Exhibit 1

Japan Finance Organization

for Municipalities

This description of Japan Finance Organization for Municipalities is dated August 4, 2011 and appears as Exhibit 1 to its Annual Report on Form 18-K to the U.S. Securities and Exchange Commission.

THE DELIVERY OF THIS DOCUMENT AT ANY TIME DOES NOT IMPLY THAT THE INFORMATION IS CORRECT AS OF ANY TIME SUBSEQUENT TO ITS DATE. THIS DOCUMENT (OTHERWISE THAN AS PART OF A PROSPECTUS CONTAINED IN A REGISTRATION STATEMENT FILED UNDER THE U.S. SECURITIES ACT OF 1933) DOES NOT CONSTITUTE AN OFFER TO SELL OR THE SOLICITATION OF AN OFFER TO BUY ANY SECURITIES OF JAPAN FINANCE ORGANIZATION FOR MUNICIPALITIES.

TABLE OF CONTENTS

FURTHER INFORMATION

This document appears as an exhibit to the Annual Report on Form 18-K of Japan Finance Organization for Municipalities (“JFM”) filed with the U.S. Securities and Exchange Commission (the Commission). Additional information with respect to JFM is available in such Annual Report, in the other exhibits to such Annual Report and in amendments thereto. Such Annual Report, exhibits and amendments may be inspected and copied at the public reference room maintained by the Commission at: 100 F Street, N.E., Washington, D.C. 20549. Information regarding the operations of the Commission’s public reference room can be obtained by calling the Commission at 1-800-SEC-0330. Copies of such documents may also be obtained from JFM by telephoning 81-3-3539-2697. The Annual Report and its exhibits and amendments are also available through the Commission’s Internet website at http://www.sec.gov.

In this document all amounts are expressed in Japanese Yen (“¥” or “yen”), except as otherwise specified. The spot buying rate quoted on the Tokyo Foreign Exchange Market on August 2, 2011, as reported by The Bank of Japan at 5:00 p.m., Tokyo time, was 77.22 = $1.00, and the noon buying rate on July 29, 2011 for cable transfers in New York City payable in yen, as reported by the Federal Reserve Bank of New York, was 77.18 =$1.00.

References to fiscal years of JFM are to the 12-month periods commencing on April 1 of the year indicated, except that references to the fiscal year 2008 refer to (1) the six-month fiscal period ended September 30, 2008 of Japan Finance Corporation for Municipal Enterprises (the predecessor to JFM) (the “Predecessor”), which was its last fiscal period, and (2) the six-month fiscal period ended March 31, 2009 of JFM, which was its first fiscal period.

Unless otherwise indicated, all amounts relating to JFM are presented on a basis consistent with the audited financial statements of JFM, which have been prepared in accordance with the Japan Finance Organization for Municipalities Law (Law No. 64 of May 30, 2007), as amended (the “JFM Law”), and which are included in this document.

Figures in tables may not add up to totals due to rounding.

JAPAN FINANCE ORGANIZATION FOR MUNICIPALITIES

JFM was established on August 1, 2008, initially under the name “Japan Finance Organization for Municipal Enterprises,” by local governments as an autonomously managed organization. JFM started its business on October 1, 2008, at which time JFM succeeded to substantially all of the rights and assets of the Predecessor and assumed all of the obligations of the Predecessor and the Predecessor was dissolved. Whereas the Predecessor’s capital was contributed entirely by the national government, JFM’s capital was provided by Japan’s local governments. At the time of JFM’s establishment, JFM received contributions in the amount of ¥16.6 billion from all of the local governments (prefectures, government-designated cities, cities, special wards of Tokyo, towns and villages – 1,857 in total as of August 1, 2008).

On June 1, 2009, the amended JFM Law went into effect, which provided for the change of JFM’s name, expansion of the scope of its lending and flexibility of its lending terms. Among other changes, the name of JFM was changed from “Japan Finance Organization for Municipal Enterprises” to “Japan Finance Organization for Municipalities”.

Under the JFM Law, JFM is supervised by the Representative Board, a committee composed of representatives of Japan’s local governments and individuals who are knowledgeable in economics, finance, law and accounting as well as the affairs of local administrations and their finances, with respect to such matters as appointment of management, business plans and annual budget.

CAPITALIZATION

The capitalization of JFM as of March 31, 2011 was as follows:

| | | | |

| | | (in millions) | |

Domestic bonds: | | | | |

Government guaranteed bonds: | | | | |

0.5%-2.2% Guaranteed Bonds due 2010-2022 | | ¥ | 9,949,950 | |

Non-government guaranteed private placement bonds | | | 3,313,700 | |

Non-government guaranteed public offering bonds | | | 4,074,490 | |

Government guaranteed bonds issued overseas | | | 1,008,090 | |

| | | | |

| |

Total long-term bonds (1) | | | 18,346,230 | |

| | | | |

| |

Net Assets: | | | | |

Capital | | | 16,602 | |

Retained earnings | | | 13,860 | |

General account surplus reserve | | | 13,860 | |

Valuation, translation adjustments and others | | | (8,645 | ) |

Management account surplus reserve | | | 47,565 | |

| | | | |

| |

Total net assets | | | 69,382 | |

| | | | |

| |

Total capitalization | | ¥ | 18,415,612 | |

| | | | |

| (1) | Includes current maturities. For additional information relating to long-term bonds, see Note 8 to JFM’s audited financial statements included elsewhere in this document. |

-3-

BUSINESS

Purpose and Authority

Under the JFM Law, JFM’s objective is to contribute to the sound financial operation of local governments and to improve the welfare of local residents by providing long-term funding at low interest rates to local governments with respect to their general account-related projects as well as to municipal enterprises, and also by supporting funding by local governments from capital markets, in order to efficiently and effectively acquire such funding. Municipal enterprises are departments within local governments which undertake public service activities, such as water supply, sewerage, hospital facilities and transportation, which are accounted for independently from general services like social welfare and education.

Government Control and Supervision

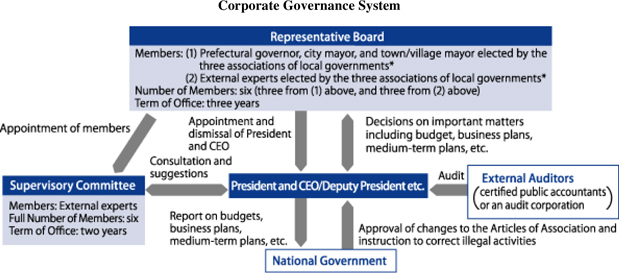

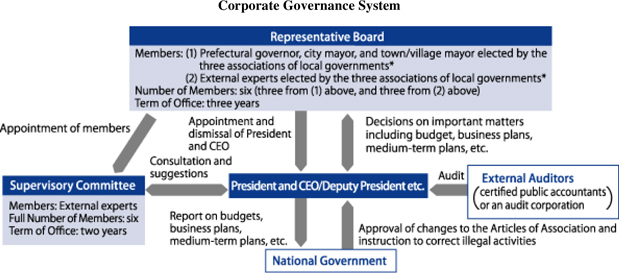

JFM’s capital is contributed by all of Japan’s local governments – 47 prefectures as well as government-designated cities, cities, special wards of Tokyo, towns and villages. JFM is subject to control and supervision of the local governments through the Representative Board, which consists of members nominated by the local governments. There are six members, three of which are heads of local governments (governors of prefectures or mayors of cities, towns or villages) and the other three are individuals knowledgeable in economics, finance, law and accounting as well as the affairs of local administrations and their finances. The term of each member is three years. The Representative Board appoints JFM’s President and Chief Executive Officer and Corporate Auditors. The Representative Board is authorized to approve such key management matters as appointment of management, business plans and annual budget. The Representative Board is also authorized to obtain from JFM’s management information relating to JFM’s operations and financial condition, and to order JFM’s management to take corrective actions with respect to any illegal or other inappropriate activities.

To ensure adequate third-party monitoring of JFM’s business activities, JFM has a Supervisory Committee (the “Committee”). The members of the Committee are appointed by the Representative Board, and are individuals knowledgeable in economics, finance, law and accounting as well as the affairs of local administrations and their finances. The Committee is authorized to monitor JFM’s annual budgets and business plans and to provide its opinions and recommendations to JFM’s management with respect to key matters on JFM’s business and operations. JFM’s management is required to report to the Representative Board, and to give due regard to, such opinions and recommendations of the Committee.

Under the JFM Law, JFM is required to report to the national government (the Minister for Internal Affairs and Communications) its annual budgets, business plans and financial statements. Changes to JFM’s articles of incorporation require the approval of the Minister for Internal Affairs and Communications. The Minister for Internal Affairs and Communications is authorized to request JFM to take corrective actions with respect to any illegal or other inappropriate activities.

-4-

The following diagram summarizes the governance structure of JFM:

| * | Three associations of local governments are National Governors’ Association, Japan Association of City Mayors and National Association of Towns and Villages. |

-5-

Loan Operations

JFM’s loan operations can be broadly divided into general loans and entrusted loans. General loans are loans to local governments. Entrusted loans are loans from funds entrusted to JFM by The Japan Finance Corporation (“JFC”), a governmental financial institution, which are used for on-lending to local governments for financing maintenance of public forests and improvements of pastures.

