Use these links to rapidly review the document

TABLE OF CONTENTS

INDEX TO FINANCIAL STATEMENTS

FILED PURSUANT TO RULE 424(b)(3)

REGISTRATION NO. 333-113924

PROSPECTUS

EXCO Resources, Inc.

OFFER TO EXCHANGE

Any and all of its outstanding 71/4% Senior Notes Due 2011

for $450,000,000 principal amount of its 71/4% Senior Notes Due 2011

which have been registered under the Securities Act

- •

- The exchange offer expires at 5:00 p.m., Eastern Time, on May 28, 2004, unless we extend the offer. We do not currently intend to extend the exchange offer.

- •

- We will exchange all outstanding notes, which we refer to in this prospectus as the "old notes," that are validly tendered and not validly withdrawn for an equal principal amount of new notes that are registered under the Securities Act, which we refer to in this prospectus as the "new notes."

- •

- The exchange offer is subject to customary conditions, which we may, but are not required to, waive.

- •

- You may withdraw tenders of old notes at any time before the exchange offer expires.

- •

- The exchange of notes will not be a taxable event for U.S. federal income tax purposes.

- •

- We will not receive any proceeds from the exchange offer.

- •

- The terms of the new notes are substantially identical to the old notes, except that the new notes will be freely tradeable.

- •

- You may tender old notes only in denominations of $1,000 and multiples of $1,000.

- •

- Our affiliates may not participate in the exchange offer.

- •

- No public market exists for the old notes. We do not intend to list the new notes on any securities exchange or automated dealer quotation system.

See "Risk Factors" beginning on page 17 for a discussion of

factors that you should consider before tendering your old notes.

- •

- Each broker-dealer that receives new notes pursuant to the exchange offer must acknowledge that it will deliver a prospectus in connection with any resale of such new notes. The letter of transmittal states that by so acknowledging and by delivering a prospectus, a broker-dealer will not be deemed to admit that it is an "underwriter" within the meaning of the Securities Act.

- •

- If the broker-dealer acquired the old notes as a result of market making or other trading activities, such broker-dealer may be a statutory underwriter and may use this prospectus for the exchange offer, as supplemented or amended, in connection with the resale of the new notes.

- •

- We have agreed that, for a period of 180 days after the consummation of the exchange offer, we will make this prospectus available to any broker-dealer for use in connection with any such resale. See "Plan of Distribution."

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the new notes or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is April 22, 2004.

TABLE OF CONTENTS

You should rely only on the information contained in this prospectus or to which we have referred you. We have not authorized anyone to provide you with information that is different. This prospectus may only be used where it is legal to sell these securities. The information in this prospectus may be accurate only on the date of this prospectus.

WHERE YOU CAN FIND MORE INFORMATION

Following completion of this exchange offer, we will be required to file periodic and current reports and other information with the SEC. You may read any of our filings and, for a fee, copy any document that we file with the SEC at the public reference facility maintained by the SEC at Room 1024, Judiciary Plaza, 450 Fifth Street, N.W., Washington, D.C. 20549. Copies of these documents may also be obtained at prescribed rates from the Public Reference Section of the SEC at Room 1024, Judiciary Plaza, 450 Fifth Street, N.W., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the operation of the Public Reference Room. You may also obtain the documents that we file electronically from the SEC's website at http://www.sec.gov. The indenture requires us to file periodic reports and other information required to be filed under the Securities

i

Exchange Act of 1934, or the Exchange Act, with the SEC and provide such information to you, upon request, regardless of whether we are subject to the reporting requirements of the Exchange Act. Our reports and other information that we have filed, or may in the future file, with the SEC are not incorporated in and do not constitute part of this prospectus.

We have filed with the SEC a registration statement on Form S-4 with respect to the new notes offered in this prospectus. This prospectus is part of the registration statement and, as permitted by the SEC's rules, does not contain all of the information presented in the registration statement. Whenever a reference is made in this prospectus to one of our contracts or other documents, please be aware that this reference is not necessarily complete and that you should refer to exhibits that are a part of the registration statement for a copy of the contract or other document and a more complete understanding of the contract or document. We refer you to the Form S-4 for further information regarding EXCO and the securities offered in this prospectus.

This prospectus incorporates business and financial information about us that is not included in or delivered with this prospectus. We will provide this information to you at no charge upon written or oral request directed to: EXCO Resources, Inc., 12377 Merit Drive, Suite 1700, Dallas, Texas 75251, (214) 368-2084. To obtain timely delivery of any of our filings, agreements or other documents, you must make your request to us no later than five business days before the expiration date of the exchange offer. The exchange offer will expire at 5:00 p.m., Eastern Time, on May 28, 2004, unless we extend the offer. See the caption "The Exchange Offer" for more detailed information.

FORWARD-LOOKING STATEMENTS

The statements contained in this prospectus regarding our future financial and operating performance and results, business strategy, market prices, future commodity price risk management activities, plans and forecasts and other statements that are not historical facts are forward-looking statements, as defined in Section 27A of the Securities Act of 1933, or the Securities Act, and Section 21E of the Exchange Act. We have based these forward-looking statements on our current assumptions, expectations and projections about future events.

We use the words "may," "will," "expect," "anticipate," "estimate," "believe," "continue," "intend," "plan," "budget" and other similar words to identify forward-looking statements. You should read statements that contain these words carefully because they discuss future expectations, contain projections of results of operations or of our financial condition and/or state other "forward-looking" information. We do not undertake any obligation to update or revise publicly any forward-looking statements. These statements also involve risks and uncertainties that could cause our actual results or financial condition to materially differ from our expectations in this prospectus, including, but not limited to:

- •

- estimates of reserves;

- •

- market factors, including demand for our production;

- •

- market prices, including regional basis differentials, of oil and natural gas;

- •

- results of future drilling and acquisitions;

- •

- marketing and commodity price risk management activities;

- •

- future production and costs;

- •

- our ability to arrange financing;

- •

- our ability to service our indebtedness; and

- •

- all the other factors described herein under "Risk Factors."

ii

We believe that it is important to communicate our expectations of future performance to our investors. However, events may occur in the future that we are unable to accurately predict, or over which we have no control. When considering our forward-looking statements, keep in mind the risk factors and other cautionary statements in this prospectus.

Our revenues, operating results, financial condition and ability to borrow funds or obtain additional capital depend substantially on prevailing prices for oil and natural gas. Declines in oil or natural gas prices may materially adversely affect our financial condition, liquidity, ability to obtain financing and operating results. Lower oil or natural gas prices also may reduce the amount of oil or natural gas that we can produce economically. A decline in oil and/or natural gas prices could have a material adverse effect on the estimated value and estimated quantities of our oil and natural gas reserves, our ability to fund our operations and our financial condition, cash flow, results of operations and access to capital. Historically, oil and natural gas prices and markets have been volatile, with prices fluctuating widely, and they are likely to continue to be volatile.

INDUSTRY AND MARKET DATA

Industry and market data used throughout this prospectus were obtained through internal company research, surveys and studies conducted by third parties and industry and general publications. We have not independently verified market and industry data from third-party sources. While we believe the internal company research is reliable and the market definitions are appropriate, neither such research nor these definitions have been verified by any independent sources.

