SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

[ ] Preliminary Proxy Statement

[x] Definitive Proxy Statement

[ ] Definitive Additional Materials

[ ] Soliciting Material Pursuant to Rule 14a-11(c) or Rule 14a-12

PACHOLDER HIGH YIELD FUND, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

[X] No fee required

[ ] Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11: |

| | (4) | Proposed maximum aggregate value of transaction: |

[ ] Fee paid previously with preliminary materials.

[ ] Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing.

(1) Amount Previously Paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Date Filed:

PACHOLDER HIGH YIELD FUND, INC.

8044 Montgomery Road, Suite 555

Cincinnati, OH 45236

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To be held on April 5, 2007

March 1, 2007

To the Shareholders:

The Annual Meeting of the shareholders of Pacholder High Yield Fund, Inc. (the “Fund”) will be held on April 5, 2007, at 10:30 a.m., Eastern Time, at the Towers of Kenwood, 8044 Montgomery Road, East Tower in the First Floor Conference Room, Cincinnati, Ohio, for the following purposes:

1. To elect a Board of four Directors to serve until the next Annual Meeting and until their successors are elected and qualified (Proposal 1); and

2. To consider and act upon such other business as may properly come before the meeting and any adjournments thereof.

The close of business on February 23, 2007 has been fixed as the record date for the determination of shareholders entitled to receive notice of and to vote at the meeting.

By Order of the Board of Directors,

Jessica K. Ditullio

Secretary

WHETHER OR NOT YOU EXPECT TO ATTEND THE MEETING, PLEASE SIGN THE ENCLOSED PROXY AND RETURN IT PROMPTLY IN THE ENVELOPE PROVIDED. YOUR PROMPT RETURN OF THE PROXY WILL HELP ENSURE A QUORUM AT THE MEETING AND AVOID THE EXPENSE TO THE FUND OF FURTHER SOLICITATION.

PACHOLDER HIGH YIELD FUND, INC.

8044 Montgomery Road, Suite 555

Cincinnati, OH 45236

PROXY STATEMENT

Annual Meeting of Shareholders to be held April 5, 2007

This proxy statement is being furnished in connection with the solicitation of proxies by the Board of Directors of Pacholder High Yield Fund, Inc. (the “Fund”) for use at the Annual Meeting of shareholders to be held on April 5, 2007 and at any adjournments thereof. If the enclosed proxy is executed properly and returned in time to be voted at the meeting, the shares represented will be voted according to the instructions contained therein. Executed proxies that are unmarked will be voted for the election of all nominees for director. A proxy may be revoked at any time prior to its exercise by filing with the Secretary of the Fund a written notice of revocation, by delivering a duly executed proxy bearing a later date, or by attending the meeting and voting in person. This proxy statement and the related proxy card will be mailed to shareholders on or about March 1, 2007.

The Board of Directors has fixed the close of business on February 23, 2007 as the record date for the determination of shareholders entitled to notice of and to vote at the meeting and any adjournments thereof. As of the record date, the Fund had outstanding 12,940,868 shares of Common Stock and 2,640 shares of Series W Auction Rate Cumulative Preferred Stock.

The presence in person or by proxy of the holders entitled to cast a majority of all the votes entitled to be cast at the meeting will constitute a quorum for the transaction of business at the Annual Meeting. Broker non-votes, abstentions and withhold-authority votes all count for the purpose of determining a quorum. If a quorum is present at the meeting but sufficient votes in favor of one or more proposals are not received, the persons named as proxies may propose one or more adjournments of the meeting to permit further solicitation of proxies. Any such adjournment will require the affirmative vote of a majority of the shareholders present at the meeting in person or by proxy. The votes of shareholders indicating a vote against a Board proposal in their proxies will be cast against adjournment or postponement in respect of that proposal.

PROPOSAL 1: ELECTION OF DIRECTORS

The Board of Directors, based on the recommendation of the Nominating Committee which met on December 12, 2007, has nominated the four persons listed below for election as directors, each to hold office until the next Annual Meeting of shareholders and until his successor is elected and qualified. Each of the nominees is currently serving as a director of the Fund and was elected at the 2006 Annual Meeting of shareholders, which was held on April 5, 2006.

Each nominee has consented to being named in this proxy statement and has agreed to serve as a director of the Fund if elected; however, should any nominee become unable or unwilling to accept nomination or election, the persons named in the proxy will exercise their voting power in favor of such other person or persons as the Board of Directors of the Fund may recommend. There are no family relationships among the nominees.

Under the Fund’s charter, the holders of the outstanding shares of Auction Rate Cumulative Preferred Stock, voting as a separate class, are entitled to elect two directors and the holders of the outstanding shares of Common Stock and Auction Rate Cumulative Preferred Stock, voting together as a single class, are entitled to elect the

remaining directors of the Fund. The Board of Directors has nominated Messrs. Morgan and Woodard for election by holders of the Auction Rate Cumulative Preferred Stock and Messrs. Grant and Williamson for election by the holders of the Common Stock and Auction Rate Cumulative Preferred Stock, voting together as a single class. The directors will be elected by a plurality of the votes cast at the meeting, provided that a quorum is present. Votes to withhold authority will not be considered votes cast for this purpose. The following tables set forth information concerning the nominees. The Fund is the only portfolio overseen by the nominees for director. None of the directors hold office as a director in a company with a class of securities registered under the Securities Exchange Act of 1934, as amended (“Exchange Act”), or subject to the requirements of Section 15(d) of the Exchange Act, other than the Fund, or any other company registered as an investment company under the Investment Company of 1940, as amended (“1940 Act”).

| | | | | | |

Name, Address

and Age

| | Position(s) Held

with the Fund

| | Term of Office and

Length of Time Served

| | Principal Occupation(s)

During Past 5 Years

|

Interested Director | | | | | | |

William J. Morgan* 8044 Montgomery Road Suite 555 Cincinnati, OH 45236 Age 52 | | Director | | Elected annually; director since 1988. | | From March 1, 2005 to present, Managing Director, J.P. Morgan Investment Management Inc., the Fund’s investment adviser. Prior to March 1, 2005, President, Treasurer and Director, Pacholder Associates, Inc. (investment adviser and parent company of predecessor investment adviser, Pacholder & Company, LLC); Prior to October 20, 2006, President of Pacholder High Yield Fund, Inc. |

| | |

Non-Interested Directors | | | | |

John F. Williamson 8044 Montgomery Road Suite 555 Cincinnati, OH 45236 Age 68 | | Chairman of the Board | | Elected annually; Chairman of the Board since February 2004 and director since 1991. | | Retired; Chairman and President, Williamson Associates, Inc. (investment adviser) January 1997 to June 2002; Director of ICO Inc. (energy company), April 1995 to May 2002, Chairman from June 2001 to May 2002 |

| | | |

George D. Woodard 8044 Montgomery Road Suite 555 Cincinnati, OH 45236 Age 60 | | Director | | Elected annually; director since 1995. | | Manager, Henry & Horne, LLP (certified public accountants) |

| | | |

Daniel A. Grant 8044 Montgomery Road Suite 555 Cincinnati, OH 45236 Age 62 | | Director | | Elected annually; director since 1992. | | President, Utility Management Services (business consulting) |

| * | Mr. Morgan is considered an “interested person” of the Fund as defined in the 1940 Act because of his affiliation with the Fund’s investment adviser. |

THE BOARD OF DIRECTORS RECOMMENDS THAT SHAREHOLDERS VOTE FOR THE ELECTION OF THE NOMINEES LISTED ABOVE.

