| OMB APPROVAL |

OMB Number: 3235-0570 Expires: August 31, 2011 Estimated average burden hours per response: 18.9 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number ___811-05646

New Century Portfolios

(Exact name of registrant as specified in charter)

| 40 William Street, Suite 100 Wellesley, Massachusetts | 02481 |

| (Address of principal executive offices) | (Zip code) |

Nicole M. Tremblay, Esq.

Weston Financial Group, Inc. 40 William Street, Suite 100 Wellesley, MA 02481

(Name and address of agent for service)

Registrant's telephone number, including area code: (781) 235-7055

Date of fiscal year end: October 31, 2009

Date of reporting period: October 31, 2009

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Reports to Stockholders. |

NEW CENTURY P O R T F O L I O S New Century Capital New Century Balanced New Century Opportunistic New Century International New Century Alternative Strategies ANNUAL REPORT Year Ended October 31, 2009

40 William Street, Suite 100, Wellesley MA 02481 781-239-0445 888-639-0102 Fax 781-237-1635 |

CONTENTS

| PRESIDENT’S LETTER TO SHAREHOLDERS | 2-3 |

| | |

| PERFORMANCE CHARTS | 4-6 |

| | |

| PORTFOLIO INFORMATION | 7-11 |

| | |

| NEW CENTURY PORTFOLIOS | |

| Schedules of Investments | 12-20 |

| Statements of Assets and Liabilities | 21 |

| Statements of Operations | 22 |

| Statements of Changes in Net Assets | 23-25 |

| Financial Highlights | 26-30 |

| Notes to Financial Statements | 31-41 |

| Report of Independent Registered Public Accounting Firm | 42 |

| Board of Trustees and Officers | 43-44 |

| Federal Tax Information | 44 |

| About Your Portfolio’s Expenses | 45-47 |

| Trustees Approval of Investment Advisory Agreements | 48-51 |

| LETTER TO SHAREHOLDERS | December 2009 |

Dear Fellow Shareholders:

I am pleased to present our 20th Annual Report. This Report contains important financial information for each of the New Century Portfolios. For additional information, I invite you to visit our website at www.newcenturyportfolios.com.

Although investors may find it impossible to believe, the overall domestic equity market, as measured by the S&P 500Æ Composite Index, clawed back a healthy, and more importantly, a positive return for the trailing twelve-month period, ended October 31, 2009. After bottoming out on March 9th, the market has recovered to October 2008 levels. Although we were unfortunate witnesses to a historic financial crisis, we have since participated in an equally impressive rebound off of the market bottom. We believe that many variables contributed to the global economic recovery. The expansive U.S. economic stimulus package helped to stabilize the credit markets and the housing markets. The stimulus plans, coupled with a rebound in investor sentiment and better than expected corporate earnings, provided the foundation that we believe is required for a recovery. While we are pleased and comforted by the rebound, we remain cautiously optimistic as we enter 2010 as market dynamics continue to be highly unpredictable and fragile.

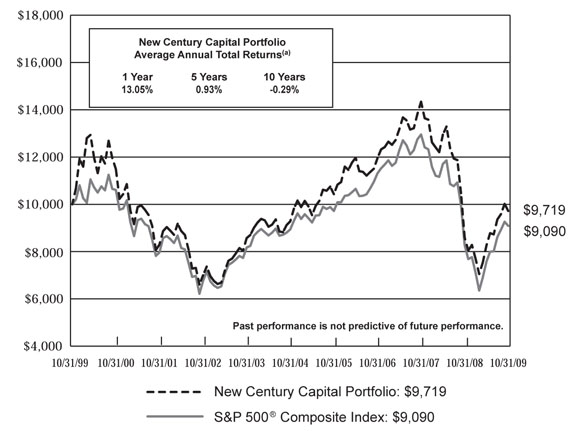

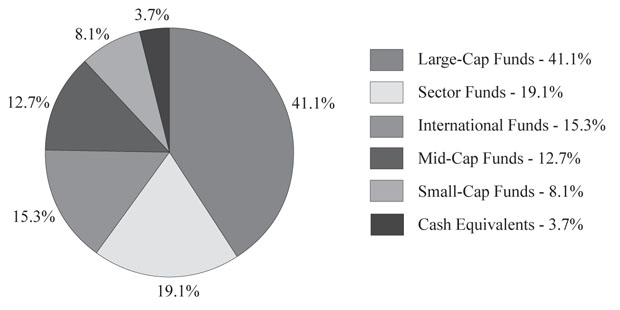

Towards the end of the first quarter of 2009, the New Century Capital Portfolio reduced cash balances that previously had been increased to provide downside protection during the volatile investment environment. Cash was reinvested in the large-cap growth and foreign equity sectors. In addition, the Portfolio’s thematic allocation continued to favor the energy and utilities sectors. During the twelve-month period ended October 31, 2009, the New Century Capital Portfolio gained 13.05% as compared to the S&P 500Æ Composite Index which gained 9.80%.

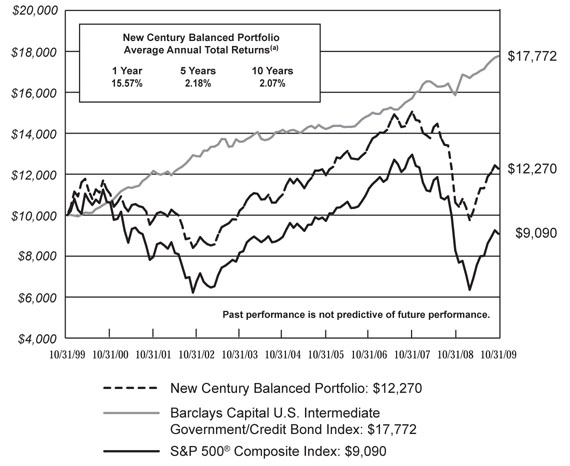

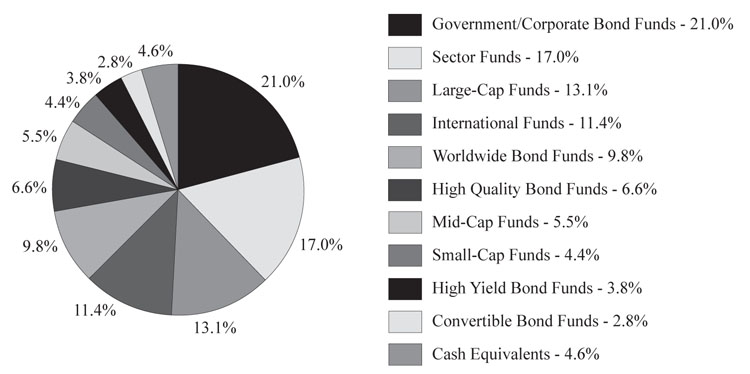

Over the last six to eight months, the New Century Balanced Portfolio also reinvested cash back into the overall market. During the period, the Portfolio increased its exposure to foreign investments - both fixed income and equities. While the Portfolio increased exposure to the foreign markets, it preserved a more-conservative stance to the overall equity market by maintaining a 50/50 equity-to-fixed income allocation. During the past two quarters, the Portfolio increased exposure to quality corporate and high-yield bonds while reducing exposure to government debt. During the twelve-month period ended October 31, 2009, the New Century Balanced Portfolio returned 15.57% as compared to the S&P 500Æ Composite Index which gained 9.80% and the Barclays Capital U.S. Intermediate Government/Credit Bond Index which gained 12.03%.

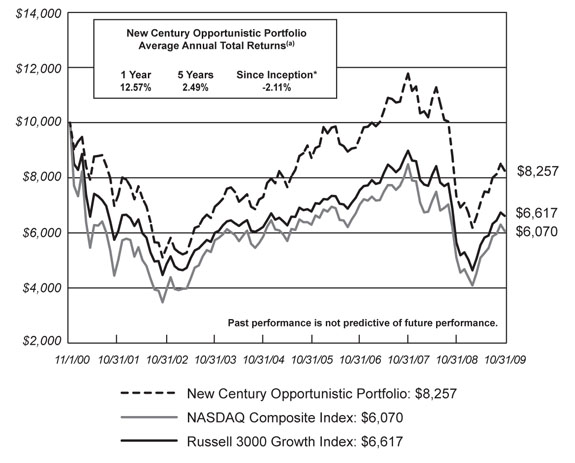

At the start of the twelve-month period ending October 31, 2009, the New Century Opportunistic Portfolio maintained a defensive posture. In the latter part of the first quarter of 2009, the Portfolio began a moderate shift to more growth orientated investments. The Portfolio repositioned its defensive cash positions primarily into consumer staples, large-cap equities, and emerging market equities. During the twelve-month period ended October 31, 2009, the New Century Opportunistic Portfolio posted a gain of 12.57% while the Russell 3000 Growth posted a gain of 17.04%.

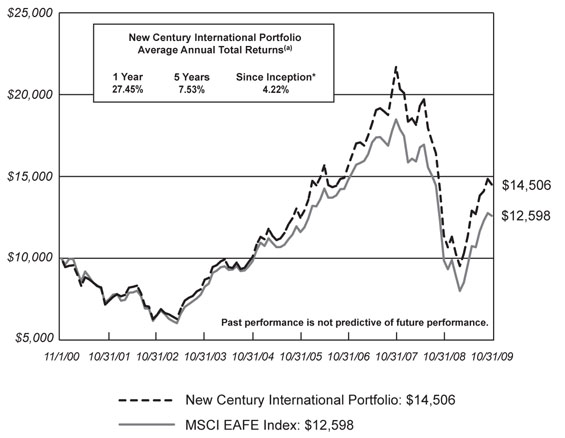

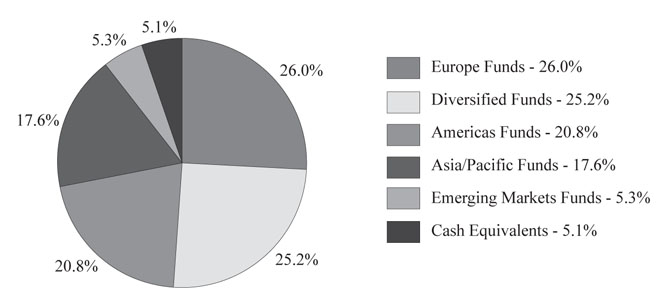

The New Century International Portfolio redeployed cash primarily into its diversified funds sector during the first half of 2009. The Portfolio also positioned itself to participate in the continuing decline of the U.S. dollar. A rising allocation to the European sector was fueled in part by positive growth, as well as cash flowing into diversified European

investments. A slight increase to the Americas (ex-U.S.) was the result of additional bias to Latin America. In addition to the Americas, the New Century International Portfolio continues to maintain holdings in non-traditional EAFE regions such as India and China. Emerging Markets continues to outperform traditional international equity markets, resulting in an increased emerging market allocation. During the twelve-month period ended October 31, 2009, the New Century International Portfolio gained 27.45%. The international equity markets, as measured by the MSCI EAFE Index, increased 27.71% during the same time period.

