UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

| Investment Company Act file number | 811-05652 |

| | |

| | BNY Mellon Municipal Income, Inc. | |

| | (Exact name of Registrant as specified in charter) | |

| | | |

| | c/o BNY Mellon Investment Adviser, Inc. 240 Greenwich Street New York, New York 10286 | |

| | (Address of principal executive offices) (Zip code) | |

| | | |

| | Deirdre Cunnane, Esq. 240 Greenwich Street New York, New York 10286 | |

| | (Name and address of agent for service) | |

| |

| Registrant's telephone number, including area code: | (212) 922-6400 |

| | |

Date of fiscal year end: | 09/30 | |

| Date of reporting period: | 09/30/2022 | |

| | | | | | | |

FORM N-CSR

Item 1. Reports to Stockholders.

BNY Mellon Municipal Income, Inc.

| |

ANNUAL REPORT September 30, 2022 |

| |

|

| |

BNY Mellon Municipal Income, Inc. Protecting Your Privacy

Our Pledge to You THE FUND IS COMMITTED TO YOUR PRIVACY. On this page, you will find the fund’s policies and practices for collecting, disclosing, and safeguarding “nonpublic personal information,” which may include financial or other customer information. These policies apply to individuals who purchase fund shares for personal, family, or household purposes, or have done so in the past. This notification replaces all previous statements of the fund’s consumer privacy policy, and may be amended at any time. We’ll keep you informed of changes as required by law. YOUR ACCOUNT IS PROVIDED IN A SECURE ENVIRONMENT. The fund maintains physical, electronic and procedural safeguards that comply with federal regulations to guard nonpublic personal information. The fund’s agents and service providers have limited access to customer information based on their role in servicing your account. THE FUND COLLECTS INFORMATION IN ORDER TO SERVICE AND ADMINISTER YOUR ACCOUNT. The fund collects a variety of nonpublic personal information, which may include: • Information we receive from you, such as your name, address, and social security number. • Information about your transactions with us, such as the purchase or sale of fund shares. • Information we receive from agents and service providers, such as proxy voting information. THE FUND DOES NOT SHARE NONPUBLIC PERSONAL INFORMATION WITH ANYONE, EXCEPT AS PERMITTED BY LAW. Thank you for this opportunity to serve you. |

| |

The views expressed in this report reflect those of the portfolio manager(s) only through the end of the period covered and do not necessarily represent the views of BNY Mellon Investment Adviser, Inc. or any other person in the BNY Mellon Investment Adviser, Inc. organization. Any such views are subject to change at any time based upon market or other conditions and BNY Mellon Investment Adviser, Inc. disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a fund in the BNY Mellon Family of Funds are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any fund in the BNY Mellon Family of Funds. |

| |

Not FDIC-Insured • Not Bank-Guaranteed • May Lose Value |

Contents

THE FUND

FOR MORE INFORMATON

Back Cover

| |

| |

Save time. Save paper. View your next shareholder report online as soon as it’s available. Log into www.im.bnymellon.com and sign up for eCommunications. It’s simple and only takes a few minutes. |

DISCUSSION OF FUND PERFORMANCE (Unaudited)

For the period from October 1, 2021, through September 30, 2022, as provided by Daniel Rabasco and Jeffrey Burger, Primary Portfolio Managers with Insight North America LLC INA or the Sub-Adviser

Market and Fund Performance Overview

For the 12-month period ended September 30, 2022, BNY Mellon Municipal Income, Inc. (the “fund”) produced a total return of −21.98% on a net asset value basis and −34.69% on a market price basis.1 Over the same period, the fund provided aggregate income dividends of $.344 per share, which reflects a distribution rate of 5.72%. In comparison, the Bloomberg U.S. Municipal Bond Index (the “Index”), the fund’s benchmark, posted a total return of −11.50% for the same period.2

Municipal bonds declined during the reporting period as the market was hindered by inflation concerns and rising interest rates.

The Fund’s Investment Approach

The fund seeks to maximize current income exempt from federal income tax to the extent consistent with the preservation of capital. Under normal market conditions, the fund invests at least 80% of the value of its net assets in municipal obligations. The fund invests in municipal obligations which, at the time of purchase, are rated investment grade or the unrated equivalent as determined by the Sub-Adviser, Inc. in the case of bonds, and rated in the two highest-rating categories or the unrated equivalent as determined by the Sub-Adviser, Inc. in the case of short-term obligations having, or deemed to have, maturities of less than one year.

To this end, we have constructed a portfolio based on identifying income opportunities through analysis of each bond’s structure, including paying close attention to each bond’s yield, maturity and early redemption features. Over time, many of the fund’s relatively higher-yielding bonds mature or are redeemed by their issuers, and we generally attempt to replace those bonds with investments consistent with the fund’s investment policies, albeit with yields that reflect the then-current interest-rate environment. When making new investments, we focus on identifying undervalued sectors and securities, and we minimize the use of interest-rate forecasting. We use fundamental analysis to estimate the relative value and attractiveness of various sectors and securities and to exploit pricing inefficiencies in the municipal bond market.

Markets Hindered by Inflation and Rising Rates

Fixed-income markets posted a negative performance during the reporting period, driven primarily by worries about rising inflation, Russia’s invasion of Ukraine and tightening monetary policy.

Early in the reporting period, the municipal bond market continued to benefit from policies put in place in response to the COVID-19 pandemic, including support from the federal government. This, and a number of other factors, produced strong inflows to the market.

The fiscal health of issuers was also supported by an economy that was strong early in the reporting period. During much of the pandemic, real estate and income tax collections failed to decline as much as predicted, and progressive tax regimes proved beneficial because higher-earning, office workers were largely able to work from home. Strong stock market returns also boosted revenues from capital gains taxes.

Later in the reporting period, however, a number of headwinds emerged. As oil prices rose, inflation measures reached multi-decade highs. This raised the possibility that higher prices would slow consumer spending and the broader economy.

In addition, the Federal Reserve (the “Fed”) began to act on the signals it sent late in 2021 that it would be raising the federal funds rate. In March 2022, the Fed raised the federal funds rate by 25 basis points (bps) and followed that up in May 2022, with an increase of 50 bps. In June, July and September rates were again raised, this time by 75 bps each time, bringing the federal funds target rate to between 3.00% and 3.25%.

2

Fears that the economy could slow were realized when the first-quarter GDP figures were released in April 2022 showing the economy declined somewhat. A still-strong labor market, however, suggested that the economy could rebound. Second-quarter data, however, showed that the economy shrank again, making for two consecutive quarters of decline, a rough indicator of recession.

The persistence of higher-than-expected inflation, combined with measures from the Fed to combat it, led to significant outflows from municipal bond mutual funds, especially in the second half of the reporting period. The need for fund managers to meet redemptions only added to the downward momentum. In addition, the latter part of the period was characterized by volatility stemming from these headwinds as well as from the war in Ukraine.

While headwinds prevailed over much of the period, and mutual fund outflows have been substantial, credit fundamentals in the municipal market remained strong. In addition, volatility has resulted in more attractive valuations in many segments of the market, creating the potential for outperformance in the future.

Duration and Security Selection Detracted

The fund’s performance was hampered primarily by its duration and security selection. The fund’s longer duration detracted from performance, as rates rose at the long end of the curve in response to inflation and rising interest rates. The leverage used to enhance performance also detracted, as rates at the short end of the curve rose, raising borrowing costs. Selections in the education, health care and pre-paid gas sectors were also detrimental to returns. The fund’s allocation to revenue bonds hindered returns as well, especially in the pre-paid gas and health care sectors.

On a more positive note, the fund’s performance was aided by certain sector allocations. Positions in tobacco bonds and in airport bonds were the primary positive contributors to performance. An allocation to appropriation debt was also beneficial. The fund did not employ derivatives during the reporting period. The fund did participate in secondary inverse floater structures.

Positioning for Higher Yields and a Rebound

We are maintaining the fund’s relatively long duration and will continue to swap out lower-yielding debt for higher-yielding debt. We also are maintaining a relatively large allocation to revenue bonds. We remain confident that the fund is also well positioned for a market rebound, which we anticipate will occur when the Fed completes its tightening cycle.

October 17, 2022

1 Total return includes reinvestment of dividends and any capital gains paid, based upon net asset value per share or market price per share, as applicable. Past performance is no guarantee of future results. Market price per share, net asset value per share and investment return fluctuates. Income may be subject to state and local taxes, and some income may be subject to the federal alternative minimum tax (AMT) for certain investors. Capital gains, if any, are fully taxable.

2 Source: Lipper, Inc. ---The Bloomberg U.S. Municipal Bond Index covers the U.S. dollar-denominated long-term tax-exempt bond market. Unlike a fund, the Index is not subject to fees and other expenses. Investors cannot invest directly in any index. Distribution rate per share is based upon dividends per share paid from net investment income during the period, annualized and divided by the market price per share at the end of the period, adjusted for any capital gain distributions.

Bonds are subject generally to interest-rate, credit, liquidity and market risks, to varying degrees. Generally, all other factors being equal, bond prices are inversely related to interest-rate changes, and rate increases can cause price declines. High yield bonds are subject to increased credit risk and are considered speculative in terms of the issuer’s perceived ability to continue making interest payments on a timely basis and to repay principal upon maturity. The use of leverage may magnify the fund’s gains or losses. For derivatives with a leveraging component, adverse changes in the value or level of the underlying asset can result in a loss that is much greater than the original investment in the derivative.

Recent market risks include pandemic risks related to COVID-19. The effects of COVID-19 have contributed to increased volatility in global markets and will likely affect certain countries, companies, industries and market sectors more dramatically than others. To the extent the fund may overweight its investments in certain countries, companies, industries or market sectors, such positions will increase the fund’s exposure to risk of loss from adverse developments affecting those countries, companies, industries or sectors.

