Exhibit 99.1

DOMINION DIAMOND CORPORATION

MANAGEMENT PROXY CIRCULAR

For the

Annual and Special Meeting of Shareholders

June 13, 2017

_____________________________________

May 8, 2017

TABLE OF CONTENTS

2

3

DOMINION DIAMOND CORPORATION

INVITATION TO SHAREHOLDERS

Dear Fellow Shareholders,

On behalf of the entire Board, I would like to thank all of our shareholders for your continued support. As stewards of your company and your capital, we remain focused on near term challenges and opportunities as well as long-term strategies that will result in increased value for the Company and our shareholders. We are committed to acting in the best interest of the Company and our shareholders by evaluating and executing on opportunities that fully recognize and enhance the value of Dominion Diamond Corporation’s unique assets.

We are pleased to invite you to attend our Annual and Special Meeting of Shareholders on Tuesday, June 13, 2017 at Shangri-La Hotel, Vancouver 1128 West Georgia Street, Conway Room Vancouver, British Columbia, Canada at 10:00 a.m. (Vancouver time). At this meeting, shareholders will be asked to, among other matters, elect the members of the Board of Directors and appoint the Company’s auditors. Whether or not you are able to attend in person, we invite you to read this circular. Your vote is important and you can vote by proxy on the Internet, by phone, by fax or by mail.

A Year of Progress

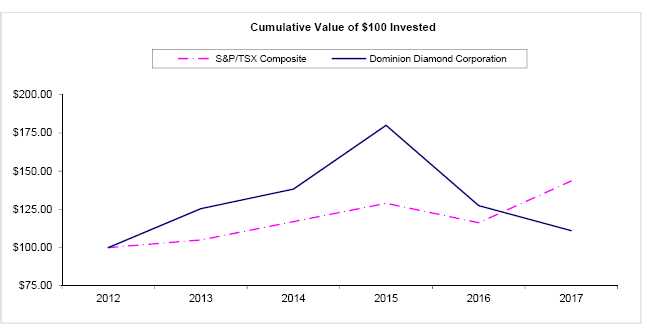

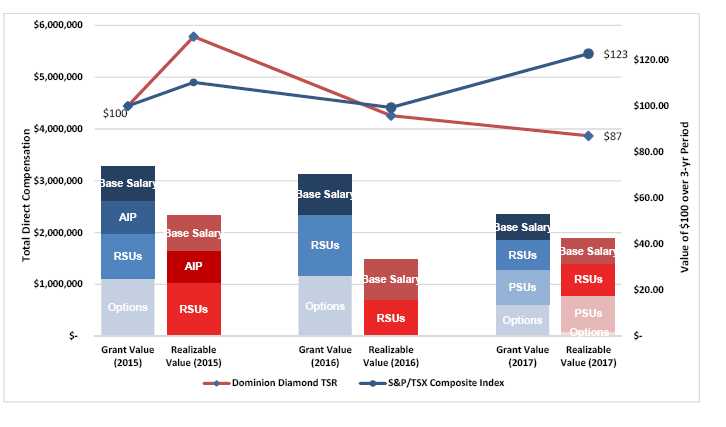

The past 12 months have marked a period of significant progress for Dominion Diamond Corporation as we continue to execute on our long-term strategy. Our focus remains squarely on optimizing our existing operations, advancing multiple near-term and longer-term development projects at the Ekati and Diavik mines, and investing in increased levels of exploration in the highly prospective Lac de Gras region. We are excited about the opportunity to leverage our infrastructure advantage in one of the world’s youngest and most prospective diamond mining districts.

Our pursuit of our strategic objectives is supported by our strong balance sheet. In addition to funding all of our organic growth projects and exploration work from internally generated cash flow, we have continued our commitment to return capital to shareholders. As part of our capital allocation strategy, we paid a semi-annual dividend of $0.20 and repurchased and retired approximately 3.4 million shares in fiscal 2017 for a total value of $40.9 million. In total, we returned $65.1 million to shareholders in fiscal 2017 through a combination of dividends and share repurchases.

This year also saw an unexpected challenge present itself in the diamond market as normal trading activity was disrupted by the demonetization of the Indian Rupee last November. While this weighed on our 2016 results, demand in the Indian retail jewelry market has proven to be resilient, and we anticipate a return to normal business conditions by the end of the second quarter of this calendar year.

4

Opportunities to Drive and Enhance Value

Our Board is keenly aware of the long-term value of the company and is committed to ensuring that shareholders realize that value. We are pursuing value creation on two parallel tracks.

First, supported by our strong balance sheet, we remain fully focused on our strategy of optimizing our operations, adding growth through our robust project development pipeline, and by investing to support our renewed exploration focus, while returning capital to shareholders.

Secondly, following an unsolicited expression of interest from another company, the Board of Directors formed a Special Committee to explore, review, and evaluate a range of potential strategic alternatives focused on maximizing shareholder value.

Working with the Company’s management team and advisors, the Special Committee will consider alternatives that could include the sale of the Company, a continuation of, or changes to, the current strategic plan, or other strategic transactions. The Board has not set a timetable for this strategic review process, nor has it made any decisions related to strategic alternatives at this time. While there can be no assurance that the exploration of strategic alternatives will result in any transaction or change in strategy, our commitment to maximizing value for the Company and our shareholders is clear.

On January 30, 2017, we announced that Mr. Brendan Bell was stepping down from his role as Chief Executive Officer, effective June 30, 2017. The Nominating & Corporate Governance Committee of the Board of Directors has begun a process to identify potential candidates to assume the role of CEO, and has engaged Korn Ferry to assist in the process. That process is well underway and several qualified candidates have been interviewed. No timetable for an appointment has been established and the Company will provide further updates as appropriate. I would like to take this opportunity to thank Brendan for his commitment and contributions to Dominion Diamond Corporation. Under his leadership, we approved the Jay project and took steps to extend the life of mine at Ekati. These accomplishments are significant and provide us with the flexibility to move forward with the implementation of our strategic plan.

Shareholder Outreach and Responsiveness

Our approach to corporate governance is thoughtful, forward-looking, and responsive to our shareholders. During Fiscal 2017, the Board of Directors completed a comprehensive renewal of its composition, resulting in the addition of six new directors. The new members achieved the goals of adding to Board deliberations, supplementing the Board’s capital markets and corporate development expertise, and providing insight into mid-stream and down-stream diamond market demand.

Over the past year we have increased our outreach to shareholders both in terms of scope and frequency, and will continue to do so in the future. We are committed to maintaining a high level of transparency and engagement with our shareholder base. Please feel free to contact us at the address below or by visiting our website.

5

On behalf of our entire Board of Directors and nearly 1,000 employees, I want to thank you for your continued support and investment in Dominion Diamond Corporation.

Sincerely,

James K. Gowans

Chair

6

DOMINION DIAMOND CORPORATION

NOTICE OF ANNUAL AND SPECIAL MEETING OF SHAREHOLDERS

NOTICE IS HEREBY GIVEN that an Annual and Special Meeting of Shareholders (the “Meeting”) ofDOMINION DIAMOND CORPORATION (the “Corporation”) will be held at the Shangri-La Hotel, Vancouver 1128 West Georgia Street, Conway Room Vancouver, British Columbia, Canada at 10:00 a.m. Vancouver timeon Tuesday, June 13, 2017, for the following purposes:

| 1. | to receive the audited consolidated financial statements of the Corporation for the fiscal year ended January 31, 2017, together with the report of the auditors thereon; |

| | |

| 2. | to elect directors; |

| | |

| 3. | to appoint auditors and authorize the directors to fix their remuneration; |

| | |

| 4. | to consider and, if thought fit, to approve, with or without variation, a resolution to ratify and confirm amendments to By-Law No. 1 of the Corporation, reflecting evolving corporate governance practices, as disclosed in the Management Proxy Circular of the Corporation; |

| | |

| 5. | to consider and, if thought fit, to approve, with or without variation, a resolution to ratify and confirm the Advance Notice By-Law of the Corporation, adopting advance notice requirements for nominations of directors by shareholders, as disclosed in the Management Proxy Circular of the Corporation; |

| | |

| 6. | to consider and, if thought fit, to approve an advisory resolution on the Corporation’s approach to executive compensation, as disclosed in the Management Proxy Circular of the Corporation; and |

| | |

| 7. | to transact such other business as may properly be brought before the Meeting or any adjournment thereof. |

The accompanyingManagement Proxy Circular of the Corporation provides additional information relating to the matters to be dealt with at the Meeting and forms part of this notice.

