As filed with the Securities and Exchange Commission on April 12, 2019

Securities Act File No.

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Form N-14

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 x

Pre-Effective Amendment No. ¨

Post-Effective Amendment No. ¨

Voya Investors Trust

(Exact Name of Registrant as Specified in Charter)

7337 East Doubletree Ranch Road, Scottsdale, Suite 100, Arizona 85258-2034

(Address of Principal Executive Offices) (Zip Code)

1-800-366-0066

(Registrant’s Area Code and Telephone Number)

Huey P. Falgout, Jr.

Voya Investment Management

7337 East Doubletree Ranch Road, Suite 100

Scottsdale, AZ 85258-2034

(Name and Address of Agent for Service)

With copies to:

Elizabeth J. Reza

Ropes & Gray LLP

Prudential Tower

800 Boylston Street

Boston, Massachusetts 02199-3600

Approximate Date of Proposed Public Offering:

As soon as practicable after this Registration Statement becomes effective.

It is proposed that this filing will become effective on May 17, 2019, pursuant to Rule 488 under the Securities Act of 1933, as amended.

No filing fee is required because an indefinite number of shares have previously been registered pursuant to Rule 24f-2 under the Investment Company Act of 1940, as amended.

Title of Securities Being Registered: Class I and Class S shares of Voya High Yield Portfolio

VY® PIONEER HIGH YIELD PORTFOLIO

7337 East Doubletree Ranch Road, Suite 100

Scottsdale, AZ 85258-2034

1-800-262-3862

June 3, 2019

Dear Shareholder:

On behalf of the Board of Directors (the “Board”) of VY® Pioneer High Yield Portfolio (“Pioneer Portfolio”), we are pleased to invite you to a special meeting of shareholders (the “Special Meeting”) of Pioneer Portfolio. The Special Meeting is scheduled for 1:00 p.m., local time, on July 23, 2019, at 7337 East Doubletree Ranch Road, Suite 100, Scottsdale, Arizona 85258-2034. At the Special Meeting shareholders of Pioneer Portfolio will be asked to vote on the proposed reorganization (the “Reorganization”) of Pioneer Portfolio with and into Voya High Yield Portfolio (“High Yield Portfolio”) (together with Pioneer Portfolio, the “Portfolios”). The Portfolios are members of the Voya family of funds.

Shares of Pioneer Portfolio have been purchased or acquired by you or at your direction through your qualified pension or retirement plan (collectively, “Qualified Plans”) or, at your direction, by your insurance company through its separate accounts to serve as investment options under your variable annuity contract or variable life insurance policy. If the Reorganization is approved by shareholders, the separate account in which you have an interest or the Qualified Plan in which you are a participant will own shares of High Yield Portfolio instead of shares of Pioneer Portfolio beginning on the date the Reorganization occurs. The Reorganization would provide the separate account in which you have an interest or the Qualified Plan in which you are a participant with an opportunity to participate in a portfolio that seeks to provide investors with a high level of current income and total return.

Formal notice of the Special Meeting appears on the next page, followed by a combined proxy statement and prospectus (the “Proxy Statement/Prospectus”). The Reorganization is discussed in detail in the enclosed Proxy Statement/Prospectus, which you should read carefully. The Board recommends that you vote “FOR” the Reorganization.

Your vote is important regardless of the number of shares you own. To avoid the added cost of follow-up solicitations and possible adjournments, please read the Proxy Statement/Prospectus and cast your vote. It is important that your vote be received no later than July 22, 2019.

We appreciate your participation and prompt response in this matter and thank you for your continued support.

Sincerely,

Dina Santoro

President

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

OF

VY® PIONEER HIGH YIELD PORTFOLIO

7337 East Doubletree Ranch Road, Suite 100

Scottsdale, AZ 85258-2034

(800) 262-3862

Scheduled for July 23, 2019

To the Shareholders:

NOTICE IS HEREBY GIVEN that a special meeting of the shareholders (the “Special Meeting”) of VY® Pioneer High Yield Portfolio (“Pioneer Portfolio”) is scheduled for 1:00 p.m., local time, on July 23, 2019 at 7337 East Doubletree Ranch Road, Suite 100, Scottsdale, Arizona 85258-2034.

At the Special Meeting, Pioneer Portfolio’s shareholders will be asked:

| 1. | To approve an Agreement and Plan of Reorganization by and between Pioneer Portfolio and Voya High Yield Portfolio (“High Yield Portfolio”), providing for the reorganization of Pioneer Portfolio with and into High Yield Portfolio (the “Reorganization”); and |

| 2. | To transact such other business, not currently contemplated, that may properly come before the Special Meeting, or any adjournments or postponements thereof, in the discretion of the proxies or their substitutes. |

Please read the enclosed combined proxy statement and prospectus (the “Proxy Statement/Prospectus”) carefully for information concerning the Reorganization to be placed before the Special Meeting.

The Board of Directors of Pioneer Portfolio recommends that you vote “FOR” the Reorganization.

Shareholders of record as of the close of business on April 29, 2019 are entitled to notice of, and to vote at, the Special Meeting, and are also entitled to vote at any adjournments or postponements thereof. Your attention is called to the accompanying Proxy Statement/Prospectus. Regardless of whether you plan to attend the Special Meeting, please complete, sign, and return the enclosed Proxy Ballot or Voting Instruction Card by July 22, 2019 so that a quorum will be present and a maximum number of shares may be voted. Proxies or voting instructions may be revoked at any time before they are exercised by submitting a revised Proxy Ballot or Voting Instruction Card, by giving written notice of revocation to Pioneer Portfolio or by voting in person at the Special Meeting.

By Order of the Board of Directors

Huey P. Falgout, Jr.

Secretary

June 3, 2019

PROXY STATEMENT/PROSPECTUS

June 3, 2019

Special Meeting of Shareholders

of VY® Pioneer High Yield Portfolio

Scheduled for July 23, 2019

| ACQUISITION OF THE ASSETS OF: | BY AND IN EXCHANGE FOR SHARES OF: |

| VY® Pioneer High Yield Portfolio | Voya High Yield Portfolio |

| (A series of Voya Partners, Inc.) | (A series of Voya Investors Trust) |

7337 East Doubletree Ranch Road, Suite 100

Scottsdale, AZ 85258-2034 | 7337 East Doubletree Ranch Road, Suite 100

Scottsdale, AZ 85258-2034 |

| (800) 262-3862 | (800) 366-0066 |

(each an open-end management investment company)

Important Notice Regarding the Availability of Proxy Materials

for the Shareholder Meeting to be Held on July 23, 2019

This Proxy Statement/Prospectus and Notice of Special Meeting are available at:www.proxyvote.com/voya

The Proxy Statement/Prospectus explains concisely what you should know before voting on the matter described herein or investing in Voya High Yield Portfolio. Please read it carefully and keep it for future reference.

THE U.S. SECURITIES AND EXCHANGE COMMISSION HAS NOT APPROVED OR DISAPPROVED THESE SECURITIES, OR DETERMINED THAT THIS PROXY STATEMENT/PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

TO OBTAIN MORE INFORMATION

To obtain more information about VY® Pioneer High Yield Portfolio (“Pioneer Portfolio”) and Voya High Yield Portfolio (“High Yield Portfolio,” and together with Pioneer Portfolio, the “Portfolios”), please write, call, or visit our website for a free copy of the current prospectus, statement of additional information, annual/semi-annual shareholder reports, or other information.

| By Phone: | 1-800-262-3862 |

| By Mail: | Voya Investment Management

7337 East Doubletree Ranch Road, Suite 100

Scottsdale, AZ 85258-2034 |

| By Internet: | www.voyainvestments.com/literature |

The following documents containing additional information about the Portfolios, each having been filed with the U.S. Securities and Exchange Commission (“SEC”), are incorporated by reference into this Proxy Statement/Prospectus:

| 1. | The Statement of Additional Information dated June 3, 2019 relating to this Proxy Statement/Prospectus (File No. [File No. generated with N-14 Filing]); |

| 2. | The Prospectus and Statement of Additional Information dated May 1, 2019 for Pioneer Portfolio (File No. 811-08319); and |

| 3. | The Prospectus and Statement of Additional Information dated May 1, 2019 for High Yield Portfolio (File No. 811-05629). |

The Portfolios are subject to the informational requirements of the Securities Exchange Act of 1934, as amended, and the Investment Company Act of 1940, as amended, and the rules, regulations, and exemptive orders, thereunder, and in accordance therewith, file reports and other information including proxy materials with the SEC.