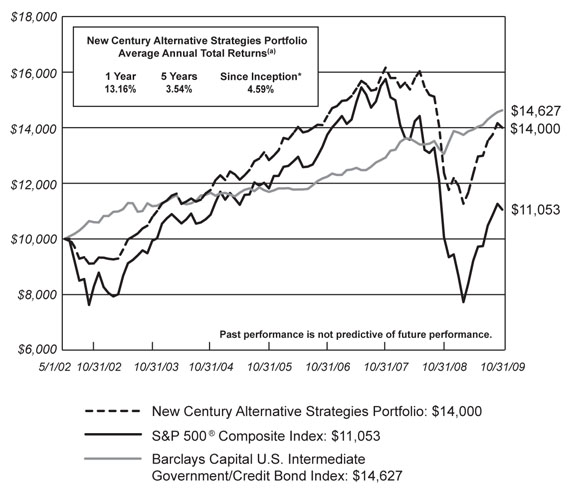

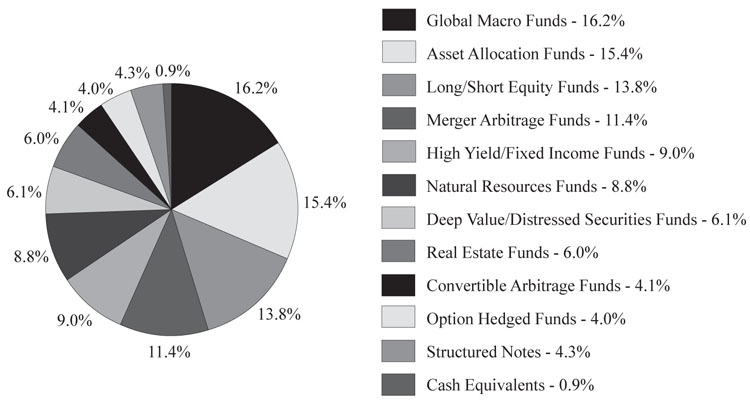

The New Century Alternative Strategies Portfolio reduced its exposure to merger arbitrage given the lack of merger activity. Long/Short equity investments were reduced in favor of global macro and asset allocation strategies to take advantage of distressed valuations in both the equity and fixed income markets. Cash balances were reduced to build fixed income holdings including structured notes. The New Century Alternative Strategies Portfolio had a total return of 13.16% for the twelve-month period ended October 31, 2009, as compared to the S&P 500Æ Composite Index which gained 9.80% and the Barclays Capital U.S. Intermediate Government/Credit Bond Index which gained 12.03% during the same time period.

While future performance is always unpredictable, we are confident that New Century’s investment philosophy -diversification, risk assessment and long-term focus - will maximize risk-adjusted returns.

New Century is committed to its shareholders and appreciates your selecting New Century as part of your long-term investment strategy.

Sincerely,

Wayne M. Grzecki

President

Investors should take into consideration the investment objectives, risks, charges and expenses of the New Century Portfolios carefully before investing. The prospectus contains these details and other information and should be read carefully before investing. Principal value of an investment will fluctuate and shares when redeemed may be worth more or less than your original investment. Past performance is not indicative of future results. Portfolio and opinions expressed herein are subject to change.

PERFORMANCE CHARTS (Unaudited)

Comparison of the Change in Value of a $10,000 Investment

in the New Century Capital Portfolio and the S&P 500® Composite Index

Comparison of the Change in Value of a $10,000 Investment

in the New Century Balanced Portfolio, S&P 500® Composite Index and

Barclays Capital U.S. Intermediate Government/Credit Bond Index

| (a) | The total returns shown do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares. |

PERFORMANCE CHARTS (Unaudited) (Continued)

Comparison of the Change in Value of a $10,000 Investment

in the New Century Opportunistic Portfolio, the NASDAQ Composite Index

and the Russell 3000 Growth Index

Comparison of the Change in Value of a $10,000 Investment

in the New Century International Portfolio and the MSCI EAFE Index

| * | Initial public offering of shares was November 1, 2000. |

| (a) | The total returns shown do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares. |

PERFORMANCE CHARTS (Unaudited) (Continued)

Comparison of the Change in Value of a $10,000 Investment

in the New Century Alternative Strategies Portfolio, S&P 500® Composite Index

and Barclays Capital U.S. Intermediate Government/Credit Bond Index

| * | Initial public offering of shares was May 1, 2002. |

| (a) | The total returns shown do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares. |

NEW CENTURY CAPITAL PORTFOLIO

PORTFOLIO INFORMATION

October 31, 2009 (Unaudited)

Asset Allocation (% of Net Assets)

Top Ten Long-Term Holdings

| Security Description | % of Net Assets |

| American Funds Growth Fund of America - Class A | 8.9% |

| iShares Dow Jones U.S. Energy Sector Index | 6.0% |

| iShares MSCI Emerging Markets Index | 5.5% |

| Marsico 21st Century | 5.3% |

| iShares S&P MidCap 400 Value Index | 5.1% |

| Amana Trust Income | 4.6% |

| Fidelity Capital Appreciation | 4.5% |

| iShares S&P 500 Growth Index | 4.1% |

| Vanguard 500 Index - Investor Shares | 3.9% |

| Goldman Sachs Growth Opportunities - Class A | 3.8% |

NEW CENTURY BALANCED PORTFOLIO

PORTFOLIO INFORMATION

October 31, 2009 (Unaudited)

Asset Allocation (% of Net Assets)

Top Ten Long-Term Holdings

| Security Description | % of Net Assets |

| Loomis Sayles Bond - Institutional Class | 9.3% |

| Templeton Global Bond - Class A | 7.5% |

| First Eagle Global - Class A | 7.2% |

| iShares S&P 500 Index | 5.6% |

| Dodge & Cox Income | 4.8% |

| S&P MidCap 400 Depositary Receipts | 4.6% |

| American Funds AMCAP - Class A | 4.2% |

| iShares MSCI EAFE Index | 4.2% |

| Loomis Sayles Institutional High Income | 3.8% |

| Fidelity Select Utilities Growth | 3.7% |

NEW CENTURY OPPORTUNISTIC PORTFOLIO

PORTFOLIO INFORMATION

October 31, 2009 (Unaudited)

Asset Allocation (% of Net Assets)

Top Ten Long-Term Holdings

| Security Description | % of Net Assets |

| iShares S&P 500 Growth Index | 18.7% |

| iShares MSCI Emerging Markets Index | 10.3% |

| S&P MidCap 400 Depositary Receipts | 9.9% |

| Technology Select Sector SPDR | 7.8% |

| iShares S&P 500 Value Index | 7.2% |

| iShares S&P North American Natural Resources Index | 7.1% |

| iShares S&P SmallCap 600 Growth Index | 5.5% |

| PowerShares Dynamic Pharmaceuticals | 4.3% |

| PowerShares Dynamic Food & Beverage | 4.2% |

| iShares Dow Jones U.S. Energy Sector Index | 3.8% |

NEW CENTURY INTERNATIONAL PORTFOLIO

PORTFOLIO INFORMATION

October 31, 2009 (Unaudited)

Asset Allocation (% of Net Assets)

Top Ten Long-Term Holdings

| Security Description | % of Net Assets |

| iShares S&P Latin America 40 Index | 7.4% |

| Fidelity Canada | 6.0% |

| iShares MSCI Germany Index | 5.4% |

| iShares FTSE/Xinhua China 25 Index | 5.2% |

| iShares MSCI United Kingdom Index | 4.2% |

| iShares MSCI EAFE Index | 4.0% |

| Vanguard European Stock ETF | 4.0% |

| iShares S&P Global Energy Sector Index | 3.6% |

| iShares MSCI Switzerland Index | 3.5% |

| iShares MSCI Australia Index | 3.4% |

NEW CENTURY ALTERNATIVE STRATEGIES PORTFOLIO

PORTFOLIO INFORMATION

October 31, 2009 (Unaudited)

Asset Allocation (% of Net Assets)

Top Ten Long-Term Holdings

| Security Description | % of Net Assets |

| First Eagle Global - Class A | 5.1% |

| FPA Crescent - Class I | 4.5% |

| Merger | 4.3% |

| Calamos Market Neutral Income - Class A | 4.1% |

| Hussman Strategic Growth | 3.8% |

| Leuthold Core Investment | 3.7% |

| Arbitrage - Class R | 3.7% |

| BlackRock Global Allocation - Class A | 3.6% |

| Fairholme | 3.0% |

| Gateway - Class A | 3.0% |

NEW CENTURY CAPITAL PORTFOLIO

SCHEDULE OF INVESTMENTS

| INVESTMENT COMPANIES — 96.3% | | Shares | | | Value | |

| Large-Cap Funds — 41.1% | | | | | | |

| Amana Trust Income | | | 145,625 | | | $ | 3,914,391 | |

| American Funds AMCAP - Class A | | | 156,403 | | | | 2,382,019 | |

| American Funds Growth Fund of America - Class A | | | 298,067 | | | | 7,573,884 | |

| Fidelity Capital Appreciation | | | 202,540 | | | | 3,789,524 | |

iShares Russell 1000 Growth Index (a) | | | 235 | | | | 10,744 | |

iShares Russell 1000 Value Index (a) | | | 28,800 | | | | 1,546,848 | |

iShares S&P 500 Growth Index (a) | | | 64,900 | | | | 3,494,216 | |

iShares S&P 500 Index (a) | | | 17,350 | | | | 1,803,359 | |

iShares S&P 500 Value Index (a) | | | 51,500 | | | | 2,541,010 | |

| Marsico 21st Century | | | 405,656 | | | | 4,547,406 | |

| Vanguard 500 Index - Investor Shares | | | 34,581 | | | | 3,307,004 | |

| | | | | | | | 34,910,405 | |

| Sector Funds — 19.1% | | | | | | | | |

Biotech HOLDRs Trust (a) (b) | | | 11,700 | | | | 1,057,680 | |

Consumer Staples Select Sector SPDR (a) | | | 74,200 | | | | 1,916,586 | |

| Fidelity Select Utilities Growth | | | 71,234 | | | | 2,954,058 | |

iShares Dow Jones U.S. Energy Sector Index (a) | | | 156,200 | | | | 5,064,004 | |

iShares Dow Jones U.S. Transportation Average Index (a) | | | 7,500 | | | | 485,325 | |

iShares S&P North American Natural Resources Index (a) | | | 31,800 | | | | 1,024,914 | |

PowerShares Dynamic Biotechnology & Genome (a) (b) | | | 58,600 | | | | 896,580 | |

PowerShares Dynamic Food & Beverage (a) | | | 77,200 | | | | 1,058,412 | |

PowerShares Dynamic Pharmaceuticals (a) | | | 59,300 | | | | 987,345 | |

SPDR Gold Trust (a) (b) (c) | | | 8,000 | | | | 820,000 | |

| | | | | | | | 16,264,904 | |

| International Funds — 15.3% | | | | | | | | |

| First Eagle Global - Class A | | | 63,341 | | | | 2,453,821 | |

iShares MSCI EAFE Growth Index (a) | | | 34,600 | | | | 1,828,610 | |

iShares MSCI EAFE Index (a) | | | 40,200 | | | | 2,142,660 | |

iShares MSCI EAFE Value Index (a) | | | 39,000 | | | | 1,923,870 | |

iShares MSCI Emerging Markets Index (a) | | | 124,200 | | | | 4,664,952 | |

| | | | | | | | 13,013,913 | |

| Mid-Cap Funds — 12.7% | | | | | | | | |

Goldman Sachs Growth Opportunities - Class A (b) | | | 186,024 | | | | 3,244,264 | |

iShares S&P MidCap 400 Growth Index (a) | | | 18,000 | | | | 1,282,500 | |

iShares S&P MidCap 400 Value Index (a) | | | 73,000 | | | | 4,334,740 | |

| Janus Orion - J Shares | | | 117,840 | | | | 1,064,099 | |

S&P MidCap 400 Depositary Receipts (a) | | | 7,200 | | | | 860,688 | |

| | | | | | | | 10,786,291 | |

| Small-Cap Funds — 8.1% | | | | | | | | |

Buffalo Small Cap (b) | | | 58,258 | | | | 1,216,437 | |

iShares S&P SmallCap 600 Growth Index (a) | | | 54,600 | | | | 2,812,446 | |

iShares S&P SmallCap 600 Value Index (a) | | | 53,700 | | | | 2,831,601 | |

| | | | | | | | 6,860,484 | |

| | | | | | | | | |

Total Investment Companies (Cost $72,456,258) | | | | | | $ | 81,835,997 | |

See accompanying notes to financial statements.

