| Overview | Consolidated

Performance Review | Segment

Performance Review | Liquidity & Capital

Resources | Quarterly Financial

Highlights | Non-IFRS Financial

Measures | Other Information

& Advisories |

Management’s Discussion & Analysis

For the three and six months ended July 31, 2017

| Dominion Diamond Corporation | Second Quarter Fiscal 2018 Management’s Discussion & Analysis | 1 |

| Overview | Consolidated

Performance Review | Segment

Performance Review | Liquidity & Capital

Resources | Quarterly Financial

Highlights | Non-IFRS Financial

Measures | Other Information

& Advisories |

Introduction and Cautions

Introduction

This management’s discussion and analysis (“MD&A”) of the results of operations for Dominion Diamond Corporation and its subsidiaries (“DDC,” “the Company,” “we,” “us” or “our”) includes information that will help you understand management’s perspective of the unaudited condensed consolidated interim financial statements and notes for the three and six months ended July 31, 2017, and the Company’s financial position as at July 31, 2017. The information is based on what we knew as of September 6, 2017 and updates our annual MD&A included in our fiscal 2017 Annual Report. This MD&A is a supplement to and should be read in conjunction with our unaudited condensed consolidated interim financial statements and related notes thereto for the three and six months ended July 31, 2017 and with our audited consolidated financial statements for the year ended January 31, 2017.

The unaudited condensed consolidated interim financial statements are expressed in United States (“US”) dollars, which is our functional currency, and prepared in accordance with International Accounting Standard 34 (“IAS 34”), as issued by the International Accounting Standards Board (“IASB”). Unless otherwise specified, all financial information is presented in US dollars. Unless otherwise indicated, all references to (i) “second quarter,” “Q2 fiscal 2018” and “Q2 2018” refer to the three months ended July 31, 2017; (ii) “Q2 fiscal 2017” and “Q2 2017” refer to the three months ended July 31, 2016; (iii) “YTD Q2 fiscal 2018” and “YTD Q2 2018” refer to the six months ended July 31, 2017; and (iv) “YTD Q2 fiscal 2017” and “YTD Q2 2017” refer to the six months ended July 31, 2016.

Caution Regarding Forward-Looking Information

This MD&A includes statements and information about our expectations for the future which constitute forward-looking information within the meaning of Canadian and United States securities laws. Forward-looking information can generally be identified by the use of terms such as “may,” “will,” “should,” “could,” “would,” “expect,” “plan,” “anticipate,” “foresee,” “appears,” “believe,” “intend,” “estimate,” “predict,” “potential,” “continue,” “objective,” “modelled,” “hope,” “forecast” or other similar expressions concerning matters that are not historical facts. Forward-looking information represents our current views and can change significantly.

Forward-looking information included in this MD&A relates to management’s strategy, plans, future outlook and anticipated events or results and includes, but is not limited to:

- statements or information regarding plans for mining, development, production, reclamation and exploration activities at our mineral properties;

- projected capital expenditure requirements, liquidity and working capital requirements;

- estimated mineral reserves and resources and production from the Ekati Diamond Mine and Diavik Diamond Mine;

- expectations concerning the diamond industry and diamond pricing;

- outcome of the July 15, 2017 arrangement agreement (“Arrangement”) between DDC and The Washington Companies

(“Washington”) under which an entity affiliated with Washington will acquire all of DDC’s outstanding common shares for $14.25 per share in cash; and - outlook for our Ekati Diamond Mine and Diavik Diamond Mine segments and other forward-looking information as set out under “Business Outlook.”

Forward-looking information is based on certain factors and assumptions described below and elsewhere in this MD&A, including, among other things:

- mining methods and the current mine plans for each of the Ekati Diamond Mine and the Diavik Diamond Mine;

- mining, production, construction and exploration activities at our mineral properties;

- the timely receipt of required regulatory approvals;

- currency exchange rates;

- estimates related to the capital expenditures required to bring the Jay, Sable, Misery Deep and A-21 pipes into production;

- required operating and capital costs, labour costs and fuel costs;

- world, China, India and US economic conditions;

- future diamond prices and demand for diamond jewelry; and

- the level of worldwide diamond production.

| Dominion Diamond Corporation | Second Quarter Fiscal 2018 Management’s Discussion & Analysis | 2 |

| Overview | Consolidated

Performance Review | Segment

Performance Review | Liquidity & Capital

Resources | Quarterly Financial

Highlights | Non-IFRS Financial

Measures | Other Information

& Advisories |

While we consider these assumptions to be reasonable based on the information currently available to us, they may prove to be incorrect. Forward-looking information is subject to certain factors, including risks and uncertainties that could cause actual results to differ materially from what we currently expect. These factors include, among other things:

- the uncertain nature of mining activities, including risks associated with underground construction and mining operations;

- risks associated with joint venture operations, including risks associated with the inability to control the timing and scope of future capital expenditures;

- risks associated with the estimates related to the capital expenditures required to bring the Jay, Sable, Misery Deep and A-21 pipes into production;

- the risk that Rio Tinto plc, the operator of the Diavik Diamond Mine, may make changes to the mine plan, and other risks arising because of the nature of joint venture activities;

- risks associated with the remote location of, and harsh climate at, our mineral property sites;

- variations in mineral resource and mineral reserve estimates or expected recovery rates;

- failure of plant, equipment or processes to operate as anticipated;

- risks resulting from macro-economic uncertainty in financial markets and other world economic conditions;

- risks associated with regulatory requirements and the ability to obtain all necessary regulatory approvals and permits;

- the risk that future diamond price assumptions may prove to be incorrect;

- modifications to existing practices so as to comply with any future permit conditions that may be imposed by regulators;

- delays in obtaining approvals and lease renewals;

- the risk of fluctuations in diamond prices and changes to consumer demand in the principal markets of US, China and India;

- the risk of increased demand for synthetic diamonds or the presence of undisclosed synthetic diamonds in jewelry, negatively impacting demand for diamond jewelry;

- uncertainty as to whether dividends will be declared by our Board of Directors or whether our dividend policy will be maintained;

- the risk of fluctuations in the Canadian/US dollar exchange rate;

- cash flow and liquidity risks; and

- uncertainties related to the satisfaction of the conditions to complete the Arrangement including the approval of the Arrangement by Shareholders and the Court, the receipt of the Regulatory Approvals, the Company having a minimum cash balance, the anticipated Effective Date of the Arrangement and the absence of any event, change or other circumstances that could give rise to the termination of the Arrangement, the delay in or increase in cost of completing the Arrangement and the failure to complete the Arrangement for any other reason.

Please see page 46 of this MD&A, as well as our current Annual Information Form available at www.sedar.com and www.sec.gov, for a discussion of these and other risks and uncertainties involved in our operations. Actual results may vary from the forward-looking information.

Readers are cautioned not to place undue importance on forward-looking information, which speaks only as of the date of this MD&A; they should not rely upon this information as of any other date. Due to assumptions, risks and uncertainties, including the assumptions, risks and uncertainties identified above and elsewhere in this MD&A, actual events may differ materially from current expectations. We use forward-looking statements because we believe such statements provide useful information with respect to the currently expected future operations and financial performance of the Company, and caution readers that the information may not be appropriate for other purposes. While we may elect to do so, we are under no obligation and do not undertake to update or revise any forward-looking information, whether as a result of new information, future events or otherwise at any particular time, except as required by law.

Caution Regarding Non-IFRS Measures

We use a number of financial measures including cash cost and total cost of production, cash cost and total cost per tonne processed, cash cost and total cost per carat produced, cash cost and total cost of sales per carat sold, EBITDA and EBITDA margin, Adjusted EBITDA and Adjusted EBITDA margin, free cash flow, cash from operating activities before changes in non-cash operating working capital, sustaining capital expenditure, and growth and exploration capital expenditure to monitor and evaluate our performance. These measures are not prescribed by International Financial Reporting Standards (“IFRS”) and will differ from measures determined in accordance with IFRS. Other companies may calculate these non-IFRS financial measures differently. These non-IFRS measures should not be considered as a substitute for, or superior to, measures of financial performance prepared in accordance with IFRS. Please refer to the section “Non-IFRS Financial Measures” of this MD&A for further details, including a reconciliation of each such measure to its most directly comparable measure calculated in accordance with IFRS.

| Dominion Diamond Corporation | Second Quarter Fiscal 2018 Management’s Discussion & Analysis | 3 |

| Overview | Consolidated

Performance Review | Segment

Performance Review | Liquidity & Capital

Resources | Quarterly Financial

Highlights | Non-IFRS Financial

Measures | Other Information

& Advisories |

Overview

Operating and Financial Highlights

(All dollar figures are in United States dollars unless otherwise indicated)

