As filed with the Securities and Exchange Commission on October 10, 2006 Registration No. _____________

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

CAPITOL BANCORP LIMITED

(Exact name of registrant as specified in its charter)

Michigan (State or other jurisdiction of incorporation or organization) | 6711 (Primary Standard Industrial Classification Code Number) | 38-2761672 (I.R.S. Employer Identification No.) |

Capitol Bancorp Center

200 Washington Square North, Fourth Floor

Lansing, Michigan 48933

(517) 487-6555

(Address, including zip code, and telephone number, including area code, of registrant's principal executive offices)

Cristin Reid English, Esq.

Capitol Bancorp Limited

Capitol Bancorp Center

200 Washington Square North, Fourth Floor

Lansing, Michigan 48933

(517) 487-6555

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Phillip D. Torrence, Esq.

Miller, Canfield, Paddock and Stone, P.L.C.

444 West Michigan Avenue

Kalamazoo, Michigan 49007

(269) 383-5804

Approximate date of commencement of proposed sale of the securities to the public: As soon as practicable after the effective date of this registration statement and upon the completion of the transactions described in the enclosed prospectus.

If the securities being registered on this form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box. ¨

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

CALCULATION OF REGISTRATION FEE

Title of Each Class of Securities to be Registered | Amount to be Registered(1) | Proposed Maximum Offering Price Per Share(2) | Proposed Maximum Aggregate Offering Price(2) | Amount of Registration Fee |

Common Stock, No Par Value | 196,182 | $45.95 | $8,818,381 | $944.00 |

| (1) | The number of shares registered pursuant to this Registration Statement is based upon the approximate number of shares of Bank of Escondido ("BOE") common stock presently outstanding, or reserved for issuance pursuant to 71,000 outstanding stock options of BOE, or otherwise expected to be issued upon the consummation of the proposed transaction to which this Registration Statement relates (less the shares held by Capitol) multiplied by the estimated exchange ratio of .349638 shares of Capitol common stock for each BOE share. |

| (2) | Pursuant to Rules 457(f)(1) and 457(f)(3) under the Securities Act of 1933, as amended, the registration fee has been calculated based on a price of $44.95 per share of Capitol common stock (the average of the high and low prices for shares of common stock of Capitol reported on the New York Stock Exchange on October 9, 2006) and the estimated number of Capitol shares that may be issued in the consummation of the share exchange transaction contemplated. |

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

| The information in this prospectus is not complete and may be changed. Capitol may not distribute or issue the shares of Capitol common stock being registered pursuant to this registration statement until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to distribute these securities and Capitol is not soliciting offers to receive these securities in any state where such offer or distribution is not permitted. |

Subject to Completion, Dated October , 2006

Offer to Exchange Each Outstanding Share of Common Stock

of

BANK OF ESCONDIDO

for Shares of Common Stock of Capitol Bancorp Limited

by

CAPITOL BANCORP LIMITED

in each case subject to the procedures and limitations described in this prospectus and the related letter of transmittal.

The exchange offer and withdrawal rights will expire at 11:59 p.m., Michigan Time, on November 30, 2006 unless extended by Capitol in its sole discretion. Shares tendered pursuant to this offer may be withdrawn at any time prior to the expiration of this offer.

Capitol Bancorp Limited ("Capitol") is offering to exchange each issued and outstanding share of Bank of Escondido ("BOE") common stock, not already owned by Capitol, for shares of Capitol's common stock. BOE is a majority-owned subsidiary of Capitol. Capitol is making this offer to provide holders of BOE common stock, excluding BOE shares already owned by Capitol, with an opportunity to receive registered securities of Capitol. Individual members of BOE's Board of Directors have indicated to Capitol an intention to tender their BOE shares pursuant to the exchange offer.

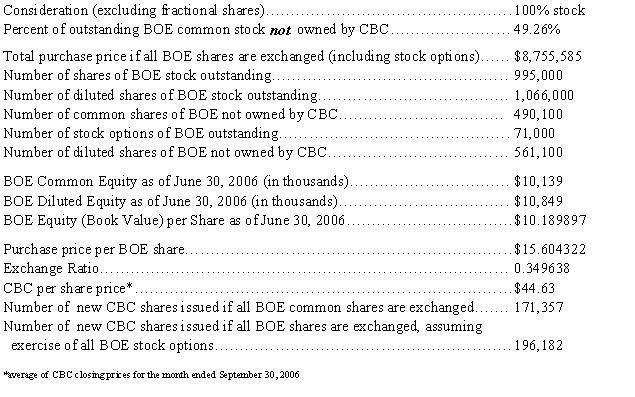

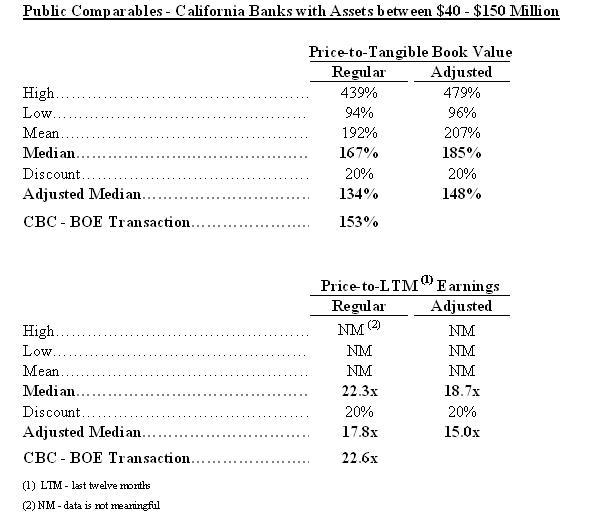

If you elect to receive Capitol common stock in the exchange offer, Capitol will determine the per share consideration you are entitled to receive according to an exchange ratio. The exchange ratio will be calculated by dividing 150% of the pro forma fully-diluted adjusted book value per share of BOE common stock as of October 31, 2006, by the average closing price of Capitol's common stock for the 30 trading day period ending one trading day prior to the close of the exchange offer ($15.604322). At June 30, 2006, the book value per share of BOE was approximately $10.189897.

The Capitol share value will be based upon the average closing price of Capitol common stock over a 30 trading day period ending one trading day prior to the close of the exchange offer. However, Capitol's stock price may fluctuate and the consideration you receive may fluctuate and may not equal the estimate per share consideration stated herein if Capitol's stock price does not equal the average closing price for the month ended September 30, 2006. The closing price of Capitol's common stock on October 9, 2006, the day before Capitol publicly announced the exchange offer, was $45.35. Based upon the average of the closing prices of the Capitol common stock for the month ended September 30, 2006 ($44.63), a holder of BOE common stock electing to receive shares of Capitol common stock in the exchange offer would receive approximately .349638 shares of Capitol common stock for each share of BOE common stock, using the BOE share value as described above. See "The Exchange Offer" beginning on page 34.

Capitol's common stock trades on the New York Stock Exchange, or NYSE, under the symbol "CBC". BOE's common stock is not traded on any established trading market. It is generally expected that any stock of Capitol received by holders of BOE common stock will not be subject to federal income tax but only if certain criteria are met. See "The Exchange Offer—Material U.S. Federal Income Tax Consequences of the Exchange Offer" beginning on page 39. Capitol's obligation to complete this exchange offer is subject to the conditions listed under "The Exchange Offer—Conditions to the Exchange Offer" beginning on page 40.

FOR A DISCUSSION OF VARIOUS FACTORS THAT YOU SHOULD CONSIDER ABOUT THE EXCHANGE OFFER, SEE "RISK FACTORS" BEGINNING ON PAGE 14. CAPITOL IS NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND CAPITOL A PROXY

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved the securities to be issued under this Proxy Statement/Prospectus or determined if this Proxy Statement/Prospectus is accurate or adequate. Any representation to the contrary is a criminal offense.

The date of this prospectus is October _____, 2006

ADDITIONAL INFORMATION

This prospectus incorporates important business and financial information about Capitol and its subsidiaries from documents filed with Securities and Exchange Commission, or the SEC, that have not been included in, or delivered with, this prospectus. This information is available on the SEC's website at http://www.sec.gov and from other sources. See "Where Can I Find More Information?" on page 50.

You may also request copies of these documents from Capitol, without charge, upon written or oral request to:

Capitol Bancorp Limited

Capitol Bancorp Center

200 Washington Square North, 4th Floor

Attn: Cristin Reid English, Esq.

