UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-05624

Morgan Stanley Institutional Fund, Inc.

(Exact Name of Registrant as Specified in Charter)

1585 Broadway, New York, New York 10036

(Address of Principal Executive Offices)

John H. Gernon

1585 Broadway, New York, New York 10036

(Name and Address of Agent for Services)

(212) 762-1886

(Registrant’s Telephone Number)

December 31

Date of Fiscal Year End

June 30, 2024

Date of Reporting Period

Item 1. Reports to Stockholders

(a)

TABLE OF CONTENTS

Morgan Stanley Institutional Fund, Inc. - Advantage Portfolio

A - MAPPX |

| | |

Morgan Stanley Institutional Fund, Inc. - Advantage Portfolio

C - MSPRX |

| | |

Morgan Stanley Institutional Fund, Inc. - Advantage Portfolio

I - MPAIX |

| | |

Morgan Stanley Institutional Fund, Inc. - Advantage Portfolio

L - MAPLX |

| | |

Morgan Stanley Institutional Fund, Inc. - Advantage Portfolio

R6 - MADSX |

| | |

Morgan Stanley Institutional Fund, Inc. - American Resilience Portfolio

A - MSCUX |

| | |

Morgan Stanley Institutional Fund, Inc. - American Resilience Portfolio

C - MSBWX |

| | |

Morgan Stanley Institutional Fund, Inc. - American Resilience Portfolio

I - MSBVX |

| | |

Morgan Stanley Institutional Fund, Inc. - American Resilience Portfolio

R6 - MSBQX |

| | |

Morgan Stanley Institutional Fund, Inc. - Asia Opportunity Portfolio

A - MSAUX |

| | |

Morgan Stanley Institutional Fund, Inc. - Asia Opportunity Portfolio

C - MSAWX |

| | |

Morgan Stanley Institutional Fund, Inc. - Asia Opportunity Portfolio

I - MSAQX |

| | |

Morgan Stanley Institutional Fund, Inc. - Asia Opportunity Portfolio

R6 - MSAYX |

| | |

Morgan Stanley Institutional Fund, Inc - Counterpoint Global Portfolio

A - GLCAX |

| | |

Morgan Stanley Institutional Fund, Inc - Counterpoint Global Portfolio

C - GLCDX |

| | |

Morgan Stanley Institutional Fund, Inc - Counterpoint Global Portfolio

I - GLCIX |

| | |

Morgan Stanley Institutional Fund, Inc - Counterpoint Global Portfolio

R6 - GLCSX |

| | |

Morgan Stanley Institutional Fund, Inc. - Developing Opportunity Portfolio

A - MDOAX |

| | |

Morgan Stanley Institutional Fund, Inc. - Developing Opportunity Portfolio

C - MDOBX |

| | |

Morgan Stanley Institutional Fund, Inc. - Developing Opportunity Portfolio

I - MDOEX |

| | |

Morgan Stanley Institutional Fund, Inc. - Developing Opportunity Portfolio

R6 - MDODX |

| | |

Morgan Stanley Institutional Fund, Inc. - Emerging Markets ex China Portfolio

A - MSDQX |

| | |

Morgan Stanley Institutional Fund, Inc. - Emerging Markets ex China Portfolio

C - MSDOX |

| | |

Morgan Stanley Institutional Fund, Inc. - Emerging Markets ex China Portfolio

I - MSDUX |

| | |

Morgan Stanley Institutional Fund, Inc. - Emerging Markets ex China Portfolio

R6 - MSDMX |

| | |

Morgan Stanley Institutional Fund, Inc. - Emerging Markets Leaders Portfolio

A - MELAX |

| | |

Morgan Stanley Institutional Fund, Inc. - Emerging Markets Leaders Portfolio

C - MEMLX |

| | |

Morgan Stanley Institutional Fund, Inc. - Emerging Markets Leaders Portfolio

I - MELIX |

| | |

Morgan Stanley Institutional Fund, Inc. - Emerging Markets Leaders Portfolio

IR - MSIWX |

| | |

Morgan Stanley Institutional Fund, Inc. - Emerging Markets Leaders Portfolio

R6 - MELSX |

| | |

Morgan Stanley Institutional Fund, Inc. - Emerging Markets Portfolio

A - MMKBX |

| | |

Morgan Stanley Institutional Fund, Inc. - Emerging Markets Portfolio

C - MSEPX |

| | |

Morgan Stanley Institutional Fund, Inc. - Emerging Markets Portfolio

I - MGEMX |

| | |

Morgan Stanley Institutional Fund, Inc. - Emerging Markets Portfolio

IR - MRGEX |

| | |

Morgan Stanley Institutional Fund, Inc. - Emerging Markets Portfolio

L - MSELX |

| | |

Morgan Stanley Institutional Fund, Inc. - Emerging Markets Portfolio

R6 - MMMPX |

| | |

Morgan Stanley Institutional Fund, Inc - Global Concentrated Portfolio

A - MLNAX |

| | |

Morgan Stanley Institutional Fund, Inc - Global Concentrated Portfolio

C - MLNCX |

| | |

Morgan Stanley Institutional Fund, Inc - Global Concentrated Portfolio

I - MLNIX |

| | |

Morgan Stanley Institutional Fund, Inc - Global Concentrated Portfolio

R6 - MLNSX |

| | |

Morgan Stanley Institutional Fund, Inc. - Global Core Portfolio

A - MLMAX |

| | |

Morgan Stanley Institutional Fund, Inc. - Global Core Portfolio

C - MLMCX |

| | |

Morgan Stanley Institutional Fund, Inc. - Global Core Portfolio

I - MLMIX |

| | |

Morgan Stanley Institutional Fund, Inc. - Global Core Portfolio

R6 - MLMSX |

| | |

Morgan Stanley Institutional Fund, Inc - Global Endurance Portfolio

A - MSJAX |

| | |

Morgan Stanley Institutional Fund, Inc - Global Endurance Portfolio

C - MSJCX |

| | |

Morgan Stanley Institutional Fund, Inc - Global Endurance Portfolio

I - MSJIX |

| | |

Morgan Stanley Institutional Fund, Inc - Global Endurance Portfolio

R6 - MSJSX |

| | |

Morgan Stanley Institutional Fund, Inc. - Global Focus Real Estate Portfolio

A - MSBEX |

| | |

Morgan Stanley Institutional Fund, Inc. - Global Focus Real Estate Portfolio

C - MSBKX |

| | |

Morgan Stanley Institutional Fund, Inc. - Global Focus Real Estate Portfolio

I - MSBDX |

| | |

Morgan Stanley Institutional Fund, Inc. - Global Focus Real Estate Portfolio

R6 - MSBPX |

| | |

Morgan Stanley Institutional Fund, Inc. - Global Franchise Portfolio

A - MSFBX |

| | |

Morgan Stanley Institutional Fund, Inc. - Global Franchise Portfolio

C - MSGFX |

| | |

Morgan Stanley Institutional Fund, Inc. - Global Franchise Portfolio

I - MSFAX |

| | |

Morgan Stanley Institutional Fund, Inc. - Global Franchise Portfolio

L - MSFLX |

| | |

Morgan Stanley Institutional Fund, Inc. - Global Franchise Portfolio

R6 - MGISX |

| | |

Morgan Stanley Institutional Fund, Inc. - Global Infrastructure Portfolio

A - MTIPX |

| | |

Morgan Stanley Institutional Fund, Inc. - Global Infrastructure Portfolio

C - MSGTX |

| | |

Morgan Stanley Institutional Fund, Inc. - Global Infrastructure Portfolio

I - MTIIX |

| | |

Morgan Stanley Institutional Fund, Inc. - Global Infrastructure Portfolio

IR - MRGOX |

| | |

Morgan Stanley Institutional Fund, Inc. - Global Infrastructure Portfolio

L - MTILX |

| | |

Morgan Stanley Institutional Fund, Inc. - Global Infrastructure Portfolio

R6 - MSGPX |

| | |

Morgan Stanley Institutional Fund, Inc. - Global Insight Portfolio

A - MIGPX |

| | |

Morgan Stanley Institutional Fund, Inc. - Global Insight Portfolio

C - MSPTX |

| | |

Morgan Stanley Institutional Fund, Inc. - Global Insight Portfolio

I - MIGIX |

| | |

Morgan Stanley Institutional Fund, Inc. - Global Insight Portfolio

L - MIGLX |

| | |

Morgan Stanley Institutional Fund, Inc. - Global Insight Portfolio

R6 - MGZZX |

| | |

Morgan Stanley Institutional Fund, Inc. - Global Opportunity Portfolio

A - MGGPX |

| | |

Morgan Stanley Institutional Fund, Inc. - Global Opportunity Portfolio

C - MSOPX |

| | |

Morgan Stanley Institutional Fund, Inc. - Global Opportunity Portfolio

I - MGGIX |

| | |

Morgan Stanley Institutional Fund, Inc. - Global Opportunity Portfolio

IR - MGORX |

| | |

Morgan Stanley Institutional Fund, Inc. - Global Opportunity Portfolio

L - MGGLX |

| | |

Morgan Stanley Institutional Fund, Inc. - Global Opportunity Portfolio

R6 - MGTSX |

| | |

Morgan Stanley Institutional Fund, Inc - Global Permanence Portfolio

A - MGKAX |

| | |

Morgan Stanley Institutional Fund, Inc - Global Permanence Portfolio

C - MGKCX |

| | |

Morgan Stanley Institutional Fund, Inc - Global Permanence Portfolio

I - MGKIX |

| | |

Morgan Stanley Institutional Fund, Inc - Global Permanence Portfolio

R6 - MGKQX |

| | |

Morgan Stanley Institutional Fund, Inc. - Global Real Estate Portfolio

A - MRLBX |

| | |

Morgan Stanley Institutional Fund, Inc. - Global Real Estate Portfolio

C - MSRDX |

| | |

Morgan Stanley Institutional Fund, Inc. - Global Real Estate Portfolio

I - MRLAX |

| | |

Morgan Stanley Institutional Fund, Inc. - Global Real Estate Portfolio

IR - MRLEX |

| | |

Morgan Stanley Institutional Fund, Inc. - Global Real Estate Portfolio

L - MGRLX |

| | |

Morgan Stanley Institutional Fund, Inc. - Global Real Estate Portfolio

R6 - MGREX |

| | |

Morgan Stanley Institutional Fund, Inc. - Global Stars Portfolio

A - MGQAX |

| | |

Morgan Stanley Institutional Fund, Inc. - Global Stars Portfolio

C - MSGQX |

| | |

Morgan Stanley Institutional Fund, Inc. - Global Stars Portfolio

I - MGQIX |

| | |

Morgan Stanley Institutional Fund, Inc. - Global Stars Portfolio

L - MGQLX |

| | |

Morgan Stanley Institutional Fund, Inc. - Global Stars Portfolio

R6 - MGQSX |

| | |

Morgan Stanley Institutional Fund, Inc. - Growth Portfolio

A - MSEGX |

| | |

Morgan Stanley Institutional Fund, Inc. - Growth Portfolio

C - MSGUX |

| | |

Morgan Stanley Institutional Fund, Inc. - Growth Portfolio

I - MSEQX |

| | |

Morgan Stanley Institutional Fund, Inc. - Growth Portfolio

IR - MGHRX |

| | |

Morgan Stanley Institutional Fund, Inc. - Growth Portfolio

L - MSHLX |

| | |

Morgan Stanley Institutional Fund, Inc. - Growth Portfolio

R6 - MGRPX |

| | |

Morgan Stanley Institutional Fund, Inc. - Inception Portfolio

A - MSSMX |

| | |

Morgan Stanley Institutional Fund, Inc. - Inception Portfolio

C - MSCOX |

| | |

Morgan Stanley Institutional Fund, Inc. - Inception Portfolio

I - MSSGX |

| | |

Morgan Stanley Institutional Fund, Inc. - Inception Portfolio

L - MSSLX |

| | |

Morgan Stanley Institutional Fund, Inc. - Inception Portfolio

R6 - MFLLX |

| | |

Morgan Stanley Institutional Fund, Inc. - International Advantage Portfolio

A - MFAPX |

| | |

Morgan Stanley Institutional Fund, Inc. - International Advantage Portfolio

C - MSIAX |

| | |

Morgan Stanley Institutional Fund, Inc. - International Advantage Portfolio

I - MFAIX |

| | |

Morgan Stanley Institutional Fund, Inc. - International Advantage Portfolio

L - MSALX |

| | |

Morgan Stanley Institutional Fund, Inc. - International Advantage Portfolio

R6 - IDVSX |

| | |

Morgan Stanley Institutional Fund, Inc. - International Equity Portfolio

A - MIQBX |

| | |

Morgan Stanley Institutional Fund, Inc. - International Equity Portfolio

C - MSECX |

| | |

Morgan Stanley Institutional Fund, Inc. - International Equity Portfolio

I - MSIQX |

| | |

Morgan Stanley Institutional Fund, Inc. - International Equity Portfolio

L - MSQLX |

| | |

Morgan Stanley Institutional Fund, Inc. - International Equity Portfolio

R6 - MIQPX |

| | |

Morgan Stanley Institutional Fund, Inc. - International Opportunity Portfolio

A - MIOPX |

| | |

Morgan Stanley Institutional Fund, Inc. - International Opportunity Portfolio

C - MSOCX |

| | |

Morgan Stanley Institutional Fund, Inc. - International Opportunity Portfolio

I - MIOIX |

| | |

Morgan Stanley Institutional Fund, Inc. - International Opportunity Portfolio

IR - MRNPX |

| | |

Morgan Stanley Institutional Fund, Inc. - International Opportunity Portfolio

L - MIOLX |

| | |

Morgan Stanley Institutional Fund, Inc. - International Opportunity Portfolio

R6 - MNOPX |

| | |

Morgan Stanley Institutional Fund, Inc - International Resilience Portfolio

A - MSDFX |

| | |

Morgan Stanley Institutional Fund, Inc - International Resilience Portfolio

C - MSDEX |

| | |

Morgan Stanley Institutional Fund, Inc - International Resilience Portfolio

I - MSDKX |

| | |

Morgan Stanley Institutional Fund, Inc - International Resilience Portfolio

R6 - MSCZX |

| | |

Morgan Stanley Institutional Fund, Inc. - Multi-Asset Real Return Portfolio

A - MRJAX |

| | |

Morgan Stanley Institutional Fund, Inc. - Multi-Asset Real Return Portfolio

C - MRJCX |

| | |

Morgan Stanley Institutional Fund, Inc. - Multi-Asset Real Return Portfolio

I - MRJIX |

| | |

Morgan Stanley Institutional Fund, Inc. - Multi-Asset Real Return Portfolio

R6 - MRJSX |

| | |

Morgan Stanley Institutional Fund, Inc. - Next Gen Emerging Markets Portfolio

A - MFMPX |

| | |

Morgan Stanley Institutional Fund, Inc. - Next Gen Emerging Markets Portfolio

C - MSFEX |

| | |

Morgan Stanley Institutional Fund, Inc. - Next Gen Emerging Markets Portfolio

I - MFMIX |

| | |

Morgan Stanley Institutional Fund, Inc. - Next Gen Emerging Markets Portfolio

L - MFMLX |

| | |

Morgan Stanley Institutional Fund, Inc. - Next Gen Emerging Markets Portfolio

R6 - MSRFX |

| | |

Morgan Stanley Institutional Fund, Inc. - Passport Overseas Equity Portfolio

A - MSIBX |

| | |

Morgan Stanley Institutional Fund, Inc. - Passport Overseas Equity Portfolio

C - MSAAX |

| | |

Morgan Stanley Institutional Fund, Inc. - Passport Overseas Equity Portfolio

I - MSACX |

| | |

Morgan Stanley Institutional Fund, Inc. - Passport Overseas Equity Portfolio

IR - MAIHX |

| | |

Morgan Stanley Institutional Fund, Inc. - Passport Overseas Equity Portfolio

L - MSLLX |

| | |

Morgan Stanley Institutional Fund, Inc. - Passport Overseas Equity Portfolio

R6 - MAIJX |

| | |

Morgan Stanley Institutional Fund, Inc - Permanence Portfolio

A - MSHNX |

| | |

Morgan Stanley Institutional Fund, Inc - Permanence Portfolio

C - MSHOX |

| | |

Morgan Stanley Institutional Fund, Inc - Permanence Portfolio

I - MSHMX |

| | |

Morgan Stanley Institutional Fund, Inc - Permanence Portfolio

R6 - MSHPX |

| | |

Morgan Stanley Institutional Fund, Inc. - U.S. Focus Real Estate Portfolio

A - MAAYX |

| | |

Morgan Stanley Institutional Fund, Inc. - U.S. Focus Real Estate Portfolio

C - MABBX |

| | |

Morgan Stanley Institutional Fund, Inc. - U.S. Focus Real Estate Portfolio

I - MAAWX |

| | |

Morgan Stanley Institutional Fund, Inc. - U.S. Focus Real Estate Portfolio

R6 - MABCX |

| | |

Morgan Stanley Institutional Fund, Inc. - U.S. Real Estate Portfolio

A - MUSDX |

| | |

Morgan Stanley Institutional Fund, Inc. - U.S. Real Estate Portfolio

C - MSURX |

| | |

Morgan Stanley Institutional Fund, Inc. - U.S. Real Estate Portfolio

I - MSUSX |

| | |

Morgan Stanley Institutional Fund, Inc. - U.S. Real Estate Portfolio

IR - MRETX |

| | |

Morgan Stanley Institutional Fund, Inc. - U.S. Real Estate Portfolio

L - MSULX |

| | |

Morgan Stanley Institutional Fund, Inc. - U.S. Real Estate Portfolio

R6 - MURSX |

| | |

Morgan Stanley Institutional Fund, Inc. - US Core Portfolio

A - MUOAX |

| | |

Morgan Stanley Institutional Fund, Inc. - US Core Portfolio

C - MUOCX |

| | |

Morgan Stanley Institutional Fund, Inc. - US Core Portfolio

I - MUOIX |

| | |

Morgan Stanley Institutional Fund, Inc. - US Core Portfolio

R6 - MUOSX |

| | |

Morgan Stanley Institutional Fund, Inc. - Vitality Portfolio

A - MSVEX |

| | |

Morgan Stanley Institutional Fund, Inc. - Vitality Portfolio

C - MSVMX |

| | |

Morgan Stanley Institutional Fund, Inc. - Vitality Portfolio

I - MSVDX |

| | |

Morgan Stanley Institutional Fund, Inc. - Vitality Portfolio

R6 - MSVOX |

| | |

0000836487morganstanley:C000198815Member2024-06-300000836487morganstanley:C000126917Membermorganstanley:GoodmanGroupCTIMember2024-06-30

Morgan Stanley Institutional Fund, Inc. - Advantage Portfolio

Semi-Annual Shareholder Report June 30, 2024

This semi-annual shareholder report contains important information about Morgan Stanley Institutional Fund, Inc. - Advantage Portfolio for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Fund at www.morganstanley.com/im/shareholderreports. You can also request this information by contacting us at 1-800-869-6397.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class A | $59 | 1.18% |

| Total Net Assets | $161,969,489 |

| # of Portfolio Holdings | 30 |

| Portfolio Turnover Rate | 28% |

What did the Fund invest in?

The following tables reflect what the Fund invested in as of the report date.

