UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-5669

_________________________________________

FIFTH THIRD FUNDS

(Exact Name of Registrant as Specified in Charter)

_________________________________________

38 Fountain Square Plaza

Cincinnati, Ohio 45263

(Address of Principal Executive Office) (Zip Code)

_________________________________________

Registrant’s Telephone Number, including area code: (800) 282-5706

(Name and Address of Agent for Service)

| E. Keith Wirtz | with a copy to: | |

| President | David A. Sturms | |

| Fifth Third Funds | Vedder Price P.C. | |

| 38 Fountain Square Plaza | 222 North LaSalle Street | |

| Cincinnati, Ohio 45263 | Chicago, IL 60601 | |

Date of fiscal year end: July 31

Date of reporting period: January 31, 2011

Item 1. Report to Stockholders.

SEMI-ANNUAL REPORTS AND ANNUAL REPORTS

This report is authorized for distribution to prospective investors only when preceded or accompanied by a prospectus for the Funds, which contains facts concerning the objectives and policies, management fees, expenses and other information.

A description of the policies and procedures that the Funds use to determine how to vote proxies relating to the portfolio securities and information regarding how the Funds voted relating to portfolio securities during the most recent 12-month period ended June 30 is available without charge, upon request, on the Funds’ website at www.fifththirdfunds.com or by calling 1-800-282-5706 and on the Securities and Exchange Commission’s website at http://www.sec.gov.

Schedules of Investments for periods ending April 30 and October 31 are filed on Form NQ and are available, without charge, on the Securities and Exchange Commission’s website at http://www.sec.gov. They may be viewed at the SEC’s Public Reference Room in Washington, D.C. (information on the operation of the Public Reference Room may be obtained by calling 800.SEC.0330).

Fifth Third Funds are distributed by FTAM Funds Distributor, Inc., member FINRA. FTAM Funds Distributor, Inc. is not an affiliate of Fifth Third Bank, Fifth Third Funds or Fifth Third Asset Management, Inc. Fifth Third Asset Management, Inc. serves as Investment Advisor to Fifth Third Funds and receives a fee for its services.

| TABLE OF CONTENTS | ||

| Economic Outlook and Commentary Section | 1 | |

| Management Discussion of Fund Performance | ||

| Small Cap Growth | 4 | |

| Mid Cap Growth | 5 | |

| Quality Growth | 6 | |

| Dividend Growth | 7 | |

| Micro Cap Value | 8 | |

| Small Cap Value | 9 | |

| All Cap Value | 10 | |

| Disciplined Large Cap Value | 11 | |

| Structured Large Cap Plus | 12 | |

| Equity Index | 13 | |

| International Equity | 14 | |

| Strategic Income | 15 | |

| Fifth Third LifeModel AggressiveSM | 16 | |

| Fifth Third LifeModel Moderately AggressiveSM | 17 | |

| Fifth Third LifeModel ModerateSM | 18 | |

| Fifth Third LifeModel Moderately ConservativeSM | 19 | |

| Fifth Third LifeModel ConservativeSM | 20 | |

| High Yield Bond | 21 | |

| Total Return Bond | 22 | |

| Short Term Bond | 23 | |

| Glossary of Terms | 24 | |

| Schedules of Investments | 27 | |

| Notes to Schedules of Investments | 77 | |

| Statements of Assets and Liabilities | 80 | |

| Statements of Operations | 84 | |

| Statements of Changes in Net Assets | 88 | |

| Statement of Cash Flows | 105 | |

| Financial Highlights | 106 | |

| Notes to Financial Highlights | 128 | |

| Notes to Financial Statements | 129 | |

| Supplemental Information | 152 |

Within the stock market, results reported during the six-month period ended January 31, 2011, included:

| • | A 17.93% advance for the S&P 500® Index1 of large cap stocks. |

| • | A 22.49% advance for the S&P 400® Index1 of mid cap stocks. |

| • | A 20.01% advance for the S&P 600® Index1 of small cap stocks. |

| • | A 16.10% advance for the MSCI EAFE Index1 of international stocks. |

In short, 2010 was quite an eventful year.

In the third and fourth quarters alone, the listing of notable events is long: We witnessed a mid-term election and political shift that reverberated throughout the country; U.S. companies continued to register extraordinary improvements in earnings and balance sheets; WikiLeaks news stories dominated the headlines globally; and economic signs indicated that better times may be ahead.

Within the capital markets during the six-month period ended January 31, 2011, stocks surged almost unabated from late August on, led by lower-quality and higher-risk stocks, especially within the small and mid cap arenas. The increasingly positive economic sentiment sparked demand for cyclical stocks, and growth names generally outperformed value holdings. On the international front, the fervor over European sovereign debt problems cooled, which led to an increased appetite for global equities, along with surging demand for commodities.

Within the fixed income asset class, interest rates (which move in the opposite direction of prices) rose along much of the yield curve, which diminished returns on bonds. Default scares punished municipal bonds even further, but previously out of favor securities, such as those tied to mortgages, posted decent gains as yield-seeking investors waded back into corners of the market that had been all but neglected since 2008. High yield bonds enjoyed a similar boost, but cash returns continued to wallow at miniscule levels as the U.S. Federal Reserve kept its Federal Funds Rate, which anchors money market funds, in a range of 0.0% to 0.25%.

To put an exclamation point on its accommodative philosophy, the Fed also rolled out a second round of quantitative easing (QE2), in which it agreed to purchase up to $600 billion worth of government debt through June 2011. Although many saw this development as a catalyst, we saw it as another reminder that yields on U.S. Treasury securities really have only one direction to go by the end of this year: up.

From a broad economic perspective, however, the economy continued to show improvement throughout the period, albeit at a subdued pace. Policy risk factors dominated our thinking in 2010 and will likely remain on our radar screen in the coming year. Yet in late December, investors received some good news when Congress approved the extension of many of the Bush-era tax cuts.

Feeling better about the macroeconomic landscape, I’m also proud to report that the family of Fifth Third Funds performed well through 2010 and into the first weeks of 2011. Although an adherence to higher-quality investments hindered results in some cases, our portfolio managers’ nimble actions reinforced the benefits of active asset management. Furthermore, given the low-quality nature of the market’s rally through the second half of 2010, we like the prospects for high-quality securities going forward.

1

As for the coming quarters, our expectations on the macro front include:

Average growth in the U.S. gross domestic product (GDP). Amid continued weakness in the housing sector, a dreary employment picture, and extended commitments to debt-reduction, we have grown accustomed to lackluster economic growth in this recovery. Buoyed by the government’s tax relief efforts, however, we’re anticipating a 3.00% growth rate in the GDP—along the lines of its historical average.

Extended job market challenges. Structural complications in the employment market and a lack of a kick-start from the good, but not great, GDP growth rate will leave the unemployment rate mired above 9% for much of 2011.

A banner year for stocks. Corporate fundamentals such as revenue and earnings expanded at historic clips in 2010, and we expect profits to advance another 10% during 2011. Meanwhile, we expect stock prices to outpace earnings per share during the coming year, with the S&P 500® Index roaring nearly 20% higher. Increased merger and acquisition activity could supply an additional jolt to the upward momentum.

Fundamentally sound growth stocks poised to rally. Stocks spent much of 2010 influenced by macro forces, and the resulting volatility suggested a lack of conviction in any one theme. Moving into 2011, an emphasis on sound fundamentals and identifying sectors that have been trading below normal potential—including Energy, Financials, and Information Technology—will complement our focus on higher-quality investments.

Higher rates on the horizon. Given the unsatisfactory condition of the U.S. labor market, it’s unlikely that the Fed will pull back on its stimulative efforts until the recovery finds better footing. Yet with the Fed’s balancing act between growth and future inflation risks, investors should be preparing for some tightening moves once QE2 ends in June. Which means tread carefully in the bond market.

A mixed inflationary outlook. Slow growth and the absence of wage pressures will help keep core inflation at bay during 2011. Longer-term, the picture is unsettling, and we’ll be watching for signs of change in the coming quarters. Commodity inflation, on the other hand, will likely be a hot theme as robust economic growth in emerging economies, especially across Asia, will add significantly to demand for oil, paper, metals, and other input materials.

