Exhibit 1

Japan

This description of Japan is dated August 12, 2016, and appears as Exhibit 1 to Japan’s Annual Report on Form 18-K to the U.S. Securities and Exchange Commission for the fiscal year ended March 31, 2016.

1

THE DELIVERY OF THIS DOCUMENT AT ANY TIME DOES NOT IMPLY THAT THE INFORMATION IS CORRECT AS OF ANY TIME SUBSEQUENT TO ITS DATE. THIS DOCUMENT (OTHERWISE THAN AS PART OF A PROSPECTUS CONTAINED IN A REGISTRATION STATEMENT FILED UNDER THE U.S. SECURITIES ACT OF 1933) DOES NOT CONSTITUTE AN OFFER TO SELL OR THE SOLICITATION OF AN OFFER TO BUY ANY SECURITIES OF OR GUARANTEED BY JAPAN.

TABLE OF CONTENTS

| | | | |

GENERAL | | | 4 | |

Area and Population | | | 4 | |

Government | | | 4 | |

Political Parties | | | 4 | |

Leadership | | | 5 | |

International Organizations | | | 5 | |

THE ECONOMY | | | 7 | |

General | | | 7 | |

Gross Domestic Product and National Income | | | 9 | |

Industry | | | 11 | |

Energy | | | 11 | |

Price Indices | | | 13 | |

Labor | | | 13 | |

Aging Workforce and Population Decrease | | | 14 | |

FOREIGN TRADE AND BALANCE OF PAYMENTS | | | 16 | |

Foreign Trade | | | 16 | |

Balance of Payments | | | 18 | |

Foreign Exchange Rates | | | 19 | |

FINANCIAL SYSTEM | | | 20 | |

The Bank of Japan and Monetary Policy | | | 20 | |

Government Financial Institutions | | | 21 | |

Private Financial Institutions | | | 22 | |

GOVERNMENT FINANCE | | | 23 | |

Revenues, Expenditures and Budgets | | | 23 | |

Tax Structure | | | 28 | |

Fiscal Investment and Loan Program | | | 28 | |

DEBT RECORD | | | 29 | |

JAPAN’S PUBLIC DEBT | | | 29 | |

INTERNAL DEBT | | | 31 | |

Direct Debt of the Japanese Government | | | 31 | |

Debt Guaranteed by the Japanese Government | | | 34 | |

EXTERNAL DEBT | | | 35 | |

Debt Guaranteed by the Japanese Government | | | 35 | |

SUBSCRIPTIONS TO INTERNATIONAL FINANCIAL ORGANIZATIONS | | | 36 | |

2

FURTHER INFORMATION

This document appears as an exhibit to Japan’s Annual Report filed with the U.S. Securities and Exchange Commission (the “Commission”) on Form 18-K for the fiscal year ended March 31, 2016. Additional information with respect to Japan is available in such Annual Report, in the other exhibits to such Annual Report and in amendments thereto. Such Annual Report, exhibits and amendments may be inspected and copied at the public reference room maintained by the Commission at: 100 F Street, N.E., Washington, D.C. 20549. Information regarding the operations of the public reference room can be obtained by calling the Commission at 1-800-SEC-0330. The Annual Report and its exhibits and amendments are also available through the Commission’s Internet website at http://www.sec.gov.

In this document all amounts are expressed in Japanese Yen (“¥” or “yen”), except as otherwise specified. The spot buying rate quoted on the Tokyo Foreign Exchange Market on August 10, 2016 as reported by The Bank of Japan at 5:00 p.m., Tokyo time, was ¥101.49=$1.00, and the noon buying rate on August 5, 2016 for cable transfers in New York City payable in yen, as reported by the Federal Reserve Bank of New York, was ¥101.74=$1.00. See “Foreign Trade and Balance of Payments — Foreign Exchange Rates”.

References herein to Japanese fiscal years (“JFYs”) are to 12-month periods commencing in each case on April 1 of the year indicated and ending on March 31 of the following year. References to years not specified as being JFYs are to calendar years.

3

Japan

GENERAL

Area and Population

Japan, an archipelago in the western Pacific, consists of four main islands (Hokkaido, Honshu, Kyushu and Shikoku) which are mostly mountainous located in the same approximate range of latitude as the east coast of the United States north of Florida. The total area of Japan is approximately 146,000 square miles, which is slightly less than that of California and about 4% of the United States. It is bordered by the Sea of Japan to the west and north, and by the Pacific Ocean to the east and south.

Japan has a total population of approximately 127.0 million (estimated as of July 1, 2016). It has one of the highest population densities in the world and approximately 23% of its people (estimated as of October 1, 2014) are concentrated in three metropolitan areas (Tokyo, Osaka and Nagoya). Japan’s average annual rate of population decrease during the years 2011-2015 showed a decline rate of 0.5%. Japan’s population decreased 0.02% during the 12 months ended October 1, 2015.

Government

The legislative power in Japan is vested in the Diet, which currently consists of a House of Representatives having 475 members and a House of Councillors having 242 members. Members of both houses are elected by direct universal suffrage, except that some members of each house are elected by proportional representation. The power of the House of Representatives is superior to that of the House of Councillors in respect of approving certain matters including the national budget and electing the Prime Minister.

The executive power is vested in the Cabinet consisting of a Prime Minister, elected by the Diet from among its members, and other Ministers appointed by the Prime Minister, a majority of whom must be members of the Diet. The judicial power is vested in the Supreme Court and such lower courts as are established by law.

Japan’s 47 prefectures, and its cities, towns and villages, have a certain degree of local autonomy through popularly elected legislative bodies and chief executives. The central government exercises its influence on local governments indirectly through financial aid and prescribing standards of local administration.

Political Parties

Members of the House of Representatives are elected for four-year terms unless the House of Representatives is dissolved prior to expiration of their terms. The House of Representatives was dissolved on November 21, 2014 and an election was held on December 14, 2014. 295 members were elected from single-member districts and 180 members were elected through a proportional representation process from 11 regional districts. The House of Councillors currently consists of 242 members who are elected for six-year terms with one-half of the membership being elected every three years. In an election in July 2016, 121 members were elected, of which 48 members were elected through a proportional representation system and 73 members were elected from 45 districts that correspond to the 47 prefectures of Japan. Currently, the House of Councillors consists of 121 members whose term expires in July 2019 and 121 members whose term expires in July 2022.

4

The following tables set forth the membership by political party of the House of Representatives as of July 26, 2016 and the House of Councillors as of July 27, 2016.

| | | | |

| | | House of

Representatives | |

Liberal Democratic Party | | | 289 | |

The Democratic Party and Club of Independents | | | 96 | |

Komeito | | | 35 | |

Japanese Communist Party | | | 21 | |

Initiatives from Osaka | | | 15 | |

The People’s Life Party & Taro Yamamoto and Friends | | | 2 | |

Social Democratic Party | | | 2 | |

Independents | | | 13 | |

Vacancies | | | 2 | |

| | | | |

Total | | | 475 | |

| | | | |

Source: House of Representatives.

| | | | |

| | | House of

Councillors | |

Liberal Democratic Party | | | 123 | |

The Democratic Party and The Shin-Ryokufukai | | | 51 | |

Komeito | | | 25 | |

Japanese Communist Party | | | 14 | |

Initiatives from Osaka | | | 12 | |

Independents Club | | | 5 | |

Kibounokai | | | 5 | |

The Party for Japanese Kokoro | | | 3 | |

Okinawa no kaze | | | 2 | |

Independents | | | 2 | |

Vacancies | | | 0 | |

| | | | |

Total | | | 242 | |

| | | | |

Source: House of Councillors.

Leadership

Japan’s current Prime Minister is Shinzo Abe, a member of the Liberal Democratic Party of Japan and member of the House of Representatives in the Diet. As the Liberal Democratic Party of Japan took its position as the ruling party as a result of the House of Representatives election, Mr. Abe was formally appointed as Japan’s 96th Prime Minister by the Emperor on December 26, 2012 and succeeded the former Prime Minister Yoshihiko Noda, who is a member of the Democratic Party of Japan. After the Democratic Party of Japan became the ruling party in September 2009, Mr. Noda served as the last Prime Minister of the Democratic Party of Japan from September 2, 2011.

International Organizations

Japan is a member of the United Nations and other international organizations, including the International Monetary Fund, International Bank for Reconstruction and Development, International Development Association, International Finance Corporation, International Fund for Agricultural Development, Multilateral Investment Fund, Multilateral Investment Guarantee Agency, Asian Development Bank, African Development Bank, African Development Fund, European Bank for Reconstruction and Development, Inter-American Development Bank and Inter-American Investment Corporation. See “Subscriptions to International Financial Organizations”.

5

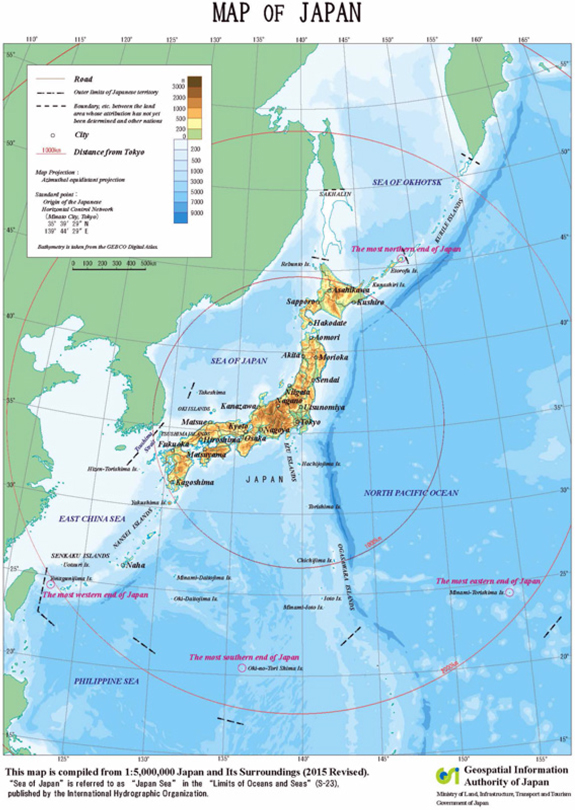

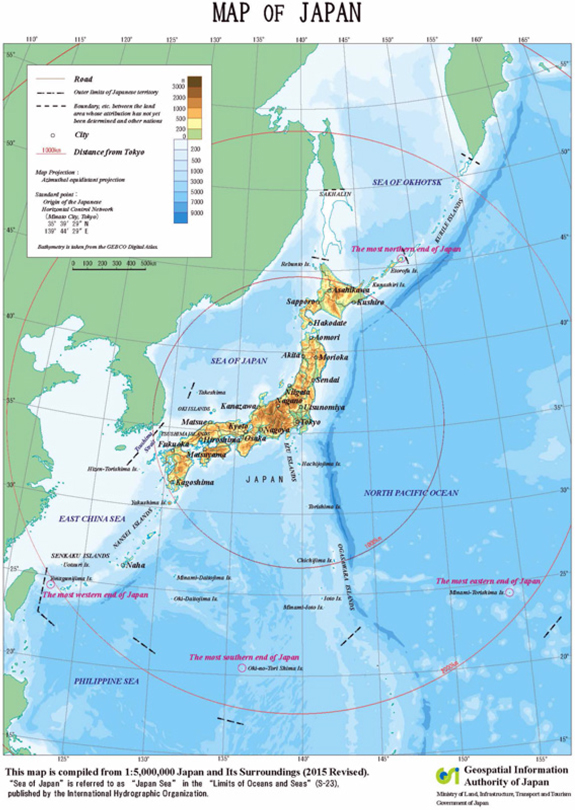

The following is a map of Japan, illustrating its location with respect to neighboring countries:

6

THE ECONOMY

General

Japan has a highly advanced and diversified economy, which has developed in response to changing conditions in Japan and the world. During the era of high economic growth in the 1960s and the early 1970s, the expansion was based on the development of heavy industries consuming large quantities of resources. During the 1980s, there was rapid growth in high value-added industries, such as electronics and precision instruments, which employ high level technology and consume relatively low quantities of resources. The service sector of the economy grew significantly during the 1980s and 1990s.

