| UNITED STATES | ||

| SECURITIES AND EXCHANGE COMMISSION | ||

| Washington, D.C. 20549 | ||

| FORM N-CSR | ||

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED | ||

| MANAGEMENT INVESTMENT COMPANIES | ||

| Investment Company Act file number: 811-5669 | ||

| FIFTH THIRD FUNDS | ||

| (Exact Name of Registrant as Specified in Charter) | ||

| 38 Fountain Square Plaza | ||

| Cincinnati, Ohio 45263 | ||

| (Address of Principal Executive Office) (Zip Code) | ||

| Registrant’s Telephone Number, including area code: (800) 282-5706 | ||

| (Name and Address of Agent for Service) | |

| E. Keith Wirtz | with a copy to: |

| President | David A. Sturms |

| Fifth Third Funds | Vedder Price P.C. |

| 38 Fountain Square Plaza | 222 North LaSalle Street |

| Cincinnati, Ohio 45263 | Chicago, IL 60601 |

Date of fiscal year end: July 31

Date of reporting period: January 31, 2012

Item 1. Report to Stockholders.

SEMI-ANNUAL REPORTS AND ANNUAL REPORTS

This report is authorized for distribution to prospective investors only when preceded or accompanied by a prospectus for the Funds, which contains facts concerning the objectives and policies, management fees, expenses and other information.

A description of the policies and procedures that the Funds use to determine how to vote proxies relating to the portfolio securities and information regarding how the Funds voted relating to portfolio securities during the most recent 12-month period ended June 30 is available without charge, upon request, on the Funds’ website at www.fifththirdfunds.com or by calling 1-800-282-5706 and on the Securities and Exchange Commission’s website at http://www.sec.gov.

Schedules of Investments for periods ending April 30 and October 31 are filed on Form NQ and are available, without charge, on the Securities and Exchange Commission’s website at http://www.sec.gov. They may be viewed at the SEC’s Public Reference Room in Washington, D.C. (information on the operation of the Public Reference Room may be obtained by calling 800.SEC.0330).

Fifth Third Funds are distributed by FTAM Funds Distributor, Inc., member FINRA. FTAM Funds Distributor, Inc. is not an affiliate of Fifth Third Bank, Fifth Third Funds or Fifth Third Asset Management, Inc. Fifth Third Asset Management, Inc. serves as Investment Advisor to Fifth Third Funds and receives a fee for its services.

| Fifth Third Funds, like all mutual funds: | |

| • | are NOT FDIC insured |

| • | have no bank guarantee |

| • | may lose value |

Rev. 11/2010

| FACTS | WHAT DOES Fifth Third Funds DO WITH YOUR PERSONAL INFORMATION? | |||

| Why? | Financial companies choose how they share your personal information. Federal law gives consumers the right to limit some but not all sharing. Federal law also requires us to tell you how we collect, share, and protect your personal information. Please read this notice carefully to understand what we do. | |||

| What? | The types of personal information we collect and share depend on the product or service you have with us. This information can include: | |||

| ■ | Social Security number and customer names | |||

| ■ | customer addresses | and tax identification numbers | ||

| ■ | account numbers | and account and transaction history | ||

| When you are no longer our customer, we continue to share your information as described in this notice. | ||||

| How? | All financial companies need to share customers’ personal information to run their everyday business. In the section below, we list the reasons financial companies can share their customers’ personal information; the reasons Fifth Third Funds chooses to share; and whether you can limit this sharing. | |||

| Reasons we can share your personal information | Does Fifth Third Funds share? | Can you limit this sharing? |

| For our everyday business purposes – such as to process your transactions, maintain your account(s), respond to court orders and legal investigations, or report to credit bureaus | Yes | No |

| For our marketing purposes – to offer our products and services to you | Yes | No |

| For joint marketing with other financial companies | No | No |

| For our affiliates’ everyday business purposes – information about your transactions and experiences | Yes | No |

| For our affiliates’ everyday business purposes – information about your creditworthiness | No | No |

| For our affiliates to market to you | No | No |

| For nonaffiliates to market to you | No | No |

| Questions? | Call 800-282-5706 or go to http://fifththirdfunds.com/ |

| Who we are | |||

| Who is providing this notice? | Fifth Third Funds | ||

| What we do | |||

| How does Fifth Third Funds protect my personal information? | To protect your personal information from unauthorized access and use, we use security measures that comply with federal law. These measures include computer safeguards and secured files and buildings. | ||

| How does Fifth Third Funds | We collect your personal information, for example, when you | ||

| collect my personal information? | |||

| ■ | open an account or conduct account | ||

| ■ | transactions or request account information or | ||

| ■ | when our service providers service your account. | ||

| Why can’t I limit all sharing? | Federal law gives you the right to limit only | ||

| ■ | sharing for affiliates’ everyday business purposes – information about your creditworthiness | ||

| ■ | affiliates from using your information to market to you | ||

| ■ | sharing for nonaffiliates to market to you | ||

State laws and individual companies may give you additional rights to limit sharing. | |||

| Definitions | |||

| Affiliates | Companies related by common ownership or control. They can be financial and nonfinancial companies. | ||

■ | Fifth Third Bank, Inc., Fifth Third Securities, Inc., Fifth Third Asset Management, Inc. See www.53.com for a list of all affiliates. | ||

| Nonaffiliates | Companies not related by common ownership or control. They can be financial and nonfinancial companies. | ||

■ | State Street Bank and Trust, Boston Financial Data Services, FTAM Funds Distributor, Inc. | ||

| Joint marketing | A formal agreement between nonaffiliated financial companies that together market financial products or services to you. | ||

■ | None | ||

| Other important information | |||

| The Fifth Third Funds require its service providers to maintain technical, physical, and administrative safeguards. Additionally, when customer information is shared, the Fifth Third Funds require third parties to treat and maintain the privacy of customer information with the same degree of diligence and careful attention required by the Fifth Third Funds. | |||

| Table of Contents | |

| Economic Outlook and Commentary Section | 2 |

| Management Discussion of Fund Performance | |

| Small Cap Growth | 4 |

| Mid Cap Growth | 5 |

| Quality Growth | 6 |

| Dividend Growth | 7 |

| Micro Cap Value | 8 |

| Small Cap Value | 9 |

| All Cap Value | 10 |

| Disciplined Large Cap Value | 11 |

| Structured Large Cap Plus | 12 |

| Equity Index | 13 |

| International Equity | 14 |

| Strategic Income | 15 |

| Fifth Third LifeModel AggressiveSM | 16 |

| Fifth Third LifeModel Moderately AggressiveSM | 17 |

| Fifth Third LifeModel ModerateSM | 18 |

| Fifth Third LifeModel Moderately ConservativeSM | 19 |

| Fifth Third LifeModel ConservativeSM | 20 |

| High Yield Bond | 21 |

| Total Return Bond | 22 |

| Short Term Bond | 23 |

| Glossary of Terms | 24 |

| Schedules of Investments | 26 |

| Notes to Schedules of Investments | 75 |

| Statements of Assets and Liabilities | 76 |

| Statements of Operations | 80 |

| Statements of Changes in Net Assets | 84 |

| Statement of Cash Flows | 101 |

| Financial Highlights | 102 |

| Notes to Financial Highlights | 124 |

| Notes to Financial Statements | 125 |

| Supplemental Information | 149 |

| 1 |

| Our Message to You |

With developments in Europe sending the world’s financial markets bouncing between the polar opposites of “risk-on” and “risk-off” mindsets on a regular basis through the second half of 2011, many investors elected to wait out the volatility in the perceived safety of U.S. Treasury securities. This tactic proved beneficial from a short-term perspective, but made for a challenging landscape for Fifth Third Funds shareholders.

Within the stock market, results reported during the six-month period ended January 31, 2012, included:

| • | A 2.71% advance for the S&P 500 Index1 of large cap stocks. |

| • | A 0.03% advance for the S&P 400 Index1 of mid cap stocks. |

| • | A 3.44% advance for the S&P 600 Index1 of small cap stocks. |

| • | A –10.42% decline for the MSCI EAFE Index1 of international stocks. |

The opening days of the period set the tone for much of the following six months as a Washington debate centered on the fiscal health – current and future – of the country led to an unprecedented downgrade in the credit rating of U.S. Treasury securities. In response, Treasuries rallied. Shortly thereafter, the Euro Zone financial mess revived itself, the stock market started a months-long slide, and political protests swept across the U.S. Again, in response, Treasuries rallied.