The following tables give details of the loans extended by the Predecessor during the two years and six months period ended September 30, 2008, and JFM during the six months period ended March 31, 2009 and the two years ended March 31, 2011.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Loans Extended | | | | |

| | |

| | | The Predecessor | | | JFM | |

| | | Years ended March 31, | | | Six months ended | | | Years ended March 31, | |

| | | 2007 | | | 2008 | | | September 30, 2008 | | | March 31, 2009 | | | 2010 | | | 2011 | |

| | | (in billions) | |

General Loans And Loans To Local Public | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Corporations | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Community facilities | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Water supply | | ¥ | 164 | | | | 13.4 | % | | ¥ | 156 | | | | 13.9 | % | | ¥ | 20 | | | | 3.1 | % | | ¥ | 131 | | | | 27.6 | % | | ¥ | 155 | | | | 12.0 | % | | ¥ | 138 | | | | 7.5 | % |

Gas supply | | | 1 | | | | 0.1 | | | | 1 | | | | 0.1 | | | | 0 | | | | 0.0 | | | | 1 | | | | 0.2 | | | | 1 | | | | 0.1 | | | | 5 | | | | 0.2 | |

Sewerage | | | 446 | | | | 36.6 | | | | 437 | | | | 38.8 | | | | 265 | | | | 41.9 | | | | 193 | | | | 40.6 | | | | 407 | | | | 31.5 | | | | 372 | | | | 20.3 | |

Public housing | | | 24 | | | | 2.0 | | | | 16 | | | | 1.5 | | | | 14 | | | | 2.2 | | | | 3 | | | | 0.5 | | | | 16 | | | | 1.3 | | | | 16 | | | | 0.9 | |

General projects | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 15 | | | | 1.2 | | | | 6 | | | | 0.3 | |

High school construction(1) | | | 6 | | | | 0.5 | | | | 2 | | | | 0.2 | | | | 2 | | | | 0.3 | | | | 0 | | | | 0.0 | | | | — | | | | — | | | | — | | | | — | |

Improvement of rivers and other waterways(1) | | | 6 | | | | 0.5 | | | | 7 | | | | 0.6 | | | | 5 | | | | 0.7 | | | | 1 | | | | 0.1 | | | | — | | | | — | | | | — | | | | — | |

Hospitals | | | 57 | | | | 4.7 | | | | 50 | | | | 4.5 | | | | 4 | | | | 0.6 | | | | 64 | | | | 13.5 | | | | 53 | | | | 4.1 | | | | 53 | | | | 2.9 | |

Elderly care | | | 4 | | | | 0.3 | | | | 3 | | | | 0.2 | | | | 1 | | | | 0.1 | | | | 1 | | | | 0.2 | | | | 0 | | | | 0.0 | | | | 0 | | | | 0 | |

Social welfare facilities constructions | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 1 | | | | 0.1 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 708 | | | | 58.0 | | | | 672 | | | | 59.7 | | | | 311 | | | | 48.9 | | | | 394 | | | | 82.7 | | | | 647 | | | | 50.2 | | | | 592 | | | | 32.3 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Road construction and transportation facilities | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Transportation (excluding subways) | | | 10 | | | | 0.8 | | | | 9 | | | | 0.8 | | | | 0 | | | | 0.0 | | | | 2 | | | | 0.5 | | | | 5 | | | | 0.4 | | | | 4 | | | | 0.2 | |

Subways | | | 64 | | | | 5.2 | | | | 53 | | | | 4.7 | | | | 1 | | | | 0.1 | | | | 48 | | | | 10.1 | | | | 46 | | | | 3.6 | | | | 46 | | | | 2.5 | |

Local road construction | | | 209 | | | | 17.1 | | | | 166 | | | | 14.8 | | | | 118 | | | | 18.6 | | | | 18 | | | | 3.8 | | | | 115 | | | | 8.9 | | | | 126 | | | | 6.9 | |

Toll roads and parking facilities | | | 2 | | | | 0.1 | | | | 1 | | | | 0.1 | | | | 1 | | | | 0.2 | | | | 0 | | | | 0.0 | | | | 2 | | | | 0.1 | | | | 1 | | | | 0 | |

Recreation facilities | | | 0 | | | | 0.0 | | | | 0 | | | | 0.0 | | | | 0 | | | | 0.0 | | | | 0 | | | | 0.0 | | | | 0 | | | | 0.0 | | | | 0 | | | | 0 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 285 | | | | 23.3 | | | | 229 | | | | 20.4 | | | | 120 | | | | 18.9 | | | | 68 | | | | 14.4 | | | | 168 | | | | 13.0 | | | | 177 | | | | 9.7 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Industry and distribution-related facilities | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Industrial water supply | | | 7 | | | | 0.5 | | | | 8 | | | | 0.8 | | | | 0 | | | | 0.0 | | | | 12 | | | | 2.5 | | | | 8 | | | | 0.6 | | | | 10 | | | | 0.5 | |

Electricity supply | | | 1 | | | | 0.1 | | | | 1 | | | | 0.1 | | | | 0 | | | | 0.0 | | | | 0 | | | | 0.1 | | | | 1 | | | | 0.1 | | | | 1 | | | | 0 | |

Port facilities | | | 6 | | | | 0.5 | | | | 5 | | | | 0.4 | | | | 3 | | | | 0.5 | | | | 1 | | | | 0.2 | | | | 4 | | | | 0.3 | | | | 4 | | | | 0.2 | |

Regional development | | | 1 | | | | 0.1 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

Industrial waste disposal | | | 4 | | | | 0.3 | | | | 0 | | | | 0.0 | | | | 0 | | | | 0.0 | | | | 0 | | | | 0.0 | | | | 0 | | | | 0.0 | | | | 0 | | | | 0 | |

Markets | | | 4 | | | | 0.4 | | | | 4 | | | | 0.3 | | | | 1 | | | | 0.1 | | | | 1 | | | | 0.1 | | | | 2 | | | | 0.1 | | | | 4 | | | | 0.2 | |

Slaughterhouse | | | 0 | | | | 0.0 | | | | 0 | | | | 0.0 | | | | 0 | | | | 0.0 | | | | 0 | | | | 0.0 | | | | 0 | | | | 0.0 | | | | 0 | | | | 0 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 23 | | | | 1.8 | | | | 18 | | | | 1.6 | | | | 4 | | | | 0.6 | | | | 14 | | | | 2.9 | | | | 15 | | | | 1.1 | | | | 19 | | | | 1.0 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Others | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Regional revitalization projects | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 0 | | | | 0.0 | | | | 10 | | | | 0.5 | |

Disaster prevention projects | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 0 | | | | 0.0 | | | | 19 | | | | 1.0 | |

Special municipal merger projects | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 11 | | | | 0.9 | | | | 183 | | | | 10.0 | |

Extraordinary financial countermeasures funding | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 449 | | | | 34.8 | | | | 766 | | | | 41.8 | |

Refinance loans | | | 200 | | | | 16.4 | | | | 200 | | | | 17.8 | | | | 199 | | | | 31.4 | | | | 0 | | | | 0.0 | | | | 0 | | | | 0.0 | | | | 67 | | | | 3.7 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

General Loans (subtotal) | | | 1,216 | | | | 99.6 | | | | 1,120 | | | | 99.4 | | | | 633 | | | | 100.0 | | | | 475 | | | | 100.0 | | | | 1,291 | | | | 100.0 | | | | 1,833 | | | | 100.0 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Local toll road public corporations | | | 5 | | | | 0.4 | | | | 6 | | | | 0.6 | | | | 0 | | | | 0.0 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

Local land development public corporations | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Loans to local public corporations (subtotal) | | | 5 | | | | 0.4 | | | | 6 | | | | 0.6 | | | | 0 | | | | 0.0 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total | | ¥ | 1,221 | | | | 100.0 | % | | ¥ | 1,126 | | | | 100.0 | % | | ¥ | 633 | | | | 100.0 | % | | ¥ | 475 | | | | 100.0 | % | | ¥ | 1,291 | | | | 100.0 | % | | ¥ | 1,833 | | | | 100.0 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Entrusted Loans | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Forests | | ¥ | 13 | | | | 98.4 | % | | ¥ | 13 | | | | 98.3 | % | | ¥ | 4 | | | | 96.3 | % | | ¥ | 4 | | | | 95.8 | % | | ¥ | 3 | | | | 95.4 | % | | ¥ | 3 | | | | 96.1 | % |

Pastures | | | 0 | | | | 1.6 | | | | 0 | | | | 1.7 | | | | 0 | | | | 3.7 | | | | 0 | | | | 4.2 | | | | 0 | | | | 4.6 | | | | 0 | | | | 3.9 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total | | ¥ | 13 | | | | 100.0 | % | | ¥ | 13 | | | | 100.0 | % | | ¥ | 4 | | | | 100.0 | % | | ¥ | 4 | | | | 100.0 | % | | ¥ | 3 | | | | 100.0 | % | | ¥ | 3 | | | | 100.0 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Note (1) Accounts consolidated since June 1, 2009

-6-

Loans Outstanding

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | The Predecessor | | | JFM | |

| | | As of March 31, | | | As of September 30, | | | As of March 31, | | | As of March 31, | |

| | | 2007 | | | 2008 | | | 2008 | | | 2009 | | | 2010 | | | 2011 | |

| | | (in billions) | | | | | | | |

General Loans And Loans To Local Public | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Corporations | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Community facilities | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Water supply | | ¥ | 4,848 | | | | 20.0 | % | | ¥ | 4,600 | | | | 19.8 | % | | ¥ | 4,313 | | | | 19.2 | % | | ¥ | 4,326 | | | | 19.5 | % | | ¥ | 4,236 | | | | 19.2 | % | | ¥ | 4,107 | | | | 18.5 | % |

