UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

| | |

| Filed by the Registrant | x |

| Filed by a Party other than the Registrant | o |

| | |

| Check the appropriate box: |

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ý | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material under Rule 14a-12 |

PATRIOT SCIENTIFIC CORPORATION

(Name of Registrant as Specified In Its Charter)

| | (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | |

| Payment of Filing Fee (Check the appropriate box): |

| ý | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| | (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

| | (3) | Filing Party: |

| | (4) | Date Filed: |

September 17, 2007

Dear Patriot Scientific Corporation Shareholder:

On behalf of the Board of Directors and management of Patriot Scientific Corporation, I’m pleased to extend a personal invitation to you to attend the annual meeting of shareholders of Patriot Scientific Corporation, which will be held from 10:00 AM until noon on Tuesday, October 23, 2007 at the La Costa Resort and Spa in Carlsbad, California. A light buffet luncheon will be provided following the meeting. I hope you’ll join us.

Financial Performance. Fiscal 2007 was more than just a good year for Patriot Scientific Corporation, it was a record-breaking year. At the end of May we posted the best financial results in Patriot’s 20-year history. The income recognized from our patent-licensing activity nearly doubled to $49 million and the Company’s net profit was $23.7 million, or $0.06 per fully diluted share.

Our cash position also improved dramatically, growing by a factor of nearly 5 times. We now have over $21 million in the bank, compared to just under $4 million at the end of fiscal 2006. Our exceptionally strong financial performance puts us in a much better position to acquire other companies, technologies, rights, or equipment going forward.

Warrants Repurchased. By the time of the shareholders’ meeting we will have bought back all the remaining outstanding warrants held by Lincoln Ventures. This action, which we announced on July 24, eliminates the last of the warrants held by Swartz and Lincoln since they became long-term supporters and shareholders of Patriot Scientific.

Shares Repurchased. Over the course of fiscal year 2007 we’ve spent over $8.8 million repurchasing shares of the Company. To date we’ve acquired more than 18 million of our own shares under a program that began back in July of 2006 when the management and the Board of Directors felt that our stock was undervalued in the market and that this would be a prudent use of corporate funds. We’ve suspended share repurchases for a while because I no longer believe this is the best use of the company’s cash at this time. Although we still believe our shares are undervalued, I strongly believe we can put that money to better and more profitable use elsewhere.

Dividends. In a similar vein, Patriot Scientific has paid out three dividends over the past two years, most recently a $0.02/share dividend on April 9, 2007. As before, the management and the Board of Directors will reconsider the topic of dividends at regular intervals, but at this time I believe the Company’s assets can be put to better use creating a revenue stream that would be in addition to the proceeds that already flow from licensing.

Licensing Activity. Since February of 2007 we’ve welcomed seven new licenses in as many months, including Nokia, Sharp, SanDisk, Bull, the LEGO Group, DMP Electronics, and Denso Wave. Our momentum is increasing and the future looks very bright, indeed.

Management Changes. Since our last shareholders’ meeting we’ve gained a new CEO, a new CFO, and a new member of the Board of Directors.

On June 5 I was appointed the Company’s president and Chief Executive Officer, succeeding David Pohl. I’m thankful to the Board of Directors and the shareholders for their trust and confidence as we begin a new chapter in the company’s growth.

Clifford Flowers joined the Company on September 17 as Chief Financial Officer, succeeding Thomas J. Sweeney. Cliff’s public-company experience with software and technology companies will be key assets as we evaluate potential acquisition candidates and eventually integrate their operations into our own.

Taking over as head of our Technology Committee is Nick Tredennick, PhD. Dr. Tredennick is a well-known Silicon Valley technology expert and entrepreneur with a string of successful products and companies on his resume. Nick adds an invaluable measure of experience, know-how, and expertise to Patriot Scientific Corporation as we move forward.

Press and Analyst Activity. Over the past few months we’ve invigorated the Company’s press and analyst outreach, conducting several print and broadcast interviews with the business and financial press. We’re beginning to see the fruits of this labor in more “column inches” and a clearer understanding of Patriot Scientific Corporation and its unique business proposition. We’ve even secured a regular monthly column in one of the industry’s biggest monthly publications, Electronic Business.

On the financial side, we’ve also engaged with a new independent research firm, which will significantly increase our visibility and coverage among the investment community. We look forward to their initial coverage of our Company later this year.

Patriot Scientific Corporation has been named to the San Diego Technology Fast 50, sponsored by Deloitte & Touche LLP. This awards recognizes Patriot Scientific as one of the 50 fastest-growing companies in the San Diego area.

Subsidiary Activities. Business continues to improve at Holocom Networks, the network- and data-security firm in which we hold an interest. On July 20 we announced that Holocom Networks had sold its interest in its multi-domain computer business (now called DataSecurus) to Pilot Power Group, a transaction that simultaneously relieved Holocom Networks of these non-core assets and put that business into good hands.

Patent Litigation. As previously reported, Patriot Scientific Corporation is party to a patent-infringement litigation pending in the Federal District Court in the Eastern District of Texas. The TPL Group and Patriot Scientific are plaintiffs seeking damages from various electronics-manufacturing companies named as defendants who are alleged to be infringing on one or more patents in the portfolio jointly owned by Patriot Scientific Corporation and the TPL Group. The petitions for relief included requests that the court issue permanent injunctions against the sale by defendants of products produced without licenses to use our patented technology.

In February a license agreement was entered into with one of the defendants, NEC Corporation, including certain NEC subsidiaries. In connection with the transaction four of the five NEC defendants, excluding NEC Electronics America Inc., were dismissed from the lawsuit.

On June 15 an important claims-construction (“Markman”) hearing was held in Marshall, Texas. The purpose of a Markman hearing is to define and clarify the exact definition of technical terms included in the patents in suit before the trial begins. The result of this hearing was quite favorable and broadly confirmed the strength of our patent portfolio. The hearing definitively established and clarified the meaning to be assigned to the claims within the patents. We’re quite encouraged by this result.

On September 13 a motion to simplify the patent-infringement trial was granted. This motion helped the Company two ways. It removed ARM Holdings as an intervener in the current litigation, and it allows us to appeal a portion of the Markman interpretation of the ’584 patent before waiting until the end of the trial.

A three-day pre-trial mediation is currently scheduled for September 25–27, and the trial date has been moved to January.

Summary. The fiscal year 2007 has been very good to Patriot Scientific and I’m more convinced than ever that we’ve got fantastic opportunities ahead of us. I look forward to sharing this good news with you at our shareholders’ meeting in October.

| · | Licensing revenues doubled to $49 million |

| · | Cash position has grown five-fold over previous fiscal year |

| · | Signed seven new patent license agreements in as many months |

| · | New President and Chief Executive Officer |

| · | New Chief Financial Officer |

| · | New head of the Technology Committee |

| · | Retired all outstanding warrants at Lincoln Ventures |

| · | Repurchased $8.8 million worth of PTSC stock |

| · | Paid out another dividend to shareholders |

| · | Began aggressively pursuing acquisition candidates |

| · | Sold non-core assets of DataSecurus to Pilot Power Group |

Sincerely,

/s/ James L. Turley

James L. Turley

President and CEO

Note: If you received in this package from your broker through ADP, we need your consent to begin the electronic process and help the environment too!

Your Company expends a significant number of dollars printing and mailing this proxy package. You can help us avoid this cost by voting at www.proxyvote.com and, after voting, providing your e-mail address. Subsequent proxy packages can then be provided to you electronically. If you received this package from InterWest Transfer Co., Inc., our transfer agent, this option is not yet available.

PATRIOT SCIENTIFIC CORPORATION

Carlsbad Corporate Plaza

6183 Paseo Del Norte, Suite 180

Carlsbad, California 92011

(760) 547-2700

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

OCTOBER 23, 2007

Notice is hereby given that the Annual Meeting of Stockholders of Patriot Scientific Corporation will be held on October 23, 2007 at 10 a.m. (Pacific Time) at The La Costa Resort & Spa, Veranda Room (Clubhouse), 2100 Costa Del Mar Road, Carlsbad, California 92009, for the following purpose:

| 1. | To ratify the selection by our board of directors of KMJ Corbin & Company to serve as our independent auditors for the fiscal year ending May 31, 2008. |

| 2. | To elect our board of directors. |

| 3. | To transact such other business as may properly come before the meeting. |

Our board of directors has fixed September 21, 2007 as the record date for the determination of stockholders entitled to notice of and to vote at the annual meeting of stockholders and any postponements or adjournments thereof. A list of stockholders entitled to vote at the annual meeting of stockholders will be available at our corporate offices for 10 days prior to the date of the meeting.