3

FUND PERFORMANCE (Unaudited)

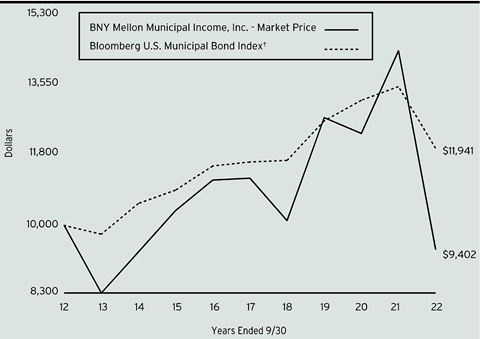

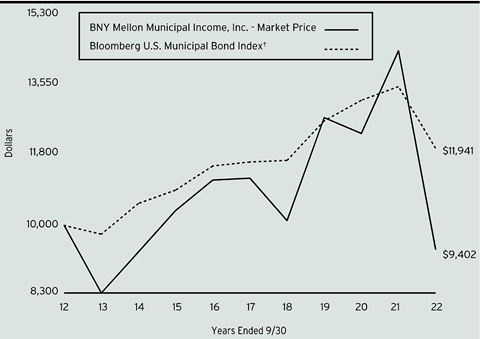

Comparison of change in value of a $10,000 investment in BNY Mellon Municipal Income, Inc. with a hypothetical investment of $10,000 in the Bloomberg U.S. Municipal Bond Index (the “Index”).

† Source: Lipper Inc.

Past performance is not predictive of future performance.

The above graph compares a hypothetical investment of $10,000 made in BNY Mellon Municipal Income, Inc. on 09/30/2012 to a hypothetical investment of $10,000 made in the Index on that date. All figures for the fund are based on market price. All dividends and capital gain distributions are reinvested.

The fund invests primarily in municipal securities and its performance shown in the line graph takes into account fees and expenses. The Index covers the U.S. dollar-denominated long-term tax-exempt bond market. Unlike a fund, the Index is not subject to fees and other expenses. Investors cannot invest directly in any index. Further information relating to fund performance, including expense reimbursements, if applicable, is contained in the Financial Highlights within this report and elsewhere in this report.

| | | | |

Average Annual Total Returns as of 9/30/2022 |

| 1 Year | 5 Years | 10 Years |

BNY Mellon Municipal Income, Inc. Fund-Market Price | -34.69% | -3.42% | -.61% |

BNY Mellon Municipal Income, Inc. Fund-Net Asset Value | -21.98% | -1.11% | 1.47% |

Bloomberg U.S. Municipal Bond Index | -11.50% | .59% | 1.79% |

The performance data quoted represents past performance, which is no guarantee of future results. Share price and investment return fluctuate and an investor’s shares may be worth more or less than original cost upon sale of the shares. Current performance may be lower or higher than the performance quoted. Go to www.im.bnymellon.com for the fund’s most recent month-end returns.

The fund’s performance shown in the graph and table does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the sale of fund shares.

4

DISTRIBUTION INFORMATION

The following information regarding the fund’s distributions is current as of September 30, 2022, the fund’s fiscal year end. The fund’s returns during the period were sufficient to meet fund distributions.

The fund’s distribution policy is intended to provide shareholders with stable, but not guaranteed, cash flow, independent of the amount or timing of income earned or capital gains realized by the fund. The fund intends to distribute all or substantially all of its net investment income through its regular monthly distribution and to distribute realized capital gains at least annually. In addition, in any monthly period, in order to try to maintain a level distribution amount, the fund may pay out more or less than its net investment income during the period. As a result, distributions sources may include net investment income, realized gains and return of capital. You should not draw any conclusions about the fund’s investment performance from the amount of the distribution or from the terms of the level distribution program. A return of capital is a non-taxable distribution of a portion of a fund’s capital. A return of capital distribution does not necessarily reflect a fund’s investment performance and should not be confused with “yield” or “income.”

The amounts and sources of distributions reported below are for financial reporting purposes and are not being provided for tax reporting purposes. The actual amounts and character of the distributions for tax reporting purposes will be reported to shareholders on Form 1099-DIV, which will be sent to shareholders shortly after calendar year-end. Because distribution source estimates are updated throughout the current fiscal year based on the fund’s performance, those estimates may differ from both the tax information reported to you in your fund’s 1099 statement, as well as the ultimate economic sources of distributions over the life of your investment. The figures in the table below provide the sources of distributions and may include amounts attributed to realized gains and/or returns of capital.

| | | | | | | | |

Distributions |

| | Current Month

Percentage of Distributions | Fiscal Year Ended

Per Share Amounts |

| Net Investment Income | Realized Gains | Return of Capital | Total Distributions | Net Investment Income | Realized Gains | Return of Capital |

BNY Mellon Municipal Income, Inc. | 100.00% | .00% | .00% | $.34 | $.34 | $.00 | $.00 |

5

SELECTED INFORMATION

September 30, 2022 (Unaudited)

| | | | | | | | | | | | | | | |

Market Price per share September 30, 2022 | | $6.01 | | |

Shares Outstanding September 30, 2022 | | 20,757,267 | | |

NYSE MKT Ticker Symbol | | DMF | | |

MARKET PRICE (NYSE MKT) |

| | | | Fiscal Year Ended September 30, 2022 | | |

| | Quarter | | Quarter | | Quarter | | Quarter |

| | Ended | | Ended | | Ended | | Ended |

| | December 31, 2021 | | March 31, 2022 | | June 30, 2022 | | September 30, 2022 |

High | $9.69 | | $8.78 | | $7.49 | | $7.18 |

Low | 8.65 | | 7.34 | | 6.54 | | 6.00 |

Close | 8.75 | | 7.59 | | 6.75 | | 6.01 |

PERCENTAGE GAIN (LOSS) based on change in Market Price† |

October 24, 1988 (commencement of operations) through September 30, 2022 | 415.79% |

October 1, 2012 through September 30, 2022 | (5.97) |

October 1, 2017 through September 30, 2022 | (15.98) |

October 1, 2021 through September 30, 2022 | (34.69) |

January 1, 2022 through September 30, 2022 | (28.86) |

April 1, 2022 through September 30, 2022 | (18.89) |

July 1, 2022 through September 30, 2022 | (9.92) |

| | | | | |

NET ASSET VALUE PER SHARE | |

October 24, 1988 (commencement of operations) | $9.26 |

September 30, 2021 | 9.29 |

December 31, 2021 | | | 9.31 |

March 31, 2022 | 8.28 |

June 30, 2022 | 7.56 |

September 30, 2022 | 6.93 |

PERCENTAGE GAIN (LOSS) based on change in Net Asset Value† | |

October 24, 1988 (commencement of operations) through September 30, 2022 | 541.95% |

October 1, 2012 through September 30, 2022 | 15.73 |

October 1, 2017 through September 30, 2022 | (5.45) |

October 1, 2021 through September 30, 2022 | (21.98) |

January 1, 2022 through September 30, 2022 | (22.95) |

April 1, 2022 through September 30, 2022 | (14.31) |

July 1, 2022 through September 30, 2022 | (7.31) |

† Total return includes reinvestment of dividends and any capital gains paid. | |

6

STATEMENT OF INVESTMENTS

September 30, 2022

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount ($) | | Value ($) | |

Long-Term Municipal Investments - 159.0% | | | | | |

Alabama - 5.5% | | | | | |

Jefferson County, Revenue Bonds, Refunding, Ser. F | | 7.75 | | 10/1/2046 | | 4,000,000 | a | 4,040,436 | |

The Lower Alabama Gas District, Revenue Bonds, Ser. A | | 5.00 | | 9/1/2046 | | 2,500,000 | | 2,397,538 | |

University of Alabama at Birmingham, Revenue Bonds, Ser. B | | 4.00 | | 10/1/2036 | | 1,500,000 | | 1,426,122 | |

| | 7,864,096 | |

Arizona - 4.9% | | | | | |

Arizona Industrial Development Authority, Revenue Bonds (Equitable School Revolving Fund LLC Obligated Group) Ser. A | | 4.00 | | 11/1/2045 | | 1,355,000 | | 1,147,335 | |

Glendale Industrial Development Authority, Revenue Bonds, Refunding (Sun Health Services Obligated Group) Ser. A | | 5.00 | | 11/15/2048 | | 1,500,000 | | 1,453,257 | |

La Paz County Industrial Development Authority, Revenue Bonds (Harmony Public Schools) Ser. A | | 5.00 | | 2/15/2046 | | 1,500,000 | b | 1,399,285 | |

La Paz County Industrial Development Authority, Revenue Bonds (Harmony Public Schools) Ser. A | | 5.00 | | 2/15/2036 | | 1,000,000 | b | 978,678 | |

Salt Verde Financial Corp., Revenue Bonds | | 5.00 | | 12/1/2037 | | 2,190,000 | | 2,157,765 | |

| | 7,136,320 | |

California - 12.6% | | | | | |

California County Tobacco Securitization Agency, Revenue Bonds, Refunding, Ser. A | | 4.00 | | 6/1/2049 | | 1,000,000 | | 811,927 | |

California County Tobacco Securitization Agency, Revenue Bonds, Refunding, Ser. A | | 4.00 | | 6/1/2039 | | 565,000 | | 499,564 | |

San Diego County Regional Airport Authority, Revenue Bonds, Ser. B | | 5.00 | | 7/1/2051 | | 3,750,000 | | 3,741,456 | |

Southern California Tobacco Securitization Authority, Revenue Bonds, Refunding (San Diego County Tobacco Asset Securitization Corp.) | | 5.00 | | 6/1/2048 | | 2,000,000 | | 1,957,411 | |

