| |

| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| WASHINGTON, DC 20549 |

| |

| SCHEDULE 14A |

| (RULE 14a-101) |

| |

| SCHEDULE 14A INFORMATION |

| |

| Proxy Statement Pursuant to Section 14(A) |

| of the Securities Exchange Act of 1934 |

| |

| Filed by the Registrant / X / |

| |

| Filed by a Party other than the Registrant / / |

| |

| Check the appropriate box: |

| |

| / X / | Preliminary Proxy Statement. |

| / / | Confidential, for use of the Commission Only (as permitted by Rule 14a-6(e) (2)). |

| / / | Definitive Proxy Statement. |

| / / | Definitive Additional Materials. |

| / / | Soliciting Material Pursuant to § 240.14a-12. |

| |

| PUTNAM AMERICAN GOVERNMENT INCOME FUND |

| PUTNAM ARIZONA TAX EXEMPT INCOME FUND |

| PUTNAM ASSET ALLOCATION FUNDS |

| PUTNAM CALIFORNIA TAX EXEMPT INCOME FUND |

| PUTNAM CONVERTIBLE INCOME-GROWTH TRUST |

| PUTNAM DIVERSIFIED INCOME TRUST |

| PUTNAM EQUITY INCOME FUND |

| PUTNAM EUROPE EQUITY FUND |

| THE PUTNAM FUND FOR GROWTH AND INCOME |

| PUTNAM FUNDS TRUST |

| THE GEORGE PUTNAM FUND OF BOSTON |

| PUTNAM GLOBAL EQUITY FUND |

| PUTNAM GLOBAL HEALTH CARE FUND |

| PUTNAM GLOBAL INCOME TRUST |

| PUTNAM GLOBAL NATURAL RESOURCES FUND |

| PUTNAM GLOBAL UTILITIES FUND |

| PUTNAM HIGH YIELD ADVANTAGE FUND |

| PUTNAM HIGH YIELD TRUST |

| PUTNAM INCOME FUND |

| PUTNAM INTERNATIONAL EQUITY FUND |

| PUTNAM INVESTMENT FUNDS |

| PUTNAM INVESTORS FUND |

| |

| PUTNAM MASSACHUSETTS TAX EXEMPT INCOME FUND |

| PUTNAM MICHIGAN TAX EXEMPT INCOME FUND |

| PUTNAM MINNESOTA TAX EXEMPT INCOME FUND |

| PUTNAM MONEY MARKET FUND |

| PUTNAM NEW JERSEY TAX EXEMPT INCOME FUND |

| PUTNAM NEW OPPORTUNITIES FUND |

| PUTNAM NEW YORK TAX EXEMPT INCOME FUND |

| PUTNAM OHIO TAX EXEMPT INCOME FUND |

| PUTNAM PENNSYLVANIA TAX EXEMPT INCOME FUND |

| PUTNAM RETIREMENTREADY® FUNDS |

| PUTNAM TAX EXEMPT INCOME FUND |

| PUTNAM TAX EXEMPT MONEY MARKET FUND |

| PUTNAM TAX-FREE INCOME TRUST |

| PUTNAM U.S. GOVERNMENT INCOME TRUST |

| PUTNAM VARIABLE TRUST |

| PUTNAM VISTA FUND |

| PUTNAM VOYAGER FUND |

| |

| (Name of Registrant as Specified in its Charter) |

| |

| (Name of Person(s) Filing Proxy Statement, |

| if Other Than the Registrant) |

| |

| |

| Payment of Filing Fee (Check the appropriate box): |

| |

| / X / | No fee required. |

| |

| / / | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) Title of each class of securities to which transaction applies: |

| | (2) Aggregate number of securities to which transaction applies: |

| | (3) Per unit price or other underlying value of transaction |

| computed pursuant to Exchange Act Rule 0-11 (set forth the |

| amount on which the filing fee is calculated and state how it |

| | was determined): |

| | (4) Proposed maximum aggregate value of transaction: |

| | (5) Total fee paid: |

| |

| / / | Fee paid previously with preliminary materials. |

| |

| / / | Check box if any part of the fee is offset as provided by Exchange Act Rule |

| | 0-11(a)(2) and identify the filing for which the offsetting fee was paid |

| | previously. Identify the previous filing by registration statement |

| | number, or the form or schedule and the date of its filing. |

| | (1) Amount Previously Paid: |

| | (2) Form, Schedule or Registration Statement No.: |

| |

| (3) Filing Party: |

| (4) Date Filed: |

VOTE TODAY

Please vote on matters affecting

your investment in the Putnam funds.

Your prompt response to this

proxy statement is important.

| | |

| Internet | Phone | Mail |

| proxyweb.com/Putnam | 1-888-221-0697 | Sign and return the |

| | | enclosed voting form |

A message from Putnam Investments and

the Board of Trustees of the Putnam Funds

Dear Fellow Shareholder:

We are writing to ask you for your vote on important matters affecting your investment in the Putnam funds. The Putnam Funds will hold a shareholder meeting on November 19, 2009, in Boston, Massachusetts, to decide several proposals. While you are welcome to attend in person, the vast majority of shareholders vote by “proxy,” which means they give instructions to persons designated by their fund’s Board of Trustees to vote on their behalf.

Please vote today on the following proposals:

·Election of TrusteesThe Putnam Funds’ Board of Trustees is responsible for overseeing the operation of the Putnam funds and for assuring that each fund is managed in the best interests of its shareholders. All but one of the Trustees are independent of Putnam Investments. All of the current Trustees work on your behalf and are up for re-election.We recommend you vote to elect all Trustees.

·Shareholder-friendly changes to Putnam fund management feesAs a Putnam fund shareholder, you typically pay a management fee that covers key services such as portfolio management, securities trading, and accounting. The management fee typically represents the single largest component of a fund’s total expenses. Key benefits of the proposal include:

·Lower management feesThe change will result in reduced management fees for virtually all Putnam funds, including significantly lower management fees for fixed income and asset allocation funds.

·Fund family breakpointsAsset-level discounts for management fees will be based on the growth of all Putnam mutual fund assets, rather than an individual Putnam fund’s assets. This change will allow shareholders to benefit from the growth of the Putnam fund family as a whole, even if their specific fund is not growing.

·Performance fees on U.S. growth funds, international funds, and Putnam Global Equity FundThese equity funds would have performance fees reflecting the strength or weakness of the investment performance of a given fund. Management fees for these funds would decline from their standard fee if the funds underperform their benchmarks and would rise if the funds outperform.

We recommend you vote for the proposed new management contracts that include these fee changes.

·Modernized investment restrictions of certain fundsSeveral different fund-specific proposals are included in this section. However, all involve modernizing and standardizing investment restrictions in certain areas to provide portfolio managers with added investment flexibility, as well as to reduce administrative and compliance burdens for the funds.We recommend you vote to modernize these investment restrictions.

·Modernized “trust” provisions of certain fundsTheorganizational, or “trust,” documents established many years ago for a small number of Putnam Funds differ from those of most Putnam funds today.We recommend you vote to modernize these trust provisions.

Shareholders of two funds will also be asked to vote on a shareholder-submitted proposal.

Please vote today

Delaying your vote will increase fund expenses if further mailings are required. If you complete your proxy card, your shares will be voted on your behalf exactly as you have instructed.If you simply sign the proxy card, your shares will be voted in accordance with the Trustees’ recommendations.

We appreciate your attention to these important matters. If you have questions about the proposals, please call a customer service representative at 1-866-451-3787 or contact your financial advisor.

Sincerely yours,

Robert L. Reynolds

President and Chief Executive Officer

Putnam Investments

John A. Hill

Chairman of the Trustees

| | |

| Table of contents | |

| |

| Notice of a Special Meeting of Shareholders | 1 |

| |

| Trustees’ Recommendations | [] |

| |

| Proposal 1: Election of Trustees | [] |

| |

| Proposal 2: Proposed New Management Contract | [] |

| |

| Proposal 3.A.: Fundamental Investment Restriction Amendment – Commodities | [] |

| |

| Proposal 3.B.: Fundamental Investment Restriction Amendment – Diversification | [] |

| |

| Proposal 3.C.: Fundamental Investment Restriction Amendment – Acquisition of | |

| Voting Securities | [] |

| |

| Proposal 3.D.: Fundamental Investment Restriction Amendment – Borrowing | [] |

| |

| Proposal 3.E.: Fundamental Investment Restriction Amendment – Making Loans | [] |

| |

| Proposal 4.A.: Declaration of Trust Amendment – Duration of Trust | [] |

| |

| Proposal 4.B.: Declaration of Trust Amendment – Redemption at Option of Trust | [] |