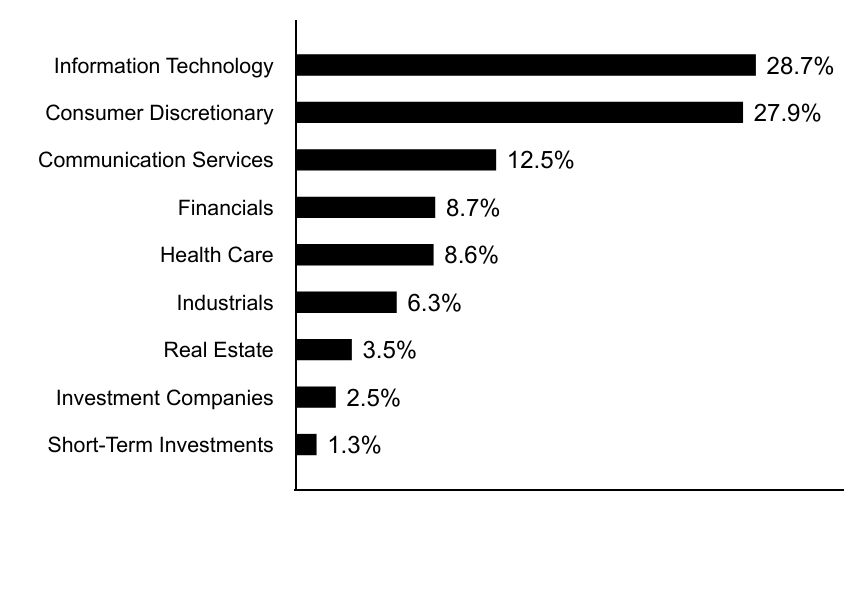

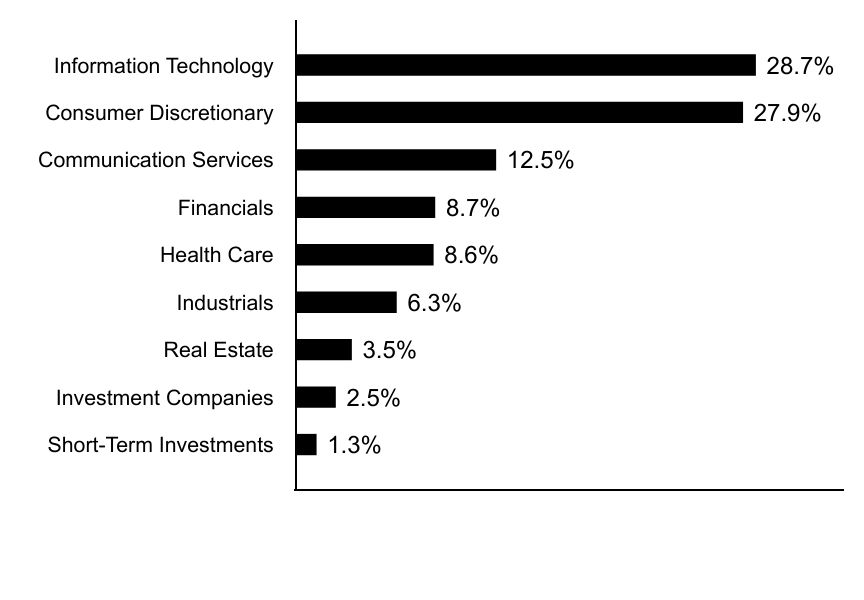

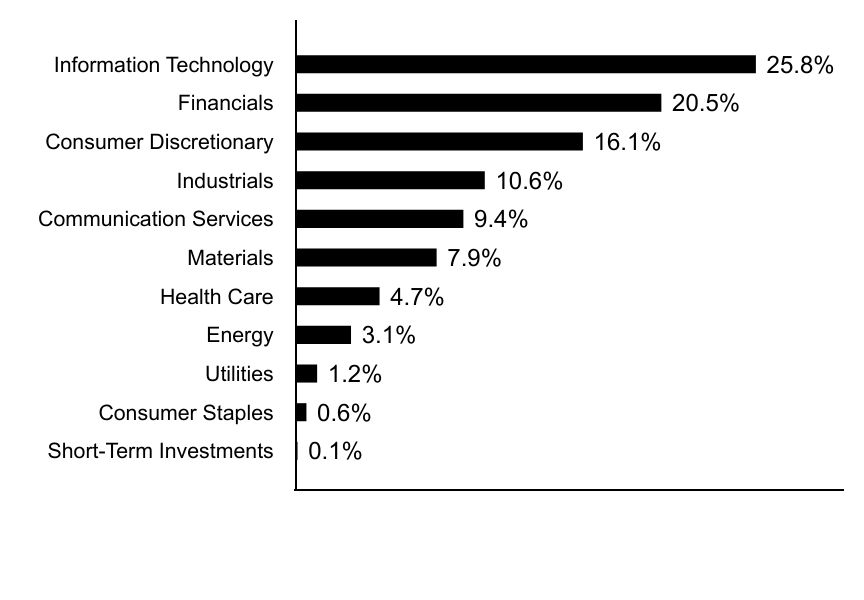

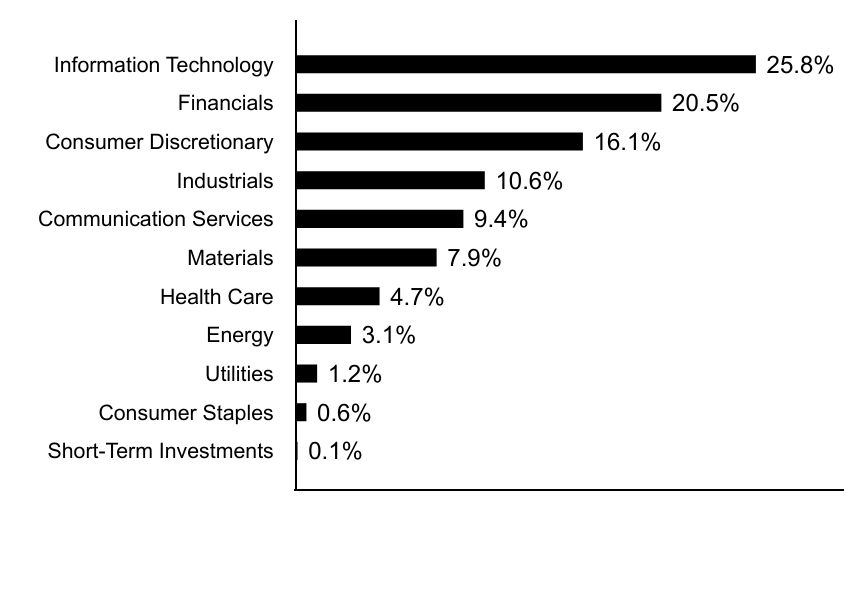

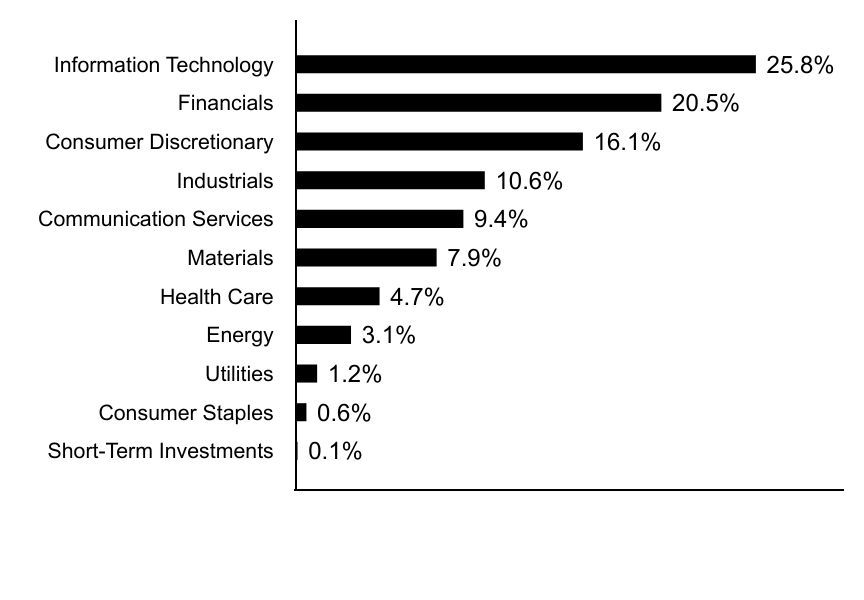

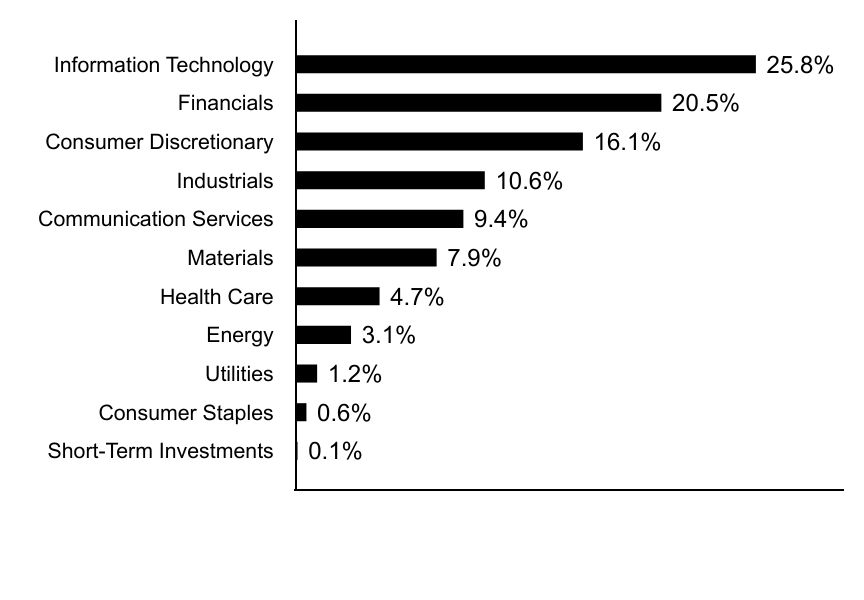

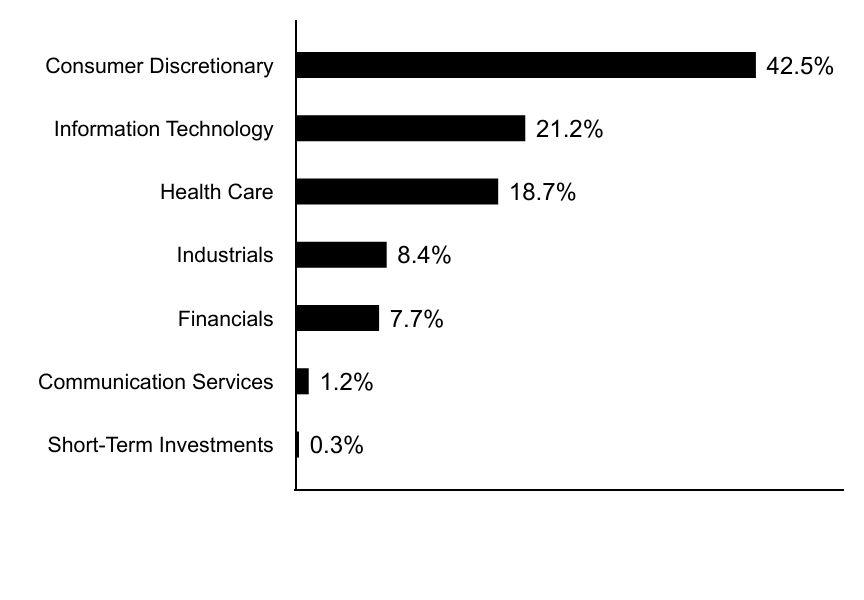

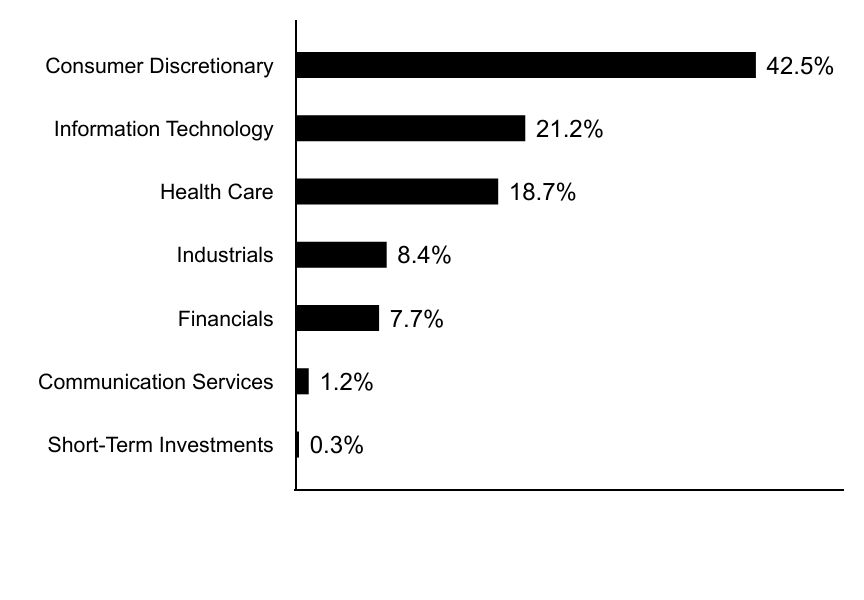

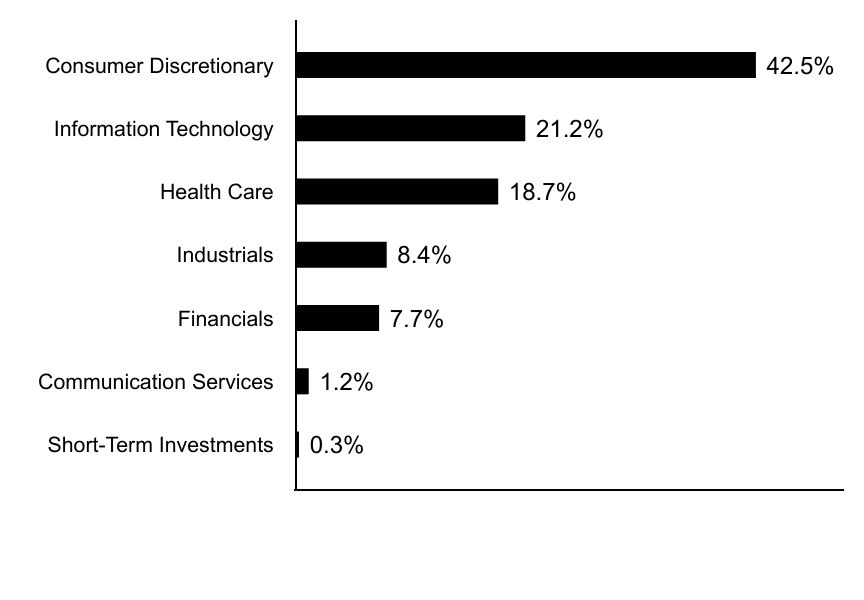

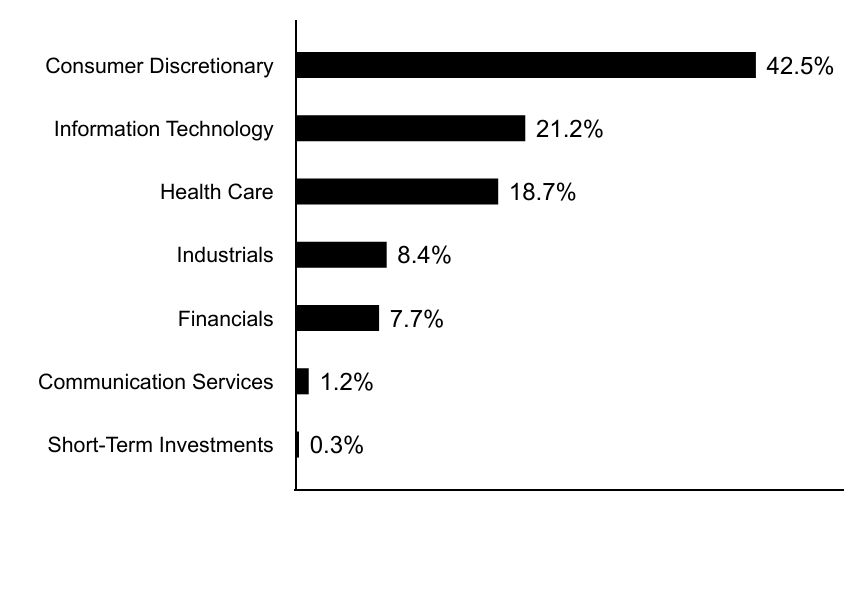

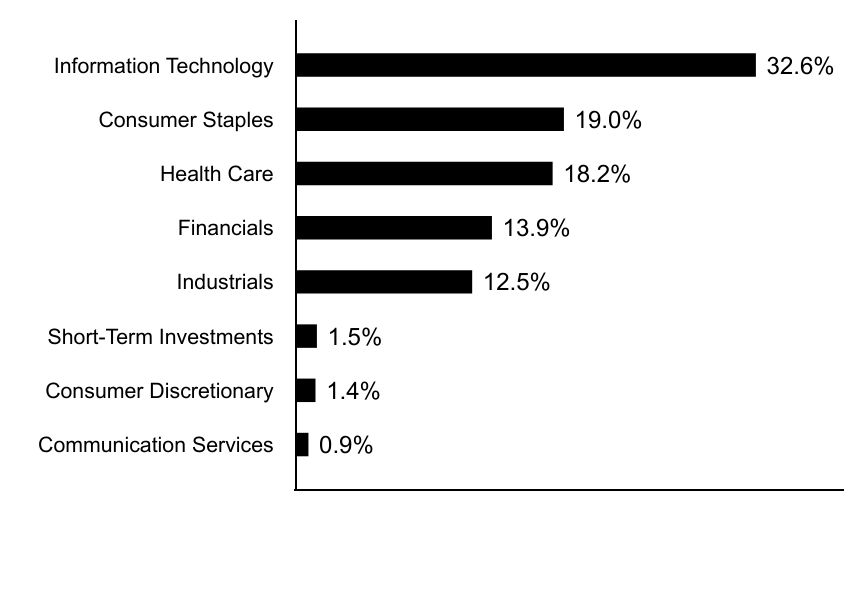

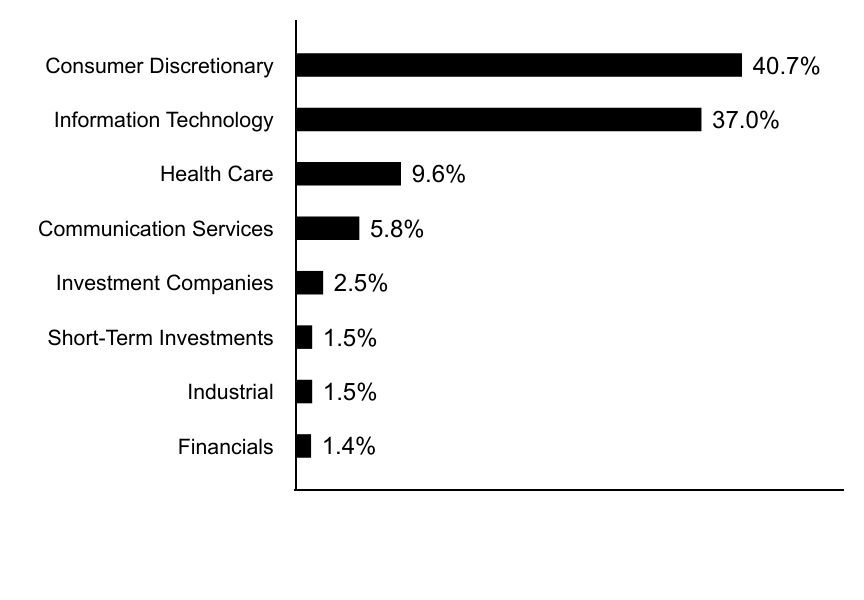

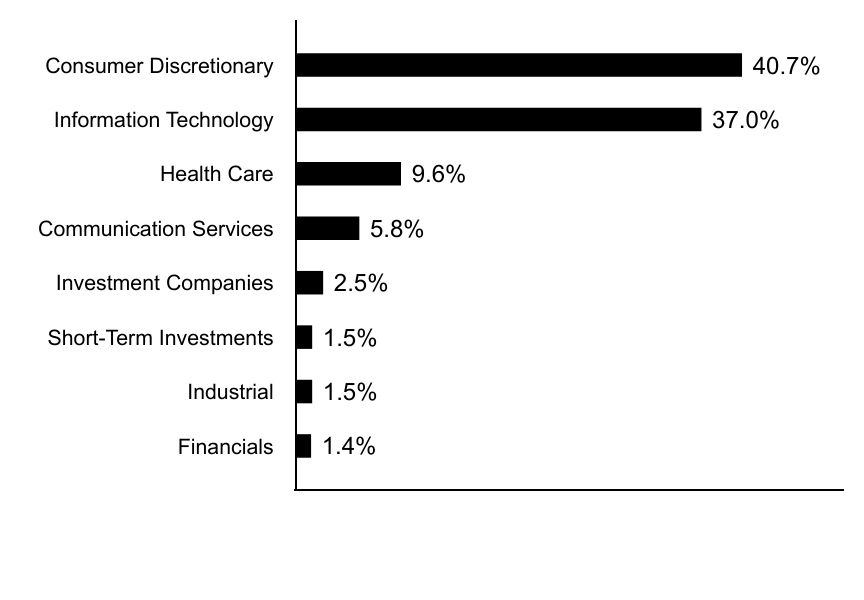

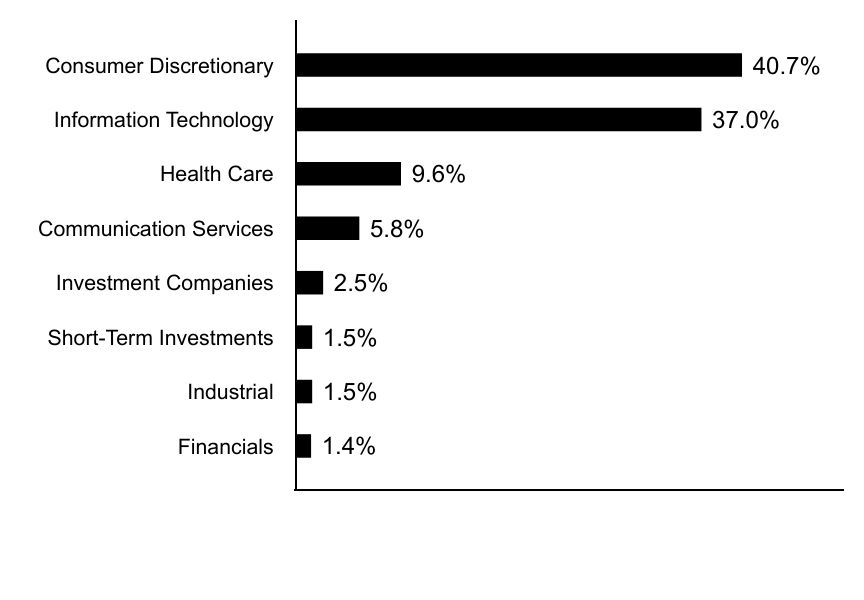

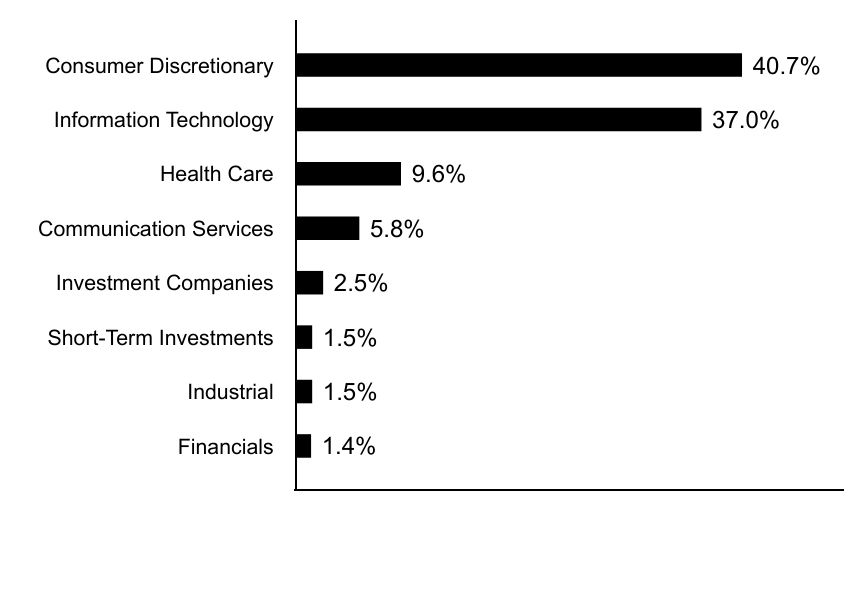

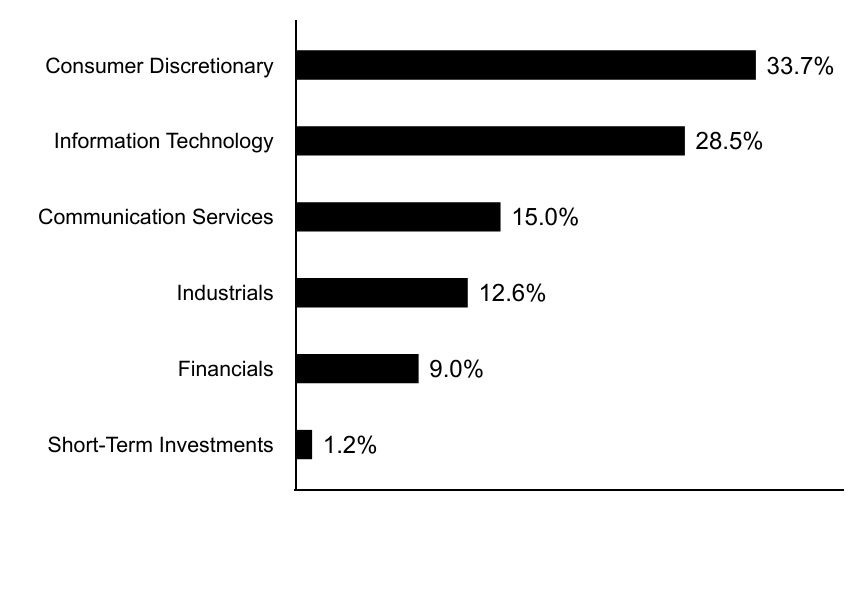

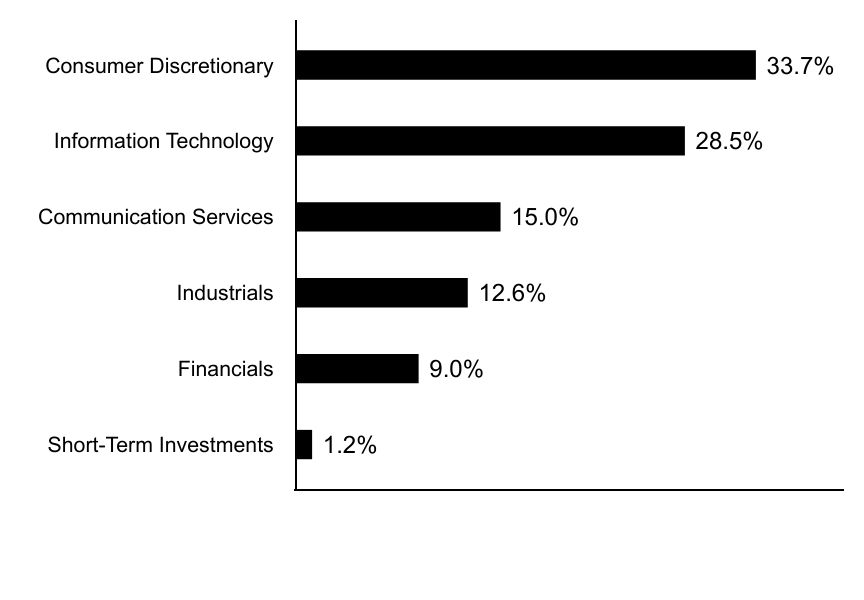

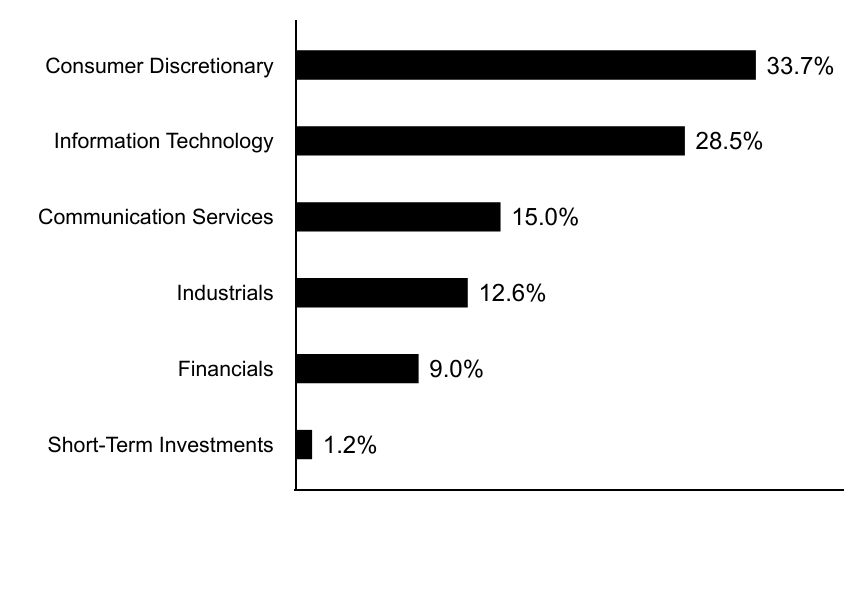

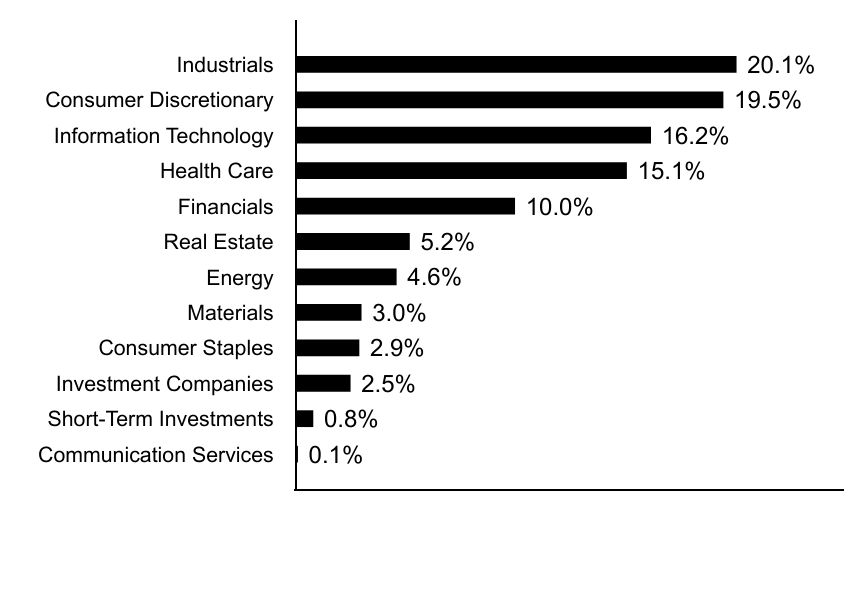

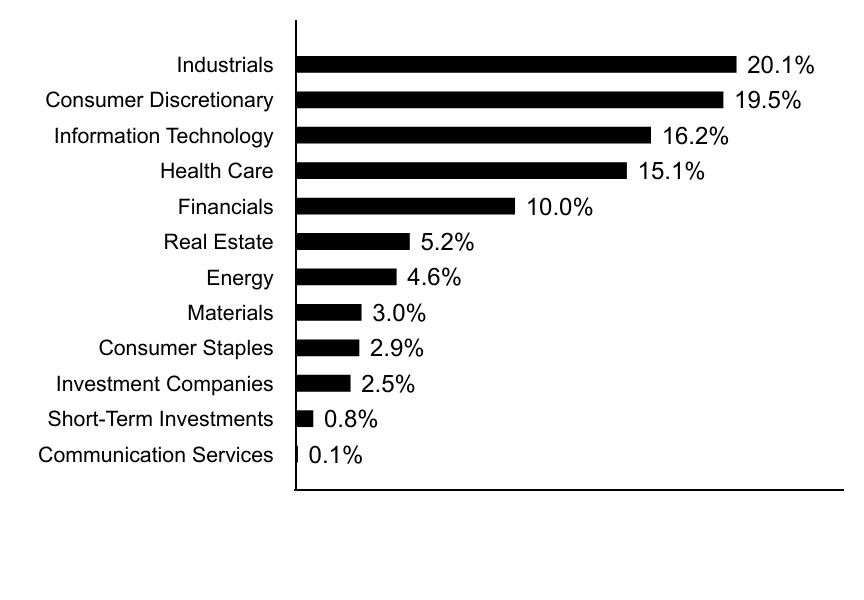

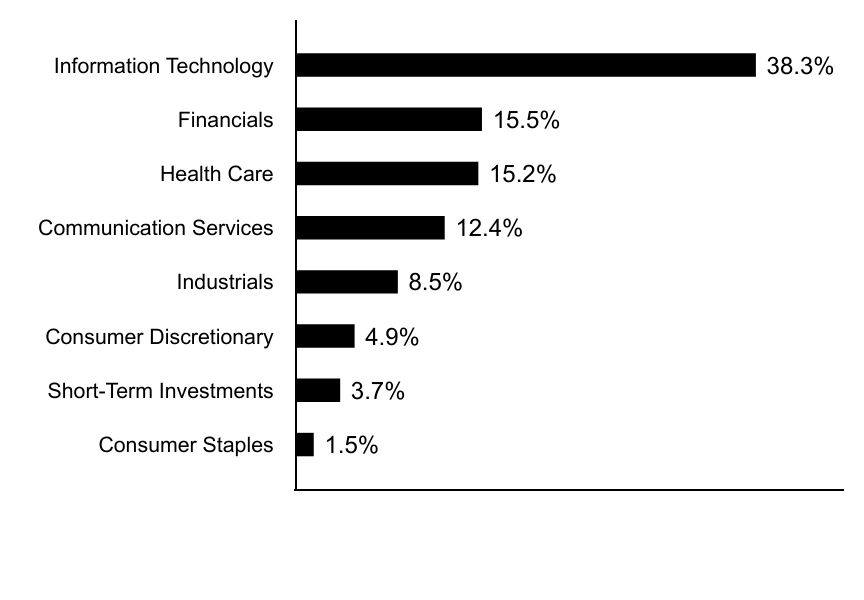

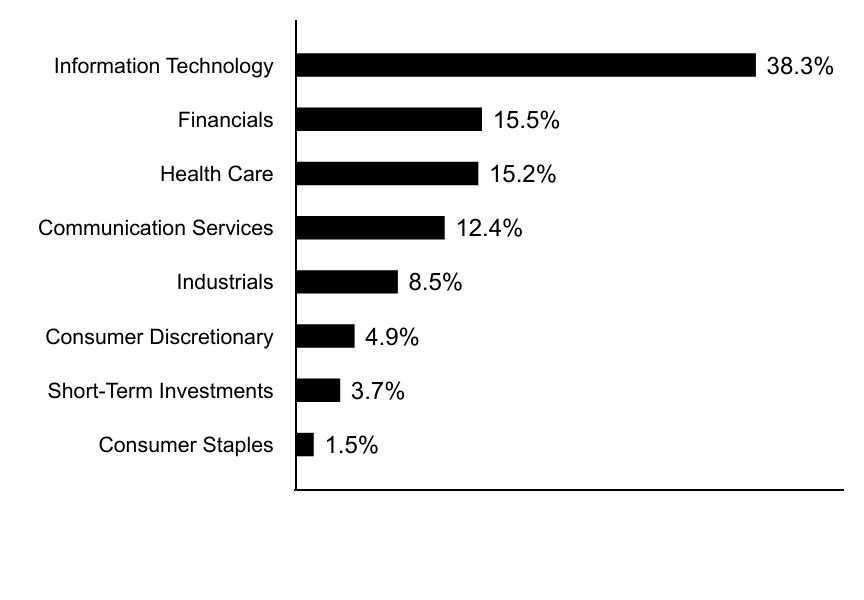

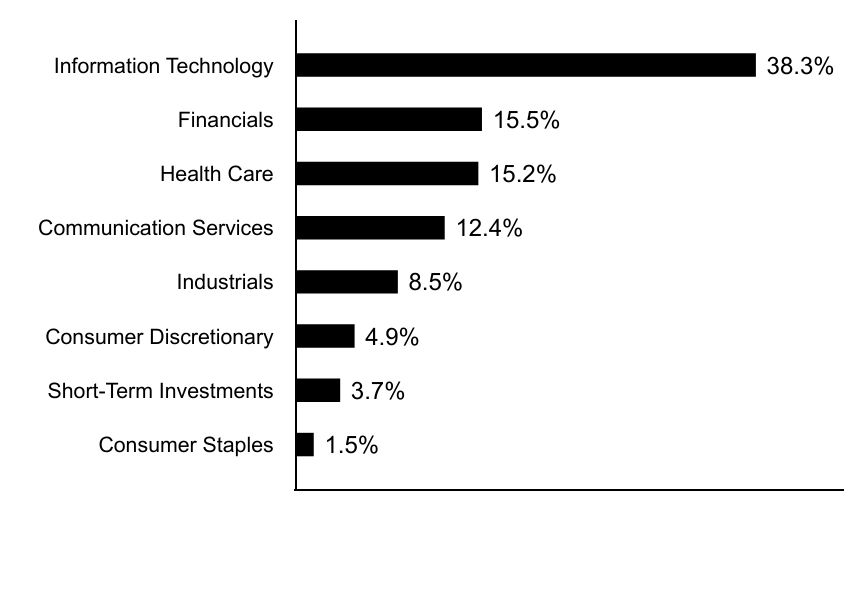

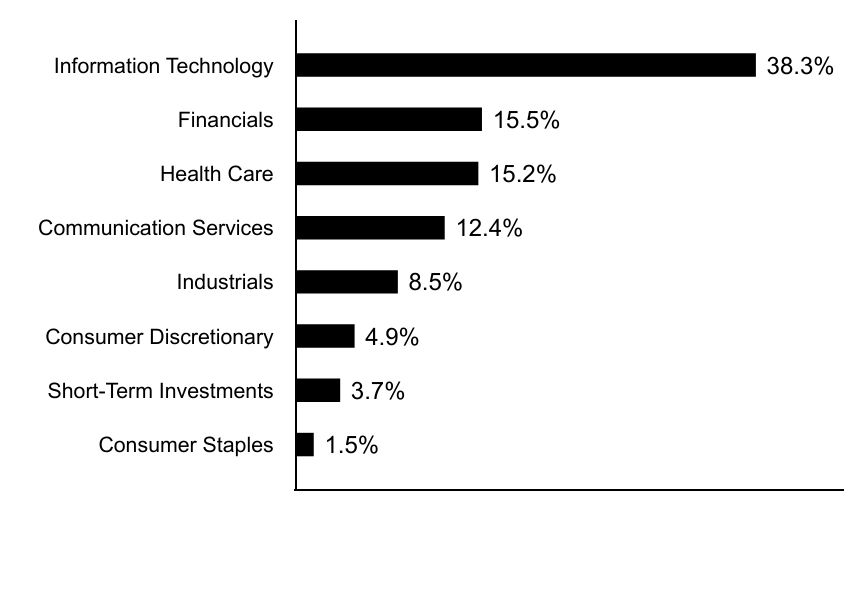

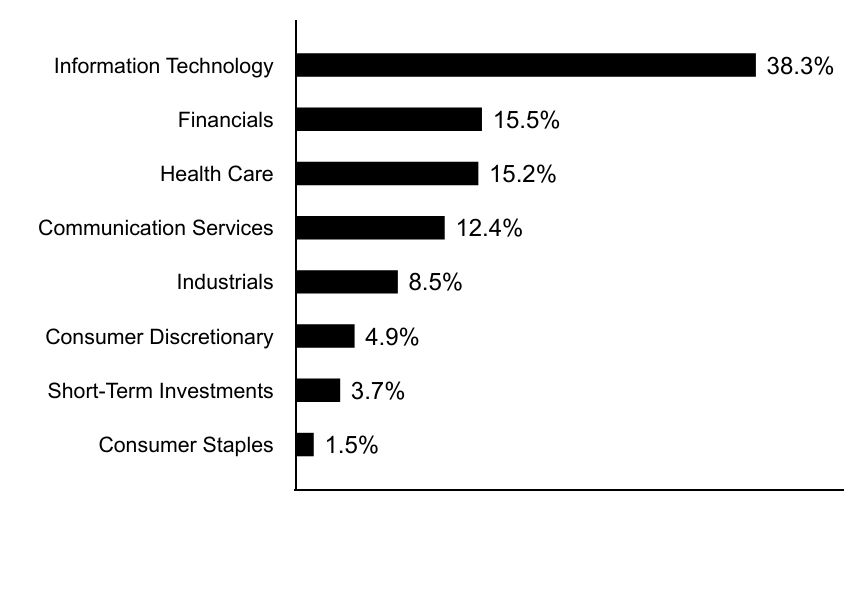

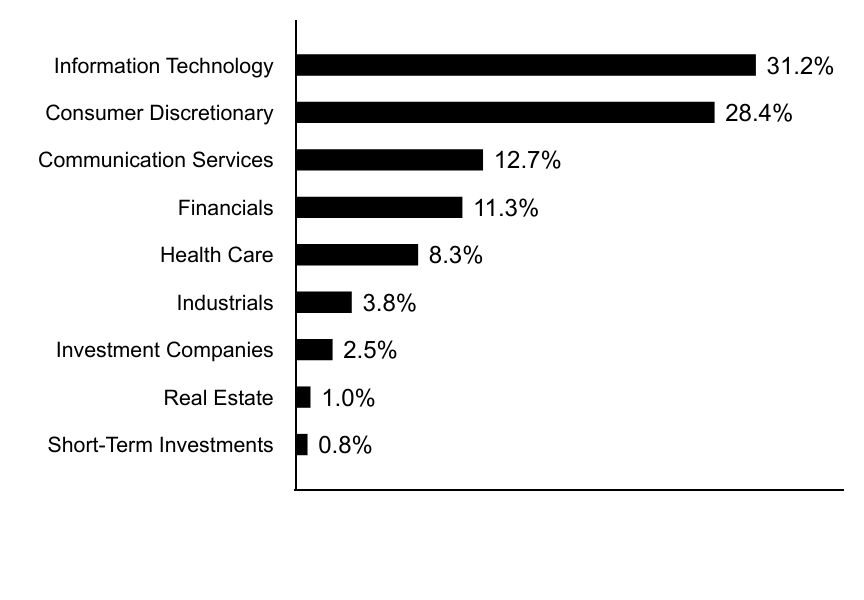

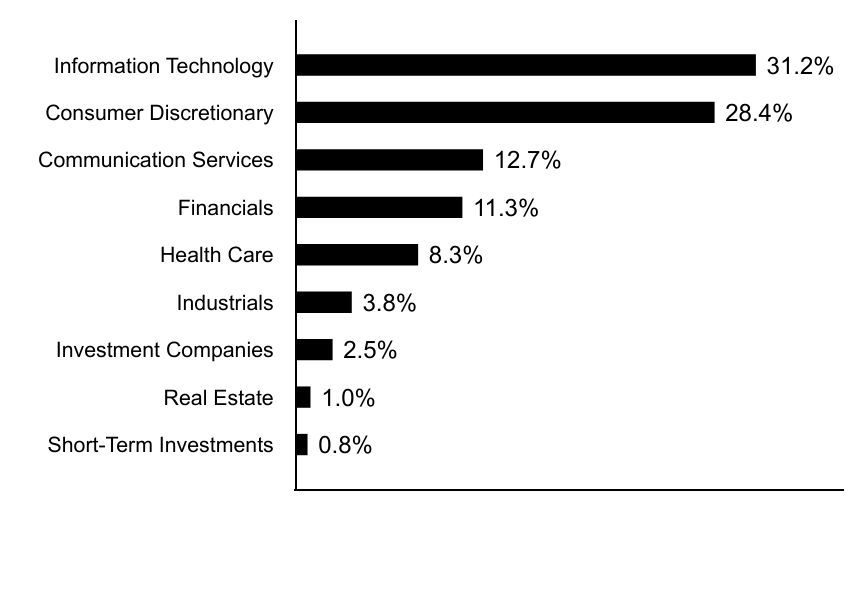

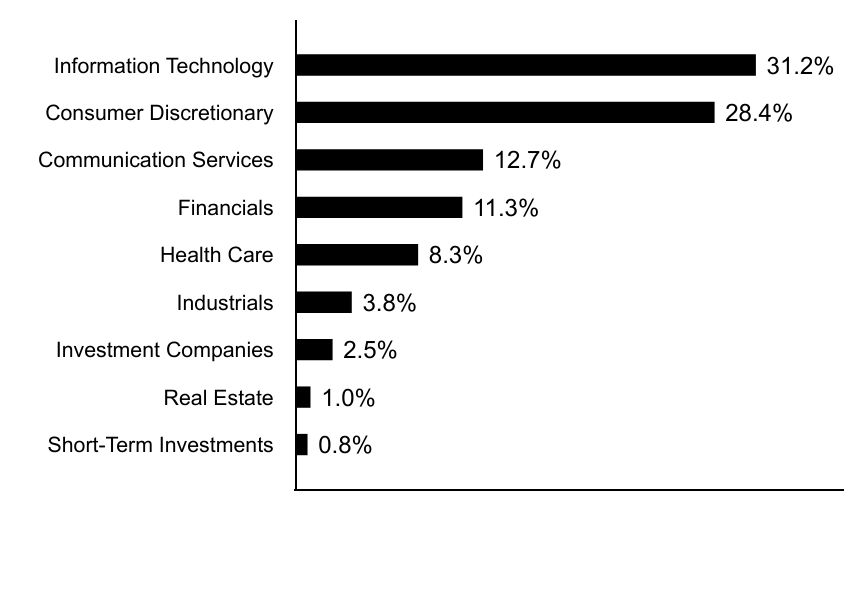

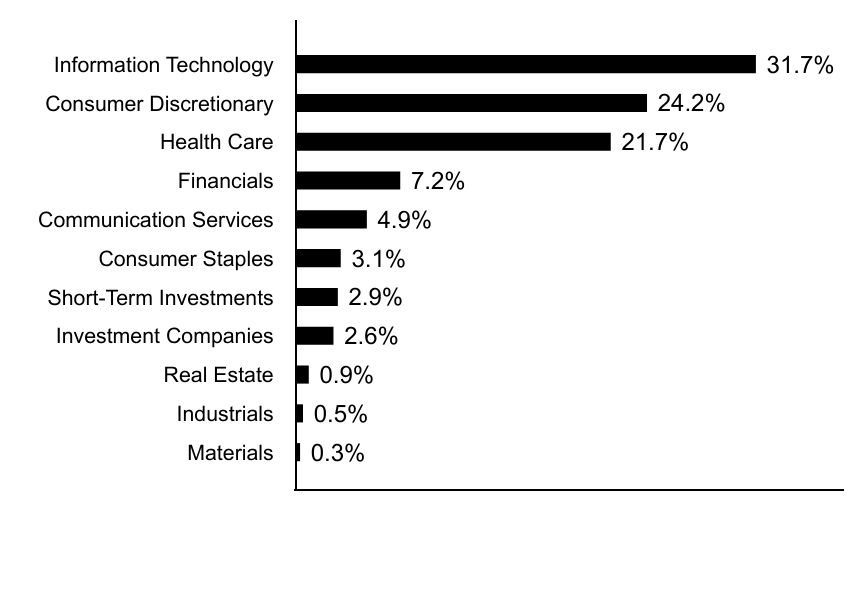

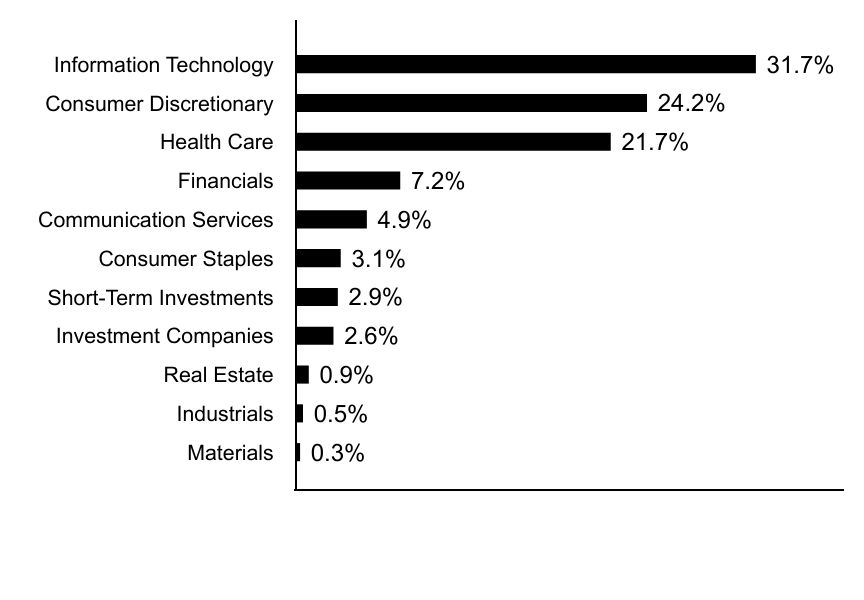

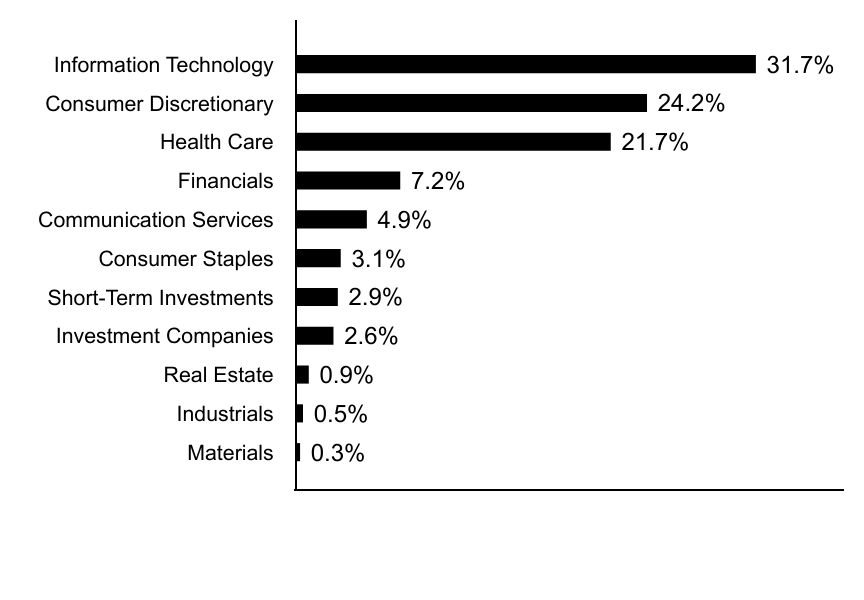

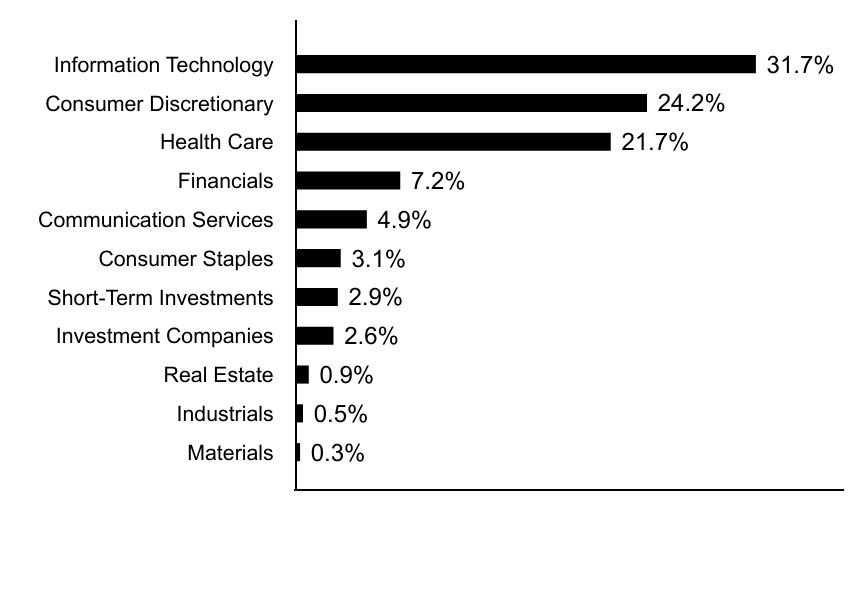

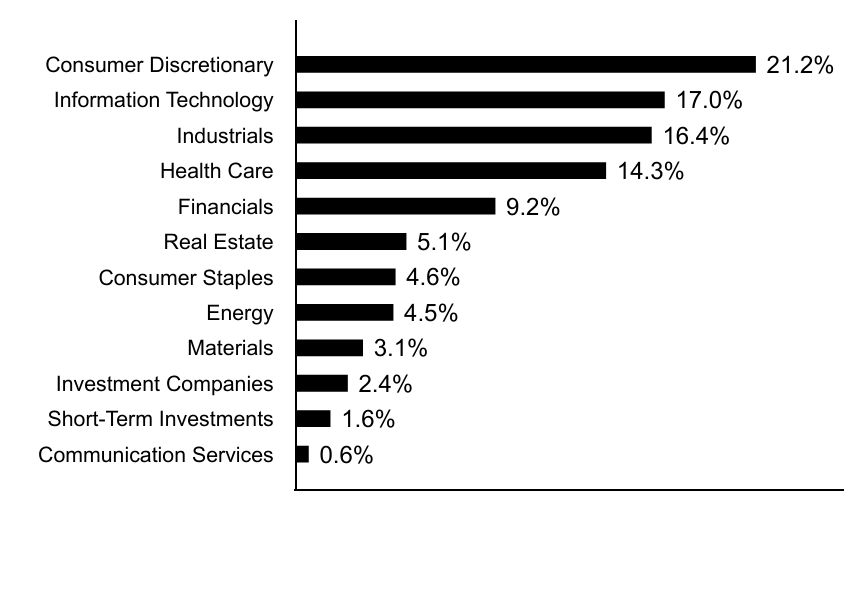

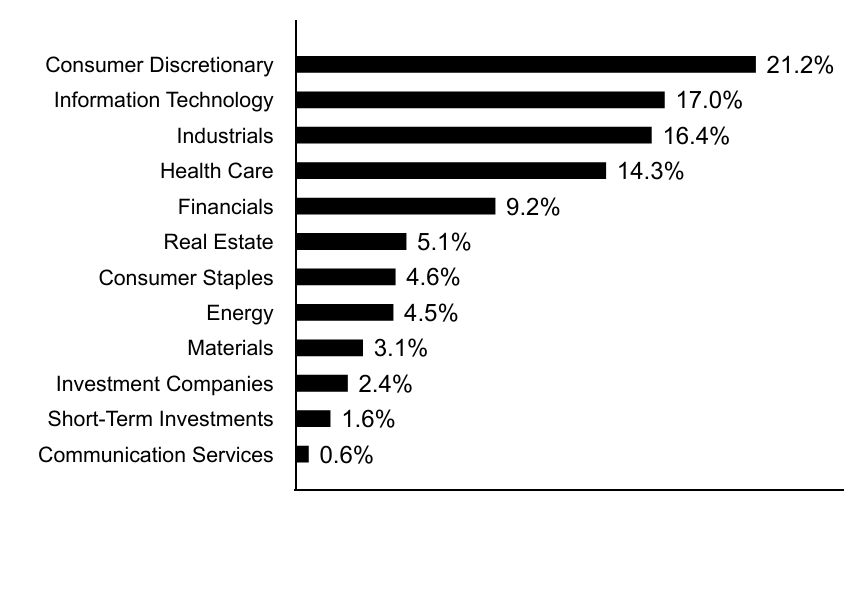

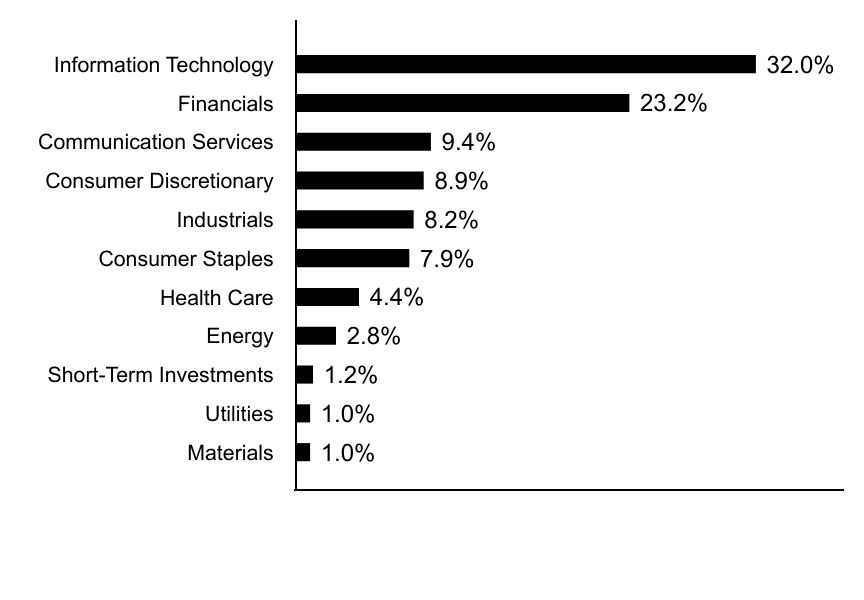

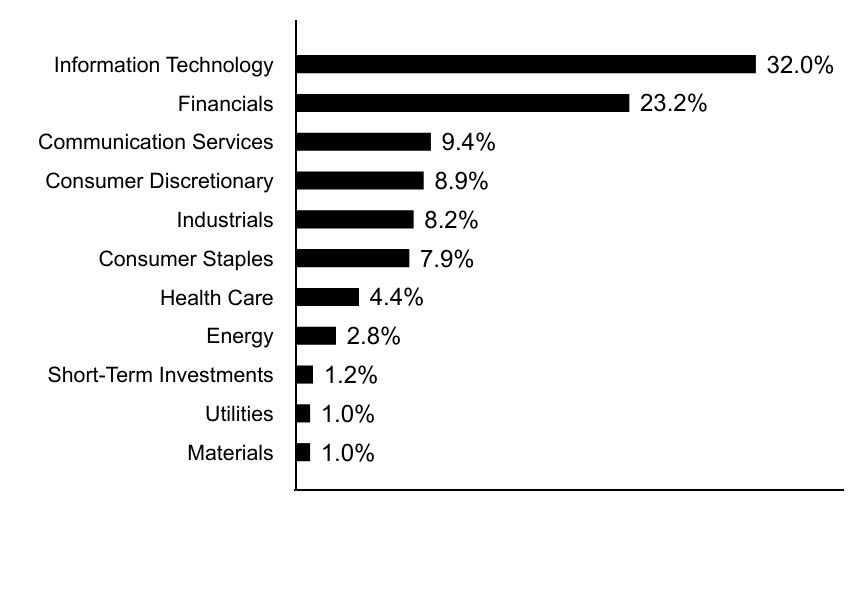

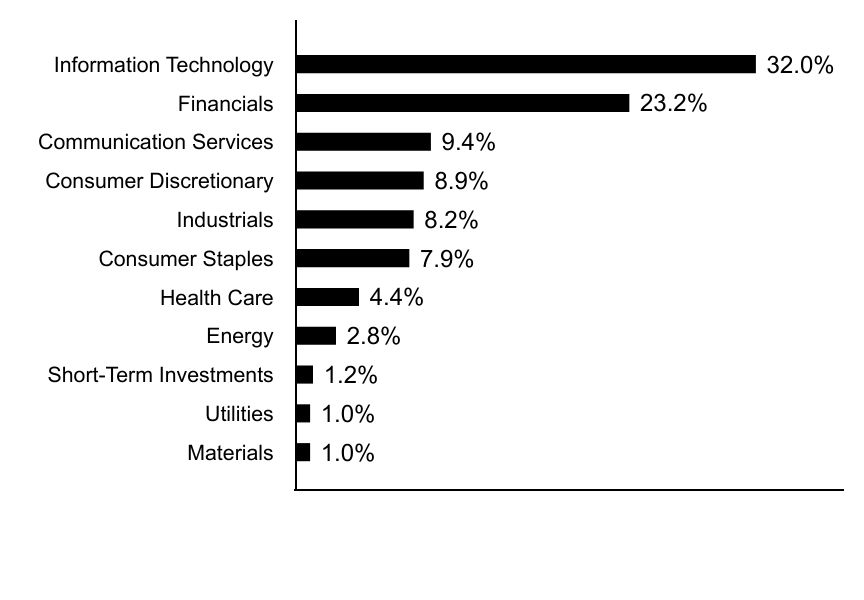

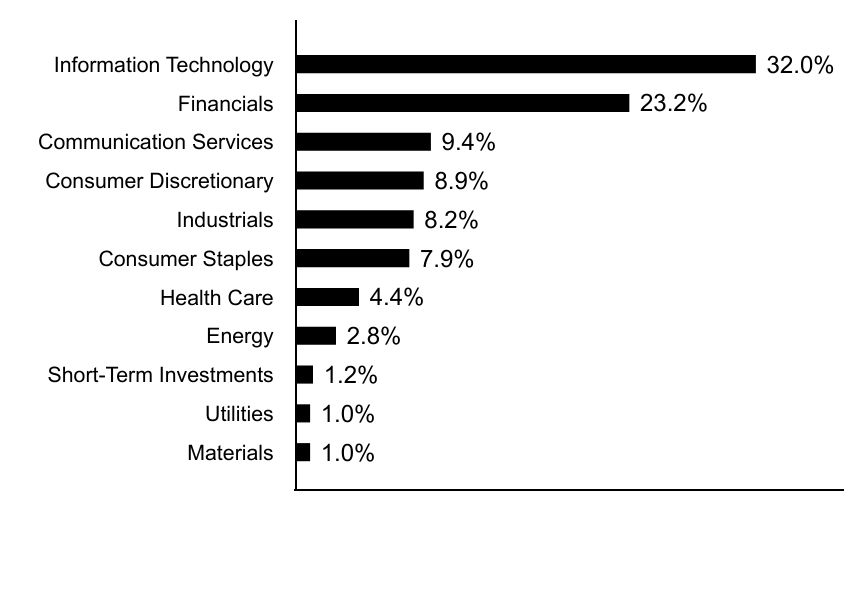

Sector Allocation (% of total investments)

| Value | Value |

|---|

| Short-Term Investments | 1.3% |

| Investment Companies | 2.5% |

| Real Estate | 3.5% |

| Industrials | 6.3% |

| Health Care | 8.6% |

| Financials | 8.7% |

| Communication Services | 12.5% |

| Consumer Discretionary | 27.9% |

| Information Technology | 28.7% |

Top Ten Holdings (% of total investments)

| Cloudflare, Inc. | 9.7% |

| DoorDash, Inc. | 7.5% |

| Trade Desk, Inc. | 7.0% |

| Shopify, Inc. | 6.2% |

| Tesla, Inc. | 6.2% |

| Snowflake, Inc. | 5.2% |

| Amazon.com, Inc. | 5.1% |

| ROBLOX Corp. | 4.9% |

| Airbnb, Inc. | 4.7% |

| Royalty Pharma PLC | 4.7% |

| Total | 61.2% |

If you wish to view additional information about the Fund, including the prospectus, statement of additional information, financial statements and holdings, please scan the QR code or visit www.morganstanley.com/im/shareholderreports. For proxy information, please visit www.morganstanley.com/im/en-us/institutional-investor/about-us/proxy-voting/vote-summary-report.desktop.html.

The Funds may deliver a single copy of certain required shareholder documents (including prospectuses, shareholder reports, and proxy materials) to investors with the same last name and the same address. Your participation will continue indefinitely unless you instruct otherwise by calling 1-800-869-6397 or by contacting your financial intermediary. Your instruction will typically be effective within 30 days of receipt.

Not FDIC Insured | May Lose Value | No Bank Guarantee

Semi-Annual Shareholder Report June 30, 2024

Morgan Stanley Institutional Fund, Inc. - Advantage Portfolio