Gas supply | | | 63 | | | | 0.3 | | | | 56 | | | | 0.2 | | | | 51 | | | | 0.2 | | | | 48 | | | | 0.2 | | | | 42 | | | | 0.2 | | | | 41 | | | | 0.2 | |

Sewerage | | | 9,736 | | | | 40.1 | | | | 9,423 | | | | 40.6 | | | | 9,240 | | | | 41.2 | | | | 9,199 | | | | 41.4 | | | | 9,119 | | | | 41.4 | | | | 8,967 | | | | 40.3 | |

Public housing | | | 777 | | | | 3.2 | | | | 719 | | | | 3.1 | | | | 691 | | | | 3.1 | | | | 663 | | | | 3.0 | | | | 617 | | | | 2.8 | | | | 569 | | | | 2.6 | |

General projects | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 330 | | | | 1.5 | | | | 299 | | | | 1.4 | |

High school construction | | | 107 | | | | 0.4 | | | | 98 | | | | 0.4 | | | | 96 | | | | 0.4 | | | | 91 | | | | 0.4 | | | | — | | | | — | | | | — | | | | — | |

Improvement of rivers and other waterways | | | 308 | | | | 1.3 | | | | 284 | | | | 1.2 | | | | 273 | | | | 1.2 | | | | 260 | | | | 1.2 | | | | — | | | | — | | | | — | | | | — | |

Hospitals | | | 484 | | | | 2.0 | | | | 503 | | | | 2.2 | | | | 492 | | | | 2.2 | | | | 541 | | | | 2.4 | | | | 561 | | | | 2.6 | | | | 584 | | | | 2.6 | |

Elderly care | | | 24 | | | | 0.1 | | | | 26 | | | | 0.1 | | | | 26 | | | | 0.1 | | | | 26 | | | | 0.1 | | | | 25 | | | | 0.1 | | | | 24 | | | | 0.1 | |

Social welfare facilities construction | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 1 | | | | 0.0 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 16,347 | | | | 67.4 | | | | 15,709 | | | | 67.6 | | | | 15,182 | | | | 67.6 | | | | 15,154 | | | | 68.2 | | | | 14,930 | | | | 67.8 | | | | 14,592 | | | | 65.6 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Road construction and transportation facilities | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Transportation (excluding subways) | | | 29 | | | | 0.1 | | | | 32 | | | | 0.1 | | | | 28 | | | | 0.1 | | | | 27 | | | | 0.1 | | | | 25 | | | | 0.1 | | | | 22 | | | | 0.1 | |

Subways | | | 1,599 | | | | 6.6 | | | | 1,558 | | | | 6.7 | | | | 1,477 | | | | 6.6 | | | | 1,481 | | | | 6.7 | | | | 1,438 | | | | 6.5 | | | | 1,391 | | | | 6.3 | |

Local road construction | | | 5,153 | | | | 21.2 | | | | 4,900 | | | | 21.1 | | | | 4,793 | | | | 21.4 | | | | 4,615 | | | | 20.8 | | | | 4,325 | | | | 19.6 | | | | 4,024 | | | | 18.1 | |

Toll roads and parking facilities | | | 126 | | | | 0.5 | | | | 114 | | | | 0.5 | | | | 109 | | | | 0.5 | | | | 103 | | | | 0.5 | | | | 92 | | | | 0.4 | | | | 79 | | | | 0.4 | |

Recreation facilities | | | 17 | | | | 0.1 | | | | 11 | | | | 0.0 | | | | 10 | | | | 0.0 | | | | 9 | | | | 0.0 | | | | 8 | | | | 0.0 | | | | 6 | | | | 0.0 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 6,924 | | | | 28.5 | | | | 6,615 | | | | 28.5 | | | | 6,418 | | | | 28.6 | | | | 6,235 | | | | 28.1 | | | | 5,888 | | | | 26.6 | | | | 5,523 | | | | 24.8 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Industry and distribution-related facilities | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Industrial water supply | | | 328 | | | | 1.4 | | | | 308 | | | | 1.3 | | | | 280 | | | | 1.3 | | | | 281 | | | | 1.3 | | | | 262 | | | | 1.2 | | | | 248 | | | | 1.1 | |

Electricity supply | | | 93 | | | | 0.4 | | | | 84 | | | | 0.4 | | | | 80 | | | | 0.4 | | | | 76 | | | | 0.4 | | | | 67 | | | | 0.3 | | | | 60 | | | | 0.3 | |

Port facilities | | | 129 | | | | 0.5 | | | | 123 | | | | 0.5 | | | | 120 | | | | 0.5 | | | | 115 | | | | 0.5 | | | | 107 | | | | 0.5 | | | | 99 | | | | 0.4 | |

Regional development | | | 104 | | | | 0.4 | | | | 68 | | | | 0.3 | | | | 67 | | | | 0.3 | | | | 56 | | | | 0.3 | | | | 49 | | | | 0.2 | | | | 34 | | | | 0.2 | |

Industrial waste disposal | | | 14 | | | | 0.1 | | | | 14 | | | | 0.1 | | | | 13 | | | | 0.0 | | | | 12 | | | | 0.0 | | | | 11 | | | | 0.1 | | | | 9 | | | | 0.0 | |

Markets | | | 112 | | | | 0.5 | | | | 106 | | | | 0.5 | | | | 102 | | | | 0.5 | | | | 97 | | | | 0.4 | | | | 90 | | | | 0.4 | | | | 84 | | | | 0.4 | |

Slaughterhouse | | | 8 | | | | 0.0 | | | | 7 | | | | 0.0 | | | | 7 | | | | 0.0 | | | | 7 | | | | 0.0 | | | | 6 | | | | 0.0 | | | | 6 | | | | 0.0 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 788 | | | | 3.2 | | | | 710 | | | | 3.1 | | | | 669 | | | | 3.0 | | | | 644 | | | | 2.9 | | | | 592 | | | | 2.7 | | | | 540 | | | | 2.4 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Others | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Regional revitalization projects | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 0 | | | | 0.0 | | | | 10 | | | | 0.0 | |

Disaster prevention projects | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 0 | | | | 0.0 | | | | 19 | | | | 0.1 | |

Special municipal merger projects | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 11 | | | | 0.1 | | | | 194 | | | | 0.9 | |

Extraordinary financial countermeasures funding | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 449 | | | | 2.1 | | | | 1,215 | | | | 5.5 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

General Loans (subtotal) | | | 24,059 | | | | 99.1 | | | | 23,033 | | | | 99.2 | | | | 22,270 | | | | 99.2 | | | | 22,036 | | | | 99.2 | | | | 21,871 | | | | 99.3 | | | | 22,092 | | | | 99.4 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Local toll road public corporations | | | 209 | | | | 0.9 | | | | 197 | | | | 0.8 | | | | 188 | | | | 0.8 | | | | 179 | | | | 0.8 | | | | 159 | | | | 0.7 | | | | 140 | | | | 0.6 | |

Local land development public corporations | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Loans To Local Public Corporations (subtotal) | | | 209 | | | | 0.9 | | | | 197 | | | | 0.8 | | | | 188 | | | | 0.8 | | | | 179 | | | | 0.8 | | | | 159 | | | | 0.7 | | | | 140 | | | | 0.6 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total | | ¥ | 24,268 | | | | 100.0 | % | | ¥ | 23,230 | | | | 100.0 | % | | ¥ | 22,459 | | | | 100.0 | % | | ¥ | 22,215 | | | | 100.0 | % | | ¥ | 22,030 | | | | 100.0 | % | | ¥ | 22,232 | | | | 100.0 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Entrusted Loans | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Forests | | ¥ | 358 | | | | 92.6 | % | | ¥ | 351 | | | | 93.0 | % | | ¥ | 348 | | | | 93.5 | % | | ¥ | 344 | | | | 93.4 | % | | ¥ | 337 | | | | 93.8 | % | | | 330 | | | | 94.2 | % |

Pastures | | | 28 | | | | 7.4 | | | | 26 | | | | 7.0 | | | | 24 | | | | 6.5 | | | | 24 | | | | 6.6 | | | | 22 | | | | 6.2 | | | | 20 | | | | 5.8 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total | | ¥ | 386 | | | | 100.0 | % | | ¥ | 377 | | | | 100.0 | % | | ¥ | 372 | | | | 100.0 | % | | ¥ | 369 | | | | 100.0 | % | | ¥ | 360 | | | | 100.0 | % | | ¥ | 350 | | | | 100.0 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Loan Terms

The terms and conditions applicable to JFM’s loans other than entrusted loans are determined by JFM in accordance with the costs of funds procured by JFM. The terms and conditions of entrusted loans are determined by JFC.

Interest Rates

Loan interest rates consist of three types: standard interest rate; special interest rate; and extra-special interest rate.

Standard Interest Rate. The standard interest rate represents the rate at which the discounted present value of cash flows of the fund raised by JFM to make loans equals the discounted present value of cash flows generated by those loans with their respective terms to maturity, grace periods and repayment methods.

-7-

Special Interest Rate. The special interest rate is set at a discount on the standard rate (0.3% below standard rate) for projects that are particularly important to the livelihood of residents.

Extra-Special Interest Rate. The extra-special interest rate is set at a further discount on the standard rate (0.35% below standard rate) for special projects of great urgency and necessity to respond appropriately to the issues of the regional community.

