EXHIBIT 13

F i n a n c i a l I n f o r m a t i o n

Table of Contents

| F-2 | |

| F-3 | |

| F-5 | |

| F-5 | |

| F-5 | |

| F-6 | |

| F-6 | |

Management's Discussion and Analysis of Capitol's Business, Financial Condition and Results of Operations: | |

| F-10 | |

| F-12 | |

| F-14 | |

| F-15 | |

| F-16 | |

| F-21 | |

| F-30 | |

| F-30 | |

| F-37 | |

| F-41 | |

| F-42 | |

| F-43 | |

Quantitative and Qualitative Disclosure About Market Risk | F-44 |

| F-47 | |

| F-47 | |

Use of Estimates in Determining the Allowance for Loan Losses | F-47 |

Accounting for Income Taxes | F-49 |

Consolidation Policy | F-49 |

| F-50 | |

| F-50 | |

| F-52 | |

| Consolidated Financial Statements: | |

| F-54 | |

| F-55 | |

| F-56 | |

| F-57 | |

| F-58 | |

| F-60 | |

| F-61 |

F-1

(in $1,000s, except per share data)

| As of and for the Year Ended December 31 | ||||||||||||||||||||

2012(1) | 2011(2) | 2010(3) | 2009(4) | 2008(5) | ||||||||||||||||

| For the year: | ||||||||||||||||||||

Interest income(6) | $ | 77,626 | $ | 94,720 | $ | 118,597 | $ | 152,470 | $ | 191,395 | ||||||||||

Interest expense(6) | 19,749 | 34,222 | 53,969 | 78,182 | 99,390 | |||||||||||||||

Net interest income(6) | 57,877 | 60,498 | 64,628 | 74,288 | 92,005 | |||||||||||||||

Provision for loan losses(6) | 1,452 | 35,630 | 142,237 | 154,555 | 69,552 | |||||||||||||||

Noninterest income(6) | 16,902 | 40,003 | 20,976 | 19,206 | 19,820 | |||||||||||||||

Noninterest expense(6) | 97,968 | 121,175 | 207,083 | 182,777 | 135,390 | |||||||||||||||

| Loss from continuing operations before income taxes | (27,597 | ) | (56,304 | ) | (263,716 | ) | (243,838 | ) | (93,117 | ) | ||||||||||

| Income (loss) from discontinued operations | 20 | 1,045 | 2,244 | (13,957 | ) | 10,272 | ||||||||||||||

| Net loss | (27,425 | ) | (51,926 | ) | (254,364 | ) | (264,540 | ) | (52,451 | ) | ||||||||||

| Net loss attributable to Capitol Bancorp Limited | (25,474 | ) | (45,427 | ) | (225,215 | ) | (195,169 | ) | (28,607 | ) | ||||||||||

| Net loss per share attributable to Capitol Bancorp | ||||||||||||||||||||

| Limited: | ||||||||||||||||||||

| Basic | (0.62 | ) | (1.17 | ) | (11.16 | ) | (11.28 | ) | (1.67 | ) | ||||||||||

| Diluted | (0.62 | ) | (1.17 | ) | (11.16 | ) | (11.28 | ) | (1.67 | ) | ||||||||||

| Cash dividends paid per share | -- | -- | -- | 0.05 | 0.50 | |||||||||||||||

| At end of year: | ||||||||||||||||||||

| Total assets | $ | 1,618,252 | $ | 2,205,265 | $ | 3,540,214 | $ | 5,131,940 | $ | 5,654,836 | ||||||||||

Total earning assets(6) | 1,505,905 | 1,862,961 | 2,289,848 | 2,910,510 | 3,187,919 | |||||||||||||||

Portfolio loans(6) | 1,206,667 | 1,515,200 | 1,912,229 | 2,421,254 | 2,882,358 | |||||||||||||||

Deposits(6) | 1,543,868 | 1,830,202 | 2,172,928 | 2,709,257 | 2,754,503 | |||||||||||||||

Notes payable and short-term borrowings(6) | 8,428 | 50,445 | 94,652 | 164,866 | 262,663 | |||||||||||||||

| Subordinated debentures | -- | 149,156 | 167,586 | 167,441 | 167,293 | |||||||||||||||

Liabilities subject to compromise(7) | 200,293 | -- | -- | -- | -- | |||||||||||||||

| Noncontrolling interests in consolidated subsidiaries | (10,247 | ) | (563 | ) | 23,173 | 72,271 | 159,220 | |||||||||||||

| Capitol Bancorp Limited stockholders' equity (deficit) | (133,869 | ) | (108,084 | ) | (61,854 | ) | 161,335 | 353,848 | ||||||||||||

| Quarterly Results of Operations (unaudited) | ||||||||||||||||||||

Total for the Year | Fourth Quarter | Third Quarter | Second Quarter | First Quarter | ||||||||||||||||

Year ended December 31, 2012:(1) | ||||||||||||||||||||

Interest income(6) | $ | 77,626 | $ | 18,252 | $ | 18,994 | $ | 19,546 | $ | 20,834 | ||||||||||

Interest expense(6) | 19,749 | 2,850 | 4,003 | 5,941 | 6,955 | |||||||||||||||

Net interest income(6) | 57,877 | 15,402 | 14,991 | 13,605 | 13,879 | |||||||||||||||

Provision for loan losses(6) | 1,452 | 13 | 280 | 293 | 866 | |||||||||||||||

| Net loss | (27,425 | ) | (1,672 | ) | (6,144 | ) | (10,678 | ) | (8,931 | ) | ||||||||||

| Net loss attributable to Capitol Bancorp Limited | (25,474 | ) | (1,550 | ) | (5,673 | ) | (10,339 | ) | (7,912 | ) | ||||||||||

Net loss per share attributable to Capitol Bancorp Limited – basic and diluted(8) | (0.62 | ) | (0.04 | ) | (0.14 | ) | (0.25 | ) | (0.19 | ) | ||||||||||

| Cash dividends paid per share | -- | -- | -- | -- | -- | |||||||||||||||

Year ended December 31, 2011:(2) | ||||||||||||||||||||

Interest income(6) | $ | 94,720 | $ | 21,417 | $ | 23,123 | $ | 24,160 | $ | 26,020 | ||||||||||

Interest expense(6) | 34,222 | 7,709 | 8,243 | 8,768 | 9,502 | |||||||||||||||

Net interest income(6) | 60,498 | 13,708 | 14,880 | 15,392 | 16,518 | |||||||||||||||

Provision for loan losses(6) | 35,630 | 2,986 | 15,529 | 5,735 | 11,380 | |||||||||||||||

| Net loss | (51,926 | ) | (6,878 | ) | (24,768 | ) | (17,506 | ) | (2,774 | ) | ||||||||||

| Net income (loss) attributable to Capitol Bancorp Limited | (45,427 | ) | (6,516 | ) | (22,762 | ) | (16,438 | ) | 289 | |||||||||||

Net income (loss) per share attributable to Capitol Bancorp Limited – basic and diluted(8) | (1.17 | ) | (0.16 | ) | (0.55 | ) | (0.40 | ) | 0.01 | |||||||||||

| Cash dividends paid per share | -- | -- | -- | -- | -- | |||||||||||||||

| (1) | Capitol sold its ownership in High Desert Bank effective November 19, 2012; First Carolina State Bank effective July 30, 2012; Bank of Michigan effective July 27, 2012 and Mountain View Bank of Commerce effective January 30, 2012. The banks' operations have been included in Capitol's consolidated totals up to the date of sale as part of discontinued operations. |

| (2) | Capitol sold its ownership in Bank of Las Colinas effective October 27, 2011; Evansville Commerce Bank effective October 7, 2011; Bank of Feather River effective October 3, 2011; Bank of the Northwest and Sunrise Bank effective July 28, 2011; Community Bank of Rowan effective April 19, 2011; Bank of Fort Bend effective March 30, 2011 and Bank of Tucson effective January 24, 2011. The banks' operations have been included in Capitol's consolidated totals up to the date of sale as part of discontinued operations. |

| (3) | Capitol sold its ownership in Southern Arizona Community Bank effective December 10, 2010; Fort Collins Commerce Bank, Larimer Bank of Commerce and Loveland Bank of Commerce effective October 29, 2010; Bank of San Francisco effective September 28, 2010; Adams Dairy Bank effective August 31, 2010; USNY Bank effective August 23, 2010; Community Bank of Lincoln effective July 30, 2010; Ohio Commerce Bank effective June 30, 2010; Napa Community Bank effective April 30, 2010 and Bank of Belleville effective April 27, 2010. The banks' operations have been included in Capitol's consolidated totals up to the date of sale; however, are included in discontinued operations. |

