Filed by Voya Investors Trust (SEC File Nos.: 33-23512; 811-5629) pursuant to Rule 425 under the Securities Act of 1933, as amended, and deemed filed pursuant to Rule 14a-12 under the Securities Exchange Act of 1934, as amended.

July 1, 2015

Voya Investment Management

ClientTalking Points

VY® DFA World Equity Portfolio

Voya Investment Management (formerly, ING U.S. Investment Management) has announced the following changes to the Portfolio.

Planned

Change(s) | Effective Date

(on or about) | Current | Surviving |

| Reorganization | August 14, 2015 | VY® DFA World Equity Portfolio | Voya Global Value Advantage Portfolio |

The Board of Trustees (the “Board”) of VY® DFA World Equity Portfolio (“DFA World Equity Portfolio”) approved an Agreement and Plan of Reorganization (“Merger” or “Reorganization”) of the DFA World Equity Portfolio into Voya Global Value Advantage Portfolio (“GVA Portfolio”). The approval of shareholders of DFA World Equity Portfolio is required before the Merger may take place.

| o | On March 12, 2015, each Portfolio’s Board approved a proposal to merge VY® DFA World Equity Portfolio into Voya Global Value Advantage Portfolio. |

| o | Shareholders of DFA World Equity Portfolio were sent a combined proxy statement and prospectus on or about June 19, 2015. |

| o | A shareholder meeting will be held on or about July 28, 2015. |

| o | Pending shareholder approval, the Merger will occur as of the close of business on or about August 14, 2015. |

| o | Dimensional Fund Advisors LP (“DFA”) serves as sub-adviser to DFA World Equity Portfolio and Voya Investment Management Co. LLC (“Voya IM”) serves as sub-adviser to GVA Portfolio. If the Merger is approved, shareholders in the DFA World Equity Portfolio will become shareholders in GVA Portfolio as of the close of business on or about August 14, 2015. |

| o | A prospectus supplement was filed on March 27, 2015 to notify shareholders of the changes. |

July 1, 2015

Client Talking Points

| n | Why is the Merger proposed? |

| o | Directed Services LLC (“DSL”), the investment adviser to DFA World Equity Portfolio (the “Adviser”) and its affiliates are conducting a comprehensive review of the mutual funds offered within the Voya mutual funds complex that is intended to, among other things, enhance the efficiency and reduce the complexity of the Voya mutual funds complex. |

| o | DSL proposed GVA Portfolio as the survivor due to similarities in investment objectives of each portfolio. |

| o | This Merger was determined to be in the best interest of shareholders by the Board after a review of several factors. |

| n | How do the Investment Objectives compare? |

As described in the chart that follows, the Portfolios have similar investment objectives.

| | DFA World Equity Portfolio | GVA Portfolio |

| Investment Objective | The Portfolio seeks long-term capital appreciation. | The Portfolio seeks long-term capital growth and current income. |

| n | What is the experience of the Voya Investment Management Team? |

GVA Portfolio is managed by the Voya IM team of Christopher Corapi, Vincent Costa, Martin Jansen, David Rabinowitz, and James Ying.

Christopher F. Corapi

Portfolio Manager

Mr. Corapi, Portfolio Manager and Chief Investment Officer of equities, joined Voya IM in February 2004. Prior to joining Voya IM, Mr. Corapi served as global head of equity research at Federated Investors since 2002. He served as head of U.S. equities and portfolio manager at Credit Suisse Asset Management beginning in 2000 and head of emerging markets research at JPMorgan Investment Management beginning in 1998.

Vincent Costa, CFA

Portfolio Manager and Head of the Portfolio Engineering Group

Mr. Costa, CFA, Portfolio Manager, also serves as the Head of the Portfolio Engineering Group responsible for managing quantitative research and both engineered and fundamental strategies. Mr. Costa joined Voya IM in April 2006 as head of portfolio management for quantitative equity. Prior to joining Voya IM, Mr. Costa managed quantitative equity investments at both Merrill Lynch Investment Management and a Bankers Trust Company.

July 1, 2015

Client Talking Points

Martin Jansen

Portfolio Manager

Mr. Jansen, Portfolio Manager, manages the Global Value Advantage strategy and has extensive experience running international value strategies. Mr. Jansen joined Voya IM in 1997 as senior manager to co-manage U.S. equity portfolios and was named head of the U.S. equity team in 1999. Mr. Jansen was previously responsible for managing the transition of the U.S. equity trading facility and U.S. equity assets from ING Investment Management The Hague to Voya IM. Prior to joining Voya IM, Mr. Jansen was responsible for the U.S. equity and venture capital portfolios at a large corporate Dutch pension fund.