Whether or not you expect to attend the Meeting, please exercise your right to vote. Shareholders who have voted may still attend the Meeting. You may vote online atwww.cstvotemyproxy.com, or by returning a completed form of proxy by mail, fax or email. Instructions on how to vote online and how to complete and return the proxy are provided with the proxy form and are described in the Management Proxy Circular. To be valid, proxies must be received by the Proxy Department of CST Trust Company by mail at P.O. Box 721, Agincourt, Ontario, Canada, M1S 0A1, or by email to proxy@canstockta.com, or by fax to 1-866-781-3111 or outside Canada and U.S. to 416-368-2502, no later than 1:00 p.m. (Toronto time) on June 9, 2017, or if the Meeting is adjourned, no later than 1:00 p.m. (Toronto time) on the last business day preceding the day to which the Meeting is adjourned. The time limit for deposit of proxies may be waived or extended by the Chair of the Meeting at his or her discretion, without notice.

7

If you have any questions or need assistance to vote, please contact our strategic shareholder advisor and proxy solicitation agent, Kingsdale Advisors by toll-free telephone in North America at 1-888-518-6805 or collect call outside North America at 416-867-2272, or by email at contactus@kingsdaleadvisors.com.

BY ORDER OF THE BOARD

Jill Rowe

Corporate Secretary

May 8, 2017

8

DOMINION DIAMOND CORPORATION

MANAGEMENT PROXY CIRCULAR

All information is as of May 8, 2017 and all dollar figures are in United States dollars, unless otherwise indicated

Q&A ON PROXY VOTING

| Q: | What am I voting on? |

| | |

| A: | At the Annual and Special Meeting of Shareholders (the “Meeting”), shareholders are voting on the election of directors to the board of directors (the “Board”) of Dominion Diamond Corporation (the “Corporation”), the appointment of auditors for the Corporation and authorizing the directors to fix the remuneration of the auditors, the resolution to ratify and confirm amendments to By-Law No. 1 of the Corporation, reflecting evolving corporate governance practices; the resolution to confirm the Advance Notice By-Law of the Corporation, adopting advance notice requirements for nominations of directors by shareholders, and the advisory resolution to accept the Corporation’s approach to executive compensation, all as disclosed in this Management Proxy Circular. |

| | |

| Q: | Who is entitled to vote? |

| | |

| A: | If you owned your Common Shares as at the close of business on May 11, 2017 (the “Record Date”), you are entitled to vote. Each Common Share is entitled to one vote on those items of business identified in the Notice of Annual and Special Meeting of Shareholders. |

| | |

| Q: | How do I vote? |

| | |

| A: | You may vote in person at the Meeting, in which case please read the instructions set out after the following question. If you do not plan to attend the Meeting and you are a registered shareholder you may vote online at:www.cstvotemyproxy.com, or sign the enclosed form of proxy appointing the named persons or some other person you choose, who need not be a shareholder, to represent you as proxyholder and vote your Common Shares at the Meeting. If your Common Shares are held in the name of a nominee (a bank, trust company, securities broker, trustee or other) (a “beneficial shareholder”), you will have received from your nominee either a request for voting instructions or a form of proxy for the number of Common Shares you hold. For your Common Shares to be voted, please follow the voting instructions provided by your nominee. |

| | |

| Additionally, the Corporation may use Broadridge’s QuickVote service to assist beneficial shareholders with voting their shares. Beneficial shareholders may be contacted by Kingsdale Advisors (“Kingsdale”) to obtain voting instructions directly over the telephone. Broadridge then tabulates the results of all the instructions received and then provides the appropriate instructions respecting the shares to be represented at the Meeting. Additional Information for Beneficial Shareholders: |

| | |

| There are two kinds of beneficial shareholders: those who object to their name being made known to the issuers of securities which they own (called “OBOs” for Objecting Beneficial Owners), and those who do not object to their name being made known to the issuers of the securities which they own (called “NOBOs” for Non-Objecting Beneficial Owners). |

| | |

| Pursuant to National Instrument 54-101 –Communication with Beneficial Owners of Securities of a Reporting Issuer of the Canadian Securities Administrators, the Corporation is distributing copies of proxy-related materials in connection with the Meeting directly to NOBOs of Common Shares and the Corporation intends to pay for delivery to OBOs. The Corporation is not relying on the notice-and-access delivery procedures set out in NI 54-101 to distribute copies of proxy-related materials in connection with the Meeting. If you are an OBO, unless you have waived your rights to receive these materials, intermediaries are required to deliver them to you as a beneficial shareholder and to seek your instructions as to how to vote your Common Shares. Often, intermediaries will use a service company to forward these Meeting materials to beneficial shareholders. |

9

OBOs who requested to receive Meeting materials will typically be given the ability to provide voting instructions in one of two ways. Usually an OBO will be given a voting instruction form which must be completed and signed by the OBO in accordance with the instructions provided by the nominee. In this case, you cannot use the mechanisms described above for registered shareholders and must follow the instructions provided by the nominee (which in some cases may allow the completion of the voting instruction form by telephone or the Internet). Occasionally, however, an OBO may be given a proxy that has already been signed by the nominee. This form of proxy is restricted to the number of Common Shares owned by the OBO. In this case, you can complete the proxy and vote as described on the proxy.

The purpose of these procedures is to allow beneficial shareholders to direct the voting of the Common Shares that they own but that are not registered in their name. Should a beneficial shareholder who receives either a form of proxy or a voting instruction form wish to attend and vote at the Meeting in person (or have another person attend and vote on his/her behalf), the beneficial shareholder, in the case of a form of proxy, should strike out the persons named in the form of proxy as the proxy holder and insert the name of the beneficial shareholder or the name of such other person in the blank space provided or, in the case of a voting instruction form, follow the corresponding instructions provided by the nominee. In either case, Beneficial Shareholders should carefully follow the instructions provided by the nominee and should contact the nominee promptly if they need assistance.

| Q: | What if I plan to attend the Meeting and vote in person? |

| | |

| A: | If you are a registered shareholder and plan to attend the Meeting and wish to vote your Common Shares in person at the Meeting, do not complete or return the form of proxy. Your vote will be taken and counted at the Meeting. Please register with the transfer agent, CST Trust Company, upon arrival at the Meeting. |

| | |

| | If your Common Shares are held in the name of a nominee, the Corporation may have no record of your shareholdings or of your entitlement to vote unless your nominee has appointed you as proxyholder. Therefore, if you wish to vote in person at the Meeting, insert your own name in the space provided on the request for voting instructions or form of proxy and return it by following the instructions provided to you by your nominee. Do not complete the voting instructions on the form, as you will be voting at the Meeting. Please register with the transfer agent, CST Trust Company, upon arrival at the Meeting. |

| | |

| Q: | Who is soliciting my proxy? |

| | |

| A: | The enclosed form of proxy is being solicited by the management of the Corporationand the associated costs will be borne by the Corporation. The solicitation will be made primarily by mail but may also be solicited personally, by telephone, e-mail, internet, facsimile, or other means of communication by employees or advisors of the Corporation. |

| | |

| The Corporation has engaged Kingsdale as strategic shareholder advisor and proxy solicitation agent and will pay fees of approximately CDN$40,000 to Kingsdale for the proxy solicitation service in addition to certain out-of-pocket expenses. Shareholders can contact Kingsdale either by mail at Kingsdale Advisors, The Exchange Tower, 130 King Street West, Suite 2950, P.O. Box 361, Toronto, Ontario M5X 1E2, by toll-free telephone in North America at 1-888-518-6805 or collect call outside North America at 416-867-2272, or by e-mail at contactus@kingsdaleshareholder.com. |

10

| Q: | What if I sign the form of proxy enclosed with this Management Proxy Circular? |

| | |

| A: | Signing the enclosed form of proxy gives authority to Chuck Strahl or David Smith, each of whom is a director of the Corporation, or to another person you have appointed, to vote your Common Shares at the Meeting. |

| | |

| Q: | Can I appoint someone other than these directors to vote my Common Shares? |

| | |

| A: | Yes. Write the name of this person, who need not be a shareholder, in the blank space provided in the accompanying form of proxy. |

| | |

| It is important to ensure that any other person you appoint is attending the Meeting and is aware that he or she has been appointed to vote your Common Shares. Proxyholders should, upon arrival at the Meeting, present themselves to a representative of CST Trust Company. |

| | |

| Q: | What do I do with my completed proxy? |

| | |

| A: | If you are a registered shareholder, return the proxy to the Corporation’s transfer agent, CST Trust Company, in the envelope provided, or by email to proxy@canstockta.com, or by fax to 1-866-781-3111 or outside Canada and U.S. to 416-368-2502, so that it arrives no later than 1:00 p.m. (Eastern Standard Time) on Friday, June 9, 2017 to record your vote. If your Common Shares are held in the name of a nominee, please follow the voting instructions provided by your nominee. |

| | |

| Q: | If I change my mind, can I take back my proxy once I have given it? |

| | |

| A: | Yes. If you change your mind and wish to revoke your proxy, prepare a written statement to this effect. The statement must be signed by you or your attorney as authorized in writing or, if the shareholder is a corporation, under its corporate seal or by an officer or attorney of the corporation duly authorized. This statement must be delivered to the Corporate Secretary of the Corporation at the following address no later than 5:00 p.m. (Eastern Standard Time) on Monday, June 12, 2017 or to the Chair on the day of the Meeting, Tuesday, June 13, 2017, or any adjournment of the Meeting. |