By period-end, gains on longer-term Treasuries, which also received a boost from the U.S. Federal Reserve’s Operation Twist program, trounced returns from all other asset classes, which lagged amid the largely “risk-off” sentiment. Initiated in October, Operation Twist featured $400 billion worth of short-term security sales by the Fed, which used the proceeds to purchase longer-term bonds. Elsewhere in the fixed income universe, municipal bonds enjoyed the second half of a year-long recovery from late 2010 woes, but corporate bonds and Mortgage-backed Securities struggled in the flight to safety. Short-term bonds continued to offer miniscule yields as the Fed vowed to keep its overnight lending rate near zero through 2014.

The overarching distaste for risk spread to the equity side of the markets as well, with stocks posting lackluster gains. Large cap growth stocks generally proved to be the best of a mediocre lot as investors sought out steady companies and reliable dividends, although more speculative names staged an impressive January rally to close the gap. International stocks finished the period with considerable losses, as European sovereign debt uncertainties loomed large and many commodity prices lost ground.

More broadly in the U.S., the economy offered less-than-inspiring signs of progress as the housing sector remained weak, secular deleveraging continued unabated, and optimism about the employment scene appeared misguided. Perhaps the most poignant assessment of the country’s economic outlook was offered by the Fed, which pledged to keep its Federal Funds Rate in a range of 0.0% to 0.25% until late 2014.

Given investors’ period-long attraction to Treasuries, the family of Fifth Third Funds struggled through the second half of 2011 and the opening month of 2012, despite our preference for higher-quality investments. But while the risk of further European-driven volatility remains high going forward, especially until the Greece situation is resolved to the point where it provides a framework for other struggling countries, we believe domestic stocks entered 2012 at attractive valuations. Furthermore, as investors weigh potential returns offered by miniscule Treasury yields versus asset classes that advance behind even modest growth rates, we believe the tide will turn back to stocks and non-government backed bonds.

As for the coming year, our expectations on the macro front include:

| Positive but subpar growth in the U.S. gross domestic product (GDP). Talk of a double-dip recession is misguided, but given the sluggishness of key corners of the economy, we’re bracing for GDP to grow at a 2.0% clip in 2012. The biggest risks? A fractured European Union and oil price shocks. | |

| Mixed labor conditions – at best. Structural challenges linger in the employment market, which will contribute to the unemployment rate hovering around 9% for much of the year. Perhaps most importantly, the jobless recovery is resulting in GDP growth that is too slow for a noticeable improvement any time soon. | |

| Inflationary pressures looming. Seemingly lost amid the Euro Zone turmoil has been the fact that the U.S. consumer price index averaged about 3.6% and wholesale prices rose more than 5.0% in 2011. For 2012, we see pricing conditions ripe for an extended period above the historical average of 3.0%, which could be detrimental, for bondholders especially. |

| 2 |

| A constructive environment for stock gains. Building on tremendous financial results over the past three years, we believe U.S. corporations are poised to enjoy further earnings growth in 2012. More specifically, we are projecting a 6% to 10% expansion in profits from the S&P 500 Index. Since share prices have lagged earnings growth for five years, we believe this is the year equities regain some traction and post near-10% gains for the year. U.S. banks ready to rumble. The domestic Financials sector has tripped up many an ambitious money manager since the world financial markets were rocked in 2008. Since we’re more than three years into a bear market for the banking industry, however, we’ve started to warm to the group. Post-blowup regulations are close to finalized, credit problems have mostly subsided, earnings are moving toward normalized potential, and valuations suggest an industry that is grossly under-owned and under-loved – often a recipe for future price gains. | |

| Wariness warranted on bonds. Returns on bonds truly shocked us in 2011. Now that that’s out of the way, we’re defensive on them in 2012 as historically low yields have little room to move lower and the Fed has declared that it’s keeping its key lending rate near zero for the next two years. Furthermore, many investors have examined the Fed’s rhetoric and deduced that rates will be stable this year. Yet, experience has taught us that the markets are puzzling and will zig when everyone expects a zag. As such, we wish to stand away from the crowd on this one. When (not if) rates move higher, the fallout will be surprisingly negative. | |

| Overseas forecast still choppy, and shifting. Europe’s 2011 problems have lapped into 2012. While the fiscal nightmares in countries such as Greece, Portugal, Italy, and Spain continue, the world remains awash in speculation about bailouts, breakups, and European banks’ balance sheets. Not surprisingly, we believe Europe will be mired in a recession through the first half of 2012. Yet by mid year, we believe the spotlight will turn to China, which we anticipate will be reaching a period of economic pause. | |

| The political season is in full swing. Back in the U.S., 2012 is an election year, with the White House in play. Ten months out, our view is simple – the issues are hot, the turnout will be large, and the turnover of elected officials will be high. If correct, this might be good for the country. Regardless, the markets will be paying attention and will likely weigh in during September or October. |

The past six months have been frustrating at times, but as I’ve mentioned before, investments rarely move in a straight line. Ups and downs are to be expected. An essential point to remember, however, is how your investments are positioned for the long haul. And having reviewed the offerings from across the family of Fifth Third Funds, I’m confident that our philosophy of investing in high-quality, fundamentally sound stocks and bonds continues to fit within any well-diversified, long-term investment plan.

| Thank you for your confidence in Fifth Third Funds. |

|

| Keith Wirtz, CFA® |

| President, Fifth Third Funds |

| 1Terms and Definitions | ||

The S&P 500® Stock Index is an index of 500 selected common stocks most of which are listed on the New York Stock Exchange, and is a measure of the U.S. stock market as a whole.

The S&P MidCap 400® Index is an index of 400 selected common stocks that tracks U.S. firms with market capitalizations of $850 million to $3.8 billion.

The S&P SmallCap 600® Index is an index of 600 selected common stocks that tracks U.S. firms with market capitalization of $250 million to $1.2 billion.

The Morgan Stanley Capital International (MSCI) Europe, Australia, and Far East (EAFE)® Index is generally representative of a sample of companies of the market structure of 20 European and Pacific Basin countries.

The above indices do not reflect the deduction of fees associated with a mutual fund such as investment management and fund accounting fees. Investors cannot invest directly in an index, although they can invest in its underlying securities.

Gross Domestic Product (GDP) is the market value of the goods and services produced by labor and property in the United States. GDP is made up of consumer and government purchases, private domestic investments, and net exports of goods and services.

Sovereign Debt is the total amount owed to the holders of bonds issued by a national government.

| 3 |

| Management Discussion of Fund Performance (Unaudited) |

| Small Cap Growth Fund | ||

Both the small cap growth sector and the Fund encountered increased volatility going into August and September timeframe. Concerns over the European debt crisis and the uncertainty surrounding the creditworthiness of U.S. debt instruments spurred a flight away from small cap growth to larger cap issues and cash. From a global economic perspective, the macro-economic picture looked brighter at the end of the six-month period than at the beginning. Europe had some negative experiences, but its economy did not collapse and many of the worst fears in the market were not realized. When the environment proved less bleak than investors and analysts had anticipated, growth-oriented stocks typical of the Fund’s selections experienced an upward surge in the October and early November timeframe.

Stock selection in the Consumer sectors decreased performance, especially in August, resulting in a Fund that was nearly 4% behind its benchmark by September 1. Then, as the market rallied throughout the fall, the Fund surged forward, keeping up with and even outperforming its benchmark at several points along the timeline. Additionally, an underweight to the Biotechnology sector, which did very well for the period, decreased performance on a relative basis.

On the upside, Technology and Healthcare both contributed positively to performance on a relative basis. Within Technology, a significant overweight to the Trading Companies and Distributors industry group was well-positioned to take advantage of last fall’s rally. An overweight to Energy, particularly in gas and oil selections, also contributed to performance.

By the end of the period, the Fund succeeded in making a number of major positioning changes to take advantage of the market’s perceived pro-cyclical bias going into the spring. Most notably, assets in the nettlesome Consumer Staples area were trimmed to zero and repositioned to cyclical areas – most significantly by adding to the overweight in the Industrials sector.

| Investment Risk Considerations | ||

Small capitalization funds typically carry additional risk since smaller companies generally have a higher risk of failure. Historically, smaller companies’ stocks have experienced a greater degree of market volatility than large company stocks on average.

