- ISSC Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

CORRESP Filing

Innovative Solutions and Support (ISSC) CORRESPCorrespondence with SEC

Filed: 27 Mar 09, 12:00am

VIA EDGAR

March 27, 2009

United States Securities and Exchange Commission

100 F Street, NE

Washington, D.C. 20549-4561

Attn: | Ms. Kathleen Collins | ||

| Ms. Melissa Feider | ||

| Mr. Kevin Dougherty | ||

| Mr. Mark P. Shuman | ||

| |||

| RE: | Innovative Solutions and Support, Inc. | |

|

| Form 10-K and Form 10-K/A for Fiscal Year Ended | |

|

| September 30, 2008 | |

|

| Filed December 11, 2008 and December 19, 2008 | |

|

| Form 10-Q for the Fiscal Quarter Ended December 31, 2008 | |

|

| Filed on February 6, 2009 | |

|

| File No. 000-31157 | |

Dear Ms. Collins:

On behalf of Innovative Solutions and Support, Inc. (the “Company”), we respond to the written comments of the staff (the “Staff”) of the Securities and Exchange Commission (the “Commission”) contained in your letter dated February 27, 2009 to John C. Long (the “Comment Letter”), with respect to Form 10-K and Form 10-K/A for Fiscal Year Ended September 30, 2008, filed with the Commission by the Company on December 11, 2008 and December 19, 2008, respectively, and Form 10-Q for the Fiscal Quarter Ended December 31, 2008, filed with the Commission by the Company on February 6, 2009 (File No. 000-31157).

The headings and numbered items of this letter correspond to the headings and numbered items contained in the Comment Letter. For the convenience of the Staff, each of the comments from the Comment Letter is restated in bold italics prior to the Company’s response.

General

1. We note that that [sic] you amended the September 30, 2008 Form 10-K to correct certain “typographical errors” in the consolidated statements of cash flows. Tell us what consideration you gave to filing an Item 4.02 Form 8-K. Also, tell us why you did not label the September 30, 2008 cash flow information as restated.

Response:

Subsequent to the filing on December 11, 2008 of the Company’s Form 10-K for the fiscal year ended September 30, 2008, the Company identified a typographical error contained on the face of

the statement of cash flows for the fiscal year ended September 30, 2008 in the document that was filed with the Commission. The net loss line item shown under cash flows from operating activities for the fiscal year ended September 30, 2008 was incorrectly presented as $1,509,139 rather than ($7,897,248). This incorrect amount on the statement of cash flows was due to a typographical error made while making the final changes to the Company’s Form 10-K for the fiscal year ended September 30, 2008 which caused data from the wrong cell on a spreadsheet to appear in the net loss line item on the statement of cash flows. As a result of the typographical error, the totals on the statement of cash flows for net cash provided by operating activities, net decrease in cash and cash equivalents and cash and cash equivalents, end of year, were not correct. However, in the same Form 10-K which was filed on December 11, 2008, those same items were properly stated in other sections of the Form 10-K, resulting in clearly identifiable internal inconsistencies in the document. For example, the net loss is properly stated as ($7,897,248) on the consolidated statements of operations on page 34 and the summary financial information table on page 21, net cash provided by operating activities is properly stated as $4.2 million on page 25 in the liquidity and capital resources section of the Management’s Discussion & Analysis of Financial Condition and Results of Operations (“MD&A”) and cash and cash equivalents, end of year, is properly stated as $35,031,932 on the consolidated balance sheet on page 33 and the summary financial information table on page 21. Upon becoming aware of this typographical error, the Company elected to correct the statement of cash flows in a Form 10-K/A, which was filed on December 19, 2008. All of the items on the statement of cash flows described above were corrected in the amended filing.

Item 4.02 of Form 8-K requires disclosure on Form 8-K if a registrant concludes that previously issued financial statements should no longer be relied upon because of an error in the financial statements as addressed in Accounting Principles Board Opinion No. 20, as it may be modified, supplemented or succeeded (“APB No. 20”). APB No. 20 has been subsequently superseded by Statement of Financial Accounting Standards No. 154 (“SFAS No. 154”). An “error in previously issued financial statements” is defined in SFAS No. 154 as “an error in recognition, measurement, presentation, or disclosure in financial statements resulting from mathematical mistakes, mistakes in the application of GAAP, or oversight or misuse of facts that existed at the time the financial statements were prepared.”

After consideration, the Company concluded that the typographical errors that appeared on the face of the consolidated statement of cash flows did not result from a mathematical mistake or a mistake in the application of GAAP, and that no facts that existed at the time the Form 10-K was filed were overlooked or misused. Therefore, the Company concluded that the financial statements did not contain an error within the meaning of SFAS No. 154, and 8-K disclosure under Item 4.02 was therefore not required. Similarly, the Company determined that because the information was correctly reported in other parts of the financial statements included in Form 10-K, the amounts in error were clearly identifiable to the user, and it was not necessary to label the financial statements as having been restated.

Item 1. Business

Customers

Retrofit Market, Page 7

2. �� You disclose, in the aggregate, the percentage of revenue supplied by a specified, limited number of your largest customers in fiscal 2008 and fiscal 2007; however, there is no explicit identification in this section of the ten percent or greater

customers. In future filings, please disclose the name of each customer accounting for ten percent or more of your consolidated revenues. To adequately explain the extent of dependence on these principal customers, it appears that the percentage contributed by each of them should be provided. You may elect to provide additional information regarding the extent of concentration of your customer base. See Item 101(c)(i)(vii) of Regulation S-K.