7

STATEMENT OF INVESTMENTS (continued)

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount ($) | | Value ($) | |

Long-Term Municipal Investments - 159.0% (continued) | | | | | |

California - 12.6% (continued) | | | | | |

Tender Option Bond Trust Receipts (Series 2016-XM0387), (Los Angeles Department of Airports, Revenue Bonds (Los Angeles International Airport)) Non-recourse, Underlying Coupon Rate (%) 5.00 | | 10.78 | | 5/15/2038 | | 4,000,000 | b,c,d | 4,009,204 | |

Tender Option Bond Trust Receipts (Series 2016-XM0390), (The Regents of the University of California, Revenue Bonds, Refunding) Non-recourse, Underlying Coupon Rate (%) 5.00 | | 10.84 | | 5/15/2036 | | 3,740,000 | b,c,d | 3,784,023 | |

Tender Option Bond Trust Receipts (Series 2022-XF3024), (San Franscisco City & County, Revenue Bonds, Refunding, Ser. A) Recourse, Underlying Coupon Rate (%) 5.00 | | 11.07 | | 5/1/2044 | | 3,360,000 | b,c,d | 3,359,933 | |

| | 18,163,518 | |

Colorado - 6.0% | | | | | |

Colorado Health Facilities Authority, Revenue Bonds, Refunding (Covenant Living Communities & Services Obligated Group) Ser. A | | 4.00 | | 12/1/2050 | | 2,000,000 | | 1,522,182 | |

Colorado High Performance Transportation Enterprise, Revenue Bonds | | 5.00 | | 12/31/2056 | | 1,500,000 | | 1,456,804 | |

Tender Option Bond Trust Receipts (Series 2016-XM0433), (Colorado Springs, Revenue Bonds) Recourse, Underlying Coupon Rate (%) 5.00 | | 10.93 | | 11/15/2043 | | 3,997,093 | b,c,d | 4,053,512 | |

Tender Option Bond Trust Receipts (Series 2020-XM0829), (Colorado Health Facilities Authority, Revenue Bonds, Refunding (CommonSpirit Health Obligated Group, Ser. A1)) Recourse, Underlying Coupon Rate (%) 4.00 | | 9.98 | | 8/1/2044 | | 1,645,000 | b,c,d | 1,651,665 | |

| | 8,684,163 | |

Connecticut - 3.6% | | | | | |

Connecticut, Revenue Bonds, Ser. A | | 5.00 | | 5/1/2040 | | 1,000,000 | | 1,051,608 | |

Connecticut Health & Educational Facilities Authority, Revenue Bonds, Refunding (Connecticut College) Ser. M | | 4.00 | | 7/1/2052 | | 2,000,000 | | 1,618,791 | |

8

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount ($) | | Value ($) | |

Long-Term Municipal Investments - 159.0% (continued) | | | | | |

Connecticut - 3.6% (continued) | | | | | |

Connecticut Health & Educational Facilities Authority, Revenue Bonds, Refunding (Trinity Health Corp. Obligated Group) | | 5.00 | | 12/1/2045 | | 2,500,000 | | 2,500,523 | |

| | 5,170,922 | |

District of Columbia - 4.9% | | | | | |

Tender Option Bond Trust Receipts (Series 2016-XM0437), (District of Columbia, Revenue Bonds) Recourse, Underlying Coupon Rate (%) 5.00 | | 10.93 | | 12/1/2035 | | 6,997,490 | b,c,d | 7,018,482 | |

Florida - 7.3% | | | | | |

Atlantic Beach, Revenue Bonds (Fleet Landing Project) Ser. A | | 5.00 | | 11/15/2048 | | 1,500,000 | | 1,467,806 | |

Florida Higher Educational Facilities Financial Authority, Revenue Bonds (Ringling College Project) | | 5.00 | | 3/1/2049 | | 1,500,000 | | 1,391,637 | |

Halifax Hospital Medical Center, Revenue Bonds, Refunding | | 4.00 | | 6/1/2025 | | 1,000,000 | e | 1,015,405 | |

Palm Beach County Health Facilities Authority, Revenue Bonds (Lifespace Communities Inc. Obligated Group) Ser. B | | 4.00 | | 5/15/2053 | | 1,000,000 | | 681,449 | |

Tampa, Revenue Bonds (H. Lee Moffitt Cancer Center & Research Institute Obligated Group) Ser. B | | 5.00 | | 7/1/2050 | | 1,500,000 | | 1,487,340 | |

Tender Option Bond Trust Receipts (Series 2019-XM0782), (Palm Beach County Florida Health Facilities Authority, Revenue Bonds, Refunding (Baptist Health South Florida Obligated Group)) Recourse, Underlying Coupon Rate (%) 4.00 | | 7.11 | | 8/15/2049 | | 2,770,000 | b,c,d | 2,339,096 | |

Tender Option Bond Trust Receipts (Series 2020-XF2877), (Greater Orlando Aviation Authority, Revenue Bonds, Ser. A) Recourse, Underlying Coupon Rate (%) 4.00 | | 7.05 | | 10/1/2049 | | 1,380,000 | b,c,d | 1,169,431 | |

Tender Option Bond Trust Receipts (Series 2022-XF1385), (Fort Myers FL Utility, Revenue Bonds, Refunding, Ser. A) Non-Recourse, Underlying Coupon Rate (%) 4.00 | | 6.02 | | 10/1/2044 | | 1,050,000 | b,c,d | 939,753 | |

| | 10,491,917 | |

9

STATEMENT OF INVESTMENTS (continued)

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount ($) | | Value ($) | |

Long-Term Municipal Investments - 159.0% (continued) | | | | | |

Georgia - 5.1% | | | | | |

Georgia Municipal Electric Authority, Revenue Bonds (Plant Vogtle Units 3&4 Project) Ser. A | | 5.00 | | 7/1/2052 | | 1,250,000 | | 1,207,908 | |

Tender Option Bond Trust Receipts (Series 2019-XF2847), (Municipal Electric Authority of Georgia, Revenue Bonds (Plant Vogtle Unis 3&4 Project, Ser. A)) Recourse, Underlying Coupon Rate (%) 5.00 | | 10.75 | | 1/1/2056 | | 1,270,000 | b,c,d | 1,224,944 | |

Tender Option Bond Trust Receipts (Series 2020-XM0825), (Brookhaven Development Authority, Revenue Bonds (Children's Healthcare of Atlanta, Ser. A)) Recourse, Underlying Coupon Rate (%) 4.00 | | 8.43 | | 7/1/2044 | | 2,660,000 | b,c,d | 2,569,542 | |

The Atlanta Development Authority, Revenue Bonds, Ser. A1 | | 5.25 | | 7/1/2040 | | 1,500,000 | | 1,541,967 | |

The Burke County Development Authority, Revenue Bonds, Refunding (Oglethorpe Power Corp.) Ser. D | | 4.13 | | 11/1/2045 | | 1,000,000 | | 825,814 | |

| | 7,370,175 | |

Illinois - 19.4% | | | | | |

Chicago Board of Education, Revenue Bonds | | 5.00 | | 4/1/2046 | | 1,725,000 | | 1,720,596 | |

Chicago II, GO, Refunding, Ser. A | | 6.00 | | 1/1/2038 | | 2,000,000 | | 2,069,205 | |

Chicago II, GO, Ser. A | | 5.00 | | 1/1/2044 | | 1,000,000 | | 953,197 | |

Chicago II Wastewater Transmission, Revenue Bonds, Refunding, Ser. C | | 5.00 | | 1/1/2039 | | 1,100,000 | | 1,077,757 | |

Chicago II Waterworks, Revenue Bonds (2nd Lien Project) | | 5.00 | | 11/1/2028 | | 1,000,000 | | 1,021,368 | |

Chicago O'Hare International Airport, Revenue Bonds, Refunding, Ser. A | | 5.00 | | 1/1/2048 | | 2,000,000 | | 1,982,983 | |

Chicago O'Hare International Airport, Revenue Bonds, Ser. A | | 5.50 | | 1/1/2055 | | 1,500,000 | | 1,529,938 | |

Chicago Transit Authority, Revenue Bonds, Refunding, Ser. A | | 5.00 | | 12/1/2045 | | 1,000,000 | | 1,002,818 | |

Illinois, GO, Refunding, Ser. A | | 5.00 | | 10/1/2029 | | 1,000,000 | | 1,021,749 | |

Illinois, GO, Ser. A | | 5.00 | | 5/1/2038 | | 1,250,000 | | 1,228,194 | |

Illinois, GO, Ser. D | | 5.00 | | 11/1/2028 | | 1,000,000 | | 1,019,690 | |

Illinois Finance Authority, Revenue Bonds, Refunding (Rosalind Franklin University of Medicine & Science) | | 5.00 | | 8/1/2047 | | 1,350,000 | | 1,309,350 | |

10

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount ($) | | Value ($) | |

Long-Term Municipal Investments - 159.0% (continued) | | | | | |

Illinois - 19.4% (continued) | | | | | |

Metropolitan Pier & Exposition Authority, Revenue Bonds (McCormick Place Expansion Project) | | 5.00 | | 6/15/2057 | | 2,500,000 | | 2,320,217 | |

Metropolitan Pier & Exposition Authority, Revenue Bonds (McCormick Place Project) (Insured; National Public Finance Guarantee Corp.) Ser. A | | 0.00 | | 12/15/2036 | | 2,500,000 | f | 1,188,915 | |

Sales Tax Securitization Corp., Revenue Bonds, Refunding, Ser. A | | 4.00 | | 1/1/2039 | | 1,500,000 | | 1,333,659 | |