David Rabinowitz

Portfolio Manager

Mr. Rabinowitz, Portfolio Manager, also serves as Head of International Equity and Director of Equity Research. Mr. Rabinowitz joined Voya IM in January 2008. He was employed by JPMorgan from May 2002 to November 2007 where he held several equity leadership positions. Most recently, he served as director of emerging markets equity research, and before that, was the director of global sector research. Previously, he was a global consumer strategist at UBS Warburg and prior to that, he was a U.S. equity analyst for Smith Barney and Sanford C. Bernstein & Company.

James Ying, CFA

Assistant Portfolio Manager

Mr. Ying, CFA, Assistant Portfolio Manager and quantitative analyst for U.S. equities, joined Voya IM in 2011. Prior to joining Voya IM, Mr. Ying was a quantitative analyst with Piedmont Investment Advisors from 2009 to 2011, Numeric Investors from 2006 to 2009, and Goldman Sachs Asset Management from 2000 to 2006.

| n | How do the Annual Operating Expenses compare? |

The table below describes the fees and expenses that you may pay if you buy and hold shares of the Portfolios. DFA Portfolio and GVA PortfolioPro Forma fees and expenses, which are the estimated fees and expenses of GVA Portfolio after giving effect to the Reorganization, assume the Reorganization occurred on December 31, 2014. Combined PortfolioPro Formafees and expenses, which are the estimated fees and expenses of the Combined Portfolio after giving effect to the Reorganization and the March Reorganizations, assume the Reorganization and March Reorganizations occurred on December 31, 2014.

The table does not reflect fees or expenses that are, or may be, imposed under your Variable Contract or Qualified Plan. For more information on these charges, please refer to the documents governing your Variable Contract or consult your plan administrator.

July 1, 2015

Client Talking Points

Annual Portfolio Operating Expenses1 Expenses you pay each year as a % of the value of your investment |

| | DFAP | GVAP | DFAP

and

GVAP

Pro

Forma | Combined

Portfolio

Pro Forma |

| Class ADV | | | | | |

| Management Fees | % | 0.352 | 0.565 | 0.565 | 0.549 |

| Distribution and/or Shareholder Services (12b-1) Fees | % | 0.75 | 0.50 | 0.50 | 0.50 |

| Other Expenses | % | 0.03 | 0.06 | 0.06 | 0.06 |

| Acquired Fund Fees and Expenses | % | 0.35 | None | None | None |

| Total Annual Portfolio Operating Expenses | % | 1.483 | 1.12 | 1.12 | 1.10 |

| Waivers and Reimbursements | % | -0.274 | None6 | -0.016,8 | None6,8 |

| Total Annual Portfolio Operating Expenses after Waivers and Reimbursements | % | 1.21 | 1.12 | 1.11 | 1.10 |

| | | | | | |

| Class I | | | | | |

| Management Fees | % | 0.352 | 0.565 | 0.565 | 0.549 |

| Distribution and/or Shareholder Services (12b-1) Fees | % | None | None | None | None |

| Other Expenses | % | 0.03 | 0.06 | 0.06 | 0.06 |

| Acquired Fund Fees and Expenses | % | 0.35 | None | None | None |

| Total Annual Portfolio Operating Expenses | % | 0.733 | 0.62 | 0.62 | 0.60 |

| Waivers and Reimbursements | % | -0.124 | None6 | -0.016,8 | None6,8 |

| Total Annual Portfolio Operating Expenses after Waivers and Reimbursements | % | 0.61 | 0.627 | 0.617 | 0.607 |

| | | | | |

| Class S | | | | | |

| Management Fees | % | 0.352 | 0.565 | 0.565 | 0.549 |

| Distribution and/or Shareholder Services (12b-1) Fees | % | 0.25 | 0.25 | 0.25 | 0.25 |

| Other Expenses | % | 0.03 | 0.06 | 0.06 | 0.06 |

| Acquired Fund Fees and Expenses | % | 0.35 | None | None | None |

| Total Annual Portfolio Operating Expenses | % | 0.983 | 0.87 | 0.87 | 0.85 |

| Waivers and Reimbursements | % | -0.124 | None6 | -0.016,8 | None6,8 |

| Total Annual Portfolio Operating Expenses after Waivers and Reimbursements | % | 0.86 | 0.87 | 0.86 | 0.85 |

| 1. | Expense ratios have been adjusted to reflect current contractual rates. |

| 2. | The portion of the Management Fee attributable to the advisory services is 0.25% and the portion of the Management Fee attributable to the administrative services is 0.10%. |

