Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ | Filed by a Party other than the Registrant ☐ |

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Under §240.14a-12

Callaway Golf Company

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules14a-6(i)(4) and0-11. | |||

| 1. | Title of each class of securities to which transaction applies:

| |||

| 2. | Aggregate number of securities to which transaction applies:

| |||

| 3. | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| 4. | Proposed maximum aggregate value of transaction:

| |||

| 5. | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| 1. | Amount Previously Paid:

| |||

| 2. | Form, Schedule or Registration Statement No.:

| |||

| 3. | Filing Party:

| |||

| 4. | Date Filed:

| |||

Table of Contents

March 26, 2018

Dear Shareholders:

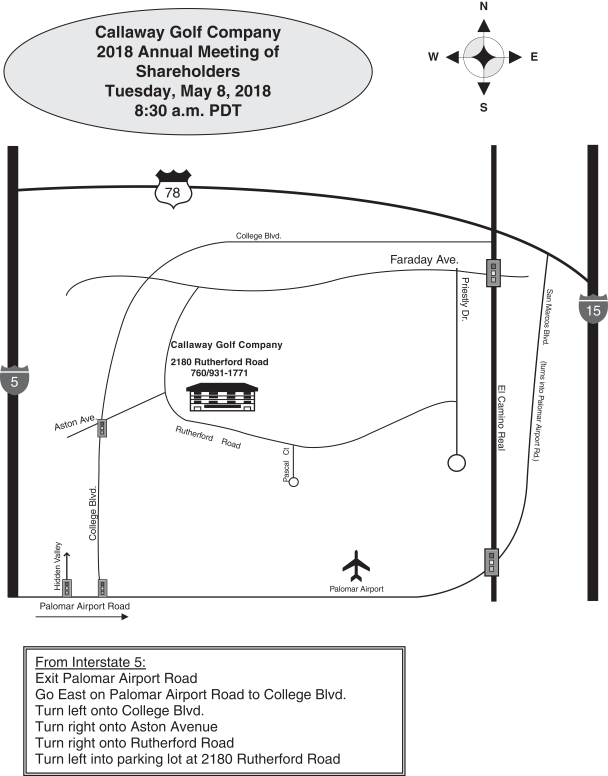

You are cordially invited to attend the Annual Meeting of Shareholders of Callaway Golf Company, which will be held on Tuesday, May 8, 2018, at our offices located at 2180 Rutherford Road, Carlsbad, California 92008, commencing at 8:30 a.m. (Pacific Time). A map is provided on the back page of these materials for your reference. Your Board of Directors and management look forward to greeting personally those shareholders who attend.

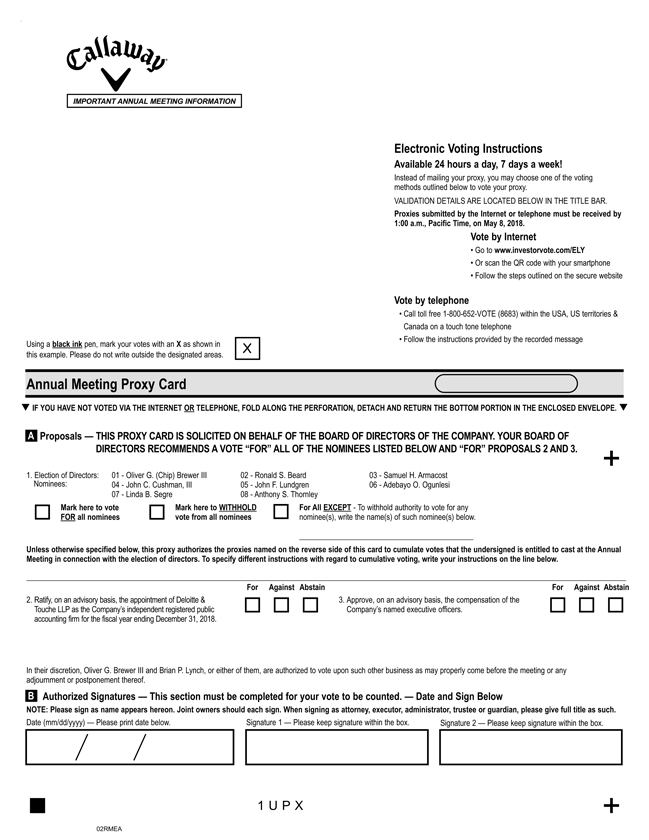

At the meeting, your Board of Directors will ask shareholders to (i) elect eight directors; (ii) ratify, on an advisory basis, the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2018; and (iii) approve, on an advisory basis, the compensation of our named executive officers. These matters are described more fully in the accompanying Proxy Statement, which you are urged to read thoroughly. Your Board of Directors recommends a vote “FOR” each of the director nominees, “FOR” ratification of the appointment of our independent registered public accounting firm and “FOR” the approval of the compensation of our named executive officers.

We have elected to take advantage of Securities and Exchange Commission rules that allow companies to furnish proxy materials to their shareholders by providing access to these documents on the Internet instead of mailing printed copies. Those rules allow a company to provide its shareholders with the information they need, while lowering the costs of delivery and reducing the environmental impact of the annual meeting. Most of our shareholders will not receive printed copies of our proxy materials unless requested, but instead will receive a notice with instructions on how they may access and review our proxy materials on the Internet and how they may cast their vote via the Internet. If you would like to receive a printed ore-mail copy of our proxy materials, please follow the instructions for requesting the materials in the Notice of Internet Availability that is being sent to you.

Your vote is important. Whether or not you plan to attend the annual meeting, please vote as soon as possible. If you received the Notice of Internet Availability, a proxy card was not sent to you and you may vote only via the Internet unless you attend the annual meeting or request that a proxy card and proxy materials be mailed to you. If you have requested that a proxy card and proxy materials be mailed to you, and you have received those materials, then you may vote via the Internet, by telephone or by mailing a completed proxy card. For specific voting instructions, please refer to the information provided in the accompanying Proxy Statement and in the Notice of Internet Availability.

Thank you for your continued interest in and support of Callaway Golf Company.

Sincerely,

Oliver G. (Chip) Brewer III

President and Chief Executive Officer

Table of Contents

CALLAWAY GOLF COMPANY

2180 Rutherford Road

Carlsbad, California 92008

NOTICE OF 2018 ANNUAL MEETING OF SHAREHOLDERS

| When | Tuesday, May 8, 2018, 8:30 a.m. (Pacific Time). | |

| Where | Callaway Golf Company 2180 Rutherford Road Carlsbad, California 92008 (A map is provided on the back page of these materials for your reference) | |

| Items of Business | 1. To elect as directors the eight nominees named in the accompanying proxy statement.

2. To ratify, on an advisory basis, the appointment of Deloitte & Touche LLP as the company’s independent registered public accounting firm for the 2018 fiscal year.

3. To approve, on an advisory basis, the compensation of the company’s named executive officers.

4. To transact such other business as may properly come before the annual meeting and at any adjournments or postponements thereof. | |

| Record Date | March 12, 2018. Only shareholders of record at the close of business on the record date are entitled to receive notice of and to vote at the annual meeting or any adjournment or postponement thereof. | |

| How to Vote | Please vote your shares promptly to ensure the presence of a quorum at the annual meeting. Please review the proxy materials for the annual meeting and follow the instructions in the section entitled “Voting Information” of the accompanying proxy statement beginning on page 3 to vote. As described on page 6 of the accompanying proxy statement, any shareholder attending the annual meeting may vote in person even if he or she previously returned a proxy or voted via the Internet or by telephone. | |

Carlsbad, California March 26, 2018 | By Order of the Board of Directors,

Brian P. Lynch Corporate Secretary |

| Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to be Held on May 8, 2018: | The Annual Report and Proxy Statement are available on the Internet at: http://www.allianceproxy.com/callawaygolf/2018 | |

Table of Contents

Table of Contents

CALLAWAY GOLF COMPANY

2180 Rutherford Road

Carlsbad, California 92008

PROXY STATEMENT

2018 ANNUAL MEETING OF SHAREHOLDERS

Why am I receiving these materials?

