Filed by BTU International, Inc.

pursuant to Rule 425 under the Securities Act

of 1933 and deemed filed under Rule 14a-12

of the Securities Exchange Act of 1934

Subject Company: BTU International, Inc.

Commission File No.: 000-17297

The following is a presentation to attendees at Needham & Company’s 17th Annual Growth Conference in New York, on Tuesday, January 13, 2015, at the New York Palace Hotel.

Important Information for Investors and Shareholders

This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. In connection with the proposed merger, Amtech Systems, Inc. (“Amtech”) and BTU International, Inc. (the “Company”) filed a registration statement on Form S-4 with the Securities and Exchange Commission (the “SEC”), containing a joint proxy statement/prospectus, relating to the proposed merger. The Company and Amtech also intend to file other relevant documents relating to the proposed merger with the SEC. The proposals for the proposed merger will be made solely through the joint proxy statement/prospectus, which was filed on December 23, 2014 with the SEC. THE COMPANY AND AMTECH URGE INVESTORS AND SHAREHOLDERS TO READ THE JOINT PROXY STATEMENT/PROSPECTUS (INCLUDING ANY AMENDMENTS AND SUPPLEMENTS THERETO) AND ANY OTHER RELEVANT DOCUMENTS FILED BY EITHER PARTY WITH THE SEC BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE COMPANY, AMTECH AND THE PROPOSED MERGER.

Investors and shareholders of the Company and Amtech will be able to obtain the joint proxy statement/prospectus and other documents filed with the SEC free of charge at the website maintained by the SEC at www.sec.gov. In addition, documents filed with the SEC by the Company will be available free of charge on the investor relations portion of the Company’s website at www.btu.com. Documents filed with the SEC by Amtech will be available free of charge on the investor relations portion of the Amtech website at www.amtechsystems.com.

Participants in the Solicitation

This communication is not a solicitation of a proxy from any security holder of the Company or Amtech. The Company and its directors and executive officers, and Amtech and its directors and executive officers may be deemed to be participants in the solicitation of proxies from the holders of Company and Amtech common stock in respect of the proposed merger and the transactions contemplated thereby. Information about the directors and executive officers of the Company is set forth in the proxy statement for the Company’s 2014 annual meeting of stockholders, which was filed with the SEC on April 14, 2014. Information about the directors and executive officers of Amtech is set forth in the proxy statement for Amtech’s 2014 annual meeting of stockholders, which was filed with the SEC on March 28, 2014. Investors and shareholders can obtain more detailed information regarding the direct and indirect interests of the Company’s and Amtech’s directors and executive officers in the proposed merger by reading the joint proxy statement/prospectus and any other relevant documents filed with the SEC.

|

Paul van der Wansem, Chairman and CEO Peter Tallian, COO © Copyright 2015 BTU International Needham Growth Conference 2015 |

|

This presentation, other than historical financial information, contains express or implied forward-looking statements regarding future business prospects. Such statements are made pursuant to the “safe harbor” provisions established by the federal securities laws, and are based on the current assumptions and expectations of the company’s management. Actual results may differ materially from those projected as a result of certain risks and uncertainties, including but not limited to, risks related to the company's pending merger with Amtech, the timely availability and acceptance of new products, general market conditions governing supply and demand, the impact of competitive products and pricing and other risks detailed in the company’s filings with the Securities and Exchange Commission. Accordingly, you should not place undue reliance on any forward-looking statements. The company anticipates that subsequent events and developments may cause management's views to change, however, it assumes no responsibility to update the information contained in this presentation. This presentation and the information contained herein is the property of BTU International, Inc. © Copyright 2015 BTU International Safe Harbor Statement |