| |

| Proposal 5: Shareholder Proposal | [] |

| |

| Further Information About Voting and the | |

| Special Meeting | [] |

| |

| Fund Information | [] |

| |

| Appendix A – | Number of Shares Outstanding | |

| as of the Record Date | A-1 |

| Appendix B – | Dollar Range and Number of Shares | |

| Beneficially Owned | B-1 |

| Appendix C – | Trustee Compensation Table | C-1 |

| Appendix D – | Forms of Proposed Management | |

| Contract | D-1 |

| Appendix E – | Current Fee Schedule | E-1 |

| Appendix F – | Proposed Fee Schedules | F-1 |

| Appendix G – | Proposed Benchmarks | G-1 |

| Appendix H – | Funds Proposed to Change to Monthly | |

| Management Fees | H-1 |

| Appendix I – | Description of Contract Approval | |

| Process | I-1 |

| | |

| Appendix J – | Management Contracts: Terms, Dates, | |

| and Approvals | J-1 |

| Appendix K – | Comparative Expense Tables | K-1 |

| Appendix L – | Comparison of Management Fees | L-1 |

| Appendix M – | Current Fundamental Investment | |

| Restrictions with Respect to Investments | |

| in Commodities | M-1 |

| Appendix N – | Current Fundamental Investment | |

| Restrictions with Respect to | |

| Diversification of Investments | N-1 |

| Appendix O – | Current Fundamental Investment | |

| Restrictions with Respect to Borrowing | O-1 |

| Appendix P – | Current Declaration of Trust Provisions | |

| with Respect to the Duration of the Trust | P-1 |

| Appendix Q – | Independent Public Accountants | Q-1 |

| Appendix R – | Other Similar Funds Advised | |

| by Putnam Management | R-1 |

| Appendix S – | Payments to Putnam Management | |

| and its Affiliates | S-1 |

| Appendix T – | 5% Beneficial Ownership | T-1 |

PROXY CARD(S) ENCLOSED

If you have any questions, please contact us at 1-866-451-3787 or call your financial advisor.

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to be Held on November 19, 2009.

The proxy statement is available at https://www.proxyweb.com/Putnam.

| |

| Notice of a Special Meeting of Shareholders |

| |

| To the Shareholders of: | |

| |

| PUTNAM AMERICAN GOVERNMENT INCOME | PUTNAM INTERNATIONAL EQUITY FUND |

| FUND | PUTNAM INVESTMENT FUNDS |

| PUTNAM ARIZONA TAX EXEMPT INCOME FUND | PUTNAM CAPITAL OPPORTUNITIES FUND |

| PUTNAM ASSET ALLOCATION FUNDS | PUTNAM GROWTH OPPORTUNITIES FUND |

| PUTNAM ASSET ALLOCATION: BALANCED | PUTNAM INTERNATIONAL CAPITAL |

| PORTFOLIO | OPPORTUNITIES FUND |

| PUTNAM ASSET ALLOCATION: CONSERVATIVE | PUTNAM INTERNATIONAL NEW OPPORTUNITIES |

| PORTFOLIO | FUND |

| PUTNAM ASSET ALLOCATION: GROWTH | PUTNAM MID CAP VALUE FUND |

| PORTFOLIO | PUTNAM RESEARCH FUND |

| PUTNAM CALIFORNIA TAX EXEMPT INCOME | PUTNAM SMALL CAP VALUE FUND |

| FUND | PUTNAM INVESTORS FUND |

| PUTNAM CONVERTIBLE INCOME-GROWTH | PUTNAM MASSACHUSETTS TAX EXEMPT |

| TRUST | INCOME FUND |

| PUTNAM DIVERSIFIED INCOME TRUST | PUTNAM MICHIGAN TAX EXEMPT INCOME FUND |

| PUTNAM EQUITY INCOME FUND | PUTNAM MINNESOTA TAX EXEMPT INCOME |

| PUTNAM EUROPE EQUITY FUND | FUND |

| THE PUTNAM FUND FOR GROWTH AND INCOME | PUTNAM MONEY MARKET FUND |

| PUTNAM FUNDS TRUST | PUTNAM NEW JERSEY TAX EXEMPT INCOME |

| PUTNAM ABSOLUTE RETURN 100 FUND | FUND |

| PUTNAM ABSOLUTE RETURN 300 FUND | PUTNAM NEW OPPORTUNITIES FUND |

| PUTNAM ABSOLUTE RETURN 500 FUND | PUTNAM NEW YORK TAX EXEMPT INCOME |

| PUTNAM ABSOLUTE RETURN 700 FUND | FUND |

| PUTNAM ASIA PACIFIC EQUITY FUND | PUTNAM OHIO TAX EXEMPT INCOME FUND |

| PUTNAM ASSET ALLOCATION: EQUITY | PUTNAM PENNSYLVANIA TAX EXEMPT INCOME |

| PORTFOLIO | FUND |

| PUTNAM CAPITAL SPECTRUM FUND | PUTNAM RETIREMENTREADY® FUNDS |

| PUTNAM EMERGING MARKETS EQUITY FUND | PUTNAM RETIREMENTREADY 2010 FUND |

| PUTNAM EQUITY SPECTRUM FUND | PUTNAM RETIREMENTREADY 2015 FUND |

| PUTNAM FLOATING RATE INCOME FUND | PUTNAM RETIREMENTREADY 2020 FUND |

| PUTNAM GLOBAL CONSUMER FUND | PUTNAM RETIREMENTREADY 2025 FUND |

| PUTNAM GLOBAL ENERGY FUND | PUTNAM RETIREMENTREADY 2030 FUND |

| PUTNAM GLOBAL FINANCIALS FUND | PUTNAM RETIREMENTREADY 2035 FUND |

| PUTNAM GLOBAL INDUSTRIALS FUND | PUTNAM RETIREMENTREADY 2040 FUND |

| PUTNAM GLOBAL TECHNOLOGY FUND | PUTNAM RETIREMENTREADY 2045 FUND |

| PUTNAM GLOBAL TELECOMMUNICATIONS FUND | PUTNAM RETIREMENTREADY 2050 FUND |

| PUTNAM INCOME STRATEGIES FUND | PUTNAM RETIREMENTREADY MATURITY FUND |

| PUTNAM INTERNATIONAL GROWTH AND INCOME | PUTNAM TAX EXEMPT INCOME FUND |

| FUND | PUTNAM TAX EXEMPT MONEY MARKET FUND |

| PUTNAM MONEY MARKET LIQUIDITY FUND | PUTNAM TAX-FREE INCOME TRUST |

| PUTNAM SMALL CAP GROWTH FUND | PUTNAM AMT-FREE MUNICIPAL FUND |

| THE GEORGE PUTNAM FUND OF BOSTON | PUTNAM TAX-FREE HIGH YIELD FUND |

| PUTNAM GLOBAL EQUITY FUND | PUTNAM U.S. GOVERNMENT INCOME TRUST |

| PUTNAM GLOBAL HEALTH CARE FUND | PUTNAM VARIABLE TRUST |

| PUTNAM GLOBAL INCOME TRUST | PUTNAM VT AMERICAN GOVERNMENT INCOME |

| PUTNAM GLOBAL NATURAL RESOURCES FUND | FUND |

| PUTNAM GLOBAL UTILITIES FUND | PUTNAM VT CAPITAL OPPORTUNITIES FUND |

| PUTNAM HIGH YIELD ADVANTAGE FUND | PUTNAM VT DIVERSIFIED INCOME FUND |

| PUTNAM HIGH YIELD TRUST | PUTNAM VT EQUITY INCOME FUND |

| PUTNAM INCOME FUND | |

| |

| PUTNAM VT THE GEORGE PUTNAM FUND OF | PUTNAM VT INTERNATIONAL NEW |

| BOSTON | OPPORTUNITIES FUND |

| PUTNAM VT GLOBAL ASSET ALLOCATION FUND | PUTNAM VT INVESTORS FUND |

| PUTNAM VT GLOBAL EQUITY FUND | PUTNAM VT MID CAP VALUE FUND |

| PUTNAM VT GLOBAL HEALTH CARE FUND | PUTNAM VT MONEY MARKET FUND |

| PUTNAM VT GLOBAL UTILITIES FUND | PUTNAM VT NEW OPPORTUNITIES FUND |

| PUTNAM VT GROWTH AND INCOME FUND | PUTNAM VT RESEARCH FUND |

| PUTNAM VT GROWTH OPPORTUNITIES FUND | PUTNAM VT SMALL CAP VALUE FUND |

| PUTNAM VT HIGH YIELD FUND | PUTNAM VT VISTA FUND |

| PUTNAM VT INCOME FUND | PUTNAM VT VOYAGER FUND |

| PUTNAM VT INTERNATIONAL EQUITY FUND | PUTNAM VISTA FUND |

| PUTNAM VT INTERNATIONAL GROWTH AND | PUTNAM VOYAGER FUND |

| INCOME FUND | |

| |

| This is the formal agenda for your fund’s shareholder meeting. It tells you what proposals |

| will be voted on and the time and place of the meeting, in the event you attend in person. |

