Table of Contents

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ | Preliminary Proxy Statement | ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

x | Definitive Proxy Statement | |||||

¨ | Definitive Additional Materials | |||||

¨ | Soliciting Material Pursuant to §240.14a-11(c) or §240.14a-12 |

Callaway Golf Company

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| 1. | Title of each class of securities to which transaction applies: |

| 2. | Aggregate number of securities to which transaction applies: |

| 3. | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4. | Proposed maximum aggregate value of transaction: |

| 5. | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 6. | Amount Previously Paid: |

| 7. | Form, Schedule or Registration Statement No.: |

| 8. | Filing Party: |

| 9. | Date Filed: |

Table of Contents

April 21, 2006

Dear Shareholder:

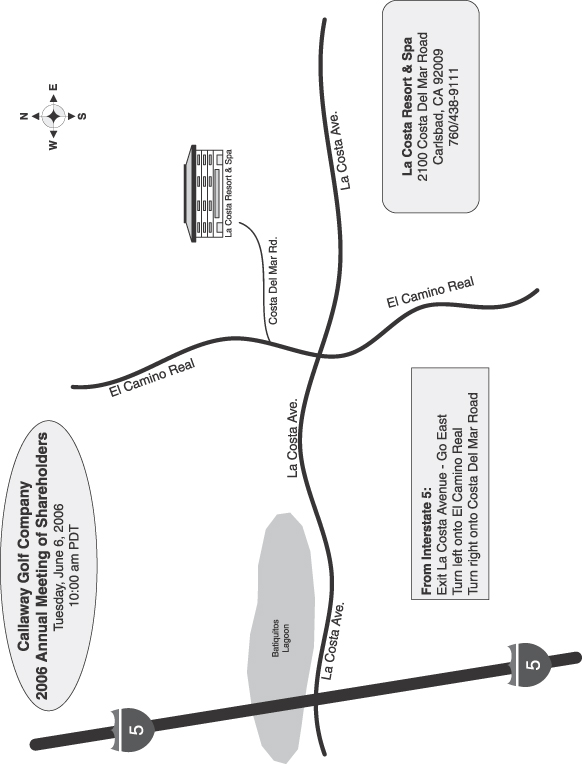

You are cordially invited to attend the Annual Meeting of Shareholders of Callaway Golf Company, which will be held on Tuesday, June 6, 2006, at the La Costa Resort and Spa, 2100 Costa Del Mar Road, Carlsbad, California 92009, commencing at 10:00 a.m. (PDT). A map is provided on the back page of these materials for your reference. Your Board of Directors and management look forward to greeting personally those shareholders who are able to attend.

At the meeting, your Board of Directors will ask shareholders to elect seven directors, approve the Amended and Restated 2001 Non-Employee Directors Stock Incentive Plan, and ratify the appointment of the Company’s independent registered public accounting firm. These matters are described more fully in the accompanying Proxy Statement, which you are urged to read thoroughly. Your Board of Directors recommends a vote “FOR” each of the nominees and “FOR” approval of each of the proposals.

It is important that your shares are represented and voted at the meeting whether or not you plan to attend. Accordingly, you are requested to return a proxy as promptly as possible either by signing, dating and returning the enclosed proxy card in the enclosed postage-prepaid envelope, or by telephone, or through the Internet in accordance with the enclosed instructions.

Sincerely, |

|

George Fellows |

| President and Chief Executive Officer |

Table of Contents

CALLAWAY GOLF COMPANY

2180 Rutherford Road

Carlsbad, California 92008

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

Meeting Date: June 6, 2006

To Our Shareholders:

The 2006 Annual Meeting of Shareholders (the “Annual Meeting”) of Callaway Golf Company, a Delaware corporation, (the “Company”) is scheduled to be held at the La Costa Resort and Spa, 2100 Costa Del Mar Road, Carlsbad, California 92009, commencing at 10:00 a.m. (PDT), on Tuesday, June 6, 2006, to consider and vote upon the following matters described in this notice and the accompanying Proxy Statement:

| 1. | To elect seven directors to the Company’s Board of Directors to serve until the 2007 annual meeting of shareholders and until their successors are elected and qualified; |

| 2. | To approve the Amended and Restated 2001 Non-Employee Directors Stock Incentive Plan; |

| 3. | To ratify the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2006; and |

| 4. | To transact such other business as may properly come before the meeting or any adjournments thereof. |

The Board of Directors has nominated the following seven individuals to stand for election to the Board of Directors at the Annual Meeting: George Fellows, Samuel H. Armacost, Ronald S. Beard, John C. Cushman, III, Yotaro Kobayashi, Richard L. Rosenfield and Anthony S. Thornley. All seven are currently members of the Company’s Board of Directors. For more information concerning these individuals, please see the accompanying Proxy Statement.

The Board of Directors has fixed the close of business on April 7, 2006 as the record date for determination of shareholders entitled to receive notice of and to vote at the Annual Meeting or any adjournments thereof, and only record holders of common stock at the close of business on that day will be entitled to vote. At the record date, 75,680,803 shares of common stock were issued and outstanding. In order to constitute a quorum for the conduct of business at the Annual Meeting, it is necessary that holders of a majority of all outstanding shares of common stock of the Company be present in person or represented by proxy.

TO ASSURE REPRESENTATION AT THE ANNUAL MEETING, SHAREHOLDERS ARE URGED TO RETURN A PROXY AS PROMPTLY AS POSSIBLE EITHER BY SIGNING, DATING AND RETURNING THE ENCLOSED PROXY CARD IN THE ENCLOSED POSTAGE-PREPAID ENVELOPE, OR BY TELEPHONE, OR THROUGH THE INTERNET IN ACCORDANCE WITH THE ENCLOSED INSTRUCTIONS. ANY SHAREHOLDER ATTENDING THE ANNUAL MEETING MAY VOTE IN PERSON EVEN IF HE OR SHE PREVIOUSLY RETURNED A PROXY.

If you plan to attend the Annual Meeting in person, we would appreciate your response by indicating so when returning the proxy.

By Order of the Board of Directors, |

|

Steven C. McCracken |

| Secretary |

Carlsbad, California

April 21, 2006

Table of Contents

TABLE OF CONTENTS

| 1 | ||

| 4 | ||

| 4 | ||

| 11 | ||

Information Concerning the Amended and Restated 2001 Non-Employee Directors | 14 | |

| 14 | ||

Information Concerning Independent Registered Public Accounting Firm | 20 | |

Proposal No. 3 — Ratification of Independent Registered Public Accounting Firm | 20 | |

| 22 | ||

| 24 | ||

Report of the Compensation and Management Succession Committee | 32 | |

| 39 | ||

| 39 | ||

| 40 | ||

| 40 | ||

| 40 | ||

| A-1 | ||

Exhibit B — Non-Employee Directors Stock Incentive Plan | B-1 |

Table of Contents

CALLAWAY GOLF COMPANY

2180 Rutherford Road

Carlsbad, California 92008

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS

Meeting Date: June 6, 2006

GENERAL INFORMATION

Purpose

This Proxy Statement and accompanying proxy card will first be mailed to shareholders on or about April 28, 2006 in connection with the solicitation of proxies by the Board of Directors of Callaway Golf Company, a Delaware corporation (the “Company” or “Callaway Golf”). The proxies are for use at the 2006 Annual Meeting of Shareholders of the Company, which will be held on Tuesday, June 6, 2006, at the La Costa Resort and Spa, 2100 Costa Del Mar Road, Carlsbad, California 92009, commencing at 10:00 a.m. (PDT), and at any meetings held upon adjournment thereof (the “Annual Meeting”). The record date for the Annual Meeting is the close of business on April 7, 2006 (the “Record Date”). Only holders of record of the Company’s common stock, $.01 par value, (the “Common Stock”) on the Record Date are entitled to notice of the Annual Meeting and to vote at the Annual Meeting.