Semi-Annual Shareholder Report June 30, 2024

This semi-annual shareholder report contains important information about Morgan Stanley Institutional Fund, Inc. - Advantage Portfolio for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Fund at www.morganstanley.com/im/shareholderreports. You can also request this information by contacting us at 1-800-869-6397.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class C | $96 | 1.92% |

| Total Net Assets | $161,969,489 |

| # of Portfolio Holdings | 30 |

| Portfolio Turnover Rate | 28% |

What did the Fund invest in?

The following tables reflect what the Fund invested in as of the report date.

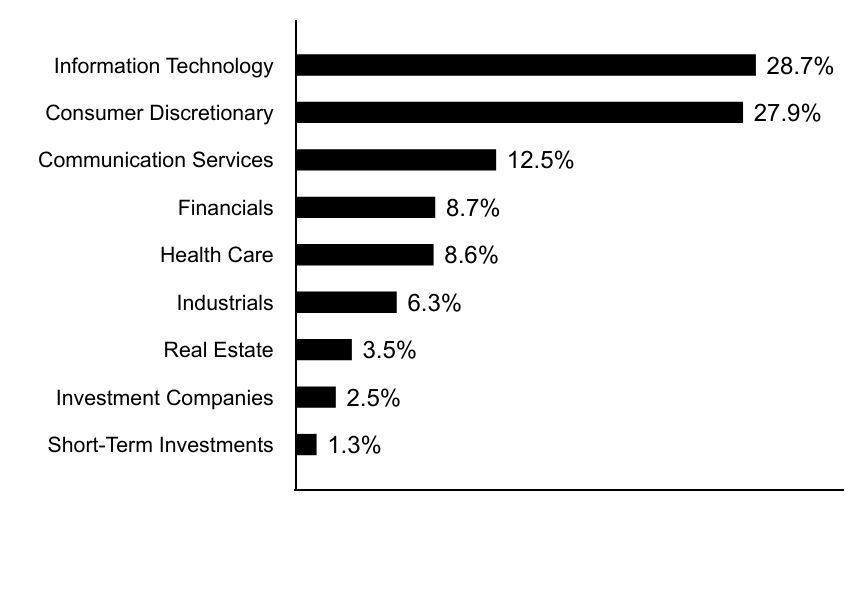

Sector Allocation (% of total investments)

| Value | Value |

|---|

| Short-Term Investments | 1.3% |

| Investment Companies | 2.5% |

| Real Estate | 3.5% |

| Industrials | 6.3% |

| Health Care | 8.6% |

| Financials | 8.7% |

| Communication Services | 12.5% |

| Consumer Discretionary | 27.9% |

| Information Technology | 28.7% |

Top Ten Holdings (% of total investments)

| Cloudflare, Inc. | 9.7% |

| DoorDash, Inc. | 7.5% |

| Trade Desk, Inc. | 7.0% |

| Shopify, Inc. | 6.2% |

| Tesla, Inc. | 6.2% |

| Snowflake, Inc. | 5.2% |

| Amazon.com, Inc. | 5.1% |

| ROBLOX Corp. | 4.9% |

| Airbnb, Inc. | 4.7% |

| Royalty Pharma PLC | 4.7% |

| Total | 61.2% |

If you wish to view additional information about the Fund, including the prospectus, statement of additional information, financial statements and holdings, please scan the QR code or visit www.morganstanley.com/im/shareholderreports. For proxy information, please visit www.morganstanley.com/im/en-us/institutional-investor/about-us/proxy-voting/vote-summary-report.desktop.html.

The Funds may deliver a single copy of certain required shareholder documents (including prospectuses, shareholder reports, and proxy materials) to investors with the same last name and the same address. Your participation will continue indefinitely unless you instruct otherwise by calling 1-800-869-6397 or by contacting your financial intermediary. Your instruction will typically be effective within 30 days of receipt.

Not FDIC Insured | May Lose Value | No Bank Guarantee

Semi-Annual Shareholder Report June 30, 2024

Morgan Stanley Institutional Fund, Inc. - Advantage Portfolio

Semi-Annual Shareholder Report June 30, 2024

This semi-annual shareholder report contains important information about Morgan Stanley Institutional Fund, Inc. - Advantage Portfolio for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Fund at www.morganstanley.com/im/shareholderreports. You can also request this information by contacting us at 1-800-869-6397.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class I | $43 | 0.85% |

| Total Net Assets | $161,969,489 |

| # of Portfolio Holdings | 30 |

| Portfolio Turnover Rate | 28% |

What did the Fund invest in?

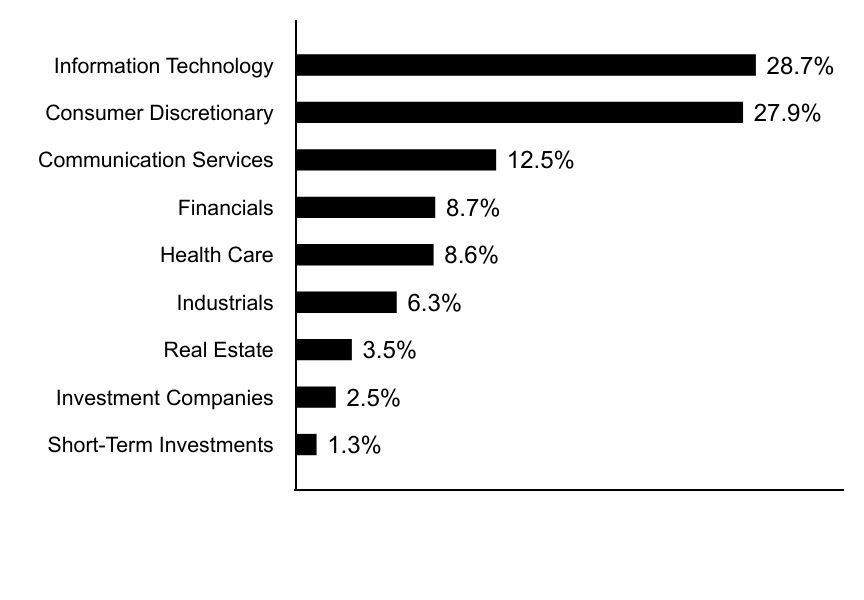

The following tables reflect what the Fund invested in as of the report date.

Sector Allocation (% of total investments)

| Value | Value |

|---|

| Short-Term Investments | 1.3% |

| Investment Companies | 2.5% |

| Real Estate | 3.5% |