We hope you will use this opportunity to take an active part in the affairs of Patriot Scientific Corporation by voting on the business to come before the annual meeting of stockholders either by executing and returning the enclosed proxy or by casting your vote in person at the meeting.

WHETHER OR NOT YOU PLAN TO ATTEND IN PERSON, YOU ARE URGED TO FILL OUT THE ENCLOSED PROXY AND TO SIGN AND FORWARD IT IN THE ENCLOSED BUSINESS REPLY ENVELOPE, WHICH REQUIRES NO POSTAGE IF MAILED IN THE UNITED STATES. IT IS IMPORTANT YOUR SHARES BE REPRESENTED AT THE MEETING TO ASSURE THE PRESENCE OF A QUORUM. ANY STOCKHOLDER WHO SIGNS AND SENDS IN A PROXY MAY REVOKE IT BY EXECUTING A NEW PROXY WITH A LATER DATE, BY WRITTEN NOTICE OF REVOCATION TO THE SECRETARY OF THE COMPANY AT ANY TIME BEFORE IT IS VOTED OR BY ATTENDING THE MEETING AND, HAVING NOTIFIED THE SECRETARY IN WRITING OF REVOCATION, VOTING IN PERSON.

YOUR VOTE IS IMPORTANT REGARDLESS OF THE NUMBER OF SHARES OF STOCK YOU HOLD. YOUR COOPERATION IN PROMPTLY RETURNING YOUR PROXY WILL HELP LIMIT EXPENSES INCIDENT TO PROXY SOLICITATION. IF A STOCKHOLDER RECEIVES MORE THAN ONE PROXY BECAUSE HE OR SHE OWNS SHARES REGISTERED IN DIFFERENT NAMES OR ADDRESSES, EACH PROXY SHOULD BE COMPLETED AND RETURNED.

| | BY ORDER OF THE BOARD OF DIRECTORS |

| | |

| | |

| | |

| September 25, 2007 | /s/ Clifford L. Flowers |

| San Diego, California | Clifford L. Flowers |

| | Corporate Secretary |

PATRIOT SCIENTIFIC CORPORATION

Carlsbad Corporate Plaza

6183 Paseo Del Norte, Suite 180

Carlsbad, California 92011

PROXY STATEMENT

This Proxy Statement is being furnished in connection with the solicitation of proxies by the Board of Directors (the “Board”) of Patriot Scientific Corporation, a Delaware corporation (the “Company”), for use in connection with the Annual Meeting of Stockholders of the Company (the “Annual Meeting”), to be held on October 23, 2007 at The La Costa Resort & Spa, Veranda Room (Clubhouse), located at 2100 Costa Del Mar Road, Carlsbad, California at 10 a.m. (Pacific Time), and any and all postponements or adjournments thereof for the purposes set forth in the accompanying Notice of Annual Meeting of Stockholders. The telephone number of the Company is (760) 547-2700 and its facsimile number is (760) 547-2705. This Proxy Statement and the accompanying form of proxy are expected to be mailed to stockholders on or about September 28, 2007.

Accompanying this Proxy Statement is the proxy for the Annual Meeting, which you may use to indicate your vote as to the proposals described in this Proxy Statement. A stockholder giving a proxy has the power to revoke it at any time before it is exercised by giving written notice of revocation to the Secretary of the Company, by executing a proxy bearing a later date, or by attending the Annual Meeting and, having notified the Secretary in writing of revocation, voting in person. Subject to any such revocation, all shares represented by properly executed proxies will be voted in accordance with the specifications on such proxy.

In addition to solicitation by use of the mail, certain of the Company’s directors, officers and employees may, without receiving additional compensation therefore, solicit the return of proxies by telephone, telegram or personal interview. The Company has requested that brokerage houses and custodians, nominees and fiduciaries forward soliciting materials to their principals, the beneficial owners of the common stock and has agreed to reimburse them for reasonable out-of-pocket expenses in connection therewith. The Company will bear the costs of the solicitation of proxies from its stockholders.

DESCRIPTION OF SECURITIES AND VOTING

The Board has fixed the close of business on September 21, 2007 as the record date for determining stockholders entitled to notice of and to vote at the Annual Meeting. As of the record date, the Company had 392,009,282 shares of common stock, $0.00001 par value per share (“Common Stock”), outstanding and entitled to vote. A majority of the shares entitled to vote on the record date, present in person or represented by proxy, will constitute a quorum at the meeting.

Each share of Common Stock issued and outstanding on the record date is entitled to one vote on any matter presented for consideration and action by the stockholders at the Annual Meeting. With respect to all matters other than the election of directors, the affirmative vote of a majority of the voting shares present in person or represented by proxy at the meeting and entitled to vote on the subject matter will be the act of the stockholders. Directors will be elected by a plurality of the votes of the shares present in person or represented by proxy and entitled to vote on the election of directors. Abstentions will have no effect for the purpose of determining whether a director has been elected. Unless otherwise instructed, proxies solicited and received by the Company will be voted “FOR” the ratification of the selection of KMJ Corbin & Company to serve as the Company’s independent auditors for the fiscal year ending May 31, 2008, and “FOR” the nominees named herein for election as directors.

If a broker indicates on the proxy that such broker does not have discretionary authority as to certain shares to vote on any proposal that requires specific instructions, those shares will not be considered as present and entitled to vote with respect to that matter. Pursuant to Delaware law, a broker non-vote will not be treated as present or voting in person or by proxy on the proposal. In determining whether a proposal has passed in a circumstance where the vote required is a majority of the shares present and entitled to vote on the subject matter, abstentions, but not broker non-votes, will be treated as shares present and entitled to vote on the subject matter. Broker non-votes will be counted when the Company’s certificate of incorporation or applicable law requires the affirmative vote of a majority of the outstanding shares.

The directors and executive officers of the Company, together with their respective affiliates, beneficially own approximately 2.7% of the outstanding Common Stock, and they have indicated that they intend to vote their shares in favor of all proposals set forth in this Proxy Statement.

The Common Stock is quoted on the OTC Bulletin Board under symbol “PTSC” and traded in the over-the-counter market.

Transfer Agent and Registrar. Interwest Transfer Company, Inc., 1981 East 4800 South, Suite 100, Salt Lake City, Utah 84117, acts as transfer agent and registrar for the Common Stock. Their telephone number is (801) 272-9294.

Dividend Policy. The declaration and payment of dividends on the Common Stock is at the absolute discretion of the Board and will depend, among other things, on the Company’s earnings, financial condition and capital requirements. During the fiscal year ended May 31, 2007 we paid a $0.02 per common share dividend on April 9, 2007. On February 22, 2007, our Board of Directors adopted a semi-annual dividend payment policy, subject to determination by our Board that payment of a dividend would be reasonable and prudent in light of our financial condition, other possible applications of our available resources, and relevant business considerations.

PRINCIPAL SHAREHOLDERS

The following table sets forth, as of August 31, 2007, the stock ownership of each officer and director of the Company, of all officers and directors of the Company as a group, and of each person known by the Company to be a beneficial owner of 5% or more of its Common Stock. The number of shares of Common Stock outstanding as of August 31, 2007, was 389,372,340. Except as otherwise noted, each person listed below is the sole beneficial owner of the shares and has sole investment and voting power over such shares. No person listed below has any option, warrant or other right to acquire additional securities of the Company, except as otherwise noted. Other than Lincoln Ventures, LLC and Swartz Private Equity, LLC, each individual’s address is Carlsbad Corporate Plaza, 6183 Paseo Del Norte, Suite 180, Carlsbad, California 92011. The address of Lincoln Ventures, LLC and Swartz Private Equity, LLC is 1120 Sanctuary Parkway, Suite 325, Alpharetta, GA 30004.