| (4) | Includes Yuma Community Bank's operations through September 21, 2009 (date at which Capitol sold its ownership of that bank) and Bank of Santa Barbara, Community Bank of Rowan ("CBR"), Summit Bank of Kansas City and Capitol Development Bancorp Limited III's ("CDBL III") operations through September 30, 2009 (the date when these entities ceased to be consolidated with Capitol due to a change in control). Effective June 30, 2010, CDBL III transferred its controlling interest in CBR to Capitol in exchange for preferred stock of Capitol and, accordingly, CBR became a consolidated subsidiary of Capitol on that date. |

| (5) | Includes Adams Dairy Bank effective January 2008, Mountain View Bank of Commerce effective February 2008, Colonia Bank effective April 2008 and Pisgah Community Bank effective May 2008. |

| (6) | Excludes amounts related to banks reclassified as discontinued operations. |

| (7) | Liabilities subject to compromise include $151,296 of subordinated debentures and $6,820 of senior notes. |

| (8) | Each period's computation of net income (loss) per share is performed independently and, accordingly, net income per share for the year (basic and diluted) may not equal the sum of the amounts shown for the quarterly periods. |

F-2

Capitol's common stock was traded on the New York Stock Exchange (the "NYSE") under the symbol "CBC" prior to early 2011. On January 27, 2011, Capitol's common stock began being quoted through the facilities of OTC Markets Group under the symbol "CBCR." It is currently being categorized under the OTCQB tier, which identifies issuers that are registered and reporting with the Securities and Exchange Commission. Market quotations regarding the range of high and low bid prices of Capitol's common stock, as reported by the OTC Markets Group for 2012 and 2011, were as follows:

2012(1) | 2011(1) | |||||||||||||||

| Low | High | Low | High | |||||||||||||

| Quarter Ended: | ||||||||||||||||

| March 31 | $ | 0.090 | $ | 0.350 | $ | 0.130 | $ | 0.300 | ||||||||

| June 30 | 0.125 | 0.345 | 0.123 | 0.171 | ||||||||||||

| September 30 | 0.090 | 0.160 | 0.075 | 0.135 | ||||||||||||

| December 31 | 0.040 | 0.145 | 0.037 | 0.095 | ||||||||||||

| (1) | Over-the-counter market quotations reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not necessarily represent actual transactions. |

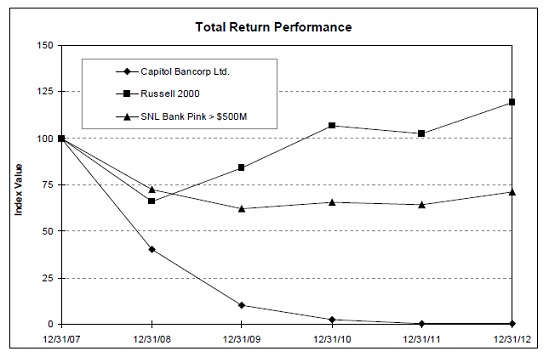

Below is a graph which summarizes the cumulative return earned by Capitol's shareholders over the last five years compared with the SNL (SNL Financial LC) Bank Pink >$500M Asset-Size Index (SNL) and the cumulative total return on the Russell 2000 Index (R-2000). This presentation assumes the initial value of an investment in Capitol's common stock and each index was $100 on December 31, 2007 and that any subsequent cash dividends were reinvested.

| Period Ending | ||||||||||||||||||||||||

| Index | 12/31/07 | 12/31/08 | 12/31/09 | 12/31/10 | 12/31/11 | 12/31/12 | ||||||||||||||||||

| Capitol Bancorp Ltd. | 100.00 | 40.10 | 10.17 | 2.69 | 0.47 | 0.26 | ||||||||||||||||||

| Russell 2000 | 100.00 | 66.21 | 84.20 | 106.82 | 102.36 | 119.09 | ||||||||||||||||||

| SNL Bank Pink > $500M | 100.00 | 72.56 | 62.04 | 65.54 | 64.43 | 71.06 | ||||||||||||||||||

F-3

INFORMATION REGARDING CAPITOL'S COMMON STOCK—Continued

Beginning in September 2009, the payment of dividends became subject to prior approval of the Federal Reserve, Capitol's primary federal regulator (see subsequent discussion of certain regulatory matters in the section captioned "Management's Discussion and Analysis of Capitol's Business, Financial Condition and Results of Operations"). In the first quarter of 2009, Capitol paid a cash dividend of $0.05 per share. During 2008, Capitol paid quarterly cash dividends of $0.25 per share for the first quarter, $0.15 in the second quarter and $0.05 in the third and fourth quarters.

As of March 15, 2013, there were 8,598 holders of Capitol's common stock, based on information supplied to Capitol from its stock transfer agent and other sources.

At March 15, 2013, 41,177,479 shares of common stock were outstanding. Capitol's stock transfer agent is Computershare (formerly BNY Mellon Shareowner Services), 480 Washington Blvd., Jersey City, NJ 07310 (telephone 866-205-7090). The website for Computershare is http://www.computershare.com/investor.

Capitol has a direct purchase and dividend reinvestment plan, the Capitol Bancorp Limited Direct Purchase and Dividend Reinvestment Plan ("Capitol Bancorp Direct"), which offers a variety of convenient features including certain fee-free transactions, certificate safekeeping and other benefits. For a copy of the Capitol Bancorp Direct prospectus, informational brochure and enrollment materials, contact Computershare at 866-205-7090 or Capitol at 517-487-6555.

In addition to Capitol's common stock, trust-preferred securities of Capitol Trust I and Capitol Trust XII (each a subsidiary of Capitol) are quoted on the OTCQB tier of the OTC Markets Group under the symbol "CBCRP" and "CBCRO," respectively, commencing in late January 2011. Those trust-preferred securities have a liquidation amount of $10 per preferred security and are guaranteed by Capitol. Capitol Trust I consists of 1,349,398, 8.5% cumulative preferred securities scheduled to mature in 2027, which are currently callable and may be extended to 2036 if certain conditions are met. Capitol Trust XII consists of 3,031,066, 10.5% cumulative preferred securities scheduled to mature in 2038 and become callable in 2013. In 2009, Capitol commenced the deferral of interest payments on its various trust-preferred securities, as is permitted under the terms of the securities, to conserve cash and capital resources. Holders of the trust-preferred securities will continue to recognize current taxable income relating to the deferred interest payments. Payment of interest on the trust-preferred securities is subject to approval of the Federal Reserve (see subsequent discussion of certain regulatory matters in the section captioned "Management's Discussion and Analysis of Capitol's Business, Financial Condition and Results of Operations").

F-4

Capitol has filed with the U.S. Securities and Exchange Commission (the "SEC") all required certifications regarding the quality of Capitol's public disclosures upon filing of Capitol's 2012 Report on Form 10-K. Further, Capitol has filed certifications with the SEC in accordance with the Sarbanes-Oxley Act of 2002 as exhibits to Capitol's 2012 Report on Form 10-K.

A copy of Capitol's 2012 Annual Report on Form 10-K, without exhibits, will be available to holders of its common stock or trust-preferred securities without charge, upon written request. Form 10-K includes certain statistical and other information regarding Capitol and its business. Requests to obtain a copy of Form 10-K should be addressed to Investor Relations, Capitol Bancorp Limited, Capitol Bancorp Center, 200 N. Washington Square, Lansing, Michigan 48933.

Form 10-K and certain other periodic reports have been or will be filed with the SEC. The SEC maintains an Internet website that contains reports, proxy and information statements and other information regarding companies which file electronically (which includes Capitol). The SEC's website address is http://www.sec.gov. Capitol's filings with the SEC are also available at Capitol's website, http://www.capitolbancorp.com.

EXECUTIVE OFFICE

| Capitol Bancorp Center |

| 200 N. Washington Square |

| Lansing, Michigan 48933 |

| 517-487-6555 |

| website: www.capitolbancorp.com |

INDEPENDENT AUDITORS

BDO USA, LLP

Grand Rapids, Michigan

F-5

DIRECT PURCHASE AND DIVIDEND REINVESTMENT PLAN

Capitol offers a direct purchase and dividend reinvestment plan, Capitol Bancorp Direct. Participation in Capitol Bancorp Direct is voluntary and shareholders and prospective investors are eligible. As a result of the Chapter 11 bankruptcy filing, purchases and sales through Capitol Bancorp Direct have been suspended until further notice. For further information regarding Capitol Bancorp Direct or for a copy of Capitol Bancorp Direct's prospectus, informational brochure and enrollment materials, please contact Computershare at 866-205-7090 or Capitol at 517-487-6555.

