” outcomes, resulting local financial market volatility proved short-lived and ultimately rewarded active managers who took advantage of dislocations.

For information regarding the indexes and certain key investment terms, see Key Investment Terms starting on page 18.

Global Multi-Sector Income Fund

MANAGER’S DISCUSSION OF FUND PERFORMANCE (Unaudited) (Continued)

November 30, 2024

Most risk markets rejoiced at the Goldilocks environment of slowing inflation, low unemployment, resilient earnings, and economic growth that exceeded expectations during the 12-month period. However, sensitivity to this data remained high, and results were varied during the period. Fixed income sector performance was also variable, with interest rates lowering during the period. Spread sectors, or securities other than risk-free government debt, outperformed U.S. Treasuries and spreads tightened. Spread refers to the additional yield over the yield of a risk-free government bond. Within spread sectors, longer duration and risk asset classes outperformed. The U.S. Treasury yield curve shifted lower, and the shape of the curve normalized. The 2-year Treasury yield decreased 0.53%, the 5-year Treasury yield decreased by 0.22%, the 10-year Treasury yield decreased by 0.16%, and the 30-year Treasury yield moved 0.13% lower.

What factors affected the Fund’s performance during its fiscal year?

For the 12 months ended November 30, 2024, the Fund’s net asset value (“NAV”) returned 13.92%, while its market price returned 24.05%. The Bloomberg Global Aggregate Bond Index, which serves as the Fund’s benchmark, returned 4.64%.

The Fund’s underweight to U.S. Treasuries contributed to performance during the period. Allocation and selection within corporate high yield and emerging markets high yield, as well as Fund positioning within investment grade corporate bonds, had a positive impact on performance for the 12-month period.

The Fund’s overweight to high quality Yankee bonds and selection within bank loans had a negative impact on performance during the period.

Level distribution practice

The Fund has a practice of seeking to maintain a specified level of monthly distributions to shareholders, which may be changed at any time. As a result of this practice, the Fund may pay distributions in excess of the Fund’s taxable net investment income and net realized gains. During the most recent fiscal year, the practice did not have a material impact on the Fund’s investment strategy. Please refer to the financial highlights and federal income tax information note in this report for further information about the Fund’s distributions and its effect on net asset value.

The preceding information is the opinion of portfolio management only through the end of the period of the report as stated on the cover. Any such opinions are subject to change at any time based upon market conditions and should not be relied upon as investment advice.

The Fund’s portfolio holdings are subject to change and may not be representative of the portfolio managers’ current or future investment decisions. The mention of individual securities held by the Fund is for informational purposes only and should not be construed as a recommendation to purchase or sell any securities. Investors seeking financial advice regarding the appropriateness of investing in any securities or investment strategies discussed should consult their financial professional.

For information regarding the indexes and certain key investment terms, see Key Investment Terms starting on page 18.

Global Multi-Sector Income Fund

MANAGER’S DISCUSSION OF FUND PERFORMANCE (Unaudited) (Continued)

November 30, 2024

Average Annual Total Returns1 for periods ended 11/30/24

| | 1 Year | 5 Years | 10 Years |

| Market Value1,2 | 24.05% | 2.56% | 4.55% |

| Net Asset Value1,2 | 13.92% | 2.69% | 3.80% |

| Bloomberg Global Aggregate Bond Index1,3 | 4.64% | -1.42% | 0.30% |

All returns represent past performance which is no guarantee of future results. Current performance may be higher or lower than the performance shown. Please visit Virtus.com for performance data current to the most recent month-end.

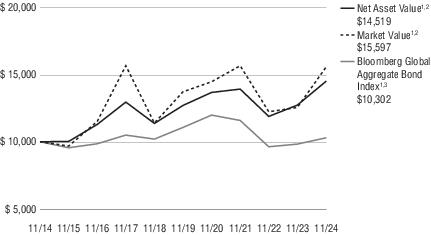

Growth of $10,000 for periods ended 11/30

This graph shows the change in value of a hypothetical investment of $10,000 in the Fund for the years indicated. For comparison, the same investment is shown in the indicated index.

| 1 | Performance data quoted represents past results. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown. Investment return and principal value will fluctuate so your shares, when redeemed, may be worth more or less than their original cost. |

| 2 | Performance reflects the deduction of Fund operating expenses. Performance does not reflect the incurrence of brokerage expenses, which typically apply to exchange traded products. Total return net of brokerage expenses would be lower than the total returns on market value shown in the table. Average annual total return is the annual compound return for the indicated period. It reflects the change in share price and the reinvestment of all dividends and capital gains. Returns for periods of one year or less are cumulative returns. |

| 3 | The index is unmanaged and not available for direct investment; therefore, its performance does not reflect the expenses associated with active management of an actual portfolio. |

For information regarding the indexes and certain key investment terms, see Key Investment Terms starting on page 18.

STONE HARBOR EMERGING MARKETS INCOME FUND

MANAGER’S DISCUSSION OF FUND PERFORMANCE (Unaudited)

November 30, 2024

About the Fund:

Virtus Stone Harbor Emerging Markets Income Fund’s (NYSE: EDF) (the “Fund”) investment objective is to maximize total return, which consists of income on its investments and capital appreciation. The Fund normally will invest at least 80% of its net assets (plus any borrowings for investment purposes) in emerging markets securities. There is no guarantee that the Fund will achieve its investment objective.

Effective December 15, 2023, the Virtus Stone Harbor Emerging Markets Total Income Fund was reorganized into Virtus Stone Harbor Emerging Markets Income Fund. The two funds had substantially similar investment objectives and strategies, and the same fund management. The merger resulted in a higher combined level of assets that may offer reduced costs, economies of scale, and increased efficiencies.

The use of leverage currently enables the Fund to borrow at short-term rates with the expectation of investing at higher yields on its investments. During the period, the Fund utilized short-term reverse repurchase agreements through which it borrowed money by selling securities under the obligation to repurchase them at a later date at a fixed price. The Fund’s management team adjusted borrowing levels to reflect the team’s outlook on emerging markets risk, increasing borrowings when it felt opportunities had improved and reducing borrowings when, in the team’s judgment, macroeconomic risk had risen. At November 30, 2024, the Fund had borrowings of approximately $50 million, which represented about 26% of the Fund’s managed assets.

Manager Comments – Stone Harbor Investment Partners (“Stone Harbor”)

Stone Harbor is a global credit specialist with expertise in emerging and developed markets debt. With three decades of informed experience allocating risk in complex areas of the fixed income markets, Stone Harbor manages global credit portfolios for institutional clients around the world. The following commentary is provided by the respective portfolio team at Stone Harbor and covers the Fund’s portfolio for the fiscal year ended November 30, 2024.

How did the markets perform during the Fund’s fiscal year ended November 30, 2024?

U.S. economic data and its implications for monetary policy remained key drivers of risk sentiment throughout much of the reporting period. Following several stronger-than-expected inflation readings in the second quarter of the fiscal year, softer inflation readings finally materialized around the start of the third quarter. Market participants interpreted the disinflationary trend as a precursor for interest rate cuts. This expectation bolstered investor sentiment ahead of the larger-than-expected initial rate cut of 0.50% by the U.S. Federal Reserve (the “Fed”) at its September meeting.

The move by the Fed and subsequent compression of U.S. interest rates helped to spur emerging markets (“EM”) debt performance. Bilateral and multilateral support, including from the International Monetary Fund (“IMF”), was instrumental in supporting several challenged, higher volatility securities. The period was also punctuated by the U.S. presidential race and Donald Trump’s victory, which reignited concerns about trade relations with several large trading partners, including China and Mexico.

For information regarding the indexes and certain key investment terms, see Key Investment Terms starting on page 18.

STONE HARBOR EMERGING MARKETS INCOME FUND

MANAGER’S DISCUSSION OF FUND PERFORMANCE (Unaudited) (Continued)

November 30, 2024

Against this backdrop, the yield on the 10-year U.S. Treasury closed at 4.18% at the end of the reporting period after reaching a period high of 4.70% in April 2024 amid renewed uncertainty about U.S. interest rate policy. Total returns of indexes for emerging markets hard currency sovereign and corporate debt were 13.16% and 11.54%, as represented by the JPMorgan EMBI Global Diversified Index and the JPMorgan CEMBI Broad Diversified Index, respectively, for the 12-month period. Local currency sovereign debt, as represented by the JPMorgan GBI-EM Global Diversified Index, underperformed, posting a total return of 2.73%. The average yield of local currency sovereign debt during the period was 6.30%.

What factors affected the Fund’s performance during its fiscal year?