Telephone: (517) 487-6555

In order to receive timely delivery of the documents, you must make requests no later than November 22, 2006 (five business days before the initially scheduled expiration date of the exchange offer).

| |

| | |

| QUESTIONS AND ANSWERS ABOUT THE EXCHANGE OFFER | 1 |

| | |

| SUMMARY | 4 |

| Reasons for the Exchange Offer | 4 |

| The Exchange Offer | 4 |

| Accounting Treatment | 5 |

| Tax Consequences of the Share Exchange to BOE Shareholders | 5 |

| There are No Dissenters' Rights in Connection with the Exchange Offer. | 6 |

| Capitol's Obligation to Complete the Exchange Offer is Subject to a Number of Conditions | 6 |

| Regulatory Approvals | 6 |

| Opinion of Financial Advisor | 7 |

| Dividend Policy of Capitol | 7 |

| Dividend Policy of BOE | 7 |

| The Exchange Offer is Currently Scheduled to Expire on November 30, 2006 | 7 |

| The Exchange Offer May be Extended, Terminated or Amended | 7 |

| The Exchange Offer Shall Occur Promptly After the Expiration Date | 8 |

| Tendered Shares May be Withdrawn at Any Time Prior to the Exchange of Those Shares | 8 |

| Shareholders Must Comply With the Procedure for Tendering Shares | 8 |

| Your Rights as a Shareholder Will Change | 8 |

| Forward-Looking Statements May Prove Inaccurate | 8 |

| | |

| SELECTED CONSOLIDATED FINANCIAL DATA OF CAPITOL | 10 |

| | |

| SELECTED CONSOLIDATED FINANCIAL DATA OF BOE | 12 |

| | |

| RISK FACTORS | 14 |

| | |

| RECENT DEVELOPMENTS | 19 |

| | |

| CAPITALIZATION | 20 |

| | |

| DIVIDENDS AND MARKET FOR COMMON STOCK | 21 |

| | |

| CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS | 22 |

| | |

| INFORMATION ABOUT CAPITOL | 23 |

| | |

| INFORMATION ABOUT BOE | 24 |

| | |

| PRO FORMA CONSOLIDATED FINANCIAL INFORMATION | 29 |

| | |

COMPARATIVE HISTORICAL, PRO FORMA AND PRO FORMA EQUIVALENT PER SHARE INFORMATION | 32 |

| | |

| BACKGROUND OF THE EXCHANGE OFFER | 33 |

| Background of the Exchange | 33 |

| Capitol's Reasons for the Exchange | 33 |

| Certain Considerations for BOE Shareholders | 33 |

| BOE's Reasons for the Exchange | 33 |

| | |

| THE EXCHANGE OFFER. | 34 |

| General | 34 |

| Consideration to be Paid | 34 |

| Timing of the Exchange Offer. | 35 |

| Extension, Termination and Amendment | 35 |

| Exchange of BOE Shares; Delivery of Capitol Common Stock | 36 |

| Cash Instead of Fractional Shares of Capitol Common Stock | 36 |

| TABLE OF CONTENTS, cont. | |

| | |

| Withdrawal Rights | 36 |

| Procedure for Tendering. | 37 |

| Guaranteed Delivery | 37 |

| Material U.S. Federal Income Tax Consequences of the Exchange Offer | 38 |

| Purpose of the Exchange Offer; Dissenters' Rights | 40 |

| Conditions to the Exchange Offer | 40 |

| Minimum Tender Condition | 40 |

| Regulatory Matters | 40 |

| Other Conditions to the Exchange Offer | 41 |

| Source and Amount of Funds | 42 |

| Certain Relationships with BOE | 42 |

| Fees and Expenses | 43 |

| Accounting Treatment | 43 |

| Pro Forma Data | 43 |

| Federal Securities Laws Consequences | 43 |

| NYSE Listing | 43 |

| Opinion of Financial Advisor | 43 |

| | |

| COMPARISON OF SHAREHOLDER RIGHTS | 46 |

| | |

| DESCRIPTION OF THE CAPITAL STOCK OF CAPITOL | 47 |

| Rights of Common Stock | 47 |

| Shares Available for Issuance | 47 |

| Capitol's Preferred Securities. | 49 |

| Anti-Takeover Provisions. | 49 |

| | |

| WHERE YOU CAN FIND MORE INFORMATION | 50 |

| | |

| LEGAL MATTERS | 51 |

| | |

| EXPERTS | 51 |

| | |

| LIST OF ANNEXES | |

| | |

ANNEX A Opinion of Financial Advisor | A-1 |

ANNEX B Financial Information Regarding BOE | B-1 |

QUESTIONS AND ANSWERS ABOUT THE EXCHANGE OFFER

Q: | Who is offering to exchange my BOE shares? |

A: | Capitol Bancorp Limited is a Michigan-incorporated bank holding company (hereinafter referred to as "Capitol"). Capitol is a bank development company with approximately $3.7 billion in total assets, with 48 individual bank charters operating in 13 states, including BOE. Capitol identifies opportunities for the development of new community banks, raises capital and mentors a community bank through its formative stages and manages its investments in community banks. Each community bank has full local decision-making authority and is managed by an on-site president under the direction of a local board of directors composed of business leaders from the bank's community. Capitol Bancorp Limited was founded in 1988 and has executive offices in Lansing, Michigan and Phoenix, Arizona. |

Q: | What is being proposed? |

A: | Capitol is proposing to acquire up to all of the issued and outstanding shares of BOE by offering to exchange all outstanding shares of BOE common stock not already owned by Capitol for shares of Capitol common stock. |

| Q: | What would I receive in the exchange offer for my BOE shares? |

A: | Under the terms of the exchange offer, you would receive shares of Capitol common stock in exchange for your shares of BOE common stock. For more detail on the consideration, see "The Exchange Offer-Consideration to be Paid" beginning on page 34. |

Q: | How long will it take to complete the exchange? |

A: | Capitol expects to complete the exchange offer in the fourth quarter of 2006, or as soon thereafter as possible. |

| Q: | Are there conditions to Capitol's acceptance of BOE shares in the exchange offer? |

A. | Yes. Capitol's offer is subject to several material conditions, and those conditions must be satisfied or waived for Capitol to complete the exchange offer. See "The Exchange Offer-Conditions to the Exchange Offer" beginning on page 40. |

| Q: | Will I have to pay any fees or commissions? |

A: | Generally, no. If you are the record owner of your shares of BOE common stock and you tender your shares of BOE common stock directly to Capitol, you will not have to pay brokerage fees or incur similar expenses. However, if you own your shares through a broker or other nominee, and your broker tenders the shares on your behalf, your broker may charge you a fee for doing so. You should consult with your broker or nominee to determine whether any charges will apply to you. |

| Q: | When does the exchange offer expire? |

A: | The exchange offer will expire on November 30, 2006, at 11:59pm, Michigan Time, unless extended by Capitol. See "The Exchange Offer-Timing of the Exchange Offer" beginning on page 35. |

| Q: | Can the exchange offer be extended? |

A: | Yes. Capitol may, without the consent of BOE, extend the period of time during which the offer remains open. You will have withdrawal rights during any extension period. See "The Exchange Offer-Extension, Termination and Amendment" beginning on page 35. |

Q: | Will I be notified if the offer is extended? |

A: | Yes. If Capitol decides or is required to extend the exchange offer, Capitol will make a public |

announcement of the results of the exchange offer, and announce the new expiration date, no later than 9:00 a.m., Michigan Time, on the next business day after the day on which the offer was previously scheduled to expire. See "The Exchange Offer-Extension, Termination and Amendment" beginning on page 35.

Q: | How do I participate in the exchange offer? |

A: | To tender your shares, you should do the following: |

| · | If you hold BOE shares in your own name, complete and sign the letter of transmittal and return it with your BOE share certificates to Capitol at the corporate office Attention: Cristin Reid English, Capitol Bancorp Center, 200 Washington Square North, Fourth Floor, Lansing, Michigan 48933 before the expiration date of the exchange offer. |

| · | If you hold your BOE shares in "street name" through a broker, instruct your broker to tender your shares before the expiration date. |

| · | If your BOE share certificates are not immediately available or if you cannot deliver your BOE share certificates and other documents to Capitol prior to the expiration of the exchange offer, you may still tender your BOE shares if you comply with the guaranteed delivery procedures described under "The Exchange Offer-Procedure for Tendering" beginning on page 37. |

| Q: | How and when can I withdraw my previously tendered shares? |

A: | To withdraw your previously tendered BOE shares, you must deliver a written or facsimile notice of withdrawal with the required information to Capitol while you still have the right to withdraw. If you tendered shares by giving instructions to a broker or bank, you must instruct the broker or bank to arrange for the withdrawal of your shares. You may withdraw previously tendered BOE shares any time prior to the expiration of the exchange offer. Once Capitol has accepted shares for exchange pursuant to the offer, all tenders become irrevocable. See "The Exchange Offer-Withdrawal Rights" on page 36. |

Q: | Is Capitol's financial condition relevant to my decision to tender shares in the offer? |

A: | Yes. Shares of BOE common stock accepted in the offer will be exchanged for shares of Capitol common stock, so you should consider Capitol's financial condition before you decide to become one of Capitol's shareholders through the exchange offer. In considering Capitol's financial condition, you should review the information contained in this prospectus and the documents incorporated by reference in this prospectus because they contain detailed business, financial and other information about Capitol. |

Q: | Where can I find more information about Capitol? |

A: | This document incorporates important business and financial information about Capitol from documents filed with the SEC that have not been delivered or included with this document. This information is available to you without charge upon written or oral request. You can obtain the documents incorporated by reference in this prospectus through the Securities and Exchange Commission website at www.sec.gov or by requesting them in writing or by telephone from Capitol at the following address: |

Capitol Bancorp Limited

Capitol Bancorp Center

200 Washington Square, Fourth Floor

Lansing, MI 48933

Attention: Lee W. Hendrickson, Chief Financial Officer

Telephone Number: (517) 487-6555

IN ORDER TO RECEIVE TIMELY DELIVERY OF THE DOCUMENTS IN ADVANCE OF THE EXCHANGE OFFER DEADLINE, YOU SHOULD MAKE YOUR REQUEST NO LATER THAN November 22, 2006.