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes.

| Average Annual Total Returns as of January 31, 2012 | ||

| 6 Months # | 1 Year | 5 Year | 10 Year | |||||

| Institutional | –4.00 | % | –1.03% | 0.63% | 3.55% | |||

| Class A Shares | –8.88 | % | –6.21% | –0.65% | 2.77% | |||

| Class B Shares | –9.19 | % | –6.82% | –0.63% | 2.68% | |||

| Class C Shares | –5.11 | % | –1.79% | –0.42% | 2.50% | |||

| Russell 2000® Growth Index 1 | 0.02 | % | 4.94% | 3.19% | 5.62% | |||

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, visit www.fifththirdfunds.com.

During the period shown, the total return figures reflect the waiver of a portion of the fund’s advisory or administrative fees. Without such waiver of fees, the total returns would have been lower. As of 1/31/12, the gross expense ratios are 1.45% (Institutional Shares), 1.70% (Class A) and 2.45% (Classes B & C). The total return figures for Institutional Shares reflect a sales charge of 0.0%. The total return figures for A Shares reflect the maximum sales charge of 5.0%. The total return figures for B Shares and C Shares reflect the maximum contingent deferred sales charge (CDSC) of 5.0% and 1.0% within the first year, respectively.

The Fund’s performance in the above table does not reflect the deduction of taxes on Fund distributions, or redemption of shares.

| # | Not Annualized |

| 1 | Please refer to Glossary of Terms for additional information. |

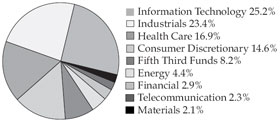

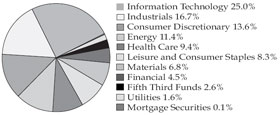

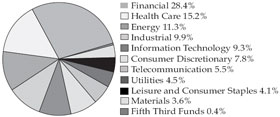

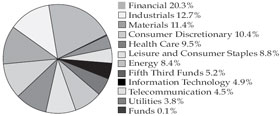

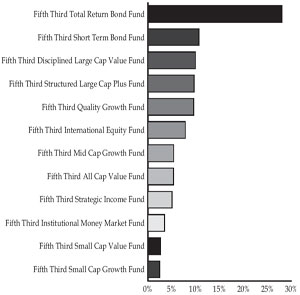

| Sector Investment Concentration as of January 31, 2012 | ||

| as a percentage of total investments | ||

| Top Ten Equity Holdings as of January 31, 2012 * | ||

| as a percentage of value of investments † | ||

| iGate Corp. | 2.68% |

| ServiceSource International, Inc. | 2.64% |

| Body Central Corp. | 2.51% |

| Mellanox Technologies, Ltd. | 2.34% |

| Cardtronics, Inc. | 2.31% |

| Furmanite Corp. | 2.28% |

| Cogent Communications Group, Inc. | 2.28% |

| Global Geophysical Services, Inc. | 2.22% |

| Endologix, Inc. | 2.21% |

| Bankrate, Inc. | 2.21% |

| * | Long-term securities. |

| † | Portfolio composition is subject to change. |

| 4 |

| Management Discussion of Fund Performance (Unaudited) |

| Mid Cap Growth Fund | ||

From a global economic perspective, the macro-economic picture looked brighter at the end of the period than at the beginning. Many of the worst fears in the market were not realized. Europe had some negative experiences, but the continental economy did not collapse. When the environment proved less bleak than investors and analysts had anticipated, mid cap growth stocks experienced an upward surge. With bad news priced into the market over the period – and fears for the most part unjustified – the markets in January began to consider the increased likelihood of more positive economic news ahead.

It’s just this kind of near-term bullishness that provides small and mid cap stocks with an opportunity to transform good news into positive earnings. Each dollar of revenue has a bigger impact on the earnings for mid cap companies than on their large cap counterparts.

For the Fund, good stock selection was the primary reason for the slight outperformance. Throughout the period, the Fund sought to minimize the influence of underperforming stocks, while favoring stocks that demonstrated good earnings and growth momentum. Healthcare proved to be the major contributor to Fund performance. In keeping with the market’s shift toward Biotechnology over the last six months, the Fund maintained an overweight to that sector. That overweight, when combined with positive merger and acquisition activity, drug approvals and broad-based stock selection, further underscored the strength of the Fund’s Health Care selections.

Other positive contributors included Consumer Staples, in which the avoidance of several major firms hobbled by poor earnings reports proved as critical to performance as favorable stock selection. Industrials proved to be a strong performer, as well, especially in the fourth quarter. In contrast, Technology and Consumer Discretionary contributed to a decrease in performance due to stock selection.

Looking ahead to the last half of the fiscal year, the Fund is cyclically biased in order to take advantage of those mid cap growth companies likely to benefit from renewed economic activity and strong earnings growth.

| Investment Risk Considerations | ||

Mid capitalization funds typically carry additional risk since mid-size companies generally have a higher risk of failure. Historically, mid-size companies’ stocks have experienced a greater degree of market volatility than large company stocks on average.

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes.

| Average Annual Total Returns as of January 31, 2012 | ||

| 6 Months # | 1 Year | 5 Year | 10 Year | |||||

| Institutional | 0.08 | % | 7.79% | 2.59% | 4.31% | |||

| Class A Shares | –5.00 | % | 2.09% | 1.28% | 3.52% | |||

| Class B Shares | –5.38 | % | 1.71% | 1.26% | 3.42% | |||

| Class C Shares | –1.32 | % | 6.72% | 1.60% | 3.28% | |||

| Russell Midcap® Growth Index 1 | 0.00 | % | 3.42% | 3.14% | 6.38% | |||

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, visit www.fifththirdfunds.com.

During the period shown, the total return figures reflect the waiver of a portion of the fund’s advisory or administrative fees. Without such waiver of fees, the total returns would have been lower. As of 1/31/12, the gross expense ratios are 1.30% (Institutional Shares), 1.55% (Class A) and 2.30% (Classes B & C). The total return figures for Institutional Shares reflect a sales charge of 0.0%. The total return figures for A Shares reflect the maximum sales charge of 5.0%. The total return figures for B Shares and C Shares reflect the maximum contingent deferred sales charge (CDSC) of 5.0% and 1.0% within the first year, respectively.

The Fund’s performance in the above table does not reflect the deduction of taxes on Fund distributions, or redemption of shares.

| # | Not Annualized |

| 1 | Please refer to Glossary of Terms for additional information. |

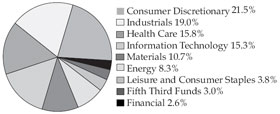

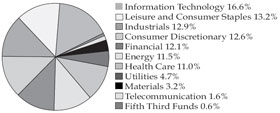

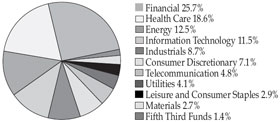

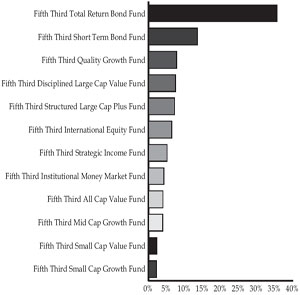

| Sector Investment Concentration as of January 31, 2012 | ||

| as a percentage of total investments | ||

| Top Ten Equity Holdings as of January 31, 2012 * | ||

| as a percentage of value of investments † | ||

| Alexion Pharmaceuticals, Inc. | 2.63% |

| Fastenal Co. | 2.05% |

| Tractor Supply Co. | 1.99% |

| Kansas City Southern | 1.98% |

| TransDigm Group, Inc. | 1.86% |

| FMC Technologies, Inc. | 1.82% |

| Rockwell Automation, Inc. | 1.82% |

| Concho Resources, Inc. | 1.76% |

| Monster Beverage Corp. | 1.72% |

| KLA-Tencor Corp. | 1.68% |

| * | Long-term securities. |

| † | Portfolio composition is subject to change. |

| 5 |

| Management Discussion of Fund Performance (Unaudited) |

| Quality Growth Fund | ||

From a global economic perspective, the macro-economic picture looked brighter at the end of the period than at the beginning. Europe had some negative experiences, but its economy did not collapse and many of the worst fears in the market were not realized. When the environment proved less bleak than investors and analysts had anticipated, growth-oriented stocks typical of the Fund’s selections experienced an upward surge in the October and early November timeframe.