CURRENCY CONVERSION

For this prospectus, we converted Canadian dollars to U.S. dollars for balance sheet items, including cash, oil and natural gas properties and bank debt, using the exchange rate at the end of the applicable period. The exchange rates of the Canadian dollar to the U.S. dollar were $0.628, $0.636 and $0.771 at December 31, 2001, 2002 and 2003, respectively. For income statement items such as revenue, production costs, general and administrative costs and interest, we converted Canadian dollars to U.S. dollars using the weighted average exchange rate across the applicable period. The weighted average exchange rates of the Canadian dollar to the U.S. dollar for the period from April 2001 (the month in which we acquired our Canadian subsidiary) to December 2001 and for the years ended December 31, 2002 and 2003 were $0.644, $0.637 and $0.716, respectively.

iii

PROSPECTUS SUMMARY

This summary highlights information contained elsewhere in this prospectus. It is not complete and may not contain all of the information that you should consider before participating in the exchange offer. Unless indicated otherwise, the term "notes" refers to the old notes issued on January 20, 2004, the old notes issued on April 13, 2004 and the new notes. Unless otherwise indicated in this prospectus or the context otherwise requires, all references in this prospectus to "EXCO," the "Company," "us," "our" or "we" are to EXCO Resources, Inc. and its consolidated subsidiaries. On July 29, 2003, we consummated a going private transaction whereby we became a wholly owned subsidiary of EXCO Holdings Inc., or EXCO Holdings. All balance sheet information presented in this prospectus at December 31, 2003 and all income statement data for the 156 day period from July 29, 2003 to December 31, 2003 represents the successor basis in accounting. See "—Recent Developments" and "Unaudited Pro Forma Financial Data." On November 26, 2003, we entered into an agreement, as subsequently amended and restated on December 4, 2003, also referred to as the "North Coast Acquisition Agreement," with North Coast Energy, Inc., or North Coast, and Nuon Energy & Water Investments, Inc., or Nuon Energy & Water, to acquire all of the issued and outstanding stock of North Coast pursuant to a tender offer and merger. We closed the North Coast acquisition on January 27, 2004. Throughout this prospectus, we refer to the issuances of the old notes, the North Coast acquisition, the repayment of substantially all of our and North Coast's existing bank debt, the repayment in full of our senior term loan, the repayment of substantially all of our Canadian indebtedness and this exchange offer collectively as the "Transactions." Unless otherwise indicated, the operating results and reserve information presented in this prospectus are those of EXCO and are not adjusted to reflect the pro forma effect of the North Coast acquisition. We have provided definitions for some of the oil and natural gas industry terms used in this prospectus in the "Glossary of Oil and Natural Gas Terms" beginning on page 175.

Our Company

We are an independent energy company engaged in the acquisition, exploration, development and exploitation of oil and natural gas properties. Our primary areas of operations are onshore in Texas, Louisiana, Colorado, Ohio, Pennsylvania, West Virginia and Alberta, Canada. As of December 31, 2003, our pro forma Proved Reserves were approximately 621.4 Bcfe, of which 74% were natural gas and 87% were Proved Developed Reserves. The related PV-10 of our pro forma Proved Reserves was $1.01 billion as of December 31, 2003 and the Standardized Measure of our pro forma Proved Reserves was $718.3 million as of December 31, 2003. For the twelve months ended December 31, 2003, on a pro forma basis we produced 37.0 Bcfe of oil and natural gas, which translates to a Reserve Life of approximately 16.8 years. On a pro forma basis for the twelve month period ended December 31, 2003, we generated $158.5 million of revenues and other income.

1

The following table sets forth a summary of our pro forma Proved Reserves, the PV-10 of such Proved Reserves and Standardized Measure of such Proved Reserves as of December 31, 2003.

| | Proved Reserves(1)

| | PV-10(1)(2)

| | Standardized

Measure(1)(2)

|

|---|

Area

| | Natural

Gas (Bcf)

| | Crude Oil

(Mmbbl)

| | NGLs

(Mmbbl)

| | Total (Bcfe)(3)

| | Amount

(in millions)

| | Amount

(in millions)

|

|---|

| United States: | | | | | | | | | | | | | | |

| EXCO | | 156.1 | | 10.5 | | 0.8 | | 223.9 | | $ | 343.7 | | $ | 234.1 |

| North Coast | | 179.9 | | 1.4 | | — | | 188.3 | | | 369.5 | | | 265.2 |

| | |

| |

| |

| |

| |

| |

|

| | Total U.S. Proved(4) | | 336.0 | | 11.9 | | 0.8 | | 412.2 | | | 713.2 | | | 499.3 |

| | |

| |

| |

| |

| |

| |

|

| Canada: | | | | | | | | | | | | | | |

| Alberta | | 126.4 | | 6.8 | | 7.0 | | 209.2 | | | 299.6 | | | 219.0 |

| | |

| |

| |

| |

| |

| |

|

| | Total U.S. and Canada Proved(4) | | 462.4 | | 18.7 | | 7.8 | | 621.4 | | $ | 1,012.8 | | $ | 718.3 |

| | |

| |

| |

| |

| |

| |

|

| Proved Developed(4) | | 403.5 | | 15.6 | | 7.1 | | 539.7 | | $ | 902.0 | | | N/A |

- (1)

- The Proved Reserves and the PV-10 of the Proved Reserves for EXCO and North Coast as of December 31, 2003 as used in this table were prepared by Lee Keeling and Associates, Inc., an independent petroleum engineering firm in Tulsa, Oklahoma. The amount of estimated future abandonment costs and the PV-10 of those costs for EXCO and North Coast used in this table were determined by EXCO.

- (2)

- The PV-10 data is based on December 31, 2003 NYMEX spot prices of $6.19 per Mmbtu for natural gas and $32.52 per Bbl for oil adjusted for differentials between NYMEX and local prices.

- (3)

- Mmbbl converted to Bcfe on a one Bbl to six Mcf conversion ratio.

- (4)

- On a pro forma basis as though we had completed the North Coast acquisition as of December 31, 2003.

Our present value of estimated future net revenues, or PV-10, is an estimate of future net revenues from a property at the date indicated, after deducting production and ad valorem taxes, future capital costs and operating expenses, but before deducting federal income taxes. The future net revenues have been discounted at an annual rate of 10% to determine their "present value." The present value is shown to indicate the effect of time on the value of the net revenue stream and should not be construed as being the fair market value of the properties. Estimates have been made using constant oil, natural gas and NGL prices and operating costs at the date indicated. The prices used do not reflect any adjustments for derivatives. We believe that the present value of estimated future net revenues before income taxes, while not in accordance with Generally Accepted Accounting Principles (GAAP), is an important financial measure used by investors and independent oil and natural gas producers for evaluating the relative significance of oil and natural gas properties and acquisitions.

The Standardized Measure represents the PV-10, after giving effect to income taxes, and as calculated in accordance with FAS 69.

North Coast Acquisition

On November 26, 2003, we entered into the North Coast Acquisition Agreement, as amended and restated on December 4, 2003, to acquire all of the issued and outstanding stock of North Coast pursuant to a tender offer and merger. We acquired all of the outstanding common stock, options and warrants of North Coast on January 27, 2004 for a purchase price of $167.8 million and we assumed $57.0 million of North Coast's outstanding indebtedness. As a result, on January 27, 2004, North Coast became one of our wholly-owned subsidiaries. North Coast focuses on the exploration, development

2

and production of natural gas reserves in the Appalachian Basin. The North Coast acquisition establishes a new core operating area for us in the Appalachian Basin, which positions us to benefit from the attractive qualities of the basin and to capitalize on consolidation opportunities in the area. North Coast's operations have several attractive attributes including:

- •

- long-life oil and natural gas reserves with a Reserve Life at December 31, 2003 of approximately 16.3 years;

- •

- significantly developed reserves with approximately 91% classified as Proved Developed Reserves at December 31, 2003;

- •

- proximity to Midwestern and East coast natural gas markets; and

- •

- positive average price differential to NYMEX.

For more information on the North Coast acquisition, see "North Coast Acquisition."

Our Competitive Strengths and Business Strategy

We intend to become a leading independent oil and natural gas acquisition, exploitation and production company. We plan to achieve reserve, production and cash flow growth by focusing on our competitive strengths and executing our business strategy as highlighted below.