The Fund’s total return on net asset value (“NAV”) for the 12 months ended November 30, 2024 was 30.38%, while its market price returned 32.71%. For the same period, the Fund’s composite benchmark, which is composed of the three sectors of emerging markets debt (hard currency sovereign debt, corporate debt and local currency sovereign debt), returned 9.09%. A key driver of the Fund’s performance was positive returns from country selection in hard currency sovereign debt.

At the country level, the largest contributors to performance were U.S. dollar-denominated sovereign debt in Argentina, followed by Ecuador and Egypt. U.S. dollar-denominated corporate debt in Mexico, Indonesia, and Colombia also enhanced performance. Other contributors to performance included local currency debt exposure in South Africa, Colombia, and Indonesia.

Some of the positive attribution was offset by other local currency debt exposures, particularly in Brazil, Mexico, and Kazakhstan. The Fund’s exposure to hard currency sovereign debt in Panama, Oman, and Hungary also detracted from performance, although to a much lesser extent.

The Fund uses various derivative instruments to implement its strategies. These derivatives are utilized to manage the Fund’s credit risk, interest rate risk, and foreign exchange risk, and to efficiently gain certain investment exposures. Derivative positions may increase or decrease the Fund’s exposure to these risks. For the reporting period, derivatives contributed 6.41% to Fund performance.

Level distribution practice

The Fund has a practice of seeking to maintain a specified level of monthly distributions to shareholders, which may be changed at any time. As a result of this practice, the Fund may pay distributions in excess of the Fund’s taxable net investment income and net realized gains. During the most recent fiscal year, the practice did not have a material impact on the Fund’s investment strategy. Please refer to the financial highlights and federal income tax information note in this report for further information about the Fund’s distributions and its effect on net asset value.

The preceding information is the opinion of portfolio management only through the end of the period of the report as stated on the cover. Any such opinions are subject to change at any time based upon market conditions and should not be relied upon as investment advice.

For information regarding the indexes and certain key investment terms, see Key Investment Terms starting on page 18.

STONE HARBOR EMERGING MARKETS INCOME FUND

MANAGER’S DISCUSSION OF FUND PERFORMANCE (Unaudited) (Continued)

November 30, 2024

The Fund’s portfolio holdings are subject to change and may not be representative of the portfolio managers’ current or future investment decisions. The mention of individual securities held by the Fund is for informational purposes only and should not be construed as a recommendation to purchase or sell any securities. Investors seeking financial advice regarding the appropriateness of investing in any securities or investment strategies discussed should consult their financial professional.

For information regarding the indexes and certain key investment terms, see Key Investment Terms starting on page 18.

STONE HARBOR EMERGING MARKETS INCOME FUND

MANAGER’S DISCUSSION OF FUND PERFORMANCE (Unaudited) (Continued)

November 30, 2024

Average Annual Total Returns1 for periods ended 11/30/24

| | 1 Year | 5 Years | 10 Years |

| Market Value1,2 | 32.71% | -4.12% | 2.70% |

| Net Asset Value1,2 | 30.38% | 3.56% | 2.65% |

| Composite Index1,3 | 9.09% | 0.91% | 2.37% |

| J.P. Morgan GBI-EM Global Diversified Index1,3 | 2.73% | -0.67% | 0.02% |

| J.P. Morgan CEMBI Broad Diversified Index1,3 | 11.54% | 2.48% | 3.89% |

| J.P. Morgan EMBI Global Diversified Index1,3 | 13.16% | 0.80% | 3.04% |

All returns represent past performance which is no guarantee of future results. Current performance may be higher or lower than the performance shown. Please visit Virtus.com for performance data current to the most recent month-end.

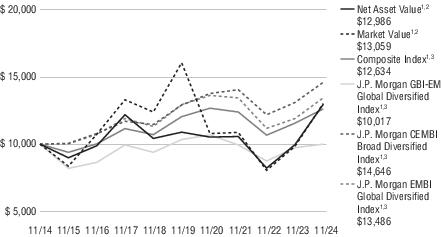

Growth of $10,000 for periods ended 11/30

This graph shows the change in value of a hypothetical investment of $10,000 in the Fund for the years indicated. For comparison, the same investment is shown in the indicated index.

| 1 | Past performance is not indicative of future results. Current performance may be lower or higher than performance in historical periods. |

For information regarding the indexes and certain key investment terms, see Key Investment Terms starting on page 18.

STONE HARBOR EMERGING MARKETS INCOME FUND

MANAGER’S DISCUSSION OF FUND PERFORMANCE (Unaudited) (Continued)

November 30, 2024

| 2 | Total return on market value is calculated assuming a purchase of common shares on the opening of the first day and sale on the closing of the last day of each period reported. Dividends and distributions are assumed, for purposes of this calculation, to be reinvested at prices obtained under the Fund’s Automatic Reinvestment and Cash Purchase Plan. Total return on market value is not annualized for periods of less than one year. Brokerage commissions that a shareholder may pay are not reflected. Total return on market value does not reflect the deduction of taxes that a shareholder may pay on fund distributions or the sale of fund shares. Total return on net asset value uses the same methodology, but with use of net asset value for the beginning, ending and reinvestment values. |

| 3 | The indexes are unmanaged and not available for direct investment; therefore, their performance does not reflect the expenses associated with active management of an actual portfolio. |

For information regarding the indexes and certain key investment terms, see Key Investment Terms starting on page 18.

TOTAL RETURN FUND INC.

MANAGER’S DISCUSSION OF FUND PERFORMANCE (Unaudited)

November 30, 2024

About The Fund

Virtus Total Return Fund Inc. (NYSE: ZTR) (the “Fund”) has an investment objective of capital appreciation, with current income as a secondary objective. The Fund seeks to meet its objectives through a balance of equity and fixed income investments. There is no guarantee that the Fund will achieve its investment objectives.

The use of leverage currently enables the Fund to borrow at short-term rates with the expectation of investing at higher yields on its investments. As of November 30, 2024, the Fund’s leverage consisted of $168 million of borrowings made pursuant to margin financing, which represented approximately 28% of the Fund’s total assets.

On March 11, 2024, the Fund announced a Tender Offer Program intended to enhance shareholder value, provide shareholders with an additional source of liquidity for their investment, and provide the potential to reduce the Fund’s trading discount to its NAV over time. The Tender Offer Program consists of a tender offer for 10% of the Fund’s outstanding shares at 98% of NAV and two conditional tender offers. As part of the program, the Fund conducted a tender offer for 10% of its outstanding shares and on May 7, 2024, announced that the Fund accepted 6,857,832 shares for payment on May 8, 2024 at a price of 98% of NAV, or $5.9976. On December 2, 2024, after the Fund’s fiscal year-end of November 30, 2024, the Fund announced it met the conditions to trigger its first conditional tender offer when the average trading discount during the measurement period exceeded 12%. The Fund commenced the conditional tender offer for 10% of its outstanding shares at 98% of NAV on January 7, 2025 with an expiration on February 6, 2025, unless extended. The Tender Offer Program concludes with a second conditional tender offer for up to 10% of the Fund’s then outstanding shares at 98% of NAV if the Fund’s average trading discount exceeds 10% during the consecutive 180 calendar day period beginning April 1, 2025.

For the fiscal year ended November 30, 2024, the Fund’s NAV returned 24.24%, including $0.60 in reinvested distributions, and its market price returned 28.66%. For the same period, the Fund’s composite benchmark, which consists of 60% FTSE Developed Core Infrastructure 50/50 Index (net) (representing equities) and 40% Bloomberg U.S. Aggregate Bond Index (representing fixed income) returned 15.00%.

Manager Comments – Duff & Phelps Investment Management Co. (“DPIM”)

The equity portion of the Fund is invested globally in owners/operators of infrastructure in the communications, utility, energy, and transportation industries (also referred to as “essential services”). DPIM manages the equity portion of the Fund’s portfolio, utilizing its global infrastructure strategy that leverages the company’s in-depth fundamental research expertise in income-producing securities. The following commentary is provided by the portfolio management team at DPIM and covers the Fund’s equity portion for the fiscal year ended November 30, 2024.

For information regarding the indexes and certain key investment terms, see Key Investment Terms starting on page 18.

TOTAL RETURN FUND INC.

MANAGER’S DISCUSSION OF FUND PERFORMANCE (Unaudited) (Continued)

November 30, 2024

How did the equity markets perform during the Fund’s fiscal year ended November 30, 2024?

Global developed market equities rose 27.83%, as measured by the MSCI World Index (net), during the 2024 fiscal year. This was a spectacular return, particularly in a year that was overshadowed by geopolitical and economic uncertainty. Central banks initiated interest rate cuts, and investors increasingly believed a soft landing for the economy could be achieved. Optimism surrounding artificial intelligence (“AI”) was also a key driver of market performance, especially in the U.S. In November, the U.S. elections triggered a risk-on trade, while reactions were more cautious outside of the U.S. due to concerns about the potential for future trade conflicts.

