EXHIBIT 99.1

| Capitol Bancorp Center 200 Washington Square North Lansing, MI 48933 2777 East Camelback Road Suite 375 Phoenix, AZ 85016 www.capitolbancorp.com |

Analyst Contact: Media Contact: | Michael M. Moran Chief of Capital Markets 877-884-5662 Stephanie Swan Director of Shareholder Services 517-372-7402 |

CAPITOL BANCORP REPORTS THIRD QUARTER RESULTS

RECENT 2009 HIGHLIGHTS

| · | Total Assets of $5.4 Billion |

| · | Total Capital Approximating 11% |

| · | Sale of One Affiliate Bank Completed |

| · | Four Additional Divestitures In Process |

| · | Regional Consolidations In Process |

LANSING, Mich. and PHOENIX, Ariz.: October 22, 2009: Capitol reported a net loss for the third quarter of approximately $30.9 million. The net loss per share for the quarter ended September 30, 2009 was $1.78, compared to a net loss of $1.90 per diluted share reported for the third quarter of 2008.

Consolidated assets were static year-over-year at approximately $5.4 billion, but reflect an annualized 6 percent decrease for the nine months ended September 30, 2009 from the approximate $5.7 billion reported at the beginning of the year, as a result of the implementation of the Corporation’s capital preservation and balance sheet deleveraging strategies. Consistent with these efforts, total portfolio loans approximated $4.2 billion at September 30, 2009, a 10 percent decline year-over-year and a more than 11 percent decline from the approximate $4.7 billion level at the beginning of the year. Total deposits increased over 5 percent to $4.5 billion from the approximate $4.3 billion reported at September 30, 2008, reflecting the Corporation’s focus on enhancing its core funding mix in this environment by emphasizing more traditional relationship-oriented deposit-gathering versus non-customer-centric borrowings. Consequently, since year-end 2008, total deposits have been relatively unchanged and reflect a modest 4 percent decline from the previous quarter.

Capitol’s Chairman and CEO Joseph D. Reid said, “Our continuing efforts to deleverage the consolidated balance sheet have been reinforced with the announcement of the divestitures of five affiliate banks, one of which was completed in the third quarter, as well as the consolidation of multiple bank charters in several regions. These pending transactions, coupled with the proposed spin-off of Michigan Commerce Bancorp, will serve to preserve capital resources and

enhance the balance sheet strength of Capitol as we continue to face significant economic and operating challenges.” Added Reid, “In this environment, the analyst and investor communities are focusing on two key performance metrics for the banking sector: the ‘pre-tax, pre-provision’ operating results and the ‘tangible equity’ measure of core balance sheet strength. When appropriately adjusted for noncontrolling interests, Capitol’s ‘pre-tax, pre-provision’ operating results approximated $0.3 million for the third quarter of 2009 ($9.6 million for the nine-month period). And, even with a challenging first nine months of 2009 that has witnessed Capitol’s provision for loan losses totaling $113 million while supporting a $5.4 billion balance sheet, the Corporation’s ‘tangible equity’ level, inclusive of noncontrolling interests in consolidated subsidiaries, was a strong 6.4 percent at September 30, 2009.” Chairman Reid stated further, “We remain resolute in our objectives to build balance sheet strength, enhance corporate-wide liquidity, marshal resources and preserve core capital to support our organization.”

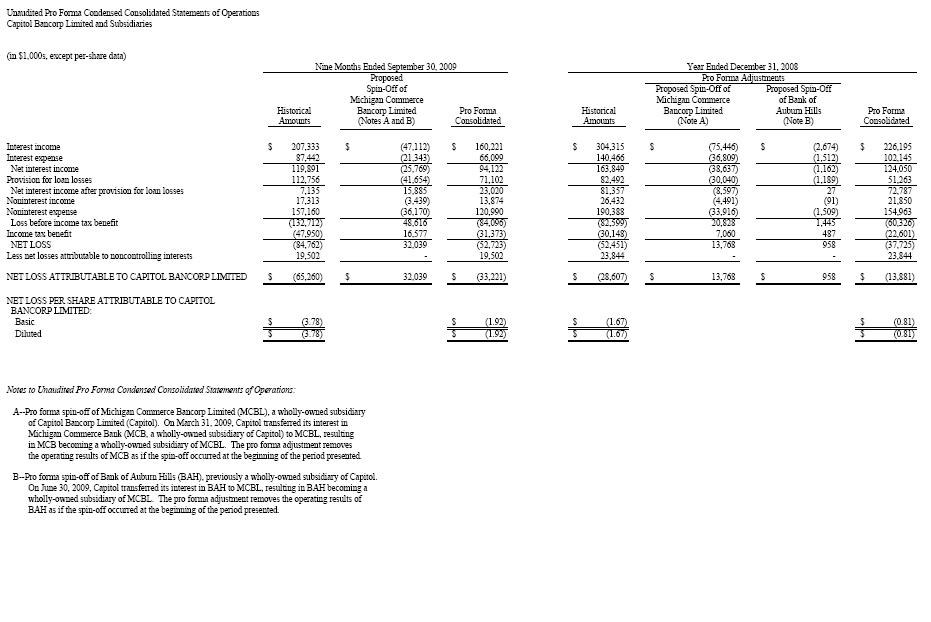

Proposed Spin-Off of Michigan Commerce Bancorp Limited

In July 2009, Capitol announced its intention to separate the operations of Michigan Commerce Bancorp Limited (“MCBL”) as an independent publicly-traded company. Upon completion of the proposed spin-off, Capitol will continue to be a bank holding company on a national basis and MCBL will become a separate publicly-traded bank holding company consisting of the substantial majority of Capitol’s prior Michigan-based banks (see pages 12 through 14 for pro forma financial statements illustrating the proposed spin-off and pending bank sales).