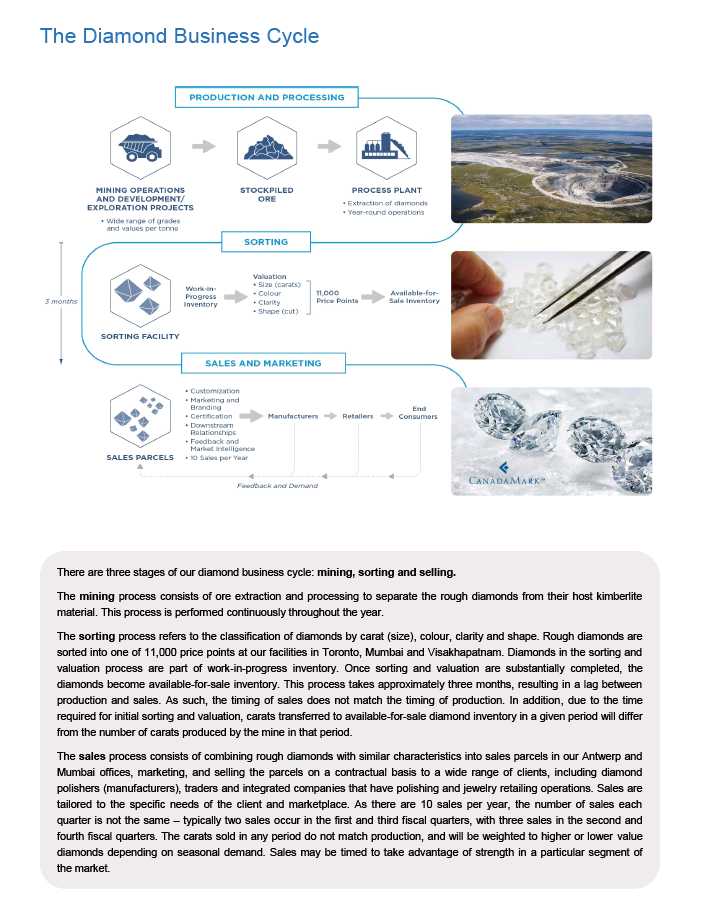

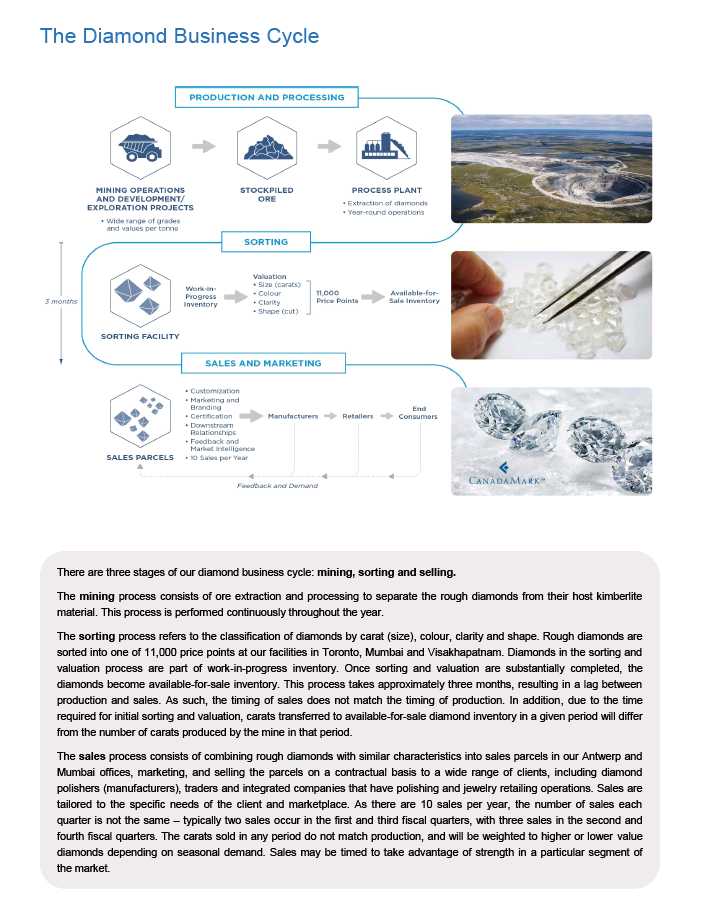

We are a Canadian company focused on the mining and marketing of rough diamonds to the global market. We have interests in two producing diamond mines and a pipeline of development and exploration projects in the Northwest Territories in Canada. We also have sorting and related sales operations in Canada, Belgium and India. In Q2 fiscal 2018, on a consolidated basis (Ekati Diamond Mine 100% and Diavik Diamond Mine 40%), production was 2.6 million carats, sales were 3.6 million carats, and the average price per carat sold was $66 per carat.

| (i) | The terms “cash cost per carat produced,” “total cost per carat produced,” “cash cost of sales per carat sold” and “total cost of sales per carat sold” do not have standardized meanings according to IFRS. See “Non-IFRS Financial Measures” for additional information. |

Our consolidated cash cost and total cost per carat produced were $36 and $64, respectively, in the second quarter of fiscal 2018, reflecting the processing of relatively high-grade ore. The consolidated cash cost of sales per carat sold was $32 during the quarter.

| Dominion Diamond Corporation | Second Quarter Fiscal 2018 Management’s Discussion & Analysis | 4 |

| Overview | Consolidated

Performance Review | Segment

Performance Review | Liquidity & Capital

Resources | Quarterly Financial

Highlights | Non-IFRS Financial

Measures | Other Information

& Advisories |

| Highlights | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| (in millions of US dollars, except where otherwise noted) | | Three months ended | | | | | | Six months ended | | | | |

| | | | | | | | | | | | | |

| Operating | | July 31, 2017 | | | July 31, 2016 | | | July 31, 2017 | | | July 31, 2016 | |

| | | | | | | | | | | | | |

| Tonnes processed (000s) | | 1,209 | | | 815 | | | 2,328 | | | 2,010 | |

| | | | | | | | | | | | | |

| Carats produced (000s) | | 2,564 | | | 1,488 | | | 4,710 | | | 3,318 | |

| | | | | | | | | | | | | |

| Cash cost per tonne processed(i)($/tonne) | $ | 74 | | $ | 82 | | $ | 79 | | $ | 81 | |

| | | | | | | | | | | | | |

| Total cost per tonne processed(i)($/tonne) | $ | 136 | | $ | 141 | | $ | 142 | | $ | 134 | |

| | | | | | | | | | | | | |

| Cash cost per carat produced(i)($/carat) | $ | 36 | | $ | 47 | | $ | 41 | | $ | 51 | |

| | | | | | | | | | | | | |

| Total cost per carat produced(i)($/carat) | $ | 64 | | $ | 77 | | $ | 70 | | $ | 81 | |

| | | | | | | | | | | | | |

| Financial | | July 31, 2017 | | | July 31, 2016 | | | July 31, 2017 | | | July 31, 2016 | |

| | | | | | | | | | | | | |

| Sales | $ | 239.8 | | $ | 160.0 | | $ | 450.8 | | $ | 338.2 | |

| | | | | | | | | | | | | |

| Carats sold (000s) | | 3,643 | | | 1,341 | | | 5,976 | | | 3,940 | |

| | | | | | | | | | | | | |

| Average price per carat sold ($/carat) | $ | 66 | | $ | 119 | | $ | 75 | | $ | 86 | |

| | | | | | | | | | | | | |

| Cash cost of sales per carat sold(i)($/carat) | $ | 32 | | $ | 74 | | $ | 37 | | $ | 58 | |

| | | | | | | | | | | | | |

| Gross margin (%) | | 16% | | | 1% | | | 15% | | | (5% | ) |

| | | | | | | | | | | | | |

| Net income (loss) | $ | 31.1 | | $ | (37.9 | ) | $ | 23.2 | | $ | (43.2 | ) |

| | | | | | | | | | | | | |

| Adjusted EBITDA(i) | $ | 115.2 | | $ | 38.6 | | $ | 212.2 | | $ | 92.9 | |

| | | | | | | | | | | | | |

| Adjusted EBITDA margin(i)(%) | | 48% | | | 24% | | | 47% | | | 27% | |

| | | | | | | | | | | | | |

| Earnings (loss) per share attributable to shareholders ($/share) | $ | 0.39 | | $ | (0.39 | ) | $ | 0.29 | | $ | (0.40 | ) |

| | | | | | | | | | | | | |

| Cash from operating activities before changes in non-cash operating working capital(i) | $ | 63.9 | | $ | 23.9 | | $ | 137.4 | | $ | 35.1 | |

| | | | | | | | | | | | | |

| Capital expenditures (sustaining capital) | $ | 32.5 | | $ | 22.3 | | $ | 80.4 | | $ | 50.0 | |

| | | | | | | | | | | | | |

| Capital expenditures (growth capital) | $ | 27.0 | | $ | 46.2 | | $ | 56.3 | | $ | 130.3 | |

| | | | | | | | | | | | | |

| Free cash flow(i) | $ | 42.8 | | $ | (20.9 | ) | $ | 27.3 | | $ | (110.9 | ) |

| (i) | The terms “cash cost per tonne processed,” “total cost per tonne processed,” “cash cost per carat produced,” “total cost per carat produced,” “cash cost of sales per carat sold,” “Adjusted EBITDA,” “Adjusted EBITDA margin,” “cash from operating activities before changes in non-cash operating working capital” and “free cash flow” do not have standardized meanings according to IFRS. See “Non-IFRS Financial Measures” for additional information. |

Carats produced were strong in the second quarter of fiscal 2018 due to the processing of high-grade Misery Main ore at the Ekati Diamond Mine. Carats produced were negatively influenced in Q2 fiscal 2017 by the process plant fire at the Ekati Diamond Mine that occurred on June 23, 2016 and resulted in the suspension of processing for approximately three months. Mining performance was strong in Q2 fiscal 2018 at the Ekati Diamond Mine and Diavik Diamond Mine as was safety and environmental performance.

