Exhibit 99.1

Presentation Materials at the Annual Meeting of Shareholders

2008 Annual Meeting

2009 Annual Meeting

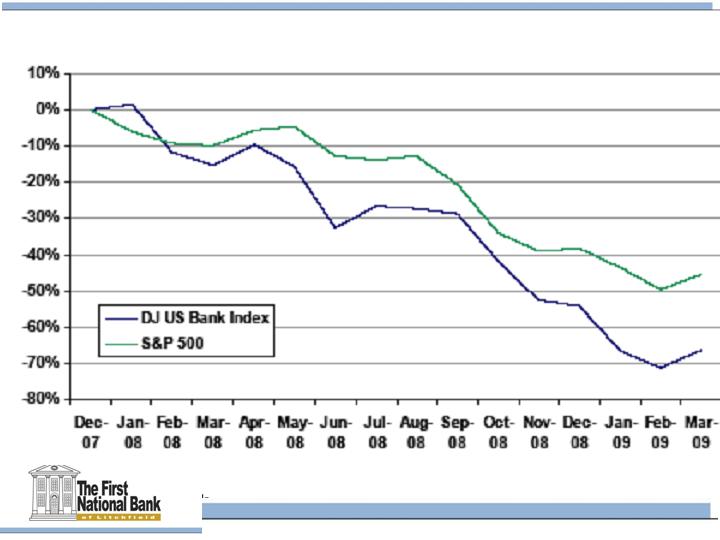

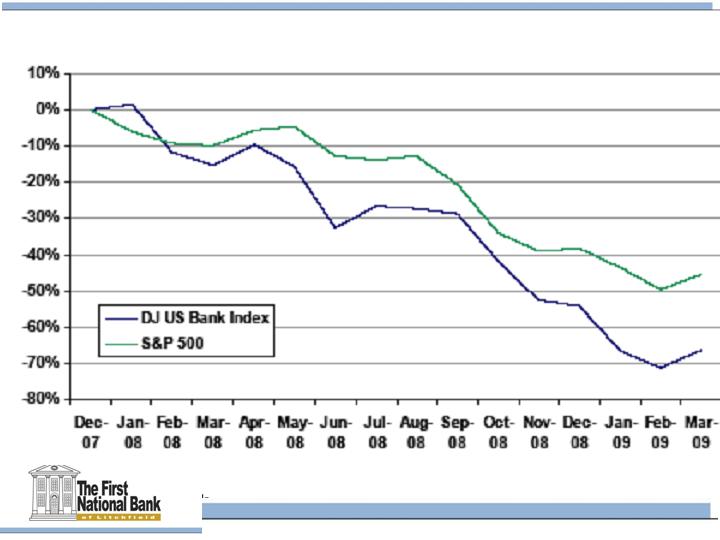

The Economy

Worst economy in 30 years

Longest recession since the great

depression

Severe depression in real estate values

All industries impacted

Bank failures since Jan of 2008 = 57

The Economy

The impact on us:

Treasury take over of Fannie Mae and

Freddie Mac:

2 investments totaling $5 million

OTTI write-down of $5 million

The impact on us:

Crisis in the financial sector

2 investments in pooled trust secured debt

OTTI write-down of $4.4 million in 2008

Total OTTI impairment of $9.4 million

Our strategy: weather the

financial storm

Shore up the balance sheet with an increased

provision for loan and lease losses

Utilize Treasury CPP funds to strengthen

capital

Preserve capital

Continue the commitment to lend to our

communities

Maintain asset quality in the balance sheet

Strategic Decisions

Reasons:

Uncertainty relative to the depths of the

recession

Enables us to focus on servicing our

communities and customers through lending

Enables us to maintain capital ratios above

the well-capitalized regulatory guidelines

2008 Operating Performance

Net interest income up 13%

Loan growth

Deposit growth

Leasing subsidiary break-even

Growth of net interest margin

2008 Operating Performance

Continued core asset base:

Loan growth 12%

Loan growth was organic within our footprint

Leasing growth – $11 million

Continued the strategy of shifting the mix of

earning assets from investments to loans

Continuation of the strategy to shift the mix of

loans from residential to commercial.