The European Union’s (EU) survival rests on Germany. Sovereign debt woes in Europe will continue to flare up in 2011, stoking questions over the viability of the euro and the very existence of the EU. As the region’s largest—and most successful—economy, Germany and its taxpayers may be asked to shoulder much of the financial burden carried by its EU colleagues.

California dreaming. As bad news swept through the municipal bond market in late 2010, many suggested that California was essentially insolvent. Yet we believe the election of Jerry Brown—a social liberal but a fiscal conservative—as governor could launch the state down a path of fiscal recovery. And a healthy California is important for a healthy U.S.

We certainly appreciated the market’s advances over the past six months, especially on the equity front, and we’re optimistic about 2011. But it’s also important to remember that investments rarely move in a straight line and a concentrated bet represents a concentrated risk. By incorporating Fifth Third Funds into a well-diversified investment plan, I believe you’re investing in high-quality, fundamentally sound stocks and bonds that will position your portfolio well for gains into the future.

Thank you for your confidence in Fifth Third Funds.

E. Keith Wirtz, CFA

President and Chief Investment Officer

Fifth Third Asset Management, Inc.

| 1Terms and Definitions | |

The S&P 500® Stock Index is an index of 500 selected common stocks most of which are listed on the New York Stock Exchange, and is a measure of the U.S. stock market as a whole.

The S&P MidCap 400® Index is an index of 400 selected common stocks that tracks U.S. firms with market capitalizations of $850 million to $3.8 billion.

The S&P SmallCap 600® Index is an index of 600 selected common stocks that tracks U.S. firms with market capitalization of $250 million to $1.2 billion.

The Morgan Stanley Capital International (MSCI) Europe, Australia, and Far East (EAFE)® Index is generally representative of a sample of companies of the market structure of 20 European and Pacific Basin countries.

The above indices do not reflect the deduction of fees associated with a mutual fund such as investment management and fund accounting fees. Investors cannot invest directly in an index, although they can invest in its underlying securities.

Gross Domestic Product (GDP) is the market value of the goods and services produced by labor and property in the United States. GDP is made up of consumer and government purchases, private domestic investments, and net exports of goods and services.

Sovereign Debt is the total amount owed to the holders of bonds issued by a national government.

2

This page intentionally left blank.

3

MANAGEMENT DISCUSSION OF FUND PERFORMANCE (Unaudited)

| Small Cap Growth Fund | |

Following a weak August, which capped a summer of market doldrums, U.S. equities enjoyed a bold move higher through the final five months of the period. The U.S. Federal Reserve played a large role in the rally as it rolled out a second round of quantitative easing—a program in which it will purchase up to $600 billion worth of government bonds through June 2011. The development bolstered investor confidence, as did the resolution of some European sovereign debt issues and improving economic data points.

Small cap stocks generally outperformed large cap holdings during the period and within the Fund, and investments in the Consumer Discretionary contributed significantly to relative gains. More specifically, holdings in the media and specialty retail industries, which tend to benefit from renewed economic optimism, outperformed. Stock selection in the Healthcare sector, one of the poorer performers in the benchmark, further enhanced relative results as investments in healthcare services and providers proved advantageous.

Alternatively, a lack of exposure to oil and natural gas companies, which surged alongside rising oil prices, diminished relative returns from the Energy sector. Within the Industrials sector, poor returns within the transportation infrastructure industry also hindered relative gains.

During the period, the Fund booked considerable profits in the Information Technology sector and directed the proceeds into the Industrials sector, which stands to benefit from continued improvement in the economy, and the Healthcare sector, which showed signs of emerging from a lengthy slump. More broadly, the Fund’s positioning at period-end reflected a preference for companies likely to benefit from a healthy economy, as well as those reporting high quality earnings that reflected solid operational efficiencies.

| Investment Risk Considerations | |

Small capitalization funds typically carry additional risk since smaller companies generally have a higher risk of failure. Historically, smaller companies’ stocks have experienced a greater degree of market volatility than large company stocks on average.

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes.

| Average Annual Total Returns as of January 31, 2011 | |

| 6 Months# | 1 Year | 5 Year | 10 Year | |||||||||||||

| Institutional | 24.15 | % | 34.25 | % | 1.61 | % | 2.67 | % | ||||||||

| Class A Shares | 17.73 | % | 27.16 | % | 0.30 | % | 1.88 | % | ||||||||

| Class B Shares | 18.35 | % | 27.79 | % | 0.38 | % | 1.63 | % | ||||||||

| Class C Shares | 22.39 | % | 32.60 | % | 0.51 | % | 1.61 | % | ||||||||

| Russell 2000® Growth Index1 | 23.25 | % | 34.38 | % | 3.26 | % | 2.92 | % | ||||||||

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, visit www.fifththirdfunds.com.

During the period shown, the total return figures reflect the waiver of a portion of the fund’s advisory or administrative fees. Without such waiver of fees, the total returns would have been lower. As of 1/31/11, the gross expense ratios are 1.28% (Institutional Shares), 1.53% (Class A) and 2.28% (Classes B & C). The total return figures for Institutional Shares reflect a sales charge of 0.0%. The total return figures for A Shares reflect the maximum sales charge of 5.0%. The total return figures for B Shares and C Shares reflect the maximum contingent deferred sales charge (CDSC) of 5.0% and 1.0% within the first year, respectively.

The quoted performance does not reflect the deduction of taxes on Fund distributions or redemption of shares. For the period prior to October 29, 2001, the quoted performance of the Small Cap Growth Fund Institutional Shares reflects the performance of the Kent Small Company Growth Fund Institutional Shares with an inception date of November 2, 1992. Prior to October 29, 2001, the quoted performance for Class A Shares reflects the performance of the Kent Small Company Growth Investment Shares, with an inception date of December 4, 1992, adjusted for the maximum sales charge. The inception date for Class B and Class C Shares is October 29, 2001. For the period prior to October 29, 2001, the performance of Class B and Class C Shares reflect the performance of Institutional Shares of the Kent Small Company Growth Fund, adjusted to reflect expenses and applicable sales charges for Class B and Class C Shares.

# Not Annualized

1 Please refer to Glossary of Terms for additional information.

| Top Ten Equity Holdings as of January 31, 2011* | |

| as a percentage of value of investments† | |

| Deckers Outdoor Corp. | 1.86 | % | |

| North American Energy Partners, Inc. | 1.81 | % | |

| Entropic Communications, Inc. | 1.67 | % | |

| Cardtronics, Inc. | 1.67 | % | |

| Entegris, Inc. | 1.66 | % | |

| Emergency Medical Services Corp. | 1.63 | % | |

| SPS Commerce, Inc. | 1.61 | % | |

| Ares Capital Corp. | 1.61 | % | |

| Align Technology, Inc. | 1.58 | % | |

| Tenneco, Inc. | 1.52 | % | |

| * Long-term securities. | |||

| † Portfolio composition is subject to change. | |||

4

MANAGEMENT DISCUSSION OF FUND PERFORMANCE (Unaudited)

| Mid Cap Growth Fund | |

Corporate earnings enjoyed considerable positive momentum during the period, especially among companies exposed to the rising global economy. Signs of improvement in the U.S. economy further bolstered investor optimism. The impact of such developments were most evident in the mid cap portion of the stock market, which performed slightly better than small cap equities and handily outgained large cap stocks.

Within the Fund, solid stock selection led to outperformance during the period. From a sector perspective, Information Technology supplied a large boost to relative returns as an overweight position, relative to the benchmark. This outperformance was further enhanced by effective stock selection. Notably, investments in the cloud computing industry, in which centralized computer systems handle corporations’ storage and applications needs, accounted for much of the relative advantage.

An overweight stake and effective stock selection in the Industrials sector further enhanced relative returns. More specifically, holdings exposed to the global economic expansion, including select stocks in the transportation, truck manufacturing, and heavy machinery industry, bolstered the Industrials stake.

Alternatively, poor stock selection in the Financials industry hindered relative gains as financial exchange operators lagged amid disappointing trading volumes and softening prices. Exposure in the Utilities sector also dragged down relative returns.