Callaway Golf Company (the “Company”) has prepared these materials for its 2018 annual meeting of shareholders and any adjournment or postponement thereof (the “Annual Meeting”). The Annual Meeting is scheduled to be held at the Company’s offices located at 2180 Rutherford Road, Carlsbad, California 92008 on Tuesday, May 8, 2018 commencing at 8:30 a.m. (Pacific Time). You are invited to attend and are requested to vote on the proposals described in this Proxy Statement. The Company is soliciting proxies for use at the Annual Meeting.

The proxy materials were first sent or made available to shareholders on or about March 26, 2018.

What is included in these proxy materials?

| • | The Notice of 2018 Annual Meeting of Shareholders |

| • | This Proxy Statement |

| • | The Company’s 2017 Annual Report to Shareholders |

If you requested printed versions by mail, you will receive a proxy card or voting instruction form.

Why did I receive aone-page notice in the mail regarding the Internet availability of proxy materials instead of a full set of proxy materials?

In accordance with rules of the Securities and Exchange Commission (“SEC”), the Company uses the Internet as the primary means of furnishing proxy materials to its shareholders. Accordingly, the Company is sending a Notice of Internet Availability of Proxy Materials to its shareholders with instructions on how to access the proxy materials over the Internet or request a printed copy of the materials, and for voting over the Internet.

Shareholders may follow the instructions in the Notice of Internet Availability of Proxy Materials to elect to receive future proxy materials in print by mail or electronically by email. The Company encourages its shareholders to take advantage of the availability of the proxy materials on the Internet to help reduce the environmental impact of its annual meetings and reduce the cost to the Company associated with the printing and mailing of materials.

What items will be voted on at the Annual Meeting?

There are three items that shareholders may vote on at the Annual Meeting:

| • | To elect to the Company’s Board of Directors (the “Board”) the eight nominees named in this Proxy Statement; |

1

Table of Contents

| • | To ratify, on an advisory basis, the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2018; and |

| • | To approve, on an advisory basis, the compensation of the Company’s named executive officers. |

Will any other business be conducted at the Annual Meeting?

Other than the proposals described in this Proxy Statement, the Company knows of no other matters to be submitted to the shareholders at the Annual Meeting. If any other matter properly comes before the shareholders at the Annual Meeting, it is the intention of the persons named as proxy holders to vote upon such matters in accordance with the Board’s recommendation.

2

Table of Contents

Who may vote at the Annual Meeting?

Only holders of record of the Company’s common stock (the “Common Stock”) as of the close of business on March 12, 2018, the record date for the Annual Meeting, are entitled to notice of and to vote at the Annual Meeting. The Company had no other class of capital stock outstanding as of the record date, and no other shares are entitled to notice of, or to vote at, the Annual Meeting.

What is the difference between a shareholder of record and a beneficial owner of shares held in street name?

If your shares are registered directly in your name with the Company’s registrar and transfer agent, Computershare Trust Company, N.A., you are considered a shareholder of record with respect to those shares and the Company’s proxy materials have been made available to you by the Company. If your shares are held in a stock brokerage account, by a bank, broker, trustee or other nominee, you are considered the beneficial owner of shares held in street name and the Company’s proxy materials are being forwarded to you by your bank, broker, trustee or other nominee that is considered the owner of record of those shares. As the beneficial owner, you have the right to instruct your bank, broker, trustee or other nominee on how to vote your shares.

If I am a shareholder of record of the Company’s shares, how do I vote?

If you are a shareholder of record, there are four ways to vote:

| • | Via the Internet. You may vote by proxy via the Internet by following the instructions provided in the Notice of Internet Availability of Proxy Materials. |

| • | By Telephone. If you request printed copies of the proxy materials by mail, you will receive a proxy card and you may vote by proxy by calling the toll free number found on the proxy card. |

| �� | By Mail. If you request printed copies of the proxy materials by mail, you will receive a proxy card and you may vote by proxy by completing, signing and dating the proxy card and returning it. |

| • | In person. You may vote in person at the Annual Meeting. You must bring valid photo identification such as a driver’s license or passport and you may be requested to provide proof of stock ownership as of the record date. |

If I am a beneficial owner of the Company’s shares held in street name, how do I vote?

You will receive instructions from the holder of record that you must follow in order for your shares to be voted. The availability of telephonic or Internet voting will depend on your bank’s, broker’s, trustee’s or other nominee’s voting process. Please check with your bank, broker, trustee or other nominee and follow the voting instructions they provide to vote your shares. If you wish to vote in person at the Annual Meeting, you must request a legal proxy from your bank, broker, trustee or other nominee that holds your shares and present that proxy and proof of identification at the Annual Meeting.

How are proxies voted?

All shares represented by valid proxies received prior to the taking of the vote at the Annual Meeting will be voted and, where a shareholder specifies by means of the proxy a choice with respect to any matter to be acted upon, the shares will be voted in accordance with the shareholder’s instructions. Similarly, if you transmit your voting instructions by telephone or via the Internet, your shares will be voted as you have instructed.

3

Table of Contents

What happens if I do not give specific voting instructions?

Shareholders of Record. If you are a shareholder of record and you indicate when voting on the Internet or by telephone that you wish to vote as recommended by the Board, then your shares will be voted at the Annual Meeting in accordance with the Board’s recommendation on all matters presented for a vote at the Annual Meeting. Similarly, if you sign and return a proxy card but do not indicate how you want to vote your shares for a particular proposal or for all of the proposals, then for any proposal for which you do not so indicate, your shares will be voted at the Annual Meeting in accordance with the Board’s recommendation.

Beneficial Owners of Shares Held in Street Name. If you are a beneficial owner of shares held in street name and do not provide the organization that holds your shares with specific voting instructions, then, under applicable New York Stock Exchange rules, the organization that holds your shares may generally vote your shares in their discretion on “routine” matters but cannot vote on“non-routine” matters. If the organization that holds your shares does not receive instructions from you on how to vote your shares on anon-routine matter, that organization will inform the inspector of election that it does not have the authority to vote on that matter with respect to your shares. This is generally referred to as a “brokernon-vote.”

Which proposals are considered “routine” or“non-routine”?

The ratification, on an advisory basis, of the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm is considered a routine matter. A bank, broker, trustee or other nominee may generally vote your shares on routine matters even without receiving instructions from you, and therefore no brokernon-votes are expected with respect to this proposal.

The election of directors and the approval, on an advisory basis, of the compensation of the Company’s named executive officers are considerednon-routine matters. Brokers and other nominees cannot vote your shares on these proposals without receiving instructions from you, and therefore brokernon-votes may occur with respect to these proposals.

How does the Board recommend that I vote?

The Board recommends that you vote:

| • | “FOR” each of the nominees for election as director as set forth in this Proxy Statement; |

| • | “FOR” ratification, on an advisory basis, of the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2018; and |

| • | “FOR” the approval, on an advisory basis, of the compensation of the Company’s named executive officers. |

By returning your proxy via the Internet or by telephone or mail, unless you notify the Company’s Corporate Secretary in writing to the contrary, you are also authorizing the proxies to vote your shares in accordance with the Board’s recommendation on any other matter that may properly come before the Annual Meeting. The Company does not currently know of any such other matter.

What is the quorum requirement for the Annual Meeting?

As of the record date for the Annual Meeting, there were 95,648,648 shares of Common Stock issued and outstanding. Under Delaware law and the Company’s Bylaws, the holders of a majority of the Common Stock issued and outstanding and entitled to vote at the Annual Meeting, present in person or represented by proxy, constitute a quorum for the transaction of business at the Annual Meeting. If you submit a properly executed proxy via the Internet or by telephone or mail, regardless of whether you abstain from voting on one or more matters, your shares will be counted as present at the

4

Table of Contents

Annual Meeting for the purpose of determining a quorum. Brokernon-votes will also be counted as present for the purpose of determining the presence of a quorum at the Annual Meeting. The inspector of election will determine whether a quorum is present and will tabulate the votes cast at the Annual Meeting.