| |

| A Special Meeting of Shareholders of your fund will be held on November 19, 2009 at 11:00 |

| a.m., Boston time, at the principal offices of the funds on the 8th floor of One Post Office |

| Square, Boston, Massachusetts 02109, to consider the following proposals, in each case as |

| applicable to the particular funds listed in the table below: |

| |

| 1. | Electing your fund’s nominees for Trustees; |

| |

| 2. | Approving a proposed new management contract for your fund; |

| |

| 3.A. | Approving an amendment to certain funds’ fundamental investment restrictions |

| | with respect to investments in commodities; |

| |

| 3.B. | Approving an amendment to certain funds’ fundamental investment restrictions |

| | with respect to diversification of investments; |

| |

| 3.C. | Approving an amendment to certain funds’ fundamental investment restrictions |

| | with respect to the acquisition of voting securities; |

| |

| 3.D. | Approving an amendment to certain funds’ fundamental investment restrictions |

| | with respect to borrowing; |

| |

| 3.E. | Approving an amendment to certain funds’ fundamental investment restrictions |

| | with respect to making loans; |

| |

| 4.A. | Approving an amendment to certain funds’ agreements and declarations of trust |

| | with respect to the duration of the trust; |

| |

| 4.B. | Approving an amendment to certain funds’ agreements and declarations of trust |

| | with respect to redemption at the option of the trust; and |

| |

| 5. | Considering a shareholder proposal for two funds requesting that the Board |

| | institute procedures to prevent the funds from holding investments in companies |

| | that, in the judgment of the Board, substantially contribute to genocide or |

| | crimes against humanity. |

| | |

| By Judith Cohen, Clerk, and by the Trustees |

| |

| John A. Hill, Chairman | |

| Jameson A. Baxter, Vice Chairman |

| |

| |

| Ravi Akhoury | Kenneth R. Leibler |

| Charles B. Curtis | Robert E. Patterson |

| Robert J. Darretta | George Putnam, III |

| Myra R. Drucker | Robert L. Reynolds |

| Paul L. Joskow | W. Thomas Stephens |

| Elizabeth T. Kennan | Richard B. Worley |

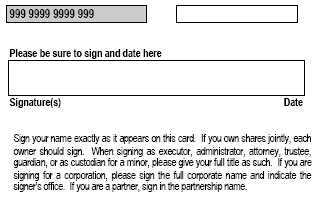

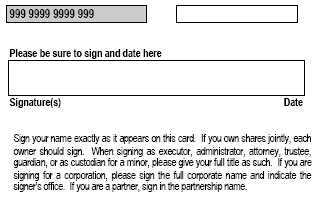

In order for you to be represented at your fund’s shareholder meeting, we urge you to record your voting instructions via the Internet or by telephone or to mark, sign, date, and mail the enclosed proxy in the postage-paid envelope provided.

[ ], 2009

The following table indicates which proposals are being considered by shareholders of each fund.

| | | |

| Proposal | Proposal | Affected Funds | Page |

| | Description | | |

|

| |

| 1. | Election of | All funds | [ ] |

| | Trustees | | |

|

| |

| 2. | Approving a | All funds* except Putnam RetirementReady® Funds | [ ] |

| | proposed new | and Putnam Money Market Liquidity Fund | |

| | management | | |

| | contract for | *As described in more detail in Proposal 2, | |

| | your fund | shareholders of the following funds: | |

| |

| | | Putnam Asia Pacific Equity Fund | |

| | | Putnam Emerging Markets Equity Fund | |

| | Putnam Europe Equity Fund | |

| | Putnam Global Equity Fund | |

| | | Putnam Growth Opportunities Fund | |

| | | Putnam International Capital Opportunities Fund | |

| | | Putnam International Equity Fund | |

| | | Putnam International Growth and Income Fund | |

| | | Putnam International New Opportunities Fund | |

| | | Putnam New Opportunities Fund | |

| | | Putnam Small Cap Growth Fund | |

| | | Putnam Vista Fund | |

| | | Putnam Voyager Fund | |

| |

| | | are being asked to approve a proposed new | |

| | | management contract that includes both Fund Family | |

| | | breakpoints and performance fees. In addition, | |

|

| | | |

| Proposal | Proposal | Affected Funds | Page |

| | Description | | |

|

| |

| | | shareholders of these 13 funds also are being asked to | |

| | | approve proposed new management contracts that have | |

| | | each, but not both, Fund Family breakpoints and | |

| | | performance fees separately. The Trustees recommend | |

| | | that shareholders of these funds vote FOR each of the | |

| | | three alternatives, but intend to implement a new | |

| | | management contract that includes both Fund Family | |

| | | breakpoints and performance fees if that alternative is | |

| | | approved by shareholders. | |

|

| |

| 3.A. | Approving an | Putnam Absolute Return 100 Fund | [ ] |

| | amendment to | Putnam Absolute Return 300 Fund | |

| | certain funds’ | Putnam Absolute Return 500 Fund | |

| | fundamental | Putnam Absolute Return 700 Fund | |

| | investment | Putnam Asia Pacific Equity Fund | |

| | restrictions | Putnam Asset Allocation: Balanced Portfolio | |

| | with respect | Putnam Asset Allocation: Conservative Portfolio | |

| | to investments | Putnam Asset Allocation: Equity Portfolio | |

| | in | Putnam Asset Allocation: Growth Portfolio | |

| | commodities | Putnam Capital Spectrum Fund | |

| | | Putnam Emerging Markets Equity Fund | |

| | | Putnam Equity Spectrum Fund | |

| | | Putnam Global Consumer Fund | |

| | | Putnam Global Energy Fund | |

| | | Putnam Global Financials Fund | |

| | Putnam Global Health Care Fund | |

| | Putnam Global Industrials Fund | |

| | | Putnam Global Natural Resources Fund | |

| | Putnam Global Technology Fund | |

| | | Putnam Global Telecommunications Fund | |

| | | Putnam Global Utilities Fund | |

| | Putnam Income Strategies Fund | |

| | | Putnam VT Global Asset Allocation Fund | |

| | | Putnam VT Global Health Care Fund | |

| | Putnam VT Global Utilities Fund | |

|

| 3.B. | Approving an | Putnam Europe Equity Fund | [ ] |

| | amendment to | Putnam Global Utilities Fund | |

| | certain funds’ | Putnam Growth Opportunities Fund | |

| | fundamental | Putnam International Capital Opportunities Fund | |

| | investment | Putnam International Equity Fund | |

| | restrictions | Putnam New Opportunities Fund | |

| | with respect | | |

| | to | | |

| | diversification | | |

| | of | | |

| | investments | | |

|

| | | |

| Proposal | Proposal | Affected Funds | Page |

| | Description | | |

|

| |

| 3.C. | Approving an | Putnam Global Natural Resources Fund | [ ] |

| | amendment to | Putnam Global Utilities Fund | |

| | certain funds’ | | |

| | fundamental | | |

| | investment | | |

| | restrictions | | |

| | with respect | | |

| | to the | | |

| | acquisition of | | |

| | voting | | |

| | securities | | |

|

| |

| 3.D. | Approving an | Putnam Europe Equity Fund | [ ] |

| | amendment to | Putnam Global Natural Resources Fund | |

| | certain funds’ | Putnam Growth Opportunities Fund | |

| | fundamental | Putnam International Capital Opportunities Fund | |

| | investment | Putnam International Equity Fund | |

| | restrictions | Putnam New Jersey Tax Exempt Income Fund | |

| | with respect | Putnam New Opportunities Fund | |

| | to borrowing | Putnam Vista Fund | |

|

| |

| 3.E. | Approving an | Putnam Europe Equity Fund | [ ] |

| | amendment to | Putnam Global Natural Resources Fund | |

| | certain funds’ | Putnam Growth Opportunities Fund | |

| | fundamental | Putnam International Capital Opportunities Fund | |

| | investment | Putnam International Equity Fund | |

| | restrictions | Putnam New Jersey Tax Exempt Income Fund | |

| | with respect | Putnam New Opportunities Fund | |

| | to making | Putnam Vista Fund | |

| | loans | | |

|

| |

| 4.A. | Approving an | The Putnam Fund for Growth and Income | [ ] |

| | amendment to | The George Putnam Fund of Boston | |

| | certain funds’ | Putnam Money Market Fund | |

| | agreements | Putnam Tax Exempt Income Fund | |

| | and | | |

| | declarations | | |

| | of trust with | | |

| | respect to the | | |

| | duration of | | |

| | the trust | | |

|

| |

| 4.B. | Approving an | The Putnam Fund for Growth and Income | [ ] |

| | amendment to | The George Putnam Fund of Boston | |

| | certain funds’ | | |

| | agreements | | |

| | and | | |

|

| | | |

| Proposal | Proposal | Affected Funds | Page |

| | Description | | |

|

| |

| | declarations | | |

| | of trust with | | |

| | respect to | | |

| | redemption at | | |

| | the option of | | |

| | the trust | | |

|

| |

| 5. | Considering a | Putnam Asset Allocation: Growth Portfolio | [ ] |

| | shareholder | Putnam Voyager Fund | |

| | proposal for | | |

| | two funds | | |

| | requesting | | |

| | that the Board | | |

| | institute | | |

| | procedures to | | |

| | prevent the | | |

| | funds from | | |

| | holding | | |

| | investments in | | |

| | companies | | |

| | that, in the | | |

| | judgment of | | |

| | the Board, | | |

| | substantially | | |

| | contribute to | | |

| | genocide or | | |

| | crimes against | | |

| | humanity | | |

|

Proxy Statement

This document will give you the information you need to vote on the proposals. Much of the information is required under rules of the Securities and Exchange Commission (“SEC”); some of it is technical. If there is anything you don’t understand, please contact us at our toll-free number, 1-866-451-3787, or call your financial advisor.