While the Fund did not participate fully in the pro-cyclical bias that emerged in the fall, it subsequently positioned itself to take advantage of improving market sentiment. Although the Fund underperformed relative to its benchmark, it’s important to view its performance in context of last fall. Broad market performance for equities increased approximately 20% from October’s market low to the end of January. However, because the Fund’s fiscal year begins August 1, the portfolio began its year underweight selections that proved to be big movers in October and early November.

Instead, the Fund began the fiscal year defensively positioned with an overweight to Healthcare. Coming through the volatile environment of August and September, the Fund was well-positioned on the downside. When the market began its rapid five-week advance in October, however, the Fund found that it was behind the market’s cyclical rotation.

Against this background, major contributors to performance included selections in the Energy sector that benefited from a combination of rising oil prices and renewed demand for energy services, exploration and production. An underweight to the Natural Gas group, whose prices declined as the price of oil surged, added to performance. Industrials with good earnings also contributed to outperformance relative to the benchmark.

Selections in Consumer Discretionary, which hindered performance, were trimmed from the portfolio. Technology selections, with too much exposure to out-of-favor mid caps, detracted from performance as well. The Fund remains underweight Consumer Staples, due to lackluster earnings reports.

At the six-month point, while the Fund is neutral in Healthcare and Financials, it has added more weight to cyclicals in Energy and Materials – as well as an overweight to Industrials – and is in step with an emerging sense of market optimism about near-term economic prospects.

| Investment Risk Considerations | ||

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes.

| Average Annual Total Returns as of January 31, 2012 | ||

| 6 Months # | 1 Year | 5 Year | 10 Year | |||||

| Institutional | –0.12 | % | 5.51% | 3.57% | 1.75% | |||

| Class A Shares | –5.23 | % | 0.00% | 2.27% | 0.98% | |||

| Class B Shares | –5.63 | % | –0.57% | 2.19% | 0.89% | |||

| Class C Shares | –1.61 | % | 4.43% | 2.53% | 0.74% | |||

| Russell 1000® Growth Index 1 | 2.84 | % | 6.07% | 3.17% | 3.38% | |||

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, visit www.fifththirdfunds.com.

During the period shown, the total return figures reflect the waiver of a portion of the fund’s advisory or administrative fees. Without such waiver of fees, the total returns would have been lower. As of 1/31/12, the gross expense ratios are 1.15% (Institutional Shares), 1.40% (Class A) and 2.15% (Classes B & C). The total return figures for Institutional Shares reflect a sales charge of 0.0%. The total return figures for A Shares reflect the maximum sales charge of 5.0%. The total return figures for B Shares and C Shares reflect the maximum contingent deferred sales charge (CDSC) of 5.0% and 1.0% within the first year, respectively.

The Fund’s performance in the above table does not reflect the deduction of taxes on Fund distributions, or redemption of shares.

| # | Not Annualized |

| 1 | Please refer to Glossary of Terms for additional information. |

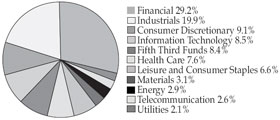

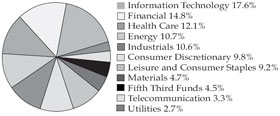

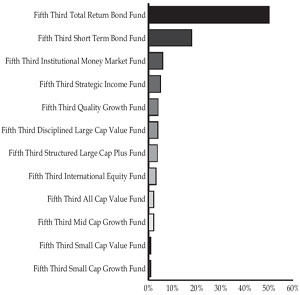

| Sector Investment Concentration as of January 31, 2012 | ||

| as a percentage of total investments | ||

| Top Ten Equity Holdings as of January 31, 2012 * | ||

| as a percentage of value of investments † | ||

| Apple, Inc. | 5.99% |

| International Business Machines Corp. | 4.02% |

| Exxon Mobil Corp. | 3.38% |

| McDonald’s Corp. | 2.60% |

| Schlumberger, Ltd. | 2.50% |

| Coca-Cola Co. (The) | 2.38% |

| Danaher Corp. | 2.12% |

| Occidental Petroleum Corp. | 2.08% |

| EMC Corp. | 1.91% |

| UnitedHealth Group, Inc. | 1.88% |

| * | Long-term securities. |

| † | Portfolio composition is subject to change. |

| 6 |

| Management Discussion of Fund Performance (Unaudited) |

| Dividend Growth Fund | ||

U.S. investors spent much of the period contending with angst originating in Europe. There, officials from governments and central banks debated how to handle the potential insolvency of heavily indebted countries such as Greece and Portugal, while bankers weighed the likely impact of proposals on their balance sheets. Meanwhile, U.S. economic data was generally weak, although it gradually improved over the course of the period.

Stocks finished the period with a tepid advance as bold rallies in October and January made up for a significant shortfall early on. Strong demand for U.S. Treasury securities, fueled by a global flight to safety and the U.S. Federal Reserve’s desire to push interest rates lower, further limited investors’ risk appetites.

Fund performance was hurt by ineffective stock selection in the Healthcare sector, most notably in the avoidance of select large U.S.-based pharmaceutical companies, which posted weak earnings but nonetheless rose amid investors’ thirst for higher yields. Investments in the Consumer Staples sector, where rising commodity costs sparked concerns, and the Energy sector further hindered relative gains. Alternatively, holdings in the Consumer Discretionary sector, especially among more defensive names, and in the Financials and Utilities sectors provided a relative boost.

By period-end, the U.S. economy appeared to be on a course of steady – albeit unspectacular – growth, while corporate earning outlooks reflected modest expectations. Historically, such conditions have led to positive returns from stocks with growing dividends. Moreover, the overall outlook for dividends for the coming quarters is positive, due primarily to the abundance of cash on corporate balance sheets and the broad realization that investors are hungry for yield in the low-rate environment. Against this backdrop, the Fund ended the period with an emphasis on sectors that are leveraged to an improving economy such as Consumer Discretionary and Industrials, as well as a smaller underweight in Financials.

| Investment Risk Considerations | ||

As a non-diversified Fund, the Fund may invest a greater percentage of assets in a particular company or a smaller number of companies as compared to diversified funds. As a result, the value of the Fund’s shares may fluctuate more than funds invested in a broader range of companies.

| Average Annual Total Returns as of January 31, 2012 | ||

| 6 Months # | 1 Year | 5 Year | 10 Year | |||||

| Institutional | 1.32 | % | 3.65% | 0.41% | 1.18% | |||

| Class A Shares | –3.88 | % | –1.79% | –0.86% | 0.43% | |||

| Class B Shares | –4.18 | % | –2.37% | –0.97% | 0.33% | |||

| Class C Shares | –0.22 | % | 2.65% | –0.63% | 0.17% | |||

| S&P 500® Index 1 | 2.71 | % | 4.22% | 0.33% | 3.52% | |||

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, visit www.fifththirdfunds.com.

During the period shown, the total return figures reflect the waiver of a portion of the fund’s advisory or administrative fees. Without such waiver of fees, the total returns would have been lower. As of 1/31/12, the gross expense ratios are 4.20% (Institutional Shares), 4.47% (Class A), 5.19% (Class B) and 5.24% (Class C). The total return figures for Institutional Shares reflect a sales charge of 0.0%. The total return figures for A Shares reflect the maximum sales charge of 5.0%. The total return figures for B Shares and C Shares reflect the maximum contingent deferred sales charge (CDSC) of 5.0% and 1.0% within the first year, respectively.