Quality asset base. We own and plan to maintain a geographically diversified reserve base. Our primary areas of operations are onshore in Texas, Louisiana, Colorado, Ohio, Pennsylvania, West Virginia and Alberta, Canada. Our reserves in these areas are generally characterized by:

- •

- established histories of production;

- •

- long reserve lives;

- •

- low finding and development expenditures;

- •

- high drilling success rates; and

- •

- a high concentration of natural gas.

We seek to improve the overall quality of our asset base by exploiting our properties that have potential for value enhancement and growth, while disposing of marginal or non-strategic properties.

Acquisition and exploitation of strategic assets. We maintain a disciplined acquisition process to seek and acquire quality producing properties that have upside potential through low-risk development drilling and exploitation projects, such as infill drilling, workovers, recompletions and secondary recovery projects. From December 1997 to December 31, 2003 and pro forma for our acquisition of North Coast, we completed 111 acquisitions for total consideration of approximately $532.4 million, of which $498.4 million was allocated to acquisition of reserves. We plan to focus our acquisition activities onshore in North America and target natural gas properties with established histories of production, low-risk drilling and exploitation opportunities and long reserve lives, such as the properties in the Appalachian Basin that were acquired in the North Coast acquisition. In addition, our extensive knowledge of our operating areas and our acquisition expertise position us to capitalize on and integrate strategic acquisition opportunities in our core areas. Due to industry trends of consolidation and asset rationalization, we believe we will continue to have opportunities to acquire oil and natural gas properties at attractive rates of return.

Cost-focused operations. As of December 31, 2003, on a pro forma basis, we operate properties that contain approximately 90% of our Proved Reserves. Having operating rights with respect to our properties permits us to manage our operating costs, capital expenditures and the timing of development and exploitation of our properties. For the twelve months ended December 31, 2003, our

3

pro forma lease operating expense, not including production and ad valorem taxes, per Mcfe was $0.95. Using our estimate of Proved Reserves at the time of the acquisitions, we acquired 576.1 Bcfe of Proved Reserves in 111 acquisitions between December 1997 and December 31, 2003, and pro forma for our acquisition of North Coast, at an average cost of approximately $0.87 per Mcfe. Between January 1, 2000 and December 31, 2003, we invested approximately $356.6 million in acquisition, development and exploitation activities, adding 489.6 Bcfe to our Proved Reserves and replacing approximately 693% of our net production at an average "all-in" cost, including revisions, of $0.73 per Mcfe. During the same period we drilled 136 developmental wells, achieved a drilling success rate of 89% and did not participate in any exploratory wells. We expect further improvement of our corporate efficiencies through the development and operation of a larger asset base from acquisitions.

Experienced, incentivized management team. With an average industry work experience of 23 years, our management team has considerable experience in acquiring and operating oil and natural gas properties. Since members of our management team first purchased a significant ownership interest in us in December 1997 and assumed positions in our senior management, we have achieved substantial growth in our reserves, production and cash flow through a strategy of acquiring producing properties with development and exploitation potential. From December 31, 1997 to December 31, 2003 and pro forma for our acquisition of North Coast, we increased our Proved Reserves from 4.7 Bcfe to 621.4 Bcfe. In addition, members of our management team and key employees own approximately 16% of the voting capital stock of EXCO Holdings.

Comprehensive commodity price risk management program. We employ a comprehensive commodity price risk management program which better enables us to execute our business plan over the entire commodity price cycle. In connection with the incurrence of debt related to our acquisition activities, our objective in entering into these commodity price risk management transactions is to manage price fluctuations and achieve more predictable cash flows. In anticipation of the additional reserves to be acquired in the North Coast acquisition and the increase in quoted future commodity pricing, we entered into additional commodity price risk management contracts. The following table sets forth our commodity price risk management contracts as of April 15, 2004.

| | Swaps

| | Floors

| | Ceilings

|

|---|

| | Gas-Mmmbtu

| | Average

contract-

$/Mmbtu

| | Oil-Mbbls

| | Average

contract-

$/Bbl

| | Gas-Mmmbtu

| | Average

contract-

$/Mmbtu

| | Gas-Mmmbtu

| | Average

contract-

$/Mmbtu

|

|---|

| 2004 | | 13,054 | | $ | 4.76 | | 764 | | $ | 24.52 | | 9,921 | | $ | 4.05 | | 6,700 | | $ | 6.01 |

| 2005 | | 15,622 | | | 4.93 | | 329 | | | 25.65 | | 1,059 | | | 4.25 | | — | | | — |

| 2006 | | 10,403 | | | 4.82 | | — | | | — | | — | | | — | | — | | | — |

| 2007 | | 6,388 | | | 4.60 | | — | | | — | | — | | | — | | — | | | — |

| 2008 | | 2,745 | | | 4.55 | | — | | | — | | — | | | — | | — | | | — |

| 2009 | | 1,825 | | | 4.51 | | — | | | — | | — | | | — | | — | | | — |

| 2010 | | 1,825 | | | 4.51 | | — | | | — | | — | | | — | | — | | | — |

| 2011 | | 1,825 | | | 4.51 | | — | | | — | | — | | | — | | — | | | — |

| 2012 | | 1,830 | | | 4.51 | | — | | | — | | — | | | — | | — | | | — |

| 2013 | | 1,825 | | | 4.51 | | — | | | — | | — | | | — | | — | | | — |

See "Management's Discussion and Analysis of Financial Condition and Results of Operations—Our Liquidity, Capital Resources and Capital Commitments—Derivative Financial Instruments" for more information regarding our commodity price risk management activities.

4

Recent Developments

North Coast Acquisition. On January 27, 2004, we closed the North Coast acquisition. See "North Coast Acquisition" for more information on the North Coast Acquisition Agreement and related transactions.

Amended and Restated Credit Facilities. Concurrent with the closing of the North Coast acquisition, we amended and restated our existing credit facilities. The amended and restated credit facilities provide for a maximum committed amount of $325.0 million and an initial borrowing base of $225.0 million. Our recent amendment to the amended and restated credit facilities permitted, among other things, the issuance of additional old notes on April 13, 2004 and provided for a reduction in the borrowing base under the amended and restated credit facilities to $200.0 million. For more information on the amended and restated credit facilities, please see "Description of Certain Indebtedness."

Private Placements. On January 20, 2004, we completed the private placement of $350.0 million aggregate principal amount of 71/4% Senior Notes Due 2011 pursuant to Rule 144A and Regulation S under the Securities Act at a price of 100% of the principal amount. The net proceeds of the January 20, 2004 offering were used to acquire North Coast, pay down debt under our credit facilities and North Coast's credit facility, repay our senior term loan in full and pay fees and expenses associated with those Transactions.

On April 13, 2004, we completed a private placement of an additional $100.0 million aggregate principal amount of 71/4% Senior Notes Due 2011 pursuant to Rule 144A, having the same terms and governed by the same indenture as the notes issued on January 20, 2004. The notes issued on April 13, 2004 were issued at a price of 103.25% of the principal amount plus interest accrued since January 20, 2004. The net proceeds of the April 13, 2004 offering were used to repay substantially all of our Canadian debt and pay fees and expenses associated therewith.

We refer to all of these privately placed notes as the old notes.

Going Private Transaction. On March 11, 2003, we entered into an Agreement and Plan of Merger providing for the merger of ER Acquisition, Inc., a wholly-owned subsidiary of EXCO Holdings into EXCO. This transaction is referred to in this prospectus as the "going private transaction."

EXCO Holdings was formed by our chairman and chief executive officer, Douglas H. Miller, and his buyout group for the purpose of completing the going private transaction, which closed on July 29, 2003. In the going private transaction, each outstanding share of our common stock, other than shares held by EXCO Holdings and its affiliates, was converted into the right to receive $18.00 in cash per share. The buyout was funded by borrowings under our existing credit facilities and approximately $172.0 million of equity. The equity capital for the going private transaction was provided by investment funds and accounts managed by Cerberus Capital Management, L.P., or Cerberus, our management and institutional and other investors. Cerberus is a New York based investment management firm that, with its affiliates, manages investment funds and accounts in excess of $12.0 billion in equity capital.