When you record your voting instructions via the Internet or telephone, or when you complete and sign your proxy card, your shares will be voted on your behalf exactly as you have instructed. If you simply sign the proxy card, your shares will be voted in accordance with the Trustees’ recommendations on page [ ] of the proxy statement.

► Who is asking for your proxy?

Your proxy is being solicited by the Trustees of the Putnam funds for use at the Special Meeting of Shareholders of each fund to be held on November 19, 2009 and, if your fund’s meeting is adjourned, at any later meetings, for the purposes stated in the Notice of a Special Meeting of Shareholders (see previous pages). The Notice of a Special Meeting of Shareholders, the enclosed proxy card and this Proxy Statement are being mailed on or about[ ], 2009.

► How do your fund’s Trustees recommend that shareholders vote on the proposals?

The Trustees recommend that you vote:

1. FOR electing your fund’s nominees for Trustees;

2. FOR approving a new management contract for your fund with Fund Family breakpoints and, in the case of certain funds, performance fees;

3.A. FOR approving an amendment to certain funds’ fundamental investment restrictions with respect to investments in commodities;

3.B. FOR approving an amendment to certain funds’ fundamental investment restrictions with respect to diversification of investments;

3.C. FOR approving an amendment to certain funds’ fundamental investment restrictions with respect to the acquisition of voting securities;

3.D. FOR approving an amendment to certain funds’ fundamental investment restrictions with respect to borrowing;

3.E. FOR approving an amendment to certain funds’ fundamental investment restrictions with respect to making loans;

4.A. FOR approving an amendment to certain funds’ agreements and declarations of trust with respect to the duration of the trust;

4.B. FOR approving an amendment to certain funds’ agreements and declarations of trust with respect to redemption at the option of the trust; and

5. AGAINST approving a shareholder proposal for two funds requesting that the Board institute procedures to prevent the funds from holding investments in companies that, in the judgment of the Board, substantially contribute to genocide or crimes against humanity.

Please see the table beginning on page [ ] for a list of the affected funds for each proposal.

Who is eligible to vote?

Shareholders of record of each fund at the close of business on August 24, 2009 (the “Record Date”) are entitled to be present and to vote at the meeting or any adjourned meeting.

The number of shares of each fund outstanding on the Record Date is shown inAppendix A. Each share is entitled to one vote, with fractional shares voting proportionately. Shares represented by a duly executed proxy will be voted in accordance with your instructions. If a duly executed proxy is submitted without filling in a vote on a proposal, your shares will be voted in accordance with the Trustees’ recommendations. If any other business is brought before your fund’s meeting, your shares will be voted at the discretion of the persons designated on the proxy card.

Shareholders of each fund vote separately with respect to each proposal other than with respect to the election of Trustees, in which case shareholders of each series of a trust vote together as a single class. The name of each trust is indicated in bold on pages [ ] of this proxy statement, with the funds that are series of that trust appearing below its name. The outcome of a vote affecting one fund does not affect any other fund, except where series of a trust vote together as a single class. However, as described below under Proposal 2, if shareholders of a significant number of funds do not approve the proposed new management contracts, the Independent Trustees and Putnam Investment Management, LLC (“Putnam Management”) currently intend to leave the current management contracts in place for all funds and will consider such other actions as may be appropriate in the circumstances. The Independent Trustees and Putnam Management may also determine not to implement t he proposed new contract, even though approved by shareholders, under various circumstances described under Proposal 2. No proposal is contingent upon the outcome of any other proposal.

The Proposals

1. ELECTING YOUR FUND’S NOMINEES FOR TRUSTEES

►Who are the nominees for Trustees?

The Board Policy and Nominating Committee of the Trustees of the fund makes recommendations concerning the nominees for Trustees of your fund. The Board Policy and Nominating Committee consists solely of Trustees who are not “interested persons” (as defined in the 1940 Act) of your fund or of Putnam Management. Those Trustees who are not “interested persons” of your fund or Putnam Management are referred to as “Independent Trustees” throughout this Proxy Statement.

The Board of Trustees, based on the recommendation of the Board Policy and Nominating Committee, has fixed the number of Trustees of your fund at 14 and recommends that you vote for the election of the nominees described in the following pages. Each nominee is currently a Trustee of your fund and of the other Putnam funds.

Your fund does not regularly hold an annual shareholder meeting, but may from time to time schedule a special meeting. In addition, your fund has voluntarily undertaken to hold a shareholder meeting at least every five years for the purpose of electing your fund’s Trustees. The last such meeting was held in 2004, and the next such meeting is expected to be held in 2014.

The nominees for Trustees and their backgrounds are shown in the following pages. This information includes each nominee’s name, year of birth, principal occupation(s) during the past 5 years, and other information about the nominee’s professional background, including other directorships the nominee holds. Each Trustee oversees all of the Putnam funds and serves until the election and qualification of his or her successor, or until he or she sooner dies, resigns, retires at age 72, or is removed. The address of all of the Trustees is One Post Office Square, Boston, Massachusetts 02109. At June 30, 2009, there were 104 Putnam funds.

► Independent Trustees

[Photo]

Ravi Akhoury(Born 1947)

Trustee since 2009

Mr. Akhoury serves as Advisor to New York Life Insurance Company. He is also a Director of Jacob Ballas Capital India (a non-banking finance company focused on private equity advisory services). He also serves as a Trustee of American India Foundation and of the Rubin Museum.

Previously, Mr. Akhoury was a Director of MaxIndia/New York Life Insurance Company in India. He was also Vice President of Fischer, Francis, Trees and Watts (a fixed-income portfolio management firm). He has also served on the Board of Bharti Telecom (an Indian telecommunications company), and on the Board of Thompson Press (a publishing company). From 1992 to 2007, he was Chairman and CEO of MacKay Shields, a multi-product investment management firm with over $40 billion in assets under management.

Mr. Akhoury graduated from the Indian Institute of Technology with a B.S. in Engineering and obtained an M.S. in Quantitative Methods from SUNY at Stony Brook.

[Photo]

Jameson A. Baxter(Born 1943)

Trustee since 1994 and Vice Chairman since 2005

Ms. Baxter is the President of Baxter Associates, Inc., a private investment firm.

Ms. Baxter serves as a Director of ASHTA Chemicals, Inc., and the Mutual Fund Directors Forum. Until 2007, she was a Director of Banta Corporation (a printing and supply chain management company), Ryerson, Inc. (a metals service corporation), and Advocate Health Care. Until 2004, she was a Director of BoardSource (formerly the National Center for Nonprofit Boards), and until 2002, she was a Director of Intermatic Corporation (a manufacturer of energy control products). She is Chairman Emeritus of the Board of Trustees of Mount Holyoke College, having served as Chairman for five years.

Ms. Baxter has held various positions in investment banking and corporate finance, including Vice President of and Consultant to First Boston Corporation and Vice President and Principal of the Regency Group. She is a graduate of Mount Holyoke College.

[Photo]

Charles B. Curtis(Born 1940)

Trustee since 2001

Mr. Curtis is President and Chief Operating Officer of the Nuclear Threat Initiative (a private foundation dealing with national security issues), and serves as Senior Advisor to the United Nations Foundation.

Mr. Curtis is a member of the Council on Foreign Relations and the National Petroleum Council. He also serves as Director of Edison International and Southern California Edison. Until 2006, Mr. Curtis served as a member of the Trustee Advisory Council of the Applied Physics Laboratory, Johns Hopkins University.

From August 1997 to December 1999, Mr. Curtis was a Partner at Hogan & Hartson LLP, an international law firm headquartered in Washington, D.C. Prior to May 1997, Mr. Curtis was Deputy Secretary of Energy and Under Secretary of the U.S. Department of Energy. He was a founding member of the law firm Van Ness Feldman. Mr. Curtis served as Chairman of the Federal Energy Regulatory Commission from 1977 to 1981 and has held positions on the staff of the U.S. House of Representatives, the U.S. Treasury Department, and the SEC.