The Fund’s performance in the above table does not reflect the deduction of taxes on Fund distributions, or redemption of shares.

| # | Not Annualized |

| 1 | Please refer to Glossary of Terms for additional information. |

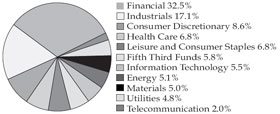

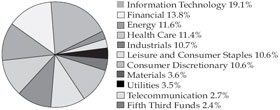

| Sector Investment Concentration as of January 31, 2012 | ||

| as a percentage of total investments | ||

| Top Ten Equity Holdings as of January 31, 2012 * | ||

| as a percentage of value of investments † | ||

| Apple, Inc. | 3.62% |

| CVS Caremark Corp. | 3.10% |

| Macy’s, Inc. | 2.91% |

| McDonald’s Corp. | 2.76% |

| PNC Financial Services Group, Inc. | 2.72% |

| General Electric Co. | 2.66% |

| Chevron Corp. | 2.59% |

| International Business Machines Corp. | 2.59% |

| Pfizer, Inc. | 2.52% |

| Bristol-Myers Squibb Co. | 2.49% |

| * | Long-term securities. |

| † | Portfolio composition is subject to change. |

| 7 |

| Management Discussion of Fund Performance (Unaudited) |

| Micro Cap Value Fund | ||

The slight decline of micro cap value stocks over the six-month period was primarily due to investor doubts relative to the likelihood of a European recession and its potential negative impact on the U.S. markets. Ongoing trepidations about the state of U.S. credit solvency also played a cautionary role that dampened investor enthusiasm. Toward the end of the calendar year, though, when the doom-filled scenarios failed to materialize and some fundamental indicators turned positive –particularly in the area of employment – the markets gained fresh conviction on prospects for domestic growth. While micro cap value stocks benefited during the fourth quarter from this more positive outlook, the time period was not enough to overcome the downbeat trend for the six months since July 31.

Along with the rest of the micro cap value market, the Fund struggled with the prospect of a double dip recession last fall. For most of the period, the Fund was positioned in more defensive selections, which allowed the portfolio to benefit from an underweight to Consumer Discretionary and an overweight to Consumer Staples – two classic defensive sectors. The Fund also typically prefers those higher quality micro cap companies that show that their balance sheets and levels of cash flow are strong.

The Fund’s overweight to Industrials was a strong contributor to performance, despite the fact that Industrials underperformed the benchmark on a relative basis overall. Within Consumer Staples, the Fund’s selection of food retailers proved to be the strongest single contributor, with one food retailer in particular providing the Fund with a large premium following its acquisition by another firm.

Basically every sector on the stock selection side of the equation – with the exception of Healthcare – contributed to portfolio performance for the period. Within Materials, silver mining selections in the Metals and Mining industry group benefited from investor doubts about the economy and delivered strong positive performance. The strongest stock selection area proved to be Technology with an emphasis on the Information Technology Services and Internet Software industry groups.

On the other hand, the Fund’s overweights in Telecommunications and Healthcare and underweights to Financials and Technology detracted from performance.

By the end of the period, though, the Fund was positioned less defensively, with more of an overweight to Industrials. As it assumes a more pro-cyclical posture in the latter half of the fiscal year, the Fund’s strategy remains closely aligned with the current direction of leading economic indicators. Positive economic numbers, notably in the employment statistics, are likely to bode well for the micro cap value universe over the next few months.

| Investment Risk Considerations | ||

Micro capitalization funds typically carry additional risk since micro-cap companies generally have a higher risk of failure. Historically, micro-cap stocks have experienced a greater degree of market volatility than large company stocks on average.

Value-based investments are subject to the risk that the broad market may not recognize their intrinsic value.

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes.

| Average Annual Total Returns as of January 31, 2012 | ||

| 6 Months # | 1 Year | 5 Year | 10 Year | |||||

| Institutional | 2.18 | % | 4.00% | 2.01% | 9.40% | |||

| Class A Shares | –3.14 | % | –1.59% | 0.71% | 8.55% | |||

| Class B Shares | –3.40 | % | –2.04% | 0.74% | 8.56% | |||

| Class C Shares | 0.33 | % | 2.96% | 0.94% | 8.39% | |||

| Russell 2000® Value Index 1 | 0.44 | % | 0.73% | –0.90% | 6.95% | |||

| Russell Microcap® Value Index 1 | –1.25 | % | –2.55% | –3.95% | 6.53%3 | |||

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, visit www.fifththirdfunds.com.

During the period shown, the total return figures reflect the waiver of a portion of the fund’s advisory or administrative fees. Without such waiver of fees, the total returns would have been lower. As of 1/31/12, the gross expense ratios are 1.77% (Institutional Shares), 2.02% (Class A) and 2.77% (Classes B & C). The total return figures for Institutional Shares reflect a sales charge of 0.0%. The total return figures for A Shares reflect the maximum sales charge of 5.0%. The total return figures for B Shares and C Shares reflect the maximum contingent deferred sales charge (CDSC) of 5.0% and 1.0% within the first year, respectively.

The Fund’s performance in the above table does not reflect the deduction of taxes on Fund distributions, or redemption of shares.

| # | Not Annualized |

| 1 | Please refer to Glossary of Terms for additional information. |

| Sector Investment Concentration as of January 31, 2012 | ||

| as a percentage of total investments | ||

| Top Ten Equity Holdings as of January 31, 2012 * | ||

| as a percentage of value of investments † | ||

| Celadon Group, Inc. | 1.49% |

| Vitran Corp., Inc. | 1.48% |

| Prestige Brands Holdings, Inc. | 1.46% |

| PowerSecure International, Inc. | 1.40% |

| Dime Community Bancshares, Inc. | 1.39% |

| North American Energy Partners, Inc. | 1.39% |

| BofI Holding, Inc. | 1.38% |

| BioScrip, Inc. | 1.37% |

| Chesapeake Utilities Corp. | 1.31% |

| Pike Electric Corp. | 1.30% |

| * | Long-term securities. |

| † | Portfolio composition is subject to change. |

| 8 |

| Management Discussion of Fund Performance (Unaudited) |

| Small Cap Value Fund | ||

The narrow advance of small cap value stocks over the six-month period was primarily due to investor doubts last fall relative to a combination of fears concerning the likelihood of a European recession and its potential, negative impact on the U.S. markets. Ongoing trepidations about the state of U.S. credit solvency also played a cautionary role that dampened investor convictions. Toward the end of the calendar year, though, when doom-filled scenarios failed to materialize and some fundamental indicators turned positive – particularly in the area of employment – the small cap value market gained fresh energy and more confidence in the prospects for domestic growth.

For most of the period, the Fund was positioned in more defensive selections, which allowed the portfolio to benefit from its overweight to Consumer Staples – a classic defensive sector. Within Consumer Staples, the Fund’s selection of food retailers proved to be the strongest single contributor, with one food retailer in particular providing the Fund with a large premium following its acquisition by another firm.

Good stock selection was the primary contributor to positive portfolio performance. Selections in Consumer Discretionary, particularly in the Multi-Line and Specialty industry group benefited the Fund, as did selections in three Technology industry groups: Internet Software and Services, Communications Equipment and Electronic Equipment and Instruments. Within Materials, silver and gold mining selections in the Metals and Mining industry group benefited from investor doubts about the economy and delivered strong positive performance. Selections in Energy provided an additional contribution to performance.

In contrast, an underweight to Consumer Discretionary stocks detracted from the Fund, even though the Fund’s stock selection was good. The Fund was also underweight to Financials which proved to be the second strongest sector in the benchmark for the period. The Fund was hurt by an overweight to Energy, especially the Natural Gas industry group, which declined due to falling natural gas prices. The Fund’s overweight to Healthcare and stock selections within this sector decreased performance as well.

By the end of the period, though, the Fund’s reduction in the overweights to Consumer Staples and Energy and a shift to an overweight in Industrials put the portfolio in a pro-cyclical posture to take advantage of any positive economic news, notably in the employment statistics, over the next few months.

| Investment Risk Considerations | ||

Small capitalization funds typically carry additional risk since smaller companies generally have a higher risk of failure. Historically, smaller companies’ stocks have experienced a greater degree of market volatility than large company stocks on average.

Value-based investments are subject to the risk that the broad market may not recognize their intrinsic value.

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes.

| Average Annual Total Returns as of January 31, 2012 | ||

| Inception Date | 6 Months # | 1 Year | 5 Year | Since Inception | |||||||

| Institutional | 4/1/03 | 1.09 | % | 7.08% | 2.86% | 9.79 | % | ||||

| Class A Shares | 4/1/03 | –4.08 | % | 1.42% | 1.54% | 8.87 | % | ||||

| Class B Shares | 4/1/03 | –4.17 | % | 0.97% | 1.46% | 8.77 | % | ||||

| Class C Shares | 4/1/03 | –0.34 | % | 6.03% | 1.82% | 8.68 | % | ||||

| Russell 2000® Value Index 1 | 0.44 | % | 0.73% | –0.90% | 10.20 | % | |||||

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, visit www.fifththirdfunds.com.