In the proposed spin-off, Capitol’s shareholders will receive shares of MCBL common stock according to a distribution ratio. The distribution ratio and related record date for the proposed distribution will be determined at a later date. The proposed spin-off is subject to a number of contingencies. The proposed transaction will enable the two separate publicly-traded companies to focus on maximizing opportunities for the distinct business markets of each, and will allow both Capitol and MCBL to each develop and implement strategic plans which fit their specific markets and operations, resulting in enhanced shareholder value in both companies.

MCBL’s consolidated total assets approximated $1.3 billion or about 23 percent of Capitol’s total assets as of September 30, 2009. If the proposed spin-off had been completed on September 30, 2009, consolidated assets for Capitol would have totaled approximately $4.1 billion, while reflecting a material decline in nonperforming assets and a modest increase in the consolidated total capital ratio.

Affiliate Bank Divestitures and Regional Bank Consolidations

Capitol previously announced intentions to sell certain affiliate banks and consolidate others in several regions. In the second quarter, Capitol announced that it had entered into definitive agreements to sell the following five institutions: Yuma Community Bank, located in Yuma, Arizona; Bank of Belleville, located in Belleville, Illinois; Bank of Santa Barbara, located in Santa Barbara, California; 1st Commerce Bank, located in North Las Vegas, Nevada; and Community Bank of Rowan, located in Salisbury, North Carolina. In September, the sale of Yuma Community Bank was completed. The four pending divestitures are subject to regulatory approvals along with other customary contingencies and are expected to be completed in the coming months.

At September 30, 2009, the four pending divestitures had total assets of approximately $313 million ($116 million included in consolidated total assets), and, with transaction book value multiples in a range of 1.4x to 1.6x of tangible equity, collectively represent in excess of $40 million of “franchise” value. The pro forma balance sheet implications and related pro forma results of operations regarding these transactions are attached (see pages 12 and 14), serving to highlight the potential capital preservation benefits of these deleveraging transactions.

Additionally, Capitol has announced its plans to consolidate affiliate banks in several regions. During the first quarter of 2009, nine Michigan bank affiliates were consolidated into what is today Michigan Commerce Bank, with an application to merge a tenth Michigan-based affiliate into this entity currently pending regulatory approval. In Arizona, application has been made to merge five affiliate banks in the Phoenix area. In the state of Washington, Capitol intends to consolidate four affiliate banks into one charter, to operate as Bank of the Northwest, and in Nevada, four banks are intended to merge and operate as Bank of Las Vegas. All proposed consolidations are subject to regulatory approval and other contingencies.

Chairman Reid stated, “In an effort to enhance balance sheet strength and preserve core capital, we have implemented plans designed to strategically realign our resources through select divestitures and consolidations. These initiatives will allow us to reallocate capital resources to markets currently struggling due to the turbulent economic environment, as well as to markets that are experiencing opportunities for growth. In addition, these initiatives will serve to better align our risk-management oversight nationwide while driving operating efficiencies within our consolidated network. With continued uncertainty and turmoil on the economic front, and the ongoing effects and implications of the national recession, we remain committed to ensuring that Capitol and its affiliate banks continue to build balance sheet strength and liquidity to weather this difficult and challenging climate.”

Quarterly Performance

In the third quarter of 2009, consolidated net operating revenues were approximately $47.2 million, a slight decrease compared to the approximate $48 million reported for the same period in 2008, reflecting the impact of a static earning asset profile over the past twelve months, combined with elevated levels of nonperforming assets causing pressure on spread revenue sources. Even with continued increases in the amount of nonperforming assets, the Corporation experienced modest improvement in its consolidated net interest margin for the second consecutive quarter. A concerted effort to focus on core deposit funding sources, as referenced earlier, coupled with both empirical and anecdotal evidence of better pricing opportunities on loans in certain markets, has helped offset the effect of increases in nonearning assets and the typical margin pressure commensurate with efforts to build system-wide liquidity. Cash and cash equivalents totaled nearly $900 million, or more than 16 percent of the Corporation’s consolidated total assets at September 30, 2009. The net interest margin increased to 3.13 percent in the third quarter from 3.02 percent for the three months ended June 30, 2009 and 2.81 percent in the first quarter of 2009.

The Corporation continues to emphasize the reduction of operating expenses through salary and staffing reductions, operational efficiencies and tight controls on corporate overhead. Noninterest, or operating, expenses increased 3.1 percent year-over-year to approximately $55.5 million in the quarter ended September 30, 2009. This more modest increase was accomplished despite dramatic increases in both costs associated with foreclosed properties and other real estate owned (which approximated $9.8 million in the recent quarter versus $2.0 million in the

2008 period) and FDIC insurance premiums and other regulatory fees (which jumped from $1.0 million in last year's third quarter to approximately $3.8 million in the most recent three-month period). Combined, these two expense areas increased to approximately $13.6 million in the current quarter, representing a more than fourfold increase from the combined $3.1 million figure posted in 2008.

The net loss for the third quarter of 2009 approximated $30.9 million compared to a net loss of $32.5 million reported for the third quarter of 2008. The net loss per share for the third quarter of 2009 was $1.78 compared to a net loss per share of $1.90 for the three months ended September 30, 2008. The third quarter 2009 provision for loan losses decreased to $48.8 million versus approximately $53.8 million for the corresponding period of 2008, but increased from $35.8 million recorded in the second quarter of 2009. During the third quarter of 2009, net loan charge-offs approximated $32.7 million, resulting in a provision-to-net-charge-offs coverage ratio of 1.5x, reflecting the Corporation’s commitment to continue to build its allowance for loan losses in this challenging environment.