The benchmark for the equity portion of the Fund, the FTSE Developed Core Infrastructure 50/50 Index (net), returned 20.58% for the 12-month period, trailing the broader market. Midstream energy and utilities led the way as AI emerged as a powerful new driver of long-term growth. The nearly insatiable power demands of AI data centers led to an “all-of-the-above” approach that featured natural gas-fired power generation and nuclear power in addition to renewables.

Communications and transportation lagged the infrastructure benchmark as macroeconomic conditions tempered investor enthusiasm. Tower stocks and toll roads were challenged by their interest rate sensitivity as rates remained high for most of the year. North American railroads trailed as an anticipated rebound in freight volumes and earnings growth was delayed. European airports provided a bright spot as passenger volumes continued a multi-year rebound.

What factors affected the performance of the Fund’s equity portfolio during the fiscal year?

For the 12 months ended November 30, 2024, the equity portion of the Fund, including the impact of leverage employed by the Fund, returned 31.14% (gross of fees and expenses), while the FTSE Developed Core Infrastructure 50/50 Index (net), which serves as the portfolio’s benchmark, returned 20.58%.

Overall, sector allocation negatively impacted relative returns, while stock selection had a positive impact. Sector allocation was hurt by overweight positions in communications and transportation, as well as an underweight in utilities. The portfolio’s overweight position in midstream energy had a positive allocation impact. Positive stock selection in transportation and communications was partly offset by negative selection in utilities and midstream energy.

For information regarding the indexes and certain key investment terms, see Key Investment Terms starting on page 18.

TOTAL RETURN FUND INC.

MANAGER’S DISCUSSION OF FUND PERFORMANCE (Unaudited) (Continued)

November 30, 2024

At the security level, the largest contributors to performance were NextEra Energy, Aena SME SA, and Targa Resources. NextEra Energy, an electric utility and leading provider of renewable energy in North America, restored investor confidence in its renewables development pipeline by posting record levels of new contracts. In addition, rate case reviews and investigations at its Florida Power & Light regulated utility subsidiary were resolved without any material impact to the company. Spanish airport operator Aena was supported by robust passenger traffic across Europe during the summer holiday season and solid schedules for the winter months. Targa Resources is an integrated midstream energy company that benefited from volume growth and reported sector-leading earnings growth during the fiscal year. Targa also executed significant share repurchases while announcing a substantial dividend increase and maintaining a robust capital spending program.

The largest detractors from performance in the portfolio were Energias de Portugal SA (EDP), Xcel Energy, and Atlas Arteria. EDP, an out-of-benchmark holding based in Portugal, is an integrated electric and gas utility that is also a leading developer of renewable energy. EDP’s stock declined amid commissioning delays at some renewable power projects and lower European power prices during the year. In addition, the stock came under pressure as investors feared that EDP’s renewables portfolio in the U.S. could face risks if the Inflation Reduction Act of 2022 (IRA) is repealed. Xcel Energy is a multi-state electric and natural gas utility. Xcel’s stock traded lower after one of the company’s electric transmission lines sparked a large wildfire in the panhandle of Texas. The Fund sold its position in Xcel Energy over concerns that the company’s large footprint in western U.S. states posed a risk due to the potential liabilities’ utilities may incur in the absence of improved state legislation. Atlas Arteria, an Australian toll road operator with toll roads in Europe and the U.S., was held at an underweight position and was ultimately sold during the reporting period. The stock lagged due to the approaching expiration of its stake in French toll roads, the company’s largest asset, and management has found it difficult to offset the upcoming value erosion.

Manager Comments - Newfleet Asset Management (“Newfleet”)

How did the fixed income markets perform during the Fund’s fiscal year ended November 30, 2024?

After U.S. economic data from the first half of 2024 kept the Federal Reserve’s (the “Fed”) interest rate activity on hold, continued improvement in inflation data and a rise in the unemployment rate gave the Fed the confidence to adjust monetary policy. The Fed lowered its benchmark interest rate by 0.50% in September, with a subsequent 0.25% cut in November. These were the first reductions since March 2020, during the height of the COVID pandemic, and since the rate hiking cycle began in March 2022 that led to 11 consecutive rate increases for a cumulative 5.25% of monetary policy tightening. U.S. economic performance remained remarkably resilient in the face of higher rates, and at the end of the reporting period, the U.S. still appeared to be headed toward the often-elusive soft landing.

For information regarding the indexes and certain key investment terms, see Key Investment Terms starting on page 18.

TOTAL RETURN FUND INC.

MANAGER’S DISCUSSION OF FUND PERFORMANCE (Unaudited) (Continued)

November 30, 2024

The Fed joined the ranks of other central banks that had already commenced monetary policy easing, including the European Central Bank (“ECB”), the Bank of England, and central banks in Switzerland, Sweden, and Canada. On the other hand, the Bank of Japan stood out with its tightening bias. Global monetary policy remained semi-desynchronized during the fiscal year, with uncertainty about the pace and magnitude of rate cuts. This condition contributed to a stretch of volatility during the period as popular currency trades were adjusted to reflect this reality.

Through the end of the reporting period, the world navigated a year in which political activity was the most active in recent history, including a tumultuous U.S. election cycle that culminated in a win for President-Elect Trump. While the common theme this year was one of several “surprise” outcomes, resulting local financial market volatility proved short-lived and ultimately rewarded active managers who took advantage of dislocations.

Most risk markets rejoiced at the Goldilocks environment of slowing inflation, low unemployment, resilient earnings, and economic growth that exceeded expectations during the 12-month period. However, sensitivity to this data remained high, and results were varied during the period. Fixed income sector performance was also variable, with interest rates lowering during the period. Spread sectors, or securities other than risk-free government debt, outperformed U.S. Treasuries and spreads tightened. Spread refers to the additional yield over the yield of a risk-free government bond. Within spread sectors, longer duration and risk asset classes outperformed. The U.S. Treasury yield curve shifted lower, and the shape of the curve normalized. The 2-year Treasury yield decreased 0.53%, the 5-year Treasury yield decreased by 0.22%, the 10-year Treasury yield decreased by 0.16%, and the 30-year Treasury yield moved 0.13% lower.

What factors affected the performance of the Fund’s fixed income portfolio during the fiscal year?

For the 12 months ended November 30, 2024, the fixed income portion of the Fund, including the impact of leverage employed by the Fund, returned 15.88% (gross of fees and expenses), while the Bloomberg U.S. Aggregate Bond Index, which serves as the portfolio’s benchmark, returned 6.88%.

The portfolio’s underweight to U.S. Treasuries contributed to performance for the period. Allocation and selection within corporate high yield, the portfolio’s allocation to emerging markets high yield, and positioning within investment grade corporate bonds had a positive impact on performance for the 12-month period.

The portfolio’s yield curve positioning relative to the Bloomberg U.S. Aggregate Index detracted from performance, as did the underweight to investment grade corporate bonds, which performed well during the period. Selection within bank loans and emerging markets high yield had a negative impact on performance during the period.

For information regarding the indexes and certain key investment terms, see Key Investment Terms starting on page 18.

TOTAL RETURN FUND INC.

MANAGER’S DISCUSSION OF FUND PERFORMANCE (Unaudited) (Continued)

November 30, 2024

Managed Distribution Plan

As discussed on the inside cover of this Report, the Fund currently operates under a Managed Distribution Plan (the “Plan”) pursuant to which the Fund makes a monthly distribution at a rate of $0.05 per share. As a result of execution on the Plan, the Fund may pay distributions in excess of the Fund’s taxable net investment income and net realized gains. During the most recent fiscal year, the Plan did not have a material impact on the Fund’s investment strategy. Please refer to the financial highlights and federal income tax information note in this report for further information about the Fund’s distributions and its effect on net asset value.

The preceding information is the opinion of portfolio management only through the end of the period of the report as stated on the cover. Any such opinions are subject to change at any time based upon market conditions and should not be relied upon as investment advice.

The Fund’s portfolio holdings are subject to change and may not be representative of the portfolio managers’ current or future investment decisions. The mention of individual securities held by the Fund is for informational purposes only and should not be construed as a recommendation to purchase or sell any securities. Investors seeking financial advice regarding the appropriateness of investing in any securities or investment strategies discussed should consult their financial professional.

For information regarding the indexes and certain key investment terms, see Key Investment Terms starting on page 18.

TOTAL RETURN FUND INC.