Dominion Diamond Corporation

c/o 1090 Don Mills Road, Suite 506, Toronto, Ontario, M3C 3R6

Attention: Jill Rowe Fax No.: 416-350-3510

| Q: | How will my Common Shares be voted if I give my proxy? |

| | |

| A: | The persons named on the form of proxy must vote for or against or withhold from voting your Common Shares in accordance with your directions, or you can let your proxyholder decide for you. In the absence of such directions, proxies received by management will be voted in favour of the election of directors to the Board as described herein, the appointment of auditors, the resolution to ratify and confirm amendments to By-Law No. 1 of the Corporation, reflecting evolving corporate governance practices; the resolution to confirm the Advance Notice By-Law of the Corporation, adopting advance notice requirements for nominations of directors by shareholders, and the advisory resolution to accept the Corporation’s approach to executive compensation, all as disclosed in this Management Proxy Circular. |

11

| Q: | What if amendments are made to these matters or if other matters are brought before the Meeting? |

| | |

| A: | The persons named in the form of proxy will have discretionary authority with respect to amendments or variations to matters identified in the Notice of Annual and Special Meeting of Shareholders and with respect to other matters which may properly come before the Meeting. As of the time of printing of this Management Proxy Circular, management of the Corporation knows of no such amendment, variation or other matter expected to come before the Meeting. If any other matters properly come before the Meeting, the persons named in the form of proxy will vote on them in accordance with their best judgment. |

| | |

| Q: | How many Common Shares are entitled to vote? |

| | |

| A: | As of the date of this Management Proxy Circular, there were 80,688,157 Common Shares issued and outstanding. Each registered shareholder has one vote for each Common Share held at the close of business on the Record Date. To the knowledge of the directors and senior officers of the Corporation, as of date hereof, there are no parties who beneficially own, directly or indirectly, or exercise control or direction over voting securities of the Corporation carrying 10% or more of the voting rights attached to any class of voting securities of the Corporation. |

| | |

| Q: | How will the votes be counted? |

| | |

| A: | Each question brought before the Meeting is determined by a majority of votes cast on the question. |

| | |

| Q: | Who counts the votes? |

| | |

| A: | The Corporation’s transfer agent, CST Trust Company, counts and tabulates the proxies, this is done independently of the Corporation. Proxies are referred to the Corporation only in cases where a shareholder clearly intends to communicate with management or when it is necessary to do so to meet the requirements of applicable law. Confidentiality may also be lost if the Board decides that disclosure is in the interest of the Corporation or its shareholders. |

| | |

| Q: | If I need to contact the transfer agent, how do I reach them? |

| | |

| A: | You can contact the transfer agent and registrar by mail at: |

CST Trust Company, P.O. Box 700, Station B, Montreal, Quebec, H3B 3K3

Telephone: 1-800-387-0825 or outside Canada and U.S. 416-682-3860

Fax: 1-888-249-6189 or outside Canada and U.S. 514-985-8843

E-mail: inquiries@canstockta.com Website: www.canstockta.com

12

REPORTING CURRENCY

The reporting currency of the Corporation is the United States dollar. Certain dollar amounts reported in the various tables in this Management Proxy Circular that were originally incurred in Canadian dollars have been converted, as applicable, into United States dollars as follows:

| 1. | The Canadian currency exchange rate, being the rate for exchanging a Canadian dollar into a United States dollar, (the “Exchange Rate”) was obtained from the Bank of Canada closing rates for the applicable dates listed below, which rates were as follows: |

| | (a) | the Exchange Rate for February 1, 2016 (the “Year-Beginning Exchange Rate”) was 0.7179; |

| | (b) | the Exchange Rate for January 31, 2017 (the “Year-End Exchange Rate”) was 0.7685; |

| | (c) | the Average Exchange Rate for the fiscal period February 1, 2016 to January 31, 2017 (the “Average Exchange Rate”) was 0.7597; |

| | (d) | the Exchange Rate for April 29, July 29, and October 31, 2016 and January 31, 2017 (each, a “Quarterly Exchange Rate”) was 0.7969, 0.7659, 0.7457 and 0.7685, respectively; and |

| | (e) | the Exchange Rate for April 19, 2017 (the “April Exchange Rate”) was 0.7424. |

| 2. | The dollar amounts shown for deferred share units (“DSUs”) granted to directors represent the Canadian dollar amount credited to their respective accounts on a quarterly basis, converted into United States dollars using the corresponding Quarterly Exchange Rate. |

| | |

| 3. | The cash retainers paid to directors represent the Canadian dollar amount paid to them on a quarterly basis, converted into United States dollars using the corresponding Average Exchange Rate. |

| | |

| 4. | The value of restricted share units (“RSUs”) granted to Named Executive Officers was converted into United States dollars using the Exchange Rate at the date of the grant. |

| | |

| 5. | The value of outstanding RSUs of Named Executive Officers was converted into United States dollars using the Year-End Exchange Rate. |

| | |

| 6. | Cash compensation paid to Named Executive Officers, was converted into United States dollars using the Average Exchange Rate. |

13

BUSINESS OF THE MEETING

Financial Statements

The Consolidated Financial Statements for the year ended January 31, 2017 are included in the 2017 Annual Report.

Election of Directors

The Articles of the Corporation provide that the minimum number of directors shall be three and the maximum number shall be twelve. There are currently eight directors. The directors of the Corporation are elected annually and hold office until the next annual meeting of shareholders or until their successors in office are duly elected or appointed, unless a director’s office is earlier vacated in accordance with the by-laws of the Corporation or theCanada Business Corporations Act(“CBCA”), or he or she becomes disqualified to act as a director. The Board has fixed the number of directors to be elected at the Meeting at eight.

Management does not contemplate that any of the persons proposed to be nominated will be unable to serve as a director. If prior to the Meeting any of such nominees is unable or unwilling to serve, the persons named in the accompanying form of proxy will vote for another nominee or nominees in their discretion if additional nominations are made at the Meeting.

Unless a proxy specifies that the Common Shares it represents should be withheld from voting in respect of the election of directors or voted in accordance with the specification in the proxy, the persons named in the enclosed form of proxy intend to vote FOR the election of the nominees whose names are set out in this Management Proxy Circular.

The list of directors and their biographies can be found on pages 20 to 25 of this Management Proxy Circular (see “Nominees for Election to the Board of Directors”). Information regarding Director Compensation can be found on pages 25 to 31 of this Management Proxy Circular (See “Compensation of Directors”, “Director Summary Compensation Table” and “Incentive Plan Awards”). Attendance at Board and Committee meetings by directors holding office during the fiscal period ended January 31, 2017 (“Fiscal 2017”), can be found on page 31 of this Management Proxy Circular (see “Meetings Held and Attendance of Directors”).

To the knowledge of the Corporation, other than as set forth below, no person nominated for election as a director of the Corporation is, or has been in the last 10 years, (a) a director, chief executive officer or chief financial officer of a company that (i) while that person was acting in that capacity, was the subject of a cease trade order or similar order (including a management cease trade order) or an order that denied the issuer access to any exemptions under securities legislation, for a period of more than 30 consecutive days, or (ii) after that person ceased to act in that capacity, was subject of a cease trade or similar order or an order that denied the issuer access to any exemption under securities legislation, for a period of more than 30 consecutive days which resulted from an event that occurred while that person acted in such capacity, or (b) a director or executive officer of a company that, while that person was acting in that capacity, or within a year of that person ceasing to act in that capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold its assets; or (c) become bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or become subject to or instituted any proceedings, arrangement or compromise with creditors, or had a receiver, receiver manager or trustee appointed to hold his or her assets.

Mr. Clow, a director of the Company, was a director of Campbell Resources Inc. ("Campbell Resources") in 2005 when that company filed for protection under the Companies Creditors' Arrangement Act (Canada) (the "CCAA"). Mr. Clow ceased to be a director of Campbell Resources on November 14, 2008, prior to Campbell Resources filing for protection from its creditors under the CCAA for a second time, on January 28, 2009.

14

Majority Voting Policy

On January 14, 2009, the Board adopted a majority voting policy (the “Majority Voting Policy”), which was amended on January 14, 2015, April 13, 2016 and March 9, 2017. The Majority Voting Policy requires that in an uncontested election, any nominee who receives a greater number of votes ‘‘withheld’’ than “for” shall submit his or her resignation to the Nominating & Corporate Governance Committee promptly following the Meeting. The Nominating & Corporate Governance Committee shall consider the resignation and recommend to the Board whether or not to accept it. The Board shall consider the recommendation of the Nominating & Corporate Governance Committee and must accept the resignation of the director absent exceptional circumstances, and announce in a press release the Board’s determination (and the reasons for rejecting the resignation, if applicable) within 90 days following the date of the Meeting. A full description of the Majority Voting Policy is included in Schedule 1 of this Management Proxy Circular.