Toward the end of the period, the Fund booked profits in some names that had surged sharply through the second half of 2010, and, in the process, cut stakes in the Information Technology and Consumer Discretionary sectors to underweight positions. Such moves seemed prudent, in the wake of the market’s bold run-up, but also allowed for additional investments in economically sensitive names within the Energy, Materials, and Industrials sectors, along with good growth opportunities in the previously struggling Healthcare sector.

| Investment Risk Considerations | |

Mid capitalization funds typically carry additional risk since mid-size companies generally have a higher risk of failure. Historically, mid-size companies’ stocks have experienced a greater degree of market volatility than large company stocks on average.

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes.

| Average Annual Total Returns as of January 31, 2011 | |

| 6 Months# | 1 Year | 5 Year | 10 Year | |||||||||||||

| Institutional | 27.48 | % | 39.22 | % | 2.18 | % | 1.67 | % | ||||||||

| Class A Shares | 20.97 | % | 31.98 | % | 0.89 | % | 0.90 | % | ||||||||

| Class B Shares | 21.92 | % | 32.91 | % | 0.93 | % | 0.66 | % | ||||||||

| Class C Shares | 25.91 | % | 37.86 | % | 1.19 | % | 0.66 | % | ||||||||

| Russell Midcap® Growth Index1 | 24.73 | % | 34.26 | % | 4.08 | % | 2.75 | % | ||||||||

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, visit www.fifththirdfunds.com.

During the period shown, the total return figures reflect the waiver of a portion of the fund’s advisory or administrative fees. Without such waiver of fees, the total returns would have been lower. As of 1/31/11, the gross expense ratios are 1.26% (Institutional Shares), 1.51% (Class A) and 2.26% (Classes B & C). The total return figures for Institutional Shares reflect a sales charge of 0.0%. The total return figures for A Shares reflect the maximum sales charge of 5.0%. The total return figures for B Shares and C Shares reflect the maximum contingent deferred sales charge (CDSC) of 5.0% and 1.0% within the first year, respectively.

The Fund’s performance in the above table does not reflect the deduction of taxes on Fund distributions, or redemption of shares.

# Not Annualized

1 Please refer to Glossary of Terms for additional information.

| Top Ten Equity Holdings as of January 31, 2011* | |

| as a percentage of value of investments† | |

| Salesforce.com, Inc. | 1.86 | % | |

| Intuit, Inc. | 1.77 | % | |

| Cummins, Inc. | 1.68 | % | |

| FMC Technologies, Inc. | 1.68 | % | |

| CF Industries Holdings, Inc. | 1.61 | % | |

| Alexion Pharmaceuticals, Inc. | 1.58 | % | |

| O’Reilly Automotive, Inc. | 1.58 | % | |

| NetApp, Inc. | 1.57 | % | |

| Informatica Corp. | 1.57 | % | |

| BorgWarner, Inc. | 1.54 | % | |

| * Long-term securities. | |||

| † Portfolio composition is subject to change. | |||

5

MANAGEMENT DISCUSSION OF FUND PERFORMANCE (Unaudited)

| Quality Growth Fund | |

Despite lingering weakness in U.S. consumer confidence and the seemingly ever-elusive housing recovery, domestic stocks performed well during the period. Moreover, sentiment regarding the outlook for the U.S. economy improved broadly, driven in part by a second round of quantitative easing from the U.S. Federal Reserve, in which it committed to buy up to $600 billion worth of government debt through June 2011, and Congress’ extension of the Bush-era tax cuts. Amid such rising optimism, commodities, small cap, and mid cap stocks exhibited market leadership during the period.

Against this backdrop, the Energy sector rallied sharply through the latter months of the period and the Fund suffered from an underweight position, relative to the benchmark, in this sector. Ineffective stock selection in the Consumer Discretionary sector also hindered relative gains, as exposure to low-beta names and a lack of exposure to the boldly advancing E-commerce retailers and services industry overshadowed solid returns from automobile-related holdings. Defensive positioning within the Materials sector further diminished performance.

Conversely, investments in cyclical names within the Industrials sector enhanced relative performance, as companies with considerable exposure to global growth trends excelled. Solid stock selection in the Consumer Staples sector, which lagged the benchmark, also supplied a relative lift.

Looking ahead, moderate economic growth and low inflation expectations should continue to support equities in 2011, although stubborn macroeconomic concerns may cause periodic spikes in volatility. Meanwhile, investors will likely shift their focus to sustainable revenue growth on the corporate front, and any shortfall could lead to a setback in the upward momentum seen through the fourth quarter of 2010 and into the opening month of 2011. As for the Fund, it ended the period with a continued cyclical bias, featuring overweight positions in the Industrials and Consumer Discretionary sectors and underweight stakes in the Information Technology and Energy sectors.

| Investment Risk Considerations | |

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes.

| Average Annual Total Returns as of January 31, 2011 | |

| 6 Months# | 1 Year | 5 Year | 10 Year | |||||||||||||

| Institutional | 20.24 | % | 20.24 | % | 3.11 | % | -0.69 | % | ||||||||

| Class A Shares | 14.06 | % | 13.89 | % | 1.81 | % | -1.45 | % | ||||||||

| Class B Shares | 14.70 | % | 14.01 | % | 1.73 | % | -1.68 | % | ||||||||

| Class C Shares | 18.66 | % | 19.05 | % | 2.07 | % | -1.70 | % | ||||||||

| Russell 1000® Growth Index1 | 20.96 | % | 25.14 | % | 3.91 | % | -0.40 | % | ||||||||

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, visit www.fifththirdfunds.com.

During the period shown, the total return figures reflect the waiver of a portion of the fund’s advisory or administrative fees. Without such waiver of fees, the total returns would have been lower. As of 1/31/11, the gross expense ratios are 1.14% (Institutional Shares), 1.39% (Class A) and 2.14% (Classes B & C). The total return figures for Institutional Shares reflect a sales charge of 0.0%. The total return figures for A Shares reflect the maximum sales charge of 5.0%. The total return figures for B Shares and C Shares reflect the maximum contingent deferred sales charge (CDSC) of 5.0% and 1.0% within the first year, respectively.

The Fund’s performance in the above table does not reflect the deduction of taxes on Fund distributions, or redemption of shares.

# Not Annualized

1 Please refer to Glossary of Terms for additional information.

| Top Ten Equity Holdings as of January 31, 2011* | |

| as a percentage of value of investments† | |

| Apple, Inc. | 4.90 | % | |

| International Business Machines Corp. | 3.12 | % | |

| Oracle Corp. | 2.27 | % | |

| BorgWarner, Inc. | 2.10 | % | |

| Deere & Co. | 2.06 | % | |

| Schlumberger, Ltd. | 1.96 | % | |

| Coca-Cola Co. (The) | 1.96 | % | |

| Ameriprise Financial, Inc. | 1.92 | % | |

| Occidental Petroleum Corp. | 1.86 | % | |

| McDonald’s Corp. | 1.86 | % | |

| * Long-term securities. | |||

| † Portfolio composition is subject to change. | |||

6

MANAGEMENT DISCUSSION OF FUND PERFORMANCE (Unaudited)

| Dividend Growth Fund | |

Optimism around the U.S. economy during the period boosted sentiment among investors, who bid cyclical growth stocks higher. A renewed commitment to an accommodative monetary policy from the U.S. Federal Reserve, which introduced the second round of quantitative easing—a program featuring up to $600 billion worth of government debt purchases by the central bank through June 2011—further whetted the market’s risk appetite. In turn, lower-quality equities outperformed higher-quality names and small and mid cap stocks posted better returns than large cap stocks.

Against such a backdrop, the Fund’s high-quality bias led to its underperformance during the period. Most notably, more defensive holdings within the Consumer Discretionary sector hindered relative gains, as did laggards in the Information Technology and Materials sectors.

Positive contributions came from positions in the Industrials sector, where the Fund’s holdings ranked among some of the sector’s best performers. Solid stock selection in the Utilities sector further enhanced relative results, as did an overweight position, relative to the benchmark, in the Energy sector.

While investors cheer the upturn in the U.S. economy, the challenge is discerning how much of that is directly tied to the abundance of liquidity in the system. Considering the lack of improvements in the employment picture and housing landscape, the argument that the economic gains will continue in a self-sustaining fashion is unconvincing.