2

Fund Shares Owned by Directors

The following table sets forth, for each director, the dollar range of equity shares beneficially owned in the Fund as of January 31, 2007. The information as to beneficial ownership is based on statements furnished to the Fund by each director. Beneficial ownership means having directly or indirectly, through any contract, arrangement, understanding, relationship or otherwise, a direct or indirect pecuniary interest in shares of the Fund, and includes shares of the Fund held by members of the person’s immediate family sharing the same household; provided, however, that the presumption of such beneficial ownership may be rebutted. Unless otherwise noted, each director’s individual beneficial shareholdings of the Fund constitute less than 1% of the outstanding shares of the Fund.

| | |

Name of Director

| | Dollar Range of Fund Shares

Beneficially Owned

|

William J. Morgan* | | Over $100,000 |

George D. Woodard | | Over $100,000 |

Daniel A. Grant | | $10,001-$50,000 |

John F. Williamson | | $50,001 to $100,000 |

| * | Mr. Morgan is considered an “interested person” of the Fund as defined in the 1940 Act because of his affiliation with the Fund’s investment adviser. |

Audit Committee, Nominating Committee and Board of Directors Meetings

The Board of Directors has an audit committee composed entirely of directors who are not “interested persons” of the Fund, J.P. Morgan Investment Management Inc. (“JPMIM”), the Fund’s investment adviser, or its affiliates as that term is defined in the 1940 Act (the “Audit Committee”). The Audit Committee operates pursuant to a written charter, which was most recently amended on May 24, 2004 and is attached hereto as Appendix 1. The Audit Committee is responsible for conferring with the Fund’s independent accountants, reviewing the scope and procedures of the year-end audit, reviewing annual and semi-annual financial statements and recommending the selection of the Fund’s independent accountants. In addition, the Audit Committee may address questions arising with respect to the valuation of certain securities in the Fund’s portfolio. George D. Woodard, Chairman of the Audit Committee, has been designated as an audit committee financial expert. Mr. Woodard is an independent director of the Fund. The report of the Audit Committee, as approved on February 23, 2007 is attached to this proxy statement as Appendix 2.

The Board of Directors has a nominating committee composed entirely of directors who are not “interested persons” of the Fund, JPMIM or its affiliates as that term is defined in the 1940 Act (“Nominating Committee”). The members of the Nominating Committee are George D. Woodard, Daniel A. Grant and John F. Williamson. The Nominating Committee operates pursuant to a written charter (the “Nominating Committee Charter”), which was adopted in December 2004, was last amended on December 12, 2006 and is attached hereto as Appendix 3. The Nominating Committee is responsible for identifying, evaluating, and recommending for nomination, candidates for the Board of Directors. The Nominating Committee may consider candidates for the Board of Directors submitted by current directors, the Fund’s investment adviser or its affiliates, the shareholders of the Fund or other appropriate sources. Shareholders can submit recommendations in writing to the attention of the Nominating Committee at 8044 Montgomery Road, Suite 555, Cincinnati, Ohio 45236. A candidate should have certain characteristics, such as a very high level of integrity, appropriate experience, and a commitment to fulfill the fiduciary duties inherent in board membership. The Nominating Committee will consider and evaluate

3

candidates submitted by shareholders on the basis of the same criteria as those used to consider and evaluate candidates submitted from other sources. The Nominating Committee also will consider the extent to which potential candidates possess sufficiently diverse skill sets and diversity characteristics that would contribute to the Board’s overall effectiveness. A detailed description of the criteria used by the Nominating Committee as well as the information required to be provided by shareholders submitting candidates for consideration is set forth in the Nominating Committee Charter. The nominees for director listed in this proxy statement are all current directors of the Fund.

During the fiscal year ended December 31, 2006, the Board of Directors met six times. All directors attended all of the Board meetings except for the meeting held on June 2, 2006 at which three of the four directors were in attendance. The Audit Committee held four meetings during 2006 at which all committee members were in attendance. The Nominating Committee met twice during 2006 at which all committee members were in attendance. The Board of Directors does not have a formal policy regarding Board member attendance at the Fund’s annual meetings. There was one member of the Board of Directors in attendance at the Fund’s 2006 Annual Meeting of shareholders.

Officers of the Fund

The officers of the Fund are elected by and hold office at the discretion of the Board of Directors of the Fund. The following table sets forth information concerning each executive officer of the Fund as well as the Chief Compliance Officer and the Secretary and Chief Legal Officer. The officers have served in these capacities since October 20, 2006.

| | | | | | |

Name, Address

and Age

| | Position(s) Held

with the Fund

| | Term of Office and

Length of Time Served

| | Principal Occupation(s)

During Past 5 Years

|

| | | |

Gary J. Madich, CFA* 1111 Polaris Parkway, Columbus, OH 43271-0152 Age 51 | | President | | Position held since October 20, 2006. | | Since February 1995, Managing Director and Chief Investment Officer of JPMorgan Investment Advisors, Inc. (formerly Banc One Investment Advisors Corporation); from 1998 until December 31, 2006, manager, Pacholder & Company, LLC. |

| | | |

Joseph F. Sanzone* 245 Park Avenue New York, NY 10167 Age 36 | | Vice President | | Position held since October 20, 2006 | | Vice President, JPMorgan Funds Management, Inc. since February 2005; Mr. Sanzone has served in various roles at JPMorgan Asset Management since 1995. |

| | | |

Arthur A. Jensen* 1111 Polaris Parkway Columbus, OH 43271-0152 Age 40 | | Treasurer | | Position held since October 20, 2006. | | Vice President, JPMorgan Funds Management, Inc. since April 2005; formerly, Vice President of Financial Services, BISYS Fund Services, Inc. from 2001 until 2005. |

4

| | | | | | |

Name, Address

and Age

| | Position(s) Held

with the Fund

| | Term of Office and

Length of Time Served

| | Principal Occupation(s)