Tender Option Bond Trust Receipts (Series 2017-XM0492), (Illinois Finance Authority, Revenue Bonds, Refunding (The University of Chicago)) Non-recourse, Underlying Coupon Rate (%) 5.00 | | 10.84 | | 10/1/2040 | | 7,000,000 | b,c,d | 7,172,979 | |

| | 27,952,615 | |

Indiana - .7% | | | | | |

Indiana Finance Authority, Revenue Bonds (Parkview Health System Obligated Group) Ser. A | | 5.00 | | 11/1/2043 | | 1,000,000 | | 1,015,540 | |

Iowa - .9% | | | | | |

Iowa Finance Authority, Revenue Bonds, Refunding (Iowa Fertilizer Co. Project) | | 5.00 | | 12/1/2050 | | 1,500,000 | | 1,306,335 | |

Kentucky - 1.7% | | | | | |

Kentucky Economic Development Finance Authority, Revenue Bonds, Refunding (Louisville Arena Project) (Insured; Assured Guaranty Municipal Corp.) Ser. A | | 5.00 | | 12/1/2045 | | 1,000,000 | | 999,705 | |

Kentucky Public Energy Authority, Revenue Bonds, Ser. A1 | | 4.00 | | 8/1/2030 | | 1,500,000 | g | 1,427,697 | |

| | 2,427,402 | |

Louisiana - 5.0% | | | | | |

Louisiana Local Government Environmental Facilities & Community Development Authority, Revenue Bonds, Refunding (Westlake Chemical Project) | | 3.50 | | 11/1/2032 | | 1,000,000 | | 916,630 | |

11

STATEMENT OF INVESTMENTS (continued)

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount ($) | | Value ($) | |

Long-Term Municipal Investments - 159.0% (continued) | | | | | |

Louisiana - 5.0% (continued) | | | | | |

Tender Option Bond Trust Receipts (Series 2018-XF2584), (Louisiana Public Facilities Authority, Revenue Bonds (Franciscan Missionaries of Our Lady Health System Project)) Non-recourse, Underlying Coupon Rate (%) 5.00 | | 10.65 | | 7/1/2047 | | 6,320,000 | b,c,d | 6,286,490 | |

| | 7,203,120 | |

Maryland - 3.6% | | | | | |

Maryland Economic Development Corp., Revenue Bonds (Green Bond) (Purple Line Transit Partners LLC) Ser. B | | 5.25 | | 6/30/2052 | | 1,000,000 | | 995,885 | |

Maryland Health & Higher Educational Facilities Authority, Revenue Bonds (Adventist Healthcare Obligated Group) Ser. A | | 5.50 | | 1/1/2046 | | 1,500,000 | | 1,512,594 | |

Maryland Health & Higher Educational Facilities Authority, Revenue Bonds, Refunding (Stevenson University Project) | | 4.00 | | 6/1/2046 | | 750,000 | | 614,616 | |

Tender Option Bond Trust Receipts (Series 2016-XM0391), (Mayor & City Council of Baltimore, Revenue Bonds, Refunding (Water Projects)) Non-recourse, Underlying Coupon Rate (%) 5.00 | | 10.84 | | 7/1/2042 | | 2,000,000 | b,c,d | 2,043,816 | |

| | 5,166,911 | |

Massachusetts - 6.5% | | | | | |

Massachusetts Development Finance Agency, Revenue Bonds, Refunding (Atrius Health Obligated Group) Ser. A | | 4.00 | | 6/1/2029 | | 1,500,000 | e | 1,548,435 | |

Massachusetts Development Finance Agency, Revenue Bonds, Refunding (UMass Memorial Health Care Obligated Group) Ser. I | | 5.00 | | 7/1/2046 | | 1,835,000 | | 1,781,698 | |

Massachusetts Development Finance Agency, Revenue Bonds, Refunding, Ser. A | | 5.00 | | 7/1/2026 | | 950,000 | | 983,767 | |

Massachusetts Port Authority, Revenue Bonds, Refunding (Bosfuel Project) Ser. A | | 4.00 | | 7/1/2044 | | 1,500,000 | | 1,302,501 | |

12

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount ($) | | Value ($) | |

Long-Term Municipal Investments - 159.0% (continued) | | | | | |

Massachusetts - 6.5% (continued) | | | | | |

Tender Option Bond Trust Receipts (Series 2016-XM0386), (University of Massachusetts Building Authority, Revenue Bonds, Refunding) Non-recourse, Underlying Coupon Rate (%) 5.00 | | 10.83 | | 5/1/2043 | | 3,695,009 | b,c,d | 3,734,444 | |

| | 9,350,845 | |

Michigan - 1.6% | | | | | |

Michigan Finance Authority, Revenue Bonds, Refunding (Beaumont-Spectrum) | | 4.00 | | 4/15/2042 | | 1,000,000 | | 897,742 | |

Michigan Finance Authority, Revenue Bonds, Refunding (Insured; National Public Finance Guarantee Corp.) Ser. D6 | | 5.00 | | 7/1/2036 | | 500,000 | | 507,393 | |

Pontiac School District, GO | | 4.00 | | 5/1/2045 | | 1,000,000 | | 880,892 | |

| | 2,286,027 | |

Minnesota - 1.2% | | | | | |

Duluth Economic Development Authority, Revenue Bonds, Refunding (Essentia Health Obligated Group) Ser. A | | 5.00 | | 2/15/2058 | | 1,000,000 | | 978,222 | |

St. Paul Minnesota Housing & Redevelopment Authority, Revenue Bonds, Refunding (HealthEast Care System Project) | | 5.00 | | 11/15/2025 | | 700,000 | e | 731,434 | |

| | 1,709,656 | |

Missouri - 1.9% | | | | | |

Kansas City Industrial Development Authority, Revenue Bonds (Kansas City International Airport Terminal) Ser. A | | 5.00 | | 3/1/2044 | | 750,000 | | 748,050 | |

The Missouri Health & Educational Facilities Authority, Revenue Bonds (Lutheran Senior Services Projects) Ser. A | | 5.00 | | 2/1/2042 | | 2,000,000 | | 1,927,840 | |

| | 2,675,890 | |

Multi-State - .9% | | | | | |

Federal Home Loan Mortgage Corp. Multifamily Variable Rate Certificates, Revenue Bonds, Ser. M048 | | 3.15 | | 1/15/2036 | | 1,420,000 | b | 1,251,326 | |

Nebraska - .7% | | | | | |

Douglas County Hospital Authority No. 2, Revenue Bonds (Children's Hospital Obligated Group) | | 5.00 | | 11/15/2036 | | 1,000,000 | | 1,015,512 | |

13

STATEMENT OF INVESTMENTS (continued)

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount ($) | | Value ($) | |

Long-Term Municipal Investments - 159.0% (continued) | | | | | |

Nevada - 2.3% | | | | | |

Clark County School District, GO (Insured; Assured Guaranty Municipal Corp.) Ser. A | | 4.25 | | 6/15/2041 | | 1,340,000 | | 1,240,173 | |

Reno, Revenue Bonds, Refunding (Insured; Assured Guaranty Municipal Corp.) | | 4.00 | | 6/1/2058 | | 1,250,000 | | 1,032,552 | |

Reno, Revenue Bonds, Refunding (Insured; Assured Guaranty Municipal Corp.) | | 4.13 | | 6/1/2058 | | 1,250,000 | | 1,060,480 | |

| | 3,333,205 | |

New Hampshire - .5% | | | | | |

New Hampshire Business Finance Authority, Revenue Bonds, Refunding (Springpoint Senior Living Obligated Group) | | 4.00 | | 1/1/2051 | | 1,000,000 | | 770,762 | |

New Jersey - 8.5% | | | | | |

New Jersey Economic Development Authority, Revenue Bonds, Refunding, Ser. XX | | 5.25 | | 6/15/2027 | | 750,000 | | 772,716 | |

New Jersey Economic Development Authority, Revenue Bonds, Ser. WW | | 5.25 | | 6/15/2040 | | 1,180,000 | | 1,186,171 | |

New Jersey Transportation Trust Fund Authority, Revenue Bonds | | 5.00 | | 6/15/2046 | | 1,250,000 | | 1,238,917 | |

New Jersey Transportation Trust Fund Authority, Revenue Bonds | | 5.25 | | 6/15/2043 | | 2,000,000 | | 2,022,787 | |

New Jersey Transportation Trust Fund Authority, Revenue Bonds, Ser. AA | | 5.25 | | 6/15/2033 | | 1,000,000 | | 1,015,203 | |

New Jersey Turnpike Authority, Revenue Bonds, Ser. A | | 4.00 | | 1/1/2048 | | 1,200,000 | | 1,071,450 | |

South Jersey Port Corp., Revenue Bonds, Ser. B | | 5.00 | | 1/1/2048 | | 1,000,000 | | 941,271 | |

Tobacco Settlement Financing Corp., Revenue Bonds, Refunding, Ser. A | | 5.00 | | 6/1/2046 | | 3,860,000 | | 3,633,250 | |

Tobacco Settlement Financing Corp., Revenue Bonds, Refunding, Ser. A | | 5.25 | | 6/1/2046 | | 390,000 | | 382,515 | |

| | 12,264,280 | |

New York - 5.8% | | | | | |

New York Convention Center Development Corp., Revenue Bonds (Hotel Unit Fee) (Insured; Assured Guaranty Municipal Corp.) Ser. B | | 0.00 | | 11/15/2049 | | 5,600,000 | f | 1,266,527 | |

14

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount ($) | | Value ($) | |

Long-Term Municipal Investments - 159.0% (continued) | | | | | |

New York - 5.8% (continued) | | | | | |

New York Transportation Development Corp., Revenue Bonds (JFK International Air Terminal LLC) | | 5.00 | | 12/1/2042 | | 1,000,000 | | 954,781 | |