While the Japanese economy expanded during the period from 2002 to 2007, amidst that expansion, and prior to the global economic crisis of 2008, Japan continued to face several domestic economic difficulties. Among other things, domestic consumption contributed to the economic recovery to a lesser degree than was the case in prior economic growth periods. Also, despite the improving employment environment at the time, the average wage failed to grow appreciably. While those Japanese manufacturing companies with a global competitive edge achieved growth on the back of the favorable world economy, small-to-medium enterprises and the non-manufacturing sectors realized only limited productivity growth and profitability. This in turn caused imbalance in the level of economic recovery among the different regions in Japan. In the longer term, Japan faced a declining population, mass retirement of the baby boomer generation, environmental/energy conservation agenda, and fiscal deficit problem. Against this backdrop, the subprime loan crisis in the United States and increases in the prices of energy and raw materials precipitated weakness in the global economy, causing the Japanese economy to deteriorate. Throughout JFY 2008, the global economy continued to worsen, as the collapse of several major financial institutions in the United States and other factors contributed to a credit tightening, volatility in stock, currency and other markets, loss of consumer confidence and decrease in business and industrial activities on a global basis. The Japanese economy was also adversely affected by these factors, especially as Japan’s export sector was hit by the decline in global demand and appreciation of the yen against other major currencies. After February 2008, Japan had entered a recession. The Japanese economy in JFY 2010 picked up, despite a difficult situation where the unemployment rate remained at a high level.

On March 11, 2011, just as the Japanese economy was in a transition from the state of stagnation to recovery, the Great East Japan Earthquake (“Earthquake”) struck Japan. As a result, the Japanese economy posted negative growth for the first and second quarter in 2011. Unlike the cases of the Great Hanshin-Awaji Earthquake in 1995 or Hurricane Katrina in 2005, personal consumption declined on a nationwide basis, with consumer sentiment deteriorating sharply after the Earthquake. The Earthquake had a severe impact on production in Japan through the shutdown of damaged factories, disruptions of the supply chains and power supply constraints. In particular, the Earthquake affected Japan’s auto industry which depends on the Tohoku region for the supply of key parts including semiconductors and other electronic components. The supply constraints and the slower growth in corporate earnings in the aftermath of the Earthquake also put downward pressure on capital investment activities. The Earthquake was accompanied by a nuclear power plant accident, which not only caused power supply constraints but also had a chilling effect on certain business activities, such as in the tourism and leisure sectors. Following the Earthquake, the number of visitors to Japan from foreign countries dropped by approximately half from the monthly averages in the prior year. The Earthquake and its aftermath prompted the Government of Japan to compile a series of supplementary budgets to support reconstruction efforts. On May 2, 2011, a first supplementary budget of approximately ¥4 trillion was approved by the Diet to finance reconstruction relating to damages from the Earthquake and tsunami. The budget was aimed at disaster relief, including providing temporary housing, rebuilding of facilities and disaster assistance loans. On July 25, 2011, the Japanese government approved a second supplementary budget of approximately ¥2 trillion aimed at further disaster relief, including increasing the Contingency Reserve for Recovery from the Great East Japan Earthquake. On November 21, 2011, the Japanese government approved the third supplementary budget of approximately ¥12 trillion aimed at disaster relief, including provision of emergency support to people affected by the disaster and reconstruction of public utilities and facilities. On February 8, 2012, the Japanese government approved the fourth supplementary budget of approximately ¥2.5 trillion aimed at meeting additional financial demand of utmost necessity and urgency.

7

The Earthquake and the nuclear disaster in Fukushima were followed by severe flooding that occurred at the end of July 2012 in Thailand, Japan’s sixth largest trading country in export and ninth in import. The suspended operations of the local factories in Thailand suppressed Japan’s Thailand bound exports of goods including intermediary materials for cars and electronics and thereby adversely affected the Japanese economy.

Thus, JFY 2011 started in a very challenging environment, with the Earthquake seriously crippling the economy, which posted negative growth for the first quarter. Over time, the government and the people joined forces in an all-out effort to rebuild the social and economic infrastructure, facilitating a rapid recovery of the supply chains and helping the economy on a track to a gradual recovery. Since the summer of 2011, however, the rapid appreciation in yen, the reduced external demand due to the Thai flooding (as described above) and deceleration in the world economy stemming from the European sovereign debt crisis kept such recovery to a modest level.

In December 2012, the Cabinet Office of the Government of Japan announced “Abenomics” (named after the incumbent Prime Minister Shinzo Abe), an economic strategy of pursuing an expansionary monetary policy, a flexible fiscal policy and an economic growth agenda that promotes private investment, with the goal of achieving GDP growth and job creation. Pursuant to this strategy, specific measures to be implemented include accelerating reconstruction efforts in areas damaged by the Great East Japan Earthquake, increasing stimulus spending and subsidies aimed at strategically important sectors and utilizing a more flexible approach to economic and fiscal management.

Additionally, in January 2013, the Government of Japan and the Bank of Japan issued a joint statement announcing measures to overcome deflation and achieve sustainable economic growth with price stability in order to establish a sustainable fiscal structure and sound fiscal management. In March 2013, Mr. Haruhiko Kuroda, former President of the Asian Development Bank, was appointed as governor of the Bank of Japan. In April 2013, the Bank of Japan announced its new quantitative and qualitative monetary easing policy, under which the Bank of Japan is aiming to achieve a price stability target of 2% in terms of the year-on-year rate of change in the consumer price index at the earliest possible time, with a time horizon of about two years. The real GDP marked an increase of 0.8% during JFY 2015, with the nominal GDP posting a positive growth by 2.2%. The Cabinet Office of the Government of Japan currently expects the Japanese economy to recover moderately during JFY 2016, posting real GDP growth of 1.7% and the nominal GDP growth of 3.1%. The Japanese Diet has passed comprehensive social security and tax reform, including an increase in the consumption tax rate from 5% to 8% in 2014, and from 8% to 10% in 2015, subject to certain conditions. Accordingly, the consumption tax rate was increased to 8% in April 2014. However, the planned increase in the consumption tax rate from 8% to 10% has been postponed to October 2019. In addition, the effective corporate tax rate was reduced from 34.62% to 32.11% for JFY 2015 and it was further reduced to 29.97% for JFY 2016.

The Japanese economy faces certain challenges. Challenges for the Japanese economy include, as further described herein, an increased dependence on LNG and other energy imports as a result of the nuclear accident at the Fukushima Daiichi Nuclear Plant and suspension of operations at other nuclear power plants and, over the long term, demographic challenges, such as an aging workforce and population decrease, and the high levels of public debt and associated debt servicing payments.

8

Gross Domestic Product and National Income

The following table sets forth information pertaining to Japan’s gross domestic product for JFY 2011 through JFY 2015.

Gross Domestic Product

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | JFY 2011 | | | JFY 2012 | | | JFY 2013 | | | JFY 2014 | | | JFY 2015 | | | Percentage

of

JFY 2015

GDP | |

| | | (yen amounts in billions) | |

Total Consumption | | | | | | | | | | | | | | | | | | | | | | | | |

Private sectors | | ¥ | 286,429 | | | ¥ | 288,370 | | | ¥ | 295,659 | | | ¥ | 293,206 | | | ¥ | 291,828 | | | | 58.3 | % |

Public sectors | | | 96,649 | | | | 97,468 | | | | 98,823 | | | | 100,961 | | | | 102,222 | | | | 20.4 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | 383,078 | | | | 385,837 | | | | 394,482 | | | | 394,167 | | | | 394,050 | | | | 78.8 | |

Total Gross Capital Formation | | | | | | | | | | | | | | | | | | | | | | | | |

Private sectors | | | | | | | | | | | | | | | | | | | | | | | | |

Producers’ Durable Equipment | | | 64,317 | | | | 64,798 | | | | 67,355 | | | | 68,391 | | | | 70,075 | | | | 14.0 | |

Residential Construction | | | 13,414 | | | | 14,095 | | | | 15,785 | | | | 14,438 | | | | 14,759 | | | | 2.9 | |

Public sectors | | | 20,804 | | | | 20,969 | | | | 23,568 | | | | 23,668 | | | | 23,041 | | | | 4.6 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | 98,535 | | | | 99,862 | | | | 106,709 | | | | 106,496 | | | | 107,874 | | | | 21.6 | |

Additions to Business Inventories | | | | | | | | | | | | | | | | | | | | | | | | |

Private sectors | | | (1,431 | ) | | | (1,080 | ) | | | (2,842 | ) | | | 194 | | | | 1,585 | | | | 0.3 | |

Public sectors | | | 67 | | | | (37 | ) | | | 16 | | | | 97 | | | | 5 | | | | 0.0 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | (1,364 | ) | | | (1,116 | ) | | | (2,826 | ) | | | 290 | | | | 1,591 | | | | 0.3 | |

Net Exports of Goods and Services | | | (6,079 | ) | | | (10,180 | ) | | | (15,964 | ) | | | (11,393 | ) | | | (3,135 | ) | | | -0.6 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

