Exhibit 99.2

SHARE PURCHASE AGREEMENT

Share Purchase Agreement dated January 11, 2013 between HWH Acquisition Company LLC (the“Vendor”), Harry Winston Diamond Corporation (the “Guarantor”) and The Swatch Group Ltd. (the“Purchaser”).

| WHEREAS: | the Vendor is the owner of all the issued and outstanding shares of HW Holdings, Inc. (the “Corporation”), a company established under the laws of the State of Delaware and having its principal offices at 718 Fifth Avenue, New York, New York, 10019, United States of America (such issued and outstanding shares being referred to as the “PurchasedShares”); |

| | | |

| AND WHEREAS: | the Corporation is the owner of all of the issued and outstanding shares of Harry Winston, Inc.; |

| | | |

| AND WHEREAS: | the Purchaser desires to purchase from the Vendor and the Vendor desires to sell to the Purchaser the Purchased Shares (the “Transaction”) in accordance with the terms and conditions set forth herein; |

| | | |

| AND WHEREAS: | the Guarantor is the indirect owner of all of the issued and outstanding shares of the Vendor; |

| | | |

| NOW THEREFORE: | this Share Purchase Agreement (the “Agreement”) sets out the terms and conditions upon which, for good and valuable consideration, the Vendor, the Purchaser and the Guarantor (collectively, the “Parties”, or each individually a “Party”) agree to complete the Transaction. |

Certain terms used in this Agreement but not otherwise defined are defined in Section 27 hereof.

| 1. | Purchase of the Purchased Shares. |

The Purchaser hereby agrees to purchase from the Vendor, and the Vendor hereby agrees to sell, transfer and assign to the Purchaser on the Closing Date and effective as of the Closing Time, the Purchased Shares free and clear of any Liens (other than Liens granted by thePurchaser) for an aggregate cash purchase price of: (a) U.S.$750 million, plus (b) the sum of all amounts contributed or invested by the Guarantor, directly or indirectly but without duplication, in excess of U.S.$5 million to or in the Corporation during the period between the date hereof and the Closing Date in connection with the maintenance of the covenants under the Retail Facilities at the end of each fiscal quarter, and less (c) the amount, if any, by which the Pro Forma Net Debt as of the date hereof is more than U.S.$250 million (such aggregate amount, the “Purchase Price”), all on the terms and conditions set forth in this Agreement.

- 2 -

| 2. | Mutual Conditions of Closing. |

The obligation of the Parties to complete the Transaction is subject to the fulfillment of each of the following conditions, which conditions are for the mutual benefit of each Party and may be waived only by mutual consent of the Parties:

| | (a) | all of the Closing Regulatory Approvals shall have been obtained; |

| | | |

| | (b) | each of the Guarantor and its subsidiaries, excepting the Corporation and its direct or indirect subsidiaries, shall have changed their names, as applicable, so as to remove all references to “Harry Winston”, “Winston” and/or “HW”; and |

| | | |

| | (c) | there shall not be in effect any applicable domestic or foreign federal, national, state, provincial or local law (statutory, common or otherwise), rule, regulation, notice, order, injunction, judgment, decree, ruling or other similar requirement enacted or made by a Governmental Authority having the force of law (collectively, “laws”) (other than any law relating to any Regulatory Approvals that are not Closing Regulatory Approvals) that makes the consummation of the Transaction illegal or otherwise prohibits or enjoins any Party from consummating the Transaction. |

| 3. | Condition of Closing for the Benefit of the Vendor. |

The Purchaser acknowledges and agrees that the Vendor’s obligation to complete the Transaction is also subject to the condition that all covenants of the Purchaser under this Agreement to be performed by it prior to the closing of the Transaction (the “Closing”) shall have been duly performed in all material respects, which condition is for the exclusive benefit of the Vendor and may be waived, in whole or in part, by the Vendor in its sole discretion.

| 4. | Condition of Closing for the Benefit of the Purchaser. |

The Vendor acknowledges and agrees that the Purchaser’s obligation to complete the Transaction is also subject to the condition that all covenants of the Vendor under this Agreement to be performed by it prior to the Closing shall have been duly performed in all material respects, which condition is for the exclusive benefit of the Purchaser and may be waived, in whole or in part, by the Purchaser in its sole discretion.

| (1) | The Closing will, subject to the satisfaction or waiver of each of the conditions set forth in Sections 2, 3 and 4 of this Agreement, take place on the fifth (5th) Business Day following the date on which all of the Closing Regulatory Approvals have been obtained, or as soon thereafter as the other conditions of Closing can be satisfied or have been waived (such date, the “Closing Date”), at 9:00 a.m. (New York time) (the “Closing Time”) at the offices of Stikeman Elliott LLP in New York, New York, or at such other time and date or such other place as may be agreed upon orally or in writing by the Parties. |

- 3 -

| (2) | The Purchaser shall deliver or cause to be delivered to the Vendor at or prior to Closing: |

| | (a) | a certificate of the Purchaser, signed on behalf of the Purchaser, without personal liability, by a senior officer of the Purchaser, addressed to the Vendor and dated the Closing Date certifying that the Purchaser has performed in all material respects all covenants of the Purchaser under this Agreement to be performed by it prior to the Closing; |

| | | |

| | (b) | a wire transfer of immediately available funds in the currency of the United States of America in accordance with the wire transfer instructions provided to the Purchaser by the Vendor prior to the Closing Date in the aggregate amount of the Purchase Price; and |

| | | |

| | (c) | certified copies of (i) the articles of the Purchaser, (ii) a confirmation of the Chair and the Secretary of the Purchaser confirming that the board of directors of the Purchaser has approved the entering into of this Agreement and the completion of the Transaction contemplated hereunder, and (iii) a list of the officers and directors of the Purchaser authorized to sign this Agreement, together with their specimen signatures. |

| (3) | The Vendor shall deliver or cause to be delivered to the Purchaser at or prior to Closing: |

| | (a) | a certificate of the Vendor, signed on behalf of the Vendor, without personal liability, by a senior officer of the Vendor, addressed to the Purchaser and dated the Closing Date certifying that the Vendor has performed in all material respects all covenants of the Vendor under this Agreement to be performed by it prior to the Closing; |

| | | |

| | (b) | evidence that the Guarantor and its subsidiaries, excepting the Corporation and its direct or indirect subsidiaries, have changed their names, as applicable, so as to remove all references to “Harry Winston”, “Winston” and/or “HW”; |

| | | |

| | (c) | a certificate of the Guarantor as to all amounts contributed or invested by the Guarantor, directly or indirectly but without duplication, to or in the Corporation during the period between the date hereof and the Closing Date in connection with the Retail Facilities, together with reasonable supporting evidence of such contributions or investments; |

| | | |

| | (d) | share certificates representing the Purchased Shares duly endorsed in blank for transfer, or accompanied by irrevocable security transfer powers of attorney duly executed in blank, in either case by the holders of record, together with evidence that the Purchaser or its nominee(s) have been entered upon the books of the Corporation as the holder of the Purchased Shares; |

- 4 -

| | (e) | share certificates for the outstanding shares of each subsidiary of the Corporation owned by the Corporation or another subsidiary of the Corporation, to the extent that such shares have not been pledged under the Retail Facilities, and in cooperation with the Purchaser, a customary “pay- off” letter from the lenders under the Retail Facilities in respect of the repayment and discharge by the Purchaser on or immediately after Closing of the Retail Facilities and providing for the release upon such repayment and discharge of all related Liens and the reconveyance and return of all applicable security, including all shares pledged as security thereunder; |

| | | |

| | (f) | certified copies of (i) the certificate of formation and limited liability company agreement of the Vendor, (ii) all resolutions of the Managers and sole Member of the Vendor approving the entering into of this Agreement and the completion of the Transaction contemplated hereunder, and (iii) a list of the officers and Managers of the Vendor authorized to sign this Agreement, together with their specimen signatures; |

| | | |

| | (g) | certified copies of the certificate of incorporation and by-laws of the Corporation; and |

| | | |

| | (h) | certified copies of (i) the articles and by-laws of the Guarantor, (ii) all resolutions of the board of directors of the Guarantor approving the entering into of this Agreement and the completion of the Transaction contemplated hereunder, and (iii) a list of the officers and directors of the Guarantor authorized to sign this Agreement, together with their specimen signatures. |

| (1) | From the date hereof until the earlier of the Closing Time and the termination of this Agreement, subject to compliance with applicable law and the terms of any existing contracts, the Vendor shall: |

| | | |

| (a) | give to the Purchaser and its representatives access, at all reasonable times, to the offices, premises, properties, books and records of the Harry Winston Group (provided that such access is not unduly disruptive to the Retail Business); and |

| | | |

| (b) | furnish to the Purchaser and its representatives such financial and operating data and other information relating to the Harry Winston Group as the Purchaser may reasonably request. |

| | | |

| (2) | Any investigations pursuant to this Section 6 shall not be unduly disruptive to the Retail Business, and any investigation of the inventories of the Harry Winston Group shall be limited to physical on-site investigations conducted at the premises of the Harry Winston Group. |

| | | |

| (3) | Without limiting the generality of the foregoing, the Vendor agrees that, subject to compliance with applicable law, it will provide to the Purchaser, as promptly as reasonably practicable following the date hereof (and prior to the Closing): |