[Photo]

Robert J. Darretta(Born 1946)

Trustee since 2007

Mr. Darretta serves as Director of United-Health Group, a diversified health-care company.

Until April 2007, Mr. Darretta was Vice Chairman of the Board of Directors of Johnson & Johnson, one of the world’s largest and most broadly based health-care companies. Prior to 2007, he had responsibility for Johnson & Johnson’s finance, investor relations, information technology, and procurement function. He served as Johnson & Johnson Chief Financial Officer for a decade, prior to which he spent two years as Treasurer of the corporation and over ten years leading various Johnson & Johnson operating companies.

Mr. Darretta received a B.S. in Economics from Villanova University.

[Photo]

Myra R. Drucker(Born 1948)

Trustee since 2004

Ms. Drucker is Chair of the Board of Trustees of Commonfund (a not-for-profit firm managing assets for educational endowments and foundations), Vice Chair of the Board of Trustees of Sarah Lawrence College, and a member of the Investment Committee of the Kresge Foundation (a charitable trust). She is also a director of Interactive Data Corporation (a provider of financial market data and analytics to financial institutions and investors).

Ms. Drucker is an ex-officio member of the New York Stock Exchange (NYSE) Pension Managers Advisory Committee, having served as Chair for seven years. She serves as an

advisor to RCM Capital Management (an investment management firm) and to the Employee Benefits Investment Committee of The Boeing Company (an aerospace firm).

From November 2001 until August 2004, Ms. Drucker was Managing Director and a member of the Board of Directors of General Motors Asset Management and Chief Investment Officer of General Motors Trust Bank. From December 1992 to November 2001, Ms. Drucker served as Chief Investment Officer of Xerox Corporation (a document company). Prior to December 1992, Ms. Drucker was Staff Vice President and Director of Trust Investments for International Paper (a paper and packaging company).

Ms. Drucker received a B.A. degree in Literature and Psychology from Sarah Lawrence College and pursued graduate studies in economics, statistics, and portfolio theory at Temple University.

[Photo]

John A. Hill(Born 1942)

Trustee since 1985 and Chairman since 2000

Mr. Hill is founder and Vice-Chairman of First Reserve Corporation, the leading private equity buyout firm specializing in the worldwide energy industry, with offices in Greenwich, Connecticut; Houston, Texas; London, England; and Shanghai, China. The firm’s investments on behalf of some of the nation’s largest pension and endowment funds are currently concentrated in 31 companies with annual revenues in excess of $15 billion, which employ over 100,000 people in 23 countries.

Mr. Hill is Chairman of the Board of Trustees of the Putnam Funds, a Director of Devon Energy Corporation and various private companies owned by First Reserve, and serves as a Trustee of Sarah Lawrence College where he serves as Chairman and also chairs the Investment Committee. He is also a member of the Advisory Board of the Millstein Center for Corporate Governance and Performance at the Yale School of Management.

Prior to forming First Reserve in 1983, Mr. Hill served as President of F. Eberstadt and Company, an investment banking and investment management firm. Between 1969 and 1976, Mr. Hill held various senior positions in Washington, D.C. with the federal government, including Deputy Associate Director of the Office of Management and Budget and Deputy Administrator of the Federal Energy Administration during the Ford Administration.

Born and raised in Midland, Texas, he received his B.A. in Economics from Southern Methodist University and pursued graduate studies as a Woodrow Wilson Fellow.

[Photo]

Paul L. Joskow(Born 1947)

Trustee since 1997

Dr. Joskow is an economist and President of the Alfred P. Sloan Foundation (a philanthropic institution focused primarily on research and education on issues related to science, technology, and economic performance). He is on leave from his position as the Elizabeth and James Killian Professor of Economics and Management at the Massachusetts Institute of Technology (MIT), where he has been on the faculty since 1972. Dr. Joskow was the Director of the Center for Energy and Environmental Policy Research at MIT from 1999 through 2007.

Dr. Joskow serves as a Trustee of Yale University, as a Director of TransCanada Corporation (an energy company focused on natural gas transmission and power services) and of Exelon Corporation (an energy company focused on power services), and as a member of the Board of Overseers of the Boston Symphony Orchestra. Prior to August 2007, he served as a Director of National Grid (a UK-based holding company with interests in electric and gas transmission and distribution and telecommunications infrastructure). Prior to July 2006, he served as President of the Yale University Council. Prior to February 2005, he served on the board of the Whitehead Institute for Biomedical Research (a non-profit research institution). Prior to February 2002, he was a Director of State Farm Indemnity Company (an automobile insurance company), and prior to March 2000, he was a Director of New England Electric System (a public utility holding company).

Dr. Joskow has published six books and numerous articles on industrial organization, government regulation of industry, and competition policy. He is active in industry restructuring, environmental, energy, competition, and privatization policies — serving as an advisor to governments and corporations worldwide. Dr. Joskow holds a Ph.D. and MPhil from Yale University and a B.A. from Cornell University.

[Photo]

Elizabeth T. Kennan(Born 1938)

Trustee since 1992

Dr. Kennan is a Partner of Cambus-Kenneth Farm (thoroughbred horse and cattle breeding). She is President Emeritus of Mount Holyoke College.

Dr. Kennan served as Chairman and is now Lead Director of Northeast Utilities. She is a Trustee of the National Trust for Historic Preservation and of Centre College. Until 2006, she was a member of The Trustees of Reservations. Prior to 2001, Dr. Kennan served on the oversight committee of the Folger Shakespeare Library. Prior to June 2005, she was a Director of Talbots, Inc., and she has served as Director on a number of other boards, including Bell Atlantic, Chastain Real Estate, Shawmut Bank, Berkshire Life Insurance, and Kentucky Home Life Insurance. Dr. Kennan has also served as President of Five Colleges Incorporated and as a Trustee of Notre Dame University, and is active in various educational and civic associations.

As a member of the faculty of Catholic University for twelve years, until 1978, Dr. Kennan directed the post-doctoral program in Patristic and Medieval Studies, taught history, and published numerous articles and two books. Dr. Kennan holds a Ph.D. from the University of

Washington in Seattle, an M.A. from Oxford University, and an A.B. from Mount Holyoke College. She holds several honorary doctorates.

[Photo]

Kenneth R. Leibler(Born 1949)

Trustee since 2006

Mr. Leibler is a founder and former Chairman of the Boston Options Exchange, an electronic marketplace for the trading of derivative securities.

Mr. Leibler currently serves as a Trustee of Beth Israel Deaconess Hospital in Boston. He is also Lead Director of Ruder Finn Group, a global communications and advertising firm, and a Director of Northeast Utilities, which operates New England’s largest energy delivery system. Prior to December 2006, he served as a Director of the Optimum Funds group. Prior to October 2006, he served as a Director of ISO New England, the organization responsible for the operation of the electric generation system in the New England states. Prior to 2000, Mr. Leibler was a Director of the Investment Company Institute in Washington, D.C.

Prior to January 2005, Mr. Leibler served as Chairman and Chief Executive Officer of the Boston Stock Exchange. Prior to January 2000, he served as President and Chief Executive Officer of Liberty Financial Companies, a publicly traded diversified asset management organization. Prior to June 1990, Mr. Leibler served as President and Chief Operating Officer of the American Stock Exchange (AMEX), and at the time was the youngest person in AMEX history to hold the title of President. Prior to serving as AMEX President, he held the position of Chief Financial Officer, and headed its management and marketing operations. Mr. Leibler graduated magna cum laude with a degree in Economics from Syracuse University, where he was elected Phi Beta Kappa.

[Photo]

Robert E. Patterson(Born 1945)

Trustee since 1984

Mr. Patterson is Senior Partner of Cabot Properties, LP and Chairman of Cabot Properties, Inc. (a private equity firm investing in commercial real estate).

Mr. Patterson serves as Chairman Emeritus and Trustee of the Joslin Diabetes Center. Prior to June 2003, he was a Trustee of Sea Education Association. Prior to December 2001, Mr. Patterson was President and Trustee of Cabot Industrial Trust (a publicly traded real estate investment trust). Prior to February 1998, he was Executive Vice President and Director of Acquisitions of Cabot Partners Limited Partnership (a registered investment adviser involved in institutional real estate investments). Prior to 1990, he served as Executive Vice President of Cabot, Cabot & Forbes Realty Advisors, Inc. (the predecessor company of Cabot Partners).

Mr. Patterson practiced law and held various positions in state government, and was the founding Executive Director of the Massachusetts Industrial Finance Agency. Mr. Patterson is a graduate of Harvard College and Harvard Law School.

[Photo]

George Putnam, III(Born 1951)

Trustee since 1984

Mr. Putnam is Chairman of New Generation Research, Inc. (a publisher of financial advisory and other research services), and President of New Generation Advisors, LLC (a registered investment adviser to private funds). Mr. Putnam founded the New Generation companies in 1986.