Nominal Gross Domestic Expenditures | | ¥ | 474,171 | | | ¥ | 474,404 | | | ¥ | 482,401 | | | ¥ | 489,560 | | | ¥ | 500,380 | | | | 100.0 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

Real Gross Domestic Expenditures(a) | | ¥ | 514,695 | | | ¥ | 519,547 | | | ¥ | 529,765 | | | ¥ | 524,784 | | | ¥ | 529,044 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Surplus of the Nation on Current Account | | | | | | | | | | | | | | | | | | | | | | | | |

Exports of Goods and Services and Other Receipts from Abroad | | | 20,568 | | | | 21,683 | | | | 25,185 | | | | 30,416 | | | | 33,763 | | | | | |

Less: Imports of Goods and Services and Other Payments Abroad | | | (5,812 | ) | | | (6,287 | ) | | | (7,225 | ) | | | (9,388 | ) | | | (10,907 | ) | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | 14,756 | | | | 15,396 | | | | 17,959 | | | | 21,028 | | | | 22,856 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Gross National Income | | ¥ | 488,927 | | | ¥ | 489,800 | | | ¥ | 500,360 | | | ¥ | 510,589 | | | ¥ | 523,236 | | | | | |

Percentage Changes of GDP from Previous Year | | | | | | | | | | | | | | | | | | | | | | | | |

At Nominal Prices | | | -1.3 | % | | | 0.0 | % | | | 1.7 | % | | | 1.5 | % | | | 2.2 | % | | | | |

At Real Prices(a) | | | 0.4 | | | | 0.9 | | | | 2.0 | | | | -0.9 | | | | 0.8 | | | | | |

Deflator | | | -1.7 | | | | -0.9 | | | | -0.3 | | | | 2.4 | | | | 1.4 | | | | | |

| (a) | Real prices are based on calendar year 2005. |

Source: Economic and Social Research Institute, Cabinet Office

9

The following table sets forth information pertaining to Japan’s gross domestic product, as seasonally adjusted, for each of the eight quarters ended March 31, 2016.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Quarterly Gross Domestic Product(a) | |

| | | 2014 | | | 2015 | | | 2016 | |

| | | Second

Quarter | | | Third

Quarter | | | Fourth

Quarter | | | First

Quarter | | | Second

Quarter | | | Third

Quarter | | | Fourth

Quarter | | | First

Quarter | |

| | | (yen amounts in billions) | |

Nominal Gross Domestic Expenditures(b) | | ¥ | 487,078 | | | ¥ | 483,821 | | | ¥ | 488,671 | | | ¥ | 498,308 | | | ¥ | 497,396 | | | ¥ | 501,135 | | | ¥ | 500,232 | | | ¥ | 503,238 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Real Gross Domestic Expenditures(b)(c) | | ¥ | 524,219 | | | ¥ | 520,676 | | | ¥ | 523,409 | | | ¥ | 530,113 | | | ¥ | 527,896 | | | ¥ | 530,138 | | | ¥ | 527,794 | | | ¥ | 530,235 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Percentage Changes of GDP from the Previous Quarter At Nominal Prices(d) | | | -0.1% | | | | -0.7% | | | | 1.0% | | | | 2.0% | | | | -0.2% | | | | 0.8% | | | | -0.2% | | | | 0.6% | |

At Real Prices(c)(d) | | | -2.0 | | | | -0.7 | | | | 0.5 | | | | 1.3 | | | | -0.4 | | | | 0.4 | | | | -0.4 | | | | 0.5 | |

Deflator(d) | | | 2.0 | | | | 0.0 | | | | 0.5 | | | | 0.7 | | | | 0.2 | | | | 0.3 | | | | 0.3 | | | | 0.1 | |

| (a) | Quarterly GDP financial data are subject to change. |

| (b) | Numbers are based on seasonally-adjusted GDP figures. |

| (c) | Real prices are based on calendar year 2005. |

| (d) | Percentage changes are based on seasonally-adjusted GDP figures. |

Source: Economic and Social Research Institute, Cabinet Office.

Per Capita Gross Domestic Product

The following table indicates per capita gross domestic product for the last five years:

| | | | |

| | | Per Capita GDP |

Fiscal Year | | Amount

(in thousands of yen) | | Year-on-year change (%) |

2010 | | 3,753 | | 1.4 |

2011 | | 3,712 | | (1.1) |

2012 | | 3,721 | | 0.2 |

2013 | | 3,790 | | 1.9 |

2014 | | 3,853 | | 1.7 |

National Income

The following table sets forth national income for calendar year 2010 through calendar year 2014.

| | | | | | | | | | | | | | | | | | | | |

| | | National Income | |

| | | 2010 | | | 2011 | | | 2012 | | | 2013 | | | 2014 | |

| | | (yen amounts in billions) | |

| | | | | |

Domestic Factor Income | | ¥ | 340,494 | | | ¥ | 332,884 | | | ¥ | 337,967 | | | ¥ | 338,901 | | | ¥ | 342,786 | |

Net Income from Abroad | | | 12,974 | | | | 14,675 | | | | 15,055 | | | | 17,641 | | | | 19,690 | |

| | | | | | | | | | | | | | | | | | | | |

National Income at Factor Cost | | ¥ | 353,469 | | | ¥ | 347,559 | | | ¥ | 353,021 | | | ¥ | 356,542 | | | ¥ | 362,475 | |

| | | | | | | | | | | | | | | | | | | | |

Percentage Changes of Income at Factor Cost from Previous Year | | | 3.9 | % | | | -1.7 | % | | | 1.6 | % | | | 1.0 | % | | | 1.7 | % |

Source: Economic and Social Research Institute, Cabinet Office.

10

Industry

The following table sets forth the proportion of gross domestic product contributed by major industrial sectors of the economy for calendar year 2010 through calendar year 2014.

GDP by Industrial Sectors (at nominal prices)

| | | | | | | | | | | | | | | | | | | | |

| | | 2010 | | | 2011 | | | 2012 | | | 2013 | | | 2014 | |

Industry | | | | | | | | | | | | | | | | | | | | |

Agriculture, Forestry and Fisheries | | | 1.2% | | | | 1.2% | | | | 1.2% | | | | 1.2% | | | | 1.2% | |

Mining | | | 0.1 | | | | 0.1 | | | | 0.1 | | | | 0.1 | | | | 0.1 | |

Manufacturing | | | 19.5 | | | | 18.5 | | | | 18.5 | | | | 18.4 | | | | 18.5 | |

Construction | | | 5.4 | | | | 5.6 | | | | 5.6 | | | | 5.9 | | | | 6.1 | |

Electric Power Generation, Gas and Water | | | 2.3 | | | | 1.8 | | | | 1.7 | | | | 1.7 | | | | 2.0 | |

Wholesale and Retail Trade | | | 13.7 | | | | 14.2 | | | | 14.3 | | | | 14.3 | | | | 14.1 | |

Finance and Insurance | | | 4.9 | | | | 4.8 | | | | 4.6 | | | | 4.5 | | | | 4.3 | |

Real Estate | | | 11.8 | | | | 12.0 | | | | 11.9 | | | | 11.7 | | | | 11.6 | |

Transportation | | | 4.9 | | | | 4.8 | | | | 5.0 | | | | 4.9 | | | | 5.0 | |

Communication | | | 5.4 | | | | 5.5 | | | | 5.5 | | | | 5.5 | | | | 5.5 | |

Services | | | 18.9 | | | | 19.3 | | | | 19.6 | | | | 19.7 | | | | 19.6 | |

| | | | | | | | | | | | | | | | | | | | |

Total | | | 88.0 | | | | 87.8 | | | | 87.9 | | | | 87.9 | | | | 87.9 | |

Public Services | | | | | | | | | | | | | | | | | | | | |

Electric Power Generation, Gas and Water | | | 0.6 | | | | 0.6 | | | | 0.6 | | | | 0.6 | | | | 0.6 | |

Services | | | 2.4 | | | | 2.4 | | | | 2.4 | | | | 2.3 | | | | 2.4 | |

Public Administration | | | 6.1 | | | | 6.3 | | | | 6.2 | | | | 6.1 | | | | 6.1 | |

| | | | | | | | | | | | | | | | | | | | |

Total | | | 9.1 | | | | 9.3 | | | | 9.2 | | | | 9.0 | | | | 9.0 | |

Non-Profit Services | | | 2.1 | | | | 2.3 | | | | 2.4 | | | | 2.3 | | | | 2.3 | |

| | | | | | | | | | | | | | | | | | | | |

Total | | | 99.2% | | | | 99.4% | | | | 99.5% | | | | 99.2% | | | | 99.2% | |

Source: Economic and Social Research Institute, Cabinet Office, Annual Report on National Accounts.

Energy

The following table sets forth the total amounts of primary energy supplied and the percentages supplied by different sources for JFY 2010 through JFY 2014.

| | | | | | | | | | | | |

| | | Total Primary Energy Supplied

(peta-joules) | | Sources of Primary Energy Supplied(a) |

JFY | | | Oil | | Coal | | Nuclear | | Natural

Gas | | Other |

2010 | | 23,200 | | 39.8% | | 22.5% | | 11.1% | | 19.2% | | 7.5% |

2011 | | 22,047 | | 42.8 | | 21.9 | | 4.1 | | 23.3 | | 7.9 |

2012 | | 21,721 | | 44.1 | | 23.3 | | 0.7 | | 24.5 | | 7.4 |

2013 | | 21,980 | | 42.7 | | 25.1 | | 0.4 | | 24.2 | | 7.6 |

2014 | | 21,056 | | 41.4 | | 25.5 | | 0.0 | | 25.2 | | 7.8 |

| (a) | Figures represent the proportion of each source as a share of the domestic primary energy supplied. Domestic primary energy supplied is total primary energy supplied less exports and inventory adjustments. |

| (b) | Standard heating value by energy source, which is used to create total primary energy supplied statistics, is revised every five years. Figures represent the revised standard heating value by energy source. |

Source: Agency for Natural Resources and Energy, Ministry of Economy, Trade and Industry, Report on Energy Supply and Demand.

11

The table below sets forth information regarding crude oil imports for JFY 2011 through JFY 2015.

| | | | | | | | | | | | | | | | | | | | |

| | | JFY 2011 | | | JFY 2012 | | | JFY 2013 | | | JFY 2014 | | | JFY 2015 | |

Volume of imports (thousand kilo-liters per day) | | | 575 | | | | 578 | | | | 587 | | | | 530 | | | | 546 | |

Cost of imports (c.i.f. in billions of yen) | | ¥ | 11,894 | | | ¥ | 12,526 | | | ¥ | 14,826 | | | ¥ | 11,860 | | | ¥ | 7,370 | |

Average price (c.i.f. in yen kilo-liters) | | ¥ | 56,681 | | | ¥ | 59,357 | | | ¥ | 69,224 | | | ¥ | 61,279 | | | ¥ | 36,995 | |

Source: Customs and Tariff Bureau, Ministry of Finance.