Reflecting such a skeptical mindset, the Fund maintained a defensive tone during the period, with a continued emphasis on high-quality stocks. Although such holdings may continue to lag the benchmark in the near-term, the long-term track record of high-quality stocks is sound, especially during periods when the cost of capital—as measured by interest rates on debt—is rising. Given the Fed’s adherence to easy money policies over much of the past decade, chances appear good that rates will move higher in the coming quarters.

| Investment Risk Considerations | |

As a non-diversified Fund, the Fund may invest a greater percentage of assets in a particular company or a smaller number of companies as compared to diversified funds. As a result, the value of the Fund’s shares may fluctuate more than funds invested in a broader range of companies.

| Average Annual Total Returns as of January 31, 2011 | |

| 6 Months# | 1 Year | 5 Year | 10 Year | |||||||||||||

| Institutional | 15.37 | % | 19.36 | % | 2.30 | % | -2.24 | % | ||||||||

| Class A Shares | 9.52 | % | 13.08 | % | 1.03 | % | -2.97 | % | ||||||||

| Class B Shares | 9.78 | % | 13.13 | % | 0.90 | % | -3.27 | % | ||||||||

| Class C Shares | 13.77 | % | 18.11 | % | 1.26 | % | -3.24 | % | ||||||||

| S&P 500 Index1 | 17.93 | % | 22.19 | % | 2.24 | % | 1.30 | % | ||||||||

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, visit www.fifththirdfunds.com.

During the period shown, the total return figures reflect the waiver of a portion of the fund’s advisory or administrative fees. Without such waiver of fees, the total returns would have been lower. As of 1/31/11, the gross expense ratios are 3.26% (Institutional Shares), 3.51% (Class A) and 4.26% (Classes B & C). The total return figures for Institutional Shares reflect a sales charge of 0.0%. The total return figures for A Shares reflect the maximum sales charge of 5.0%. The total return figures for B Shares and C Shares reflect the maximum contingent deferred sales charge (CDSC) of 5.0% and 1.0% within the first year, respectively.

The Fund’s performance in the above table does not reflect the deduction of taxes on Fund distributions, or redemption of shares.

# Not Annualized

1 Please refer to Glossary of Terms for additional information.

| Top Ten Equity Holdings as of January 31, 2011* | |

| as a percentage of value of investments† | |

| International Business Machines Corp. | 3.56 | % | |

| Apple, Inc. | 3.15 | % | |

| Schlumberger, Ltd. | 2.78 | % | |

| Procter & Gamble Co. (The) | 2.55 | % | |

| Apache Corp. | 2.49 | % | |

| MetLife, Inc. | 2.27 | % | |

| JP Morgan Chase & Co. | 2.23 | % | |

| AmerisourceBergen Corp. | 2.10 | % | |

| Ameriprise Financial, Inc. | 2.07 | % | |

| Exxon Mobil Corp. | 2.04 | % | |

| * Long-term securities. | |||

| † Portfolio composition is subject to change. | |||

7

MANAGEMENT DISCUSSION OF FUND PERFORMANCE (Unaudited)

| Micro Cap Value Fund | |

A number of factors helped propel the U.S. equity markets during the period, including the U.S. Federal Reserve’s introduction of a second round of quantitative easing, a program in which the central bank will purchase up to $600 billion worth of government debt by June 2011. In addition, the mid-term elections generated what appeared to be business-friendly results, Congress approved the extension of Bush-era tax cuts, and corporations posted solid earnings results.

While investor enthusiasm mounted during the period, the Fund’s defensive orientation faltered. More specifically, a lack of exposure to the surging pharmaceuticals industry hindered returns from the Healthcare sector, along with laggards in the medical equipment and supplies industry. Within the Industrials sector, a lack of exposure to the surging aerospace and defense industry hindered returns, as did a considerable stake in the trucking industry, which slumped in late 2010 after a strong start to the year.

Alternatively, an overweight position, relative to the benchmark, in the semiconductor and semiconductor capital equipment industry, which rallied behind a bullish rise in capital expenditure plans, boosted relative returns from the Information Technology sector. Elsewhere, exposure in the Financials sector, led by rising investments in banks and insurers, proved advantageous, as did holdings in the Consumer Discretionary sector.

At period-end, the Fund maintained its defensive posture with regard to consumer-related stocks as household debt-reduction efforts and stubbornly high unemployment continued to curtail consumer spending. As a result, the Fund continued to hold overweight stakes in the Consumer Staples and Healthcare sectors. Optimism about global growth trends prompted overweight positions in the Industrials and Information Technology sectors, although the Fund was considerably underweight in the Energy sector, where rising oil prices had pushed many valuations beyond attractive levels.

| Investment Risk Considerations | |

Micro capitalization funds typically carry additional risk since micro-cap companies generally have a higher risk of failure. Historically, micro-cap stocks have experienced a greater degree of market volatility than large company stocks on average.

Value-based investments are subject to the risk that the broad market may not recognize their intrinsic value.

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes.

| Average Annual Total Returns as of January 31, 2011 | |

| 6 Months# | 1 Year | 5 Year | 10 Year | |||||||||||||

| Institutional | 14.80 | % | 30.06 | % | 2.20 | % | 10.10 | % | ||||||||

| Class A Shares | 9.16 | % | 23.01 | % | 0.90 | % | 9.28 | % | ||||||||

| Class B Shares | 9.15 | % | 23.37 | % | 0.97 | % | 9.13 | % | ||||||||

| Class C Shares | 13.15 | % | 28.37 | % | 1.13 | % | 9.14 | % | ||||||||

| Russell 2000® Value Index1 | 18.21 | % | 28.33 | % | 1.90 | % | 8.13 | % | ||||||||

| Russell Microcap® Value Index1 | 17.72 | % | 29.62 | % | -0.97 | % | 8.73 | % | ||||||||

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, visit www.fifththirdfunds.com.

During the period shown, the total return figures reflect the waiver of a portion of the fund’s advisory or administrative fees. Without such waiver of fees, the total returns would have been lower. As of 1/31/11, the gross expense ratios are 1.76% (Institutional Shares), 2.01% (Class A) and 2.76% (Classes B & C). The total return figures for Institutional Shares reflect a sales charge of 0.0%. The total return figures for A Shares reflect the maximum sales charge of 5.0%. The total return figures for B Shares and C Shares reflect the maximum contingent deferred sales charge (CDSC) of 5.0% and 1.0% within the first year, respectively.

The Fund’s performance in the above table does not reflect the deduction of taxes on Fund distributions, or redemption of shares.

# Not Annualized

1 Please refer to Glossary of Terms for additional information.

| Top Ten Equity Holdings as of January 31, 2011* | |

| as a percentage of value of investments† | |

| Celadon Group, Inc. | 1.52 | % | |

| Overhill Farms, Inc. | 1.47 | % | |

| North American Energy Partners, Inc. | 1.43 | % | |

| BofI Holding, Inc. | 1.31 | % | |

| Berkshire Hills Bancorp, Inc. | 1.28 | % | |

| Benihana, Inc. | 1.27 | % | |

| Pike Electric Corp. | 1.27 | % | |

| Ciber, Inc. | 1.24 | % | |

| Greenbrier Cos., Inc. | 1.23 | % | |

| WSFS Financial Corp. | 1.23 | % | |

| * Long-term securities. | |||

| † Portfolio composition is subject to change. | |||

8

MANAGEMENT DISCUSSION OF FUND PERFORMANCE (Unaudited)

| Small Cap Value Fund | |

As signs of growth in the U.S. economy surfaced during the period, growth rates accelerated elsewhere in the world, most notably in emerging markets such as China. In turn, corporate earnings steadily improved. Meanwhile, the U.S. Federal Reserve, in an effort to encourage investment in riskier assets, rolled out a second round of quantitative easing—a program in which it agreed to purchase up to $600 billion worth of government bonds through June 2011.

Although the U.S. unemployment rate remained stubbornly high and inflationary pressures pushed energy and commodity prices higher, investor sentiment soared from late August 2010 on. Accordingly, stocks rallied as the capping of the BP oil spill in the Gulf of Mexico and the mid-term elections supplied additional positive catalysts.

The Fund’s performance was diminished by stock selection in the Energy sector as a result of investments in the natural gas industry where prices stagnated or declined. The Fund also suffered from a lack of exposure to rising coal mining stocks. Ineffective stock selection among commercial banks weighed on returns from the Financials sector. In the Materials sector, lagging investments in chemical and paper producers overshadowed gains generated by an overweight position, relative to the benchmark, in the precious metals industry.