| 3. | Total Annual Portfolio Operating Expenses shown may be higher than the Portfolio’s ratio of expenses to average net assets shown in the Portfolio’s Financial Highlights, which reflects the operating expenses of the Portfolio and does not include Acquired Fund Fees and Expenses. |

| 4. | The Adviser is contractually obligated to limit expenses to 1.05%, 0.45%, and 0.70% for Class ADV, Class I, and Class S shares, respectively, through May 1, 2017. The limitation does not extend to interest, taxes, investment-related costs, leverage expenses, extraordinary expenses, and Acquired Fund Fees and Expenses. This limitation is subject to possible recoupment by the Adviser within 36 months of the waiver or reimbursement. In addition, the Adviser is contractually obligated to further limit expenses to 1.21%, 0.61%, and 0.86% for Class ADV, Class I, and Class S shares, respectively, including the Portfolio’s Acquired Fund Fees and Expenses, through May 1, 2017. The Distributor is contractually obligated to waive 0.15% of its distribution fee for Class ADV shares through May 1, 2017. Termination or modification of these obligations requires approval by the Board. |

| 5. | The portion of the Management Fee attributable to the advisory services is 0.46% and the portion of the Management Fee attributable to the administrative services is 0.10%. |

July 1, 2015

Client Talking Points

| 6. | The Adviser is contractually obligated to limit expenses to 1.34%, 0.84%, and 1.09% for Class ADV, Class I, and Class S shares, respectively, through May 1, 2017. This limitation is subject to possible recoupment by the adviser within 36 months of waiver or reimbursement. In addition, the Adviser is contractually obligated to further limit expenses to 1.14%, 0.64%, and 0.89 for Class ADV, Class I, and Class S shares, respectively, through May 1, 2017. The limitations do not extend to interest, taxes, investment-related costs, leverage expenses, extraordinary expenses, and Acquired Fund Fees and Expenses. Termination or modification of these obligations requires approval by the Board. |

| 7. | Based on Class ADV shares’ expenses adjusted for contractual differences. |

| 8. | If shareholders approve the Reorganization, the Adviser is contractually obligated to further limit expenses to 1.11%, 0.61%, and 0.86% for Class ADV, Class I, and Class S shares, respectively, through May 1, 2017. The limitations do not extend to interest, taxes, investment-related costs, leverage expenses, extraordinary expenses, and Acquired Fund Fees and Expenses. Termination or modification of this obligations requires approval by the Board. |

| 9. | The portion of the Management Fee attributable to the advisory services is 0.44% and the portion of the Management Fee attributable to the adminsitrative services is 0.10%. |

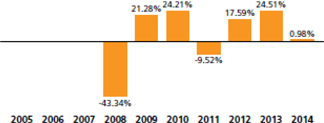

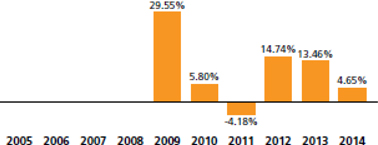

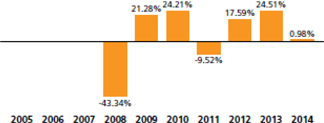

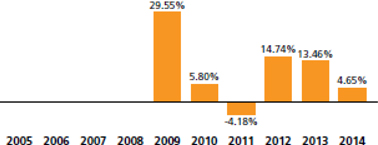

| n | How does DFA World Equity Portfolio’s performance compare to GVA Portfolio? |

The following information is intended to help you understand the risks of investing in the Portfolios. The following bar charts show the changes in the Portfolios’ performance from year to year, and the table compares the Portfolios’ performance to the performance of a broad-based securities market index/indices for the same period. The Portfolios’ performance information reflects applicable fee waivers and/or expense limitations in effect during the period presented. Absent such fee waivers/expense limitations, if any, performance would have been lower. The bar charts show the performance of the Portfolios’ Class ADV shares. Other class shares’ performance would be higher than Class ADV shares’ performance because of the higher expenses paid by Class ADV shares. Performance in the Average Annual Total Returns table does not include insurance-related charges imposed under a Variable Contract or expenses related to a Qualified Plan. If these charges or expenses were included, performance would be lower. Thus, you should not compare the Portfolios’ performance directly with the performance information of other investment products without taking into account all insurance-related charges and expenses payable under your Variable Contract or Qualified Plan. The Portfolio’s past performance is no guarantee of future results.