NEW CENTURY CAPITAL PORTFOLIO

SCHEDULE OF INVESTMENTS (Continued)

| MONEY MARKET FUNDS — 3.8% | | Shares | | | Value | |

AIM STIT-STIC Prime Portfolio (The) - Institutional Class, 0.13% (d) (Cost $3,240,524) | | | 3,240,524 | | | $ | 3,240,524 | |

| | | | | | | | | |

Total Investments at Value — 100.1% (Cost $75,696,782) | | | | | | $ | 85,076,521 | |

| | | | | | | | | |

| Liabilities in Excess of Other Assets — (0.1%) | | | | | | | (76,224 | ) |

| | | | | | | | | |

| Net Assets — 100.0% | | | | | | $ | 85,000,297 | |

| (b) | Non-income producing security. |

| (c) | For federal income tax purposes, structured as a grantor trust. |

| (d) | Variable rate security. The rate shown is the 7-day effective yield as of October 31, 2009. |

See accompanying notes to financial statements.

NEW CENTURY BALANCED PORTFOLIO

SCHEDULE OF INVESTMENTS

| INVESTMENT COMPANIES — 95.4% | | Shares | | | Value | |

| Government/Corporate Bond Funds — 21.0% | | | | | | |

| American Century Target Maturities Trust Series 2015 - Investor Class | | | 15,740 | | | $ | 1,529,000 | |

iShares Barclays 3-7 Year Treasury Bond (a) | | | 5,000 | | | | 562,250 | |

iShares Barclays Aggregate Bond (a) | | | 10,000 | | | | 1,048,100 | |

| Loomis Sayles Bond - Institutional Class | | | 440,172 | | | | 5,726,632 | |

ProShares UltraShort 20+ Year Treasury (a) (b) | | | 38,000 | | | | 1,735,080 | |

Rydex Inverse Government Long Bond Strategy - Investor Class (b) | | | 127,984 | | | | 1,821,205 | |

| Vanguard Inflation-Protected Securities - Investor Shares | | | 41,736 | | | | 530,050 | |

| | | | | | | | 12,592,317 | |

| Sector Funds — 17.0% | | | | | | | | |

Biotech HOLDRs Trust (a) (b) | | | 7,600 | | | | 687,040 | |

Consumer Staples Select Sector SPDR (a) | | | 54,000 | | | | 1,394,820 | |

| Fidelity Select Utilities Growth | | | 55,287 | | | | 2,292,747 | |

iShares Dow Jones U.S. Energy Sector Index (a) | | | 69,400 | | | | 2,249,948 | |

iShares S&P North American Natural Resources Index (a) | | | 31,800 | | | | 1,024,914 | |

PowerShares Dynamic Biotechnology & Genome (a) (b) | | | 36,900 | | | | 564,570 | |

PowerShares Dynamic Food & Beverage (a) | | | 78,000 | | | | 1,069,380 | |

PowerShares Dynamic Pharmaceuticals (a) | | | 40,100 | | | | 667,665 | |

SPDR Gold Trust (a) (b) (c) | | | 5,300 | | | | 543,250 | |

| | | | | | | | 10,494,334 | |

| Large-Cap Funds — 13.1% | | | | | | | | |

| American Funds AMCAP - Class A | | | 171,567 | | | | 2,612,962 | |

iShares Russell 1000 Growth Index (a) | | | 19,600 | | | | 896,112 | |

iShares Russell 1000 Value Index (a) | | | 20,300 | | | | 1,090,313 | |

iShares S&P 500 Index (a) | | | 33,400 | | | | 3,471,596 | |

| | | | | | | | 8,070,983 | |

| International Funds — 11.4% | | | | | | | | |

| First Eagle Global - Class A | | | 114,262 | | | | 4,426,493 | |

iShares MSCI EAFE Index (a) | | | 48,800 | | | | 2,601,040 | |

| | | | | | | | 7,027,533 | |

| Worldwide Bond Funds — 9.8% | | | | | | | | |

| Loomis Sayles Global Bond - Institutional Class | | | 86,833 | | | | 1,407,569 | |

| Templeton Global Bond - Class A | | | 370,778 | | | | 4,634,723 | |

| | | | | | | | 6,042,292 | |

| High Quality Bond Funds — 6.6% | | | | | | | | |

| Calvert Social Investment - Class I | | | 71,889 | | | | 1,099,907 | |

| Dodge & Cox Income | | | 229,480 | | | | 2,978,650 | |

| | | | | | | | 4,078,557 | |

| Mid-Cap Funds — 5.5% | | | | | | | | |

iShares S&P MidCap 400 Value Index (a) | | | 9,000 | | | | 534,420 | |

S&P MidCap 400 Depositary Receipts (a) | | | 23,580 | | | | 2,818,753 | |

| | | | | | | | 3,353,173 | |

See accompanying notes to financial statements.

NEW CENTURY BALANCED PORTFOLIO

SCHEDULE OF INVESTMENTS (Continued)

| INVESTMENT COMPANIES — 95.4% (Continued) | | Shares | | | Value | |

| Small-Cap Funds — 4.4% | | | | | | |

iShares S&P SmallCap 600 Growth Index (a) | | | 30,800 | | | $ | 1,586,508 | |

iShares S&P SmallCap 600 Value Index (a) | | | 21,300 | | | | 1,123,149 | |

| | | | | | | | 2,709,657 | |

| High Yield Bond Funds — 3.8% | | | | | | | | |

| Loomis Sayles Institutional High Income | | | 310,478 | | | | 2,316,164 | |

| | | | | | | | | |

| Convertible Bond Funds — 2.8% | | | | | | | | |

| Davis Appreciation & Income - Class A | | | 75,221 | | | | 1,708,280 | |

| | | | | | | | | |

Total Investment Companies (Cost $56,505,940) | | | | | | $ | 58,753,290 | |

| | | | | | | | | |

| MONEY MARKET FUNDS — 4.7% | | Shares | | | Value | |

AIM STIT-STIC Prime Portfolio (The) - Institutional Class, 0.13% (d) | | | | | | | | |

| (Cost $2,890,634) | | | 2,890,634 | | | $ | 2,890,634 | |

| | | | | | | | | |

Total Investments at Value — 100.1% (Cost $59,396,574) | | | | | | $ | 61,643,924 | |

| | | | | | | | | |

| Liabilities in Excess of Other Assets — (0.1%) | | | | | | | (66,361 | ) |

| | | | | | | | | |

| Net Assets — 100.0% | | | | | | $ | 61,577,563 | |

| (b) | Non-income producing security. |

| (c) | For federal income tax purposes, structured as a grantor trust. |

| (d) | Variable rate security. The rate shown is the 7-day effective yield as of October 31, 2009. |

See accompanying notes to financial statements.

NEW CENTURY OPPORTUNISTIC PORTFOLIO

SCHEDULE OF INVESTMENTS

| INVESTMENT COMPANIES — 97.5% | | Shares | | | Value | |

| Sector Funds — 37.1% | | | | | | |

Biotech HOLDRs Trust (a) (b) | | | 3,200 | | | $ | 289,280 | |

Consumer Staples Select Sector SPDR (a) | | | 12,300 | | | | 317,709 | |

iShares Dow Jones U.S. Energy Sector Index (a) | | | 13,200 | | | | 427,944 | |

iShares S&P North American Natural Resources Index (a) | | | 24,900 | | | | 802,527 | |

PowerShares Dynamic Biotechnology & Genome (a) (b) | | | 26,500 | | | | 405,450 | |

PowerShares Dynamic Food & Beverage (a) | | | 35,000 | | | | 479,850 | |

PowerShares Dynamic Pharmaceuticals (a) | | | 29,500 | | | | 491,175 | |

SPDR Gold Trust (a) (b) (c) | | | 1,000 | | | | 102,500 | |

Technology Select Sector SPDR (a) | | | 42,800 | | | | 882,108 | |

| | | | | | | | 4,198,543 | |

| Large-Cap Funds — 29.4% | | | | | | | | |

iShares S&P 500 Growth Index (a) | | | 39,400 | | | | 2,121,296 | |

iShares S&P 500 Value Index (a) | | | 16,500 | | | | 814,110 | |

Vanguard Growth ETF (a) | | | 8,000 | | | | 389,040 | |

| | | | | | | | 3,324,446 | |

| International Funds — 13.6% | | | | | | | | |

iShares MSCI Emerging Markets Index (a) | | | 31,100 | | | | 1,168,116 | |

| Janus Overseas - J Shares | | | 9,487 | | | | 366,655 | |

| | | | | | | | 1,534,771 | |

| Mid-Cap Funds — 9.9% | | | | | | | | |

S&P MidCap 400 Depositary Receipts (a) | | | 9,402 | | | | 1,123,915 | |

| | | | | | | | | |

| Small-Cap Funds — 7.5% | | | | | | | | |

iShares S&P SmallCap 600 Growth Index (a) | | | 12,000 | | | | 618,120 | |

iShares S&P SmallCap 600 Value Index (a) | | | 4,400 | | | | 232,012 | |

| | | | | | | | 850,132 | |

| | | | | | | | | |

Total Investment Companies (Cost $10,593,933) | | | | | | $ | 11,031,807 | |

| | | | | | | | | |

| MONEY MARKET FUNDS — 2.6% | | Shares | | | Value | |

AIM STIT-STIC Prime Portfolio (The) - Institutional Class, 0.13% (d) | | | | | | | | |

| (Cost $294,203) | | | 294,203 | | | $ | 294,203 | |

| | | | | | | | | |

Total Investments at Value — 100.1% (Cost $10,888,136) | | | | | | $ | 11,326,010 | |

| | | | | | | | | |

| Liabilities in Excess of Other Assets — (0.1%) | | | | | | | (10,005 | ) |

| | | | | | | | | |

| Net Assets — 100.0% | | | | | | $ | 11,316,005 | |

| (b) | Non-income producing security. |

| (c) | For federal income tax purposes, structured as a grantor trust. |

| (d) | Variable rate security. The rate shown is the 7-day effective yield as of October 31, 2009. |

See accompanying notes to financial statements.