Quorum and Voting

Whether or not you plan to attend the Annual Meeting in person, please return a proxy indicating how you wish your shares to be voted as promptly as possible. You may return a proxy either by signing, dating and returning the enclosed proxy card in the postage-prepaid envelope provided, or by telephone or through the Internet. Please follow the enclosed instructions. Any shareholder who returns a proxy has the power to revoke it at any time prior to its effective use either by filing with the Secretary of the Company a written instrument revoking it, or by returning (by mail, telephone or Internet) another later-dated proxy, or by attending the Annual Meeting and voting in person. If you sign and return your proxy but do not indicate how you want to vote your shares for each proposal, then for any proposal for which you do not so indicate, your shares will be voted at the Annual Meeting in accordance with the recommendation of the Board of Directors. The Board of Directors recommends a vote “FOR” each of the nominees for election as director as set forth in this Proxy Statement, “FOR” approval of the Amended and Restated 2001 Non-Employee Directors Stock Incentive Plan, and “FOR” ratification of the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2006. By returning the proxy (either by mail, telephone or Internet), unless you notify the Secretary of the Company in writing to the contrary, you are also authorizing the proxies to vote with regard to any other matter which may properly come before the Annual Meeting or any adjournment thereof. The Company does not currently know of any such other matter. If there were any such additional matters, the proxies would vote your shares in accordance with the recommendation of the Board of Directors.

At the Record Date, there were 75,680,803 shares of the Company’s Common Stock issued and outstanding. No other voting securities of the Company were outstanding at the Record Date. The presence, either in person or by proxy, of persons entitled to vote a majority of the Company’s outstanding Common Stock is necessary to constitute a quorum for the transaction of business at the Annual Meeting. Under the rules of the New York Stock Exchange, brokers who hold shares in street name for customers do not have the authority to vote on certain items when they have not received instructions from beneficial owners (“broker non-votes”). Abstentions

1

Table of Contents

may be specified for all proposals except the election of directors. Abstentions and broker non-votes are counted for purposes of determining a quorum. Abstentions are counted in the tabulation of votes cast and have the same effect as voting against a proposal. Broker non-votes are not considered as having voted for purposes of determining the outcome of a vote. The election of directors (Proposal #1) and ratification of the appointment of independent registered public accounting firm (Proposal #3) being voted upon at the Annual Meeting are considered routine and brokers may generally vote on such proposals in their discretion if they do not receive instructions from the beneficial owners. The approval of the Amended and Restated 2001 Non-Employee Directors Stock Incentive Plan (Proposal #2) is considered to be non-routine and brokers may not vote on such proposal if they do not receive instructions from the beneficial owners.

Holders of Common Stock have one vote for each share on any matter that may be presented for consideration and action by the shareholders at the Annual Meeting, except that shareholders have cumulative voting rights with respect to the election of directors. Cumulative voting rights entitle each shareholder to cast as many votes as are equal to the number of directors to be elected multiplied by the number of shares owned by such shareholder, which votes may be cast for one candidate or distributed among two or more candidates. A shareholder may exercise cumulative voting rights by indicating on the proxy card the manner in which such votes should be allocated. The seven nominees for director receiving the highest number of votes at the Annual Meeting will be elected. A return of a proxy giving authority to vote for the nominees named in this Proxy Statement will also give discretion to the proxies to vote shares cumulatively for one or more nominees so as to elect the maximum number of directors recommended by the Board of Directors.

Solicitation of Proxies

The cost of preparing, assembling, printing and mailing this Proxy Statement and the accompanying proxy card, and the cost of soliciting proxies relating to the Annual Meeting, will be borne by the Company. The Company may request banks and brokers to solicit their customers who beneficially own Common Stock listed of record in the name of such bank or broker or other third party, and will reimburse such banks, brokers and third parties for their reasonable out-of-pocket expenses for such solicitations. The solicitation of proxies by mail may be supplemented by telephone, telegram, facsimile, Internet and personal solicitation by directors, officers and other employees of the Company, but no additional compensation will be paid to such individuals. The Company has retained the firm of Mellon Investor Services LLC to assist in the solicitation of proxies for a base fee of approximately $8,000, plus out-of-pocket expenses.

Householding

With regard to the delivery of annual reports and proxy statements, under certain circumstances the Securities and Exchange Commission permits a single set of such documents to be sent to any household at which two or more shareholders reside if they appear to be members of the same family. Each shareholder, however, still receives a separate proxy card. This procedure, known as “householding,” reduces the amount of duplicate information received at a household and reduces mailing and printing costs as well. A number of banks, brokers and other firms have instituted householding and have previously sent a notice to that effect to certain of the Company’s shareholders whose shares are registered in the name of the bank, broker or other firm. As a result, unless the shareholders receiving such notice gave contrary instructions, only one annual report and one annual proxy statement will be mailed to an address at which two or more such shareholders reside. If any shareholder residing at such an address wishes to receive a separate annual report or annual proxy statement in the future, such shareholder should telephone the householding election system (toll-free) at 1-800-542-1061. In addition, (i) if any shareholder who previously consented to householding desires to receive a separate copy of the annual report or annual proxy statement for each shareholder at his or her same address, or (ii) if any shareholder shares an address with another shareholder and both shareholders of such address desire to receive only a single copy of the annual report or annual proxy statement, then such shareholder should contact his or her bank, broker or other firm in whose name the shares are registered or contact the Company as follows: Callaway Golf Company, ATTN: Investor Relations, 2180 Rutherford Road, Carlsbad, CA 92008, telephone (760) 931-1771.

2

Table of Contents

Other Matters

The main purpose of the Annual Meeting of Shareholders is to conduct the business described in this Proxy Statement. On some occasions in the past, the Company has chosen to expand the scope of the meeting to include presentations on portions of the Company’s business and to conduct a question and answer session with the Company’s leadership. At the upcoming Annual Meeting, it is the Company’s intention to have a brief presentation by the Chief Executive Officer after the completion of all business, followed by a short question and answer period. Limited beverage and light food service will also be provided. Due to legal and practical constraints, including regulations regarding the selective disclosure of material information, and consistent with the fact that the main purpose of the Annual Meeting is to conduct the necessary business of the Company, a significant, substantive presentation on the Company’s current or expected performance is not planned.

3

Table of Contents

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

Introduction

Corporate governance is the system by which business corporations ensure that they are managed ethically and in the best interests of the Company’s shareholders. The Company is committed to maintaining high standards of corporate governance. A copy of the Company’s Corporate Governance Guidelines is available on the Company’s website atwww.callawaygolf.com under Investor Relations — Corporate Governance.

One of the most important aspects of corporate governance is the election of a Board of Directors to oversee the operation of the business and affairs of the Company. The Company’s Bylaws provide that the Company’s directors shall be elected at each annual meeting of shareholders. As a result, as discussed below, the first proposal the shareholders will be asked to vote upon at the Annual Meeting is the election of seven directors to serve until the 2007 annual meeting of shareholders and until their successors are elected and qualified.

In today’s business environment, the selection of a qualified independent auditor has become a key aspect of corporate governance. This year the Board of Directors has asked that shareholders ratify the Board’s selection of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2006.

Proposal No. 1 — Election of Directors

Independence. The Company’s Bylaws and Corporate Governance Guidelines provide that a substantial majority of the Company’s directors must be independent. A director is independent only if the director is not an employee of the Company and the Board has determined that the director has no direct or indirect material relationship to the Company. To be independent, a director must also satisfy any other independence requirements under applicable law, regulation or listing standard of the New York Stock Exchange. In evaluating a particular relationship, the Board considers the materiality of the relationship to the Company, to the director and, if applicable, to an organization with which the director is affiliated. Compliance with these independence standards is reviewed at least annually. The Board currently consists of six independent directors and two non-independent directors — George Fellows, the Company’s President and Chief Executive Officer, and William C. Baker, the Company’s former Chairman and interim Chief Executive Officer.