Board of Directors Diversity Policy

On January 14, 2015 the Board adopted a Board of Directors diversity policy (the “Diversity Policy”), which was reconfirmed on January 20, 2016 and amended on March 9, 2017. The Board is committed to continued growth and development with respect to diversity among its board members and senior management.In addition, the Board is committed to ensuring that its members are reflective of diverse professional experience, skills, knowledge and other attributes that are essential to its successful operation and the achievement of the Corporation’s current and future plans and objectives.

When identifying candidates to nominate for election to the Board or recommend for appointment as senior management, the primary objectives of the Board and the Nominating & Corporate Governance Committee are to ensure consideration of individuals who are highly qualified, based on their talents, experience, functional expertise and personal skills, character and qualities, having regard to the Corporation’s current and future plans and objectives, as well as anticipated regulatory and market developments.

In furtherance of the Corporation’s commitment to diversity, the Board and the Nominating & Corporate Governance Committee will have due regard for the need to identify and promote individuals who are reflective of diversity for nomination for election to the Board and appointment as senior management, including requiring that director candidates considered include women and candidates from diverse backgrounds to ensure that its recruiting processes are likely to increase the representation of women and candidates from diverse backgrounds on the Board.

The Board believes that its members have the expertise, skills, geographic representation, diversity, and size to make effective decisions. A full description of the Board of Directors Diversity Policy is included in Schedule 1 of this Management Proxy Circular.

Appointment of Auditors

Shareholders will be asked to vote for the reappointment of KPMG LLP as auditors of the Corporation for the ensuing year, and to authorize the directors of the Corporation to fix their remuneration. A simple majority of the votes cast at the Meeting must be voted in favour thereof. Fees paid to KPMG LLP during the years ended January 31, 2016 and 2017 were as follows:

| | 2017 ($) | 2016 ($) |

| Audit Fees(1) | 1,143,100 | 927,000 |

| Audit Related Fees(2) | 44,500 | 33,300 |

| Tax Fees(3) | - | 77,500 |

| All Other Fees(4) | - | - |

| TOTAL | 1,187,600 | 1,037,800 |

15

| (1) | Audit fees were for professional services rendered by KPMG LLP for the audit of the Corporation’s annual consolidated financial statements and services provided in connection with statutory and regulatory filings or engagements and interim reviews. Base audit fees during the year ended January 31, 2016 and 2017 were identical; the additional fees for the year ended January 31, 2017 arose from a number of special projects, including advice related to reporting under theExtractive Sector Transparency Measures Act. |

| (2) | Audit-related fees were for assurance and related services reasonably related to the performance of the audit or review of the financial statements that are not reported under “Audit Fees” above. |

| (3) | Tax fees were for tax compliance, tax advice and tax planning professional services. These services consisted of: tax compliance including the review of tax returns, and tax planning and advisory services relating to common forms of domestic and international taxation (i.e. income tax, capital tax, goods and services tax, payroll tax and value added tax). |

| (4) | All Other Fees include services other than the audit fees, audit-related fees and tax fees described. |

The Audit Committee negotiates with the auditors of the Corporation on an arm’s length basis to determine the fees to be paid to the auditors. Such fees have been based on the nature and complexity of the matters in question, and the time incurred by the auditors.

It is within the mandate of the Corporation’s Audit Committee to approve all audit and non-audit related fees and accordingly 100% of the Audit Fees, Audit-Related Fees, Tax Fees and All Other Fees were approved by the Audit Committee. The Audit Committee has adopted a policy for the pre-approval of specifically identified non-audit related services, including tax compliance, review of tax returns, documentation of processes and controls as submitted to the Audit Committee from time to time.

The Corporation’s Audit Committee has implemented a policy restricting the services that may be provided by the Corporation’s auditors and the fees paid to the Corporation’s auditors. Prior to the engagement of the Corporation’s auditors to perform both audit, and non-audit services, the Audit committee pre-approves the provision of the services. In making their determination regarding non-audit services, the Audit Committee considers compliance with the policy and the provision of non-audit services in the context of avoiding an adverse impact on auditor independence. All audit and non-audit fees paid to KPMG LLP, for the financial year ended January 31, 2017, were pre-approved by the Corporation’s Audit Committee and none were approved on the basis of the de minimis exemption set forth in Rule 2-01(c)(7)(i)(C) of Regulation S-X. Based on the Audit Committee’s discussions with management and the independent auditors, the Audit Committee is of the view that the provision of non-audit services by KPMG LLP described above is compatible with maintaining the firm’s independence from the Corporation.

Confirmation of Amendments to the Corporation’s By-Law No. 1

On May 6, 2017, in light of evolving corporate governance practices, the Board approved amendments to the Corporation’s By-Law No.1 (the “By-Law Amendments”). The By-Law Amendments must be ratified by the shareholders at the Meeting to continue to have effect after the Meeting. The By-Law Amendments are described in more detail below.

Quorum

The By-Law Amendments increased the quorum required for the transaction of business at any meeting of shareholders from two persons present in person, each being a shareholder entitled to vote thereat or a duly appointed proxyholder for or representative of such shareholder and together holding or representing in the aggregate not less than 5% of the outstanding shares of the Corporation entitled to be voted at the meeting, to two persons present in person, each being a shareholder entitled to vote thereat or a duly appointed proxyholder for or representative of such shareholder and together holding or representing in the aggregate not less than 25% of the outstanding shares of the Corporation entitled to be voted at the meeting.

Designation of Chair and Removal of Chairman’s Casting Votes

The By-Law Amendments removed the Chair’s entitlement to a second vote or casting vote in the case of an equality of votes at a meeting of the Board. The By-Law Amendments also removed the Chair’s entitlement to a second vote or casting vote in the case of an equality of votes at a meeting of shareholders, and provided the Board with additional flexibility in the appointment of a chairperson for a meeting of shareholders.

16

The above summary is qualified in its entirety by the full text of the By-Law Amendments which is set out in Schedule 2 to this Management Proxy Circular. We encourage shareholders to read the full text of the By-Law Amendments before voting on this resolution. The full text of the By-Law Amendments will also be filed under the Corporation’s profile on SEDAR at www.sedar.com.

Shareholders will be asked at the Meeting to approve the following resolution (the “By-Law Amendments Resolution”), with or without variation, relating to the ratification and confirmation of the By-Law Amendments as described above:

BE IT RESOLVED THAT:

| 1. | the amendments to By-Law No. 1 of the Corporation in the form adopted by the Board on May 6, 2017 and reflected in Schedule 2 to the Management Information Circular dated May 8, 2017, are hereby ratified and confirmed; and |

| | |

| 2. | any one director or officer of the Corporation is hereby authorized and directed for and on behalf of the Corporation to execute or cause to be executed and to deliver or cause to be delivered all such documents, and to do or cause to be done all such acts and things, as such director or officer may deem necessary or desirable in connection with the foregoing resolution. |

The Board recommends a vote FOR the By-Law Amendments Resolution confirming and ratifying the By-Law Amendments. Unless a shareholder directs that his or her Common Shares are to be voted against the By-Law Amendments Resolution, the Board representatives designated in the enclosed form of proxy intend to vote FOR the By-Law Amendments Resolution. If approval is not obtained at the Meeting, the Corporation’s By-Law No.1 will remain effective in its unamended form.

Confirmation of Advance Notice By-Law

On May 6, 2017, in light of evolving corporate governance practices, the Board approved the adoption of the Advance Notice By-Law, which requires that advance notice be given to the Corporation in circumstances where nominations of persons for election as a director of the Corporation are made by shareholders other than pursuant to: (i) a requisition of a meeting made pursuant to the provisions of the CBCA; or (ii) a shareholder proposal made pursuant to the provisions of the CBCA.

The requirements and procedures set forth in the Advance Notice By-Law will not apply to the Meeting. If the Advance Notice By-Law is not ratified by shareholders at the Meeting, it will not be effective.

At the Meeting, shareholders will be asked to consider and, if thought appropriate, to approve an ordinary resolution confirming and ratifying the Advance Notice By-Law. In general, the Advance Notice By-Law fixes a deadline by which shareholders must submit a notice of director nominations to the Corporation prior to any annual or special meeting of shareholders where directors are to be elected and sets forth the information that the shareholder must include for the notice to be valid. To be timely, a shareholder wishing to nominate a director must provide notice to the Corporation within the following time periods:

| • | in the case of an annual meeting of shareholders (including an annual and special meeting of shareholders), not later than the close of business on the 30th day before the date of the meeting provided, however, if the first public announcement made by the Corporation of the date of the annual meeting is less than 50 days prior to the meeting date, notice to the Corporation must be given no later than the close of business on the 10th day following such public announcement; and |

17

| • | in the case of a special meeting of shareholders (which is not also an annual meeting) called for any purpose which includes the election of directors to the Board, not later than the close of business on the 15th day following the day on which the first public announcement of the date of the special meeting is made. |

The Advance Notice By-Law authorizes the chairman of any meeting of shareholders to determine whether a nomination was made in accordance with the procedures set forth in the Advance Notice By-Law and, if any proposed nomination is not in compliance with such provisions, to declare that such defective nomination be disregarded. The Board may, in its sole discretion, waive any requirement of the Advance Notice By-Law.