Mr. Putnam is a Director of The Boston Family Office, LLC (a registered investment adviser). He is a Trustee of St. Mark’s School, a Trustee of Epiphany School and a Trustee of the Marine Biological Laboratory in Woods Hole, Massachusetts. Until 2006, he was a Trustee of Shore Country Day School, and until 2002, was a Trustee of the Sea Education Association.

Mr. Putnam previously worked as an attorney with the law firm of Dechert LLP (formerly known as Dechert Price & Rhoads) in Philadelphia. He is a graduate of Harvard College, Harvard Business School, and Harvard Law School.

[Photo]

W. Thomas Stephens(Born 1942)

Trustee since 2009

Mr. Stephens is aDirector of TransCanada Pipelines, Ltd. (an energy infrastructure company).

From 1997 to 2008, Mr. Stephens served as a Trustee on the Board of the Putnam Funds, which he rejoined as a Trustee in 2009. Until 2004, Mr. Stephens was a Director of Xcel Energy Incorporated (a public utility company), Qwest Communications and Norske Canada, Inc. (a paper manufacturer). Until 2003, Mr. Stephens was a Director of Mail-Well, Inc. (a diversified printing company). Prior to July 2001, Mr. Stephens was Chairman of Mail-Well.

Prior to 2009, Mr. Stephens was Chairman and Chief Executive Officer of Boise Cascade, L.L.C. (a paper, forest product and timberland assets company). He holds B.S. and M.S. degrees from the University of Arkansas.

[Photo]

Richard B. Worley(Born 1945)

Trustee since 2004

Mr. Worley is Managing Partner of Permit Capital LLC, an investment management firm.

Mr. Worley serves as a Trustee of the University of Pennsylvania Medical Center, The Robert Wood Johnson Foundation (a philanthropic organization devoted to health-care issues), and the National Constitution Center. He is also a Director of The Colonial Williamsburg Foundation (a historical preservation organization), and the Philadelphia Orchestra Association. Mr. Worley also serves on the investment committees of Mount Holyoke College and World Wildlife Fund (a wildlife conservation organization).

Prior to joining Permit Capital LLC in 2002, Mr. Worley served as President, Chief Executive Officer, and Chief Investment Officer of Morgan Stanley Dean Witter Investment Management and as a Managing Director of Morgan Stanley, a financial services firm. Mr. Worley also was the Chairman of Miller Anderson & Sherrerd, an investment management firm that was acquired by Morgan Stanley in 1996.

Mr. Worley holds a B.S. degree from the University of Tennessee and pursued graduate studies in economics at the University of Texas.

► Interested Trustee

[Photo]

Robert L. Reynolds* (Born 1952)

Trustee since 2008 and President of the Putnam Funds since July 2009

Mr. Reynolds is President and Chief Executive Officer of Putnam Investments, a member of Putnam Investments’ Executive Board of Directors, and President of the Putnam Funds. He has more than 30 years of investment and financial services experience.

Prior to joining Putnam Investments in 2008, Mr. Reynolds was Vice Chairman and Chief Operating Officer of Fidelity Investments from 2000 to 2007. During this time, he served on the Board of Directors for FMR Corporation, Fidelity Investments Insurance Ltd., Fidelity Investments Canada Ltd., and Fidelity Management Trust Company. He was also a Trustee of the Fidelity Family of Funds. From 1984 to 2000, Mr. Reynolds served in a number of increasingly responsible leadership roles at Fidelity.

Mr. Reynolds serves on several not-for-profit boards, including those of the West Virginia University Foundation, Concord Museum, Dana-Farber Cancer Institute, Lahey Clinic, and Initiative for a Competitive Inner City in Boston. He is a member of the Chief Executives Club of Boston, the National Innovation Initiative, and the Council on Competitiveness.

Mr. Reynolds received a B.S. in Business Administration/Finance from West Virginia University.

* Nominee who is an “interested person” of the fund and/or Putnam Management and/or Putnam Retail Management Limited Partnership (“Putnam Retail Management”). Mr. Reynolds is deemed an “interested person” by virtue of his position as an officer of the fund, Putnam Management and/or Putnam Retail Management. Mr. Reynolds is the President and Chief Executive Officer of Putnam Investments.

Each of the nominees has agreed to serve as a Trustee, if elected. If any of the nominees is unavailable for election at the time of the meeting, which is not anticipated, the Trustees may vote for other nominees at their discretion, or the Trustees may fix the number of Trustees at fewer than 14 for your fund.

►What are the Trustees’ responsibilities?

Your fund’s Trustees are responsible for the general oversight of your fund’s affairs and for assuring that your fund is managed in the best interests of its shareholders. The Trustees regularly review your fund’s investment performance as well as the quality of other services provided to your fund and its shareholders by Putnam Management and its affiliates, including administration, custody, and shareholder servicing. At least annually, the Trustees review and evaluate the fees and operating expenses paid by your fund for these services and negotiate changes that they deem appropriate. In carrying out these responsibilities, the Trustees are assisted by an independent administrative staff and by your fund’s auditors, independent counsel and other experts as appropriate, selected by and responsible to the Trustees.

At least 75% of the trustees of your fund are required to not be interested persons of your fund or your fund’s investment manager. These Independent Trustees must vote separately to approve all financial arrangements and other agreements with your fund’s investment manager and other affiliated parties. The role of independent trustees has been characterized as that of a “watchdog” charged with oversight to protect shareholders’ interests against overreaching and abuse by those who are in a position to control or influence a fund. Your fund’s Independent Trustees meet regularly as a group in executive session. Thirteen of the 14 nominees for election as Trustee are now, and would be, if elected, Independent Trustees.

Board committees.Your fund’s Trustees have determined that the efficient conduct of your fund’s affairs makes it desirable to delegate responsibility for certain specific matters to committees of the board. Certain committees (the Executive Committee, Distributions Committee, and Audit and Compliance Committee) are authorized to act for the Trustees as specified in their charters. The other committees review and evaluate matters specified in their charters and make recommendations to the Trustees as they deem appropriate. Each committee may utilize the resources of your fund’s independent staff, counsel and auditors as well as other experts. The committees meet as often as necessary, either in conjunction with regular meetings of the Trustees or otherwise. The membership and chairperson of each committee are appointed by the Trustees upon recommendation of the Board Policy and Nominating Committee.

Audit and Compliance Committee.The Audit and Compliance Committee provides oversight on matters relating to the preparation of the funds’ financial statements, compliance matters, internal audit functions, and Codes of Ethics issues. This oversight is discharged by regularly meeting with management and the funds’ independent auditors and keeping current

on industry developments. Duties of this Committee also include the review and evaluation of all matters and relationships pertaining to the funds’ independent auditors, including their independence. The members of the Committee include only Independent Trustees. Each member of the Committee also is “independent”, as such term is interpreted for purposes of Rule 10A-3(b)(1) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and the listing standards of the New York Stock Exchange. The Board of Trustees has adopted a written charter for the Committee. The Committee currently consists of Messrs. Patterson (Chairperson), Darretta, Hill, Leibler, Stephens and Ms. Drucker.

Board Policy and Nominating Committee.The Board Policy and Nominating Committee reviews policy matters pertaining to the operations of the Board of Trustees and its committees, the compensation of the Trustees and their staff, and the conduct of legal affairs for the Putnam funds. The Committee also oversees the voting of proxies associated with portfolio investments of the Putnam funds, with the goal of ensuring that these proxies are voted in the best interest of the fund’s shareholders.

The Committee evaluates and recommends all candidates for election as Trustees and recommends the appointment of members and chairs of each board committee. The Committee also identifies prospective nominees for election as trustee by considering individuals that come to its attention through the recommendation of current Trustees, Putnam Management or shareholders. Candidates properly submitted by shareholders (as described below) will be considered and evaluated on the same basis as candidates recommended by other sources. The Committee may, but is not required to, engage a third-party professional search firm to assist it in identifying and evaluating potential nominees.

When evaluating a potential candidate for membership on the Board of Trustees, the Committee considers the skills and characteristics that it feels would most benefit the Putnam funds at the time the evaluation is made. The Committee may take into account a wide variety of attributes in considering potential trustee candidates, including, but not limited to: (i) availability and commitment of a candidate to attend meetings and perform his or her responsibilities to the Board of Trustees, (ii) other board experience, (iii) relevant industry and related experience, (iv) educational background, (v) financial expertise, (vi) an assessment of the candidate’s ability, judgment and expertise, (vii) an assessment of the perceived needs of the Board of Trustees and its committees at that point in time and (viii) overall Board of Trustees composition. In connection with this evaluation, the Committee will determine whether to interview prospective nominees, and, if warranted, one or more members of the Committee, and other Trustees and representatives of the funds, as appropriate, will interview prospective nominees in person or by telephone. Once this evaluation is completed, the Committee recommends such candidates as it determines appropriate to the Independent Trustees for nomination, and the Independent Trustees select the nominees after considering the recommendation of the Committee.