The Board determined that Mr. Rosenfield was not an independent director during the time Mr. Baker served as interim Chief Executive Officer (August 2004 to August 2005) due to Mr. Baker’s service on the compensation committee of California Pizza Kitchen, Inc., where Mr. Rosenfield is co-chief executive officer. Upon Mr. Baker’s resignation as interim Chief Executive Officer in August 2005, the Board determined that Mr. Rosenfield regained his status as an independent director. Mr. Baker remains a director of the Company but is not deemed to be an independent director due to his service as interim Chief Executive Officer, and he will not be standing for re-election to the Board at the Annual Meeting.

Nominees for Election. The Board of Directors has nominated seven of the Company’s eight current directors to stand for election at the Annual Meeting to serve until the 2007 annual meeting of shareholders and until their respective successors are elected and qualified. Mr. Baker, the eighth current director, will retire upon expiration of his term this year. Each nominee has consented to being named in this Proxy Statement as a nominee for election as director and has agreed to serve as a director if elected. If any one or more of such nominees should for any reason become unavailable for election, the persons named in the accompanying form of proxy may vote for the election of such substitute nominees as the Board of Directors may propose. The accompanying form of proxy contains a discretionary grant of authority with respect to this matter.

4

Table of Contents

The nominees for election as directors at the Annual Meeting are set forth below:

Name | Positions with the Company | Director Since | ||

George Fellows | President and Chief Executive Officer | 2005 | ||

Ronald S. Beard | Chairman of the Board and Lead Independent Director | 2001 | ||

Samuel H. Armacost | Director | 2003 | ||

John C. Cushman, III | Director | 2003 | ||

Yotaro Kobayashi | Director | 1998 | ||

Richard L. Rosenfield | Director | 1994 | ||

Anthony S. Thornley | Director | 2004 |

Biographical Information of Nominees. Set forth below is certain biographical information about each of the nominees:

George Fellows. Mr. Fellows, 63, is President and Chief Executive Officer of the Company as well as one of its Directors. He has served in such capacities since August 2005. Prior to joining the Company, during the period 2000 through July 2005, he served as President and Chief Executive Officer of GF Consulting, a management consulting firm, and served as Senior Advisor to Investcorp International, Inc. and J.P. Morgan Partners, LLC. Previously, Mr. Fellows was a member of senior management of Revlon, Inc. from 1993 to 1999, including his term as President commencing 1995 and Chief Executive Officer commencing 1997. He is a member of the board of directors of VF Corporation (one of the world’s largest global apparel companies). Mr. Fellows graduated in 1964 with a B.S. degree from City College of New York, received an MBA from Columbia University in 1966, and completed the Advanced Management Program at Harvard in 1981.

Ronald S. Beard. Mr. Beard, 67, has served as a Director of the Company since June 2001, held the position of Lead Independent Director since August 2002 and was appointed Chairman in August 2005. He is Chair of the Nominating and Corporate Governance Committee. Mr. Beard is currently a partner in the Zeughauser Group, consultants to the legal industry. Mr. Beard is a retired former Partner of the law firm of Gibson, Dunn & Crutcher LLP. He joined the firm in 1964, served as Chairman of the firm from April 1991 until December 2001, and was also its Managing Partner from April 1991 until mid-1997. Mr. Beard served as the Company’s general outside counsel from 1998 until he joined the Board of Directors. Mr. Beard also serves as a Director of Document Sciences Corporation and Javo Beverage Company. He received his law degree in 1964 from Yale Law School.

Samuel H. Armacost. Mr. Armacost, 67, has served as a Director of the Company since April 2003 and is Chair of the Compensation and Management Succession Committee. He is Chairman of SRI International (formerly Stanford Research Institute). Mr. Armacost joined SRI International in 1998. He was Managing Director of Weiss, Peck & Greer LLC (an investment management and venture capital firm) from 1990 to 1998. He was Managing Director of Merrill Lynch Capital Markets from 1987 to 1990. Prior to that he was President and Chief Executive Officer of BankAmerica Corporation from 1981 to 1986. He also served as Chief Financial Officer of BankAmerica Corporation from 1979 to 1981. Currently, Mr. Armacost serves as a member of the Board of Directors of ChevronTexaco Corporation, Exponent, Inc., Del Monte Foods Company and Franklin Resources, Inc. Mr. Armacost is a graduate of Denison University and received his MBA from Stanford University in 1964.

John C. Cushman, III. Mr. Cushman, 65, has served as a Director of the Company since April 2003. He has been Chairman of Cushman & Wakefield, Inc. since it merged with Cushman Realty Corporation in 2001, which he co-founded in 1978. Mr. Cushman also serves as Director and Chief Executive Officer of Cushman Winery Corporation, which is the owner of Zaca Mesa Winery, and which he co-founded in 1972. He began his career with Cushman & Wakefield, Inc., a commercial real estate firm, from 1963 to 1978. Currently, Mr. Cushman also serves on the boards of D.A. Cushman Realty Corporation and Inglewood Park Cemetery. Mr. Cushman is a graduate of Colgate University (1963) and he completed the Advanced Management Program at Harvard University.

Yotaro Kobayashi. Mr. Kobayashi, 72, has served as a Director of the Company since June 1998. He is Chief Corporate Advisor of Fuji Xerox Co., Ltd. Mr. Kobayashi joined Fuji Photo Film Co., Ltd. in 1958, was

5

Table of Contents

assigned to Fuji Xerox Co., Ltd. in 1963, named President and Chief Executive Officer in 1978 and Chairman and Chief Executive Officer in 1992. He served as Chairman of the Board from 1999 through March 2006. Mr. Kobayashi is also a Director of Sony Corporation, Nippon Telegraph and Telephone Corporation (NTT) and the American Productivity and Quality Center. He holds positions as Chairman of The Aspen Institute Japan, Pacific Asia Chairman of the Trilateral Commission, and Chairman of the International University of Japan as well as Life-Time Trustee of Keizai Doyukai. He also is on the Advisory Board of the Council on Foreign Relations and is an Advisory Council Member for Stanford University’s Institute of International Studies. In addition, Mr. Kobayashi serves on the Board of Trustees of Keio University. He is a 1956 graduate of Keio University and received his MBA from The Wharton School in 1958.

Richard L. Rosenfield. Mr. Rosenfield, 60, has served as a Director of the Company since April 1994. He is the Chair of the Executive Committee. He is co-founder, co-Chairman, co-President and co-Chief Executive Officer of California Pizza Kitchen, Inc., a gourmet pizza restaurant chain founded in 1985. In 2002, Mr. Rosenfield co-founded and served as co-President of LA Food Show, Inc., which is now owned by California Pizza Kitchen, Inc. From 1973 to 1985, Mr. Rosenfield was a principal and partner of the law firm of Flax & Rosenfield, a private law firm in Beverly Hills, California. From 1969 to 1973, Mr. Rosenfield served as an attorney in the U.S. Department of Justice. He is a 1969 graduate of DePaul University College of Law.

Anthony S. Thornley. Mr. Thornley, 59, has served as a Director of the Company since April 2004. He is the Chair and Designated “Financial Expert” of the Audit Committee. From February 2002 to July 2005, he served as President and Chief Operating Officer of QUALCOMM Incorporated, the San Diego-based company that pioneered and developed technologies used in wireless networks throughout much of the world. He previously served as QUALCOMM’s Chief Financial Officer since 1994, while also holding titles of Vice President, Senior Vice President and Executive Vice President. Prior to joining QUALCOMM, Mr. Thornley worked for Nortel for 16 years, serving in various financial and information systems management positions including Vice President of Public Networks, Vice President of Finance NT World Trade, and Corporate Controller Northern Telecom Limited. Before Nortel, Mr. Thornley worked for Coopers & Lybrand. Mr. Thornley received his degree in chemistry from Manchester University, England, and is qualified as a chartered accountant.