For more information on the matters incorporated by reference in this document, see "Where You Can Find More Information".

WHO CAN ANSWER YOUR QUESTIONS?

If you have additional questions, you should contact:

Bank of Escondido

200 West Grand Avenue

Escondido, CA 92025

(760) 520-0400

Attention: Michael Peters

Or

Capitol Bancorp Limited

Capitol Bancorp Center

200 Washington Square North, Fourth Floor

Lansing, Michigan 48933

(517) 487-6555

Attention: Cristin Reid English

If you would like additional copies of this

prospectus you should contact:

Capitol Bancorp Limited at the above address and phone number.

[The remainder of this page intentionally left blank]

SUMMARY

This summary does not contain all of the information that may be important to you and is qualified in its entirety by reference to the information contained elsewhere in, or incorporated by reference into, this prospectus. You are urged to read the entire prospectus, including the information set forth in the section entitled "Risk Factors" beginning on page 14 and the attached exhibits and annexes. Also, see "Where You Can Find More Information" on page 50.

Capitol Bancorp Limited describes itself as a bank-development enterprise and is a bank holding company with its Eastern Region headquarters located at the Capitol Bancorp Center, 200 Washington Square North, Fourth Floor, Lansing, Michigan 48933. Capitol's telephone number is (517) 487-6555. Capitol has its Western Region headquarters located at 2777 East Camelback Road, Suite 375, Phoenix, Arizona 85016. Capitol's telephone number at its Western Region headquarters is (602) 955-6100.

Capitol is a uniquely structured affiliation of community banks. It currently has nearly 50 wholly or majority-owned bank subsidiaries. Each of Capitol's banks are viewed by management as being a separate business from the perspective of monitoring performance and allocation of financial resources. Capitol uses a unique strategy of bank ownership and development.

Capitol's operating strategy is to provide transactional, processing and administrative support and mentoring to aid in the effective growth and development of its banks. It provides access to support services and management with significant experience in community banking. These administrative and operational support services do not require a direct interface with the bank customer and therefore can be consolidated more efficiently without affecting the bank customer relationship. Subsidiary banks have full decision-making authority in structuring and approving loans and in the delivery and pricing of other banking services.

BOE is now and has been, since it commenced business, an affiliate and a controlled subsidiary of Capitol. BOE was organized as a California bank in October of 2003. Capitol owns 50.74% of the outstanding shares of BOE. BOE's executive management and Board of Directors hold 10.80% of the outstanding shares of BOE common stock (excluding outstanding BOE stock options). Capitol's executive management and Board of Directors that are not executive management and directors of BOE hold 26.13% of the outstanding shares of BOE's common stock (excluding outstanding BOE stock options).

Reasons for the Exchange Offer (Page 33).

Capitol is offering to exchange shares of BOE with shares of its common stock because it has been Capitol's practice to provide a liquidity opportunity to the minority shareholders of its affiliate banks after approximately three years of operation. This was disclosed to the minority shareholders in the offering circular at the time they made their original investment in BOE.

It is believed that the exchange will provide BOE's shareholders with greater liquidity and flexibility because Capitol's common stock is publicly traded. The exchange will also provide BOE's shareholders with greater diversification, since Capitol is active in more than one geographic area and across a broader customer base.

The Exchange Offer (Page 34)

General

Under the terms of the exchange offer, Capitol is offering to exchange previously unissued Capitol common stock for each issued and outstanding share of BOE common stock not already owned by Capitol.

Consideration to be received

If you elect to tender your shares of BOE common stock pursuant to the exchange offer, Capitol will determine the per share consideration you are entitled to receive according to an exchange ratio. The exchange ratio will be calculated by dividing 150% of the pro forma fully-diluted adjusted book value per share of BOE common stock as of October 31, 2006 ($15.604322), by the average closing prices of Capitol's common stock for the 30 trading day

period ending one trading day prior to the close of the exchange offer. At June 30, 2006, the book value per share of BOE was approximately $10.189897.

The Capitol share value will be based upon the average closing price of Capitol common stock over a 30 trading day period ending one trading day prior to the close of the exchange offer. However, Capitol's stock price may fluctuate and the consideration you receive may fluctuate and may not equal the estimated per share consideration herein if Capitol's stock price does not equal the average closing price for the month ended September 30, 2006. The closing price of Capitol's common stock on October 9, 2006, the day before Capitol publicly announced the exchange offer, was $45.35. Based upon the average of the closing prices of the Capitol common stock for the month ended September 30, 2006 ($44.63), the last practicable date before printing of this prospectus, a holder of BOE common stock electing to receive shares of Capitol common stock in the exchange offer would receive approximately .349638 shares of Capitol common stock for each share of BOE common stock, using the BOE share value as described above.

The total number of shares of Capitol common stock that Capitol will issue and deliver to BOE shareholders in exchange for their shares (estimated to be 171,357 shares issued based on the average of the closing prices of Capitol common stock for the month ended September 30, 2006 and BOE share value as described above, excluding potential exercise of BOE's outstanding stock options) will not exceed the product of the exchange ratio and the number of BOE shares accepted at the close of the exchange offer.

You will not receive any fractional shares of Capitol common stock in the exchange offer. Instead, you will receive a check in an amount equal to the value of the fractional share of Capitol common stock that you would otherwise have been entitled to receive, along with your Capitol stock certificate.

For more detail on the consideration you receive, see "The Exchange Offer-Consideration to be Paid" beginning on page 34.

Accounting Treatment (page 43).

Capitol's acquisition of the additional shares of BOE resulting from the exchange offer will be accounted for under the purchase method of accounting. After the exchange, assuming all of the BOE shares not already owned by Capitol are acquired by Capitol pursuant to the exchange offer, all of BOE's results from operations will be included in Capitol's income statement, as opposed to only a portion, which is currently reported.

Tax Consequences of the Exchange Offer to BOE Shareholders (page 38).

Any cash you receive as consideration in the exchange offer will cause taxable gain recognition, which means that you will have to pay taxes as a result. The cash portion of the consideration the BOE shareholders receive for their BOE common stock, from receipt of cash in lieu of fractional shares, will cause taxable gain recognition. BOE shareholders who receive cash will be taxed on the amount of the lesser of the cash received or the gain realized on the exchange. Depending upon your particular circumstances, the receipt of cash may be treated either as received in a sale or exchange of stock or as received in a corporate distribution.

Capitol has structured the exchange offer to qualify as a reorganization within the meaning of Section 368(a) of the Internal Revenue Code of 1986, as amended, or the Code. Capitol will consult, from time to time, with Miller, Canfield, Paddock and Stone, p.l.c., counsel to Capitol, regarding whether the exchange will qualify as a reorganization. Miller, Canfield, Paddock and Stone, p.l.c. has issued an opinion to Capitol that the exchange offer will qualify as a reorganization. That opinion has been filed with the SEC as an exhibit to Capitol's registration statement on Form S-4 in connection with the exchange offer. Miller, Canfield, Paddock and Stone, p.l.c.'s opinion is subject to certain assumptions which may limit its application in particular instances. In the event that unanticipated intervening events occur whereby Miller, Canfield, Paddock and Stone, p.l.c., determines that the exchange offer will not qualify as a reorganization (including Capitol's waiver of the minimum tender condition), Capitol may nevertheless proceed with the exchange offer. In that event, the exchange offer may be fully taxable at the BOE shareholder level and each BOE shareholder will recognize gain or loss measured by the difference between (1) the cash plus the fair market value of the Capitol common stock received in the exchange offer, and (2) the exchanging BOE shareholder's tax basis for the shares of common stock surrendered in the exchange offer.

Tax matters are very complicated, and the tax consequences of the exchange offer to each BOE shareholder will depend on the facts of that shareholder's situation. You are urged to consult your tax advisor for a full understanding of the tax consequences of the exchange to you.

See "The Exchange Offer-Material U.S. Federal Income Tax Consequences of the Exchange Offer" beginning on page 38.

There are No Dissenters' Rights in Connection with the Exchange Offer (Page 40).

No dissenters' rights are available in connection with the exchange offer.

Capitol's Obligation to Complete the Exchange Offer is Subject to a Number of Conditions (Page 40).