TRUST-PREFERRED SECURITIES TRADING INFORMATION

Preferred securities of Capitol Trust I and Capitol Trust XII (each a subsidiary of Capitol) are quoted on the OTC Markets Group under the trading symbols "CBCRP" and "CBCRO," respectively.

TRUST-PREFERRED SECURITIES TRUSTEE

Capitol Trust I: Bank of New York Mellon – Chicago, Illinois

Capitol Trust XII: M&T Trust Company of Delaware

Some of the statements contained in this annual report, including Capitol's consolidated financial statements, Management's Discussion and Analysis of Capitol's Business, Financial Condition and Results of Operations and in documents incorporated into this document by reference that are not historical facts, including, without limitation, statements of future expectations, projections of results of operations and financial condition, statements of future economic performance and other forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, are subject to known and unknown risks, uncertainties and other factors which may cause the actual future results, performance or achievements of Capitol and/or its subsidiaries and other operating units to differ materially from those contemplated in such forward-looking statements. The words "intend," "expect," "project," "estimate," "predict," "anticipate," "should," "could," "believe," "may," "might," and similar expressions also are intended to identify forward-looking statements. Important factors which may cause actual results to differ from those contemplated in such forward-looking statements include, but are not limited to:

· Capitol may not be able to successfully emerge from Chapter 11 bankruptcy and restructure its existing unsecured debt obligations;

· Capitol's ability to continue as a going concern;

· The availability and cost of capital and liquidity on favorable terms, if at all, which may depend in part on Capitol's asset quality, prospects and outlook;

· The risk that Capitol may not be able to complete its various proposed divestitures, mergers and consolidations of certain of its subsidiary banks or, if completed, realize the anticipated benefits of the proposed transactions;

F-6

CAUTIONS REGARDING FORWARD-LOOKING STATEMENTS—Continued

· The risk of additional future losses if the proceeds Capitol receives upon the liquidation of assets are less than the carrying value of such assets;

· Restrictions or limitations on access to funds from subsidiaries and potential obligations to contribute additional capital to Capitol's subsidiaries, which may restrict its ability to make payments on its obligations;

· Administrative or enforcement actions of banking regulators in connection with any material failure of Capitol or its subsidiary banks to comply with banking laws, rules or regulations or formal enforcement actions with regulatory agencies;

· The costs and effects of litigation, investigations, inquiries or similar matters, or adverse facts and developments related thereto;

· The possibility of the Federal Deposit Insurance Corporation ("FDIC") or an applicable state banking regulator seizing one or more of Capitol's subsidiary banks;

· The possibility of the FDIC assessing Capitol's banking subsidiaries for any cross-guaranty liability;

· Capitol's compliance with the terms of its written agreement with the Federal Reserve Bank, amendments thereto, or subsequent regulatory agreements;

· The current prohibition of Capitol's subsidiary banks to pay dividends to Capitol without prior written authorization from regulatory agencies;

· The risk that the realization of deferred tax assets may not occur;

· The risk that Capitol could have an "ownership change" under Section 382 of the Internal Revenue Code, which could impair its ability to timely and fully utilize its net operating losses for tax purposes and so-called built-in losses that may exist if such an "ownership change" occurs;

· The risks associated with the high concentration of commercial real estate loans within Capitol's consolidated loan portfolio, along with other credit risks associated with individual large loans;

· The concentration of Capitol's nonperforming assets by loan type in certain geographic regions and with affiliated borrowing groups;

· The overall adequacy of the allowance for loan losses to absorb the amount of actual losses inherent within the loan portfolio;

· The failure of assumptions underlying estimates for the allowance for loan losses and estimation of values of collateral or cash flow projections related to impaired loans;

· Capitol's ability to manage fluctuations in the value of its assets and liabilities and maintain sufficient capital and liquidity to support its operations;

· Fluctuations in the value of Capitol's investment securities;

F-7

CAUTIONS REGARDING FORWARD-LOOKING STATEMENTS—Continued

· Volatility of interest rate sensitive deposits and the uncertainties of future depositor activity regarding potentially uninsured deposits;

· The ability to successfully acquire deposits for funding and the pricing thereof;

· The continued availability of credit facilities provided by Federal Home Loan Banks to Capitol's banking subsidiaries;

· Management's ability to effectively manage interest rate risk and the impact of interest rates, in general, on the volatility of Capitol's net interest income;

· The ability to successfully execute strategies to increase noninterest income;

· The impact of possible future material impairment charges;

· Capitol's ability to adapt successfully to technological changes in order to compete effectively in the marketplace;

· Operational risks, including data processing system failures or fraud;

· The ability to retain senior management experienced in banking and financial services;

· A continuation of unprecedented volatility in the capital markets;

· The decline in commercial and residential real estate values and sales volume and the likely potential for continuing illiquidity in the real estate market;

· The uncertainties in estimating the fair value of developed real estate and undeveloped land relating to collateral-dependent loans and other real estate owned in light of decreased demand for such assets, falling prices and continuing illiquidity in the real estate market;

· The impact of negative developments and disruptions in the credit and lending markets on Capitol's business and the businesses of its customers, as well as on other banks and lending institutions with which Capitol has commercial relationships;

· Continued unemployment, the overall continued national economic weakness, rising commodity prices and the impact on Capitol's customers' savings rates and their ability to service debt obligations;

· Changes in the general economic environment, industry conditions, competition or other factors, either nationally or regionally, that could influence loan demand and repayment, deposit inflows and outflows, the quality of the loan portfolio and loan and deposit pricing;

· The effects of competition from other commercial banks, savings associations, mortgage banking firms, consumer finance companies, credit unions, securities brokerage firms, insurance companies, money market and mutual funds, and other financial institutions operating in Capitol's markets or elsewhere which provide similar services;

F-8

CAUTIONS REGARDING FORWARD-LOOKING STATEMENTS—Continued

· Changes in legislation or regulatory and accounting principles, policies, or guidelines affecting the business conducted by Capitol and/or its operating strategy;

· The impact on Capitol's financial results, reputation and business if it is unable to comply with all applicable federal and state regulations and applicable formal enforcement actions, consent orders, other regulatory actions and any related capital requirements;

· The effect of the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, Emergency Economic Stabilization Act of 2008, the implementation by the Department of the U.S. Treasury and federal banking regulators of a number of programs to address capital and liquidity issues within the banking system and additional programs that may apply to Capitol in the future, all of which may have significant effects on Capitol and the financial services industry;

· Governmental monetary and fiscal policies, as well as legislative and regulatory changes, that may result in the imposition of costs and constraints on Capitol through higher FDIC insurance premiums, significant fluctuations in market interest rates, increases in capital requirements and operational limitations;

· Acts of war or terrorism; and

· Other factors and other information contained in this document and in other reports and filings that Capitol makes with the SEC under the Securities Exchange Act of 1934, as amended, including, without limitation, under the caption "Risk Factors."

For a discussion of these and other risks that may cause actual results to differ from expectations, you should refer to the risk factors and other information in this Annual Report and Capitol's other periodic filings, including quarterly reports on Form 10-Q and current reports on Form 8-K, that Capitol files from time to time with the SEC. All written or oral forward-looking statements that are made by or are attributable to Capitol are expressly qualified by this cautionary notice. You should not place undue reliance on any forward-looking statements, since those statements speak only as of the date on which the statements are made. Capitol undertakes no obligation to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made to reflect the occurrence of new information or unanticipated events, except as may otherwise be required by law.

F-9

Management's Discussion and Analysis of Capitol's Business,

Financial Condition and Results of Operations

This section of the Annual Report is intended to discuss, from management's perspective, matters of importance regarding Capitol's operations, financial position and other matters which have a significant effect on Capitol, its business and its banks. This narrative includes comments about future events and other forward-looking statements, and readers are advised to carefully read the cautionary statement about forward-looking statements which is on page F-6 of this Annual Report.

Capitol operates community banks in a wide variety of markets in eight states, and operates in one business segment, community banking. Capitol's banks are staffed with banking professionals, serving customers who desire professional banking services delivered personally.