MANAGER’S DISCUSSION OF FUND PERFORMANCE (Unaudited) (Continued)

November 30, 2024

Average Annual Total Returns1 for periods ended 11/30/24

| | 1 Year | 5 Years | 10 Years |

| Market Value1,2 | 28.66% | 0.83% | 5.56% |

| Net Asset Value1,2 | 24.24% | 5.25% | 6.18% |

| Virtus Total Return Fund Inc. Linked Benchmark1 | 15.00% | 3.39% | 3.90% |

| Bloomberg U.S. Aggregate Bond Index1,3 | 6.88% | -0.01% | 1.52% |

| FTSE Developed Core Infrastructure 50/50 Index (net)1,3 | 20.58% | 5.23% | 6.00% |

All returns represent past performance which is no guarantee of future results. Current performance may be higher or lower than the performance shown. Please visit Virtus.com for performance data current to the most recent month-end.

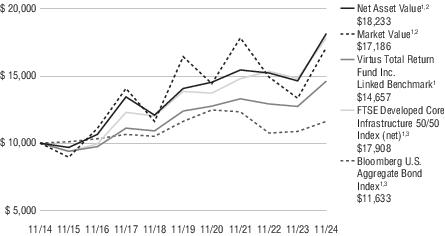

Growth of $10,000 for periods ended 11/30

This graph shows the change in value of a hypothetical investment of $10,000 in the Fund for the years indicated. For comparison, the same investment is shown in the indicated index.

| 1 | Past performance is not indicative of future results. Current performance may be lower or higher than performance in historical periods. |

For information regarding the indexes and certain key investment terms, see Key Investment Terms starting on page 18.

TOTAL RETURN FUND INC.

MANAGER’S DISCUSSION OF FUND PERFORMANCE (Unaudited) (Continued)

November 30, 2024

| 2 | Total return on market value is calculated assuming a purchase of common shares on the opening of the first day and sale on the closing of the last day for each period reported. Dividends and distributions are assumed, for the purpose of this calculation, to be reinvested at prices under the Fund’s Automatic Reinvestment and Cash Purchase Plan. Total return on market value is not annualized for periods of less than one year. Brokerage commissions that a shareholder may pay are not reflected. Total return on market value does not reflect the deduction of taxes that a shareholder may pay on fund distributions or the sale of fund shares. Total return on net asset value uses the same methodology, but with the use of net asset value for beginning and ending values. |

| 3 | The index is unmanaged and not available for direct investment; therefore, its performance does not reflect the expenses associated with active management of an actual portfolio. |

For information regarding the indexes and certain key investment terms, see Key Investment Terms starting on page 18.

PORTFOLIO HOLDINGS SUMMARY WEIGHTINGS (Unaudited)

November 30, 2024

The following tables present the portfolio holdings within certain industries/sectors or countries as a percentage of total investments (excluding reverse repurchase agreements and swap contracts) at November 30, 2024.

Asset Allocation

Global Multi-Sector Income Fund

| Corporate Bonds and Notes | | 40% |

| Financials | 13% | |

| Energy | 9 | |

| Industrials | 4 | |

| All other Corporate Bonds and Notes | 14 | |

| Foreign Government Securities | | 30 |

| Mortgage-Backed Securities | | 12 |

| Leveraged Loans | | 10 |

| Asset-Backed Securities | | 7 |

| U.S. Government Securities | | 1 |

| Total | | 100% |

Stone Harbor Emerging Markets Income Fund

| Foreign Government Securities | | 71% |

| Corporate Bonds and Notes | | 27 |

| Exploration & Production | 14% | |

| Financial & Lease | 3 | |

| Electric | 3 | |

| Refining | 2 | |

| All other Corporate Bonds and Notes | 5 | |

| Credit Linked Notes | | 2 |

| Total | | 100% |

Total Return Fund Inc.

| Common Stocks | | 76% |

| Utilities | 37% | |

| Industrials | 20 | |

| Energy | 13 | |

| All Other Common Stocks | 6 | |

| Corporate Bonds and Notes | | 9 |

| Financials | 3 | |

| Energy | 2 | |

| Industrials | 1 | |

| All Other Corporate Bonds and Notes | 3 | |

| Mortgage-Backed Securities | | 5 |

| Leveraged Loans | | 3 |

| Asset-Backed Securities | | 3 |

| Foreign Government Securities | | 3 |

| U.S. Government Securities | | 1 |

| Total | | 100% |

PORTFOLIO HOLDINGS SUMMARY WEIGHTINGS (Unaudited) (Continued)

Global Multi-Sector Income Fund

| United States | 53% |

| Mexico | 4 |

| Turkey | 3 |

| Saudi Arabia | 3 |

| Indonesia | 3 |

| United Arab Emirates | 2 |

| Canada | 2 |

| Other | 30 |

| Total | 100% |

Stone Harbor Emerging Markets Income Fund

| Mexico | 14% |

| Argentina | 11 |

| Ecuador | 10 |

| Brazil | 6 |

| Egypt | 5 |

| Iraq | 5 |

| Gabon | 5 |

| Other | 44 |

| Total | 100% |

Total Return Fund Inc.

| United States | 62% |

| Spain | 9 |

| Canada | 8 |

| United Kingdom | 5 |

| Netherlands | 3 |

| Switzerland | 2 |

| Germany | 2 |

| Other | 9 |

| Total | 100% |

KEY INVESTMENT TERMS (Unaudited)

November 30, 2024

Bloomberg Global Aggregate Bond Index

The Bloomberg Global Aggregate Bond Index is a flagship measure of global investment grade debt from twenty-four local currency markets. This multi-currency benchmark includes treasury, government-related, corporate and securitized fixed-rate bonds from both developed and emerging markets issuers. The index is calculated on a total return basis. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and is not available for direct investment.

Bloomberg U.S. Aggregate Bond Index

The Bloomberg U.S. Aggregate Bond Index measures the U.S. investment-grade fixed-rate bond market. The index is calculated on a total return basis. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and it is not available for direct investment.

Bloomberg U.S. Corporate High Yield Bond Index

The Bloomberg U.S. Corporate High Yield Bond Index measures the U.S. dollar-denominated, high yield, fixed-rate corporate bond market. The index is calculated on a total return basis. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and it is not available for direct investment.

Stone Harbor Emerging Markets Income Fund Composite Index: 33% J.P. Morgan EMBI Global Diversified / 33% J.P. Morgan CEMBI Broad Diversified / 33% J.P. Morgan GBI-EM Global Diversified

The Stone Harbor Emerging Markets Income Fund composite index consists of 33.33% J.P. Morgan EMBI Global Diversified Index, 33.33% J.P. Morgan CEMBI Broad Diversified Index and 33.33% J.P. Morgan GBI-EM Global Diversified Index. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and it is not available for direct investment.

Designated Activity Company (“DAC”)

A new company type that was created as part of the New Companies Act 2014, which came into force on June 1st, 2015, in Ireland. This limited company type is applicable to those companies who wish to outline and define a specific type of business in their constitution, rather than have unlimited powers as per the LTD company type.

European Central Bank (“ECB”)

The ECB is responsible for conducting monetary policy for the Euro zone. The ECB was established as the core of the Eurosystem and the European System of Central Banks (“ESCB”). The ESCB comprises the ECB and the National Central Banks of all 17 European Union Member States whether or not they have adopted the Euro.

European Union (“EU”)

The EU is a unique economic and political union of 28 European countries. The EU was created in the aftermath of the Second World War and has developed an internal single market through a standardized system of laws that apply to all member states. A monetary union was established in 1999 and is composed of the 19 member states which use the Euro currency.

Exchange-Traded Fund (“ETF”)

An open-end fund that is traded on a stock exchange. Most ETFs have a portfolio of stocks or bonds that track a specific market index.

Federal Reserve (the “Fed”)

The central bank of the U.S., responsible for controlling money supply, interest rates and credit with the goal of keeping the U.S. economy and currency stable. Governed by a seven-member

KEY INVESTMENT TERMS (Unaudited) (Continued)

November 30, 2024

board, the system includes 12 regional Federal Reserve Banks, 25 branches, and all national and state banks that are part of the system.

FTSE Developed Core Infrastructure 50/50 Index (net)

The FTSE Developed Core Infrastructure 50/50 Index (net) is a free float-adjusted market capitalization-weighted index that gives participants an industry-defined interpretation of infrastructure and adjusts the exposure to certain infrastructure sub-sectors. The constituent weights for the index are 50% utilities, 30% transportation including capping of 7.5% for railroads/railways and a 20% mix of other sectors including pipelines, satellites, and telecommunication towers. The index is calculated on a total return basis with net dividends reinvested. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and is not available for direct investment.