|

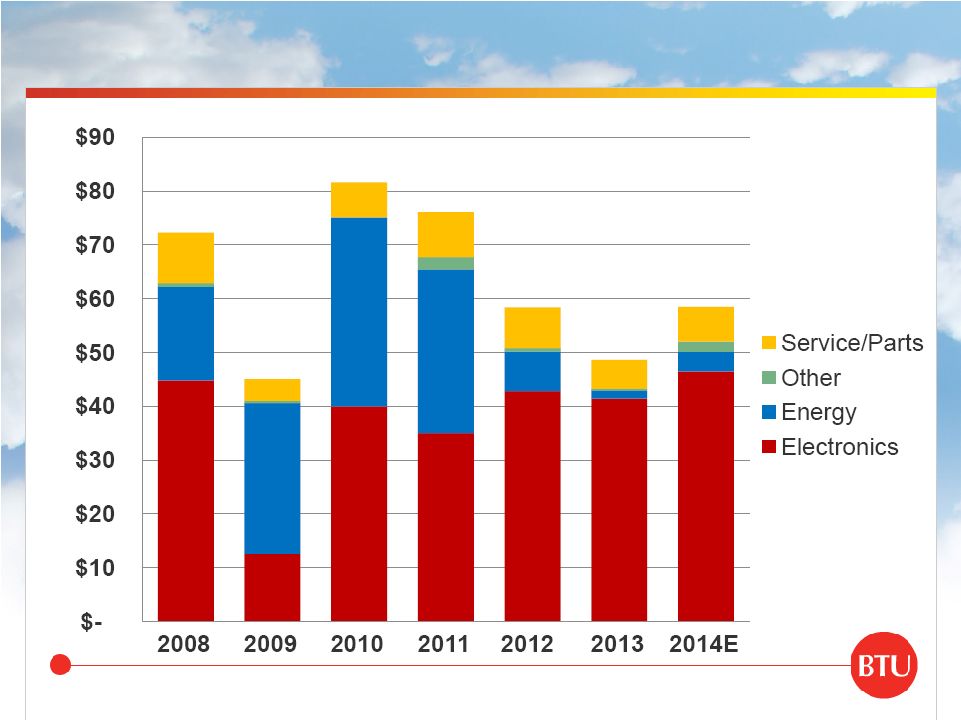

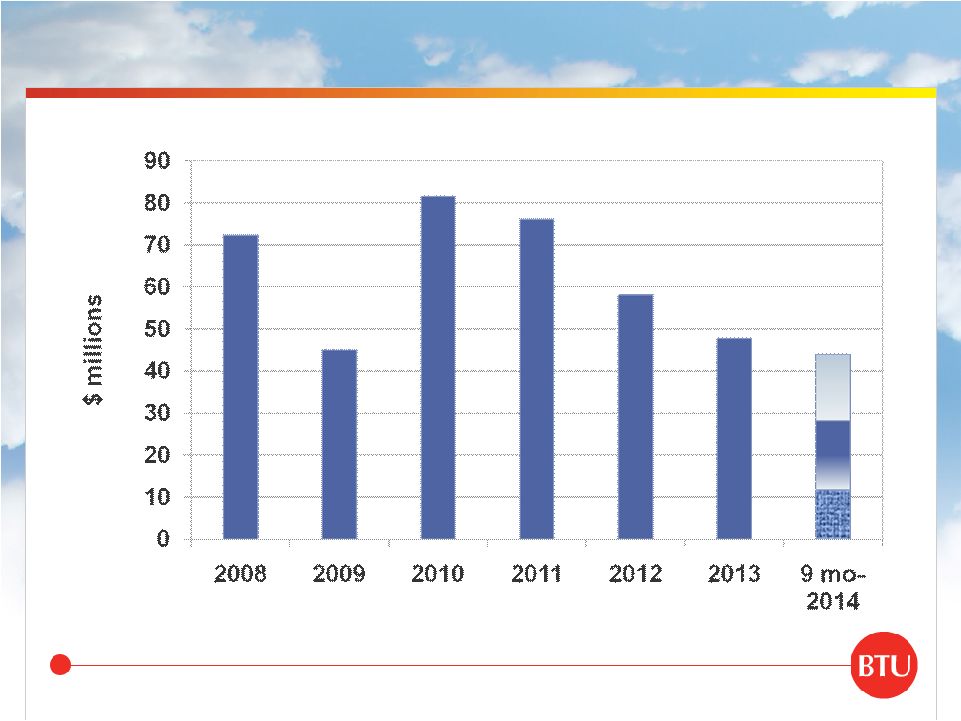

© Copyright 2015 BTU International Corporate Facts • BTU Background • Thermal process equipment for in-line, high volume mfg. • Founded in 1950 • Public since 1989 (NASDAQ: BTUI) • Headquarters in Billerica, MA • Manufacturing and engineering in US and China • Worldwide sales and support • 285 employees worldwide • Revenue FY 2010, $81.6M FY 2011, $76.1M FY 2012, $58.1M FY 2013, $47.8M FY 2014, $44.0 M- 9m 11% 25% 64% Asia Americas Europe 2014E Shipments by Territory |