NEW CENTURY INTERNATIONAL PORTFOLIO

SCHEDULE OF INVESTMENTS

| INVESTMENT COMPANIES — 94.9% | | Shares | | | Value | |

| Europe Funds — 26.0% | | | | | | |

| Franklin Mutual European - Class A | | | 109,551 | | | $ | 2,120,901 | |

iShares MSCI France Index (a) | | | 10,000 | | | | 245,000 | |

iShares MSCI Germany Index (a) | | | 227,200 | | | | 4,791,648 | |

iShares MSCI Spain Index (a) | | | 37,200 | | | | 1,803,456 | |

iShares MSCI Sweden Index (a) | | | 58,000 | | | | 1,361,840 | |

iShares MSCI Switzerland Index (a) | | | 147,300 | | | | 3,149,274 | |

iShares MSCI United Kingdom Index (a) | | | 244,146 | | | | 3,781,822 | |

| Ivy European Opportunities - Class A | | | 115,423 | | | | 2,441,194 | |

Vanguard European Stock ETF (a) | | | 74,200 | | | | 3,584,602 | |

| | | | | | | | 23,279,737 | |

| Diversified Funds — 25.2% | | | | | | | | |

| Columbia Acorn International Select - Class A | | | 56,993 | | | | 1,278,360 | |

iShares MSCI EAFE Growth Index (a) | | | 45,500 | | | | 2,404,675 | |

iShares MSCI EAFE Index (a) | | | 67,800 | | | | 3,613,740 | |

iShares MSCI EAFE Value Index (a) | | | 51,000 | | | | 2,515,830 | |

iShares S&P Global Energy Sector Index (a) | | | 92,400 | | | | 3,213,672 | |

iShares S&P Global Infrastructure Index (a) | | | 36,600 | | | | 1,174,860 | |

iShares S&P Global Materials Index (a) | | | 26,700 | | | | 1,450,611 | |

| Janus Overseas - J Shares | | | 77,834 | | | | 3,008,266 | |

| MainStay International Equity - Class A | | | 204,290 | | | | 2,502,554 | |

| Templeton Institutional Funds - Foreign Smaller Companies Series | | | 97,554 | | | | 1,361,848 | |

| | | | | | | | 22,524,416 | |

| Americas Funds — 20.8% | | | | | | | | |

| Fidelity Canada | | | 120,676 | | | | 5,365,247 | |

iShares MSCI Canada Index (a) | | | 126,000 | | | | 3,005,100 | |

iShares MSCI Mexico Investable Market Index (a) | | | 59,800 | | | | 2,607,280 | |

iShares S&P Latin America 40 Index (a) | | | 154,600 | | | | 6,658,622 | |

PowerShares DB U.S. Dollar Index Bearish (a) (b) | | | 36,000 | | | | 1,010,880 | |

| | | | | | | | 18,647,129 | |

| Asia/Pacific Funds — 17.6% | | | | | | | | |

| Fidelity Japan | | | 197,238 | | | | 1,978,300 | |

iShares FTSE/Xinhua China 25 Index (a) | | | 111,300 | | | | 4,642,323 | |

iShares MSCI Australia Index (a) | | | 138,100 | | | | 3,028,533 | |

iShares MSCI Japan Index (a) | | | 143,800 | | | | 1,374,728 | |

iShares MSCI Pacific ex-Japan Index (a) | | | 64,800 | | | | 2,565,432 | |

| Matthews Pacific Tiger - Class I | | | 119,303 | | | | 2,114,057 | |

| | | | | | | | 15,703,373 | |

| Emerging Market Funds — 5.3% | | | | | | | | |

iShares MSCI Emerging Markets Index (a) | | | 64,000 | | | | 2,403,840 | |

Vanguard Emerging Markets Stock Index (a) | | | 61,000 | | | | 2,293,600 | |

| | | | | | | | 4,697,440 | |

| | | | | | | | | |

Total Investment Companies (Cost $70,624,229) | | | | | | $ | 84,852,095 | |

| See accompanying notes to financial statements. |

| NEW CENTURY INTERNATIONAL PORTFOLIO |

SCHEDULE OF INVESTMENTS (Continued) |

| MONEY MARKET FUNDS — 5.2% | | Shares | | | Value | |

AIM STIT-STIC Prime Portfolio (The) - Institutional Class, 0.13% (c) (Cost $4,683,721) | | | 4,683,721 | | | $ | 4,683,721 | |

| | | | | | | | | |

Total Investments at Value — 100.1% (Cost $75,307,950) | | | | | | $ | 89,535,816 | |

| | | | | | | | | |

| Liabilities in Excess of Other Assets — (0.1%) | | | | | | | (86,351 | ) |

| | | | | | | | | |

| Net Assets — 100.0% | | | | | | $ | 89,449,465 | |

| (b) | Non-income producing security. |

| (c) | Variable rate security. The rate shown is the 7-day effective yield as of October 31, 2009. |

See accompanying notes to financial statements.

NEW CENTURY ALTERNATIVE STRATEGIES PORTFOLIO

SCHEDULE OF INVESTMENTS

| INVESTMENT COMPANIES — 94.8% | | Shares | | | Value | |

| Global Macro Funds — 16.2% | | | | | | |

| BlackRock Global Allocation - Class A | | | 290,254 | | | $ | 5,032,997 | |

| First Eagle Global - Class A | | | 182,504 | | | | 7,070,220 | |

iPath S&P 500 VIX Short-Term Futures ETN (a) (b) | | | 67,000 | | | | 3,230,740 | |

| Ivy Asset Strategy - Class A | | | 171,212 | | | | 3,609,139 | |

| Mutual Global Discovery - Class Z | | | 136,044 | | | | 3,597,011 | |

| | | | | | | | 22,540,107 | |

| Asset Allocation Funds — 15.4% | | | | | | | | |

| Berwyn Income | | | 207,310 | | | | 2,578,931 | |

| FPA Crescent - Class I | | | 258,710 | | | | 6,201,268 | |

| Greenspring | | | 161,726 | | | | 3,574,143 | |

| Leuthold Core Investment | | | 341,518 | | | | 5,197,902 | |

| Oakmark Equity & Income - Class I | | | 160,696 | | | | 3,945,082 | |

| | | | | | | | 21,497,326 | |

| Long/Short Equity Funds — 13.8% | | | | | | | | |

| CGM Focus | | | 79,402 | | | | 2,166,882 | |

| Diamond Hill Long-Short - Class I | | | 259,063 | | | | 4,062,109 | |

Federated Prudent Bear - Class A (b) | | | 349,990 | | | | 2,036,941 | |

| Hussman Strategic Growth | | | 406,731 | | | | 5,271,235 | |

| Schwab Hedged Equity - Select Shares | | | 208,846 | | | | 2,808,983 | |

TFS Market Neutral (b) | | | 188,413 | | | | 2,811,123 | |

| | | | | | | | 19,157,273 | |

| Merger Arbitrage Funds — 11.4% | | | | | | | | |

Arbitrage - Class R (b) | | | 399,426 | | | | 5,128,633 | |

| Gabelli ABC | | | 292,889 | | | | 2,841,025 | |

Gabelli Global Deal (c) | | | 131,154 | | | | 1,865,010 | |

| Merger | | | 392,223 | | | | 6,032,393 | |

| | | | | | | | 15,867,061 | |

| High Yield/Fixed Income Funds — 9.0% | | | | | | | | |

| Eaton Vance National Municipal - Class I | | | 196,010 | | | | 1,854,250 | |

| Loomis Sayles Institutional High Income | | | 522,406 | | | | 3,897,148 | |

Nuveen Multi-Strategy Income & Growth 2 (c) | | | 230,000 | | | | 1,610,000 | |

| Oppenheimer International Bond - Class A | | | 262,320 | | | | 1,715,573 | |

| Principal High Yield - Class A | | | 145,396 | | | | 1,106,460 | |

Western Asset Emerging Markets Debt (c) | | | 143,600 | | | | 2,334,936 | |

| | | | | | | | 12,518,367 | |

| Natural Resources Funds — 8.8% | | | | | | | | |

| Goldman Sachs Commodity Strategy - Institutional Shares | | | 259,554 | | | | 1,596,255 | |

| Permanent Portfolio | | | 20,224 | | | | 757,797 | |

| PIMCO Commodity Real Return Strategy - Class A | | | 255,625 | | | | 2,037,329 | |

PowerShares Water Resources Portfolio (a) | | | 163,000 | | | | 2,562,360 | |

| RS Global Natural Resources - Class A | | | 38,866 | | | | 1,064,925 | |

SPDR Gold Trust (a) (b) (d) | | | 18,000 | | | | 1,845,000 | |

| T. Rowe Price New Era | | | 9,618 | | | | 393,089 | |

| Vanguard Precious Metals & Minerals - Investor Shares | | | 109,815 | | | | 1,998,633 | |

| | | | | | | | 12,255,388 | |

See accompanying notes to financial statements.

NEW CENTURY ALTERNATIVE STRATEGIES PORTFOLIO

SCHEDULE OF INVESTMENTS (Continued)

| INVESTMENT COMPANIES — 94.8% (Continued) | | Shares | | | Value | |

| Deep Value/Distressed Securities Funds — 6.1% | | | | | | |

| Fairholme | | | 152,724 | | | $ | 4,209,073 | |

| Mutual Beacon - Class Z | | | 155,259 | | | | 1,687,670 | |

| Third Avenue Value | | | 57,821 | | | | 2,578,825 | |

| | | | | | | | 8,475,568 | |

| Real Estate Funds — 6.0% | | | | | | | | |

| AIM Real Estate - Class A | | | 144,660 | | | | 2,291,415 | |

| Cohen & Steers International Realty - Class I | | | 75,573 | | | | 835,085 | |

| ING Global Real Estate - Class I | | | 153,248 | | | | 2,185,320 | |

| Third Avenue Real Estate Value | | | 154,939 | | | | 3,077,098 | |

| | | | | | | | 8,388,918 | |

| Convertible Arbitrage Funds — 4.1% | | | | | | | | |

| Calamos Market Neutral Income - Class A | | | 508,067 | | | | 5,766,561 | |

| | | | | | | | | |

| Option Hedged Funds — 4.0% | | | | | | | | |

| Gateway - Class A | | | 171,386 | | | | 4,202,397 | |

NFJ Dividend, Interest & Premium Strategy (c) | | | 100,000 | | | | 1,319,000 | |

| | | | | | | | 5,521,397 | |

| | | | | | | | | |

Total Investment Companies (Cost $131,626,257) | | | | | | $ | 131,987,966 | |

| | | | | | | | | |

| STRUCTURED NOTES — 4.3% | | Par Value | | | Value | |

| Credit Suisse, Buffered Accelerated Return Equity Security Linked Note, | | | | | | | | |

| due 03/29/2010 | | $ | 1,500,000 | | | $ | 1,810,200 | |

| Credit Suisse, Buffered Accelerated Return Equity Security Linked Note, | | | | | | | | |

| due 05/05/2011 | | | 1,250,000 | | | | 1,538,000 | |

| Credit Suisse, Callable Yield Note, 17%, due 02/26/2010 | | | 1,200,000 | | | | 1,228,320 | |

| Deutsche Bank, Buffered Barrier Rebate Securities Linked Note, | | | | | | | | |

| due 06/30/2010 | | | 1,200,000 | | | | 1,380,120 | |

Total Structured Notes (Cost $5,150,000) | | | | | | $ | 5,956,640 | |

| | | | | | | | | |

| MONEY MARKET FUNDS — 0.7% | | Shares | | | Value | |

AIM STIT-STIC Prime Portfolio (The) - Institutional Class, 0.13% (e) | | | | | | | | |

| (Cost $929,609) | | | 929,609 | | | $ | 929,609 | |

| | | | | | | | | |

Total Investments at Value — 99.8% (Cost $137,705,866) | | | | | | $ | 138,874,215 | |

| | | | | | | | | |

| Other Assets in Excess of Liabilities — 0.2% | | | | | | | 293,718 | |

| | | | | | | | | |

| Net Assets — 100.0% | | | | | | $ | 139,167,933 | |

| (b) | Non-income producing security. |

| (d) | For federal income tax purposes, structured as a grantor trust. |

| (e) | Variable rate security. The rate shown is the 7-day effective yield as of October 31, 2009. |

See accompanying notes to financial statements.

