FINANCIAL HIGHLIGHTS

(For a share outstanding throughout each year)

| | | INVESTOR CLASS | |

| | | | |

| | | Years Ended September 30, | |

| | | 2015 | | | 2014 | | | 2013 | | | 2012 | | | 2011 | |

| Net asset value | | | | | | | | | | | | | | | |

| Beginning of year | | $ | 11.21 | | | $ | 10.72 | | | $ | 11.31 | | | $ | 10.83 | | | $ | 10.97 | |

| | | | | | | | | | | | | | | | | | | | | |

| Income from investment operations | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | 0.31 | | | | 0.32 | | | | 0.34 | | | | 0.34 | | | | 0.39 | |

| Net gain (loss) on securities (both realized and unrealized) | | | — | | | | 0.49 | | | | (0.59 | ) | | | 0.48 | | | | (0.14 | ) |

| Total from investment operations | | | 0.31 | | | | 0.81 | | | | (0.25 | ) | | | 0.82 | | | | 0.25 | |

| | | | | | | | | | | | | | | | | | | | | |

| Less distributions | | | | | | | | | | | | | | | | | | | | |

| Dividends from net investment income | | | (0.31 | ) | | | (0.32 | ) | | | (0.34 | ) | | | (0.34 | ) | | | (0.39 | ) |

| Distributions from capital gains | | | — | | | | — | | | | — | | | | — | | | | — | |

| Total distributions | | | (0.31 | ) | | | (0.32 | ) | | | (0.34 | ) | | | (0.34 | ) | | | (0.39 | ) |

| End of year | | $ | 11.21 | | | $ | 11.21 | | | $ | 10.72 | | | $ | 11.31 | | | $ | 10.83 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total return | | | 2.81 | % | | | 7.69 | % | | | -2.28 | % | | | 7.65 | % | | | 2.45 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of year (in 000's) | | $ | 166,036 | | | $ | 166,315 | | | $ | 161,209 | | | $ | 172,661 | | | $ | 158,266 | |

| Ratio of expenses to average net assets | | | 1.05 | % | | | 1.03 | %(a) | | | 1.01 | %(a) | | | 1.04 | %(a) | | | 1.03 | %(a) |

| Ratio of net investment income to average net assets | | | 2.79 | % | | | 3.02 | % | | | 3.07 | % | | | 3.06 | % | | | 3.74 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Portfolio turnover | | | 5.87 | % | | | 13.46 | % | | | 9.43 | % | | | 22.52 | % | | | 13.68 | % |

| (a) | Ratios of expenses to average net assets after the reduction of custodian fees and other expenses under a custodian arrangement were 1.03%, 1.01%, 1.03%, and 1.02%, for the years ended September 30, 2014, 2013, 2012, and 2011, respectively. See Note 5. |

See accompanying notes to financial statements.

HAWAII MUNICIPAL FUND

NOTES TO FINANCIAL STATEMENTS

September 30, 2015

| (1) | ORGANIZATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES |

Hawaii Municipal Fund ("Fund") is a series of Lee Financial Mutual Fund, Inc. which is registered under the Investment Company Act of 1940, as a non-diversified open-end management investment company. Lee Financial Mutual Fund, Inc. currently has two investment portfolios, including the Fund which is currently authorized to offer one Class of Shares: Investor Shares.

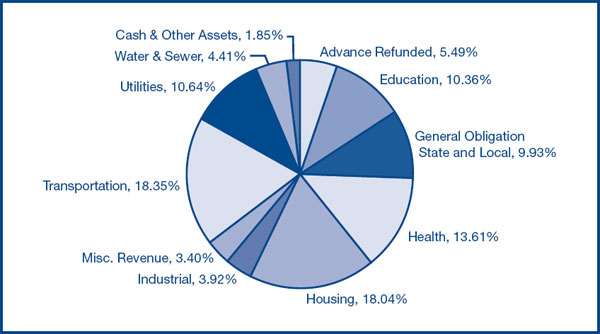

The investment objective of the Fund is to provide a high level of current income exempt from federal and Hawaii state income taxes, consistent with preservation of capital and prudent investment management. The Fund seeks to achieve its objective by investing primarily in a portfolio of investment grade municipal securities issued by or on behalf of the State of Hawaii, or any of its political subdivisions, which pay interest that is exempt from regular federal and Hawaii income taxes.