- 5 -

| (a) | a schedule of the corporate and capital structure of the Corporation and its subsidiaries, together with certified copies of the articles and by-laws (or similar constating documents) of each of the subsidiaries of the Corporation; |

| | | |

| (b) | a schedule of the registered patents and design patents of the Corporation and/or its subsidiaries; |

| | | |

| (c) | a schedule of the registered trade-marks of the Corporation and/or its subsidiaries; |

| | | |

| (d) | a schedule of the real property owned by the Corporation or its subsidiaries; |

| | | |

| (e) | a schedule of the real property leased or subleased to the Corporation or its subsidiaries; |

| | | |

| (f) | a schedule of the Material Contracts (as defined in Schedule “A”); |

| | | |

| (g) | a schedule of the insurance policies of the Corporation and its subsidiaries; |

| | | |

| (h) | a schedule of all employees of the Corporation and its subsidiaries, including elements of their compensation and remuneration; |

| | | |

| (i) | a schedule of all Employee Plans and the benefits payable thereunder; and |

| | | |

| (j) | when available, the audited consolidated financial statements of the Harry Winston Group as of and for the twelve months ending January 31, 2013. |

| | | |

| (4) | The Vendor agrees that, subject to compliance with applicable law, it will use all commercially reasonable efforts to provide to the Purchaser, on or prior to the Closing Date: |

| | | |

| (a) | a copy of all bank account details of the Corporation and each of its subsidiaries, as well as copies of statements of each bank account of each of those companies made up to a date as close as commercially practicable to the Closing Date; |

| | | |

| (b) | the letters of resignation of all members of the board of directors of the Corporation and each subsidiary of the Corporation, effective as of the Closing Date, except to the extent otherwise directed by the Purchaser; and |

| | | |

| (c) | the letter of resignation of the Corporation’s auditor(s), effective as of the Closing Date. |

| | | |

| (5) | The Purchaser acknowledges and agrees that the Vendor’s contact for purposes of this Agreement and the Transaction is Robert A. Gannicott, and that neither it nor any of its representatives will contact any other officers or employees of the Vendor or the Corporation or any of their subsidiaries or affiliates without the express prior consent of Robert A. Gannicott. |

- 6 -

| (6) | The Parties acknowledge that the Guarantor and the Purchaser entered into a non- disclosure agreement[REDACTED - DATE](the “Non-Disclosure Agreement”). The Parties agree that the Non-Disclosure Agreement continues to apply, including in respect of all information directly or indirectly disclosed to the Purchaser pursuant to this Agreement, and that the Parties are bound by its terms. Upon Closing, the Non-Disclosure Agreement will terminate. If the Closing does not occur, the Non-Disclosure Agreement will remain in effect in accordance with and subject to its terms. |

| 7. | Filings and Authorizations. |

| (1) | Subject to the terms and conditions of this Agreement, the Parties shall use their reasonable best efforts, on a cooperative basis, to take, or cause to be taken, all actions and to do, or cause to be done, all things necessary, proper or advisable under applicable laws to consummate the Transaction as soon as practicable, including: |

| | | |

| (a) | cooperating with each other and acting reasonably to determine as promptly as practicable following the date hereof which potential regulatory approvals identified in Schedule “C” will be the “Regulatory Approvals”, and which will be the “Closing Regulatory Approvals”, and which will be neither; |

| | | |

| (b) | using their reasonable best efforts to obtain and maintain all Regulatory Approvals and all approvals, clearances, consents, registrations, permits, authorizations, notices and other confirmations required to be obtained from any third party that are necessary, proper or advisable to consummate the Transaction contemplated by this Agreement; |

| | | |

| (c) | preparing and filing as promptly as practicable all necessary documents, registrations, statements, petitions, filings and applications for the Regulatory Approvals; and |

| | | |

| (d) | using reasonable best efforts to oppose, lift or rescind any injunction or restraining or other order or notice seeking to stop, or otherwise adversely affecting their ability to consummate, the Transaction or imposing any material restrictions, limitations or conditions on the Parties or the Transaction. |

| | | | (2) | The Parties shall co-operate in the preparation of all applications for the Regulatory Approvals and any other orders, clearances, consents, notices, rulings, exemptions, certificates, no-action letters and approvals reasonably deemed by either the Purchaser or the Vendor to be necessary to discharge their respective obligations under this Agreement or which are otherwise advisable under applicable laws in connection with the Transaction. |

| | | |

| (3) | Subject to applicable laws, the Parties shall cooperate with and keep each other fully informed as to all filings, submissions, correspondence, discussions, communications, meetings and proceedings relating to obtaining the Regulatory Approvals and any other actions or activities pursuant to this Section 7, and shall promptly notify each other of any material communication or correspondence from any Governmental Authority in respect of the Transaction or this Agreement, and shall not make, have or send any filings, submissions, correspondence, discussions, communications, meetings or proceedings, or participate in any communications or meetings with or to any Governmental Authority, in respect of any of the Regulatory Approvals or the transactions contemplated by this Agreement unless such Party consults with the other Parties in advance and, to the extent not precluded by such Governmental Authority, gives the other Parties the opportunity to review and comment on drafts of any such filings, submissions, correspondence or communications and provides final copies of such submissions, correspondence and communications, and to attend and participate in any communications, meetings and proceedings. The Parties will each provide the others with copies of all business records, including documents and emails, which are provided to a Governmental Authority in connection with the Regulatory Approvals or the transactions contemplated by this Agreement. |

- 7 -

| (4) | To the extent that any information or documentation to be provided by a Party to the other Parties pursuant to Section 6 or Section 7 of this Agreement is competitively sensitive, such information may be provided only to external counsel for such Party on an external counsel only basis. In addition, no provision contained in this Agreement shall be interpreted or construed as requiring the Purchaser to share with the Vendor or the Vendor’s counsel the specific value of the Purchaser’s turnover or sales in countries where Regulatory Approvals are not sought by the Parties. |

| | |

| (5) | Each Party shall pay its own costs and fees incurred in connection with the Regulatory Approvals. Filing fees payable to Governmental Authorities in connection with the Regulatory Approvals shall be split equally between the Purchaser and the Vendor. |

| | |

| (6) | The Purchaser shall take any and all steps necessary to obtain the Regulatory Approvals, including, without limitation, making such arrangements, undertakings or agreements in respect of any of the businesses, properties, assets, rights or interests of the Harry Winston Group and/or the Purchaser and its subsidiaries and affiliates (in each such case without any reduction in the Purchase Price) as may be required in order to obtain the Regulatory Approvals. |

| | |

| (7) | The Purchaser acknowledges and agrees that on Closing of the Transaction the Purchaser shall, without any reduction in the Purchase Price, pay and discharge in full, or cause to be paid and discharged in full, all amounts outstanding under the Retail Facilities, and agrees that it shall, in cooperation with the Vendor and the Corporation, make all necessary arrangements to do so and to obtain the release of all related Liens and any guarantees in respect of the Retail Facilities provided by the Guarantor and any of its subsidiaries. The Vendor, the Guarantor and the Purchaser acknowledge and agree that they shall cooperate with each other in making arrangements for the full repayment and discharge by the Purchaser of the Retail Facilities on Closing and all related Liens and guarantees, including by cooperating to obtain all necessary “pay-off” letters from the lenders under the Retail Facilities and the return, as applicable, of the share certificates representing the shares of the Corporation’s subsidiaries that have been pledged under the Retail Facilities. In addition, the Purchaser acknowledges and agrees that following Closing of the Transaction it will, to the extent required, without any reduction in the Purchase Price, pay and discharge in full, or cause to be paid and discharged in full, all amounts outstanding under the Japan Facilities. |