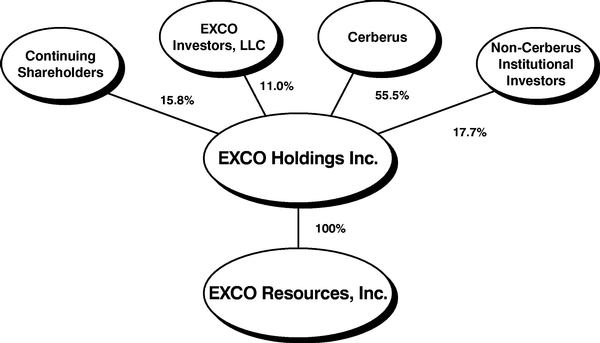

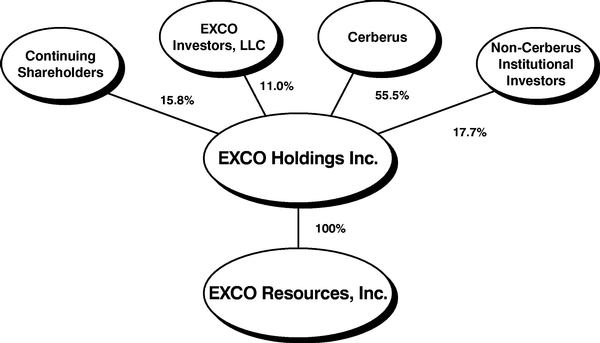

The voting capital stock of EXCO Holdings is owned by:

- •

- members of our management and other of our employees, who own in the aggregate approximately 16% of the voting capital stock of EXCO Holdings;

- •

- EXCO Investors, LLC, a limited liability company formed prior to the merger for the purpose of holding capital stock of EXCO Holdings, the members of which include business acquaintances of Mr. Miller, which owns approximately 11% of the voting capital stock of EXCO Holdings (the vote of which shares is controlled by Mr. Miller);

5

- •

- affiliates of Cerberus, which own in the aggregate approximately 55% of the voting capital stock of EXCO Holdings; and

- •

- other institutional investors, which own in the aggregate approximately 18% of the voting capital stock of EXCO Holdings.

See "Change of Control Transaction."

Corporate Information

We are a Texas corporation incorporated in October 1955. Our principal executive office is located at 12377 Merit Drive, Suite 1700, Dallas, Texas 75251. Our telephone number is (214) 368-2084.

6

The Exchange Offer

| Background | | On January 20, 2004, we completed the private placement of $350,000,000 in aggregate principal amount of our old notes pursuant to Rule 144A and Regulation S under the Securities Act. On April 13, 2004, we completed the private placement of an additional $100,000,000 in aggregate principal amount of our old notes pursuant to Rule 144A under the Securities Act. In connection with those private placements, we entered into registration rights agreements in which we agreed, among other things, to deliver this prospectus to you and to use our commercially reasonable efforts to cause the exchange offer registration statement to become effective under the Securities Act within 180 days after the consummation of the North Coast acquisition. |

The Exchange Offer |

|

We are offering to exchange our new notes which have been registered under the Securities Act for a like principal amount of our outstanding, unregistered old notes. Old notes may only be tendered in integral multiples of $1,000 principal amount at maturity. As of the date of this prospectus, $450,000,000 in aggregate principal amount of our old notes is outstanding. |

Expiration Date |

|

The exchange offer expires at 5:00 p.m., Eastern Time, on May 28, 2004, unless we extend the offer. We do not currently intend to extend the exchange offer. Pursuant to the terms of the registration rights agreements, the exchange offer must remain open for not less than thirty days (or longer if required by applicable law) after the date that the notice of the exchange offer is mailed to holders of the old notes. |

Resale of New Notes |

|

Based on an interpretation by the staff of the Securities and Exchange Commission, or the SEC, set forth in no-action letters issued to third parties, we believe that new notes issued pursuant to the exchange offer in exchange for old notes may be offered for resale, resold and otherwise transferred by you without compliance with the registration and prospectus delivery provisions of the Securities Act, provided that: |

|

|

• |

|

you are acquiring the new notes in the ordinary course of your business; |

|

|

• |

|

you are not a broker-dealer who acquired the new notes directly from us without compliance with the registration and prospectus delivery provisions of the Securities Act; |

| | | | | |

7

|

|

• |

|

you have not engaged in, do not intend to engage in, and have no arrangement or understanding with any person to participate in the distribution of the new notes; and |

|

|

• |

|

you are not our affiliate as defined under Rule 405 of the Securities Act. |

|

|

Each participating broker-dealer that receives new notes for its own account pursuant to the exchange offer in exchange for old notes that were acquired as a result of market-making or other trading activity must acknowledge that it will deliver a prospectus in connection with any resale of new notes. Prospectus delivery requirements are discussed in greater detail in the section captioned "Plan of Distribution." |

|

|

Any holder of old notes who: |

|

|

• |

|

is our affiliate; |

|

|

• |

|

does not acquire new notes in the ordinary course of its business; |

|

|

• |

|

tenders in the exchange offer with the purpose of participating, in a distribution of new notes; or |

|

|

• |

|

is a broker-dealer that acquired the old notes directly from us |

|

|

must comply with the registration and prospectus delivery requirements of the Securities Act in connection with the resale of new notes. |

Consequences For Not Exchanging

Old Notes |

|

Old notes that are not tendered in the exchange offer or are not accepted for exchange will continue to bear legends restricting their transfer. You will not be able to offer or sell the old notes unless: |

|

|

• |

|

you do so pursuant to an exemption from the requirements of the Securities Act; |

|

|

• |

|

the old notes are registered under the Securities Act; or |

|

|

• |

|

the transaction requires neither such an exemption nor registration. |

|

|

After the exchange offer is closed, we will no longer have an obligation to register the old notes. |

| | | | | |

8

Conditions to the Exchange Offer |

|

The exchange offer is subject to customary conditions, which we may, but are not required to, waive. For additional information regarding the conditions to the exchange offer, see "The Exchange Offer—Conditions to the Exchange Offer." |

Procedures for Tendering Old Notes |

|

If you are a holder of old notes who wishes to accept the exchange offer, you must: |

|

|

• |

|

complete, sign and date the accompanying letter of transmittal, or a facsimile of the letter of transmittal, and mail or otherwise deliver the letter of transmittal, together with all other documents required by the letter of transmittal, including your old notes, to the exchange agent at the address set forth on the cover page of the letter of transmittal; or |

|

|

• |

|

arrange for The Depository Trust Company to transmit certain required information, including an agent's message forming part of a book-entry transfer in which you agree to be bound by the terms of the letter of transmittal, to the exchange agent in connection with a book-entry transfer. |

|

|

By tendering your old notes in either manner, you will be representing among other things, that: |

|

|

• |

|

the new notes you receive pursuant to the exchange offer are being acquired in the ordinary course of your business; |

|

|

• |

|

you are not participating, do not intend to participate and have no arrangement or understanding with any person to participate, in the distribution of the new notes issued to you in the exchange offer; and |

|

|

• |

|

you are not an "affiliate" of ours, or if you are an affiliate of ours you will comply with the applicable registration and prospectus delivery requirements of the Securities Act. |

|

|

If a broker, dealer, commercial bank, trust company or other nominee is the registered holder of your old notes, we urge you to contact that person or entity promptly to tender your old notes in the exchange offer. |

|

|

For more information on tendering your old notes, please refer to the sections in this prospectus entitled "The Exchange Offer—Acceptance of Old Notes for Exchange" and "—Procedures for Tendering Old Notes." |

| | | | | |

9

Guaranteed Delivery |

|

If you wish to tender your old notes and: |

|

|

• |

|

certificates representing your old notes are not lost but are not immediately available, |

|

|

• |

|

time will not permit your letter of transmittal and other required documents to reach the exchange agent on or prior to the expiration date of the exchange offer, or |

|

|

• |

|

the procedures for book-entry transfer cannot be completed on or prior to the expiration date of the exchange offer, |

|

|

you must tender your old notes according to the guaranteed delivery procedures described in this prospectus under the caption "The Exchange Offer—Procedures for Tendering Old Notes—Guaranteed Delivery." |