Consolidated sales were also strong in the second quarter of fiscal 2018 with an improved gross margin over the comparable period in the previous year. The improvement was largely attributable to the sale of diamonds recovered from higher value kimberlite pipes at the Ekati Diamond Mine, combined with continued strong performance from the Diavik Diamond Mine. During the first half of fiscal 2018, both sales and gross margin were further strengthened by the auction of approximately $40 million of high value fancy coloured and large diamonds, primarily produced from the Ekati Diamond Mine.

| Dominion Diamond Corporation | Second Quarter Fiscal 2018 Management’s Discussion & Analysis | 5 |

| Overview | Consolidated

Performance Review | Segment

Performance Review | Liquidity & Capital

Resources | Quarterly Financial

Highlights | Non-IFRS Financial

Measures | Other Information

& Advisories |

Who We Are and What We Do

Dominion Diamond Corporation is Canada’s largest independent diamond producer and one of the world’s largest producers and suppliers of premium rough diamond assortments to the global market. Our diamonds are natural and responsibly mined in Canada. We own a controlling interest in and operate the Ekati Diamond Mine and we also hold a 40% ownership interest in the Diavik Diamond Mine, which is operated by Rio Tinto plc. Both mines are located in the Lac de Gras region in the Northwest Territories of Canada. Our diamond sorting facilities are located in Toronto, Canada, and in Mumbai and Visag, India, and we sell our diamonds in the two global centres of the diamond trade – Mumbai, India, and Antwerp, Belgium.

| Dominion Diamond Corporation | Second Quarter Fiscal 2018 Management’s Discussion & Analysis | 6 |

| Overview | Consolidated

Performance Review | Segment

Performance Review | Liquidity & Capital

Resources | Quarterly Financial

Highlights | Non-IFRS Financial

Measures | Other Information

& Advisories |

| Dominion Diamond Corporation | Second Quarter Fiscal 2018 Management’s Discussion & Analysis | 77 |

| Overview | Consolidated

Performance Review | Segment

Performance Review | Liquidity & Capital

Resources | Quarterly Financial

Highlights | Non-IFRS Financial

Measures | Other Information

& Advisories |

| Dominion Diamond Corporation | Second Quarter Fiscal 2018 Management’s Discussion & Analysis | 8 |

| Overview | Consolidated

Performance Review | Segment

Performance Review | Liquidity & Capital

Resources | Quarterly Financial

Highlights | Non-IFRS Financial

Measures | Other Information

& Advisories |

Corporate Developments

On January 31, 2017, we announced that Mr. Brendan Bell will step down from his role as Chief Executive Officer (CEO) of the Company and as a member of the Board of Directors. Mr. Bell has agreed to continue to serve in his role as CEO pending the expected completion of the Arrangement.

On March 31, 2017, we announced that we had filed an updated technical report under National Instrument 43-101 for the Diavik Diamond Mine with an effective date of January 31, 2017 (“2017 Technical Report”). The 2017 Technical Report reflects a 16% increase in mineral reserves, or an increase of 6.3 million carats, for the calendar year 2017 through the end of mine life compared to the comparable period in the previous technical report. The 2017 Technical Report also reflects an extension of the mine life from calendar 2023 to calendar 2025 and an after-tax net present value of approximately $2.6 billion at a 7% discount rate, based on the assumptions and analysis contained therein.

On May 23, 2017, we announced positive results of a pre-feasibility study on the development of an underground operation below the Misery open pit at the Ekati Diamond Mine. See the section “Development Projects” for additional detail.

On June 5, 2017, we reached an agreement with Archon Minerals Limited (“Archon”) to convert Archon’s participating interest in the Buffer Zone at the Ekati Diamond Mine to a royalty equal to 2.3% of all future gross revenue from diamonds produced from the Buffer Zone. As a result of this transaction, our ownership interest in the Buffer Zone increased to 100.0% . We had previously determined on February 1, 2017 that our participating interest in the Buffer Zone had increased from 65.3% to 72.0%, in accordance with the Buffer Zone Joint Venture agreement. The increase in ownership resulted from the decision of Archon not to participate in the full fiscal year 2017 capital program for the Buffer Zone. We funded those elements of the program that were not funded by Archon.

On July 7, 2017, the Minister of Environment and Natural Resources, Government of the Northwest Territories, approved the Type A Water Licence for the Ekati Diamond Mine, including the Jay Project. This followed the amendment of the Type A Water Licence by the Wek’èezhìi Land and Water Board (“WLWB”) in May 2017 to include the Jay Project. See the section “Development Projects” for additional detail.

On July 15, 2017, DDC and The Washington Companies (“Washington”) entered into an Arrangement under which an entity affiliated with Washington will acquire all of the outstanding common shares of DDC for $14.25 per share in cash for a total consideration of approximately $1.2 billion. This Arrangement completed a strategic review process commenced in March 2017 to explore strategic alternatives focused on maximizing shareholder value. Under the Arrangement, all of our outstanding share-based awards including stock options, restricted share units, performance share units and deferred share units will be deemed vested and transferred to the Company in exchange for a cash payment to the holders. The Arrangement remains subject to a number of closing conditions, including shareholder approval, court approval, and applicable government and regulatory approvals and is anticipated to be completed in the fourth quarter of calendar 2017. The Arrangement is also subject to our having a minimum cash balance of $150 million if closing is on or before November 30, 2017, or $200 million if closing is after November 30, 2017. If the Arrangement is not completed as a result of a superior proposal, or in certain other circumstances, we will be required to pay Washington a termination fee equal to $43.9 million. In connection with the transaction, we have suspended the declaration and payment of dividends and have terminated our normal course issuer bid (“NCIB”).

Additional information and the full text of the Arrangement are included in our Management Information Circular dated August 15, 2017, which is filed on SEDAR at www.sedar.com.

On September 6, 2017, we announced results of a preliminary economic assessment on the development of an underground operation below the Fox open pit at the Ekati Diamond Mine. See the section “Development Projects” for additional detail.

| Dominion Diamond Corporation | Second Quarter Fiscal 2018 Management’s Discussion & Analysis | 9 |

| Overview | Consolidated

Performance Review | Segment

Performance Review | Liquidity & Capital

Resources | Quarterly Financial

Highlights | Non-IFRS Financial

Measures | Other Information

& Advisories |

Business Outlook

Market and Diamond Price Update

The momentum of demand in the rough diamond market that was evident in the first quarter of calendar 2017 continued into the second quarter and then slowed for the traditionally quieter summer period. One notable area of demand in the rough market was for the commercial and cheaper ranges of goods as factories returned to full production after the disruption caused by the demonetization of the Indian rupee in November 2016 and the ensuing hiatus in trading activity.

The challenges in the US retail market continued to cause some concern despite a positive JCK Las Vegas Jewelry show which was driven by the more active smaller chains and independents rather than the larger chains that are going through a period of restructuring. While demand remained flat in the US, demand from both China and India continues to grow. In China and Hong Kong, sales have improved significantly which bodes well for the business in the third and fourth quarters, and Indian retail is ramping up to what is expected to be a positive Diwali and wedding season from October until January.

In the table below, we have modelled the approximate rough diamond average price per carat for each Ekati and Diavik kimberlite process plant feed type based on the average prices per carat achieved in our July 2017 sale.

In the first half of fiscal 2018, and as we expected, full trading liquidity has returned to all segments of the market as the effects of the demonetization of the Indian rupee abated. Prices for higher value goods were not as significantly influenced by demonetization and have remained relatively stable. Prices of brown goods exhibited very strong price appreciation from depressed levels earlier in the year. Lastly, prices have partially recovered for smaller white goods, although not to the same extent as for brown goods. Overall, this has led to an increase in average prices of approximately 3% from the February 2017 sale for Ekati feed types and flat average prices for Diavik feed types during the same period.

Average price changes represent an aggregate net change in prices for all goods from each feed type, both higher value and lower value. Prices for the higher value and lower value market segments can move independently of one another, depending on relative demand. As such, strengthening prices in one market segment can offset weakening prices in another, resulting in minimal average price change.

In addition to changes in market prices, our average prices per carat by process plant feed type are periodically updated as a result of production trials whereby diamonds are recovered from batch processing of unblended ore in order to monitor their average volume, size and quality distribution. Production trials were completed for Pigeon and Misery Main in fiscal 2017 and for Koala underground in May 2017. The results of the Koala-only production trial (stone frequency and quality distributions) were finalized in August 2017. The results of the trial indicated that the quality assortment and overall volume (grade) of Koala underground diamonds recovered were as expected. However, the relative volume of carats in the smaller size categories was higher than expected. As a result of the production trial, the average price per carat for Koala underground for the remainder of FY18 was revised to $207 per carat.

| | | | July 2017 sales | |

| | | | cycle average price | |

| Mine | Feed type | | per carat | |

| Ekati Diamond Mine | Koala | $ | 207 | |

| | Misery Main | | 56 | |

| | Misery Southwest Extension | | 40 | |

| | Pigeon | | 144 | |

| Diavik Diamond Mine | A-154 South | | 111 | |

| | A-154 North | | 147 | |

| | A-418 | | 80 | |

| | COR | | 40 | |

| Dominion Diamond Corporation | Second Quarter Fiscal 2018 Management’s Discussion & Analysis | 10 |

| Overview | Consolidated

Performance Review | Segment

Performance Review | Liquidity & Capital

Resources | Quarterly Financial

Highlights | Non-IFRS Financial

Measures | Other Information

& Advisories |

Mining Operations

Our mining operations are located in Canada’s Northwest Territories. At the Ekati Diamond Mine, the Koala, Misery, Pigeon and Lynx kimberlite pipes are currently in production. Additional material is sourced as necessary from the Misery Satellites (Misery South and Misery Southwest pipes) and coarse ore rejects (“COR”), which are not classified as mineral reserves and do not have demonstrated economic viability. We hold a 40% ownership interest in the Diavik Diamond Mine where there are three pipes currently in production: A-418, A-154 South and A-154 North. We are also advancing a number of exploration and development projects at both mines.