You also may view or obtain these documents from the SEC:

| In Person: | Public Reference Section

100 F Street, N.E.

Washington, D.C. 20549(202) 551-8090 |

| By Mail: | U.S. Securities and Exchange Commission

Public Reference Section

100 F Street, N.E.

Washington, D.C. 20549(Duplication Fee Required) |

| By Email: | publicinfo@sec.gov

(Duplication Fee Required) |

| By Internet: | www.sec.gov |

When contacting the SEC, you will want to refer to the Portfolios’ SEC file numbers noted in each of (1), (2), and (3) above.

Table of Contents

| 1 |

| 1 |

| 1 |

| 1 |

| 1 |

| 1 |

| 2 |

| 3 |

| 3 |

| 3 |

| 3 |

| 3 |

| 4 |

| 5 |

| 9 |

| 11 |

| 12 |

| 12 |

| 12 |

| 14 |

| 14 |

| 15 |

| 15 |

| 16 |

| 16 |

| 16 |

| 16 |

| 16 |

| 16 |

| 17 |

| 17 |

| 17 |

| 18 |

| 27 |

| 32 |

| 32 |

| 32 |

INTRODUCTION

What is happening?

On November 16, 2018, the Boards of Directors/Trustees (the “Board”) of VY® Pioneer High Yield Portfolio (“Pioneer Portfolio”) and Voya High Yield Portfolio (“High Yield Portfolio,” together with Pioneer Portfolio, the “Portfolios”) approved an Agreement and Plan of Reorganization (the “Reorganization Agreement”), which provides for the reorganization of Pioneer Portfolio with and into High Yield Portfolio (the “Reorganization”). The Reorganization Agreement requires approval by shareholders of Pioneer Portfolio, and if approved, is expected to be effective on August 23, 2019, or such other date as the parties may agree (the “Closing Date”).

Why did you send me this booklet?

Shares of Pioneer Portfolio have been purchased or acquired by you or at your direction through your qualified pension or retirement plan (“Qualified Plans”) or, at your direction, by your insurance company (“Participating Insurance Company”) through its separate accounts (“Separate Accounts”) to serve as an investment option under your variable annuity and/or variable life contract (“Variable Contract”).

This booklet includes a combined proxy statement and prospectus (the “Proxy Statement/Prospectus”) and a Proxy Ballot or Voting Instruction Card for Pioneer Portfolio. It provides you with information you should review before providing voting instructions on the matters listed in the Notice of Special Meeting.

The Separate Accounts and Qualified Plans or their trustees, as record owners of Pioneer Portfolio shares are, in most cases, the “shareholders” of record of Pioneer Portfolio; however, participants in Qualified Plans (“Plan Participants”) or holders of Variable Contracts (“Variable Contract Holders”) may be asked to instruct their Qualified Plan trustee or Separate Accounts, as applicable, as to how they would like the shares attributed to their Qualified Plan or Variable Contract to be voted. For clarity and ease of reading, references to “shareholder” or “you” throughout this Proxy Statement/Prospectus do not refer to the shareholder of record (e.g., the Separate Accounts or Qualified Plans) but rather refer to the persons who are being asked to provide voting instructions on the proposals, unless the context indicates otherwise. Similarly, for ease of reading, references to “voting” or “vote” do not refer to the technical vote but rather to the voting instructions provided by Variable Contract Holders or Plan Participants.

Because you are being asked to approve a Reorganization Agreement that will result in a transaction in which you will ultimately hold shares of High Yield Portfolio, this Proxy Statement also serves as a prospectus for High Yield Portfolio. High Yield Portfolio is an open-end management investment company that seeks to provide investors with a high level of current income and total return, as described more fully below.

Who is eligible to vote?

Shareholders of record holding an investment in shares of Pioneer Portfolio as of the close of business on April 29, 2019 (the “Record Date”) are eligible to vote at the special meeting of shareholders (the “Special Meeting”) or any adjournments or postponements thereof.

How do I vote?

You may submit your Proxy Ballot or Voting Instruction Card in one of four ways:

| • | By Internet. The web address and instructions for voting can be found on the enclosed Proxy Ballot or Voting Instruction Card. You will be required to provide your control number located on the Proxy Ballot or Voting Instruction Card. |

| • | By Telephone. The toll-free number for telephone voting can be found on the enclosed Proxy Ballot or Voting Instruction Card. You will be required to provide your control number located on the Proxy Ballot or Voting Instruction Card. |

| • | By Mail. Mark the enclosed Proxy Ballot or Voting Instruction Card, sign and date it, and return it in the postage-paid envelope we provided. Both joint owners must sign the Proxy Ballot or Voting Instruction Card. |

| • | In Person at the Special Meeting. You can vote your shares in person at the Special Meeting. If you expect to attend the Special Meeting in person, please call Shareholder Services toll-free at 1-800-262-3862. |

To be certain your vote will be counted, a properly executed Proxy Ballot or Voting Instruction Card must be received no later than 5:00 p.m., local time, on July 22, 2019.

When and where will the Special Meeting be held?

The Special Meeting is scheduled to be held at 7337 East Doubletree Ranch Road, Suite 100, Scottsdale, Arizona 85258-2034, on July 23, 2019, at 1:00 p.m., local time, and if the Special Meeting is adjourned or postponed, any adjournments or postponements of the Special Meeting will also be held at the above location. If you expect to attend the Special Meeting in person, please call Shareholder Services toll-free at 1-800-262-3862.

SUMMARY OF THE PROPOSED REORGANIZATION

You should read this entire Proxy Statement/Prospectus, and the Reorganization Agreement, which is included in Appendix A. For more information about High Yield Portfolio, please consult Appendix B and High Yield Portfolio’s Prospectus dated May 1, 2019.

On November 16, 2018, the Board approved the Reorganization. Subject to shareholder approval, the Reorganization Agreement provides for:

| • | the transfer of all of the assets of Pioneer Portfolio to High Yield Portfolio in exchange for shares of beneficial interest of High Yield Portfolio; |

| • | the assumption by High Yield Portfolio of all the liabilities of Pioneer Portfolio; |

| • | the distribution of shares of High Yield Portfolio to the shareholders of Pioneer Portfolio; and |

| • | the complete liquidation of Pioneer Portfolio. |

If shareholders of Pioneer Portfolio approve the Reorganization, each owner of Class I or Class S shares of Pioneer Portfolio would become a shareholder of the corresponding share class of High Yield Portfolio. The Reorganization is expected to be effective on the Closing Date. Each shareholder of Pioneer Portfolio will hold, immediately after the close of the Reorganization (the “Closing”), shares of High Yield Portfolio having an aggregate value equal to the aggregate value of the shares of Pioneer Portfolio held by that shareholder as of the close of business on the Closing Date. High Yield Portfolio also offers Class ADV and Class S2 shares which are not subject to this transaction.

In considering whether to approve the Reorganization, you should note that:

| • | The Portfolios have similar investment objectives. The investment objective of Pioneer Portfolio is to maximize total return through income and capital appreciation. The investment objective of High Yield Portfolio is to provide investors with a high level of current income and total return. |

| • | The Portfolios have somewhat different principal investment strategies. Each Portfolio’s investment process is driven mainly by bottom-up fundamental analysis. However, Pioneer Portfolio invests more heavily in non-high yield securities (e.g. preferred stock, convertible bonds, convertible preferred equity, and equity) compared to High Yield Portfolio. High Yield Portfolio also does not hold equity-linked securities to the same extent as Pioneer Portfolio and may invest a greater portion of its assets in lower rated high-yield securities. |

| • | Voya Investments, LLC (“Voya Investments” or the “Adviser”) serves as the investment advisor to each Portfolio. Amundi Pioneer Asset Management, Inc. serves as the sub-adviser to Pioneer Portfolio. Voya Investment Management Co. LLC serves as the sub-adviser to High Yield Portfolio. |

| • | Each Portfolio is distributed by Voya Investments Distributor, LLC (the “Distributor”). |

| • | The shareholders of Pioneer Portfolio are expected to benefit from a reduction in total gross expenses as shareholders of High Yield Portfolio. In addition, shareholders of Pioneer Portfolio are expected to benefit from a reduction in total net expenses as shareholders of High Yield Portfolio. |

| • | The Reorganization will not affect a shareholder’s right to purchase, redeem, or exchange shares of the Portfolios. In addition, the Reorganization will not affect how shareholders purchase or sell their shares. |

| • | The Reorganization is intended to qualify for federal income tax purposes as a tax-free reorganization pursuant to Section 368(a) of the Internal Revenue Code of 1986, as amended (the “Code”); accordingly, pursuant to this treatment, neither Pioneer Portfolio nor its shareholders, nor High Yield Portfolio nor its shareholders are expected to recognize any gain or loss for federal income tax purposes from the Reorganization. |

APPROVAL OF THE REORGANIZATION

What is the proposed Reorganization?