During Past 5 Years

|

| | | |

Jessica K. Ditullio* 1111 Polaris Parkway Columbus, OH 43271-0152 Age 44 | | Secretary and Chief Legal Officer | | Position held since October 20, 2006 | | Vice President and Assistant General Counsel, JPMorgan Chase & Co. since 2005; Ms. Ditullio has served as an attorney with various titles for JPMorgan Chase & Co. (formerly Bank One Corporation) since 1990. |

| | | |

Penny D. Grandominico* 1111 Polaris Parkway Columbus, OH 43271-0152 Age 57 | | Chief Compliance Officer | | Position held since October 20, 2006 | | Vice President and Compliance Manager, JPMorgan Chase & Co. since February 2006; from August 2004 until February 2006, Compliance Director, BISYS Fund Services, Inc.; from March 1999 to August 2004, Compliance Manager, Banc One Investment Advisors Corporation. |

| * | Messrs. Madich, Sanzone and Jensen and Mesdames Ditullio and Grandominico are considered “interested persons” of the Fund as defined in the 1940 Act because of their affiliation with the Fund’s Adviser or its affiliates. |

Compensation of Directors and Officers

The Fund pays each director who is not an employee of the adviser or any corporate affiliate of the adviser an annual fee of $15,000 plus $1,750 for each meeting of the Board of Directors, Audit Committee, or Nominating Committee attended in person or $1,000 for each meeting attended by telephone, and reimburses directors for travel and other out-of-pocket expenses incurred by them in connection with attending in-person meetings.

The officers of the Fund receive no direct remuneration from the Fund. The Fund’s officers are compensated by advisory affiliates of JPMorgan Chase & Co. for services rendered to the Fund. The following table sets forth the information concerning the compensation paid by the Fund to directors during the fiscal year ended December 31, 2006.

| | | |

Name and Position

| | Aggregate Compensation

from the Fund (1)

|

John F. Williamson

Chairman of the Board | | $ | 33,500 |

William J. Morgan*

Director | | | $0 |

George D. Woodard

Director | | $ | 33,500 |

Daniel A. Grant

Director | | $ | 33,500 |

| (1) | The Fund does not offer any pension or retirement plan benefits to its directors or officers. |

| * | Mr. Morgan is considered an “interested person” of the Fund as defined in the 1940 Act because of his affiliation with the Fund’s investment adviser |

5

Procedures for Communications to the Board of Directors

The Board of Directors has adopted a process for shareholders to send communications to the Board. To communicate with the Board of Directors or an individual director, a shareholder must send written communications to 8044 Montgomery Road, Suite 555, Cincinnati, Ohio 45236, addressed to the Board of Directors of Pacholder High Yield Fund, Inc. or the individual director. All shareholder communications received in accordance with this process will be forwarded to the Board of Directors or the individual director.

Share Ownership and Certain Beneficial Owners

To the Fund’s knowledge, no person owned beneficially 5% or more of the outstanding shares of the Fund, as of the record date, other than First Trust Portfolios L.P., First Trust Advisors L.P., and The Charger Corporation, 1001 Warrenville Road, Lisle, Ill 60532 (collectively, the “Reporting Persons”), which, pursuant to a Schedule 13G filed by the Reporting Persons with the SEC on June 10, 2005, beneficially owned 844,059 of the common shares which if still owned as of the record date, would be 6.5% of the Fund’s common shares. As of February 23, 2007, the directors and officers of the Fund as a group owned beneficially 90,594 shares of the Common Stock of the Fund.

Section 16(a) Beneficial Owner Reporting Compliance

Based on information submitted to the Fund, all directors and officers of the Fund filed on a timely basis with the Securities and Exchange Commission (“SEC”) the reports of beneficial ownership of Fund shares required by Section 16(a) of the Exchange Act except a Form 3 was not timely filed to report David A. Groshoff’s appointment as the Fund’s former Chief Compliance Officer. A Form 3 was filed on November 8, 2006 to report this event and a Form 5 was filed on February 13, 2007 to reflect that Mr. Groshoff is no longer required to file such reports. Mr. Groshoff did not own any shares of the Fund.

OTHER BUSINESS

The management of the Fund knows of no other business that may come before the Annual Meeting. If any additional matters are properly presented at the meeting, the persons named in the accompanying proxy, or their substitutes, will vote such proxy in accordance with their best judgment on such matters.

INFORMATION CONCERNING THE ADVISER AND THE ADMINISTRATOR

J.P. Morgan Investment Management Inc., 245 Park Avenue, New York, NY 10167 serves as the Adviser. JPMorgan Funds Management, Inc., 1111 Polaris Parkway, Columbus, OH 43240 serves as the Fund’s administrator. J.P. Morgan Funds Management, Inc. and J.P. Morgan Investment Management Inc. are indirect wholly owned subsidiaries of JPMorgan Chase & Co.

INFORMATION CONCERNING THE INDEPENDENT AUDITORS

The Board of Directors has selected PricewaterhouseCoopers LLP (“PwC”) as the independent auditors for the Fund for the fiscal year ending December 31, 2007. PwC will also prepare the Fund’s federal and state

6

income tax returns and provide certain permitted non-audit services. PwC, in accordance with Independence Standards Board Standard No. 1, has confirmed to the Audit Committee that they are independent auditors with respect to the Fund. The Audit Committee has considered whether the provision by PwC to the Fund of non-audit services to the Fund or of professional services to the Fund’s investment adviser and entities that control, are controlled by or are under common control with the adviser is compatible with maintaining PwC’s independence and has discussed PwC’s independence with them. Representatives of PwC are not expected to be present at the Annual Meeting but have been given the opportunity to make a statement if they so desire and will be available should any matter arise requiring their presence. PwC served as the Fund’s independent auditors for the fiscal years ended December 31, 2005 and 2006.

Audit Fees

The aggregate fees billed by PwC for professional services rendered for the audit of the Fund’s annual financial statements, and the review of the financial statements included in the Fund’s reports to shareholders, for fiscal years ended December 31, 2005 and 2006 were $52,000 and $73,600, respectively.

Audit Related Fees

The aggregate fees billed by PwC for professional services rendered reasonably related to the performance of the audit or review of the Fund’s financial statements for fiscal years ended December 31, 2005 and 2006 were $9,000 and $5,000, respectively. Audit related fees include amounts for attestation services and review of internal controls.

Tax Fees

The aggregate fees billed by PwC for professional services rendered for tax compliance, tax advice and tax planning for fiscal years ended December 31, 2005 and 2006 were $3,750 and $4,300, respectively. Tax fees include amounts for tax compliance, tax planning and tax advice.

All Other Fees

The aggregate fees billed by for professional services rendered for services other than audit, audit related, and tax compliance, tax advice and tax planning for fiscal years ended December 31, 2005 and 2006 were $5,000 and $0, respectively. These fees include amounts for research regarding the booking of certain assets.

The aggregate non-audit fees billed by PwC for professional services rendered to the Fund, the Adviser, and any entity controlling, controlled by, or under common control with the Adviser for fiscal years ended December 31, 2005 and December 31, 2006 were $55,300,000 and $57,074,000, respectively. All non-audit services discussed above were pre-approved by the Audit Committee, who considered whether these services were compatible with maintaining PwC’s independence.