| Industrials | 6.3% |

| Health Care | 8.6% |

| Financials | 8.7% |

| Communication Services | 12.5% |

| Consumer Discretionary | 27.9% |

| Information Technology | 28.7% |

Top Ten Holdings (% of total investments)

| Cloudflare, Inc. | 9.7% |

| DoorDash, Inc. | 7.5% |

| Trade Desk, Inc. | 7.0% |

| Shopify, Inc. | 6.2% |

| Tesla, Inc. | 6.2% |

| Snowflake, Inc. | 5.2% |

| Amazon.com, Inc. | 5.1% |

| ROBLOX Corp. | 4.9% |

| Airbnb, Inc. | 4.7% |

| Royalty Pharma PLC | 4.7% |

| Total | 61.2% |

If you wish to view additional information about the Fund, including the prospectus, statement of additional information, financial statements and holdings, please scan the QR code or visit www.morganstanley.com/im/shareholderreports. For proxy information, please visit www.morganstanley.com/im/en-us/institutional-investor/about-us/proxy-voting/vote-summary-report.desktop.html.

The Funds may deliver a single copy of certain required shareholder documents (including prospectuses, shareholder reports, and proxy materials) to investors with the same last name and the same address. Your participation will continue indefinitely unless you instruct otherwise by calling 1-800-869-6397 or by contacting your financial intermediary. Your instruction will typically be effective within 30 days of receipt.

Not FDIC Insured | May Lose Value | No Bank Guarantee

Semi-Annual Shareholder Report June 30, 2024

Morgan Stanley Institutional Fund, Inc. - Advantage Portfolio

Semi-Annual Shareholder Report June 30, 2024

This semi-annual shareholder report contains important information about Morgan Stanley Institutional Fund, Inc. - Advantage Portfolio for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Fund at www.morganstanley.com/im/shareholderreports. You can also request this information by contacting us at 1-800-869-6397.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class L | $50 | 0.99% |

| Total Net Assets | $161,969,489 |

| # of Portfolio Holdings | 30 |

| Portfolio Turnover Rate | 28% |

What did the Fund invest in?

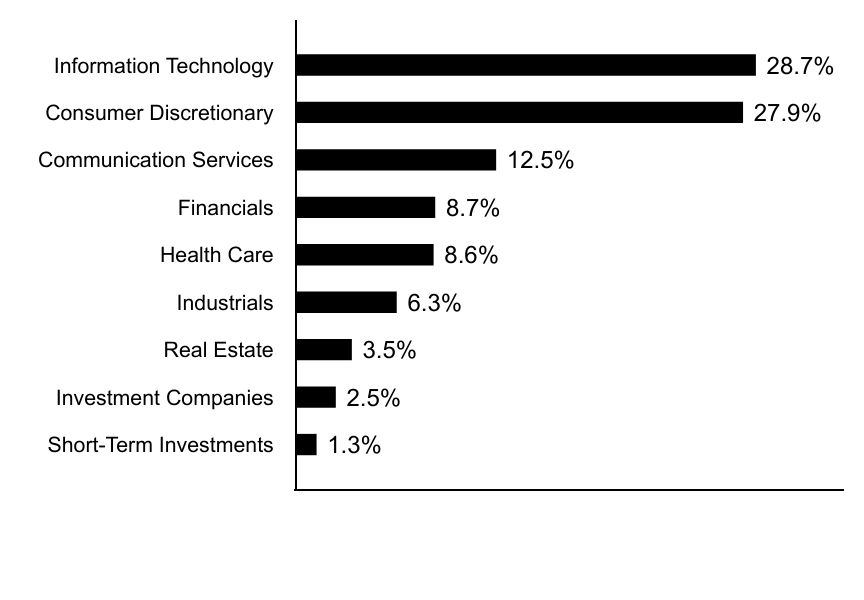

The following tables reflect what the Fund invested in as of the report date.

Sector Allocation (% of total investments)

| Value | Value |

|---|

| Short-Term Investments | 1.3% |

| Investment Companies | 2.5% |

| Real Estate | 3.5% |

| Industrials | 6.3% |

| Health Care | 8.6% |

| Financials | 8.7% |

| Communication Services | 12.5% |

| Consumer Discretionary | 27.9% |

| Information Technology | 28.7% |

Top Ten Holdings (% of total investments)

| Cloudflare, Inc. | 9.7% |

| DoorDash, Inc. | 7.5% |

| Trade Desk, Inc. | 7.0% |

| Shopify, Inc. | 6.2% |

| Tesla, Inc. | 6.2% |

| Snowflake, Inc. | 5.2% |

| Amazon.com, Inc. | 5.1% |

| ROBLOX Corp. | 4.9% |

| Airbnb, Inc. | 4.7% |

| Royalty Pharma PLC | 4.7% |

| Total | 61.2% |

If you wish to view additional information about the Fund, including the prospectus, statement of additional information, financial statements and holdings, please scan the QR code or visit www.morganstanley.com/im/shareholderreports. For proxy information, please visit www.morganstanley.com/im/en-us/institutional-investor/about-us/proxy-voting/vote-summary-report.desktop.html.