Shareholders of Pioneer Portfolio are being asked to approve a Reorganization Agreement, providing for the reorganization of Pioneer Portfolio with and into High Yield Portfolio. If the Reorganization is approved, shareholders of Pioneer Portfolio will become shareholders of High Yield Portfolio as of the Closing.

Why is a Reorganization proposed?

The Adviser initiated a review of Amundi Pioneer Asset Management, Inc.’s (“Amundi Pioneer”) continued service as sub-adviser to Pioneer Portfolio in light of recent changes in key peronnel at Amundi Pioneer, and, based on that review, the Adviser determined to recommend the reorganization, for the reasons described in further detail below. Consequently, at the November 2018 meeting of the Board, the Adviser proposed, and the Board approved, the Reorganization of Pioneer Portfolio into High Yield Portfolio. In support of its proposal, the Adviser noted that, in its view, the Reorganization would provide shareholders of Pioneer Portfolio with the potential for improved performance, lower volatility, lower tracking error and an immediate benefit through lower gross and net expense ratios.

How do the Investment Objectives compare?

Each Portfolio’s investment objective is described in the chart below.

| | Pioneer Portfolio | High Yield Portfolio |

| Investment Objective | The Portfolio seeks to maximize total return through income and capital appreciation. | The Portfolio seeks to provide investors with a high level of current income and total return. |

Each Portfolio’s investment objective is non-fundamental and may be changed by a vote of the Board, without shareholder approval. A Portfolio will provide 60 days’ prior written notice of any change in a non-fundamental investment objective.

How do the Annual Portfolio Operating Expenses compare?

The table below describes the fees and expenses that you may pay if you buy and hold shares of the Portfolios. Pro forma fees and expenses, which are the estimated fees and expenses of High Yield Portfolio after giving effect to the Reorganization, assume the Reorganization occurred on December 31, 2018. The table does not reflect fees or expenses that are, or may be, imposed under your Variable Contract or Qualified Plan. If these fees or expenses were included in the table, the Portfolios’ expenses would be higher. For more information on these charges, please refer to the documents governing your Variable Contract or consult your plan administrator.

The advisory agreement between the Adviser and High Yield Portfolio provides for a “bundled fee” arrangement under which the Adviser provides or engages service providers to provide (in addition to the advisory services) custodial, administrative, transfer agency, portfolio accounting, auditing, and ordinary legal services in return for a single management fee. The advisory agreement between the Adviser and Pioneer Portfolio provides for an advisory fee for which the Adviser provides advisory and administrative services only. Other services are provided to Pioneer Portfolio under separate agreements at additional expense. Both Portfolios are responsible for distribution or shareholder servicing plan payments, interest, taxes, investment-related costs, leverage expenses, and extraordinary expenses.

Annual Portfolio Operating Expenses

Expenses you pay each year as a % of the value of your investment |

| | Pioneer Portfolio | High Yield Portfolio | High Yield Portfolio

Pro Forma |

| Class I | | | | |

| Management Fees | % | 0.70 | 0.49 | 0.49 |

| Distribution and/or Shareholder Services (12b-1) Fees | % | None | None | None |

| Other Expenses | % | 0.08 | 0.01 | 0.01 |

| Total Annual Portfolio Operating Expenses | % | 0.78 | 0.50 | 0.50 |

| Waivers and Reimbursements | % | (0.07)1 | None2 | None2 |

| Total Annual Portfolio Operating Expenses after Waivers and Reimbursements | % | 0.71 | 0.50 | 0.50 |

| Class S | | | | |

| Management Fees | % | 0.70 | 0.49 | 0.49 |

| Distribution and/or Shareholder Services (12b-1) Fees | % | 0.25 | 0.25 | 0.25 |

| Other Expenses | % | 0.08 | 0.01 | 0.01 |

| Total Annual Portfolio Operating Expenses | % | 1.03 | 0.75 | 0.75 |

| Waivers and Reimbursements | % | (0.07)1 | None2 | None2 |

| Total Annual Portfolio Operating Expenses after Waivers and Reimbursements | % | 0.96 | 0.75 | 0.75 |

| 1. | The Adviser is contractually obligated to limit expenses to 0.71% and 0.96% for Class I and Class S shares, respectively, through May 1, 2021. The limitation does not extend to interest, taxes, investment-related costs, leverage expenses, extraordinary expenses, and Acquired Fund Fees and Expenses. This limitation is subject to possible recoupment by the Adviser within 36 months of the waiver or reimbursement. Termination or modification of this obligation requires approval by Pioneer Portfolio’s Board. |

| 2. | The Adviser is contractually obligated to waive 0.015% of the management fee through May 1, 2020. Including this waiver, Class I expenses would be 0.48%, Class I pro forma expenses would be 0.48%, Class S expenses would be 0.73%, and Class S pro forma expenses would be 0.73%. Termination or modification of this obligation requires approval by VIT’s Board. |

Expense Example

The Example is intended to help you compare the cost of investing in shares of the Portfolio with the costs of investing in other mutual funds. The Example does not reflect expenses and charges which are, or may be, imposed under your Variable Contract or Qualified Plan. The Example assumes that you invest $10,000 in the Portfolio for the time periods indicated. The Example also assumes that your investment had a 5% return each year and that the Portfolio's operating expenses remain the same.

| | | Pioneer Portfolio | High Yield Portfolio | High Yield Portfolio

Pro Forma |

| Class | | 1 Yr | 3 Yrs | 5 Yrs | 10 Yrs | 1 Yr | 3 Yrs | 5 Yrs | 10 Yrs | 1 Yr | 3 Yrs | 5 Yrs | 10 Yrs |

| Class I | $ | 73 | 242 | 426 | 960 | 51 | 160 | 280 | 628 | 51 | 160 | 280 | 628 |

| Class S | $ | 98 | 321 | 562 | 1,253 | 77 | 240 | 417 | 930 | 77 | 240 | 417 | 930 |

The Examples reflect applicable expense limitation agreements and/or waivers in effect, if any, for the one-year period and the first year of the three-, five-, and ten-year periods.

How do the Principal Investment Strategies compare?

Each Portfolio’s principal investment strategies are described in more detail in the table below. Both Portfolios invest primarily in high-yield (high risk) debt securities. Pioneer Portfolio invests primarily in below investment-grade (high-yield) debt securities and preferred stocks. Pioneer Portfolio’s sub-adviser uses a value investing approach in managing the Portfolio, seeking securities selling at reasonable prices or substantial discounts to their underlying values. Pioneer Portfolio then holds these securities for their incremental yields or until market values reflect their intrinsic values. With respect to High Yield Portfolio, the sub-adviser invests primarily in a diversified portfolio of high-yield (high risk) bonds commonly known as “junk bonds.” High Yield Portfolio’s sub-adviser combines extensive company and industry research with relative value analysis to identify high-yield bonds expected to provide above-average returns. Relative value analysis is intended to enhance returns by moving from overvalued to undervalued sectors of the bond market.

| | Pioneer Portfolio | High Yield Portfolio |

Investment

Strategies | Under normal market conditions, the Portfolio invests at least 80% of its net assets (plus borrowings for investment purposes) in below investment-grade (high-yield) debt securities and preferred stocks. The Portfolio will provide shareholders with at least 60 days' prior written notice of any change in this investment policy. Debt securities rated below investment-grade are commonly referred to as “junk bonds” and may be considered speculative. The Portfolio may invest in high-yield securities of any rating, including securities where the issuer is in default or bankruptcy at the time of purchase. For purposes of satisfying the 80% requirement, the Portfolio also may invest in derivative instruments that have economic characteristics similar to such high-yield debt securities and preferred stocks.