Name | Amount & Nature of Beneficial Ownership | Percent of Class |

| Gloria H. Felcyn, CPA | 1,439,700 (1) | * |

| Helmut Falk, Jr. | 3,428,231 (2) | * |

| Carlton M. Johnson, Jr. | 1,675,000 (3) | * |

| David H. Pohl | 2,657,846 (4) | * |

| Thomas J. Sweeney | 275,000 (5) | * |

| James L. Turley | 1,075,000 (6) | * |

| Harry (Nick) L. Tredennick III | 100,000 (7) | * |

| Lincoln Ventures, LLC | 29,624,189 (8) | 7.61% |

| Swartz Private Equity, LLC | 5,759,940 (8) | 1.48% |

| All directors & officers as a group (7 persons) | 10,650,777 (9) | 2.74% |

——————

*Less than 1%

| (1) | Includes 1,050,000 shares issuable upon the exercise of outstanding stock options exercisable within 60 days of August 31, 2007. |

| (2) | Includes 1,000,000 shares issuable upon the exercise of outstanding stock options exercisable within 60 days of August 31, 2007. |

| (3) | Includes 1,400,000 shares issuable upon the exercise of outstanding stock options exercisable within 60 days of August 31, 2007. |

| (4) | Includes 775,000 shares issuable upon the exercise of outstanding stock options exercisable within 60 days of August 31, 2007 |

| (5) | Represents shares issuable upon the exercise of outstanding stock options exercisable within 60 days of August 31, 2007. |

| (6) | Includes 1,000,000 shares issuable upon the exercise of outstanding stock options exercisable within 60 days of August 31, 2007. |

| (7) | Represents shares issuable upon the exercise of outstanding stock options exercisable within 60 days of August 31, 2007. |

| (8) | Includes 5,000,000 shares issuable upon the exercise of warrants. The documents governing Lincoln Ventures, LLC’s (“Lincoln”) warrants contain a provision prohibiting Lincoln from exercising warrants for shares of Common Stock if doing so would result in it and its affiliates beneficially owning shares of Common Stock representing more than 9.99% of the outstanding shares of Common Stock as determined under Section 13(d) of the Securities Exchange Act of 1934. If Swartz Private Equity LLC (“Swartz”) were determined to be an affiliate of Lincoln, then Lincoln’s exercisable warrant position would be reduced to the extent necessary to limit the combined beneficial ownership of Lincoln and Swartz to 9.99% of the Company’s outstanding Common Stock. |

| (9) | Includes 5,600,000 shares issuable upon exercise of outstanding stock options exercisable within 60 days of August 31, 2007. |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) requires the Company’s directors, executive officers and persons who beneficially own 10% or more of a class of securities registered under Section 12 of the Exchange Act to file reports of beneficial ownership and changes in beneficial ownership with the Securities and Exchange Commission (“SEC”). Directors, executive officers and greater than 10% stockholders are required by the rules and regulations of the SEC to furnish the Company with copies of all reports filed by them in compliance with Section 16(a).

Based solely on the Company’s review of copies of the Forms 3, 4 and 5 and amendments thereto furnished to the Company by the persons required to make such filings during the 2007 fiscal year and the Company’s own records, the Company believes that Mr. Falk, Mr. Sweeney, Mr. Pohl and Mr. Johnson each failed to file timely a Form 4 to report changes in beneficial ownership and Mr. Turley failed to file timely two Form 4’s to report changes in beneficial ownership.

PROPOSAL NUMBER 1

RATIFICATION OF THE APPOINTMENT OF KMJ CORBIN & COMPANY

The Board has appointed KMJ Corbin & Company, certified public accountants to serve as the Company’s independent auditors for the fiscal year ending May 31, 2008. The Company’s stockholders are being requested to ratify the appointment. The Audit Committee of the Board recommended the appointment of KMJ Corbin & Company to the Board. KMJ Corbin & Company has served as the Company’s independent auditors and accountants since November 23, 2005. A representative of KMJ Corbin & Company is expected to be present at the Annual Meeting. They will have the opportunity to make a statement if they desire to do so, and they are expected to be available to respond to appropriate questions. See the section entitled “Independent Public Accountants,” below for more information.

Vote Required; Board Recommendation

The Board recommends a vote in favor of this proposal. The affirmative vote of a majority of the votes cast will be required to approve this proposal.

PROPOSAL NUMBER 2

ELECTION OF DIRECTORS

The Company’s bylaws provide that the number of directors of the Company may be no less than three and no more than seven, with the exact number to be fixed as the Board determines. The Board has fixed the number of directors at six. The Board has nominated the following individuals for election to the Board: (i) David H. Pohl, (ii) Carlton M. Johnson, Jr., (iii) Helmut Falk, Jr., (iv) Gloria H. Felcyn, (v) James L. Turley, and (vi) Harry (Nick) L. Tredennick III. If elected, each director will each serve a one-year term and until their respective successors have been elected and qualified. The Board has no reason to expect that any of the nominees will not stand for election or decline to serve if elected. There is no arrangement between any director or nominee and any other person pursuant to which such director or nominee was or is to be selected as a director or nominee.

UNLESS OTHERWISE SPECIFIED, ALL PROXIES RECEIVED WILL BE VOTED FOR THE ELECTION OF ALL NOMINEES. IF ANY NOMINEE SHOULD NOT STAND FOR ELECTION FOR ANY REASON, YOUR PROXY WILL BE VOTED FOR ANY PERSON OR PERSONS DESIGNATED BY THE BOARD TO REPLACE SUCH NOMINEE.

The following table and biographical summaries set forth information, including principal occupation and business experience, concerning the members of the Board, the nominees for the Board and the executive officers of the Company as of September 21, 2007. There is no blood or other familial relationship between or among the nominees, directors or executive officers of the Company.

NAME | AGE | POSITION, OFFICE and TERM |

| Helmut Falk, Jr. | 51 | Director (since December 1997) |

| Gloria H. Felcyn | 60 | Director (since October 2002) |

| Carlton M. Johnson, Jr. | 47 | Director (since August 2001) |

| David H. Pohl | 70 | Director (since April 2001)/Chairman |

| James L. Turley | 45 | Director (since February 2006)/President and Chief Executive Officer |

| Harry (Nick) L. Tredennick, III | 61 | Director (since August 2007) |

| Clifford L. Flowers | 49 | Chief Financial Officer/Secretary (since September 17, 2007) |

HELMUT FALK, JR. From 1992 until 2000, Dr. Falk served as the Director of Anesthesia of, and served on the medical executive committee for, The Johnson Memorial Hospital in Franklin, Indiana. Since 2000, Dr. Falk has worked at St. Francis Hospital in Mooresville, Indiana as a staff anesthesiologist and has been Chairman of its Pharmacy and Therapeutics Committee. Dr. Falk received his D.O. degree from the College of Osteopathic Medicine of the Pacific in 1987 and his B.S. in Biology from the University of California, Irvine in 1983. Dr. Falk is the son of the late Helmut Falk, who was the sole shareholder of nanoTronics and the Chairman and CEO of the Company until his death in July 1995. Dr. Falk is also an heir to the Helmut Falk Estate, which is the beneficial owner of the Company’s shares held by the Helmut Falk Family Trust.

GLORIA H. FELCYN. Gloria Felcyn has served as a Director of the Company since October, 2002 and is the Chairman of the Audit Committee of the Board of Directors. Since 1982, Ms. Felcyn has been the principal in her own certified public accounting firm, during which time she represented Helmut Falk Sr. and nanoTronics, along with other major individual and corporate clients in Silicon Valley. Following Mr. Falk’s death, Ms. Felcyn represented his estate and family trust as Executrix and Trustee of the Falk Estate and The Falk Trust. Prior to establishing her firm, Ms. Felcyn worked for the national accounting firm of Hurdman and Cranston from 1969 through 1970 and Price Waterhouse & Co. in San Francisco and New York City from 1970 through 1976, during which period, she represented major Fortune 500 companies. Subsequent to that, Ms. Felcyn worked in the field of International Tax Planning with a major Real Estate Syndication Company in Los Angeles until 1982 when she decided to start her own practice in Northern California. A major portion of Ms. Felcyn’s current practice is “Forensic Accounting”, which involves valuation of business entities and investigation of assets. Ms. Felcyn has published tax articles for “The Tax Advisor” and co-authored a book published in 1982, “International Tax Planning “. Ms. Felcyn has a degree in Business Economics from Trinity University and is a member of the American Institute of CPA’s.