Response:

The Company notes the Staff’s comment and in future filings will disclose the name of each customer accounting for ten percent or more of the Company’s consolidated revenues and the percentage of revenues contributed by each of these customers. Had this enhanced disclosure been provided in the Company’s Form 10-K for the fiscal year ended September 30, 2008, it would have read as follows:

Historically, a majority of our sales have come from the retrofit market. Among other reasons, we have pursued the retrofit market specifically because of its continued rapid growth in response to the increasing need to support the world’s aging fleet of aircraft. During fiscal year 2008 we derived 26% of our revenues from three retrofit customers, Department of Defense (“DOD”), Federal Express and American Airlines. During fiscal year 2008 DoD, our largest retrofit customer, accounted for 10% of our total revenues. During fiscal year 2007 three retrofit customers, DoD, Eclipse and Western Aircraft accounted for 20%, 16% and 11% of our total revenues, respectively.

Item 1A. Risk Factors

Risks Related to Our Industry, page 16

3. You do not appear to address the cyclical nature of the aerospace industry in which you sell your products. Additional global terrorists’ attacks, higher fuel prices, large fluctuations in commodity prices, and/or further airline bankruptcies all have the ability to change the course of the recovery of the aerospace industry and affect demand for your products. Please tell us what thought you gave to expressing these or other industry risks that may be material in separate headings under “risks related to our industry.”

Response:

The Company notes the Staff’s comment and respectfully submits that the Company believes that its exposure to what the Staff refers to in its comment as the “cyclical nature of the aerospace industry” is mitigated by both the Company’s diversified customer base and its focus on the retrofit market. The Company’s customer base spans three markets within the aerospace industry, namely military, commercial air transport and general aviation. While terrorist attacks, higher fuel prices, fluctuations in commodity prices and airline bankruptcies may impact certain markets within the industry (for example, commercial air transport), other aspects of the market, in particular military sales, can remain robust or even be enhanced due to those factors. In addition, the Company believes that its focus on retrofitting existing aircraft provides the Company with opportunities in both times of expansion and times of contraction in the aerospace industry. As stated on page 22 of the Company’s Form 10-K, the Company believes that in a declining economic environment customers that may have otherwise elected to purchase newly manufactured aircraft will instead be interested in retrofitting existing aircraft as a cost effective

alternative. Also, in an expanding market, the Company believes that capacity constraints prevent the two largest suppliers of new aircraft from meeting all of the demand in the market, which creates opportunity for industry participants such as the Company who focus on retrofitting existing aircraft. Therefore, the Company believes that these reasons mitigate the risk to the extent that it does not believe that an additional risk factor on the cyclical nature of the aerospace industry is required in addition to those already included in the Form 10-K for the fiscal year ended September 30, 2008 to provide investors with an overview of the significant risks facing the business.

Moreover, the Company respectfully submits that it believes that its exposure to the significant risks inherent in competing in the aerospace industry are adequately addressed by the risk factors already included in the Form 10-K for the fiscal year ended September 30, 2008. In particular, the risk factors entitled “Our sales principally relate to flat panel display systems and air data products, and we cannot be certain that the market will continue to accept these or other products,” “A global recession and continued credit tightening could adversely affect us,” “The loss of a key customer or significant deterioration in the financial condition of a key customer could have a material adverse effect on our results of operations,” and “Growth in our customer base could be limited by delays or difficulties in completing development and introduction of our planned products or product enhancements. If we fail to enhance existing products or to develop and achieve market acceptance for flat panel displays and other new products that meet customer requirements, our business will be adversely affected,” each describe the significant risks that exist in competing in the aerospace industry. Based on its experience and its knowledge of the aerospace industry, the Company believes these risk factors properly convey to investors the key risks the Company faces in the markets in which it sells its products. The Company will continue to monitor these risks each quarter and will add additional risk factors in the future regarding the cyclical nature of the aerospace industry or other topics as it deems appropriate based on market conditions at the time of each future filing on Form 10-K or Form 10-Q.

Item 5. Market for the Registrant’s Common Equity, Related Stockholder Matters and Issuer Repurchase of Equity Securities

Comparison of the Five Year Total Return, page 20

4. We note that your stock performance table uses a market capitalization index instead of an industry specific or peer issuer index. Issuers with similar market capitalization, such as the Russell 2000 index, can be used in place of a recognized applicable industry index, or a self-constructed peer index only in limited circumstances. See Item 201(e)(1)(ii)(C) of Regulation S-K. Please explain why your presentation of the market capitalization based index is permissible.

Response:

The Company notes the Staff’s comment and respectfully submits that the Company believes that its presentation of a market capitalization based index is permissible based on the Company’s individual circumstances and the requirements of Item 201(e)(1)(ii)(C) of Regulation S-K. Item 201(e)(1)(ii) of Regulation S-K provides that the performance graph may include: (A) a published industry or line-of-business index, (B) peer issuers selected in good faith, or (C) an index based on similar market capitalization. If the Company does not use a published industry or line-of-business index and does not believe it can reasonably identify a peer group, a presentation of issuers with a similar market capitalization is permissible under the rules.