The Committee will consider nominees for trustee recommended by shareholders of a fund provided shareholders submit their recommendations by the date disclosed in the paragraph entitled “Date for receipt of shareholders’ proposals for subsequent meeting of shareholders” in the section “Further Information About Voting and the Special Meeting,” and provided the

shareholders’ recommendations otherwise comply with applicable securities laws, including Rule 14a-8 under the Securities Exchange Act of 1934, as amended.

The Committee consists only of Independent Trustees. The Trustees have adopted a written charter for the Board Policy and Nominating Committee, a current copy of which is available at www.putnam.com/individual. The Board Policy and Nominating Committee currently consists of Dr. Kennan (Chairperson), Ms. Baxter and Messrs. Hill, Patterson and Putnam.

Brokerage Committee.The Brokerage Committee reviews the funds’ policies regarding the execution of portfolio trades and Putnam Management’s practices and procedures relating to the implementation of those policies. The Committee reviews periodic reports on the cost and quality of execution of portfolio transactions and the extent to which brokerage commissions have been used (i) by Putnam Management to obtain brokerage and research services generally useful to it in managing the portfolios of the funds and of its other clients, and (ii) by the funds to pay for certain fund expenses. The Committee reports to the Trustees and makes recommendations to Trustees regarding these matters. The Committee currently consists of Drs. Joskow (Chairperson) and Kennan, Ms. Baxter and Messrs. Akhoury, Curtis, Putnam and Worley.

Communications, Service and Marketing Committee.The Communications, Service and Marketing Committee reviews the quality of services provided to shareholders and oversees the marketing and sale of fund shares by Putnam Retail Management. The Committee also exercises general oversight of marketing and sales communications used by Putnam Retail Management, as well as other communications sent to fund shareholders. The Committee also reviews periodic summaries of any correspondence to the Trustees from shareholders. The Committee reports to the Trustees and makes recommendations to the Trustees regarding these matters. The Committee currently consists of Messrs. Putnam (Chairperson), Curtis, Patterson, Stephens and Drs. Joskow and Kennan.

Contract Committee.The Contract Committee reviews and evaluates at least annually all arrangements pertaining to (i) the engagement of Putnam Management and its affiliates to provide services to the funds, (ii) the expenditure of the funds’ assets for distribution purposes pursuant to Distribution Plans of the funds, and (iii) the engagement of other persons to provide material services to the funds, including in particular those instances where the cost of services is shared between the funds and Putnam Management and its affiliates or where Putnam Management or its affiliates have a material interest. The Committee also reviews the proposed organization of new fund products, proposed structural changes to existing funds and matters relating to closed-end funds. The Committee reports and makes recommendations to the Trustees regarding these matters. The Committee currently consists of Ms. Baxter (Chairperson), Drs. Joskow and Kennan and Mes srs. Akhoury, Curtis, Putnam and Worley.

Distributions Committee.The Distributions Committee oversees all dividends and distributions by the funds. The Committee makes recommendations to the Trustees of the funds regarding the amount and timing of distributions paid by the funds, and determines such matters when the Trustees are not in session. The Committee also oversees the policies and procedures pursuant to which Putnam Management prepares recommendations for

distributions, and meets regularly with representatives of Putnam Management to review the implementation of such policies and procedures. The Committee reports to the Trustees and makes recommendations to the Trustees regarding these matters. The Committee currently consists of Ms. Drucker (Chairperson) and Messrs. Darretta, Hill, Leibler, Patterson, and Stephens.

Executive Committee.The functions of the Executive Committee are twofold. The first is to ensure that the funds’ business may be conducted at times when it is not feasible to convene a meeting of the Trustees or for the Trustees to act by written consent. The Committee may exercise any or all of the power and authority of the Trustees when the Trustees are not in session. The second is to establish annual and ongoing goals, objectives and priorities for the Board of Trustees and to ensure coordination of all efforts between the Trustees and Putnam Management on behalf of the shareholders of the funds. The Committee currently consists of Messrs. Hill (Chairperson), Curtis, Patterson and Putnam, Dr. Joskow and Ms. Baxter.

Investment Oversight Committees.The Investment Oversight Committees regularly meet with investment personnel of Putnam Management to review the investment performance and strategies of the funds in light of their stated investment objectives and policies. The Committees seek to identify any compliance issues that are unique to the applicable categories of funds and work with the appropriate Board committees to ensure that any such issues are properly addressed. Investment Oversight Committee A currently consists of Messrs. Darretta (Chairperson) and Putnam and Ms. Baxter. Investment Oversight Committee B currently consists of Messrs. Akhoury (Chairperson) and Curtis. Investment Oversight Committee C currently consists of Messrs. Leibler (Chairperson) and Hill and Dr. Kennan. Investment Oversight Committee D currently consists of Messrs. Worley (Chairperson) and Stephens and Dr. Joskow. Investment Oversight Committee E currently consists of Ms. Dr ucker (Chairperson) and Messrs. Patterson and Reynolds.

Investment Oversight Coordinating Committee.The Investment Oversight Coordinating Committee coordinates the work of the Investment Oversight Committees and works with representatives of Putnam Management to coordinate the Board’s general oversight of the investment performance of the funds. From time to time, as determined by the Chairman of the Board, the Committee may also review particular matters relating to fund investments and Putnam Management’s investment process. The Committee currently consists of Ms. Drucker (Chairperson) and Messrs. Akhoury, Darretta, Leibler and Worley.

Pricing Committee.The Pricing Committee oversees the valuation of assets of the Putnam funds and reviews the funds’ policies and procedures for achieving accurate and timely pricing of fund shares. The Committee also oversees implementation of these policies, including fair value determinations of individual securities made by Putnam Management or other designated agents of the funds. The Committee also oversees compliance by money market funds with Rule 2a-7 and the correction of occasional pricing errors. The Committee also reviews matters related to the liquidity of portfolio holdings. The Committee reports to the Trustees and makes recommendations to the Trustees regarding these matters. The Committee currently consists of Messrs. Leibler (Chairperson), Darretta, Hill, Patterson, Stephens and Ms. Drucker.

►How large a stake do the Trustees have in the Putnam family of funds?

The Trustees allocate their investments among the Putnam funds based on their own investment needs. The number of shares beneficially owned by each nominee for Trustee, as well as the value of each nominee’s holdings in each fund and across all Putnam funds, as of June 30, 2009 is included inAppendix B. As a group, the Trustees owned shares of the Putnam funds valued at approximately $31 million as of June 30, 2009.

As of June 30, 2009, to the knowledge of your fund, the Trustees, and the officers and Trustees of the fund as a group, owned less than 1% of the outstanding shares of each class of each fund, except as listed inAppendix B.

►What are some of the ways in which the Trustees represent shareholder interests?

Among other ways, the Trustees seek to represent shareholder interests:

• by carefully reviewing your fund’s investment performance on an individual basis with your fund’s investment personnel;

• by discussing with senior management of Putnam Management steps being taken to address any performance deficiencies;

• by carefully reviewing the quality of the various other services provided to your fund and its shareholders by Putnam Management and its affiliates;

• by reviewing in depth the fees paid by each fund and by negotiating with Putnam Management to ensure that such fees remain reasonable and competitive with those of comparable funds, while at the same time providing Putnam Management sufficient resources to continue to provide high quality services in the future;

• by reviewing brokerage costs and fees, allocations among brokers, soft dollar expenditures and similar expenses of your fund;

• by monitoring potential conflicts of interest between the funds and Putnam Management and its affiliates to ensure that the funds continue to be managed in the best interests of their shareholders; and

• by monitoring potential conflicts among funds managed by Putnam Management to ensure that shareholders continue to realize the benefits of participation in a large and diverse family of funds.

►How can shareholders communicate with the Trustees?

The Board of Trustees provides a process for shareholders to send communications to the Trustees. Shareholders may direct communications to the Board of Trustees as a whole or to specified individual Trustees by submitting them in writing to the following address:

|

| The Putnam Funds |

| Attention: “Board of Trustees” or any specified Trustee(s) |

|

| One Post Office Square |

| Boston, Massachusetts 02109 |

Written communications must include the shareholder’s name, be signed by the shareholder, refer to the Putnam fund(s) in which the shareholder holds shares and include the class and number of shares held by the shareholder as of a recent date.

Representatives of the Funds’ transfer agent responsible for investor servicing functions will cause all shareholder communications sent to Trustees to be responded to. However, due to the volume of correspondence, all shareholder communications will not be shared directly with the Trustees. A summary of the shareholder communications is presented to the Trustees on a periodic basis.

►How often do the Trustees meet?