The Portfolio’s investments (which may include bank loans) may have fixed or variable principal payments and all types of interest rate and dividend payment and reset terms, including fixed-rate, adjustable rate, floating rate, zero-coupon, contingent, deferred, payment in kind, and auction rate features. The Portfolio's investments may include investments that allow for balloon payments or negative amortization payments. The Portfolio invests in securities with a broad range of maturities, and its high-yield securities investments may be convertible into equity securities of the issuer. The Portfolio may also invest in event-linked bonds, and credit default swaps.

The Portfolio may invest in securities of Canadian issuers to the same extent as securities of U.S. issuers. The Portfolio may invest up to 15% of its assets in foreign securities (excluding Canadian issuers) including debt and equity securities of corporate issuers and debt securities of government issuers in developed and emerging markets.

The Portfolio may invest in investment-grade and below investment-grade convertible bonds and preferred stocks that | Under normal market conditions, the Portfolio invests at least 80% of its net assets (plus borrowings for investment purposes) in a diversified portfolio of high-yield (high risk) bonds commonly known as “junk bonds.” The Portfolio will provide shareholders with at least 60 days’ prior notice of any change in this investment policy.

High-yield bonds are debt instruments that, at the time of purchase, are not rated by a nationally recognized statistical rating organization (“NRSRO”) or are rated below investment-grade (for example, rated below BBB- by S&P Global Ratings or Baa3 by Moody’s Investors Service, Inc.) or have an equivalent rating by a NRSRO. The Portfolio defines high-yield bonds to include: bank loans; payment-in-kind securities; fixed and variable floating rate and deferred interest debt obligations; zero-coupon bonds and debt obligations provided they are unrated or rated below investment-grade. In evaluating the quality of a particular high-yield bond for investment by the Portfolio, the sub-adviser (“Sub-Adviser”) does not rely exclusively on ratings assigned by a NRSRO. The Sub-Adviser will utilize a security’s credit rating as simply one indication of an issuer’s creditworthiness and will principally rely upon its own analysis of any security. However, the Sub-Adviser does not have restrictions on the rating level of the securities held in the Portfolio and may purchase and hold securities in default. There are no restrictions on the average maturity of the Portfolio or the maturity of any single investment. Maturities may vary widely depending on the Sub-Adviser’s assessment of interest rate trends and other economic or market factors.

Any remaining assets may be invested in investment-grade debt instruments; common and preferred stocks; U.S. government securities; money market instruments; and debt instruments of foreign issuers including securities of companies |

| | Pioneer Portfolio | High Yield Portfolio |

| | are convertible into the equity securities of the issuer. The Portfolio also may invest in mortgage-related securities, including “sub-prime” mortgages and asset-backed securities, mortgage derivatives and structured securities. Consistent with its investment objective, the Portfolio invests in equity securities of U.S. and non-U.S. issuers when the sub-adviser (“Sub-Adviser”) believes they offer the potential for capital appreciation or to diversify the Portfolio's investment portfolio. Equity securities may include common stocks, depositary receipts, warrants, rights, and other equity interests. The Portfolio may also invest in other investment companies, including exchange-traded funds, to the extent permitted under the Investment Company Act of 1940, as amended, and the rules, regulations, and exemptive orders thereunder (“1940 Act”), and in real estate-related securities, including real estate investment trusts.

The Portfolio may use futures and options on securities, indices and currencies; forward foreign currency exchange contracts; and other derivatives. The Portfolio may use derivatives for a variety of purposes, including: in an attempt to hedge against adverse changes in the market prices of securities; interest rates or currency exchange rates; as a substitute for purchasing or selling securities; to attempt to increase the Portfolio's return as a non-hedging strategy that may be considered speculative; and to manage the portfolio characteristics.

The Sub-Adviser uses a value investing approach in managing the Portfolio, seeking securities selling at reasonable prices or substantial discounts to their underlying values. The Portfolio then holds these securities for their incremental yields or until market values reflect their intrinsic values. The Sub-Adviser evaluates a security's potential value, including the attractiveness of its market valuation, based on the company's assets and prospects for earnings growth. In determining whether an investment is appropriate for the Portfolio, the Sub-Adviser employs fundamental research and an evaluation of the issuer based on its financial statements and operations and a security's potential to provide income. From time to time, the Portfolio may invest more than 25% of its assets in the same market segment.

In assessing the appropriate maturity, rating and sector weighting of the Portfolio's investment portfolio, the Sub-Adviser considers a variety of factors that are expected to influence economic activity and interest rates. These factors include fundamental economic indicators, such as the rates of economic growth and inflation; Federal Reserve monetary policy; and the relative value of the U.S. dollar compared to other currencies. The Sub-Adviser adjusts sector weightings to reflect its outlook on the market for high-yield securities, rather than using a fixed sector allocation. The Sub-Adviser makes these adjustments periodically as part of its ongoing review of the Portfolio's investment portfolio.

Normally, the Portfolio invests substantially all of its assets to meet its investment objective. The Portfolio may invest the remainder of its assets in securities with remaining maturities of less than one year, cash equivalents or may hold cash.

The Sub-Adviser may sell securities for a variety of reasons, such as to secure gains, limit losses, or redeploy assets into opportunities believed to be more promising, among others.

The Portfolio may lend portfolio securities on a short-term or long-term basis, up to 33 1⁄3% of its total assets. | in emerging markets. The Portfolio may invest in derivatives, including, structured debt obligations, dollar roll transactions, swap agreements, including credit default swaps and interest rate swaps, and options on swap agreements. The Portfolio typically uses derivatives to reduce exposure to other risks, such as interest rate or currency risk, to substitute for taking a position in the underlying asset, and/or to enhance returns in the Portfolio. The Portfolio may invest in companies of any market capitalization size.

The Portfolio may invest in other investment companies, including exchange-traded funds, to the extent permitted under the Investment Company Act of 1940, as amended, and the rules, regulations, and exemptive orders thereunder (“1940 Act”).

In choosing investments for the Portfolio, the Sub-Adviser combines extensive company and industry research with relative value analysis to identify high-yield bonds expected to provide above-average returns. Relative value analysis is intended to enhance returns by moving from overvalued to undervalued sectors of the bond market. The Sub-Adviser’s approach to decision making includes contributions from individual portfolio managers responsible for specific industry sectors.

The Sub-Adviser may sell securities for a variety of reasons, such as to secure gains, limit losses, or redeploy assets into opportunities believed to be more promising, among others.

The Portfolio may lend portfolio securities on a short-term or long-term basis, up to 33 1⁄3% of its total assets. |

How do the Principal Risks compare?

The following table summarizes and compares the principal risks of investing in the Portfolios. You could lose money on an investment in the Portfolios. Any of the following risks, among others, could affect Portfolio performance or cause the Portfolio to lose money or to underperform market averages of other funds.

| Risks | Pioneer Portfolio | High Yield Portfolio |

| Bank Instruments: Bank instruments include certificates of deposit, fixed time deposits, bankers’ acceptances, and other debt and deposit-type obligations issued by banks. Changes in economic, regulatory or political conditions, or other events that affect the banking industry may have an adverse effect on bank instruments or banking institutions that serve as counterparties in transactions with the Portfolio. | | ✓ |

| Cash/Cash Equivalents: Investments in cash or cash equivalents may lower returns and result in potential lost opportunities to participate in market appreciation which could negatively impact the Portfolio’s performance and ability to achieve its investment objective. | ✓ | |

| Company: The price of a company’s stock could decline or underperform for many reasons including, among others, poor management, financial problems, reduced demand for company goods or services, regulatory fines and judgments, or business challenges. If a company declares bankruptcy or becomes insolvent, its stock could become worthless. | ✓ | ✓ |

| Convertible Securities: Convertible securities are securities that are convertible into or exercisable for common stocks at a stated price or rate. Convertible securities are subject to the usual risks associated with debt instruments, such as interest rate and credit risk. In addition, because convertible securities react to changes in the value of the stocks into which they convert, they are subject to market risk. | ✓ | |

| Credit: The price of a bond or other debt instrument is likely to fall if the issuer’s actual or perceived financial health deteriorates, whether because of broad economic or issuer-specific reasons. In certain cases, the issuer could be late in paying interest or principal, or could fail to pay its financial obligations altogether. | ✓ | ✓ |