The Fund is subject to the risk of price fluctuation of the municipal securities held in its portfolio which is generally a function of the underlying credit rating of an issuer, the maturity length of the securities, the securities' yield, and general economic and interest rate conditions.

Since the Fund invests primarily in obligations of issuers located in Hawaii, the Fund is subject to additional concentration of risk. Due to the level of investment in Hawaii municipal obligations, the marketability and market value of these obligations may be affected by certain Hawaiian constitutional provisions, legislative measures, executive orders, administrative regulations, voter initiatives, and other political and economic developments. If any such problems arise, they could adversely affect the ability of various Hawaiian issuers to meet their financial obligation. Therefore, an investment in the Fund may be riskier than investment in other types of municipal bond funds.

Portfolio securities, that are fixed income securities, are valued by an independent pricing service using methodologies that it believes are appropriate including actual market transactions, mean between bid and ask prices, broker-dealer supplied valuations, matrix pricing, or other electronic data processing techniques designed to identify market values for such securities, in accordance with procedures established in good faith by the Board of Directors. Securities with remaining maturities of 60 days or less are valued on the amortized cost basis as reflecting fair value. Securities for which market quotations are not readily available or for which available prices are suspect will be valued at "fair value" using methods determined in good faith by or at the direction of the Board of Directors. For these purposes, "fair value" means the price that the Investment Manager reasonably expects the Fund could receive from an arm's-length buyer upon the current sale of the securities within seven (7) days, after considering all appropriate factors and indications of value available to them. Such value will be cost if the Investment Manager determines such valuation is appropriate after considering a multitude of factors in accordance with established procedures.

The Fund utilizes various methods to measure the fair value of most of its investments on a recurring basis. U.S. generally accepted accounting principles ("GAAP") establishes a hierarchy that prioritizes inputs to valuation methods. The three levels of inputs are:

Level 1 – Unadjusted quoted prices in active markets for identical assets or liabilities that the Fund has the ability to access.

HAWAII MUNICIPAL FUND

NOTES TO FINANCIAL STATEMENTS – (Continued)

September 30, 2015

Level 2 – Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data.

Level 3 – Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Fund's own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available.

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety, is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

Changes in valuation techniques may result in transfers in/out changing an investment's assigned level within the hierarchy.

The following is a description of the valuation techniques applied to the Fund's major categories of financial instruments measured at fair value on a recurring basis:

Municipal bonds are categorized in Level 2 of the fair value hierarchy.

The following is a summary of the inputs used in valuing the Fund's investments, as of September 30, 2015. The inputs or methodology used for valuing securities are not necessarily an indication of the risks associated with investing in those securities.

Valuation Inputs at Reporting Date:

| Description | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Municipal Bonds | | | $-0- | | | | $162,957,344 | | | | $-0- | | | | $162,957,344 | |

There were no transfers in to and out of Levels 1 and 2 during the current period presented. There were no purchases, sales issuances, and settlements on a gross basis relating to Level 3 measurements during the current period presented.

HAWAII MUNICIPAL FUND

NOTES TO FINANCIAL STATEMENTS – (Continued)

September 30, 2015

It is the Fund's policy to comply with the requirements of the Internal Revenue Code applicable to regulated investment companies and to distribute its taxable income, if any, to its shareholders. Therefore, no federal income tax provision is required.

The Fund has reviewed all open tax years for all major jurisdictions, which is the Federal jurisdiction, and concluded that there are no significant uncertain tax positions that would require recognition in the financial statements. As of September 30, 2015, open Federal tax years include the tax years ended September 30, 2012 – September 30, 2015. The Fund has no examination in progress and is also not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months.