Nine Month Performance

Net operating revenues approximated $137.2 million for the nine months ended September 30, 2009, a 5.5 percent decrease compared to the approximate $145.2 million for the year-ago period, due to a lower earning-asset base and general softness across all major revenue components. Noninterest, or operating, expenses expanded 7 percent year-over-year to approximately $157.2 million, attributable primarily to the dramatic increases in costs associated with foreclosed properties and other real estate owned coupled with FDIC insurance premiums and other regulatory fees. For the nine-month period ended September 30, 2009, costs associated with foreclosed properties and other real estate owned increased to approximately $18 million from the $4.1 million reported in the comparable 2008 period, while FDIC insurance premiums and other regulatory fees increased from $2.9 million in the first nine months of 2008 to nearly $11.3 million in the 2009 period. Combining both expense categories would reflect a $29.3 million figure for the 2009 period, or more than four times greater than the combined $7.0 million total reported in the first nine months of 2008. A significant increase in the provision for loan losses, which approximated $112.8 million for the nine-month 2009 period (reflecting a provision-to-net-charge-offs ratio of 1.5x) versus $71.8 million for the comparable 2008 period, was a primary contributor in Capitol’s loss for the period. The net loss per share for the nine-month period of 2009 was $3.78, compared to a net loss of $1.73 per diluted share reported for the corresponding period in 2008. Bank performance, reserve building and related operating losses of the Corporation’s mature banks in its Great Lakes Region were major reasons for the net loss.

Balance Sheet

With total capital resources approximating $575.1 million at September 30, 2009, the total capital-to-asset ratio was 10.6 percent, providing continued support for the Corporation’s $5.4 billion balance sheet.

Net charge-offs of 2.90 percent of average loans (annualized) for the three months ended September 30, 2009 increased from the 1.83 percent reported for the second quarter, and 1.74 percent reported for the corresponding period of 2008. The ratio of nonperforming loans to total portfolio loans was 6.7 percent at September 30, 2009 compared to 5.8 percent reported at June 30, 2009. Although an increase from the previous quarter, the approximate 9 percent linked-quarter rate of increase during the three months ended September 30, 2009 for nonperforming

assets continued the slowing trend first experienced last quarter, when the quarterly rate of increase measured in excess of 15 percent versus the dramatic 34 percent growth posted in the first quarter of 2009. The continued increase in nonperforming assets is attributable to borrower stress and nonperformance, coupled with a virtually nonexistent market, especially in the state of Michigan, for the sale of real estate, which hinders the disposition of such assets. The allowance coverage ratio of nonperforming loans improved to approximately 45 percent at September 30, 2009, while the allowance for loan losses increased significantly to 3.01 percent of portfolio loans from 2.49 percent at June 30, 2009 and 1.96 percent at the beginning of the year. The Michigan market, dealing with significant secular change versus what had historically been cyclical challenges, continues to be the source of a dominant portion of nonperforming loans, representing approximately 51 percent of consolidated nonperforming loans but only 33 percent of the Corporation’s consolidated loan portfolio. Capitol’s loan portfolio practices continue to reflect a disciplined approach to review, analysis and proper identification of portfolio issues with a long-term view to value preservation.

Subsequent Events

A new accounting standard became effective for interim 2009 financial reporting which requires the consideration of subsequent events occurring after the balance-sheet date for matters which may require adjustment to, or disclosure in, financial statements. The review period for subsequent events is up to and including the filing date of a public company’s interim financial statements in Form 10-Q when filed with the Securities and Exchange Commission. Accordingly, the financial information in this announcement is subject to change.

About Capitol Bancorp Limited

Capitol Bancorp Limited (NYSE: CBC) is a $5.4 billion national community banking company, with a network of separately chartered banks with operations in 17 states. Founded in 1988, Capitol Bancorp Limited has executive offices in Lansing, Michigan, and Phoenix, Arizona.

| CAPITOL BANCORP LIMITED |

| SUMMARY OF SELECTED FINANCIAL DATA |

| (in thousands, except share and per share data) |

| | | | | | | | | | | | | | | | | |

| | | | Three Months Ended | | | | | | Nine Months Ended | |

| | | | September 30 | | | | | | September 30 | |

| | | | 2009 | | | 2008 | | | | | | 2009 | | | 2008 | |

| | | | | | | | | | | | | | | | | |

| Condensed results of operations: | | | | | | | | | | | | | | | |

| Interest income | | | $ | 69,145 | | | $ | 75,496 | | | | | | $ | 207,333 | | | $ | 231,136 | |

| Interest expense | | | | 27,293 | | | | 34,457 | | | | | | | 87,442 | | | | 105,970 | |

| Net interest income | | | 41,852 | | | | 41,039 | | | | | | | 119,891 | | | | 125,166 | |

| Provision for loan losses | | | 48,771 | | | | 53,810 | | | | | | | 112,756 | | | | 71,787 | |

| Noninterest income | | | | 5,362 | | | | 6,951 | | | | | | | 17,313 | | | | 19,993 | |

| Noninterest expense | | | 55,477 | | | | 53,792 | | | | | | | 157,160 | | | | 146,385 | |

| Loss before income tax benefit | | | (57,034 | ) | | | (59,612 | ) | | | | | | (132,712 | ) | | | (73,013 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Net loss attributable to Capitol Bancorp Limited | | $ | (30,890 | ) | | $ | (32,495 | ) | | | | | $ | (65,260 | ) | | $ | (29,681 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Net loss per share attributable to Capitol Bancorp Limited: | | | | | | | | | | | | | | | | |

| Basic | | | $ | (1.78 | ) | | $ | (1.90 | ) | | | | | $ | (3.78 | ) | | $ | (1.73 | ) |