| Credit Default Swaps: A Portfolio may enter into credit default swaps, either as a buyer or a seller of the swap. A buyer of a swap pays a fee to buy protection against the risk that a security will default. If no default occurs, a Portfolio will have paid the fee, but typically will recover nothing under the swap. A seller of a swap receives payment(s) in return for an obligation to pay the counterparty the full notional value of a security in the event of a default of the security issuer. As a seller of a swap, a Portfolio would effectively add leverage to its portfolio because, in addition to its total net assets, a Portfolio would be subject to investment exposure on the full notional value of the swap. Credit default swaps are particularly subject to counterparty, credit, valuation, liquidity and leveraging risks and the risk that the swap may not correlate with its underlying asset as expected. Certain standardized swaps are subject to mandatory central clearing. Central clearing is expected to reduce counterparty credit risk and increase liquidity; however, there is no assurance that central clearing will achieve that result, and in the meantime, central clearing and related requirements expose a Portfolio to new kinds of costs and risks. In addition, credit default swaps expose a Portfolio to the risk of improper valuation. | ✓ | ✓ |

| Currency: To the extent that a Portfolio invests directly or indirectly in foreign (non-U.S.) currencies or in securities denominated in, or that trade in, foreign (non-U.S.) currencies, it is subject to the risk that those foreign (non-U.S.) currencies will decline in value relative to the U.S. dollar or, in the case of hedging positions, that the U.S. dollar will decline in value relative to the currency being hedged by a Portfolio through foreign currency exchange transactions. | ✓ | ✓ |

| Derivative Instruments: Derivative instruments are subject to a number of risks, including the risk of changes in the market price of the underlying securities, credit risk with respect to the counterparty, risk of loss due to changes in market interest rates and liquidity and volatility risk. The amounts required to purchase certain derivatives may be small relative to the magnitude of exposure assumed by a Portfolio. Therefore, the purchase of certain derivatives may have an economic leveraging effect on a Portfolio and exaggerate any increase or decrease in the net asset value. Derivatives may not perform as expected, so a Portfolio may not realize the intended benefits. When used for hedging purposes, the change in value of a derivative may not correlate as expected with the currency, security or other risk being hedged. When used as an alternative or substitute for direct cash investments, the return provided by the derivative may not provide the same return as direct cash investment. In addition, given their complexity, derivatives expose a Portfolio to the risk of improper valuation. | ✓ | ✓ |

| Risks | Pioneer Portfolio | High Yield Portfolio |

| Floating Rate Loans: In the event a borrower fails to pay scheduled interest or principal payments on a floating rate loan, the Portfolio will experience a reduction in its income and a decline in the market value of such investment. This will likely reduce the amount of dividends paid and may lead to a decline in the net asset value. If a floating rate loan is held by the Portfolio through another financial institution, or the Portfolio relies upon another financial institution to administer the loan, the receipt of scheduled interest or principal payments may be subject to the credit risk of such financial institution. Investors in floating rate loans may not be afforded the protections of the anti-fraud provisions of the Securities Act of 1933, as amended, and the Securities Exchange Act of 1934, as amended, because loans may not be considered “securities” under such laws. Additionally, the value of collateral, if any, securing a floating rate loan can decline or may be insufficient to meet the issuer’s obligations under the loan. Furthermore, such collateral may be difficult to liquidate. No active trading market may exist for many floating rate loans and many floating rate loans are subject to restrictions on resale. Transactions in loans typically settle on a delayed basis and may take longer than 7 days to settle. As a result, the Portfolio may not receive the proceeds from a sale of a floating rate loan for a significant period of time. Delay in the receipts of settlement proceeds may impair the ability of the Portfolio to meet its redemption obligations. It may also limit the ability of the Portfolio to repay debt, pay dividends, or to take advantage of new investment opportunities. | ✓ | |

| Focused Investing: To the extent that the Portfolio invests a substantial portion of its assets in securities related to a particular industry, sector, market segment, or geographic area, its investments will be sensitive to developments in that industry, sector, market segment, or geographic area. The Portfolio is subject to the risk that changing economic conditions; changing political or regulatory conditions; or natural and other disasters affecting the particular industry, sector, market segment, or geographic area in which the Portfolio focuses its investments could have a significant impact on its investment performance and could ultimately cause the Portfolio to underperform, or its net asset value to be more volatile than, other funds that invest more broadly. | ✓ | |

| Foreign Investments/Developing and Emerging Markets: Investing in foreign (non-U.S.) securities may result in the Portfolio experiencing more rapid and extreme changes in value than a fund that invests exclusively in securities of U.S. companies due to: smaller markets; differing reporting, accounting, and auditing standards; nationalization, expropriation, or confiscatory taxation; foreign currency fluctuations, currency blockage, or replacement; potential for default on sovereign debt; or political changes or diplomatic developments, which may include the imposition of economic sanctions or other measures by the United States or other governments and supranational organizations. Markets and economies throughout the world are becoming increasingly interconnected, and conditions or events in one market, country or region may adversely impact investments or issuers in another market, country or region. Foreign investment risks may be greater in developing and emerging markets than in developed markets. | ✓ | ✓ |

| High-Yield Securities: Lower quality securities (including securities that have fallen below investment-grade and are classified as “junk bonds” or “high yield securities”) have greater credit risk and liquidity risk than higher quality (investment-grade) securities, and their issuers' long-term ability to make payments is considered speculative. Prices of lower quality bonds or other debt instruments are also more volatile, are more sensitive to negative news about the economy or the issuer, and have greater liquidity and price volatility risk. | ✓ | ✓ |

| Interest in Loans: The value and the income streams of interests in loans (including participation interests in lease financings and assignments in secured variable or floating rate loans) will decline if borrowers delay payments or fail to pay altogether. A significant rise in market interest rates could increase this risk. Although loans may be fully collateralized when purchased, such collateral may become illiquid or decline in value. The value and the income streams of interests in loans (including participation interests in lease financings and assignments in secured variable or floating rate loans) will decline if borrowers delay payments or fail to pay altogether. A significant rise in market interest rates could increase this risk. Although loans may be fully collateralized when purchased, such collateral may become illiquid or decline in value. | ✓ | ✓ |

| Risks | Pioneer Portfolio | High Yield Portfolio |

| Interest Rate: With bonds and other fixed rate debt instruments, a rise in market interest rates generally causes values to fall; conversely, values generally rise as market interest rates fall. The higher the credit quality of the instrument, and the longer its maturity or duration, the more sensitive it is likely to be to interest rate risk. In the case of inverse securities, the interest rate paid by the securities is a floating rate, which generally will decrease when the market rate of interest to which the inverse security is indexed increases and will increase when the market rate of interest to which the inverse security is indexed decreases. [As of the date of this Prospectus, market interest rates in the United States are near historic lows, which may increase the Portfolio’s exposure to risks associated with rising market interest rates.] Rising market interest rates could have unpredictable effects on the markets and may expose fixed-income and related markets to heightened volatility. To the extent that the Portfolio invests in fixed-income securities, an increase in market interest rates may lead to increased redemptions and increased portfolio turnover, which could reduce liquidity for certain investments, adversely affect values, and increase costs. Increased redemptions may cause the Portfolio to liquidate portfolio positions when it may not be advantageous to do so and may lower returns. If dealer capacity in fixed-income markets is insufficient for market conditions, it may further inhibit liquidity and increase volatility in the fixed-income markets. Further, recent and potential future changes in government policy may affect interest rates. | ✓ | ✓ |

| Liquidity: If a security is illiquid, a Portfolio might be unable to sell the security at a time when a Portfolio’s manager might wish to sell, or at all. Further, the lack of an established secondary market may make it more difficult to value illiquid securities, exposing a Portfolio to the risk that the price at which it sells illiquid securities will be less than the price at which they were valued when held by a Portfolio. The prices of illiquid securities may be more volatile than more liquid investments. The risks associated with illiquid securities may be greater in times of financial stress. A Portfolio could lose money if it cannot sell a security at the time and price that would be most beneficial to a Portfolio. | ✓ | ✓ |

| Market: Stock prices may be volatile or have reduced liquidity in response to real or perceived impacts of factors including, but not limited to, economic conditions, changes in market interest rates, and political events. Stock markets tend to be cyclical, with periods when stock prices generally rise and periods when stock prices generally decline. Any given stock market segment may remain out of favor with investors for a short or long period of time, and stocks as an asset class may underperform bonds or other asset classes during some periods. Additionally, legislative, regulatory or tax policies or developments in these areas may adversely impact the investment techniques available to a manager, add to costs and impair the ability of a Portfolio to achieve its investment objectives. | ✓ | ✓ |