New York Transportation Development Corp., Revenue Bonds (LaGuardia Airport Terminal B Redevelopment Project) Ser. A | | 5.25 | | 1/1/2050 | | 1,500,000 | | 1,456,220 | |

Port Authority of New York & New Jersey, Revenue Bonds, Refunding, Ser. 223 | | 4.00 | | 7/15/2051 | | 1,250,000 | | 1,051,553 | |

Tender Option Bond Trust Receipts (Series 2022-XM1004), (Metropolitan Transportation Authority, Revenue Bonds, Refunding (Green Bond) (Insured; Assured Guaranty Municipal Corp., Ser. C)) Non-recourse, Underlying Coupon Rate (%) 4.00 | | 4.98 | | 11/15/2047 | | 2,000,000 | b,c,d | 1,777,955 | |

Triborough Bridge & Tunnel Authority, Revenue Bonds, Ser. C1A | | 4.00 | | 5/15/2046 | | 2,000,000 | | 1,797,769 | |

| | 8,304,805 | |

Ohio - 1.2% | | | | | |

Buckeye Tobacco Settlement Financing Authority, Revenue Bonds, Refunding, Ser. A2 | | 4.00 | | 6/1/2048 | | 1,000,000 | | 816,327 | |

Cuyahoga County, Revenue Bonds, Refunding (The MetroHealth System) | | 5.00 | | 2/15/2052 | | 1,000,000 | | 950,700 | |

| | 1,767,027 | |

Oregon - .5% | | | | | |

Salem Hospital Facility Authority, Revenue Bonds, Refunding (Capital Manor Project) | | 4.00 | | 5/15/2057 | | 1,000,000 | | 711,916 | |

Pennsylvania - 9.2% | | | | | |

Allentown School District, GO, Refunding (Insured; Build America Mutual) Ser. B | | 5.00 | | 2/1/2032 | | 1,255,000 | | 1,343,380 | |

Clairton Municipal Authority, Revenue Bonds, Refunding, Ser. B | | 5.00 | | 12/1/2042 | | 1,000,000 | | 1,000,203 | |

Montgomery County Industrial Development Authority, Revenue Bonds, Refunding (ACTS Retirement-Life Communities Inc. Obligated Group) | | 5.00 | | 11/15/2036 | | 1,000,000 | | 1,011,053 | |

15

STATEMENT OF INVESTMENTS (continued)

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount ($) | | Value ($) | |

Long-Term Municipal Investments - 159.0% (continued) | | | | | |

Pennsylvania - 9.2% (continued) | | | | | |

Pennsylvania Economic Development Financing Authority, Revenue Bonds, Refunding (Presbyterian Senior Living) | | 4.00 | | 7/1/2046 | | 1,000,000 | | 813,844 | |

Pennsylvania Higher Educational Facilities Authority, Revenue Bonds, Refunding (University of Sciences) | | 5.00 | | 11/1/2033 | | 2,000,000 | | 2,032,100 | |

Pennsylvania Turnpike Commission, Revenue Bonds, Ser. A | | 4.00 | | 12/1/2043 | | 2,000,000 | | 1,796,033 | |

Pennsylvania Turnpike Commission, Revenue Bonds, Ser. A1 | | 5.00 | | 12/1/2046 | | 1,000,000 | | 1,011,115 | |

Pennsylvania Turnpike Commission, Revenue Bonds, Ser. B | | 4.00 | | 12/1/2051 | | 1,000,000 | | 877,282 | |

Pennsylvania Turnpike Commission Oil Franchise, Revenue Bonds, Ser. B | | 5.25 | | 12/1/2048 | | 1,000,000 | | 1,029,076 | |

Philadelphia Water & Wastewater, Revenue Bonds, Ser. A | | 5.00 | | 11/1/2050 | | 1,000,000 | | 1,031,701 | |

The Philadelphia School District, GO (Insured; State Aid Withholding) Ser. A | | 4.00 | | 9/1/2036 | | 1,345,000 | | 1,249,371 | |

| | 13,195,158 | |

Rhode Island - .4% | | | | | |

Providence Public Building Authority, Revenue Bonds (Insured; Assured Guaranty Municipal Corp.) Ser. A | | 5.00 | | 9/15/2037 | | 500,000 | | 524,786 | |

South Carolina - 7.5% | | | | | |

South Carolina Jobs-Economic Development Authority, Revenue Bonds (Bishop Gadsden Episcopal Retirement Community Obligated Group) | | 5.00 | | 4/1/2054 | | 1,000,000 | | 861,739 | |

South Carolina Public Service Authority, Revenue Bonds, Refunding, Ser. A | | 4.00 | | 12/1/2055 | | 1,000,000 | | 795,079 | |

Tender Option Bond Trust Receipts (Series 2016-XM0384), (South Carolina Public Service Authority, Revenue Bonds, Refunding (Santee Cooper)) Non-recourse, Underlying Coupon Rate (%) 5.13 | | 9.03 | | 12/1/2043 | | 4,800,000 | b,c,d | 4,796,783 | |

Tobacco Settlement Revenue Management Authority, Revenue Bonds, Ser. B | | 6.38 | | 5/15/2030 | | 3,750,000 | | 4,377,723 | |

| | 10,831,324 | |

16

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount ($) | | Value ($) | |

Long-Term Municipal Investments - 159.0% (continued) | | | | | |

Tennessee - 1.4% | | | | | |

Tender Option Bond Trust Receipts (Series 2016-XM0388), (Metropolitan Government of Nashville & Davidson County, Revenue Bonds, Refunding) Non-recourse, Underlying Coupon Rate (%) 5.00 | | 10.51 | | 7/1/2040 | | 2,000,000 | b,c,d | 2,026,471 | |

Texas - 14.0% | | | | | |

Clifton Higher Education Finance Corp., Revenue Bonds (IDEA Public Schools) Ser. A | | 4.00 | | 8/15/2047 | | 2,275,000 | | 1,916,784 | |

Clifton Higher Education Finance Corp., Revenue Bonds (Uplift Education) Ser. A | | 4.25 | | 12/1/2034 | | 1,000,000 | | 926,132 | |

Harris County-Houston Sports Authority, Revenue Bonds, Refunding (Insured; Assured Guaranty Municipal Corp.) Ser. A | | 0.00 | | 11/15/2052 | | 4,000,000 | f | 741,925 | |

New Hope Cultural Education Facilities Finance Corp., Revenue Bonds, Refunding (Webminister Project) | | 4.00 | | 11/1/2049 | | 1,600,000 | | 1,239,735 | |

San Antonio Education Facilities Corp., Revenue Bonds, Refunding (University of the Incarnate Word) | | 4.00 | | 4/1/2046 | | 1,675,000 | | 1,328,268 | |

Tender Option Bond Trust Receipts (Series 2016-XM0377), (San Antonio, Revenue Bonds) Non-recourse, Underlying Coupon Rate (%) 5.00 | | 10.84 | | 2/1/2043 | | 6,300,000 | b,c,d | 6,338,225 | |

Tender Option Bond Trust Receipts (Series 2022-XF1366), (Tarrant County Cultural Education Facilities Finance Corp., Revenue Bonds (Christus Health) Ser. A) Non-recourse, Underlying Coupon Rate (%) 5.00 | | 11.00 | | 7/1/2053 | | 2,000,000 | b,c,d | 1,980,076 | |

Texas Private Activity Bond Surface Transportation Corp., Revenue Bonds (Blueridge Transportation Group LLC) | | 5.00 | | 12/31/2055 | | 1,000,000 | | 909,332 | |

Texas Private Activity Bond Surface Transportation Corp., Revenue Bonds (Blueridge Transportation Group LLC) | | 5.00 | | 12/31/2050 | | 1,200,000 | | 1,105,295 | |

Texas Private Activity Bond Surface Transportation Corp., Revenue Bonds (Segment 3C Project) | | 5.00 | | 6/30/2058 | | 2,500,000 | | 2,294,290 | |

17

STATEMENT OF INVESTMENTS (continued)

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount ($) | | Value ($) | |

Long-Term Municipal Investments - 159.0% (continued) | | | | | |

Texas - 14.0% (continued) | | | | | |

Texas Private Activity Bond Surface Transportation Corp., Revenue Bonds, Refunding (LBJ Infrastructure Group LLC) | | 4.00 | | 12/31/2039 | | 1,600,000 | | 1,378,932 | |

| | 20,158,994 | |

U.S. Related - .7% | | | | | |

Puerto Rico Highway & Transportation Authority, Revenue Bonds, Refunding (Insured; Assured Guaranty Municipal Corp.) Ser. CC | | 5.25 | | 7/1/2034 | | 1,000,000 | | 981,416 | |

Utah - 1.6% | | | | | |

Utah Charter School Finance Authority, Revenue Bonds, Refunding (Summit Academy Inc.) Ser. A | | 5.00 | | 4/15/2031 | | 860,000 | | 913,246 | |

Utah Infrastructure Agency, Revenue Bonds, Refunding, Ser. A | | 5.00 | | 10/15/2037 | | 1,500,000 | | 1,443,173 | |

| | 2,356,419 | |

Virginia - 2.5% | | | | | |

Virginia Small Business Financing Authority, Revenue Bonds (Transform 66 P3 Project) | | 5.00 | | 12/31/2052 | | 2,000,000 | | 1,886,934 | |

Virginia Small Business Financing Authority, Revenue Bonds, Refunding | | 5.00 | | 12/31/2057 | | 1,000,000 | | 959,386 | |

Virginia Small Business Financing Authority, Revenue Bonds, Refunding (95 Express Lanes LLC) | | 4.00 | | 1/1/2048 | | 1,000,000 | | 813,022 | |

| | 3,659,342 | |

Washington - 8.9% | | | | | |

Port of Seattle, Revenue Bonds | | 4.00 | | 4/1/2044 | | 1,000,000 | | 846,981 | |