SOLICITATION OF PROXIES

In addition to solicitation by mail, solicitations on behalf of the Board of Directors may be made by personal interview, telegram and telephone. Certain officers and regular agents of the Fund, who will receive no additional

7

compensation for their services, may use their efforts, by telephone or otherwise, to request the return of proxies. The costs of the Annual Meeting, including the costs of preparing, assembling, mailing and transmitting proxy materials and of soliciting proxies on behalf of the Board of Directors, will be borne by the Fund. The Fund will reimburse, upon request, broker-dealers and other custodians, nominees and fiduciaries for their reasonable expenses of sending proxy solicitation materials to beneficial owners.

SHAREHOLDER PROPOSALS

If a shareholder wishes to present a proposal for inclusion in the proxy statement for the next Annual Meeting of shareholders, the proposal must be submitted in writing and received by the Secretary of the Fund within a reasonable time before the Fund begins to print and mail its proxy materials.

SHAREHOLDER REPORTS

The Fund’s Annual Report for the fiscal year ended December 31, 2006 may be obtained without charge by calling the Fund toll free at 1-888-294-8217 or by writing to Pacholder High Yield Fund, Inc., 8044 Montgomery Road, Suite 555, Cincinnati, OH 45236.

8

Appendix 1

PACHOLDER HIGH YIELD FUND, INC.

AUDIT COMMITTEE CHARTER

| I. | Audit Committee Membership and Qualifications |

The Audit Committee of Pacholder High Yield Fund, Inc. (the “Company”) shall consist of at least three (3) members appointed by the Company’s Board of Directors (the “Board”). The Board may replace members of the Audit Committee for any reason.

No member of the Audit Committee shall be an “interested person” of the Company, as that term is defined in Section 2(a)(19) of the Investment Company Act of 1940, nor shall any member receive any compensation from the Company except compensation for service as a member of the Board or a committee of the Board. Each member of the Committee must be “financially literate” — that is, be able to read and understand fundamental financial statements, including a balance sheet, income statement and cash flow statement.

The Board shall determine annually whether any member of the Audit Committee is an “audit committee financial expert” as defined in Item 3 of Form N-CSR.

| II. | Purposes of the Audit Committee |

The purposes of the Audit Committee are:

| | (a) | to oversee the accounting and financial reporting processes of the Company and its internal control over financial reporting and, as the Committee deems appropriate, to inquire into the internal control over financial reporting of certain third-party service providers; |

| | (b) | to oversee the quality and integrity of the Company’s financial statements and the independent audit thereof; |

| | (c) | to oversee, or, as appropriate, assist Board oversight of, the Company’s compliance with legal and regulatory requirements that relate to the Company’s accounting and financial reporting, internal control over financial reporting and independent audits; |

| | (d) | to approve prior to appointment the engagement of the Company’s independent auditors and, in connection therewith, to review and evaluate the qualifications, independence and performance of the Company’s independent auditors; |

| | (e) | to act as a liaison between the Company’s independent auditors and the full Board; and |

| | (f) | to prepare an audit committee report as required by Item 306 of Regulation S-K to be included in proxy statements relating to the election of directors. |

The independent auditors for the Company shall report directly to the Audit Committee.

1

| III. | Duties and Responsibilities of the Audit Committee |

To carry out its purposes, the Audit Committee shall have the following duties and responsibilities:

| | (a) | to approve prior to appointment the engagement of auditors to annually audit and provide their opinion on the Company’s financial statements, to recommend to those Board members who are not “interested persons” (as that term is defined in Section 2(a)(19) of the Investment Company Act) the selection, retention or termination of the Company’s independent auditors and, in connection therewith, to review and evaluate matters potentially affecting the independence and capabilities of the auditors. In evaluating the auditors’ qualifications, performance and independence, the Committee must, among other things, obtain and review a report by the auditors, at least annually, describing all relationships between the auditors and the Company, as well as the Company’s investment adviser or any control affiliate of the adviser that provides ongoing services to the Company. It is a responsibility of the Audit Committee to engage actively in a dialogue with the auditors with respect to any disclosed relationship or services that may impact the objectivity and independence of the auditors and to take, or recommend that the full Board take, appropriate action to oversee the independence of the auditors; |

| | (b) | to approve prior to appointment the engagement of the auditors to provide other audit services to the Company or to provide non-audit services to the Company, its investment adviser or any entity controlling, controlled by, or under common control with the investment adviser (“adviser affiliate”) that provides ongoing services to the Company, if the engagement relates directly to the operations and financial reporting of the Company; |

| | (c) | to develop, to the extent deemed appropriate by the Audit Committee, policies and procedures for pre-approval of the engagement of the Company’s auditors to provide any of the services described in (b) above; |

| | (d) | to consider the controls applied by the auditors and any measures taken by management in an effort to assure that all items requiring pre-approval by the Audit Committee are identified and referred to the Committee in a timely fashion; |

| | (e) | to consider whether the non-audit services provided by the Company’s auditors to the Company’s investment adviser or any adviser affiliate that provides ongoing services to the Company, which services were not pre-approved by the Audit Committee, are compatible with maintaining the auditors’ independence; |

| | (f) | to review the arrangements for and scope of the annual audit and any special audits; |

| | (g) | to review and approve the fees proposed to be charged to the Company by the auditors for each audit and non-audit service; |

| | (h) | to consider information and comments from the auditors with respect to the Company’s accounting and financial reporting policies, procedures and internal control over financial reporting (including the Company’s critical accounting policies and practices), to consider management’s responses to any such comments and, to the extent the Audit Committee deems necessary or appropriate, to promote improvements in the quality of the Company’s accounting and financial reporting; |

| | (i) | to consider information and comments from the auditors with respect to, and meet with the auditors to discuss any matters of concern relating to, the Company’s financial statements, including any adjustments to such statements recommended by the auditors, and to review the auditors’ opinion on the Company’s financial statements; |

2

| | (j) | to resolve disagreements between management and the auditors regarding financial reporting; |

| | (k) | to review with the Company’s principal executive officer and/or principal financial officer in connection with required certifications on Form N-CSR any significant deficiencies in the design or operation of internal control over financial reporting or material weaknesses therein and any reported evidence of fraud involving management or other employees who have a significant role in the Company’s internal control over financial reporting; |

| | (l) | to establish procedures for the receipt, retention and treatment of complaints received by the Company, its investment adviser, administrator, principal underwriter or any other provider of accounting related services to the Company, relating to accounting, internal accounting controls or auditing matters, and the confidential, anonymous submission to the Company of concerns about accounting or auditing matters, and to address reports from attorneys or auditors of possible violations of federal or state law or fiduciary duty; |

| | (m) | to investigate or initiate an investigation of reports of improprieties or suspected improprieties in connection with the Company’s accounting or financial reporting; |

| | (n) | to report its activities to the full Board on a regular basis and to make such recommendations with respect to the above and other matters as the Audit Committee may deem necessary or appropriate; and |

| | (o) | to perform such other functions and to have such powers as may be necessary or appropriate in the efficient and lawful discharge of the duties and responsibilities provided in this Charter. |

The Audit Committee shall have the resources and authority appropriate to discharge its responsibilities, including appropriate funding, as determined by the Committee, for payment of compensation to the auditors for the purpose of conducting the audit and rendering their audit report, the authority to retain and compensate special counsel and other experts or consultants as the Committee deems necessary, and the authority to obtain specialized training for Audit Committee members, at the expense of the Company, as appropriate.