The Funds may deliver a single copy of certain required shareholder documents (including prospectuses, shareholder reports, and proxy materials) to investors with the same last name and the same address. Your participation will continue indefinitely unless you instruct otherwise by calling 1-800-869-6397 or by contacting your financial intermediary. Your instruction will typically be effective within 30 days of receipt.

Not FDIC Insured | May Lose Value | No Bank Guarantee

Semi-Annual Shareholder Report June 30, 2024

Morgan Stanley Institutional Fund, Inc. - Advantage Portfolio

Semi-Annual Shareholder Report June 30, 2024

This semi-annual shareholder report contains important information about Morgan Stanley Institutional Fund, Inc. - Advantage Portfolio for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Fund at www.morganstanley.com/im/shareholderreports. You can also request this information by contacting us at 1-800-869-6397.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class R6 | $41 | 0.81% |

| Total Net Assets | $161,969,489 |

| # of Portfolio Holdings | 30 |

| Portfolio Turnover Rate | 28% |

What did the Fund invest in?

The following tables reflect what the Fund invested in as of the report date.

Sector Allocation (% of total investments)

| Value | Value |

|---|

| Short-Term Investments | 1.3% |

| Investment Companies | 2.5% |

| Real Estate | 3.5% |

| Industrials | 6.3% |

| Health Care | 8.6% |

| Financials | 8.7% |

| Communication Services | 12.5% |

| Consumer Discretionary | 27.9% |

| Information Technology | 28.7% |

Top Ten Holdings (% of total investments)

| Cloudflare, Inc. | 9.7% |

| DoorDash, Inc. | 7.5% |

| Trade Desk, Inc. | 7.0% |

| Shopify, Inc. | 6.2% |

| Tesla, Inc. | 6.2% |

| Snowflake, Inc. | 5.2% |

| Amazon.com, Inc. | 5.1% |

| ROBLOX Corp. | 4.9% |

| Airbnb, Inc. | 4.7% |

| Royalty Pharma PLC | 4.7% |

| Total | 61.2% |

If you wish to view additional information about the Fund, including the prospectus, statement of additional information, financial statements and holdings, please scan the QR code or visit www.morganstanley.com/im/shareholderreports. For proxy information, please visit www.morganstanley.com/im/en-us/institutional-investor/about-us/proxy-voting/vote-summary-report.desktop.html.

The Funds may deliver a single copy of certain required shareholder documents (including prospectuses, shareholder reports, and proxy materials) to investors with the same last name and the same address. Your participation will continue indefinitely unless you instruct otherwise by calling 1-800-869-6397 or by contacting your financial intermediary. Your instruction will typically be effective within 30 days of receipt.

Not FDIC Insured | May Lose Value | No Bank Guarantee

Semi-Annual Shareholder Report June 30, 2024

Morgan Stanley Institutional Fund, Inc. - American Resilience Portfolio

Semi-Annual Shareholder Report June 30, 2024

This semi-annual shareholder report contains important information about Morgan Stanley Institutional Fund, Inc. - American Resilience Portfolio for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Fund at www.morganstanley.com/im/shareholderreports. You can also request this information by contacting us at 1-800-869-6397.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class A | $53 | 1.05% |

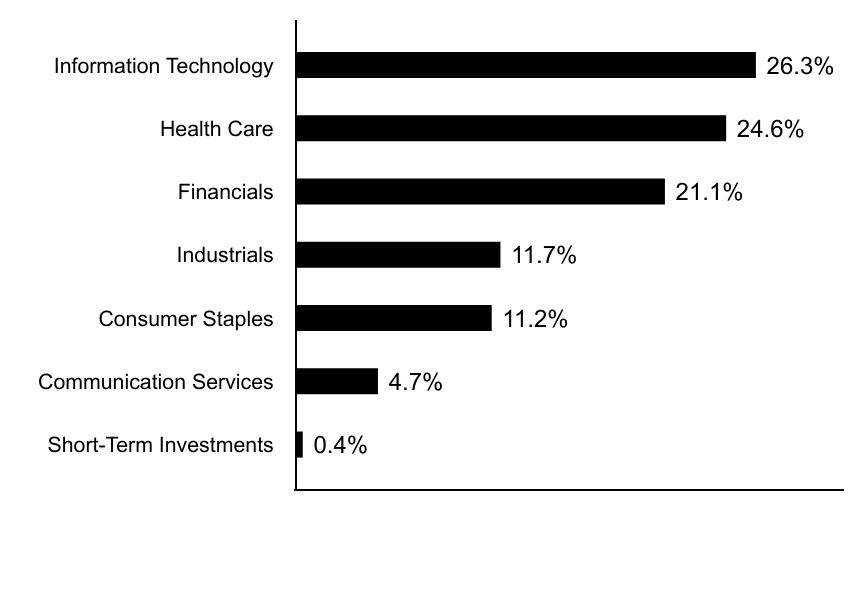

| Total Net Assets | $1,194,575 |

| # of Portfolio Holdings | 35 |

| Portfolio Turnover Rate | 21% |

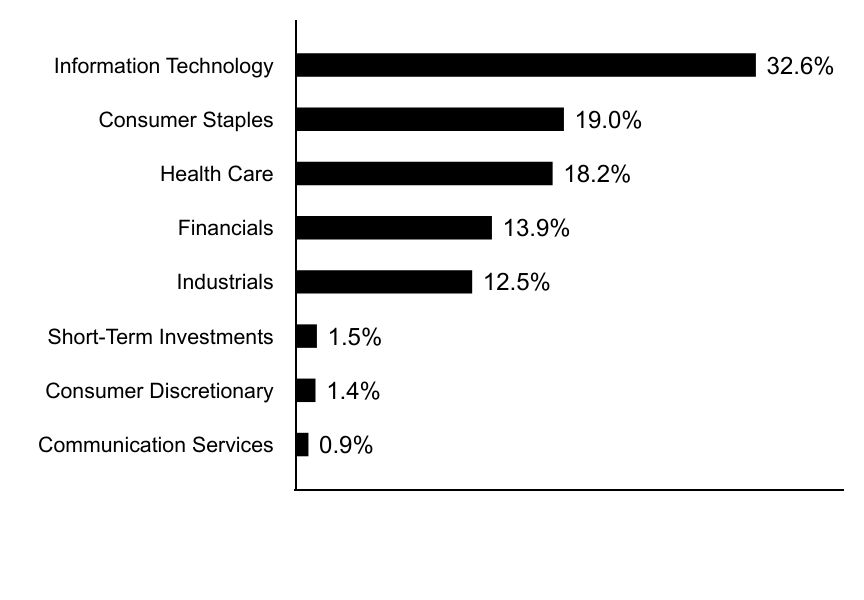

What did the Fund invest in?

The following tables reflect what the Fund invested in as of the report date.

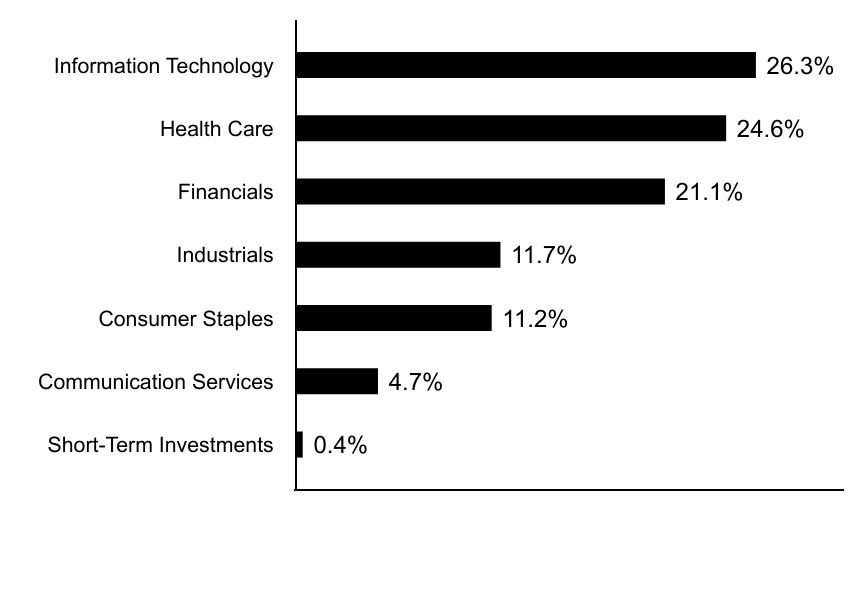

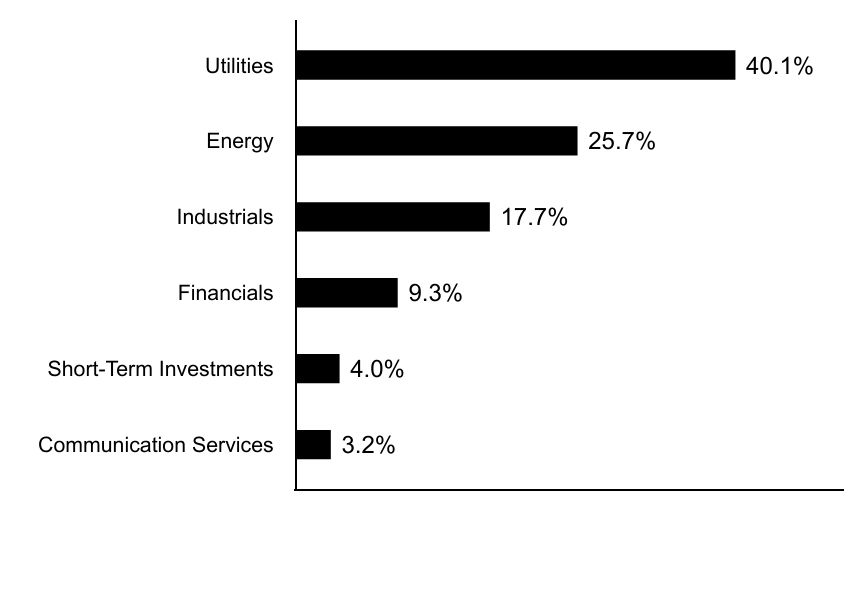

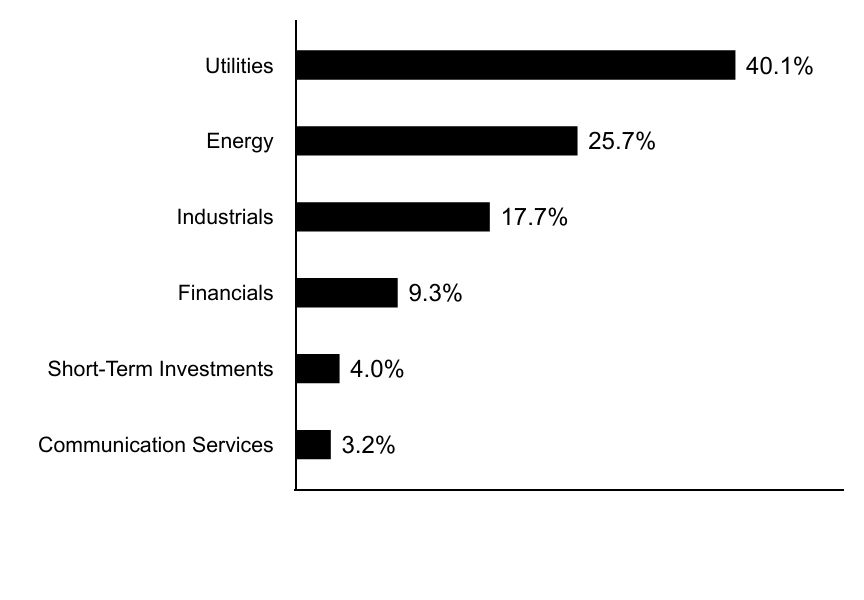

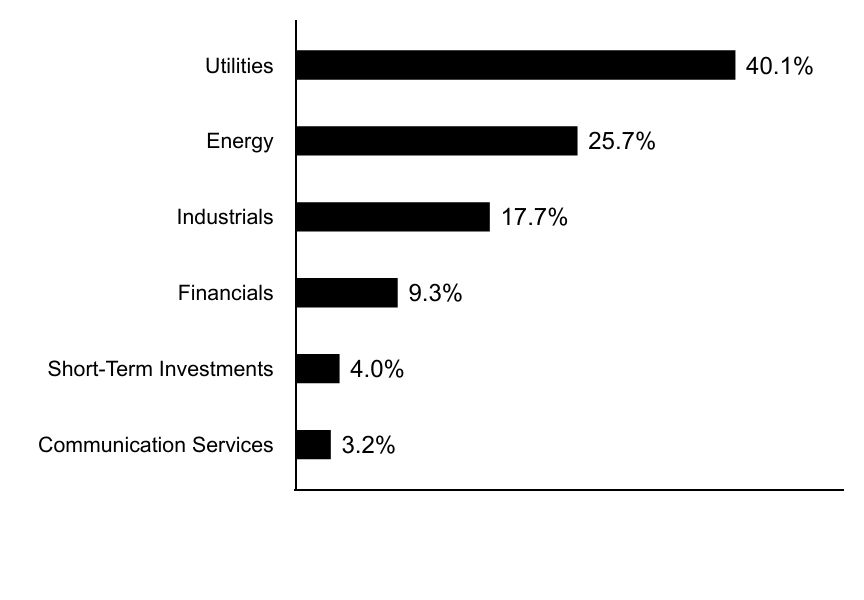

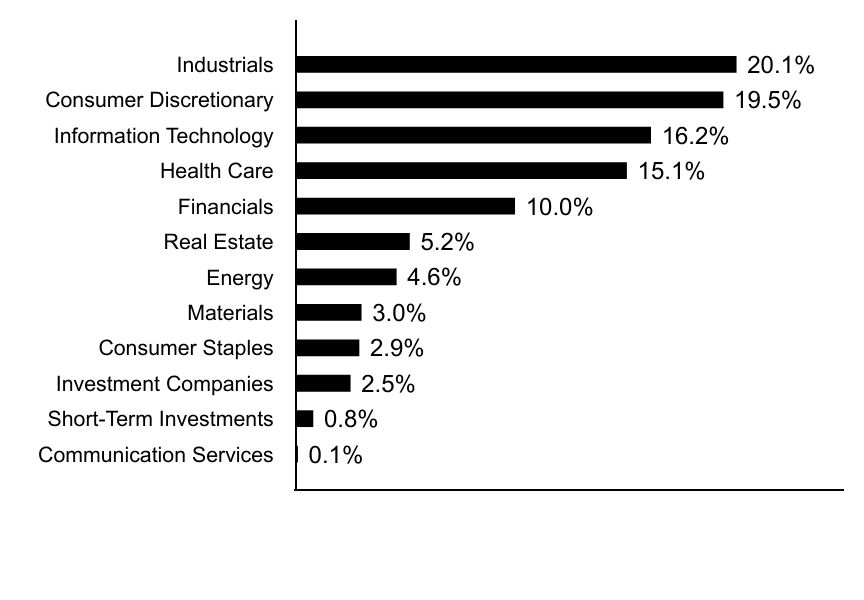

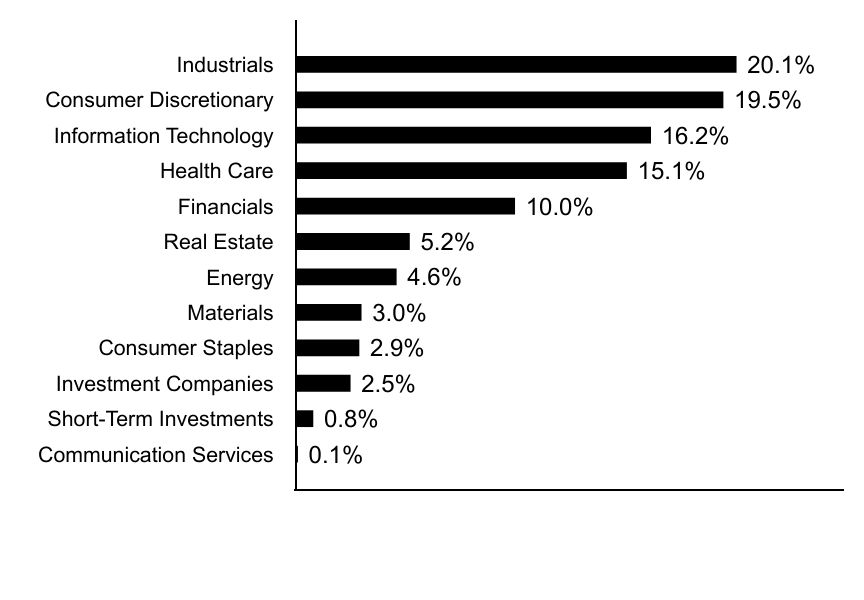

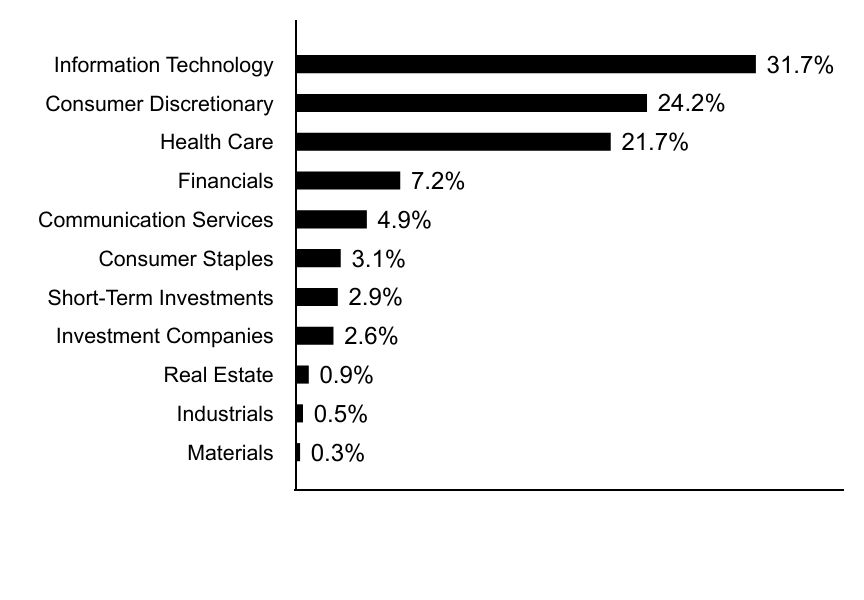

Sector Allocation (% of total investments)

| Value | Value |

|---|

| Short-Term Investments | 0.4% |

| Communication Services | 4.7% |

| Consumer Staples | 11.2% |

| Industrials | 11.7% |

| Financials | 21.1% |

| Health Care | 24.6% |

| Information Technology | 26.3% |

Top Ten Holdings (% of total investments)Footnote Referencea

| Microsoft Corp. | 8.2% |

| Visa, Inc. | 5.8% |

| Accenture PLC | 5.1% |

| Alphabet, Inc. | 4.7% |

| Intercontinental Exchange, Inc. | 4.6% |

| Texas Instruments, Inc. | 4.3% |

| Thermo Fisher Scientific, Inc. | 3.8% |

| UnitedHealth Group, Inc. | 3.7% |

| Procter & Gamble Co. | 3.6% |

| Aon PLC | 3.5% |

| Total | 47.3% |

| Footnote | Description |

Footnotea | Excluding cash equivalents. |

If you wish to view additional information about the Fund, including the prospectus, statement of additional information, financial statements and holdings, please scan the QR code or visit www.morganstanley.com/im/shareholderreports. For proxy information, please visit www.morganstanley.com/im/en-us/institutional-investor/about-us/proxy-voting/vote-summary-report.desktop.html.

The Funds may deliver a single copy of certain required shareholder documents (including prospectuses, shareholder reports, and proxy materials) to investors with the same last name and the same address. Your participation will continue indefinitely unless you instruct otherwise by calling 1-800-869-6397 or by contacting your financial intermediary. Your instruction will typically be effective within 30 days of receipt.

Not FDIC Insured | May Lose Value | No Bank Guarantee

Semi-Annual Shareholder Report June 30, 2024

Morgan Stanley Institutional Fund, Inc. - American Resilience Portfolio

Semi-Annual Shareholder Report June 30, 2024

This semi-annual shareholder report contains important information about Morgan Stanley Institutional Fund, Inc. - American Resilience Portfolio for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Fund at www.morganstanley.com/im/shareholderreports. You can also request this information by contacting us at 1-800-869-6397.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class C | $91 | 1.80% |

| Total Net Assets | $1,194,575 |

| # of Portfolio Holdings | 35 |

| Portfolio Turnover Rate | 21% |

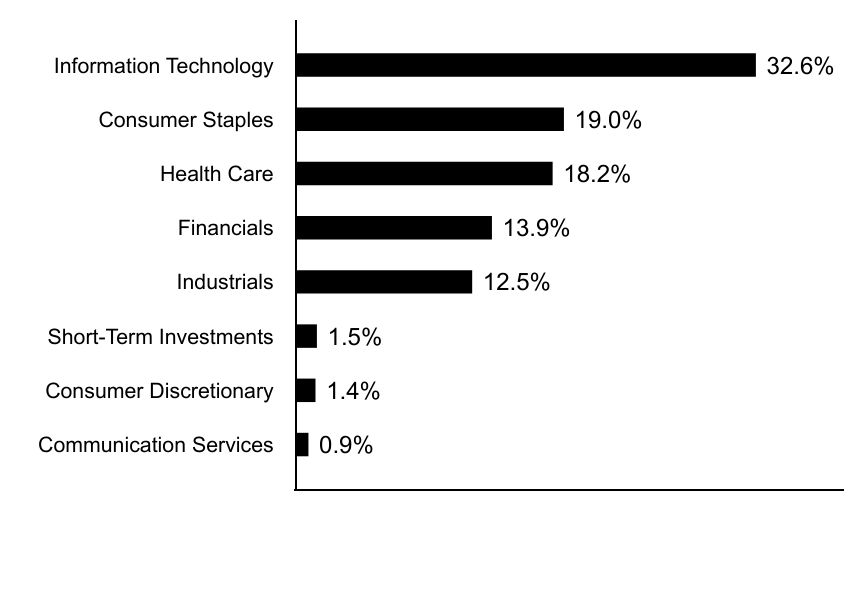

What did the Fund invest in?

The following tables reflect what the Fund invested in as of the report date.

Sector Allocation (% of total investments)

| Value | Value |

|---|

| Short-Term Investments | 0.4% |

| Communication Services | 4.7% |

| Consumer Staples | 11.2% |

| Industrials | 11.7% |

| Financials | 21.1% |

| Health Care | 24.6% |

| Information Technology | 26.3% |

Top Ten Holdings (% of total investments)Footnote Referencea

| Microsoft Corp. | 8.2% |

| Visa, Inc. | 5.8% |

| Accenture PLC | 5.1% |

| Alphabet, Inc. | 4.7% |

| Intercontinental Exchange, Inc. | 4.6% |

| Texas Instruments, Inc. | 4.3% |

| Thermo Fisher Scientific, Inc. | 3.8% |

| UnitedHealth Group, Inc. | 3.7% |

| Procter & Gamble Co. | 3.6% |

| Aon PLC | 3.5% |

| Total | 47.3% |

| Footnote | Description |

Footnotea | Excluding cash equivalents. |

If you wish to view additional information about the Fund, including the prospectus, statement of additional information, financial statements and holdings, please scan the QR code or visit www.morganstanley.com/im/shareholderreports. For proxy information, please visit www.morganstanley.com/im/en-us/institutional-investor/about-us/proxy-voting/vote-summary-report.desktop.html.