18

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount ($) | | Value ($) | |

Long-Term Municipal Investments - 159.0% (continued) | | | | | |

Washington - 8.9% (continued) | | | | | |

Tender Option Bond Trust Receipts (Series 2018-XM0680), (Washington Convention Center Public Facilities District, Revenue Bonds) Non-recourse, Underlying Coupon Rate (%) 5.00 | | 6.72 | | 7/1/2058 | | 13,000,000 | b,c,d | 11,904,400 | |

| | 12,751,381 | |

Total Investments (cost $247,768,969) | | 159.0% | 228,898,058 | |

Liabilities, Less Cash and Receivables | | (38.0%) | (54,720,969) | |

Preferred Stock, at redemption value | | (21.0%) | (30,225,000) | |

Net Assets Applicable to Common Shareholders | | 100.0% | 143,952,089 | |

a Zero coupon until a specified date at which time the stated coupon rate becomes effective until maturity.

b Security exempt from registration pursuant to Rule 144A under the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At September 30, 2022, these securities were valued at $83,810,513 or 58.22% of net assets.

c The Variable Rate shall be determined by the Remarketing Agent in its sole discretion based on prevailing market conditions and may, but need not, be established by reference to one or more financial indices.

d Collateral for floating rate borrowings. The coupon rate given represents the current interest rate for the inverse floating rate security.

e These securities are prerefunded; the date shown represents the prerefunded date. Bonds which are prerefunded are collateralized by U.S. Government securities which are held in escrow and are used to pay principal and interest on the municipal issue and to retire the bonds in full at the earliest refunding date.

f Security issued with a zero coupon. Income is recognized through the accretion of discount.

g These securities have a put feature; the date shown represents the put date and the bond holder can take a specific action to retain the bond after the put date.

| | |

Portfolio Summary (Unaudited) † | Value (%) |

General | 30.4 |

Education | 24.6 |

Medical | 19.4 |

Transportation | 16.8 |

Airport | 13.5 |

Water | 8.8 |

Tobacco Settlement | 8.7 |

Nursing Homes | 8.6 |

Utilities | 8.5 |

Power | 5.6 |

General Obligation | 4.4 |

School District | 3.3 |

Development | 3.2 |

Prerefunded | 2.3 |

Multifamily Housing | .9 |

| | 159.0 |

† Based on net assets.

See notes to financial statements.

19

| | | | |

| |

Summary of Abbreviations (Unaudited) |

| |

ABAG | Association of Bay Area Governments | AGC | ACE Guaranty Corporation |

AGIC | Asset Guaranty Insurance Company | AMBAC | American Municipal Bond Assurance Corporation |

BAN | Bond Anticipation Notes | BSBY | Bloomberg Short-Term Bank Yield Index |

CIFG | CDC Ixis Financial Guaranty | COP | Certificate of Participation |

CP | Commercial Paper | DRIVERS | Derivative Inverse Tax-Exempt Receipts |

EFFR | Effective Federal Funds Rate | FGIC | Financial Guaranty Insurance Company |

FHA | Federal Housing Administration | FHLB | Federal Home Loan Bank |

FHLMC | Federal Home Loan Mortgage Corporation | FNMA | Federal National Mortgage Association |

GAN | Grant Anticipation Notes | GIC | Guaranteed Investment Contract |

GNMA | Government National Mortgage Association | GO | General Obligation |

IDC | Industrial Development Corporation | LIBOR | London Interbank Offered Rate |

LOC | Letter of Credit | LR | Lease Revenue |

NAN | Note Anticipation Notes | MFHR | Multi-Family Housing Revenue |

MFMR | Multi-Family Mortgage Revenue | MUNIPSA | Securities Industry and Financial Markets Association Municipal Swap Index Yield |

OBFR | Overnight Bank Funding Rate | PILOT | Payment in Lieu of Taxes |

PRIME | Prime Lending Rate | PUTTERS | Puttable Tax-Exempt Receipts |

RAC | Revenue Anticipation Certificates | RAN | Revenue Anticipation Notes |

RIB | Residual Interest Bonds | SFHR | Single Family Housing Revenue |

SFMR | Single Family Mortgage Revenue | SOFR | Secured Overnight Financing Rate |

TAN | Tax Anticipation Notes | TRAN | Tax and Revenue Anticipation Notes |

U.S. T-BILL | U.S. Treasury Bill Money Market Yield | XLCA | XL Capital Assurance |

| | | | |

See notes to financial statements.

20

STATEMENT OF ASSETS AND LIABILITIES

September 30, 2022

| | | | | | | |

| | | | | | |

| | | Cost | | Value | |

Assets ($): | | | | |

Investments in securities—See Statement of Investments | 247,768,969 | | 228,898,058 | |

Cash | | | | | 1,844,921 | |

Interest receivable | | 3,322,159 | |

Prepaid expenses | | | | | 10,442 | |

| | | | | 234,075,580 | |

Liabilities ($): | | | | |

Due to BNY Mellon Investment Adviser, Inc. and affiliates—Note 2(b) | | 108,087 | |

Payable for inverse floater notes issued—Note 3 | | 57,244,592 | |

Payable for investment securities purchased | | 1,595,940 | |

Dividends payable to Common Shareholders | | 498,177 | |

Interest and expense payable related to

inverse floater notes issued—Note 3 | | 332,413 | |

Commissions payable—Note 1 | | 18,314 | |

Dividends payable to Preferred Shareholders | | 5,120 | |

Other accrued expenses | | | | | 95,848 | |

| | | | | 59,898,491 | |

Auction Preferred Stock, Series A and B, par value $.001 per share (1,209 shares issued and outstanding at $25,000 per share liquidation preference)—Note 1 | | 30,225,000 | |

Net Assets Applicable to Common Shareholders ($) | | | 143,952,089 | |

Composition of Net Assets ($): | | | | |

Common Stock, par value, $.001 per share

(20,757,267 shares issued and outstanding) | | | | | 20,757 | |

Paid-in capital | | | | | 179,014,708 | |

Total distributable earnings (loss) | | | | | (35,083,376) | |

Net Assets Applicable to Common Shareholders ($) | | | 143,952,089 | |

| | | | | |

Shares Outstanding | | |

(110 million shares authorized) | 20,757,267 | |

Net Asset Value Per Share of Common Stock ($) | | 6.94 | |

| | | | |

See notes to financial statements. | | | | |

21

STATEMENT OF OPERATIONS

Year Ended September 30, 2022

| | | | | | | |

| | | | | | |

| | | | | | |

Investment Income ($): | | | | |

Interest Income | | | 10,031,484 | |

Expenses: | | | | |

Management fee—Note 2(a) | | | 1,426,057 | |

Interest and expense related to inverse

floater notes issued—Note 3 | | | 736,564 | |

Professional fees | | | 140,260 | |

Directors’ fees and expenses—Note 2(c) | | | 87,287 | |

Commission fees—Note 1 | | | 52,019 | |

Shareholders’ reports | | | 35,715 | |

Shareholder servicing costs | | | 24,314 | |

Registration fees | | | 18,333 | |

Chief Compliance Officer fees—Note 2(b) | | | 10,338 | |

Custodian fees—Note 2(b) | | | 4,407 | |

Miscellaneous | | | 35,234 | |

Total Expenses | | | 2,570,528 | |

Net Investment Income | | | 7,460,956 | |

Realized and Unrealized Gain (Loss) on Investments—Note 3 ($): | | |

Net realized gain (loss) on investments | (4,908,390) | |

Net change in unrealized appreciation (depreciation) on investments | (43,966,411) | |

Net Realized and Unrealized Gain (Loss) on Investments | | | (48,874,801) | |

Dividends to Preferred Shareholders | | | (301,213) | |

Net (Decrease) in Net Assets Applicable to Common

Shareholders Resulting from Operations | | (41,715,058) | |

| | | | | | |

See notes to financial statements. | | | | | |

22

STATEMENT OF CASH FLOWS

Year Ended September 30, 2022

| | | | | | | |

| | | | | |

| | | | | | |

Cash Flows from Operating Activities ($): | | | | | |

Purchases of portfolio securities | | (68,908,800) | | | |

Proceeds from sales of portfolio securities | 80,003,335 | | | |

Dividends paid to Preferred Shareholders | (296,417) | | | |

Interest income received | | 10,209,896 | | | |

Interest and expense related to inverse floater notes issued | | (558,354) | | | |

Expenses paid to BNY Mellon Investment

Adviser, Inc. and affiliates | | (1,466,136) | | | |

Operating expenses paid | | (409,056) | | | |

Net Cash Provided (or Used) in Operating Activities | | | | 18,574,468 | |

Cash Flows from Financing Activities ($): | | | | | |

Dividends paid to Common Shareholders | | (7,332,858) | | | |

Decrease in payable for inverse floater notes issued | | (10,185,000) | | | |

Net Cash Provided (or Used) in Financing Activities | | (17,517,858) | |

Net Increase (Decrease) in Cash | | 1,056,610 | |

Cash at beginning of period | | 788,311 | |

Cash at End of Period | | 1,844,921 | |

Reconciliation of Net Increase (Decrease) in Net Assets Applicable to | | | |

| Common Shareholders Resulting from Operations to | | | |

| Net Cash Provided (or Used) in Operating Activities ($): | | | |

Net (Decrease) in Net Assets Resulting From Operations | | (41,715,058) | |

Adjustments to Reconcile Net Increase (Decrease) in Net Assets | | | |

| Applicable to Common Shareholders Resulting from | | | |

| Operations to Net Cash Provided (or Used) in Operating Activities ($): | | | |

Increase in investments in securities at cost | | 14,406,985 | |

Decrease in interest receivable | | 178,412 | |

Increase in prepaid expenses | | (1,616) | |

Decrease in Due to BNY Mellon Investment Adviser, Inc. and affiliates | | (25,334) | |