The Company designs, manufactures and sells flat panel display systems and advanced monitoring systems to the Department of Defense, government agencies, defense contractors, commercial air transport carriers, original equipment manufacturers and the corporate/general aviation markets. The Company does not use a published industry or line-of-business index because it is not aware of any such index made of companies that are comparable to it and that would be accessible to the Company’s security holders or is widely recognized and used. Further, the Company is not reasonably able to identify a peer group because its competitors are either private companies or divisions of much larger public companies, and a comparison to the stock price of these public company competitors may be misleading since there are many factors that affect the share price of these larger, more diversified companies that would not be relevant to the Company. As a result, the Company chose to include a comparison to the Russell 2000 index, an index of issuers with a similar market capitalization, in accordance with Item 201(e)(1)(ii)(C) of Regulation S-K. The Company does note, however that a statement regarding the reasons for choosing a market capitalization based index under Item 201(e)(1)(ii)(C) of Regulation S-K to accompany the stock performance graph in Form 10-K and in future filings will include a statement describing the reasons mentioned above.

Item 7A. Quantitative and qualitative disclosures about market risk, page 30

5. You disclose that changes in interest rates could impact interest income and expense along with cash flows. Please tell us your consideration and conclusion with respect to quantitative disclosure regarding market risk of interest rate fluctuations. We are unable to locate a sensitivity analysis or other quantitative presentation of the potential impact of changes in interest rates and their potential impact on interest income, expense and cash flows. See Item 305(a)(1) of Regulation S-K.

Response:

The Company notes the Staff’s comment and in future filings will provide the following disclosure to attempt to quantify for investors the impact of changes in interest rates and their potential impact on interest income, interest expense, and cash flows, although to date the impact of changes in interest rates would not have had a material effect on the Company’s consolidated financial statements taken as a whole. Had this enhanced disclosure been provided in the Company’s Form 10-K for the fiscal year ended September 30, 2008, it would have read as follows:

Item 7A. Quantitative and qualitative disclosures about market risk.

The Company’s operations are exposed to market risks primarily as a result of changes in interest rates. The Company does not use derivative financial instruments for speculative or trading purposes. The Company’s exposure to market risk for changes in interest rates relates to its cash equivalents and an industrial revenue bond. The Company’s cash equivalents consist of funds invested in money market accounts, which bear interest at a variable rate, while the industrial revenue bond carries an interest rate that is consistent with 30-day tax-exempt commercial paper. Assuming that the balances during the fiscal year ending September 30, 2008 were to remain constant and no actions were taken to alter the existing interest rate sensitivity, a hypothetical 1% change in our variable interest rates would have affected interest income by approximately $430,000 and interest expense by approximately $43,000, resulting in a net impact on cash flows of approximately $387,000 for the fiscal year ended September 30, 2008.

As the interest rates are variable, a change in interest rates earned on the cash equivalents or paid on the industrial revenue bond would impact interest income and expense along with cash flows, but would not impact the fair market value of the related underlying instruments.

Note 3. Summary of Significant Accounting Policies

Revenue Recognition, page 39

6. Given the shift in product mix from sales of air data systems and components to flat panels, please update us as to the applicability of SOP 97-2 to your products. In your response, please tell us the percentage of revenue recognized pursuant to SOP 97-2 for fiscal 2008 and fiscal 2007 for both current and long-term contracts. If a significant portion of your revenue is recognized pursuant to SAB 104, then please tell us how the Company considered the guidance in footnote 2 to SOP 97-2 in determining that software is incidental to the product as a whole. Additionally, tell us how the Company considered disclosing which products are accounted for pursuant to SOP 97-2 and which are accounted for pursuant to SAB 104 in the revenue recognition footnote. We may have further comments.

Response:

The Company’s net revenues have historically been recognized in accordance with EITF Issue No. 00-21, Revenue Arrangements with Multiple Deliverables (“EITF 00-21”), Staff Accounting Bulletin No. 104, Revenue Recognition (“SAB 104”) and/or Statement of Position 81-1, Accounting for Performance of Construction-Type and Certain Production-Type Contracts (“SOP 81-1”).

The Company has been migrating the mix of its products and related sales from air data systems and related components to flat panel displays. In December 2006 the Company entered into a development and purchase agreement with Eclipse Aviation Corp (“Eclipse”), which represented a significant milestone for the Company. In the immediate aftermath of signing the Eclipse Contract, management’s initial view was that embedded software used to operate the display panels was more than incidental, and therefore such arrangements would be subject to Statement of Position 97-2, Software Revenue Recognition (“SOP 97-2”). This was the basis for the Company’s response to the Commission on March 2, 2007. Subsequent to the Company’s response and based on the continued evaluation of this multiple element arrangement, management determined that sales of its products, including flat panel displays, were not within the scope of the SOP 97-2 and that the embedded software component of the product was in fact not more-than-incidental to the product as a whole (for the reasons described in the detailed discussion below).

Based on the Company’s consideration and understanding of its products, their functionality and integration into respective aircraft, the Company has considered the applicability of SOP 97-2 to its arrangements including the guidance reflected in footnote 2 to the SOP 97-2. The guidance in SOP 97-2 provides that the following factors may indicate that the software is more than incidental to the product:

1. the software is a significant focus of the marketing effort or is sold separately,

2. the vendor is providing postcontract customer support, and

3. the vendor incurs significant costs that are within the scope of FASB Statement No. 86, Accounting for the Costs of Computer Software to Be Sold, Leased, or Otherwise Marketed.