The Audit Committee may delegate any portion of its authority, including the authority to grant pre-approvals of audit and permitted non-audit services, to a subcommittee of one or more members. Any decisions of the subcommittee to grant pre-approvals shall be presented to the full Audit Committee at its next regularly scheduled meeting.

| IV. | Function of the Audit Committee |

The function of the Audit Committee is oversight; it is management’s responsibility to maintain appropriate systems for accounting and internal control over financial reporting, and the auditors’ responsibility to plan and carry out a proper audit. Specifically, Company’s management is responsible for: (1) the preparation, presentation and integrity of the Company’s financial statements; (2) the maintenance of appropriate accounting and financial reporting principles and policies; and (3) the maintenance of internal control over financial reporting and other procedures designed to assure compliance with accounting standards and related laws and regulations. The independent auditors are responsible for planning and carrying out an audit consistent with applicable legal and professional standards and the terms of their engagement letter. Nothing in this Charter shall be construed to reduce the responsibilities or liabilities of the Company’s service providers, including the auditors.

3

Although the Audit Committee is expected to take a detached and questioning approach to the matters that come before it, the review of a Company’s financial statements by the Audit Committee is not an audit, nor does the Committee’s review substitute for the responsibilities of the Company’s management for preparing, or the independent auditors for auditing, the financial statements. Members of the Audit Committee are not full-time employees of the Company and, in serving on this Committee, are not, and do not hold themselves out to be, acting as accountants or auditors. As such, it is not the duty or responsibility of the Committee or its members to conduct “field work” or other types of auditing or accounting reviews or procedures.

In discharging their duties the members of the Audit Committee are entitled to rely on information, opinions, reports or statements, including financial statements and other financial data, if prepared or presented by: (1) one or more officers of the Company whom the director reasonably believes to be reliable and competent in the matters presented; (2) legal counsel, public accountants or other persons as to matters the director reasonably believes are within the person’s professional or expert competence; or (3) a Board committee of which the director is not a member.

| V. | Operations of the Audit Committee |

| | (a) | The Audit Committee shall meet on a regular basis and at least four (4) times annually and is empowered to hold special meetings as circumstances require. The chair or a majority of the members shall be authorized to call a meeting of the Audit Committee and send notice thereof. |

| | (b) | The Audit Committee shall ordinarily meet in person; however, members may attend telephonically, and the Committee may act by written consent, to the extent permitted by law and by the Company’s bylaws. |

| | (c) | The Audit Committee shall have the authority to meet privately and to admit non-members individually by invitation. |

| | (d) | The Audit Committee shall regularly meet, in separate executive sessions, with representatives of Company management and the Company’s independent auditors. The Committee may also request to meet with internal legal counsel and compliance personnel of the Company’s investment adviser and with entities that provide significant accounting or administrative services to the Company to discuss matters relating to the Company’s accounting and compliance as well as other Company-related matters. |

| | (e) | The Audit Committee shall prepare and retain minutes of its meetings and appropriate documentation of decisions made outside of meetings by delegated authority. |

| | (f) | The Audit Committee may select one of its members to be the chair and may select a vice chair. |

| | (g) | A majority of the members of the Audit Committee shall constitute a quorum for the transaction of business at any meeting of the Committee. The action of a majority of the members of the Audit Committee present at a meeting at which a quorum is present shall be the action of the Committee. |

| | (h) | The Board shall adopt and approve this Charter and may amend it on the Board’s own motion. The Audit Committee shall review this Charter at least annually and recommend to the full Board any changes the Committee deems appropriate. |

As of December 12, 2006

4

Appendix 2

PACHOLDER HIGH YIELD FUND, INC.

(the “Fund”)

AUDIT COMMITTEE REPORT

The Audit Committee of the Board of Directors of the Fund met on February 23, 2007 to review the Fund’s audited financial statements for the fiscal year ended December 31, 2006. The Audit Committee operates pursuant to a charter last amended May 24, 2004 and reviewed by the Audit Committee on December 12, 2006, that sets forth the roles of the Fund’s management, independent auditors, the Board of Directors and the Audit Committee in the Fund’s financial reporting process. Pursuant to the charter, the Fund’s management is responsible for the preparation, presentation and integrity of the Fund’s financial statements, internal controls, and for the procedures designed to assure compliance with accounting standards and applicable laws and regulations. The independent auditors for the Fund are responsible for planning and carrying out proper audits and reviews. The role of the Audit Committee is to assist the Board of Directors in its oversight of the financial reporting process by, among other things, reviewing the scope and results of the Fund’s annual audit with the Fund’s independent auditors and recommending the initial and ongoing engagement of such auditors.

In performing its oversight function, the Audit Committee has reviewed and discussed the audited financial statements with the Fund’s management and its independent auditors, PricewaterhouseCoopers LLP. The Audit Committee has discussed with PricewaterhouseCoopers LLP the matters required to be discussed by Statement on Auditing Standards No. 61 and has received the written disclosures and the letter from PricewaterhouseCoopers LLP required by Independence Standards Board Standard No. 1. The Audit Committee also has discussed the independence of PricewaterhouseCoopers LLP with PricewaterhouseCoopers LLP.

Members of the Audit Committee rely without independent verification on the information provided and the representations made to them by management and PricewaterhouseCoopers LLP. Accordingly, the Audit Committee’s oversight does not provide an independent basis to determine that management has maintained appropriate accounting and financial reporting principles and policies or appropriate internal controls and procedures designed to ensure compliance with accounting standards and applicable laws and regulations. Furthermore, the Audit Committee’s considerations and discussions referred to above do not guarantee that the audit of the Fund’s financial statements has been carried out in accordance with generally accepted auditing standards, that the financial statements are presented in accordance with generally accepted accounting principles or that PricewaterhouseCoopers LLP is in fact “independent.”

Based upon this review and related discussions, and subject to the limitations on the role and responsibilities of the Audit Committee set forth above and in the charter, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in the Fund’s Annual Report for the year ended December 31, 2006.