How many votes does each share have?

Holders of Common Stock have one vote for each share on any matter that may be presented for consideration and action by the shareholders at the Annual Meeting, except that shareholders have cumulative voting rights with respect to the election of directors. Cumulative voting rights entitle each shareholder to cast as many votes as are equal to the number of directors to be elected multiplied by the number of shares owned by such shareholder, which votes may be cast for one candidate or distributed among two or more candidates. A shareholder of record may exercise cumulative voting rights by indicating on the proxy card the manner in which such votes should be allocated, or if such shareholder votes in person at the Annual Meeting, such shareholder must submit a ballot and make an explicit statement of the intent to cumulate votes. A shareholder who holds shares beneficially through a bank, broker, trustee or other nominee and wishes to cumulate votes, should contact his, her or its bank, broker, trustee or other nominee. Internet and telephone voting cannot accommodate cumulative voting.

What is the voting requirement to approve each of the proposals?

Assuming a quorum is present at the Annual Meeting, the eight nominees for director receiving the highest number of votes at the Annual Meeting will be elected. Returning a proxy giving authority to vote for the nominees named in this Proxy Statement will also give discretion to the designated proxies to cumulate votes and cast such votes in favor of the election of some or all of the applicable director nominees in their sole discretion.

Assuming a quorum is present at the Annual Meeting, the affirmative vote of the holders of a majority of the shares having voting power present in person or represented by proxy at the Annual Meeting is required for the ratification, on an advisory basis, of the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm and for the approval, on an advisory basis, of the compensation of the Company’s named executive officers

How are abstentions and brokernon-votes treated?

As noted above, abstentions and brokernon-votes are counted for purposes of determining a quorum. For purposes of determining whether a proposal is approved (other than the election of directors), abstentions are counted in the tabulation of shares present in person or represented by proxy and have the same effect as voting against a proposal. Brokernon-votes are not considered as shares having voting power present in person or represented by proxy and will not be counted toward the vote total and therefore will have no effect on the outcome of a proposal.

Can I change my vote after I have voted?

Shareholders of Record. You may revoke your proxy and change your vote at any time before your shares are voted at the Annual Meeting by taking any of the following actions:

| • | filing with the Company’s Corporate Secretary either a written notice of revocation or a duly executed proxy dated later than the proxy you wish to revoke; |

| • | voting again on a later date via the Internet or by telephone (in which case only your latest Internet or telephone proxy submitted will be counted); or |

| • | attending the Annual Meeting and voting in person (your attendance at the Annual Meeting, in and of itself, will not revoke your proxy). |

5

Table of Contents

Any written notice of revocation or later dated proxy that is mailed must be received by the Company’s Corporate Secretary before the close of business on May 7, 2018, and should be addressed as follows: Callaway Golf Company, Attention: Corporate Secretary, 2180 Rutherford Road, Carlsbad, California 92008. Alternatively, you may hand deliver a written revocation notice or a later dated proxy to the Company’s Corporate Secretary at the Annual Meeting before voting begins.

Beneficial Owners of Shares Held in Street Name. You must follow the instructions provided by your bank, broker, trustee or other nominee if you wish to change your vote.

Why did I receive more than one Notice of Internet Availability of Proxy Materials or proxy card?

If you receive more than one Notice of Internet Availability of Proxy Materials or proxy card, it means you hold shares that are registered in more than one account. To ensure that all of your shares are voted, please mark your votes and date, sign and return each proxy card, or vote your proxy via the Internet or by telephone as instructed on each proxy card.

Who is soliciting these proxies and who is paying the solicitation costs?

The cost of preparing, assembling, printing and mailing the proxy materials and, if applicable, proxy card, and the cost of soliciting proxies relating to the Annual Meeting, will be borne by the Company. The Company may request banks, brokers and other third parties to solicit their customers who beneficially own Common Stock listed of record in the name of such bank, broker or other third party, and the Company will reimburse such banks, brokers and third parties for their reasonableout-of-pocket expenses for such solicitations. The solicitation of proxies by mail may be supplemented by telephone, facsimile, Internet and personal solicitation by directors, officers and other employees of the Company, but no additional compensation will be paid to such individuals. The Company has retained Alliance Advisors LLC to assist in the solicitation of proxies for a base fee of approximately $11,500, plusout-of-pocket expenses.

I share an address with another shareholder, and we received only one paper copy of the proxy materials. How can I obtain an additional copy?

With regard to the delivery of annual reports and proxy statements, under certain circumstances the SEC permits the Company to send a single set of such proxy materials or, where applicable, one Notice of Internet Availability of Proxy Materials, to any household at which two or more shareholders reside if they appear to be members of the same family (unless otherwise requested by one or more of such shareholders). Each shareholder, however, still receives a separate proxy card if he or she receives paper copies. This procedure, known as “householding,” reduces the amount of duplicate information received at a household and reduces mailing and printing costs as well. This year, the Company will be mailing primarily Notices of Internet Availability of Proxy Materials and only a small number of printed copies of the annual report and Proxy Statement to parties who have requested paper copies.

A number of banks, brokers and other third parties have instituted householding and have previously sent a notice to that effect to certain of the Company’s beneficial shareholders whose shares are registered in the name of the bank, broker or other third party. As a result, unless the shareholders receiving such notice gave contrary instructions, only one annual report and one proxy statement or one Notice of Internet Availability of Proxy Materials will be mailed to an address at which two or more such shareholders reside. If any shareholder residing at such an address wishes to receive a separate annual report and proxy statement or Notice of Internet Availability of Proxy Materials in the future, such shareholder should telephone the householding election system (toll-free) at1-800-522-6645.

In addition, (i) if any shareholder who previously consented to householding desires to promptly receive a separate copy of the annual report and proxy statement or Notice of Internet Availability of

6

Table of Contents

Proxy Materials, for each shareholder at his or her same address, or (ii) if any shareholder shares an address with another shareholder and both shareholders at such address desire to receive only a single copy of the annual report and proxy statement or Notice of Internet Availability of Proxy Materials, then such shareholder should, if such shareholder is a beneficial shareholder, contact his or her bank, broker or other third party in whose name the shares are registered or, if such shareholder is a shareholder of record, contact the Company as follows: Callaway Golf Company, Attention: Investor Relations, 2180 Rutherford Road, Carlsbad, California 92008, telephone(760) 931-1771. Upon written or oral request, the Company will promptly deliver a separate copy of the annual report and proxy statement or Notice of Internet Availability of Proxy Materials to any shareholder at a shared address to which a single copy of such material was delivered.

What else is expected to take place at the Annual Meeting?

The main purpose of the Annual Meeting is to conduct the business described in this Proxy Statement. As such, the Company intends to conduct the required business and then have a short question and answer period. The Company does not intend to make a formal presentation to shareholders. Since no presentation is planned, it is expected that the meeting will last only a few minutes.