The Company’s analysis and conclusion regarding each of these factors is detailed below:

Marketing Efforts - With respect to the first criterion, no reference to the Company’s software is made in the Company’s marketing materials nor on the Company’s website. Additionally, the Company has never sold, nor has plans to sell, software separately. Based on these facts, the Company has concluded that its marketing efforts do not indicate that software is more-than-incidental to the product.

Postcontract Customer Support - The Company does provide customer support-type provisions in connection with the sale of its products. However, these support services do not include implicit or explicit rights to future updates or upgrades. Additionally, the scope of the Company’s support is limited to: (i) providing customers with a hotline to expedite warranty-related claims as necessary to ensure that the Company’s products maintain compliance with published specifications, and/or (ii) requests for product service subject to additional future consideration. Based on consideration of both paragraph 31 of SOP 97-2, as well as AICPA TPA 5100.43, the Company believes that the scope of its support operations qualify for accounting under FASB Statement No. 5, Accounting for Contingencies. Accordingly, the Company has concluded that its arrangements do not include implicit or explicit postcontract customer support, providing additional evidence that software is not more-than-incidental to its products.

Software Development Costs - As part of the migration from air data systems to flat panel displays, the Company experienced an increase in the number of product engineers on staff in order to support the evolution of its product line. A significant focus of the Company’s engineering and development effort is to analyze the aircraft in question and its configuration relative to existing on-airplane communications, navigation, monitoring and control equipment that will be required to be connected to the Company’s product. Additionally, given the regulated and monitored environment within which the Company operates, significant documentation is required for each installation to facilitate certification by the Federal Aviation Administration (if in the United States), or other equivalent regulatory body.

As of September 30, 2008 the Company employed 165 personnel, including 52 engineers, of which only approximately 6 full time equivalent personnel created or modified the software that is embedded in the Company’s products. During fiscal year 2008 the cost associated with software engineering represented only 5.1% of the Company’s annual research and development costs of $13.3 million, which the Company believes is further indicative of the fact that its software is not more-than-incidental to its products.

Further, the Company, in developing its conclusion regarding the applicability of SOP 97-2 to its sales arrangements, critically evaluated the nature and context of its products that are marketed and sold to the aviation industry. The Company’s flat panel displays, although very similar in operation and consistent in design and production, are specifically engineered to connect with and function in specific aircraft. As a result, all of the Company’s products are subject to certification by the Federal Aviation Administration (“FAA”) prior to being placed into operation. An important aspect of this approval process is that the FAA only certifies the Company’s products and, accordingly, all of the Company’s marketing and regulatory efforts center on the capabilities of its products—not the embedded software. The flat panel display hardware and underlying

software provides capabilities which differentiate the Company’s physical products from those of our competitors; however, the Company does not market its software.

The Company’s flat panel displays functionality and operation relative to the aircraft in which it is installed is similar to the functionality and operation of a flat screen television relative to connected devices in that it:

· is connected to, and dependent upon, other components via a series of wired connections;

· receives and processes different signals (e.g. analog, digital, high definition) received from each of the connected components and processes the signals using a combination of hardware and software technologies; and

· allows the operator to select and display data from other components via hardware controls (switches, buttons, etc.) as well as control display settings via a series of on-screen menus.

The example of a television is discussed in the guide published by KPMG, LLP entitled “Software Revenue Recognition – An Analysis of SOP 97-2 and Related Guidance.” That publication sets forth the following as example 1.1:

ABC Corp. is a manufacturer of televisions. A television produced by ABC contains a microprocessor chip that includes embedded software to enhance the features and functionality of the television. ABC does not provide customers with upgrades or enhancements or any other services specifically related to the software embedded in the components of the televisions.

Generally, the software embedded in the televisions produced by ABC would be considered incidental to the product as a whole and, thus, the provisions of SOP 97-2 would not apply. Accordingly, ABC would apply other appropriate accounting guidance for recognizing revenue on the sale of televisions.

Much like a television, the Company’s product contains embedded software, the customer is purchasing the product because of its functional capabilities and physical requirements, and the Company does not believe that the software is in the forefront of the customer’s mind when making the purchasing decision.

After consideration of all of these factors, and after reconsideration of the Company’s arrangements in context of these factors, the Company had previously concluded, and continues to conclude, that the software utilized is not more-than-incidental to the Company’s flat panel products and therefore is not subject to revenue recognition under SOP 97-2. The Company has not recognized any revenue under SOP 97-2 in its historical financial statements. As a result, the Company’s revenue has been recognized either upon sale of the Company’s products once the criteria included in SAB 104 have been met (if an arrangement does not include multiple elements), or in accordance with the guidance included in EITF 00-21 (if an arrangement does include multiple elements) for which the Company recognizes revenue related to design and engineering services in accordance with SOP 81-1 and sales of the Company’s products once the criteria included in SAB 104 are met. The Company believes that its historical financial statements accurately reflected the application of each of these standards to each of its customer arrangements.

To further assist in understanding the Company’s products please refer to the attached Exhibits A through D which show examples of the Company’s Flat Panel Display related products.