This report has been approved by all of the members of the Audit Committee (whose names are listed below), each of whom has been determined to be independent pursuant to Section 121(A) of the American Stock Exchange’s listing standards.

Submitted by the Audit Committee

of the Fund’s Board of Directors

George D. Woodard (Chairman)

Daniel A. Grant

John F. Williamson

As approved on February 23, 2007

1

Appendix 3

PACHOLDER HIGH YIELD FUND, INC.

NOMINATING COMMITTEE CHARTER

The Board of Directors (the “Board”) of Pacholder High Yield Fund, Inc. (the “Fund”) has established a Nominating Committee (the “Committee”), which is constituted and has the responsibilities and exercises the powers and authority delegated by the Board, as set forth in this Nominating Committee Charter (“Charter”) as from time to time amended.

| I. | Membership and Qualifications |

The Committee shall be composed of those members of the Board who are not officers of the Fund or otherwise “interested persons” of the Fund within the meaning of Section 2(a)(19) of the Investment Company Act of 1940, as amended (“1940 Act”). The members of the Committee shall receive no compensation from the Fund except compensation for service as a member of the Fund’s Board or a committee of the Board and shall be free from any relationship that, in the opinion of the Board, would interfere with their exercise of independent judgment as members of the Committee.

| II. | Purposes and Function of the Committee |

The purposes of the Committee are:

| | (1) | To identify and recommend for nomination candidates to serve as Board members who are not “interested persons” of the Fund as that term is defined in the 1940 Act (“Independent Directors”); |

| | (2) | To evaluate and make recommendations to the full Board regarding potential Board candidates who are “interested persons” of the Fund (“Interested Persons”) as that term is defined by the 1940 Act; |

| | (3) | To review periodically the workload and capabilities of Board members and, as the Committee deems appropriate, to make recommendations to the Board if such a review suggests that changes to the size or composition of the Board are warranted; and |

| | (4) | To review periodically the amount of compensation payable to the Independent Directors and other Directors who are not employees of the investment adviser of the Fund and report its findings and recommendation to the Board. |

To carry out its purpose, the Committee has the following duties and powers:

| | (1) | To consider recommendations for candidates from any source it deems appropriate, including shareholders. The names of potential candidates may be accepted from Board members, the Fund’s shareholders, legal counsel to the Fund or other such sources as the Committee deems appropriate. |

| | (2) | To evaluate candidates’ qualifications for Board membership and their independence from the Fund’s investment adviser and other principal service providers. The Committee shall consider the effect of any relationships delineated in the 1940 Act or other types of relationships (e.g., business, financial or |

1

| | family relationships with the investment adviser or other principal service providers) that might impair independence. In determining candidates’ qualifications for Board membership, the Committee may consider all factors it may determine to be relevant to fulfilling the role of being a member of the Board. |

| | (3) | To recommend to the Board the selection and nomination of candidates for election as director, whether proposed to be appointed by the Board or to be elected by shareholders. |

| | (4) | To review the composition of the Board and each committee thereof and the backgrounds and skill sets of the Board and committee members to determine whether it may be appropriate to recommend adding or removing directors. The Committee shall propose to the Board and the Independent Directors changes to the number of positions on the Board and each committee. The Committee shall also review as necessary the responsibilities of any committees of the Board, whether there is a continuing need for each committee, whether there is a need for additional committees, and whether committees should be combined or reorganized. |

| | (5) | To review the compensation of the Independent Directors and such other Directors who are not employees of the investment adviser. The Committee shall also make recommendations to the Board regarding other matters relating to compensation, including deferred compensation plans, expense reimbursement policies and related policies for the Independent Directors and other Directors who are not employees of the investment adviser. |

| IV. | Criteria for Selecting Nominees |

The Committee shall nominate candidates for new or vacant Board positions based on its evaluation of which applicants or potential candidates are most qualified to serve and protect the interests of the Fund’s shareholders and to promote the effective operations of the Board. In order for the Committee to consider an applicant or potential candidate, the Committee initially must receive at least the following information regarding such person: (1) name; (2) date of birth; (3) education; (4) business, professional or other relevant experience and areas of expertise; (5) current business, professional or other relevant experience and areas of expertise; (6) current business and home addresses and contact information; (7) other board positions and/or prior board experience; and (8) any knowledge and experience relating to investment companies and investment company governance (collectively, “Preliminary Information”).

A successful candidate should have certain uniform characteristics, such as a very high level of integrity, appropriate experience, and a commitment to fulfill the fiduciary duties inherent in Board membership. The Committee also shall consider the extent to which potential candidates possess sufficiently diverse skill sets and diversity characteristics that would contribute to the Board’s overall effectiveness.

| V. | Submissions by Shareholders of Potential Nominees |

The Committee shall consider potential candidates for nomination identified by one or more shareholders of the Fund. Shareholders can submit recommendations in writing to the attention of the Committee at the Fund’s address. In order to be considered by the Committee, any shareholder recommendation must include the Preliminary Information set forth in Section IV above.

2

Following an initial evaluation by the Committee based on the Preliminary Information, a successful candidate proposed by a shareholder must:

| | (1) | Demonstrate the integrity, experience, sound business judgment, talents and commitment necessary to fulfill the fiduciary duties inherent in Board membership and to add value to the Board’s performance of its duties; |

| | (2) | Be prepared to submit written answers to a questionnaire seeking professional and personal information that will assist the Committee in evaluating the candidate and determining, among other matters, whether the candidate would qualify as an Independent Director under the 1940 Act or otherwise have material relationships with principal service providers to the Fund; |

| | (3) | Submit character references and agree to appropriate background checks; |

| | (4) | Demonstrate the disposition to act independently from management, but effectively within a board composed of a number of members; |

| | (5) | Be willing to meet with one or more members of the Committee at a time and location convenient to those Committee members in order to discuss the candidate’s qualifications; and |

| | (6) | If nominated, elected and qualified, be able to prepare for and attend in person Board and committee meetings at various locations in the United States. |

The Committee shall evaluate those Interested Persons who are proposed by management of the Fund to serve as Board members and then make appropriate recommendations to the Board regarding such proposed nominees. The Committee shall review such information as it deems appropriate in order to make this evaluation. At its option, the Committee also can seek to interview any such potential nominee.

| | (1) | The Committee may select one of its members to be the chair. |

| | (2) | The Committee shall hold meetings as circumstances require. The chair or a majority of the members shall be authorized to call a meeting of the Committee and send notice thereof. Meetings may be in person or by telephone, and the Committee may act by written consent, to the extent permitted by law and the Fund’s bylaws. |

| | (3) | The Committee shall have the authority to meet privately, to admit non-members individually by invitation and to retain special counsel and other experts or consultants. |

| | (4) | A majority of the members of the Committee shall constitute a quorum for the transaction of business at any meeting of the Committee. The action of a majority of the members of the Committee present at a meeting at which a quorum is present shall be the action of the Committee. |

| | (5) | The Committee shall prepare and retain minutes of its meetings and the appropriate documentation of decisions made outside of meetings by delegated authority. |

| | (6) | The Board shall adopt and approve this Charter and may amend it on the Board’s own motion. The Committee shall review this Charter periodically and recommend to the full Board any changes the Committee deems appropriate. |