Financial Restructuring Plan

On June 22, 2012, Capitol announced the commencement of a voluntary restructuring plan designed to facilitate Capitol's objective of converting existing debt to equity and with the primary objectives of enhancing capital levels, improving liquidity and accelerating Capitol's return to profitability. The initiative includes the opportunity to preserve Capitol's substantial deferred tax assets.

Under the restructuring plan, which was approved by Capitol's board of directors and reviewed with Capitol's primary regulators, existing debt holders were asked to exchange their debt securities for both preferred and common stock of the Corporation (the "Exchange Offer"). Simultaneously, Capitol solicited votes from all debt and equity holders for a prepackaged plan of reorganization (the "Standby Plan") for Capitol and its affiliate, Financial Commerce Corporation ("FCC", formerly known as Michigan Commerce Bancorp Limited), to be commenced in the event that the Exchange Offer was not successful or Capitol believed the transactions contemplated by the Standby Plan to be in the best interests of all stakeholders. The Standby Plan contemplates the conversion of all current trust-preferred security holders, unsecured senior note holders, current preferred equity shareholders and current common equity shareholders into new classes of common stock, which will retain approximately 53% of the voting control and value of the restructured company. Capitol has also been actively seeking to identify external capital sources sufficient to restore all affiliate institutions to "well-capitalized" status in exchange for approximately 47% of the restructured Corporation, which is a critical component of the likelihood of success of the Standby Plan.

When the trust-preferred securities were originally issued, and until December 31, 2010, substantially all of those securities comprised a crucial element of Capitol's compliance with regulatory capital requirements because they were a material component of regulatory capital. As a result of Capitol's weakened financial condition and changes to banking regulations affecting its ability (as well as that of other bank holding companies in the United States) to include any portion of these securities in regulatory capital computations, none of these

F-10

securities are currently included in the Corporation's regulatory capital measurements. The restructuring initiatives will facilitate the conversion of Capitol's trust-preferred securities to equity and represent an efficient opportunity to strengthen the composition of Capitol's capital base by increasing its Tier 1 common and tangible common equity ratios, while also reducing the dividend and interest expense associated with these securities. By increasing its common equity component, and successfully completing the capital raise component of the plan, Capitol expects to have increased capital flexibility to continue to support its community banking platform, strategically take advantage of select market opportunities and implement its long-term strategies.

The Exchange Offer and voting on the Standby Plan expired on July 27, 2012. The results were overwhelmingly in support of the Standby Plan. All classes voted to accept the Standby Plan with all votes substantially exceeding the required thresholds for a successful solicitation. The conditions were not satisfied for the exchange offers to the existing debt holders.

Accordingly, on August 9, 2012, Capitol and FCC proceeded with filing a voluntary joint prepackaged bankruptcy petition (the "Joint Plan of Reorganization") in order to restructure its debt and streamline its capital structure. Capitol's banking subsidiaries were not part of the filing and continue to conduct business on an uninterrupted basis. Capitol was also granted a motion by the Court requiring that trading in the Corporation's senior notes, trust-preferred securities, preferred stock and common stock be restricted to preserve certain of its deferred tax assets.

The Joint Plan of Reorganization provides for the restructuring of Capitol's and FCC's liabilities in a manner designed to maximize recoveries to all creditors and to enhance the financial stability of the reorganized debtors while simultaneously raising new capital from outside investors which can be immediately deployed into the reorganized debtor's subsidiary banks, thus avoiding the disastrous consequences that would result from the seizure of any subsidiary bank. Specifically, the Joint Plan of Reorganization restructures Capitol's senior notes, trust-preferred securities, Series A preferred stock and common stock and leaves unimpaired the rights of all other claim holders. The Joint Plan of Reorganization also contemplates an equity infusion of at least $70 million and up to $115 million which would be pursuant to a separate equity commitment agreement to be entered into by Capitol and certain third-party investors prior to the date on which the Joint Plan of Reorganization becomes effective.

It is important at the outset to emphasize the limited dimensions of this process:

| · | No banking subsidiary of Capitol or their respective depositors will be affected in any way. Each subsidiary bank continues to operate and its customers' deposits remain insured up to the applicable limits by the FDIC. Banks themselves cannot file for reorganization, but bank holding companies can use the reorganization process under federal law. Capitol and FCC are bank holding companies, not banks. |

F-11

| · | Subject to the approval of the Court, all of Capitol's general unsecured creditors will be paid in full in order to maintain the regular course of business at the Corporation's subsidiary banks, as uninterrupted service at the subsidiary bank level is critical to the success of the recapitalization efforts. A loss of customer confidence in the safety of their deposits would have disastrous consequences for the Corporation. |

Financial Statement Impact of Emergence from Bankruptcy

Upon approval and exit from bankruptcy, Capitol's financial statements will be impacted significantly in accordance with "Fresh-Start Accounting" rules. Under these accounting and reporting rules:

| · | Assets are marked to estimated fair value. The difference between the carrying value of loans, investments and other financial assets before fresh-start accounting (including allowance for loan losses) and the estimated fair value as recorded in fresh-start accounting will be accreted/amortized to interest income over the estimated life of the assets. This prospective accounting will result in a reduced level of loan charge-offs compared to historic results due to the adjustment of loan balances and concurrent elimination of the allowance for loan losses under fresh-start accounting. |

| · | Liabilities, including debt, will also be marked to estimated fair value. The difference between the carrying value of deposits, debt and other financial liabilities before the emergence date and the estimated fair value at the emergence date as recorded in fresh-start accounting will be accreted/amortized to interest expense over the estimated life of the liabilities or debt. |

| · | All equity held by stockholders prior to emergence from bankruptcy will be cancelled and retained-earnings deficits eliminated. Upon emergence, new common equity will be issued to certain debt holders. |

Assuming completion of the Joint Plan of Reorganization by June 30, 2013, Capitol's consolidated financial statements as of that date will reflect the assets and liabilities of Capitol, inclusive of adjustments for fresh-start accounting. The consolidated financial statements will also include a Statement of Operations and a Statement of Comprehensive Income for (1) the period from January 1, 2013 until the date of emergence from bankruptcy and (2) the period from the date of emergence until June 30, 2013.

Each bank began as a single-location office, led by a bank president and a team of banking professionals with significant local experience, overseen by an independent board of directors composed of business leaders drawn from the local community. Generally, each bank has significant on-site authority to make decisions which directly affect the customer, such as credit approval and the pricing and structure of both loans and deposits. The philosophy of

F-12

banking as a profession is key to Capitol's model where its banks' customers seek relationships with banking professionals to meet their needs, as opposed to transaction-oriented financial institutions pushing financial products at customers and emphasizing market share.

With Capitol's customer-focused professional banking model, bank development on a national scale has been a natural extension of this business philosophy. Bank development consists of management and oversight of banks in which Capitol has a direct or indirect controlling interest and, through mid-2008, included formation of start-up banks. Capitol's banks were formed with a portion of their start-up capital provided by local investors in the communities of those banks.

Notably, 'market size' is not a strategic factor in Capitol's approach to community banking. Rather, the critical factor is 'people'. Capitol has recognized from its beginning that its banking focus is, and always will be, a people business. Its banks are small in market stature in relation to their competitors, emphasizing personalized banking relationships.

Capitol's community bank model, in a stable economic environment, is intended to maintain a scalable, low overhead structure focused on delivering return-on-equity results, while empowering its individual banks with operating autonomy in all areas impacting the customer relationship. Capitol's centralized 'back-office' functions, which support the banks, are capable of adjusting coverage in concert with the evolution of its banking subsidiaries.

Capitol's relationship with its banks is multidimensional as an investor, mentor and service provider. As an investor, Capitol closely monitors the financial performance of its bank subsidiaries. This mentoring role of providing assistance and guidance when and where necessary to help enhance bank performance is most important for its youngest affiliates where additional guidance is needed. As a service provider, Capitol provides efficient back-office support services which can be performed centrally for all of its banks and which do not involve a direct interface with the bank customer, such as:

· Accounting and taxation services | |

· Management reporting and budgeting | |

· Asset/liability management and reporting | |

· Capital management | |

· Credit administration support | |

· Data processing | |

· Human resources administration | |

· Internal audit | |

· Legal support | |

· Regulatory compliance and risk management |

Some of these functions are performed nationally from a single location, while others are performed regionally, where it is more efficient to have personnel located geographically based on their respective responsibilities in relation to the physical location of the banks.