- 8 -

| (8) | [REDACTED – COMMERCIALLY SENSITIVE INFORMATION] |

| 8. | Conduct of the Retail Business Prior to Closing. |

| (1) | The Vendor covenants and agrees that, during the period from the date of this Agreement until the earlier of the Closing Date and the time that this Agreement is terminated in accordance with its terms, and except as otherwise contemplated by this Agreement or the business plans for the Retail Business for the fiscal year beginning February 1, 2013 provided to the Purchaser prior to the date hereof and included in the Data Room Materials, or as required by applicable law, Governmental Authority or the terms of any existing contract in respect of the Retail Business, the Vendor shall, and shall cause each of the Corporation and its subsidiaries to, conduct the Retail Business in the ordinary course consistent with past practice, and shall use its commercially reasonable efforts to preserve intact the present business organization of the Corporation and its subsidiaries and to preserve the current relationships of the Corporation and its subsidiaries with customers, suppliers, distributors, licensors, licencees, employees and other persons with which the Corporation or any of its subsidiaries has significant business relations. |

| | | |

| (2) | Without limiting the generality of the foregoing, from the date of this Agreement until the earlier of the Closing Date and the time that this Agreement is terminated in accordance with its terms, and except as otherwise contemplated by this Agreement or the business plans for the Retail Business for the fiscal year beginning February 1, 2013 provided to the Purchaser prior to the date hereof and included in the Data Room Materials, as required by applicable law, Governmental Authority or the terms of any existing contract in respect of the Retail Business, or as consented to by the Purchaser, the Vendor shall ensure that the Corporation and its subsidiaries do not: |

| | | |

| (a) | amend their articles of incorporation, articles of amalgamation, by-laws or, their similar organizational documents; |

| | | |

| (b) | split, combine or reclassify any shares of the Corporation or declare, set aside or pay any dividend or other distribution (whether in cash, stock or property or any combination thereof) on any of their shares, other than dividends or distributions from a subsidiary of the Corporation to the Corporation or another wholly-owned subsidiary of the Corporation; |

| | | |

| (c) | redeem, repurchase, or otherwise acquire or offer to redeem, repurchase or otherwise acquire any shares of the Corporation or any of its subsidiaries, except for the acquisition of shares of capital stock of any wholly-owned subsidiary of the Corporation by the Corporation or by any other wholly- owned subsidiary of the Corporation; |

- 9 -

| | (d) | issue, deliver or sell, or authorize the issuance, delivery or sale of any shares, or any options, warrants or similar rights exercisable or exchangeable for or convertible into such shares, of the Corporation or any of its subsidiaries, other than the issuance of any shares of any subsidiary of the Corporation to the Corporation or any other wholly-owned subsidiary of the Corporation or the issuance of additional shares of the Corporation to the Vendor (which additional shares shall, for greater certainty, also be “Purchased Shares”); |

| | | |

| | (e) | acquire (by merger, consolidation, acquisition of stock or assets or otherwise), directly or indirectly, in one transaction or in a series of related transactions, assets, securities, properties, interests or businesses having a cost, on a per transaction or series of related transactions basis, in excess of U.S.$2 million, other than for greater certainty ordinary course procurement contracts or the acquisition of inventory or other assets for resale or use by the Corporation and/or any of its subsidiaries in connection with the ordinary course operation of the Retail Business; |

| | | |

| | (f) | sell, lease or otherwise transfer, in one transaction or in a series of related transactions, any assets, securities, properties, interests or businesses, having a cost or proceeds, as applicable, on a per transaction or series of related transactions basis, in excess of U.S.$2 million, other than: (i) for greater certainty, the sale, lease or other use or transfer of inventories and products in the ordinary course of business; or (ii) in respect of obsolete assets; |

| | | |

| | (g) | make any capital expenditure or commitment to do so outside of the ordinary course operation of the Retail Business that individually or in the aggregate exceeds U.S.$2 million; |

| | | |

| | (h) | except as required by applicable law or by the terms of any employee plans or contracts in effect on the date hereof: (i) increase any severance, change of control or termination pay to (or amend any existing arrangement with) any employee, director or executive officer of the Corporation or any of its subsidiaries; (ii) increase the benefits payable under any existing severance or termination pay policies with any employee, director or executive officer of the Corporation or any of its subsidiaries; (iii) increase compensation, bonus levels or other benefits payable to any employee, director or executive officer of the Corporation or any of its subsidiaries other than in a manner consistent with past practice; or (iv) enter into any employment, deferred compensation or other similar agreement (or amend any such existing agreement) with any director or executive officer of the Corporation or any of its subsidiaries; |

| | | |

| | (i) | grant or commit to grant an exclusive or non-exclusive licence of any Intellectual Property Rights (as defined in Schedule “A” hereto) or otherwise transfer any Intellectual Property Rights or other rights in or in respect thereto, other than any right to use Intellectual Property Rights granted in the ordinary course of the Retail Business consistent with past practice; |

| | | |

| | (j) | amend the Retail Facilities; |

- 10 -

| | (k) | cancel or waive any material claims or rights; or |

| | | |

| | (l) | agree, resolve or commit to do any of the foregoing; |

provided for greater certainty that this Section 8 shall not prevent the Corporation and its subsidiaries from effecting transactions in respect of amounts owing wholly between the Corporation and/or one or more of its subsidiaries, or between subsidiaries of the Corporation, where such transactions do not result in any adverse consequences to the Corporation or any of its subsidiaries.

| 9. | Post-Closing Arrangements. |

| (1) | The Purchaser agrees that it will, from and following the Closing, engage the Guarantor, on a non-exclusive basis, to source polished diamonds for the Purchaser and its affiliates, such sourcing to be on terms and conditions satisfactory to each of the Purchaser, its affiliates and the Guarantor, each acting reasonably, and to be generally consistent (with such changes thereto as may be necessary or desirable to reflect arm’s length terms and prevailing market conditions) with the sourcing arrangements between the Guarantor and the Harry Winston Group in existence on the date hereof. The Purchaser and the Guarantor agree that any such sourcing arrangement consists of and shall continue to consist of competitive conditions with regard to price, terms of delivery, specifications, quality and quantity of the sourced products. The Guarantor also agrees that it will, at the request of the Purchaser, for such transition period from and following the Closing as may be agreed to between the Guarantor and the Purchaser, continue to make available to the Harry Winston Group the services of the head of the Guarantor’s rough diamond sorting and sales group, such services to be provided on reasonable terms and conditions, including as to cost, extent and duration, that are satisfactory to both the Purchaser and the Guarantor, each acting reasonably. |

| | |

| (2) | The Guarantor agrees that it will at the request of the Purchaser, for such transition period from and following the Closing as may be agreed to between the Guarantor and the Purchaser, continue to provide to the Harry Winston Group security services that are generally consistent with those provided by the Guarantor to the Harry Winston Group as of the date hereof, such services to be provided on reasonable terms and conditions, including as to price and limits of liability, that are satisfactory to both the Purchaser and the Guarantor, each acting reasonably. |

| 10. | Representations and Warranties of the Vendor. |

Except in each case as contained in the Data Room Materials, the Vendor hereby represents and warrants to the Purchaser that the statements contained in Schedule “A” hereto are true and correct as of the date hereof, and acknowledges that the Purchaser is relying upon such representations and warranties in connection with the purchase, assignment and transfer of the Purchased Shares.