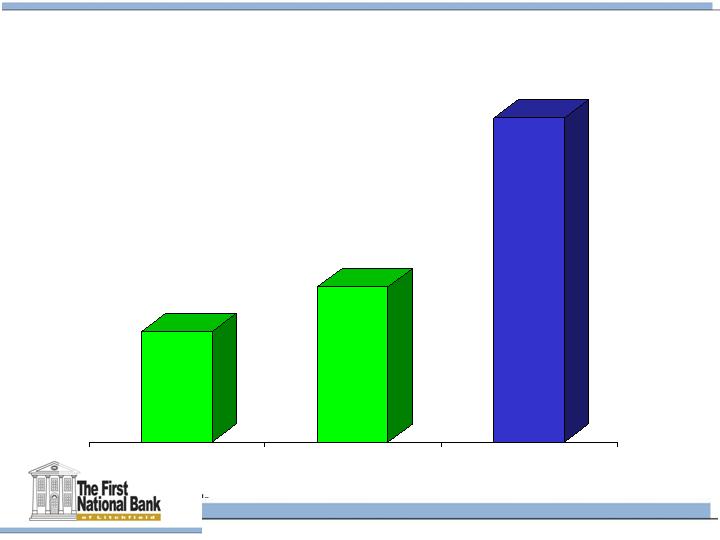

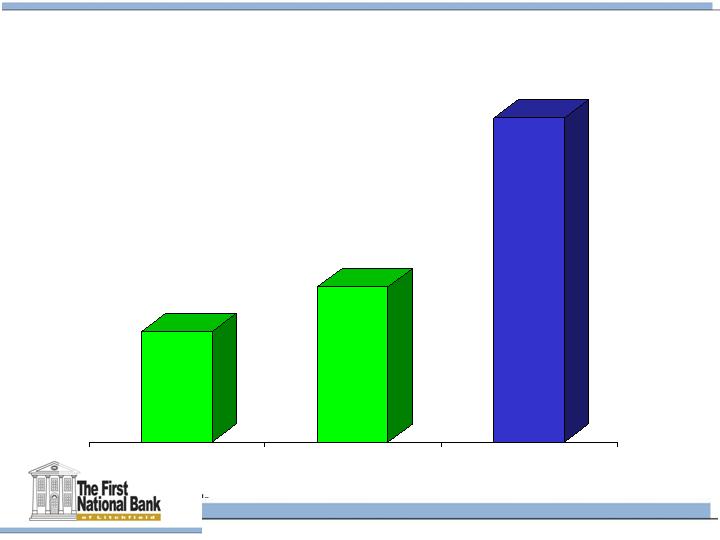

Total Assets

$501

2006

2007

2008

$532

$508

In millions

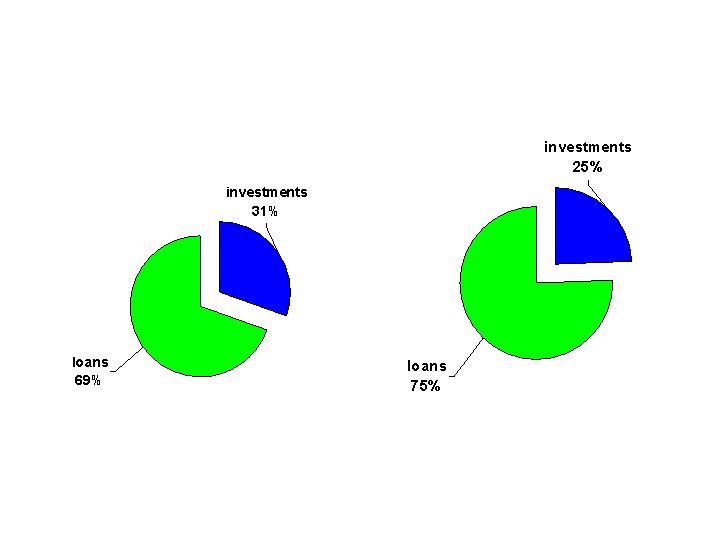

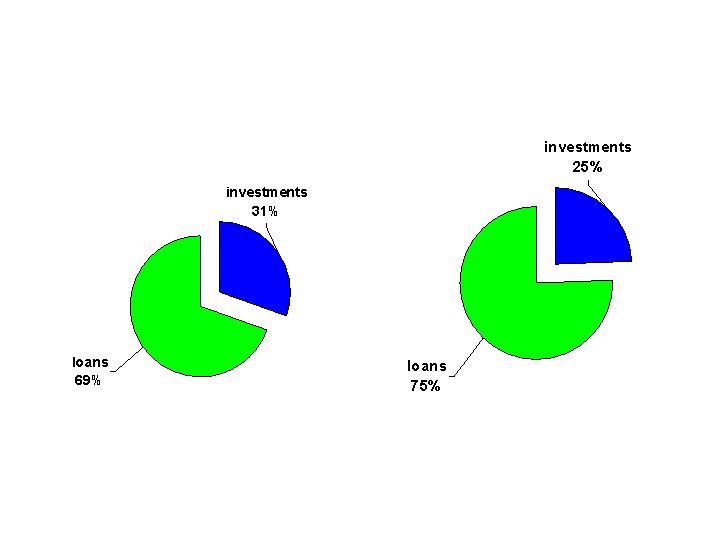

Mix of Earning Assets

2008

2007

Investments include interest –bearing cash and due and restricted stock

Mix of loans

2008

2007

Loans

$296

2006

2007

2008

$329

$370

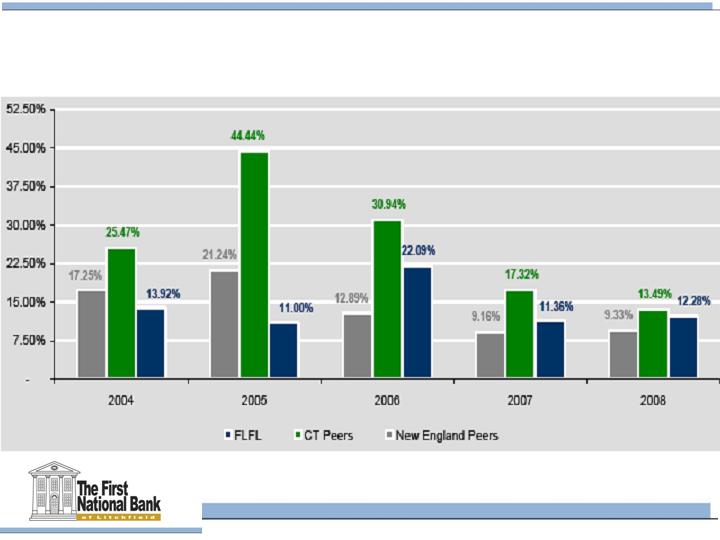

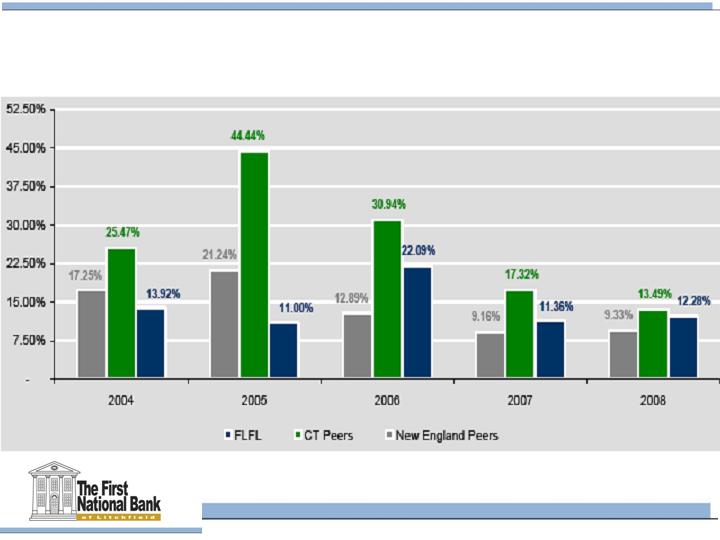

2004-2008 Gross Loan Growth %

Deposits

$333

2006

2007

2008

$343

$336

In millions

Net Interest Income

$14,940

$13,213

$12,691

2006

2007

2008

In thousands

Net Interest Margin

2.91%

3.13%

2.99%

2006

2007

2008

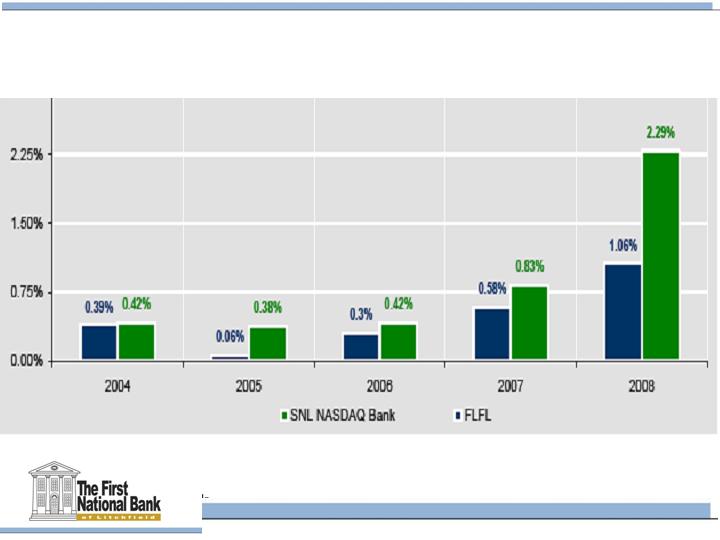