Withdrawal Rights |

|

You may withdraw your tender of old notes at any time prior to the expiration date of the exchange offer. See "The Exchange Offer—Withdrawal of Tenders" for a more complete description of the withdrawal provisions. |

Accounting Treatment |

|

We will not recognize any gain or loss for accounting purposes upon the completion of the exchange offer. The expenses of the exchange offer that we pay will increase our deferred financing costs in accordance with generally accepted accounting principles. See "The Exchange Offer—Accounting Treatment." |

United States Federal Income Tax Consequences |

|

We believe that the exchange of old notes for new notes will not result in any gain or loss to you for United States federal income tax purposes. See "U.S. Federal Income Tax Considerations" for a more detailed description of the tax consequences of the exchange offer. |

Use of Proceeds |

|

We will not receive any proceeds from the exchange or the issuance of the new notes in connection with the exchange offer. We are making this exchange offer solely to satisfy our obligations under our registration rights agreements. See "Use of Proceeds." |

Fees and Expenses |

|

We will bear all expenses related to the exchange offer. See "The Exchange Offer—Fees and Expenses." |

| | | | | |

10

Exchange Agent |

|

We have appointed Wilmington Trust Company as exchange agent for the exchange offer. You should direct questions, requests for assistance and requests for additional copies of this prospectus (including the letter of transmittal) to the exchange agent at the address set forth under "The Exchange Offer—Exchange Agent." |

Summary of Terms of The New Notes

The terms and covenants of the new notes are substantially identical to those of the old notes except that the new notes are registered under the Securities Act and will not have restrictions on transfer or registration rights. The new notes will evidence the same debt as the old notes and will be governed by the same indenture under which the old notes were issued. For purposes of the description of the new notes included in this prospectus, references to "us," "we," "our" and EXCO refer only to EXCO Resources, Inc. and do not include our subsidiaries. The following summary contains basic information about the new notes and is not intended to be complete. It does not contain all of the information that is important to you. For a more complete understanding of the new notes, please refer to the section of this prospectus entitled "Description of the New Notes."

Issuer |

|

EXCO Resources, Inc. |

New Notes Offered |

|

$450.0 million aggregate principal amount of 71/4% Senior Notes Due 2011. |

Maturity Date |

|

January 15, 2011. |

Interest Payments |

|

71/4% per annum, payable semi-annually in arrears on January 15 and July 15 of each year, commencing July 15, 2004. Interest on the new notes will accrue from the last interest payment date on which interest was paid on the old notes surrendered in exchange therefor, or, if no interest has been paid on such old notes, from January 20, 2004. |

Optional Redemption |

|

Prior to January 15, 2007, we may redeem all, but not less than all, of the new notes in cash at a redemption price equal to 100% of the principal amount of the new notes plus the Applicable Premium (as defined in "Description of the New Notes—Optional Redemption"), plus accrued and unpaid interest to the redemption date. |

|

|

We may redeem some or all of the new notes beginning on January 15, 2007 at the redemption prices listed under "Description of the New Notes—Optional Redemption." |

|

|

Prior to January 15, 2007, we may redeem up to 35% of the aggregate principal amount of the new notes with the net proceeds of certain equity offerings at the redemption price set forth in "Description of the New Notes—Optional Redemption." |

| | | | | |

11

Change of Control |

|

If a change of control occurs, subject to certain conditions, we must offer holders of the new notes an opportunity to sell us their new notes at a purchase price of 101% of the principal amount of the new notes, plus accrued and unpaid interest to the date of the purchase. See "Description of the New Notes—Change of Control." |

Guaranties |

|

The payment of the principal, premium and interest on the new notes will be guaranteed on a senior basis by all of our current and some of our future domestic subsidiaries (except that the guarantee of Taurus Acquisition, Inc. is subordinated to its guarantee under our amended and restated credit facilities). See "Description of the New Notes—Guaranties." |

Share Pledge |

|

Due to tax considerations, the new notes will not be guaranteed by Addison Energy Inc., our Canadian subsidiary. Instead, the new notes will be secured, subject to specified permitted liens and except as described below, by a second-priority security interest in 65% of the capital stock of Addison Energy Inc. and 100% of the capital stock of Taurus Acquisition, Inc. behind the first-priority security interest securing obligations relating to EXCO Resources, Inc.'s obligations under the amended and restated credit facilities or future indebtedness incurred to refinance or replace such amended and restated credit facilities on a first-priority basis. These share pledges will be limited such that, at any time, the aggregate par value, book value as carried by us or market value (whichever is greatest) of such pledged capital stock of either Addison Energy Inc. or Taurus Acquisition, Inc. is not equal to or greater than 20% of the then outstanding aggregate principal amount of the new notes. |

|

|

Amendments to or waivers of the pledge agreement governing the first-priority share pledge will, in certain circumstances, automatically apply, without consent of the holders of the new notes, to the pledge agreement governing the share pledge securing the new notes. Also, in the event of a foreclosure, liquidation, bankruptcy or similar proceeding of us or any of our subsidiary guarantors, no assurance can be given that the proceeds from any sale or liquidation of the pledged shares will be sufficient to pay any of our obligations under the new notes, in full or in part, after first satisfying our obligations and those of our guarantors under our amended and restated credit facilities. See "Description of the New Notes—Share Pledge." |

| | | | | |

12

|

|

Subject to certain exceptions, the pledge agreement will provide that the first-priority lien holders will control all remedies and other actions related to the pledged shares at all times prior to the payment in full of the obligations secured by the first-priority liens and the termination of the commitments thereunder. As a result, in most circumstances neither the collateral agent, the trustee nor the holders of the new notes will be able to force a sale of the pledged shares or otherwise exercise remedies normally available to secured creditors without the concurrence of lenders under the amended and restated credit facilities and other holders of first-priority liens. |

Intercreditor Agreement |

|

Pursuant to an intercreditor agreement, the share pledges securing the new notes will be expressly second in priority to the share pledges securing EXCO Resources, Inc.'s obligations under the amended and restated credit facilities and future indebtedness incurred to replace or refinance the amended and restated credit facilities in accordance with the terms of the indenture. The second-priority share pledges securing the new notes may not be enforced at any time when the obligations secured by first-priority share pledges are outstanding, subject to certain limited exceptions. Any proceeds received by the trustee on behalf of holders of the new notes from the sale of the pledged shares prior to the payment in full of the obligations secured by the first-priority share pledges must be delivered to the holders of those obligations. See "Description of the New Notes—Share Pledge." |