- 11 -

| 11. | Representations and Warranties of the Purchaser. |

The Purchaser hereby represents and warrants to the Vendor that the statements contained in Schedule “B” hereto are true and correct as of the date hereof, and acknowledges that the Vendor is relying upon such representations and warranties in selling, transferring and assigning the Purchased Shares.

| 12. | Survival of Representations and Warranties. |

The representations and warranties contained in this Agreementshallsurvive the Closing and continue in full force and effect for a period of three (3) years after the Closing Date, except that:

| | (a) | the representations and warranties set out in paragraphs (a), (f), and (i) of Schedule “A”, and paragraphs (a) and (d) of Schedule “B” survive and continue in full force and effect without limitation of time; |

| | | |

| | (b) | the representations and warranties set out in paragraph (bb) of Schedule “A” will survive and continue in full force and effect until twelve (12) months after the expiration of the period during which any Tax assessment (which includes any assessment, reassessment or other form of recognized document assessing liability for Taxes under applicable law) may be issued by a Governmental Authority in respect of any taxation year to which such representations and warranties extend (such period to be determined without regard to any consent, waiver, agreement or other document, made or filed after the Closing Date that extends the period during which a Governmental Authority may issue a Tax assessment); and |

| | | |

| | (c) | there is no limitation as to time for claims against a Party based on fraudulent misrepresentation by that Party. |

| (1) | This Agreement may be terminated: |

| | (a) | by mutual written agreement of the Purchaser and the Vendor; or |

| | | |

| | (b) | by the Purchaser, if there has been a failure to perform any covenant or agreement on the part of the Vendor set forth in this Agreement that would cause the condition set forth in Section 4 not to be satisfied, provided that the Purchaser is not then in breach of this Agreement so as to cause the condition set forth in Section 3 not to be satisfied; or |

| | | |

| | (c) | by the Vendor, if there has been a failure to perform any covenant or agreement on the part of the Purchaser set forth in this Agreement that would cause the condition set forth in Section 3 not to be satisfied, provided that the Vendor is not then in breach of this Agreement so as to cause the condition set forth in Section 4 not to be satisfied; or |

| | | |

| | (d) | by either the Purchaser or the Vendor if Closing has not occurred on or prior to the Outside Date, except that the right to terminate this Agreement under this Section 13(1)(d) will not be available to a Party whose breach of this Agreement has been the cause of, or resulted in, the failure of Closing to occur by such date. |

- 12 -

| (2) | The Purchaser may not exercise its right to terminate this Agreement pursuant to Section 13(1)(b), and the Vendor may not exercise its right to terminate this Agreement pursuant to Section 13(1)(c), unless the Party seeking to terminate the Agreement shall have delivered a written notice to the breaching Party specifying in reasonable detail all breaches of covenants which the Party delivering such notice is asserting as the basis for the termination right. If any such notice is properly delivered, provided that the applicable Party is proceeding diligently to cure such matter (if such matter qualifies as a basis for termination by the applicable Party) and such matter is capable of being cured, the Party seeking to terminate this Agreement may not exercise such termination right until the earlier of (a) the Outside Date, and (b) the date that is thirty (30) Business Days following receipt of such notice by the Party to whom the notice was delivered, if such matter has not been cured by such date. |

| | | |

| (3) | The Parties agree that irreparable harm would occur for which money damages would not be an adequate remedy at law in the event that any of the provisions of this Agreement were not performed in accordance with their specific terms or were otherwise breached. It is accordingly agreed that the Parties shall be entitled to an injunction or injunctions and other equitable relief to prevent breaches of this Agreement, any requirement for the securing or posting of any bond in connection with the obtaining of any such injunctive or other equitable relief hereby being waived. |

| | | |

| (4) | If this Agreement is terminated pursuant to Section 13(1): |

| | | |

| (a) | the provisions of this Section 13, Section 7(5), Section 19 and Section 24 shall survive any termination hereof pursuant to Section 13(1); and |

| | | |

| (b) | the terminating Party’s right to pursue all legal remedies will survive such termination unimpaired. |

| (1) | Subject to Section 16, following Closing the Vendor will indemnify and save each of the Purchaser and the Corporation harmless of and from, and will pay for, any Damages suffered by, imposed upon or asserted against the Purchaser or the Corporation as a result of, in respect of, connected with, or arising out of, under, or pursuant to: |

| | | |

| (a) | any breach or inaccuracy of any representation or warranty of the Vendor contained in this Agreement for which a notice of claim under Section 15 has been provided to the Vendor within the applicable period specified in Section 12; and |

- 13 -

| (b) | any failure of the Vendor to perform or fulfil any of its covenants or obligations under this Agreement. |

| | | | (2) | Subject to Section 16, following Closing the Purchaser will indemnify and save the Vendor harmless of and from, and will pay for, any Damages suffered by, imposed upon or asserted against the Vendor as a result of, in respect of, connected with, or arising out of, under or pursuant to: |

| | | |

| (a) | any breach or inaccuracy of any representation or warranty of the Purchaser contained in this Agreement for which a notice of claim under Section 15 has been provided to the Purchaser within the applicable period specified in Section 12; and |

| | | |

| (b) | any failure of the Purchaser to perform or fulfil any of its covenants or obligations under this Agreement. |

| | | | (3) | Except as provided in this Section 14, following Closing, the indemnities provided in Section 14(1) and Section 14(2) constitute the only remedy of the Purchaser or the Vendor, respectively, against a Party in the event of any breach of a representation, warranty, covenant or obligation of such Party contained in this Agreement. Each of the Purchaser and the Vendor expressly waives and renounces any other remedies whatsoever, whether at law or in equity, which it would otherwise be entitled to as against any other Party. |

| | | |

| (4) | No Party is entitled to double recovery for any claims even though they may have resulted from the breach of more than one of the representations, warranties, covenants and obligations of a Party in this Agreement. |

| | | |

| (5) | Nothing in this Agreement in any way restricts or limits the general obligation at law of a Party to mitigate any loss which it may suffer or incur by reason of the breach by another Party of any representation, warranty, covenant or obligation of such Party under this Agreement. If any claim can be reduced by any recovery, settlement or otherwise under or pursuant to any insurance coverage, or pursuant to any claim, recovery, settlement or payment by or against any other person, the Party seeking indemnification shall take, or shall cause to be taken, all appropriate steps to enforce such recovery, settlement or payment. If the matter forming the basis of any claim by the Purchaser is capable of remedy by the Vendor or its affiliates, then the Purchaser shall, and shall cause the Corporation and its subsidiaries to, provide all reasonable assistance to the Vendor (at the Vendor’s expense) to allow the Vendor to remedy any such matter. |

| | | |

| (6) | Any payment made by the Vendor to the Purchaser under this Section 14 is a dollar- for-dollar decrease in the Purchase Price. |

| 15. | Notification of Claims. |

| (1) | If a Third Party Claim is instituted or asserted against an Indemnified Party, the Indemnified Party will promptly notify the Indemnifying Party in writing of the Third Party Claim. The notice must specify in reasonable detail the identity of the person making the Third Party Claim and, to the extent known, the nature of the Damages and the estimated amount needed to investigate, defend, remedy or address the Third Party Claim. |

- 14 -

| (2) | If an Indemnified Party becomes aware of a Direct Claim, the Indemnified Party will promptly notify the Indemnifying Party in writing of the Direct Claim. |

| | |

| (3) | Notice to an Indemnifying Party under this Section 15 of a Direct Claim or a Third Party Claim is an assertion of a claim for indemnification against the Indemnifying Party under this Agreement. Upon receipt of such notice, the provisions of Section 17 will apply to any Direct Claim and the provisions of Section 18 will apply to any Third Party Claim. |

| 16. | Limitations on Indemnification. |

| (1) | A Party has no obligation or liability for indemnification or otherwise with respect to any representation or warranty made by such Party in this Agreement after the end of the applicable time period specified in Section 12, except for claims that the Party has been notified of prior to the end of the applicable time period. Following Closing, a Party has no obligation or liability for indemnification or otherwise with respect to any breach or inaccuracy of any representation or warranty in this Agreement if the person making the claim had actual knowledge of the breach or inaccuracy on or prior to the date hereof. |

| | |

| (2) | For purposes of calculating Damages in this Agreement, none of the Parties have any liability for, or obligation with respect to, any special, indirect, consequential, punitive or aggravated Damages, including Damages based on multiples of earnings, earnings before interest, taxes, depreciation and amortization, or net operating income. |

| | |

| (3) | The amount of any Damages subject to indemnification hereunder or of any claim therefor shall be calculated (a) on an after-Tax basis, and (b) net of any insurance proceeds (net of direct collection expenses) actually received by the Indemnified Party or any of its affiliates or subsidiaries on account of such Damages. The Indemnified Party shall, and shall cause its affiliates and subsidiaries to, as applicable, seek full recovery under all insurance policies covering any Damages to the same extent as they would if such Damages were not subject to indemnification hereunder. In the event that an insurance recovery is received by the Indemnified Party and/or any of its affiliates or subsidiaries with respect to any Damages for which the Indemnified Party has been indemnified hereunder, then the Indemnified Party shall, and shall cause its affiliates and subsidiaries, as applicable, to promptly make a refund equal to the aggregate amount of the recovery (net of all direct collection expenses) to the Indemnifying Party. The Indemnifying Party shall be subrogated to all rights in respect of any Damages indemnified by the Indemnifying Party, but the Indemnified Party and its affiliates and subsidiaries have no claim against the Indemnifying Party as a result thereof. |

| | |

| (4) | Subject to the other provisions of this Section 16, an Indemnifying Party has no liability or obligation with respect to any single claim for indemnification or otherwise with respect to the matters described in Section 14 unless the amount of the Damages with respect to such claim is greater than U.S.$500,000. The amount of Damages with respect to any such claim that does not meet such threshold amount shall not be taken into account in determining whether or not the total of all Damages meets the threshold amount under Section 16(5). |