In light of the constant evolution of its products, as well as the fact that they do include embedded software, the Company plans to continue to consider the applicability of SOP 97-2 to each new product and/or customer arrangement. However, based on the receipt of the comment from the Staff and the Company’s reconsideration of the disclosure included in the Company’s Form 10-K, the following disclosure will be incorporated by the Company in future filings to more clearly indicate the accounting method and policy utilized in recognizing revenue. The Company will begin this disclosure with its second quarter Form 10-Q in the current fiscal year.

Note XX - Revenue Recognition

The Company enters into sales arrangements with customers that, in general, provide for the Company to design, develop, manufacture and deliver flight information computers, large flat-panel displays, and advanced monitoring systems that measure and display critical flight information, including data relative to aircraft separation, airspeed, altitude as well as engine and fuel data measurements. The Company’s sales arrangements may include multiple deliverables as defined in EITF Issue No. 00-21, Revenue Arrangements with Multiple Deliverables, which typically include design and engineering services and the production and delivery of the flat panel display and related components.

Multiple Element Arrangements -

The Company identifies all goods and/or services that are to be delivered separately under such a sales arrangement and allocates revenue to each deliverable (if more than one) based on that deliverable’s fair value. The Company then considers the appropriate recognition method for each deliverable; deliverables under multiple element arrangements are typically purchased engineering and design services and product sales. To the extent that an arrangement contains defined design and development activities as an identified deliverable in addition to products (resulting in a multiple element arrangement), the Company recognizes as Engineering – Modification and Development (“EMD”) Revenue amounts earned during the design and development phase of the contract following the guidance included in the American Institute of Certified Public Accountants (AICPA) Statement of Position 81-1, Accounting for Performance of Construction-Type and Certain Production-Type Contracts (SOP 81-1). To the extent that multiple element arrangements include product sales, revenue is generally recognized once revenue recognition criteria for the product deliverable has been met based on the provisions of Staff Accounting Bulletin No. 104, Revenue Recognition (SAB 104).

Single Element Arrangements –

Products -

To the extent that a single element arrangement provides for product sales and repairs, revenue is generally recognized once revenue recognition criteria for the product deliverable has been met based on the provisions of SAB 104. The Company also receives orders for existing equipment and parts. Revenue from the sale of such products is generally recognized upon shipment to the customer.

The Company offers its customers extended warranties for additional fees. These warranty sales are recorded as deferred revenue and recognized as sales on a straight-line basis over the warranty period.

Engineering Services -

The Company also may enter into service arrangements to perform specified design and development services related to its products. The Company recognizes revenue from these arrangements as Engineering – Modification and Development revenue, following the guidance included in SOP 81-1. The Company considers the nature of these service arrangements (including term, size of contract, level of effort) when determining the appropriate accounting treatment for a particular contract. The Company recognizes the revenue from these contracts using either the percentage-of-completion method or completed contract method of accounting.

The Company records revenue relating to these contracts using the percentage-of-completion method when the Company determines that progress toward completion is reasonable and reliably estimable and the contract is long-term in nature; the Company uses the completed contract method for all others.

7. Additionally, we note in your response letter dated March 2, 2007 to our prior comment 4 that “current product sales” accounted for under SOP 97-2 did not contain postcontract customer support or services. We also note from your disclosures on page 9 that the Company offers a customer service program with twenty-four hour telephone support for product repair or upgrade concerns and also offers customers extended warranties for additional fees. Please confirm whether these services are provided with current and/or long-term arrangements that are accounted for pursuant to SOP 97-2. If so, tell us how the Company accounts for such arrangements and specifically address how you establish vendor specific objective evidence for these services pursuant to paragraph 10 and/or 57 of SOP 97-2.

Response:

As indicated in the Company’s response to comment #6, the Company’s current product sales are not accounted for under SOP 97-2 as a result of the Company’s conclusion that software is not more than incidental to its products. The scope of the Company’s product support is limited to: (i) providing customers with a hotline to expedite warranty-related claims as necessary to ensure that the Company’s products maintain compliance with published specifications, and/or (ii) requests for product service which are subject to additional future consideration. The upgrades discussed on page 9 of our Form 10-K represent increased capabilities that can be purchased by the Company’s customers for additional future consideration. These increased capabilities are representative of the adaptability of the product and its ability to accept additional and new data inputs from other equipment that the aircraft owner may purchase from other sources. An example would be an increased capability to allow the flat panel equipment to accept and display weather radar images received from a satellite radio receiver, which is a modification that the Company could provide to the product for an additional fee. Accordingly, the Company has concluded that its arrangements do not include any postcontract customer support obligation within the meaning of SOP 97-2, and the prospective disclosure regarding the Company’s revenue recognition policies included in the Company’s response to comment #6 no longer includes any reference to postcontract customer support.

The Company’s extended warranties are sold separately for additional consideration and are recorded as deferred revenue and recognized as revenue on a straight-line basis over the warranty period.

8. We note from your disclosures on page 37 that government agencies accounted for approximately 23%, 36%, and 51% of revenue for fiscal 2008, 2007, and 2006,

respectively. Please tell us how you considered the guidance of paragraphs 31 to 33 of SOP 97-2 and/or SAB Topic 13.A.4, as applicable, in accounting for fiscal funding clauses included in your software arrangements. Specifically, tell us how you assess that collection is reasonably assured/probable given your disclosure on page 9 that indicates such customers retain the right to terminate the contract at any time.