Vote Required. Assuming a quorum is present, the seven nominees receiving the highest number of votes cast at the Annual Meeting will be elected as directors. You may vote “for” or “withhold” your vote with respect to the election of any or all of the nominees.

Majority Vote Policy. The Company’s Corporate Governance Guidelines set forth the Company’s procedure regarding a director who is elected but receives a majority of “withheld” votes. In an uncontested election of directors, any nominee who has a greater number of votes “withheld” from his or her election than votes “for” such election (a “Majority Withheld Vote”) is required to submit in writing an offer to resign. The Nominating and Corporate Governance Committee would consider, among other things, the reasons for the Majority Withheld Vote and make a recommendation to the full Board whether or not to accept the resignation offer. The Board would consider the recommendation, determine whether or not to accept the resignation offer and disclose the basis for its determination. Full details of this procedure are set out in the Company’s Corporate Governance Guidelines, posted on its website atwww.callawaygolf.com under Investor Relations — Corporate Governance.

YOUR BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” EACH OF THE NOMINEES LISTED ABOVE.

Committees of the Board of Directors

The Board of Directors currently has five standing committees. They are the Audit Committee, the Compensation and Management Succession Committee, the Executive Committee, the Finance Committee and the Nominating and Corporate Governance Committee. The Board of Directors has adopted written charters for each of the Committees. A copy of each of the charters is available on the Company’s website atwww.callawaygolf.comunder Investor Relations — Corporate Governance. Upon request, the Company will

6

Table of Contents

provide to any person without charge a copy of such charters. Any such requests may be made by contacting the Company’s Investor Relations Department at the Company’s principal executive offices located at 2180 Rutherford Road, Carlsbad, CA 92008. More detailed information about each committee is set forth below.

Audit Committee. The Audit Committee currently consists of Messrs. Thornley (Chair), Beard and Armacost. The Board of Directors has determined that each member of the Company’s Audit Committee is independent within the meaning of Item 7(d)(3)(iv)(A)(1) of Schedule 14A under the Securities Exchange Act of 1934 and the applicable listing standards of the New York Stock Exchange. The Board of Directors has also determined that each member of the Audit Committee is financially literate and has accounting or related financial management expertise within the meaning of the rules of the New York Stock Exchange. In addition, the Board of Directors has determined that at least one member of the Audit Committee qualifies as an Audit Committee Financial Expert as defined by Item 401(h)(2) of Regulation S-K. The Board of Directors has designated Anthony S. Thornley as the Audit Committee Financial Expert. The Board also believes that the collective experiences of the other members of the Audit Committee make them well qualified to serve on the Company’s Audit Committee. Shareholders should understand that Mr. Thornley’s designation as an Audit Committee Financial Expert is a Securities and Exchange Commission disclosure requirement, and it does not impose on Mr. Thornley any duties, obligations or liabilities that are greater than those which are generally imposed on him as a member of the Audit Committee and the Board, and his designation as an Audit Committee Financial Expert pursuant to this requirement does not affect the duties, obligations or liabilities of any other member of the Audit Committee or the Board.

The Audit Committee is responsible for representing the Board of Directors in discharging its oversight responsibility relating to the accounting, reporting and financial practices of the Company and its subsidiaries, including the integrity of the Company’s financial statements, as well as oversight of the Company’s internal audit function. The Audit Committee also has oversight responsibility with regard to the Company’s legal and regulatory matters and has sole authority for all matters relating to the Company’s independent registered public accounting firm, including the appointment, compensation, evaluation, retention and termination of such firm. A copy of the Audit Committee Charter is set forth as Exhibit A to this Proxy Statement.

Compensation and Management Succession Committee. The Compensation and Management Succession Committee currently consists of Messrs. Armacost (Chair), Beard, Cushman and Thornley. All of the members of this Committee are independent directors as determined under the independence standards described above, including the NYSE listing standards. The Committee is responsible for discharging the responsibilities of the Board relating to compensation of the Company’s executives and for assisting the Board with management succession issues and planning. The Committee is also responsible for reviewing the performance of the Company’s Chief Executive Officer and for setting the compensation of the Chief Executive Officer and the Company’s other executive officers.

Executive Committee. The Executive Committee currently consists of Messrs. Rosenfield (Chair), Baker, Beard and Cushman. As disclosed above, Messrs. Rosenfield, Beard and Cushman are all currently deemed to be independent directors as determined under the independence standards described above, including the NYSE listing standards, and Mr. Baker is deemed to be a non-independent director. There is no requirement that the Company have an executive committee or that the members of the committee be independent. The Charter of the Executive Committee provides that a majority of the members be non-management directors. The Committee is responsible for assisting the Board of Directors in discharging its duties to the Company and to the Company’s shareholders. The Committee performs such tasks as the Board of Directors delegates to it from time to time. This Committee did not meet in 2005.

Finance Committee. The Finance Committee currently consists of Messrs. Baker (Chair), Armacost, Beard and Cushman. Other than Mr. Baker, each of the members of this Committee is an independent director as determined under the independence standards described above, including the NYSE listing standards. The Committee is responsible for assisting the Board as needed with the Company’s finance matters, including the

7

Table of Contents

Company’s strategic business objectives and initiatives, financial performance, budget, credit facilities, capital structure, investments and banking relationships. During 2005, the duties of the Committee were largely assumed by the Audit Committee and by the Board as a whole. As a result, the Finance Committee met only once.

Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee currently consists of Messrs. Beard (Chair), Armacost, Cushman, Kobayashi, Rosenfield and Thornley. All of the members of this Committee are independent directors as determined under the independence standards described above, including the NYSE listing standards. The Committee has responsibility for identifying and recommending to the Board individuals who are qualified to serve on the Board of Directors and has responsibility for making recommendations as to the candidates who should stand for election at each annual meeting of shareholders. The Committee also has responsibility for oversight of the Company’s corporate governance practices, including the Company’s Corporate Governance Guidelines, and evaluation of the effectiveness of the Board and Board Committees.

The Committee believes that the continuing service of qualified incumbents promotes stability and continuity among the Board of Directors and contributes to the Board’s ability to function effectively. The continuing service of qualified incumbents also provides the Company with the benefit of the familiarity with and insight into the Company’s affairs that its directors have accumulated during their tenure. As a result, in considering candidates for nomination for each annual meeting of shareholders, the Committee first considers the Company’s incumbent directors who desire to continue their service on the Board. The Committee will generally recommend to the Board an incumbent director for reelection if the Committee has determined that (i) the incumbent director continues to satisfy the threshold criteria described below, (ii) the incumbent director has satisfactorily performed his or her duties as a director during the most recent term and (iii) there exists no reason why in the Committee’s view the incumbent director should not be reelected.

If a vacancy becomes available on the Board of Directors as a result of the death, resignation or removal of an incumbent director or as a result of action taken by the Board to increase the size of the Board, the Committee will proceed to identify candidates who meet the threshold criteria described below. The Committee may use a variety of methods for identifying director candidates, including professional search firms and recommendations from the Company’s officers, directors, shareholders or other persons. Once a candidate has been identified, the Committee evaluates whether the candidate has the appropriate skills and characteristics to become a director and whether the candidate satisfies the following threshold criteria: (i) a candidate should exhibit very high personal and professional ethics, integrity and values; (ii) a candidate should not have any conflicting interest that would materially impair his or her ability to discharge the fiduciary duties of a director; (iii) a candidate should be committed to the best interests of the Company’s shareholders and be able to represent fairly and equally all shareholders without favoring or advancing any particular shareholder or other constituency; and (iv) a candidate should be able to devote adequate time to his or her service as a director. Candidates are also evaluated based upon their independence, education and relevant business and industry experience. These factors, and others, are considered by the Nominating and Corporate Governance Committee in the context of the Board as a whole and in light of the Board’s needs at a particular time.