- 15 -

| (5) | Subject to the other provisions of this Section 16, an Indemnifying Party has no obligation to make any payment for Damages for indemnification or otherwise with respect to the matters described in Section 14 until the total of all Damages with respect to such matters (consisting only of individual claims each amounting to more than U.S.$500,000 in Damages) exceeds U.S.$4 million, in which event the Indemnified Party shall be entitled to claim all of such amount, and in all cases the maximum aggregate liability of the Vendor and the Guarantor under this Agreement for indemnification or otherwise with respect to the matters described in Section 14 shall be U.S.$300 million (the “Damages Cap”).The Vendor and the Guarantor shall have no obligation to make any payment for Damages for indemnification or otherwise in excess of the Damages Cap; provided that: (a) with respect to indemnification for breaches of the representations and warranties set out in paragraph (i) and paragraph (x) of Schedule “A”, the Damages Cap shall be considered to be U.S.$375 million; and (b) the Damages Cap shall not apply with respect to breaches of representations and warranties or covenants as a result of fraudulent misrepresentation, intentional dishonesty or intentional fraud. |

| (1) | Following receipt of notice of a Direct Claim, the Indemnifying Party has ninety (90) days to investigate the Direct Claim and respond in writing. For purposes of the investigation, the Indemnified Party shall make available to the Indemnifying Party the information relied upon by the Indemnified Party to substantiate the Direct Claim, together with such other information as the Indemnifying Party may reasonably request. |

| | |

| (2) | If the Indemnifying Party disputes the validity or amount of the Direct Claim, the Indemnifying Party shall provide written notice of the dispute to the Indemnified Party within the ninety (90) day period specified in Section 17(1). The dispute notice must describe in reasonable detail the nature of the Indemnifying Party’s dispute. During the thirty (30) day period immediately following receipt of a dispute notice by the Indemnified Party, the Indemnifying Party and the Indemnified Party shall attempt in good faith to resolve the dispute. If the Indemnifying Party and the Indemnified Party fail to resolve the dispute within that thirty (30) day time period, the Indemnified Party is free to pursue all rights and remedies available to it, subject to this Agreement. If the Indemnifying Party fails to respond in writing to the Direct Claim within the ninety (90) day period specified in Section 17(1), the Indemnifying Party is deemed to have rejected the Direct Claim, in which event the Indemnified Party is free to pursue all rights remedies available to it, subject to this Agreement. |

- 16 -

| 18. | Procedure for Third Party Claims. |

| (1) | Upon receiving notice of a Third Party Claim, the Indemnifying Party may participate in the investigation and defence of the Third Party Claim and may also elect to assume the investigation and defence of the Third Party Claim. |

| | | |

| (2) | In order to assume the investigation and defence of a Third Party Claim, the Indemnifying Party must give the Indemnified Party written notice of its election within thirty (30) days of the Indemnifying Party’s receipt of notice of the Third Party Claim. |

| | | |

| (3) | If the Indemnifying Party assumes the investigation and defence of a Third Party Claim: |

| | | |

| (a) | the Indemnifying Party will pay for all reasonable costs and expenses of the investigation and defence of the Third Party Claim except that the Indemnifying Party will not, so long as it diligently conducts such defence, be liable to the Indemnified Party for any fees of other counsel or any other expenses with respect to the defence of the Third Party Claim incurred by the Indemnified Party after the date the Indemnifying Party validly exercised its right to assume the investigation and defence of the Third Party Claim; and |

| | | |

| (b) | the Indemnifying Party will reimburse the Indemnified Party for all costs and expenses incurred by the Indemnified Party in connection with the investigation and defence of the Third Party Claim prior to the date the Indemnifying Party validly exercised its right to assume the investigation and defence of the Third Party Claim. |

| | | | (4) | If the Indemnified Party undertakes the defence of the Third Party Claim, the Indemnifying Party will not be bound by any determination of the Third Party Claim or any compromise or settlement of the Third Party Claim effected without the consent of the Indemnifying Party (which consent may not be unreasonably withheld or delayed). |

| | | |

| (5) | The Indemnifying Party will not be permitted to compromise and settle or to cause a compromise and settlement of a Third Party Claim without the prior written consent of the Indemnified Party, which consent may not be unreasonably withheld or delayed, except that the consent of the Indemnified Party will not be required if: |

| | | |

| (a) | the terms of the compromise and settlement require only the payment of money for which the Indemnified Party is entitled to full indemnification under this Agreement; and |

| | | |

| (b) | the Indemnified Party is not required to admit any wrongdoing, take or refrain from taking any action, acknowledge any rights of the person making the Third Party Claim or waive any rights that the Indemnified Party may have against the person making the Third Party Claim. |

- 17 -

| (6) | The Indemnified Party and the Indemnifying Party agree to keep the other fully informed of the status of any Third Party Claim and any related proceedings. If the Indemnifying Party assumes the investigation and defence of a Third Party Claim, the Indemnified Party will, at the request and expense of the Indemnifying Party, use its reasonable efforts to make available to the Indemnifying Party, on a timely basis, those employees whose assistance, testimony or presence is necessary to assist the Indemnifying Party in investigating and defending the Third Party Claim. The Indemnified Party shall, at the request and expense of the Indemnifying Party, make available to the Indemnifying Party or its representatives, on a timely basis, all documents, records and other materials in the possession, control or power of the Indemnified Party, reasonably required by the Indemnifying Party for its use solely in defending any Third Party Claim which it has elected to assume the investigation and defence of. The Indemnified Party shall cooperate on a timely basis with the Indemnifying Party in the defence of any Third Party Claim. |

This Agreement shall be governed by and interpreted in accordance with the laws of Denmark, excluding the applicable laws on conflict of laws, regardless of the place or places of its physical execution and performance. All disputes arising in connection with this Agreement shall be finally settled under the Rules of Arbitration of the International Chamber of Commerce by three (3) arbitrators appointed in accordance with such Rules. The arbitration shall take place in Copenhagen, Denmark. The proceedings shall be held in English. Adherence to this Section 19 regarding arbitration shall not limit the right of the Parties hereto, as applicable, to seek any provisional remedy including, without limitation, injunctive or equitable relief, from any court of competent jurisdiction.

Any notice, direction or other communication given pursuant to this Agreement (each a “Notice”) must be in writing, sent by personal delivery, courier, facsimile or email and addressed:

| if to the Purchaser: | The Swatch Group Ltd. |

| | Seevorstadt 6 |

| | 2501 Biel/ Bienne |

| | Switzerland |

| | Attention: | Dr. Hanspeter Rentsch |

| | Email: | Hanspeter.rentsch@swatchgroup.com |

| | Fax: | +41 32 343 69 23 |

| if to the Guarantor or the | Harry Winston Diamond Corporation |

| Vendor: | P.O. Box 4569 |

| Station A |

| | Toronto, Ontario |

| M5W 4T9 |

- 18 -

| | Attention: | Robert A. Gannicott |

| | Email: | rgannicott@gmail.com |

| | Fax: | (416) 362-2230 |

| | | |

| with a copy to: | Stikeman Elliott LLP |

| | 5300 Commerce Court West |

| 199 Bay Street |

| | Toronto, Ontario M5L 1B9 |

| | | |

| | Attention: | Sean Vanderpol |

| | Email: | svanderpol@stikeman.com |

| | Fax: | (416) 947-0866 |

Any Notice, if personally delivered, shall be deemed to have been validly and effectively given and received on the date of such delivery, if delivered before 5:00 p.m. on a Business Day in the place of delivery, or the next Business Day in the place of delivery, if not delivered on a Business Day or if sent after 5:00 p.m., and if sent by telecopier or other electronic communication with confirmation of transmission, shall be deemed to have been validly and effectively been given and received on the Business Day in the place of delivery next following the day it was transmitted. Any Party may at any time change its address for service from time to time by giving notice to the other Parties in accordance with this Section 20.