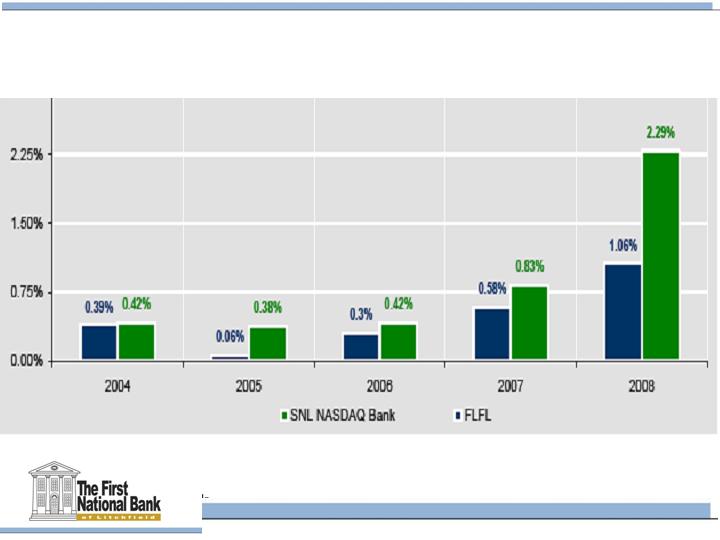

Nonperforming Assets to Total Assets

Non-interest income

Without security gains or losses

2006

2007

2008

$2,940,000

$3,412,000

$3,522,000

Exhibit 99.1

Presentation Materials

Forward-looking Statements

Statements in this presentation regarding First Litchfield Financial

Corporation’s business that are not historical facts are “forward-looking

statements” within the meaning of the Private Securities Litigation Reform

Act of 1995. These statements are based on the beliefs and expectations

of management as well as the assumption made using information

currently available to management. Since these statements reflect the

views of management concerning future events, these statements involve

risks, uncertainties and assumptions, including, among others: changes

in market interest rates and general and regional economic conditions;

changes in government regulations; changes in accounting principles;

and the quality of composition of the loan and investment portfolios and

other factors that may be described in the Company’s quarterly reports on

Form 10-Q and its annual report on Form 10-K, each filed with the

Securities and Exchange Commission, which are available at the

Securities and Exchange Commission’s internet website (www.sec.gov)

and to which reference is hereby made. Therefore, actual future results

may differ significantly from results discussed in the forward-look

ing statements.

2008 Annual Meeting

2009 Annual Meeting