If confirmed, the Advance Notice By-Law will provide a mechanism through which shareholders are able to receive appropriate disclosure with respect to proposed director nominees prior to a meeting. It will also provide the Corporation with the opportunity to confirm the eligibility of a proposed director to serve as a director and to confirm certain other information about the proposed nominee and the nominating shareholder that could be material to a reasonable shareholder’s decision regarding such proposed nominee. The proposed timing for the delivery of a notice under the Advance Notice By-Law and the information that must be submitted are in keeping with recognized good governance principles.

The Board believes that the Advance Notice By-Law will benefit shareholders by:

| • | facilitating an orderly and efficient meeting process; |

| | |

| • | treating all shareholders fairly by providing timely and adequate notice of director nominations; |

| | |

| • | allowing the Corporation and its shareholders to evaluate the proposed nominees’ qualifications and suitability as a director of the Corporation; and |

| | |

| • | allowing shareholders to cast an informed vote for the election of directors. |

The above summary is qualified in its entirety by the full text of the Advance Notice By-Law which is set out in Schedule 3 to this Management Proxy Circular. We encourage shareholders to read the full text of the Advance Notice By-Law before voting on this resolution.

Shareholders will be asked at the Meeting to approve the following resolution (the “Advance Notice Resolution”), with or without variation, relating to the ratification and confirmation of the Advance Notice By-Law as described above:

BE IT RESOLVED THAT:

| 1. | the Advance Notice By-Law, in the form adopted by the Board, and as set out in Schedule 3 of the Management Proxy Circular of the Corporation dated May 8, 2017, is hereby ratified and confirmed; and |

| | |

| 2. | any one director or officer of the Corporation is hereby authorized and directed for and on behalf of the Corporation to execute or cause to be executed and to deliver or cause to be delivered all such documents, and to do or cause to be done all such acts and things, as such director or officer may deem necessary or desirable in connection with the foregoing resolution. |

The Board recommends a vote FOR the Advance Notice Resolution confirming and ratifying the Advance Notice By-Law. Unless a shareholder directs that his or her Common Shares are to be voted against the Advance Notice Resolution, the Board representatives designated in the enclosed form of proxy intend to vote FOR the Advance Notice Resolution. If the Advance Notice By-Law is not confirmed and ratified by shareholders at the Meeting, it will not be effective.

18

Shareholder Advisory Vote on Approach to Executive Compensation

The Board will hold an advisory shareholder vote on the Corporation’s approach to executive compensation (say on pay) annually and is submitting to shareholders a non-binding advisory vote relating to executive compensation to provide shareholders with the opportunity to vote “For” or “Against” the Corporation’s approach to executive compensation, through the following advisory resolution:

“Resolved, on an advisory basis and not to diminish the role and responsibilities of the Board, that the shareholders accept the approach to executive compensation disclosed in the Corporation’s information circular delivered in advance of the 2017 Annual and Special Meeting of shareholders.”

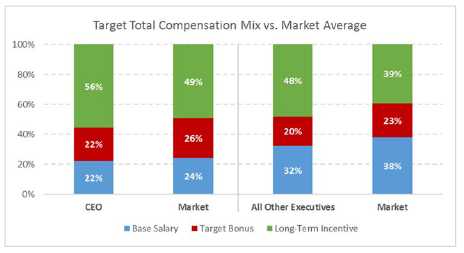

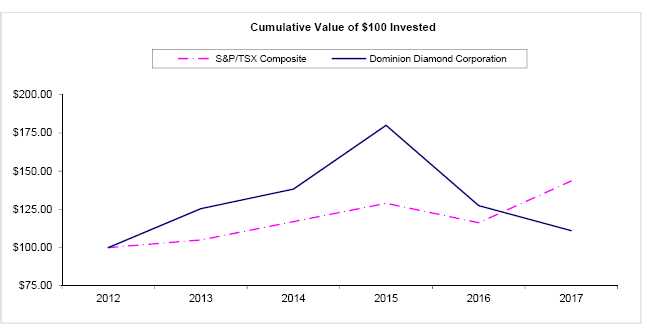

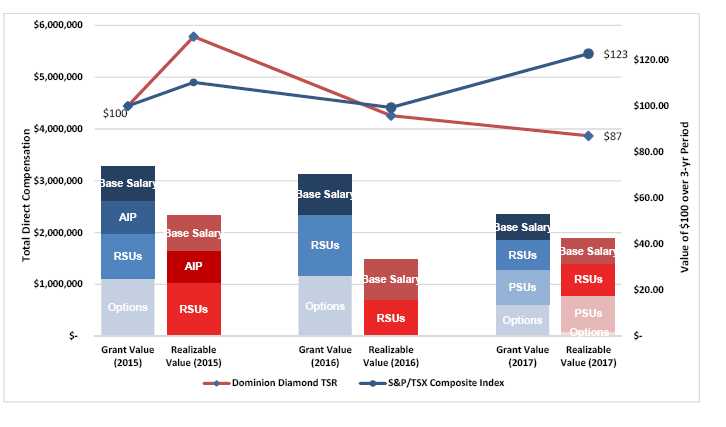

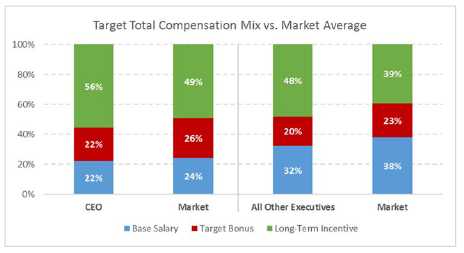

The “Compensation Discussion and Analysis” found on pages 39 to 50 of this Management Proxy Circular discusses the Corporation’s compensation philosophy and strategy, the components of the Corporation’s compensation programs, mix of compensation elements, and how compensation is determined. The Corporation’s policy for determining executive compensation is based on the following fundamental principles:

| | • | Compensation programs are aligned with Management’s fundamental objective which is to maximize long-term shareholder value; |

| | | |

| | • | A significant portion of executive officer compensation is contingent on performance; and |

| | | |

| | • | Compensation levels and programs should support recruitment and retention of key employees. |

Since this vote is advisory, it will not be binding upon the Board. However, the Board, and in particular, the Human Resources & Compensation Committee, will consider the outcome of the vote as part of its ongoing review of executive compensation and when considering future compensation policies, procedures and decisions. At the 2016 annual meeting of shareholders, 88.80% of votes were in favour of that year’s say on pay resolution.

The Board recommends a vote FOR the advisory resolution to accept the approach to executive compensation disclosed in this Management Proxy Circular.

19

BOARD OF DIRECTORS

Nominees for Election to the Board of Directors

The following are the nominees for election to the Board of the Corporation:

| Name of Director | Biography |

James K. Gowans(1)

Age: 65

Surrey, BC, Canada

Chair

Director since 2016

Independent(2)

| James Gowans brings over 35 years of practical management experience in most aspects of the mining industry, including exploration, major projects, operations and human resources, as well as extensive leadership experience both in Canada and internationally. Mr. Gowans’ considerable expertise is a critical asset to the Board. He has extensive mining experience in Canada and internationally and also brings significant experience in the areas of corporate and social responsibility, safety, health and environment and operational excellence. Appointed as Chair in April 2016, Mr. Gowans is currently President and Chief Executive Officer of Arizona Mining Inc., a junior exploration company. His primary focus in that role is on marketing and business development, investor relations and execution of the company strategy. Arizona Mining is focused on the exploration and development of two projects and its chief operating officer oversees the exploration work. It also employs an executive chairman, who shares the responsibility for business development with Mr. Gowans. |

|

Prior to joining Arizona, Mr. Gowans was with Barrick Gold Corporation before retiring at the end of 2015 from his last position as Senior Advisor to the Chairman and where he also served in the roles of Co-President, Executive Vice-President and Chief Operating Officer. Mr. Gowans has held various senior roles for a number of major mining companies including, the De Beers Group, including Chief Executive Officer of De Beers Canada, Debswana Diamond Company, Cominco (now Teck), Placer Dome and Inco. Mr. Gowans is a former Chair of the Mining Association of Canada (MAC), and is the Past-President of the Canadian Institute of Mining, Metallurgy and Petroleum (CIM). He currently serves on the board of directors of Cameco Inc., Gedex Inc., and Arizona Mining Inc. Mr. Gowans is a Professional Engineer with a Bachelor of Applied Science degree in Mining and Mineral Process Engineering from the University of British Columbia. |

|

Mr. Gowans had a 100% attendance record in the past year, attending all board and committee meetings. |

| Areas of Expertise | | Securities Held | |

| Management and Business | | Common Shares(7): | Nil |

| Metals and Mining | | Stock Options: | Nil |

| | | DSUs: | 4,708 |

| Board and Committee Attendance Record | | | |

| Board of Directors: | 100% | Value of DSUs(9): | $58,786 |

| Audit: | 100%(1) | | |

| Health, Safety & Environmental: | 100%(1) | | |

| Human Resources & Compensation: | 100%(1) | | |

| Nominating & Corporate Governance: | 100%(1) | | |

20

Name of Director | Biography |

Thomas A. Andruskevich(3)(5)(6)