None of the Parties may assign or transfer this Agreement or any of the rights or obligations under it without the prior written consent of the other Parties. Notwithstanding the foregoing, the Purchaser shall be entitled to assign its rights under this Agreement without the consent of the Vendor or the Guarantor to any wholly-owned subsidiary of the Purchaser who agrees to be bound by all of the covenants of the Purchaser contained herein and comply with the provisions of this Agreement and who delivers to the Vendor and the Guarantor a duly executed undertaking to such effect in form and substance satisfactory to the Vendor and the Guarantor, acting reasonably, and provided that any such assignment shall not relieve the Purchaser of any of its obligations hereunder.

The Parties agree that during the period up to and including the Closing Date, no press release, public statement or announcement or other public disclosure (a “Public Statement”) with respect to this Agreement or the Transaction may be made except with the prior written consent and joint approval of the Purchaser and the Guarantor, or if required by law or a Governmental Authority, and that where the Public Statement is required by law or a Governmental Authority, the Party required to make the Public Statement will use reasonable commercial efforts to obtain the approval of the other Parties as to the form, nature and extent of the disclosure. A Party shall, however, after announcement of the Transaction, be permitted to discuss this Agreement or the Transaction with investors and shareholders, provided that any such discussions are based on information already publicly disclosed by such Party in accordance with the terms hereof.

- 19 -

This Agreement contains, for good and valuable consideration, the entire agreement of the Parties relating to the subject matter hereof and there are no representations, covenants or other agreements relating to the subject matter hereof except as stated or referred to herein. This Agreement may not be amended or modified in any respect except by written instrument executed by each of the Parties.

Except as otherwise contemplated by this Agreement, all costs and expenses (including the fees and disbursements of legal counsel and other professional advisors) incurred in connection with this Agreement and the Transaction contemplated herein shall be paid by the Party incurring such expenses.

This Agreement becomes effective only when executed by the Parties. After that time, it is binding upon and enures to the benefit of the Parties and their respective successors and assigns.

If any provision of this Agreement is determined by a court of competent jurisdiction to be invalid, illegal or unenforceable in any respect, such determination shall not impair or affect the validity, legality or enforceability of the remaining provisions hereof, and each provision is hereby declared to be separate, severable and distinct.

In this Agreement, unless there is something in the subject matter or context inconsistent therewith:

| | (a) | “including” means including without limitation; |

| | | |

| | (b) | unless otherwise specified, the word “Section” followed by a number means and refers to the specified Section of this Agreement; |

| | | |

| | (c) | in the computation of periods of time from a specified date to a later specified date, unless otherwise expressly stated, the word “from” means “from and including” and the words “to” and “until” each mean “to but excluding”; |

| | | |

| | (d) | words importing the singular number only shall include the plural and vice versa and words importing any gender shall include all genders; |

| | | |

| | (e) | if a word or phrase is defined, its other grammatical forms have a corresponding meaning; |

| | | |

| | (f) | the division of this Agreement into Sections and other subdivisions and the insertion of headings are for convenient reference only and do not affect the Agreement’s interpretation; |

- 20 -

| | (g) | all references in this Agreement to dollars, or to “$” or “U.S.$” mean the currency of the United States of America unless otherwise specifically indicated; |

| | | |

| | (h) | all references in this Agreement to “the knowledge of the Vendor” means the actual knowledge[REDACTED – CERTAIN INDIVIDUALS]; |

| | | |

| | (i) | unless otherwise provided in this Agreement, any reference in this Agreement to a statute refers to such statute and all rules and regulations made under it, as it or they may have been or may from time to time be amended or re-enacted, and any reference in this Agreement to a person includes its successors and permitted assigns; |

| | | |

| | (j) | except as otherwise provided in this Agreement, the term “Agreement” and any reference to this Agreement or any other agreement or document includes, and is a reference to, this Agreement or such other agreement or document as it may have been, or may from time to time be amended, restated, replaced, supplemented or novated and includes all schedules to it; |

| | | |

| | (k) | unless expressly provided in any particular section of this Agreement, references in certain sections of this Agreement to dollar amounts are not intended to be, and shall not be deemed to be, illustrative or interpretive for purposes of determining a standard of materiality; |

| | | |

| | (l) | “Authorization” means, with respect to any person, any order, permit, approval, consent, waiver, license or similar authorization of any Governmental Authority having jurisdiction over the person; |

| | | |

| | (m) | “Business Day”means any day of the year, other than a Saturday, Sunday or any day on which major banks are closed for business in Toronto, Ontario, New York, New York or Zurich, Switzerland. In the event that any action is required or permitted to be taken under this Agreement on or by a date that is not a Business Day, such action may be taken on or by the Business Day immediately following such date; |

| | | |

| | (n) | [REDACTED – COMMERCIALLY SENSITIVE INFORMATION]; |

| | | |

| | (o) | “Closing Regulatory Approvals” means the HSR Approval, as well as those other approvals identified in Schedule “C” that the Vendor and the Purchaser agree, each acting reasonably and as contemplated by Section 7(1)(a), the failure of which to obtain before Closing would reasonably be expected to materially adversely affect the ability of the Parties to consummate the Transaction to a material extent; |

| | | |

| | (p) | “Damages” means any losses, liabilities, damages or out-of-pocket expenses (including reasonable legal fees and expenses) whether resulting from an action, suit, proceeding, arbitration, claim or demand that is instituted or asserted by a third party, including a Governmental Authority, or a cause, matter, thing, act, omission or state of facts not involving a third party; |

- 21 -

| | (q) | “Data Room Materials” means the material and information contained in the virtual data room established by the Guarantor and made available to the Purchaser and its representatives on or prior to 9:00 a.m. (London time) on January 10, 2013, an electronic copy of the contents of which has been delivered to the Purchaser concurrently with the execution and delivery of this Agreement; |

| | | |

| | (r) | “Direct Claim”means any cause, matter, thing, act, omission or state of facts not involving a Third Party Claim which entitles an Indemnified Party to make a claim for indemnification under this Agreement; |

| | | |

| | (s) | “Employee Plans”means all the employee benefit, fringe benefit, supplemental unemployment benefit, bonus, incentive, profit sharing, termination, change of control, pension, retirement, stock option, stock purchase, stock appreciation, health, welfare, medical, dental, disability, life insurance and similar plans, programmes, arrangements or practices relating to the current or former employees of the Harry Winston Group maintained, sponsored or funded by the Corporation or any of its subsidiaries, whether written or oral, funded or unfunded, insured or self-insured, registered or unregistered; |

| | | |

| | (t) | “Environmental Laws”means all applicable laws and agreements with Governmental Authorities and all other statutory requirements relating to public health or the protection of the environment and all Authorizations issued pursuant to such laws, agreements or statutory requirements; |

| | | |

| | (u) | “GAAP” means generally accepted accounting principles set forth in the opinions and pronouncements of the Accounting Principles Board, the American Institute of Certified Public Accountants and the Financial Accounting Standards Board or in such other statements by such other entity as may be in general use by significant segments of the accounting profession in the United States as in effect at the relevant time; |

| | | |

| | (v) | “Governmental Authority” means (i) any international, multinational, national, federal, provincial, state, municipal, local or other governmental or public department, central bank, court, minister, governor-in-council, cabinet commission, board, bureau, agency, commissioner, tribunal or instrumentality, domestic or foreign, (ii) any subdivision or authority of any of the above, (iii) any stock exchange and (iv) any quasi-governmental or private body exercising any regulatory, expropriation or taxing authority under or for the account of any of the above; |

| | | |

| | (w) | “Harry Winston Group” means the Corporation and its subsidiaries; |

| | | |

| | (x) | “HSR Approval” means the waiting period applicable to the completion of the Transaction under theHart-Scott-Rodino Antitrust Improvements Act of 1976, as amended, shall have expired or been terminated, and no Governmental Authority shall have applied for an injunction or other order under the antitrust laws of the United States of America or any state thereof in respect of the Transaction; |