| Market Capitalization: Stocks fall into three broad market capitalization categories - large, mid, and small. Investing primarily in one category carries the risk that, due to current market conditions, that category may be out of favor with investors. If valuations of large-capitalization companies appear to be greatly out of proportion to the valuations of mid- or small-capitalization companies, investors may migrate to the stocks of mid- and small-sized companies causing a fund that invests in these companies to increase in value more rapidly than a fund that invests in larger companies. Investing in mid- and small-capitalization companies may be subject to special risks associated with narrower product lines, more limited financial resources, smaller management groups, more limited publicly available information, and a more limited trading market for their stocks as compared with larger companies. As a result, stocks of mid- and small-capitalization companies may be more volatile and may decline significantly in market downturns. | ✓ | ✓ |

| Mortgage- and/or Asset-Backed Securities: Defaults on, or low credit quality or liquidity of the underlying assets of the asset-backed (including mortgage-backed) securities may impair the value of these securities and result in losses. There may be limitations on the enforceability of any security interest or collateral granted with respect to those underlying assets and the value of collateral may not satisfy the obligation upon default. These securities also present a higher degree of prepayment and extension risk and interest rate risk than do other types of debt instruments. | ✓ | |

| Other Investment Companies: The main risk of investing in other investment companies, including exchange-traded funds (“ETFs”), is the risk that the value of the securities underlying an investment company might decrease. Shares of investment companies that are listed on an exchange may trade at a discount or premium from their net asset value. You will pay a proportionate share of the expenses of those other investment companies (including management fees, administration fees, and custodial fees) in addition to the expenses of a Portfolio. The investment policies of the other investment companies may not be the same as those of a Portfolio; as a result, an investment in the other investment companies may be subject to additional or different risks than those to which a Portfolio is typically subject. | ✓ | ✓ |

| Risks | Pioneer Portfolio | High Yield Portfolio |

| Prepayment and Extension: Many types of debt instruments are subject to prepayment and extension risk. Prepayment risk is the risk that the issuer of a debt instrument will pay back the principal earlier than expected. This may occur when interest rates decline. Prepayment may expose the Portfolio to a lower rate of return upon reinvestment of principal. Also, if a debt instrument subject to prepayment has been purchased at a premium, the value of the premium would be lost in the event of prepayment. Extension risk is the risk that the issuer of a debt instrument will pay back the principal later than expected. This may occur when interest rates rise. This may negatively affect performance, as the value of the debt instrument decreases when principal payments are made later than expected. Additionally, the Portfolio may be prevented from investing proceeds it would have received at a given time at the higher prevailing interest rates. | ✓ | ✓ |

| Real Estate Companies and Real Estate Investment Trusts (“REITs”): Investing in real estate companies and REITs may subject a Portfolio to risks similar to those associated with the direct ownership of real estate, including losses from casualty or condemnation, changes in local and general economic conditions, supply and demand, market interest rates, zoning laws, regulatory limitations on rents, property taxes, and operating expenses in addition to terrorist attacks, war, or other acts that destroy real property. Investments in REITs are affected by the management skill and creditworthiness of the REIT. A Portfolio will indirectly bear its proportionate share of expenses, including management fees, paid by each REIT in which it invests. | ✓ | |

| Securities Lending: Securities lending involves two primary risks: “investment risk” and “borrower default risk.” When lending securities, a Portfolio will receive cash or U.S. government securities as collateral. Investment risk is the risk that a Portfolio will lose money from the investment of the cash collateral received from the borrower. Borrower default risk is the risk that a Portfolio will lose money due to the failure of a borrower to return a borrowed security. Securities lending may result in leverage. The use of leverage may exaggerate any increase or decrease in the net asset value, causing a Portfolio to be more volatile. The use of leverage may increase expenses and increase the impact of a Portfolio’s other risks. | ✓ | ✓ |

| Sovereign Debt: These securities are issued or guaranteed by foreign government entities. Investments in sovereign debt are subject to the risk that a government entity may delay payment, restructure its debt, or refuse to pay interest or repay principal on its sovereign debt. Some of these reasons may include cash flow problems, insufficient foreign currency reserves, political considerations, social changes, the relative size of its debt position to its economy or its failure to put in place economic reforms required by the International Monetary Fund or other multilateral agencies. If a government entity defaults, it may ask for more time in which to pay or for further loans. There is no legal process for collecting sovereign debts that a government does not pay or bankruptcy proceeding by which all or part of sovereign debt that a government entity has not repaid may be collected. | ✓ | |

| U.S. Government Securities and Obligations: U.S. government securities are obligations of, or guaranteed by, the U.S. government, its agencies or government-sponsored enterprises. U.S. government securities are subject to market and interest rate risk, and may be subject to varying degrees of credit risk. | | ✓ |

| Value Investing: Securities that appear to be undervalued may never appreciate to the extent expected. Further, because the prices of value-oriented securities tend to correlate more closely with economic cycles than growth-oriented securities, they generally are more sensitive to changing economic conditions, such as changes in market interest rates, corporate earnings and industrial production. The manager may be wrong in its assessment of a company’s value and the securities a Portfolio holds may not reach their full values. A particular risk of a Portfolio’s value approach is that some holdings may not recover and provide the capital growth anticipated or a security judged to be undervalued may actually be appropriately priced. The market may not favor value-oriented securities and may not favor equities at all. During those periods, a Portfolio’s relative performance may suffer. There is a risk that funds that invest in value-oriented stocks may underperform other funds that invest more broadly. | ✓ | |

| Zero-Coupon Bonds and Pay-in-Kind Securities: Zero-coupon bonds and pay-in-kind securities may be subject to greater fluctuations in price due to market interest rate changes than conventional interest-bearing securities. The Portfolio may have to pay out the imputed income on zero-coupon bonds without receiving the actual cash currency resulting in a loss. | ✓ | ✓ |

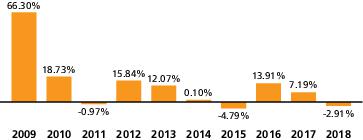

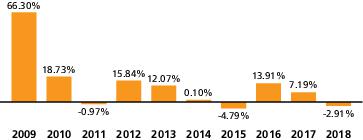

How does VY® Pioneer High Yield Portfolio’s performance compare to Voya High Yield Portfolio?

The following information is intended to help you understand the risks of investing in the Portfolios. The following bar charts show the changes in the Portfolios’ performance from year to year, and the table compares each Portfolio’s performance to the performance of a broad-based securities market index/indices for the same period. The Portfolios’ performance information reflects applicable fee waivers and/or expense limitations in effect during the period presented. Absent such fee waivers/expense limitations, if any, performance

would have been lower. The bar chart shows the performance of each Portfolio’s Class S shares. Performance for other share classes would differ to the extent they have differences in their fees and expenses. Performance in the Average Annual Total Returns table does not include insurance-related charges imposed under a Variable Contract or expenses related to a Qualified Plan. If these charges or expenses were included, performance would be lower. Thus, you should not compare the Portfolios’ performance directly with the performance information of other investment products without taking into account all insurance-related charges and expenses payable under your Variable Contract or Qualified Plan. The Portfolios’ past performance is no guarantee of future results.

Pioneer Portfolio

Calendar Year Total Returns Class S

(as of December 31 of each year)

| Bar Chart Graphic | CUSIP/Fund ID |

| 2009 | 66.30% |

| 2010 | 18.73% |

| 2011 | -0.97% |

| 2012 | 15.84% |

| 2013 | 12.07% |

| 2014 | 0.10% |

| 2015 | -4.79% |

| 2016 | 13.91% |

| 2017 | 7.19% |

| 2018 | -2.91% |

41 graphic description end -->

Best quarter: 2nd 2009, 28.73% and Worst quarter: 3rd 2011, -12.46%

Average Annual Total Returns %

(for the periods ended December 31, 2018)

| | | 1 Yr | 5 Yrs | 10 Yrs | Since

Inception | Inception

Date |

| Class I | % | -2.67 | 2.71 | 11.39 | N/A | 01/03/06 |

| ICE BofAML U.S. HY Index1 | % | -2.26 | 3.82 | 10.99 | N/A | |

| ICE BofAML SG U.S. Convertible Index1 | % | -7.00 | 3.60 | 13.36 | N/A | |

| Class S | % | -2.91 | 2.47 | 11.11 | N/A | 01/20/06 |

| ICE BofAML U.S. HY Index1 | % | -2.26 | 3.82 | 10.99 | N/A | |

| ICE BofAML SG U.S. Convertible Index1 | % | -7.00 | 3.60 | 13.36 | N/A | |

| 1 | The index returns do not reflect deductions for fees, expenses, or taxes. |