Age: 66

Ft. Lauderdale, FL, USA

Director since 2016

Independent(2) | Thomas Andruskevich brings more than 30 years of experience in the jewelry, diamond and timepiece industry to the Board. Mr. Andruskevich is currently the Chairman and Chief Executive Officer of TAA Consulting, LLC and an Operating Partner for Jewelry and Timepieces at Marvin Traub Associates. As an Independent Business Advisor and Board Director, he provides strategic, luxury goods, retail and wholesale distribution, brand development and repositioning consulting services. He is also an Executive Partner of Comvest Partners, a private equity firm. Mr. Andruskevich has worked as a senior executive in the jewelry and luxury goods industry for over 30 years, including 16 years as the President & Chief Executive Officer of Birks & Mayors, Inc. (formerly Henry Birks & Sons) until 2012. Previously, he was the President and Chief Executive Officer of Mondi of America, and was Executive VP, International & Trade of Tiffany & Co, where he spent 12 years. Mr. Andruskevich has also held various leadership positions in jewelry industry trade organizations. He currently serves on the Board of Directors of Robbins Bros. Jewelry Acquisition Holdings, LLC, and served as a Director of VEREIT, Inc. until September 29, 2015. Mr. Andruskevich earned a Bachelor of Science in Business and Economics from Lehigh University. |

| Areas of Expertise | | Securities Held | |

| Management and Business | | Common Shares(7): | 11,418 |

| Finance and Capital Markets | | Stock Options: | Nil |

| Jewelry, Diamond and Timepiece Industry | | DSUs: | 5,791 |

| | | | |

| Board and Committee Attendance Record | | Value of Shares(8): | $142,578 |

| Board of Directors: | 100% | Value of DSUs(9): | $72,315 |

| Audit: | 100% | | |

| Human Resources & Compensation: | 100% | | |

| Nominating & Corporate Governance: | 100% | | |

Graham G. Clow(4)(5)

Age: 66

Toronto, ON, Canada

Director since 2013

Independent(2) | Graham Clow brings more than 40 years’ experience in all aspects of mine exploration, feasibility, finance, development, construction, operations, and closure to the Board. Appointed a director in February 2013, Mr. Clow is the Chairman of the Board of Roscoe Postle Associates Inc. Prior to joining Roscoe Postle Associates Inc., Mr. Clow held senior executive positions, including Chief Executive Officer and operating responsibility for several publicly listed mining companies. He has lived and worked extensively in mining operations in northern Canada. He is a Designated Consulting Engineer under the Association of Professional Engineers of Ontario and Fellow of the Canadian Institute of Mining, Metallurgy and Petroleum. For a number of years, he was an Adjunct Professor at the Lassonde Mineral Institute, University of Toronto, where he lectured in resource and reserve estimation. He currently serves on the board of Barrick Gold Corporation. Mr. Clow has degrees in Geological Engineering and Mining Engineering from Queen's University. |

| Areas of Expertise | | Securities Held | |

| International Business | | Common Shares(7): | 10,000 |

| Metals and Mining | | Stock Options: | Nil |

| | | DSUs: | 20,738 |

| Board and Committee Attendance Record | | | |

| Board of Directors: | 100% | Value of Shares(8): | $124,872 |

| Health, Safety & Environmental: | 100% | Value of DSUs(9): | $258,962 |

| Human Resources & Compensation: | 100% | | |

21

Name of Director | Biography |

Trudy Curran(3)(4)

Age: 54

Calgary, AB, Canada

Director since 2016

Independent(2)

| Trudy Curran brings 30 years’ experience to the Board in mergers and acquisitions, financing and capital markets, executive compensation, and governance across a range of industries including oil and gas, mining and transportation. Ms. Curran served as an officer of Canadian Oil Sands Limited from 2002 to the time of its sale in February 2016. As Senior Vice President, General Counsel & Corporate Secretary of Canadian Oil Sands Limited, she was responsible for legal, human resources and administration and as a member of the executive team focused on strategy and risk management. From 2003 to 2016, she was a Director of Syncrude Canada Ltd., where she served as Chair of the Human Resources and Compensation Committee and as a member of the Pension Committee. Ms. Curran currently serves on the Board of Directors of Baytex Energy Corp. and is a member of its Audit Committee and its Nominating and Governance Committee. She also serves on the Executive Committee of the Calgary chapter of the Institute of Corporate Directors and is a member of the board and the Finance and Audit Committee of Kids Cancer Care Foundation of Alberta. Ms. Curran holds a BA (with distinction) and a LLB (with distinction) from the University of Saskatchewan and is the recipient of the Governor General’s Bronze medal award. She also was named one of Canada’s top 100 Most Powerful Women in 2012. |

| Areas of Expertise | | Securities Held | |

| International Business | | Common Shares(7): | Nil |

| Metals and Mining | | Stock Options: | Nil |

| Finance and Capital Markets | | DSUs: | Nil |

| | | | |

| Board and Committee Attendance Record | | | |

| Board of Directors: | 100% | | |

| Audit: | 100% | | |

| Health, Safety & Environmental: | 100% | | |

22

Tim Dabson(3)(4)(6)

Age: 62

London, UK

Director since 2016

Independent(2) | Tim Dabson brings 35 years’ experience across the whole of the diamond industry value chain from manufacturing through distribution to consumer marketing to the Board. Mr. Dabson worked for De Beers for 33 years in a variety of positions, most recently in the role of Executive Director – Beneficiation which culminated in the transfer of De Beers’ international distribution activities from London to Botswana at the end of 2013. In this role, he also worked in close cooperation and coordination with producer country governments, including Botswana, Namibia, South Africa and Canada. Following his work at De Beers, Mr. Dabson established an independent consultancy serving a diverse range of projects and initiatives within the diamond value chain. Mr. Dabson possesses a thorough understanding of the global trends and strategic issues impacting the diamond industry from planning through to implementation and from mine to consumer with a particular focus on corporate responsibility, ethical assurance and responsible sourcing. Mr. Dabson holds a BSc. (Honours) in Mechanical Engineering from the University of Brighton and is a member of the Institute of Directors in London. |

| Areas of Expertise | | Securities Held | |

| International Business | | Common Shares(7): | Nil |

| Metals and Mining | | Stock Options: | Nil |

| | | DSUs: | Nil |

| Board and Committee Attendance Record | | | |

| Board of Directors: | 100% | | |

| Audit Committee: | 100% | | |

| Health, Safety & Environmental: | 100% | | |

| Nominating & Corporate Governance: | 100% | | |

David S. Smith(3)(5)

Age: 59

West Vancouver, BC, Canada

Director since 2016

Independent(2) | David Smith brings more than 30 years of financial and executive leadership experience to the Board. Appointed a director in February 2016, Mr. Smith served as the Chief Financial Officer and Executive Vice President of Finning International Inc. from 2009 to 2014, where he was instrumental in overall corporate strategy development and operations performance management. Prior to joining Finning, Mr. Smith served as Chief Financial Officer and a Vice President of Ballard Power Systems, Inc. Previously, he spent 16 years with Placer Dome Inc. (now Barrick Gold Corporation) in various senior positions and four years with PwC (Pricewaterhouse Coopers). Mr. Smith currently is a Director of Nevsun Resources Ltd. and Paramount Gold Nevada Corporation. He also serves on the Board of Governors of Collingwood School. Mr. Smith is a Certified Public Accountant, and holds a Bachelor of Science degree in Business Administration from California State University, Sacramento. He has also completed the Institute of Corporate Directors course, Directors Education Program, and has been a member since 2009. |

| Areas of Expertise | | Securities Held | |

| Management and Business | | Common Shares(7): | 8,700 |

| Finance and Capital Markets | | Stock Options: | Nil |

| | | DSUs: | 7,375 |

| Board and Committee Attendance Record | | | |

| Board of Directors: | 100% | Value of Shares(8): | $108,638 |

| Audit Committee: | 100% | Value of DSUs(9): | $92,093 |

| Human Resources & Compensation: | 100% | | |

23

Chuck Strahl(4)(6)