The trend of loan interest rates for fiscal year 2010 is shown below. During this period, extra-special interest rates were at the same level as the rates of the Fiscal Loan Fund provided by the national government.

| | | | | | | | | | | | | | | | | | | | | | | | |

Month/Year | | April ’10 | | | May ’10 | | | June ’10 | | | July ’10 | | | August ’10 | | | September ’10 | |

Interest Rate Reset Date | | | Apr. 21 | | | | May 25 | | | | Jun. 28 | | | | Jul. 28 | | | | Aug. 25 | | | | Sep. 28 | |

Standard Interest Rate | | | 2.10 | % | | | 2.05 | % | | | 1.95 | % | | | 1.80 | % | | | 1.65 | % | | | 1.85 | % |

Special Interest Rate | | | 2.10 | | | | 2.00 | | | | 1.90 | | | | 1.80 | | | | 1.60 | | | | 1.80 | |

Extra-Special Interest Rate | | | 2.10 | | | | 2.00 | | | | 1.90 | | | | 1.80 | | | | 1.60 | | | | 1.80 | |

Interest Rate of Fiscal Loan Fund | | | 2.10 | | | | 2.00 | | | | 1.90 | | | | 1.80 | | | | 1.60 | | | | 1.80 | |

| | | | | | |

Month/Year | | October ’10 | | | November ’10 | | | December ’10 | | | January ’11 | | | February ’11 | | | March ’11 | |

Interest Rate Reset Date | | | Oct.27 | | | | Nov.24 | | | | Dec.21 | | | | Jan.26 | | | | Feb.23 | | | | Mar.18 | |

Standard Interest Rate | | | 1.75 | % | | | 1.85 | % | | | 2.05 | % | | | 2.00 | % | | | 2.05 | % | | | ® | |

Special Interest Rate | | | 1.70 | | | | ® | | | | 1.90 | % | | | ® | | | | ® | | | | ® | |

Extra-Special Interest Rate | | | 1.70 | | | | ® | | | | 1.90 | % | | | ® | | | | ® | | | | ® | |

Interest Rate of Fiscal Loan Fund | | | 1.70 | | | | ® | | | | 1.90 | % | | | ® | | | | ® | | | | ® | |

| * | The figures in the above table relate to fixed interest rates for loans with a 30-year maturity and 5-year grace period. The interest rates of the Fiscal Loan Fund are based on the same conditions. |

Maturities

The loan maturity, which is set according to the purpose of the loan, was previously 28 years at the maximum. As a result of the review of the loan maturity for each purpose, which was conducted at the time of the reorganization of JFM in June 2009, the maximum term to maturity was extended to 30 years for fiscal 2009 loans. The new loan maturities for major purposes are shown below.

| | | | | | | | | | | | | | | | |

| | | Loans for Fiscal 2011 (years) | |

| | | Fixed Interest Rate | | | Adjustable Interest Rate* | |

Loan Category by Project | | Maturity | | | Grace

Period | | | Maturity | | | Grace

Period | |

Loans for Public Projects, etc | | | 20 | | | | 5 | | | | 20 | | | | 5 | |

Public Housing | | | 25 | | | | 5 | | | | 25 | | | | 5 | |

Social Welfare Facilities Construction Projects | | | 20 | | | | 3 | | | | 20 | | | | 3 | |

General Projects | | | 20 | | | | 5 | | | | 20 | | | | 5 | |

Regional Revitalization Projects | | | 30 | | | | 5 | | | | 30 | | | | 5 | |

Disaster Prevention Projects | | | 30 | | | | 5 | | | | 30 | | | | 5 | |

Local Road Construction Projects | | | 20 | | | | 5 | | | | 20 | | | | 5 | |

Special Municipal Merger Projects | | | 30 | | | | 5 | | | | 30 | | | | 5 | |

Extraordinary Financial Countermeasures Funding | | | | | | | | | | | | | | | | |

Prefectures and Government-Designated Cities | | | — | | | | — | | | | 30 | | | | 3 | |

Cities, Towns and Villages | | | — | | | | — | | | | 20 | | | | 3 | |

Water Supply | | | 30 | | | | 5 | | | | 30 | | | | 5 | |

Transportation | | | 30 | | | | 5 | | | | 30 | | | | 5 | |

Hospitals | | | 30 | | | | 5 | | | | 30 | | | | 5 | |

Sewerage | | | 30 | | | | 5 | | | | 30 | | | | 5 | |

Industrial Water Supply | | | 30 | | | | 5 | | | | 30 | | | | 5 | |

Electricity Supply | | | 30 | | | | 5 | | | | 30 | | | | 5 | |

Gas Supply | | | 25 | | | | 5 | | | | 25 | | | | 5 | |

Port Facilities | | | 20 | | | | 5 | | | | 30 | | | | 5 | |

Markets | | | 25 | | | | 5 | | | | 25 | | | | 5 | |

Slaughterhouses | | | 20 | | | | 5 | | | | 20 | | | | 5 | |

(* Note: Reviewed every 10 years)

-8-

The following table sets forth information concerning the maturities of JFM’s outstanding loans as of March 31, 2011.

Loans Outstanding by Maturity

| | | | | | | | |

| | | (in millions) | |

5 years or less | | ¥ | 1,505,364 | | | | 6.8 | % |

More than 5 years to 10 years | | | 3,474,337 | | | | 15.6 | % |

More than 10 years to 20 years | | | 11,242,483 | | | | 50.6 | % |

More than 20 years | | | 6,009,672 | | | | 27.0 | % |

| | | | | | | | |

Total | | ¥ | 22,231,856 | | | | 100.0 | % |

| | | | | | | | |

Funds Available for Lending

The following table gives details of funds available for lending of the Predecessor during the two years and six months period ended September 30, 2008, and JFM during the two years and six months period ended March 31, 2011 (other than funds entrusted by JFC).

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | The Predecessor | | | JFM | |

| | | Years ended March 31, | | | Six months ended | | | Year ended March 31, | |

| | | 2007 | | | 2008 | | | September 30,

2008 | | | March 31,

2009 | | | 2010 | | | 2011 | |

| | | (in billions) | |

Cash and bank deposits and securities at the beginning of the year | | ¥ | 721 | | | ¥ | 768 | | | ¥ | 1,122 | | | ¥ | 17 | | | ¥ | 1,130 | | | ¥ | 1,134 | |

Government guaranteed bonds (domestic) | | | 739 | | | | 650 | | | | 220 | | | | 720 | | | | 820 | | | | 650 | |

Government guaranteed bonds (foreign) | | | 120 | | | | 119 | | | | 75 | | | | 0 | | | | 0 | | | | 83 | |

Non-guaranteed public offering bonds (domestic) | | | 360 | | | | 370 | | | | 150 | | | | 160 | | | | 721 | | | | 900 | |

Non-guaranteed private placement bonds | | | 334 | | | | 255 | | | | 127 | | | | 0 | | | | 400 | | | | 400 | |

Contributions of the proceeds from public races | | | 11 | | | | 14 | | | | 2 | | | | (10 | ) | | | 9 | | | | 7 | |

Proceeds from collection of loans | | | 1,716 | | | | 2,164 | | | | 1,405 | | | | 719 | | | | 1,476 | | | | 1,631 | |

Other | | | 734 | | | | 693 | | | | 315 | | | | 1,715 | | | | 560 | | | | 542 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Subtotal | | ¥ | 4,734 | | | ¥ | 5,032 | | | ¥ | 3,416 | | | ¥ | 3,320 | | | ¥ | 5,116 | | | ¥ | 5,347 | |

Bonds redeemed and other outflows | | | 2,748 | | | | 2,783 | | | | 1,358 | | | | 1,397 | | | | 2,692 | | | | 2,540 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Funds available for lending | | | 1,986 | | | | 2,249 | | | | 2,058 | | | | 1,605 | | | | 2,424 | | | | 2,807 | |

Total loan funds | | ¥ | 1,218 | | | ¥ | 1,126 | | | ¥ | 633 | | | ¥ | 475 | | | ¥ | 1,291 | | | ¥ | 1,833 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Cash and bank deposits and securities at the end of the period | | | 768 | | | | 1,122 | | | | 1,425 | | | | 1,130 | | | | 1,134 | | | | 974 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

JFM raises funds for its loan operations mainly by issuing non-guaranteed bonds in the capital markets. JFM is permitted to issue Japanese government-guaranteed bonds to refinance previously-issued Japanese government-guaranteed bonds (including those issued by the Predecessor). The national government draws up a plan for its Fiscal Investment and Loan Program (Zaito plan) each year. The annual Zaito plan, which is subject to approval by the Diet, determines the allocation of funds and extent of government guarantees for institutions including JFM.

Contributions of the proceeds from horse, bicycle, motorcycle and boat races, operated exclusively by local governments, are forwarded to JFM in accordance with the Local Finance Law. The contributions are accumulated in a separate account (Fund for Improvement of Operations of Municipalities) and monies transferred from returns from the management of the Fund to the accounts are applied to contribute to the reduction of interest rates on loans to local governments.

Risk Management

JFM established the Integrated Risk Management Committee as part of its efforts to identify and formulate appropriate responses to the various risks JFM must deal with in the course of operations, including interest rate risk. In addition, JFM is promoting more advanced analytical procedures for its asset and liability management.

-9-

Credit Risk

Credit risk is the risk of loss arising from a credit event, such as deterioration in the financial condition of a borrower, that causes an asset to lose value or become worthless. In addition to credit risk associated with loans, market transactions also involve credit risk.

Credit risk for loans. JFM makes loans exclusively to local governments, and does not expect any default on loans made to local governments for the reasons outlined below. JFM and the Predecessor have never experienced any loan losses.