In order to avoid imposition of the excise tax applicable to regulated investment companies, the Fund intends to declare each year as dividends in each calendar year at least 98% of its net investment income (earned during the calendar year) and 98% of its net realized capital gains (earned during the twelve months ended October 31) plus undistributed amounts, if any, from prior years.

On December 22, 2010, the Regulated Investment Company Modernization Act of 2010 (the "Act") was enacted. The Act modernizes several of the federal income and excise tax provisions related to regulated investment companies such as the Fund, and, with certain exceptions, is effective for taxable years beginning after December 22, 2010. Among the changes made are changes to the capital loss carryforward rules allowing for capital losses to be carried forward indefinitely. Rules in effect as of the report date limit the carryforward period to eight years. Capital loss carryforwards generated in taxable years beginning after effective date of the Act must be fully used before capital loss forwards generated in taxable years prior to effective date of the Act; therefore, under certain circumstances, capital loss carryforwards available as of the report date, if any, may expire unused. At September 30, 2015, the Hawaii Municipal Fund had a capital loss carryforward of $1,156,096 of which $547,947 expires in 2017, $120,704 expires in 2018, and $290,254 short-term capital loss and $197,191 long-term capital loss which do not expire.

The Fund did not incur any net capital losses after October 31, 2014. Net capital losses incurred after October 31, and within the taxable year are deemed to arise on the first business day of the Fund's next taxable year.

| (C) | SECURITY TRANSACTIONS, INVESTMENT INCOME AND DISTRIBUTIONS TO SHAREHOLDERS |

| | Security transactions are recorded on the trade date. Interest income is recorded on the accrual basis. Bond discounts and premiums are amortized using the interest method. Distributions to shareholders are declared daily and reinvested or paid in cash monthly. |

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

HAWAII MUNICIPAL FUND

NOTES TO FINANCIAL STATEMENTS – (Continued)

September 30, 2015

The net asset value per share for the Fund is determined by calculating the total value of the Fund's assets, deducting its total liabilities and dividing the result by the number of shares outstanding.

| (2) | INVESTMENT MANAGEMENT FEE AND OTHER TRANSACTIONS WITH AFFILIATES |

Lee Financial Group Hawaii, Inc. ("LFG") provides the Fund with management and administrative services pursuant to a management agreement and administrative services agreement, respectively. In accordance with the terms of the management agreement and of the administrative services agreement, LFG receives compensation at the annual rate of 0.50% and up to 0.05% of the Fund's average daily net assets, respectively. For the period ended September 30, 2015, the Fund was allocated, and paid LFG, $62,333 of the Chief Compliance Officer fee.

The Fund's distributor, Lee Financial Securities, Inc. ("LFS"), a wholly-owned subsidiary of LFG, received $244,235 for costs incurred in connection with the sale of the Fund's shares (See Note 3).

Lee Financial Recordkeeping, Inc. ("LFR"), a wholly-owned subsidiary of LFG, serves as the transfer agent for the Fund. In accordance with the terms of the transfer agent agreement, LFR receives compensation at the annual rate of 0.06% of the Fund's average daily net assets. LFR has delegated certain of its duties and responsibilities to Ultimus Fund Solutions, LLC as sub-transfer agent. LFR also provides the Fund with certain clerical, bookkeeping and shareholder services pursuant to a service agreement approved by the Fund's directors. As compensation for these services LFR receives a fee, computed daily and payable monthly, at an annualized rate of 0.10% of the Fund's average daily net assets.

Certain officers and directors of the Fund are also officers of LFG, LFS and LFR.

The Fund's Board of Directors, including a majority of the Directors who are not "interested persons" of the Fund, as defined in the Investment Company Act of 1940, adopted a distribution plan pursuant to Rule 12b-1 of the Act. Rule 12b-1 regulates the manner in which a regulated investment company may assume costs of distributing and promoting the sales of its shares.