Response:

The Company’s contracts with governmental agencies do not include fiscal funding clauses and, as a result, the Company does not believe that the provisions of paragraphs 31 through 33 of SOP 97-2 apply. Additionally, at the time of revenue recognition, the Company considers whether collectability is reasonably assured in light of customer cancellation rights. To date, the Company’s customer contracts have included provisions requiring the payment of all revenue earned and costs incurred through the date of contract termination and, as a result, the Company has concluded that collectability of fees has been reasonably assured.

9. We note that in fiscal 2008, the Company suspended work on the Eclipse VLJ program due to Eclipse Aviation filing for Chapter 11 bankruptcy on November 25, 2008. We also note from your disclosure on page 23 that revenue from Eclipse Aviation represented 42% of fiscal 2008 revenue and that the Company recorded a bad debt and inventory reserve of $4.1 million and $1.9 million, respectively. Tell us the balance of gross accounts receivable and gross inventory as of September 30, 2008 and December 31, 2008 related to Eclipse Aviation. If the balances are not fully reserved, then please explain why this is the case. Additionally, tell us which accounting literature the Company applied to sales from this customer, the nature of their payment terms, and how the loss of their business impacted revenue recognition.

Response:

The balances of Eclipse’s gross accounts receivable and gross inventory as of September 30, 2008 were $4.1 million and $2.0 million, respectively, of which the accounts receivable balance was fully reserved for and $1.5 million of the gross inventory was reserved. At that time the Company believed that certain of the Eclipse inventory may be used for other products.

The balances of Eclipse’s gross accounts receivable and gross inventory as of December 31, 2008 were $0 and $2.0 million, respectively. In the quarterly period ended December 31, 2008, the Company removed both the gross accounts receivable and the related allowance account associated with sales to Eclipse. The gross inventory as of December 31, 2008 was subject to a full reserve. The additional $0.5 million reserve as of December 31, 2008 was the result of the Company’s determination that certain inventory could not be used in other products as originally anticipated. The full amount of the gross inventory as of December 31, 2008 was subject to a full reserve.

Although Eclipse represented 42% or $12.8 million of the Company’s fiscal 2008 revenue, revenue recognized during the quarterly period ended September 30, 2008 from Eclipse was only $2.2 million. The Company stopped recognizing revenue from Eclipse in August 2008 after the Company became aware of Eclipse’s deteriorating financial condition. The Company continued to receive cash receipts from Eclipse through August 2008.

The Company recognized revenue related to Eclipse under EITF 00-21 consistent with the discussion and response to comment # 6 above. At the time of each shipment to Eclipse, the Company considered, as indicated in the response to comment #6, whether collectability was reasonably assured in accordance with SAB 104. In reaching a conclusion, the Company considered both the payment terms as well as Eclipse Aviation’s ability to pay for amounts due under the contract, noting the following:

1. Amounts invoiced under the contract were due within 45 days of related milestone billing, representing terms which were substantially similar to the terms offered to many of the Company’s other customers (and which the Company had been successful in enforcing).

2. The payment terms were not of a duration which could have increased the risk of technological obsolescence and thus resulted in the risk of non-payment or future concessions.

3. The Company inquired regarding Eclipse’s ability to pay for the contract deliverables and noted that although Eclipse was still in the development stage, it had raised a substantial amount of capital in a series of financing transactions.

Based on the results of steps 1-3 above, in accordance with SAB 104 the Company concluded that collectability was reasonably assured as of each shipment date and, accordingly, that it was appropriate to recognize revenue associated with the Company’s shipments to Eclipse (including shipments which occurred during July and August 2008).

Subsequent to the end of the Company’s fiscal year, a member of senior management met with members of Eclipse’s management at Eclipse’s manufacturing facility in order to determine whether there were any indications of a change in the business which would have caused substantial doubt about Eclipse’s ability to pay. Based on the results of that visit, the Company determined that there was enough concern to warrant the recognition of an allowance effective as of September 30, 2008 against both the outstanding accounts receivable balance as well as Eclipse-related inventory.

Form 10-Q for the Fiscal Quarter Ended December 31, 2008

Note 1. Summary of Significant Accounting Policies

Recent Accounting Pronouncements, page 6

10. We note that the adoption of SFAS 157 on October 1, 2008 did not have an impact on the Company’s financial statements. We also note that your cash equivalents balance includes funds held in money market accounts. If material, tell us how you considered providing the disclosure requirements of paragraphs 32 to 35 of SFAS 157 related to your money market investments. In addition, please tell us and in the future revise to disclose the composition of your cash and cash equivalents and the amounts held in each type of instrument. In your response, please provide us with the balance of your money-market funds for each period presented in your fiscal 2008 Form 10-K and as of December 31, 2008.

Response:

The Company notes the Staff’s comment and confirms that future filings will include the expanded disclosure required by SFAS No. 157, Fair Value Measurements (“SFAS 157”). As of December 31, 2008, all of the Company’s cash equivalents invested in money market funds are considered Level 1 in the fair value hierarchy.

The Company has concluded that, for each reporting period, all of its money market fund investments qualify as cash and cash equivalents under paragraph 8 of SFAS 95 since (i) they are readily convertible into cash and (ii) they have short maturity terms that present an insignificant risk of change in value. Furthermore, all of the money market fund investments have original maturities of three months or less and there are no withdrawal restrictions on the fund investments.