7

Table of Contents

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

Corporate Governance Guidelines

Corporate governance is the system by which corporations ensure that they are managed ethically and in the best interests of their shareholders. The Company is committed to maintaining high standards of corporate governance, and the Board has adopted Corporate Governance Guidelines to provide the Company’s shareholders and other interested parties with insight into the Company’s corporate governance practices. The Corporate Governance Guidelines are reviewed regularly and updated as appropriate. The full text of the Corporate Governance Guidelines is available on the Company’s website at www.callawaygolf.com under Investor Relations — Corporate Governance. They address, among other topics:

• Board size • Board leadership • Board oversight responsibility • Succession planning • Director and executive officer stock ownership guidelines | • Director independence • Limits on directors serving on other boards • Director compensation • Director orientation and continuing education | • Board membership criteria • Majority vote policy in uncontested director elections • Board access to independent auditors and advisors • Annual Board assessment |

The Company’s Bylaws and Corporate Governance Guidelines provide that a substantial majority of the Company’s directors must be independent. A director is independent only if the director is not a Company employee and the Board has determined that the director has no direct or indirect material relationship to the Company. To be independent, a director must also satisfy any other independence requirements under applicable law or regulation and the listing standards of the New York Stock Exchange (the “NYSE”). In evaluating a particular relationship, the Board considers the materiality of the relationship to the Company, to the director and, if applicable, to any organization with which the director is affiliated. To assist in its independence evaluation, the Board adopted categorical independence standards, which are listed in Appendix A to the Corporate Governance Guidelines. Compliance with these internal and NYSE independence standards is reviewed at least annually. The Board has determined that each of the seven currentnon-management directors is independent. Oliver G. Brewer III, the Company’s President and Chief Executive Officer, is the only current director who is not independent. Therefore, a substantial majority of the Board members is independent, and all director nominees other than Mr. Brewer are independent.

The Nominating and Corporate Governance Committee is responsible, among other things, for developing and recommending to the Board criteria for Board membership and for identifying and recruiting potential Board candidates based on the identified criteria in the context of the Board as a whole and in light of the Board’s needs at a particular time. The Nominating and Corporate Governance Committee has worked with the Board to identify certain minimum criteria that every candidate must meet in order to be considered eligible to serve on the Board: a candidate must (i) exhibit very high personal and professional ethics, integrity and values; (ii) not have any conflicting interest that would materially impair his or her ability to discharge the fiduciary duties of a director; (iii) be committed to the best interests of the Company’s shareholders and be able to represent fairly and equally all shareholders without favoring or advancing any particular shareholder or other constituency; and (iv) be able to devote adequate time to Board activities. A potential candidate will not be considered for a directorship unless he or she satisfies these threshold criteria.

8

Table of Contents

In addition to these minimum threshold criteria, the Board believes that, as a whole, the Board should possess a combination of skills, professional experience, and diversity of backgrounds necessary to oversee the Company’s business. In this regard, the Board has determined that one or more of its members, among other things, should (i) be currently serving as an active executive of another corporation, (ii) have prior experience as a chief executive officer or an operating executive with significant responsibility for operating results, (iii) have public company executive experience, (iv) have public company board experience, (v) have corporate governance experience, (vi) have executive compensation experience, and (vii) have consumer products experience. The Board also believes that one or more of its members should have functional expertise in each of finance, accounting, legal matters, investment banking, technology, manufacturing, international business, research and development, strategic planning, consumer sales and marketing, retail business, and mergers and acquisitions. Potential candidates are evaluated based upon the factors described above as well as their independence and relevant business and industry experience.

The annual evaluation and assessment of the Board and its committees that is performed under the direction of the Nominating and Corporate Governance Committee enables the Board to update its determination of the skills and experience it seeks on the Board as a whole and in individual directors as the Company’s needs evolve and change over time. See the section below entitled, “— Annual Board and Committee Evaluation and Assessment.” In identifying director candidates from time to time, the Board or Nominating and Corporate Governance Committee may establish specific skills and experience that it believes the Company should seek in order to constitute a balanced and effective board.

In addition, although the Board does not have a formal policy regarding diversity, it believes that ethnic, gender and cultural diversity among its members can provide distinct value and is important. In considering a potential new candidate, the Board considers whether he or she would increase the Board’s ethnic, gender or cultural diversity.

Identification of Potential Director Candidates

The Nominating and Corporate Governance Committee uses a variety of methods for identifying director candidates, including professional search firms and recommendations from the Company’s officers, directors, shareholders or other persons. If a shareholder believes that he or she has identified an appropriate candidate who is willing to serve on the Board, the shareholder may submit a written recommendation to the Chair of the Nominating and Corporate Governance Committee, c/o Corporate Secretary at 2180 Rutherford Road, Carlsbad, California 92008. Such recommendation must include detailed biographical information concerning the recommended candidate, including a statement regarding the candidate’s qualifications. The Nominating and Corporate Governance Committee may require such further information and obtain such further assurances concerning the recommended candidate as it deems reasonably necessary. The Nominating and Corporate Governance Committee will evaluate director candidates properly submitted by shareholders in the same manner as it evaluates all other director candidates. In addition to bringing potential qualified candidates to the attention of the Nominating and Corporate Governance Committee as discussed above, a nomination of a person for election to the Board at an annual meeting of shareholders may be made by shareholders who meet the qualifications set forth in the Company’s Bylaws and who make such nominations in accordance with the procedures set forth in the Company’s Bylaws, including the procedures described under the section entitled “Shareholder Proposals” in this Proxy Statement.

The Nominating and Corporate Governance Committee believes that the continuing service of qualified incumbents promotes stability and continuity on the Board and contributes to its ability to function effectively. The continuing service of qualified incumbents also provides the Company with the benefit of the familiarity with and insight into the Company’s affairs that its directors have accumulated

9

Table of Contents

during their tenure. As a result, in considering candidates for nomination for each annual meeting of shareholders, the Nominating and Corporate Governance Committee first considers the Company’s incumbent directors who desire to continue their service. The Nominating and Corporate Governance Committee will generally recommend to the Board an incumbent director forre-election if the Nominating and Corporate Governance Committee has determined that (i) the incumbent director continues to satisfy the threshold criteria described above, (ii) the incumbent director has satisfactorily performed his or her duties as a director during the most recent term and (iii) there exists no reason why, in the Nominating and Corporate Governance Committee’s view, the incumbent director should not bere-elected. If a Board vacancy becomes available as a result of the death, resignation or removal of an incumbent director or as a result of action taken by the Board to increase its size, the Nominating and Corporate Governance Committee proceeds to identify candidates who meet the required criteria and attributes.

Service on Other Public Boards

Under the Company’s Corporate Governance Guidelines, a director may not serve on the board of directors of more than four other public corporations in addition to the Company’s Board. In addition, in advance of accepting an invitation to serve on the board of another public corporation, directors should consult with the Board Chairman or the Chair of the Nominating and Corporate Governance Committee to confirm that service on such other board does not interfere with the director’s service on the Company’s Board or create an unacceptable conflict of interest. Further, no member of the Audit Committee may serve on the audit committee (or board committee performing similar functions) of more than two other public corporations without the prior approval of the Company’s Board. Regardless of a director’s outside activities, a director is always required to be able to devote sufficient time and attention to the Company’s business and to the performance of the director’s duties as a member of the Company’s Board.

Under the Company’s Corporate Governance Guidelines, in an uncontested election of directors, any nominee who has a greater number of votes “withheld” from his or her election than votes “for” such election, which the Company refers to as a “Majority Withheld Vote,” is required to submit in writing an offer to resign to the Board Chairman promptly upon certification of the shareholder vote. The Chairman refers the matter to the Nominating and Corporate Governance Committee, which in turn will consider, among other things, the reasons for the Majority Withheld Vote and will recommend to the Board whether or not to accept the resignation offer. The Board will consider such recommendation and will determine whether to accept the resignation and, if it does not accept the resignation, whether any further action is needed to address the reasons for the Majority Withheld Vote. The Board is required to publicly disclose such determination and the basis therefor. The director nominee who received the Majority Withheld Vote does not participate in the Nominating and Corporate Governance Committee’s recommendation or the Board’s decision.

Annual Board and Committee Assessment and Evaluation

Pursuant to the Company’s Corporate Governance Guidelines, the Board and each of its committees conduct, under the direction of the Nominating and Corporate Governance Committee, an annual assessment of their functionality and effectiveness, including an assessment of the skills and experience that are currently represented on the Board and that the Board will find valuable in the future given the Company’s current situation and strategic plans. As part of this process, the Nominating and Corporate Governance Committee invites input from each director on the performance of each of the other directors. The Nominating and Corporate Governance Committee considers individual director performance at least annually when deciding whether to nominate an incumbent director forre-election.