The national government includes local government debt servicing costs in the expenditure of the Local Government Finance Program, and secures the total amount of local allocation tax which balances local governments’ total expenditures including debt servicing costs and total revenue. Thus, the national government effectively secures revenue sources for principal and interest payments for local governments. The national government also secures revenue sources for debt service for individual local governments by including a portion of local government debt servicing costs in the Standard Financial Needs when calculating local allocation tax.

Under the consultation system for local government bonds and loans, credit reviews must include checks on situations of local government debt servicing, and tax revenue and necessary revenue sources to be secured. Additionally, under the Early Warning System, the local governments whose debt servicing costs and financial deficits exceed a certain level must apply for approval to issue bonds or obtain loans, so that the credit standing of local government bonds and loans is maintained.

Under the Law Relating to the Financial Soundness of Local Governments, which was promulgated in June 2007, local governments whose fiscal indicators exceed the early warning limits must make their own efforts toward achieving fiscal soundness, and local governments whose fiscal indicators exceed the reconstruction limits must take necessary actions to restore fiscal soundness under the oversight of the national government with regard to redemption of local government bonds and loans, and other operations.

As of March 31, 2011, JFM’s total outstanding loans stood at ¥22,231.8 billion. The amount of outstanding loans made to local government road corporations by the Predecessor was ¥140.0 billion which accounted for approximately 0.6 % of the total loans.

-10-

JFM is not subject to the “Banking Law” or the “Financial Reconstruction Law,” but performs selfassessment of loans made to local government road corporations in accordance with the “Financial Inspection Manual” of the Financial Services Agency (FSA). All of these loans have been processed as unclassified assets based on the self-assessment.

The amount of loans made to local governments whose fiscal indicators exceeded the early warning limits or the reconstruction limits accounted for approximately 0.2% of the total loans.

Credit risk associated with market transactions. JFM is exposed to the risk of loss arising from credit events, such as deterioration in the financial condition of a counterparty, which causes an asset to lose value or become worthless. However, JFM appropriately manages credit risk of this type by constantly monitoring counterparties’ financial standing and limiting them to financial institutions that meet the credit rating and other criteria. In addition, JFM enters into ISDA Master Agreements and CSA (Credit Support Annex) with financial institutions which are its derivatives transaction counterparties to reduce credit risk resulting from fluctuations in the value of derivative transactions.

Market Risk

Market risk is the risk of loss resulting from changes in the value of assets and liabilities due to fluctuations in risk factors such as interest rates, securities prices and foreign exchange rates, or the risk of loss resulting from changes in earnings generated from assets and liabilities. Market risk includes interest rate risk, foreign exchange risk, inflation risk and price change risk.

Interest rate risk. Interest rate risk is the risk of loss resulting from fluctuations in interest rates. More specifically, it is the risk of losses incurred or decrease in profits, which would arise from fluctuations in interest rates when there is an interest rate or maturity gap between assets and liabilities.

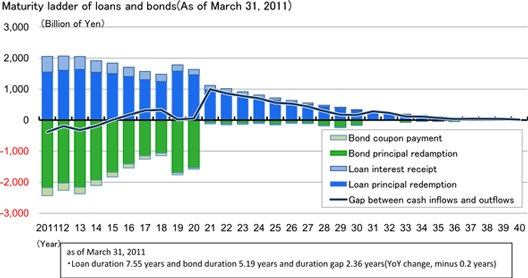

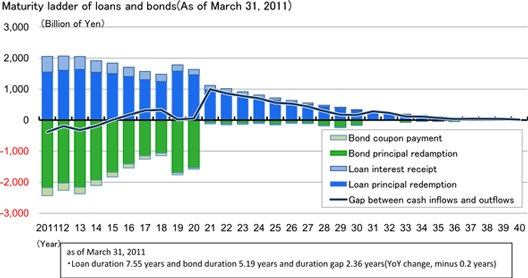

JFM makes loans to local governments. The maximum term to maturity is 30 years, but the majority of the funds for these loans is raised mainly through issuance of 10-year bonds, which creates interest rate risk associated with bond refinance.

(Reference)

JFM takes the following measures to address the interest rate risk resulting from a duration gap between lending and fund-raising.

-11-

• JFM maintains necessary reserves for interest rate volatility to cope with the interest rate risk resulting from a duration gap between lending and fund-raising. The amount of the above reserves stood at ¥660 billion in the General account and ¥3,136 billion in the Management account for a total of ¥3,796 billion in both accounts at the end of March 2011.

• As assets and liabilities in JFM’s General account are expected to expand as a result of the loans and fund-raising for local governments after JFM was established, JFM carries out an ALM analysis of this account in a timely and appropriate manner to further enhance the effectiveness of its management of interest rate risk. JFM also endeavors to reduce its exposure to interest rate risk by setting the following medium-term between fiscal 2009 and fiscal 2013 management target, by continuously issuing super-long bonds with maturities exceeding 10 years, and by utilizing interest rate swaps. Since it had only been two-and-a-half years since JFM started its operation, both assets and liabilities were small compared to the Management account, but the outlier ratio for the end of fiscal 2010 was 14.6% and the duration gap was 1.12 years, within the management target.

(1) Keep the “outlier ratio” below approximately 20%. “Outlier ratio” is the ratio of “decline in economic value” as a result of interest rate shocks to net assets including reserves for interest rate volatility and the Fund for Improvement of Operations of Municipalities. “Decline in economic value” is the decline of present value after interest rate shocks (an upward and downward 200 bp parallel shift of the yield curve).

(2) Keep a duration gap below approximately 2 years.

• The Management account, which manages assets and liabilities related to money loaned by the Predecessor, is currently exposed to greater interest rate risk than the General account, but JFM contributes to the required Reserves for Interest Rate Volatility as described above. The amount of the above reserves stood at ¥3,136 billion. But in the future, assets and liabilities will contract as time passes since new loans have not been made after October 2008, and interest rate risk will decline.

JFM is also exposed to pipeline risk, whereby losses would be incurred or profits decrease as a result of interest rate fluctuations during the time from which JFM raises money through bond issuance and the point at which the money is loaned to local governments.

JFM uses swap transactions to hedge against pipeline risk.

Foreign exchange and other risks. Various risks associated with bond principal and interest payments are hedged by swap transactions. These risks include foreign exchange risk related to foreign currency denominated bonds, interest rate risk related to floating rate bonds, and risk of fluctuations in the amounts of principal and interest of inflation-indexed bonds.

JFM’s investments of surplus funds are exposed to the risk of losses on the sale of securities resulting from price declines and the risk of realized losses on foreign currency-denominated deposits resulting from fluctuations in foreign exchange rates. Accordingly, in principle JFM minimizes the risk of price fluctuation by holding investments until maturity, and hedges foreign exchange risk by using foreign exchange contracts.

-12-

Liquidity Risk

Liquidity risk is the risk that JFM would incur losses because it finds it difficult to secure the necessary funds or is forced to obtain funds at far higher interest rates than under normal conditions due to a mismatch between the maturities of assets and liabilities or an unexpected outflow of funds (funding liquidity risk). It also includes the risk that JFM would incur losses because it is unable to conduct market transactions or is forced to conduct transactions at far more unfavorable prices than under normal conditions due to market disruption or other difficult situations (market liquidity risk).

JFM’s exposure to liquidity risk is extremely low because loans are made to local governments according to a pre-set schedule, and the daily cash and liquidity management is carried out based on a quarterly plan for fund management. Moreover, JFM has entered into overdraft agreements with several financial institutions to prepare for the unexpected, and invests surplus funds only in short-term financial products.

Operational Risk

Operational risk is the risk of loss resulting from inadequate operation processes, inadequate activities by management and staff, and inadequate computer systems, or from external events.

Administrative risk. Administrative risk is the risk of loss resulting from the neglect by management and staff to properly conduct administrative work, accidents caused by them and violation of laws conducted by them in the course of the administrative work process.

JFM endeavors to mitigate its exposure to administrative risk by preparing operational manuals, holding educational seminars and reducing operational workload through systematization.

Systems risk. Systems risk is the risk that the confidentiality, integrity and availability of information assets will be impaired as a result of computer system inadequacies or the fraudulent use of computer systems.

JFM has established and implemented the “Systems Risk Management Policy” and the “Systems Risk Management Standard” to appropriately manage systems risk and ensure smooth business operations.

JFM has also prepared the “Contingency Plan” to minimize the scope of losses and the impact on operations and restore normal operations promptly and efficiently in the event that computer systems break down or cannot be used due to unexpected accidents, disasters or malfunctions.

Other risks. In addition to the aforementioned risks, JFM appropriately identifies and addresses other risks, such as legal risk, personnel risk, physical asset risk and reputation risk.

-13-

MANAGEMENT

JFM is managed by the President and Chief Executive Officer, one Deputy President and up to three Senior Executive Directors. In addition, it has two Corporate Auditors. The President and Chief Executive Officer and the Corporate Auditors are appointed by the Representative Board. The Deputy President and the Senior Executive Directors are appointed by the President and Chief Executive Officer with the approval of the Representative Board. When the Representative Board or the President and Chief Executive Officer has appointed an officer, JFM is required to notify the officer’s name and address to the Minister for Internal Affairs and Communications.

The President and Chief Executive Officer has the authority to manage all operations and holds the right of final decision and representation on all matters related to JFM. The Deputy President and Senior Executive Directors assist the President and Chief Executive Officer in the performance of his duties.