The Plan provides that the Hawaii Municipal Fund Investor Class may incur certain costs, which may not exceed 0.25% per annum of the Fund's average daily net assets, for payment to the distributor for items such as advertising expenses, selling expenses, commissions or travel, reasonably intended to result in sales of shares of the Fund.

| (4) | PURCHASES AND SALES OF SECURITIES |

Purchases and sales of securities aggregated $11,694,621 and $9,593,846, respectively, for the Fund during the period October 1, 2014 through September 30, 2015.

Under an agreement with the Fund's custodian bank, a portion of the custodian fees were paid by credits for cash balances. Any remaining credits were used to offset expenses of other vendors and service providers. If not for the offset agreement, the assets could have been employed to produce income. Effective August 1, 2014, this arrangement has ceased.

HAWAII MUNICIPAL FUND

NOTES TO FINANCIAL STATEMENTS – (Continued)

September 30, 2015

| (6) | TAX COMPONENTS OF CAPITAL AND DISTRIBUTIONS TO SHAREHOLDERS |

The tax character of distributions paid during the years ended September 30, 2015 and 2014 were as follows:

| | | Exempt-

Interest

Dividends | | | Ordinary

Income | | | Long-Term

Capital

Gains | | | Total

Distributions | |

| Hawaii Municipal Fund | | | | | | | | |

| 2015 | | $ | 4,667,320 | | | $ | — | | | $ | — | | | $ | 4,667,320 | |

| 2014 | | $ | 4,783,046 | | | $ | — | | | $ | — | | | $ | 4,783,046 | |

The tax character of distributable earnings at September 30, 2015 were as follows:

| | | Undistributed

Ordinary Exempt-

Interest Income | | | Undistributed

Capital Gains | | | Capital Loss

Carryforwards | | | Post

October

Losses | | | Unrealized

Gain/

(Loss)* | | | Total

Distributable

Earnings | |

| | | | | | | | | | | | | | |

| Hawaii Municipal Fund | | $ | — | | | $ | — | | | $ | (1,156,096 | ) | | $ | — | | | $ | 7,803,418 | | | $ | 6,647,322 | |

| * | The difference between book basis and tax basis unrealized appreciation is attributable to market discount on debt securities. |

Accounting principles generally accepted in the United States of America require that certain components of net assets be reclassified between financial and tax reporting. These reclassifications have no effect on net assets or net asset value per share. The primary difference relates to the different treatment on amortization of discount for financial reporting purposes versus tax reporting purposes. For the year-ended September 30, 2015, the Hawaii Municipal Fund's undistributed investment income was decreased by $3,134, and accumulated net realized loss on investments was decreased by $3,134.

| (7) | NEW ACCOUNTING PRONOUNCEMENT |

In May 2015, the Financial Accounting Standards Board ("FASB") issued Accounting Standards Update ("ASU") No. 2015-07 Disclosure for Investments in Certain Entities that Calculate Net Asset Value per Share (or Its Equivalent). The amendments in ASU No. 2015-07 remove the requirement to categorize within the fair value hierarchy investments measured using the net asset value per share ("NAV") practical expedient. The ASU also removes certain disclosure requirements for investments that qualify, but do not utilize, the NAV practical expedient. The amendments in the ASU are effective for fiscal years beginning after December 15, 2015, and interim periods within those fiscal years. The Fund's management is currently evaluating the impact these changes will have on the Fund's financial statements and related disclosures.

| (8) | SUBSEQUENT EVENTS DISCLOSURE |

In preparing the Fund's financial statements as of September 30, 2015, the Fund's management considered the impact of subsequent events for potential recognition or disclosure in these financial statements.

LEE FINANCIAL MUTUAL FUND, INC.