If a shareholder believes that he or she has identified an appropriate candidate who is willing to serve on the Company’s Board of Directors, the shareholder may submit a written recommendation to the Chair of the Nominating and Corporate Governance Committee c/o the Company’s Secretary at 2180 Rutherford Road, Carlsbad, California 92008. Such recommendation must include detailed biographical information concerning the recommended candidate, including a statement regarding the candidate’s qualifications. The Nominating and Corporate Governance Committee may require such further information and obtain such further assurances concerning the recommended candidate as it deems reasonably necessary. The Nominating and Corporate Governance Committee will review properly submitted shareholder candidates in the same manner as it evaluates all other director candidates. In addition to bringing potential qualified candidates to the attention of the Nominating and Corporate Governance Committee as discussed above, a nomination of a person for election to the Board of Directors at an annual meeting of shareholders may be made by shareholders who meet the qualifications set forth

8

Table of Contents

in the Company’s Bylaws and who make such nominations in accordance with the procedures set forth in the Company’s Bylaws, including the procedures described at “Shareholder Proposals” in this Proxy Statement.

Ad Hoc Committees.The Board of Directors also forms from time to time ad hoc committees. In 2005, the Board formed an ad hoc Special Committee to assist it with evaluating strategic alternatives.

Lead Independent Director

The Board also appoints a Lead Independent Director. Ronald S. Beard is currently the designated Lead Independent Director and he has served in that role since August 2002. The Lead Independent Director coordinates the activities of the independent directors and serves as a liaison between the Chief Executive Officer and the independent directors. The Lead Independent Director also presides at the executive sessions (without management) of the independent directors. A copy of the Charter for the Lead Independent Director position is available at the corporate governance section of the Company’s website atwww.callawaygolf.comunder Investor Relations — Corporate Governance.

Meetings

During 2005, the Company’s Board of Directors met 5 times and the independent directors met in executive session at 4 of those meetings; the Audit Committee met 12 times; the Compensation and Management Succession Committee met 9 times; the Finance Committee met 1 time (as during 2005, the duties of the Finance Committee were largely assumed by the Audit Committee and by the Board as a whole); the Nominating and Corporate Governance Committee met 2 times; and the Executive Committee did not have a need to hold any meetings. In addition to meetings, the members of the Board of Directors and its committees sometimes take action by written consent in lieu of a meeting, which is permitted, or discuss Company business without calling a formal meeting. During 2005, all of the Company’s current directors attended in excess of 75% of the meetings of the Board of Directors and committees of the Board of Directors on which they served, except for Mr. Baker who attended 71% of such meetings. All of the Board members standing for re-election are expected to attend the annual meetings of shareholders and all directors attended the 2005 shareholders’ meeting.

Director Compensation

During 2005, directors who are not employees of the Company received $30,000 per year in base cash compensation, plus reimbursement of expenses, for serving on the Board of Directors. Non-employee directors also received additional cash compensation in the amount of $1,000 per day for each Board and committee meeting attended as a regular member. The Chair of each committee received an additional $300 per day per committee meeting for which the director served as Chair. The Lead Independent Director and the Chair of the Audit Committee received an additional retainer at the annual rate of $30,000 and $10,000, respectively, in recognition of the significant amount of time they are required to spend on Company business between meetings.

On March 9, 2006, after engaging a nationally recognized, independent compensation consulting firm to conduct a comprehensive review of director compensation, and upon the recommendation of the Compensation and Management Succession Committee, the Board adopted changes to the Company’s current compensation program for directors (which changes became effective April 1, 2006). The new director compensation program increased the annual base cash compensation for non-employee directors from $30,000 to $45,000 and increased the amount paid per day for each Board and committee meeting attended from $1,000 to $1,500. The committee Chairs will continue to receive an additional $300 per day for each committee meeting attended. The Chair of the Compensation and Management Succession Committee will be paid an additional $5,000 annual retainer. The additional annual retainers for the Lead Independent Director and the Chair of the Audit Committee, in the amount of $30,000 and $10,000, respectively, will remain unchanged.

During 2005, the non-employee directors participated in the Callaway Golf Company 2001 Non-Employee Directors Stock Option Plan (the “2001 Plan”), which was approved by the shareholders at the Company’s 2000

9

Table of Contents

annual meeting. Pursuant to the 2001 Plan, a non-employee director is automatically granted upon his or her initial election or appointment to the Board an option to purchase 20,000 shares of the Company’s Common Stock at an exercise price equal to the fair market value of the Common Stock on the date of election or appointment. Thereafter, on each anniversary of a director’s election or appointment, each non-employee director who was expected to continue to serve as such for at least another year received an additional option to purchase 6,000 shares of the Company’s Common Stock at an exercise price equal to the fair market value of the Common Stock on the date of grant. Initial options vested 50% upon the first anniversary of a director’s initial election or appointment and 50% upon the second anniversary. Additional options vested 100% after two years from the date of grant, subject to certain conditions, including continuous service on the Board. Subject to certain anti-dilution adjustments, a maximum of 500,000 shares were approved for issuance upon the exercise of stock options granted under the 2001 Plan. At this year’s Annual Meeting, the Company is seeking shareholder approval of an amendment and restatement to the 2001 Plan, which would be renamed the “Amended and Restated 2001 Non-Employee Directors Stock Incentive Plan” (the “Amended and Restated 2001 Plan”). The Amended and Restated 2001 Plan would also permit the Company to grant to directors restricted stock or restricted stock unit awards. The Amended and Restated 2001 Plan is described more fully in the proxy statement under “Proposal No. 2 — Approval of the Amended and Restated 2001 Non-Employee Directors Stock Incentive Plan.”

The Company has a policy that the non-employee directors should promote the Company’s products by using the Company’s products whenever they play golf. To assist the directors in complying with this policy, non-employee directors are entitled to receive golf club products of the Company, free of charge, for their own personal use and the use of immediate family members. The directors also receive other products (e.g., golf balls and accessories) and benefits (e.g., the right to participate in the Company’s deferred compensation plan) that are not material in amount.

Communications with the Board

Shareholders and other interested parties may contact the Company’s Lead Independent Director or the non-management directors as a group by email at:Non-managementdirectors@callawaygolf.com,or by mail to: Board of Directors, Callaway Golf Company, 2180 Rutherford Road, Carlsbad, California 92008. The Corporate Secretary’s office will review all incoming communications and will filter out solicitations and junk mail. All legitimate communications will be forwarded to the Lead Independent Director for distribution to the other non-management directors or for handling as appropriate.

Corporate Governance Guidelines and Code of Conduct

The Board of Directors has adopted and published on its website its Corporate Governance Guidelines to provide the Company’s shareholders and other interested parties with insight into the Company’s corporate governance practices. The Nominating and Corporate Governance Committee is responsible for overseeing these guidelines and for reporting and making recommendations to the Board concerning these guidelines. The Corporate Governance Guidelines cover, among other things, board composition and director qualification standards, responsibilities of the Board of Directors, Board compensation, committees of the Board of Directors and other corporate governance matters.

The Board of Directors has also adopted a Code of Conduct that applies to all of the Company’s employees, including its senior financial and executive officers, as well as the Company’s directors. The Company’s Code of Conduct covers the basic standards of conduct applicable to all directors, officers and employees of the Company, as well as the Company’s Conflicts of Interest and Ethics Policy and other specific compliance standards and related matters. The Company will promptly disclose any waivers of, or amendments to, any provision of the Code of Conduct that applies to the Company’s directors and senior financial and executive officers on its website atwww.callawaygolf.com.