CARLTON M. JOHNSON, JR. Carlton Johnson has served as a Director of the Company since 2001, and is Chairman of the Executive Committee of the Board of Directors. Mr. Johnson is in-house legal counsel for Roswell Capital Partners, LLC, a position he has held since June 1996. Mr. Johnson has been admitted to the practice of law in Alabama since 1986, Florida since 1982 and Georgia since 1997. He has been a shareholder in the Pensacola, Florida AV- rated law firm of Smith, Sauer, DeMaria Johnson and was President-Elect of the 500 member Escambia-Santa Rosa Bar Association. He also served on the Florida Bar Young Lawyers Division Board of Governors. Mr. Johnson earned a degree in History/Political Science at Auburn University and Juris Doctor at Samford University - Cumberland School of Law. Mr. Johnson is also a director and member of the audit committee of Peregrine Pharmaceuticals, Inc., a publicly held company.

DAVID H. POHL. David Pohl has served as a Director of the Company since April 2001, and served as an officer of the Company from January 2001 to March 2002. He was elected Chairman, Chief Executive Officer and President on June 13, 2005. On June 5, 2007 he retired as President and Chief Executive Officer. Except for his service with the Company, Mr. Pohl has been in the private practice of law counseling business clients since 1997, and most recently was Of Counsel with the law firm of Herold & Sager in Encinitas, California. He is a member of the Intellectual Property Law and Business Law Sections of the State Bar of California. In 1995 and 1996, Mr. Pohl was Special Counsel to the Ohio Attorney General regarding investments in entrepreneurial firms by state pension funds. Previously he was a senior attorney with a large U.S. law firm, and held positions as a senior officer and general counsel in large financial services corporations. Mr. Pohl earned a J.D. degree in 1962 from The Ohio State University College of Law, and also holds a B.S. in Administrative Sciences from Ohio State. Mr. Pohl is also a director and member of the audit committee of Peregrine Pharmaceuticals, Inc., a publicly held company.

JAMES L. TURLEY. Jim Turley has been a Director of the Company since February 2006, and is Chairman of the Technology Committee of the Board of Directors. On June 6, 2007 he was elected President and Chief Executive Officer. Mr. Turley is an acknowledged authority on microprocessor chips, semiconductor intellectual property, computers, and silicon technology. Until August 2006, Mr. Turley served as the Editor-in-Chief of Embedded Systems Design, a global magazine for high-tech developers and managers. He also served as Conference Chairman of the Embedded Systems Conferences, a series of electronics design shows. In addition, since August 2001, Mr. Turley has managed his own technology consulting and analysis business, Silicon Insider. From 1999 to 2001, he served as Senior Vice President of Marketing for ARC International, a microprocessor intellectual property company based in the UK. Mr. Turley has authored seven books on microprocessor chips, semiconductor intellectual property, computers, and silicon technology. He has served as editor of the prestigious industry journal Microprocessor Report (a three-time winner of the Computer Press Award), and is a frequent speaker at industry events. Mr. Turley also serves on the board of directors and/or technical advisory boards of several high-tech companies in the U.S. and Europe.

HARRY (NICK) L. TREDENNICK, III. Nick Tredennick has been a Director of the Company since August 2007. Since 1989, Dr. Tredennick has been the Chief Technical Officer of Tredennick, Inc., a technology consulting firm. Dr. Tredennick was named a fellow of the Institute of Electrical and Electronics Engineers (IEEE) for contributions to microprocessor design. While at Motorola (now Freescale), he designed the microprocessor that became the central processor for the original Apple Macintosh. Dr. Tredennick also designed a System/370 microprocessor as a research staff member at IBM’s Thomas J. Watson Research Center. Dr. Tredennick was chief scientist at Altera, a programmable logic company and has taught at the University of Texas at Austin and the University of California, Berkeley. Dr. Tredennick has been on the editorial advisory board for several technical publications including IEEE Spectrum and Microprocessor Report. He has been a founder and director of several companies, including Pacific Fiberoptics and NexGen Microsystems (later acquired by AMD) and Tredennick, Inc. Dr. Tredennick has written a textbook and more than sixty technical papers and has nine patents. Dr. Tredennick has a PhD in electrical engineering from the University of Texas and was a registered professional engineer for many years.

CLIFFORD L. FLOWERS. Cliff Flowers became the Company’s Chief Financial Officer on September 17, 2007 and is Secretary of the Company. Prior to that date and from May 2007, Mr. Flowers was the interim CFO for BakBone Software Inc., working as a consultant on behalf of Resources Global Professionals, Inc. From June 2004 through December 2006, Mr. Flowers was the senior vice president of finance and operations and CFO for Financial Profiles, Inc. a developer and marketer of software for the financial planning industry. Prior to joining Financial Profiles, Mr. Flowers served as CFO of Xifin, Inc. a provider of hosted software services to the commercial laboratory marketplace. Prior to Xifin, Mr. Flowers served for nine years in positions of increasing responsibility at Previo, Inc. a developer and marketer of various PC and server-based products, including backup and business continuity offerings. As CFO of Previo, Mr. Flowers’ global responsibilities included all financial operations and legal affairs. He earlier served as an audit manager with Price Waterhouse, LLP. Mr. Flowers is a graduate of San Diego State University with a B.S. summa cum laude in Business Administration with an emphasis in accounting and holds a CPA license in California.

Vote Required; Board Recommendation

Directors are elected by plurality vote, meaning that (should there be more nominees than seats available) the nominees who receive the most votes will be elected for the term nominated, even if the number of votes received by any one or more nominees is less than a majority of the votes cast. Cumulative voting is not allowed in the election of directors. The Board recommends a vote in favor of each nominee set forth above.

BOARD OF DIRECTORS AND COMMITTEES

During the fiscal year ended May 31, 2007, the Company’s Board of Directors consisted of: David H. Pohl, Carlton M. Johnson Jr., Gloria H. Felcyn, Helmut Falk Jr., and James L. Turley. All of the directors were independent directors under NASDAQ listing standards, with the exception of Mr. Pohl who was an officer of the Company.

Director Attendance

During the fiscal year ended May 31, 2007, the Board held a total of seven meetings. During the 2007 fiscal year, each of the directors of the Company attended at least 75% of the aggregate of (i) the total number of Board meetings and (ii) the total number of meetings held by all committees of the Board on which such director served during 2007. The Board expects all directors to attend its annual stockholder meetings; all of its directors attended the annual meeting of stockholders in April 2007, for the fiscal year ending May 31, 2006.

Committees of the Board of Directors

Audit Committee

The Audit Committee reviews the audit and control functions of the Company, the Company’s accounting principles, policies and practices and financial reporting, the scope of the audit conducted by the Company’s auditors, the fees and all non-audit services of the independent auditors and the independent auditors’ opinion and letter of comment to management and management’s response thereto. During the last fiscal year, the Audit Committee held ten meetings.

Audit Committee Report

Notwithstanding anything to the contrary set forth in any of the Company’s previous or future filings under the Securities Act of 1933 (“Securities Act”) or the Exchange Act that might incorporate this Proxy Statement or future filings with SEC, in whole or in part, the following report shall not be deemed to be incorporated by reference into any such filing.

Membership and Role of the Audit Committee

The Audit Committee is appointed by the Board. The Audit Committee operates under a written charter adopted by the Board, a copy of which is attached as an appendix to this Proxy Statement.

The primary function of the Audit Committee is to provide advice to the Board with respect to the Company’s financial matters and to assist the Board in fulfilling its oversight responsibilities regarding finance, accounting, tax and legal compliance. The Audit Committee’s primary duties and responsibilities are to:

| · | Serve as an independent and objective party to monitor the Company’s financial reporting process and internal control system; |

| · | Review and appraise the audit efforts of the Company’s independent accountants; |

| · | Evaluate the Company’s quarterly financial performance as well as its compliance with laws and regulations; |

| · | Oversee management’s establishment and enforcement of financial policies and business practices; and |

| · | Provide an open avenue of communication among the independent accountants, financial and senior management, counsel, and the Board. |

The Audit Committee has considered whether the non-audit services provided by the Company’s auditors in connection with the fiscal year ended May 31, 2007 were compatible with the auditors’ independence.