NEW CENTURY PORTFOLIOS

STATEMENTS OF ASSETS AND LIABILITIES

| | | New Century Capital Portfolio | | | New Century Balanced Portfolio | | | New Century Opportunistic Portfolio | | | New Century International Portfolio | | | New Century Alternative Strategies Portfolio | |

| ASSETS | | | | | | | | | | | | | | | |

| Investments in securities: | | | | | | | | | | | | | | | |

| At acquisition cost | | $ | 75,696,782 | | | $ | 59,396,574 | | | $ | 10,888,136 | | | $ | 75,307,950 | | | $ | 137,705,866 | |

| At value (Note 1A) | | $ | 85,076,521 | | | $ | 61,643,924 | | | $ | 11,326,010 | | | $ | 89,535,816 | | | $ | 138,874,215 | |

| Dividends and interest receivable | | | 588 | | | | 568 | | | | 69 | | | | 775 | | | | 61,598 | |

| Receivable for investment securities sold | | | — | | | | — | | | | — | | | | — | | | | 300,000 | |

| Receivable for capital shares sold | | | 16,992 | | | | 1,975 | | | | — | | | | 41,923 | | | | 249,685 | |

| Other assets | | | 5,664 | | | | 4,251 | | | | 802 | | | | 5,725 | | | | 9,849 | |

| TOTAL ASSETS | | | 85,099,765 | | | | 61,650,718 | | | | 11,326,881 | | | | 89,584,239 | | | | 139,495,347 | |

| | | | | | | | | | | | | | | | | | | | | |

| LIABILITIES | | | | | | | | | | | | | | | | | | | | |

| Payable for investment securities purchased | | | — | | | | — | | | | — | | | | — | | | | 23,442 | |

| Payable for capital shares redeemed | | | — | | | | — | | | | — | | | | 27,740 | | | | 185,406 | |

| Payable to Advisor (Note 2) | | | 77,859 | | | | 55,729 | | | | 3,138 | | | | 81,739 | | | | 94,779 | |

| Payable to Distributor (Note 3) | | | 14,500 | | | | 11,000 | | | | 2,600 | | | | 18,000 | �� | | | 15,000 | |

| Other accrued expenses | | | 7,109 | | | | 6,426 | | | | 5,138 | | | | 7,295 | | | | 8,787 | |

| TOTAL LIABILITIES | | | 99,468 | | | | 73,155 | | | | 10,876 | | | | 134,774 | | | | 327,414 | |

| | | | | | | | | | | | | | | | | | | | | |

| NET ASSETS | | $ | 85,000,297 | | | $ | 61,577,563 | | | $ | 11,316,005 | | | $ | 89,449,465 | | | $ | 139,167,933 | |

| | | | | | | | | | | | | | | | | | | | | |

| Net assets consist of: | | | | | | | | | | | | | | | | | | | | |

| Paid-in capital | | $ | 86,078,475 | | | $ | 62,855,232 | | | $ | 13,223,470 | | | $ | 84,249,367 | | | $ | 149,508,192 | |

| Undistributed net investment income | | | 197,710 | | | | 286,958 | | | | 12,312 | | | | 407,805 | | | | 690,216 | |

| Accumulated net realized losses on investments | | | (10,655,627 | ) | | | (3,811,977 | ) | | | (2,357,651 | ) | | | (9,435,573 | ) | | | (12,198,824 | ) |

| Net unrealized appreciation on investments | | | 9,379,739 | | | | 2,247,350 | | | | 437,874 | | | | 14,227,866 | | | | 1,168,349 | |

| Net assets | | $ | 85,000,297 | | | $ | 61,577,563 | | | $ | 11,316,005 | | | $ | 89,449,465 | | | $ | 139,167,933 | |

| | | | | | | | | | | | | | | | | | | | | |

| Shares of beneficial interest outstanding (unlimited number of shares authorized, no par value) | | | 6,412,570 | | | | 5,161,216 | | | | 1,419,868 | | | | 7,044,838 | | | | 12,531,578 | |

| | | | | | | | | | | | | | | | | | | | | |

Net asset value, offering price and redemption price per share (a) | | $ | 13.26 | | | $ | 11.93 | | | $ | 7.97 | | | $ | 12.70 | | | $ | 11.11 | |

| (a) | Redemption price may differ from the net asset value per share depending upon the length of time held (Note 1B). |

See accompanying notes to financial statements.

NEW CENTURY PORTFOLIOS

STATEMENTS OF OPERATIONS

For the Year Ended October 31, 2009

| | | New Century Capital Portfolio | | | New Century Balanced Portfolio | | | New Century Opportunistic Portfolio | | | New Century International Portfolio | | | New Century Alternative Strategies Portfolio | |

| INVESTMENT INCOME | | | | | | | | | | | | | | | |

| Dividends | | $ | 1,306,954 | | | $ | 2,062,413 | | | $ | 170,702 | | | $ | 2,041,691 | | | $ | 3,112,585 | |

| Interest | | | — | | | | — | | | | — | | | | — | | | | 243,012 | |

| Total income | | | 1,306,954 | | | | 2,062,413 | | | | 170,702 | | | | 2,041,691 | | | | 3,355,597 | |

| | | | | | | | | | | | | | | | | | | | | |

| EXPENSES | | | | | | | | | | | | | | | | | | | | |

| Investment advisory fees (Note 2) | | | 776,821 | | | | 585,552 | | | | 105,825 | | | | 762,042 | | | | 996,203 | |

| Distribution costs (Note 3) | | | 146,003 | | | | 117,478 | | | | 26,283 | | | | 167,870 | | | | 177,509 | |

| Accounting fees | | | 37,833 | | | | 35,859 | | | | 31,049 | | | | 37,600 | | | | 43,251 | |

| Administration fees (Note 2) | | | 29,834 | | | | 24,047 | | | | 9,406 | | | | 29,369 | | | | 46,585 | |

| Legal and audit fees | | | 24,728 | | | | 20,547 | | | | 9,048 | | | | 23,669 | | | | 37,991 | |

| Transfer agent fees | | | 21,000 | | | | 21,000 | | | | 21,000 | | | | 21,000 | | | | 21,000 | |

| Trustees’ fees and expenses (Note 2) | | | 20,073 | | | | 15,240 | | | | 2,801 | | | | 19,592 | | | | 34,745 | |

| Custody and bank service fees | | | 14,306 | | | | 11,803 | | | | 3,891 | | | | 15,129 | | | | 24,580 | |

| Insurance expense | | | 8,961 | | | | 6,290 | | | | 1,186 | | | | 9,169 | | | | 13,060 | |

| Other expenses | | | 18,297 | | | | 13,092 | | | | 9,762 | | | | 15,296 | | | | 19,311 | |

| Total expenses | | | 1,097,856 | | | | 850,908 | | | | 220,251 | | | | 1,100,736 | | | | 1,414,235 | |

| Less fees waived by the Advisor (Note 2) | | | — | | | | — | | | | (61,513 | ) | | | — | | | | — | |

| Net expenses | | | 1,097,856 | | | | 850,908 | | | | 158,738 | | | | 1,100,736 | | | | 1,414,235 | |

| | | | | | | | | | | | | | | | | | | | | |

| NET INVESTMENT INCOME | | | 209,098 | | | | 1,211,505 | | | | 11,964 | | | | 940,955 | | | | 1,941,362 | |

| | | | | | | | | | | | | | | | | | | | | |

| REALIZED AND UNREALIZED GAINS (LOSSES) ON INVESTMENTS | | | | | | | | | | | | | | | | | | | | |

| Net realized gains (losses) on investments | | | (943,200 | ) | | | (9,218 | ) | | | 31,585 | | | | (2,148,251 | ) | | | (12,689,464 | ) |

| Capital gain distributions from regulated investment companies | | | 456,941 | | | | 434,303 | | | | — | | | | 631,323 | | | | 3,563,874 | |

| Net change in unrealized appreciation (depreciation) on investments | | | 9,081,737 | | | | 6,385,829 | | | | 1,308,727 | | | | 19,348,921 | | | | 22,991,658 | |

| | | | | | | | | | | | | | | | | | | | | |

| NET REALIZED AND UNREALIZED GAINS ON INVESTMENTS | | | 8,595,478 | | | | 6,810,914 | | | | 1,340,312 | | | | 17,831,993 | | | | 13,866,068 | |

| | | | | | | | | | | | | | | | | | | | | |

| NET INCREASE IN NET ASSETS FROM OPERATIONS | | $ | 8,804,576 | | | $ | 8,022,419 | | | $ | 1,352,276 | | | $ | 18,772,948 | | | $ | 15,807,430 | |

See accompanying notes to financial statements.

NEW CENTURY PORTFOLIOS

STATEMENTS OF CHANGES IN NET ASSETS

| | | New Century Capital Portfolio | | | New Century Balanced Portfolio | |

| | | Year Ended October 31, 2009 | | | Year Ended October 31, 2008 | | | Year Ended October 31, 2009 | | | Year Ended October 31, 2008 | |

| FROM OPERATIONS | | | | | | | | | | | | |

| Net investment income | | $ | 209,098 | | | $ | 99,564 | | | $ | 1,211,505 | | | $ | 1,423,100 | |

| Net realized losses from security transactions | | | (943,200 | ) | | | (13,968,157 | ) | | | (9,218 | ) | | | (5,827,215 | ) |

| Capital gain distributions from regulated investment companies | | | 456,941 | | | | 4,895,351 | | | | 434,303 | | | | 1,970,480 | |

| Net change in unrealized appreciation (depreciation) on investments | | | 9,081,737 | | | | (47,999,307 | ) | | | 6,385,829 | | | | (24,432,963 | ) |

| Net increase (decrease) in net assets from operations | | | 8,804,576 | | | | (56,972,549 | ) | | | 8,022,419 | | | | (26,866,598 | ) |

| | | | | | | | | | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | | | | | | | | | |

| From net investment income (Note 1E) | | | (208,624 | ) | | | (998,890 | ) | | | (1,229,934 | ) | | | (1,727,951 | ) |

| From net realized gains on security transactions (Note 1E) | | | — | | | | (5,981,681 | ) | | | — | | | | (4,963,213 | ) |

| Decrease in net assets from distributions to shareholders | | | (208,624 | ) | | | (6,980,571 | ) | | | (1,229,934 | ) | | | (6,691,164 | ) |

| | | | | | | | | | | | | | | | | |

| FROM CAPITAL SHARE TRANSACTIONS | | | | | | | | | | | | | | | | |

| Proceeds from shares sold | | | 5,209,472 | | | | 5,466,809 | | | | 2,231,634 | | | | 1,980,783 | |

| Proceeds from redemption fees collected (Note 1B) | | | 256 | | | | 93 | | | | — | | | | 43 | |

| Net asset value of shares issued in reinvestment of distributions to shareholders | | | 197,220 | | | | 6,680,167 | | | | 1,183,887 | | | | 6,441,127 | |

| Payments for shares redeemed | | | (13,121,162 | ) | | | (8,303,148 | ) | | | (11,053,884 | ) | | | (7,492,684 | ) |

| Net increase (decrease) in net assets from capital share transactions | | | (7,714,214 | ) | | | 3,843,921 | | | | (7,638,363 | ) | | | 929,269 | |