Hard Currency

Hard currency refers to a currency that is generally issued by developed countries, globally traded, and seen as politically and economically stable. Generally, when a fund invests in hard currency sovereign debt, that debt is denominated in U.S. Dollars.

International Monetary Fund (“IMF”)

The International Monetary Fund is a major financial agency of the United Nations, and an international financial institution, headquartered in Washington, D.C., consisting of 190 countries. The IMF works to achieve sustainable growth and prosperity for all of its member countries by supporting economic policies that promote financial stability and monetary cooperation, which are essential to increase productivity, job creation, and economic well-being.

J.P. Morgan CEMBI Broad Diversified Index

The J.P. Morgan CEMBI Broad Diversified Index tracks total returns of U.S. dollar-denominated debt instruments issued by corporate entities in emerging market countries and consists of an investable universe of corporate bonds. The minimum amount outstanding required is $300 million for the J.P. Morgan CEMBI Broad Diversified. The J.P. Morgan CEMBI Broad Diversified limits the weights of those index countries with larger corporate debt stocks by only including a specified portion of these countries’ eligible current face amounts of debt outstanding. The index is calculated on a total return basis. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and it is not available for direct investment.

J.P. Morgan EMBI Global Diversified Index

The J.P. Morgan EMBI Global Diversified Index (EMBI Global Diversified) tracks total returns for U.S. dollar-denominated debt instruments issued by emerging markets sovereign and quasi-sovereign entities: Brady bonds, loans, and Eurobonds. The index limits the weights of those index countries with larger debt stocks by only including specified portions of these countries’ eligible current face amounts outstanding. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and it is not available for direct investment.

J.P. Morgan GBI-EM Global Diversified Index

The J.P. Morgan GBI-EM Global Diversified Index consists of regularly traded, liquid fixed-rate, domestic currency government bonds to which international investors can gain exposure. The weightings among the countries are more evenly distributed within this index. The index is calculated on a total return basis. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and it is not available for direct investment.

Joint Stock Company (“JSC”)

A joint-stock company is a business entity in which shares of the company’s stock can be bought and sold by shareholders. Each shareholder owns company stock in proportion, evidenced by

KEY INVESTMENT TERMS (Unaudited) (Continued)

November 30, 2024

their shares (certificates of ownership). Shareholders are able to transfer their shares to others without any effects to the continued existence of the company.

London Interbank Offered Rate (“LIBOR”)

A benchmark rate that some of the world’s leading banks charge each other for short-term loans and that serves as the first step to calculating interest rates on various loans throughout the world.

MSCI Emerging Markets Index (net)

The MSCI Emerging Markets Index (net) is a free float-adjusted market capitalization-weighted index designed to measure equity market performance in the global emerging markets. The index is calculated on a total return basis with net dividends reinvested. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and it is not available for direct investment.

MSCI EAFE® Index (net)

The MSCI EAFE® (Europe, Australasia, Far East) Index (net) is a free float-adjusted market capitalization-weighted index that measures developed foreign market equity performance, excluding the U.S. and Canada. The index is calculated on a total return basis with net dividends reinvested. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and it is not available for direct investment.

MSCI World Index (net)

The MSCI World Index (net) is a free float-adjusted market capitalization-weighted index that measures developed global market equity performance. The index is calculated on a total return basis with net dividends reinvested. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and it is not available for direct investment.

Russell 2000® Index

The Russell 2000® Index is a market capitalization-weighted index of the 2,000 smallest companies in the Russell Universe, which comprises the 3,000 largest U.S. companies. The index is calculated on a total return basis with dividends reinvested. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and it is not available for direct investment.

S&P 500® Index

The S&P 500® Index is a free-float market capitalization-weighted index of 500 of the largest U.S. companies. The index is calculated on a total return basis with dividends reinvested. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and it is not available for direct investment.

Secured Overnight Financing Rate (“SOFR”)

A broad measure of the cost of borrowing cash overnight collateralized by U.S. Treasury securities.

Virtus Total Return Fund Inc. Linked Benchmark

The Virtus Total Return Fund Inc. Linked Benchmark consists of 60% FTSE Developed Core Infrastructure 50/50 Index (net) and 40% Bloomberg U.S. Aggregate Bond Index. Performance of the Virtus Total Return Fund Linked benchmark prior to 3/1/2017 represents an allocation of 60% MSCI World Infrastructure Sector Capped lndex and 40% Bloomberg U.S. Aggregate Bond Index.

KEY INVESTMENT TERMS (Unaudited) (Continued)

November 30, 2024

Yield Curve

A line that plots the interest rates, at a set point in time, of bonds having equal credit quality, but differing maturity dates. The most frequently reported yield curve compares the three-month, two-year, five-year and 30-year U.S. Treasury debt. This yield curve is used as a benchmark for other debt in the market, such as mortgage rates or bank lending rates. The curve is also used to predict changes in economic output and growth.

Global Multi-Sector Income Fund

SCHEDULE OF INVESTMENTS

November 30, 2024

($ reported in thousands)

| | Par Value(1) | | Value |

| U.S. Government Securities—0.7% |

| U.S. Treasury Bonds | | | |

| 4.250%, 2/15/54 | $ 130 | | $ 127 |

| 4.625%, 5/15/54 | 575 | | 598 |

Total U.S. Government Securities

(Identified Cost $707) | | 725 |

| | | | |

| |

| Foreign Government Securities—42.5% |

| Abu Dhabi Government International Bond | | | |

144A

5.000%, 4/30/34(2)(3) | 245 | | 249 |

144A

3.875%, 4/16/50(2)(3) | 310 | | 248 |

Arab Republic of Egypt 144A

8.500%, 1/31/47(2) | 1,172 | | 943 |

Benin Government International Bond 144A

7.960%, 2/13/38(2) | 39 | | 38 |

Bolivarian Republic of Venezuela RegS

7.650%, 4/21/25(4)(5) | 1,380 | | 174 |

Brazil Notas do Tesouro Nacional Series F

10.000%, 1/1/31 | 1,200 BRL | | 171 |

Costa Rica Government 144A

6.550%, 4/3/34(2) | 341 | | 351 |

Czech Republic

1.750%, 6/23/32 | 5,200 CZK | | 188 |

| Dominican Republic | | | |

144A

5.500%, 2/22/29(2) | 142 | | 139 |

144A

4.875%, 9/23/32(2) | 899 | | 825 |

144A

6.850%, 1/27/45(2) | 305 | | 312 |

Dubai Government International Bonds RegS

3.900%, 9/9/50(3)(5) | 205 | | 150 |

Federal Republic of Ethiopia 144A

6.625%, 12/11/24(2)(4) | 470 | | 370 |

| Federative Republic of Brazil | | | |

| 6.000%, 10/20/33 | 297 | | 294 |

| | Par Value(1) | | Value |

| | | | |

| Foreign Government Securities—continued |

| 4.750%, 1/14/50 | $ 365 | | $ 267 |

| 7.125%, 5/13/54 | 907 | | 901 |

| Finance Department Government of Sharjah | | | |

144A

6.500%, 11/23/32(2) | 300 | | 316 |

144A

4.000%, 7/28/50(2) | 1,075 | | 719 |

Gaci First Investment Co. RegS

4.875%, 2/14/35(3)(5) | 560 | | 541 |

Honduras Government 144A

8.625%, 11/27/34(2) | 279 | | 278 |

Hungary Government International Bond 144A

6.250%, 9/22/32(2)(3) | 803 | | 829 |

Islamic Republic of Pakistan 144A

7.375%, 4/8/31(2) | 111 | | 93 |

Kingdom of Bahrain 144A

5.625%, 5/18/34(2) | 595 | | 548 |

Kingdom of Jordan 144A

5.850%, 7/7/30(2) | 250 | | 238 |

| Kingdom of Morocco | | | |

144A

3.000%, 12/15/32(2) | 193 | | 159 |

144A

5.500%, 12/11/42(2) | 95 | | 86 |

Lebanese Republic RegS

7.000%, 3/23/32(4)(5) | 570 | | 53 |

Malaysia Government Bond

2.632%, 4/15/31(3) | 920 MYR | | 194 |

Mex Bonos Desarr

7.750%, 11/13/42(3) | 4,700 MXN | | 184 |

| Oman Government International Bond | | | |

144A

7.375%, 10/28/32(2) | 595 | | 668 |

144A

6.750%, 1/17/48(2) | 52 | | 54 |

Republic of Angola 144A

8.750%, 4/14/32(2) | 912 | | 816 |

Republic of Argentina

0.750%, 7/9/30(6) | 2,620 | | 1,932 |

See Notes to Financial Statements

Global Multi-Sector Income Fund

SCHEDULE OF INVESTMENTS (Continued)