10

Table of Contents

The Board believes that strong, independent board leadership is a critical aspect of effective corporate governance. The Board Chairman is selected by the Board as it deems to be in the best interests of the Company from time to time, and may be either a management or anon-management director. The Company’s Corporate Governance Guidelines provide that if the Board Chairman is not an independent director (e.g., when the Chairman is also the Chief Executive Officer), then the Board will appoint a lead independent director. The independent chairman or the lead independent director, as the case may be, works with the Company’s Chief Executive Officer and the Company’s Corporate Secretary to set the Board’s work program and meeting agendas, coordinates the activities of the independent directors, serves as a liaison between the Company’s Chief Executive Officer and the independent directors, and presides at the executive sessions (without management) of the independent directors.

The Company currently separates the positions of Board Chairman and Chief Executive Officer in recognition of the differences between the two roles. The Board Chairman is Ronald S. Beard, and Mr. Brewer is our Chief Executive Officer. Separating these positions and having the Chairman lead the Board in its oversight responsibilities enables the Company’s Chief Executive Officer to focus onday-to-day business and his other responsibilities. The Board has determined that the Company’s Board leadership structure is the most appropriate at this time, given the specific characteristics and circumstances of the Company, and the unique skills and experience of each of Mr. Beard and Mr. Brewer. Accordingly, because Mr. Beard, who is an independent director, is serving as Board Chairman, the Board therefore does not currently have a director with the title of lead independent director. A copy of the charter for the Board Chairman position is available on the Company’s website at www.callawaygolf.com under Investor Relations — Corporate Governance — Board Memberships.

The Board oversees an enterprise-wide approach to risk management and works with the Audit Committee and management in executing its oversight responsibility for risk management. The Board generally oversees risks related to the Company’s strategic and operational objectives and is responsible for overseeing the amounts and types of risks taken by management in executing those objectives. In addition, the Board has delegated to the Audit Committee the responsibility for oversight of certain of the Company’s risk oversight and compliance matters, including oversight of (i) material legal proceedings and material contingent liabilities, (ii) the Company’s policies regarding risk assessment and management, (iii) the Company’s compliance programs with respect to legal and regulatory requirements and the Company’s Code of Conduct, and (iv) the establishment of procedures for the receipt and handling of complaints regarding accounting, internal accounting controls and auditing matters. The Board has delegated to the Nominating and Corporate Governance Committee the responsibility for overseeing any related party transactions.

On aday-to-day basis, it is management’s responsibility to manage risk and bring to the attention of the Board any significant risks facing the Company and the controls in place to manage those risks. As part of this responsibility, management conducts a periodic enterprise risk management assessment, which is led by the Company’s corporate audit department. All members of management responsible for key business functions and operations participate in this assessment. The assessment includes an identification, and quantification of the potential impact, of the top risks facing the Company and the controls in place to mitigate such risks as well as possible opportunities to reduce such risks. This report is shared with the Audit Committee and the full Board.

See “Executive Officer Compensation—Governance and Other Considerations—Risk Assessment of Compensation Programs” below for information regarding the Company’s risk assessment of its compensation programs.

11

Table of Contents

The Board currently has three standing committees:

| • | the Audit Committee; |

| • | the Compensation and Management Succession Committee (sometimes referred to as the “Compensation Committee” in this Proxy Statement); and |

| • | the Nominating and Corporate Governance Committee. |

The Board has adopted written charters for each of the three standing committees, copies of which are available on the Company’s website atwww.callawaygolf.comunder Investor Relations — Corporate Governance — Board Committees. Upon request, the Company will provide to any person without charge a copy of such charters. Any such request may be made by contacting the Company’s Investor Relations Department by telephone at(760) 931-1771 or by mail at Callaway Golf Company, Attention: Investor Relations, 2180 Rutherford Road, Carlsbad, California 92008.

The Board has determined that the chair of each committee and all committee members are independent under applicable NYSE and SEC rules for committee memberships. The members of the committees are shown in the table below.

Director | Independent | Audit Committee | Compensation Committee | Nominating and Corporate Governance Committee | ||||

Samuel H. Armacost | ✓ | Chair | Member | — | ||||

Ronald S. Beard | ✓ | Member | Member | Member | ||||

Oliver G. Brewer III | — | — | — | — | ||||

John C. Cushman, III | ✓ | — | Member | Member | ||||

John F. Lundgren | ✓ | Member | Chair | — | ||||

Adebayo O. Ogunlesi | ✓ | Member | — | Chair | ||||

Linda B. Segre | ✓ | — | Member | Member | ||||

Anthony S. Thornley | ✓ | Member | — | Member |

Audit Committee. The Audit Committee is a separately designated standing audit committee established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Audit Committee’s role includes representing and assisting the Board in discharging its oversight responsibility relating to: (a) the accounting, reporting and financial practices of the Company, including the integrity of the Company’s financial statements; (b) the Company’s outside auditors, including their qualifications, performance and independence; (c) the performance of the Company’s internal audit function; and (d) the Company’s compliance with legal and regulatory requirements. The Audit Committee:

| • | is responsible for all matters relating to the Company’s outside auditors, including their appointment, compensation, evaluation, retention, oversight and termination; |

| • | obtains and reviews, at least annually, a report by the outside auditors describing (a) the outside auditors’ internal quality-control procedures and (b) any material issues raised by the most recent internal quality-control review, or peer review, or by any inquiry or investigation by governmental or professional authorities, within the preceding five years, respecting one or more independent audits carried out by the outside auditor, and any steps taken to deal with any such issues; |

| • | reviews and considers, at least annually, the independence of the outside auditors; |

| • | annually reviews and discusses the performance and effectiveness of the internal audit function; |

12

Table of Contents

| • | reviews and discusses the adequacy and effectiveness of the Company’s internal controls, including any material weaknesses or significant deficiencies in internal controls and significant changes in such controls reported to the Audit Committee by the outside auditors or management; |

| • | reviews and discusses the adequacy and effectiveness of the Company’s disclosure controls and procedures and management reports thereon; |

| • | reviews and discusses the Company’s policies with respect to risk assessment and risk management; and |

| • | oversees the Company’s compliance programs with respect to legal and regulatory requirements and the Company’s Code of Conduct, including review of conflict of interest issues. |

Audit Committee Financial Sophistication and Expertise.The Board has determined that each Audit Committee member is financially literate and has the accounting or related financial management expertise within the meaning of NYSE listing standards. The Board has also determined that at least one Audit Committee member qualifies as an Audit Committee Financial Expert as defined by Item 407(d)(5) of RegulationS-K. The Board has designated Mr. Armacost as the Audit Committee Financial Expert. The Board also believes that the collective experiences of the other Audit Committee members make them well qualified to serve on the Audit Committee. Shareholders should understand that Mr. Armacost’s designation as an Audit Committee Financial Expert is an SEC disclosure requirement, and it does not impose on Mr. Armacost any duties, obligations or liabilities that are greater than those which are generally imposed on him as a member of the Audit Committee and the Board, and his designation as an Audit Committee Financial Expert pursuant to this requirement does not affect the duties, obligations or liabilities of any other member of the Audit Committee or the Board.

Additional information regarding the Audit Committee’s responsibilities can be found under the sections entitled “— Risk Oversight,” above and “Audit Committee Report” and “Information Concerning Independent Registered Public Accounting Firm,” below.