The Funds may deliver a single copy of certain required shareholder documents (including prospectuses, shareholder reports, and proxy materials) to investors with the same last name and the same address. Your participation will continue indefinitely unless you instruct otherwise by calling 1-800-869-6397 or by contacting your financial intermediary. Your instruction will typically be effective within 30 days of receipt.

Not FDIC Insured | May Lose Value | No Bank Guarantee

Semi-Annual Shareholder Report June 30, 2024

Morgan Stanley Institutional Fund, Inc. - American Resilience Portfolio

Semi-Annual Shareholder Report June 30, 2024

This semi-annual shareholder report contains important information about Morgan Stanley Institutional Fund, Inc. - American Resilience Portfolio for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Fund at www.morganstanley.com/im/shareholderreports. You can also request this information by contacting us at 1-800-869-6397.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class I | $36 | 0.70% |

| Total Net Assets | $1,194,575 |

| # of Portfolio Holdings | 35 |

| Portfolio Turnover Rate | 21% |

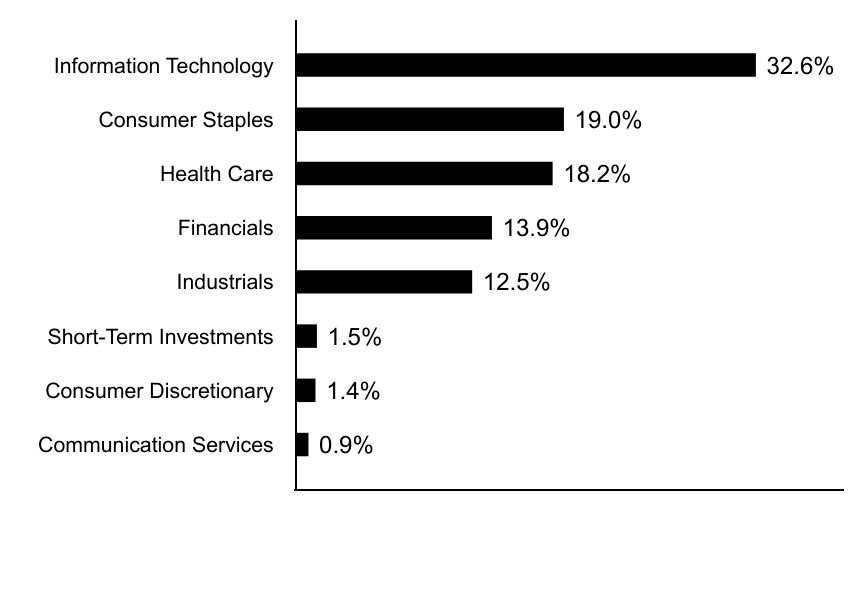

What did the Fund invest in?

The following tables reflect what the Fund invested in as of the report date.

Sector Allocation (% of total investments)

| Value | Value |

|---|

| Short-Term Investments | 0.4% |

| Communication Services | 4.7% |

| Consumer Staples | 11.2% |

| Industrials | 11.7% |

| Financials | 21.1% |

| Health Care | 24.6% |

| Information Technology | 26.3% |

Top Ten Holdings (% of total investments)Footnote Referencea

| Microsoft Corp. | 8.2% |

| Visa, Inc. | 5.8% |

| Accenture PLC | 5.1% |

| Alphabet, Inc. | 4.7% |

| Intercontinental Exchange, Inc. | 4.6% |

| Texas Instruments, Inc. | 4.3% |

| Thermo Fisher Scientific, Inc. | 3.8% |

| UnitedHealth Group, Inc. | 3.7% |

| Procter & Gamble Co. | 3.6% |

| Aon PLC | 3.5% |

| Total | 47.3% |

| Footnote | Description |

Footnotea | Excluding cash equivalents. |

If you wish to view additional information about the Fund, including the prospectus, statement of additional information, financial statements and holdings, please scan the QR code or visit www.morganstanley.com/im/shareholderreports. For proxy information, please visit www.morganstanley.com/im/en-us/institutional-investor/about-us/proxy-voting/vote-summary-report.desktop.html.

The Funds may deliver a single copy of certain required shareholder documents (including prospectuses, shareholder reports, and proxy materials) to investors with the same last name and the same address. Your participation will continue indefinitely unless you instruct otherwise by calling 1-800-869-6397 or by contacting your financial intermediary. Your instruction will typically be effective within 30 days of receipt.

Not FDIC Insured | May Lose Value | No Bank Guarantee

Semi-Annual Shareholder Report June 30, 2024

Morgan Stanley Institutional Fund, Inc. - American Resilience Portfolio

Semi-Annual Shareholder Report June 30, 2024

This semi-annual shareholder report contains important information about Morgan Stanley Institutional Fund, Inc. - American Resilience Portfolio for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Fund at www.morganstanley.com/im/shareholderreports. You can also request this information by contacting us at 1-800-869-6397.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class R6 | $33 | 0.65% |

| Total Net Assets | $1,194,575 |

| # of Portfolio Holdings | 35 |

| Portfolio Turnover Rate | 21% |

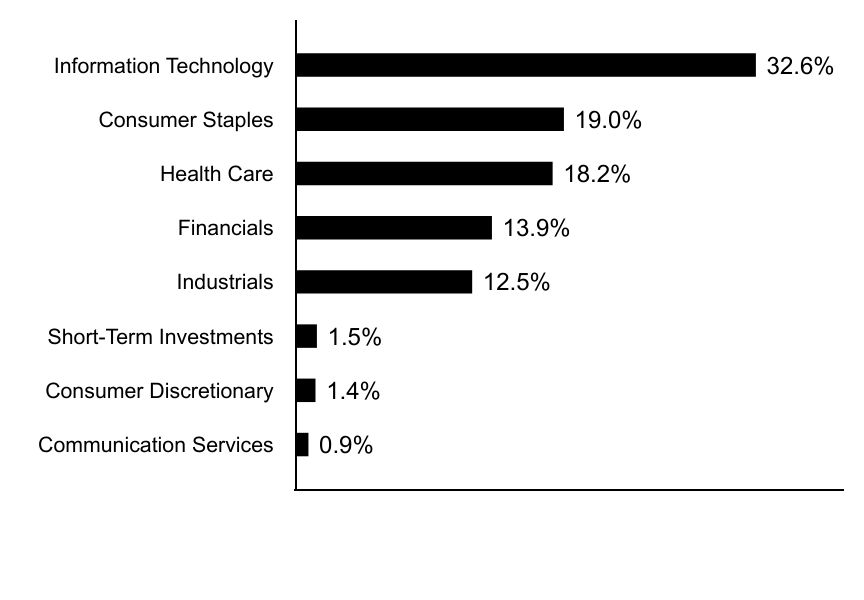

What did the Fund invest in?

The following tables reflect what the Fund invested in as of the report date.

Sector Allocation (% of total investments)

| Value | Value |

|---|

| Short-Term Investments | 0.4% |

| Communication Services | 4.7% |

| Consumer Staples | 11.2% |

| Industrials | 11.7% |

| Financials | 21.1% |

| Health Care | 24.6% |

| Information Technology | 26.3% |

Top Ten Holdings (% of total investments)Footnote Referencea

| Microsoft Corp. | 8.2% |

| Visa, Inc. | 5.8% |

| Accenture PLC | 5.1% |

| Alphabet, Inc. | 4.7% |

| Intercontinental Exchange, Inc. | 4.6% |

| Texas Instruments, Inc. | 4.3% |

| Thermo Fisher Scientific, Inc. | 3.8% |

| UnitedHealth Group, Inc. | 3.7% |

| Procter & Gamble Co. | 3.6% |

| Aon PLC | 3.5% |

| Total | 47.3% |

| Footnote | Description |

Footnotea | Excluding cash equivalents. |

If you wish to view additional information about the Fund, including the prospectus, statement of additional information, financial statements and holdings, please scan the QR code or visit www.morganstanley.com/im/shareholderreports. For proxy information, please visit www.morganstanley.com/im/en-us/institutional-investor/about-us/proxy-voting/vote-summary-report.desktop.html.

The Funds may deliver a single copy of certain required shareholder documents (including prospectuses, shareholder reports, and proxy materials) to investors with the same last name and the same address. Your participation will continue indefinitely unless you instruct otherwise by calling 1-800-869-6397 or by contacting your financial intermediary. Your instruction will typically be effective within 30 days of receipt.

Not FDIC Insured | May Lose Value | No Bank Guarantee

Semi-Annual Shareholder Report June 30, 2024

Morgan Stanley Institutional Fund, Inc. - Asia Opportunity Portfolio

Semi-Annual Shareholder Report June 30, 2024

This semi-annual shareholder report contains important information about Morgan Stanley Institutional Fund, Inc. - Asia Opportunity Portfolio for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Fund at www.morganstanley.com/im/shareholderreports. You can also request this information by contacting us at 1-800-869-6397.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class A | $73 | 1.43% |

| Total Net Assets | $130,899,988 |

| # of Portfolio Holdings | 32 |

| Portfolio Turnover Rate | 9% |

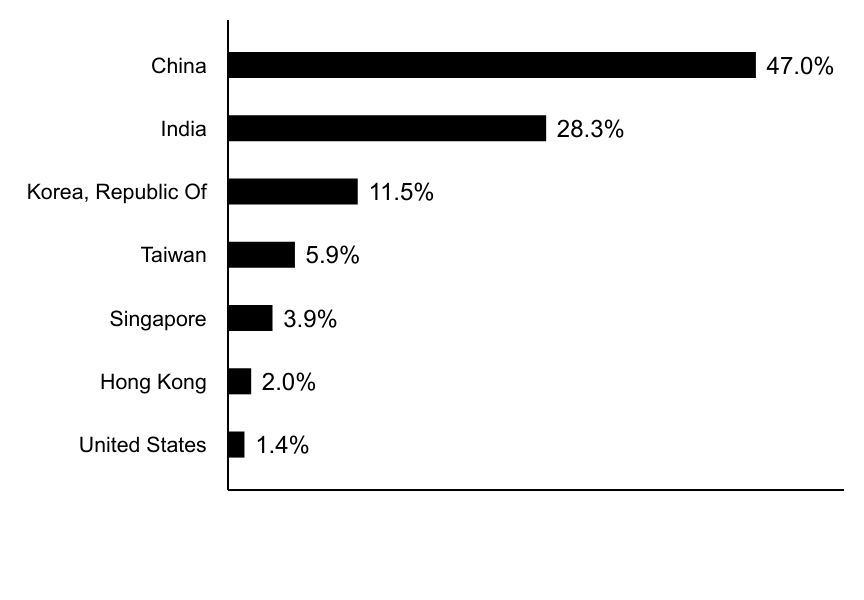

What did the Fund invest in?

The following tables reflect what the Fund invested in as of the report date.

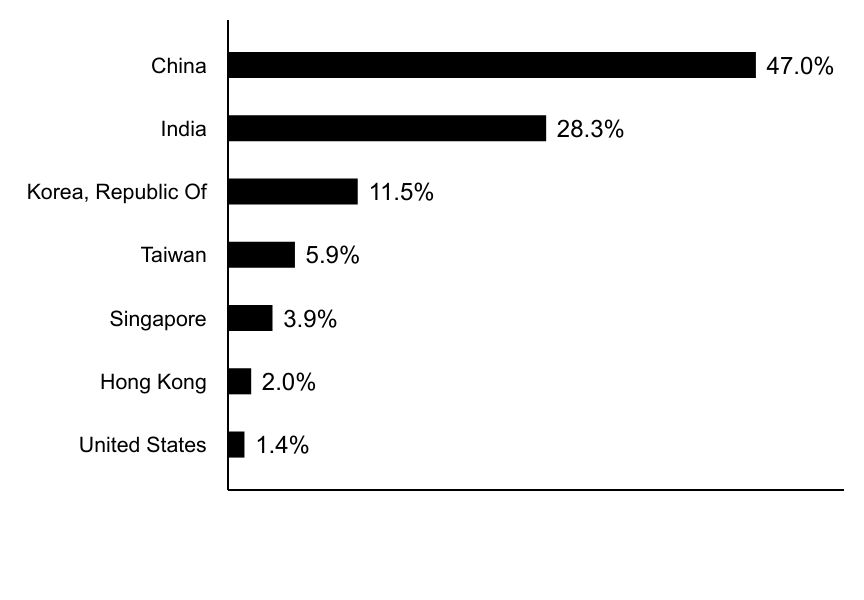

Country Weightings (% of total investments)

| Value | Value |

|---|

| United States | 1.4% |

| Hong Kong | 2.0% |

| Singapore | 3.9% |

| Taiwan | 5.9% |

| Korea, Republic Of | 11.5% |

| India | 28.3% |

| China | 47.0% |

Top Ten Holdings (% of total investments)

| ICICI Bank Ltd. | 7.2% |

| Coupang, Inc. | 6.4% |

| Trip.com Group Ltd. | 6.3% |

| HDFC Bank Ltd. | 6.2% |

| Meituan | 5.7% |

| Tencent Holdings Ltd. | 5.2% |

| Taiwan Semiconductor Manufacturing Co. Ltd. | 4.6% |

| Axis Bank Ltd. | 4.3% |

| Zomato Ltd. | 4.0% |

| KE Holdings, Inc. | 4.0% |

| Total | 53.9% |

If you wish to view additional information about the Fund, including the prospectus, statement of additional information, financial statements and holdings, please scan the QR code or visit www.morganstanley.com/im/shareholderreports. For proxy information, please visit www.morganstanley.com/im/en-us/institutional-investor/about-us/proxy-voting/vote-summary-report.desktop.html.

The Funds may deliver a single copy of certain required shareholder documents (including prospectuses, shareholder reports, and proxy materials) to investors with the same last name and the same address. Your participation will continue indefinitely unless you instruct otherwise by calling 1-800-869-6397 or by contacting your financial intermediary. Your instruction will typically be effective within 30 days of receipt.

Not FDIC Insured | May Lose Value | No Bank Guarantee

Semi-Annual Shareholder Report June 30, 2024

Morgan Stanley Institutional Fund, Inc. - Asia Opportunity Portfolio

Semi-Annual Shareholder Report June 30, 2024

This semi-annual shareholder report contains important information about Morgan Stanley Institutional Fund, Inc. - Asia Opportunity Portfolio for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Fund at www.morganstanley.com/im/shareholderreports. You can also request this information by contacting us at 1-800-869-6397.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class C | $111 | 2.17% |

| Total Net Assets | $130,899,988 |

| # of Portfolio Holdings | 32 |

| Portfolio Turnover Rate | 9% |

What did the Fund invest in?

The following tables reflect what the Fund invested in as of the report date.

Country Weightings (% of total investments)

| Value | Value |

|---|

| United States | 1.4% |

| Hong Kong | 2.0% |

| Singapore | 3.9% |

| Taiwan | 5.9% |

| Korea, Republic Of | 11.5% |

| India | 28.3% |

| China | 47.0% |

Top Ten Holdings (% of total investments)

| ICICI Bank Ltd. | 7.2% |

| Coupang, Inc. | 6.4% |

| Trip.com Group Ltd. | 6.3% |

| HDFC Bank Ltd. | 6.2% |

| Meituan | 5.7% |

| Tencent Holdings Ltd. | 5.2% |

| Taiwan Semiconductor Manufacturing Co. Ltd. | 4.6% |

| Axis Bank Ltd. | 4.3% |

| Zomato Ltd. | 4.0% |

| KE Holdings, Inc. | 4.0% |

| Total | 53.9% |

If you wish to view additional information about the Fund, including the prospectus, statement of additional information, financial statements and holdings, please scan the QR code or visit www.morganstanley.com/im/shareholderreports. For proxy information, please visit www.morganstanley.com/im/en-us/institutional-investor/about-us/proxy-voting/vote-summary-report.desktop.html.

The Funds may deliver a single copy of certain required shareholder documents (including prospectuses, shareholder reports, and proxy materials) to investors with the same last name and the same address. Your participation will continue indefinitely unless you instruct otherwise by calling 1-800-869-6397 or by contacting your financial intermediary. Your instruction will typically be effective within 30 days of receipt.

Not FDIC Insured | May Lose Value | No Bank Guarantee

Semi-Annual Shareholder Report June 30, 2024

Morgan Stanley Institutional Fund, Inc. - Asia Opportunity Portfolio

Semi-Annual Shareholder Report June 30, 2024

This semi-annual shareholder report contains important information about Morgan Stanley Institutional Fund, Inc. - Asia Opportunity Portfolio for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Fund at www.morganstanley.com/im/shareholderreports. You can also request this information by contacting us at 1-800-869-6397.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class I | $56 | 1.10% |

| Total Net Assets | $130,899,988 |

| # of Portfolio Holdings | 32 |

| Portfolio Turnover Rate | 9% |

What did the Fund invest in?

The following tables reflect what the Fund invested in as of the report date.

Country Weightings (% of total investments)

| Value | Value |

|---|

| United States | 1.4% |

| Hong Kong | 2.0% |

| Singapore | 3.9% |

| Taiwan | 5.9% |

| Korea, Republic Of | 11.5% |

| India | 28.3% |

| China | 47.0% |

Top Ten Holdings (% of total investments)

| ICICI Bank Ltd. | 7.2% |

| Coupang, Inc. | 6.4% |

| Trip.com Group Ltd. | 6.3% |

| HDFC Bank Ltd. | 6.2% |

| Meituan | 5.7% |

| Tencent Holdings Ltd. | 5.2% |

| Taiwan Semiconductor Manufacturing Co. Ltd. | 4.6% |

| Axis Bank Ltd. | 4.3% |

| Zomato Ltd. | 4.0% |

| KE Holdings, Inc. | 4.0% |

| Total | 53.9% |

If you wish to view additional information about the Fund, including the prospectus, statement of additional information, financial statements and holdings, please scan the QR code or visit www.morganstanley.com/im/shareholderreports. For proxy information, please visit www.morganstanley.com/im/en-us/institutional-investor/about-us/proxy-voting/vote-summary-report.desktop.html.

The Funds may deliver a single copy of certain required shareholder documents (including prospectuses, shareholder reports, and proxy materials) to investors with the same last name and the same address. Your participation will continue indefinitely unless you instruct otherwise by calling 1-800-869-6397 or by contacting your financial intermediary. Your instruction will typically be effective within 30 days of receipt.

Not FDIC Insured | May Lose Value | No Bank Guarantee

Semi-Annual Shareholder Report June 30, 2024

Morgan Stanley Institutional Fund, Inc. - Asia Opportunity Portfolio

Semi-Annual Shareholder Report June 30, 2024

This semi-annual shareholder report contains important information about Morgan Stanley Institutional Fund, Inc. - Asia Opportunity Portfolio for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Fund at www.morganstanley.com/im/shareholderreports. You can also request this information by contacting us at 1-800-869-6397.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class R6 | $54 | 1.05% |

| Total Net Assets | $130,899,988 |

| # of Portfolio Holdings | 32 |

| Portfolio Turnover Rate | 9% |

What did the Fund invest in?

The following tables reflect what the Fund invested in as of the report date.

Country Weightings (% of total investments)

| Value | Value |

|---|

| United States | 1.4% |

| Hong Kong | 2.0% |

| Singapore | 3.9% |

| Taiwan | 5.9% |

| Korea, Republic Of | 11.5% |

| India | 28.3% |

| China | 47.0% |

Top Ten Holdings (% of total investments)

| ICICI Bank Ltd. | 7.2% |

| Coupang, Inc. | 6.4% |

| Trip.com Group Ltd. | 6.3% |

| HDFC Bank Ltd. | 6.2% |

| Meituan | 5.7% |

| Tencent Holdings Ltd. | 5.2% |

| Taiwan Semiconductor Manufacturing Co. Ltd. | 4.6% |

| Axis Bank Ltd. | 4.3% |

| Zomato Ltd. | 4.0% |

| KE Holdings, Inc. | 4.0% |

| Total | 53.9% |

If you wish to view additional information about the Fund, including the prospectus, statement of additional information, financial statements and holdings, please scan the QR code or visit www.morganstanley.com/im/shareholderreports. For proxy information, please visit www.morganstanley.com/im/en-us/institutional-investor/about-us/proxy-voting/vote-summary-report.desktop.html.

The Funds may deliver a single copy of certain required shareholder documents (including prospectuses, shareholder reports, and proxy materials) to investors with the same last name and the same address. Your participation will continue indefinitely unless you instruct otherwise by calling 1-800-869-6397 or by contacting your financial intermediary. Your instruction will typically be effective within 30 days of receipt.

Not FDIC Insured | May Lose Value | No Bank Guarantee

Semi-Annual Shareholder Report June 30, 2024

Morgan Stanley Institutional Fund, Inc - Counterpoint Global Portfolio

Semi-Annual Shareholder Report June 30, 2024

This semi-annual shareholder report contains important information about Morgan Stanley Institutional Fund, Inc - Counterpoint Global Portfolio for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Fund at www.morganstanley.com/im/shareholderreports. You can also request this information by contacting us at 1-800-869-6397.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class A | $70 | 1.39% |

| Total Net Assets | $10,042,729 |

| # of Portfolio Holdings | 216 |

| Portfolio Turnover Rate | 51% |

What did the Fund invest in?

The following tables reflect what the Fund invested in as of the report date.