On April 30, 2010, DFA Portfolio was converted from a stand-alone mutual fund, which invested directly in securities, to a fund-of-funds, which invests in other mutual funds. The following information shows performance of DFA Portfolio as a stand-alone mutual fund for the period of August 20, 2007 through April 30, 2010. In addition, on April 30, 2010 DFA Portfolio’s Sub-Adviser changed to Dimensional Fund Advisors LP and DFA Portfolio’s name was changed from ING Focus 5 Portfolio to ING DFA Global All Equity Portfolio. Subsequently, on August 23, 2010, DFA Portfolio changed its name from ING DFA Global All Equity Portfolio to ING DFA World Equity Portfolio.

Because Class I shares of GVA Portfolio had not commenced operations as of the calendar year ended December 31, 2014, no performance information for Class I shares is provided below.

DFA Portfolio - Calendar Year Total Returns

(as of December 31 of each year) |

|

|

July 1, 2015

Client Talking Points

| Best quarter: 3rd, 2009, 19.29% and Worst quarter: 4th, 2008, -26.09 |

| |

| The Portfolio’s Class ADV shares’ year-to-date total return as of March 31, 2015: 2.65% |

GVA Portfolio - Calendar Year Total Returns

(as of December 31 of each year) |

|

|

| |

Best quarter: 2nd, 2009, 24.14% and Worst quarter: 1st, 2009, -17.03% |

| |

| The Portfolio’s Class ADV shares’ year-to-date total return as of March 31, 2015: 4.06% |

Average Annual Total Returns % (for the periods ended December 31, 2014) |

| | 1 Year | 5 Years | 10 Years | Since

Inception | Inception

Date |

| DFA Portfolio | | | | | | |

| Class ADV | % | 0.98 | 10.69 | N/A | 2.41 | 08/20/07 |

| MSCI ACW IndexSM1 | % | 4.16 | 9.17 | N/A | 3.64 | |

| Class I | % | 1.55 | 11.38 | N/A | 3.07 | 08/20/07 |

| MSCI ACW IndexSM1 | % | 4.16 | 9.17 | N/A | 3.64 | |

| Class S | % | 1.42 | 11.11 | N/A | 2.83 | 08/20/07 |

| MSCI ACW IndexSM1 | % | 4.16 | 9.17 | N/A | 3.64 | |

| | | | | | | |

| GVA Portfolio2 | | | | | | |

| Class ADV | % | 4.65 | 6.67 | N/A | 1.43 | 01/28/08 |

| MSCI ACW IndexSM1 | % | 4.16 | 9.17 | N/A | 4.24 | |

| Class S | % | 4.87 | 6.90 | N/A | 1.69 | 01/28/08 |

| MSCI ACW IndexSM1 | % | 4.16 | 9.17 | N/A | 4.24 | |

| 1. | The index returns include the reinvestment of dividends and distributions net of withholding taxes, but do not reflect fees, brokerage commissions, or other expenses. |

| 2. | Prior to July 12, 2013, the Portfolio had a different investment objective and principal investment strategies. |

The performance quoted represents past performance and does not guarantee future results. Current performance may be lower or higher than the performance information shown. The investment return and principal value of an investment in the Portfolio will fluctuate, so that your shares, when redeemed, may be worth more or less than their original cost. You may obtain performance information current to the most recent month end by visitingwww.voyainvestments.com.

TheMSCI All Country World IndexSM (“MSCI ACW IndexSM”) is a free-float adjusted market capitalization index that is designed to measure equity market performance in the global developed and emerging markets.

July 1, 2015

Client Talking Points

| n | Additional Information about the Portfolios |

Capitalization

The following table shows on an unaudited basis the capitalization of each of the Portfolios as of December 31, 2014 and on apro forma basis as of December 31, 2014, giving effect to the Reorganization.

| | | DFA Portfolio | GVA Portfolio | Adjustments | GVA Portfolio

Pro Forma |

| Class ADV | | | | | |

| Net Assets | $ | 5,376,285 | 1,278,591 | - | 6,654,876 |

| Net Asset Value Per Share | $ | 10.55 | 9.11 | - | 9.11 |

| Shares Outstanding | | 509,769 | 140,405 | 80,3831 | 730,557 |

| | | | | | |

| Class I | | | | | |

| Net Assets | $ | 3,619,036 | N/A2 | - | 3,619,036 |

| Net Asset Value Per Share | $ | 10.82 | N/A2 | - | 10.82 |

| Shares Outstanding | | 334,379 | N/A2 | - | 334,379 |

| | | | | | |

| Class S | | | | | |

| Net Assets | $ | 174,700,252 | 168,481,699 | - | 343,181,951 |

| Net Asset Value Per Share | $ | 10.80 | 9.20 | - | 9.20 |

| Shares Outstanding | | 16,182,358 | 18,308,728 | 2,806,8001 | 37,297,886 |

| 1. | Reflects new shares issued, net of retired shares of DFA Portfolio. (Calculation: Net Assets ÷ NAV per share.) |

| 2. | As of December 31, 2014, Class I has not commenced operations. |

The following tables shows on an unaudited basis the capitalization of each of the Portfolios, GRP, and IVP as of December 31, 2014 and on apro formabasis as of December 31, 2014, giving effect to the Reorganization and the March Reorganizations.