The Corporate Auditors are responsible for auditing the accounts of JFM, and may, at their discretion, submit reports to the Representative Board, the President and Chief Executive Officer and the Ministers of Internal Affairs and Communications.

The executive officers and corporate auditors of JFM as of the date of this Exhibit are as follows:

| | |

President and Chief Executive Officer | | Yuji Watanabe |

| |

Deputy President | | Masamichi Fukunaga |

| |

Senior Executive Directors | | Takeji Takei |

| | Senior Executive Director (in charge of overall coordination, Corporate Planning Department, Administration Department, Loan Department and Credit) |

| | Sadaji Hiranuma |

| | Senior Executive Director (in charge of Finance Department) |

| | Keiichi Hikita |

| | Senior Executive Director (part-time) |

| |

Corporate Auditors | | Katsuhiko Hara |

| | Nadamu Takata (part-time) |

-14-

DEBT RECORD

There has been no default of interest or principal on any obligation of JFM or the Predecessor.

-15-

FINANCIAL STATEMENTS OF JFM

Set forth below are JFM’s audited financial statements for the fiscal year ended March 31, 2011.

-16-

Audited Financial Statements of JFM for the fiscal year ended March 31, 2011

Report of Independent Auditors

To the President of Japan Finance Organization for Municipalities

We have audited the accompanying balance sheets of Japan Finance Organization for Municipalities as of March 31, 2011 and 2010, and the related statements of income, changes in net assets and cash flows and appropriation of profit for the years then ended, all expressed in yen. These financial statements are the responsibility of the President. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with auditing standards generally accepted in Japan. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of Japan Finance Organization for Municipalities at March 31, 2011 and 2010, and the results of its operations and its cash flows for the years then ended in conformity with accounting principles generally accepted in Japan (refer to Note 1 of the Notes to Financial Statements).

The U.S. dollar amounts in the accompanying financial statements with respect to the year ended March 31, 2011 are presented solely for convenience. Our audit also included the translation of yen amounts into U.S. dollar amounts and, in our opinion, such translation has been made on the basis described in Note 1.

/s/ Ernst & Young ShinNihon LLC

May 20, 2011

-17-

Balance Sheets (As of March 31, 2010 and 2011)

(Millions of Yen) (Thousands of US dollars)

| | | | | | | | | | | | |

| | | Fiscal 2009

(March 31, 2010) | | | Fiscal 2010

(March 31, 2011) | |

Item | | Amount | |

Assets | | | | | | | | | | | | |

Loans (Note 4) | | ¥ | 22,030,227 | | | ¥ | 22,231,856 | | | $ | 267,145,594 | |

Securities (Note 17) | | | 984,477 | | | | 457,590 | | | | 5,498,561 | |

Cash and bank deposits | | | 149,264 | | | | 516,633 | | | | 6,208,040 | |

Other assets | | | 17,159 | | | | 17,033 | | | | 204,675 | |

Tangible fixed assets (Note 6) | | | 2,948 | | | | 2,918 | | | | 35,065 | |

Intangible fixed assets (Note 6) | | | 921 | | | | 756 | | | | 9,095 | |

| | | | | | | | | | | | |

Total assets | | ¥ | 23,184,998 | | | ¥ | 23,226,787 | | | $ | 279,101,030 | |

| | | | | | | | | | | | |

| | | |

Liabilities | | | | | | | | | | | | |

Bonds (Notes 7 and 8) | | ¥ | 18,534,475 | | | ¥ | 18,327,190 | | | $ | 220,225,787 | |

Other liabilities | | | 17,726 | | | | 17,698 | | | | 212,666 | |

Reserve for bonuses (Note 9) | | | 43 | | | | 41 | | | | 501 | |

Reserve for directors’ bonuses (Note 9) | | | 7 | | | | 6 | | | | 83 | |

Reserve for retirement benefits (Notes 9 and 12) | | | 210 | | | | 195 | | | | 2,349 | |

Reserve for retirement benefits for directors and corporate

auditors (Note 9) | | | 56 | | | | 27 | | | | 327 | |

Fund for improvement of operations of municipalities | | | 906,939 | | | | 915,823 | | | | 11,004,853 | |

Basic fund for improvement of operations of municipalities

(Note 11) | | | 901,407 | | | | 908,104 | | | | 10,912,097 | |

Additional fund for improvement of operations of

municipalities (Note 11) | | | 5,531 | | | | 7,719 | | | | 92,756 | |

Reserve under special laws | | | 3,664,927 | | | | 3,896,421 | | | | 46,820,740 | |

Reserve for interest rate volatility (Note 10) | | | 440,000 | | | | 660,000 | | | | 7,930,786 | |

Management account reserve for interest rate volatility

(Note 10) | | | 3,111,043 | | | | 3,136,532 | | | | 37,689,651 | |

Reserve for interest rate reduction | | | 113,883 | | | | 99,889 | | | | 1,200,303 | |

| | | | | | | | | | | | |

Total liabilities | | | 23,124,384 | | | | 23,157,405 | | | | 278,267,306 | |

| | | | | | | | | | | | |

| | | |

Net Assets | | | | | | | | | | | | |

Capital | | | 16,602 | | | | 16,602 | | | | 199,497 | |

Retained earnings | | | 5,834 | | | | 13,860 | | | | 166,555 | |

General account surplus reserve | | | 5,834 | | | | 13,860 | | | | 166,555 | |

Valuation, translation adjustments and others | | | (1,340 | ) | | | (8,645 | ) | | | (103,892 | ) |

Management account surplus reserve | | | 39,517 | | | | 47,565 | | | | 571,564 | |

| | | | | | | | | | | | |

Total net assets | | | 60,613 | | | | 69,382 | | | | 833,724 | |

| | | | | | | | | | | | |

Total liabilities and net assets | | ¥ | 23,184,998 | | | ¥ | 23,226,787 | | | $ | 279,101,030 | |

| | | | | | | | | | | | |

-18-

Statements of Income (For the Years Ended March 31, 2010 and 2011)

(Millions of Yen) (Thousands of US dollars)

| | | | | | | | | | | | |

| | | Fiscal 2009

(April 1, 2009 to

March 31, 2010) | | | Fiscal 2010 (April 1, 2010 to

March 31, 2011) | |

Item | | Amount | | | Amount | |

Income | | ¥ | 558,528 | | | ¥ | 539,997 | | | $ | 6,488,794 | |

Interest income | | | 558,369 | | | | 539,812 | | | | 6,486,568 | |

Fees and commissions | | | 140 | | | | 134 | | | | 1,620 | |

Other income | | | 18 | | | | 50 | | | | 606 | |

| | | |

Expenses | | | 308,357 | | | | 292,428 | | | | 3,513,918 | |

Interest expenses | | | 297,347 | | | | 283,177 | | | | 3,402,754 | |

Fees and commissions | | | 271 | | | | 269 | | | | 3,242 | |

Other operating expenses | | | 4,641 | | | | 4,418 | | | | 53,101 | |

General and administrative expenses | | | 2,365 | | | | 2,374 | | | | 28,532 | |

Other expenses | | | 3,731 | | | | 2,187 | | | | 26,289 | |

Transfer to fund for improvement of operations of municipalities

(Note 11) | | | 3,731 | | | | 2,187 | | | | 26,289 | |

| | | |

Ordinary income | | | 250,170 | | | | 247,569 | | | | 2,974,876 | |

| | | |

Special gains | | | 235,010 | | | | 233,994 | | | | 2,811,754 | |

Reversal of Management account reserve for interest rate volatility

(Note 10) | | | 220,000 | | | | 220,000 | | | | 2,643,595 | |

Reversal of reserve for interest rate reduction | | | 15,010 | | | | 13,994 | | | | 168,159 | |

Special losses | | | 476,315 | | | | 465,489 | | | | 5,593,475 | |

Provision for reserve for interest rate volatility (Note 10) | | | 220,000 | | | | 220,000 | | | | 2,643,595 | |

Provision for Management account reserve for interest rate volatility

(Note 10) | | | 256,315 | | | | 245,489 | | | | 2,949,880 | |

| | | | | | | | | | | | |

Net income | | ¥ | 8,866 | | | ¥ | 16,074 | | | $ | 193,155 | |

| | | | | | | | | | | | |

-19-

| | | | | | |

Appropriation of Profit [General Account] (For the year ended March 31, 2010) | | | | | | (Millions of Yen) |

| | | |

1 Profit to be appropriated | | | | | | ¥4,539 |

Net income | | | | ¥4,539 | | |

Accumulated deficit brought down | | — | | | | |

2 Profit appropriated | | | | | | |

Surplus reserve | | | | 4,539 | | 4,539 |

| | | | |

Notes: | | 1. | | Profit was appropriated at the end of this fiscal year in accordance with the provisions of Article 39, Section 1 of the Japan Finance Organization for Municipal Enterprises Law (Law No. 64, 2007). |

| | |

| | 2. | | Surplus reserve appropriated was posted as General account surplus reserve on the Balance Sheet. |

| | | | | | |

Appropriation of Profit [General Account] (For the year ended March 31, 2011) | | | | | | (Millions of Yen) |

| | | |

1 Profit to be appropriated | | | | | | ¥8,025 |

Net income | | | | ¥8,025 | | |

Accumulated deficit brought down | | — | | | | |

2 Profit appropriated | | | | | | |

Surplus reserve | | | | 8,025 | | 8,025 |

| | | |

| | | | | | (Thousands of US dollars) |

| | | |

1 Profit to be appropriated | | | | | | $96,443 |

Net income | | | | $96,443 | | |

Accumulated deficit brought down | | — | | | | |

2 Profit appropriated | | | | | | |

Surplus reserve | | | | 96,443 | | 96,443 |

| | | | |

Notes: | | 1. | | Profit was appropriated at the end of this fiscal year in accordance with the provisions of Article 39, Section 1 of the Japan Finance Organization for Municipalities Law (Law No. 64, 2007). |

| | |

| | 2. | | Surplus reserve appropriated was posted as General account surplus reserve on the Balance Sheet. |