The Audit Committee has reviewed and discussed the audited financial statements of the Company for the fiscal year ended May 31, 2007 with management. The Audit Committee has discussed with KMJ Corbin & Company (“Corbin”), the Company’s independent public accountants for the fiscal year ended May 31, 2007, the matters required to be discussed by Statement on Auditing Standards No. 61 (Communication with Audit Committees), as modified, for the fiscal year ended May 31, 2007.

The Audit Committee has also received the written disclosures and the letter from Corbin required by Independence Standards Board Standard No. 1 (Independence Discussion with Audit Committees) and the Audit Committee has discussed the independence of Corbin with that firm.

Based on the Audit Committee’s review and discussions noted above, the Audit Committee recommended to the Board that the Company’s audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended May 31, 2007 for filing with the SEC.

The Audit Committee is composed of two outside directors, both of whom were determined by the Board of Directors to be independent directors and are independent as defined under the NASDAQ listing standards. During fiscal 2006 and to date, the Audit Committee has consisted of Ms. Felcyn (Chairperson) and Mr. Johnson. The Board of Directors has determined that Ms. Felcyn is an audit committee financial expert as defined in Item 401 of Regulation S-B, promulgated by the SEC. The Board’s conclusions regarding the qualifications of Ms. Felcyn as an audit committee financial expert were based on her standing as a certified public accountant and her degree in business economics.

Gloria H. Felcyn, Chairperson

Carlton M. Johnson, Jr.

Nominating Committee

On August 28, 2003, the Board created the Nominating Committee and approved the Nominating Committee Charter, a copy of which was attached as an appendix to the 2005 Proxy Statement filed with the SEC on March 14, 2005. The members of the Nominating Committee are Carlton M. Johnson and David H. Pohl.

The Nominating Committee reviews and recommends to the Board for nomination candidates for election to the Board. Stockholders desiring to recommend nominees must submit proposals to the Corporate Secretary in accordance with established procedures set forth in the section entitled, “Shareholder Proposals and Communications” below. The Nominating Committee has a policy with respect to director candidates that applies whether the recommendations are made by stockholders or the committee. Certain qualifications and considerations that the Nominating Committee takes into account include whether candidates possess such attributes and experience as are necessary to provide a broad range of characteristics, including diversity, management skills, financial, technological and business experience, as well as whether such candidates are able to commit the requisite time for preparation and attendance at regularly scheduled meetings and to participate in other matters necessary for good corporate governance. During the last fiscal year, the Nominating Committee did not hold any meetings. The entire Board acted in lieu of the Nominating Committee and in accordance with the policies that apply to the Nominating Committee.

During fiscal 2007, Mr. Pohl was an officer of the Company and was not considered to be an independent director under NASDAQ listing standards. Mr. Johnson is an independent director under NASDAQ listing standards. Because of the small number of independent directors serving on the Board, the Board appointed Mr. Pohl to serve on the Nominating Committee.

Compensation Committee

The Compensation Committee reviews and recommends to the Board the salaries, bonuses and perquisites of the Company’s executive officers. The Compensation Committee also reviews and recommends to the Board any new compensation or retirement plans and administers the Company’s 1996, 2001, 2003 and 2006 Stock Option Plans. During the last fiscal year, the Compensation Committee held five meetings. The Compensation Committee also reviews and approves corporate goals and objectives relevant to the compensation of the Company’s executive officers and evaluates their performance in light of these goals and objectives. The Compensation Committee operates under a charter that it reviews annually. Changes to the charter are recommended by the Committee and must be approved by the Board.

Membership and Role of the Compensation Committee. The Compensation Committee consists of three non-employee directors, each of whom is independent as defined under the NASDAQ listing standards and by the SEC. The Compensation Committee approves the compensation for any executive officer who also serves as a director of the Company, and acts on such other matters relating to their compensation, as it deems appropriate. Beginning October 2002, the Compensation Committee has also approved the compensation for the Company’s other executive officers and acts on such other matters relating to their compensation, as it deems appropriate. With respect to all eligible recipients except members of the Compensation Committee, the Compensation Committee also administers the Company’s 1996, 2001, 2003 and 2006 Stock Option Plans and determines the participants in the plans and the amount, timing and other terms and conditions of awards under these plans. The Board as a whole exercises these responsibilities with respect to members of the Compensation Committee as eligible recipients under these plans. The Compensation Committee operates under a written charter adopted by the Board, a copy of which is attached as an appendix to this Proxy Statement.

Compensation Committee Interlocks and Insider Participation. None.

Overview

In this section we review our plans and programs for compensating the Company’s executive officers who are named in the Summary Compensation Table that appears under the caption “Executive Compensation.”

Compensation Discussion and Analysis

Compensation Philosophy and Objectives. The Compensation Committee is committed to the general principle that overall executive compensation should be commensurate with corporate performance, the performance of the individual executive officers, and the attainment of predetermined corporate goals. The primary objectives of the Company’s executive compensation program are to:

| · | reward the achievement of desired corporate and individual performance goals; |

| · | provide compensation that enables the Company to attract and retain key executives; and |

| · | provide compensation opportunities that are linked to Company performance and that directly link the interests of executives with the interests of stockholders. |

The Company’s executive compensation program provides a level of compensation opportunity that is competitive with those offered by companies in comparable industries and of comparable development, complexity and size. In determining compensation levels, the Compensation Committee considers a number of factors, including corporate performance, both separately and in relation to other companies competing in the Company’s markets, the individual performance of each executive officer, comparative compensation surveys concerning compensation levels and stock grants at other companies, the Company’s historical compensation levels and stock awards, and the overall competitive environment for executives and the level of compensation necessary to attract and retain key executives. Compensation levels may be greater or less than competitive levels in comparable companies based upon factors such as annual and long-term corporate and individual performance.

Executive Compensation Program Components. The Company’s executive compensation program consists of base salary, bonuses and stock options. The particular elements of the compensation program are discussed more fully below.

Base Salary

Base salary levels of executives are determined by the potential impact of the individual on the Company and corporate performance, the skills and experience required by the position, the individual performance and potential of the executive, and market data for comparable positions in companies in comparable industries and of comparable development, complexity and size. Base salaries for executives are generally evaluated and adjusted annually. The Compensation Committee has the discretionary authority to adjust such base level salaries based on the Company’s actual and projected performance, including factors related to revenue and profitability. In considering the performance of the Company in fiscal year 2007 in relation to the performance of other companies in its industry generally, the Company feels that the current compensation levels of its executive officers are appropriate.

The Omnibus Reconciliation Act of 1993 added Section 162(m) to the Internal Revenue Code limiting corporate deductions to $1,000,000 for certain types of compensation paid to the chief executive officer and each of the four other most highly compensated executives of publicly held companies. The Company does not believe that it will pay “compensation” within the meaning of Section 162(m) to such executive officers in excess of $1,000,000 in the foreseeable future. Therefore, the Company does not have a policy at this time regarding qualifying compensation paid to its executive officers for deductibility under Section 162(m), but will formulate a policy if compensation levels ever approach $1,000,000.

Base salary is the only element of compensation that is used in determining the amount of contributions permitted under the Company’s 401(k) plan.

Bonuses

The Compensation Committee may establish the goals and measurements for the bonus plan to align executive pay with achievement of critical strategies and operating goals. The targets for executive officers have been set at 50% of base salary for the Chief Executive Officer and 40% of base salary for other officers, except as otherwise reflected in individual employment contracts.

The Compensation Committee typically determines that one-half of the bonus shall be based on the achievement of revenue and profit goals and the other half on achievement of specific strategic objectives. The Compensation Committee has determined that there will be no payout for the portions based on revenue and profit unless at least 90% of the revenue and profit goals have been met.

The Company paid a bonus of $50,000 to Mr. Pohl on June 1, 2006. The Company paid a bonus of $15,000 to Mr. Sweeney on October 27, 2006.

Stock Options

The Company uses stock options to enable key executives to participate in a meaningful way in the Company’s success and to link their interests directly with those of stockholders. The number of stock options the Company grants to executives is based upon a number of factors, including base salary level and how such base salary level relates to those of other companies in the Company’s industry, the number of options previously granted, individual and corporate performance during the year, and the size and nature of option packages granted to comparable employees in comparable companies.