- 22 -

| | (y) | “Indemnified Party”means a Party with indemnification rights or benefits under Section 14 or otherwise under this Agreement; |

| | | |

| | (z) | “Indemnifying Party”means a Party against which a claim may be made for indemnification under this Agreement, including pursuant to Section 14; |

| | | |

| | (aa) | “Japan Facilities” means the secured credit facilities between Harry Winston Japan K.K. and ABN AMRO Bank N.V.; |

| | | |

| | (bb) | “Lien” means any mortgage, charge, pledge, hypothec or security interest granted to a third party to secure payment or performance of an obligation; |

| | | |

| | (cc) | “material fact” means a fact that would reasonably be expected to have a significant effect on the value of the Harry Winston Group; |

| | | |

| | (dd) | “Outside Date”means: (a) July 31, 2013, provided that either the Purchaser or the Vendor may elect from time to time by notice in writing delivered not less than 10 Business Days prior to the Outside Date to extend the Outside Date by a period of not less than 10 Business Days, if all of the Closing Regulatory Approvals have not been obtained by the date of such extension and if the Party so extending the Outside Date reasonably believes that all of the Closing Regulatory Approvals are capable of being obtained prior to the Outside Date as it may be so extended, and provided further that such extensions may not exceed three (3) months in the aggregate; or (b) such earlier or later date as the Parties may agree in writing; |

| | | |

| | (ee) | “Permitted Liens” means any Lien that is permitted to be created, incurred, assumed or to exist by Section 6.13 of the Retail Facilities, and includes for greater certainty the Liens created pursuant to the Retail Facilities; |

| | | |

| | (ff) | “Pro Forma Net Debt” means (a) the aggregate indebtedness of the Harry Winston Group actually outstanding as of the date hereof under the credit facilities identified in Schedule “G”, less (b) the sum of the consolidated cash of the Harry Winston Group as of the date hereof and U.S.$8.5 million; |

| | | |

| | (gg) | “Public Filings” means, collectively, all of the documents publicly filed by the Guarantor with the Ontario Securities Commission and the United States Securities and Exchange Commission during the period from February 1, 2011 to the date hereof, which documents are accessible on the System for Electronic Document Analysis and Retrieval of the Canadian Securities Administrators and the Electronic Data-Gathering, Analysis, and Retrieval system of the United States Securities and Exchange Commission, respectively; |

| | | |

| | (hh) | “Regulatory Approvals” means those sanctions, rulings, consents, orders, exemptions, permits and other approvals (including the lapse, without objection, of a prescribed time under any law that states that a transaction may be implemented if a prescribed time lapses following the giving of notice without an objection being made) of Governmental Authorities required in connection with the Transaction, including for greater certainty the Closing Regulatory Approvals; |

- 23 -

| | (ii) | “Retail Business” means all business carried on by the Harry Winston Group as of the date hereof, including but not limited to the diamond jewelry and luxury timepiece business; |

| | | |

| | (jj) | “Retail Facilities”means the Senior Secured Revolving Credit Agreement dated as of August 30, 2012 among Harry Winston, Inc., Standard Chartered Bank, ABN AMRO Bank N.V., and the various lenders from time to time party thereto, as amended by a First Amendment and Assignment Agreement dated as of November 7, 2012, and as further amended, supplemented or amended and restated from time to time after the date hereof; |

| | | |

| | (kk) | “Tax Returns” means any and all returns, reports, declarations and elections, filed or required to be filed in respect of Taxes; |

| | | |

| | (ll) | “Taxes” means (i) any and all taxes, duties, fees, excises, premiums, assessments, imposts, levies and other charges or assessments of any kind whatsoever imposed by any Governmental Authority, and (ii) all interest, penalties, fines, additions to tax or other additional amounts imposed by any Governmental Authority on or in respect of amounts of the type described in clause (i) above or this clause (ii); |

| | | |

| | (mm) | “Third Party Claim” means any action, suit, proceeding, arbitration, claim or demand that is instituted or asserted by a third party, including a Governmental Authority, against an Indemnified Party which entitles the Indemnified Party to make a claim for indemnification under this Agreement; |

| | | |

| | (nn) | the term “person” is to be broadly interpreted and includes an individual, a natural person, a firm, a corporation, a partnership, a trust, an unincorporated organization, the government of a country or any political subdivision thereof, or any agency or department of any such government, and the executors, administrators or other legal representatives of an individual in such capacity; |

| | | |

| | (oo) | a person is deemed to be an affiliate of another person if one is a subsidiary of the other, or if both are subsidiaries of the same person, or if each of them is controlled by the same person; |

| | | |

| | (pp) | a person is deemed to be a subsidiary of another person if it is controlled directly or indirectly by that person, and includes a subsidiary of that subsidiary; and |

- 24 -

| | (qq) | control means control in any manner that results in control in fact, whether directly through the ownership of securities or indirectly through a trust, an agreement or arrangement or otherwise. |

The schedules attached to this Agreement form an integral part of this Agreement for all purposes of it.

| (1) | From time to time after the Closing Date, each Party will, at the request of any other Party, execute and deliver such additional conveyances, transfers and other assurances as may be reasonably required to effectively transfer the Purchased Shares to the Purchaser or carry out the intent of this Agreement. |

| | |

| (2) | The Guarantor agrees that if, following the Closing Date, any assets of the Corporation or any of its subsidiaries inadvertently remain in the possession or control of the Guarantor, then the Guarantor shall co-operate with the Purchaser to promptly deliver possession of any such assets to the Purchaser or as it may direct. |

| | |

| (3) | In order to facilitate the resolution of any claims made against the Vendor after the Closing, or for any other reasonable purpose, for a period of three years after the Closing, the Purchaser shall: (a) retain the books and records (including personnel files) of the Harry Winston Group relating to periods prior to the Closing in a manner reasonably consistent with the prior practices of the Harry Winston Group, and (b) upon reasonable notice, afford the representatives of the Vendor or the Guarantor reasonable access (including the right to make, at their expense, photocopies), during normal business hours, to such books and records, provided that such access is not unduly disruptive to the business of the Harry Winston Group. |

Time is of the essence in this Agreement.

This Agreement may be executed in any number of counterparts, each of which shall be deemed to be an original and all of which taken together shall be deemed to constitute one and the same instrument. Counterparts may be executed either in original or electronic form and the Parties may rely on delivery by electronic delivery of an executed copy of this Agreement.

- 25 -

The Guarantor irrevocably and unconditionally guarantees the timely and complete performance of, and compliance with, all of the terms, covenants, warranties, representations, conditions and provisions that are to be performed and complied with by the Vendor under this Agreement, as the same may be amended, changed, replaced or otherwise modified from time to time. The Guarantor agrees that it is jointly and severally liable with the Vendor for the performance of, and compliance with, the terms, covenants, conditions and provisions to be performed and complied with by the Vendor under this Agreement. The Guarantor agrees that the Purchaser is not bound to proceed against the Vendor or pursue any rights or remedies against the Vendor before being entitled to pursue its rights against the Guarantor. The liabilities and obligations of the Guarantor are subject to the terms of this Agreement and will not exceed any liability or obligation of the Vendor to the Purchaser under this Agreement. For greater certainty, the Guarantor is entitled to all rights, privileges, defences and limitations available to the Vendor with respect to any obligation or liability under this Agreement as though it were the Vendor, including without limitation all provisions of this Agreement relating to limitation of liability, including Section 16.

[Remainder of page intentionally left blank. Signature pages follow.]