Conversely, an overweight stake in the Industrials sector supplied a relative lift, bolstered by gainers in the electrical equipment and aerospace and defense industries. Solid stock selection among semiconductor-related names enhanced relative gains from the Information Technology sector, while investments in the wireless communications space helped relative results from the Telecommunication Services sector.

During the period, improved confidence in the U.S. economic recovery prompted a reduction in exposure to the traditionally defensive Consumer Staples sector and a greater stake in the economically sensitive Consumer Discretionary sector. The Fund also modestly upped its weightings to the Industrials and previously beaten down Healthcare sectors, while holdings in the soaring Energy sector and sluggish Financials sector were trimmed.

| Investment Risk Considerations | |

Small capitalization funds typically carry additional risk since smaller companies generally have a higher risk of failure. Historically, smaller companies’ stocks have experienced a greater degree of market volatility than large company stocks on average.

Value-based investments are subject to the risk that the broad market may not recognize their intrinsic value.

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes.

| Average Annual Total Returns as of January 31, 2011 | |

| Inception Date | 6 Months# | 1 Year | 5 Year | Since Inception | ||||||||||||||||

| Institutional | 4/1/03 | 14.04 | % | 20.61 | % | 2.91 | % | 10.14 | % | |||||||||||

| Class A Shares | 4/1/03 | 8.25 | % | 14.23 | % | 1.60 | % | 9.14 | % | |||||||||||

| Class B Shares | 4/1/03 | 8.55 | % | 14.44 | % | 1.56 | % | 9.04 | % | |||||||||||

| Class C Shares | 4/1/03 | 12.47 | % | 19.37 | % | 1.86 | % | 9.02 | % | |||||||||||

| Russell 2000® Value Index1 | 18.21 | % | 28.33 | % | 1.90 | % | 11.48 | % | ||||||||||||

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, visit www.fifththirdfunds.com.

During the period shown, the total return figures reflect the waiver of a portion of the fund’s advisory or administrative fees. Without such waiver of fees, the total returns would have been lower. As of 1/31/11, the gross expense ratios are 1.32% (Institutional Shares), 1.57% (Class A) and 2.32% (Classes B & C). The total return figures for Institutional Shares reflect a sales charge of 0.0%. The total return figures for A Shares reflect the maximum sales charge of 5.0%. The total return figures for B Shares and C Shares reflect the maximum contingent deferred sales charge (CDSC) of 5.0% and 1.0% within the first year, respectively.

The Fund’s performance in the above table does not reflect the deduction of taxes on Fund distributions, or redemption of shares.

# Not Annualized

1 Please refer to Glossary of Terms for additional information.

| Top Ten Equity Holdings as of January 31, 2011* | |

| as a percentage of value of investments† | |

| Coeur d’Alene Mines Corp. | 2.08 | % | |

| FNB Corp. | 1.99 | % | |

| Fresh Del Monte Produce, Inc. | 1.94 | % | |

| Old National Bancorp | 1.84 | % | |

| Rent-A-Center, Inc. | 1.78 | % | |

| KAR Auction Services, Inc. | 1.76 | % | |

| Fred’s, Inc. | 1.75 | % | |

| Great Lakes Dredge & Dock Corp. | 1.75 | % | |

| Cash America International, Inc. | 1.73 | % | |

| * Long-term securities. | |||

| † Portfolio composition is subject to change. | |||

9

MANAGEMENT DISCUSSION OF FUND PERFORMANCE (Unaudited)

| All Cap Value Fund | |

Fears of a double-dip recession, which plagued the U.S. financial markets for much of the summer of 2010, started fading early in the period amid initial hints that the U.S. Federal Reserve would approve a second round of quantitative easing. In fact, the program, featuring up to $600 billion worth of purchases of government bonds through June 2011 by the central bank, was rolled out in November 2010, shortly after investors cheered the Congress-altering outcome of the mid-term elections.

Both developments contributed to a surge in risk tolerance among domestic investors, who were further emboldened by increasing calmness in the previously volatile European debt markets. In turn, lower-quality, smaller cap, and higher-beta stocks generally led the market. This proved advantageous for the Fund, which carried an average weighted market cap of $58.9 billion, smaller than the benchmark’s $66.9 billion average.

In addition, as improving economic confidence sparked investor enthusiasm for more cyclical stocks, the Fund benefited from such holdings in the Industrials and Materials sectors. Overweight positions, relative to the benchmark, in both sectors further aided relative returns, as did an overweight stake in the soaring Energy sector and holdings in the Financials sector, where declining levels of delinquent and non-performing loans helped reinforce improving fundamentals.

Laggards in the Information Technology and consumer-related sectors diminished relative gains. Most notably, earnings disappointments from specialty retailers impacted returns in the Consumer Discretionary sector and tighter margins among food retailers bogged down the Consumer Staples stake.

During the period, the Fund took advantage of sizeable gains in the Industrials sector to book profits and direct many of the proceeds into the Financials sector. Elsewhere, the encouraging economic outlook contributed to overweight positions in the Information Technology, Materials, and Energy sectors, as well as underweight stakes in the Healthcare, Utilities, and Consumer Staples sectors.

| Investment Risk Considerations | |

Small capitalization funds typically carry additional risk since smaller companies generally have a higher risk of failure. Historically, smaller companies’ stocks have experienced a greater degree of market volatility than large company stocks on average.

Value-based investments are subject to the risk that the broad market may not recognize their intrinsic value.

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes.

| Average Annual Total Returns as of January 31, 2011 | |

| 6 Months# | 1 Year | 5 Year | 10 Year | |||||||||||||

| Institutional | 19.27 | % | 20.28 | % | 0.59 | % | 4.88 | % | ||||||||

| Class A Shares | 13.25 | % | 14.05 | % | -0.66 | % | 4.08 | % | ||||||||

| Class B Shares | 13.68 | % | 14.05 | % | -0.67 | % | 3.88 | % | ||||||||

| Class C Shares | 17.67 | % | 19.05 | % | -0.41 | % | 3.87 | % | ||||||||

| Russell 3000® Value Index1 | 16.73 | % | 22.09 | % | 1.02 | % | 3.79 | % | ||||||||

| Russell Midcap® Value Index1 | 19.77 | % | 31.13 | % | 3.66 | % | 8.35 | % | ||||||||

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, visit www.fifththirdfunds.com.

During the period shown, the total return figures reflect the waiver of a portion of the fund’s advisory or administrative fees. Without such waiver of fees, the total returns would have been lower. As of 1/31/11, the gross expense ratios are 1.47% (Institutional Shares), 1.72% (Class A) and 2.47% (Classes B & C). The total return figures for Institutional Shares reflect a sales charge of 0.0%. The total return figures for A Shares reflect the maximum sales charge of 5.0%. The total return figures for B Shares and C Shares reflect the maximum contingent deferred sales charge (CDSC) of 5.0% and 1.0% within the first year, respectively.

The Fund’s performance in the above table does not reflect the deduction of taxes on Fund distributions, or redemption of shares. For the period prior to August 13, 2001, the quoted performance of the All Cap Value Fund Institutional Shares reflects the performance of the Fifth Third/Maxus Equity Fund Institutional Shares with an inception date of April 1, 1999. The inception date for the Class A, Class B and Class C Shares is August 13, 2001. Prior to such date, the quoted performance for Class A Shares reflects performance of the Fifth Third/Maxus Equity Fund Investor Shares and is adjusted for the maximum sales charges. The quoted performance of Class B and Class C Shares reflects the performance of the Fifth Third/Maxus Equity Fund Investor Shares and is adjusted to reflect expenses and applicable sales charges for Class B and Class C Shares.