As amended December 12, 2006

3

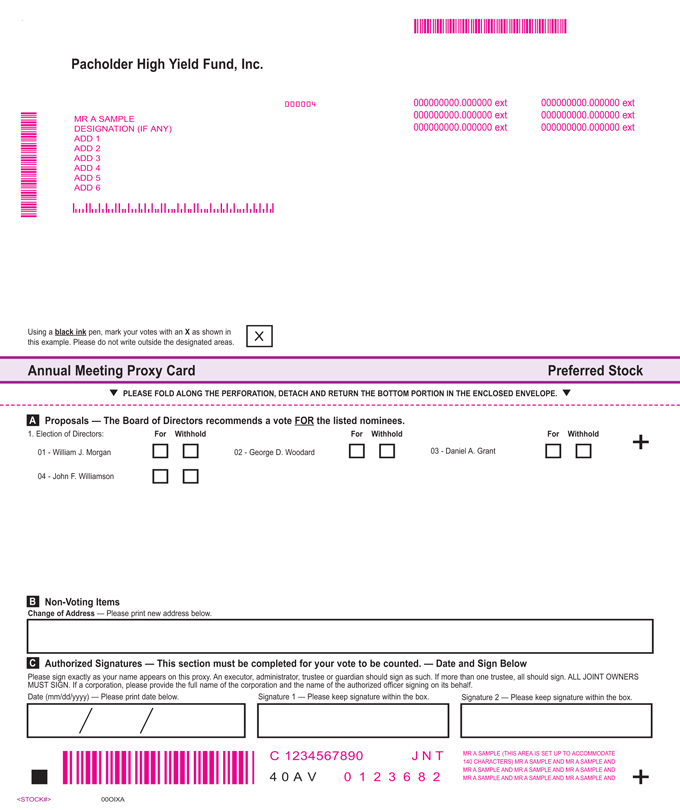

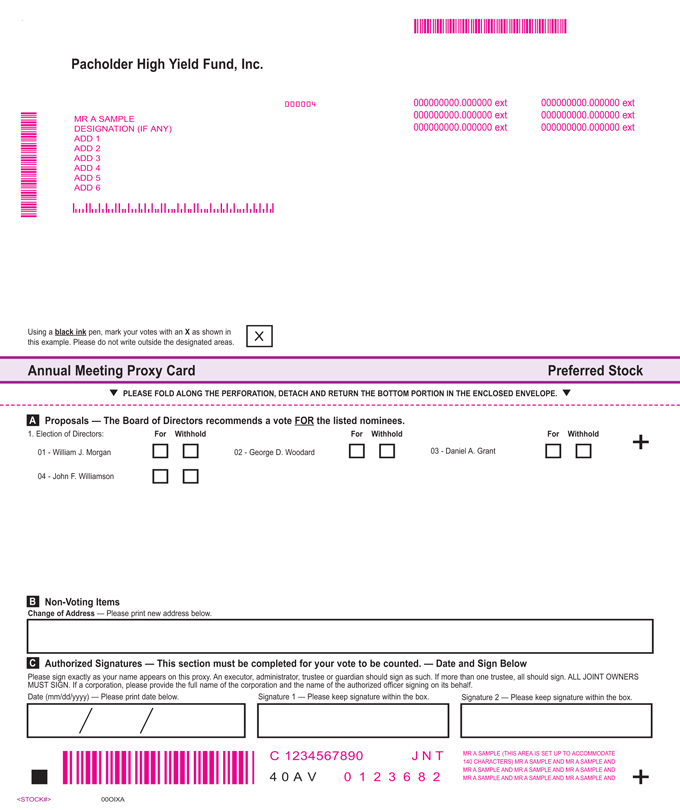

Pacholder High Yield Fund, Inc. 000004 000000000.000000 ext 000000000.000000 ext 000000000.000000 ext

000000000.000000 ext 000000000.000000 ext 000000000.000000 ext

MR A SAMPLE DESIGNATION (IF ANY) ADD 1 ADD 2 ADD 3 ADD 4 ADD 5 ADD 6

Using a black ink pen, mark your votes with an X as shown in this example. Please do not write outside the designated areas.

Annual Meeting Proxy Card Preferred Stock

t PLEASE FOLD ALONG THE PERFORATION, DETACH AND RETURN THE BOTTOM PORTION IN THE ENCLOSED ENVELOPE. t A Proposals — The Board of Directors recommends a vote FOR the listed nominees.

1. Election of Directors: For Withhold For Withhold For Withhold 01 -William J. Morgan

02 -George D. Woodard 03 -Daniel A. Grant 04 -John F. Williamson

B Non-Voting Items Change of Address — Please print new address below.

C Authorized Signatures — This section must be completed for your vote to be counted. — Date and Sign Below

Please sign exactly as your name appears on this proxy. An executor, administrator, trustee or guardian should sign as such. If more than one trustee, all should sign. ALL JOINT OWNERS MUST SIGN. If a corporation, please provide the full name of the corporation and the name of the authorized officer signing on its behalf.

Date (mm/dd/yyyy) — Please print date below. Signature 1 — Please keep signature within the box. Signature 2 — Please keep signature within the box. C 1234567890 J N T MR A SAMPLE (THIS AREA IS SET UP TO ACCOMMODATE 40 A V 0 1 2 3 6 8 2 140 CHARACTERS) MR A SAMPLE AND MR A SAMPLE AND MR A SAMPLE AND MR A SAMPLE AND MR A SAMPLE AND MR A SAMPLE AND MR A SAMPLE AND MR A SAMPLE AND

<STOCK#> 00OIXA

t PLEASE FOLD ALONG THE PERFORATION, DETACH AND RETURN THE BOTTOM PORTION IN THE ENCLOSED ENVELOPE. t

Proxy — Pacholder High Yield Fund, Inc. 2007 ANNUAL MEETING

Series W Auction Rate Cumulative Preferred Stock, $.01 Par Value This proxy is solicited on behalf of the Board of Directors

The undersigned hereby appoints William J. Morgan, James E. Gibson and James P. Shanahan, Jr., and each of them, as proxies with power of substitution, and hereby authorizes each of them to represent and to vote as designated on the reverse side, all the shares of Series W Auction Rate Cumulative Preferred Stock, par value $.01 per share, of Pacholder High Yield Fund, Inc. which the undersigned is entitled to vote at the Annual Meeting of shareholders to be held on April 5, 2007, and at any adjournments thereof.