Japan has historically depended on oil for most of its energy requirements and almost all its oil is imported, mostly from the Middle East. Oil price movements thus have a major impact on the domestic economy. In recent years, as the demand for oil in emerging economies such as China and India has expanded and the geopolitical tension in the Middle East worsened, crude oil prices increased significantly.

Japan has worked to reduce its dependence on oil by encouraging energy conservation and the use of alternative fuels. In addition, a restructuring of industry, with emphasis shifting from primary industries to processing and assembly type industries and from manufacturing industry to service industry, has also contributed to the reduction of oil consumption.

The following table sets forth information relating to total electric power generating capacity and electric power generation for JFY 2010 through JFY 2014.

| | | | | | | | | | | | | | | | | | | | |

| | | JFY 2010 | | | JFY 2011 | | | JFY 2012 | | | JFY 2013 | | | JFY 2014 | |

Electric power generating capacity(a) | | | (megawatts) | |

Fossil Fuel | | | 182,381 | | | | 185,309 | | | | 188,904 | | | | 191,258 | | | | 193,356 | |

Nuclear | | | 48,960 | | | | 48,960 | | | | 46,148 | | | | 44,264 | | | | 44,264 | |

Hydro-electric | | | 48,111 | | | | 48,419 | | | | 48,934 | | | | 48,932 | | | | 49,597 | |

Other | | | 2,863 | | | | 3,041 | | | | 3,341 | | | | 4,717 | | | | 7,343 | |

| | | | | | | | | | | | | | | | | | | | |

Total | | | 282,315 | | | | 285,729 | | | | 287,327 | | | | 289,171 | | | | 294,560 | |

| | | | | | | | | | | | | | | | | | | | |

Electric power generation: | | | (gigawatt-hours) | |

Fossil Fuel | | | 771,306 | | | | 906,946 | | | | 986,758 | | | | 987,345 | | | | 955,352 | |

Nuclear | | | 288,230 | | | | 101,761 | | | | 15,939 | | | | 9,303 | | | | — | |

Hydro-electric | | | 90,681 | | | | 91,709 | | | | 83,645 | | | | 84,885 | | | | 86,942 | |

Other | | | 6,670 | | | | 7,412 | | | | 7,607 | | | | 8,949 | | | | 11,423 | |

| | | | | | | | | | | | | | | | | | | | |

Total | | | 1,156,888 | | | | 1,107,829 | | | | 1,093,950 | | | | 1,090,482 | | | | 1,053,717 | |

| | | | | | | | | | | | | | | | | | | | |

| (a) | At the end of fiscal year — March 31 |

Source: Handbook of Electric Power Industry, Agency for Natural Resources and Energy, Ministry of Economy, Trade and Industry.

12

Price Indices

The table below sets forth information concerning changes in Japan’s Corporate Goods and consumer price indices for the periods indicated.

| | | | | | | | | | | | | | | | |

| | | Corporate Goods Price

Index(a) | | | Consumer Price

Index(b) | |

| | | Index(c) | | | Annual %

Change | | | Index | | | Annual %

Change | |

2011 | | | 101.5 | | | | 1.5 | | | | 99.7 | | | | -0.3 | |

2012 | | | 100.6 | | | | -0.9 | | | | 99.7 | | | | 0.0 | |

2013 | | | 101.9 | | | | 1.3 | | | | 100.0 | | | | 0.4 | |

2014 | | | 105.1 | | | | 3.2 | | | | 102.8 | | | | 2.7 | |

2015 | | | 102.7 | | | | -2.3 | | | | 103.6 | | | | 0.8 | |

| (a) | All commodities. Calendar year 2010=100. Source: Domestic Corporate Goods Price Index, Bank of Japan. |

| (b) | General index. Calendar year 2010=100. Source: Consumer Price Index, Statistics Bureau, Ministry of Internal Affairs and Communications. |

| (c) | Indices are calculated using the monthly averages. |

Labor

The number of employees was on an upward trend from 2004 to 2007, decreased from 2008 to 2012 and recovered in 2013. In 2014, the average employment was estimated at 63.5 million, of which 24.4% were employed in mining, manufacturing and construction, 3.6% were employed in agriculture, forestry and fisheries, and 72.0% in services and other sectors. In 2015, the average employment was estimated at 63.8 million, of which 24.1% were employed in mining, manufacturing and construction, 3.6% were employed in agriculture, forestry and fisheries, and 72.3% were employed in services and other sectors. The unemployment rate (seasonally adjusted) in Japan gradually increased from 2008 to the middle of 2009, but has gradually decreased since the end of 2009. It ranged between 3.2% and 3.5% during 2015. (Note: Due to the impact of the Great East Japan Earthquake, it has become difficult to conduct a labor search in the following prefectures: Iwate, Miyagi and Fukushima. For this reason, the nationwide unemployment rate for the period between March 2011 and August 2011 does not account for these three prefectures.) The seasonally adjusted unemployment rate was 3.2% for January, 3.3% for February, 3.2% for March, 3.2% for April and 3.2% for May in 2016, the most recent five months for which statistics are available.

The following table indicates unemployment statistics for Japan for each of the last five years:

| | |

Calendar Year | | Unemployment Rate (%) |

2011 | | 4.6 |

2012 | | 4.3 |

2013 | | 4.0 |

2014 | | 3.6 |

2015 | | 3.4 |

| (Note) | From the Ministry of Internal Affairs and Communications “Labor Force Survey”. The unemployment rate for CY 2011 is based on an estimate with respect to Iwate, Miyagi and Fukushima Prefectures. |

The table below sets forth information regarding wage index (total cash earnings (nominal)) and industrial production index (manufacturing and mining) for the periods indicated.

| | | | | | | | | | | | | | | | |

| | | Wage Index(a) | | | Industrial

Production

Index(b) | |

Calendar Year | | Index(c) | | | Annual %

Change | | | Index | | | Annual %

Change | |

2011 | | | 99.8 | | | | -0.2 | | | | 97.2 | | | | -2.8 | |

2012 | | | 98.9 | | | | -0.9 | | | | 97.8 | | | | 0.6 | |

2013 | | | 98.5 | | | | -0.4 | | | | 97.0 | | | | -0.8 | |

2014 | | | 98.9 | | | | 0.4 | | | | 99.0 | | | | 2.1 | |

2015 | | | 99.0 | | | | 0.1 | | | | 97.8 | | | | -1.2 | |

| (a) | Calendar year 2010=100. Source: Monthly Labor Survey, Ministry of Health, Labor and Welfare. |

| (b) | Calendar year 2010=100. Source: Ministry of Economy, Trade and Industry. |

| (c) | Indices are calculated using the monthly averages. |

13

Aging Workforce and Population Decrease

One of the risks that the Japanese economy bears is the issue of the aging of the population accompanied with an overall population decrease. Aging and population decrease placed downward pressure on economic growth. The negative impact can be reduced by enhancing productivity and competitiveness through the further opening of the Japanese economy to the world. Aging and population decrease have an impact not only on the macro growth rate but also on spending patterns (such as the older generations spending more than younger generations on service consumption) and, consequently, the country’s economic structure.

The impact of the aging and shrinking population on Japan’s fiscal structure looms as a long-term risk. Social security benefit payments under the current system will increase. The ratio of pensions to national income are expected to remain at the same level, but that of welfare including medical benefits and nursing-care benefits is expected to increase. Aging and population decrease will thus modify the Japanese revenue structure. Furthermore, amid increasing capital mobility, it is imperative for Japan to foster an environment attractive to business enterprises. Under these circumstances, it has become more and more difficult to impose additional tax burdens on the income of individuals and corporations. The effects of the aging and shrinkage of the population would also be prominent in Japan’s regional economies.

The following table indicates the age distribution of Japan’s population:

Population and Percentage distribution by Age (5-Year Age Group)

| | | | | | | | | | | | | | | | | | | | |

| | | Both sex | |

Age groups | | 2005* | | | 2012 | | | 2013 | | | 2014 | | | 2015** | |

| | | Population (in thousands) | |

Total | | | 127,768 | | | | 127,515 | | | | 127,298 | | | | 127,083 | | | | 127,110 | |

| | | | | |

0 – 4 years old | | | 5,599 | | | | 5,273 | | | | 5,239 | | | | 5,213 | | | | 5,199 | |

5 – 9 | | | 5,950 | | | | 5,407 | | | | 5,361 | | | | 5,307 | | | | 5,302 | |

10 – 14 | | | 6,036 | | | | 5,868 | | | | 5,790 | | | | 5,713 | | | | 5,607 | |

15 – 19 | | | 6,593 | | | | 6,050 | | | | 6,047 | | | | 6,005 | | | | 5,983 | |

20 – 24 | | | 7,381 | | | | 6,272 | | | | 6,205 | | | | 6,203 | | | | 6,250 | |

| | | | | |

25 – 29 | | | 8,314 | | | | 7,048 | | | | 6,869 | | | | 6,678 | | | | 6,530 | |

30 – 34 | | | 9,795 | | | | 7,833 | | | | 7,623 | | | | 7,466 | | | | 7,325 | |

35 – 39 | | | 8,772 | | | | 9,420 | | | | 9,060 | | | | 8,670 | | | | 8,359 | |

40 – 44 | | | 8,113 | | | | 9,469 | | | | 9,667 | | | | 9,793 | | | | 9,808 | |

45 – 49 | | | 7,755 | | | | 8,205 | | | | 8,406 | | | | 8,608 | | | | 8,746 | |

| | | | | |

50 – 54 | | | 8,828 | | | | 7,678 | | | | 7,734 | | | | 7,791 | | | | 8,003 | |

55 – 59 | | | 10,294 | | | | 7,954 | | | | 7,731 | | | | 7,654 | | | | 7,570 | |

60 – 64 | | | 8,577 | | | | 10,246 | | | | 9,666 | | | | 8,980 | | | | 8,507 | |

65 – 69 | | | 7,460 | | | | 8,204 | | | | 8,699 | | | | 9,154 | | | | 9,729 | |

70 – 74 | | | 6,661 | | | | 7,396 | | | | 7,596 | | | | 7,928 | | | | 7,788 | |

| | | | | |

75 – 79 | | | 5,280 | | | | 6,253 | | | | 6,302 | | | | 6,269 | | | | 6,365 | |

80 – 84 | | | 3,423 | | | | 4,631 | | | | 4,762 | | | | 4,869 | | | | 5,023 | |

85 – 89 | | | 1,855 | | | | 2,780 | | | | 2,926 | | | | 3,063 | | | | 3,175 | |

90 – 94 | | | 843 | | | | 1,146 | | | | 1,216 | | | | 1,305 | | | | 1,389 | |

95 – 99 | | | 212 | | | | 331 | | | | 343 | | | | 352 | | | | 390 | |

| | | | | |

100 and over | | | 25 | | | | 51 | | | | 55 | | | | 60 | | | | 62 | |

| | | | | |

Regrouped | | | | | | | | | | | | | | | | | | | | |

0 – 14 years old | | | 17,585 | | | | 16,547 | | | | 16,390 | | | | 16,233 | | | | 16,108 | |