-20-

| | | | | | |

Appropriation of Profit [Management Account] (For the year ended March 31, 2010) | | | | | | (Millions of Yen) |

| | | |

1 Profit to be appropriated | | | | | | ¥4,326 |

Net income | | | | ¥4,326 | | |

Accumulated deficit brought down | | — | | | | |

2 Profit appropriated | | | | | | |

Surplus reserve | | | | 4,326 | | 4,326 |

| | | | |

Notes: | | 1. | | Profit was appropriated at the end of this fiscal year in accordance with the provisions of Article 13, Section 8 of the supplementary provisions of the Japan Finance Organization for Municipal Enterprises Law (Law No.64, 2007). |

| | |

| | 2. | | Surplus reserve appropriated was posted as Management account surplus reserve on the Balance Sheet. |

| | | | | | |

Appropriation of Profit [Management Account] (For the year ended March 31, 2011) | | | | | | (Millions of Yen) |

| | | |

1 Profit to be appropriated | | | | | | ¥8,048 |

Net income | | | | ¥8,048 | | |

Accumulated deficit brought down | | — | | | | |

2 Profit appropriated | | | | | | |

Surplus reserve | | | | 8,048 | | 8,048 |

| | | |

| | | | | | (Thousands of US dollars) |

| | | |

1 Profit to be appropriated | | | | | | $96,712 |

Net income | | | | $96,712 | | |

Accumulated deficit brought down | | — | | | | |

2 Profit appropriated | | | | | | |

Surplus reserve | | | | 96,712 | | 96,712 |

| | | | |

Notes: | | 1. | | Profit was appropriated at the end of this fiscal year in accordance with the provisions of Article 13, Section 8 of the supplementary provisions of the Japan Finance Organization for Municipal Law (Law No.64, 2007). |

| | |

| | 2. | | Surplus reserve appropriated was posted as Management account surplus reserve on the Balance Sheet. |

-21-

Statements of Changes in Net Assets

| | | | | | | | | | | | | | |

| (From April 1, 2009 through March 31, 2010) | | | | | | (Millions of Yen) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Stockholders’ equity | | | Valuation,

translation

adjustments

and others | | | | | | | |

| | | | | | Retained earnings | | | | | | | | | | | | | |

| | | Capital | | | General

account

surplus

reserve | | | Total retained

earnings | | | Total

stockholders’

equity | | | Unrealized

loss from

hedging

instruments | | | Management

account

surplus

reserve | | | Total net

assets | |

Balance at end of previous fiscal year | | ¥ | 16,602 | | | ¥ | 1,295 | | | ¥ | 1,295 | | | ¥ | 17,897 | | | ¥ | — | | | ¥ | 35,190 | | | ¥ | 53,087 | |

Changes during accounting period | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net income | | | — | | | | 4,539 | | | | 4,539 | | | | 4,539 | | | | — | | | | 4,326 | | | | 8,866 | |

Net changes during accounting period in items other than stockholders’ equity | | | — | | | | — | | | | — | | | | — | | | | (1,340 | ) | | | — | | | | (1,340 | ) |

Net changes during accounting period | | | — | | | | 4,539 | | | | 4,539 | | | | 4,539 | | | | (1,340 | ) | | | 4,326 | | | | 7,525 | |

Balance at March 31, 2010 | | ¥ | 16,602 | | | ¥ | 5,834 | | | ¥ | 5,834 | | | ¥ | 22,436 | | | ¥ | (1,340 | ) | | ¥ | 39,517 | | | ¥ | 60,613 | |

| | | | | | | | | | | | | | |

| (From April 1, 2010 through March 31, 2011) | | | | | | (Millions of Yen) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Stockholders’ equity | | | Valuation,

translation

adjustments

and others | | | | | | | |

| | | | | | Retained earnings | | | | | | | | | | | | | |

| | | Capital | | | General

account

surplus

reserve | | | Total retained

earnings | | | Total

stockholders’

equity | | | Unrealized

loss from

hedging

instruments | | | Management

account

surplus

reserve | | | Total net

assets | |

Balance at end of previous fiscal year | | ¥ | 16,602 | | | ¥ | 5,834 | | | ¥ | 5,834 | | | ¥ | 22,436 | | | ¥ | (1,340 | ) | | ¥ | 39,517 | | | ¥ | 60,613 | |

Changes during accounting period | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net income | | | — | | | | 8,025 | | | | 8,025 | | | | 8,025 | | | | — | | | | 8,048 | | | | 16,074 | |

Net changes during accounting period in items other than stockholders’ equity | | | — | | | | — | | | | — | | | | — | | | | (7,305 | ) | | | — | | | | (7,305 | ) |

Net changes during accounting period | | | — | | | | 8,025 | | | | 8,025 | | | | 8,025 | | | | (7,305 | ) | | | 8,048 | | | | 8,768 | |

Balance at March 31, 2011 | | ¥ | 16,602 | | | ¥ | 13,860 | | | ¥ | 13,860 | | | ¥ | 30,462 | | | ¥ | (8,645 | ) | | ¥ | 47,565 | | | ¥ | 69,382 | |

| | | | | | | | | | | | | | |

| | | | |

(From April 1, 2010 through March 31, 2011) | | | | | | | | (Thousands of US dollars) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | |

| | | Stockholders’ equity | | | Valuation,

translation

adjustments

and others | | | | | | | |

| | | | | | Retained earnings | | | | | | | | | | | | | |

| | | Capital | | | General

account

surplus

reserve | | | Total retained

earnings | | | Total

stockholders’

equity | | | Unrealized

loss from

hedging

instruments | | | Management

account

surplus

reserve | | | Total net

assets | |

Balance at end of previous fiscal year | | $ | 199,497 | | | $ | 70,112 | | | $ | 70,112 | | | $ | 269,609 | | | $ | (16,105 | ) | | $ | 474,852 | | | $ | 728,356 | |

Changes during accounting period | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net income | | | — | | | | 96,443 | | | | 96,443 | | | | 96,443 | | | | — | | | | 96,712 | | | | 193,155 | |

Net changes during accounting period in items other than stockholders’ equity | | | — | | | | — | | | | — | | | | — | | | | (87,787 | ) | | | — | | | | (87,787 | ) |

Net changes during accounting period | | | — | | | | 96,443 | | | | 96,443 | | | | 96,443 | | | | (87,787 | ) | | | 96,712 | | | | 105,368 | |

Balance at March 31, 2011 | | $ | 199,497 | | | $ | 166,555 | | | $ | 166,555 | | | $ | 366,052 | | | $ | (103,892 | ) | | $ | 571,564 | | | $ | 833,724 | |

-22-

Statements of Cash Flows (For the Years Ended March 31, 2010 and 2011)

(Millions of Yen) (Thousands of US dollars)

| | | | | | | | | | | | |

| | | Fiscal 2009

(April 1, 2009 to

March 31, 2010) | | | Fiscal 2010

(April 1, 2010 to

March 31, 2011) | |

Item | | Amount | | | Amount | |

I Cash flows from operating activities | | | | | | | | | | | | |

Net income | | ¥ | 8,866 | | | ¥ | 16,074 | | | $ | 193,155 | |

Depreciation and amortization | | | 294 | | | | 353 | | | | 4,250 | |

Interest income | | | (558,369 | ) | | | (539,812 | ) | | | (6,486,568 | ) |

Interest expenses | | | 297,347 | | | | 283,177 | | | | 3,402,754 | |

Decrease in reserve for bonuses | | | (4 | ) | | | (1 | ) | | | (19 | ) |

Decrease in reserve for directors’ bonuses | | | (0 | ) | | | (0 | ) | | | (3 | ) |

Increase /(decrease) in reserve for retirement benefits | | | 7 | | | | (14 | ) | | | (176 | ) |

Increase /(decrease) in reserve for retirement benefits for directors and corporate auditors | | | 5 | | | | (28 | ) | | | (348 | ) |

Increase in fund for improvement of operations of municipalities | | | 3,731 | | | | 2,187 | | | | 26,289 | |

Increase in reserve for interest rate volatility | | | 220,000 | | | | 220,000 | | | | 2,643,595 | |

Increase in Management account reserve for interest rate volatility | | | 36,315 | | | | 25,489 | | | | 306,285 | |

Decrease in reserve for interest rate reduction | | | (15,010 | ) | | | (13,994 | ) | | | (168,159 | ) |

Net (increase)/decrease in loans | | | 185,060 | | | | (201,628 | ) | | | (2,422,842 | ) |

Net decrease in bonds | | | (447,921 | ) | | | (211,245 | ) | | | (2,538,393 | ) |

Interest received | | | 557,974 | | | | 539,475 | | | | 6,482,522 | |

Interest paid | | | (293,491 | ) | | | (279,095 | ) | | | (3,353,705 | ) |

Others | | | (325 | ) | | | (7,434 | ) | | | (89,337 | ) |

| | | | | | | | | | | | |

Net cash used by operating activities | | | (5,520 | ) | | | (166,498 | ) | | | (2,000,700 | ) |

| | | | | | | | | | | | |

II Cash flows from investing activities | | | | | | | | | | | | |

Proceeds from redemption of securities | | | 5,536,800 | | | | 6,711,500 | | | | 80,647,681 | |