Compensation and Management Succession Committee. The Compensation Committee:

| • | oversees the Company’s overall compensation philosophy, policies and programs, and assesses whether the Company’s compensation philosophy establishes appropriate incentives given the Company’s strategic and operational objectives; |

| • | administers and makes recommendations to the Board with respect to the Company’s incentive-compensation plans and equity-based compensation plans, including granting awards under any such plans, and approves, amends or modifies the terms of compensation and benefit plans as appropriate; |

| • | is responsible for discharging the Board’s responsibilities relating to compensation of the Company’s executive officers; |

| • | reviews and approves corporate goals and objectives relevant to the compensation of the Company’s chief executive officer, evaluates his or her performance in light of those goals and objectives, and, together with the other independent members of the Board, determines and approves the chief executive officer’s compensation level based on this evaluation; |

| • | evaluates the performance of the Company’s other executive officers and sets their compensation after considering the recommendation of the Company’s chief executive officer; |

| • | reviews and approves employment agreements and severance arrangements for the Company’s executive officers, includingchange-in-control provisions, plans or agreement; |

13

Table of Contents

| • | is responsible for assisting the Board with management succession issues and planning; |

| • | reviews compensation and benefits plans affecting employees in addition to those applicable to the Company’s executive officers; and |

| • | reviews the compensation of directors for service on the Board and its committees and recommend changes in compensation to the Board. |

Additional information regarding the Compensation Committee’s responsibilities can be found under the section entitled “Executive Officer Compensation,” below.

Nominating and Corporate Governance Committee.The Nominating and Corporate Governance Committee:

| • | identifies and recommends to the Board individuals who are qualified to serve on the Board and who should stand for election at each annual meeting of shareholders; |

| • | oversees the Company’s corporate governance matters and policies, including the Company’s Corporate Governance Guidelines; |

| • | oversees the annual evaluation and assessment of the Board and its committees; |

| • | reviews the leadership structure of the Board and recommends changes to the Board as appropriate; |

| • | makes recommendations to the Board concerning the structure, composition and functioning of the Board and its committees; and |

| • | recommends candidates to the Board for appointment to its committees. |

Additional information regarding the Nominating and Corporate Governance Committee’s responsibilities can be found under the sections entitled “— Director Qualifications,” “— Identification of Potential Director Candidates,” “— Nomination Process” and “— Annual Board and Committee Assessment and Evaluation,” above.

Meetings and Director Attendance

During 2017, the Board met nine times and the independent directors met in executive session at four of those meetings and determined that there was no need to meet in executive session at the other meetings; the Audit Committee met nine times; the Compensation Committee met six times; and the Nominating and Corporate Governance Committee met four times. In addition to meetings, the members of the Board and its committees sometimes take action by written consent in lieu of a meeting, which is permitted under Delaware corporate law, or discuss Company business without calling a formal meeting.

During 2017, all of the Company’s directors attended in excess of 75% of the meetings of the Board and of its committees on which they served. All of the directors standing forre-election are expected to attend the annual meetings of shareholders, and all such directors who were serving on the Board at such time attended the 2017 annual meeting of shareholders.

Shareholders and other interested parties may contact the Board Chairman or thenon-management directors as a group bye-mail at:non-managementdirectors@callawaygolf.com,or by mail to: Board of Directors, Callaway Golf Company, 2180 Rutherford Road, Carlsbad, California 92008. The Company’s Corporate Secretary’s office reviews all incoming communications and filters out solicitations and junk mail. All legitimatenon-solicitation andnon-junk mail communications are distributed to thenon-management directors or handled as appropriate as directed by the Board Chairman.

14

Table of Contents

The Board has adopted a Code of Conduct that applies to all of the Company’s employees, including its senior financial and executive officers, as well as the Company’s directors. The Code of Conduct covers the basic standards of conduct applicable to all directors, officers and employees of the Company, as well as the Company’s Conflicts of Interest and Ethics Policy and other specific compliance standards and related matters. The Company will promptly disclose any waivers of, or amendments to, any provision of the Code of Conduct that apply to the Company’s directors and senior financial and executive officers on its website atwww.callawaygolf.com.

The Code of Conduct is available on the Company’s website at www.callawaygolf.com under Investor Relations — Code of Conduct. Upon request, the Company will provide to any person without charge a copy of the Code of Conduct. Any such request may be made by contacting the Company’s Investor Relations department by telephone at(760) 931-1771 or by mail at Callaway Golf Company, Attention: Investor Relations, 2180 Rutherford Road, Carlsbad, California 92008.

In order to promote ownership of the Common Stock by the Company’snon-management directors and executive officers and thereby more closely align their interests with the interests of the Company’s shareholders, the Board has adopted stock ownership guidelines requiring the Company’snon-management directors and executive officers to own Common Stock interests with a value equal to at least the following minimum amounts:

Chief Executive Officer | 3x Base Salary | |

Other Executive Officers | 1x Base Salary | |

Non-Employee Directors | 3x Annual Base Cash Compensation |

The minimum share ownership amounts are required to be achieved within five years of an individual first becoming subject to these guidelines. All shares for which a director or an executive officer is deemed to be the beneficial owner under Section 16 of the Exchange Act, including shares held in a living trust for the individual’s benefit, count toward this ownership requirement. Restricted stock and service-based restricted stock unit awards held by the director or executive count toward the holding requirements. Performance-based restricted stock units do not count toward this ownership requirement unless and until the performance criteria are satisfied. Stock options, stock appreciation rights, and phantom stock units do not count toward this ownership requirement unless and until any underlying shares are issued. Unless anon-management director or executive officer is in compliance with these guidelines, he or she is required to retain and hold 50% of any “net shares” of Common Stock issued in connection with any equity-based awards granted under the Company’s compensation plans after suchnon-management director or executive officer first becomes subject to these guidelines. “Net shares” are those shares that remain after shares are sold or withheld (i) to pay the exercise price and withholding taxes in the case of stock options or (ii) to pay withholding taxes in the case of other awards. Compliance with these guidelines is assessed on an annual basis. At the time compliance was assessed in 2017, all directors and executive officers attained the minimum ownership levels.

Policy on Speculative Trading Activities — Anti-Hedging and Pledging Policy

The Company’s insider trading policy provides, among other things, that directors, officers and other employees may not engage in certain types of speculative activities with respect to the Company’s securities, including short sales, transactions in put options, call options or other derivative securities, hedging transactions, pledging of Company stock as collateral for a loan, or holding shares of Company stock in a margin account.

15

Table of Contents

Compensation Committee Interlocks and Insider Participation

In 2017, the Company’s executive officer compensation matters were handled by the Compensation Committee, which was during 2017 and is currently comprised of the following directors: Messrs. Armacost, Beard, Cushman, Lundgren and Ms. Segre. Richard L. Rosenfield also served as a member of the Compensation Committee during 2017 until his retirement from the Board in May 2017. During the times of their committee service during 2017, all of such members were determined to be independent and there were no compensation committee interlocks.

Directors who are not also Company employees are compensated for their service on the Board and its committees with a mix of cash and equity-based compensation. Directors are also reimbursed for their travel expenses incurred in connection with their duties, and receive other benefits such as the right to use, and the right to purchase at a discount, the Company’s products. As discussed above, the Compensation Committee periodically reviews the compensation and benefits the directors receive from the Company for service on the Board and on Board committees and recommends changes to the Board. In 2016, the Compensation Committee, with the assistance and counsel of its outside compensation consultant, Mercer LLC, undertook a review of director compensation, which had not been materially changed since 2006. This review included consultation with its independent compensation consultant, Mercer, and a review of various benchmark data. Following such review, the Compensation Committee recommended, and the Board approved, changes to the Company’s compensation program for directors (which changes became effective January 1, 2017). The new director compensation program increased the annual base compensation fornon-employee directors from $45,000 to $75,000 and eliminated the additional daily cash compensation for attendance at Board and Board committee meetings. The Board also increased the equity portion of director compensation to $100,000 in 2017 as compared to the annual $50,000 level that had been in place since 2006.

Mr. Brewer, as the Company’s President and Chief Executive Officer, does not receive any additional cash or equity-based compensation for serving on the Board.

Cash Compensation. During 2017,non-employee directors were paid an annual base cash compensation of $75,000.Non-employee directors who serve as chairs of Board committees are paid an additional annual retainer fee. The Chair of the Audit Committee is paid $15,000; the Chair of the Compensation Committee is paid $12,500; the Chair of the Nominating Committee is paid $10,000; and the Board Chairman is paid an additional annual $40,000 cash retainer.