10

Table of Contents

Both the Corporate Governance Guidelines and Code of Conduct are available on the Company’s website atwww.callawaygolf.comunder Investor Relations — Corporate Governance and Corporate Overview. Upon request, the Company will provide to any person without charge a copy of the Company’s Corporate Governance Guidelines or Code of Conduct. Any such requests may be made by contacting the Company’s Investor Relations department at the Company’s principal executive offices located at 2180 Rutherford Road, Carlsbad, California 92008.

The duties and responsibilities of the Audit Committee are set forth in its written charter. In summary, they are:

| • | Review and discuss with the outside auditors the scope and results of the annual audit and any reports with respect to interim periods. |

| • | Review and discuss with management and the outside auditors the annual and quarterly financial statements of the Company, including any significant financial reporting issues and judgments, the effects of regulatory and accounting initiatives and off-balance sheet structures on the Company’s financial statements, disclosures under “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in reports filed with the Securities and Exchange Commission, and any major issues regarding the Company’s accounting principles and financial statements. |

| • | Review and discuss the Company’s policies with respect to earnings releases and other disclosures of financial information and/or guidance. |

| • | Responsibility and sole authority for all matters relating to the Company’s outside auditors, including their appointment, compensation, evaluation, retention and termination. |

| • | Approval of all services to be performed by the outside auditors, including pre-approval of any permissible non-audit services. |

| • | Recommend to the Board, based on its review and discussions with management and the outside auditors, whether the financial statements should be included in the Annual Report on Form 10-K. |

| • | Review and consider the independence of the outside auditors. |

| • | Obtain and review a report by the outside auditors on their internal quality control procedures and any material issues raised by the most recent internal quality control review or peer review. |

| • | Review and discuss with the principal internal auditor of the Company the scope and results of the internal audit program, and the adequacy and effectiveness of internal controls. |

| • | Review and discuss the adequacy and effectiveness of the Company’s disclosure controls and procedures. |

| • | Review material pending legal proceedings and material contingent liabilities. |

| • | Review and discuss the Company’s policies with respect to risk assessment and risk management, and oversee the Company’s legal and regulatory compliance programs, code of conduct, and conflict of interest policies. |

| • | Establish procedures for handling complaints about accounting, internal controls and audit matters. |

| • | Evaluate annually the performance of the Audit Committee and the adequacy of its charter. |

In addition to its charter, the Audit Committee has also adopted (i) a written policy restricting the hiring of candidates for accounting or financial reporting positions if such candidates have certain current or former relationships with the Company’s independent auditors; (ii) procedures for the receipt, retention and treatment of complaints regarding accounting or auditing matters and the confidential submission by employees regarding any accounting or auditing concerns; (iii) a policy governing the preapproval of audit and non-audit fees and services to be performed by the Company’s independent auditors; and (iv) a written policy requiring management to report to the Committee transactions with the Company’s officers or certain other parties.

11

Table of Contents

In general, the Audit Committee represents the Board of Directors in discharging its general oversight responsibilities for the Company and its subsidiaries in the areas of accounting, auditing, financial reporting, risk assessment and management, and internal controls. Management has the responsibility for the preparation, presentation and integrity of the Company’s financial statements and for its financial reporting process and the Company’s independent auditors are responsible for expressing an opinion on the conformance of the Company’s financial statements to accounting principles generally accepted in the United States. The Audit Committee is responsible for reviewing and discussing with management and the Company’s independent auditors the Company’s annual and quarterly financial statements and financial reporting process and for providing advice, counsel and direction to management and the Company’s independent auditors on such matters based upon the information it receives, its discussions with management and the independent auditors and the experience of the Audit Committee members in business, financial and accounting matters.

The Company has an internal audit department that, among other things, is responsible for objectively reviewing and evaluating the adequacy and effectiveness of the Company’s system of internal controls, including controls relating to the reliability of the Company’s financial reporting. The internal audit department reports directly to the Audit Committee and, for administrative purposes, to the Chief Financial Officer.

During 2005, the Audit Committee met formally 12 times. Messrs. Armacost, Beard, and Thornley served on the Committee throughout 2005. Mr. Beard served as Chair of the Committee until May 2005, when Mr. Thornley was appointed as Chair. The Board has determined that throughout 2005 all members of the Audit Committee met the independence requirements of the New York Stock Exchange during the time they served on the Committee, and that all members of the Audit Committee were financially literate and had accounting or related financial management expertise within the meaning of the NYSE listing standards. In addition, the Audit Committee has designated Mr. Thornley as the Audit Committee Financial Expert. Shareholders should understand that this designation is a Securities and Exchange Commission disclosure requirement, and does not impose on Mr. Thornley any duties, obligations or liabilities that are greater than those which are generally imposed on him as a member of the Audit Committee and the Board, and his designation as an Audit Committee Financial Expert pursuant to this requirement does not affect the duties, obligations or liabilities of him or any other member of the Audit Committee or the Board.

Deloitte & Touche LLP (“Deloitte”) served as the Company’s independent auditors for 2005. The Audit Committee reviewed and discussed with management and Deloitte the Company’s quarterly and audited annual financial statements for the year ended December 31, 2005. The Audit Committee discussed with Deloitte the matters that the independent auditors are required to discuss with the Audit Committee pursuant to Statement on Auditing Standards No. 61 (Communication with Audit Committees), including (a) the Company’s significant accounting policies and their application, (b) the reasonableness of management’s accounting estimates and judgments used in the preparation of the Company’s financial statements and (c) the quality of the Company’s accounting procedures and practices.

In addition, the Audit Committee has received from the independent auditors the written disclosures and the letter required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees). Although such letter is only required annually, as a matter of procedure the Audit Committee requests that the Company’s independent auditors provide such letter quarterly. The Audit Committee actively engaged in a dialogue with the independent auditors with respect to any disclosed relationships or services that might impact the auditors’ objectivity and independence.

In accordance with the Sarbanes-Oxley Act of 2002 and applicable rules of the Securities and Exchange Commission, it is the Audit Committee’s policy that all non-audit services to be performed by the Company’s independent auditors must be preapproved by the Audit Committee. The Audit Committee approves the use of the Company’s auditors to perform non-audit services only in limited circumstances and the non-audit services that have been approved in the past generally have been audit-related services and tax-related services as are permitted under the Sarbanes-Oxley Act of 2002 and applicable rules of the Securities and Exchange

12

Table of Contents

Commission. The only non-audit services approved by the Audit Committee and performed by Deloitte during 2005 were for the audit of the Company’s 401(k) Retirement Investment Plan as described in the proxy statement under “Information Concerning Independent Registered Public Accounting Firm — Fees of Independent Registered Public Accounting Firm.” Total fees paid for such non-audit services were $23,000, or 1.4% of the total amount paid by the Company to its independent outside auditors in 2005. In approving these non-audit services, the Audit Committee considered whether the auditors’ provision of such services during 2005 was compatible with maintaining the auditors’ independence and concluded that it was.

During the course of 2005, the principal internal auditor and management completed its second year of documentation, testing and evaluation of the Company’s system of internal control over financial reporting in response to the requirements of Section 404 of the Sarbanes-Oxley Act of 2002 and related regulations. The Audit Committee was kept apprised of the progress of the evaluation and provided oversight and advice during the process. In connection with this oversight, the Committee received periodic updates provided by the principal internal auditor, management and Deloitte at each regularly scheduled Committee meeting. Upon completion of the evaluation, the principal internal auditor and management reported to the Committee regarding the effectiveness of the Company’s internal control over financial reporting. The Committee also reviewed the report of management contained in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2005, as well as Deloitte’s Report of Independent Registered Public Accounting Firm included in the Company’s Annual Report on Form 10-K related to its audits of (i) the consolidated financial statements and financial statement schedule, (ii) management’s assessment of the effectiveness of internal control over financial reporting, and (iii) the effectiveness of internal control over financial reporting. The Committee continues to oversee the Company’s efforts related to its internal control over financial reporting.