November 30, 2024

($ reported in thousands)

| | Par Value(1) | | Value |

| | | | |

| Foreign Government Securities—continued |

Republic of Armenia 144A

3.600%, 2/2/31(2) | $ 245 | | $ 204 |

Republic of Chile

5.330%, 1/5/54(3) | 1,061 | | 1,037 |

| Republic of Colombia | | | |

| 3.250%, 4/22/32(3) | 690 | | 540 |

| 8.000%, 11/14/35 | 743 | | 767 |

| 4.125%, 5/15/51 | 475 | | 284 |

| Republic of Ecuador | | | |

144A

6.900%, 7/31/30(2)(6) | 667 | | 451 |

RegS

6.900%, 7/31/30(5)(6) | 1,110 | | 751 |

Republic of El Salvador 144A

7.650%, 6/15/35(2) | 590 | | 558 |

Republic of Gabon 144A

6.950%, 6/16/25(2) | 100 | | 97 |

| Republic of Ghana | | | |

144A

0.000%, 7/3/26(2)(7) | 10 | | 9 |

144A

5.000%, 7/3/29(2)(6) | 236 | | 207 |

144A

0.000%, 1/3/30(2)(7) | 17 | | 14 |

144A

5.000%, 7/3/35(2)(6) | 665 | | 472 |

RegS

0.000%, 7/3/26(5)(7) | 8 | | 7 |

RegS

5.000%, 7/3/29(5)(6) | 61 | | 53 |

RegS

0.000%, 1/3/30(5)(7) | 14 | | 11 |

RegS

5.000%, 7/3/35(5)(6) | 87 | | 62 |

Republic of Guatemala 144A

6.600%, 6/13/36(2) | 727 | | 737 |

| Republic of Indonesia | | | |

| 2.850%, 2/14/30(3) | 1,272 | | 1,154 |

| 4.750%, 9/10/34(3) | 91 | | 89 |

| 5.100%, 2/10/54(3) | 59 | | 57 |

Republic of Iraq RegS

5.800%, 1/15/28(5) | 545 | | 529 |

| Republic of Ivory Coast | | | |

144A

6.375%, 3/3/28(2) | 20 | | 20 |

| | Par Value(1) | | Value |

| | | | |

| Foreign Government Securities—continued |

144A

6.125%, 6/15/33(2) | $ 435 | | $ 395 |

144A

8.250%, 1/30/37(2) | 623 | | 620 |

Republic of Kenya 144A

8.000%, 5/22/32(2) | 249 | | 228 |

| Republic of Nigeria | | | |

144A

7.143%, 2/23/30(2) | 153 | | 138 |

144A

7.375%, 9/28/33(2) | 880 | | 744 |

| Republic of Panama | | | |

| 7.500%, 3/1/31 | 34 | | 36 |

| 8.000%, 3/1/38 | 1,411 | | 1,494 |

Republic of Paraguay 144A

6.000%, 2/9/36(2) | 292 | | 300 |

Republic of Peru

5.875%, 8/8/54(3) | 241 | | 242 |

| Republic of Philippines | | | |

| 4.750%, 3/5/35(3) | 418 | | 408 |

| 3.700%, 3/1/41(3) | 793 | | 655 |

Republic of Poland

4.875%, 10/4/33(3) | 1,110 | | 1,092 |

Republic of Serbia 144A

6.500%, 9/26/33(2) | 497 | | 518 |

| Republic of South Africa | | | |

| 5.875%, 6/22/30 | 98 | | 96 |

| 5.650%, 9/27/47 | 360 | | 283 |

| 8.750%, 2/28/48 | 4,200 ZAR | | 191 |

144A

7.100%, 11/19/36(2) | 196 | | 198 |

Republic of Sri Lanka 144A

6.200%, 5/11/27(2)(4) | 508 | | 338 |

| Republic of Turkiye | | | |

| 7.625%, 4/26/29 | 1,175 | | 1,236 |

| 9.125%, 7/13/30 | 1,168 | | 1,311 |

| 7.625%, 5/15/34 | 533 | | 555 |

| 4.875%, 4/16/43 | 780 | | 567 |

| Republic of Zambia | | | |

144A

5.750%, 6/30/33(2)(6) | 200 | | 177 |

144A

0.500%, 12/31/53(2) | 53 | | 30 |

Republica Orient Uruguay

4.975%, 4/20/55 | 551 | | 511 |

See Notes to Financial Statements

Global Multi-Sector Income Fund

SCHEDULE OF INVESTMENTS (Continued)

November 30, 2024

($ reported in thousands)

| | Par Value(1) | | Value |

| | | | |

| Foreign Government Securities—continued |

Romania Government International Bond 144A

7.125%, 1/17/33(2) | $ 966 | | $ 1,001 |

| Saudi International Bond | | | |

144A

4.875%, 7/18/33(2)(3) | 1,098 | | 1,092 |

144A

4.500%, 10/26/46(2)(3) | 1,655 | | 1,407 |

| State of Qatar | | | |

144A

3.750%, 4/16/30(2)(3) | 450 | | 433 |

144A

4.400%, 4/16/50(2)(3) | 365 | | 323 |

Trinidad & Tobago Government International Bond 144A

6.400%, 6/26/34(2) | 113 | | 111 |

| Ukraine Government Bond | | | |

144A

1.750%, 2/1/29(2)(6) | 43 | | 28 |

144A

0.000%, 2/1/30(2)(6) | 8 | | 4 |

144A

0.000%, 2/1/34(2)(6) | 29 | | 12 |

144A

1.750%, 2/1/34(2)(6) | 43 | | 23 |

144A

0.000%, 2/1/35(2)(6) | 25 | | 14 |

144A

1.750%, 2/1/35(2)(6) | 162 | | 83 |

144A

0.000%, 2/1/36(2)(6) | 21 | | 12 |

144A

1.750%, 2/1/36(2)(6) | 7 | | 4 |

RegS

1.750%, 2/1/29(5)(6) | 51 | | 32 |

RegS

0.000%, 2/1/30(5)(6) | 9 | | 5 |

RegS

0.000%, 2/1/34(5)(6) | 34 | | 14 |

RegS

1.750%, 2/1/34(5)(6) | 51 | | 26 |

RegS

0.000%, 2/1/35(5)(6) | 29 | | 17 |

| | Par Value(1) | | Value |

| | | | |

| Foreign Government Securities—continued |

RegS

1.750%, 2/1/35(5)(6) | $ 59 | | $ 30 |

RegS

0.000%, 2/1/36(5)(6) | 24 | | 14 |

RegS

1.750%, 2/1/36(5)(6) | 8 | | 4 |

| United Mexican States | | | |

| 2.659%, 5/24/31(3) | 310 | | 258 |

| 6.350%, 2/9/35(3) | 628 | | 634 |

| 6.338%, 5/4/53(3) | 427 | | 400 |

| 6.400%, 5/7/54(3) | 750 | | 708 |

Uzbekistan International Bond 144A

6.900%, 2/28/32(2) | 405 | | 403 |

Total Foreign Government Securities

(Identified Cost $42,575) | | 40,893 |

| | | | |

| |

| Mortgage-Backed Securities—16.7% |

| Agency—6.3% | | |

| Federal Home Loan Mortgage Corporation | | | |

Pool #SD6322

4.500%, 8/1/53 | 869 | | 836 |

Pool #SD8382

5.000%, 12/1/53 | 1,408 | | 1,382 |

| Federal National Mortgage Association | | | |

Pool #FS4438

5.000%, 11/1/52 | 837 | | 824 |

Pool #FS7751

4.000%, 3/1/53 | 1,373 | | 1,285 |

Pool #MA4785

5.000%, 10/1/52 | 414 | | 407 |

Pool #MA4805

4.500%, 11/1/52 | 750 | | 721 |

Pool #MA5072

5.500%, 7/1/53 | 634 | | 634 |

| | | | 6,089 |

| | | | |

| |

See Notes to Financial Statements

Global Multi-Sector Income Fund

SCHEDULE OF INVESTMENTS (Continued)

November 30, 2024

($ reported in thousands)

| | Par Value(1) | | Value |

| | | | |

| Non-Agency—10.4% | | |

A&D Mortgage Trust 2023-NQM3, A1 144A

6.733%, 7/25/68(2)(8) | $ 122 | | $ 123 |

Ajax Mortgage Loan Trust 2022-B, A1 144A

3.500%, 3/27/62(2)(8) | 504 | | 477 |

Angel Oak Mortgage Trust 2023-1, A1 144A

4.750%, 9/26/67(2)(8) | 144 | | 142 |

Arroyo Mortgage Trust 2019-1, A1 144A

3.805%, 1/25/49(2)(8) | 62 | | 60 |

BBCMS Mortgage Trust 2018-TALL, A (1 month Term SOFR + 0.919%, Cap N/A, Floor 0.872%) 144A