High Yield Portfolio

Calendar Year Total Returns Class S

(as of December 31 of each year)

| Bar Chart Graphic | CUSIP/Fund ID |

| 2009 | 49.37% |

| 2010 | 14.25% |

| 2011 | 4.41% |

| 2012 | 14.04% |

| 2013 | 5.62% |

| 2014 | 1.16% |

| 2015 | -2.01% |

| 2016 | 14.61% |

| 2017 | 6.20% |

| 2018 | -3.20% |

41 graphic description end -->

Best quarter: 2nd 2009, 21.23% and Worst quarter: 3rd 2011, -5.87%

Average Annual Total Returns %

(for the periods ended December 31, 2018)

| | | 1 Yr | 5 Yrs | 10 Yrs | Since

Inception | Inception

Date |

| Class I | % | -2.96 | 3.41 | 9.91 | N/A | 04/29/05 |

| Bloomberg Barclays High Yield Bond - 2% Issuer Constrained Composite Index1 | % | -2.08 | 3.84 | 11.14 | N/A | |

| Class S | % | -3.20 | 3.15 | 9.62 | N/A | 05/03/04 |

| Bloomberg Barclays High Yield Bond - 2% Issuer Constrained Composite Index1 | % | -2.08 | 3.84 | 11.14 | N/A | |

| 1 | The index returns do not reflect deductions for fees, expenses, or taxes. |

How does the management of the Portfolios compare?

The following table describes the management of the Portfolios.

| | Pioneer Portfolio | High Yield Portfolio |

| Investment Adviser | Voya Investments, LLC (the “Adviser”) | Adviser |

Management Fee

(as a percentage of average daily net assets) | 0.700% on the first $2 billion of average daily net assets; 0.600% on next $1 billion of average daily net assets; 0.500% on the next $1 billion of average daily net assets; and 0.400% on average daily assets in excess of $4 billion | 0.490% on the first $1 billion of average daily net assets; 0.480% on next $1 billion of average daily net assets; and 0.470% on average daily assets in excess of $2 billion |

| Sub-Adviser | Amundi Pioneer | Voya Investment Management Co. LLC (“Voya IM”) |

Sub-Advisory Fee

(as a percentage of average daily net assets) | 0.30% on the first $500 million of average daily net assets; and 0.25% on average daily net assets in excess of $500 million | 0.22% on the first $1 billion of average daily net assets; 0.216% on the next $1 billion of average daily net assets; and 0.212% of average daily net assets in excess of $2 billion |

| Portfolio Managers | Andrew Feltus (since 04/07)

Matthew Shulkin (since 10/17) | Rick Cumberledge, CFA (since 02/14)

Randall Parrish, CFA (since 02/14) |

| Distributor | Voya Investments Distributor, LLC (the “Distributor”) | Distributor |

Voya Investments, LLC

Voya Investments, LLC (the “Adviser”), an Arizona limited liability company, serves as the investment adviser to each Portfolio. The Adviser has overall responsibility for the management of each Portfolio. The Adviser oversees all investment advisory and portfolio management services and assists in managing and supervising all aspects of the general day-to-day business activities and operations of each Portfolio, including custodial, transfer agency, dividend disbursing, accounting, auditing, compliance and related services. The Adviser is registered with the SEC as an investment adviser.

The Adviser is an indirect, wholly-owned subsidiary of Voya Financial, Inc. Voya Financial, Inc. is a U.S.-based financial institution whose subsidiaries operate in the retirement, investment, and insurance industries.

The Adviser’s principal office is located at 7337 East Doubletree Ranch Road, Suite 100, Scottsdale, Arizona 85258. As of December 31, 2018, the Adviser managed approximately $78.5 billion in assets.

Amundi Pioneer Asset Management, Inc.

Amundi Pioneer is an indirect, wholly-owned subsidiary of Amundi and Amundi’s wholly-owned subsidiary, Amundi USA, Inc. Amundi, one of the world’s largest asset managers, is headquartered in Paris, France. The principal address of Amundi Pioneer is 60 State Street, Boston, Massachusetts 02109. As of December 31, 2018, Amundi had more than $1.6 trillion in assets under management worldwide. As of December 31, 2018, Amundi Pioneer (and its U.S. affiliates) had over $80 billion in assets under management.

The following individuals are jointly and primarily responsible for the day-to-day management of Pioneer Portfolio.

Andrew Feltus, Portfolio Manager, director of high yield and a senior vice president of Amundi Pioneer joined Amundi Pioneer in 1994.

Matthew Shulkin, CFA, Vice President and Portfolio Manager, joined Amundi Pioneer in 2013 as a member of the U.S. fixed income team and has twenty years of investment experience. Prior to joining Amundi Pioneer, Mr. Shulkin worked as an analyst at MAST Capital Management (2008 – 2013).

Voya Investment Management Co. LLC

Voya Investment Management Co. LLC (“Voya IM”), a Delaware limited liability company, was founded in 1972 and is registered with the SEC as an investment adviser. Voya IM is an indirect, wholly-owned subsidiary of Voya Financial, Inc. and is an affiliate of the Adviser. Voya IM has acted as adviser or sub-adviser to mutual funds since 1994 and has managed institutional accounts since 1972. Voya IM's principal office is located at 230 Park Avenue, New York, New York 10169. As of December 31, 2018, Voya IM managed approximately $102.8 billion in assets.

The following individuals are jointly and primarily responsible for the day-to-day management of High Yield Portfolio.

Rick Cumberledge, CFA, Senior Portfolio Manager, joined Voya IM in 2007. Prior to that, Mr. Cumberledge was a senior high-yield credit analyst at Federated Investors (2001 – 2007).

Randall Parrish, CFA, serves as Senior Portfolio Manager and head of U.S. high-yield at Voya IM. Before being named a portfolio manager in 2007, Mr. Parrish served as a high-yield analyst focused on the media and retail/consumer sectors. Prior to joining Voya IM, Mr. Parrish was a corporate banker in leveraged finance with Sun Trust Bank and predecessors to Bank of America.

Voya Investments Distributor, LLC

Voya Investments Distributor, LLC (“Distributor”) is the principal underwriter and distributor of each Portfolio. It is a Delaware limited liability company with its principal offices at 7337 East Doubletree Ranch Road, Suite 100, Scottsdale, Arizona 85258. The Distributor is an indirect, wholly-owned subsidiary of Voya Financial, Inc. and is an affiliate of the Adviser.

The Distributor is a member of FINRA. To obtain information about FINRA member firms and their associated persons, you may contact FINRA at www.finra.org or the Public Disclosure Hotline at 800-289-9999.

What are the key differences in the rights of shareholders of VY® Pioneer High Yield Portfolio and Voya High Yield Portfolio?

VY® Pioneer High Yield Portfolio is organized as a series of Voya Partners, Inc. (“VPI”), a Maryland corporation. Voya High Yield Portfolio is organized as a series of Voya Investors Trust (“VIT”), a Massachusetts business trust. Both Portfolios are governed by a board of Directors/Trustees consisting of the same 10 members. For more information on the history of VPI or VIT, see each Portfolio’s Statement of Additional Information dated May 1, 2019.

The key differences are described in the table below.

| Pioneer Portfolio | High Yield Portfolio |

| At any meeting of shareholders duly called for the purpose and only as required by the 1940 Act, shareholders may elect Directors by the vote of a majority of all the shares entitled to vote. | Shareholders may elect Trustees by the vote of a plurality of votes cast at any shareholder meeting called for that purpose, to the extent required by the 1940 Act. |

| At any meeting of shareholders duly called for the purpose, shareholders have the power to remove Directors by the vote of a majority of all the shares entitled to vote. Directors of a Maryland corporation do not have the power to remove Directors. | A Trustee may be removed at any time by written instrument signed by at least two-thirds of the number of Trustees prior to such removal, specifying the date when such removal shall become effective. Trustees may also be removed at any meeting of shareholders of the Trust by a vote of two-thirds of the outstanding shares or by a written declaration executed, without a meeting, by the holders of not less than two-thirds of the outstanding shares. |

| The liquidation of a particular series in which there are shares then outstanding may be authorized by a vote of a majority of the Directors then in office, subject to the approval of a majority of the outstanding shares of a series. The Corporation may be dissolved upon a vote of a majority of the outstanding shares. | The Trust or any series or class thereof may be terminated by the affirmative vote of a majority of the Trustees. |

| In general, amendments to the Articles of Incorporation must be approved by the Directors and by the affirmative vote of a majority of the outstanding shares, except that no action affecting the validity or assessibility of such shares shall be taken without the unanimous approval of the outstanding shares affected thereby. | A majority of the Trustees have the power to amend the Declaration of Trust, except that no amendment to the Declaration of Trust that would materially adversely affect the rights of shareholders may be made without the approval of a majority of shares outstanding and entitled to vote. |

Additional Information about the Portfolios

Dividends and Other Distributions

Each Portfolio generally distributes most or all of its net earnings in the form of dividends, consisting of net investment income and capital gains distributions. Each Portfolio distributes capital gains, if any, annually. Each Portfolio also declares dividends and pays dividends consisting of net investment income, if any, monthly. All dividends and capital gains distributions will be automatically reinvested in additional shares of a Portfolio at the NAV of such shares on the payment date unless a participating insurance company’s separate account is permitted to hold cash and elects to receive payment in cash. From time to time a portion of a Portfolio’s distribution may constitute a return of capital. To comply with federal tax regulations, each Portfolio may also pay an additional capital gains distribution.