| | | | | | | | | | | | | | | | | |

| TOTAL INCREASE (DECREASE) IN NET ASSETS | | | 881,738 | | | | (60,109,199 | ) | | | (845,878 | ) | | | (32,628,493 | ) |

| | | | | | | | | | | | | | | | | |

| NET ASSETS | | | | | | | | | | | | | | | | |

| Beginning of year | | | 84,118,559 | | | | 144,227,758 | | | | 62,423,441 | | | | 95,051,934 | |

| End of year | | $ | 85,000,297 | | | $ | 84,118,559 | | | $ | 61,577,563 | | | $ | 62,423,441 | |

| | | | | | | | | | | | | | | | | |

| UNDISTRIBUTED NET INVESTMENT INCOME (end of year) | | $ | 197,710 | | | $ | 191,871 | | | $ | 286,958 | | | $ | 281,588 | |

| | | | | | | | | | | | | | | | | |

| CAPITAL SHARE ACTIVITY | | | | | | | | | | | | | | | | |

| Shares sold | | | 453,982 | | | | 345,411 | | | | 200,591 | | | | 144,570 | |

| Shares reinvested | | | 17,453 | | | | 359,535 | | | | 112,859 | | | | 444,216 | |

| Shares redeemed | | | (1,213,660 | ) | | | (525,669 | ) | | | (1,073,900 | ) | | | (561,016 | ) |

| Net increase (decrease) in shares outstanding | | | (742,225 | ) | | | 179,277 | | | | (760,450 | ) | | | 27,770 | |

| Shares outstanding, beginning of year | | | 7,154,795 | | | | 6,975,518 | | | | 5,921,666 | | | | 5,893,896 | |

| Shares outstanding, end of year | | | 6,412,570 | | | | 7,154,795 | | | | 5,161,216 | | | | 5,921,666 | |

See accompanying notes to financial statements.

NEW CENTURY PORTFOLIOS

STATEMENTS OF CHANGES IN NET ASSETS

| | | New Century Opportunistic Portfolio | | | New Century International Portfolio | |

| | | Year Ended October 31, 2009 | | | Year Ended October 31, 2008 | | | Year Ended October 31, 2009 | | | Year Ended October 31, 2008 | |

| FROM OPERATIONS | | | | | | | | | | | | |

| Net investment income (loss) | | $ | 11,964 | | | $ | (87,741 | ) | | $ | 940,955 | | | $ | 2,065,042 | |

| Net realized gains (losses) from security transactions | | | 31,585 | | | | (2,629,023 | ) | | | (2,148,251 | ) | | | (12,761,412 | ) |

| Capital gain distributions from regulated investment companies | | | — | | | | 409,448 | | | | 631,323 | | | | 5,535,179 | |

| Net change in unrealized appreciation (depreciation) on investments | | | 1,308,727 | | | | (4,068,236 | ) | | | 19,348,921 | | | | (66,231,378 | ) |

| Net increase (decrease) in net assets from operations | | | 1,352,276 | | | | (6,375,552 | ) | | | 18,772,948 | | | | (71,392,569 | ) |

| | | | | | | | | | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | | | | | | | | | |

| From net investment income (Note 1E) | | | — | | | | (65,157 | ) | | | (835,144 | ) | | | (2,455,459 | ) |

| From net realized gains on security transactions (Note 1E) | | | — | | | | (464,131 | ) | | | — | | | | (3,446,048 | ) |

| Decrease in net assets from distributions to shareholders | | | — | | | | (529,288 | ) | | | (835,144 | ) | | | (5,901,507 | ) |

| | | | | | | | | | | | | | | | | |

| FROM CAPITAL SHARE TRANSACTIONS | | | | | | | | | | | | | | | | |

| Proceeds from shares sold | | | 2,205,934 | | | | 2,921,340 | | | | 8,943,153 | | | | 15,672,710 | |

| Proceeds from redemption fees collected (Note 1B) | | | 657 | | | | 29 | | | | 1,481 | | | | 1,655 | |

| Net asset value of shares issued in reinvestment of distributions to shareholders | | | — | | | | 529,288 | | | | 568,685 | | | | 4,112,509 | |

| Payments for shares redeemed | | | (2,829,435 | ) | | | (894,407 | ) | | | (14,236,006 | ) | | | (13,674,851 | ) |

| Net increase (decrease) in net assets from capital share transactions | | | (622,844 | ) | | | 2,556,250 | | | | (4,722,687 | ) | | | 6,112,023 | |

| | | | | | | | | | | | | | | | | |

| TOTAL INCREASE (DECREASE) IN NET ASSETS | | | 729,432 | | | | (4,348,590 | ) | | | 13,215,117 | | | | (71,182,053 | ) |

| | | | | | | | | | | | | | | | | |

| NET ASSETS | | | | | | | | | | | | | | | | |

| Beginning of year | | | 10,586,573 | | | | 14,935,163 | | | | 76,234,348 | | | | 147,416,401 | |

| End of year | | $ | 11,316,005 | | | $ | 10,586,573 | | | $ | 89,449,465 | | | $ | 76,234,348 | |

| | | | | | | | | | | | | | | | | |

| UNDISTRIBUTED NET INVESTMENT INCOME (end of year) | | $ | 12,312 | | | $ | 325 | | | $ | 407,805 | | | $ | 289,020 | |

| | | | | | | | | | | | | | | | | |

| CAPITAL SHARE ACTIVITY | | | | | | | | | | | | | | | | |

| Shares sold | | | 313,506 | | | | 281,392 | | | | 831,409 | | | | 968,648 | |

| Shares reinvested | | | — | | | | 48,470 | | | | 57,385 | | | | 231,040 | |

| Shares redeemed | | | (389,287 | ) | | | (102,198 | ) | | | (1,405,219 | ) | | | (985,571 | ) |

| Net increase (decrease) in shares outstanding | | | (75,781 | ) | | | 227,664 | | | | (516,425 | ) | | | 214,117 | |

| Shares outstanding, beginning of year | | | 1,495,649 | | | | 1,267,985 | | | | 7,561,263 | | | | 7,347,146 | |

| Shares outstanding, end of year | | | 1,419,868 | | | | 1,495,649 | | | | 7,044,838 | | | | 7,561,263 | |

See accompanying notes to financial statements.

NEW CENTURY PORTFOLIOS

STATEMENTS OF CHANGES IN NET ASSETS

| | | New Century Alternative Strategies Portfolio | |

| | | Year Ended October 31, 2009 | | | Year Ended October 31, 2008 | |

| FROM OPERATIONS | | | | | | |

| Net investment income | | $ | 1,941,362 | | | $ | 2,087,513 | |

| Net realized losses from security transactions | | | (12,689,464 | ) | | | (4,079,115 | ) |

| Capital gain distributions from regulated investment companies | | | 3,563,874 | | | | 5,212,537 | |

| Net change in unrealized appreciation (depreciation) on investments | | | 22,991,658 | | | | (43,649,109 | ) |

| Net increase (decrease) in net assets from operations | | | 15,807,430 | | | | (40,428,174 | ) |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | |

| From net investment income (Note 1E) | | | (4,198,238 | ) | | | (3,290,139 | ) |

| From net realized gains on security transactions (Note 1E) | | | — | | | | (2,850,232 | ) |

| Decrease in net assets from distributions to shareholders | | | (4,198,238 | ) | | | (6,140,371 | ) |

| | | | | | | | | |

| FROM CAPITAL SHARE TRANSACTIONS | | | | | | | | |

| Proceeds from shares sold | | | 35,102,853 | | | | 66,371,741 | |

| Proceeds from redemption fees collected (Note 1B) | | | 5,281 | | | | 20,136 | |

| Net asset value of shares issued in reinvestment of distributions to shareholders | | | 4,137,046 | | | | 6,072,156 | |

| Payments for shares redeemed | | | (48,685,015 | ) | | | (17,013,854 | ) |

| Net increase (decrease) in net assets from capital share transactions | | | (9,439,835 | ) | | | 55,450,179 | |

| | | | | | | | | |

| TOTAL INCREASE IN NET ASSETS | | | 2,169,357 | | | | 8,881,634 | |

| | | | | | | | | |

| NET ASSETS | | | | | | | | |

| Beginning of year | | | 136,998,576 | | | | 128,116,942 | |

| End of year | | $ | 139,167,933 | | | $ | 136,998,576 | |

| | | | | | | | | |

UNDISTRIBUTED NET INVESTMENT INCOME (end of year) | | $ | 690,216 | | | $ | 1,308,842 | |

| | | | | | | | | |

| CAPITAL SHARE ACTIVITY | | | | | | | | |

Shares sold | | | 3,534,810 | | | | 5,294,506 | |

Shares reinvested | | | 427,823 | | | | 469,255 | |

Shares redeemed | | | (4,941,286 | ) | | | (1,450,613 | ) |

| Net increase (decrease) in shares outstanding | | | (978,653 | ) | | | 4,313,148 | |

| Shares outstanding, beginning of year | | | 13,510,231 | | | | 9,197,083 | |

| Shares outstanding, end of year | | | 12,531,578 | | | | 13,510,231 | |

See accompanying notes to financial statements.

NEW CENTURY CAPITAL PORTFOLIO

Selected Per Share Data and Ratios for a Share Outstanding Throughout Each Year

| | | Years Ended October 31, | |

| | | 2009 | | | 2008 | | | 2007 | | | 2006 | | | 2005 | |

| PER SHARE OPERATING PERFORMANCE | | | | | | | | | | | | | | | |

| Net asset value, beginning of year | | $ | 11.76 | | | $ | 20.68 | | | $ | 17.23 | | | $ | 15.04 | | | $ | 13.38 | |

| | | | | | | | | | | | | | | | | | | | | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) | | | 0.03 | | | | 0.02 | | | | (0.06 | ) | | | (0.08 | ) | | | (0.09 | ) |

| Net realized and unrealized gains(losses) on investments | | | 1.50 | | | | (7.94 | ) | | | 3.51 | | | | 2.27 | | | | 1.75 | |

| Total from investment operations | | | 1.53 | | | | (7.92 | ) | | | 3.45 | | | | 2.19 | | | | 1.66 | |

| | | | | | | | | | | | | | | | | | | | | |

| Less distributions: | | | | | | | | | | | | | | | | | | | | |

| Distributions from net investment income | | | (0.03 | ) | | | (0.14 | ) | | | — | | | | — | | | | — | |

| Distributions from net realized gains | | | — | | | | (0.86 | ) | | | — | | | | — | | | | — | |

| Total distributions | | | (0.03 | ) | | | (1.00 | ) | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | |

| Proceeds from redemption fees collected | | | 0.00 | (a) | | | 0.00 | (a) | | | 0.00 | (a) | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | |

| Net asset value, end of year | | $ | 13.26 | | | $ | 11.76 | | | $ | 20.68 | | | $ | 17.23 | | | $ | 15.04 | |

| | | | | | | | | | | | | | | | | | | | | |

TOTAL RETURN (b) | | | 13.05% | | | | (40.06% | ) | | | 20.02% | | | | 14.56% | | | | 12.41% | |

| | | | | | | | | | | | | | | | | | | | | |

| RATIOS/SUPPLEMENTAL DATA | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of year (000’s) | | $ | 85,000 | | | $ | 84,119 | | | $ | 144,228 | | | $ | 123,888 | | | $ | 110,578 | |

| | | | | | | | | | | | | | | | | | | | | |

Ratio of expenses to average net assets (c) | | | 1.41% | | | | 1.29% | | | | 1.25% | | | | 1.27% | | | | 1.35% | |

| | | | | | | | | | | | | | | | | | | | | |

Ratio of net investment income (loss) to average net assets (d) | | | 0.27% | | | | 0.08% | | | | (0.32% | ) | | | (0.47% | ) | | | (0.57% | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Portfolio turnover | | | 4% | | | | 27% | | | | 21% | | | | 12% | | | | 13% | |

| (a) | Amount rounds to less than $0.01 per share. |

| (b) | Total return is a measure of the change in the value of an investment in the Portfolio over the periods covered, which assumes dividends or capital gains distributions, if any, are reinvested in shares of the Portfolio. Returns shown do not reflect the taxes a shareholder would pay on Portfolio distributions, if any, or the redemption of Portfolio shares. |

| (c) | The ratios of expenses to average net assets do not reflect the Portfolio’s proportionate share of expenses of the underlying investment companies in which the Portfolio invests. |

| (d) | Recognition of net investment income (loss) by the Portfolio is affected by the timing of the declaration of dividends by the underlying investment companies in which the Portfolio invests. |

See accompanying notes to financial statements.