| Diluted | | | | (1.78 | ) | | | (1.90 | ) | | | | | | (3.78 | ) | | | (1.73 | ) |

| Book value per share at end of period | | | 16.61 | | | | 20.37 | | | | | | | 16.61 | | | | 20.37 | |

| Common stock closing price at end of period | | $ | 2.61 | | | $ | 19.49 | | | | | | $ | 2.61 | | | $ | 19.49 | |

| Common shares outstanding at end of period | | | 17,510,000 | | | | 17,337,000 | | | | | | | 17,510,000 | | | | 17,337,000 | |

| Number of shares used to compute: | | | | | | | | | | | | | | | | | | | |

| Basic loss per share | | | 17,398,000 | | | | 17,145,000 | | | | | | | 17,269,000 | | | | 17,144,000 | |

| Diluted loss per share | | | 17,398,000 | | | | 17,145,000 | | | | | | | 17,269,000 | | | | 17,144,000 | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | 3rd Quarter | | | 2nd Quarter | | 1st Quarter | | | 4th Quarter | | | 3rd Quarter | |

| | | | 2009 | | | 2009 | | | 2009 | | | 2008 | | | 2008 | |

| Condensed summary of financial position: | | | | | | | | | | | | | | | | | | | |

| Total assets | | | $ | 5,415,214 | | | $ | 5,726,148 | | | $ | 5,782,608 | | | $ | 5,654,836 | | | $ | 5,427,347 | |

| Portfolio loans | | | | 4,189,534 | | | | 4,580,428 | | | | 4,695,317 | | | | 4,735,229 | | | | 4,662,772 | |

| Deposits | | | | 4,508,343 | | | | 4,695,019 | | | | 4,706,562 | | | | 4,497,612 | | | | 4,283,561 | |

| Capitol Bancorp Limited stockholders' equity | | | 290,792 | | | | 321,585 | | | | 337,491 | | | | 353,848 | | | | 353,108 | |

| Total capital | | | $ | 575,056 | | | $ | 631,874 | | | $ | 656,942 | | | $ | 680,361 | | | $ | 681,154 | |

| | | | | | | | | | | | | | | | | | | | | | |

| Key performance ratios: | | | | | | | | | | | | | | | | | | | | | |

| Return on average assets | | | -- | | | | -- | | | | -- | | | | 0.08 | % | | | -- | |

| Return on average Capitol Bancorp Limited stockholders' equity | | | -- | | | | -- | | | | -- | | | | 1.23 | % | | | -- | |

| Net interest margin | | | | 3.13 | % | | | 3.02 | % | | | 2.81 | % | | | 2.98 | % | | | 3.30 | % |

| Efficiency ratio | | | | 117.50 | % | | | 108.64 | % | | | 117.87 | % | | | 97.52 | % | | | 112.09 | % |

| | | | | | | | | | | | | | | | | | | | | | |

| Asset quality ratios: | | | | | | | | | | | | | | | | | | | | | |

| Allowance for loan losses / portfolio loans | | | 3.01 | % | | | 2.49 | % | | | 2.12 | % | | | 1.96 | % | | | 2.09 | % |

| Total nonperforming loans / portfolio loans | | | 6.72 | % | | | 5.78 | % | | | 4.95 | % | | | 3.59 | % | | | 2.73 | % |

| Total nonperforming assets / total assets | | | 7.42 | % | | | 6.44 | % | | | 5.53 | % | | | 4.20 | % | | | 3.43 | % |

| Net charge-offs (annualized) / average portfolio loans | | | 2.90 | % | | | 1.83 | % | | | 1.83 | % | | | 1.30 | % | | | 1.74 | % |

| Allowance for loan losses / nonperforming loans | | | 44.79 | % | | | 43.17 | % | | | 42.86 | % | | | 54.66 | % | | | 76.78 | % |

| | | | | | | | | | | | | | | | | | | | | | |

| Capital ratios: | | | | | | | | | | | | | | | | | | | | | |

| Capitol Bancorp Limited stockholders' equity / total assets | | | 5.37 | % | | | 5.62 | % | | | 5.84 | % | | | 6.26 | % | | | 6.51 | % |

| Total capital / total assets | | | 10.62 | % | | | 11.03 | % | | | 11.36 | % | | | 12.03 | % | | | 12.55 | % |

| Forward-Looking Statements |

| This press release contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. |

| Forward-looking statements include expressions such as "expect," "intend," "believe," "estimate," "may," "will," "anticipate" and "should" |

| and similar expressions also identify forward-looking statements which are not necessarily statements of belief as to the expected outcomes |

| of future events. Actual results could materially differ from those presented due to a variety of internal and external factors. Actual results |

| could materially differ from those contained in, or implied by, such statements. Capitol Bancorp Limited undertakes no obligation to release |

| revisions to these forward-looking statements or reflect events or circumstances after the date of this release. |

| | Supplemental analyses follow providing additional detail regarding Capitol's results of operations, financial position, asset quality |

| | and other supplemental data. | | | | | | | | | | | |

| CAPITOL BANCORP LIMITED |

| Condensed Consolidated Statements of Operations (Unaudited) |

| (in thousands, except per share data) |

| | | | | | | | | | | | | |

| | | Three Months Ended September 30 | | | Nine Months Ended September 30 | |

| | | 2009 | | | 2008 | | | 2009 | | | 2008 | |

| INTEREST INCOME: | | | | | | | | | | | | |

| Portfolio loans (including fees) | | $ | 66,502 | | | $ | 73,328 | | | $ | 202,937 | | | $ | 224,897 | |

| Loans held for sale | | | 183 | | | | 145 | | | | 744 | | | | 681 | |

| Taxable investment securities | | | 128 | | | | 154 | | | | 432 | | | | 389 | |