Capitalization

The following table shows on an unaudited basis the capitalization of each of the Portfolios as of April 30, 2019 and on a pro forma basis as of April 30, 2019, giving effect to the Reorganization.

| | | Pioneer

Portfolio | High Yield

Portfolio | Adjustments | High Yield Portfolio

Pro Forma |

| Class I | | | | | |

| Net Assets | $ | | | 1 | |

| Shares Outstanding | | | | 2 | |

| Net Asset Value Per Share | $ | | | - | |

| Class S | | | | | |

| Net Assets | $ | | | 1 | |

| Shares Outstanding | | | | 2 | |

| Net Asset Value Per Share | $ | | | - | |

| 1. | Reflects adjustment for estimated one-time merger and consolidation expenses. |

| 2. | Reflects new shares issued, net of retired shares of Pioneer Portfolio. (Calculation: Net Assets ÷ NAV per share). |

Additional Information about the Reorganization

The Reorganization Agreement

The terms and conditions under which the proposed transaction may be consummated are set forth in the Reorganization Agreement. Significant provisions of the Reorganization Agreement are summarized below. Shareholders are encouraged to review a form of the Reorganization Agreement, which is attached to this Proxy Statement/Prospectus as Appendix A.

The Reorganization Agreement provides for: (i) the transfer, as of the Closing Date, of all of the assets of Pioneer Portfolio to High Yield Portfolio in exchange for shares of beneficial interest of High Yield Portfolio; (ii) the assumption by High Yield Portfolio of all of Pioneer Portfolio’s liabilities; and (iii) the distribution of shares of High Yield Portfolio to shareholders of Pioneer Portfolio, as provided for in the Reorganization Agreement in complete liquidation of Pioneer Portfolio.

Each shareholder of Class I or Class S shares of Pioneer Portfolio will hold, immediately after the Closing, the corresponding share class of High Yield Portfolio having an aggregate value equal to the aggregate value of the shares of Pioneer Portfolio held by that shareholder as of the close of business on the Closing Date. High Yield Portfolio also offers Class ADV and Class S2 shares which are not subject to this transaction.

The obligations of the Portfolios under the Reorganization Agreement are subject to various conditions, including approval of the shareholders of Pioneer Portfolio and that each Portfolio receives an opinion from the law firm of Ropes & Gray LLP to the effect that the Reorganization will qualify as a tax-free reorganization for federal income tax purposes. A copy of this opinion will be filed with the SEC shortly after the Closing. The Reorganization Agreement also requires that each of the Portfolios take, or cause to be taken, all actions, and do or cause to be done, all things reasonably necessary, proper or advisable to consummate and make effective the transactions contemplated by the Reorganization Agreement. The Reorganization Agreement may be terminated by mutual agreement of the parties or by one party on certain other grounds. Please refer to Appendix A to review the terms and conditions of the Reorganization Agreement.

Expenses of the Reorganization

The expenses of the Reorganization will be shared equally by the Adviser (or an affiliate) and Pioneer Portfolio. The expenses of the Reorganization include, but are not limited to, the costs associated with the preparation of necessary filings with the SEC, printing and distribution of the Proxy Statement/Prospectus and proxy materials, legal fees, accounting fees, securities registration fees, and expenses of holding the Special Meeting. The expenses of the Reorganization are estimated to be $123,100 and do not include the transition costs described in “Portfolio Transitioning” below.

Portfolio Transitioning

If the Reorganization is approved by shareholders, Pioneer Portfolio would partially transition its portfolio prior to the closing of the Reorganization. Specifically, it is expected that Amundi Pioneer would assist in transitioning derivatives, bank loans, and equity positions held by Pioneer Portfolio prior to the Closing and, following the Closing, Voya IM would continue to align holdings with those of High Yield Portfolio. There will be a turnover of substantially all holdings of Pioneer Portfolio through pre-Reorganization trades by Amundi Pioneer and post-Reorganization trades by Voya IM, and the proceeds from the sale of Pioneer Portfolio’s holdings will be reinvested in securities consistent with the investment policies of High Yield Portfolio.

Costs of portfolio transitions are measured using implementation shortfall, which measures the change between the market value of a portfolio at the close of the market the day before any trading related to the portfolio transition occurs and the actual price at which the trades are executed during the portfolio transition. Implementation shortfall includes both explicit and implicit transition costs. The explicit costs include brokerage commissions, fees, and taxes. The explicit transition costs are estimated to be $2,000 and will be shared equally by the Adviser (or an affiliate) and Pioneer Portfolio. All the other costs of transitioning the Portfolios are considered implicit costs. These include spread costs, market impact costs, and opportunity costs. Quantifying implicit costs is difficult and involves some degree of subjective determinations. These implicit costs will be borne by Pioneer Portfolio.

If shareholders approve the Reorganization, from the close of business on July 26, 2019 through the close of business on August 23, 2019, Pioneer Portfolio is expected to be in a “transition period.” During the transition period, Pioneer Portfolio might not be pursuing its investment objective and strategies, and limitations on permissible investments and investment restrictions will not apply. After the Closing, Voya IM, as the sub-adviser to High Yield Portfolio, may also sell portfolio holdings that it acquired from Pioneer Portfolio, and High Yield Portfolio may not be immediately fully invested in accordance with its stated investment strategies. In addition, each Portfolio may engage in a variety of transition management techniques to facilitate the portfolio transition process, including without limitation, the purchase and sale of baskets of securities and exchange-traded funds, and enter into and close futures contracts or other derivative transactions. Such sales and purchases by the Portfolios during the transition period may be made at a disadvantageous time and could result in potential losses to the Portfolios.

Tax Considerations

The Reorganization is intended to qualify for federal income tax purposes as a tax-free reorganization under Section 368 of the Code. Accordingly, pursuant to this treatment, neither Pioneer Portfolio nor the Separate Accounts and Qualified Plans as its shareholders, nor High Yield Portfolio nor the Separate Accounts and Qualified Plans as its shareholders, are expected to recognize any gain or loss for federal income tax purposes from the transactions contemplated by the Reorganization Agreement. As a condition to the closing of the Reorganization, the Portfolios will receive an opinion from tax counsel to the effect that, on the basis of existing provisions of the Code, U.S. Treasury Regulations promulgated thereunder, current administrative rules, pronouncements and court decisions, and subject to certain qualifications, the Reorganization will qualify as a tax-free reorganization for federal income tax purposes.

Prior to the Closing Date, Pioneer Portfolio will pay to the Separate Accounts of Participating Insurance Companies and Qualified Plans that own its shares, a distribution consisting of any undistributed investment company taxable income, any net tax-exempt income, and/or any undistributed realized net capital gains, including any net gains realized from any sales of assets prior to the Closing Date, including portfolio transitions in connection with the Reorganization. Variable Contract owners and Plan Participants are not expected to recognize any income or gains for federal income tax purposes from this cash distribution.

Future Allocation of Premiums

Shares of Pioneer Portfolio have been purchased at the direction of Variable Contract Holders by Participating Insurance Companies through Separate Accounts to fund benefits payable under a Variable Contract. If the Reorganization is approved, Participating Insurance Companies have advised us that all premiums or transfers to Pioneer Portfolio will be allocated to High Yield Portfolio.

What is the Board’s recommendation?