BOARD OF DIRECTORS AND OFFICERS (Unaudited)

Overall responsibility for management of Lee Financial Mutual Fund, Inc., (the "Company") rests with the Board of Directors. Each Director serves during the lifetime of the Company and until its termination, or until the Director's death, resignation, retirement or removal. The Directors, in turn, elect the officers of the Company to actively supervise its day-to-day operations. The officers have been elected for an annual term. The following table provides information regarding each Director and officer of the Company. Unless otherwise indicated below, the address of each Director and Officer is c/o Lee Financial Group Hawaii, Inc., 3113 Olu Street, Honolulu, HI 96816.

| Name, Age and Address | Position & Office

With the Company | Term of Office and Length of Time Served | Principal Occupation During the Past Five Years | Number of Portfolios

in Company Complex Overseen by Director* | Other Directorships

Held by Director |

| DISINTERESTED DIRECTORS | | | |

Clayton W.H. Chow (63) | Director | Unlimited Term 27 years | Retired; March 2012-August 2014, Sales Manager, Estes Express; April 2010 –January 2012, Sales Consultant, Henry Schein Dental; prior to April 2010, Office Technology Specialist, Xerox Corporation, and Account Executive, Roadway Express | 2 | None |

Lynden M. Keala (61) | Director | Unlimited Term 26 years | February 2014–Present, Account Executive, American Solutions for Business; September 2005-January 2014, Account Executive, Workflow One (formerly The Relizon Company) | 2 | None |

Stuart S. Marlowe (75) | Director | Unlimited Term 27 years | Owner, Surfside Sales and Marketing (Sales and marketing of music for the State of Hawaii) | 2 | None |

Karen T. Nakamura (71) | Director | Unlimited Term 18 years | January 2015-Present, Karen T. Nakamura Associates, Partner; December 2000-Present, Vice President, Wallpaper Hawaii, Ltd.; December 1998-December 2014, CEO, Building Industry Association of Hawaii | 2 | None |

Kim F. Scoggins (68) | Director | Unlimited Term 18 years | Vice President & Division Manager, Colliers International HI, LLC | 2 | None |

| INTERESTED DIRECTORS | | | |

| Terrence K.H. Lee (58) | Director, Chairman, President and CEO | Unlimited Term 27 years | Director, President and CEO, Lee Financial Group Hawaii, Inc., Lee Financial Securities, Inc., and Lee Financial Recordkeeping, Inc. | 2 | None |

| OFFICERS | | |

Nora B. Foley (55) | Treasurer (Since October 2004), Chief Compliance Officer (Since October 2004), Assistant Secretary (Since July 2002) | | Vice President, CCO, CFO, and Treasurer Lee Financial Group Hawaii, Inc., Lee Financial Securities, Inc., and Lee Financial Recordkeeping, Inc. | | |

Charlotte A. Meyer (62) | Assistant Treasurer (Since October 2004) | | Director, Assistant Treasurer and Vice President, Lee Financial Group Hawaii, Inc., Lee Financial Securities, Inc., and Lee Financial Recordkeeping, Inc. | | |

Lugene Endo Lee (59) | Secretary (Since July 1991) | | Director, Secretary and Vice President, Lee Financial Group Hawaii, Inc., Lee Financial Securities, Inc., and Lee Financial Recordkeeping, Inc. | | |

Terrence K.H. Lee and Lugene Endo Lee are husband and wife.

Terrence K.H. Lee is an interested person of the Company by virtue of his relationship as a director, officer and shareholder of the Fund's investment manager, as a director and officer of the Fund's principal underwriter and transfer agent and because he has had a material and professional relationship with the Company for the last two completed calendar years.

| * | Each Company director oversees two portfolios of the Company that are currently offered for sale. |

Additional information about members of the Board of Directors and executive officers is available in the Fund's Statement of Additional Information ("SAI"). To obtain a free copy of the SAI, please call (808) 988-8088.

HAWAII MUNICIPAL FUND INVESTOR CLASS (Unaudited)

Shareholder Information

Household Delivery of Shareholder Documents: Only one Prospectus, Annual and Semi-Annual Report will be sent to shareholders with the same last name and address on their Fund account, unless you request multiple copies. If you would like to receive separate copies, please call us at (808) 988-8088. We will begin sending you additional copies within 30 days. If your shares are held through a service provider, please contact them directly.