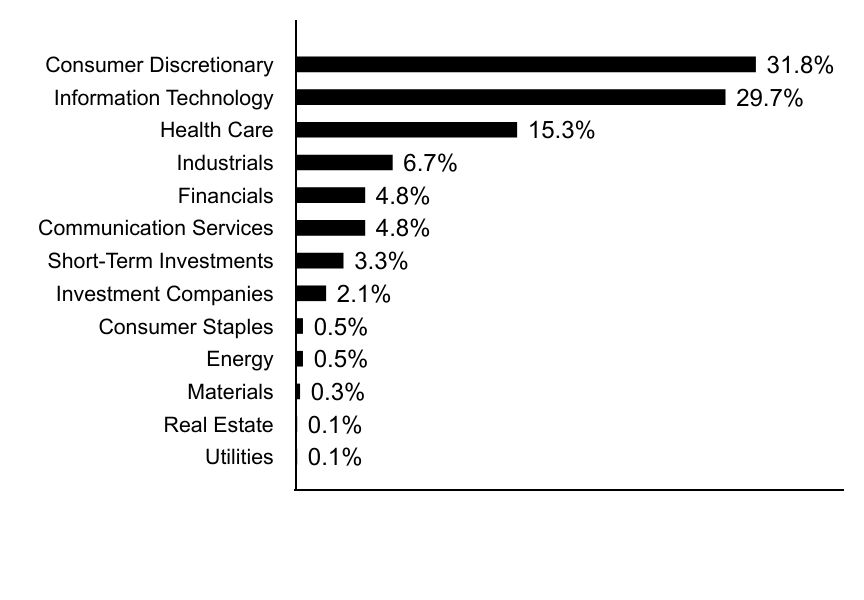

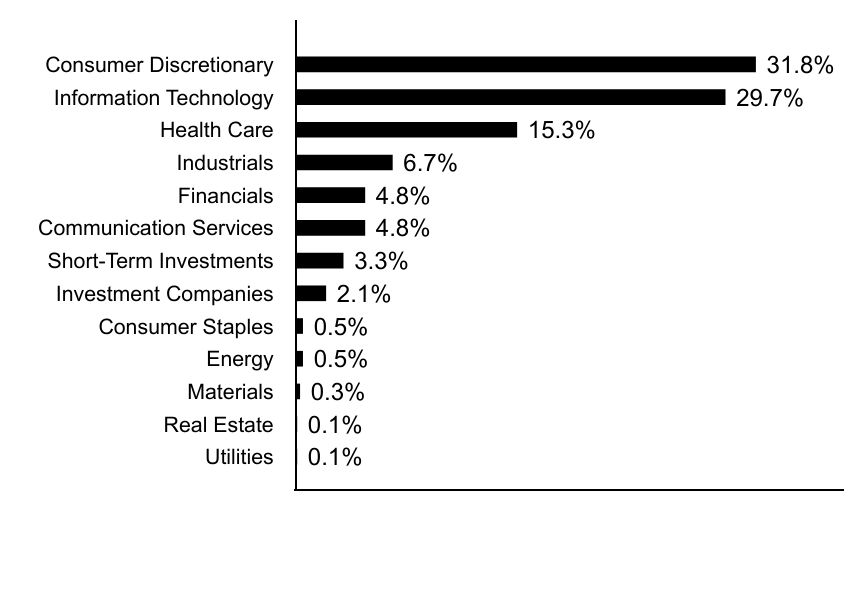

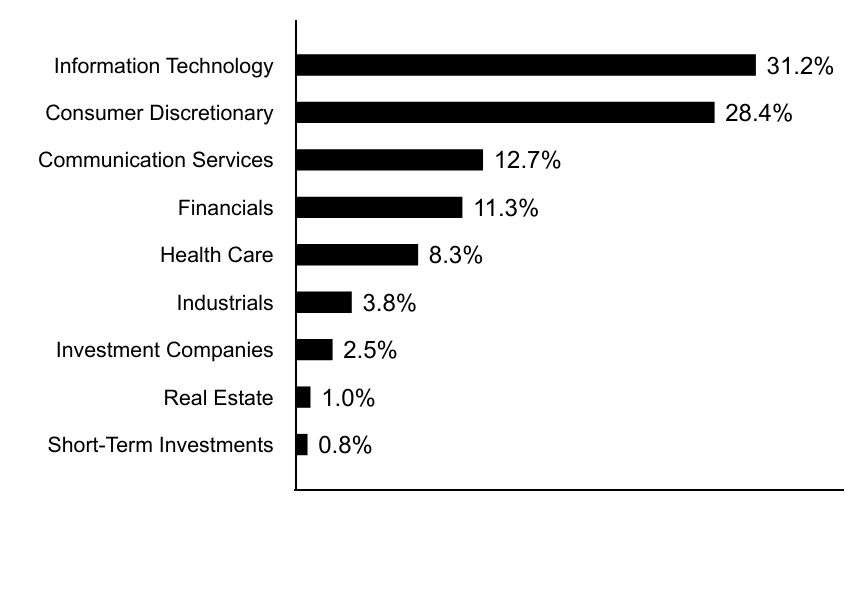

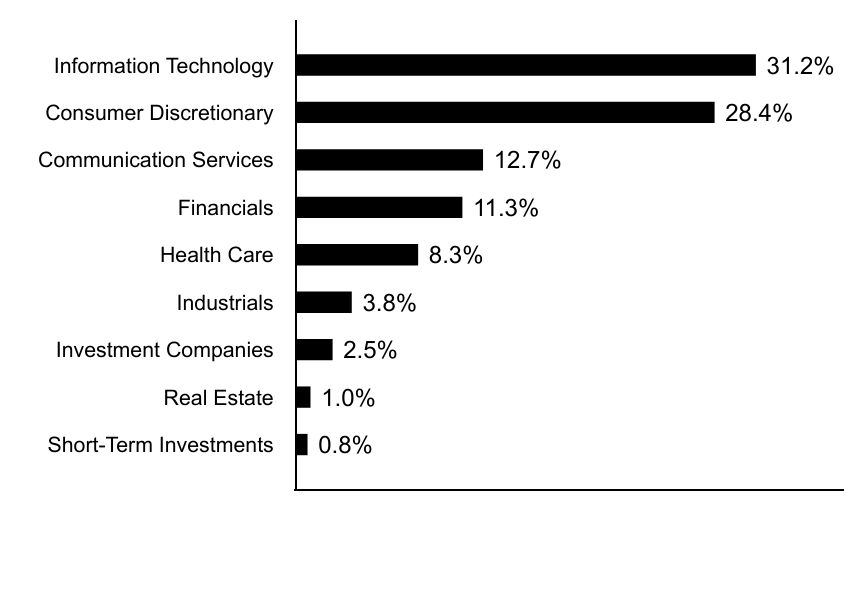

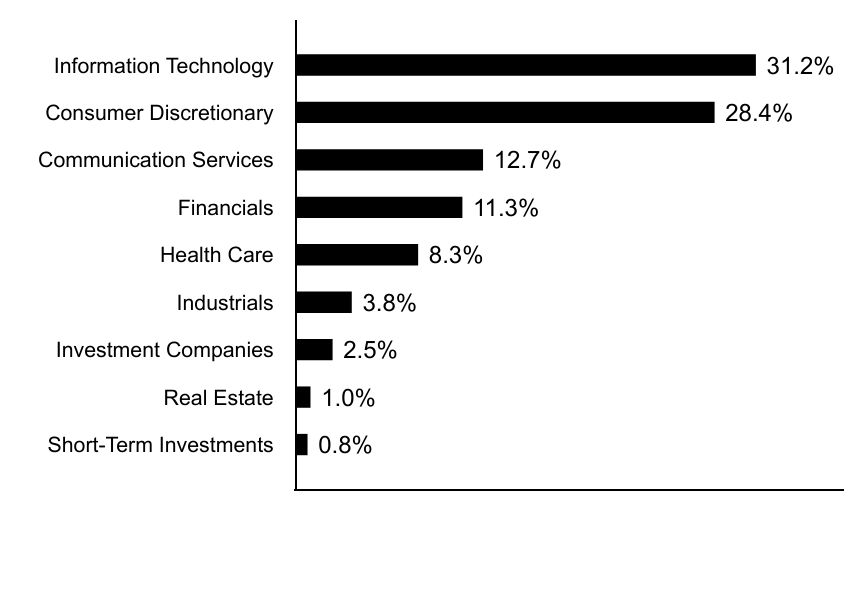

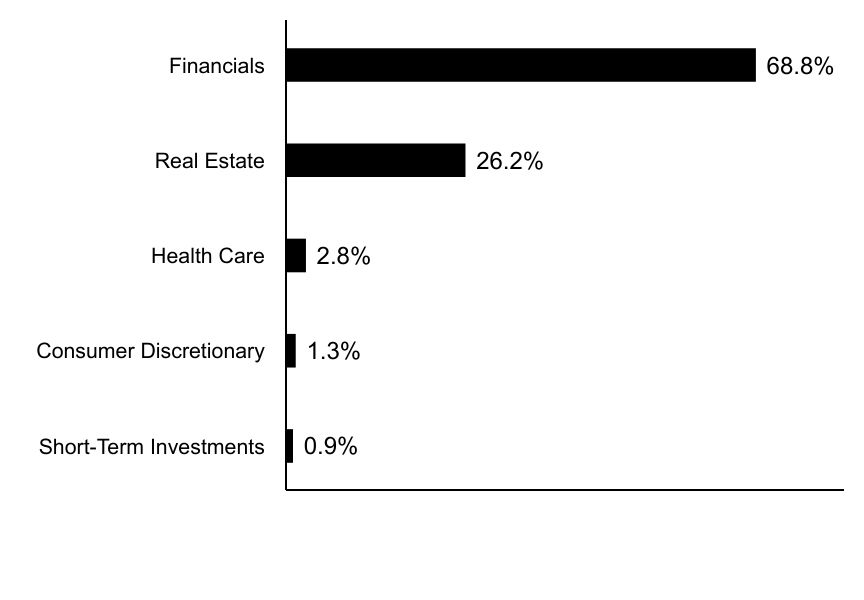

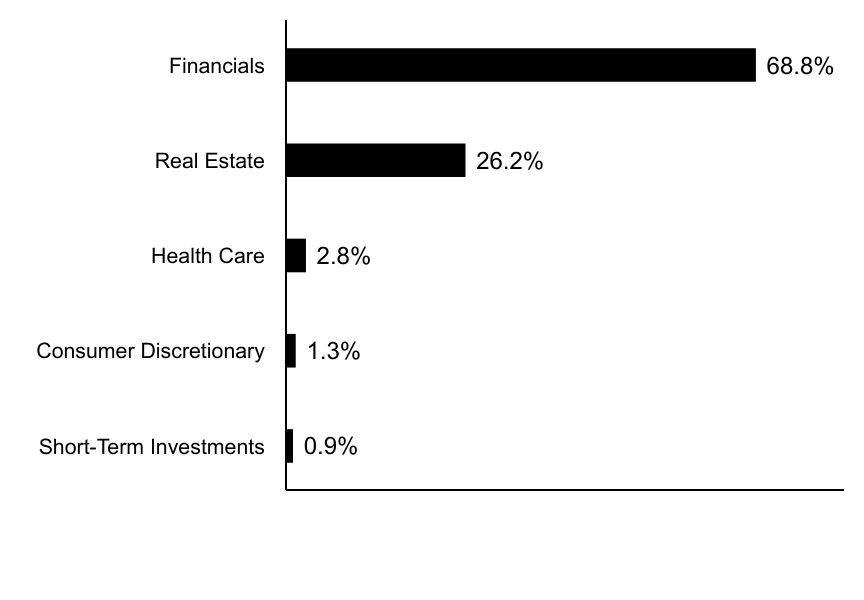

Sector Allocation (% of total investments)

| Value | Value |

|---|

| Utilities | 0.1% |

| Real Estate | 0.1% |

| Materials | 0.3% |

| Energy | 0.5% |

| Consumer Staples | 0.5% |

| Investment Companies | 2.1% |

| Short-Term Investments | 3.3% |

| Communication Services | 4.8% |

| Financials | 4.8% |

| Industrials | 6.7% |

| Health Care | 15.3% |

| Information Technology | 29.7% |

| Consumer Discretionary | 31.8% |

Top Ten Holdings (% of total investments)Footnote Referencea

| Cloudflare, Inc. | 9.1% |

| Tesla, Inc. | 6.1% |

| Carvana Co. | 4.1% |

| MicroStrategy, Inc. | 4.0% |

| Arbutus Biopharma Corp. | 3.2% |

| Agilon Health, Inc. | 2.7% |

| XOMA Corp. | 2.6% |

| Global-e Online Ltd. | 2.4% |

| Royalty Pharma PLC | 2.4% |

| iShares Bitcoin Trust | 2.1% |

| Total | 38.7% |

| Footnote | Description |

Footnotea | Excluding cash equivalents. |

This is a summary of certain changes of the Fund since June 30, 2024

The Board of Directors of Morgan Stanley Institutional Fund, Inc. (the “Company”) approved a Plan of Liquidation with respect to the Fund, a portfolio of common stock of the Company. Pursuant to the Plan of Liquidation, the assets of the Fund were liquidated, known or reasonable ascertainable liabilities of the Fund were satisfied, the remaining proceeds were distributed to the Fund’s shareholders and all the issued and outstanding shares of the Fund were redeemed (the “Liquidation”). The Liquidation occurred on July 22, 2024.

If you wish to view additional information about the Fund, including the prospectus, statement of additional information, financial statements and holdings, please scan the QR code or visit www.morganstanley.com/im/shareholderreports. For proxy information, please visit www.morganstanley.com/im/en-us/institutional-investor/about-us/proxy-voting/vote-summary-report.desktop.html.

The Funds may deliver a single copy of certain required shareholder documents (including prospectuses, shareholder reports, and proxy materials) to investors with the same last name and the same address. Your participation will continue indefinitely unless you instruct otherwise by calling 1-800-869-6397 or by contacting your financial intermediary. Your instruction will typically be effective within 30 days of receipt.

Not FDIC Insured | May Lose Value | No Bank Guarantee

Semi-Annual Shareholder Report June 30, 2024

Morgan Stanley Institutional Fund, Inc - Counterpoint Global Portfolio

Semi-Annual Shareholder Report June 30, 2024

This semi-annual shareholder report contains important information about Morgan Stanley Institutional Fund, Inc - Counterpoint Global Portfolio for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Fund at www.morganstanley.com/im/shareholderreports. You can also request this information by contacting us at 1-800-869-6397.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class C | $107 | 2.14% |

| Total Net Assets | $10,042,729 |

| # of Portfolio Holdings | 216 |

| Portfolio Turnover Rate | 51% |

What did the Fund invest in?

The following tables reflect what the Fund invested in as of the report date.

Sector Allocation (% of total investments)

| Value | Value |

|---|

| Utilities | 0.1% |

| Real Estate | 0.1% |

| Materials | 0.3% |

| Energy | 0.5% |

| Consumer Staples | 0.5% |

| Investment Companies | 2.1% |

| Short-Term Investments | 3.3% |

| Communication Services | 4.8% |

| Financials | 4.8% |

| Industrials | 6.7% |

| Health Care | 15.3% |

| Information Technology | 29.7% |

| Consumer Discretionary | 31.8% |

Top Ten Holdings (% of total investments)Footnote Referencea

| Cloudflare, Inc. | 9.1% |

| Tesla, Inc. | 6.1% |

| Carvana Co. | 4.1% |

| MicroStrategy, Inc. | 4.0% |

| Arbutus Biopharma Corp. | 3.2% |

| Agilon Health, Inc. | 2.7% |

| XOMA Corp. | 2.6% |

| Global-e Online Ltd. | 2.4% |

| Royalty Pharma PLC | 2.4% |

| iShares Bitcoin Trust | 2.1% |

| Total | 38.7% |

| Footnote | Description |

Footnotea | Excluding cash equivalents. |

This is a summary of certain changes of the Fund since June 30, 2024

The Board of Directors of Morgan Stanley Institutional Fund, Inc. (the “Company”) approved a Plan of Liquidation with respect to the Fund, a portfolio of common stock of the Company. Pursuant to the Plan of Liquidation, the assets of the Fund were liquidated, known or reasonable ascertainable liabilities of the Fund were satisfied, the remaining proceeds were distributed to the Fund’s shareholders and all the issued and outstanding shares of the Fund were redeemed (the “Liquidation”). The Liquidation occurred on July 22, 2024.

If you wish to view additional information about the Fund, including the prospectus, statement of additional information, financial statements and holdings, please scan the QR code or visit www.morganstanley.com/im/shareholderreports. For proxy information, please visit www.morganstanley.com/im/en-us/institutional-investor/about-us/proxy-voting/vote-summary-report.desktop.html.

The Funds may deliver a single copy of certain required shareholder documents (including prospectuses, shareholder reports, and proxy materials) to investors with the same last name and the same address. Your participation will continue indefinitely unless you instruct otherwise by calling 1-800-869-6397 or by contacting your financial intermediary. Your instruction will typically be effective within 30 days of receipt.

Not FDIC Insured | May Lose Value | No Bank Guarantee

Semi-Annual Shareholder Report June 30, 2024

Morgan Stanley Institutional Fund, Inc - Counterpoint Global Portfolio

Semi-Annual Shareholder Report June 30, 2024

This semi-annual shareholder report contains important information about Morgan Stanley Institutional Fund, Inc - Counterpoint Global Portfolio for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Fund at www.morganstanley.com/im/shareholderreports. You can also request this information by contacting us at 1-800-869-6397.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class I | $52 | 1.04% |

| Total Net Assets | $10,042,729 |

| # of Portfolio Holdings | 216 |

| Portfolio Turnover Rate | 51% |

What did the Fund invest in?

The following tables reflect what the Fund invested in as of the report date.

Sector Allocation (% of total investments)

| Value | Value |

|---|

| Utilities | 0.1% |

| Real Estate | 0.1% |

| Materials | 0.3% |

| Energy | 0.5% |

| Consumer Staples | 0.5% |

| Investment Companies | 2.1% |

| Short-Term Investments | 3.3% |

| Communication Services | 4.8% |

| Financials | 4.8% |

| Industrials | 6.7% |

| Health Care | 15.3% |

| Information Technology | 29.7% |

| Consumer Discretionary | 31.8% |

Top Ten Holdings (% of total investments)Footnote Referencea

| Cloudflare, Inc. | 9.1% |

| Tesla, Inc. | 6.1% |

| Carvana Co. | 4.1% |

| MicroStrategy, Inc. | 4.0% |

| Arbutus Biopharma Corp. | 3.2% |

| Agilon Health, Inc. | 2.7% |

| XOMA Corp. | 2.6% |

| Global-e Online Ltd. | 2.4% |

| Royalty Pharma PLC | 2.4% |

| iShares Bitcoin Trust | 2.1% |

| Total | 38.7% |

| Footnote | Description |

Footnotea | Excluding cash equivalents. |

This is a summary of certain changes of the Fund since June 30, 2024

The Board of Directors of Morgan Stanley Institutional Fund, Inc. (the “Company”) approved a Plan of Liquidation with respect to the Fund, a portfolio of common stock of the Company. Pursuant to the Plan of Liquidation, the assets of the Fund were liquidated, known or reasonable ascertainable liabilities of the Fund were satisfied, the remaining proceeds were distributed to the Fund’s shareholders and all the issued and outstanding shares of the Fund were redeemed (the “Liquidation”). The Liquidation occurred on July 22, 2024.

If you wish to view additional information about the Fund, including the prospectus, statement of additional information, financial statements and holdings, please scan the QR code or visit www.morganstanley.com/im/shareholderreports. For proxy information, please visit www.morganstanley.com/im/en-us/institutional-investor/about-us/proxy-voting/vote-summary-report.desktop.html.

The Funds may deliver a single copy of certain required shareholder documents (including prospectuses, shareholder reports, and proxy materials) to investors with the same last name and the same address. Your participation will continue indefinitely unless you instruct otherwise by calling 1-800-869-6397 or by contacting your financial intermediary. Your instruction will typically be effective within 30 days of receipt.

Not FDIC Insured | May Lose Value | No Bank Guarantee

Semi-Annual Shareholder Report June 30, 2024

Morgan Stanley Institutional Fund, Inc - Counterpoint Global Portfolio

Semi-Annual Shareholder Report June 30, 2024

This semi-annual shareholder report contains important information about Morgan Stanley Institutional Fund, Inc - Counterpoint Global Portfolio for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Fund at www.morganstanley.com/im/shareholderreports. You can also request this information by contacting us at 1-800-869-6397.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class R6 | $50 | 0.99% |

| Total Net Assets | $10,042,729 |

| # of Portfolio Holdings | 216 |

| Portfolio Turnover Rate | 51% |

What did the Fund invest in?

The following tables reflect what the Fund invested in as of the report date.

Sector Allocation (% of total investments)

| Value | Value |

|---|

| Utilities | 0.1% |

| Real Estate | 0.1% |

| Materials | 0.3% |

| Energy | 0.5% |

| Consumer Staples | 0.5% |

| Investment Companies | 2.1% |

| Short-Term Investments | 3.3% |

| Communication Services | 4.8% |

| Financials | 4.8% |

| Industrials | 6.7% |

| Health Care | 15.3% |

| Information Technology | 29.7% |

| Consumer Discretionary | 31.8% |

Top Ten Holdings (% of total investments)Footnote Referencea

| Cloudflare, Inc. | 9.1% |

| Tesla, Inc. | 6.1% |

| Carvana Co. | 4.1% |

| MicroStrategy, Inc. | 4.0% |

| Arbutus Biopharma Corp. | 3.2% |

| Agilon Health, Inc. | 2.7% |

| XOMA Corp. | 2.6% |

| Global-e Online Ltd. | 2.4% |

| Royalty Pharma PLC | 2.4% |

| iShares Bitcoin Trust | 2.1% |

| Total | 38.7% |

| Footnote | Description |

Footnotea | Excluding cash equivalents. |

This is a summary of certain changes of the Fund since June 30, 2024

The Board of Directors of Morgan Stanley Institutional Fund, Inc. (the “Company”) approved a Plan of Liquidation with respect to the Fund, a portfolio of common stock of the Company. Pursuant to the Plan of Liquidation, the assets of the Fund were liquidated, known or reasonable ascertainable liabilities of the Fund were satisfied, the remaining proceeds were distributed to the Fund’s shareholders and all the issued and outstanding shares of the Fund were redeemed (the “Liquidation”). The Liquidation occurred on July 22, 2024.

If you wish to view additional information about the Fund, including the prospectus, statement of additional information, financial statements and holdings, please scan the QR code or visit www.morganstanley.com/im/shareholderreports. For proxy information, please visit www.morganstanley.com/im/en-us/institutional-investor/about-us/proxy-voting/vote-summary-report.desktop.html.

The Funds may deliver a single copy of certain required shareholder documents (including prospectuses, shareholder reports, and proxy materials) to investors with the same last name and the same address. Your participation will continue indefinitely unless you instruct otherwise by calling 1-800-869-6397 or by contacting your financial intermediary. Your instruction will typically be effective within 30 days of receipt.

Not FDIC Insured | May Lose Value | No Bank Guarantee

Semi-Annual Shareholder Report June 30, 2024

Morgan Stanley Institutional Fund, Inc. - Developing Opportunity Portfolio

Semi-Annual Shareholder Report June 30, 2024

This semi-annual shareholder report contains important information about Morgan Stanley Institutional Fund, Inc. - Developing Opportunity Portfolio for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Fund at www.morganstanley.com/im/shareholderreports. You can also request this information by contacting us at 1-800-869-6397.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class A | $76 | 1.47% |

| Total Net Assets | $32,286,126 |

| # of Portfolio Holdings | 34 |

| Portfolio Turnover Rate | 22% |

What did the Fund invest in?

The following tables reflect what the Fund invested in as of the report date.

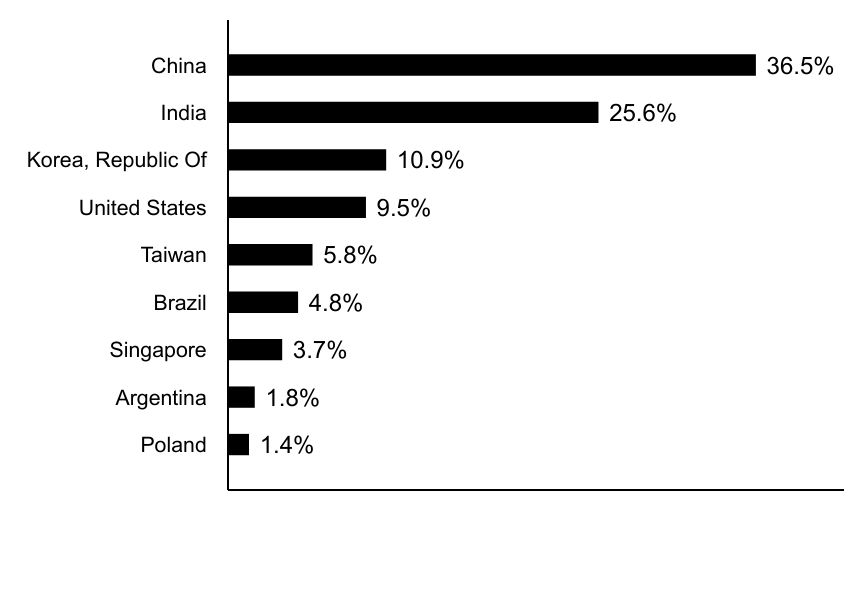

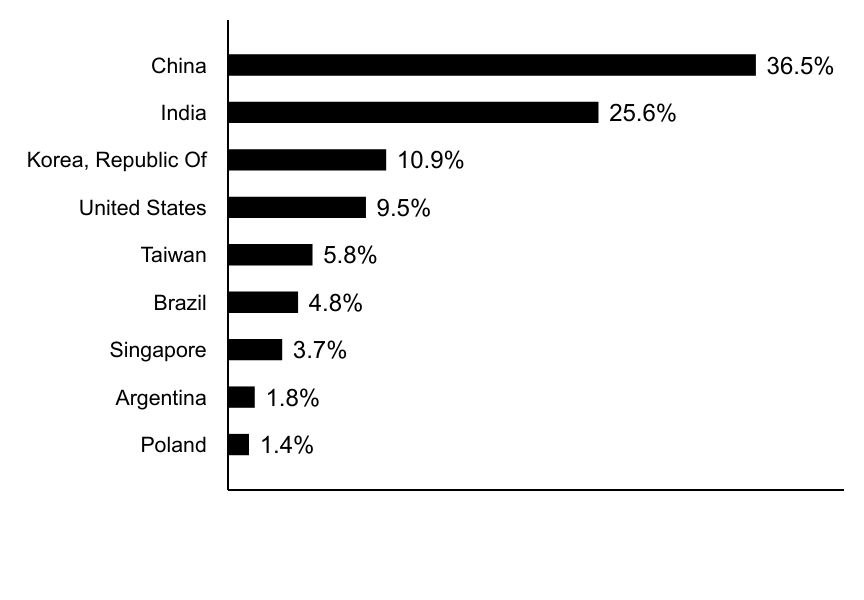

Country Weightings (% of total investments)

| Value | Value |

|---|

| Poland | 1.4% |

| Argentina | 1.8% |

| Singapore | 3.7% |

| Brazil | 4.8% |

| Taiwan | 5.8% |

| United States | 9.5% |

| Korea, Republic Of | 10.9% |

| India | 25.6% |

| China | 36.5% |

Top Ten Holdings (% of total investments)

| MercadoLibre, Inc. | 7.3% |

| Coupang, Inc. | 6.3% |

| ICICI Bank Ltd. | 6.3% |

| Meituan | 5.7% |

| HDFC Bank Ltd. | 5.4% |

| Trip.com Group Ltd. | 4.9% |

| NU Holdings Ltd. | 4.8% |

| Taiwan Semiconductor Manufacturing Co. Ltd. | 4.5% |

| Axis Bank Ltd. | 4.1% |

| Zomato Ltd. | 3.7% |

| Total | 53.0% |

If you wish to view additional information about the Fund, including the prospectus, statement of additional information, financial statements and holdings, please scan the QR code or visit www.morganstanley.com/im/shareholderreports. For proxy information, please visit www.morganstanley.com/im/en-us/institutional-investor/about-us/proxy-voting/vote-summary-report.desktop.html.