IN WITNESS WHEREOFthe Parties have executed this Share Purchase Agreement.

| | THE SWATCH GROUP LTD. |

| | |

| | By: (signed) “George N. Hayek” |

| | Name: George N. Hayek |

| | Title: Chief Executive Officer |

| | |

| | By: (signed) “Hanspeter Rentsch” |

| | Name: Hanspeter Rentsch |

| | Title: Chief Legal Officer |

| | |

| | HWH ACQUISITION COMPANY LLC |

| | |

| | By: (signed) “Robert A. Gannicott” |

| | Name: Robert A. Gannicott |

| | Title: Manager |

| | |

| | HARRYWINSTONDIAMONDCORPORATION |

| | |

| | By: (signed) “Robert A. Gannicott” |

| | Name: Robert A. Gannicott |

| Title: Chairman & Chief Executive Officer |

[End of Agreement – Schedules Follow]

Schedule “A”

REPRESENTATIONS AND WARRANTIES OF THE VENDOR

Constitutional, Corporate and Transaction Matters

| | (a) | Incorporation and Qualification. Each of the Corporation and each of its subsidiaries, the Vendor and the Guarantor are corporations duly incorporated, validly existing and in good standing under the laws of their jurisdictions of incorporation and each has the corporate power to own and operate its property, carry on its business in each jurisdiction in which it carries on any business and, as applicable, enter into and perform its obligations under this Agreement. |

| | | | |

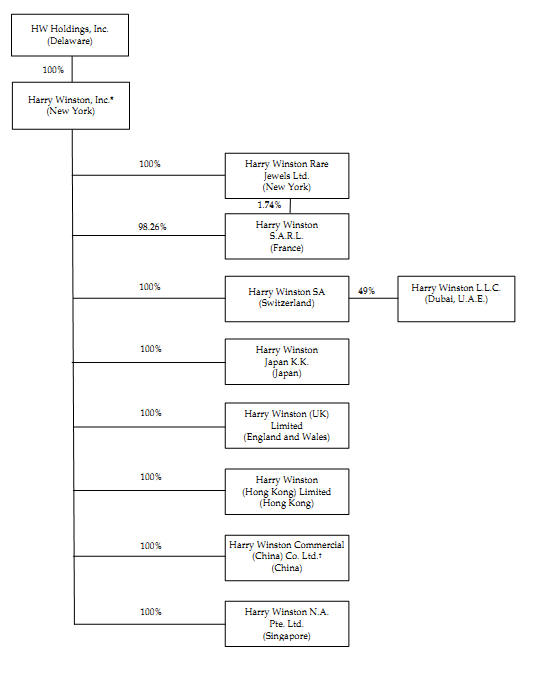

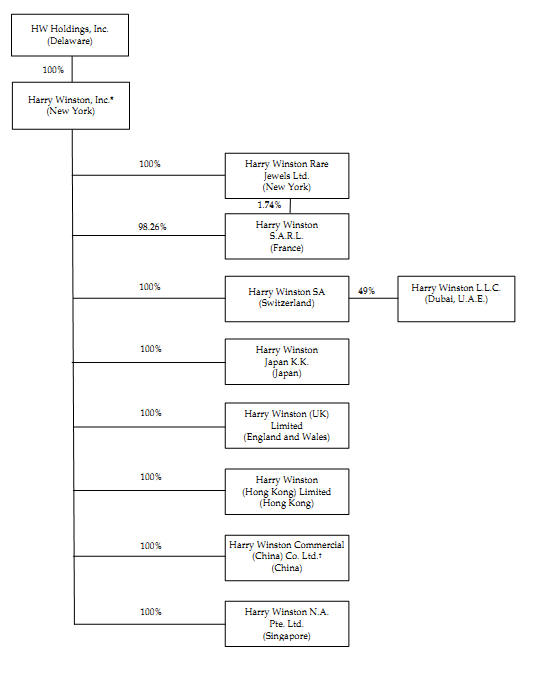

| | (b) | Corporate Structure.The corporate structure of the Harry Winston Group is as set out in Schedule “D”. With the exception of the subsidiaries disclosed in Schedule “D”, the Corporation has no subsidiaries. Except for the Purchaser’s rights under this Agreement, no person has any right (whether exercisable now or in the future and whether contingent or not) to call for the allotment, issue, sale or transfer of any shares of the Corporation under any option or other agreement (including conversion rights and rights of pre-emption). |

| | | | |

| | (c) | Corporate Authorization. The execution and delivery of and performance by each of the Vendor and the Guarantor of this Agreement have been authorized by all necessary corporate action and approvals on the part of the Vendor and the Guarantor, including all necessary corporate action and approvals of the Corporation’s subsidiaries, as applicable. |

| | | | |

| | (d) | No Conflict. The execution and delivery of this Agreement and the performance by the Vendor of the Transaction contemplated by this Agreement: |

| | | | |

| | | (i) | do not and will not constitute or result in a violation or breach of, or conflict with, or allow any person to exercise any rights under, any of the terms or provisions of the constating documents or by-laws of the Vendor, the Corporation or any of its subsidiaries; |

| | | | |

| | | (ii) | other than the Retail Facilities and the Japan Facilities, do not and will not constitute or result in a material breach of, or allow any person to exercise any rights under, any contract to which the Corporation or any of its subsidiaries is a party, in each case which would be material and adverse to the Harry Winston Group; |

| | | | |

| | | (iii) | do not and will not result in a breach of, or cause the termination or revocation of, any Authorization held by the Corporation or any of its subsidiaries that is necessary to the operation of the Retail Business; |

| | | | |

| | | (iv) | subject to receipt of the Regulatory Approvals, do not result in the material violation of any law; and |

A - 1

| | | (v) | do not violate in any material way any judicial or administrative order or judgment applicable to the Corporation or any of its subsidiaries. |

| | | | |

| | (e) | Required Consents. Other than in respect of the Retail Facilities and the Japan Facilities, there is no requirement to obtain any consent, approval or waiver of a party under any contract, license, lease or instrument to which the Corporation or any of its subsidiaries is a party, to the completion by the Vendor of the Transaction, where the failure to obtain such consent, approval or waiver would be material and adverse to the Harry Winston Group. |

| | | | |

| | (f) | Execution and Binding Obligation. This Agreement has been duly executed and delivered by each of the Vendor and the Guarantor and constitutes a legal, valid and binding agreement enforceable against each of them in accordance with its terms, subject to any limitation under applicable laws relating to (i) bankruptcy, winding-up, insolvency, arrangement, fraudulent preference and conveyance, assignment and preference and other laws of general application affecting the enforcement of creditors' rights, and (ii) the discretion that a court may exercise in the granting of equitable remedies such as specific performance and injunction. |

| | | | |

| | (g) | Authorized and Issued Capital.The authorized capital of the Corporation consists of 600,000 shares of common stock having a par value of $0.01 per share, of which 509,262 shares are issued and outstanding as of the date of this Agreement as fully paid and non-assessable. |

| | | | |

| | (h) | No Other Agreements to Purchase. Except for the Purchaser’s right under this Agreement, no person has any contractual right or privilege for (i) the purchase or acquisition from the Vendor of any of the Purchased Shares or from the Corporation or any of its subsidiaries of any of the shares of such subsidiaries, or (ii) the purchase, subscription, allotment or issuance of any of the unissued shares or other equity securities of the Corporation or any of its subsidiaries. |

| | | | |

| | (i) | Title to Purchased Shares. The Purchased Shares are owned by the Vendor as the registered and beneficial owner, with good title, free and clear of all Liens. Upon completion of the transaction contemplated by this Agreement, the Purchaser will have good and valid title to the Purchased Shares, free and clear of all Liens other than Liens granted by the Purchaser. |

| | | | |

| | (j) | Title to Shares of the Corporation’s Subsidiaries.Except as otherwise set out in Schedule “D”, all of the shares of the Corporation’s subsidiaries are owned by the Corporation or one of its subsidiaries, as applicable, as the registered and beneficial owner, with good title, free and clear of all Liens other than (i) those restrictions on transfer, if any, contained in the constating documents of the applicable subsidiary, and (ii) Liens granted in connection with the Retail Facilities. Upon completion of the transaction contemplated by this Agreement, the Corporation will continue to have good and valid title to the shares of its subsidiaries, free and clear of all Liens other than (i) those restrictions on transfer, if any, contained in the constating documents of the applicable subsidiary, (ii) Liens granted in connection with the Retail Facilities, and (iii) Liens granted by the Purchaser. |

A - 2

| | (k) | Corporate Records.The corporate records of the Corporation and its subsidiaries are complete and accurate in all material respects and include the applicable articles and by-laws (or similar constating documents), minutes of all material meetings of the shareholders and directors, all material resolutions of the shareholders and the directors, and the share certificate books, securities register, register of transfers and register of directors of the Corporation or its subsidiaries. The Corporation and its subsidiaries are in possession of or have control over their respective corporate records and material documents, which have been prepared in compliance with all applicable laws in all material respects. |

| | | |

| | (l) | Due Diligence. The Vendor has not withheld from the Purchaser any material information relating to the Harry Winston Group and actually known[REDACTED – CERTAIN INDIVIDUALS]. |

| | | |

| | (m) | Public Disclosure.The Public Filings did not, at the time of their respective filing, contain an untrue statement of a material fact relating to the Harry Winston Group; and did not, at the time of their respective filing, fail to state a material fact relating to the Harry Winston Group required to be stated in order to make the statements contained therein not misleading in light of the circumstances in which they were made. |