15 – 64 | | | 84,422 | | | | 80,175 | | | | 79,010 | | | | 77,850 | | | | 77,081 | |

65 and over | | | 25,761 | | | | 30,793 | | | | 31,898 | | | | 33,000 | | | | 33,921 | |

65 – 74 years old | | | 14,122 | | | | 15,601 | | | | 16,295 | | | | 17,082 | | | | 17,517 | |

75 and over | | | 11,639 | | | | 15,193 | | | | 15,603 | | | | 15,917 | | | | 16,405 | |

14

| | | | | | | | | | | | | | | | | | | | |

| | | Both sex | |

Age groups | | 2005* | | | 2012 | | | 2013 | | | 2014 | | | 2015** | |

| | | Percentage Distribution (%) | |

Total | | | 100.00 | | | | 100.00 | | | | 100.00 | | | | 100.00 | | | | 100.00 | |

| | | | | |

0 – 4 years old | | | 4.38 | | | | 4.13 | | | | 4.12 | | | | 4.10 | | | | 4.09 | |

5 – 9 | | | 4.66 | | | | 4.24 | | | | 4.21 | | | | 4.18 | | | | 4.17 | |

10 – 14 | | | 4.72 | | | | 4.60 | | | | 4.55 | | | | 4.50 | | | | 4.41 | |

15 – 19 | | | 5.16 | | | | 4.74 | | | | 4.75 | | | | 4.73 | | | | 4.71 | |

20 – 24 | | | 5.78 | | | | 4.92 | | | | 4.87 | | | | 4.88 | | | | 4.92 | |

| | | | | |

25 – 29 | | | 6.51 | | | | 5.53 | | | | 5.40 | | | | 5.25 | | | | 5.14 | |

30 – 34 | | | 7.67 | | | | 6.14 | | | | 5.99 | | | | 5.88 | | | | 5.76 | |

35 – 39 | | | 6.87 | | | | 7.39 | | | | 7.12 | | | | 6.82 | | | | 6.58 | |

40 – 44 | | | 6.35 | | | | 7.43 | | | | 7.59 | | | | 7.71 | | | | 7.72 | |

45 – 49 | | | 6.07 | | | | 6.43 | | | | 6.60 | | | | 6.77 | | | | 6.88 | |

| | | | | |

50 – 54 | | | 6.91 | | | | 6.02 | | | | 6.08 | | | | 6.13 | | | | 6.30 | |

55 – 59 | | | 8.06 | | | | 6.24 | | | | 6.07 | | | | 6.02 | | | | 5.96 | |

60 – 64 | | | 6.71 | | | | 8.04 | | | | 7.59 | | | | 7.07 | | | | 6.69 | |

65 – 69 | | | 5.84 | | | | 6.43 | | | | 6.83 | | | | 7.20 | | | | 7.65 | |

70 – 74 | | | 5.21 | | | | 5.80 | | | | 5.97 | | | | 6.24 | | | | 6.13 | |

| | | | | |

75 – 79 | | | 4.13 | | | | 4.90 | | | | 4.95 | | | | 4.93 | | | | 5.01 | |

80 – 84 | | | 2.68 | | | | 3.63 | | | | 3.74 | | | | 3.83 | | | | 3.95 | |

85 – 89 | | | 1.45 | | | | 2.18 | | | | 2.30 | | | | 2.41 | | | | 2.50 | |

90 – 94 | | | 0.66 | | | | 0.90 | | | | 0.96 | | | | 1.03 | | | | 1.09 | |

95 – 99 | | | 0.17 | | | | 0.26 | | | | 0.27 | | | | 0.28 | | | | 0.31 | |

| | | | | |

100 and over | | | 0.02 | | | | 0.04 | | | | 0.04 | | | | 0.05 | | | | 0.05 | |

| | | | | |

Regrouped | | | | | | | | | | | | | | | | | | | | |

0 – 14 years old | | | 13.76 | | | | 12.98 | | | | 12.88 | | | | 12.77 | | | | 12.67 | |

15 – 64 | | | 66.07 | | | | 62.87 | | | | 62.07 | | | | 61.26 | | | | 60.64 | |

65 and over | | | 20.16 | | | | 24.15 | | | | 25.06 | | | | 25.97 | | | | 26.69 | |

65 – 74 years old | | | 11.05 | | | | 12.23 | | | | 12.80 | | | | 13.44 | | | | 13.78 | |

75 and over | | | 9.11 | | | | 11.91 | | | | 12.26 | | | | 12.53 | | | | 12.91 | |

| | |

(Note) * | | Statistics Bureau, Ministry of Internal Affairs and Communications, “Population Census”. (Unknown age population is included after being prorated to each age population.) |

| |

** | | Figures are subject to change based on the result of “Population Census” conducted during 2015. |

15

FOREIGN TRADE AND BALANCE OF PAYMENTS

Foreign Trade

Japan is one of the leading trading nations of the world, ranking fourth to China, United States and Germany in merchandise exports and ranking fourth to the United States, China and Germany in merchandise imports among the IMF member countries in 2015.

The trade deficit slightly increased from ¥2,565 billion in 2011 to ¥2,792 billion in 2015 despite an increase in exports for three consecutive years, meaning that Japan has had a trade deficit for five consecutive years. The primary reasons for the trade deficit include increased imports of oil and natural gas as alternatives to nuclear energy. Imports of fossil fuels increased as the demand increased for power generation at thermal power stations after the nuclear accident at the Fukushima Daiichi Nuclear Plant caused suspension of operations at other nuclear plants, resulting in reduced energy supply. Due to increased imports of fossil fuels, Japan’s trade balance in 2011 turned to a deficit for the first time in 31 years. In 2012, the trade deficit expanded and it hit a record high in 2014. In 2015, it decreased substantially again and back to the level of 2011. As of December 2015, it was expected that in 2016 exports would continue to stagnate due to strong yen against Asian currencies, while imports would slightly increase due to the expansion of domestic demand as a result of a decrease in energy prices which increased real income, based on the premise of the rise in consumption tax scheduled in April 2017. However, on June 1, 2016, the Japanese government announced the postponement of such rise to October 2019.

The following tables set forth information relating to foreign trade for the years indicated. In these tables exports are stated on an f.o.b. basis and imports on a c.i.f. basis. Monetary figures are based on actual movements of goods as calculated by the Ministry of Finance. (This method of computation differs from that used in calculating balance of payments, in which both exports and imports are stated on an f.o.b. basis.)

Foreign Trade of Japan

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Value Index(a) | | | Quantum Index(a) | | | Unit Value(a) Index | | | Terms of

Trade(b) | |

| | | Exports | | | Imports | | | Exports | | | Imports | | | Exports | | | Imports | | | Index | |

2011 | | | 97.3 | | | | 112.1 | | | | 96.2 | | | | 102.6 | | | | 101.1 | | | | 109.3 | | | | 92.5 | |

2012 | | | 94.6 | | | | 116.3 | | | | 91.6 | | | | 105.0 | | | | 103.3 | | | | 110.8 | | | | 93.2 | |

2013 | | | 103.5 | | | | 133.7 | | | | 90.2 | | | | 105.3 | | | | 114.8 | | | | 127.0 | | | | 90.4 | |

2014 | | | 108.4 | | | | 141.4 | | | | 90.7 | | | | 106.0 | | | | 119.6 | | | | 133.4 | | | | 89.7 | |

2015 | | | 112.2 | | | | 129.0 | | | | 89.8 | | | | 103.0 | | | | 125.0 | | | | 125.3 | | | | 99.8 | |

| (a) | Calendar year 2010=100. |

| (b) | Unit value index of exports divided by unit value index of imports, multiplied by 100. |

Source: Japan Tariff Association, Ministry of Finance.

16

Composition of Japan’s Exports and Imports

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2011 | | | 2012 | | | 2013 | | | 2014 | | | 2015 | |

| | | (yen amounts in billions) | |

JAPAN’S EXPORTS | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Textile Products | | ¥ | 812 | | | | 1.2 | % | | ¥ | 790 | | | | 1.2 | % | | ¥ | 869 | | | | 1.2 | % | | ¥ | 928 | | | | 1.3 | % | | ¥ | 985 | | | | 1.3 | % |

Metals and Metal Products | | | 5,997 | | | | 9.1 | | | | 5,805 | | | | 9.1 | | | | 6,352 | | | | 9.1 | | | | 6,598 | | | | 9.0 | | | | 6,315 | | | | 8.4 | |

Machinery and Equipment: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Ships | | | 2,046 | | | | 3.1 | | | | 1,716 | | | | 2.7 | | | | 1,452 | | | | 2.1 | | | | 1,299 | | | | 1.8 | | | | 1,334 | | | | 1.8 | |

Motor Vehicles | | | 8,204 | | | | 12.5 | | | | 9,225 | | | | 14.5 | | | | 10,413 | | | | 14.9 | | | | 10,919 | | | | 14.9 | | | | 12,046 | | | | 15.9 | |

TV and Radio Receivers | | | 101 | | | | 0.2 | | | | 104 | | | | 0.2 | | | | 111 | | | | 0.2 | | | | 128 | | | | 0.2 | | | | 142 | | | | 0.2 | |

Motorcycles | | | 266 | | | | 0.4 | | | | 249 | | | | 0.4 | | | | 277 | | | | 0.4 | | | | 316 | | | | 0.4 | | | | 294 | | | | 0.4 | |

Scientific and Optical Instruments | | | 2,109 | | | | 3.2 | | | | 2,085 | | | | 3.3 | | | | 2,223 | | | | 3.2 | | | | 2,436 | | | | 3.3 | | | | 2,376 | | | | 3.1 | |

Other(a) | | | 28,916 | | | | 44.1 | | | | 28,053 | | | | 44.0 | | | | 29,594 | | | | 42.4 | | | | 31,227 | | | | 42.7 | | | | 32,155 | | | | 42.5 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total Machinery and Equipment | | | 41,642 | | | | 63.5 | | | | 41,432 | | | | 65.0 | | | | 44,069 | | | | 63.2 | | | | 46,327 | | | | 63.4 | | | | 48,347 | | | | 63.9 | |