# Not Annualized

1 Please refer to Glossary of Terms for additional information.

| Top Ten Equity Holdings as of January 31, 2011* | |

| as a percentage of value of investments† | |

| General Electric Co. | 3.84 | % | |

| JP Morgan Chase & Co. | 3.49 | % | |

| ConocoPhillips | 2.43 | % | |

| Citigroup, Inc. | 2.42 | % | |

| Dow Chemical Co. (The) | 2.32 | % | |

| UnitedHealth Group, Inc. | 2.14 | % | |

| Apache Corp. | 2.08 | % | |

| Chevron Corp. | 2.02 | % | |

| Forest Laboratories, Inc. | 1.96 | % | |

| Goldman Sachs Group, Inc. (The) | 1.95 | % | |

| * Long-term securities. | |||

| † Portfolio composition is subject to change. | |||

10

MANAGEMENT DISCUSSION OF FUND PERFORMANCE (Unaudited)

| Disciplined Large Cap Value Fund | |

Investor sentiment improved markedly during the period as the U.S. economy firmed and the U.S. Federal Reserve rolled out a second round of quantitative easing. The program, under which it will buy up to $600 billion worth of government debt through June 2011, inspired investors to turn away from more conservative asset classes such as U.S. Treasury securities and push into riskier investments. Accordingly, small and mid cap stocks generally outperformed large capitalization equities and lower quality stocks generally outperformed higher quality names.

From a sector perspective, pro-cyclical groups tended to outperform during the period, with the Energy, Materials, and Industrials sectors leading the benchmark. Traditionally defensive sectors such as Consumer Staples and Utilities ranked among the poorest performers, along with the Financials sector, which contended with lingering uncertainties in the banking industry.

Within the Fund, advantageous stock selection in the Financials, Telecommunication Services, and Healthcare sectors bolstered relative returns. In addition, an overweight position, relative to the benchmark, in the Energy sector enhanced relative performance, as did underweight stakes in the Consumer Staples and Utilities sectors.

Alternatively, investments in the Consumer Discretionary, Information Technology, and Utilities sectors hindered relative gains, as did a high-quality bias that was present for much of the period.

| Investment Risk Considerations | |

Value-based investments are subject to the risk that the broad market may not recognize their intrinsic value.

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes.

| Average Annual Total Returns as of January 31, 2011 | |

| 6 Months# | 1 Year | 5 Year | 10 Year | |||||||||||||

| Institutional | 16.99 | % | 18.70 | % | 1.31 | % | 3.36 | % | ||||||||

| Class A Shares | 11.00 | % | 12.44 | % | 0.01 | % | 2.57 | % | ||||||||

| Class B Shares | 11.47 | % | 12.52 | % | -0.01 | % | 2.35 | % | ||||||||

| Class C Shares | 15.41 | % | 17.40 | % | 0.29 | % | 2.32 | % | ||||||||

| Russell 1000® Value Index1 | 16.60 | % | 21.54 | % | 0.96 | % | 3.45 | % | ||||||||

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, visit www.fifththirdfunds.com.

During the period shown, the total return figures reflect the waiver of a portion of the fund’s advisory or administrative fees. Without such waiver of fees, the total returns would have been lower. As of 1/31/11, the gross expense ratios are 1.11% (Institutional Shares), 1.36% (Class A) and 2.11% (Classes B & C). The total return figures for Institutional Shares reflect a sales charge of 0.0%. The total return figures for A Shares reflect the maximum sales charge of 5.0%. The total return figures for B Shares and C Shares reflect the maximum contingent deferred sales charge (CDSC) of 5.0% and 1.0% within the first year, respectively.

The Fund’s performance in the above table does not reflect the deduction of taxes on Fund distributions, or redemption of shares.

# Not Annualized

1 Please refer to Glossary of Terms for additional information.

| Top Ten Equity Holdings as of January 31, 2011* | |

| as a percentage of value of investments† | |

| Chevron Corp. | 4.76 | % | |

| UnitedHealth Group, Inc. | 4.35 | % | |

| JP Morgan Chase & Co. | 4.28 | % | |

| General Electric Co. | 4.18 | % | |

| Citigroup, Inc. | 3.70 | % | |

| ConocoPhillips | 3.44 | % | |

| Verizon Communications, Inc. | 3.00 | % | |

| Teva Pharmaceutical Industries, Ltd. | 2.81 | % | |

| Apache Corp. | 2.67 | % | |

| U.S. Bancorp | 2.51 | % | |

| * Long-term securities. | |||

| † Portfolio composition is subject to change. | |||

11

MANAGEMENT DISCUSSION OF FUND PERFORMANCE (Unaudited)

| Structured Large Cap Plus Fund | |

Stocks, in general, performed well during the period as improved economic conditions prompted increased optimism about the economy and corporate earnings. The U.S. Federal Reserve bolstered rising sentiment by rolling out a second round of quantitative easing—a program in which the central bank will purchase up to $600 billion worth of government debt through June 2011. Investors responded by bidding up riskier stocks, particularly low quality names in the small and mid cap universes.

During such periods when higher beta, high risk and low quality stocks lead the market, the quantitative model that drives the Fund’s investment strategy tends to struggle. As such, valuation was the lone factor group to positively impact Fund returns, while earnings quality, capital discipline, and investor sentiment detracted from relative results. Driven by solid performance of valuation factors, the Fund’s return forecasting model successfully identified many companies that went on to outperform the benchmark. Yet it was unsuccessful in identifying companies that proceeded to underperform the benchmark. Stock selection among the laggards, however, helped mitigate the negative impact on overall relative returns.

An underweight position, relative to the benchmark, in the Financials sector also helped Fund performance, along with solid stock selection in the diversified financial services and capital markets industries. Additionally, solid stock selection in the computers and peripherals industry bolstered returns from the Information Technology sector, along with effective investments in the pharmaceuticals industry.

Detractors from performance included ineffective investments in the Utilities sector and the Consumer Staples sector, where poor selection among food producers hurt performance. An overweight stake in the metals and mining industry also limited relative gains from the Materials sector. Additionally, the Fund’s short positions modestly detracted from relative results.

| Investment Risk Considerations | |

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes.

The Fund is subject to risks associated with short selling, which may result in the Fund sustaining greater losses or lower returns than if the Fund held only long positions.

| Average Annual Total Returns as of January 31, 2011 | |

| 6 Months# | 1 Year | 5 Year | 10 Year | |||||||||||||

| Institutional | 18.79 | % | 23.37 | % | -3.31 | % | -1.88 | % | ||||||||

| Class A Shares | 12.82 | % | 16.83 | % | -4.51 | % | -2.62 | % | ||||||||

| Class B Shares | 13.24 | % | 17.21 | % | -4.62 | % | -2.85 | % | ||||||||

| Class C Shares | 17.13 | % | 22.05 | % | -4.31 | % | -2.87 | % | ||||||||

| S&P 500 Index1 | 17.93 | % | 22.19 | % | 2.24 | % | 1.30 | % | ||||||||

| Russell 1000® Index1 | 18.76 | % | 23.33 | % | 2.51 | % | 1.74 | % | ||||||||

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, visit www.fifththirdfunds.com.

During the period shown, the total return figures reflect dividends on short sales, extraordinary expenses and interest expense as well as the waiver of a portion of the fund’s advisory or administrative fees. Without such waiver of fees, the total returns would have been lower. As of 1/31/11, the gross expense ratios are 1.71% (Institutional Shares), 1.96% (Class A) and 2.71% (Classes B & C). The total return figures for Institutional Shares reflect a sales charge of 0.0%. The total return figures for A Shares reflect the maximum sales charge of 5.0%. The total return figures for B Shares and C Shares reflect the maximum contingent deferred sales charge (CDSC) of 5.0% and 1.0% within the first year, respectively.

The Fund’s performance in the above table does not reflect the deduction of taxes on Fund distributions, or redemption of shares. For the period prior to October 29, 2001, the quoted performance of the Structured Large Cap Plus Fund Institutional Shares reflects the performance of the Kent Growth and Income Fund Institutional Shares with an inception date of November 2, 1992. Prior to October 29, 2001, the quoted performance for the Class A Shares reflects performance of the Kent Growth and Income Fund Investment Shares, with an inception date of December 1, 1992, adjusted for maximum sales charge. The inception date of Class B and Class C Shares is October 29, 2001. The quoted performance of Class B and Class C Shares reflects the performance of the Institutional Shares and is adjusted to reflect expenses and applicable sales charges for Class B and Class C Shares.