| Federal funds sold | | | 31 | | | | 1,259 | | | | 89 | | | | 3,480 | |

| Other | | | 2,301 | | | | 610 | | | | 3,131 | | | | 1,689 | |

| Total interest income | | | 69,145 | | | | 75,496 | | | | 207,333 | | | | 231,136 | |

| | | | | | | | | | | | | | | | | |

| INTEREST EXPENSE: | | | | | | | | | | | | | | | | |

| Deposits | | | 21,197 | | | | 27,149 | | | | 68,980 | | | | 84,826 | |

| Debt obligations and other | | | 6,096 | | | | 7,308 | | | | 18,462 | | | | 21,144 | |

| Total interest expense | | | 27,293 | | | | 34,457 | | | | 87,442 | | | | 105,970 | |

| | | | | | | | | | | | | | | | | |

| Net interest income | | | 41,852 | | | | 41,039 | | | | 119,891 | | | | 125,166 | |

| | | | | | | | | | | | | | | | | |

| PROVISION FOR LOAN LOSSES | | | 48,771 | | | | 53,810 | | | | 112,756 | | | | 71,787 | |

| Net interest income (deficiency) after | | | | | | | | | | | | | |

| provision for loan losses | | | (6,919 | ) | | | (12,771 | ) | | | 7,135 | | | | 53,379 | |

| | | | | | | | | | | | | | | | | |

| NONINTEREST INCOME: | | | | | | | | | | | | | | | | |

| Service charges on deposit accounts | | | 1,562 | | | | 1,526 | | | | 4,569 | | | | 4,316 | |

| Trust and wealth-management revenue | | | 1,288 | | | | 1,791 | | | | 3,811 | | | | 4,999 | |

| Fees from origination of non-portfolio residential | | | | | | | | | | | | | | | | |

| mortgage loans | | | 788 | | | | 926 | | | | 3,186 | | | | 2,910 | |

| Gain on sales of government-guaranteed loans | | | 1,242 | | | | 608 | | | | 1,887 | | | | 1,831 | |

| Realized gains (losses) on sale of investment | | | | | | | | | | | | | | | | |

| securities available for sale | | | (572 | ) | | | 5 | | | | (571 | ) | | | 50 | |

| Other | | | 1,054 | | | | 2,095 | | | | 4,431 | | | | 5,887 | |

| Total noninterest income | | | 5,362 | | | | 6,951 | | | | 17,313 | | | | 19,993 | |

| | | | | | | | | | | | | | | | | |

| NONINTEREST EXPENSE: | | | | | | | | | | | | | | | | |

| Salaries and employee benefits | | | 23,482 | | | | 29,319 | | | | 76,977 | | | | 82,597 | |

| Occupancy | | | 4,864 | | | | 4,968 | | | | 14,598 | | | | 13,872 | |

| Equipment rent, depreciation and maintenance | | | 3,046 | | | | 3,821 | | | | 9,680 | | | | 9,695 | |

| Costs associated with foreclosed properties and | | | | | | | | | | | | | | | | |

| other real estate owned | | | 9,834 | | | | 2,040 | | | | 17,971 | | | | 4,132 | |

| FDIC insurance premiums and other regulatory fees | | | 3,796 | | | | 1,029 | | | | 11,258 | | | | 2,899 | |

| Other | | | 10,455 | | | | 12,615 | | | | 26,676 | | | | 33,190 | |

| Total noninterest expense | | | 55,477 | | | | 53,792 | | | | 157,160 | | | | 146,385 | |

| | | | | | | | | | | | | | | | | |

| Loss before income tax benefit | | | (57,034 | ) | | | (59,612 | ) | | | (132,712 | ) | | | (73,013 | ) |

| | | | | | | | | | | | | | | | | |

| Income tax benefit | | | (20,531 | ) | | | (20,732 | ) | | | (47,950 | ) | | | (25,428 | ) |

| | | | | | | | | | | | | | | | | |

| NET LOSS | | | (36,503 | ) | | | (38,880 | ) | | | (84,762 | ) | | | (47,585 | ) |

| | | | | | | | | | | | | | | | | |

| Less interest in net losses attributable to noncontrolling interests | | | 5,613 | | | | 6,385 | | | | 19,502 | | | | 17,904 | |

| | | | | | | | | | | | | | | | | |

| NET LOSS ATTRIBUTABLE TO CAPITOL | | | | | | | | | | | | | | | | |

| BANCORP LIMITED | | $ | (30,890 | ) | | $ | (32,495 | ) | | $ | (65,260 | ) | | $ | (29,681 | ) |

| | | | | | | | | | | | | | | | | |

| NET LOSS PER SHARE ATTRIBUTABLE | | | | | | | | | | | | | | | | |

| TO CAPITOL BANCORP LIMITED: | | | | | | | | | | | | | | | | |

| Basic | | $ | (1.78 | ) | | $ | (1.90 | ) | | $ | (3.78 | ) | | $ | (1.73 | ) |

| | | | | | | | | | | | | | | | | |

| Diluted | | $ | (1.78 | ) | | $ | (1.90 | ) | | $ | (3.78 | ) | | $ | (1.73 | ) |