5.529%, 3/15/37(2)(8) | 480 | | 451 |

Benchmark Mortgage Trust 2023-B38, A2

5.626%, 4/15/56 | 165 | | 166 |

BPR Trust 2022-OANA, A (1 month Term SOFR + 1.898%, Cap N/A, Floor 1.898%) 144A

6.507%, 4/15/37(2)(8) | 270 | | 271 |

BX Trust 2019-OC11, D 144A

4.075%, 12/9/41(2)(8) | 780 | | 711 |

CENT Trust 2023-CITY, A (1 month Term SOFR + 2.620%, Cap N/A, Floor 2.620%) 144A

7.229%, 9/15/38(2)(8) | 275 | | 277 |

Chase Home Lending Mortgage Trust 2023-RPL1, A1 144A

3.500%, 6/25/62(2)(3)(8) | 301 | | 278 |

| Chase Mortgage Finance Corp. | | | |

2016-SH1, M2 144A

3.750%, 4/25/45(2)(8) | 71 | | 64 |

2016-SH2, M2 144A

3.750%, 12/25/45(2)(8) | 184 | | 168 |

CIM Trust 2022-R2, A1 144A

3.750%, 12/25/61(2)(8) | 293 | | 273 |

| COLT Mortgage Loan Trust | | | |

2022-4, A1 144A

4.301%, 3/25/67(2)(8) | 131 | | 128 |

| | Par Value(1) | | Value |

| | | | |

| Non-Agency—continued | | |

2022-5, A1 144A

4.550%, 4/25/67(2)(8) | $ 389 | | $ 383 |

COMM Mortgage Trust 2013-300P, A1 144A

4.353%, 8/10/30(2) | 400 | | 386 |

Ellington Financial Mortgage Trust 2019-2, A3 144A

3.046%, 11/25/59(2)(8) | 25 | | 24 |

Fashion Show Mall LLC 2024-SHOW, A 144A

5.274%, 10/10/41(2)(8) | 280 | | 277 |

FirstKey Homes Trust 2020-SFR2, B 144A

1.567%, 10/19/37(2) | 475 | | 461 |

Homes Trust 2023-NQM2, A1 144A

6.456%, 2/25/68(2)(8) | 415 | | 418 |

JPMorgan Chase Mortgage Trust 2014-5, B2 144A

2.702%, 10/25/29(2)(8) | 163 | | 151 |

MFA Trust 2022-INV2, A1 144A

4.950%, 7/25/57(2)(8) | 606 | | 602 |

Mill City Mortgage Loan Trust 2017-3, B1 144A

3.250%, 1/25/61(2)(8) | 335 | | 297 |

MIRA Trust 2023-MILE, A 144A

6.755%, 6/10/38(2) | 170 | | 177 |

Morgan Stanley Bank of America Merrill Lynch Trust 2015-C22, AS

3.561%, 4/15/48 | 220 | | 214 |

| New Residential Mortgage Loan Trust | | | |

2016-3A, B1 144A

4.000%, 9/25/56(2)(8) | 141 | | 135 |

2016-4A, B1A 144A

4.500%, 11/25/56(2)(8) | 428 | | 415 |

Palisades Mortgage Loan Trust 2021-RTL1, A1 144A

3.487%, 6/25/26(2)(8) | 61 | | 61 |

Provident Funding Mortgage Trust 2019-1, A2 144A

3.000%, 12/25/49(2)(8) | 69 | | 59 |

See Notes to Financial Statements

Global Multi-Sector Income Fund

SCHEDULE OF INVESTMENTS (Continued)

November 30, 2024

($ reported in thousands)

| | Par Value(1) | | Value |

| | | | |

| Non-Agency—continued | | |

ROCK Trust 2024-CNTR, C 144A

6.471%, 11/13/41(2) | $ 215 | | $ 218 |

| Towd Point Mortgage Trust | | | |

2016-4, B1 144A

4.045%, 7/25/56(2)(8) | 260 | | 248 |

2017-1, M1 144A

3.750%, 10/25/56(2)(8) | 265 | | 258 |

2017-4, A2 144A

3.000%, 6/25/57(2)(8) | 171 | | 159 |

2018-6, A2 144A

3.750%, 3/25/58(2)(8) | 215 | | 197 |

Tricon Residential Trust 2021-SFR1, B 144A

2.244%, 7/17/38(2) | 150 | | 143 |

| Verus Securitization Trust | | | |

2022-4, A1 144A

4.474%, 4/25/67(2)(8) | 267 | | 265 |

2022-6, A1 144A

4.910%, 6/25/67(2)(8) | 183 | | 182 |

2022-6, A3 144A

4.910%, 6/25/67(2)(8) | 400 | | 396 |

2023-8, A1 144A

6.259%, 12/25/68(2)(8) | 253 | | 256 |

| | | | 9,971 |

| | | | |

| |

Total Mortgage-Backed Securities

(Identified Cost $16,396) | | 16,060 |

| | | | |

| |

| Asset-Backed Securities—10.7% |

| Automobiles—2.9% | | |

Arivo Acceptance Auto Loan Receivables Trust 2024-1A, B 144A

6.870%, 6/17/30(2) | 396 | | 406 |

DT Auto Owner Trust 2023-1A, D 144A

6.440%, 11/15/28(2) | 450 | | 457 |

Huntington Bank Auto Credit-Linked Notes 2024-1, B1 144A

6.153%, 5/20/32(2) | 223 | | 226 |

| LAD Auto Receivables Trust | | | |

2021-1A, D 144A

3.990%, 11/15/29(2) | 470 | | 465 |

| | Par Value(1) | | Value |

| | | | |

| Automobiles—continued | | |

2023-2A, D 144A

6.300%, 2/15/31(2) | $ 365 | | $ 369 |

OneMain Direct Auto Receivables Trust 2022-1A, C 144A

5.310%, 6/14/29(2) | 320 | | 320 |

U.S. Bank N.A. 2023-1, B 144A

6.789%, 8/25/32(2) | 212 | | 215 |

Veros Auto Receivables Trust 2024-1, C 144A

7.570%, 12/15/28(2) | 350 | | 357 |

| | | | 2,815 |

| | | | |

| |

| Consumer Loans—0.4% | | |

Affirm Asset Securitization Trust 2023-B, A 144A

6.820%, 9/15/28(2) | 350 | | 355 |

| Credit Card—0.4% | | |

Mission Lane Credit Card Master Trust 2023-B, A 144A

7.690%, 11/15/28(2) | 355 | | 358 |

| Other—7.0% | | |

Adams Outdoor Advertising LP 2023-1, A2 144A

6.967%, 7/15/53(2) | 365 | | 380 |

Aqua Finance Trust 2024-A, B 144A

5.060%, 4/18/50(2) | 355 | | 350 |

Auxilior Term Funding LLC 2023-1A, D 144A

7.270%, 12/16/30(2) | 240 | | 244 |

BXG Receivables Note Trust 2023-A, A 144A

5.770%, 11/15/38(2) | 302 | | 306 |

Commercial Equipment Finance LLC 2024-1A, A 144A

5.970%, 7/16/29(2) | 329 | | 332 |

FAT Brands Royalty LLC 2021-1A, A2 144A

5.750%, 4/25/51(2) | 468 | | 394 |

See Notes to Financial Statements

Global Multi-Sector Income Fund

SCHEDULE OF INVESTMENTS (Continued)