| | | DFA

Portfolio | GRP | IVP | GVA

Portfolio | Adjustments | GVA

Portfolio

Pro Forma |

| Class ADV | | | | | | | |

| Net Assets | $ | 5,376,285 | 106,790,500 | 1,264,337 | 1,278,591 | (106,790,500)1 | 7,919,213 |

| Net Asset Value Per Share | $ | 10.55 | 17.86 | 8.80 | 9.11 | - | 9.11 |

| Shares Outstanding | | 509,769 | 5,979,540 | 143,691 | 140,405 | (5,904,062)1,2 | 869,343 |

| | | | | | | | |

| Class I | | | | | | | |

| Net Assets | $ | 3,619,036 | 21,534,472 | 102,751,524 | N/A3 | - | 127,905,032 |

| Net Asset Value Per Share | $ | 10.82 | 18.54 | 8.89 | N/A3 | - | 9.79 |

| Shares Outstanding | | 334,379 | 1,161,506 | 11,564,202 | N/A3 | - | 13,060,087 |

| | | | | | | | |

| Class S | | | | | | | |

| Net Assets | $ | 174,700,252 | 424,954,420 | 6,834,768 | 168,481,699 | - | 774,971,139 |

| Net Asset Value Per Share | $ | 10.80 | 18.41 | 9.07 | 9.20 | - | 9.20 |

| Shares Outstanding | | 16,182,358 | 23,080,819 | 753,581 | 18,308,728 | 25,906,0072 | 84,231,493 |

| 1. | Class ADV shares of GRP merged into Class T shares of GVA Portfolio. |

| 2. | Reflects new shares issued, net of retired shares of DFA Portfolio, GRP, and IVP. (Calculation: Net Assets ÷ NAV per share.) |

July 1, 2015

Client Talking Points

| 3. | As of December 31, 2014, Class I has not commenced operations. |

For financial professional use only. Not for inspection by or distribution to the general public.

The foregoing is not an offer to sell, nor a solicitation of an offer to buy, shares of any fund, nor is it a solicitation of any proxy. For information regarding the Portfolio, please call Voya Investment Management toll free at 1-800-992-0180.

For information regarding any of the Portfolios discussed in this Client Talking Points, please call Voya Investment Management toll free at 1-800-992-0180. To receive a free copy of a Prospectus Supplement and/or Proxy Statement/Prospectus (when available) relating to the proposed merger of VY® DFA World Equity Portfolio with and into Voya Global Value Advantage Portfolio, please call Voya Investment Management toll free at 1-800-992-0180. This Client Talking Points is qualified in its entirety by reference to the Prospectus Supplement and/or Proxy Statement/Prospectus (when available), and supersedes any prior Client Talking Points. The Prospectus Supplement and/or Proxy Statement/Prospectus contain important information about the pending Portfolio changes, and therefore you are advised to read it. The Prospectus Supplement and/or Proxy Statement/Prospectus and shareholder reports and other information are or will be available for free on the SEC’s website (www.sec.gov). Please read the any Proxy Statement/Prospectus, and the Prospectus Supplement, carefully before making any decision to invest or to approve the merger.

This information is proprietary and cannot be reproduced or distributed. Certain information may be received from sources Voya Investment Management considers reliable; Voya Investment Management does not represent that such information is accurate or complete. Certain statements contained herein may constitute "projections," "forecasts" and other "forward-looking statements" which do not reflect actual results and are based primarily upon applying retroactively a hypothetical set of assumptions to certain historical financial data. Actual results, performance or events may differ materially from those in such statements. Any opinions, projections, forecasts and forward looking statements presented herein are valid only as of the date of this document and are subject to change. Nothing contained herein should be construed as: (i) an offer to buy any security; or (ii) a recommendation as to the advisability of investing in, purchasing or selling any security. Voya Investment Management assumes no obligation to update any forward-looking information. Past performance is no guarantee of future results.

Your clients should consider the investment objectives, risks, charges and expenses of the Portfolio(s) carefully before investing. For a free copy of the Portfolio’s prospectus, which contains this and other information, visit us atwww.voyainvestments.com or call Voya Investment Management at 1-800-992-0180. Please instruct your clients to read the prospectus carefully before investing.

CID – IM-0715-15228-0716