Ranking |

|

The new notes and the guarantees will be our and the guarantors' senior obligations (except that the guarantee of Taurus Acquisition, Inc. will be subordinated to its guarantee under our amended and restated credit facilities). They will rank equal in right of payment with our existing and future senior indebtedness and senior in right of payment to any of our existing and future subordinated indebtedness. The new notes will be effectively subordinate to all of our secured debt to the extent of the value of the assets securing such debt and structurally subordinated to all of the existing and future liabilities of our subsidiaries that do not guarantee the new notes. The new notes and the old notes will constitute a single class of securities under the indenture. As of December 31, 2003, after giving effect to the Transactions, we, excluding our subsidiaries, would have had approximately $450.0 million of senior indebtedness, including the $450.0 million of old notes and no guarantees on a senior secured basis of indebtedness of our Canadian subsidiary; excluding guarantees of the indebtedness of EXCO Resources, Inc., our subsidiary guarantors would have had no indebtedness; and our non-guarantor subsidiary would have had no indebtedness. |

| | | | | |

13

Restrictive Covenants |

|

The indenture governing the notes contains covenants which limit our ability and certain of our subsidiaries' ability to: |

|

|

• |

|

incur or guarantee additional debt and issue certain types of preferred stock; |

|

|

• |

|

pay dividends on our capital stock or redeem, repurchase or retire our capital stock or subordinated debt; |

|

|

• |

|

make investments; |

|

|

• |

|

create liens on our assets; |

|

|

• |

|

enter into sale/leaseback transactions; |

|

|

• |

|

create restrictions on the ability of our restricted subsidiaries to pay or make other payments to us; |

|

|

• |

|

engage in transactions with our affiliates; |

|

|

• |

|

transfer or issue shares of stock of subsidiaries; |

|

|

• |

|

transfer or sell assets; and |

|

|

• |

|

consolidate, merge or transfer all or substantially all of our assets and the assets of our subsidiaries. |

|

|

These covenants are subject to important exceptions and qualifications, which are described under the caption "Description of the New Notes—Certain Covenants." |

Absence of a Public Market for the

New Notes |

|

The new notes will be a new issue of debt securities of the same class as the old notes and will generally be freely transferable. Notwithstanding the foregoing, we cannot assure you as to the development of an active market for the new notes or their liquidity. We do not intend to apply for listing of the new notes on any securities exchange or any automated dealer quotation system. |

Risk Factors

Investing in the new notes involves substantial risk. You should carefully consider the information under the caption "Risk Factors" and all other information included in this prospectus before investing in the new notes.

14

Summary Unaudited Pro Forma Financial and Operating Data

The following tables set forth summary unaudited pro forma financial and operating data to give effect to the Transactions and the going private transaction. The unaudited pro forma statement of operations data assume that the Transactions and the going private transaction occurred on January 1, 2003. The unaudited pro forma balance sheet data assume that the Transactions occurred on December 31, 2003. The unaudited pro forma financial and operating data do not purport to be indicative of the results of operations or the financial position that would have occurred had the Transactions or the going private transaction occurred on the dates indicated, nor do they purport to be indicative of future results of operations or financial position. The unaudited pro forma financial and operating data should be read in conjunction with our historical consolidated financial statements and related notes and the historical consolidated financial statements and related notes for North Coast, our unaudited condensed consolidated pro forma financial statements and related notes, "Management's Discussion and Analysis of Financial Condition and Results of Operations" and other financial and operating information contained in this prospectus.

| | Year Ended

December 31, 2003

| |

|---|

| | (Dollars in thousands)

| |

|---|

| Statement of Operations Data: | | | | |

| Revenues and other income: | | | | |

| Oil and natural gas | | $ | 165,964 | |

| Commodity price risk management activities | | | (11,160 | ) |

| Well operating, gathering and other | | | 3,244 | |

| Other expense | | | 421 | |

| | |

| |

| | Total revenues and other income | | | 158,469 | |

| | |

| |

| Costs and expenses: | | | | |

| Oil and natural gas production | | | 43,896 | |

| Well operating, gathering and other | | | 2,952 | |

| Depreciation, depletion and amortization | | | 42,469 | |

| Accretion of asset retirement obligations | | | 1,604 | |

| General and administrative | | | 20,870 | |

| Interest | | | 34,233 | |

| | |

| |

| | Total costs and expenses | | | 146,024 | |

| | |

| |

| Income before income taxes | | | 12,445 | |

| Income tax benefit | | | (523 | ) |

| | |

| |

| Net income | | $ | 12,968 | |

| | |

| |

| | At December 31, 2003

|

|---|

| | (Dollars in thousands)

|

|---|

| Balance Sheet Data: | | | |

| Cash | | $ | 24,976 |

| Total assets | | | 769,353 |

| Total debt(1) | | | 453,250 |

| Stockholders' equity | | | 182,181 |

- (1)

- Total debt includes $3.2 million of premium related to the old notes issued on April 13, 2004.

15

| | Year Ended

December 31, 2003

|

|---|

| | (Dollars in thousands, except average prices and costs)

|

|---|

| Other Financial and Operating Data: | | | |

| Ratio of earnings to fixed charges(1) | | | 1.36 |

Production: |

|

|

|

| Oil (Mbbls) | | | 1,317 |

| Natural gas liquids (Mbbls) | | | 392 |

| Natural gas (Mmcf) | | | 26,778 |

| Oil and natural gas (Mmcfe) | | | 37,032 |

Average Sales Prices (before cash settlements of derivatives): |

|

|

|

| Oil (Bbls) | | $ | 29.03 |

| Natural gas liquids (Bbls) | | | 24.72 |

| Natural gas (Mcf) | | | 5.13 |

| Oil and natural gas (Mcfe) | | | 5.00 |

Average Sales Prices (after cash settlements of derivatives): |

|

|

|

| Oil (Bbls) | | $ | 25.03 |

| Natural gas liquids (Bbls) | | | 24.72 |

| Natural gas (Mcf) | | | 4.37 |

| Oil and natural gas (Mcfe) | | | 4.31 |

Average Costs (per Mcfe): |

|

|

|

| Lease operating expense | | $ | 0.95 |

| Production taxes | | | 0.23 |

| General and administrative | | | 0.56 |

| Depletion, depreciation and amortization | | | 1.15 |

- (1)

- For purposes of computing the ratio of earnings to fixed charges, earnings are defined as pre-tax income plus fixed charges. Fixed charges consist of interest expense, deferred debt issuance costs and an estimate of rent expense, which equals approximately 33% of the total rent expense.

16

RISK FACTORS

An investment in the new notes involves certain risks. You should consider carefully these risks together with all of the other information included in this prospectus and the documents to which we have referred you before deciding whether this investment is suitable for you.

The risk factors noted in this section and other factors contained in this prospectus describe examples of risks, uncertainties and events that may cause our actual results to differ materially from those contained in any forward-looking statement. If one or more of these risks or uncertainties materialize, or if underlying assumptions prove incorrect, actual outcomes may vary materially from those included in this prospectus.

Risks Related to Our Business

Our revenue depends on oil and natural gas prices, which fluctuate.

Our future financial condition, access to capital, cash flow and results of operations depend upon the prices we receive for our oil and natural gas. Historically, oil and natural gas prices have been volatile and are subject to fluctuations in response to changes in supply and demand, market uncertainty and a variety of additional factors that are beyond our control. The NYMEX spot prices for crude oil and natural gas at the close of business on December 31, 2001 were $19.84 per Bbl and $2.57 per Mmbtu and at December 31, 2003 were $32.52 per Bbl and $6.19 per Mmbtu. In addition, natural gas prices in Canada and the DJ Basin in Colorado, which accounted for an aggregate of approximately 61.1% of our natural gas production during twelve months ended December 31, 2003, have been and may continue to be subject to lower market prices primarily due to higher transportation costs and capacity restraints. On a pro forma basis for the twelve months ended December 31, 2003, natural gas constituted 72.3% of our total production. Factors that affect the prices we receive for our oil and natural gas include:

- •

- the level of domestic production;

- •

- the availability of imported oil and natural gas;

- •

- actions taken by foreign oil and natural gas producing nations;

- •

- the cost and availability of transportation and pipeline systems with adequate capacity;

- •

- the cost and availability of other competitive fuels;

- •

- fluctuating and seasonal demand for oil and natural gas;

- •

- conservation and the extent of governmental price controls and regulation of production;

- •

- weather;

- •

- foreign and domestic government relations; and

- •

- overall economic conditions.

Our ability to maintain or increase our borrowing capacity, to repay current or future indebtedness and to obtain additional capital on attractive terms depends substantially upon oil and natural gas prices.

Our commodity price risk management program may cause us to forego additional future profits or result in our making cash payments.