Purchases of securities | | | (5,645,665 | ) | | | (6,184,118 | ) | | | (74,310,487 | ) |

Purchases of tangible fixed assets | | | (9 | ) | | | (15 | ) | | | (192 | ) |

Purchases of intangible fixed assets | | | (463 | ) | | | (195 | ) | | | (2,343 | ) |

| | | | | | | | | | | | |

Net cash provided /(used) by investing activities | | | (109,338 | ) | | | 527,170 | | | | 6,334,659 | |

| | | | | | | | | | | | |

III Cash flows from financing activities | | | | | | | | | | | | |

Revenue from contributions made from municipally operated racing | | | 8,576 | | | | 6,696 | | | | 80,471 | |

Refund of contributions made from municipally operated racing | | | (44 | ) | | | — | | | | — | |

| | | | | | | | | | | | |

Net cash provided by financing activities | | | 8,532 | | | | 6,696 | | | | 80,471 | |

| | | | | | | | | | | | |

IV Effect of exchange rate changes on cash and cash equivalents | | | — | | | | — | | | | — | |

| | | | | | | | | | | | |

V Net increase/(decrease) in cash and cash equivalents | | | (106,327 | ) | | | 367,368 | | | | 4,414,430 | |

| | | | | | | | | | | | |

VI Cash and cash equivalents at beginning of year | | | 255,591 | | | | 149,264 | | | | 1,793,610 | |

| | | | | | | | | | | | |

VII Cash and cash equivalents at end of year | | ¥ | 149,264 | | | ¥ | 516,633 | | | $ | 6,208,040 | |

| | | | | | | | | | | | |

-23-

Notes to Financial Statements

1. Basis of Presentation

Japan Finance Organization for Municipalities (hereinafter, “JFM”) has prepared financial statements pursuant to the Japan Finance Organization for Municipalities Law (Law No. 64 of May 30, 2007) and The Ministerial Ordinance on Finance and Accounting of Japan Finance Organization for Municipalities. (Ordinance No.87 of the Ministry of Internal Affairs and Communications, 2008)

Since JFM does not have any subsidiaries or affiliates, it does not prepare consolidated financial statements.

Amounts less than one million yen have been omitted. As a result, the totals in Japanese yen shown in the financial statements do not necessarily agree with the sum of the individual amounts.

The translation of the Japanese yen amounts into U.S. Dollars is included solely for the convenience of readers outside Japan, using the prevailing exchange rate as of March 31, 2011, the final business day of the fiscal year, which was ¥83.22 to US$1.

2. Significant Accounting Policies

As for security valuation, held-to-maturity securities are carried at amortized cost. (straight-line method)

| | (2) | Derivative transactions |

Derivative transactions are carried at fair value with changes in unrealized gain or loss charged or credited to operations, except for those which meet the criteria for hedge accounting.

Depreciation of tangible fixed assets is calculated by the straight-line method based on the estimated useful lives and the residual value determined by management. The estimated useful lives of major items are as follows:

Buildings: 20 to 41 years

Others: 2 to 19 years

| | (b) | Intangible fixed assets |

Amortization of intangible fixed assets is calculated by the straight-line method based on the estimated useful lives and the residual value determined by management. Software for internal use owned by JFM is amortized over 5 years.

Bond issuance costs are expensed in full when incurred.

| | (5) | Translation of assets and liabilities denominated in foreign currencies into Japanese yen |

Monetary assets and liabilities denominated in foreign currencies, for which foreign currency swaps or foreign exchange forward contracts are used to hedge the foreign currency fluctuation, are translated at the contracted rate as the swap contracts or the forward contracts qualify for deferral hedge accounting.

| | (a) | Reserve for possible loan losses |

JFM has never experienced any loan losses. Accordingly, no reserve for loan losses has been maintained.

Reserve for bonuses is provided for payment of bonuses to employees, in the amount of estimated bonuses, which are attributable to the fiscal year.

| | (c) | Reserve for directors’ bonuses |

Reserve for directors’ bonuses is provided for payment of bonuses to directors, in the amount of estimated bonuses, which are attributable to the fiscal year.

| | (d) | Reserve for retirement benefits |

Reserve for retirement benefits is provided for payment of retirement benefits to employees, in the amount deemed accrued at the fiscal year-end, based on the projected retirement benefit obligation and fair value of plan assets at the fiscal year-end.

| | (e) | Reserve for retirement benefits for directors and corporate auditors |

Reserve for retirement benefits for directors and corporate auditors is provided for payment of retirement benefits to directors and corporate auditors, in the amount deemed accrued at the fiscal year-end based on the internal policies.

| | (a) | Hedge accounting method |

-24-

Interest rate swaps used to hedge the risk of interest rate fluctuations and which qualify for hedge accounting and meet specific matching criteria are not measured at fair value, but the differential paid or received under the swap agreements is recognized and included in interest expense or income. If swap contracts or forward contracts used to hedge the foreign currency fluctuation qualify for deferral hedge accounting, foreign currency-denominated assets and liabilities are translated at the contracted rate.

| | (b) | Hedging instruments and hedged items |

| | | | |

| (i) | | Hedging instruments | | Interest rate swap |

| | |

| | Hedged items | | Bonds |

| | |

| (ii) | | Hedging instruments | | Currency swap |

| | |

| | Hedged items | | Foreign currency-denominated bonds |

| | |

| (iii) | | Hedging instruments | | Foreign exchange forward contract |

| | |

| | Hedged items | | Receipt of interest and principal of foreign currency-denominated bank deposits |

JFM uses hedging instruments as a means of hedging exposure to interest rate risk and foreign exchange risk resulting from bond issuances. Hedged items are identified by each individual contract.

As a means of hedging foreign exchange fluctuation risks associated with the receipt of interest and principal of foreign currency-denominated bank deposits, we arrange a foreign exchange forward contract at the time of deposit to hedge the risks.

| | (d) | Assessment of hedge effectiveness |

JFM designates hedging instruments and hedged items with the same major terms when making hedges to offset bond market fluctuations. Accordingly, JFM deems these to be highly effective and thus does not assess its effectiveness. Moreover, a periodic assessment of hedge effectiveness for interest rate swaps and currency swaps and forward contracts which qualify for deferral hedge accounting is omitted when the exceptional accrual method is applied.

| | (8) | Cash and cash equivalents |

Cash and cash equivalents in the Statement of Cash Flows consist of “Cash and bank deposits” on the Balance Sheet.

| | (9) | Fund for improvement of operations of municipalities |

In accordance with the provisions of Article 46, Section 1 of the Law, JFM has established the Fund for improvement of operations of municipalities to reserve contributions as stipulated in Article 32-2 of the Local Finance Law (Law No. 109, 1948). Also, pursuant to the provisions of Article 46, Section 5 of the Law, income arising from the investment of the Fund (hereinafter, “investment income”) is used to reduce interest rates of the loans to municipalities, and if there is any surplus in the investment income after this interest rates reduction process, the surplus amount is added to the Fund. Further, pursuant to the provisions of Article 46, Section 6 of the Law, if there is any shortfall after the interest rates reduction process, the shortfall is covered by withdrawal of the Fund within the limits of the total of the additional portion to the Fund made up to the previous fiscal year and the contributions made in the relative fiscal year.

| | (10) | Reserve for interest rate volatility and Management account reserve for interest rate volatility |

Reserve for interest rate volatility is set aside to prepare for interest rate risk associated with refinancing of our bonds (excluding the bonds issued by the former Japan Finance Corporation for Municipal Enterprises) pursuant to the provisions of Article 38, Sections 1 and 3 of the Law, and Article 9, Section 8 of the supplementary provisions of the Law, and is calculated and accounted for based on the provisions of Article 34 of the Ministerial Ordinance on Finance and Accounting of Japan Finance Organization for Municipalities (Ordinance No. 87 of the Ministry of Internal Affairs and Communications, 2008; hereinafter, “Ordinance on Finance and Accounting”) and Article 22 of the Government Ordinance on preparation of relevant government ordinances and provisional measures for the abolishment of the Japan Finance Corporation for Municipal Enterprises Law (Government Ordinance No. 226, 2008; hereinafter, “Preparation Ordinance”).

Management account reserve for interest rate volatility is set aside to prepare for interest rate risk associated with refinancing of the bonds issued by the former Japan Finance Corporation for Municipal Enterprise (hereinafter, “former JFM”) pursuant to the provisions of Article 9, Sections 9 and 10, and Article 13, Sections 5 and 7 of the supplementary provisions of the Law, and is calculated and accounted for based on the provisions of Articles 1 through 3 of the Ministerial Ordinance on the operations of the Management Account at Japan Finance Organization for Municipal Enterprises (Ordinance No. 2 of the Ministry of Internal Affairs and Communication, and the Ministry of Finance, 2008; hereinafter, “Management Account Operations Ordinance”) and Articles 3 and 5 of the supplementary provisions of the above ordinance.

-25-

| | (11) | Reserve for interest rate reduction |

Reserve for interest rate reduction is set aside to reduce interest rates on the loans made by the former JFM to local governments pursuant to the provisions of Article 9, Section 13, and Article 13, Section 8 of the supplementary provisions of the Law, and Article 26, Sections 1, 3 and 4 of the Preparation Ordinance, and is calculated and accounted for based on the provisions of Article 5 of the Management Account Operations Ordinance.

| | (12) | Management account surplus reserve |