F-13

Like many community banks, Capitol's banking affiliates have been impacted by the recent national recession and declines in real estate values. Capitol's consolidated financial position has been significantly adversely affected by large net losses in 2012, 2011 and 2010. The net losses resulted primarily from especially large provisions for loan losses and significantly elevated maintenance and collateral protection costs associated with foreclosed properties and other real estate owned. Those net losses resulted in an equity-deficit as of December 31, 2012 and 2011 and a regulatory-capital classification of less than "adequately-capitalized." In addition, numerous banking subsidiaries of Capitol have regulatory capital classifications as "undercapitalized" or "significantly-undercapitalized" at December 31, 2012, due to significant operating losses and capital infusions from Capitol in amounts insufficient to improve their regulatory classification and compliance with the terms of various regulatory enforcement actions between the banks and/or Capitol and their respective regulatory agencies.

Capitol and its affiliates continue ongoing capital preservation efforts, including expense reductions and infrastructure adjustments. For instance, Capitol has merged or divested 52 community banks since 2009. In 2010 through 2012, significant reductions in compensation costs were recognized through efforts which began in 2009 to combine certain banking subsidiaries and reduce staffing. To further streamline bank operations and reduce expenses, Capitol had also consolidated some of its individual bank charters regionally and has plans for potential further charter-consolidation activities in 2013.

In mid-2009, as part of its capital strategies and restructuring activities, Capitol announced plans to selectively divest some of its banks as a means to raise additional capital and redeploy capital resources to its remaining banks. Thirteen bank divestitures were completed prior to 2011, eight bank divestitures and one branch sale were completed during 2011 and four divestitures were completed in 2012. A few additional divestiture transactions have been announced and are expected to be completed in 2013, subject to regulatory approval and other contingencies.

These changes and structural matters are discussed in further detail later in this narrative.

[The remainder of this page intentionally left blank]

F-14

Total assets and revenues of each bank included in continuing operations within Capitol's market regions are summarized below as of and for the years ended December 31, 2012 and 2011 (in $1,000s):

| Total Assets | Total Revenues(1) | |||||||||||||||

| 2012 | 2011 | 2012 | 2011 | |||||||||||||

| Arizona Region: | ||||||||||||||||

| Central Arizona Bank | $ | 32,511 | $ | 41,976 | $ | 1,578 | $ | 2,952 | ||||||||

| Sunrise Bank of Albuquerque | 48,108 | 60,063 | 2,528 | 3,022 | ||||||||||||

| Sunrise Bank of Arizona | 215,387 | 303,513 | 12,695 | 18,420 | ||||||||||||

| Arizona Region Total | 296,006 | 405,552 | 16,801 | 24,394 | ||||||||||||

| Great Lakes Region: | ||||||||||||||||

| Bank of Maumee | 34,977 | 33,495 | 1,620 | 1,904 | ||||||||||||

| Capitol National Bank | 144,737 | 153,938 | 7,268 | 8,537 | ||||||||||||

| Indiana Community Bank | 101,358 | 119,372 | 5,226 | 6,269 | ||||||||||||

| Michigan Commerce Bank | 659,716 | 776,289 | 43,405 | 53,329 | ||||||||||||

| Great Lakes Region Total | 940,788 | 1,083,094 | 57,519 | 70,039 | ||||||||||||

| Nevada Region: | ||||||||||||||||

1st Commerce Bank | 23,577 | 26,375 | 1,077 | 1,185 | ||||||||||||

| Bank of Las Vegas | 260,248 | 318,174 | 12,467 | 13,630 | ||||||||||||

| Nevada Region Total | 283,825 | 344,549 | 13,544 | 14,815 | ||||||||||||

| Southeast Region: | ||||||||||||||||

| Pisgah Community Bank | 24,844 | 28,120 | 830 | 1,178 | ||||||||||||

| Sunrise Bank | 65,548 | 81,119 | 3,461 | 4,580 | ||||||||||||

| Southeast Region Total | 90,392 | 109,239 | 4,291 | 5,758 | ||||||||||||

Parent company and other, net(2) | 7,241 | 9,313 | 2,373 | 19,717 | ||||||||||||

| Consolidated totals--continuing | ||||||||||||||||

| operations | $ | 1,618,252 | $ | 1,951,747 | $ | 94,528 | $ | 134,723 | ||||||||

| (1) | Total revenues is the sum of interest income and noninterest income. |

| (2) | Includes corporate and other nonbank entities. |

[The remainder of this page intentionally left blank]

F-15

For 2012, the net loss attributable to Capitol approximated $25.5 million ($0.62 per share) compared to $45.4 million ($1.17 per share) in 2011 and $225.2 million ($11.16 per share) in 2010. As previously mentioned, Capitol incurred net losses related primarily to significant provisions for loan losses and costs associated with foreclosed properties and other real estate owned. Further, in 2010, a goodwill impairment charge of $55.8 million was recorded (excluding discontinued operations).

The table below presents operating results of each bank included in continuing operations without regard to Capitol's direct or indirect ownership percentage (in $1,000s) and, where applicable, the related rates of return on average equity and assets (none in 2010):

Net Income (Loss) | Return on Average Equity | Return on Average Assets | ||||||||||||||||||||||||||

| 2012 | 2011 | 2010 | 2012 | 2011 | 2012 | 2011 | ||||||||||||||||||||||

| Arizona Region: | ||||||||||||||||||||||||||||

| Central Arizona Bank | $ | (1,383 | ) | $ | (1,797 | ) | (5,592 | ) | ||||||||||||||||||||

| Sunrise Bank of Albuquerque | (810 | ) | (1,871 | ) | (4,189 | ) | ||||||||||||||||||||||

| Sunrise Bank of Arizona | (3,559 | ) | (14,443 | ) | (41,500 | ) | ||||||||||||||||||||||

| Arizona Region Total | (5,752 | ) | (18,111 | ) | (51,281 | ) | ||||||||||||||||||||||

| Great Lakes Region: | ||||||||||||||||||||||||||||

| Bank of Maumee | (470 | ) | (1,089 | ) | (1,254 | ) | ||||||||||||||||||||||

| Capitol National Bank | 370 | 386 | (2,753 | ) | 3.36 | % | 3.63 | % | 0.23 | % | 0.24 | % | ||||||||||||||||

Indiana Community Bank(3) | 380 | (596 | ) | (5,063 | ) | 4.64 | % | 0.35 | % | |||||||||||||||||||

Michigan Commerce Bank(2) | 199 | (20,326 | ) | (73,686 | ) | 1.11 | % | 0.03 | % | |||||||||||||||||||

| Great Lakes Region Total | 479 | (21,625 | ) | (82,756 | ) | |||||||||||||||||||||||

| Nevada Region: | ||||||||||||||||||||||||||||

1st Commerce Bank | (593 | ) | (3,788 | ) | (3,299 | ) | ||||||||||||||||||||||

Bank of Las Vegas(4) | (3,722 | ) | (8,033 | ) | (51,713 | ) | ||||||||||||||||||||||

| Nevada Region Total | (4,315 | ) | (11,821 | ) | (55,012 | ) | ||||||||||||||||||||||

| Southeast Region: | ||||||||||||||||||||||||||||

| Pisgah Community Bank | (1,961 | ) | (3,787 | ) | (9,569 | ) | ||||||||||||||||||||||

Sunrise Bank(1) | (3,794 | ) | (5,604 | ) | (8,451 | ) | ||||||||||||||||||||||

| Southeast Region Total | (5,755 | ) | (9,391 | ) | (18,020 | ) | ||||||||||||||||||||||

Parent company and other, net(5) | (12,102 | ) | 7,977 | (49,539 | ) | |||||||||||||||||||||||

| Consolidated totals-- | ||||||||||||||||||||||||||||

| continuing operations | $ | (27,445 | ) | $ | (52,971 | ) | $ | (256,608 | ) | |||||||||||||||||||

| (1) | Effective July 30, 2010, Peoples State Bank and Sunrise Bank of Atlanta merged with and into Bank of Valdosta. Upon completion of the merger, the surviving bank was renamed Sunrise Bank. Prior to the merger, each bank was either a majority-owned subsidiary of Capitol or majority-owned by a bank-development subsidiary in which Capitol holds a controlling interest. |

| (2) | Effective March 31, 2010, Bank of Auburn Hills and Paragon Bank & Trust merged with and into Michigan Commerce Bank. Prior to the merger, Bank of Auburn Hills and Paragon Bank & Trust were wholly-owned subsidiaries of Capitol. |

| (3) | Effective March 22, 2010, Elkhart Community Bank merged with and into Goshen Community Bank. Upon completion of the merger, the surviving bank was renamed Indiana Community Bank. Prior to the merger, each bank was a wholly-owned subsidiary of Capitol. |

| (4) | Effective January 29, 2010, Black Mountain Community Bank, Desert Community Bank and Red Rock Community Bank merged with and into Bank of Las Vegas. Prior to the merger, each bank was a wholly-owned subsidiary of Capitol. |

| (5) | Includes corporate and other nonbank entities. |

F-16

Operating losses were incurred in 2012 at banks located within all regions except the Great Lakes Region. The largest banking affiliate, Michigan Commerce Bank, returned to profitability in 2012 after experiencing significant losses in 2011 and 2010. Operating results of the Great Lakes-based group of banks amounted to net income of $479,000 in 2012, compared to a net loss of $21.6 million in 2011 and $82.8 million in 2010.