To reduce our exposure to changes in the prices of oil and natural gas, we have entered into and may in the future enter into commodity price risk management arrangements for a portion of our oil and natural gas production. The agreements that we have entered into generally have the effect of

17

providing us with a fixed price for a portion of our expected future oil and natural gas production over a fixed period of time. Commodity price risk management arrangements may expose us to the risk of financial loss in some circumstances, including the following:

- •

- the counterparty to the commodity price risk management contract may default on its contractual obligations;

- •

- there is a change in the expected differential between the underlying price in the commodity price risk management agreement and actual prices received; or

- •

- market prices may exceed the prices at which we are contracted, resulting in our need to make significant cash payments.

Our commodity price risk management activities could have the effect of reducing our revenues. As of December 31, 2003, the net unrealized loss on our commodity price risk management contracts was $15.7 million for EXCO and $3.1 million for North Coast. See "Management's Discussion and Analysis of Financial Condition and Results of Operations—Our Liquidity, Capital Resources and Capital Commitments—Derivative Financial Instruments" for more information about our commodity price risk management arrangements.

We may be unable to acquire or develop additional reserves.

As is generally the case in the oil and natural gas industry, our success depends upon our ability to find, develop or acquire additional oil and natural gas reserves that are profitable to produce. Factors that may hinder our ability to acquire additional oil and natural gas reserves include competition, access to capital, prevailing oil and natural gas prices and the number of properties for sale. If we are unable to conduct successful development activities or acquire properties containing Proved Reserves, our total Proved Reserves will generally decline as a result of production. Also, our production will generally decline. In addition, if our reserves and production decline then the amount we are able to borrow under our credit agreements will also decline. We may not be able to locate additional reserves, drill economically productive wells or acquire properties containing Proved Reserves.

We may not realize the anticipated benefits from the North Coast acquisition.

Our estimates regarding the expenses and liabilities or the increase in our reserves and production resulting from the North Coast acquisition may prove to be incorrect or we may not be successful in integrating North Coast's properties into our existing business, all of which could significantly reduce our ability to generate cash needed to service our debt and fund our capital program and other working capital requirements.

We have joint and several liability for tax and ERISA liabilities attributable to members of Nuon Energy & Water's tax group.

North Coast and its subsidiaries are part of Nuon Energy & Water's consolidated, combined or unitary group for tax and ERISA purposes for tax years 2003 and 2004, and as a result, North Coast and its subsidiaries are jointly and severally liable for the taxes and ERISA liabilities of all members within that group. There is a risk that a federal, state, local or foreign taxing or other governmental authority may file a claim against North Coast and its subsidiaries for taxes and/or ERISA liabilities attributable to Nuon Energy & Water's consolidated, combined or unitary group for 2003 or 2004. Such taxes and/or ERISA liabilities may be significant and may include taxes associated with the North Coast acquisition. As set forth in the North Coast Acquisition Agreement, if such a claim is asserted, Nuon Energy & Water has agreed to be responsible for, and to indemnify us for, all taxes or ERISA liabilities attributable to Nuon Energy & Water and any of its affiliates other than North Coast and its subsidiaries, for any liability imposed on North Coast and its subsidiaries due to their inclusion in Nuon

18

Energy & Water's consolidated, combined or unitary group, including any tax liability of North Coast as a result of North Coast making an election under Section 338(h)(10) of the Internal Revenue Code. Nuon Energy & Water's parent, n.v. NUON, a Dutch company with limited liability, has entered into an unconditional, unsecured guaranty agreement with us to guaranty Nuon Energy & Water's performance of its obligations under the North Coast Acquisition Agreement (specifically the tax indemnification provisions), the stock tender agreement and the escrow agreement. Both Nuon Energy & Water's indemnity and n.v. NUON's guaranty are unsecured obligations. There is a risk that neither entity will honor its obligations. Furthermore, neither entity may have any assets in the United States against which we could collect any final judgment we might be awarded.

We may not identify all risks associated with the acquisition of oil and natural gas properties.

Generally, it is not feasible for us to review in detail every individual property involved in an acquisition. Our business strategy focuses on acquisitions of producing oil and natural gas properties. Any future acquisitions will require an assessment of recoverable reserves, future oil and natural gas prices, operating costs, potential environmental hazards and other liabilities and other similar factors. Ordinarily, our review efforts are focused on the higher-valued properties. However, even a detailed review of these properties and records may not reveal existing or potential problems, nor will it permit us to become sufficiently familiar with the properties to assess fully their deficiencies and capabilities. We do not inspect every well that we acquire. Potential problems, such as deficiencies in the mechanical integrity of equipment or environmental conditions that may require significant remedial expenditures, are not necessarily observable even when we inspect a well. Even if we were able to identify problems with an acquisition, the seller may be unwilling or unable to provide effective contractual protection or indemnity against all or part of these problems. Even if a seller agrees to provide indemnity, the indemnity may not be fully enforceable. We were not indemnified for these types of risks in the North Coast acquisition.

We may be unable to obtain additional financing to implement our growth strategy.

The growth of our business will require substantial capital on a continuing basis. Because we will pledge substantially all of our assets as collateral under our amended and restated credit facilities, it may be difficult for us in the foreseeable future to obtain financing on an unsecured basis or to obtain additional secured financing other than purchase money indebtedness. If we are unable to obtain additional capital on satisfactory terms and conditions, we may lose opportunities to acquire oil and natural gas properties and businesses.

We may not be successful in managing our growth.

The North Coast acquisition represents a significant increase in our resources and production. The North Coast acquisition constitutes the largest acquisition we have ever completed, increasing the size of our company, measured by Proved Reserves, by over 43%. In addition, in connection with the North Coast acquisition, we added 3,709 gross wells to our portfolio of wells, including approximately 3,535 operated wells, which more than quadrupled the number of wells we operated prior to completion of the North Coast acquisition. Finally, the North Coast acquisition represents our entry into a new geographic production region in which we have not previously operated. All of these factors present significant integration challenges for us. The pursuit of additional acquisitions is a key part of our strategy. Our growth could strain our managerial, financial, technical, operational and administrative resources. Failure to manage our growth successfully could adversely affect our operations and net revenues through increased operating costs and revenues that do not meet our expectations. We may not be able to successfully integrate acquired oil and natural gas properties into our operations or achieve desired profitability.

19

We may encounter marketing obstacles.

Our ability to market our oil and natural gas production will depend upon the availability and capacity of natural gas gathering systems, pipelines and other transportation facilities. We are primarily dependent upon third parties to transport our products. Transportation space on the gathering systems and pipelines we utilize is occasionally limited or unavailable due to repairs or improvements to facilities or due to space being utilized by other companies that have priority transportation agreements. Our access to transportation options can also be affected by U.S. federal and state regulation and Canadian regulation of oil and natural gas production and transportation, general economic conditions and changes in supply and demand. These factors and the availability of markets are beyond our control. If market factors dramatically change, the financial impact on our revenues could be substantial and could adversely affect our ability to produce and market oil and natural gas.

Our Canadian operations may be adversely affected by currency fluctuations and economic and political developments.

We have significant oil and natural gas operations in Canada, representing approximately 34% of our Proved Reserves at December 31, 2003, on a pro forma basis. Our Canadian operations are subject to the risk of fluctuations in the relative value of the Canadian and U.S. dollars. We have not hedged any currency risk exposure associated with our Canadian operations in prior periods. We are required to recognize foreign currency transaction and translation gains or losses related to our Canadian operations in our consolidated financial statements. Our Canadian operations may be adversely affected by political and economic developments, royalty and tax increases and other laws or policies in Canada, as well as U.S. policies affecting trade, taxation and investment in Canada.

Our Canadian properties and operations are subject to foreign regulations.