Capitol's obligation to exchange shares of common stock for BOE common stock pursuant to the exchange offer is subject to the following material conditions, any of which Capitol may waive:

| · | The tender of enough shares of BOE common stock so that, after the completion of the exchange offer, Capitol owns a number of shares of BOE common stock which, together with any shares of BOE common stock that Capitol beneficially owns for Capitol's account, constitutes at least 80% of the total outstanding shares of BOE common stock on a fully diluted basis, as though all options or other securities convertible into or exercisable or exchangeable for shares of BOE common stock had been converted, exercised or exchanged; and |

| · | BOE not having entered into or effectuated any other agreement or transaction with any person or entity having the effect of impairing Capitol's ability to acquire BOE common stock or otherwise diminishing the value of the acquisition of BOE common stock. |

Capitol's obligation to exchange shares of Capitol common stock for BOE common stock pursuant to the exchange offer is also subject to the following material conditions, none of which Capitol may waive:

| · | The receipt of all applicable regulatory approvals required to consummate the exchange offer, including the expiration or termination of any applicable waiting periods; |

| · | No temporary restraining order, preliminary or permanent injunction or other order or decree issued by any court or agency of competent jurisdiction or other legal restraint or prohibition preventing the completion of the exchange offer shall be in effect and no statute, rule, regulation, order, injunction or decree shall have been enacted, entered, promulgated or enforced by any court, administrative agency or commission or other governmental authority or instrumentality which prohibits, restricts or makes illegal the completion of the exchange offer; and |

| · | The effectiveness of Capitol's registration statement filed with the SEC, relating to the securities to be issued in the exchange offer. |

These material conditions and the other conditions to the exchange offer are discussed under "The Exchange Offer-Conditions to the Exchange Offer" on page 40.

As a bank holding company, Capitol is subject to regulation by the Federal Reserve Board. Federal Reserve Board rules require Capitol to obtain the Federal Reserve Board's permission to acquire control of a subsidiary bank. The rules of the Federal Reserve Board do not differentiate between control of and ownership of 100% of the stock of the subsidiary bank. Capitol and its affiliates received permission to acquire control of BOE prior to BOE commencing business. Accordingly, Capitol will not be required to seek any further approval from the Federal Reserve Board for the exchange. Capitol is not aware of any other requirement for the filing of information with, or the obtaining of the approval of, governmental authorities in the United States or in any non-U.S. jurisdiction that is applicable to the exchange offer.

Capitol's operating strategy is to provide transactional, processing and administrative support and mentoring to aid in the effective growth and development of its banks. It provides access to support services and management with significant experience in community banking. These administrative and operational support services do not require a direct interface with the bank customer and therefore can be consolidated more efficiently without affecting the bank customer relationship. Capitol's banks have full decision-making authority in structuring and approving loans and in the delivery and pricing of other banking services to customers.

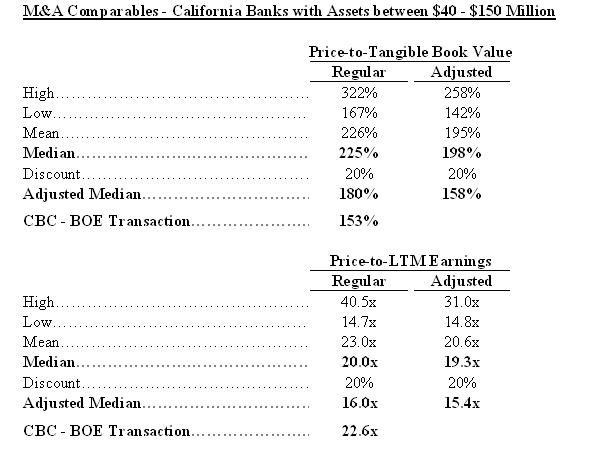

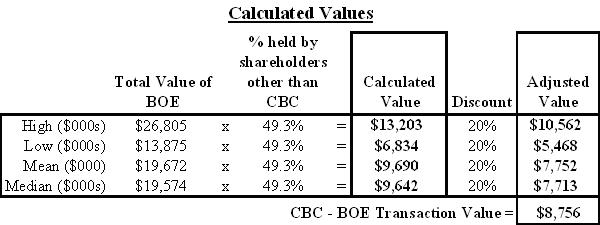

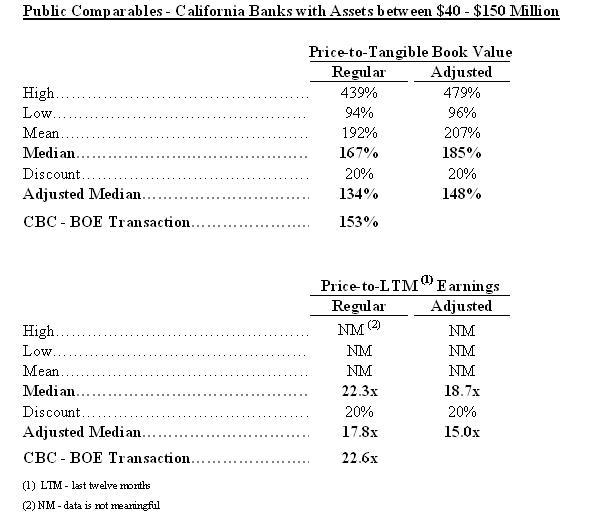

Opinion of Financial Advisor (page 43).

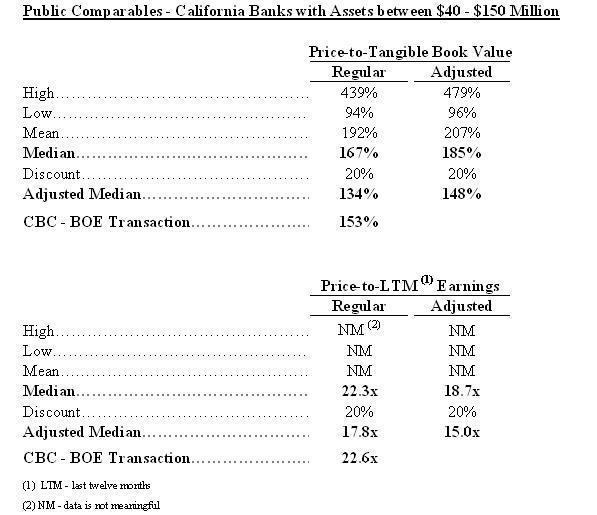

BOE retained Howe Barnes as its financial advisor and agent in connection with the exchange offer to render a financial fairness opinion as to the fairness of the proposed transaction to BOE's shareholders. The opinion states that as of its date and subject to the considerations described in it the consideration to be paid in the exchange by holders of BOE common stock is fair from a financial point of view. The opinion is attached as Annex A to this prospectus.

Dividend Policy of Capitol (Page 7).

Capitol typically pays quarterly cash dividends to its common shareholders (although there is no assurance such dividends will continue in the future). Capitol has been paying quarterly cash dividends of $0.25 per share most recently ($0.20 per share in 1st quarter 2006, $0.19 per share in 4th quarter 2005, $0.18 per share in 2nd and 3rd quarter 2005, $0.17 per share in 1st quarter 2005 and 4th quarter 2004). Future payment of cash dividends by Capitol, if any, is dependent upon many variables and is subject to approval by Capitol's Board of Directors.

Dividend Policy of BOE (Page 7).

BOE has never paid a cash dividend.

The Exchange Offer is Currently Scheduled to Expire on November 30, 2006 (Page 35).

The expiration date of the exchange offer is scheduled for 11:59 p.m., Michigan Time, on November 30, 2006, unless Capitol extends the period of time for which the exchange offer is open.

The Exchange Offer May be Extended, Terminated or Amended (Page 35).

Capitol expressly reserves the right, in its sole discretion, at any time or from time to time, to extend the period of time during which the exchange offer remains open, and Capitol can do so by announcing the new expiration date. Capitol is not providing any assurance that Capitol will exercise this right to extend the exchange offer, although Capitol currently intends to do so until all conditions have been satisfied or, to the extent permissible, waived. During any extension, all shares of BOE common stock previously tendered and not properly withdrawn will remain subject to the exchange offer, subject to the right of each shareholder of BOE to withdraw his or her shares of BOE common stock.

Subject to the SEC's applicable rules and regulations, Capitol also reserves the right, in its sole discretion, at any time or from time to time:

| · | to delay Capitol's acceptance for exchange or the exchange of any shares of BOE common stock, or to terminate the exchange offer, upon the failure of any of the conditions of the exchange offer to be satisfied prior to the expiration date; |

| · | to waive any condition, other than the conditions relating to the receipt of regulatory approvals, the absence of an order or decree of any court or agency of competent jurisdiction preventing the completion of the exchange offer, and the effectiveness of the registration statement for the Capitol shares to be issued in the exchange offer; or |

| · | to amend the exchange offer in any respect, by giving oral or written notice of such delay, termination or amendment by making a public announcement. |

Capitol will follow any extension, termination, amendment or delay, as promptly as practicable, with a public announcement. In the case of an extension, any related announcement will be issued no later than 9:00 A.M.,

Michigan Time, on the next business day after the previously scheduled expiration date. Subject to applicable law, including the Securities Exchange Act of 1934, as amended, which may require that any material change in the information published, sent or given to BOE's shareholders in connection with the exchange offer be promptly sent to those shareholders in a manner reasonably designed to inform them of that change, and without limiting the manner in which Capitol may choose to make any public announcement, Capitol assumes no obligation to publish, advertise or otherwise communicate any public announcement of this type other than by making a release to the PR Newswire or some other similar national news service.

The Exchange Shall Occur Promptly After the Expiration Date (Page 36).

Upon the terms and subject to the conditions of the exchange offer, including, if the exchange offer is extended or amended, the terms and conditions of any extension or amendment, Capitol will accept for exchange, and will exchange, shares of BOE common stock validly tendered and not properly withdrawn promptly after the expiration date.

Tendered Shares May be Withdrawn at Any Time Prior to the Exchange of Those Shares (Page 36).