|

BTU’s Diverse Customer Base © Copyright 2015 BTU International |

|

Business Mix (in $M) © Copyright 2015 BTU International |

|

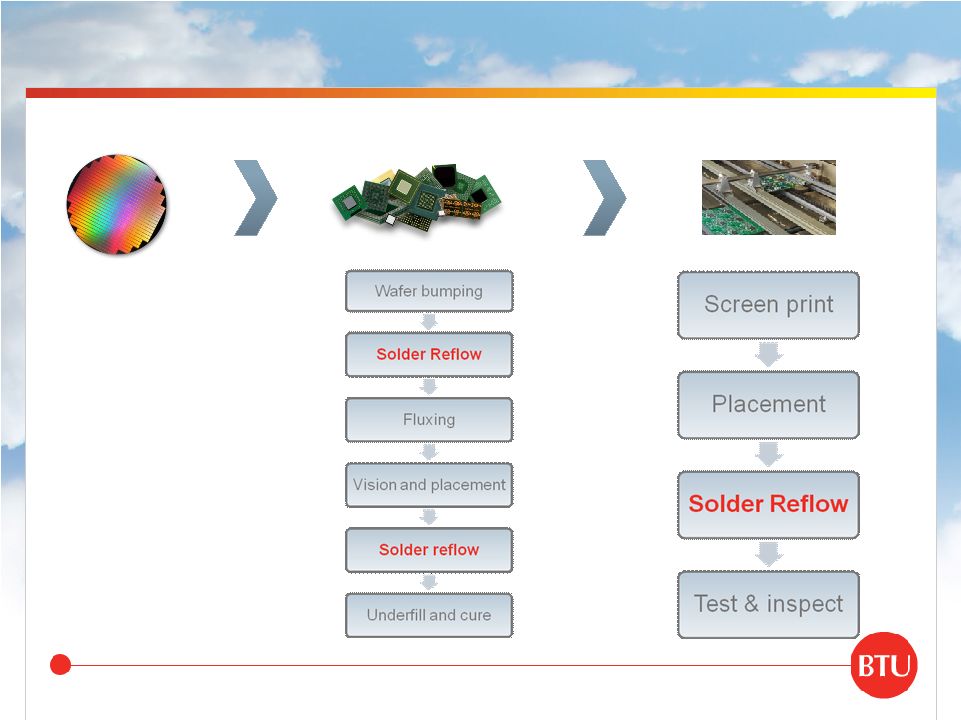

Electronics Value Chain – Where we Compete © Copyright 2015 BTU International Assembly Packaging Semiconductor |

|

Electronics Market Outlook • 2014 was a strong recovery year • In 2015 growth and recovery are projected to continue along with expanding global GDP • Packaging and assembly are expected to be particularly strong versus other segments © Copyright 2015 BTU International Sources: Gartner, Sept 2014 2014 2015 Global Real GDP +2.7 +3.3 U.S. Real GDP +2.2 +2.9 Elec. Equipment 1 +2.2 +2.0 SATS +7.9 +6.4 Capital Spending +11.4 +8.8 Equip. Spending +17.1 +11.3 WFE +17.6 +10.7 PAE +13.9 +14.9 ATE +16.8 +13.1 1 Production revenue |

|

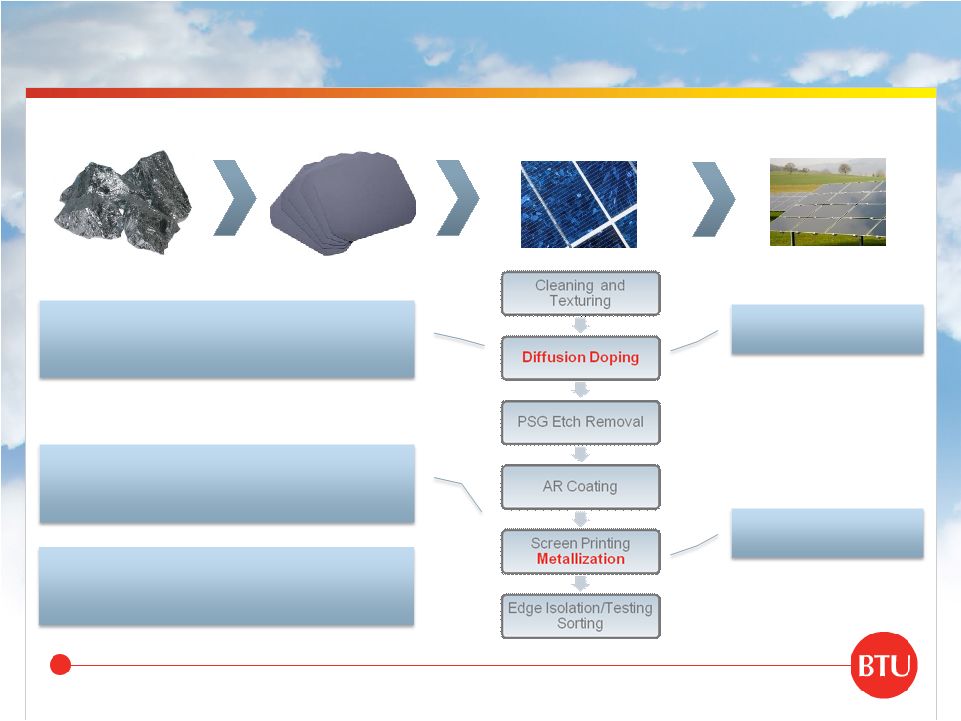

Solar Value Chain – Where we Compete © Copyright 2015 BTU International Module Cell Ingot/Wafer Silicon Source: Solarbuzz & BTU estimate, Sept. 2014 Mkt Size: $90M Mkt Size: >$30M BTU Meridian In-line Diffusion System BTU Metallization Drying and Firing $0.8 to $1M ASP BTU Advanced Cell Processing Annealing/Advanced Metallization $200 to $400K ASP $150 to $300K ASP |