The oil and natural gas industry in Canada is subject to extensive legislation and regulation governing its operations. This legislation and regulation, enacted by various levels of government, impacts a number of areas, including royalties, land tenure, exploration, development, production, refining, transportation, marketing, environmental protection, exports, taxes, labor standards and health and safety standards. In addition, extensive legislation and regulation exists with respect to pricing and taxation of oil and natural gas and related products. Canadian governmental legislation and regulation may have a material effect on our operating results and may have a material adverse effect on our results of operations and our financial condition.

We may be unable to overcome risks associated with our drilling activity.

Our drilling involves numerous risks, including the risk that we will not encounter commercially productive oil or natural gas reservoirs. We must incur significant expenditures to identify and acquire properties and to drill and complete wells. The costs of drilling and completing wells is often uncertain, and drilling operations may be curtailed, delayed or canceled as a result of a variety of factors, including unexpected drilling conditions, pressure or irregularities in formations, equipment failures or accidents, weather conditions and shortages or delays in the delivery of equipment. While we use advanced technology in our operations, this technology does not allow us to know conclusively prior to drilling a well that oil or natural gas is present or economically producible.

We may not correctly evaluate reserve data or the exploitation potential of properties as we engage in our acquisition, development and exploitation activities.

Our future success will depend on the success of our acquisition, development and exploitation activities. Our decisions to purchase, develop or otherwise exploit properties or prospects will depend in part on the evaluation of data obtained from production reports and engineering studies, geophysical

20

and geological analyses and seismic and other information, the results of which are often inconclusive and subject to various interpretations.

We cannot control the development of the properties we own but do not operate.

As of December 31, 2003, we do not operate wells that represent approximately 10% of the present value of estimated future net revenues of our Proved Reserves on a pro forma basis. As a result, the success and timing of our drilling and development activities on those properties depend upon a number of factors outside of our control, including:

- •

- the timing and amount of capital expenditures;

- •

- the operators' expertise and financial resources;

- •

- the approval of other participants in drilling wells; and

- •

- the selection of suitable technology.

If drilling and development activities are not conducted on these properties, we may not be able to increase our production or offset normal production declines.

Our estimates of oil, natural gas and NGL reserves involve inherent uncertainty.

Numerous uncertainties are inherent in estimating quantities of proved oil, natural gas and NGL reserves, including many factors beyond our control. This prospectus contains estimates of our proved oil, natural gas and NGL reserves and the PV-10 of the proved oil, natural gas and NGL reserves. These estimates are based upon reports of our own engineers and our independent petroleum engineers. These reports rely upon various assumptions, including assumptions required by the SEC, as to constant oil, natural gas and NGL prices, drilling and operating expenses, capital expenditures, taxes and availability of funds. These estimates should not be construed as the current market value of our estimated Proved Reserves. The process of estimating oil, natural gas and NGL reserves is complex, requiring significant decisions and assumptions in the evaluation of available geological, engineering and economic data for each reservoir. As a result, the estimates are inherently imprecise evaluations of reserve quantities and future net revenue. Our actual future production, revenues, taxes, development expenditures, operating expenses and quantities of recoverable oil, natural gas and NGL reserves may vary substantially from those we have assumed in the estimates. Any significant variance in our assumptions could materially affect the quantity and value of reserves described in this prospectus. In addition, our reserves may be revised downward or upward, based upon production history, results of future exploitation and development activities, prevailing oil and natural gas prices and other factors. A material decline in prices paid for our production can adversely impact the estimated volumes of our reserves.

We are exposed to operating hazards and uninsured risks.

Our operations are subject to the risks inherent in the oil and natural gas industry, including the risks of:

- •

- fire, explosions and blowouts;

- •

- pipe failure;

- •

- abnormally pressured formations; and

- •

- environmental accidents such as oil spills, gas leaks, ruptures or discharges of toxic gases, brine or well fluids into the environment (including groundwater contamination).

21

These events may result in substantial losses to us from:

- •

- injury or loss of life;

- •

- severe damage to or destruction of property, natural resources and equipment;

- •

- pollution or other environmental damage;

- •

- environmental clean-up responsibilities;

- •

- regulatory investigation;

- •

- penalties and suspension of operations; or

- •

- attorney's fees and other expenses incurred in the prosecution or defense of litigation.

As is customary in our industry, we maintain insurance against some, but not all, of these risks. Our insurance may not be adequate to cover these losses or liabilities. Further, with the turmoil in the commercial insurance industry as a result of the events of September 11, 2001, insurance coverage may not continue to be available at commercially acceptable premium levels or at all. We do not carry business interruption insurance. Losses and liabilities arising from uninsured or under-insured events could require us to make large unbudgeted cash expenditures that could materially impact our cash flow.

We have renewed well control coverage for our Canadian drilling and workover activities effective as of March 1, 2004. Well control coverage for our U.S. operations was renewed as of March 10, 2004. The new policy covers our U.S. workover operations unlike our previous policy as the premiums have become more economical. North Coast's well control policy is in effect through May 9, 2004. We cannot assure you that we will be able to renew North Coast's well control policy at commercially acceptable premiums or at all. In addition, we cannot assure you that, if we are unable to renew North Coast's well control policy, we will be able to add North Coast and its subsidiaries to our current well control policy on commercially acceptable terms or at all.

We may experience production curtailments.

The producing wells that we own an interest in have, from time to time, experienced reduced or terminated production. These curtailments may result from mechanical failures, contract terms, pipeline and processing plant interruptions, market conditions and weather conditions. These curtailments may last from a few days to many months.

Repercussions from terrorist activities or armed conflict could harm our business.

Terrorist activities, anti-terrorist efforts and other armed conflict involving the United States or its interests abroad may adversely affect the United States and global economies and could prevent us from meeting our financial and other obligations. If events of this nature occur and persist, the attendant political instability and societal disruption could reduce overall demand for oil and natural gas, potentially putting downward pressure on prevailing oil and natural gas prices and causing a reduction in our revenues. Oil and natural gas production facilities, transportation systems and storage facilities could be direct targets of terrorist attacks, and our operations could be adversely impacted if infrastructure integral to our operations is destroyed or damaged by such an attack. Costs for insurance and other security may increase as a result of these threats, and some insurance coverage may become more difficult to obtain if available at all.

Our business exposes us to liability and extensive regulation on environmental matters.

Our operations are subject to numerous U.S. federal, state and local and Canadian laws and regulations relating to the protection of the environment, including those governing the discharge of

22

materials into the water and air, the generation, management and disposal of hazardous substances and wastes and the cleanup of contaminated sites. We could incur material costs, including cleanup costs, fines and civil and criminal sanctions and third-party claims for property damage and personal injury as a result of violations of, or liabilities under, environmental laws and regulations. Such laws and regulations not only expose us to liability for our own activities, but may also expose us to liability for the conduct of others or for actions by us that were in compliance with all applicable laws at the time those actions were taken. In addition, we could incur substantial expenditures complying with environmental laws and regulations, including future environmental laws and regulations which may be more stringent.

Our business depends on a limited number of key personnel.

We are substantially dependent upon the skills of two key individuals within our management, Mr. Douglas H. Miller and Mr. T. W. Eubank. Both individuals have experience in acquiring, financing and restructuring oil and natural gas companies. We do not have employment agreements with these individuals or maintain key man insurance. The loss of the services of either one of these individuals could hinder our ability to successfully implement our business strategy.

Our principal stockholder is in a position to affect our ongoing operations, corporate transactions and other matters.

EXCO Holdings, as our sole stockholder, has the right to elect our board of directors. For so long as EXCO Acquisition LLC, an affiliate of Cerberus, owns at least 20% of the issued and outstanding shares of EXCO Holdings, it has the right to elect a majority of the board of directors of EXCO Holdings. The interests of EXCO Acquisition LLC and its affiliates may conflict with the interests of the holders of the notes. In particular, EXCO Acquisition LLC may cause a change of control at a time when we do not have sufficient funds to repurchase the notes as described under "Description of the New Notes—Change of Control."

We may have write-downs of our asset values.