The Company generally sets the exercise price of stock options at the fair market value of the Company’s Common Stock on the date of grant. Fair market value is determined as the closing price of the Company’s stock on the grant date. The Company does not backdate options or grant options retroactively. The Company does not loan funds to employees to enable them to exercise stock options.

All of the Company’s stock options are granted at the sole discretion of the Board of Directors or the Compensation Committee. Named Executive Officers may be granted stock options in accordance with terms of their employment contracts.

For the fiscal year ended May 31, 2007 Mr. Pohl received options to purchase 1,700,000 shares of the Company’s common stock and Mr. Sweeney received options to purchase 125,000 shares of the Company’s common stock. All of these option grants vested fully on the date of grant.

Benefits

Named Executive Officers also participate in the Company’s benefit plans on the same terms as other employees. These plans include medical and dental insurance, as well as life and disability insurance.

Retirement Plan

The Company maintains a 401(k) plan for all eligible employees. Pursuant to the plan, the Company provides a 50% match on the first 6% of a participant’s compensation. Matching contributions vest over a three year period. Participants choose to invest their account balances from a selection of funds provided by the plan fiduciary. None of the investment options are in Company stock.

Severance Benefits

Named Executive Officers are entitled to severance benefits as specified in their employment contracts. Mr. Pohl is entitled to a severance payment of $100,000, which is being paid bi-weekly over a six month period that will end in December 2007.

Management’s Role in Establishing Compensation

Our named executive officers do not determine or approve any element or component of their own base salary, annual incentive awards, long-term incentives or other aspects of compensation. The named executive officers do provide input and make recommendations to the Compensation Committee with respect to the compensation of officers who report to them. These recommendations are based on various factors, including individual contribution and performance, company performance, labor market conditions, complexity and importance of roles and responsibilities, reporting relationships, retention needs and internal pay relationships.

Compensation Committee Report

The Compensation Committee reviewed and discussed the Company’s Compensation Discussion and Analysis with management. Based upon such review and discussions, the Committee recommended to the Board of Directors that the Company’s Compensation Discussion and Analysis be included in this proxy statement and incorporated by reference in the Company’s Annual Report on Form 10-K for the fiscal year ended May 31, 2007.

Carlton M. Johnson, Chairperson

Gloria H. Felcyn

Helmut Falk, Jr.

The following table summarizes the compensation of the Named Executive Officers for the fiscal year ended May 31, 2007. The Named Executive Officers are the Company’s Chief Executive Officer and Chief Financial Officer.

Summary Compensation Table

For Fiscal Year Ended May 31, 2007

Name and Principal Position | Year | | Salary ($) | | | Bonus ($) | | | Option Awards ($) (1) | | | All Other Compensation ($) (2) | | | Total Compensation ($) | |

| David H. Pohl, CEO | 2007 | | $ | 247,279 | | | $ | 50,000 | | | $ | 1,636,137 | | | $ | 7,368 | | | $ | 1,940,784 | |

| Thomas J. Sweeney, CFO | 2007 | | | 223,875 | | | | 15,000 | | | | 123,763 | | | | -- | | | | 362,638 | |

| | | | | | | | | | | | | | | | | | | | | | |

| 1. | Represents the compensation costs of stock options for financial reporting purposes for fiscal 2007, computed in accordance with SFAS 123R, rather than an amount paid to or realized by the Named Executive Officer. See Note 2 to the financial statements included in our Annual Report on Form 10-K for the fiscal year ended May 31, 2007 for the assumptions made in determining SFAS 123R values. The SFAS 123R value as of the grant date for options is spread over the number of months of service required for the grant to become non-forfeitable. In addition, ratable amounts expensed for grants that were granted in prior years are included. There were no forfeited awards of options granted to Named Executive Officers for the fiscal year ended May 31, 2007. |

| 2. | Represents the Company match on employee contributions to the Company’s 401(k) plan. |

The following table provides information on stock options granted in fiscal 2007 to each of the Company’s Named Executive Officers. There can be no assurance that the Grant Date Fair Value of Option Awards will ever be realized. The amount of these awards that were expensed in fiscal 2007 is shown in the Summary Compensation Table above.

Grants of Plan-Based Awards

For Fiscal Year End May 31, 2007

Name | Grant Date | Board Approval Date | | All Other Option Awards: Number of Securities Underlying Options | | | Exercise Price of Option Awards | | | Closing Price on Grant Date | | | Grant Date Fair Value of Option Awards (4) | |

| David H. Pohl, CEO | 6/5/06 | 6/1/06 | | | 1,500,000 | (1) | | $ | 0.165 | | | $ | 1.14 | | | | 1,527,019 | |

| | 2/9/07 | 2/9/07 | | | 200,000 | (3) | | | 0.60 | | | | 0.60 | | | | 109,118 | |

| Thomas J. Sweeney | 10/23/06 | 10/23/06 | | | 100,000 | (2) | | | 0.86 | | | | 0.86 | | | | 79,787 | |

| | 2/9/07 | 2/9/07 | | | 25,000 | (3) | | | 0.60 | | | | 0.60 | | | | 13,640 | |

| 1. | Represents options granted to the Mr. Pohl outside of the Company’s stock option plans. |

| 2. | Represents options granted under the Company’s 2001 Stock Option Plan. |

| 3. | Represents options granted under the Company’s 2006 Stock Option Plan. |

| 4. | Represents the aggregate SFAS 123R values of options granted during the year. The per-option SFAS 123R grant date value for Mr. Pohl’s June 2006 options was $1.02, and $0.55 for the February 2007 option grant. The per-option SFAS 123R grant date value for Mr. Sweeney’s October 2006 options was $0.80 and $0.55 for the February 2007 option grant. See Note 2 to the financial statements included in our Annual Report on Form 10-K for the fiscal year ended May 31, 2007 for the assumptions made in determining SFAS 123R values. There can be no assurance that the options will ever be exercised (in which case no value will be realized by the executive) or that the value on exercise will equal the SFAS 123R value. |

Pursuant to the Company’s 2001 Stock Option Plan, the options of grantees who die expire on the earlier of six months from the date of death, or the original expiration date. If a grantee is disabled, the options expire on the earlier of twelve months from the date of disability or the original expiration date. For employment terminations or cessation of service on the Company’s board of directors, options that are then vested expire within three months of termination or cessation of service and unvested options expire immediately.

Pursuant to the Company’s 2006 Stock Option Plan, the options of grantees who die or become disabled expire on the earlier of twelve months from the date of death, or the original expiration date. For employment terminations or cessation of service on the Company’s board of directors, options that are then vested expire within three months of termination or cessation of service and unvested options expire immediately.

The exercise price of all options granted in 2007 under the Company’s stock option plans, equals the closing price of the Company’s common stock on the grant date.

The following table shows the number of shares covered by exercisable and un-exercisable options held by the Company’s Named Executive Officers for the fiscal year ended May 31, 2007.

Outstanding Equity Awards

For Fiscal Year Ended May 31, 2007

Name | | Number of Securities Underlying Options (#) Exercisable | | | Number of Securities Underlying Unexercised Options (#) Unexercisable | | | Option Exercise Price ($) | | Option Expiration Date |

| David H. Pohl, CEO | | | 100,000 | (1) | | | -- | | | $ | 0.102 | | 2/16/2010 |

| | | | 100,000 | (1) | | | -- | | | | 0.05 | | 10/23/2008 |

| | | | 500,000 | (1) | | | -- | | | | 0.163 | | 6/22/2010 |

| | | | 400,000 | (1) | | | -- | | | | 0.70 | | 5/25/2011 |

| | | | 1,500,000 | (2) | | | -- | | | | 0.165 | | 8/15/2007 |

| | | | 200,000 | (1) | | | -- | | | | 0.60 | | 2/09/2012 |

| Thomas J. Sweeney | | | 50,000 | (1) | | | -- | | | $ | 0.70 | | 5/25/2011 |

| | | | 100,000 | (1) | | | -- | | | | 0.86 | | 10/23/2011 |

| | | | 25,000 | (1) | | | -- | | | | 0.60 | | 2/09/2012 |

| | | | | | | | | | | | | | |

1. All of the options fully vested upon date of grant and have a term of five years.

2. The option fully vested upon date of grant and has a term of fourteen months and ten days.

The following table shows the number of shares of the Company’s common stock acquired during the fiscal year ended May 31, 2007 upon the exercise of options by the Company’s Named Executive Officers.