Equity-Based Compensation. Upon the initial election or appointment of a new director and for each year of continuing service on the Board, anon-employee director is granted stock options, restricted stock, restricted stock units, phantom stock units or a combination thereof as the long-term incentive portion of director compensation. Such equity-based awards are made as of the date of appointment orre-election in the form and amount as determined by the Board on the recommendation of the Compensation Committee. The value and the number of equity awards granted to the directors in 2017 are reported in the table below.

Other Benefits. The Company has a policy that thenon-employee directors should promote the Company’s products by using the Company’s current products whenever they play golf. To assist them in complying with this policy,non-employee directors are entitled to receive a limited amount of the Company’s golf club and golf ball products, free of charge, for their own personal use and the use of immediate family members residing in their households.Non-employee directors also receive a limited amount of other products (e.g., apparel and other accessories) free of charge and the right to purchase a limited amount of additional golf clubs, balls and accessories at a discount that is not material in amount. The aggregate value of this personal benefit did not exceed $10,000 for any director in 2017 and is therefore not required to be reported in the table below.

16

Table of Contents

Director Compensation in Fiscal Year 2017

The following table summarizes the compensation of the Company’snon-employee directors for fiscal year 2017:

Name | Fees Earned or Paid in Cash ($)(1) | Stock Awards ($)(2) | Option Awards ($) | Non-Equity Incentive Plan Compensation ($) | Change in Pension Value and Nonqualified Deferred Compensation Earnings ($) | All Other Compensation ($) | Total ($) | |||||||||||||||||||||

Samuel H. Armacost | $ | 90,000 | $ | 100,000 | $ | — | $ | — | $ | — | $ | — | $ | 190,000 | ||||||||||||||

Ronald S. Beard | $ | 115,000 | $ | 100,000 | $ | — | $ | — | $ | — | $ | — | $ | 215,000 | ||||||||||||||

John C. Cushman, III | $ | 75,000 | $ | 100,000 | $ | — | $ | — | $ | — | $ | — | $ | 175,000 | ||||||||||||||

John F. Lundgren | $ | 87,500 | $ | 100,000 | $ | — | $ | — | $ | — | $ | — | $ | 187,500 | ||||||||||||||

Adebayo O. Ogunlesi | $ | 85,000 | $ | 100,000 | $ | — | $ | — | $ | — | $ | — | $ | 185,000 | ||||||||||||||

Richard L. Rosenfield(3) | $ | 25,343 | $ | — | $ | — | $ | — | $ | — | $ | — | $ | 25,343 | ||||||||||||||

Linda B. Segre | $ | 75,000 | $ | 100,000 | $ | — | $ | — | $ | — | $ | — | $ | 175,000 | ||||||||||||||

Anthony S. Thornley | $ | 75,000 | $ | 100,000 | $ | — | $ | — | $ | — | $ | — | $ | 175,000 | ||||||||||||||

(1) Mr. Beard was paid an additional $40,000 for service as Board Chair. Mr. Armacost was paid an additional $15,000 for service as Audit Committee Chair. Mr. Lundgren was paid an additional $12,500 for service as Compensation Committee Chair. Mr. Ogunlesi was paid an additional $10,000 for service as Nominating Committee Chair.

(2) Represents the aggregate grant date fair value of restricted stock units (“RSUs”) calculated for financial reporting purposes for the year utilizing the provisions of Accounting Standards Codification Topic 718, “Compensation — Stock Compensation” (“ASC 718”). See Note 15, “Share-Based Compensation,” to the Company’s Audited Consolidated Financial Statements set forth in the Company’s Form10-K for the year ended December 31, 2017 for information concerning the ASC 718 values, which are based on the fair value of the Common Stock on the date of grant. In 2017, eachnon-employee director who wasre-elected to the Board was granted 8,621 RSUs with a grant date fair value of $100,000 as continuing service awards, which, subject to continued service, generally vest on theone-year anniversary of the grant date. As of December 31, 2017, eachnon-employee director had 8,640 RSUs outstanding, including accrued share dividend equivalents.

(3) Mr. Rosenfield retired from the Board in May 2017.

17

Table of Contents

PROPOSAL NO. 1 - ELECTION OF DIRECTORS

The terms of all of the Company’s directors expire at the Annual Meeting. Upon the recommendation of the Nominating and Corporate Governance Committee, the Board has nominated the eight current directors identified in the table below to stand for election at the Annual Meeting to serve until the 2019 annual meeting of shareholders and until their respective successors are elected and qualified.

Director Nominee | Positions with the Company | |

Oliver G. (Chip) Brewer III | President and Chief Executive Officer | |

Ronald S. Beard | Chairman of the Board | |

Samuel H. Armacost | Director | |

John C. Cushman, III | Director | |

John F. Lundgren | Director | |

Adebayo O. Ogunlesi | Director | |

Linda B. Segre | Director | |

Anthony S. Thornley | Director |

Each director nominee has consented to being named in this Proxy Statement as a nominee and has agreed to serve as a director if elected. If any one or more of such nominees should for any reason become unavailable for election, the persons named in the accompanying form of proxy may vote for the election of such substitute nominees as the Board may propose. The accompanying form of proxy contains a discretionary grant of authority with respect to this matter. There is no family relationship between any director, executive officer, or person nominated or chosen by the Company to become a director or executive officer.

| Oliver G. (Chip) Brewer III | Director and President and Chief Executive Officer | |

Age:54

Director Since: 2012

Board Committees: None | Since 2012, Mr. Brewer has served as the Company’s President and Chief Executive Officer and as a member of the Board. He has also, since 2012, served as a Director of Topgolf International, Inc., in which the Company has a minority ownership interest. Additionally, Mr. Brewer currently serves on the National Golf Foundation’s Board. From January 2002 to February 2012, Mr. Brewer served as the President and Chief Executive Officer and as a member of the board of Adams Golf, Inc. He was President and Chief Operating Officer of Adams Golf from August 2000 to January 2002 and served as its Senior Vice President of Sales and Marketing from September 1998 to August 2000. Mr. Brewer is a graduate of William and Mary College and received his MBA from Harvard Business School in 1991.

Specific Qualifications, Attributes, Skills & Experience Mr. Brewer is highly qualified, and was renominated, to serve on the Board, among other reasons, because the Board believes it is important to have the Company’s Chief Executive Officer serve on the Board as he is the one closest to the Company’sday-to-day operations. In addition, Mr. Brewer has extensive experience in the golf industry, public golf company board and executive officer experience, and has functional expertise in finance, human resources and manufacturing, international business, research and development, strategic planning, consumer sales and marketing, selling to retailers, and mergers and acquisitions.

|

18

Table of Contents

| Ronald S. Beard | Chairman of the Board | |

Age:79

Director Since: 2001

Board Committees:Audit, Compensation, Nominating and Corporate Governance

| Mr. Beard has served as Board Chairman since 2005 and held the position of Lead Independent Director from August 2002 until that position was merged into his position as Chairman. Mr. Beard is currently a partner in the Zeughauser Group, consultants to the legal industry. Mr. Beard is a retired former partner of the law firm of Gibson, Dunn & Crutcher LLP. He joined the firm in 1964, served as Chairman of the firm from April 1991 until December 2001, and was also its Managing Partner from April 1991 untilmid-1997. Mr. Beard served as the Company’s general outside counsel from 1998 until he joined the Board. Mr. Beard also served as a board member of Javo Beverage Company from 2004 until 2011 and as a board member of Document Sciences Corporation from 2004 until 2008 when it was sold. He received his law degree in 1964 from Yale Law School.