The Trustees hold regular meetings each month (except August), usually over a two-day period, to review the operations of the Putnam funds. A portion of these meetings is devoted to meetings of various committees of the board that focus on particular matters. Each Trustee generally attends at least two formal committee meetings during each regular meeting of the Trustees. In addition, the Trustees meet in small groups with senior investment personnel and portfolio managers to review recent performance and the current investment climate for selected funds. These meetings ensure that fund performance is reviewed in detail at least twice a year. The committees of the board, including the Executive Committee, may also meet on special occasions as the need arises. During calendar year 2008, the average Trustee participated in approximately 68 committee and board meetings.

The number of times each committee met during calendar year 2008 is shown in the table below:

| | |

| Audit and Compliance Committee | 12 | |

| |

| Board Policy and Nominating Committee | 11 | |

| |

| Brokerage Committee | 7 | |

| |

| Communications, Service and Marketing Committee | 8 | |

| |

| Contract Committee | 13 | |

| |

| Distributions Committee | 11 | |

| |

| Executive Committee | 1 | |

| |

| Investment Oversight Committees | 27 | |

| |

| Investment Oversight Coordinating Committee | 14 | |

| |

| Pricing Committee | 8 | |

| |

►What are the Trustees paid for their services?

Each Independent Trustee of the fund receives an annual retainer fee and additional fees for each Trustees’ meeting attended, for attendance at industry seminars and for certain compliance-related services. Independent Trustees also are reimbursed for costs incurred in connection with their services, including costs of travel, seminars and educational materials.

All of the current Independent Trustees of the fund are Trustees of all the Putnam funds and receive fees for their services.

The Trustees periodically review their fees to ensure that such fees continue to be appropriate in light of their responsibilities as well as in relation to fees paid to trustees of other mutual fund complexes. The Board Policy and Nominating Committee, which consists solely of Independent Trustees of the fund, estimates that committee and Trustee meeting time, together with the appropriate preparation, requires the equivalent of at least three business days per Trustee meeting. The table found inAppendix Cincludes the year each Trustee became a Trustee of the Putnam funds, the fees paid to each of those Trustees by each fund included in this proxy for its most recent fiscal year (ended between July 31, 2008 and June 30, 2009) and the fees paid to each of those Trustees by all of the Putnam funds during calendar year 2008.

Under a Retirement Plan for Trustees of the Putnam funds (the Plan), each Trustee who retires with at least five years of service as a Trustee of the funds is entitled to receive an annual retirement benefit equal to one-half of the average annual attendance and retainer fees paid to such Trustee for calendar years 2003, 2004 and 2005. This retirement benefit is payable during a Trustee’s lifetime, beginning the year following retirement, for the number of years of service through December 31, 2006. A death benefit, also available under the Plan, ensures that the Trustee or his or her beneficiaries will receive benefit payments for the lesser of an aggregate period of (i) ten years or (ii) such Trustee’s total years of service.

The Plan Administrator (currently the Board Policy and Nominating Committee) may terminate or amend the Plan at any time, but no termination or amendment will result in a reduction in the amount of benefits (i) currently being paid to a Trustee at the time of such termination or amendment, or (ii) to which a current Trustee would have been entitled had he or she retired immediately prior to such termination or amendment. The Trustees have terminated the Plan with respect to any Trustee first elected to the board after 2003.

►What is the voting requirement for electing Trustees?

If a quorum for your trust is present at the Special Meeting, the fourteen nominees for election as Trustees who receive the greatest number of votes cast at the Special Meeting will be elected as Trustees of your fund.

2. APPROVING A PROPOSED NEW MANAGEMENT CONTRACT FOR YOUR FUND

►What is this proposal?

The Trustees are recommending approval of a new management contract for 88 Putnam Funds as part of shareholder-friendly changes proposed by Putnam Management to Putnam fund management fees. (The only funds for which a new management contract is not being proposed are the RetirementReady® Funds and the Money Market Liquidity Fund; Putnam Management currently does not collect any management fees for these funds.)

As discussed in the “Message from Putnam Investments and the Board of Trustees of the Putnam Funds” at the beginning of this proxy statement, the key aspects of this proposal are as follows:

·Lower management fees: The proposal would result in lower contractual management fees for virtually all Putnam funds, including significantly lower management fees for fixed income and asset allocation funds.

·Fund Family breakpoints: Asset-level discounts for management fees would be based on the growth of all Putnam mutual fund assets, rather than an individual fund’s assets. (“Fund Family” for purposes of this proxy statement refers to all open-end mutual funds sponsored by Putnam Management, except for the Putnam RetirementReady® Funds and Putnam Money Market Liquidity Fund.) The proposal would allow shareholders to benefit from the growth of the Fund Family as a whole, even if their specific fund is not growing.

·Performance fees on U.S. growth funds, international equity funds, and Putnam Global Equity Fund: These equity funds would have performance fees reflecting the strength or weakness of the investment performance of a given fund. Management fees for these funds would decline from their standard fee if the funds underperform their benchmarks and would rise if the funds outperform their benchmarks.

►Why did Putnam Management propose a new management contract with Fund Family breakpoints and for certain funds only, performance fees?

The proposed new management contracts differ from the funds’ current management contracts principally by providing for Fund Family breakpoints for 88 funds and, for U.S. growth funds, international equity funds, and Putnam Global Equity Fund, performance fees as well.

Fund Family breakpoints.The implementation of Fund Family breakpoints would result in lower contractual management fees for virtually all Putnam funds. More generally, Putnam Management believes that the determination of your fund’s management fee through breakpoints based on the aggregate net assets of the Fund Family would be in the best interests of your fund’s shareholders for four reasons.

First, Putnam Management believes that Fund Family breakpoints would be more reflective than individual fund breakpoints of the underlying costs Putnam Management incurs in providing investment management-related services to the Fund Family. Putnam Management believes that, because investment management-related services are typically shared across a modern mutual fund family, the costs of these services tend to vary proportionately with the growth or decline of the size of the overall mutual fund family more than with the size of an individual fund. In Putnam Management’s opinion, investment management-related services are now shared broadly across the Fund Family, rather than being specific to any particular fund. Securities trading, some securities research, quantitative analysis, technology, fund administration, accounting services, and legal and compliance

oversight are examples of investment management-related services that are shared across the Fund Family. All in all, Fund Family breakpoints would likely be more reflective than individual fund breakpoints of the manner in which “economies of scale” may be realized.

Currently, each Putnam fund (other than the RetirementReady® Funds) has an individual fund breakpoint schedule that results in a lower effective management fee as assets in that fund increase. As a result of this arrangement, shareholders benefit directly from growth of the fund they own, regardless of any changes in the size of other funds or in the overall level of assets of the Fund Family. While Putnam Management believes that this structure has served shareholders well historically, Putnam Management believes that the use of Fund Family breakpoints would represent an enhancement to each fund’s fee structure given the nature of economies of scale in the modern mutual fund family.

Second, shareholders would benefit under Fund Family breakpoints from “cost diversification,” which allows them to benefit from the growth of the Fund Family as a whole even if their specific fund is not growing. Putnam funds are likely to grow and/or shrink at different rates as market conditions change. Fund Family breakpoints assure that, in total, all shareholders benefit from the Fund Family’s overall growth, regardless of the specific funds driving such growth at any one time.

Third, because Fund Family breakpoints would allow each shareholder in the Fund Family to benefit proportionately from every dollar invested in any fund in the Fund Family, Fund Family breakpoints would give all shareholders an enhanced stake in the future growth of Putnam mutual fund assets.

Fourth, the proposed fee categories under Fund Family breakpoints presented inAppendix Fwould result in management fees that will not favor one fund over another in the same fee category solely on the basis of one fund having achieved greater size than another. Putnam Management believes that this feature of Fund Family breakpoints should enhance the value of the exchange privilege available to shareholders across the Fund Family of diversified products.

Performance fees.Putnam Management proposes to extend further its philosophy that strong investment performance should be rewarded with higher management fees, while poor performance should command lower management fees, for the funds listed below:

| | |

| U.S. growth funds | International equity funds | |

|

| Putnam Growth | Putnam Asia Pacific Equity | Putnam Global Equity Fund |

| Opportunities Fund | Fund | |

| Putnam New Opportunities | Putnam Emerging Markets | |

| Fund | Equity Fund | |

| Putnam Small Cap Growth | Putnam Europe Equity Fund | |

| Fund | Putnam International Capital | |

| Putnam Vista Fund | Opportunities Fund | |

| | |

| Putnam Voyager Fund | Putnam International Equity | |

| | Fund | |

| | Putnam International Growth | |

| | and Income Fund | |

| | Putnam International New | |

| | Opportunities Fund | |

By extending this philosophy, already employed by Putnam’s “Absolute Return” and “Spectrum” funds, to these 13 funds, Putnam Management would be providing significant numbers of additional shareholders with a management fee that adjusts based on the strength of the investment performance results that are obtained on their behalf. These 13 funds, along with the “Absolute Return” and “Spectrum” funds, together represent approximately 22% of Putnam mutual fund assets as of June 30, 2009.