Increase in payable for investment securities purchased | | 1,595,940 | |

Increase in interest and expense payable related to inverse floater notes issued | | 178,210 | |

Increase in dividends payable to Preferred Shareholders | | 4,796 | |

Decrease in commissions payable and other accrued expenses | | (14,278) | |

Net change in unrealized (appreciation) depreciation on investments | | 43,966,411 | |

Net Cash Provided (or Used) in Operating Activities | | 18,574,468 | |

Supplemental Disclosure Cash Flow Information ($): | | | |

Non-cash financing activities: | | | |

Reinvestment of dividends | | 17,869 | |

| | | | | | |

See notes to financial statements. | | | | | |

23

STATEMENT OF CHANGES IN NET ASSETS

| | | | | | | | | | |

| | | | Year Ended September 30, |

| | | | 2022 | | 2021 | |

Operations ($): | | | | | | | | |

Net investment income | | | 7,460,956 | | | | 8,476,662 | |

Net realized gain (loss) on investments | | (4,908,390) | | | | 513,504 | |

Net change in unrealized appreciation

(depreciation) on investments | | (43,966,411) | | | | 4,805,711 | |

Dividends to Preferred Shareholders | | | (301,213) | | | | (36,373) | |

Net Increase (Decrease) in Net Assets Applicable

to Common Shareholders Resulting from

Operations | (41,715,058) | | | | 13,759,504 | |

Distributions ($): | |

Distributions to Common Shareholders | | | (7,140,441) | | | | (8,715,428) | |

Capital Stock Transactions ($): | |

Distributions reinvested | | | 17,869 | | | | 42,929 | |

Increase (Decrease) in Net Assets

from Capital Stock Transactions | 17,869 | | | | 42,929 | |

Total Increase (Decrease) in Net Assets

Applicable to Common Shareholders | (48,837,630) | | | | 5,087,005 | |

Net Assets Applicable to Common Shareholders ($): | |

Beginning of Period | | | 192,789,719 | | | | 187,702,714 | |

End of Period | | | 143,952,089 | | | | 192,789,719 | |

Capital Share Transactions (Common Shares): | |

Shares issued for distributions reinvested | | | 1,936 | | | | 4,533 | |

Net Increase (Decrease) in Shares Outstanding | 1,936 | | | | 4,533 | |

| | | | | | | | | |

See notes to financial statements. | | | | | | | | |

24

FINANCIAL HIGHLIGHTS

The following table describes the performance for the fiscal periods indicated. Market price total return is calculated assuming an initial investment made at the market price at the beginning of the period, reinvestment of all dividends and distributions at market price during the period, and sale at the market price on the last day of the period. These figures have been derived from the fund’s financial statements and, with respect to common stock, market price data for the fund’s common shares.

| | | | | | | | | | | | | |

| | | | | | |

| | Year Ended September 30, |

| | 2022 | 2021 | 2020 | 2019 | 2018 |

Per Share Data ($): | | | | | | |

Net asset value, beginning of period | | 9.29 | 9.05 | 9.36 | 8.90 | 9.35 |

Investment Operations: | | | | | | |

Net investment incomea | | .36 | .41 | .43 | .46 | .50 |

Net realized and unrealized gain

(loss) on investments | | (2.35) | .25 | (.30) | .46 | (.52) |

Dividends to Preferred Shareholders

from net investment income | | (.02) | (.00)b | (.02) | (.04) | (.04) |

Total from Investment Operations | | (2.01) | .66 | .11 | .88 | (.06) |

Dividends from net investment

income | | (.34) | (.42) | (.42) | (.42) | (.44) |

Net asset value resulting from

Auction Preferred Stock

tendered as a discount | | - | - | - | - | .05 |

Net asset value, end of period | | 6.94 | 9.29 | 9.05 | 9.36 | 8.90 |

Market value, end of period | | 6.01 | 9.63 | 8.63 | 9.35 | 7.83 |

Market Price Total Return (%) | | (34.69) | 16.90 | (3.13) | 25.58 | (9.55) |

25

FINANCIAL HIGHLIGHTS (continued)

| | | | | | | | | | | | |

| | | | | | |

| | Year Ended September 30, |

| | 2022 | 2021 | 2020 | 2019 | 2018 |

Ratios/Supplemental Data (%): | | | | | | |

Ratio of total expenses to average

net assets applicable to

Common Stockc | | 1.48 | 1.25 | 1.68 | 1.89 | 1.75 |

Ratio of net expenses to average net

assets applicable to Common Stockc | | 1.48 | 1.25 | 1.67 | 1.89 | 1.75 |

Ratio of interest and expense related

to floating rate notes issued to

average net assets applicable to

Common Stockc | | .42 | .25 | .67 | .90 | .60 |

Ratio of net investment income

to average net assets applicable to

Common Stockc | | 4.30 | 4.37 | 4.78 | 5.04 | 5.46 |

Ratio of total expenses to

total average net assets | | 1.26 | 1.08 | 1.44 | 1.63 | 1.45 |

Ratio of net expense to total average

net assets | | 1.26 | 1.08 | 1.44 | 1.63 | 1.45 |

Ratio of interest and expense related

to floating rate notes issued to total

average net assets | | .36 | .22 | .58 | .78 | .50 |

Ratio of net investment income to

total average net assets | | 3.66 | 3.78 | 4.12 | 4.34 | 4.52 |

Portfolio Turnover Rate | | 31.87 | 11.33 | 26.85 | 31.62 | 17.70 |

Asset Coverage of Preferred Stock,

end of period | | 576 | 738 | 721 | 742 | 711 |

Net Assets applicable to

Common Shareholders,

end of period ($ x 1,000) | | 143,952 | 192,790 | 187,703 | 194,114 | 184,587 |

Preferred Stock Outstanding,

end of period ($ x 1,000) | | 30,225 | 30,225 | 30,225 | 30,225 | 30,225 |

Floating Rate Notes Outstanding,

end of period ($ x 1,000) | | 57,245 | 67,430 | 71,180 | 85,492 | 74,682 |

a Based on average common shares outstanding.

b Amount represents less than $.01 per share.

c Does not reflect the effect of dividends to Preferred Shareholders.

See notes to financial statements.

26

NOTES TO FINANCIAL STATEMENTS

NOTE 1—Significant Accounting Policies:

BNY Mellon Municipal Income, Inc. (the “fund”), which is registered under the Investment Company Act of 1940, as amended (the “Act”), is a diversified closed-end management investment company. The fund’s investment objective is to maximize current income exempt from federal income tax to the extent consistent with the preservation of capital. BNY Mellon Investment Adviser, Inc. (the “Adviser”), a wholly-owned subsidiary of The Bank of New York Mellon Corporation (“BNY Mellon”), serves as the fund’s investment adviser. Insight North America LLC (the “Sub-Adviser”), a wholly-owned subsidiary of BNY Mellon and an affiliate of the Adviser, serves as the fund’s sub-adviser. The fund’s Common Stock trades on the NYSE American under the ticker symbol DMF.

The fund has outstanding 616 Series A shares and 593 Series B shares, Auction Preferred Stock (“APS”), with a liquidation preference of $25,000 per share (plus an amount equal to accumulated but unpaid dividends upon liquidation). APS dividend rates are determined pursuant to periodic auctions or by reference to a market rate. Deutsche Bank Trust Company America, as the Auction Agent, receives a fee from the fund for its services in connection with such auctions. The fund also compensates broker-dealers generally at an annual rate of .15%-.25% of the purchase price of shares of APS.

The fund is subject to certain restrictions relating to the APS. Failure to comply with these restrictions could preclude the fund from declaring any distributions to shareholders of Common Stock (“Common Shareholders”) or repurchasing shares of Common Stock and/or could trigger the mandatory redemption of APS at liquidation value. Thus, redemptions of APS may be deemed to be outside of the control of the fund.

The holders of APS, voting as a separate class, have the right to elect at least two directors. The holders of APS will vote as a separate class on certain other matters, as required by law. The fund’s Board of Directors (the “Board”) has designated Nathan Leventhal and Benaree Pratt Wiley as directors to be elected by the holders of APS.

The Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) is the exclusive reference of authoritative U.S. generally accepted accounting principles (“GAAP”) recognized by the FASB to be applied by nongovernmental entities. Rules and interpretive releases of the Securities and Exchange Commission (“SEC”) under authority of federal laws are also sources of authoritative GAAP for SEC

27

NOTES TO FINANCIAL STATEMENTS (continued)

registrants. The fund is an investment company and applies the accounting and reporting guidance of the FASB ASC Topic 946 Financial Services-Investment Companies. The fund’s financial statements are prepared in accordance with GAAP, which may require the use of management estimates and assumptions. Actual results could differ from those estimates.

The fund enters into contracts that contain a variety of indemnifications. The fund’s maximum exposure under these arrangements is unknown. The fund does not anticipate recognizing any loss related to these arrangements.

(a) Portfolio valuation: The fair value of a financial instrument is the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (i.e., the exit price). GAAP establishes a fair value hierarchy that prioritizes the inputs of valuation techniques used to measure fair value. This hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements).

Additionally, GAAP provides guidance on determining whether the volume and activity in a market has decreased significantly and whether such a decrease in activity results in transactions that are not orderly. GAAP requires enhanced disclosures around valuation inputs and techniques used during annual and interim periods.

Various inputs are used in determining the value of the fund’s investments relating to fair value measurements. These inputs are summarized in the three broad levels listed below:

Level 1—unadjusted quoted prices in active markets for identical investments.

Level 2—other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.).

Level 3—significant unobservable inputs (including the fund’s own assumptions in determining the fair value of investments).