This proxy, when properly executed, will be voted in the manner directed herein by the undersigned shareholder. If no direction is given, this proxy will be voted “FOR” all proposals. In their discretion, the proxies are authorized to vote upon such other business as may properly come before the meeting. PLEASE BE SURE TO SIGN AND DATE THIS PROXY AND RETURN USING THE ENVELOPE PROVIDED.

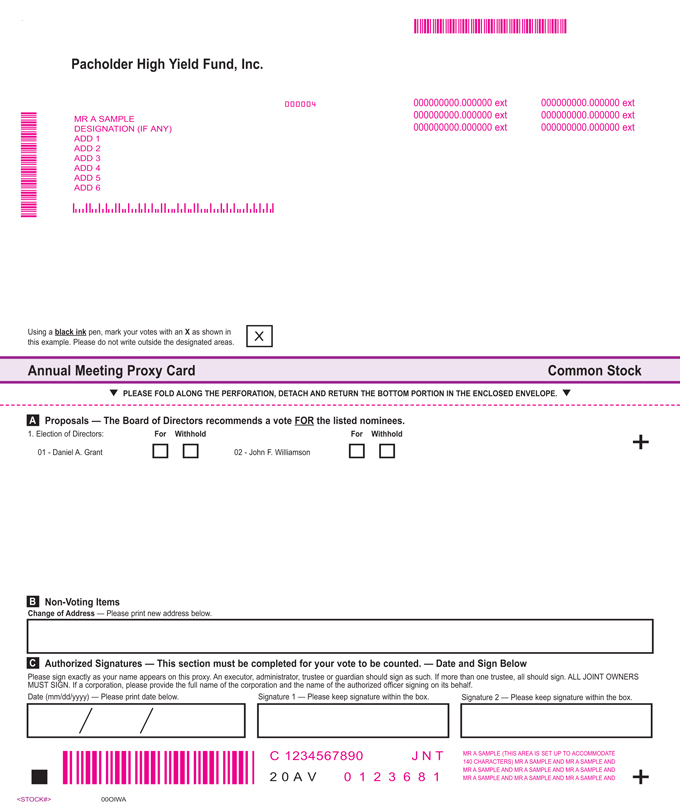

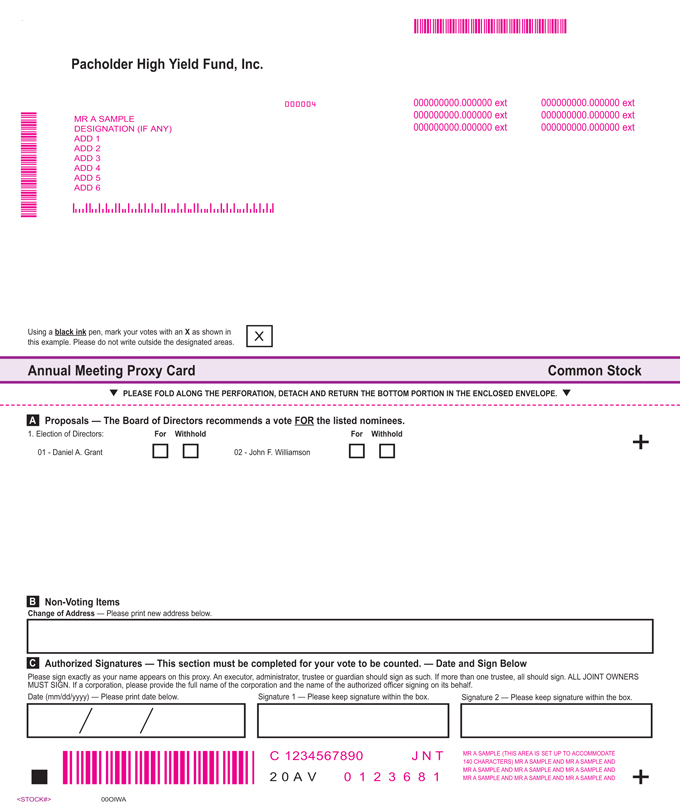

Pacholder High Yield Fund, Inc. 000004 000000000.000000 ext 000000000.000000 ext 000000000.000000 ext 000000000.000000 ext 000000000.000000 ext 000000000.000000 ext

MR A SAMPLE DESIGNATION (IF ANY) ADD 1 ADD 2 ADD 3 ADD 4 ADD 5 ADD 6

Using a black ink pen, mark your votes with an X as shown in this example. Please do not write outside the designated areas. Annual Meeting Proxy Card Common Stock

t PLEASE FOLD ALONG THE PERFORATION, DETACH AND RETURN THE BOTTOM PORTION IN THE ENCLOSED ENVELOPE. t A Proposals — The Board of Directors recommends a vote FOR the listed nominees.

1. Election of Directors: For Withhold For Withhold 01 - Daniel A. Grant 02 -John F. Williamson

B Non-Voting Items Change of Address — Please print new address below. C Authorized Signatures — This section must be completed for your vote to be counted. — Date and Sign Below

Please sign exactly as your name appears on this proxy. An executor, administrator, trustee or guardian should sign as such. If more than one trustee, all should sign. ALL JOINT OWNERS MUST SIGN. If a corporation, please provide the full name of the corporation and the name of the authorized officer signing on its behalf. Date (mm/dd/yyyy) — Please print date below. Signature 1 — Please keep signature within the box. Signature 2 — Please keep signature within the box.

C 1234567890 J N T MR A SAMPLE (THIS AREA IS SET UP TO ACCOMMODATE 2 0 A V 0 1 2 3 6 8 1 140 CHARACTERS) MR A SAMPLE AND MR A SAMPLE AND MR A SAMPLE AND MR A SAMPLE AND MR A SAMPLE AND MR A SAMPLE AND MR A SAMPLE AND MR A SAMPLE AND <STOCK#> 00OIWA

t PLEASE FOLD ALONG THE PERFORATION, DETACH AND RETURN THE BOTTOM PORTION IN THE ENCLOSED ENVELOPE. t Proxy — Pacholder High Yield Fund, Inc. 2007 ANNUAL MEETING Common Stock, $.01 Par Value This proxy is solicited on behalf of the Board of Directors

The undersigned hereby appoints William J. Morgan, James E. Gibson and James P. Shanahan, Jr., and each of them, as proxies with power of substitution, and hereby authorizes each of them to represent and to vote as designated below on this card, all the shares of Common Stock, par value $.01 per share, of Pacholder High Yield Fund, Inc. which the undersigned is entitled to vote at the Annual Meeting of shareholders to be held on April 5, 2007, and at any adjournments thereof.

This proxy, when properly executed, will be voted in the manner directed herein by the undersigned shareholder. If no direction is given, this proxy will be voted “FOR” all proposals. In their discretion, the proxies are authorized to vote upon such other business as may properly come before the meeting. PLEASE BE SURE TO SIGN AND DATE THIS PROXY AND RETURN USING THE ENVELOPE PROVIDED.