NORTHWEST TERRITORIES, CANADA

| Dominion Diamond Corporation | Second Quarter Fiscal 2018 Management’s Discussion & Analysis | 11 |

| Overview | Consolidated

Performance Review | Segment

Performance Review | Liquidity & Capital

Resources | Quarterly Financial

Highlights | Non-IFRS Financial

Measures | Other Information

& Advisories |

In fiscal 2018, we expect to recover 7.5 –8.0 million carats at the Ekati Diamond Mine from 3.7 –4.0 million tonnes processed (on a 100% basis) and in calendar 2017, we expect to recover 7.2 –7.6 million carats at the Diavik Diamond Mine from 2.0 –2.2 million tonnes processed (on a 100% basis). Mining activities by kimberlite pipe as well as the approximate proportions of processed material and recovered carats that are expected to be sourced from each kimberlite pipe in fiscal 2018 for the Ekati Diamond Mine and calendar 2017 for the Diavik Diamond Mine are indicated in the table below.

| | | | | | | | % of tonnes | % of carats |

| Mine | Pipe | | Q1 FY18 | Q2 FY18 | Q3 FY18 | Q4 FY18 | processed | produced |

| Ekati | Misery Main | Open pit | Continuing production | 35% | 80% |

| Diamond | Koala | Underground | Continuing production | 35% | 8% |

| Mine | Pigeon | Open pit | Continuing production | 20% | 5% |

| | Misery | Open pit | Continuing production | 5% | 2% |

| | Southwest | | | | | | | |

| | Lynx | Open pit | Waste stripping | First ore | Continuing production | 5% | 5% |

| | Sable | Open pit | Site construction | Waste stripping | – | – |

| Diavik | A-154 South | Underground | Continuing production | 20% | 20% |

| Diamond | A-154 North | Underground | Continuing production | 35% | 25% |

| Mine | A-418 | Underground | Continuing production | 45% | 55% |

| | A-21 | Open pit | Dike completion | De-watering | De-watering | – | – |

| | | | | | | Waste stripping | | |

At the Ekati Diamond Mine, we plan to mine 28–30 million total tonnes in fiscal 2018. Construction at the Sable pipe was completed significantly ahead of schedule and waste stripping activities have been prioritized at that pipe in the second half of fiscal 2018 with a corresponding reduction in waste stripping activities at the Lynx and Pigeon pipes. Based on the results of a positive pre-feasibility study and following a decision in June 2017 to proceed with the development of an underground operation below the Misery Main open pit, we have revised our processing plan for the remainder of fiscal 2018 and expect to process more high value Misery Main and Koala ore in the second half of fiscal 2018, displacing lower value Pigeon and Misery Southwest material. Due to Misery Main being a higher grade ore source, this has resulted in an increase in expected carats produced in fiscal 2018. Processing of Lynx ore commenced in August 2017 and the recovery of diamonds from the Lynx pipe is expected to be completed in Q3 fiscal 2018.

A fines dense media separation (“Fines DMS”) unit was commissioned at the Ekati Diamond Mine in Q4 fiscal 2017 in order to improve the recovery of small diamonds. In Q1 fiscal 2018, the unit ramped up to its design throughput; however, the recovery of small diamonds did not initially meet our expectations. We continue to make improvements and have noted higher recovery in Q2 fiscal 2018. We expect the recovery to improve through the second half of the year. The small diamonds that were planned to have been recovered through Fines DMS in fiscal 2018 were relatively low in value. As such, the reduced recoveries of small diamonds experienced in the first half of fiscal 2018 has a minimal influence on the expected total value recovered.

Both the production guidance and approximate proportions of tonnes processed and carats produced per pipe reflect the operating case at the Ekati mine; this includes the Misery Southwest pipe which is currently an inferred mineral resource. Mineral resources that are not mineral reserves do not have demonstrated economic viability. Inferred mineral resources are considered too speculative geologically to have economic considerations applied to them that would enable them to be categorized as mineral reserves. There is no certainty that the operating case will be realized.

We prepared and verified the foregoing scientific and technical information for the Ekati Diamond Mine under the supervision of Chantal Lavoie, P. Eng., Chief Operating Officer, and President of Dominion Diamond Ekati Corporation (DDEC). Mr. Lavoie is a Qualified Person within the meaning of National Instrument 43-101 of the Canadian Securities Administrators.

At the Diavik Diamond Mine, underground mining will continue at A-418, A-154 South and A-154 North pipes. In calendar 2017, we expect to mine 2.1 –2.3 million tonnes (on a 100% basis). The ore sources expected to be processed and volume of carats produced continue to be in line with our original expectations.

The aforementioned mine plan for the Diavik Diamond Mine was prepared and verified by DDMI, operator of the Diavik Diamond Mine, under the supervision of Calvin Yip, P. Eng., Principal Advisor, Strategic Planning of DDMI, and a Qualified Person within the meaning of National Instrument 43-101 of the Canadian Securities Administrators.

| Dominion Diamond Corporation | Second Quarter Fiscal 2018 Management’s Discussion & Analysis | 12 |

| Overview | Consolidated

Performance Review | Segment

Performance Review | Liquidity & Capital

Resources | Quarterly Financial

Highlights | Non-IFRS Financial

Measures | Other Information

& Advisories |

Financial Outlook

(in millions of United States dollars, except where otherwise noted)

| | | Ekati (100% | ) | | Diavik (40% | ) | | Consolidated Fiscal 2018 | |

| Sales | $ | 595–625 | | $ | 300–330 | | $ | 895–955 | |

| Adjusted EBITDA(i) | | 300–330 | | | 185–205 | | | 465–515 | |

| Depreciation and amortization | | 225–250 | | | 85–95 | | | 310–345 | |

| Average price per carat sold | | 60–75 | | | 90–105 | | | 70–85 | |

| (i) | The term “Adjusted EBITDA” does not have a standardized meaning according to IFRS. See “Non-IFRS Financial Measures” for additional information. |

Sales are expected to be between $895 million and $955 million with strong sales experienced in the first half of the year continuing throughout the remainder of fiscal 2018. Previous guidance for sales for fiscal 2018 was between $875 million and $975 million. Sales are expected to continue to benefit from a return in demand for the commercial and cheaper ranges of goods experienced in the first half of fiscal 2018 as well as ongoing sales of fancy coloured diamonds recovered from the Ekati Diamond Mine. These positive developments have been offset by our downward revision of the estimated average value per carat for diamonds recovered from Koala underground. In line with the improvement in demand for smaller and brown goods experienced in the first half of fiscal 2018, we expect a greater volume of sales in these segments than originally planned and have reduced our expected average price per carat sold for both Ekati and Diavik.

Adjusted EBITDA is expected to be between $465 million and $515 million, compared to our original guidance of between $475 million and $560 million. While our guidance for the Diavik segment remains unchanged, Adjusted EBITDA for the Ekati segment has been reduced by a downward revision of the estimated value per carat for Koala underground, influencing both gross margin and Adjusted EBITDA in that segment. Guidance ranges reflect continued strong cost controls at both the Ekati Diamond Mine and Diavik Diamond Mine.

Unit cost production guidance for each of the Ekati and Diavik Diamond Mines is indicated in the table below. Per carat metrics in any particular quarter may vary from the annual guidance due to variations in the ore blend.

| (in United States dollars) | | | | | | | | | |

| | | | | | | | | | |

| | | Ekati Fiscal 2018 | | | Diavik Fiscal 2018 | | | Consolidated Fiscal 2018 | |

| Cash cost per tonne processed(i) | $ | 60–70 | | $ | 120–130 | | $ | 70–80 | |

| Total cost per tonne processed(i) | | 120–135 | | | 220–235 | | | 140–155 | |

| Cash cost per carat produced(i) | | 30–35 | | | 35–40 | | | 35–40 | |

| Total cost per carat produced(i) | | 60–70 | | | 60–70 | | | 60–70 | |

| (i) | The terms “cash cost per tonne processed,” “total cost per tonne processed,” “cash cost per carat produced” and “total cost per carat produced” do not have standardized meanings according to IFRS. See “Non-IFRS Financial Measures” for additional information. |

Unit cost production guidance on a tonnes processed basis remains unchanged for fiscal 2018, reflecting strong cost control at both the Ekati and Diavik Diamond Mines. Cash cost per tonne processed at the Ekati Diamond Mine has been near the upper end of the range in the first half of fiscal 2018 as a result of unplanned maintenance, and to a lesser extent, seasonal weather-related material handling challenges experienced in the first quarter of fiscal 2018. However, we have mitigated some of this shortfall in the second quarter, and expect this to continue in the second half of fiscal 2018. Unit cost production guidance on a carat produced basis remains unchanged for Diavik and has been reduced for Ekati, reflecting the expected increase in carats produced as a result of changes in the ore blend in the remainder of fiscal 2018.