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. Valuation techniques used to value the fund’s investments are as follows:

28

The Board has designated the Adviser as the fund’s valuation designee, effective September 8, 2022, to make all fair value determinations with respect to the fund’s portfolio investments, subject to the Board’s oversight and pursuant to Rule 2a-5 under the Act.

Investments in municipal securities, excluding short-term investment (other than U.S. Treasury Bills), are valued each business day by an independent pricing service (the “Service”) approved by the Board. Investments for which quoted bid prices are readily available and are representative of the bid side of the market in the judgment of the Service are valued at the mean between the quoted bid prices (as obtained by the Service from dealers in such securities) and asked prices (as calculated by the Service based upon its evaluation of the market for such securities). Municipal investments (which constitute a majority of the portfolio securities) are carried at fair value as determined by the Service, based on methods which include consideration of the following: yields or prices of municipal securities of comparable quality, coupon, maturity and type; indications as to values from dealers; and general market conditions. The Service is engaged under the general oversight of the Board. All of the preceding securities are generally categorized within Level 2 of the fair value hierarchy.

When market quotations or official closing prices are not readily available, or are determined not to accurately reflect fair value, such as when the value of a security has been significantly affected by events after the close of the exchange or market on which the security is principally traded, but before the fund calculates its net asset value, the fund may value these investments at fair value as determined in accordance with the procedures approved by the Board. Certain factors may be considered when fair valuing investments such as: fundamental analytical data, the nature and duration of restrictions on disposition, an evaluation of the forces that influence the market in which the securities are purchased and sold, and public trading in similar securities of the issuer or comparable issuers. These securities are either categorized within Level 2 or 3 of the fair value hierarchy depending on the relevant inputs used.

For securities where observable inputs are limited, assumptions about market activity and risk are used and such securities are generally categorized within Level 3 of the fair value hierarchy.

The following is a summary of the inputs used as of September 30, 2022 in valuing the fund’s investments:

29

NOTES TO FINANCIAL STATEMENTS (continued)

| | | | | | | |

| | Level 1-Unadjusted Quoted Prices | Level 2- Other Significant Observable Inputs | | Level 3-Significant Unobservable Inputs | Total | |

Assets ($) | | |

Investments in Securities:† | | |

Municipal Securities | - | 228,898,058 | | - | 228,898,058 | |

Liabilities ($) | | |

Other Financial Instruments: | | |

Inverse Floater Notes†† | - | (57,244,592) | | - | (57,244,592) | |

† See Statement of Investments for additional detailed categorizations, if any.

†† Certain of the fund’s liabilities are held at carrying amount, which approximates fair value for financial reporting purposes.

(b) Securities transactions and investment income: Securities transactions are recorded on a trade date basis. Realized gains and losses from securities transactions are recorded on the identified cost basis. Interest income, adjusted for accretion of discount and amortization of premium on investments, is earned from settlement date and recognized on the accrual basis. Securities purchased or sold on a when-issued or delayed delivery basis may be settled a month or more after the trade date.

(c) Market Risk: The value of the securities in which the fund invests may be affected by political, regulatory, economic and social developments, and developments that impact specific economic sectors, industries or segments of the market. The value of a security may also decline due to general market conditions that are not specifically related to a particular company or industry, such as real or perceived adverse economic conditions, changes in the general outlook for corporate earnings, changes in interest or currency rates, changes to inflation, adverse changes to credit markets or adverse investor sentiment generally. In addition, turbulence in financial markets and reduced liquidity in equity, credit and/or fixed income markets may negatively affect many issuers, which could adversely affect the fund. Global economies and financial markets are becoming increasingly interconnected, and conditions and events in one country, region or financial market may adversely impact issuers in a different country, region or financial market. These risks may be magnified if certain events or developments adversely interrupt the global supply chain; in these and other circumstances, such risks might affect companies world-wide. Recent examples include pandemic risks related to COVID-19 and aggressive measures taken world-wide in response by governments, including closing borders, restricting international and domestic travel, and the imposition of prolonged quarantines of large populations, and by businesses, including changes to operations and reducing staff.

30

(d) Dividends and distributions to Common Shareholders: Dividends and distributions are recorded on the ex-dividend date. Dividends from net investment income are normally declared and paid monthly. Dividends from net realized capital gains, if any, are normally declared and paid annually, but the fund may make distributions on a more frequent basis to comply with the distribution requirements of the Internal Revenue Code of 1986, as amended (the “Code”). To the extent that net realized capital gains can be offset by capital loss carryovers, it is the policy of the fund not to distribute such gains. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP.

Common Shareholders will have their distributions reinvested in additional shares of the fund, unless such Common Shareholders elect to receive cash, at the lower of the market price or net asset value per share (but not less than 95% of the market price). If market price is equal to or exceeds net asset value, shares will be issued at net asset value. If net asset value exceeds market price, Computershare Inc., the transfer agent for the fund’s Common Stock, will buy fund shares in the open market and reinvest those shares accordingly.

On September 29, 2022, the Board declared a cash dividend of $.024 per share from net investment income, payable on October 31, 2022 to Common Shareholders of record as of the close of business on October 17, 2022. The ex-dividend date was October 14, 2022.

(e) Dividends and distributions to shareholders of APS: Dividends, which are cumulative, are generally reset every seven days for each series of APS pursuant to a process specified in related fund charter documents. Dividend rates as of September 30, 2022, for each series of APS were as follows: Series A–3.420% and Series B–3.530%. These rates reflect the “maximum rates” under the governing instruments as a result of “failed auctions” in which sufficient clearing bids are not received. The average dividend rates for the period ended September 30, 2022 for each series of APS were as follows: Series A–1.002% and Series B–.991%.

(f) Federal income taxes: It is the policy of the fund to continue to qualify as a regulated investment company, which can distribute tax-exempt dividends, by complying with the applicable provisions of the Code, and to make distributions of income and net realized capital gain sufficient to relieve it from substantially all federal income and excise taxes.

As of and during the period ended September 30, 2022, the fund did not have any liabilities for any uncertain tax positions. The fund recognizes interest and penalties, if any, related to uncertain tax positions as income

31

NOTES TO FINANCIAL STATEMENTS (continued)

tax expense in the Statement of Operations. During the period ended September 30, 2022, the fund did not incur any interest or penalties.

Each tax year in the four-year period ended September 30, 2022 remains subject to examination by the Internal Revenue Service and state taxing authorities.

At September 30, 2022, the components of accumulated earnings on a tax basis were as follows: undistributed tax-exempt income $483,874, accumulated capital losses $16,373,969 and unrealized depreciation $18,689,984.

The fund is permitted to carry forward capital losses for an unlimited period. Furthermore, capital loss carryovers retain their character as either short-term or long-term capital losses.

The accumulated capital loss carryover is available for federal income tax purposes to be applied against future net realized capital gains, if any, realized subsequent to September 30, 2022. The fund has $8,934,431 of short-term capital losses and $7,439,538 of long-term capital losses which can be carried forward for an unlimited period.

The tax character of distributions paid to shareholders during the fiscal years ended September 30, 2022 and September 30, 2021 were as follows: tax-exempt income $7,441,654 and $8,751,801, respectively.

(g) New accounting pronouncements: In March 2020, the FASB issued Accounting Standards Update 2020-04, Reference Rate Reform (Topic 848): Facilitation of the Effects of Reference Rate Reform on Financial Reporting (“ASU 2020-04”), and in January 2021, the FASB issued Accounting Standards Update 2021-01, Reference Rate Reform (Topic 848): Scope (“ASU 2021-01”), which provides optional, temporary relief with respect to the financial reporting of contracts subject to certain types of modifications due to the planned discontinuation of the LIBOR and other interbank offered rates as of the end of 2021. The temporary relief provided by ASU 2020-04 and ASU 2021-01 is effective for certain reference rate-related contract modifications that occur during the period from March 12, 2020 through December 31, 2022 (“FASB Effective Date”). Management had evaluated the impact of ASU 2020-04 and ASU 2021-01 on the fund’s investments, derivatives, debt and other contracts that will undergo reference rate-related modifications as a result of the Reference Rate Reform. Management will be adopting ASU 2020-04 and ASU 2021-01 on FASB Effective Date or if amended ASU 2020-04 new extended FASB Effective Date, if any. Management will continue to work with other financial institutions and counterparties to modify contracts as required by applicable regulation and within the regulatory deadlines. As

32

of September 30, 2022, management believes these accounting standards have no impact on the fund and does not have any concerns of adopting the regulations by FASB Effective Date.

NOTE 2—Management Fee, Advisory Fee and Other Transactions with Affiliates:

(a) Pursuant to a management agreement (the “Agreement”) with the Adviser, the management fee is computed at the annual rate of ..70% of the value of the fund’s average weekly net assets (including net assets representing APS outstanding) and is payable monthly. The Agreement provides that if in any full fiscal year the aggregate expenses of the fund (excluding taxes, interest on borrowings, brokerage fees and extraordinary expenses) exceed the expense limitation of any state having jurisdiction over the fund, the fund may deduct from payments to be made to the Adviser, or the Adviser will bear, the amount of such excess to the extent required by state law. During the period ended September 30, 2022, there was no expense reimbursement pursuant to the Agreement.

Pursuant to a sub-investment advisory agreement between the Adviser and the Sub-Adviser, the Adviser pays the Sub-Adviser a monthly fee at an annual rate of .336% of the value of the fund’s average weekly net assets, (including net assets representing APS outstanding).

(b) The fund has an arrangement with The Bank of New York Mellon (the “Custodian”), a subsidiary of BNY Mellon and an affiliate of the Adviser, whereby the fund may receive earnings credits when positive cash balances are maintained, which are used to offset custody fees. For financial reporting purposes, the fund includes net earnings credits as an expense offset in the Statement of Operations.