As the money market fund investments qualify as cash and cash equivalents, the adoption of SFAS 157 was deemed to have no effect on the accounting for the money market fund investments. The money market fund investments have historically, and are currently, reported at cost, which is consistent with fair value based on market quotes (net asset value of $1 per share based on its quoted market price).

During 2008, the Company invested in money market funds that invested in domestic commercial paper, securities issued or guaranteed by the U.S. government or its agencies, U.S. bank obligations, fully collateralized repurchase agreements and variable and floating rate demand notes.

The balance of the Company’s cash and cash equivalents were as follows:

|

| September 30, |

| September 30, |

| December 31, |

| |||

|

|

|

|

|

|

|

| |||

Cash |

| $ | 637,612 |

| $ | 1,637,650 |

| $ | 1,124,916 |

|

Money market fund investments |

| 48,513,466 |

| 33,394,283 |

| 32,600,754 |

| |||

Total cash and cash equivalents |

| $ | 49,151,078 |

| $ | 35,031,933 |

| $ | 33,725,670 |

|

Furthermore, the Company will incorporate, in future filings, a disclosure to comply with the disclosure requirements of SFAS 157. The Company will begin this disclosure with its second quarter Form 10-Q in the current fiscal year. Had this enhanced disclosure been provided in the Company’s Form 10-Q for the fiscal quarterly period ended December 31, 2008, it would have read as follows:

Note X. Fair Value of Financial Instruments

The Company adopted SFAS 157 in the first quarter of fiscal 2009 for financial assets and liabilities. This standard defines fair value as the price at which an asset could be exchanged in a current transaction between knowledgeable, willing parties. A liability’s fair value is defined as the amount that would be paid to transfer the liability to a new obligor, not the amount that would be paid to settle the liability with the creditor.

Assets and liabilities measured at fair value are categorized based upon the level of judgment associated with the inputs used to measure their fair value. Hierarchical levels, defined by SFAS 157 and directly related to the amount of subjectivity associated with the inputs to fair valuation of these assets and liabilities, are as follows:

Level 1 — Unadjusted quoted prices that are available in active markets for the identical assets or liabilities at the measurement date.

Level 2 — Other observable inputs available at the measurement date, other than quoted prices included in Level 1, either directly or indirectly, including:

· Quoted prices for similar assets or liabilities in active markets;

· Quoted prices for identical or similar assets in non-active markets;

· Inputs other than quoted prices that are observable for the asset or liability; and

· Inputs that are derived principally from or corroborated by other observable market data.

Level 3 — Unobservable inputs that cannot be corroborated by observable market data and reflect the use of significant management judgment. These values are generally determined using pricing models for which the assumptions utilize management’s estimates of market participant assumptions.

The following table sets forth by level within the fair value hierarchy, the Company’s financial assets and liabilities that were accounted for at fair value on a recurring basis as of December 31, 2008, according to the valuation techniques the Company used to determine their fair values.

|

| Fair Value Measurements on December 31, 2008 |

| ||||

|

| Quoted Prices in |

| Significant Other |

| Significant |

|

|

| (Level 1) |

| (Level 2) |

| (Level 3) |

|

Assets |

|

|

|

|

|

|

|

Cash and cash equivalents: |

|

|

|

|

|

|

|

Money market funds |

| $32,600,754 |

|

|

|

|

|

Note 3. Income Taxes, page 9

11. We note that the effective tax rate for the quarter ended December 31, 2008 differs from the statutory tax rate due to “the reversal of certain deductible temporary differences which at September 30, 2008 were offset by a valuation allowance, such amounts will be deductible for income tax purposes in the current year based on forecasted earnings.” Please confirm what portion of the valuation allowance was released and what accounts were impacted by the release (e.g. deferred tax assets, income tax expense, taxes receivable/payable, etc.). Additionally, please tell us how the Company assessed the effective rate of 4% for the first quarter was reflective of the estimated annual effective tax rate pursuant to paragraphs 8 and 20 of FIN 18. In this regard, please describe in greater detail the nature of the positive and negative evidence you considered in your determination to release the allowance and how that evidence was weighted. Specifically, tell us how you determined that generating net income for one fiscal quarter is enough positive evidence to conclude that it is more likely than not that certain deferred tax assets will be realized. We refer you to paragraphs 20 to 25 and 103 of SFAS 109.

Response:

The Company respectfully submits that the effective tax rate for the quarter ended December 31, 2008 was primarily impacted by the write-off of a bad debt reserve that was initially established during the fourth quarter of the fiscal year ended September 30, 2008. When the bad debt reserve was initially recorded ($4.1 million) for book purposes, it created a deferred tax asset that was fully offset by a valuation allowance at September 30, 2008 as the Company had concluded that it was more likely than not that the tax benefit of this deferred tax asset would not be realized. It should be noted that as of both the fiscal year ended September 30, 2008 and the quarter ended December 31, 2008, net deferred tax assets are fully offset by a valuation allowance such that no net deferred tax asset is carried on the balance sheet at either date. During the quarter ended December 31, 2008, the account receivable for which the bad debt reserve was established was written off, thereby resulting in a current tax deduction.

Accordingly, upon the specific write-off of the account receivable during the quarter ended December 31, 2008, the deferred tax asset that was recorded upon the establishment of the bad debt reserve was credited, and the associated valuation allowance was debited by the same amount, thereby yielding a net deferred tax expense of zero for the quarter. At December 31, 2008, net deferred tax assets remained fully offset by a valuation allowance. The write-off created a current tax deduction for the year ended September 30, 2009, which was incorporated in the Company’s computation of forecast income tax expense (current tax) for that year.