The capital expenditures at the Ekati Diamond Mine for fiscal 2018 are expected to be approximately $210 million to $230 million, compared to our original guidance of between $230 million and $280 million. The expected decrease from our original guidance is due to lower sustaining capital expenditures primarily as a result of the deferral of waste stripping activities at the Lynx and Pigeon open pits. This decrease was partially offset by an increase in growth capital due to the acceleration of initial waste stripping at Sable and the addition of the Misery underground project, approved in June 2017.

| Dominion Diamond Corporation | Second Quarter Fiscal 2018 Management’s Discussion & Analysis | 13 |

| Overview | Consolidated

Performance Review | Segment

Performance Review | Liquidity & Capital

Resources | Quarterly Financial

Highlights | Non-IFRS Financial

Measures | Other Information

& Advisories |

| (in millions of United States dollars, except where otherwise noted) | | | | | Fiscal 2018 | |

|

|

|

Cost |

|

| Percentage of

growth capital |

|

| | | | | | | | |

| Ekati Diamond | Growth capital | $ | 90–100 | | | | |

| Mine (100%) | | | | | | | |

| | Lynx | | | | | 5% | |

| | Sable | | | | | 45% | |

| | Jay | | | | | 25% | |

| | Misery underground | | | | | 10% | |

| | Other | | | | | 15% | |

| | Sustaining capital (including production stripping) | | 120–130 | | | | |

The capital expenditures at the Diavik Diamond Mine (40% basis) for calendar 2017 are expected to be approximately $48 million to $55 million, compared to our original guidance of between $38 million and $45 million. The A-21 project remains on budget but due to the accelerated project schedule, additional expenditure is expected to be incurred in calendar 2017 with a corresponding reduction in future periods.

| (in millions of United States dollars, except where otherwise noted) | | | | | Calendar 2017 | |

| | | | | | | | |

| | | | | | | | |

| | | | Cost | | | | |

| | | | | | | | |

| Diavik Diamond | Growth capital | $ | 35–40 | | �� | | |

| Mine (40%) | A-21 | | | | | | |

| | Sustaining capital(i) | | 13–15 | | | | |

(ii) Sustaining includes underground mine development.

| Dominion Diamond Corporation | Second Quarter Fiscal 2018 Management’s Discussion & Analysis | 14 |

| Overview | Consolidated

Performance Review | Segment

Performance Review | Liquidity & Capital

Resources | Quarterly Financial

Highlights | Non-IFRS Financial

Measures | Other Information

& Advisories |

Development Projects

A number of medium and longer-term development opportunities continue to be advanced in fiscal 2018.

| Mine | Project | Update |

| | | |

| Ekati Diamond Mine | Jay Project (open pit) | On July 7, 2017, we received approval from the Minister of Environment and Natural Resources, Government of the Northwest Territories (“GNWT”), on the Type A Water Licence for the Ekati Diamond Mine, including the Jay project. |

| | | |

| | Construction of early works is also progressing. In June 2017, we started crushing Lynx waste rock to produce road base material, and subsequently commenced construction of the access road to the project site. |

| | | |

| | Due to the incorporation of Misery Deep into the life-of-mine plan following the Misery Deep Pre- Feasibility Study, we have extended the Jay Project schedule by one year. In calendar 2018, laydowns will be constructed at the project site, and equipment will be mobilized for dike construction. Dike construction is now scheduled to begin in July 2019, continuing for three open-water seasons from 2019–2021. In calendar 2022, we expect dike construction and instrumentation to be completed, and de-watering to begin. |

| | | |

| | This change enables underground mining beneath the Misery Pit for an additional year, prior to the use of this pit as a mine-water management facility for the Jay Project. The revised project schedule defers all remaining capital expenditures on the project by a year, with the exception of access road construction which is proceeding as scheduled in the Jay Feasibility Study. The revised project schedule does not affect the estimated cost to complete the project. |

| | | |

| Sable Project (open pit) | Final site infrastructure at the Sable pipe is nearing completion and we expect the initial development capital for the project to be approximately 25% below the pre-feasibility investment case. Pre-stripping commenced in July 2017, significantly ahead of the schedule outlined in the pre-feasibility study. |

| | | |

| | Following waste stripping, the first production of high value carats from the Sable pipe is anticipated in fiscal 2020. |

| | | |

| Misery Deep Project (underground) | On May 23, 2017, we announced the results of a pre-feasibility study on the development of an underground operation below the Misery Main open pit. The pre-feasibility study is based on the mining of Misery Deep from calendar 2018 to calendar 2022 and involves the extraction of 1.8 million tonnes of kimberlite and 8.7 million carats. |

| | | |

| | Our Board of Directors has approved the construction of the project. In August 2017, we filed a water licence amendment and land use permit application with the Wek'èezhìi Land and Water Board for the development of the project. |

| | | |

| Fox Deep

(underground) | Based on successful results from the Fox Deep drilling program, indicated resources at the Fox kimberlite pipe increased to 45.6 million tonnes and 16.5 million carats in January 2017. |

| | | |

| | Work continues on the evaluation of an underground mine below the large Fox open pit. A preliminary economic assessment on the project was completed in September 2017. The preliminary economic assessment is based on the mining of Fox Deep from calendar 2032 to calendar 2041 and involves the extraction of 31.3 million tonnes of kimberlite and 11.0 million carats. A pre-feasibility study is scheduled for completion by the end of the fiscal year. |

| | | |

| Diavik Diamond Mine | A-21 Project (open pit) | Development of the A-21 pipe continues to progress ahead of schedule and on budget, with the completion of the dike and the start of de-watering expected in late calendar 2017. The start of waste stripping is now expected in late calendar 2017, concurrent with de-watering. Following waste stripping, processing of ore from the A-21 pipe is expected to commence in calendar 2018. |

| Dominion Diamond Corporation | Second Quarter Fiscal 2018 Management’s Discussion & Analysis | 15 |

| Overview | Consolidated

Performance Review | Segment

Performance Review | Liquidity & Capital

Resources | Quarterly Financial

Highlights | Non-IFRS Financial

Measures | Other Information

& Advisories |

Exploration Activities

The Lac de Gras region in Canada’s Northwest Territories hosts some of the richest kimberlite pipes in the world and is the focus of our exploration efforts.

| Location | Update |

| | |

| Ekati Diamond Mine | In May 2017, we announced a maiden inferred mineral resource of 51 million tonnes and 16 million carats at the Leslie kimberlite pipe, the highest priority amongst pipes at the Ekati Diamond Mine that have been bulk sampled but not yet included in the mine plan. A concept study is planned for the Leslie pipe in calendar 2017, and future work plans are under consideration. |

| | |

| A renewed brownfield exploration program has commenced in calendar 2017 at the Ekati Diamond Mine. There are 150 known kimberlites on the property, of which approximately 110 have not been evaluated to date with follow-up bulk sampling. A four-part program is underway including an assessment of historical geophysical data, till sample data analysis, evaluation of known kimberlites and field programs (geophysics and diamond drilling). A summer exploration program on the Ekati mining leases was in progress at the end of the second quarter and included ground geophysics, an Unmanned Aerial Vehicle (“UAV”) magnetic survey and diamond drilling. |

| | |

| | Three diamond drill holes were completed during the quarter, including a vertical diamond drill hole at the Kodiak kimberlite pipe and two exploration drill holes on new targets. Kodiak is considered a high priority kimberlite pipe; it has not been bulk sampled and is land-based, located approximately seven kilometres east of the central infrastructure at the Ekati Diamond Mine. Approximately 530 kilograms of Kodiak kimberlite drill core was submitted for microdiamond analysis with results expected in the third quarter of fiscal 2018. Pending the results of this program, a reverse circulation bulk sample program may be planned for winter 2018. At the end of the second quarter, two exploration targets had been drilled with no kimberlite intersections. |

| | |

| Diavik Diamond Mine | After startup of the Diavik Diamond Mine in 2002, exploration continued until 2013. In 2017, exploration activities have resumed. |

| | |

| | Three priority kimberlites – C42, T29 and A61 – have been highlighted for additional work based on potential size and proximity to the existing infrastructure. Drilling was performed at these three kimberlites resulting in collection of samples which were submitted for microdiamond analysis. Sample results are pending. |

| | |

| Lac de Gras Property | Exploration work by prior operators has resulted in the discovery of three kimberlites within the Lac de Gras Joint Venture property and has produced a large database of sampling, drilling and geophysical information. A comprehensive review of this database was conducted during 2016. |

| | |

| | Ground geophysics including magnetic, gravity and resistivity surveys were completed over 20 airborne geophysical anomalies located on the Lac de Gras Joint Venture property. Data is currently being analyzed and interpreted to select drill targets for a 2018 drilling campaign. A 5,500 line kilometre airborne geophysical survey commenced over the southern part of the Lac de Gras property and at the end of the second quarter, 30% of the survey had been flown. |

| | |

| Glowworm Lake Property | A data review of the Glowworm Lake property has been partially completed with the historical sampling review highlighting several targets for follow-up. The geophysical data review is still in progress. The land use permit application submitted earlier in the year was approved allowing for follow-up field work later in the year. |

| Outstanding Share Information | |

| | |

| | As at September 6, 2017 |

| | |

| Authorized | Unlimited |

| | |

| Issued and outstanding shares | 81,913,956 |

| | |

| Options and share RSU outstanding | 1,079,917 |

| | |

| Fully diluted | 82,993,873 |

| | |

| Dominion Diamond Corporation | Second Quarter Fiscal 2018 Management’s Discussion & Analysis | 16 |