# Not Annualized

1 Please refer to Glossary of Terms for additional information.

| Top Ten Equity Holdings as of January 31, 2011* | |

| as a percentage of value of investments† | |

| International Business Machines Corp. | 2.32 | % | |

| Microsoft Corp. | 2.26 | % | |

| JP Morgan Chase & Co. | 2.16 | % | |

| Apple, Inc. | 1.87 | % | |

| Chevron Corp. | 1.81 | % | |

| Intel Corp. | 1.70 | % | |

| ConocoPhillips | 1.68 | % | |

| Exxon Mobil Corp. | 1.62 | % | |

| Verizon Communications, Inc. | 1.59 | % | |

| Procter & Gamble Co. (The) | 1.48 | % | |

| * Long-term securities. | |||

| † Portfolio composition is subject to change. | |||

12

MANAGEMENT DISCUSSION OF FUND PERFORMANCE (Unaudited)

| Equity Index Fund | |

The Fund generally seeks to replicate the returns of the S&P 500® Index, but modest underperformance may result from Fund expenses and an assortment of technical factors. One area where an advantage may materialize is in the process surrounding index membership changes. During the period, eight index changes occurred, including three due to merger and acquisition activity and five due to shifts between the benchmark and the S&P 400® Index of mid cap stocks.

More broadly, equities performed well during the period as economic indicators firmed in the U.S. and abroad. Overlooking stubbornly high unemployment and extended struggles in the housing market, investors also cheered continued monetary accommodation from the U.S. Federal Reserve, which introduced a second round of quantitative easing. The program authorized up to $600 billion in purchases of government debt by the central bank through June 2011.

Such conditions fueled a drive for cyclical growth stocks, which tend to perform well as economic growth rates climb. As a result, the Energy, Materials, and Industrials sectors led the index during the period.

Alternatively, returns from traditionally defensive sectors trailed the index’s broader results, although all 10 sectors generated gains on an absolute basis. Laggards included the Utilities, Consumer Staples, and Healthcare sectors.

| Investment Risk Considerations | |

The Fund invests substantially all of its assets in common stock of companies that make up the S&P 500® Index. The Advisor attempts to track the performance of the S&P 500® Index to achieve a correlation of 95% between the performance of the Fund and that of the S&P 500® Index without taking into account the Fund’s expenses.

It is important to remember that there are risks associated with index investing, including the potential risk of market decline, as well as the risks associated with investing in specific companies.

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes.

| Average Annual Total Returns as of January 31, 2011 | |

| 6 Months# | 1 Year | 5 Year | 10 Year | |||||||||||||

| Institutional | 17.89 | % | 22.10 | % | 2.14 | % | 1.11 | % | ||||||||

| Class A Shares | 11.83 | % | 15.69 | % | 0.84 | % | 0.34 | % | ||||||||

| Class B Shares | 12.31 | % | 15.90 | % | 0.75 | % | 0.10 | % | ||||||||

| Class C Shares | 16.16 | % | 20.60 | % | 1.07 | % | 0.07 | % | ||||||||

| Select Shares | 17.80 | % | 22.01 | % | 2.06 | % | 1.02 | % | ||||||||

| Preferred Shares | 17.82 | % | 21.93 | % | 1.99 | % | 0.95 | % | ||||||||

| Trust Shares | 17.74 | % | 21.79 | % | 1.89 | % | 0.86 | % | ||||||||

| S&P 500® Index1 | 17.93 | % | 22.19 | % | 2.24 | % | 1.30 | % | ||||||||

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, visit www.fifththirdfunds.com.

During the period shown, the total return figures reflect the waiver of a portion of the fund’s advisory or administrative fees. Without such waiver of fees, the total returns would have been lower. As of 1/31/11, the gross expense ratios are 0.60% (Institutional Shares), 0.85% (Class A), 0.68% (Select Shares), 0.75% (Preferred Shares), 0.85% (Trust shares) and 1.60% (Classes B & C). The total return figures for Institutional Shares reflect a sales charge of 0.0%. The total return figures for A Shares reflect the maximum sales charge of 5.0%. The total return figures for B Shares and C Shares reflect the maximum contingent deferred sales charge (CDSC) of 5.0% and 1.0% within the first year, respectively.

The Fund’s performance in the above table does not reflect the deduction of taxes on Fund distributions, or redemption of shares. For the period prior to October 29, 2001, the quoted performance of the Equity Index Fund Institutional Shares reflects the performance of the Kent Index Equity Fund Institutional Shares with an inception date of November 2, 1992. Prior to October 29, 2001, the quoted performance for the Class A Shares reflects the performance of the Kent Index Equity Fund Investment Shares, with an inception date of November 25, 1992, adjusted for maximum sales charge. The inception date for the Class B and Class C is October 29, 2001. Prior to such date, quoted performance of Class B and Class C reflects performance of the Institutional Shares and is adjusted to reflect expenses and applicable sales charges for Class B and Class C. The inception date for the Select, Preferred and Trust Shares is October 20, 2003. Prior to such date, quoted performance of the Select, Preferred and Trust Shares reflects performance of the Institutional Shares and is adjusted to reflect expenses for Select, Preferred and Trust Shares.

# Not Annualized

1 Please refer to Glossary of Terms for additional information.

| Top Ten Equity Holdings as of January 31, 2011* | |

| as a percentage of value of investments† | |

| Exxon Mobil Corp. | 3.28 | % | |

| Apple, Inc. | 2.51 | % | |

| General Electric Co. | 1.73 | % | |

| Microsoft Corp. | 1.68 | % | |

| International Business Machines Corp. | 1.62 | % | |

| Chevron Corp. | 1.54 | % | |

| Procter & Gamble Co. (The) | 1.42 | % | |

| JP Morgan Chase & Co. | 1.42 | % | |

| Wells Fargo & Co. | 1.37 | % | |

| Johnson & Johnson | 1.32 | % | |

| * Long-term securities. | |||

| † Portfolio composition is subject to change. | |||

13

MANAGEMENT DISCUSSION OF FUND PERFORMANCE (Unaudited)

| International Equity Fund | |

Better corporate earnings and improving macroeconomic data helped propel international stocks to solid gains during the period. An easing of concerns over European sovereign debt issues bolstered investor confidence, while rising demand for energy and commodities helped push markets higher in countries that produce raw materials, including many emerging market countries.

Within the Fund, solid stock selection in the Financials, Materials, and Industrials sectors contributed positively to relative gains. Most notably, investments in commercial banks and insurers aided the Financials stake, while chemicals and metals and mining companies boosted the Materials exposure. Within the Industrials sector, outperformance among construction and engineering firms led the way.

Alternatively, an underweight position, relative to the benchmark, in the automobiles industry and weak stock selection in the media industry resulted in underperformance in the Consumer Discretionary sector. Overweight stakes in the Telecommunication Services and Utilities sectors—two of the poorest performers in the benchmark—further weighed on relative returns.

From a geographic perspective, investments in Japan, especially within the Financials sector, the Netherlands, and Australia supplied a relative lift. Conversely, ineffective stock selection in France, Hong Kong, and Switzerland proved a drag.

Among the Fund’s factor groups—valuation, earnings quality, and sentiment—valuation and sentiment positively impacted relative returns. Meanwhile, quality factors generated essentially flat results.

| Investment Risk Considerations | |

An investment in this Fund entails the special risks of international investing, including currency exchange fluctuation, government regulations, and the potential for political and economic instability. The Fund’s share price is expected to be more volatile than that of a U.S.-only fund.

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes.

| Average Annual Total Returns as of January 31, 2011 | |

| 6 Months# | 1 Year | 5 Year | 10 Year | |||||||||||||

| Institutional | 17.42 | % | 17.58 | % | 0.55 | % | 3.24 | % | ||||||||

| Class A Shares | 11.51 | % | 11.37 | % | -0.73 | % | 2.50 | % | ||||||||

| Class B Shares | 11.85 | % | 11.37 | % | -0.70 | % | 2.22 | % | ||||||||

| Class C Shares | 15.97 | % | 16.46 | % | -0.45 | % | 2.21 | % | ||||||||

| MSCI EAFE Index, Net1 | 16.10 | % | 15.38 | % | 1.72 | % | 3.75 | % | ||||||||

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, visit www.fifththirdfunds.com.

During the period shown, the total return figures reflect interest expense as well as the waiver of a portion of the fund’s advisory or administrative fees. Without such waiver of fees, the total returns would have been lower. As of 1/31/11, the gross expense ratios are 1.35% (Institutional Shares), 1.60% (Class A) and 2.35% (Classes B & C). The total return figures for Institutional Shares reflect a sales charge of 0.0%. The total return figures for A Shares reflect the maximum sales charge of 5.0%. The total return figures for B Shares and C Shares reflect the maximum contingent deferred sales charge (CDSC) of 5.0% and 1.0% within the first year, respectively.