| | | | | | | | | | | | | | | | | |

| CAPITOL BANCORP LIMITED |

| Condensed Consolidated Balance Sheets |

| (in thousands, except share data) |

| | | | | | | | |

| | | | | | | | |

| | | | (Unaudited) | | | | |

| | | | September 30 | | | December 31 | |

| | | | 2009 | | | 2008 | |

| ASSETS | | | | | | | |

| | | | | | | | |

| Cash and due from banks | | | $ | 95,929 | | | $ | 136,499 | |

| Money market and interest-bearing deposits | | | 768,582 | | | | 391,836 | |

| Federal funds sold | | | | 25,183 | | | | 96,031 | |

| Cash and cash equivalents | | | 889,694 | | | | 624,366 | |

| Loans held for sale | | | | 14,432 | | | | 10,474 | |

| Investment securities: | | | | | | | | | |

| Available for sale, carried at fair value | | | 18,005 | | | | 15,584 | |

| Held for long-term investment, carried at | | | | | | | | |

| amortized cost which approximates fair value | | | 30,789 | | | | 32,856 | |

| Total investment securities | | | 48,794 | | | | 48,440 | |

| Portfolio loans: | | | | | | | | | |

| Loans secured by real estate: | | | | | | | | | |

| Commercial | | | | 2,013,473 | | | | 2,115,515 | |

| Residential (including multi-family) | | | 806,027 | | | | 879,754 | |

| Construction, land development and other land | | | 579,752 | | | | 797,486 | |

| Total loans secured by real estate | | | 3,399,252 | | | | 3,792,755 | |

| Commercial and other business-purpose loans | | | 707,302 | | | | 845,593 | |

| Consumer | | | | 45,866 | | | | 61,340 | |

| Other | | | | 37,114 | | | | 35,541 | |

| Total portfolio loans | | | 4,189,534 | | | | 4,735,229 | |

| Less allowance for loan losses | | | | (126,188 | ) | | | (93,040 | ) |

| Net portfolio loans | | | 4,063,346 | | | | 4,642,189 | |

| Premises and equipment | | | | 49,353 | | | | 59,249 | |

| Accrued interest income | | | | 16,069 | | | | 18,871 | |

| Goodwill | | | | 68,078 | | | | 72,342 | |

| Other real estate owned | | | | 119,801 | | | | 67,171 | |

| Other assets | | | | 145,647 | | | | 111,734 | |

| | | | | | | | | | |

| TOTAL ASSETS | | | $ | 5,415,214 | | | $ | 5,654,836 | |

| | | | | | | | | | |

| | | | | | | | | | |

| LIABILITIES AND EQUITY | | | | | | | | | |

| | | | | | | | | | |

| LIABILITIES: | | | | | | | | | |

| Deposits: | | | | | | | | | |

| Noninterest-bearing | | | $ | 651,887 | | | $ | 700,786 | |

| Interest-bearing | | | | 3,856,456 | | | | 3,796,826 | |

| Total deposits | | | 4,508,343 | | | | 4,497,612 | |

| Debt obligations: | | | | | | | | | |

| Notes payable and short-term borrowings | | | 300,326 | | | | 446,925 | |

| Subordinated debentures | | | | 167,402 | | | | 167,293 | |

| Total debt obligations | | | 467,728 | | | | 614,218 | |

| Accrued interest on deposits and other liabilities | | | 31,489 | | | | 29,938 | |

| Total liabilities | | | 5,007,560 | | | | 5,141,768 | |

| | | | | | | | | | |

| EQUITY: | | | | | | | | | |

| Capitol Bancorp Limited stockholders' equity: | | | | | | | | |

| Preferred stock, 20,000,000 shares authorized; | | | | | | | | |

| none issued and outstanding | | | | | | | | | |

| Common stock, no par value, 50,000,000 shares authorized; | | | | | | | | |

| issued and outstanding: 2009 - 17,509,631 shares | | | | | | | | |

| 2008 - 17,293,908 shares | | | 277,087 | | | | 274,018 | |

| Retained earnings | | | | 14,158 | | | | 80,255 | |

| Undistributed common stock held by employee- | | | | | | | | |

| benefit trust | | | | (569 | ) | | | (569 | ) |

| Fair value adjustment (net of tax effect) for | | | | | | | | |

| investment securities available for sale (accumulated | | | | | | | | |

| other comprehensive income) | | | 116 | | | | 144 | |

| Total Capitol Bancorp Limited stockholders' equity | | | 290,792 | | | | 353,848 | |

| Noncontrolling interests in consolidated subsidiaries | | | 116,862 | | | | 159,220 | |

| Total equity | | | 407,654 | | | | 513,068 | |

| | | | | | | | | | |

| TOTAL LIABILITIES AND EQUITY | | $ | 5,415,214 | | | $ | 5,654,836 | |

| | | | | | | | | | |

CAPITOL BANCORP LIMITED

Allowance for Loan Losses Activity

ALLOWANCE FOR LOAN LOSSES ACTIVITY (in thousands):

| | | Periods Ended September 30 | |

| | | Three Month Period | | | Nine Month Period | |

| | | 2009 | | | 2008 | | | 2009 | | | 2008 | |

| Allowance for loan losses at beginning of period | | $ | 114,215 | | | $ | 63,904 | | | $ | 93,040 | | | $ | 58,124 | |

| | | | | | | | | | | | | | | | | |

| Loans charged-off: | | | | | | | | | | | | | | | | |

| Loans secured by real estate: | | | | | | | | | | | | | | | | |

| Commercial | | | (5,593 | ) | | | (2,186 | ) | | | (11,218 | ) | | | (5,630 | ) |

| Residential (including multi-family) | | | (6,845 | ) | | | (2,428 | ) | | | (18,213 | ) | | | (5,590 | ) |

Construction, land development and other land | | | (11,862 | ) | | | (12,128 | ) | | | (25,729 | ) | | | (15,248 | ) |