| Overview | Consolidated

Performance Review | Segment

Performance Review | Liquidity & Capital

Resources | Quarterly Financial

Highlights | Non-IFRS Financial

Measures | Other Information

& Advisories |

Consolidated Performance Review

Financial Performance

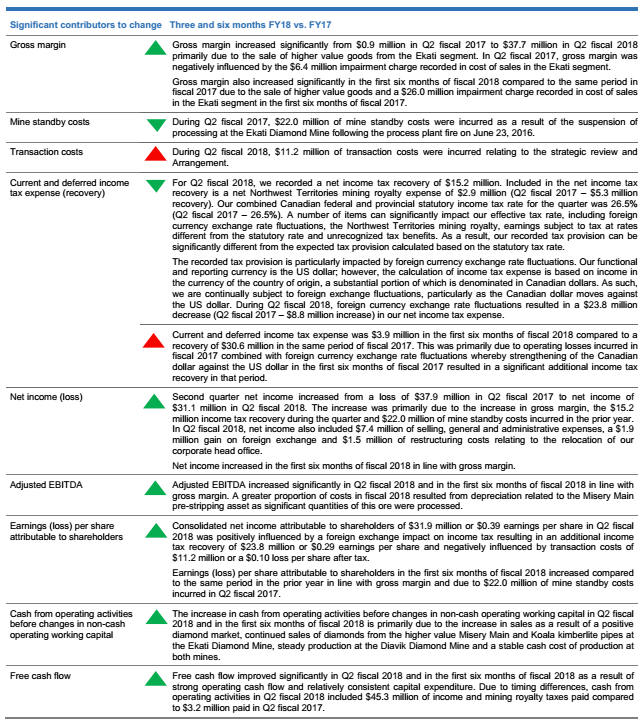

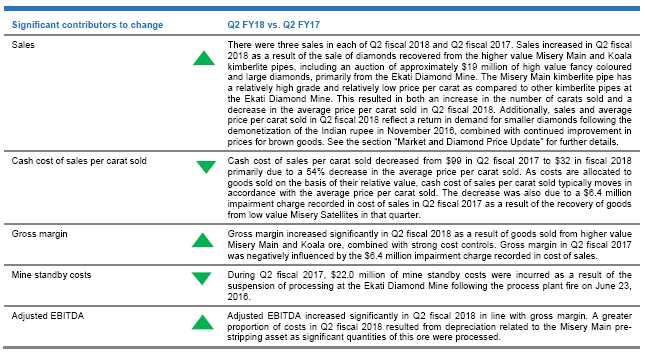

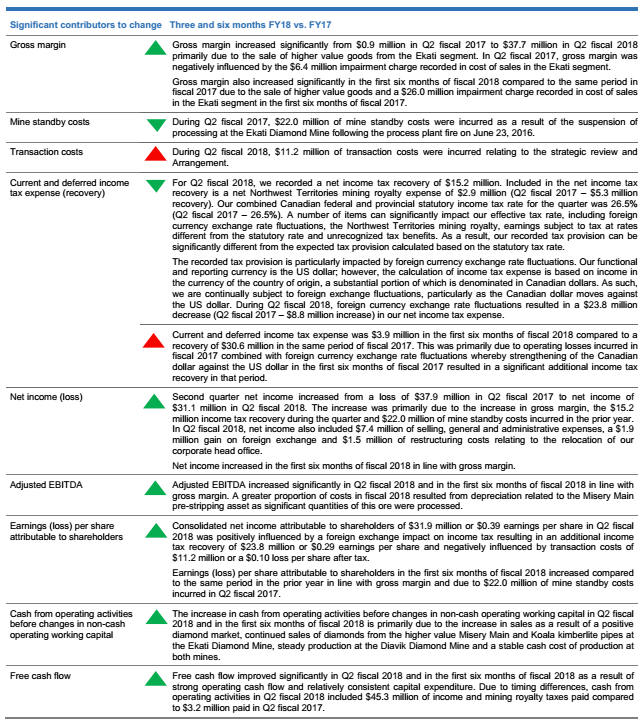

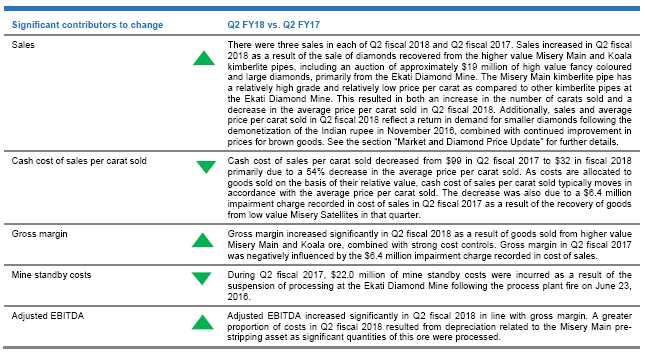

Consolidated sales were strong in the second quarter of fiscal 2018 with a substantially improved gross margin over the comparable period in the previous year. The improvement was largely attributable to the sale of diamonds recovered from higher value kimberlite pipes at the Ekati Diamond Mine, combined with continued strong performance from the Diavik Diamond Mine.

| (in millions of United States dollars, except where otherwise noted) | | Three months ended July 31 | | | | | | Six months ended July 31 | | | | |

| | | 2017 | | | 2016 | | | 2017 | | | 2016 | |

| | | | | | | | | | | | | |

| Sales | $ | 239.8 | | $ | 160.0 | | $ | 450.8 | | $ | 338.2 | |

| Carats sold (000s) | | 3,643 | | | 1,341 | | | 5,976 | | | 3,940 | |

| Average price per carat sold ($/carat) | $ | 66 | | $ | 119 | | $ | 75 | | $ | 86 | |

| Cash cost of sales per carat sold(i)($/carat) | $ | 32 | | $ | 74 | | $ | 37 | | $ | 58 | |

| Gross margin | $ | 37.7 | | $ | 0.9 | | $ | 68.4 | | $ | (18.0 | ) |

| Gross margin (%) | | 16% | | | 1% | | | 15% | | | (5% | ) |

| Selling, general and administrative expenses | $ | 7.4 | | $ | 9.2 | | $ | 15.6 | | $ | 17.2 | |

| Mine standby costs | $ | – | | $ | 22.0 | | $ | – | | $ | 22.0 | |

| Transaction costs | $ | 11.2 | | $ | – | | $ | 11.2 | | $ | – | |

| Current and deferred income tax expense (recovery) | $ | (15.2 | ) | $ | – | | $ | 3.9 | | $ | (30.6 | ) |

| Net income (loss) | $ | 31.1 | | $ | (37.9 | ) | $ | 23.2 | | $ | (43.2 | ) |

| Adjusted EBITDA(i) | $ | 115.2 | | $ | 38.6 | | $ | 212.2 | | $ | 92.9 | |

| Adjusted EBITDA margin(i)(%) | | 48% | | | 24% | | | 47% | | | 27% | |

| Depreciation and amortization | $ | 85.1 | | $ | 62.6 | | $ | 160.9 | | $ | 124.1 | |

| Earnings (loss) per share attributable to shareholders ($/share) | $ | 0.39 | | $ | (0.39 | ) | $ | 0.29 | | $ | (0.40 | ) |

| Cash from operating activities before changes in non-cash operating working capital(i) | $ | 63.9 | | $ | 23.9 | | $ | 137.4 | | $ | 35.1 | |

| Free cash flow(i) | $ | 42.8 | | $ | (20.9 | ) | $ | 27.3 | | $ | (110.9 | ) |

(i) | The terms “cash cost of sales per carat sold,” “Adjusted EBITDA,” “Adjusted EBITDA margin,” “cash from operating activities before changes in non-cash operating working capital" and “free cash flow” do not have standardized meanings according to IFRS. See “Non-IFRS Financial Measures” for additional information. |

| Dominion Diamond Corporation | Second Quarter Fiscal 2018 Management’s Discussion & Analysis | 17 |

| Overview | Consolidated

Performance Review | Segment

Performance Review | Liquidity & Capital

Resources | Quarterly Financial

Highlights | Non-IFRS Financial

Measures | Other Information

& Advisories |

| Dominion Diamond Corporation | Second Quarter Fiscal 2018 Management’s Discussion & Analysis | 18 |

| Overview | Consolidated

Performance Review | Segment

Performance Review | Liquidity & Capital

Resources | Quarterly Financial

Highlights | Non-IFRS Financial

Measures | Other Information

& Advisories |

| Diamond Inventory | | | | | | | | | |

| (in millions of United States dollars, except where otherwise noted) | | | | | | | | | |

| | | | | | | | | | |

| | | July 31, 2017 | | | April 30, 2017 | | | January 31, 2017 | |

| | | | | | | | | | |

| Carats in inventory available-for-sale (000s) | | 2,439 | | | 3,551 | | | 3,674 | |

| Estimated market value of inventory available-for-sale | $ | 170 | | $ | 200 | | $ | 212 | |

| Estimated average market value per carat available-for-sale ($/carat) | $ | 70 | | $ | 56 | | $ | 58 | |

| Cost of inventory available-for-sale | $ | 149 | | $ | 159 | | $ | 182 | |

Rough diamond inventory classified as available-for-sale represents diamonds that have substantially completed the sorting and valuation process. Carats still undergoing sorting and valuation are classified as work-in-progress inventory.

The 31% decrease in carats in inventory available-for-sale from 3.6 million at April 30, 2017 to 2.4 million at July 31, 2017 reflects 2.5 million carats transferred to available-for-sale during the quarter compared to 3.6 million carats sold. Due to the time required for initial sorting and valuation, carats transferred to available-for-sale diamond inventory in a given period will differ from the number of carats produced in that period. At July 31, 2017, we also had approximately 0.5 million carats of rough diamond inventory that was work in progress in the Ekati segment (April 30, 2017 – 0.6 million carats).