Chemicals | | | 6,798 | | | | 10.4 | | | | 6,365 | | | | 10.0 | | | | 7,507 | | | | 10.8 | | | | 7,818 | | | | 10.7 | | | | 7,759 | | | | 10.3 | |

Foods and Beverages | | | 359 | | | | 0.5 | | | | 355 | | | | 0.6 | | | | 436 | | | | 0.6 | | | | 482 | | | | 0.7 | | | | 599 | | | | 0.8 | |

Other Exports(b) | | | 9,938 | | | | 15.2 | | | | 9,001 | | | | 14.1 | | | | 10,540 | | | | 15.1 | | | | 10,941 | | | | 15.0 | | | | 11,609 | | | | 15.4 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Grand Total | | ¥ | 65,546 | | | | 100.0 | % | | ¥ | 63,748 | | | | 100.0 | % | | ¥ | 69,774 | | | | 100.0 | % | | ¥ | 73,093 | | | | 100.0 | % | | ¥ | 75,614 | | | | 100.0 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

JAPAN’S IMPORTS | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Foods and Beverages | | | 5,854 | | | | 8.6 | % | | | 5,852 | | | | 8.3 | % | | | 6,473 | | | | 8.0 | % | | | 6,732 | | | | 7.8 | % | | | 7,002 | | | | 8.9 | % |

Raw Materials | | | 5,270 | | | | 7.7 | | | | 4,768 | | | | 6.7 | | | | 5,358 | | | | 6.6 | | | | 5,590 | | | | 6.5 | | | | 4,853 | | | | 6.2 | |

Chemicals | | | 6,098 | | | | 9.0 | | | | 5,926 | | | | 8.4 | | | | 6,464 | | | | 8.0 | | | | 6,864 | | | | 8.0 | | | | 7,748 | | | | 9.9 | |

Mineral Fuels: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Petroleum | | | 11,415 | | | | 16.8 | | | | 12,247 | | | | 17.3 | | | | 14,245 | | | | 17.5 | | | | 13,873 | | | | 16.1 | | | | 8,185 | | | | 10.4 | |

Coal | | | 2,459 | | | | 3.6 | | | | 2,321 | | | | 3.3 | | | | 2,307 | | | | 2.8 | | | | 2,086 | | | | 2.4 | | | | 1,974 | | | | 2.5 | |

Other(c) | | | 7,942 | | | | 11.7 | | | | 9,520 | | | | 13.5 | | | | 10,892 | | | | 13.4 | | | | 11,734 | | | | 13.7 | | | | 8,059 | | | | 10.3 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total Mineral Fuel | | | 21,816 | | | | 32.0 | | | | 24,088 | | | | 34.1 | | | | 27,444 | | | | 33.8 | | | | 27,692 | | | | 32.2 | | | | 18,218 | | | | 23.2 | |

Machinery and Equipment | | | 16,176 | | | | 23.7 | | | | 17,334 | | | | 24.5 | | | | 20,817 | | | | 25.6 | | | | 23,249 | | | | 27.1 | | | | 24,274 | | | | 31.0 | |

Other Imports(d) | | | 12,897 | | | | 18.9 | | | | 12,721 | | | | 18.0 | | | | 14,687 | | | | 18.1 | | | | 15,782 | | | | 18.4 | | | | 16,310 | | | | 20.8 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Grand Total | | ¥ | 68,111 | | | | 100.0 | % | | ¥ | 70,689 | | | | 100.0 | % | | ¥ | 81,243 | | | | 100.0 | % | | ¥ | 85,909 | | | | 100.0 | % | | ¥ | 78,406 | | | | 100.0 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (a) | This category includes general machinery, electronic components including semiconductors and electronic equipment including electronic circuit. |

| (b) | This category includes raw materials, mineral fuels and vehicle parts. |

| (c) | This category includes liquid natural gas and petroleum products. |

| (d) | This category includes clothing and accessories thereof, non-ferrous metal and scientific and optical instruments. |

Source: The Summary Report on Trade of Japan, Japan Tariff Association, Ministry of Finance.

17

Geographic Distribution of Japan’s Exports and Imports

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2011 | | | 2012 | | | 2013 | | | 2014 | | | 2015 | |

| | | (yen amounts in billions) | |

JAPAN’S EXPORTS | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Asia | | | 36,686 | | | | 56.0 | % | | | 34,855 | | | | 54.7 | % | | | 37,867 | | | | 54.3 | % | | | 39,518 | | | | 54.1 | % | | | 40,329 | | | | 53.3 | % |

China | | | 12,902 | | | | 19.7 | | | | 11,509 | | | | 18.1 | | | | 12,625 | | | | 18.1 | | | | 13,381 | | | | 18.3 | | | | 13,223 | | | | 17.5 | |

(Asia NIES) | | | 14,917 | | | | 22.8 | | | | 13,720 | | | | 21.5 | | | | 15,271 | | | | 21.9 | | | | 15,952 | | | | 21.8 | | | | 16,438 | | | | 21.7 | |

(ASEAN) | | | 9,799 | | | | 14.9 | | | | 10,328 | | | | 16.2 | | | | 10,828 | | | | 15.5 | | | | 11,080 | | | | 15.2 | | | | 11,495 | | | | 15.2 | |

Oceania | | | 1,778 | | | | 2.7 | | | | 1,837 | | | | 2.9 | | | | 2,029 | | | | 2.9 | | | | 1,958 | | | | 2.7 | | | | 2,099 | | | | 2.8 | |

Australia | | | 1,418 | | | | 2.2 | | | | 1,471 | | | | 2.3 | | | | 1,656 | | | | 2.4 | | | | 1,501 | | | | 2.1 | | | | 1,555 | | | | 2.1 | |

North America | | | 10,727 | | | | 16.4 | | | | 12,007 | | | | 18.8 | | | | 13,776 | | | | 19.7 | | | | 14,495 | | | | 19.8 | | | | 16,161 | | | | 21.4 | |

U.S.A. | | | 10,018 | | | | 15.3 | | | | 11,188 | | | | 17.6 | | | | 12,928 | | | | 18.5 | | | | 13,649 | | | | 18.7 | | | | 15,225 | | | | 20.1 | |

Canada | | | 709 | | | | 1.1 | | | | 819 | | | | 1.3 | | | | 848 | | | | 1.2 | | | | 846 | | | | 1.2 | | | | 936 | | | | 1.2 | |

Central and South America | | | 3,528 | | | | 5.4 | | | | 3,435 | | | | 5.4 | | | | 3,560 | | | | 5.1 | | | | 3,563 | | | | 4.9 | | | | 3,375 | | | | 4.5 | |

Western Europe | | | 8,150 | | | | 12.4 | | | | 6,684 | | | | 10.5 | | | | 7,140 | | | | 10.2 | | | | 7,745 | | | | 10.6 | | | | 8,102 | | | | 10.7 | |

EU | | | 7,619 | | | | 11.6 | | | | 6,501 | | | | 10.2 | | | | 7,000 | | | | 10.0 | | | | 7,585 | | | | 10.4 | | | | 7,985 | | | | 10.6 | |

Central and Eastern Europe, Russia etc. | | | 1,670 | | | | 2.5 | | | | 1,635 | | | | 2.6 | | | | 1,810 | | | | 2.6 | | | | 1,720 | | | | 2.4 | | | | 1,346 | | | | 1.8 | |

Russia | | | 941 | | | | 1.4 | | | | 1,005 | | | | 1.6 | | | | 1,069 | | | | 1.5 | | | | 972 | | | | 1.3 | | | | 618 | | | | 0.8 | |

Middle East | | | 1,955 | | | | 3.0 | | | | 2,262 | | | | 3.5 | | | | 2,478 | | | | 3.6 | | | | 2,988 | | | | 4.1 | | | | 3,167 | | | | 4.2 | |

Africa | | | 1,053 | | | | 1.6 | | | | 1,032 | | | | 1.6 | | | | 1,115 | | | | 1.6 | | | | 1,107 | | | | 1.5 | | | | 1,036 | | | | 1.4 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total | | ¥ | 65,546 | | | | 100.0 | % | | ¥ | 63,748 | | | | 100.0 | % | | ¥ | 69,774 | | | | 100.0 | % | | ¥ | 73,093 | | | | 100.0 | % | | ¥ | 75,614 | | | | 100.0 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2011 | | | 2012 | | | 2013 | | | 2014 | | | 2015 | |

| | | (yen amounts in billions) | |

JAPAN’S IMPORTS | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Asia | | | 30,391 | | | | 44.6 | % | | | 31,306 | | | | 44.3 | % | | | 35,972 | | | | 44.3 | % | | | 38,618 | | | | 45.0 | % | | | 38,358 | | | | 48.9 | % |

China | | | 14,642 | | | | 21.5 | | | | 15,039 | | | | 21.3 | | | | 17,660 | | | | 21.7 | | | | 19,176 | | | | 22.3 | | | | 19,429 | | | | 24.8 | |

(Asia NIES) | | | 5,836 | | | | 8.6 | | | | 5,975 | | | | 8.5 | | | | 6,692 | | | | 8.2 | | | | 7,109 | | | | 8.3 | | | | 7,245 | | | | 9.2 | |

(ASEAN) | | | 9,951 | | | | 14.6 | | | | 10,306 | | | | 14.6 | | | | 11,486 | | | | 14.1 | | | | 12,252 | | | | 14.3 | | | | 11,843 | | | | 15.1 | |

Oceania | | | 4,893 | | | | 7.2 | | | | 4,901 | | | | 6.9 | | | | 5,376 | | | | 6.6 | | | | 5,706 | | | | 6.6 | | | | 4,887 | | | | 6.2 | |

Australia | | | 4,514 | | | | 6.6 | | | | 4,504 | | | | 6.4 | | | | 4,977 | | | | 6.1 | | | | 5,090 | | | | 5.9 | | | | 4,210 | | | | 5.4 | |

North America | | | 6,970 | | | | 10.2 | | | | 7,103 | | | | 10.0 | | | | 7,993 | | | | 9.8 | | | | 8,741 | | | | 10.2 | | | | 9,178 | | | | 11.7 | |

U.S.A. | | | 5,931 | | | | 8.7 | | | | 6,082 | | | | 8.6 | | | | 6,815 | | | | 8.4 | | | | 7,543 | | | | 8.8 | | | | 8,060 | | | | 10.3 | |