NEW CENTURY BALANCED PORTFOLIO

Selected Per Share Data and Ratios for a Share Outstanding Throughout Each Year

| | | Years Ended October 31, | |

| | | 2009 | | | 2008 | | | 2007 | | | 2006 | | | 2005 | |

| PER SHARE OPERATING PERFORMANCE | | | | | | | | | | | | | | | |

| Net asset value, beginning of year | | $ | 10.54 | | | $ | 16.13 | | | $ | 14.57 | | | $ | 13.15 | | | $ | 12.30 | |

| | | | | | | | | | | | | | | | | | | | | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | 0.22 | | | | 0.25 | | | | 0.19 | | | | 0.17 | | | | 0.15 | |

| Net realized and unrealized gains (losses) on investments | | | 1.39 | | | | (4.69 | ) | | | 1.56 | | | | 1.44 | | | | 0.89 | |

| Total from investment operations | | | 1.61 | | | | (4.44 | ) | | | 1.75 | | | | 1.61 | | | | 1.04 | |

| | | | | | | | | | | | | | | | | | | | | |

| Less distributions: | | | | | | | | | | | | | | | | | | | | |

| Distributions from net investment income | | | (0.22 | ) | | | (0.30 | ) | | | (0.19 | ) | | | (0.19 | ) | | | (0.19 | ) |

| Distributions from net realized gains | | | — | | | | (0.85 | ) | | | — | | | | — | | | | — | |

| Total distributions | | | (0.22 | ) | | | (1.15 | ) | | | (0.19 | ) | | | (0.19 | ) | | | (0.19 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Proceeds from redemption fees collected | | | — | | | | 0.00 | (a) | | | 0.00 | (a) | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | |

| Net asset value, end of year | | $ | 11.93 | | | $ | 10.54 | | | $ | 16.13 | | | $ | 14.57 | | | $ | 13.15 | |

| | | | | | | | | | | | | | | | | | | | | |

TOTAL RETURN (b) | | | 15.57% | | | | (29.46% | ) | | | 12.09% | | | | 12.37% | | | | 8.51% | |

| | | | | | | | | | | | | | | | | | | | | |

| RATIOS/SUPPLEMENTAL DATA | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of year (000’s) | | $ | 61,578 | | | $ | 62,423 | | | $ | 95,052 | | | $ | 85,799 | | | $ | 77,128 | |

| | | | | | | | | | | | | | | | | | | | | |

Ratio of expenses to average net assets (c) | | | 1.45% | | | | 1.38% | | | | 1.35% | | | | 1.38% | | | | 1.38% | |

| | | | | | | | | | | | | | | | | | | | | |

Ratio of net investment income to average net assets (d) | | | 2.07% | | | | 1.71% | | | | 1.21% | | | | 1.20% | | | | 1.12% | |

| | | | | | | | | | | | | | | | | | | | | |

| Portfolio turnover | | | 13% | | | | 22% | | | | 28% | | | | 22% | | | | 21% | |

| (a) | Amount rounds to less than $0.01 per share. |

| (b) | Total return is a measure of the change in the value of an investment in the Portfolio over the periods covered, which assumes dividends or capital gains distributions, if any, are reinvested in shares of the Portfolio. Returns shown do not reflect the taxes a shareholder would pay on Portfolio distributions, if any, or the redemption of Portfolio shares. |

| (c) | The ratios of expenses to average net assets do not reflect the Portfolio’s proportionate share of expenses of the underlying investment companies in which the Portfolio invests. |

| (d) | Recognition of net investment income by the Portfolio is affected by the timing of the declaration of dividends by the underlying investment companies in which the Portfolio invests. |

See accompanying notes to financial statements.

NEW CENTURY OPPORTUNISTIC PORTFOLIO

Selected Per Share Data and Ratios for a Share Outstanding Throughout Each Year

| | | Years Ended October 31, | |

| | | 2009 | | | 2008 | | | 2007 | | | 2006 | | | 2005 | |

| PER SHARE OPERATING PERFORMANCE | | | | | | | | | | | | | | | |

| Net asset value, beginning of year | | $ | 7.08 | | | $ | 11.78 | | | $ | 9.45 | | | $ | 8.72 | | | $ | 7.30 | |

| | | | | | | | | | | | | | | | | | | | | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) | | | 0.01 | | | | (0.05 | ) | | | (0.05 | ) | | | (0.08 | ) | | | (0.06 | ) |

| Net realized and unrealized gains (losses) on investments | | | 0.88 | | | | (4.26 | ) | | | 2.38 | | | | 0.81 | | | | 1.48 | |

| Total from investment operations | | | 0.89 | | | | (4.31 | ) | | | 2.33 | | | | 0.73 | | | | 1.42 | |

| | | | | | | | | | | | | | | | | | | | | |

| Less distributions: | | | | | | | | | | | | | | | | | | | | |

| Distributions from net investment income | | | — | | | | (0.05 | ) | | | — | | | | — | | | | — | |

| Distributions from net realized gains | | | — | | | | (0.34 | ) | | | — | | | | — | | | | — | |

| Total distributions | | | — | | | | (0.39 | ) | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | |

| Proceeds from redemption fees collected | | | 0.00 | (a) | | | 0.00 | (a) | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | |

| Net asset value, end of year | | $ | 7.97 | | | $ | 7.08 | | | $ | 11.78 | | | $ | 9.45 | | | $ | 8.72 | |

| | | | | | | | | | | | | | | | | | | | | |

TOTAL RETURN (b) | | | 12.57% | | | | (37.74% | ) | | | 24.66% | | | | 8.37% | | | | 19.45% | |

| | | | | | | | | | | | | | | | | | | | | |

| RATIOS/SUPPLEMENTAL DATA | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of year (000’s) | | $ | 11,316 | | | $ | 10,587 | | | $ | 14,935 | | | $ | 11,949 | | | $ | 6,891 | |

| | | | | | | | | | | | | | | | | | | | | |

| Ratios of expenses to average net assets: | | | | | | | | | | | | | | | | | | | | |

Before expense reimbursement and waived fees (c) | | | 2.08% | | | | 1.79% | | | | 1.88% | | | | 2.00% | | | | 2.56% | |

After expense reimbursement and waived fees (c) | | | 1.50% | | | | 1.50% | | | | 1.50% | | | | 1.50% | | | | 1.50% | |

| | | | | | | | | | | | | | | | | | | | | |

| Ratios of net investment income (loss) to average net assets: | | | | | | | | | | | | | | | | | | | | |

Before expense reimbursement and waived fees (d) | | | (0.47% | ) | | | (0.89% | ) | | | (0.88% | ) | | | (1.39% | ) | | | (1.80% | ) |

After expense reimbursement and waived fees (d) | | | 0.11% | | | | (0.60% | ) | | | (0.50% | ) | | | (0.89% | ) | | | (0.74% | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Portfolio turnover | | | 10% | | | | 56% | | | | 47% | | | | 49% | | | | 19% | |

| (a) | Amount rounds to less than $0.01 per share. |

| (b) | Total return is a measure of the change in the value of an investment in the Portfolio over the periods covered, which assumes dividends or capital gains distributions, if any, are reinvested in shares of the Portfolio. Returns shown do not reflect the taxes a shareholder would pay on Portfolio distributions, if any, or the redemption of Portfolio shares. |

| (c) | The ratios of expenses to average net assets do not reflect the Portfolio’s proportionate share of expenses of the underlying investment companies in which the Portfolio invests. |

| (d) | Recognition of net investment income (loss) by the Portfolio is affected by the timing of the declaration of dividends by the underlying investment companies in which the Portfolio invests. |

See accompanying notes to financial statements.

NEW CENTURY INTERNATIONAL PORTFOLIO

Selected Per Share Data and Ratios for a Share Outstanding Throughout Each Year

| | | Years Ended October 31, | |

| | | 2009 | | | 2008 | | | 2007 | | | 2006 | | | 2005 | |

| PER SHARE OPERATING PERFORMANCE | | | | | | | | | | | | | | | |

| Net asset value, beginning of year | | $ | 10.08 | | | $ | 20.06 | | | $ | 15.06 | | | $ | 12.12 | | | $ | 10.07 | |

| | | | | | | | | | | | | | | | | | | | | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) | | | 0.13 | | | | 0.28 | | | | 0.03 | | | | (0.06 | ) | | | (0.06 | ) |

| Net realized and unrealized gains (losses) on investments | | | 2.61 | | | | (9.47 | ) | | | 5.61 | | | | 3.12 | | | | 2.42 | |

| Total from investment operations | | | 2.74 | | | | (9.19 | ) | | | 5.64 | | | | 3.06 | | | | 2.36 | |

| | | | | | | | | | | | | | | | | | | | | |

| Less distributions: | | | | | | | | | | | | | | | | | | | | |

| Distributions from net investment income | | | (0.12 | ) | | | (0.33 | ) | | | (0.06 | ) | | | — | | | | — | |

| Distributions from net realized gains | | | — | | | | (0.46 | ) | | | (0.58 | ) | | | (0.12 | ) | | | (0.31 | ) |

| Total distributions | | | (0.12 | ) | | | (0.79 | ) | | | (0.64 | ) | | | (0.12 | ) | | | (0.31 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Proceeds from redemption fees collected | | | 0.00 | (a) | | | 0.00 | (a) | | | 0.00 | (a) | | | 0.00 | (a) | | | 0.00 | (a) |

| | | | | | | | | | | | | | | | | | | | | |

| Net asset value, end of year | | $ | 12.70 | | | $ | 10.08 | | | $ | 20.06 | | | $ | 15.06 | | | $ | 12.12 | |

| | | | | | | | | | | | | | | | | | | | | |

TOTAL RETURN (b) | | | 27.45% | | | | (47.52% | ) | | | 38.62% | | | | 25.35% | | | | 23.70% | |

| | | | | | | | | | | | | | | | | | | | | |

| RATIOS/SUPPLEMENTAL DATA | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of year (000’s) | | $ | 89,449 | | | $ | 76,234 | | | $ | 147,416 | | | $ | 102,945 | | | $ | 45,014 | |

| | | | | | | | | | | | | | | | | | | | | |

| Ratios of expenses to average net assets: | | | | | | | | | | | | | | | | | | | | |