During the period shown, the total return figures reflect the waiver of a portion of the fund’s advisory or administrative fees. Without such waiver of fees, the total returns would have been lower. As of 1/31/12, the gross expense ratios are 1.40% (Institutional Shares), 1.65% (Class A) and 2.40% (Classes B & C). The total return figures for Institutional Shares reflect a sales charge of 0.0%. The total return figures for A Shares reflect the maximum sales charge of 5.0%. The total return figures for B Shares and C Shares reflect the maximum contingent deferred sales charge (CDSC) of 5.0% and 1.0% within the first year, respectively.

The Fund’s performance in the above table does not reflect the deduction of taxes on Fund distributions, or redemption of shares.

| # | Not Annualized |

| 1 | Please refer to Glossary of Terms for additional information. |

| Sector Investment Concentration as of January 31, 2012 | ||

| as a percentage of total investments | ||

| Top Ten Equity Holdings as of January 31, 2012 * | ||

| as a percentage of value of investments † | ||

| Prestige Brands Holdings, Inc. | 2.04% |

| Navigant Consulting, Inc. | 1.93% |

| AuRico Gold, Inc. | 1.90% |

| Spirit Aerosystems Holdings, Inc. | 1.87% |

| Old National Bancorp | 1.83% |

| Black Hills Corp. | 1.82% |

| Coeur d’Alene Mines Corp. | 1.80% |

| Greenbrier Cos., Inc. | 1.77% |

| Rent-A-Center, Inc. | 1.74% |

| ViewPoint Financial Group | 1.68% |

| * | Long-term securities. |

| † | Portfolio composition is subject to change. |

| 9 |

| Management Discussion of Fund Performance (Unaudited) |

| All Cap Value Fund | ||

For the period, a change toward the positive in investor perceptions regarding the global economy alleviated, but did not eliminate, recessionary fears. This new tone in the market, most apparent in the latter part of the period, tended to benefit value stocks overall. Many value stocks which had done poorly on a calendar year basis suddenly found themselves in a better position by the early part of 2012.

The Fund’s underperformance for the period relative to its benchmark was due to a number of factors. From a capitalization perspective, an overweight to company selections under $1 billion in market capitalization detracted from relative performance. An underweight to mega caps – those with capitalizations above $100 billion – also detracted. Together, these two allocations contributed to about 90% of the Fund’s relative underperformance. Additionally, an underexposure to higher quality selections and an over-exposure on the beta side of the equation also detracted for the period.

Sector allocations also contributed to underperformance; while, in contrast, the Fund’s stock selection contributed to outperformance. Over the course of the period, the overweights in Materials, Financials and Industrials gradually shifted to overweights in Financials, Telecommunications and Healthcare – mostly in the Biotechnology industry group. The Fund also reduced its overweight in Materials and was slightly underweight Industrials at the fiscal year’s half-way point.

While Financials were under pressure and lost a full percentage point of capitalization in its benchmark, the Fund took advantage of the selling pressure and added to its positions. The Fund also increased its exposure to Pharmaceuticals which had begun the year underweight. Major underweights continued in Consumer Staples, Utilities and Consumer Discretionary. For the six-month period, the underweight and stock selection for Utilities contributed to a decrease in performance. The Fund’s exposure to the Energy Equipment and Service industry sector was overweight relative to the benchmark, which resulted in a decrease in relative return.

As the Fund enters the second half of the fiscal year, evidence mounts for a more optimistic outlook in the face of strengthening market conditions both domestically and overseas.The portfolio will maintain a slight pro-cyclical exposure.

| Investment Risk Considerations | ||

Small capitalization funds typically carry additional risk since smaller companies generally have a higher risk of failure. Historically, smaller companies’ stocks have experienced a greater degree of market volatility than large company stocks on average.

Value-based investments are subject to the risk that the broad market may not recognize their intrinsic value.

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes.

| Average Annual Total Returns as of January 31, 2012 | ||

| 6 Months # | 1 Year | 5 Year | 10 Year | |||||

| Institutional | 0.81 | % | –1.16% | –2.57% | 4.78% | |||

| Class A Shares | –4.30 | % | –6.32% | –3.78% | 3.99% | |||

| Class B Shares | –4.61 | % | –6.99% | –3.83% | 3.90% | |||

| Class C Shares | –0.69 | % | –2.12% | –3.54% | 3.73% | |||

| Russell 3000® Value Index 1 | 1.63 | % | 1.78% | –2.06% | 4.56% | |||

| Russell Midcap® Value Index 1 | 0.50 | % | 1.19% | 0.39% | 8.08% | |||

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, visit www.fifththirdfunds.com.

During the period shown, the total return figures reflect the waiver of a portion of the fund’s advisory or administrative fees. Without such waiver of fees, the total returns would have been lower. As of 1/31/12, the gross expense ratios are 1.54% (Institutional Shares), 1.79% (Class A) and 2.54% (Classes B & C). The total return figures for Institutional Shares reflect a sales charge of 0.0%. The total return figures for A Shares reflect the maximum sales charge of 5.0%. The total return figures for B Shares and C Shares reflect the maximum contingent deferred sales charge (CDSC) of 5.0% and 1.0% within the first year, respectively.

The Fund’s performance in the above table does not reflect the deduction of taxes on Fund distributions, or redemption of shares.

| # | Not Annualized |

| 1 | Please refer to Glossary of Terms for additional information. |

| Sector Investment Concentration as of January 31, 2012 | ||

| as a percentage of total investments | ||

| Top Ten Equity Holdings as of January 31, 2012 * | ||

| as a percentage of value of investments † | ||

| General Electric Co. | 3.68% |

| Amgen, Inc. | 3.12% |

| UnitedHealth Group, Inc. | 2.88% |

| Citigroup, Inc. | 2.82% |

| Merck & Co., Inc. | 2.65% |

| JP Morgan Chase & Co. | 2.56% |

| Intel Corp. | 2.45% |

| Chevron Corp. | 2.34% |

| BP PLC | 2.25% |

| Microsoft Corp. | 2.20% |

| * | Long-term securities. |

| † | Portfolio composition is subject to change. |

| 10 |

| Management Discussion of Fund Performance (Unaudited) |

| Disciplined Large Cap Value Fund | ||

Market influences for the period presented a mixed picture. While the European debt crisis left a negative imprint on the market up until October and November, that sentiment dried up quickly after the markets realized that despite the shortcomings of the European debt super-committee, the Continental economy would indeed survive. As the market ended slightly up for the period, the fourth quarter timeframe showed more pronounced advances largely due to positive economic signs in the U.S. and greater confidence about the prospects for resolving the European debt crisis sometime down the road. In summary, while the last six months began with a risk-off bias toward cash, that bias was quickly followed by a directionless period before ending the fourth calendar quarter with a predominantly risk-on bias – based on a renewed confidence in the markets.

The portfolio receives more than half of its risk exposure from its deviation from the benchmark at the individual stock level. Over the past six months, this helped the Fund, especially in the area of Financials. Stock selection was particularly positive in the Commercial Bank and Insurance industry groups.

Stock selection also contributed to underperformance in Technology, especially in the Electronic Equipment, Instruments and Components industry group – primarily due to lower television sales. Additionally, an underweight to Communications Equipment contributed to underperformance for the period. This was mitigated somewhat by an overweight to Technology overall, which was one of the best-performing sectors relative to the benchmark. An overweight in the Energy sector, which was the worst-performing sector relative to the benchmark, was off-set by stock selection which contributed positively to performance for the period. The fact that oil prices had firmed up during the period also contributed to strong performance.

Throughout the period, the Fund maintained a slight anti-dollar exposure that proved helpful to performance even though it did not correlate directly, point-by-point, with the price movements of the currency on an absolute basis.

Similar to the way it ended its fiscal year last July, the Fund finished the recent six-month period with a slightly pro-cyclical exposure and overweights in Energy and Healthcare relative to the benchmark.

| Investment Risk Considerations | ||

Value-based investments are subject to the risk that the broad market may not recognize their intrinsic value.

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes.

| Average Annual Total Returns as of January 31, 2012 | ||

| 6 Months # | 1 Year | 5 Year | 10 Year | |||||

| Institutional | 1.27 | % | 0.68% | –1.87% | 4.49% | |||

| Class A Shares | –3.95 | % | –4.57% | –3.11% | 3.70% | |||

| Class B Shares | –4.20 | % | –5.25% | –3.18% | 3.61% | |||

| Class C Shares | –0.24 | % | –0.23% | –2.84% | 3.45% | |||

| Russell 1000® Value Index 1 | 1.74 | % | 1.88% | –2.16% | 4.36% | |||

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, visit www.fifththirdfunds.com.