The Funds may deliver a single copy of certain required shareholder documents (including prospectuses, shareholder reports, and proxy materials) to investors with the same last name and the same address. Your participation will continue indefinitely unless you instruct otherwise by calling 1-800-869-6397 or by contacting your financial intermediary. Your instruction will typically be effective within 30 days of receipt.

Not FDIC Insured | May Lose Value | No Bank Guarantee

Semi-Annual Shareholder Report June 30, 2024

Morgan Stanley Institutional Fund, Inc. - Developing Opportunity Portfolio

Semi-Annual Shareholder Report June 30, 2024

This semi-annual shareholder report contains important information about Morgan Stanley Institutional Fund, Inc. - Developing Opportunity Portfolio for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Fund at www.morganstanley.com/im/shareholderreports. You can also request this information by contacting us at 1-800-869-6397.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class C | $116 | 2.25% |

| Total Net Assets | $32,286,126 |

| # of Portfolio Holdings | 34 |

| Portfolio Turnover Rate | 22% |

What did the Fund invest in?

The following tables reflect what the Fund invested in as of the report date.

Country Weightings (% of total investments)

| Value | Value |

|---|

| Poland | 1.4% |

| Argentina | 1.8% |

| Singapore | 3.7% |

| Brazil | 4.8% |

| Taiwan | 5.8% |

| United States | 9.5% |

| Korea, Republic Of | 10.9% |

| India | 25.6% |

| China | 36.5% |

Top Ten Holdings (% of total investments)

| MercadoLibre, Inc. | 7.3% |

| Coupang, Inc. | 6.3% |

| ICICI Bank Ltd. | 6.3% |

| Meituan | 5.7% |

| HDFC Bank Ltd. | 5.4% |

| Trip.com Group Ltd. | 4.9% |

| NU Holdings Ltd. | 4.8% |

| Taiwan Semiconductor Manufacturing Co. Ltd. | 4.5% |

| Axis Bank Ltd. | 4.1% |

| Zomato Ltd. | 3.7% |

| Total | 53.0% |

If you wish to view additional information about the Fund, including the prospectus, statement of additional information, financial statements and holdings, please scan the QR code or visit www.morganstanley.com/im/shareholderreports. For proxy information, please visit www.morganstanley.com/im/en-us/institutional-investor/about-us/proxy-voting/vote-summary-report.desktop.html.

The Funds may deliver a single copy of certain required shareholder documents (including prospectuses, shareholder reports, and proxy materials) to investors with the same last name and the same address. Your participation will continue indefinitely unless you instruct otherwise by calling 1-800-869-6397 or by contacting your financial intermediary. Your instruction will typically be effective within 30 days of receipt.

Not FDIC Insured | May Lose Value | No Bank Guarantee

Semi-Annual Shareholder Report June 30, 2024

Morgan Stanley Institutional Fund, Inc. - Developing Opportunity Portfolio

Semi-Annual Shareholder Report June 30, 2024

This semi-annual shareholder report contains important information about Morgan Stanley Institutional Fund, Inc. - Developing Opportunity Portfolio for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Fund at www.morganstanley.com/im/shareholderreports. You can also request this information by contacting us at 1-800-869-6397.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class I | $59 | 1.15% |

| Total Net Assets | $32,286,126 |

| # of Portfolio Holdings | 34 |

| Portfolio Turnover Rate | 22% |

What did the Fund invest in?

The following tables reflect what the Fund invested in as of the report date.

Country Weightings (% of total investments)

| Value | Value |

|---|

| Poland | 1.4% |

| Argentina | 1.8% |

| Singapore | 3.7% |

| Brazil | 4.8% |

| Taiwan | 5.8% |

| United States | 9.5% |

| Korea, Republic Of | 10.9% |

| India | 25.6% |

| China | 36.5% |

Top Ten Holdings (% of total investments)

| MercadoLibre, Inc. | 7.3% |

| Coupang, Inc. | 6.3% |

| ICICI Bank Ltd. | 6.3% |

| Meituan | 5.7% |

| HDFC Bank Ltd. | 5.4% |

| Trip.com Group Ltd. | 4.9% |

| NU Holdings Ltd. | 4.8% |

| Taiwan Semiconductor Manufacturing Co. Ltd. | 4.5% |

| Axis Bank Ltd. | 4.1% |

| Zomato Ltd. | 3.7% |

| Total | 53.0% |

If you wish to view additional information about the Fund, including the prospectus, statement of additional information, financial statements and holdings, please scan the QR code or visit www.morganstanley.com/im/shareholderreports. For proxy information, please visit www.morganstanley.com/im/en-us/institutional-investor/about-us/proxy-voting/vote-summary-report.desktop.html.

The Funds may deliver a single copy of certain required shareholder documents (including prospectuses, shareholder reports, and proxy materials) to investors with the same last name and the same address. Your participation will continue indefinitely unless you instruct otherwise by calling 1-800-869-6397 or by contacting your financial intermediary. Your instruction will typically be effective within 30 days of receipt.

Not FDIC Insured | May Lose Value | No Bank Guarantee

Semi-Annual Shareholder Report June 30, 2024

Morgan Stanley Institutional Fund, Inc. - Developing Opportunity Portfolio

Semi-Annual Shareholder Report June 30, 2024

This semi-annual shareholder report contains important information about Morgan Stanley Institutional Fund, Inc. - Developing Opportunity Portfolio for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Fund at www.morganstanley.com/im/shareholderreports. You can also request this information by contacting us at 1-800-869-6397.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class R6 | $57 | 1.10% |

| Total Net Assets | $32,286,126 |

| # of Portfolio Holdings | 34 |

| Portfolio Turnover Rate | 22% |

What did the Fund invest in?

The following tables reflect what the Fund invested in as of the report date.

Country Weightings (% of total investments)

| Value | Value |

|---|

| Poland | 1.4% |

| Argentina | 1.8% |

| Singapore | 3.7% |

| Brazil | 4.8% |

| Taiwan | 5.8% |

| United States | 9.5% |

| Korea, Republic Of | 10.9% |

| India | 25.6% |

| China | 36.5% |

Top Ten Holdings (% of total investments)

| MercadoLibre, Inc. | 7.3% |

| Coupang, Inc. | 6.3% |

| ICICI Bank Ltd. | 6.3% |

| Meituan | 5.7% |

| HDFC Bank Ltd. | 5.4% |

| Trip.com Group Ltd. | 4.9% |

| NU Holdings Ltd. | 4.8% |

| Taiwan Semiconductor Manufacturing Co. Ltd. | 4.5% |

| Axis Bank Ltd. | 4.1% |

| Zomato Ltd. | 3.7% |

| Total | 53.0% |

If you wish to view additional information about the Fund, including the prospectus, statement of additional information, financial statements and holdings, please scan the QR code or visit www.morganstanley.com/im/shareholderreports. For proxy information, please visit www.morganstanley.com/im/en-us/institutional-investor/about-us/proxy-voting/vote-summary-report.desktop.html.

The Funds may deliver a single copy of certain required shareholder documents (including prospectuses, shareholder reports, and proxy materials) to investors with the same last name and the same address. Your participation will continue indefinitely unless you instruct otherwise by calling 1-800-869-6397 or by contacting your financial intermediary. Your instruction will typically be effective within 30 days of receipt.

Not FDIC Insured | May Lose Value | No Bank Guarantee

Semi-Annual Shareholder Report June 30, 2024

Morgan Stanley Institutional Fund, Inc. - Emerging Markets ex China Portfolio

Semi-Annual Shareholder Report June 30, 2024

This semi-annual shareholder report contains important information about Morgan Stanley Institutional Fund, Inc. - Emerging Markets ex China Portfolio for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Fund at www.morganstanley.com/im/shareholderreports. You can also request this information by contacting us at 1-800-869-6397.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class A | $71 | 1.35% |

| Total Net Assets | $7,457,096 |

| # of Portfolio Holdings | 78 |

| Portfolio Turnover Rate | 14% |

What did the Fund invest in?

The following tables reflect what the Fund invested in as of the report date.

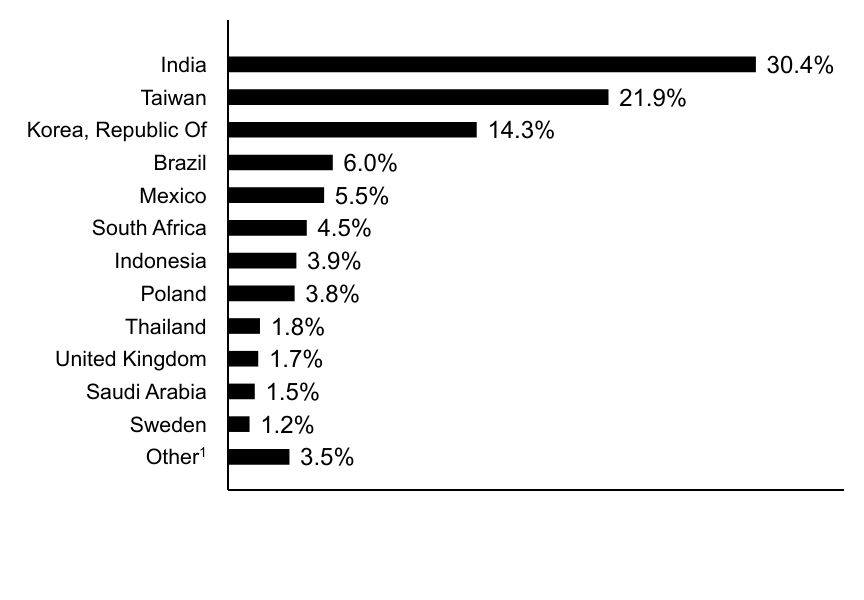

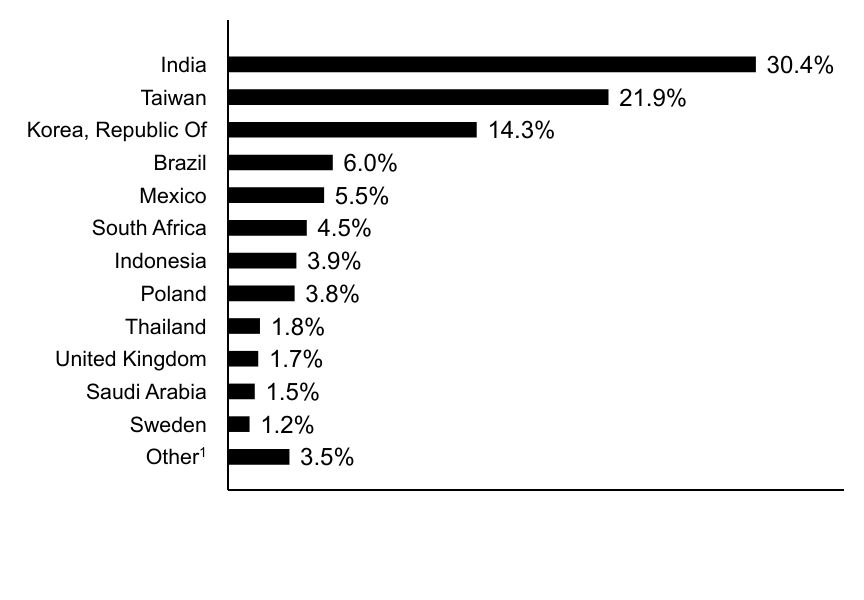

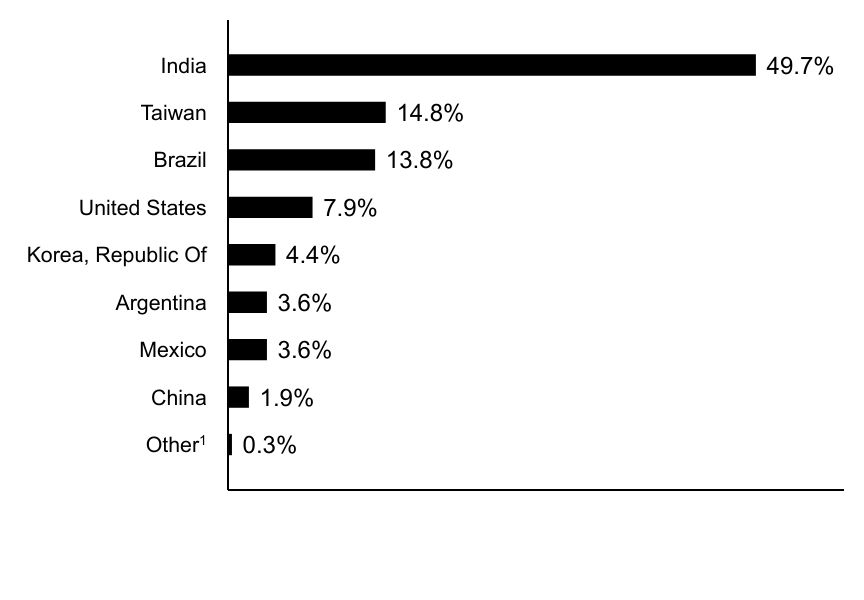

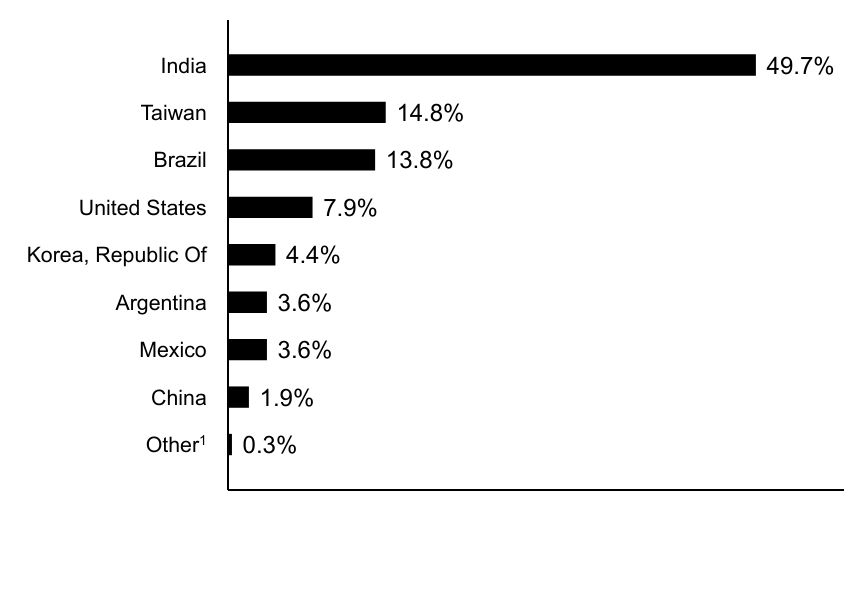

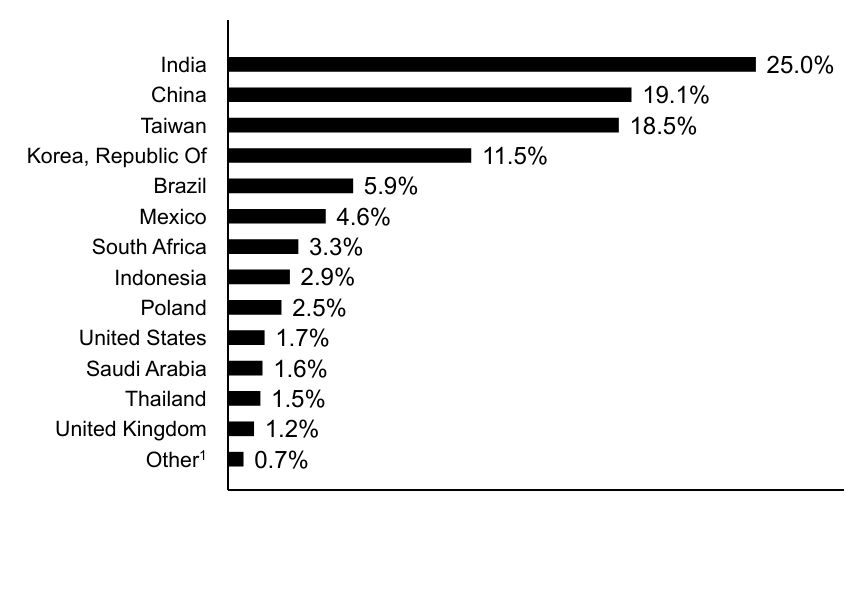

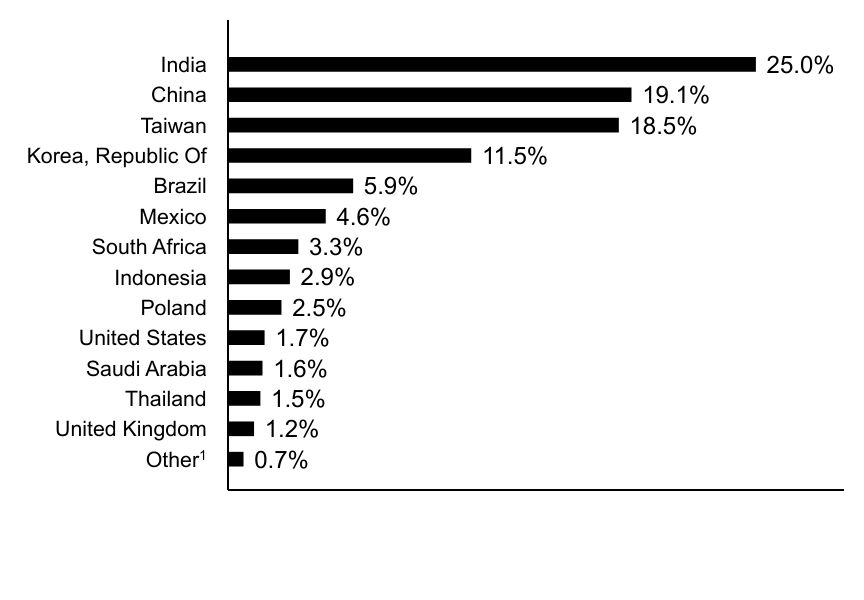

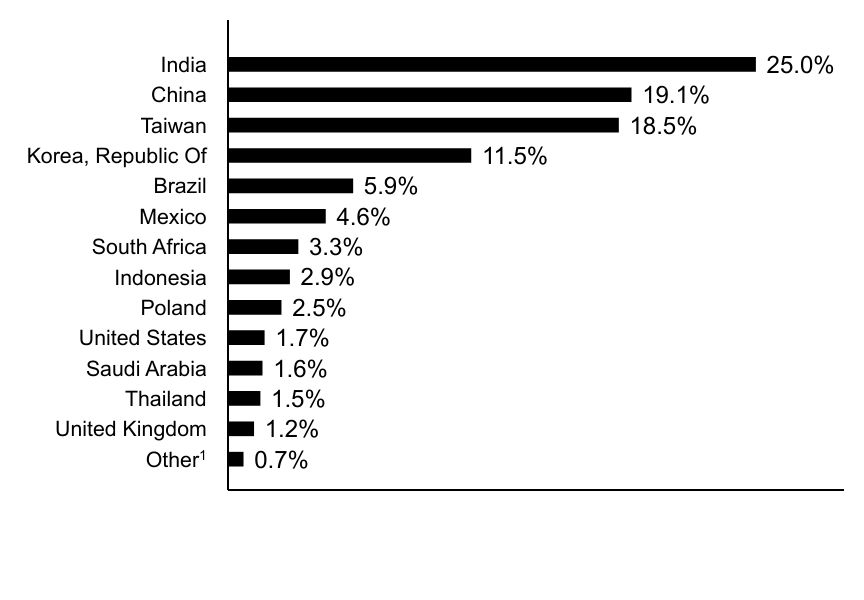

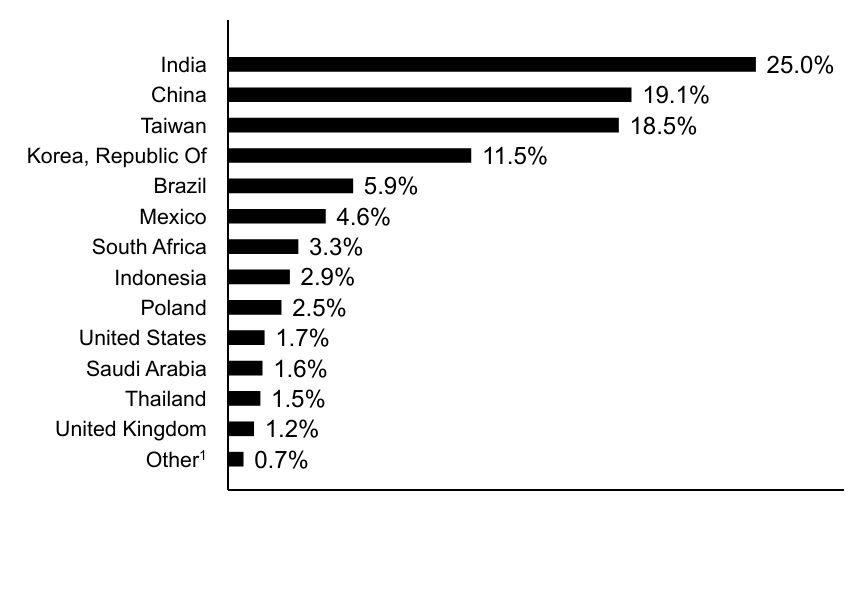

Country Weightings (% of total investments)

| Value | Value |

|---|

OtherFootnote Reference1 | 3.5% |

| Sweden | 1.2% |

| Saudi Arabia | 1.5% |

| United Kingdom | 1.7% |

| Thailand | 1.8% |

| Poland | 3.8% |

| Indonesia | 3.9% |

| South Africa | 4.5% |

| Mexico | 5.5% |

| Brazil | 6.0% |