Before expense reimbursement and waived fees (c) | | | 1.44% | | | | 1.29% | | | | 1.35% | | | | 1.50% | | | | 1.55% | |

After expense reimbursement and waived fees (c) | | | 1.44% | | | | 1.29% | (e) | | | 1.35% | (e) | | | 1.50% | (e) | | | 1.50% | |

| | | | | | | | | | | | | | | | | | | | | |

| Ratios of net investment income (loss) to average net assets: | | | | | | | | | | | | | | | | | | | | |

Before expense reimbursement and waived fees (d) | | | 1.23% | | | | 1.66% | | | | 0.11% | | | | (0.46% | ) | | | (0.72% | ) |

After expense reimbursement and waived fees (d) | | | 1.23% | | | | 1.66% | (e) | | | 0.11% | (e) | | | (0.46% | )(e) | | | (0.67% | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Portfolio turnover | | | 11% | | | | 34% | | | | 10% | | | | 22% | | | | 3% | |

| (a) | Amount rounds to less than $0.01 per share. |

| (b) | Total return is a measure of the change in the value of an investment in the Portfolio over the periods covered, which assumes dividends or capital gains distributions, if any, are reinvested in shares of the Portfolio. Returns shown do not reflect the taxes a shareholder would pay on Portfolio distributions, if any, or the redemption of Portfolio shares. |

| (c) | The ratios of expenses to average net assets do not reflect the Portfolio’s proportionate share of expenses of the underlying investment companies in which the Portfolio invests. |

| (d) | Recognition of net investment income (loss) by the Portfolio is affected by the timing of the declaration of dividends by the underlying investment companies in which the Portfolio invests. |

| (e) | Absent the recoupment of fees previously waived and reimbursed by the Advisor, the ratios of expenses to average net assets would have been 1.28%, 1.32% and 1.41% and the ratios of net investment income (loss) to average net assets would have been 1.68%, 0.14% and (0.37%) for the years ended October 31, 2008, 2007 and 2006, respectively (Note 2). |

See accompanying notes to financial statements.

NEW CENTURY ALTERNATIVE STRATEGIES PORTFOLIO

Selected Per Share Data and Ratios for a Share Outstanding Throughout Each Year

| | | Years Ended October 31, | |

| | | 2009 | | | 2008 | | | 2007 | | | 2006 | | | 2005 | |

| PER SHARE OPERATING PERFORMANCE | | | | | | | | | | | | | | | |

| Net asset value, beginning of year | | $ | 10.14 | | | $ | 13.93 | | | $ | 13.03 | | | $ | 11.99 | | | $ | 11.46 | |

| | | | | | | | | | | | | | | | | | | | | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | 0.14 | | | | 0.27 | | | | 0.18 | | | | 0.21 | | | | 0.15 | |

| Net realized and unrealized gains (losses) on investments | | | 1.15 | | | | (3.39 | ) | | | 1.34 | | | | 1.23 | | | | 0.87 | |

| Total from investment operations | | | 1.29 | | | | (3.12 | ) | | | 1.52 | | | | 1.44 | | | | 1.02 | |

| | | | | | | | | | | | | | | | | | | | | |

| Less distributions: | | | | | | | | | | | | | | | | | | | | |

| Distributions from net investment income | | | (0.32 | ) | | | (0.36 | ) | | | (0.32 | ) | | | (0.33 | ) | | | (0.24 | ) |

| Distributions from net realized gains | | | — | | | | (0.31 | ) | | | (0.30 | ) | | | (0.07 | ) | | | (0.25 | ) |

| Total distributions | | | (0.32 | ) | | | (0.67 | ) | | | (0.62 | ) | | | (0.40 | ) | | | (0.49 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Proceeds from redemption fees collected | | | 0.00 | (a) | | | 0.00 | (a) | | | 0.00 | (a) | | | — | | | | 0.00 | (a) |

| | | | | | | | | | | | | | | | | | | | | |

| Net asset value, end of year | | $ | 11.11 | | | $ | 10.14 | | | $ | 13.93 | | | $ | 13.03 | | | $ | 11.99 | |

| | | | | | | | | | | | | | | | | | | | | |

TOTAL RETURN (b) | | | 13.16% | | | | (23.44% | ) | | | 12.09% | | | | 12.32% | | | | 9.12% | |

| | | | | | | | | | | | | | | | | | | | | |

| RATIOS/SUPPLEMENTAL DATA | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of year (000’s) | | $ | 139,168 | | | $ | 136,999 | | | $ | 128,117 | | | $ | 97,811 | | | $ | 76,560 | |

| | | | | | | | | | | | | | | | | | | | | |

Ratios of expenses to average net assets (c) | | | 1.06% | | | | 1.00% | | | | 1.06% | | | | 1.08% | | | | 1.06% | |

| | | | | | | | | | | | | | | | | | | | | |

Ratios of net investment income to average net assets (d) | | | 1.46% | | | | 1.46% | | | | 1.07% | | | | 1.43% | | | | 1.06% | |

| | | | | | | | | | | | | | | | | | | | | |

| Portfolio turnover | | | 27% | | | | 17% | | | | 8% | | | | 12% | | | | 11% | |

| (a) | Amount rounds to less than $0.01 per share. |

| (b) | Total return is a measure of the change in the value of an investment in the Portfolio over the periods covered, which assumes dividends or capital gains distributions, if any, are reinvested in shares of the Portfolio. Returns shown do not reflect the taxes a shareholder would pay on Portfolio distributions, if any, or the redemption of Portfolio shares. |

| (c) | The ratios of expenses to average net assets do not reflect the Portfolio’s proportionate share of expenses of the underlying investment companies in which the Portfolio invests. |

| (d) | Recognition of net investment income by the Portfolio is affected by the timing of the declaration of dividends by the underlying investment companies in which the Portfolio invests. |

See accompanying notes to financial statements.

NEW CENTURY PORTFOLIOS

NOTES TO FINANCIAL STATEMENTS

| (1) | SIGNIFICANT ACCOUNTING POLICIES |

New Century Portfolios (“New Century”) is organized as a Massachusetts business trust which is registered under the Investment Company Act of 1940, as amended, as an open-end management investment company and currently offers shares of five series: New Century Capital Portfolio, New Century Balanced Portfolio, New Century Opportunistic Portfolio, New Century International Portfolio and New Century Alternative Strategies Portfolio (together, the “Portfolios”). New Century Capital Portfolio and New Century Balanced Portfolio commenced operations on January 31, 1989. New Century Opportunistic Portfolio and New Century International Portfolio commenced operations on November 1, 2000, and New Century Alternative Strategies Portfolio commenced operations on May 1, 2002.

Weston Financial Group, Inc. (the “Advisor”), a wholly-owned subsidiary of The Washington Trust Company, serves as the investment advisor to each Portfolio. Weston Securities Corporation (the “Distributor”), a wholly-owned subsidiary of Washington Trust Bancorp, Inc., serves as the distributor and principal underwriter to each Portfolio.

The investment objective of New Century Capital Portfolio is to provide capital growth, with a secondary objective to provide income, while managing risk. This Portfolio seeks to achieve its objectives by investing primarily in shares of other registered investment companies that emphasize investments in equities (domestic and foreign).

The investment objective of New Century Balanced Portfolio is to provide income, with a secondary objective to provide capital growth, while managing risk. This Portfolio seeks to achieve its objectives by investing primarily in shares of other registered investment companies that emphasize investments in equities (domestic and foreign), fixed income securities (domestic and foreign), or in a composite of such securities. This Portfolio maintains at least 25% of its assets in fixed income securities by selecting registered investment companies that invest in such securities.

The investment objective of New Century Opportunistic Portfolio is to provide capital growth, without regard to current income, while managing risk. This Portfolio seeks to achieve its objective by investing primarily in shares of registered investment companies that emphasize investments in equities (domestic and foreign), fixed income securities that seek appreciation such as high-yield, lower rated debt securities (domestic or foreign), or other securities that are selected by those investment companies to achieve growth.

NEW CENTURY PORTFOLIOS

NOTES TO FINANCIAL STATEMENTS (Continued)

The investment objective of New Century International Portfolio is to provide capital growth, with a secondary objective to provide income, while managing risk. This Portfolio seeks to achieve its objectives by investing primarily in shares of registered investment companies that emphasize investments in equities and fixed income securities (foreign, worldwide, emerging markets and domestic).

The investment objective of New Century Alternative Strategies Portfolio is to provide long-term capital appreciation, with a secondary objective to earn income, while managing risk. This Portfolio seeks to achieve its objectives by investing primarily in shares of other registered investment companies that emphasize alternative strategies.

The price of shares of each Portfolio fluctuates daily and there is no assurance that the Portfolios will be successful in achieving their stated investment objectives.

The following is a summary of significant accounting policies consistently followed by the Portfolios in the preparation of their financial statements. These policies are in conformity with accounting principles generally accepted in the United States of America (“GAAP”).

Investments in shares of other open-end investment companies are valued at their net asset value as reported by such companies. The Portfolios may also invest in closed-end investment companies, exchange traded funds, and to a certain extent, directly in securities. Investments in closed-end investment companies, exchange traded funds and direct investments in securities are valued at market prices, as described in the paragraph below. The net asset value as reported by open-end investment companies may be based on fair value pricing; to understand the fair value pricing process used by such companies, consult their most current prospectus.

Investments in securities traded on a national securities exchange or included in NASDAQ are generally valued at the last reported sales price, the closing price or the official closing price; and securities traded in the over-the-counter market and listed securities for which no sale is reported on that date are valued at the last reported bid price. It is expected that fixed income securities will ordinarily be traded in the over-the-counter market. When market quotations are not readily available, fixed income securities may be valued on the basis of prices provided by an independent pricing service. Other assets and securities for which no quotations are readily available or for which quotations the Advisor believes do not reflect market value are valued at their fair value as determined in good faith by the Advisor under the procedures established by the Board of Trustees. Short-term investments are valued at amortized cost which approximates market value.

NEW CENTURY PORTFOLIOS

NOTES TO FINANCIAL STATEMENTS (Continued)

GAAP establish a single authoritative definition of fair value, set out a framework for measuring fair value and require additional disclosures about fair value measurements. Various inputs are used in determining the value of the Portfolios’ investments. These inputs are summarized in the three broad levels listed below:

• Level 1 – quoted prices in active markets for identical securities

• Level 2 – other significant observable inputs

• Level 3 – significant unobservable inputs

The inputs or methodology used for valuing securities are not necessarily an indication of the risks associated with investing in those securities.

The following is a summary of the inputs used to value each Portfolio’s investments as of October 31, 2009:

| Valuation Inputs | | New Century Capital Portfolio | | | New Century Balanced Portfolio | | | New Century Opportunistic Portfolio | | | New Century International Portfolio | | | New Century Alternative Strategies Portfolio | |

| Level 1 – Quoted Prices | | $ | 85,076,521 | | | $ | 61,643,924 | | | $ | 11,326,010 | | | $ | 89,535,816 | | | $ | 132,917,575 | |

| Level 2 – Other Significant Observable Inputs | | | — | | | | — | | | | — | | | | — | | | | 5,956,640 | |

| Level 3 – Significant Unobservable Inputs | | | — | | | | — | | | | — | | | | — | | | | — | |

| Total | | $ | 85,076,521 | | | $ | 61,643,924 | | | $ | 11,326,010 | | | $ | 89,535,816 | | | $ | 138,874,215 | |