During the period shown, the total return figures reflect the waiver of a portion of the fund’s advisory or administrative fees. Without such waiver of fees, the total returns would have been lower. As of 1/31/12, the gross expense ratios are 1.11% (Institutional Shares), 1.36% (Class A) and 2.11% (Classes B & C). The total return figures for Institutional Shares reflect a sales charge of 0.0%. The total return figures for A Shares reflect the maximum sales charge of 5.0%. The total return figures for B Shares and C Shares reflect the maximum contingent deferred sales charge (CDSC) of 5.0% and 1.0% within the first year, respectively.

The Fund’s performance in the above table does not reflect the deduction of taxes on Fund distributions, or redemption of shares.

| # | Not Annualized |

| 1 | Please refer to Glossary of Terms for additional information. |

| Sector Investment Concentration as of January 31, 2012 | ||

| as a percentage of total investments | ||

| Top Ten Equity Holdings as of January 31, 2012 * | ||

| as a percentage of value of investments † | ||

| UnitedHealth Group, Inc. | 4.34% |

| Merck & Co., Inc. | 4.03% |

| Intel Corp. | 3.86% |

| General Electric Co. | 3.84% |

| Cisco Systems, Inc. | 3.71% |

| Chevron Corp. | 3.47% |

| Citigroup, Inc. | 3.40% |

| Amgen, Inc. | 3.03% |

| BP PLC | 2.96% |

| AT&T, Inc. | 2.82% |

| * | Long-term securities. |

| † | Portfolio composition is subject to change. |

| 11 |

| Management Discussion of Fund Performance (Unaudited) |

| Structured Large Cap Plus Fund | ||

Both the Fund and the benchmark encountered increased volatility going into the August and September timeframe. Concerns over the European debt crisis and the uncertainty surrounding the U.S. debt ceiling and the creditworthiness of U.S. Treasuries, added to investor anxiety. By October, however, modestly positive third quarter earnings reports buoyed market sentiment.

Against that backdrop, large cap stocks typical of the Fund’s selections experienced an upward surge in the October and early November timeframe, which continued intermittently through January 31.

Contributions to the Fund’s outperformance during the period came from a wide number of sources. Early in the period, the short positions sustained the Fund while the market was trading downward in the August and September timeframe. The shorts proved extremely helpful to the portfolio in offsetting risk exposures during the late summer volatility. The long positions, in contrast, added to performance as the market rallied during the fourth quarter.

The top three sector contributors to portfolio performance were Healthcare, Financials and Information Technology. Performance was especially aided by good stock selections in the Biotechnology and Health Care Providers & Service Industries groups, as well as the Diversified Financial Services and Capital Markets Industry groups. Additionally the portfolio saw a strong showing from the Semiconductors & Semiconductor Equity Industry group.

In contrast, Utilities, Materials and Industrials decreased portfolio performance. Selections within the Independent Power Producers & Energy Traders Industry group and an allocation to the Electric Utilities and Multi-Line Utilities Industry groups decreased performance. Performance was also detracted by an allocation to and selection within the Construction Materials and Containers & Packaging Industry groups. Finally, within Industrials, the Commercial Services & Supplies Industry group also subtracted from performance.

At the six month point, the Fund has taken a more risk adverse position and is less leveraged than normal, due to the belief that the markets may be nearing an inflection point. The Funds normal long to short allocation of 130/30 is currently 115/15. However, if macro-economic circumstances in Europe worsen, the portfolio may add to its risk profile.

| Investment Risk Considerations | ||

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes.

The Fund is subject to risks associated with short selling, which may result in the Fund sustaining greater losses or lower returns than if the Fund held only long positions.

| Average Annual Total Returns as of January 31, 2012 | ||

| 6 Months # | 1 Year | 5 Year | 10 Year | |||||

| Institutional | 5.00 | % | 10.93% | –4.04% | 1.00% | |||

| Class A Shares | –0.44 | % | 5.13% | –5.25% | 0.25% | |||

| Class B Shares | –0.58 | % | 4.80% | –5.35% | 0.16% | |||

| Class C Shares | 3.70 | % | 10.09% | –4.97% | 0.02% | |||

| S&P 500® Index 1 | 2.71 | % | 4.22% | 0.33% | 3.52% | |||

| Russell 1000® Index 1 | 2.29 | % | 3.95% | 0.55% | 3.97% | |||

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, visit www.fifththirdfunds.com.

During the period shown, the total return figures reflect dividends on short sales, extraordinary expenses and interest expense as well as the waiver of a portion of the fund’s advisory or administrative fees.Without such waiver of fees, the total returns would have been lower. As of 1/31/12, the gross expense ratios are 1.66% (Institutional Shares), 1.91% (Class A), 2.66% (Class B) and 2.64% (Class C). The total return figures for Institutional Shares reflect a sales charge of 0.0%. The total return figures for A Shares reflect the maximum sales charge of 5.0%. The total return figures for B Shares and C Shares reflect the maximum contingent deferred sales charge (CDSC) of 5.0% and 1.0% within the first year, respectively.

The Fund’s performance in the above table does not reflect the deduction of taxes on Fund distributions, or redemption of shares.

| # | Not Annualized |

| 1 | Please refer to Glossary of Terms for additional information. |

| Sector Investment Concentration as of January 31, 2012 | ||

| as a percentage of total investments | ||

| Top Ten Equity Holdings as of January 31, 2012 * | ||

| as a percentage of value of investments † | ||

| Apple, Inc. | 2.84% |

| Exxon Mobil Corp. | 2.55% |

| International Business Machines Corp. | 2.11% |

| Microsoft Corp. | 2.09% |

| Procter & Gamble Co. (The) | 1.68% |

| Pfizer, Inc. | 1.68% |

| Chevron Corp. | 1.66% |

| AT&T, Inc. | 1.62% |

| Wells Fargo & Co. | 1.59% |

| JP Morgan Chase & Co. | 1.49% |

| * | Long-term securities. |

| † | Portfolio composition is subject to change. |

| 12 |

| Management Discussion of Fund Performance (Unaudited) |

| Equity Index Fund | ||

Both the Fund and the benchmark encountered increased volatility going into August and September. Concerns over the European debt crisis and the uncertainty surrounding the U.S. debt ceiling and the creditworthiness of U.S. Treasuries, spurred a flight toward larger cap securities which benefited both the Fund and the Index. From a global economic perspective, the macro-economic picture looked brighter at the end of the six-month period compared to the beginning. Although Europe had some negative experiences, many of the worst fears in the market were not realized. When the environment proved better than investors and analysts had anticipated, the large cap stocks typical of the Fund’s selections experienced an upward surge in the October and early November timeframe which continued intermittently through January 31.

The Fund’s investment approach closely tracked the broadly diversified S&P 500 Index.

Allocations to Utilities, Information Technology and Health were the top three contributors to performance, while allocations to Energy, Financials and Materials were the top three detractors from performance.

Throughout the period, there were ten Index changes, only three of which resulted from merger and acquisition activity. On occasion, the Fund may implement transactions earlier or later than the Index’s official change date, which can generate returns slightly different from those of the Index. Such strategies vary based on the broader market environment and the makeup of the Index changes. The below average number of Index changes was due primarily to market uncertainty over the six-month time period.

| Investment Risk Considerations | ||

The Fund invests substantially all of its assets in common stock of companies that make up the S&P 500. Index. The Advisor attempts to track the performance of the S&P 500. Index to achieve a correlation of 95% between the performance of the Fund and that of the S&P 500. Index without taking into account the Fund’s expenses.

It is important to remember that there are risks associated with index investing, including the potential risk of market decline, as well as the risks associated with investing in specific companies.