Shares of BOE common stock tendered pursuant to the exchange offer may be withdrawn at any time prior to the expiration date, unless Capitol previously accepted them pursuant to the exchange offer.

Shareholders Must Comply With the Procedure for Tendering Shares (Page 37).

For you to validly tender shares of BOE common stock pursuant to the exchange offer:

| · | Capitol must receive at one of its addresses set forth on the back cover of this prospectus (1) a properly completed and duly executed letter of transmittal, along with any required signature guarantees, and any other required documents, and (2) certificates for tendered shares of BOE common stock before the expiration date, or |

| · | you must comply with the guaranteed delivery procedures set forth in "The Exchange Offer-Guaranteed Delivery" on page 37. |

Your Rights as a Shareholder Will Change (page 46)

Your rights as a BOE shareholder are determined by California's banking law and by BOE's articles of incorporation and bylaws. If you tender your shares of BOE common stock, your rights as a Capitol shareholder will be determined by Michigan law relating to business corporations (not the banking law) and by Capitol's articles of incorporation and bylaws. See "Comparison of Shareholders Rights".

Forward-Looking Statements May Prove Inaccurate (Page 22).

Capitol has made forward looking statements in this document, and in certain documents referred to in this prospectus, that are subject to risks and uncertainty. Such statements include, but are not limited to: statements with respect to Capitol's plans, objectives, expectations and intentions and other statements that are not historical facts; and other statements identified by words such as "believes", "expects", "anticipates", "estimates", "intends", "plans", "targets", "projects" and other similar expressions. These statements are based upon Capitol's current beliefs and expectations and are subject to significant risks and uncertainties. Actual results may differ from those set forth in the forward-looking statements.

The following factors, among others, could cause actual results to differ materially from the anticipated results or other expectations expressed in the forward-looking statements:

| · | the results of management's efforts to implement Capitol's business strategy including planned expansion into new markets; |

| · | adverse changes in the banks' loan portfolios and the resulting credit risk-related losses and expenses; |

| · | adverse changes in the economy of the banks' market areas that could increase credit-related losses and expenses; |

| · | adverse changes in real estate market conditions that could also negatively affect credit risk; |

| · | the possibility of increased competition for financial services in Capitol's markets; |

| · | fluctuations in interest rates and market prices, which could negatively affect net interest margins, asset valuations and expense expectations; and |

| · | other factors described in "Risk Factors". |

Additional factors that could cause Capitol's results to differ materially from those described in the forward-looking statements can be found in Capitol's reports (such as Annual Reports on Form 10-K, Quarterly Reports on Form l0-Q and Current Reports on Form 8-K) filed with the SEC and available on the SEC's Internet site at http://www.sec.gov. Capitol does not undertake any obligation to update any forward-looking statement to reflect circumstances or events that occur after the date the forward-looking statement is made.

Notwithstanding any statement in this prospectus, Capitol acknowledges that the safe harbor for forward-looking statements under Section 27A of the Securities Act and Section 21E of the Exchange Act and added by the Private Securities Litigation Reform Act of 1995, does not apply to forward -looking statements made in connection with the exchange offer.

[The remainder of this page intentionally left blank]

SELECTED CONSOLIDATED FINANCIAL DATA OF CAPITOL BANCORP LIMITED

The consolidated financial data below summarizes historical consolidated financial information for the periods indicated and should be read in conjunction with the financial statements and other information included in Capitol's Annual Report on Form 10-K for the year ended December 31, 2005, which is incorporated herein by reference. The consolidated financial data below for the interim periods indicated has been derived from, and should be read in conjunction with, Capitol's Quarterly Report on Form 10-Q for the period ended June 30, 2006. See "Where You Can Find More Information". The interim results include all adjustments of a normal recurring nature that are, in the opinion of management, considered necessary for a fair presentation. Interim results for the six months ended June 30, 2006 are not necessarily indicative of results which may be expected in future periods, including the year ending December 31, 2006. Because of the number of banks added throughout the period of Capitol's existence, and because of the differing ownership percentage of banks included in the consolidated amounts, historical operating results are of limited relevance in comparing financial performance and predicting Capitol's future operating results.

Capitol's consolidated balance sheets as of December 31, 2005 and 2004, and the related consolidated statements of income, changes in stockholders' equity and cash flows for the years ended December 31, 2005, 2004 and 2003 are incorporated herein by reference. The selected financial data provided below as of June 30, 2006 and for the six months ended June 30, 2006 and 2005 have been derived from Capitol's consolidated financial statements which are incorporated herein by reference. Selected balance sheet data as of June 30, 2005 and December 31, 2003, 2002 and 2001 and results of operations data for the years ended December 31, 2002 and 2001 were derived from consolidated financial statements which are not incorporated in this prospectus.

Under current accounting rules, generally, entities for which a controlling financial interest (usually a majority voting interest) is owned by another are consolidated or combined for financial reporting purposes. This means that all of the assets and liabilities of subsidiaries (including BOE) are included in Capitol's condensed consolidated balance sheet. Capitol's consolidated net income, however, only includes its subsidiaries' (including BOE) net income or net loss to the extent of its ownership percentage. This means that when a newly formed bank or bank-development subsidiary incurs early start-up losses, Capitol will only reflect that loss based on its ownership percentage. Conversely, when banks generate income, Capitol will only reflect that income based on its ownership percentage.

Capitol Bancorp Limited |

| |

| | | | As of and for the Six Months Ended June 30 | As of and for the Years Ended December 31 |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | 2006 | | | 2005 | | | 2005 | | | 2004 | | | 2003 | | | 2002 | | | 2001 | |

(dollars in thousands, except per share data) |

| Selected Results of Operations Data: | | | | | | | | | | | | | | | | | | | | | | |

| Interest income | | $ | 131,293 | | $ | 104,412 | | $ | 224,439 | | $ | 179,809 | | $ | 164,416 | | $ | 156,454 | | $ | 153,797 | |

| Interest expense | | | 46,303 | | | 30,017 | | | 67,579 | | | 47,496 | | | 49,490 | | | 55,860 | | | 73,292 | |

| Net interest income | | | 84,990 | | | 74,395 | | | 156,860 | | | 131,593 | | | 114,926 | | | 100,594 | | | 80,505 | |

| Provision for loan losses | | | 5,271 | | | 5,062 | | | 10,960 | | | 12,708 | | | 9,861 | | | 12,676 | | | 8,167 | |

| Net interest income after provision | | | | | | | | | | | | | | | | | | | | | | |

| for loan losses | | | 79,719 | | | 69,333 | | | 145,900 | | | 118,885 | | | 105,065 | | | 87,918 | | | 72,338 | |

| Noninterest income | | | 10,566 | | | 10,197 | | | 21,048 | | | 19,252 | | | 20,087 | | | 14,982 | | | 9,585 | |

| Noninterest expense | | | 68,446 | | | 55,169 | | | 117,289 | | | 97,787 | | | 86,952 | | | 76,538 | | | 63,944 | |

| Income before income tax expense and | | | | | | | | | | | | | | | | | | | | | | |

| minority interest | | | 21,839 | | | 24,361 | | | 49,659 | | | 40,350 | | | 38,200 | | | 26,362 | | | 17,979 | |

| Income tax expense | | | 7,945 | | | 9,323 | | | 19,232 | | | 14,699 | | | 14,035 | | | 9,314 | | | 6,016 | |

| Minority interest in net losses (income) | | | | | | | | | | | | | | | | | | | | | | |

| of consolidated subsidiaries | | | 6,326 | | | 1,274 | | | 5,498 | | | 1,065 | | | (785 | ) | | (395 | ) | | (1,245 | ) |

| Net income | | | 20,220 | | | 16,312 | | | 35,925 | | | 26,716 | | | 23,380 | | | 16,653 | | | 10,718 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

Capitol Bancorp Limited |

| | | As of and for the Six Months Ended June 30 | As of and for the Years Ended December 31 |

| | | | 2006 | | | 2005 | | | 2005 | | | 2004 | | | 2003 | | | 2002 | | | 2001 | |

| | | (dollars and shares in thousands, except per share data) | |

Per Share Data: | | | | | | | | | | | | | | | | | | | | | | |

| Net income per common share: | | | | | | | | | | | | | | | | | | | | | | |

| Basic | | $ | 1.29 | | $ | 1.11 | | $ | 2.42 | | $ | 1.88 | | $ | 1.86 | | $ | 1.64 | | $ | 1.38 | |

| Diluted | | | 1.24 | | | 1.06 | | | 2.34 | | | 1.79 | | | 1.77 | | | 1.57 | | | 1.35 | |

| Cash dividends declared | | | 0.45 | | | 0.35 | | | 0.72 | | | 0.65 | | | 0.51 | | | 0.44 | | | 0.40 | |

| Book value | | | 19.95 | | | 17.75 | | | 19.13 | | | 17.00 | | | 15.60 | | | 13.72 | | | 10.24 | |