Business Continuity Plan Summary Disclosure Statement: Lee Financial Mutual Fund, Inc., Lee Financial Group Hawaii, Inc., Lee Financial Securities, Inc. and Lee Financial Recordkeeping, Inc. have developed Business Continuity Plans on how we will respond to events that significantly disrupt our business. Since the timing and impact of disasters and disruptions is unpredictable, we will have to be flexible in responding to actual events as they occur. Contacting Us - If after a significant business disruption you cannot contact us as you usually do at (808) 988-8088, you should go to our website at www.LeeHawaii.com. Please visit our website at www.LeeHawaii.com for the Business Continuity Plan Disclosure Statement.

Proxy Voting Policies and Procedures

The Fund has established Proxy Voting Policies and Procedures ("Policies") that the Fund uses to determine how to vote proxies relating to portfolio securities. Shareholders may request copies of the Policies free of charge by calling (808) 988-8088 or by sending a written request to Lee Financial Group Hawaii, Inc., 3113 Olu Street, Honolulu, HI 96816. Copies of the Fund's proxy voting records are posted on the Securities and Exchange Commission's website at www.sec.gov and the Fund's website at www.LeeHawaii.com and reflect the 12-month period beginning July 1, 2014 and ending June 30, 2015.

Quarterly Statement of Investments

The Fund files a complete statement of investments with the Securities and Exchange Commission for the first and third quarters for each fiscal year on Form N-Q. Shareholders may view the filed Form N-Q by visiting the Commission's website at www.sec.gov or the Fund's website at www.LeeHawaii.com. The filed form may also be viewed and copied at the Commission's Public Reference Room in Washington, DC. Information regarding the operations of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

Disclosure Regarding Approval of the Investment Management Agreement

Hawaii Municipal Fund (Unaudited)

At a meeting held on July 29, 2015, the Board of Directors (the "Board") of Lee Financial Mutual Fund, Inc. (the "Fund") considered and approved the continuance of the Investment Management Agreement between the Fund and Lee Financial Group Hawaii, Inc. (the "LFG") with respect to the Hawaii Municipal Fund (the "Portfolio"), a series of Lee Financial Mutual Fund, Inc., for an additional one-year period ending September 30, 2016.

Prior to the meeting, the Board had received detailed information from LFG. This information together with other information provided by LFG and the information provided to the Board throughout the course of year formed the primary (but not exclusive) basis for the Board's determinations as summarized below. The information, material factors and conclusions that formed the basis for the Board's subsequent approval of the Investment Management Agreement are described below.

1. Information Received

Materials reviewed. During the course of the year, the Board received a wide variety of materials relating to the services provided by LFG, including reports on the Portfolio's investment results; portfolio composition; portfolio trading practices; and other information relating to the nature, extent and quality of services provided by LFG to the Fund and Portfolio. In addition, the Board reviewed and considered supplementary information and presentations by LFG that included materials regarding the Portfolio's investment results; management fee; performance; financial and profitability information regarding LFG, descriptions of various functions such as compliance monitoring and portfolio trading, and information about the experience and qualifications of the personnel providing investment management and administrative services to the Portfolio. Further, an independent third party prepared an analytical report which provided comparative management fee, expense and performance information for the Portfolio and its peer group.

Review Process. The Board received assistance regarding legal and industry standards from independent counsel to the independent Directors of the Board. The Board discussed the renewal of the agreement with LFG representatives. In deciding to recommend the renewal of the agreement, the Board did not identify any single issue or particular information that, in isolation, was the controlling factor. This summary describes the most important, but not all, of the factors considered by the Board.

2. Nature, Extent and Quality of Services

In the Board's review of LFG, its personnel and its resources, it considered the depth and quality of LFG's investment management process; the experience, capability and integrity of its senior management, portfolio manager and other personnel; the turnover rates of its personnel and the changes to the portfolio management over the last year; and the overall financial strength and stability of its organization. Based on this review, the Board determined that LFG has the capabilities, resources and personnel necessary to manage the Fund and Portfolio and the Board is satisfied with the quality of services provided by LFG in advising the Portfolio.