Age: 60

Chilliwack, BC, Canada

Director since 2012

Independent(2)

| The Honourable Chuck Strahl brings more than 30 years of management and leadership experience, as well as extensive experience and understanding of government, regulations, and northern affairs to the Board. Mr. Strahl left his successful logging and road building company to be elected to the Canadian House of Commons in 1993, eventually serving in six consecutive Parliaments before retiring from politics on the eve of the 2011 election. While in office, Mr. Strahl served at different times as Minister of Agriculture, Minister of Indian and Northern Affairs, and Minister of Transport and Infrastructure. Mr. Strahl is a Director of the Manning Centre for Building Democracy (a not-for-profit organization). Mr. Strahl is also the Honorary Lieutenant Colonel of the Royal Westminster Regiment, and a member of the Privy Council. |

| Areas of Expertise | | Securities Held | |

| Management and Business | | Common Shares(7): | 3,966 |

| Political, Governmental, and Business Strategies | | Stock Options: | Nil |

| | | DSUs: | 21,937 |

| Board and Committee Attendance Record | | | |

| Board of Directors: | 100% | Value of Shares(8): | $49,524 |

| Health, Safety & Environmental: | 100% | Value of DSUs(9): | $273,928 |

| Nominating & Corporate Governance: | 100% | | |

Josef Vejvoda(3)(5)(6)

Age: 51

Waterloo, ON, Canada

Director since 2016

Independent(2) | Josef Vejvoda brings financial expertise to the Board, including extensive experience with and knowledge of Canadian capital markets and expertise in corporate governance. He is currently Portfolio Manager at K2 & Associates Investment Management Inc., a multi-strategy investment fund. Prior to joining K2, Mr. Vejvoda held leadership positions in investment banking and held senior roles at a number of Canada’s largest financial institutions, including Merrill Lynch Canada, Bank of Montreal, National Bank Financial and TD Securities. Mr. Vejvoda currently serves on the boards of Absolute Software Corporation and ShoreTel Inc. Previously he served on the board of PNI Digital Media Inc., as well as Acerus Pharma Corporation. Mr. Vejvoda obtained a Bachelor degree in Computer Science from Queen’s University. He is a registered portfolio manager with the Ontario Securities Commission and has earned the Chartered Investment Manager designation from the Canadian Securities Institute. Mr. Vejvoda has also graduated from the Institute of Corporate Directors. |

| Areas of Expertise | | Securities Held | |

| Management and Business | | Common Shares(7): | Nil |

| Finance and Capital Markets | | Stock Options: | Nil |

| | | DSUs: | 7,200 |

| Board and Committee Attendance Record | | | |

| Board of Directors: | 100% | Value of DSUs(9): | $89,904 |

| Audit Committee: | 100% | | |

| Human Resources & Compensation: | 100% | | |

| Nominating & Corporate Governance: | 100% | | |

| (1) | Mr. Gowans is an ex-officio non-voting member of the Audit Committee, Human Resources & Compensation Committee, Nominating & Corporate Governance Committee and Health Safety & Environmental Committee. |

| (2) | “Independent” refers to the standards of independence established under Section 1.2 of Canadian Securities Administrators’ (“CSA”) National Instrument 58-101 – Disclosure of Corporate Governance Practices, Section 1.4 of the CSA National Instrument 52-110 – Audit Committees, Section 303A.02 of the New York Stock Exchange Listed Company Manual, and Section 301 of theSarbanes-Oxley Act of 2002(“SOX”). The Board, in its annual review of Director independence, considers employment status of the Director (and his or her spouse and children, if applicable), other board memberships, company shareholdings and business relationships, to determine whether there are any circumstances which might interfere with a Director’s ability to exercise independent judgment. |

| (3) | Member of the Audit Committee. |

| (4) | Member of the Health, Safety & Environmental Committee. |

| (5) | Member of the Human Resources & Compensation Committee. |

| (6) | Member of the Nominating & Corporate Governance Committee. |

24

| (7) | “Common Shares” refers to the number of Common Shares owned by each nominee for election as director and includes all Common Shares beneficially owned, directly or indirectly, or over which such nominee exercised control or direction, as of March 31, 2017. Such information, not being within the knowledge of the Corporation, has been furnished by the respective directors individually. |

| (8) | “Value of Shares” represents the total market value of the Common Shares held by each nominee as of March 31, 2017. The “Value of Shares” is determined by multiplying the number of Common Shares held by each nominee as of March 31, 2017 by the closing price of the Common Shares on the Toronto Stock Exchange (“TSX”) on such date (being Cdn$16.82 per Common Share) (in this section the “Closing Price”), converted at the April Exchange Rate. |

| (9) | “Value of DSUs” represents the total market value of DSUs held by each nominee. The “Value of DSUs” is determined by multiplying the number of DSUs held by each nominee as of March 31, 2017 by the Closing Price of the Common Shares on the TSX, converted at the April Exchange Rate. |

Compensation of Directors

The Human Resources & Compensation Committee is responsible for reviewing the adequacy and form of compensation for non-executive directors at the Corporation as required, with the goal that it:

| • | Remains competitive in light of the time commitments required from directors; and |

| • | Aligns directors’ interests with those of the shareholders. |

These reviews are conducted with the assistance of compensation consultants, but the decisions are made by, and are the responsibility of, the Human Resources & Compensation Committee, and may reflect factors and considerations other than the information and recommendations provided by its consultants. The Human Resources & Compensation Committee ultimately recommends the directors’ compensation to the Board for approval.

The Human Resources & Compensation Committee is composed entirely of unrelated and independent directors, namely Graham G. Clow (Chair), Thomas A. Andruskevich, David S. Smith, and Josef Vejvoda. James K. Gowans is an ex-officio non-voting member of the Human Resources & Compensation Committee. The biographies of each of these directors can be found on pages 20 to 25 of this Management Proxy Circular (see “Nominees for Election to the Board of Directors”). The Human Resources & Compensation Committee’s responsibilities are set out in its Charter, a summary of which can be found on page 35 of this Management Proxy Circular (see “Report of the Human Resources & Compensation Committee”). The Charter of the Human Resources & Compensation Committee is available on the Corporation’s website.

Directors who are not officers or employees of the Corporation or any of its subsidiaries are compensated for their services as directors through a combination of retainer and meeting fees and DSUs. A DSU is a notional share that has the same value as a Common Share. DSUs earn dividend equivalents at the same rate as dividends paid on Common Shares. DSUs are paid out when directors retire from the Board. A full description of DSUs is on page 28 of this Management Proxy Circular.

Brendan Bell, the Chief Executive Officer of the Corporation, was a management director for the period from February 1, 2015 up to and including January 31, 2017, and did not receive compensation for his services as a director during this time.

25

The following table sets out the non-executive directors’ compensation for Fiscal 2017:

| Compensation | Fiscal 2017(1) |

| Board Service | |

| Annual cash retainer | Cdn$80,000 |

| Meeting fee | Cdn$1,500 |

| Committee Service | |

| Annual Chair's retainer for Audit Committee(2) | Cdn$20,000 |

| Annual Chair's retainer for Human Resources & Compensation Committee(2) | Cdn$15,000 |

| Annual Chair’s retainer for Nominating & Corporate Governance Committee(2) | Cdn$10,000 |

| Annual Chair’s retainer for Health, Safety & Environmental Committee(2) | Cdn$10,000 |

| Meeting fee | Cdn$1,500 |

| Board Leadership | |

| Annual Lead Director’s retainer(3) | Cdn$20,000 |

| Other | |

| Annual equity grant(3) | Cdn$50,000 (paid in DSUs) |

| Travel fee (for out-of-province) | Cdn$1,500 |

| Meeting expenses | Reimbursement of expenses |

| Share ownership | |

| Guideline | 3 x annual cash retainer |

| (1) | Directors can elect to receive all or a portion of their cash remuneration in the form of DSUs (see “Deferred Share Unit Plan” on page 28 of this Management Proxy Circular). |

| (2) | The Board of Directors maintained a Lead Director, who presided over all executive sessions of the Board of Directors, prior to the appointment of James K. Gowans as independent Chair of the Board on April 12, 2016. |

| (3) | See “Changes to Director Compensation” below. |

Changes to Director Compensation

Meridian Compensation Partners (“Meridian”) reviewed director compensation relative to the same comparator group as is used for benchmarking executive compensation (see “Compensation Comparator Group” on page 44 of this Management Proxy Circular) in November 2013. No changes were made to director compensation at that time, even though the review prepared by Meridian showed that director compensation was well below the median of the market.

Director compensation was again reviewed by the Board and Meridian in 2016. Meridian advised that director compensation remained well below the median of the market. On January 16, 2017, the Board approved changes to the director compensation structure effective January 1, 2017, including an increase of all Committee Chair retainers by Cdn$5,000.00 on a pro rata basis, and establishing an annual equity grant of Cdn$55,000 to be paid in DSUs to all directors. The Board also terminated the practice of providing an initial equity grant of Cdn$50,000 paid in DSUs to new directors of the Corporation effective January 1, 2017. These changes position compensation for directors at the median of the market, compared to the same peer group as is used for benchmarking executive compensation (see“Compensation Comparator Group” on page 44 of this Management Proxy Circular).