Canada | | | 1,032 | | | | 1.5 | | | | 1,012 | | | | 1.4 | | | | 1,170 | | | | 1.4 | | | | 1,190 | | | | 1.4 | | | | 1,109 | | | | 1.4 | |

Central and South America | | | 2,772 | | | | 4.1 | | | | 2,821 | | | | 4.0 | | | | 3,293 | | | | 4.1 | | | | 3,196 | | | | 3.7 | | | | 3,075 | | | | 3.9 | |

Western Europe | | | 7,031 | | | | 10.3 | | | | 7,246 | | | | 10.2 | | | | 8,266 | | | | 10.2 | | | | 8,855 | | | | 10.3 | | | | 9,347 | | | | 11.9 | |

EU | | | 6,411 | | | | 9.4 | | | | 6,642 | | | | 9.4 | | | | 7,649 | | | | 9.4 | | | | 8,169 | | | | 9.5 | | | | 8,625 | | | | 11.0 | |

Central and Eastern Europe, Russia etc. | | | 1,855 | | | | 2.7 | | | | 2,074 | | | | 2.9 | | | | 2,811 | | | | 3.5 | | | | 3,183 | | | | 3.7 | | | | 2,593 | | | | 3.3 | |

Russia | | | 1,514 | | | | 2.2 | | | | 1,660 | | | | 2.3 | | | | 2,308 | | | | 2.8 | | | | 2,619 | | | | 3.0 | | | | 1,905 | | | | 2.4 | |

Middle East | | | 12,832 | | | | 18.8 | | | | 13,542 | | | | 19.2 | | | | 15,667 | | | | 19.3 | | | | 15,826 | | | | 18.4 | | | | 9,571 | | | | 12.2 | |

Africa | | | 1,366 | | | | 2.0 | | | | 1,696 | | | | 2.4 | | | | 1,864 | | | | 2.3 | | | | 1,783 | | | | 2.1 | | | | 1,395 | | | | 1.8 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Grand Total | | ¥ | 68,111 | | | | 100.0 | % | | ¥ | 70,689 | | | | 100.0 | % | | ¥ | 81,243 | | | | 100.0 | % | | ¥ | 85,909 | | | | 100.0 | % | | ¥ | 78,406 | | | | 100.0 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Source: Press Release dated March 10, 2016, Ministry of Finance.

Balance of Payments

In 2011, the Current Account surplus significantly decreased to ¥10,401 billion due to a substantial decrease in the Trade Balance. In 2012, the Current Account surplus continued to significantly decrease to ¥4,764 billion due to a substantial decrease in the Trade Balance. In 2013, the trade deficit continued to expand and the Current Account surplus decreased to ¥4,457 billion. In 2014, the trade deficit hit a record high and the Current Account surplus continued to decrease to ¥3,881 billion. In 2015, trade deficit significantly improved, and Current Account surplus increased to ¥16,413 billion.

18

In October 2013, Ministry of Finance and Bank of Japan announced that they will revise balance of payments statistics, to be based on IMF Balance of Payments Manual, 6th Edition, starting with transactions in January 2014. The information below reflects the updated statistics.

Balance of Payments of Japan

| | | | | | | | | | | | | | | | | | | | |

| | | 2011 | | | 2012 | | | 2013 | | | 2014 | | | 2015 | |

| | | (in billions) | |

Current Account | | ¥ | 10,401 | | | ¥ | 4,764 | | | ¥ | 4,457 | | | ¥ | 3,881 | | | ¥ | 16,413 | |

Balance on Goods and Services | | | -3,110 | | | | -8,083 | | | | -12,252 | | | | -13,499 | | | | -2,307 | |

Trade Balance | | | -330 | | | | -4,272 | | | | -8,773 | | | | -10,465 | | | | -629 | |

Exports (f.o.b.) | | | 62,965 | | | | 61,957 | | | | 67,829 | | | | 74,075 | | | | 75,265 | |

Imports (f.o.b.) | | | 63,296 | | | | 66,229 | | | | 76,602 | | | | 84,540 | | | | 75,894 | |

Services | | | -2,780 | | | | -3,811 | | | | -3,479 | | | | -3,034 | | | | -1,678 | |

Primary Income | | | 14,621 | | | | 13,991 | | | | 17,698 | | | | 19,374 | | | | 20,653 | |

Secondary Income | | | -1,110 | | | | -1,145 | | | | -989 | | | | -1,995 | | | | -1,933 | |

Capital Account | | | 28 | | | | -80 | | | | -744 | | | | -209 | | | | -271 | |

Financial Account | | | 12,629 | | | | 4,193 | | | | -409 | | | | 6,237 | | | | 21,145 | |

Assets | | | 5,990 | | | | 8,452 | | | | 8,526 | | | | 2,202 | | | | 32,108 | |

Liabilities | | | -6,639 | | | | 4,260 | | | | 8,935 | | | | -4,035 | | | | 10,963 | |

Net Errors and Omissions | | | 2,200 | | | | -491 | | | | -4,122 | | | | 2,566 | | | | 5,004 | |

| (a) | Positive figures (+) show increases in net assets, negative figures (-) show decreases in net assets in “Financial Account”. |

Source: Balance of Payments, Ministry of Finance.

Official Foreign Exchange Reserves(a)

| | | | | | | | | | | | | | | | | | | | |

As of December 31, | | Gold(b) | | | Foreign

Exchange | | | IMF Reserve

Position | | | Special Drawing

Rights | | | Total | |

| | | (in millions) | |

2011 | | | 37,666 | | | | 1,220,785 | | | | 17,181 | | | | 19,745 | | | | 1,295,841 | |

2012 | | | 40,939 | | | | 1,193,077 | | | | 13,697 | | | | 19,911 | | | | 1,268,125 | |

2013 | | | 29,560 | | | | 1,202,443 | | | | 14,202 | | | | 20,129 | | | | 1,266,815 | |

2014 | | | 29,504 | | | | 1,199,651 | | | | 11,993 | | | | 18,895 | | | | 1,260,548 | |

2015 | | | 26,134 | | | | 1,179,004 | | | | 9,531 | | | | 18,048 | | | | 1,233,214 | |

| (a) | The foreign exchange reserves, which are officially recorded in U.S. dollars by the Ministry of Finance, do not include: (i) net balance of bilateral accounts between the Bank of Japan and foreign central banks, and (ii) foreign exchange holdings of commercial banks. |

| (b) | Until 1999, gold was valued at SDR 35 per ounce. Since 2000, the valuation of gold has been changed to reflect marked-to-market values. |

Source: International Reserves/Foreign Currency Liquidity, Ministry of Finance.

Foreign Exchange Rates

The following table sets forth the high, low and average daily interbank rate for the U.S. dollar against the yen in the Tokyo foreign exchange market for the years indicated.

| | | | | | | | | | | | | | | | | | | | |

| | | 2011 | | | 2012 | | | 2013 | | | 2014 | | | 2015 | |

Average (Central Rate) | | ¥ | 79.76 | | | ¥ | 79.79 | | | ¥ | 97.71 | | | ¥ | 105.79 | | | ¥ | 121.09 | |

High | | | 85.53 | | | | 86.63 | | | | 105.41 | | | | 121.86 | | | | 125.66 | |

Low | | | 75.52 | | | | 76.11 | | | | 86.83 | | | | 100.76 | | | | 115.85 | |

Source: Status of Transactions on Tokyo Foreign Exchange Market, Bank of Japan.

19

FINANCIAL SYSTEM

The Bank of Japan and Monetary Policy

The Bank of Japan (“BOJ”), with 55% of its capital owned by the government, is the central bank and sole issuing bank, as well as the depository and fiscal agent for the government. As of July 20, 2016, the BOJ had total assets of ¥435,940 billion.

One of the missions of the BOJ is to contribute to the sound development of the national economy, through the pursuit of price stability. In order to fulfill this mission, the BOJ controls the overall volume of money in the economy and through market operations, along with monetary policy decided at the BOJ Policy Board Meetings. From March 2001 to March 2006, in order to fight deflation and revive the Japanese economy, the BOJ implemented a quantitative easing policy by conducting money market operations to adjust the outstanding balance of the current accounts at the BOJ. And in March 2006, the BOJ announced an exit from the quantitative easing policy and a return to monetary policy that targeted policy interest rate (uncollateralized overnight call rate). At the same time, the BOJ decided to encourage the rate to remain at effectively zero percent. Then, the BOJ increased the policy interest rate to 0.25% in July 2006, and to 0.5% in February 2007. From the fall of 2008, however, when the turmoil in global financial markets intensified, the BOJ implemented various monetary policy measures including reductions in the policy interest rate. It decreased the policy interest rate to 0.3% in October 2008, and further to 0.1% in December 2008. Furthermore, in October 2010, in order to further enhance monetary easing, the BOJ implemented a comprehensive monetary easing policy, which included the establishment of an Asset Purchase Program (APP) to purchase financial assets, including risk assets, as well as to provide loans. Since the APP’s introduction, the BOJ has repeatedly and significantly increased the maximum amount outstanding of the APP, from about 35 trillion yen to about 101 trillion yen at the end of 2013. Moreover, in February 2012, the BOJ decided to pursue powerful monetary easing by conducting its virtually zero interest rate policy and by implementing the APP, with the aim of achieving the goal of 1% in terms of the year-on-year rate of change in the consumer price index (CPI). In order to state clearly the shared understanding concerning the roles of the government and the BOJ, the BOJ decided to release “Measures Aimed at Overcoming Deflation” in October 2012. In January 2013, the BOJ introduced the “price stability target” of 2% in terms of the year-on-year rate of change in the CPI. The BOJ also introduced the “open-ended asset purchasing method”, aimed at achieving this target. It released a joint statement with the government to announce that in order to overcome deflation early and achieve sustainable economic growth with price stability, the government and the BOJ would strengthen their policy coordination and work together. Furthermore, in April 2013, the BOJ introduced a policy of “quantitative and qualitative monetary easing”, aimed at achieving this target at the earliest possible time. In order to do so, under this policy, the BOJ would enter a new phase of monetary easing both in terms of quantity and quality. The BOJ would double the monetary base in two years by conducting money market operations so that the monetary base would increase at an annual pace of about 60-70 trillion yen. The BOJ would also purchase Japanese government bonds (“JGBs”) so that their amount outstanding would increase at an annual pace of about 50 trillion yen, and the average remaining maturity of the BOJ’s JGB purchases would be extended from slightly less than three years at the time to about seven years, which was equivalent to the average maturity of the amount outstanding of JGBs issued. Additionally, the BOJ would purchase exchange-traded funds (“ETFs”) and Japan real estate investment trusts (“J-REITs”) so that their amounts outstanding would increase at an annual pace of 1 trillion yen and 30 billion yen, respectively. In October 2014, the BOJ expanded its quantitative and qualitative monetary easing measures to further increase its purchases of JGBs, ETFs and J-REITs to achieve an increase in its purchases of JGBs, ETFs and J-REITs at an annual pace of about 80 trillion yen, 3 trillion yen and 90 billion yen, respectively. In order to achieve 2% “price stability target,” in January 2016, the BOJ adopted “quantitative and qualitative monetary easing with a negative interest rate,” under which (i) a negative interest rate of minus 0.1% is applied to a part of BOJ accounts held by financial institutions1 (if judged necessary by the BOJ, the rate will be lowered even further), (ii) the BOJ will conduct money market operations so that the monetary base will increase at an annual pace of about 80 trillion yen, and (iii) the BOJ will purchase assets as follows: (1) purchase JGBs so that their amount outstanding will increase at an annual pace of about 80 trillion yen, (2) purchase ETFs and J-REITs so that their amounts outstanding will increase at an annual pace of about 3 trillion yen (revised to 3.3 trillion yen in April 2016) and about 90 billion yen, respectively, and (3) maintain the amounts outstanding of commercial paper and corporate bonds at about 2.2 trillion yen and about 3.2 trillion yen, respectively. The BOJ will continue with “quantitative and qualitative monetary easing with a negative interest rate,” aiming to achieve the price stability target of 2 percent, as long as it is necessary for maintaining that target in a stable manner.