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes.

| Average Annual Total Returns as of January 31, 2012 | ||

| 6 Months # | 1 Year | 5 Year | 10 Year | |||||

| Institutional | 2.57 | % | 4.00% | 0.23% | 3.34% | |||

| Class A Shares | –2.65 | % | –1.43% | –1.04% | 2.56% | |||

| Class B Shares | –2.93 | % | –2.03% | –1.14% | 2.47% | |||

| Class C Shares | 1.10 | % | 3.02% | –0.82% | 2.29% | |||

| Select Shares | 2.52 | % | 3.92% | 0.15% | 3.26% | |||

| Preferred Shares | 2.53 | % | 3.84% | 0.08% | 3.18% | |||

| Trust Shares | 2.47 | % | 3.75% | –0.02% | 3.09% | |||

| S&P 500® Index 1 | 2.71 | % | 4.22% | 0.33% | 3.52% | |||

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, visit www.fifththirdfunds.com.

During the period shown, the total return figures reflect the waiver of a portion of the fund’s advisory or administrative fees. Without such waiver of fees, the total returns would have been lower. As of 1/31/12, the gross expense ratios are 0.60% (Institutional Shares), 0.85% (Class A), 0.68% (Select Shares), 0.75% (Preferred Shares), 0.85% (Trust shares) and 1.60% (Classes B & C). The total return figures for Institutional Shares reflect a sales charge of 0.0%. The total return figures for A Shares reflect the maximum sales charge of 5.0%. The total return figures for B Shares and C Shares reflect the maximum contingent deferred sales charge (CDSC) of 5.0% and 1.0% within the first year, respectively.

The Fund’s performance in the above table does not reflect the deduction of taxes on Fund distributions, or redemption of shares.The inception date for the Select, Preferred and Trust Shares is October 20, 2003. Prior to such date, quoted performance of the Select, Preferred and Trust Shares reflects performance of the Institutional Shares and is adjusted to reflect expenses for Select, Preferred and Trust Shares.

| # | Not Annualized |

| 1 | Please refer to Glossary of Terms for additional information. |

| Sector Investment Concentration as of January 31, 2012 | ||

| as a percentage of total investments | ||

| Top Ten Equity Holdings as of January 31, 2012 * | ||

| as a percentage of value of investments † | ||

| Apple, Inc. | 3.48% |

| Exxon Mobil Corp. | 3.30% |

| International Business Machines Corp. | 1.86% |

| Microsoft Corp. | 1.82% |

| Chevron Corp. | 1.69% |

| General Electric Co. | 1.62% |

| Johnson & Johnson | 1.48% |

| AT&T, Inc. | 1.43% |

| Procter & Gamble Co. (The) | 1.42% |

| Pfizer, Inc. | 1.35% |

| * | Long-term securities. |

| † | Portfolio composition is subject to change. |

| 13 |

| Management Discussion of Fund Performance (Unaudited) |

| International Equity Fund | ||

Both the Fund and the benchmark experienced increased downward volatility throughout the period. Concerns over the European debt crisis and uncertainty surrounding the U.S. debt ceiling and creditworthiness of U.S. Treasuries continued to increase the selling pressure on international stocks. Over the six month period, wary investors generally turned instead to larger cap issues domiciled in the U.S. – and cash. From a global economic perspective, the macroeconomic picture looked brighter at the end of the period than at the beginning. However, while a pro-cyclical sentiment may be gaining in regard to U.S. equities, that mood has not yet crossed over to international stocks, due to ongoing fears surrounding the European debt crisis.

While the Fund experienced a partial recovery in the fourth quarter, it wasn’t enough to offset a double digit decrease in performance. For the benchmark, performance in the third quarter was the worst for a quarter since 2008. The Fund’s model, which blends diversified sources of alpha that are region and sector specific, was slightly up for the period after struggling through August, and through December and January. Additionally, the model’s value and momentum factors were up, while growth and quality factors were lower.

From a country perspective, primary contributors to performance were the Netherlands with good stock selection in Technology, Germany with a strong allocation to Consumer Discretionary and Norway with good stock selection in Energy. Additionally, the strongest sector contributors for the period included Industrials in Japan and the U.K., Technology in Hong Kong and Telecommunications in Japan. In contrast, primary country detractors from performance included Sweden (Financials and Energy), Belgium (Consumer Staples), and Italy (Consumer Discretionary). Sector detractors included Consumer Discretionary in France and Japan; and Healthcare in the U.K.

At the six month point, the Fund has been positioned to anticipate further market volatility by reducing exposures to riskier countries and sectors. Simultaneously, the Fund is modifying its model to stand ready to assume a pro-cyclical posture to take advantage of any positive international investor sentiment that appears in the next few months.

| Investment Risk Considerations | ||

An investment in this Fund entails the special risks of international investing, including currency exchange fluctuation, government regulations, and the potential for political and economic instability. The Fund’s share price is expected to be more volatile than that of a U.S.-only fund.

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes.

| Average Annual Total Returns as of January 31, 2012 | ||

| 6 Months # | 1 Year | 5 Year | 10 Year | |||||

| Institutional | –11.27 | % | –11.27% | –4.78% | 4.38% | |||

| Class A Shares | –15.75 | % | –15.94% | –6.01% | 3.63% | |||

| Class B Shares | –16.16 | % | –16.57% | –5.99% | 3.51% | |||

| Class C Shares | –12.64 | % | –12.33% | –5.76% | 3.33% | |||

| MSCI EAFE Index, Net 1 | –10.42 | % | –9.59% | –3.85% | 5.79% | |||

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, visit www.fifththirdfunds.com.

During the period shown, the total return figures reflect interest expense as well as the waiver of a portion of the fund’s advisory or administrative fees. Without such waiver of fees, the total returns would have been lower. As of 1/31/12, the gross expense ratios are 1.42% (Institutional Shares), 1.67% (Class A) and 2.42% (Classes B & C). The total return figures for Institutional Shares reflect a sales charge of 0.0%. The total return figures for A Shares reflect the maximum sales charge of 5.0%. The total return figures for B Shares and C Shares reflect the maximum contingent deferred sales charge (CDSC) of 5.0% and 1.0% within the first year, respectively.

The Fund’s performance in the above table does not reflect the deduction of taxes on Fund distributions, or redemption of shares.

| # | Not Annualized |

| 1 | Please refer to Glossary of Terms for additional information. |

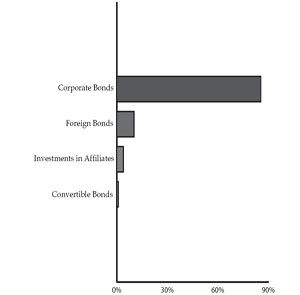

| Sector Investment Concentration as of January 31, 2012 | ||

| as a percentage of total investments | ||

| Top Ten Equity Holdings as of January 31, 2012 * | ||

| as a percentage of value of investments † | ||

| Rio Tinto PLC | 1.95% |

| Nestle SA | 1.86% |

| Novartis AG | 1.78% |

| BHP Billiton PLC | 1.74% |

| BASF SE | 1.66% |

| Royal Dutch Shell PLC | 1.61% |

| Bayer AG | 1.60% |

| ASML Holding NV | 1.53% |

| Sanofi-Aventis SA | 1.43% |

| Total SA | 1.42% |

| * | Long-term securities. |

| † | Portfolio composition is subject to change. |

| 14 |

| Management Discussion of Fund Performance (Unaudited) |

| Strategic Income Fund | ||

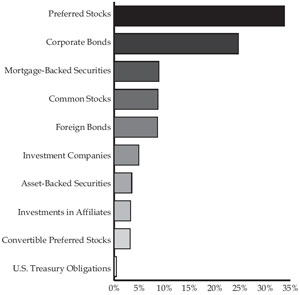

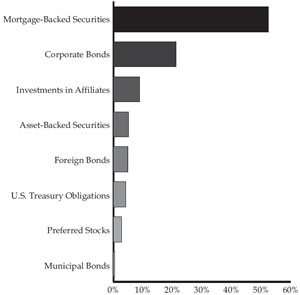

Financial markets around the world spent much of the period laboring under the overhang of Europe’s debt uncertainties. As officials from governments and central banks across the Continent debated how to handle the potential insolvency of heavily indebted countries such as Greece and Portugal, European banks weighed the potential impact upon their balance sheets. In turn, investors generally favored risk-averse strategies, although any glimmer of hope for resolution spurred brief relief rallies.

Given the unknowns, U.S. Treasury securities benefited from a broad flight to safety, which drove yields (which move in the opposite direction of prices) lower along the yield curve. Long-term rates were also pressured by the October introduction of the U.S. Federal Reserve’s Operation Twist, a program in which the central bank will sell a total of $400 billion worth of short-term debt to purchase longer-term Treasury securities through June 2012.