Specific Qualifications, Attributes, Skills & Experience Mr. Beard is highly qualified, and was renominated, to serve on the Board, among other reasons, due to his extensive experience with the Company as a Board member and previously as its primary outside legal advisor. Mr. Beard, among other things, has other public company board experience, and experience with corporate governance, executive compensation, as well as executive officer experience as chairman of a leading global law firm. Mr. Beard also has functional expertise in finance, accounting, legal matters, international business, strategic planning, and mergers and acquisitions.

| |

| Samuel H. Armacost | Director | |

Age:78

Director Since: 2003

Board Committees:Audit (Chair), Compensation | From 1981 to 2010, Mr. Armacost served as a Director of SRI International (formerly Stanford Research Institute), an independent nonprofit research institute, and was its Chairman from 1998 to March 2010 and Chairman Emeritus from April 2010 through December 2016. He was Managing Director of Weiss, Peck & Greer LLC (an investment management and venture capital firm) from 1990 to 1998. He was Managing Director of Merrill Lynch Capital Markets from 1987 to 1990. He was President and Chief Executive Officer of BankAmerica Corporation from 1981 to 1986. He also served as Chief Financial Officer of BankAmerica Corporation from 1979 to 1981. Mr. Armacost also served as a board member of Chevron Corporation from 1982 to 2011, of Del Monte Foods, Inc. from 2002 to 2011, of Exponent, Inc. from 1989 to 2013 and of Franklin Resources, Inc. from 2004 to 2014. Mr. Armacost is a graduate of Denison University and received his MBA from Stanford University in 1964.

Specific Qualifications, Attributes, Skills & Experience Mr. Armacost is highly qualified, and was renominated, to serve on the Board, among other reasons, due to his extensive experience with the Company as a Board member as well as his prior chief executive officer experience of a public company, his other public company board experience, and his experience with corporate governance and executive compensation. He also has functional expertise in finance, accounting, investment banking, human resources/compensation, technology, international business, research and development, strategic planning, and mergers and acquisitions.

|

19

Table of Contents

| John C. Cushman, III | Director | |

Age:77

Director Since: 2003

Board Committees:Compensation, Nominating and Corporate Governance

| Mr. Cushman is Chairman, Global Transactions of Cushman & Wakefield, Inc. He has served as its Chairman,Co-Chairman or Senior Advisor, Office of the CEO, since it merged with Cushman Realty Corporation in 2001. Mr. Cushmanco-founded Cushman Realty Corporation in 1978 and also served as its Chief Executive Officer. Mr. Cushman also serves as Director and Chief Executive Officer of Cushman Winery Corporation, which is the owner of Zaca Mesa Winery, and which heco-founded in 1972. Mr. Cushman is a 1963 graduate of Colgate University where he also earned an Honorary Doctorate in Humane Letters in 2008, and he completed the Advanced Management Program at Harvard University in 1977.

Specific Qualifications, Attributes, Skills & Experience Mr. Cushman is highly qualified, and was renominated, to serve on the Board, among other reasons, due to his extensive experience with the Company as a Board member as well as his current executive position with Cushman & Wakefield, his prior chief executive officer experience, his other public company board experience, and his experience with corporate governance and executive compensation. Mr. Cushman also has functional expertise in finance, human resources/compensation, international business, strategic planning, the retail industry, and mergers and acquisitions.

| |

| John F. Lundgren | Director | |

Age:66

Director Since: 2009

Board Committees:Audit, Compensation (Chair)

| Mr. Lundgren served as Chairman and Chief Executive Officer of Stanley Black & Decker, Inc., from 2004 through July 2016, after which time he served as Special Advisor to the company through April 2017. Stanley Black & Decker, Inc. is the successor entity following the merger of The Stanley Works and Black and Decker in March 2010. Prior to the merger, Mr. Lundgren served as Chairman and Chief Executive Officer of The Stanley Works, a worldwide supplier of consumer products, industrial tools and security solutions for professional, industrial and consumer use. Prior to joining The Stanley Works in 2004, Mr. Lundgren served as President — European Consumer Products, of Georgia Pacific Corporation and also held various positions in finance, manufacturing, corporate development and strategic planning with Georgia Pacific and its predecessor companies, namely James River Corporation from 1995 to 1997 and Fort James Corporation from 1997 to 2000. Mr. Lundgren began his business career in brand management at the Gillette Corporation. Mr. Lundgren is currently a member of the board of directors of VISA Inc. Mr. Lundgren also served as a member of the board of directors of Staples, Inc. prior to its sale to a private equity fund in September 2017. Mr. Lundgren is a graduate of Dartmouth College and received his MBA from Stanford University.

Specific Qualifications, Attributes, Skills & Experience Mr. Lundgren is highly qualified, and was renominated, to serve on the Board, among other reasons, due to his prior experience with the Company as a Board member as well as his recent experience as a chief executive officer of a public company, his prior operating experience, and his experience with corporate governance and executive compensation matters. Mr. Lundgren also has functional expertise in finance, human resources/compensation, manufacturing, international business, strategic planning, consumer sales and marketing, retail sell-through, and mergers and acquisitions.

|

20

Table of Contents

| Adebayo O. Ogunlesi | Director | |

Age:64

Director Since: 2010

Board Committees:Audit, Nominating and Corporate Governance (Chair)

| Mr. Ogunlesi is Chairman and Managing Partner of Global Infrastructure Management, LLC, a private equity firm with over $40.0 billion in assets under management and which invests worldwide in infrastructure assets in the energy, transport, and water and waste industry sectors. Prior to founding Global Infrastructure Management, Mr. Ogunlesi spent 23 years at Credit Suisse where he held senior positions, including Executive Vice Chairman and Chief Client Officer and prior to that Global Head of Investment Banking. Mr. Ogunlesi is currently a member of the board of directors of The Goldman Sachs Group, a position he has held since 2012, and Kosmos Energy Ltd., a position he has held since 2004. Mr. Ogunlesi holds a B.A. (First Class Honours) in Politics, Philosophy and Economics from Oxford University, a J.D. (magna cum laude) from Harvard Law School and an M.B.A. from Harvard Business School. Prior to joining Credit Suisse, he was an attorney with the New York law firm of Cravath, Swaine & Moore. From 1980 to 1981, he served as a Law Clerk to the Honorable Thurgood Marshall, Associate Justice of the United States Supreme Court.

Specific Qualifications, Attributes, Skills & Experience Mr. Ogunlesi is highly qualified, and was renominated, to serve on the Board, among other reasons, due to his prior service on the Company’s Board, his current executive officer position at Global Infrastructure Management, LLC, and his experience with investment banking, legal matters, corporate governance and executive compensation. Mr. Ogunlesi also has functional expertise in finance, international business, strategic planning, and mergers and acquisitions.

| |

| Linda B. Segre | Director | |

Age:58

Director Since: 2015

Board Committees: Compensation, Nominating and Corporate Governance

| Ms. Segre served as Executive Vice President, Chief Strategy and People Officer of Diamond Foods, Inc., a San Francisco-based, publicly-traded company that produced premium snack food and culinary nut products, from 2009 until its sale in February 2016. Ms. Segre first joined Diamond Foods in 2009 as Senior Vice President, Corporate Strategy. Before joining Diamond Foods, Ms. Segre served as Managing Director of Google.org and Vice President and Managing Director of The Boston Consulting Group’s San Francisco Office. From 1981 until 1985, Ms. Segre was a touring golf professional in the United States, Europe and Asia having won five tournaments including the Irish Open and the Reno Open. Ms. Segre holds a degree in economics and an MBA from Stanford University.

Specific Qualifications, Attributes, Skills & Experience Ms. Segre is highly qualified, and was nominated, to serve on the Board, among other reasons, due to her extensive public company executive officer experience, her extensive knowledge of corporate strategy and the consumer products industry and the unique perspective regarding the golf business that she brings as a former professional golfer. Ms. Segre also has functional expertise in finance, investor relations, human resources, executive compensation, strategic planning, and mergers and acquisitions.

|

21

Table of Contents

| Anthony S. Thornley | Director | |

Age:71

Director Since: 2004

Board Committees:Audit, Nominating and Corporate Governance