Capitol's other banks showed similar signs of improvement when compared to 2011 and 2010, despite most posting net losses in 2012. Losses continue to be primarily the result of compressed net interest margins, elevated costs associated with foreclosure activities and other real estate owned properties, and management of nonperforming loans.

Most of the amounts discussed in this narrative are based upon the "continuing operations" of Capitol and its consolidated banking subsidiaries. Results of operations for 2011 and 2010 in this report have been adjusted to reflect 2012 sales of banking subsidiaries as "discontinued operations" in order to present operating results on a comparable basis.

The principal revenue sources for Capitol's banks is interest income from loans, noninterest income comprised primarily of service charges on deposit accounts, fees on trust and wealth management accounts, fees on the origination of loans, and gains on the sale of residential mortgage and government-guaranteed commercial loans. Net interest income is the total of all interest income less interest expense and is an important measure used to help determine the amount of net operating revenue for financial institutions. Net operating revenue is the sum of net interest income and noninterest income.

Net interest income totaled $57.9 million in 2012, a 4.3% decrease from the $60.5 million reported in 2011. Net interest income also decreased during 2011 and 2010 by 6.4% and 13.0%, respectively. The declining trend in net interest income has resulted from a reduction in interest earning assets but has been mitigated somewhat by increased yield on average loans, decreased cost of average deposits and a reduction in nonperforming assets. The mitigating factors described above have caused net interest margin to gradually improve to 3.48% in 2012, as compared to 2.93% for 2011 and 2.50% for 2010. Beginning in the third quarter of 2012, consolidated net interest income and net interest margin also benefited from the suspension of interest accrual on trust-preferred securities. Continued reduction in nonperforming loans and normalization of on-balance sheet liquidity, if the risk profiles of the banks improve, should result in additional net interest margin improvement.

During 2012, net interest income exceeded the provision for loan losses by $56.4 million, a significant improvement compared to $24.9 million in 2011. During 2010, provision for loan losses exceeded net interest income by $77.6 million. The provision for loan losses approximated $1.5 million, $35.6 million and $142.2 million in 2012, 2011 and 2010, respectively. The provision for loan losses in 2012 decreased by $34.2 million, or 95.9%, from 2011. The decline is reflective of overall improvement in the loan portfolio's performance, as Capitol experienced signs of stabilizing real estate values and moderately improving levels of economic activity. The lower provision for loan losses is also a result of a $308.5 million decrease in the overall loan portfolio from December 31, 2011 to December 31, 2012 due to

F-17

tepid loan demand. The amount of the provision for loan losses is determined based on management's analysis of amounts necessary for the allowance for loan losses which is discussed in greater detail later in the Capitol's Financial Position section of this narrative.

Total consolidated net operating revenues decreased to approximately $74.8 million in 2012, compared to $100.5 million in 2011 and $85.6 million in 2010. Noninterest income for these years was $16.9 million, $40.0 million and $21.0 million, respectively. Noninterest income was influenced by the following infrequent events in 2011 and 2010; in 2011, Capitol recorded a $16.9 million gain on exchange of trust-preferred securities (see Note K to the consolidated financial statements). In 2010, Capitol realized a gain on exchange of promissory notes for common stock of $1.3 million. When excluding each of these gains, noninterest income decreased 27.0% in 2012 compared to 2011, and increased 17.3% in 2011 compared to 2010.

Service charges on deposit accounts remained stable at approximately $2.5 million in 2012, compared with $2.7 million in 2011 and $3.0 million in 2010. Revenue from trust and wealth management activities decreased about $288,000 in 2012, or 9%, compared to 2011, following a decrease of 23% in 2011 and 15% in 2010. Large decreases in this revenue source in 2011 and 2010 were the result of lower levels of client account balances in the midst of an uncertain economic environment and declines in the value of Capitol's common stock which is held in many fee-based accounts.

Due to the nature of other categories of noninterest income, including gain on the sales of government-guaranteed loans, the origination and sale of residential mortgage loans, and other service fee income, amounts can vary significantly from year to year depending on interest rates, business opportunities and other factors.

Noninterest expense totaled $98.0 million, $121.2 million and $151.3 million in 2012, 2011 and 2010, respectively, exclusive of goodwill impairment charges of $55.8 million in 2010 (none in 2012 and 2011). Such expenses decreased 19.2% in 2012 and 19.9% in 2011, exclusive of the charges related to goodwill impairment. As previously mentioned, in mid-2009 and continuing through 2012, as part of its capital strategies and restructuring activities, Capitol selectively divested of many of its banks as a means to redeploy capital resources to the remaining banks. These restructuring activities also necessitated adjustments to Capitol's infrastructure and resulted in operating expense reductions. Capitol continued to preserve capital in 2012 by undertaking additional cost containment measures and further downsizing of its infrastructure as 52 community banks were either merged or divested of since 2009. Salary and employee benefit expenses have decreased significantly as Capitol has made infrastructure and operational changes at both the bank and corporate level. Other components of noninterest expense associated with Capitol's infrastructure and operations, such as occupancy and equipment rental and maintenance costs, remained stable in 2012 but decreased in 2011, commensurate with bank mergers and divestitures. Primarily as a result of reduced nonperforming assets, costs associated with foreclosed properties and other real estate owned decreased $11.3 million in 2012 and $10.0 million in 2011.

F-18

After performing an annual review for potential goodwill impairment in the fourth quarter of 2010, Capitol concluded that all of its recorded goodwill (approximately $64.5 million, including $8.7 million from discontinued operations) was deemed to be impaired. Accordingly, such amount was written off as of December 31, 2010.

With the exception of 2010, which included the aforementioned goodwill impairment charge, the largest component of noninterest expense is salaries and employee benefits, which approximated $41.3 million, $46.8 million and $55.1 million in 2012, 2011 and 2010, respectively. Salaries and employee benefits decreased $5.4 million, or 11.6%, in 2012, $8.3 million, or 15.1%, in 2011 and $13.2 million, or 19.3%, in 2010. As previously mentioned, employee compensation costs decreased through employee attrition and as a result of Capitol's efforts to streamline staffing at its bank and corporate offices, as well as through the mergers of banking subsidiaries in Capitol's larger markets.

Occupancy costs fluctuated within a narrow range in 2012 and 2010 and decreased $2.1 million, or 18.0%, in 2011. Equipment rent, depreciation and maintenance expense decreased $1.7 million (24.1%) in 2012, $1.2 million (14.0%) in 2011 and $7.9 million (48.6%) in 2010, primarily related to certain lease-related costs incurred in 2009 which had resulted in an increase of about 77% in that year.

Costs associated with foreclosed properties and other real estate owned declined during 2012 to $17.0 million, compared to $28.3 million in 2011 and $38.3 million in 2010. The decrease in these costs was attributed primarily to a reduction in the overall level of other real estate owned, fewer and smaller valuation adjustments associated with other real estate owned due to the gradual stabilization in values in several geographical areas, and reduced holding costs. Since its peak in 2009 of over $102 million, the level of other real estate owned has declined to $81.0 million at December 31, 2012.

Prior to April 1, 2011, FDIC insurance premiums ranged from .07% to .78% of average domestic deposits, depending on an institution's risk classification and other factors. Effective April 1, 2011, banks were assessed FDIC insurance premiums based on net assets (defined by the FDIC for assessment purposes as quarter-to-date average daily total assets less the corresponding amount of Tier 1 capital) rather than based on average deposits. Currently, base assessment rates range from .05% to .35% of net assets and may be adjusted for certain factors. Future assessment rates and methodology are difficult to predict. Capitol's FDIC insurance premiums and other regulatory fees amounted to $6.3 million in 2012, a decrease of $2.5 million, or 28.5%, compared to 2011. These costs decreased $4.2 million during 2011 and increased $2.3 million during 2010. The recent reduction in costs resulted from a steady decline in both total deposits and assets.