Total loans secured by real estate | | | (24,300 | ) | | | (16,742 | ) | | | (55,160 | ) | | | (26,468 | ) |

| Commercial and other business-purpose loans | | | (8,582 | ) | | | (3,753 | ) | | | (21,340 | ) | | | (8,051 | ) |

| Consumer | | | (485 | ) | | | (73 | ) | | | (1,029 | ) | | | (262 | ) |

| Other | | | (34 | ) | | | -- | | | | (35 | ) | | | (34 | ) |

| Total charge-offs | | | (33,401 | ) | | | (20,568 | ) | | | (77,564 | ) | | | (34,815 | ) |

| Recoveries: | | | | | | | | | | | | | | | | |

| Loans secured by real estate: | | | | | | | | | | | | | | | | |

| Commercial | | | 29 | | | | 181 | | | | 151 | | | | 899 | |

| Residential (including multi-family) | | | 51 | | | | 130 | | | | 252 | | | | 590 | |

Construction, land development and other land | | | 385 | | | | 17 | | | | 506 | | | | 240 | |

Total loans secured by real estate | | | 465 | | | | 328 | | | | 909 | | | | 1,729 | |

| Commercial and other business-purpose loans | | | 163 | | | | 102 | | | | 1,042 | | | | 686 | |

| Consumer | | | 88 | | | | 9 | | | | 117 | | | | 74 | |

| Other | | | 1 | | | | -- | | | | 2 | | | | -- | |

| Total recoveries | | | 717 | | | | 439 | | | | 2,070 | | | | 2,489 | |

| Net charge-offs | | | (32,684 | ) | | | (20,129 | ) | | | (75,494 | ) | | | (32,326 | ) |

| Additions to allowance charged to expense | | | 48,771 | | | | 53,810 | | | | 112,756 | | | | 71,787 | |

| | | | | | | | | | | | | | | | | |

Less allowance for loan losses of subsidiaries no longer consolidated | | | (4,114 | ) | | | | | | | (4,114 | ) | | | | |

| | | | | | | | | | | | | | | | | |

| Allowance for loan losses at September 30 | | $ | 126,188 | | | $ | 97,585 | | | $ | 126,188 | | | $ | 97,585 | |

| | | | | | | | | | | | | | | | | |

Average total portfolio loans for period ended September 30 | | $ | 4,505,447 | | | $ | 4,617,153 | | | $ | 4,623,317 | | | $ | 4,521,165 | |

| | | | | | | | | | | | | | | | | |

Ratio of net charge-offs (annualized) to average portfolio loans outstanding | | | 2.90 | % | | | 1.74 | % | | | 2.18 | % | | | 0.95 | % |

CAPITOL BANCORP LIMITED

Asset Quality Data

ASSET QUALITY (in thousands):

| | | September 30 2009 | | | June 30 2009 | | | March 31 2009 | | | December 31 2008 | |

| Nonaccrual loans: | | | | | | | | | | | | |

| Loans secured by real estate: | | | | | | | | | | | | |

| Commercial | | $ | 101,704 | | | $ | 84,879 | | | $ | 68,537 | | | $ | 39,892 | |

| Residential (including multi-family) | | | 54,226 | | | | 57,764 | | | | 62,961 | | | | 35,675 | |

| Construction, land development and other land | | | 86,720 | | | | 87,055 | | | | 77,861 | | | | 72,996 | |

| Total loans secured by real estate | | | 242,650 | | | | 229,698 | | | | 209,359 | | | | 148,563 | |

| Commercial and other business-purpose loans | | | 25,002 | | | | 24,767 | | | | 17,233 | | | | 16,283 | |

| Consumer | | | 513 | | | | 586 | | | | 356 | | | | 190 | |

| Total nonaccrual loans | | | 268,165 | | | | 255,051 | | | | 226,948 | | | | 165,036 | |

| | | | | | | | | | | | | | | | | |

Past due (>90 days) loans and accruing interest: | | | | | | | | | | | | | | | | |

| Loans secured by real estate: | | | | | | | | | | | | | | | | |

| Commercial | | | 4,520 | | | | 2,706 | | | | 2,345 | | | | 1,623 | |

| Residential (including multi-family) | | | 1,787 | | | | 1,318 | | | | 2,371 | | | | 365 | |

| Construction, land development and other land | | | 2,990 | | | | 4,284 | | | | 109 | | | | 2,293 | |

| Total loans secured by real estate | | | 9,297 | | | | 8,308 | | | | 4,825 | | | | 4,281 | |

| Commercial and other business-purpose loans | | | 4,223 | | | | 1,152 | | | | 636 | | | | 747 | |

| Consumer | | | 29 | | | | 42 | | | | 50 | | | | 146 | |

| Total past due loans | | | 13,549 | | | | 9,502 | | | | 5,511 | | | | 5,174 | |

| | | | | | | | | | | | | | | | | |

| Total nonperforming loans | | $ | 281,714 | | | $ | 264,553 | | | $ | 232,459 | | | $ | 170,210 | |

| | | | | | | | | | | | | | | | | |

Real estate owned and other repossessed assets | | | 120,107 | | | | 103,953 | | | | 87,074 | | | | 67,449 | |

| | | | | | | | | | | | | | | | | |

| Total nonperforming assets | | $ | 401,821 | | | $ | 368,506 | | | $ | 319,533 | | | $ | 237,659 | |