The estimated market value of diamond inventory available-for-sale decreased by 15% from approximately $200 million at April 30, 2017 to approximately $170 million at July 31, 2017 primarily as a result of strong sales in Q2 fiscal 2018. The estimated market value per carat of $70 for the remaining goods in available-for-sale inventory at the end of the quarter reflects diamonds recovered in Q2 fiscal 2018 that will be sold in the second half of fiscal 2018 following the finalization of the sorting and valuation process. Cost of inventory available-for-sale decreased in line with decreases in carats and market value.

| Dominion Diamond Corporation | Second Quarter Fiscal 2018 Management’s Discussion & Analysis | 19 |

| Overview | Consolidated

Performance Review | Segment

Performance Review | Liquidity & Capital

Resources | Quarterly Financial

Highlights | Non-IFRS Financial

Measures | Other Information

& Advisories |

Operational Performance

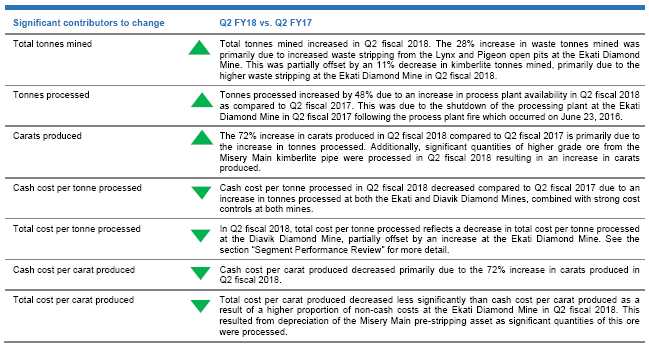

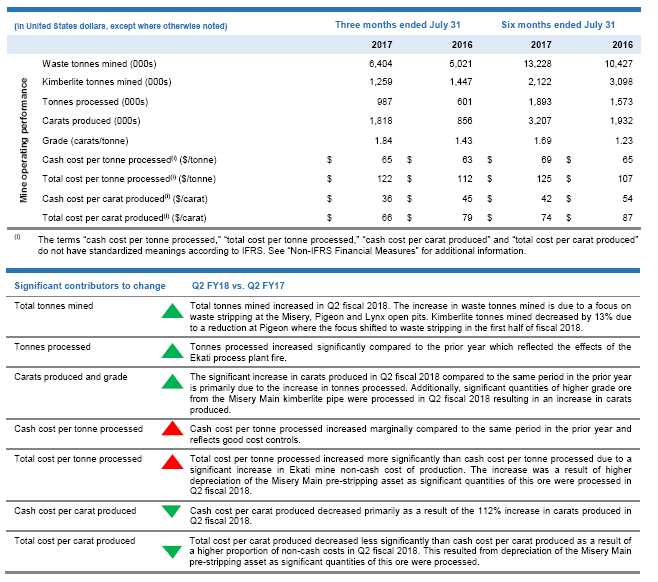

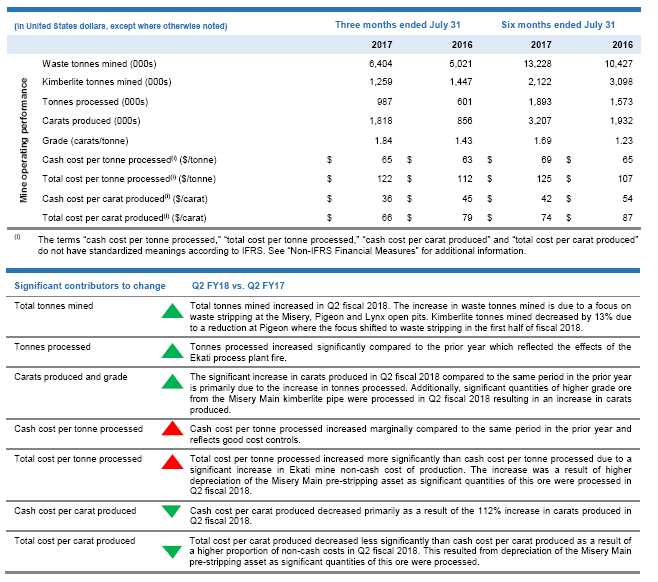

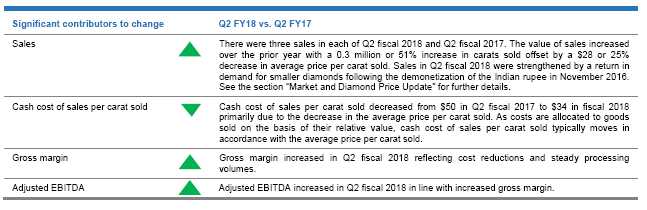

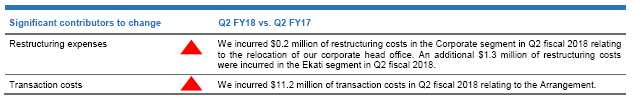

Carats produced in Q2 fiscal 2018 increased to 2.6 million carats from 1.5 million carats in Q2 fiscal 2017. While the production mix at the Diavik Diamond Mine remained relatively consistent quarter-over-quarter, continued processing of higher proportions of high-grade ore from the Misery Main open pit at the Ekati Diamond Mine resulted in an increase in carats produced in Q2 fiscal 2018. Tonnes processed and carat recoveries in Q2 fiscal 2017 were also negatively influenced by the Ekati Diamond Mine process plant fire on June 23, 2016 which resulted in a shutdown of the processing plant for approximately three months. Mining performance was strong in Q2 fiscal 2018 at both the Ekati and Diavik Diamond Mines. Cash cost and total cost per tonne processed decreased in Q2 fiscal 2018 due to the increase in tonnes processed. Cash cost and total cost per carat produced decreased as a result of the increase in carats produced. Significant contributors to change in Q2 2018 are outlined below.

| (i) | The terms “cash cost per tonne processed,” “total cost per tonne processed,” “cash cost per carat produced” and “total cost per carat produced” do not have standardized meanings according to IFRS. See “Non-IFRS Financial Measures” for additional information. |

| Dominion Diamond Corporation | Second Quarter Fiscal 2018 Management’s Discussion & Analysis | 20 |

| Overview | Consolidated

Performance Review | Segment

Performance Review | Liquidity & Capital

Resources | Quarterly Financial

Highlights | Non-IFRS Financial

Measures | Other Information

& Advisories |

Segment Performance Review

Our operating segments include the Ekati Diamond Mine, the Diavik Diamond Mine and the Corporate segment. The Corporate segment captures costs not specifically related to operating the Ekati and Diavik mines. Our segmented analysis reflects how we manage our business and classify our operations for planning and measurement purposes.

Ekati Diamond Mine (100% basis)

| Financial Performance | | | | | | | | | | | | |

| (in millions of United States dollars, except where otherwise noted) | | Three months ended July 31 | | | Six months ended July 31 | |

| | | | | | | | | | | | | |

| | | 2017 | | | 2016 | | | 2017 | | | 2016 | |

| | | | | | | | | | | | | |

| Sales | $ | 152.2 | | $ | 83.3 | | $ | 289.9 | | $ | 188.4 | |

| Carats sold (000s) | | 2,626 | | | 668 | | | 4,460 | | | 2,213 | |

| Average price per carat sold ($/carat) | $ | 58 | | $ | 125 | | $ | 65 | | $ | 85 | |

| Cash cost of sales per carat sold(i)($/carat) | $ | 32 | | $ | 99 | | $ | 35 | | $ | 71 | |

| Gross margin | $ | 7.6 | | $ | (22.8 | ) | $ | 17.3 | | $ | (54.6 | ) |

| Gross margin (%) | | 5% | | | (27% | ) | | 6% | | | (29% | ) |

| Mine standby costs | $ | – | | $ | 22.0 | | $ | – | | $ | 22.0 | |

| Adjusted EBITDA(i) | $ | 68.1 | | $ | 4.1 | | $ | 132.4 | | $ | 30.0 | |

| Adjusted EBITDA margin(i)(%) | | 45% | | | 5% | | | 46% | | | 16% | |

| Depreciation and amortization | $ | 62.0 | | $ | 43.5 | | $ | 118.0 | | $ | 82.4 | |

| (i) | The terms “cash cost of sales per carat sold,” “Adjusted EBITDA” and “Adjusted EBITDA margin” do not have standardized meanings according to IFRS. See “Non-IFRS Financial Measures” for additional information. |

| Dominion Diamond Corporation | Second Quarter Fiscal 2018 Management’s Discussion & Analysis | 21 |

| Overview | Consolidated

Performance Review | Segment

Performance Review | Liquidity & Capital

Resources | Quarterly Financial

Highlights | Non-IFRS Financial

Measures | Other Information

& Advisories |

| Diamond Inventory | | | | | | | | | |

| | | | | | | | | | |

| (in millions of United States dollars, except where otherwise noted) | | | | | | | | | |

| | | | | | | | | | |

| | | July 31, 2017 | | | April 30, 2017 | | | January 31, 2017 | |

| | | | | | | | | | |

| Carats in inventory available-for-sale (000s) | | 1,784 | | | 2,491 | | | 3,046 | |

| Estimated market value of inventory available-for-sale | $ | 124 | | $ | 125 | | $ | 156 | |

| Estimated average market value per carat available-for-sale ($/carat) | $ | 70 | | $ | 50 | | $ | 51 | |

| Cost of inventory available-for-sale | $ | 122 | | $ | 115 | | $ | 143 | |

Rough diamond inventory classified as available-for-sale represents diamonds that have substantially completed the sorting and valuation process. Carats still undergoing sorting and valuation are classified as work-in-progress inventory.