|

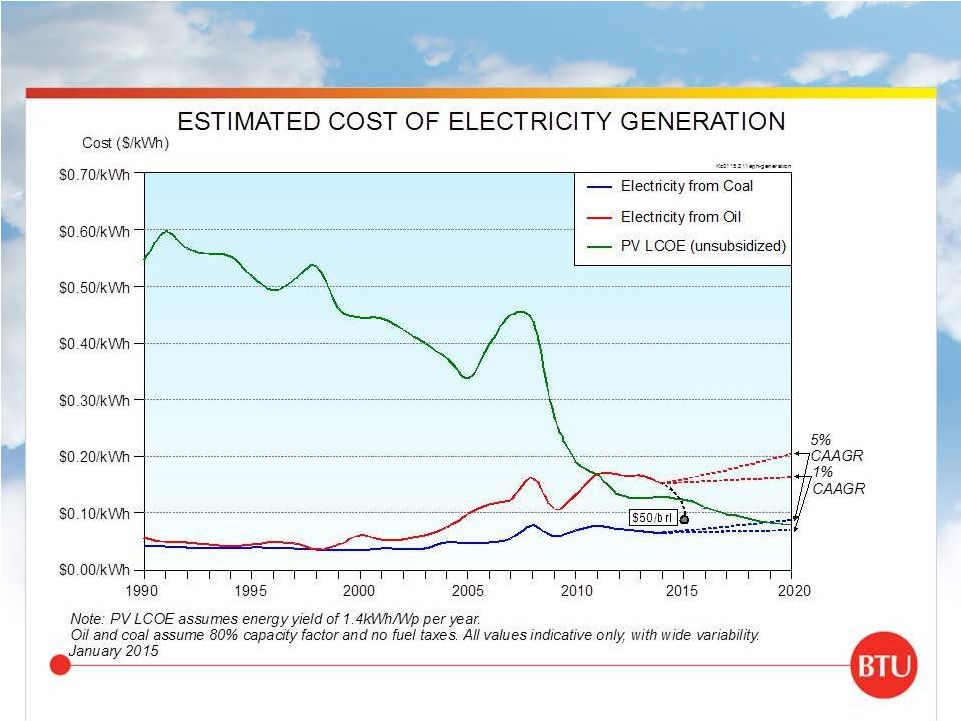

Solar is Becoming Cost Competitive © Copyright 2015 BTU International Source: Prismark Partners, 2015 |

|

Nuclear Fuel • High volume, high temperature processing of nuclear fuels • BTU customers include most major nuclear fuel producers • Over 60 units shipped for high volume production of Uranium Oxide (UO 3 ) fuel • Requires ultra-high temperature (1800 C) and very precise process atmosphere • China, Russia, India: building > 45+ new nuclear reactors • US & Europe: limited expansion • Increasing energy source in high growth economies Nuclear pellet, rod and bundle © Copyright 2015 BTU International |

|

Net Sales © Copyright 2015 BTU International |

|

Financial Highlights ($ millions except per share data) © Copyright 2015 BTU International 2009 2010 2011 2012 2013 9 m-2014 Net Sales $45.1 $81.6 $76.1 $58.1 $47.8 $44.0 Gross Margin % 27.5 41.4 37.5 28.4 30.8% 38.9% S, G & A 19.0 23.1 22.7 21.0 19.8 14.6 R, D & E 6.9 6.6 7.1 5.5 4.6 3.2 Restructuring 0.4 0.4 Net Income/loss (14.6) 2.2 (2.7) (11.0) (11.5) (1.2) Income/loss per share (1.58) 0.24 (0.29) (1.16) (1.20) (0.12) Cash 25.4 22.8 18.9 20.2 14.0 10.4 Stockholders’ Equity 35.7 39.8 39.5 29.5 18.9 18.1 |

|

Summary • “The Foundation” - Electronics • Strong global brand name and customer base • Established infrastructure to support growth • Additional market penetration in – low cost consumer segment • “Growth opportunity ” - Solar 2015+ • • Increased throughput and cell efficiencies lower cost/watt • “Largely Asian Opportunities” – Nuclear • “The Back Bone” • Thermal & process-gas expertise and innovation • High volume, continuous processing • Operational excellence and manufacturing footprint in USA & China • Strong Worldwide / Asian customer base © Copyright 2015 BTU International New products for - Metallization and Anneal |

|

© Copyright 2015 BTU International - Thank you - |