The effective tax rate of 4% reflects the estimated annual effective tax rate as prescribed by paragraph 19 of APB Opinion No. 28, Interim Financial Reporting (“APB 28”), of 9%, less certain relatively minor discrete tax benefits to arrive at the overall effective tax rate for the quarter ended December 31, 2008 of 4%. The APB 28 estimated annual effective tax rate is based on a forecasted pretax ordinary income, and after taking into account forecast permanent differences, the impact of originating and reversing temporary differences on current tax expense (including the reversal related to the bad debt write-off as described above), and utilization of available tax credits, a current tax liability was computed that yielded the 9% estimated annual effective tax rate. As forecast deferred tax expense for the fiscal year is zero after consideration of the full valuation allowance position with respect to all net deferred tax assets, the 9% effective tax rate represents the APB 28 tax rate as of December 31, 2008. Certain discrete return-to-accrual adjustments brought the overall effective rate for the quarter-ended December 31, 2008 to 4%. The Company has no federal tax loss carryforward as of September 30, 2008.

The Company continued to maintain the posture established at the quarter ended March 31, 2008 that all net deferred tax assets are fully offset by a valuation allowance. Further, the reduction in the valuation allowance recorded against net deferred tax assets was directly attributable to the reduction in such deferred tax assets, primarily relating to the write off of the bad debt reserve in the quarter ended December 31, 2008. As of December 31, 2008, the net deferred tax asset position per the financial statements remained zero as a result of the full valuation allowance posture, and the Company’s recognition of the negative evidence (operating pre-tax losses for the three previous fiscal years) that exists in the evaluation of its deferred tax position, notwithstanding that the Company generated positive net income in the last fiscal quarter.

The 9% estimated annual effective tax rate as determined by the Company for the fiscal year ending September 30, 2009 reflects the significant impact of the specific bad debt write-off in the current year relative to forecasted earnings.

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Three Months Ended December 31, 2008 and 2007, page 13

12. You disclose that net sales increased $5.8 million, or 123% to $10.6 million, for the three months ended December 31, 2008 from the same period in fiscal 200[8] [sic], primarily related to growth in flat panel display sales to various customers of $5.0 million and $0.8 million in Engineering-modification and design sales for several projects completed for a major customer. Considering the impact of the bankruptcy of Eclipse Aviation, from whom you had anticipated to receive $4.5 million in sales per quarter, a reasonably detailed explanation of the strategy you developed and pursued to nevertheless realize increases in revenues would appear to be warranted. Please tell us if these sales represent contracts to retrofit 757/67 airplanes with flat panel display systems, and if so, tell us what consideration you gave to disclosing entry into specific new agreements, events that led to increases in sales under existing agreements, or arrangements that played a significant role in your substantial revenue growth.

Response:

The Company notes the Staff’s comment and respectfully submits that the increase in revenues for the three months ended December 31, 2008 was not due to the entry into new agreements, new events that led to increases in sales under existing agreements or any new arrangements that are required to be discussed in the MD&A for the quarter. Instead, the increase in revenue compared to the same quarter in the prior year was due to existing backlog, which was $57.3 million as of September 30, 2008, as indicated on page 8 of the Company’s Form 10-K. The increase in revenue was also due to programs that have been in effect with customers under contracts entered into during prior quarters which have begun to produce increased revenues consistent with the Company’s budgeted amounts, in particular under existing contracts with both American Airlines and Federal Express. Any revenues that would have been generated from Eclipse had Eclipse not declared bankruptcy would have been earned in addition to the revenues that the Company actually earned during the quarter. There was no new strategy or plan entered into to offset the loss of the Eclipse revenues with revenues from other customers that the Company could explain in the MD&A that accounts for the Company’s increased revenues during the three months ended December 31, 2008.

If you have any questions or comments regarding the foregoing, please feel free to contact the undersigned at 215.994.2621. Thank you for your cooperation and attention to this matter.

| Sincerely, |

|

|

|

|

| Stephen M. Leitzell, Esq. |

cc: | Geoffrey S. M. Hedrick |

| John C. Long |

| Henry N. Nassau, Esq. |

Exhibit A

Eclipse Flat Panel Display – Front View

Exhibit B

Eclipse Flat Panel Display Harness wiring and sensors

Exhibit C

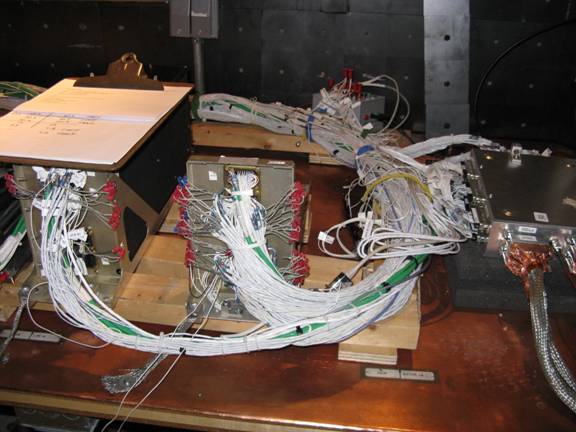

Component wiring

Exhibit D

Eclipse rear view of wiring harnesses