The Fund’s performance in the above table does not reflect the deduction of taxes on Fund distributions, or redemption of shares.

# Not Annualized

1 Please refer to Glossary of Terms for additional information.

| Top Ten Equity Holdings as of January 31, 2011* | |

| as a percentage of value of investments† | |

| Royal Dutch Shell PLC, Class A | 2.07 | % | |

| Novartis AG | 1.82 | % | |

| BNP Paribas | 1.62 | % | |

| BHP Billiton PLC | 1.57 | % | |

| Allianz SE | 1.57 | % | |

| British American Tobacco PLC | 1.47 | % | |

| AstraZeneca PLC | 1.45 | % | |

| BASF SE | 1.44 | % | |

| Total SA | 1.40 | % | |

| Novo Nordisk AS | 1.32 | % | |

| * Long-term securities. | |||

| † Portfolio composition is subject to change. | |||

14

MANAGEMENT DISCUSSION OF FUND PERFORMANCE (Unaudited)

| Strategic Income Fund | |

Optimism around the U.S. economy during the period boosted sentiment among investors, who bid cyclical growth stocks higher. A renewed commitment to an accommodative monetary policy from the U.S. Federal Reserve, which introduced the second round of quantitative easing—a program featuring up to $600 billion worth of government debt purchases by the central bank through June 2011—further whetted the market’s risk appetite. In turn, most equities rallied sharply and preferred stocks, corporate bonds, and high yield bonds all outperformed U.S. Treasury securities, which posted dismal returns.

Within such a risk inclined environment, the Fund’s equity exposure, investments in mortgage-related Real Estate Investment Trusts (REITs), corporate bonds, and REIT preferred stocks contributed to the Fund’s outperformance. An already underweight exposure, relative to the benchmark, to Treasuries was cut further, while investments in the European Financials sector proved a modest drag.

Watching investors cheer the upturn in the U.S. economy, the challenge is discerning how much of that is directly tied to the abundance of liquidity in the system. Considering the lack of improvements in the employment picture and housing landscape, the argument that the economic gains will continue in a self-sustaining fashion is unconvincing.

Reflecting such a skeptical mindset, the Fund adopted a more defensive tone during the period, selling holdings that reached price targets and adding securities with optimal risk-reward characteristics. For example, it added some sovereign debt issued by New Zealand and Poland—two countries with solid economic dynamics and select convertible bonds, which tend to offer steadier near-term prospective returns and potential exposure to equity gains in the future.

| Investment Risk Considerations | |

Bonds offer a relatively stable level of income, although bond prices will fluctuate providing the potential for principal gain or loss. Intermediate-term, higher-quality bonds generally offer less risk than longer-term bonds and a lower rate of return.

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes.

| Average Annual Total Returns as of January 31, 2011 | |

| 6 Months# | 1 Year | 5 Year | 10 Year | |||||||||||||

| Institutional | 5.78 | % | 12.38 | % | 5.17 | % | 6.22 | % | ||||||||

| Class A Shares | 0.33 | % | 6.61 | % | 3.86 | % | 5.36 | % | ||||||||

| Class B Shares | 0.16 | % | 6.31 | % | 3.83 | % | 5.20 | % | ||||||||

| Class C Shares | 4.22 | % | 11.32 | % | 4.15 | % | 5.15 | % | ||||||||

| Barclays Capital U.S. Aggregate Bond Index1 | 0.20 | % | 5.06 | % | 5.82 | % | 5.68 | % | ||||||||

| Barclays Capital Intermediate Credit Bond Index1 | 1.59 | % | 6.74 | % | 6.17 | % | 6.06 | % | ||||||||

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, visit www.fifththirdfunds.com.

During the period shown, the total return figures reflect the waiver of a portion of the fund’s advisory or administrative fees. Without such waiver of fees, the total returns would have been lower. As of 1/31/11, the gross expense ratios are 1.37% (Institutional Shares), 1.62% (Class A) and 2.37% (Classes B & C). The total return figures for Institutional Shares reflect a sales charge of 0.0%. The total return figures for A Shares reflect the maximum sales charge of 5.0%. The total return figures for B Shares and C Shares reflect the maximum contingent deferred sales charge (CDSC) of 5.0% and 1.0% within the first year, respectively.

The quoted performance does not reflect the deduction of taxes on Fund distributions or redemption of shares. For the period prior to October 22, 2001, the quoted performance for the Fifth Third Strategic Income Fund Institutional Shares reflects the performance of the Fifth Third/Maxus Income Fund Institutional Shares with an inception date of September 1, 1998. Class A, Class B and Class C Shares were initially offered on April 1, 2004, April 1, 2004 and October 29, 2001, respectively. The performance figures for Class A, Class B and Class C Shares for periods prior to such dates represent the performance for the Fifth Third/Maxus Income Fund Investor Shares with an inception date of March 10, 1985 and are adjusted to reflect expenses and applicable sales charges for the respective share class.

# Not Annualized

1 Please refer to Glossary of Terms for additional information.

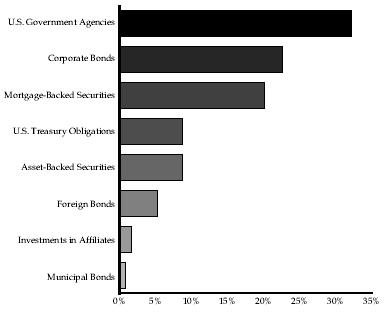

| Fund Holdings as of January 31, 2011 | |

| as a percentage of value of investments† | |

† Portfolio composition is subject to change.

15

MANAGEMENT DISCUSSION OF FUND PERFORMANCE (Unaudited)

| Fifth Third LifeModel Aggressive FundSM | |

As sentiment spread that the U.S. would not tumble into a double-dip recession—a cloud that hung over the financial markets for much of the summer of 2010—investors grew increasingly comfortable with riskier assets during the period. As such, equities across the spectrum posted double-digit gains, led by small cap and mid cap stocks, particularly among growth holdings and lower-quality names. Impressive improvements in corporate earnings further propelled stock prices, which climbed nearly unabated from late August on.

In turn, fixed income investments suffered as prices fell and rates rose. Although the U.S. Federal Reserve kept its overnight lending rate between 0.00% and 0.25%, the key rate served as an anchor for a steepening yield curve, which reflected climbing rates at all other maturities. A new version of quantitative easing, in which the Fed agreed to purchase up to $600 billion worth of government debt by June 2011, did little to slow the ascent, especially at the long end of the yield curve.

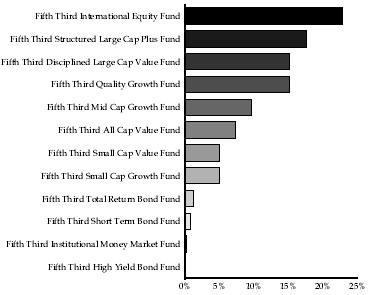

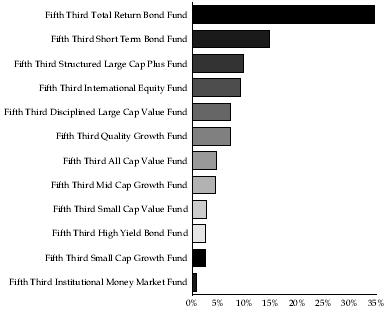

Within the Fund, a considerably overweight position, relative to the benchmark targets, in equities aided relative performance. Within the stock exposure, overweight stakes in mid cap growth and small cap growth equities bolstered relative gains. Alternatively, overweight stakes in international and large cap stocks modestly diminished performance.

At period-end, investors seemed to have settled into the expectation that the U.S. economy was following a path of modest growth. Steeled by the experiences of the recent recession, corporations—especially high-quality entities—reported sound fundamentals and appeared ready to capitalize on opportunities for growth. Fixed income investors, on the other hand, tread carefully as the likelihood for higher rates in the near future loomed even larger.

| Investment Risk Considerations | |

The Fund invests in underlying funds, so its investment performance is directly related to the performance of those underlying funds. Before investing, investors should assess the risks associated with and types of investments made by each of the underlying funds in which the Fund invests.