Pro forma consolidated book value (1) | | | 20.21 | | | N/A | | | 19.41 | | | N/A | | | N/A | | | N/A | | | N/A | |

| Dividend payout ratio | | | 34.88 | % | | 31.53 | % | | 29.75 | % | | 34.57 | % | | 27.42 | % | | 26.83 | % | | 28.99 | % |

| Weighted average number of | | | | | | | | | | | | | | | | | | | | | | |

| common shares outstanding | | | 15,674 | | | 14,694 | | | 14,867 | | | 14,183 | | | 12,602 | | | 10,139 | | | 7,784 | |

| | | | | | | | | | | | | | | | | | | | | | | |

Selected Balance Sheet Data: | | | | | | | | | | | | | | | | | | | | | | |

| Total assets | | $ | 3,722,642 | | $ | 3,341,000 | | $ | 3,475,721 | | $ | 3,091,418 | | $ | 2,737,062 | | $ | 2,409,288 | | $ | 2,044,006 | |

| Investment securities | | | 42,549 | | | 47,550 | | | 43,674 | | | 42,363 | | | 93,207 | | | 34,139 | | | 43,687 | |

| Portfolio loans | | | 3,196,209 | | | 2,843,508 | | | 2,991,189 | | | 2,692,904 | | | 2,247,440 | | | 1,991,372 | | | 1,734,589 | |

| Allowance for loan losses | | | (43,311 | ) | | (38,870 | ) | | (40,559 | ) | | (37,572 | ) | | (31,404 | ) | | (28,953 | ) | | (23,238 | ) |

| Deposits | | | 2,987,606 | | | 2,721,257 | | | 2,785,259 | | | 2,510,072 | | | 2,288,664 | | | 2,062,072 | | | 1,740,385 | |

| Debt obligations: | | | | | | | | | | | | | | | | | | | | | | |

Notes payable and short-term borrowings | | | 177,076 | | | 165,998 | | | 175,729 | | | 172,534 | | | 92,774 | | | 93,398 | | | 89,911 | |

| Subordinated debentures | | | 100,988 | | | 100,893 | | | 100,940 | | | 100,845 | | | 90,816 | | | 51,583 | | | 48,621 | |

| Total debt obligations | | | 278,064 | | | 266,891 | | | 276,669 | | | 273,379 | | | 183,590 | | | 144,981 | | | 138,532 | |

| Minority interests in | | | | | | | | | | | | | | | | | | | | | | |

| consolidated subsidiaries | | | 116,602 | | | 66,588 | | | 83,838 | | | 39,520 | | | 30,946 | | | 28,016 | | | 70,673 | |

| Stockholders' equity | | | 318,308 | | | 266,083 | | | 301,866 | | | 252,159 | | | 218,897 | | | 160,037 | | | 80,172 | |

| | | | | | | | | | | | | | | | | | | | | | | |

Performance Ratios (2) | | | | | | | | | | | | | | | | | | | | | | |

| Return on average equity | | | 13.01 | % | | 12.68 | % | | 13.34 | % | | 11.25 | % | | 12.97 | % | | 13.33 | % | | 15.22 | % |

| Return on average assets | | | 1.13 | % | | 1.02 | % | | 1.08 | % | | 0.91 | % | | 0.91 | % | | 0.75 | % | | 0.58 | % |

| Net interest margin (fully taxable | | | | | | | | | | | | | | | | | | | | | | |

| equivalent) | | | 5.12 | % | | 4.98 | % | | 5.09 | % | | 4.81 | % | | 4.80 | % | | 4.80 | % | | 4.60 | % |

Efficiency ratio (3) | | | 71.63 | % | | 65.22 | % | | 65.93 | % | | 64.83 | % | | 64.40 | % | | 66.22 | % | | 70.98 | % |

| | | | | | | | | | | | | | | | | | | | | | | |

Asset Quality: | | | | | | | | | | | | | | | | | | | | | | |

Nonperforming loans (4) | | $ | 27,743 | | $ | 26,861 | | $ | 26,732 | | $ | 28,471 | | $ | 26,872 | | $ | 22,890 | | $ | 17,238 | |

| Allowance for loan losses to | | | | | | | | | | | | | | | | | | | | | | |

| nonperforming loans | | | 156.12 | % | | 144.71 | % | | 151.72 | % | | 131.97 | % | | 116.87 | % | | 126.49 | % | | 134.81 | % |

| Allowance for loan losses to | | | | | | | | | | | | | | | | | | | | | | |

| portfolio loans | | | 1.36 | % | | 1.37 | % | | 1.36 | % | | 1.40 | % | | 1.40 | % | | 1.45 | % | | 1.34 | % |

| Nonperforming loans to total | | | | | | | | | | | | | | | | | | | | | | |

| portfolio loans | | | 0.87 | % | | 0.94 | % | | 0.89 | % | | 1.06 | % | | 1.20 | % | | 1.15 | % | | 0.99 | % |

| Net loan losses to average | | | | | | | | | | | | | | | | | | | | | | |

| portfolio loans | | | 0.16 | % | | 0.27 | % | | 0.28 | % | | 0.29 | % | | 0.36 | % | | 0.37 | % | | 0.15 | % |

| | | | | | | | | | | | | | | | | | | | | | | |

Capital Ratios: | | | | | | | | | | | | | | | | | | | | | | |

| Average equity to average assets | | | 8.71 | % | | 8.02 | % | | 8.12 | % | | 8.06 | % | | 7.01 | % | | 5.59 | % | | 3.78 | % |

| Tier 1 risk-based capital ratio | | | 14.69 | % | | 13.17 | % | | 14.25 | % | | 12.03 | % | | 12.25 | % | | 10.52 | % | | 10.54 | % |

| Total risk-based capital ratio | | | 15.94 | % | | 14.56 | % | | 15.50 | % | | 13.91 | % | | 14.31 | % | | 11.77 | % | | 11.85 | % |

| Leverage ratio | | | 13.60 | % | | 11.94 | % | | 12.91 | % | | 10.93 | % | | 11.03 | % | | 9.07 | % | | 10.23 | % |

| ____________________ | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| N/A -- Not applicable | | | | | | | | | | | | | | | | | | | | | | |

(1) Based on the estimated exchange ratio of .349638 shares of Capitol for each share of BOE as discussed in this prospectus. The actual exchange ratio will be different. Excludes the pro forma effect of other share exchange transactions or proposals of Capitol (see "Recent Developments"). |

(2) These ratios are annualized for the periods indicated. |

(3) Efficiency ratio is computed by dividing noninterest expense by the sum of net interest income and noninterest income. |

(4) Nonperforming loans consist of loans on nonaccrual status and loans more than 90 days delinquent. |

SELECTED FINANCIAL DATA OF BANK OF ESCONDIDO

The financial data below summarizes historical financial information (in $1,000's, except per share data) for the periods indicated and should be read in conjunction with the audited and unaudited financial statements of BOE attached to this prospectus.

| | | As of and for the Six Months Ended June 30 | | | | As of and for Periods Ended December 31 | |

Selected Results of Operations Data: | | | 2006 | | | | | | 2005 | | | | | | 2005 | | | | | | 2004 | | | | | | 2003 | |

| Interest income | | $ | 2,418 | | | | | $ | 1,642 | | | | | $ | 3,646 | | | | | $ | 1,976 | | | | | $ | 131 | |

| Interest expense | | | 597 | | | | | | 281 | | | | | | 715 | | | | | | 271 | | | | | | 12 | |

| Net interest income | | | 1,821 | | | | | | 1,361 | | | | | | 2,931 | | | | | | 1,705 | | | | | | 119 | |

| Provision (credit) for loan losses | | | (25 | ) | | | | | 60 | | | | | | 110 | | | | | | 230 | | | | | | 120 | |

| Net interest income (deficiency) after provision | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (credit) for loan losses | | | 1,846 | | | | | | 1,301 | | | | | | 2,821 | | | | | | 1,475 | | | | | | (1 | ) |

| Noninterest income | | | 130 | | | | | | 83 | | | | | | 143 | | | | | | 78 | | | | | | 5 | |

| Noninterest expense | | | 1,237 | | | | | | 1,065 | | | | | | 2,271 | | | | | | 1,824 | | | | | | 746 | |

| Income (loss) before income taxes (benefit) | | | 739 | | | | | | 319 | | | | | | 694 | | | | | | (271 | ) | | | | | (742 | ) |

| Income taxes (benefit) | | | 298 | | | | | | 112 | | | | | | 242 | | | | | | (85 | ) | | | | | (251 | ) |

| Net income (loss) | | | 441 | | | | | | 207 | | | | | | 452 | | | | | | (186 | ) | | | | | (491 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Per Share Data: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net income (loss) per common share - basic and diluted | | $ | 0.44 | | | | | $ | 0.21 | | | | | $ | 0.46 | | | | | $ | (0.19 | ) | | | | $ | (0.50 | ) |

| Book value | | | 10.19 | | | | | | 9.47 | | | | | | 9.76 | | | | | | 9.32 | | | | | | 9.50 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Selected Balance Sheet Data: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total assets | | $ | 76,052 | | | | | $ | 9,866 | | | | | $ | 70,807 | | | | | $ | 50,956 | | | | | $ | 26,843 | |

| Investment securities | | | 649 | | | | | | 664 | | | | | | 655 | | | | | | -- | | | | | | -- | |

| Portfolio loans | | | 30,651 | | | | | | 36,274 | | | | | | 38,228 | | | | | | 33,166 | | | | | | 9,273 | |

| Allowance for loan losses | | | (435 | ) | | | | | (410 | ) | | | | | (460 | ) | | | | | (350 | ) | | | | | (120 | ) |

| Deposits | | | 65,739 | | | | | | 50,366 | | | | | | 60,895 | | | | | | 41,680 | | | | | | 17,415 | |

| Stockholders' equity | | | 10,139 | | | | | | 9,423 | | | | | | 9,709 | | | | | | 9,223 | | | | | | 9,409 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Performance Ratios: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Return on average equity | | | 8.96 | % | | | | | 4.48 | % | | | | | 4.78 | % | | | | | N/A | | | | | | N/A | |

| Return on average assets | | | 1.19 | % | | | | | 0.74 | % | | | | | 0.72 | % | | | | | N/A | | | | | | N/A | |

| Net interest margin (fully taxable equivalent) | | | 6.52 | % | | | | | 7.98 | % | | | | | 5.53 | % | | | | | 4.43 | % | | | | | 1.44 | % |