Other Services. The Board considered, in connection with the performance of LFG's investment management services to the Fund and the Portfolio, the following: LFG's policies, procedures and systems for compliance with applicable laws and regulations and its commitment to these programs; its efforts to keep the Board informed; and its attention to matters that may involve conflicts of interest with the Fund. As a point of comparison, the Board also considered the nature, extent, quality and cost of certain non-investment related administrative services provided by LFG to the Fund and Portfolio under the Administrative Agreement.

3. Investment Performance

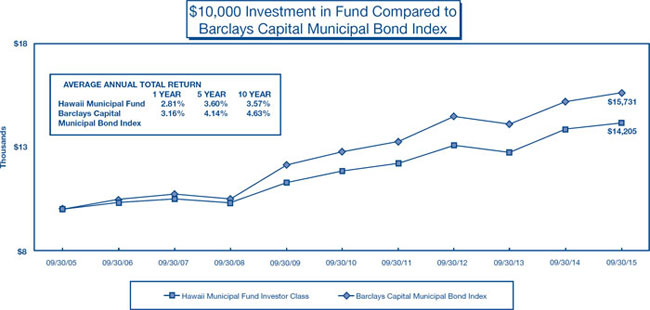

The Board considered the Portfolio's unique pursuit of its investment objective and the investment results of the Portfolio in light of its objective. The Board reviewed the short-term and long-term performance of the Portfolio on an absolute basis and in comparison to its benchmark index and other comparable Hawaii and other single-state mutual funds. The Board also reviewed the rankings for the Portfolio by an independent rating and ranking organization. The Board took into consideration LFG's explanation that because the Portfolio has a shorter effective maturity than the Barclays Capital Municipal Bond Index, the Portfolio performance tends to lag the Index. LFG also reported that for the three year period ended June 30, 2015, an independent rating and ranking organization had rated the Portfolio as having low risk and an above average return as compared to other single state long municipal bond funds. The Board concluded that the performance of the Portfolio is generally competitive (in some cases performance for certain periods was higher than the comparative performance information, and in other cases it was lower) as compared to its benchmark index and other comparable mutual funds.

4. Management Fees and Total Operating Expenses

The Board reviewed and considered the management fee payable by the Portfolio to LFG in light of the nature, extent and quality of the investment management and administrative services provided by LFG. Additionally, the Board received and considered information comparing the Portfolio's management fee and overall expenses with those of other comparable funds. The comparative information included investment style, share class characteristics, asset size, expenses broken down by category, and showed that the Portfolio's management fee and operating expenses are competitive with the fees and expenses of such other funds as the current Portfolio management fee, however, falls directly between the peer group and category medians. The Board also considered the advisory fee information for other LFG clients that are similarly managed to the Portfolio. Based on this information the Board concluded that: the management fees and total operating expenses for the Portfolio are reasonable in light of the nature, extent and quality of the investment management and administrative services provided by LFG.

5. Adviser Costs, Level of Profits, Economies of Scale and Ancillary Benefits

The Board reviewed information regarding LFG's costs of providing services to the Fund and the Portfolio, as well as the resulting level of profits to LFG. The Board further concluded that the profit to LFG for investment management services seems reasonable based on the services provided. The Board noted that since the management fee does not contain breakpoints, there would be no economies of scale from reduction of the management fee as the Portfolio's assets grow. In assessing the benefits to LFG from its relationships with the Portfolio, the Board noted that there are no soft dollar arrangements. The Board also took into account potential benefits to LFG as the Fund's administrator and the engagement of affiliates for distribution, shareholder servicing and transfer agency services and concluded that the management fee for the Portfolio was reasonable in relation to the benefits derived by LFG and its affiliates from these relationships.

6. Conclusions

No single factor was determinative of the Board's decision to re-approve the Fund Portfolio Investment Management Agreement, but rather the Board based their determination on the total mix of information available to them. Based on their review, including their consideration of each of the factors referred to above, the Board, including all of the Fund's Independent Directors of the Board present, concluded that the Portfolio's Investment Management Agreement, and the compensation is determined to be fair and reasonable in light of such services provided and expenses incurred under the Agreement.