| 1 | More specifically, accounts held by financial institutions are divided into three levels referred to as “basic balance” (a positive interest rate of 0.1% is applied), “macro add-on balance” (a zero interest rate is applied), and “policy-rate balance” (a negative interest rate of minus 0.1% is applied). “ Policy-rate balance” is the balance in excess of “basic balance” and “macro add-on balance.” |

20

In April 2016, the BOJ adopted special measures to assist financial institutions affected by the recent earthquake in Kumamoto Prefecture, such as lending a total of 300 billion yen at a zero interest rate and adding twice as much as the amount outstanding of financial institutions’ borrowing through this operation to their macro add-on balances, to which a zero interest rate is applied.

The following table sets forth the principal economic indicators relating to monetary policy from 2011 through 2015.

| | | | | | | | | | | | | | | | | | | | | | |

| | | Current

Account

Balances(a) | | | Monetary Base | | Money Stock | | Loans and Bills

Discounts Domestically

Licensed Banks |

| | | | | | Total(a) | | | Annual %

Change | | Total(a) | | | Annual %

Change | | Total(a) | | | Annual %

Change |

| | | | | | (yen amounts in billions) |

2011 | | | 29,622 | | | | 113,415 | | | 15.2 | | | 796,610 | | | 2.7 | | | 425,858 | | | 1.3 |

2012 | | | 35,913 | | | | 121,380 | | | 7.0 | | | 816,530 | | | 2.5 | | | 433,824 | | | 1.9 |

2013 | | | 74,992 | | | | 163,153 | | | 34.4 | | | 845,971 | | | 3.6 | | | 449,135 | | | 3.5 |

2014 | | | 142,429 | | | | 233,648 | | | 43.2 | | | 874,836 | | | 3.4 | | | 461,148 | | | 2.7 |

2015 | | | 217,631 | | | | 313,121 | | | 34.0 | | | 907,134 | | | 3.7 | | | 475,937 | | | 3.2 |

| (a) | Average amounts outstanding. |

Source: Bank of Japan Statistics, Bank of Japan.

Government Financial Institutions

The activities of private institutions are supplemented by a number of financial institutions under government supervision, the appointment of whose senior officials is subject to approval by the government and whose funds are supplied principally or partially by the government. Among these are Japan Finance Corporation (“JFC”), the successor to National Life Finance Corporation (“NLFC”), Japan Finance Corporation for Small and Medium Enterprise (“JASME”), and Agriculture, Forestry and Fisheries Finance Corporation (“AFC”), whose main purposes are to contribute to the improvement of the quality of the national life. They also include Japan Bank for International Cooperation (“JBIC”) and The Okinawa Development Finance Corporation (“ODFC”), whose purposes are to supplement private financing in their respective fields of activity, and Development Bank of Japan Inc. (“DBJ”) and The Shoko Chukin Bank (“SCB”), which will be privatized.

The central government has been steadily promoting reform of governmental financial institutions. The “Outline of Administrative Reforms” decided by the Cabinet on December 1, 2000, requires that the businesses and organizational forms of all special public institutions, which include governmental financial institutions, undergo a thorough review. Pursuant to the Act on Promotion of Administrative Reform for Realization of Small and Efficient Government (the “Administrative Reform Promotion Act”), which was enacted on May 26, 2006, (1) the former Development Bank of Japan was succeeded to by DBJ as of October 1, 2008, which is currently wholly owned by the Japanese government and will be privatized, (2) the international financial operations of JBIC, together with the functions of NLFC, JASME, AFC were transferred to JFC as of October 1, 2008, and the overseas economic cooperation operations of JBIC were transferred to the Japan International Cooperation Agency, and (3) as of October 1, 2008, Japan Finance Corporation for Municipal Enterprises was succeeded by Japan Finance Organization for Municipalities, which is funded by local governments. Each of these measures was implemented through individual laws that were enacted in 2007, pursuant to which these successor institutions were formed on October 1, 2008.

21

With regard to (1) above, as originally enacted, the Development Bank of Japan Inc. Act (Act No. 85 of 2007), as amended (the “DBJ Act”), contemplated full privatization of DBJ over a period of five to seven years from its establishment on October 1, 2008. During that time period, the DBJ Act (as originally enacted) provided that the Japanese government would dispose of all of the common stock of DBJ that it currently owns (the “full privatization”), and that steps would be taken to abolish the DBJ Act promptly after the full privatization. On June 26, 2009, the Japanese Diet approved the Act for Partial Amendment of the Development Bank of Japan Inc. Act (Act No. 67 of 2009) (the “2009 Amendment Act”), which, as part of the Japanese government’s response to economic and financial crises, enables the Japanese government to strengthen DBJ’s financial base through capital injections up to the end of March 2012. In addition, under the Amendment Act, the targeted timing for the full privatization of DBJ has been extended to approximately five to seven years from April 1, 2012. Further, the Amendment Act provides that the Japanese government is to review the organization of DBJ, including the way of the Japanese government’s holding of the DBJ shares, by the end of fiscal year 2011, and until such time, the Japanese government shall not be disposing of the DBJ’s shares held by it. Additionally, on May 2, 2011, in order to address the Great East Japan Earthquake of March 11, 2011, the Japanese Diet approved the Act for Extraordinary Expenditure and Assistance to Cope with the Great East Earthquake (Act No. 40 of 2011) (the “Extraordinary Expenditure Act”). The Extraordinary Expenditure Act enables to the Japanese government to strengthen DBJ’s financial base through capital injection through March 2015 so that DBJ can smoothly implement its crisis response operations. In addition, under Extraordinary Expenditure Act, the targeted timing for the full privatization of DBJ has been extended to approximately five to seven years from April 1, 2015. Further, the Extraordinary Expenditure Act provides that the Japanese government is to review the organization of DBJ, including the way of the Japanese government’s holding of the DBJ’s shares by the end of fiscal year 2014, and until such time, the Japanese government shall not dispose of the DBJ’s shares held by it. Furthermore, on May 13, 2015, the Japanese Diet approved the Act for Partial Amendment of the Development Bank of Japan Inc. Act (Act No. 23 of 2015) (the “2015 Amendment Act”), under which, in conjunction with DBJ’s full privatization, and taking into consideration the current business environment in the private financial sector, DBJ, utilizing its investment and loan functions, is to take measures necessary for implementing the its crisis response operations and supply of growth capital — that is, DBJ is to take all possible measures to supply funds to deal with large-scale disasters, economic crises and so forth, and to promote the supply of growth capital to revitalize regional economies and to reinforce the competitiveness of enterprises. In order to assure the sufficient implementation of the necessary operations, under the 2015 Amendment Act, the Japanese government shall maintain its stake in excess of one-third for DBJ’s crisis response operations, and one half or more for DBJ’s special investment operations, for as long as the government shall take such measures.

With regard to (2) above, The Japan Bank for International Cooperation Act (the “JBIC Act”) was passed into law on April 28, 2011 to spin off the Japan Bank for International Cooperation Operations from the domestic financial operations of the Japan Finance Corporation. Pursuant to the JBIC Act, Japan Bank for International Cooperation was newly established on April 1, 2012.

Private Financial Institutions

According to the Financial Services Agency, the private banking system included four city banks, 16 trust banks, and 15 other banks as of August 17, 2015, as well as 106 local banks (including the Saitama Resona Bank) as of October 1, 2015. In addition, 53 foreign banks had branches in Japan as of June 24, 2016.

There are also credit associations, credit cooperative associations, labor credit associations and the national federations of each of such associations, which are engaged mainly in making small business loans. Agricultural cooperatives, prefectural credit federations of such cooperatives and The Norinchukin Bank operate in the field of agricultural credit.

22

GOVERNMENT FINANCE

Revenues, Expenditures and Budgets

The responsibility for the preparation of the budget and the administration of government finances rests with the Ministry of Finance. The fiscal year commences on April 1, and the Cabinet usually submits the budget to the Diet for its decision in the preceding January. Supplementary budgets revising the original budget may be submitted to the Diet from time to time during the fiscal year.

For advancing fiscal consolidation, the Cabinet approved the “Basic Framework for Fiscal Consolidation: Medium-term Fiscal Plan” on August 8, 2013. This plan provided the following targets for achieving fiscal consolidation.

| | • | | Halving the primary deficit of the national and local governments to GDP ratio by JFY 2015 from the ratio in JFY 2010. (This target is expected to be achieved.) |

| | • | | Achieving a primary surplus of the national and local governments to GDP ratio by JFY 2020. |

| | • | | Steadily reducing the public debt to GDP ratio after achieving a primary surplus by JFY 2020. |

These targets are firmly maintained in the “Basic Policies for the Economic and Fiscal Management and Reform 2015” decided by the Cabinet on June 30, 2015, including “The Plan to Advance Economic and Fiscal Consolidation” (hereafter, the fiscal consolidation plan) which is an effective and concrete plan for achieving primary surplus target by JFY2020, covering five year period (JFY2016-JFY2020). In the fiscal consolidation plan, the government will assess the progress of reforming expenditure and revenue measures by using several benchmarks. Through using these benchmarks, the government will review the progress of expenditure and revenue reform in JFY 2018 and will consider additional expenditure and/or revenue measures to achieve the fiscal consolidation target of JFY 2020 if necessary.