Option Exercises

For Fiscal Year Ended May 31, 2007

Name | Number of Shares Acquired on Exercise (#) | Value Realized On Exercise ($) |

| David H. Pohl | -- | -- |

| Thomas J. Sweeney | -- | -- |

| | | |

Equity Compensation Plan Information

The following table sets forth certain information concerning aggregate stock options authorized for issuance under our 1996, 2001, 2003 and 2006 stock option plans as of May 31, 2007.

Shares of common stock issuable on the exercise of warrants have not been approved by our stockholders. Additionally, during the year ended May 31, 2007, we issued options to acquire 1,500,000 shares of our common stock at a per share price of $0.165 to an officer outside of the above referenced stock option plans. The sum of these two items has been segregated in the table below under the item “Equity compensation plans not approved by security holders”.

Plan Category | | Number of securities to be issued upon exercise of outstanding options and warrants | | | Weighted-average exercise price of outstanding options and warrants | | | Number of securities remaining available for future issuance under equity compensation plans | |

| Equity compensation plans approved by security holders | | | 5,745,000 | | | $ | 0.46 | | | | 4,429,000 | |

| Equity compensation plans not approved by security holders | | | 13,560,915 | | | $ | 0.11 | | | | -- | |

| Total | | | 19,305,915 | | | | | | | | 4,429,000 | |

Employment Contracts

The Company has an agreement with Mr. Pohl. Under terms of the agreement, Mr. Pohl is being paid a severance payment of $100,000 payable in bi-weekly installments over a six month period that will end December 2007.

The Company had an employment agreement with Mr. Sweeney. Under the terms of the agreement, Mr. Sweeney was paid a salary of $1,125 per day, subject to increase in the Company’s sole discretion. Mr. Sweeney was also entitled to a cash bonus, stock options and severance pay, in each case, as determined by the Compensation Committee in its sole discretion. During the course of Mr. Sweeney’s employment with the Company, Mr. Sweeney remained a partner of Tatum CFO Partners, LLP (“Tatum”). As a partner of Tatum, Mr. Sweeney shared with Tatum a portion of his economic interest in any stock options or equity bonus that the Company paid him, to the extent specified in a Part-Time Engagement Resources Agreement between the Company and Tatum. Mr. Sweeney was eligible for any Company employment retirement and/or 401(k) plan and for vacation and holidays consistent with the Company’s policy as it applies to senior management.

In connection with Mr. Turley’s appointment as President and Chief Executive Officer, and commencing on June 5, 2007, the Company entered into an Employment Agreement with Mr. Turley for a one-year term. Pursuant to the Agreement, Mr. Turley is to receive a base salary of $225,000 per year and is eligible to receive an annual merit bonus as determined in the sole discretion of the Board of Directors. Also pursuant to the Agreement and on the date of the Agreement, Mr. Turley received incentive stock options to purchase 400,000 shares of the Company’s common stock and non-qualified stock options to purchase 1.5 million shares of the Company’s common stock. The Agreement also provides for Mr. Turley to receive customary employee benefits, an automobile allowance, and reimbursement for reasonable lodging and commuting expenses for the first six months of the term of the Agreement.

In connection with Mr. Flowers’ appointment as the Chief Financial Officer, and also commencing on September 17, 2007, the Company entered into an Employment Agreement (the “Agreement”) with Mr. Flowers for an initial 120-day term if not terminated pursuant to the Agreement, with an extension period of one year and on a day-to-day basis thereafter. Pursuant to the Agreement, Mr. Flowers is to receive a base salary of $225,000 per year and is eligible to receive an annual merit bonus of up to 50% of his base salary, as determined in the sole discretion of the Board of Directors. Also pursuant to the Agreement and on the date of the Agreement, Mr. Flowers received a grant of non-qualified stock options to purchase 150,000 shares of the Company’s common stock and a grant of non-qualified stock options to purchase 600,000 shares of the Company’s common stock. The Agreement also provides for Mr. Flowers to receive customary employee benefits, including health, life and disability insurance.

Pursuant to the Agreement, if Mr. Flowers is terminated without cause or resigns with good reason within the first two years of employment, he is entitled to receive an amount equal to his annual base salary for the greater of (i) 6 months or (ii) the period remaining in the extended one-year term. If Mr. Flowers is terminated without cause or resigns with good reason any time after two years of continuous employment, he is entitled to receive an amount equal to 12 months of his annual base salary. Mr. Flowers is also entitled to certain payments upon a change of control of the Company if the surviving corporation does not retain him. All such payments are conditional upon the execution of a general release.

Director Compensation

As described more fully below, this table summarizes the annual cash compensation for the Company’s non-employee directors during the fiscal year ended May 31, 2007.

Director Compensation

For Fiscal Year Ended May 31, 2007

Name | | Fees Earned or Paid in Cash ($) | | | Option Awards ($) (1) | | | All Other Compensation | | | Total Compensation ($) | |

| Carlton M. Johnson, Jr. | | $ | 132,000 | (2) | | $ | 109,118 | | | | -- | | | $ | 241,118 | |

| Gloria H. Felcyn | | | 76,000 | (3) | | | 109,118 | | | | -- | | | | 185,118 | |

| Helmut Falk, Jr. | | | 36,000 | | | | 109,118 | | | | -- | | | | 145,118 | |

| James L. Turley | | | 86,000 | (4) | | | 109,118 | | | | -- | | | | 195,118 | |

| 1. | Represents the compensation costs of stock options for financial reporting purposes for fiscal 2007, computed in accordance with SFAS 123R, rather than an amount paid to or realized by the director. See Note 2 to the financial statements included in our Annual Report on Form 10-K for the fiscal year ended May 31, 2007 for the assumptions made in determining SFAS 123R values. There can be no assurance that the SFAS 123R amounts will ever be realized. The per-option SFAS 123R grant date value was $1.83 for options granted in fiscal 2007. |

| 2. | Consists of $36,000 board fee, $36,000 Phoenix Digital Solutions, LLC management committee fee, and $60,000 Compensation Committee and Executive Committee Chair fee (August 2006 to May 2007). |

| 3. | Consists of $36,000 board fee and $40,000 Audit Committee Chair fee (August 2006 to May 2007). |

| 4. | Consists of $36,000 board fee and $50,000 Technology Committee Chair fee (August 2006 to May 2007). |

At May 31, 2007 the aggregate number of options outstanding was: Mr. Johnson – 1,400,000 shares, Ms. Felcyn – 1,050,000 shares, Mr. Falk – 1,025,000 shares, and Mr. Turley – 600,000 shares.

All stock options issued to the Company’s directors vest immediately upon grant, have a term of five years and are subject to the terms and conditions of the Company’s stock option plans.

Directors who are not Company employees are compensated for their service as a director as shown in the table below:

Schedule of Director Fees

May 31, 2007

Compensation Item | | Amount | |

| Board | | $ | 36,000 | |

| Technology Committee Chair | | | 60,000 | (1) |

| Audit Committee Chair | | | 48,000 | (1) |

| Compensation Committee Chair/Executive Committee Chair | | | 72,000 | (1) |

| Phoenix Digital Solutions, LLC Management Committee Board Member | | | 36,000 | |

1. Effective August 2006.

All retainers are paid in monthly installments.

Other

The Company reimburses all directors for travel and other necessary business expenses incurred in the performance of their services for the Company.

Transactions With Directors, Executive Officers and Principal Shareholders

The Audit Committee, as part of its charter, reviews and approves all transactions between the Company and any related party.

There were no transactions, or series of transactions during the fiscal year ended May 31, 2007, nor are there any currently proposed transactions, or series of transactions, to which the Company is a party, in which the amount exceeds $120,000, and in which to its knowledge any director, executive officer, nominee, five percent or greater stockholder, or any member of the immediate family of any of the foregoing persons, has or will have any direct or indirect material interest other than as described below.

During the past five years, no director, executive officer or nominee for the Board has been involved in any legal proceedings that are material to an evaluation of their ability or integrity to become a director or executive officer of the Company.