Based on the review and discussions referred to above, the Audit Committee recommended to the Board of Directors that the Company’s audited financial statements be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2005, for filing with the Securities and Exchange Commission.

MEMBERSOFTHE AUDIT COMMITTEE |

Anthony S. Thornley(Chair) |

Ronald S. Beard |

Samuel H. Armacost |

The preceding “Report of the Audit Committee” shall not be deemed soliciting material or to be filed with the Securities and Exchange Commission, nor shall any information in this report be incorporated by reference into any past or future filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except to the extent the Company specifically incorporates it by reference into such filing.

13

Table of Contents

INFORMATION CONCERNING THE AMENDED AND RESTATED

2001 NON-EMPLOYEE DIRECTORS STOCK INCENTIVE PLAN

Proposal No. 2 — Approval of the Amended and Restated 2001 Non-Employee Directors Stock Incentive Plan

General Information

The Callaway Golf Company 2001 Non-Employee Directors Stock Option Plan (the “2001 Plan”) was previously approved by the Company’s shareholders effective January 1, 2001. The 2001 Plan is designed to promote the interests of the Company and its shareholders by using investment interests in the Company to attract and retain highly qualified independent directors (referred to as “non-employee directors” or “outside directors”) and to align their interests with the interests of shareholders. However, stock options were designated as the exclusive vehicle for providing such interests pursuant to the 2001 Plan. A total of 500,000 shares of Common Stock was authorized under the 2001 Plan for issuance upon the exercise of stock options granted under the 2001 Plan. As of the date of this proxy statement, there are 282,000 shares available for grant under the 2001 Plan. The Company is not seeking approval of any additional shares, but wishes to provide alternatives to stock options under the 2001 Plan.

As discussed above, the Compensation and Management Succession Committee of the Board of Directors engaged a nationally recognized, independent compensation consulting firm to conduct a comprehensive review of director compensation, including a review of market practices and recommended best practices. Based on that review, and consistent with emerging practices of using restricted stock and restricted stock units for the equity portion of director compensation, the Board of Directors desires to amend the 2001 Plan to permit awards of restricted stock and restricted stock units. At the upcoming Annual Meeting, the Company is therefore seeking shareholder approval of an Amendment and Restatement of the 2001 Plan (the “Amended and Restated 2001 Plan”) that would (among other changes) change the name of the 2001 Plan to the “Amended and Restated 2001 Non-Employee Directors Stock Incentive Plan,” authorize the grant of restricted stock and restricted stock units (each as defined below), and allow the Board greater flexibility in setting the terms and conditions of awards under the Amended and Restated 2001 Plan. The Company believes that these changes would update its director compensation practices to make them consistent with emerging practices and trends and would provide the flexibility to better align the non-employee directors’ interests with the interests of the Company’s shareholders.

Under the existing 2001 Plan, all non-employee directors are eligible to receive an initial grant of an option (an “Initial Option”) to purchase up to 20,000 shares of the Company’s Common Stock at an exercise price per share equal to the fair market value of the Company’s Common Stock on the date of his or her election to the Board. Initial Options vest 50% per year over two years, provided that the director remains on the Company’s Board. In addition, upon a director’s re-election to the Board at each annual meeting of shareholders, the director is automatically granted an additional option (an “Additional Option”) to purchase up to 6,000 shares of the Company’s Common Stock at an exercise price equal to the fair market value of the Company’s Common Stock on the date of grant. Additional Options vest 100% on the second anniversary of the grant date, subject to certain conditions, including continued service.

The Amended and Restated 2001 Plan would maintain the general format of initial and annual awards for non-employee directors, but with the following changes. First, both the initial and annual awards would consist of options, restricted stock, and/or restricted stock units (or any combination of each) as determined by the Board in its discretion. Initial awards would be made on the date a director is appointed to the Board, and annual awards would be made upon re-election on the date of each annual meeting of the Company’s shareholders. Second, the Amended and Restated 2001 Plan would set a maximum number of shares that could be issued pursuant to any initial or annual grant; subject to that maximum, the actual number of shares to be issued pursuant to any award would be determined by the Board in its discretion. Third, the terms and provisions relating to the vesting of and other restrictions on awards would be determined by the Board and set forth in individual award agreements.

14

Table of Contents

The Company is not seeking approval of any additional shares for the Plan. The aggregate number of shares authorized under the 2001 Plan (500,000 shares) would remain the same under the Amended and Restated 2001 Plan, if approved. The term of the 2001 Plan (which expires on December 31, 2011) also would remain the same.

All outside directors of the Company would be eligible for awards under the Amended and Restated 2001 Plan. If all of the directors nominated for election are elected at the Annual Meeting, there would be 6 non-employee directors eligible for awards under the Amended and Restated 2001 Plan, if approved. The Amended and Restated 2001 Plan is being submitted to the shareholders for approval in order to comply with New York Stock Exchange regulations.

Summary of Plan

The following summary of the material terms of the Amended and Restated 2001 Plan is qualified in its entirety by reference to the full text of the Amended and Restated 2001 Plan, a copy of which is attached as Exhibit B to this Proxy Statement and incorporated herein by reference. Please refer to Exhibit B for more detailed information.

Purpose. The purpose of the Amended and Restated 2001 Plan is to promote the interests of the Company and its shareholders by using investment interests in the Company to attract and retain highly qualified non-employee directors.

Administration. The Amended and Restated 2001 Plan is administered by the Company’s Board, or a committee designated by the Board, which, subject to limitations contained in the Amended and Restated 2001 Plan, has the authority to determine whether awards will be comprised of options, restricted stock, restricted stock units, or a combination of the foregoing; the number of shares covered by such options or other awards; and the exercise price of options (provided the exercise price may not be less than the fair market value of the common stock on the date of grant). The Board or designated committee has sole authority to construe the Amended and Restated 2001 Plan, to determine all questions arising under the plan, to adopt and amend such rules and regulations for the administration of the plan as it may deem desirable, and otherwise to carry out the terms of the Amended and Restated 2001 Plan.

Eligible Directors. Each person who is a duly elected or appointed member of the Board, but is not then otherwise an employee of the Company or any of its subsidiaries or affiliates and has not been an employee of the Company or any of its subsidiaries or affiliates since the beginning of the Company’s preceding fiscal year, is eligible to receive awards under the Amended and Restated 2001 Plan (an “Eligible Director,” also referred to at times below as a “participant”).

Annual and Initial Grants. Each Eligible Director will receive an initial award upon first being appointed to serve on the Board. The grant date for initial awards shall be the date upon which such appointment is effective. In addition, each Eligible Director will receive an annual award for each fiscal year in which they are elected to serve on the Board, provided that any director who is first appointed to the Board within three months prior to the Company’s annual meeting of shareholders will not be eligible to receive an annual award upon election at such annual meeting but would be eligible upon election at the following annual meeting of shareholders. The grant date for annual awards is the date on which the annual meeting of the Company’s shareholders takes place.

Common Stock Subject to the Plan; Grant Limit. The shares that may be made subject to awards under the Amended and Restated 2001 Plan are the authorized and unissued shares of the Company’s Common Stock. The maximum aggregate number of shares that may be issued pursuant to all such awards is 500,000 shares, subject to adjustment in the case of certain change in the Company’s capital structure or corporate transactions. The Amended and Restated 2001 Plan continues to draw from the 500,000 shares originally authorized as of January 1, 2001 under the 2001 Plan. The maximum number of shares that may be issued pursuant to any initial grant to an individual Eligible Director is 20,000 shares. The maximum number of shares that may be issued pursuant to any annual grant to an individual Eligible Director is 10,000 shares.