F-19

The more significant elements of other noninterest expense consisted of the following (in $1,000s):

| 2012 | 2011 | 2010 | ||||||||||

| Attorney fees | $ | 4,036 | $ | 3,386 | $ | 4,309 | ||||||

| Other professional fees | 2,541 | 2,168 | 3,569 | |||||||||

| Insurance | 1,955 | 2,216 | 1,509 | |||||||||

| Loan and collection expense | 1,150 | 1,626 | 2,389 | |||||||||

Bank services (ATMs, telephone banking and Internet banking) | 1,018 | 1,104 | 1,134 | |||||||||

| Communications | 767 | 865 | 972 | |||||||||

| Travel, lodging and meals | 696 | 814 | 996 | |||||||||

| Paper, printing and supplies | 641 | 768 | 1,043 | |||||||||

| Contracted labor | 639 | 502 | 295 | |||||||||

| Directors' fees | 424 | 1,055 | 1,462 | |||||||||

| Advertising | 418 | 583 | 845 | |||||||||

| Postage | 412 | 500 | 658 | |||||||||

| Other | 3,680 | 5,012 | 5,727 | |||||||||

| Total | $ | 18,377 | $ | 20,599 | $ | 24,908 | ||||||

Professional fees related to management of problem loans declined in 2012. However, total professional fees, including attorney and accounting fees, increased in 2012 due largely to costs directly associated with the Corporation's research, planning, and implementation of its Exchange Offer and Standby Plan for financial restructuring incurred prior to the bankruptcy filing date. Professional and attorney fees related to the restructuring incurred after the bankruptcy filing date are included in reorganization items in the consolidated financial statements. Professional services fees declined in 2011 compared to 2010, due to lower levels of nonperforming assets, reduced foreclosures and fewer bank divestitures. With the exception of insurance expense, which increased in 2011 compared to 2010 due to increased other real estate owned property insurance costs, most other components of noninterest expense detailed above have declined for two consecutive years. The declining trend is commensurate with ongoing cost containment efforts, staffing reductions and streamlining of operations, as previously discussed. The largest decline was in directors' fees which decreased $631,000 in 2012 compared to 2011, primarily as a result of the election in early 2012 by Capitol's directors to waive payment of such fees.

In 2012, 2011 and 2010, an income tax benefit from continuing operations of $152,000, $3.3 million and $7.1 million, respectively, was recognized, related primarily to the intraperiod allocation of income tax expense associated with the gain on sale of bank subsidiaries and the reversal of related income tax valuation allowances associated with the sale of these bank subsidiaries included in discontinued operations. In 2011, Capitol recorded additional income tax expense in the amount of $6.5 million for a liability pertaining to expense deductions as a result of an Internal Revenue Service examination of a prior year. The examination concluded in 2012 and the liability was determined to be $6.4 million. A valuation allowance equal to deferred income tax assets was maintained at December 31, 2012 ($190.5 million), based on management's assessment of the realizability of such assets not meeting the requisite more-likely-than-not criteria. The valuation allowance for deferred income tax assets may reduce income tax expense requirements to the extent of Capitol's profitability in future periods.

F-20

Income from discontinued operations declined for the past two years due to fewer bank divestitures occurring in each year. Gain on sales of banks of $143,000, $5.5 million and $15.8 million were realized in 2012, 2011 and 2010, respectively. Pending bank divestiture activity is discussed later in this narrative.

Consolidated total assets decreased to $1.6 billion in 2012 from $2.2 billion at the end of 2011. The 2012 decrease in total assets resulted primarily from Capitol's previously mentioned divestitures of bank subsidiaries, infrastructure downsizing and ongoing efforts to deleverage its consolidated balance sheet through reductions in portfolio loans and borrowings.

Most of the amounts discussed in this narrative are based upon the "continuing operations" of Capitol and its consolidated bank subsidiaries. Asset and liability balances as of December 31, 2011 and 2010 have been adjusted to reflect recent sales of banking subsidiaries as "discontinued operations" in order to present Capitol's financial position on a comparable basis.

Key to the balance sheet of Capitol is an understanding of its capital position in terms of stated amounts (including any deficit amounts), regulatory capital levels and ratios and the regulatory classification of Capitol and its banking subsidiaries based upon those amounts and ratios, and liquidity (cash and cash equivalents) at December 31, 2012. Those important elements are discussed in a later section of this narrative, Liquidity, Capital Resources and Capital Adequacy.

Relative to Capitol's financial position, as shown on its consolidated balance sheet, the single largest asset category is portfolio loans. Accordingly, the narrative in this section is devoted primarily to loans and related aspects of asset quality.

Net portfolio loans (total portfolio loans after deducting the allowance for loan losses) approximated $1.1 billion at December 31, 2012 and $1.4 billion at December 31, 2011 (excluding discontinued operations). These amounts approximated 70.6% of total consolidated assets (excluding discontinued operations) at December 31, 2012 and 73.2% at December 31, 2011. The decrease in net portfolio loans during 2012 was the result of normal amortization of the loan portfolio and resolutions of troubled or adversely graded loans. The decline was consistent with Capitol's efforts to deleverage its balance sheet by its discontinued operations and to preserve liquidity and capital to the extent reasonably possible.

Capitol's banking subsidiaries have focused on offering commercial loans, consistent with their emphasis on lending to local entrepreneurs, professional service firms and other businesses. All of Capitol's banks use a common credit policy; however, credit decisions are made locally at the banks. Utilization of an enterprise-wide credit policy has several key benefits, such as providing procedural guidance to the banks in the following areas:

| · | Loan underwriting and documentation; |

| · | Credit-granting authority; |

| · | Acceptable collateral and loan structuring; |

F-21

| · | Loan participations amongst bank affiliates or external funding sources when proposals exceed an individual bank's limitations; |

| · | Collections and workouts; |

| · | Troubled debt restructuring; |

| · | Documentation, methodology, process and evaluation of the adequacy of the allowance for loan losses; and |

| · | Establishing corporate credit administration resources to aid the banks when requested or needed. |

General underwriting policies on all construction, commercial real estate, and commercial and industrial loans include analyzing and documenting:

| · | Borrower and project financial data; |

| · | Contingent liabilities and related cash flows; |

| · | Adequacy of liquidity and the components of borrowers' and guarantors' net worth; |

| · | Historic and projected cash flow data, including debt service and vacancy rate sensitivity analysis; |

| · | Character and credit history of borrowers and guarantors, and ability of management regarding the borrower's enterprise; |

| · | Appraisal market valuation, evaluation of local market conditions and related volatility; and |

| · | Proposed use of loan proceeds and potential future uses of the property (for loans secured by real estate). |

Additional lending requirements include regulatory loan-to-value guidelines, which are calculated based on current appraised value for loans that finance properties acquired by the borrower.

Variable-rate commercial loans are preferred in the current low interest rate environment. Most variable-rate commercial loans have stated minimum interest rates and are underwritten with ongoing evaluation, including stress testing the borrower's repayment ability in an increasing rate environment. Since substantially all residential mortgage loan origination volume is underwritten to secondary-market standards and sold into those markets without recourse, Capitol and its banks have no material exposure to hybrid loans such as option-ARMs or subprime credits.

As part of the banks' emphasis on commercial lending, commercial real estate has been sought as the primary source of collateral where possible. This emphasis on commercial real estate as collateral has been a consistent practice of Capitol and its banks from their earliest days of operation, based on the use of appropriate loan-to-value ratios at the time of loan origination, avoidance of large real estate development projects and the belief that, even in volatile economies, commercial real estate historically tends to experience substantially less loss potential than other types of business-asset collateral, such as receivables, inventory and equipment, which can completely evaporate during periods of severe operational stress for small business enterprises.

F-22

Market conditions and values of real estate as collateral had deteriorated significantly, as evidenced by adverse asset quality trends since 2007, resulting in large provisions for loan losses, charge-offs of uncollectible loans and materially negative valuation adjustments of other real estate owned. Other real estate owned arises from a foreclosure proceeding or acceptance of a deed in lieu of foreclosure. Those properties are held for sale at the lower of cost or fair value, less estimated costs to sell, and are reviewed periodically for subsequent impairment.