26

Director Summary Compensation Table

The following table sets forth the compensation awarded, paid to or earned by the non-executive directors of the Corporation during Fiscal 2017:

| Name | Fees

Earned

(US$)(1) | Share-

Based

Awards

(US$)(9) | Option-

Based

Awards

(US$) | Non-Equity

Incentive Plan

Compensation

(US$) | Pension

Value

(US$) | All Other

Compensation

(US$) | Total

(US$) |

| James K. Gowans(2) | 116,614 | Nil(3) | Nil | Nil | Nil | Nil | 116,614 |

| Thomas A. Andruskevich(4) | 53,179 | 38,451 | Nil | Nil | Nil | Nil | 91,630 |

| Graham G. Clow | 96,040 | Nil | Nil | Nil | Nil | Nil | 96,040 |

| Trudy Curran(5) | 49,697 | Nil(6) | Nil | Nil | Nil | Nil | 49,697 |

| Tim Dabson(5) | 50,900 | Nil(6) | Nil | Nil | Nil | Nil | 50,900 |

| David S. Smith(7) | 103,827 | 38,811 | Nil | Nil | Nil | Nil | 142,637 |

| Chuck Strahl | 97,939 | Nil | Nil | Nil | Nil | Nil | 97,939 |

| Josef Vejvoda(8) | 102,939 | 39,451 | Nil | Nil | Nil | Nil | 142,390 |

| (1) | Fees earned are converted into United States dollars at the Average Exchange Rate. |

| (2) | Effective April 12, 2016, James K. Gowans was appointed Chairman of the Corporation and ceased receiving meeting fees for Board and Committee meetings. |

| (3) | Mr. Gowan’s equity grant of Cdn$150,000 in DSUs remains outstanding. |

| (4) | Thomas A. Andruskevich was appointed as a director at the annual general meeting of shareholders on July 20, 2016. |

| (5) | Trudy Curran and Tim Dabson were appointed as directors of the Corporation on August 16, 2016. |

| (6) | Ms. Curran’s and Mr. Dabson’s initial equity grants of Cdn$50,000 in DSUs remains outstanding. |

| (7) | David S. Smith was appointed as a director of the Corporation on February 19, 2016. |

| (8) | Josef Vejvoda was appointed as a director of the Corporation on January 13, 2016. |

| (9) | Share Based Awards are the initial grants of DSUs made to new directors of the Board in Fiscal 2017, converted into United States dollars using the applicable Quarterly Exchange Rate. These amounts do not include compensation which the directors have elected to take in the form of DSUs. Initial grants of DSUs were only made to new directors of the Board in accordance with the director compensation structure in place at that time. |

The following table sets forth the compensation awarded, paid to or earned byformer non-executive directors of the Corporation during Fiscal 2017:

| Name | Fees

Earned

(US$)(1) | Share-

Based

Awards

(US$)(4) | Option-

Based

Awards

(US$) | Non-Equity

Incentive Plan

Compensation

(US$) | Pension

Value

(US$) | All Other

Compensation

(US$) | Total

(US$) |

| Robert A. Gannicott(2) | 37,225 | Nil | Nil | Nil | Nil | Nil | 37,225 |

| Daniel Jarvis(3) | 52,989 | Nil | Nil | Nil | Nil | Nil | 52,989 |

| Tom Kenny(3) | 49,381 | Nil | Nil | Nil | Nil | Nil | 49,381 |

| (1) | Fees earned are converted into United States dollars at the Average Exchange Rate. |

| (2) | Robert A. Gannicott passed away on August 3, 2016 and accordingly ceased being a director of the Corporation on that date. |

| (3) | Messrs. Jarvis and Kenny did not stand for re-election at the 2016 annual meeting of shareholders, and accordingly ceased being directors on July 20, 2017. |

| (4) | Share Based Awards are initial grants of DSUs made to new directors of the Board in Fiscal 2017, converted into United States dollars using the applicable Quarterly Exchange Rate. These amounts do not include compensation which the directors have elected to take in the form of DSUs. Initial grants of DSUs were only made to new directors of the Board in accordance with the director compensation structure in place at that time. |

27

The breakdown of the fees earned by the non-executive directors in Fiscal 2017, and the percentage of the total fees taken in DSUs, is as follows (all amounts converted into United States dollars using the Average Exchange Rate):

| Directors | BoardRetainer(US$) | CommitteeChairRetainer(US$) | BoardMeeting Fees(US$) | CommitteeMeeting Fees(US$) | Travel Fees(US$) | TotalFeesEarned(US$) | % and Value of Retainer &

Meeting Fees Taken in

DSUs |

| % | (US$) |

| Directors Standing for Re-Election |

| James K. Gowans(1) | 100,660 | N/A | 4,558 | 3,419 | 7,977 | 116,614 | (1) | 1,711 |

| Thomas A. Andruskevich | 30,388 | N/A | 9,116 | 9,116 | 4,558 | 53,179 | (2) | 12,410 |

| Graham G. Clow | 60,776 | 7,915 | 15,954 | 7,977 | 3,419 | 96,040 | 50 | 48,664 |

| Trudy Curran | 30,388 | 2,216 | 7,977 | 5,698 | 3,419 | 49,697 | 0 | 0 |

| Tim Dabson | 30,388 | N/A | 7,977 | 7,997 | 4,558 | 50,900 | 0 | 0 |

| David S. Smith | 60,776 | 8,864 | 15,954 | 11,396 | 6,837 | 103,827 | (2) | 26,692 |

| Chuck Strahl | 60,776 | 4,116 | 17,093 | 9,116 | 6,837 | 97,939 | 50 | 49,651 |

| Josef Vejvoda | 60,776 | N/A | 17,093 | 15,954 | 9,116 | 102,939 | (2) | 24,830 |

| Former Directors |

| Robert A. Gannicott | 30,388 | N/A | 6,837 | N/A | N/A | 37,225 | 0 | 0 |

| Daniel Jarvis | 34,187 | 2,849 | 7,977 | 4,558 | 3,419 | 52,989 | 0 | 0 |

| Tom Kenny | 30,388 | 1,899 | 7,977 | 4,558 | 4,558 | 49,381 | 0 | 0 |

| (1) | The Board Retainer for James K. Gowans includes Chairman fees paid during Fiscal 2017. Upon appointment as Chairman, Mr. Gowans no longer received meeting fees for Board or Committee meetings. Effective August 1, 2016, Mr. Gowans elected to receive 50% of his travel fees in DSUs. |

| (2) | Effective August 1, 2016, Messrs. Smith and Vejvoda elected to receive 50% of their retainer and meeting fees in DSUs and Thomas Andruskevich elected to receive 25% of his retainer and meeting fees in DSUs. Prior to such date, no DSU election had been made. |

Deferred Share Unit Plan

The Corporation has a Deferred Share Unit Plan (the “DSU Plan”) for its directors.

DSUs granted under the DSU Plan vest immediately, but are only redeemable following retirement from the Board, or upon death. When a dividend is paid on the Common Shares, each director’s DSU account is allocated additional DSUs equal in value to the dividend paid on an equivalent number of Common Shares.

The value of the DSUs credited to a director is payable after he or she ceases to serve as a director of the Corporation. The value is calculated by multiplying the number of DSUs in the director’s account by the market value of a Common Share at the time of payment. Non-executive directors are not entitled to stock option grants.

Prior to January 1, 2017, non-executive directors received an initial grant of Cdn$50,000 in DSUs when first appointed to the Board. Effective January 1, 2017, with the introduction of changes to the director compensation program (see above under the heading“Changes to Director Compensation”), Directors will receive an annual equity grant of Cdn$55,000, to be paid in DSUs. Directors may also elect to take all or a portion of their annual retainer and meeting fees in the form of DSUs.

28

Evaluation of Board Performance

In Fiscal 2017, an annual formal Board, Committee and individual director evaluation, including a peer review, was conducted. Board members completed a written survey designed to assess the Board’s effectiveness as a whole, and the effectiveness, and contribution of its Committees and individual directors. If it was brought to light that any of the Corporations directors were not able to meet the required commitments, then that would be considered as part of the annual nomination process. The individual surveys were sent to the Chair of the Nominating & Corporate Governance Committee, accompanied with a summary of the responses. The Chair of the Nominating & Corporate Governance Committee reviewed the surveys with that Committee and the Board.

In addition to the formal evaluations, the Corporate Governance Guidelines of the Corporation requires that each director notify the Nominating & Corporate Governance Committee in the event that he or she: (a) joins or resigns from another public company’s board of directors; or (b) significantly changes his or her primary employment or occupation (any such event referred to as a “Status Change”). The Nominating and Corporate Governance Committee re-evaluates the appropriateness of the continuing membership of the director on the Board in light of the Status Change, and recommends to the Board the appropriate action, if any, to be taken with respect to the director. If the Nominating and Corporate Governance Committee believed that a director was not able to meet the required commitments of the Board or Committees, as applicable, that would be considered as part of the annual nomination process.

Share Ownership Guidelines