15

Table of Contents

Share Usage. Shares of Common Stock covered by an award are not counted as used unless and until they are actually issued and delivered to an Eligible Director. If an award lapses, expires, terminates or is cancelled prior to the issuance of shares under it or if shares of Common Stock are issued under the Amended and Restated 2001 Plan to an Eligible Director and are thereafter reacquired by the Company, the shares subject to such awards and the reacquired shares will again be available for issuance under the Amended and Restated 2001 Plan. The following items are not counted against the total number of shares available for issuance under the Amended and Restated 2001 Plan: (i) the payment in cash of dividends or dividend equivalents and (ii) any dividends or dividend equivalents that are reinvested into additional shares or credited as additional restricted stock or restricted stock units (each as defined below). Shares that are withheld in payment of the exercise price of an option are counted against the number of shares available for issuance under the Amended and Restated 2001 Plan.

Amendment. The Board may amend, suspend or discontinue the Amended and Restated 2001 Plan, except that no such amendment is permitted if it would diminish rights under any outstanding award, unless the award holder consents. In addition, without further shareholder approval, the Amended and Restated 2001 Plan may not be amended to (i) increase the number of shares subject to the Amended and Restated 2001 Plan (as adjusted under the terms of the Amended and Restated 2001 Plan); (ii) increase the individual share limits set forth in the Amended and Restated 2001 Plan and described above; (iii) change the class of persons eligible to receive awards; (iv) reduce the exercise price of options, or cancel outstanding options and in exchange substitute new options with lower exercise prices (except pursuant to a change in the Company’s capital structure or a corporate transaction) and; (v) provide for the grant of options having an exercise price per option share less than the fair market value on the grant date; or (vi) extend the final date upon which awards may be granted under the Amended and Restated 2001 Plan.

Term of Plan. The Amended and Restated 2001 Plan expires on December 31, 2011.

Award Agreements; Vesting and Restrictions. Provisions relating to the vesting and/or other terms and restrictions of options or other awards are set forth in award agreements. No award shall vest sooner than one year from the grant date.

Nonassignability. Awards under the Amended and Restated 2001 Plan generally are not transferable except by will or by the laws of descent and distribution.

Options. The Board generally sets the terms and conditions applicable to options granted under the Amended and Restated 2001 Plan, such as the number of shares of Common Stock issuable upon exercise of the option, the exercise price, the time during which the option is exercisable, and the times at which the option vests and becomes exercisable. These terms are set forth in an individual award agreement. The Amended and Restated 2001 Plan sets forth rules under which an option may be exercised after an Eligible Director ceases to be a director of the Company. Notwithstanding the Board’s authority to set the terms of options, the exercise price of options may not be less than the fair market value of a share of Common Stock on the grant date. For purposes of the Amended and Restated 2001 Plan, the term “fair market value” generally means the closing price of the Common Stock on the New York Stock Exchange during regular session trading for a single trading day as reported for such day in The Wall Street Journal or other reliable source. The option exercise price may be paid in cash or through a “cashless exercise.” Stock tendered to the Company or deducted from the number of shares that otherwise would be received upon the exercise of an option as payment of the exercise price are not added back to the aggregate number of shares subject to the Amended and Restated 2001 Plan. Options expire and terminate no more than ten years from the date of their grant.

Restricted Stock and Restricted Stock Units. For purposes of the Amended and Restated 2001 Plan, “restricted stock” means an award of shares of Common Stock, the rights of ownership of which may be subject to restrictions prescribed by the Board, and “restricted stock units” means an award similar to restricted stock but that is denominated in units of Common Stock. The Board may grant restricted stock and restricted stock units on such terms and conditions and subject to such repurchase or forfeiture restrictions, if any (which may be based on

16

Table of Contents

continuous service on the Board or any other measure) as the Board determines, which terms, conditions and restrictions shall be set forth in the agreement evidencing the award. Upon the satisfaction of any terms, conditions and restrictions prescribed with respect to restricted stock or restricted stock units, or upon a participant’s release from any terms, conditions and restrictions of restricted stock or restricted stock units, (i) the shares of restricted stock become freely transferable and (ii) restricted stock units are paid in cash, shares of Common Stock or a combination of each. Participants holding shares of restricted stock or restricted stock units may, if the Board so determines, be credited with dividends paid with respect to the underlying shares or dividend equivalents while they are so held in a manner determined by the Board in its sole discretion. The Board may apply any restriction to the dividends or dividend equivalents that the Board deems appropriate. The Board, in its sole discretion, may determine the form of payment of dividends or dividend equivalents, including cash, shares of Common Stock, restricted stock or restricted stock units.

Anti-dilution Adjustments. The Amended and Restated 2001 Plan permits appropriate adjustments to be made in the case of a change in the Company’s capital structure or a corporate transaction to the aggregate number of shares of Common Stock available for issuance under the plan, the maximum number of shares issuable pursuant to initial or annual awards, the number of shares covered by an outstanding option, and the exercise price per share of options.

Federal Income Tax Consequences

Stock Options. Stock options granted under the Amended and Restated 2001 Plan are non-qualified options. In general, there are no tax consequences to the optionee or to the Company on the grant of a non-qualified stock option. On exercise, however, the optionee generally will recognize ordinary income equal to the excess of the fair market value of the shares as of the exercise date over the purchase price paid for such shares, and the Company generally will be entitled to a deduction equal to the amount of ordinary income recognized by the optionee. Upon a subsequent disposition of the shares received under a non-qualified stock option, the difference between the amount realized on such disposition and the fair market value of the shares on the date of exercise generally will be treated as a capital gain or loss.

Restricted Stock and Restricted Stock Units. The tax consequences to the participant of receiving restricted stock will vary depending on whether the stock is subject to an option to repurchase in favor of the Company or is received outright, and whether the participant makes an election under Section 83(b) of the Code. A participant will not recognize taxable income upon the grant of a restricted stock unit. Upon the distribution of cash or shares to a participant pursuant to the terms of a restricted stock unit, the participant will recognize taxable ordinary income equal to the amount of any cash and/or the fair market value of any shares received.

Tax Consequences to the Company. In all cases, the Company will be entitled to take a deduction at the same time as, and in the same amount as, the participant recognizes ordinary income in respect of an award under the Amended and Restated 2001 Plan.

17

Table of Contents

Securities Authorized for Issuance Under Equity Compensation Plans

Information about all of the Company’s equity compensation plans at December 31, 2005 is as follows:

Equity Compensation Plan Information

Plan Category | Number of Shares to be Issued Upon Exercise of Outstanding Options | Weighted Average Exercise Price of Outstanding Options | Number of Shares Remaining Available for Future Issuance | |||||

| (In thousands, except dollar amounts) | ||||||||

Equity Compensation Plans Approved by Shareholders(1) | 5,308 | $ | 16.92 | 6,766 | (2) | |||

Equity Compensation Plans Not Approved by Shareholders(3) | 4,986 | $ | 17.00 | — | ||||

Total | 10,294 | $ | 16.96 | 6,766 | (2) | |||

| (1) | Consists of the following plans: 1991 Stock Incentive Plan, 1996 Stock Option Plan, 1998 Stock Incentive Plan, Non-Employee Directors Stock Option Plan, 2001 Non-Employee Directors Stock Option Plan and 2004 Equity Incentive Plan and Employee Stock Purchase Plan. No shares are available for grant under the 1991 Stock Incentive Plan, 1996 Stock Option Plan, 1998 Stock Incentive Plan or Non-Employee Directors Stock Option Plan at December 31, 2005. The 2001 Non-Employee Directors Stock Option Plan provides for stock option awards only. The 2004 Equity Incentive Plan permits the award of stock options, restricted stock and various other stock-based awards. |

| (2) | Includes 3.7 million shares reserved for issuance under the Employee Stock Purchase Plan. |

| (3) | Consists of the following plans: 1995 Employee Stock Incentive Plan and 1992 Promotion, Marketing and Endorsement Stock Incentive Plan. No shares are available for grant under these plans at December 31, 2005. |

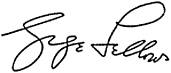

Equity Compensation Plans Not Approved By Shareholders