Efficiency ratio (1) | | | 63.41 | % | | | | | 73.76 | % | | | | | 73.88 | % | | | | | 102.28 | % | | | | | 600.96 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Asset Quality: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Non-performing loans | | $ | 21 | | | | | $ | -- | | | | | $ | 23 | | | | | $ | -- | | | | | $ | -- | |

| Allowance for loan losses to | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| non-performing loans | | | N/M | | | | | | -- | | | | | | N/M | | | | | | -- | | | | | | -- | |

| Allowance for loan losses to portfolio loans | | | 1.42 | % | | | | | 1.13 | % | | | | | 1.20 | % | | | | | 1.06 | % | | | | | 1.29 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Capital Ratios: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Average equity to average assets | | | 13.28 | % | | | | | 16.45 | % | | | | | 15.09 | % | | | | | 21.91 | % | | | | | 45.59 | % |

| Tier 1 risk-based capital ratio | | | 24.59 | % | | | | | 22.48 | % | | | | | 22.24 | % | | | | | 23.39 | % | | | | | 68.22 | % |

| Total risk-based capital ratio | | | 25.64 | % | | | | | 23.48 | % | | | | | 23.30 | % | | | | | 24.31 | % | | | | | 69.12 | % |

| Leverage ratio | | | 13.37 | % | | | | | 15.38 | % | | | | | 13.60 | % | | | | | 17.44 | % | | | | | 34.12 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| N/A - Not applicable | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| N/M - Not meaningful |

(1) Efficiency ratio is computed by dividing noninterest expense by the sum of net interest income and noninterest income. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

SELECTED FINANCIAL DATA OF BANK OF ESCONDIDO, continued

| Quarterly Results of Operations |

| | | | Total for the year | | | Fourth Quarter | | | Third Quarter | | | Second Quarter | | | First Quarter | |

| | | | | | | | | | | | | | | | | |

| Six Months ended June 30, 2006: | | | | | | | | | | | | | | | | |

| Interest income | | $ | 2,418 | | | | | | | | $ | 1,260 | | $ | 1,158 | |

| Interest expense | | | 597 | | | | | | | | | 316 | | | 281 | |

| Net interest income | | | 1,821 | | | | | | | | | 944 | | | 877 | |

| Provision (credit) for loan losses | | | (25 | ) | | | | | | | | (40 | ) | | 15 | |

| Net income | | | 441 | | | | | | | | | 242 | | | 199 | |

| Net income per share (basic and diluted) | | | 0.44 | | | | | | | | | 0.20 | | | 0.24 | |

| | | | | | | | | | | | | | | | | |

| Year ended December 31, 2005: | | | | | | | | | | | | | | | | |

| Interest income | | $ | 3,646 | | $ | 1,058 | | $ | 946 | | $ | 859 | | $ | 783 | |

| Interest expense | | | 715 | | | 249 | | | 185 | | | 150 | | | 131 | |

| Net interest income | | | 2,931 | | | 809 | | | 761 | | | 709 | | | 652 | |

| Provision for loan losses | | | 110 | | | 9 | | | 41 | | | 35 | | | 25 | |

| Net income | | | 452 | | | 141 | | | 104 | | | 136 | | | 71 | |

| Net income per share (basic and diluted) | | | 0.46 | | | 0.14 | | | 0.11 | | | 0.14 | | | 0.07 | |

| | | | | | | | | | | | | | | | | |

| Year ended December 31, 2004: | | | | | | | | | | | | | | | | |

| Interest income | | $ | 1,976 | | $ | 693 | | $ | 551 | | $ | 462 | | $ | 270 | |

| Interest expense | | | 271 | | | 101 | | | 74 | | | 57 | | | 39 | |

| Net interest income | | | 1,705 | | | 592 | | | 478 | | | 405 | | | 231 | |

| Provision for loan losses | | | 230 | | | 35 | | | 70 | | | 60 | | | 65 | |

| Net income (loss) | | | (186 | ) | | 58 | | | (14 | ) | | (58 | ) | | (172 | ) |

| Net income (loss) per share (basic and diluted) | | | (0.19 | ) | | 0.06 | | | (0.02 | ) | | (0.06 | ) | | (0.17 | ) |

| | | | | | | | | | | | | | |

| Period ended December 31, 2003: | | | | | | | | | | | | | |

| Interest income | | $ | 131 | | $ | 131 | | | | | | | | |

| Interest expense | | | 12 | | | 12 | | | | | | | | |

| Net interest income | | | 119 | | | 119 | | | | | | | | |

| Provision for loan losses | | | 120 | | | 120 | | | | | | | | |

| Net loss | | | (491 | ) | | (491 | ) | | | | | | | |

| Net loss per share (basic and diluted) | | | (0.50 | ) | | (0.50 | ) | | | | | | | |

[The remainder of this page left intentionally blank]

RISK FACTORS

In deciding whether to tender your shares of BOE common stock for exchange pursuant to the exchange offer, you should read carefully this prospectus and all other documents attached to or incorporated by reference into this prospectus. You should, in particular, read and consider the following risk factors, as well as the other risks associated with each of the businesses of BOE and Capitol, because these risks also will affect the combined businesses should the exchange offer be completed. These other risks associated with the businesses of BOE and Capitol can be found in Capitol's Annual Report on Form 10-K for the year ended December 31, 2005, and Capitol's documents filed subsequent thereto with the SEC and incorporated by reference into this prospectus.

The shares of common stock that are being offered are not savings accounts or deposits or other obligations of a bank and are not insured by the Federal Deposit Insurance Corporation or any other governmental agency.

Investing in Capitol's common stock will provide you with an equity ownership interest in Capitol. As a Capitol shareholder, your investment may be impacted by risks inherent in its business. You should carefully consider the following factors, as well as other information contained in this prospectus, before deciding to vote to exchange your BOE common stock for Capitol's common stock.

This prospectus also contains certain forward-looking statements that involve risks and uncertainties. These statements relate to Capitol's future plans, objectives, expectations and intentions. These statements may be identified by the use of words such as "believes," "expects," "may," "will," "should," "seeks," "pro forma," "anticipates," and similar expressions. Actual results could differ materially from those discussed in these statements. Factors that could contribute to these differences include those discussed below and elsewhere in this prospectus.

Inherent Conflicts of Interest in the Exchange Offer.

BOE is already a majority-owned subsidiary of Capitol. By virtue of the existing relationship between BOE and Capitol, the proposed exchange offer presents inherent conflicts of interest. For example, no other proposals are being considered and, if there were any, Capitol would likely vote its BOE shares against any other proposals. Capitol's proposal to value BOE shares at 150% of pro forma fully-diluted adjusted book value per share of BOE as of October 31, 2006 ($15.604322) in the exchange offer is based solely on its judgment in making such proposal. Accordingly, the BOE share value and related exchange ratio have not been determined absent the inherent conflicts of interest between Capitol and BOE. It is unknown what exchange ratio or BOE share value, if any, that might be negotiated between BOE and unaffiliated entities. BOE has obtained a fairness opinion by Howe Barnes Hoefer & Arnett, Inc. with respect to the tender offer.

Newly Formed Banks Are Likely to Incur Significant Operating Losses That Could Negatively Affect the Availability of Earnings to Support Future Growth.

Many of Capitol's bank subsidiaries are less than three years old and Capitol's oldest bank is twenty-three years old. Capitol engaged in significant new bank development activity in 2006. Newly formed banks are expected to incur operating losses in their early periods of operation because of an inability to generate sufficient net interest income to cover operating costs. Newly formed banks may never become profitable. Current accounting rules require immediate write-off, rather than capitalization, of start-up costs and, as a result, future newly formed banks are expected to report larger early period operating losses. Those operating losses can be significant and can occur for longer periods than planned depending upon the ability to control operating expenses and generate net interest income, which could affect the availability of earnings retained to support future growth.

If Capitol is Unable to Manage its Growth, its Ability to Provide Quality Services to Customers Could Be Impaired and Cause its Customer and Employee Relations to Suffer.