A loan may be deemed collateral-dependent when repayment is expected solely from liquidation of the loan's collateral. Many of the banking subsidiaries' collateral-dependent impaired loans are located in real estate markets that have been depressed relative to historical valuations, such as Michigan, Arizona, Georgia and Nevada. In those markets, historic appraisal data may reflect less useful information than in other real estate markets in estimating fair value because "comparable" sale transactions, generally used as important points of reference in such appraisals, have been infrequent, may not be "orderly" and may be the result of distressed or forced sale transactions. An increasing trend of non-distressed sales has been observed in these markets, providing comparable sale data which reflects owner-user or income driven valuations. Bank regulatory agencies require Capitol's banks to base their fair value estimates upon appraisal data in substantially all valuations of real estate. As of December 31, 2012 and 2011, such estimates of fair value for collateral-dependent loans and other real estate owned were based on appraisal data or other internal valuation techniques.

Updated appraisals are generally obtained when it has been determined that a loan has become collateral-dependent. Adjustments to the loan's carrying value (or requirements for an allocation of the allowance for loan losses) are made, when appropriate, after the review of an appraisal or evaluation. The timing of when a collateral-dependent loan should be classified as a nonperforming loan is contingent upon several factors, including the performance of the loan, the borrower's payment history and/or results of the bank's review of updated borrower financial information.

When a borrower's performance has deteriorated (for example, the borrower has become delinquent on required payments, the borrower's updated financial information received indicates adverse financial trends or sales/leasing activity is less than expected in the case of multi-unit properties), the loan will be downgraded and, if appropriate, an updated appraisal will be ordered for the loan if it is deemed collateral-dependent. Non-collateral dependent loans will be included within loss contingency pools, in conjunction with estimating the bank's requirements for its allowance for loan losses. Upon receipt and review of updated appraisal data and after any further fair value analysis is completed on those loans deemed to be collateral-dependent, the loans will be further evaluated for appropriate write-down. Negative differences between appraised value, less the estimated costs to sell, and the related carrying value of the loans are charged to the allowance for loan losses, as partial write-downs/charge-offs, on a timely basis. Occasionally, additional potential loss amounts may be included if circumstances exist which may further adversely impact fair value estimates. Internally-developed evaluations may be used when the amount of a loan is less than $250,000. Internally-prepared evaluations may also be used to estimate the current valuation changes

F-23

driven by current economic conditions. Updated fair value information is generally obtained at least annually for collateral-dependent loans and other real estate owned.

A potentially negative aspect of real estate as a primary source of collateral for commercial loans, among other things, is that when some commercial loans develop performance difficulties and reach nonperforming status (i.e., become 90 days past due), the resolution period will likely involve an extended period of time due to the foreclosure process, and may be further extended if real estate sales volume is weak or nonexistent. In contrast, a commercial loan secured by receivables, inventory or equipment, which becomes nonperforming, tends to have a higher loss potential due to the probable rapid dissipation of collateral value.

At December 31, 2012, the allowance for loan losses approximated $63.5 million, or 5.26%, of total portfolio loans outstanding, compared with $85.8 million, or 5.66%, at December 31, 2011. As stated earlier, the allowance is based on significant judgment and management's analysis of inherent losses in the loan portfolio at the balance-sheet date. The level of the allowance for loan losses in recent periods, and the percentage relationship to portfolio loans, remains high due to periods of volatile economic conditions. The decrease in 2012 was the result of the noted slow but stabilizing environment, most specifically for commercial and residential real estate.

As also discussed more extensively in the Critical Accounting Policies section, which appears later in this narrative, the use of estimates in determining the adequacy of the allowance for loan losses is extremely important to an understanding of Capitol's consolidated financial statements.

Capitol had 11 separately-chartered banks at year-end 2012. Each bank separately computes and documents the adequacy of its respective allowance for loan losses. The process of evaluating and determining the adequacy of the allowance for loan losses at each individual bank and on a consolidated basis is labor intensive and requires a high degree of judgment. It is possible that others, given the same information, may at any point in time reach different reasonable conclusions.

The allowance for loan losses reflects management's judgment of probable loan losses inherent in the loan portfolio at the balance-sheet date. Management uses a disciplined process to establish the allowance for loan losses each quarter, which includes estimating the reserves needed for each segment of the loan portfolio, including loans analyzed individually and loans analyzed on a pooled basis, for probable future losses. Loans are also categorized based on the type of collateral which secures such loans. Additions to the allowance for loan losses are made by charges to the provision for loan losses. Credit exposures deemed to be uncollectible are charged against the allowance for loan losses, and recoveries of previously charged-off amounts are credited to the allowance for loan losses.

F-24

The establishment of the allowance for loan losses relies on a consistent estimation process that requires multiple layers of management review and judgment, and factors in changes in economic conditions, loan volume and concentrations and collateral values, among other influences. The banks' allowance for loan losses is also dependent on, and sensitive to, risk ratings assigned to all loans, especially those that are individually evaluated, as well as economic assumptions and delinquency trends driving historical loss experience. Individual loan risk ratings are evaluated based on each lending relationship and situation by experienced senior credit officers and independently reviewed on a regular basis by both internal loan review officers and external regulatory examiners to confirm compliance with applicable internal and external standards. Furthermore, management closely monitors differences between estimated and actual incurred loan losses. This monitoring process includes periodic assessments by senior management of loan portfolios and the models used to estimate incurred losses in those portfolios.

To determine the balance of the allowance for loan losses, loans are pooled by class on the basis of collateral types. Losses are modeled using historical loss experience and, in some banks, an approach called migration analysis. Capitol uses internally developed models in this process that have recently been validated by independent accounting and consulting firms for conformity with regulatory and authoritative accounting guidance or independent internal sources. The models were independently validated and reviewed to ensure that their theoretical foundation, assumptions, data integrity, computational processes, reporting practices and end-user controls are appropriate and properly documented. Management exercises significant judgment to determine the estimation method and other additional inputs in the modeling process that fit the credit risk characteristics within each portfolio segment. Management must also use judgment in establishing additional input metrics which serve to adjust the historical loss experience for qualitative environmental factors. From time to time, events or economic factors may affect the loan portfolio, causing management to provide additional amounts to or, when appropriate, release balances from the allowance for loan losses account, although at the current time a release of reserves may be prohibited and could be subject to intense regulatory scrutiny and approval.

In addition, bank regulatory agencies have the authority to review the adequacy of the allowance for loan losses during their periodic examinations of the banks, and to require changes to the recorded allowance for loan losses, superseding management's judgment. Those changes or adjustments could involve directing the banks to increase their allowance for loan losses and the banks may be required to reflect the changes or adjustments retroactively. Such changes or adjustments may be required to be made long after management completed its process for the evaluation and documentation of the adequacy of the allowance for loan losses, based on information which was not available at the time that process was completed or based solely on their judgment.

F-25

In 2011, Capitol received regulatory guidance regarding the methodology used to determine the allowance for loan losses at its three largest banks. The guidance recommended that the banks' methodology be modified such that higher loss rates, in part derived from loan charge-off history on the substandard risk-rated loan pools, be applied to the "watch" rated loans as well as the "pass" (or acceptable credit quality) rated loan pool, the largest category of loans in the banks' portfolios. Corporate management, in frequent dialogue with the regulators concerning their guidance for determining the allowance for loan losses, evaluated other methodologies permissible in accordance with regulatory pronouncements and industry practices. As a result of the evaluation, Capitol began to phase in migration analysis effective December 31, 2011. Since that time, migration analyses have been used, at least in part, to conclude on the appropriate level for the allowance for loan losses at its three largest banks. The calculations are tailored to each individual bank in order to account for loss histories and market conditions within the markets served by the bank. The time periods for the loan portfolio look-back period were selected in such a manner as to capture losses incurred based on current economic conditions.

Over the past year, an independent professional accounting and consulting firm has validated the migration technique used by Capitol's largest banks for two accounting periods (December 31, 2011 and September 30, 2012). Based on management's analysis and judgment, and supported by the external firm's validation of the migration technique and the internal validation of the historical loss approach used at the smaller banks, the Corporation believes that the methodologies used in determining the allowance for loan losses meet both regulatory guidance and requirements under United States' generally accepted accounting principles ("U.S. GAAP"), and represents management's best estimate of probable incurred losses in the consolidated loan portfolio as of December 31, 2012.