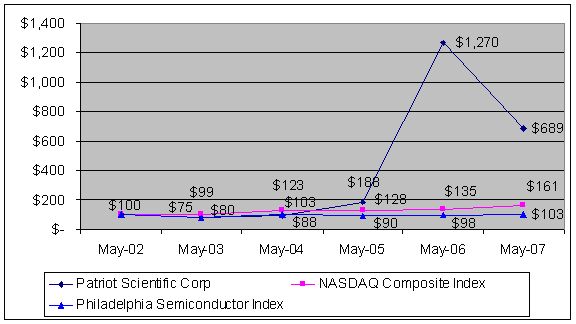

Company Stock Price Performance

The stock price performance graph below is required by the SEC and will not be deemed to be incorporated by reference by any general statement incorporating by reference this Proxy Statement into any filing under the Securities Act of 1933, as amended, or under the Securities Exchange Act of 1934, as amended, except to the extent that the Company specifically incorporates this information by reference, and shall not otherwise be deemed soliciting material or filed under such Acts.

The following graph compares the five-year cumulative total return on the Company’s Common Stock to the total returns of 1) NASDAQ Composite Index and 2) Philadelphia Semiconductor Index. This comparison assumes in each case that $100 was invested on May 31, 2002 and all dividends were reinvested. The Company’s fiscal year ends on May 31.

| | | 2002 | | | 2003 | | | 2004 | | | 2005 | | | 2006 | | | 2007 | |

| Patriot Scientific Corporation | | $ | 100 | | | $ | 75 | | | $ | 88 | | | $ | 188 | | | $ | 1,270 | | | $ | 689 | |

| NASDAQ Composite Index | | | 100 | | | | 99 | | | | 123 | | | | 128 | | | | 135 | | | | 161 | |

| Philadelphia Semiconductor Index | | | 100 | | | | 80 | | | | 103 | | | | 90 | | | | 98 | | | | 103 | |

INDEPENDENT PUBLIC ACCOUNTANTS

During the Company’s two most recent fiscal years ended May 31, 2007 and May 31, 2006, there were no disagreements between the Company and KMJ Corbin & Company, LLP (“Corbin”) on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which disagreements, if not resolved to Corbin’s satisfaction, as applicable, would have caused them to make reference to the subject matter of the disagreement in their respective reports on the financial statements for such years.

To help ensure the independence of the Company’s independent auditor, the Audit Committee has approved and adopted a Policy on Engagement of Independent Auditor, which is available on the Company’s web site at www.ptsc.com.

Pursuant to the Policy on Engagement of Independent Auditor, the Audit Committee is directly responsible for the appointment, compensation and oversight of the independent auditor. The Audit Committee preapproves all audit services and non-audit services to be provided by the independent auditor and has approved 100% of the audit, audit-related and tax fees listed below. The Audit Committee may delegate to one or more of its members the authority to grant the required approvals, provided that any exercise of such authority is presented at the next Audit Committee meeting for ratification.

Each audit, non-audit and tax service that is approved by the Audit Committee will be reflected in a written engagement letter or writing specifying the services to be performed and the cost of such services, which will be signed by either a member of the Audit Committee or by an officer of the Company authorized by the Audit Committee to sign on behalf of the Company.

The Audit Committee will not approve any prohibited non-audit service or any non-audit service that individually or in the aggregate may impair, in the Audit Committee’s opinion, the independence of the independent auditor.

In addition, since January 1, 2003, the Company’s independent auditor may not provide any services to officers of the Company or Audit Committee members, including financial counseling or tax services.

Audit Fees

During the fiscal years ended May 31, 2007 and 2006, the aggregate fees billed by the Company’s principal accountants for professional services rendered for the audit of the Company’s annual financial statements, audits of effectiveness of internal control over financial reporting, restatements of prior years financials and reviews of quarterly financial statements included in the Company’s reports on Form 10-Q and 10-QSB, and audit services provided in connection with other statutory or regulatory filings were $828,098 and $337,364, respectively.

Audit-Related Fees

During the fiscal years ended May 31, 2007 and 2006, the aggregate fees billed by the Company’s principal accountants for assurance and related services reasonably related to the performance of the audit or review of the Company’s financial statements that are not reported under “Audit Fees” were $12,808 and $23,228, which were primarily for review of registration and proxy statements.

Tax Fees

During the fiscal years ended May 31, 2007 and 2006, the aggregate fees billed by the Company’s principal accountant for tax compliance, tax advice and tax planning rendered on behalf of the Company were $13,080 and $8,000, respectively, which related to the preparation of federal and state income tax returns.

All Other Fees

The Company’s principal accountant billed no other fees for the fiscal years ended May 31, 2007 and 2006, except as disclosed above.

SHAREHOLDER PROPOSALS AND COMMUNICATIONS

Under certain circumstances, stockholders are entitled to have the Company include stockholder proposals in its proxy statement for presentment at a meeting of stockholders. The Company intends to hold its next annual meeting of stockholders in October 2008. Stockholders who desire to have their proposal included on the Company’s proxy card and included in its proxy statement for the next annual meeting of stockholders must submit such proposals to the Company no later than June 1, 2008. Proposals received by the Company after such date will be considered untimely. Stockholder proposals should be directed to the attention of the Corporate Secretary, addressed as follows: Patriot Scientific Corporation, Mr. Clifford L. Flowers, Corporate Secretary, 6183 Paseo Del Norte, Suite 180, Carlsbad, CA 92011. The submission of a proposal does not guarantee that it will be included in the proxy statement or proxy. Shareholder proposals are subject to certain regulations and requirements under the federal securities laws.

Stockholders who intend to submit proposals to the stockholders at the next annual meeting of stockholders but intend to submit such proposals on their own, either from the floor or through their own proxy statement and proxy, must, in order for such matters to be voted upon by the stockholders, give notice of such to the Company by August 15, 2008. The persons named as proxies for the next annual meeting of stockholders will have discretionary authority to vote on any stockholder proposal not included in the Company’s proxy materials for the meeting, unless the Company receives notice of the proposal by August 15, 2008. If proper notice is received by that date, the proxy holders will not have discretionary voting authority except as provided in federal regulations governing stockholder proposals.

The Company encourages stockholders to communicate with members of the Board. Shareholders wishing to communicate with directors may send correspondence addressed as follows: Patriot Scientific Corporation, Mr. Clifford L. Flowers, Corporate Secretary, 6183 Paseo Del Norte, Suite 180, Carlsbad, CA 92011. All communications will be provided directly to the Board.

HOUSEHOLDING OF PROXY MATERIALS

The SEC has adopted rules that permit companies and intermediaries (e.g., brokers) to satisfy the delivery requirements for proxy statements and annual reports with respect to two or more stockholders sharing the same address by delivering a single proxy statement addressed to those stockholders. This process, which is commonly referred to as “householding,” potentially means extra convenience for stockholders and cost savings for companies.

This year the Company may be “householding” the Company’s Proxy Statement and Annual Report. A single proxy statement and annual report will be delivered to multiple stockholders sharing an address unless contrary instructions have been received from the affected stockholders. The Company will deliver promptly upon written or oral request a separate copy of the annual report or proxy statement to a security holder at a shared address to which a single copy of the document was delivered. If, at any time, a stockholder no longer wishes to participate in “householding” and would prefer to receive a separate proxy statement and annual report, the affected stockholder may contact Mr. Clifford L. Flowers, Corporate Secretary, Patriot Scientific Corporation, 6183 Paseo Del Norte, Suite 180, Carlsbad, CA 92011 or (760) 547-2700. Shareholders who currently receive multiple copies of the proxy statement at their address and would like to request “householding” of their communications should also contact Mr. Flowers as indicated in the preceding sentence.

FINANCIAL AND OTHER AVAILABLE INFORMATION

The Company is subject to the informational and reporting requirements of Section 13 of the Exchange Act and in accordance with those requirements files reports and other information with the SEC. Such reports and other information filed with the SEC are available for inspection and copying at the Public Reference Branch of the SEC, located at Room 1024, 450 Fifth Street N.W., Washington, DC 20549, at prescribed rates. The Company’s filings under the Exchange Act may also be accessed through the SEC’s web site (http://www.sec.gov).