November 30, 2024

($ reported in thousands)

| | Par Value(1) | | Value |

| | | | |

| Other—continued | | |

Hardee’s Funding LLC 2024-1A, A2 144A

7.253%, 3/20/54(2) | $ 398 | | $ 407 |

Jersey Mike’s Funding LLC 2019-1A, A2 144A

4.433%, 2/15/50(2) | 1 | | 1 |

Libra Solutions LLC 2024-1A, A 144A

5.880%, 9/30/38(2) | 335 | | 329 |

MetroNet Infrastructure Issuer LLC 2024-1A, A2 144A

6.230%, 4/20/54(2) | 310 | | 317 |

MVW LLC 2024-1A, A 144A

5.320%, 2/20/43(2) | 352 | | 356 |

Octane Receivables Trust 2023-3A, C 144A

6.740%, 8/20/29(2) | 425 | | 437 |

Oportun Funding XIV LLC 2021-A, B 144A

1.760%, 3/8/28(2) | 100 | | 98 |

Planet Fitness Master Issuer LLC 2024-1A, A2I 144A

5.765%, 6/5/54(2) | 420 | | 423 |

Purchasing Power Funding LLC 2024-A, B 144A

6.430%, 8/15/28(2) | 420 | | 425 |

Reach ABS Trust 2024-1A, B 144A

6.290%, 2/18/31(2) | 425 | | 430 |

Retained Vantage Data Centers Issuer LLC 2024-1A, A2 144A

4.992%, 9/15/49(2) | 475 | | 461 |

Trinity Rail Leasing LLC 2019-1A, A 144A

3.820%, 4/17/49(2) | 273 | | 267 |

USQ Rail III LLC 2024-1A, A 144A

4.990%, 9/28/54(2) | 350 | | 343 |

| | Par Value(1) | | Value |

| | | | |

| Other—continued | | |

VFI ABS LLC 2022-1A, B 144A

3.040%, 7/24/28(2) | $ 221 | | $ 221 |

Zaxby’s Funding LLC 2021-1A, A2 144A

3.238%, 7/30/51(2) | 255 | | 232 |

| | | | 6,753 |

| | | | |

| |

Total Asset-Backed Securities

(Identified Cost $10,280) | | 10,281 |

| | | | |

| |

| Corporate Bonds and Notes—57.4% |

| Communication Services—2.8% | | |

Altice France Holding S.A. 144A

6.000%, 2/15/28(2) | 185 | | 49 |

| Altice France S.A. | | | |

| 144A 5.125%, 7/15/29(2)(3) | 125 | | 95 |

| 144A 5.500%, 10/15/29(2)(3) | 185 | | 142 |

CMG Media Corp. 144A

8.875%, 6/18/29(2)(3) | 225 | | 156 |

| CSC Holdings LLC | | | |

| 144A 7.500%, 4/1/28(2)(3) | 295 | | 213 |

| 144A 11.750%, 1/31/29(2) | 200 | | 198 |

DIRECTV Financing LLC 144A

8.875%, 2/1/30(2)(3) | 150 | | 151 |

Gray Television, Inc. 144A

7.000%, 5/15/27(2)(3) | 330 | | 323 |

Hughes Satellite Systems Corp.

6.625%, 8/1/26(3) | 170 | | 139 |

Level 3 Financing, Inc. 144A

3.625%, 1/15/29(2) | 365 | | 291 |

Millennium Escrow Corp. 144A

6.625%, 8/1/26(2)(3) | 250 | | 181 |

Rackspace Technology Global, Inc. 144A

5.375%, 12/1/28(2) | 275 | | 83 |

Sprint Capital Corp.

8.750%, 3/15/32(3) | 235 | | 286 |

See Notes to Financial Statements

Global Multi-Sector Income Fund

SCHEDULE OF INVESTMENTS (Continued)

November 30, 2024

($ reported in thousands)

| | Par Value(1) | | Value |

| | | | |

| Communication Services—continued | | |

Telesat Canada 144A

6.500%, 10/15/27(2)(3) | $ 180 | | $ 59 |

Univision Communications, Inc. 144A

6.625%, 6/1/27(2) | 300 | | 299 |

| | | | 2,665 |

| | | | |

| |

| Consumer Discretionary—2.3% | | |

Aptiv plc

6.875%, 12/15/54(3) | 270 | | 262 |

Ashton Woods USA LLC 144A

4.625%, 4/1/30(2)(3) | 80 | | 74 |

Clarios Global LP 144A

8.500%, 5/15/27(2)(3) | 245 | | 246 |

Ford Motor Credit Co. LLC

7.350%, 3/6/30(3) | 200 | | 215 |

Great Canadian Gaming Corp. 144A

8.750%, 11/15/29(2)(3) | 50 | | 52 |

Meritage Homes Corp. 144A

3.875%, 4/15/29(2)(3) | 183 | | 173 |

Newell Brands, Inc.

6.625%, 9/15/29(3) | 227 | | 233 |

Nissan Motor Acceptance Co. LLC 144A

7.050%, 9/15/28(2)(3) | 145 | | 148 |

Ontario Gaming GTA LP 144A

8.000%, 8/1/30(2)(3) | 175 | | 180 |

PetSmart, Inc. 144A

7.750%, 2/15/29(2)(3) | 145 | | 143 |

Prime Security Services Borrower LLC 144A

6.250%, 1/15/28(2)(3) | 215 | | 215 |

Weekley Homes LLC 144A

4.875%, 9/15/28(2)(3) | 270 | | 258 |

| | | | 2,199 |

| | | | |

| |

| Consumer Staples—1.5% | | |

BAT Capital Corp.

7.750%, 10/19/32(3) | 270 | | 313 |

Herbalife Nutrition Ltd. 144A

7.875%, 9/1/25(2)(3) | 250 | | 250 |

| | Par Value(1) | | Value |

| | | | |

| Consumer Staples—continued | | |

| Kronos Acquisition Holdings, Inc. | | | |

| 144A 8.250%, 6/30/31(2)(3) | $ 180 | | $ 174 |

| 144A 10.750%, 6/30/32(2) | 215 | | 196 |

Pilgrim’s Pride Corp.

6.250%, 7/1/33(3) | 215 | | 225 |

Post Holdings, Inc. 144A

6.375%, 3/1/33(2)(3) | 120 | | 120 |

Triton Water Holdings, Inc. 144A

6.250%, 4/1/29(2)(3) | 125 | | 124 |

| | | | 1,402 |

| | | | |

| |

| Energy—12.9% | | |

Adnoc Murban Rsc Ltd. 144A

4.500%, 9/11/34(2)(3) | 621 | | 594 |

Aker BP ASA 144A

5.125%, 10/1/34(2) | 355 | | 344 |

Alliance Resource Operating Partners LP 144A

8.625%, 6/15/29(2)(3) | 150 | | 158 |

Ascent Resources Utica Holdings LLC 144A

8.250%, 12/31/28(2)(3) | 255 | | 261 |

BP Capital Markets plc

4.875% (3)(9) | 375 | | 363 |

| Columbia Pipelines Operating Co. LLC | | | |

| 144A 6.036%, 11/15/33(2)(3) | 215 | | 227 |

| 144A 6.714%, 8/15/63(2)(3) | 40 | | 45 |

Coronado Finance Pty Ltd. 144A

9.250%, 10/1/29(2)(3) | 150 | | 155 |

CVR Energy, Inc. 144A

8.500%, 1/15/29(2)(3) | 215 | | 211 |

| Ecopetrol S.A. | | | |

| 4.625%, 11/2/31(3) | 195 | | 162 |

| 8.875%, 1/13/33 | 97 | | 100 |

Encino Acquisition Partners Holdings LLC 144A

8.750%, 5/1/31(2)(3) | 65 | | 69 |

Energy Transfer LP Series H

6.500% (9) | 245 | | 245 |

See Notes to Financial Statements

Global Multi-Sector Income Fund

SCHEDULE OF INVESTMENTS (Continued)

November 30, 2024

($ reported in thousands)

| | Par Value(1) | | Value |

| | | | |

| Energy—continued | | |

Flex Intermediate Holdco LLC 144A

3.363%, 6/30/31(2)(3) | $ 290 | | $ 252 |

Genesis Energy LP

8.875%, 4/15/30(3) | 250 | | 261 |

Greensaif Pipelines Bidco S.a.r.l. 144A

6.129%, 2/23/38(2)(3) | 235 | | 240 |

Gulfport Energy Operating Corp. 144A

6.750%, 9/1/29(2)(3) | 80 | | 82 |

Helix Energy Solutions Group, Inc. 144A

9.750%, 3/1/29(2)(3) | 185 | | 200 |

International Petroleum Corp. 144A, RegS

7.250%, 2/1/27(2)(3)(5) | 500 | | 493 |

KazMunayGas National Co. JSC 144A

6.375%, 10/24/48(2) | 244 | | 235 |

Kraken Oil & Gas Partners LLC 144A

7.625%, 8/15/29(2)(3) | 155 | | 154 |

Magnolia Oil & Gas Operating LLC 144A

6.875%, 12/1/32(2)(3) | 30 | | 30 |

Mesquite Energy, Inc. 144A

7.250%, 2/15/23(2) | 135 | | 2 |

Nabors Industries, Inc. 144A

7.375%, 5/15/27(2)(3) | 10 | | 10 |

| Occidental Petroleum Corp. | | | |

| 5.550%, 10/1/34(3) | 70 | | 70 |

| 6.200%, 3/15/40(3) | 140 | | 143 |

| Pertamina Persero PT | | | |

| 144A 2.300%, 2/9/31(2)(3) | 1,075 | | 912 |

| RegS 6.450%, 5/30/44(5) | 231 | | 247 |

Petroleos de Venezuela S.A. 144A