Capitol has rapidly and significantly expanded its operations, engaged in significant new bank development activity in 2006 and anticipates that further expansion will be required to realize its growth strategy. Capitol's rapid growth has placed significant demands on its management and other resources which, given its expected future growth rate, are likely to continue. To manage future growth, Capitol will need to attract, hire and retain highly skilled and motivated officers and employees and improve existing systems and/or implement new systems for:

| · | transaction processing; |

| · | operational and financial management; and |

| · | training, integrating and managing Capitol's growing employee base. |

Favorable Environment for Formation of New Banks Could Change Adversely, Which Could Severely Limit Capitol's Expansion Opportunities.

Capitol's growth strategy includes the addition of new banks. Thus far, Capitol has experienced favorable business conditions for the formation of its small, community and customer-focused banks. Those favorable conditions could change suddenly or over an extended period of time. A change in the availability of financial capital, human resources or general economic conditions could eliminate or severely limit expansion opportunities. To the extent Capitol is unable to effectively attract personnel and deploy its capital in new or existing banks; this could adversely affect future asset growth, earnings and the value of Capitol's common stock.

Capitol's Banks' Small Size May Make it Difficult to Compete With Larger Institutions Because Capitol is Not Able to Compete With Large Banks in the Offering of Significantly Larger Loans.

Capitol endeavors to capitalize its newly formed banks with a moderate dollar amount permitted by regulatory agencies. As a result, the legal lending limits of Capitol's banks severely constrain the size of loans that those banks can make. In addition, many of the banks' competitors have significantly larger capitalization and, hence, an ability to make significantly larger loans. The inability to offer larger loans limits the revenues that can be earned from interest amounts charged on larger loan balances.

Capitol's banks are intended to be small in size. Many operate from single locations. They are small relative to the dynamic markets in which they operate. Each of those markets has a variety of large and small competitors that have resources far beyond those of Capitol's banks. While it is the intention of Capitol's banks to operate as niche players within their geographic markets, their continued existence is dependent upon being able to attract and retain loan customers in those large markets that are dominated by substantially larger regulated and unregulated financial institutions.

If Capitol Cannot Recruit Additional Highly Qualified Personnel, Capitol's Banks' Customer Service Could Suffer, Causing its Customer Base to Decline.

Capitol's strategy is also dependent upon its continuing ability to attract and retain other highly qualified personnel. Competition for such employees among financial institutions is intense. Availability of personnel with appropriate community banking experience varies. If Capitol does not succeed in attracting new employees or retaining and motivating current and future employees, Capitol's business could suffer significantly.

Capitol and its Banks Operate in an Environment Highly Regulated by State and Federal Government; Changes in Federal and State Banking Laws and Regulations Could Have a Negative Impact on Capitol's Business.

As a bank holding company, Capitol is regulated primarily by the Federal Reserve Board. Capitol's current bank affiliates are regulated primarily by the state banking regulators and the FDIC and, in the case of one national bank, the Office of the Comptroller of the Currency (OCC).

Federal and the various state laws and regulations govern numerous aspects of the banks' operations, including:

| · | adequate capital and financial condition; |

| · | permissible types and amounts of extensions of credit and investments; |

| · | training, integrating and managing Capitol's growing employee; and |

| · | restrictions on dividend payments. |

Federal and state regulatory agencies have extensive discretion and power to prevent or remedy unsafe or unsound practices or violations of law by banks and bank holding companies. Capitol and its banks also undergo periodic examinations by one or more regulatory agencies. Following such examinations, Capitol may be required, among other things, to change its asset valuations or the amounts of required loan loss allowances or to restrict its operations. Those actions would result from the regulators' judgments based on information available to them at the time of their examination.

The banks' operations are required to follow a wide variety of state and federal consumer protection and similar statutes and regulations. Federal and state regulatory restrictions limit the manner in which Capitol and its banks

may conduct business and obtain financing. Those laws and regulations can and do change significantly from time to time and any such change could adversely affect Capitol.

Regulatory Action Could Severely Limit Future Expansion Plans.

To carry out some of its expansion plans, Capitol is required to obtain permission from the Federal Reserve Board. Applications for the formation of new banks are submitted to the state and federal bank regulatory agencies for their approval.

While Capitol's prior experience with the regulatory application process has been favorable, the future climate for regulatory approval is impossible to predict. Regulatory agencies could prohibit or otherwise significantly restrict the expansion plans of Capitol, its current bank subsidiaries and future new start-up banks.

The Banks' Allowances For Loan Losses May Prove Inadequate to Absorb Actual Loan Losses, Which May Adversely Impact Net Income or Increase Operating Losses.

Capitol believes that its consolidated allowance for loan losses is maintained at a level adequate to absorb inherent losses in the loan portfolios at the balance sheet date. Management's estimates are used to determine the allowance and are based on historical loss experience, specific problem loans, value of underlying collateral and other relevant factors. These estimates are subjective and their accuracy depends on the outcome of future events. Actual future losses may differ from current estimates. Depending on changes in economic, operating and other conditions, including changes in interest rates that are generally beyond Capitol's control, actual loan losses could increase significantly. As a result, such losses could exceed current allowance estimates. No assurance can be provided that the allowance will be sufficient to cover actual future loan losses should such losses be realized.

Loan loss experience, which is helpful in estimating the requirements for the allowance for loan losses at any given balance sheet date, has been minimal at many of Capitol's banks. Because many of Capitol's banks are young, they do not have seasoned loan portfolios, and it is likely that the ratio of the allowance for loan losses to total loans may need to be increased in future periods as the loan portfolios become more mature and loss experience evolves. If it becomes necessary to increase the ratio of the allowance for loan losses to total loans, such increases would be accomplished through higher provisions for loan losses, which may adversely impact net income or increase operating losses.

Widespread media reports of concerns about the health of the domestic economy have continued in 2006. Capitol's loan losses in recent years have varied. Further, levels of nonperforming loans have fluctuated and it is anticipated that levels of nonperforming loans and related loan losses may increase as economic conditions, locally and nationally, evolve.

In addition, bank regulatory agencies, as an integral part of their supervisory functions, periodically review the adequacy of the allowance for loan losses. Regulatory agencies may require Capitol or its banks to increase their provision for loan losses or to recognize further loan charge-offs based upon judgments different from those of management. Any increase in the allowance required by regulatory agencies could have a negative impact on Capitol's operating results.

Capitol's Commercial Loan Concentration to Small Businesses and Collateralized by Commercial Real Estate Increases the Risk of Defaults by Borrowers and Substantial Credit Losses Could Result, Causing Shareholders to Lose Their Investment in Capitol's Common Stock.

Capitol's banks make various types of loans, including commercial, consumer, residential mortgage and construction loans. Capitol's strategy emphasizes lending to small businesses and other commercial enterprises. Capitol typically uses commercial real estate as a source of collateral for many of its loans. Recently, regulatory agencies have expressed concern with banks with large concentration in commercial real estate due to the recent downturn in the real estate market in certain areas of the country possibly leading to increased risk of credit loss and extended periods of sale. Loans to small and medium-sized businesses are generally riskier than single-family mortgage loans. Typically, the success of a small or medium-sized business depends on the management talents and efforts of one or two persons or a small group of persons, and the death, disability or resignation of one or more of these persons could have a material adverse impact on the business. In addition, small and medium-sized businesses frequently have smaller market shares than their competition, may be more vulnerable to economic downturns, often need substantial additional capital to expand or compete and may experience substantial variations in operating results, any of which may impair a borrower's ability to repay a loan. Substantial credit losses could result, causing shareholders to lose their entire investment in Capitol's common stock.

Actions by the Open Market Committee of the Federal Reserve Board (FRBOMC) May Adversely Affect Capitol's Net Interest Income.

Changes in Net Interest Income. Capitol's profitability is significantly dependent on net interest income. Net interest income is the difference between interest income on interest-earning assets, such as loans, and interest expense on interest-bearing liabilities, such as deposits. Therefore, any change in general market interest rates, whether as a result of changes in monetary policies of the Federal Reserve Board or otherwise, can have a significant effect on net interest income. Capitol's assets and liabilities may react differently to changes in overall market rates or conditions because there may be mismatches between the repricing or maturity characteristic of assets and liabilities. As a result, changes in interest rates can affect net interest income in either a positive or negative way.

Recently, the Federal Reserve has increased interest rates several times. Future stability of interest rates and Federal Reserve Open Market Committee policy, which impact such rates, are uncertain.

Changes in The Yield Curve. Changes in the difference between short and long-term interest rates, commonly known as the yield curve, may also harm Capitol's business. For example, short-term deposits may be used to fund longer-term loans. When differences between short-term and long-term interest rates shrink or disappear, the spread between rates paid on deposits and received on loans could narrow significantly, decreasing net interest income.

Existing Subsidiaries of Capitol May Need Additional Funds to Aid in Their Growth or To Meet Other Anticipated Needs Which Could Reduce Capitol's Funds Available For New Bank Development or Other Corporate Purposes.

Future growth of existing banks may require additional capital infusions or other investment by Capitol to maintain compliance with regulatory capital requirements or to meet growth opportunities. Such capital infusions could reduce funds available for development of new banks or other corporate purposes.

Capitol has Debt Securities Outstanding Which May Prohibit Future Cash Dividends on Capitol's Common Stock or Otherwise Adversely Affect Regulatory Capital Compliance.