CAPITOL BANCORP LIMITED

Selected Supplemental Data

EPS COMPUTATION COMPONENTS (in thousands):

| | | Periods Ended September 30 | |

| | | Three Month Period | | | Nine Month Period | |

| | | 2009 | | | 2008 | | | 2009 | | | 2008 | |

| | | | | | | | | | | | | |

Numerator—net loss attributable to Capitol Bancorp Limited for the period | | $ | (30,890 | ) | | $ | (32,495 | ) | | $ | (65,260 | ) | | $ | (29,681 | ) |

| | | | | | | | | | | | | | | | | |

| Denominator: | | | | | | | | | | | | | | | | |

Weighted average number of shares outstanding, excluding unvested restricted shares (denominator for basic earnings per share) | | | 17,398 | | | | 17,145 | | | | 17,269 | | | | 17,144 | |

| Effect of dilutive securities: | | | | | | | | | | | | | | | | |

| Unvested restricted shares | | | -- | | | | -- | | | | -- | | | | -- | |

| Stock options | | | -- | | | | -- | | | | -- | | | | -- | |

| Total effect of dilutive securities | | | -- | | | | -- | | | | -- | | | | -- | |

| Denominator for diluted net loss per share— | | | | | | | | | | | | | | | | |

Weighted average number of shares and potential dilution | | | 17,398 | | | | 17,145 | | | | 17,269 | | | | 17,144 | |

| | | | | | | | | | | | | | | | | |

Number of antidilutive stock options excluded from diluted net loss per share computation | | | 2,375 | | | | 2,389 | | | | 2,375 | | | | 2,389 | |

| | | | | | | | | | | | | | | | | |

Number of antidilutive unvested restricted shares excluded from diluted net loss per share computation | | | 109 | | | | 61 | | | | 109 | | | | 73 | |

AVERAGE BALANCES (in thousands):

| | | Periods Ended September 30 | |

| | | Three Month Period | | | Nine Month Period | |

| | | 2009 | | | 2008 | | | 2009 | | | 2008 | |

| | | | | | | | | | | | | |

| Portfolio loans | | $ | 4,505,447 | | | $ | 4,617,153 | | | $ | 4,623,317 | | | $ | 4,521,165 | |

| Earning assets | | | 5,347,993 | | | | 4,971,600 | | | | 5,348,237 | | | | 4,809,042 | |

| Total assets | | | 5,730,665 | | | | 5,379,283 | | | | 5,722,755 | | | | 5,182,329 | |

| Deposits | | | 4,731,159 | | | | 4,212,518 | | | | 4,662,313 | | | | 4,044,868 | |

Capitol Bancorp Limited stockholders' equity | | | 313,260 | | | | 375,914 | | | | 329,869 | | | | 383,251 | |

Capitol Bancorp’s National Network of Community Banks

| | |

| | |

| Arizona Region: | |

| Arrowhead Community Bank | Glendale, Arizona |

| Asian Bank of Arizona | Phoenix, Arizona |

| Bank of Tucson | Tucson, Arizona |

| Camelback Community Bank | Phoenix, Arizona |

| Central Arizona Bank | Casa Grande, Arizona |

| Colonia Bank | Phoenix, Arizona |

| Mesa Bank | Mesa, Arizona |

| Southern Arizona Community Bank | Tucson, Arizona |

| Sunrise Bank of Albuquerque | Albuquerque, New Mexico |

| Sunrise Bank of Arizona | Phoenix, Arizona |

| | |

| California Region: | |

| Bank of Escondido | Escondido, California |

| Bank of Feather River | Yuba City, California |

| Bank of San Francisco | San Francisco, California |

| Bank of Santa Barbara | Santa Barbara, California |

| Napa Community Bank | Napa, California |

| Point Loma Community Bank | San Diego, California |

| Sunrise Bank of San Diego | San Diego, California |

| Sunrise Community Bank | Palm Desert, California |

| | |

| Colorado Region: | |

| Fort Collins Commerce Bank | Fort Collins, Colorado |

| Larimer Bank of Commerce | Fort Collins, Colorado |

| Loveland Bank of Commerce | Loveland, Colorado |

| Mountain View Bank of Commerce | Westminster, Colorado |

| | |

Great Lakes Region: | |

| Bank of Auburn Hills | Auburn Hills, Michigan |

| Bank of Maumee | Maumee, Ohio |

| Bank of Michigan | Farmington Hills, Michigan |

| Capitol National Bank | Lansing, Michigan |

| Elkhart Community Bank | Elkhart, Indiana |

| Evansville Commerce Bank | Evansville, Indiana |

| Goshen Community Bank | Goshen, Indiana |

| Michigan Commerce Bank | Ann Arbor, Michigan |

| Ohio Commerce Bank | Beachwood, Ohio |

| Paragon Bank & Trust | Holland, Michigan |

| | |

Midwest Region: | |

| Adams Dairy Bank | Blue Springs, Missouri |

| Bank of Belleville | Belleville, Illinois |

| Community Bank of Lincoln | Lincoln, Nebraska |

| Summit Bank of Kansas City | Lee’s Summit, Missouri |

| | |

| Nevada Region: | |

| 1st Commerce Bank | North Las Vegas, Nevada |

| Bank of Las Vegas | Las Vegas, Nevada |

| Black Mountain Community Bank | Henderson, Nevada |

| Desert Community Bank | Las Vegas, Nevada |

| Red Rock Community Bank | Las Vegas, Nevada |

| | |

Northeast Region: | |

| USNY Bank | Geneva, New York |

| | |

Northwest Region: | |

| Bank of Bellevue | Bellevue, Washington |

| Bank of Everett | Everett, Washington |

| Bank of Tacoma | Tacoma, Washington |

| High Desert Bank | Bend, Oregon |

| Issaquah Community Bank | Issaquah, Washington |

| Capitol’s National Network of Community Banks – Continued |

| | |

| | |

Southeast Region: | |

| Bank of Valdosta | Valdosta, Georgia |

| Community Bank of Rowan | Salisbury, North Carolina |

| First Carolina State Bank | Rocky Mount, North Carolina |

| Peoples State Bank | Jeffersonville, Georgia |

| Pisgah Community Bank | Asheville, North Carolina |

| Sunrise Bank of Atlanta | Atlanta, Georgia |

| | |

| Texas Region: | |

| Bank of Fort Bend | Sugar Land, Texas |

| Bank of Las Colinas | Irving, Texas |