The 28% decrease in carats in inventory available-for-sale from 2.5 million at April 30, 2017 to 1.8 million at July 31, 2017 reflects 1.9 million carats transferred to available-for-sale during the quarter compared to 2.6 million carats sold. Due to the time required for initial sorting and valuation, carats transferred to available-for-sale diamond inventory in a given period will differ from the number of carats produced by the mine in that period. At July 31, 2017, we also had approximately 0.5 million carats of rough diamond inventory that was work-in-progress (April 30, 2017 – 0.6 million carats) and that were primarily from Misery Main and Koala underground.

The estimated market value of diamond inventory available-for-sale remained relatively consistent from April 30, 2017 to July 31, 2017, whereas the carats available for sale decreased by 28% during this period. This change reflects strong sales of brown goods and smaller white goods in Q2 fiscal 2018 resulting from a return in trading activity for these segments of the market as the trading liquidity issues resulting from the demonetization of the Indian rupee in November 2016 abated. The estimated market value per carat of $70 for the remaining goods in available-for-sale inventory at the end of the quarter reflects diamonds recovered in Q2 fiscal 2018 that we expect to sell in the second half of fiscal 2018 following the finalization of the sorting and valuation process.

Operational Performance

During Q2 fiscal 2018, the Ekati Diamond Mine recovered, on a 100% basis, 1.8 million carats from 1.0 million tonnes processed (Q2 fiscal 2017 – 0.9 million carats from 0.6 million tonnes processed), representing a 112% increase in carats produced from Q2 fiscal 2017. Carat production was positively influenced in the quarter by the continued processing of a large proportion of high-grade Misery Main ore. Tonnes processed and carats produced in Q2 fiscal 2017 were negatively influenced by the Ekati Diamond Mine process plant fire on June 23, 2016 which resulted in a shutdown of the processing plant for approximately three months.

| | For the three months ended July 31, 2017 | | For the three months ended July 31, 2016 |

| | | | | | | | |

| Tonnes

processed

(000s tonnes) |

Carats

(000s) |

Grade

(carats/tonne) | | Tonnes

processed

(000s tonnes) |

Carats

(000s) |

Grade

(carats/tonne) |

| | | | | | | | |

| Koala | 397 | 167 | 0.42 | | 205 | 116 | 0.57 |

| Misery Main | 358 | 1,522 | 4.26 | | 135 | 459 | 3.41 |

| Pigeon | 209 | 79 | 0.38 | | 157 | 64 | 0.41 |

| Misery Satellites | 23 | 50 | 2.21 | | 104 | 217 | 2.08 |

| Total | 987 | 1,818 | 1.84 | | 601 | 856 | 1.43 |

| Dominion Diamond Corporation | Second Quarter Fiscal 2018 Management’s Discussion & Analysis | 22 |

| Overview | Consolidated

Performance Review | Segment

Performance Review | Liquidity & Capital

Resources | Quarterly Financial

Highlights | Non-IFRS Financial

Measures | Other Information

& Advisories |

| | For the six months ended July 31, 2017 | | | | For the six months ended July 31, 2016 | | |

| | | | | | | | |

| Tonnes

processed

(000s tonnes) |

Carats

(000s) |

Grade

(carats/tonne) |

| Tonnes

processed

(000s tonnes) |

Carats

(000s) |

Grade

(carats/tonne) |

| | | | | | | | |

| Koala | 897 | 388 | 0.43 | | 518 | 313 | 0.60 |

| Misery Main | 616 | 2,637 | 4.28 | | 209 | 663 | 3.17 |

| Pigeon | 357 | 132 | 0.37 | | 406 | 173 | 0.43 |

| Misery Satellites | 23 | 50 | 2.21 | | 440 | 783 | 1.78 |

| Total | 1,893 | 3,207 | 1.69 | | 1,573 | 1,932 | 1.23 |

Mining activities in Q2 fiscal 2018 were focused at the Misery, Pigeon and Lynx open pits and at Koala underground. Approximately 1.9 million tonnes of kimberlite material remained in stockpiles at the end of Q2 fiscal 2018, primarily from Misery Satellites, Pigeon and Lynx. Cash cost per tonne processed remained relatively stable in Q2 fiscal 2018 and cash cost per carat produced decreased in the same period as a result of increased carat production. Significant contributors to change in Q2 2018 are outlined below.

| Dominion Diamond Corporation | Second Quarter Fiscal 2018 Management’s Discussion & Analysis | 23 |

| Overview | Consolidated

Performance Review | Segment

Performance Review | Liquidity & Capital

Resources | Quarterly Financial

Highlights | Non-IFRS Financial

Measures | Other Information

& Advisories |

The charts below show the Ekati Diamond Mine tonnes processed, recovered grade and carats produced for the eight most recent fiscal quarters. Carat recovery reflected the expected shift in the mine plan beginning in fiscal 2016 from higher value production from the Koala, Koala North and Fox ore bodies to lower value material from Misery Satellites and COR, while pre-stripping was being completed in the high value Misery Main open pit. Misery Main commenced commercial production in May 2016 and initial sales began in late fiscal 2017. A fire at the Ekati Diamond Mine process plant that occurred in June 2016 resulted in a shutdown of the process plant between June and September 2016 and negatively influenced tonnes processed and carats produced in the second and third fiscal quarters of 2017. The processing of material from the high-grade Misery Main open pit led to a greater number of carats produced in Q4 fiscal 2017 and in the first half of fiscal 2018.

| Dominion Diamond Corporation | Second Quarter Fiscal 2018 Management’s Discussion & Analysis | 24 |

| Overview | Consolidated

Performance Review | Segment

Performance Review | Liquidity & Capital

Resources | Quarterly Financial

Highlights | Non-IFRS Financial

Measures | Other Information

& Advisories |

Capital Expenditure

The chart below sets out the year to date capital expenditure by project for fiscal 2018 at the Ekati Diamond Mine. Capital expenditure in Q2 fiscal 2018 included $27.6 million of sustaining capital and $17.6 million of growth capital. Capital expenditure includes development projects and sustaining capital, and is presented on an accrual basis. There may be differences in timing between the recording of capital expenditure on an accrual basis for accounting purposes and the date of cash payment.

| (i) | Presented on an accrual basis. |

| | |

| (ii) | Represents excess waste stripping in open pits that have achieved commercial production. Costs are capitalized as deferred stripping assets and amortized on a unit-of-production basis as the associated material is processed. |

| Project | Update |

| | |

| Sable | In Q2 fiscal 2018, construction of the Two Rock Dam was completed and construction of the Two Rock Filter Dike neared completion. Other construction activities such as the construction of the fuel storage facility and the maintenance building are well underway. As a result of strong progress on the Sable Project, we expect initial development capital for the project to be approximately 25% below the pre-feasibility investment case. |

| | |

| Jay | Expenditure for the Jay Project in Q2 fiscal 2018 related primarily to preparing materials and equipment for road construction, and the start of road construction. |

| | |

| Lynx | Following waste stripping at the Lynx open pit in Q1 fiscal 2018, first ore was mined in March 2017 and the Lynx pipe achieved commercial production on April 1, 2017. Subsequent expenditure is being expensed as a cost of production. |

| | |

| Other growth | Other growth projects in Q2 fiscal 2018 included construction of a new maintenance facility for the dual-powered road trains and a permanent tipping wall to facilitate efficient uploading of the road trains. Construction of a diamond cleaning and sorting facility at the Ekati Mine site was substantially completed, below budget. |

| | |

| Production stripping | In Q2 fiscal 2018 expenditure related primarily to production stripping at the Lynx and Pigeon open pits where mining was focused on waste removal. There was no production stripping recognized at the Misery open pit in Q2 fiscal 2018. |

| | |

| Other sustaining | Sustaining capital expenditure for Q2 fiscal 2018 included the completion of equipment rebuilds, reconditioning of the airport runway and mine site roads. |

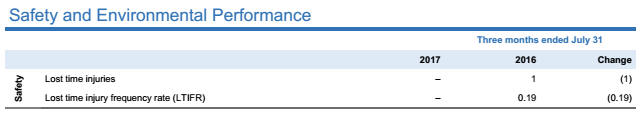

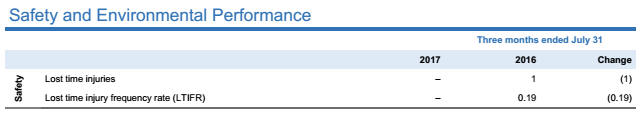

Safety performance was strong with no lost time injuries during Q2 fiscal 2018, resulting in a frequency rate per 200,000 hours worked (“LTIFR”) of 0.00 (Q2 fiscal 2017 -1 lost time injury for an LTIFR of 0.19).

In Q2 fiscal 2018, there were no significant environmental incidents at the Ekati Diamond Mine.

| Dominion Diamond Corporation | Second Quarter Fiscal 2018 Management’s Discussion & Analysis | 25 |

| Overview | Consolidated

Performance Review | Segment

Performance Review | Liquidity & Capital

Resources | Quarterly Financial

Highlights | Non-IFRS Financial

Measures | Other Information

& Advisories |

Diavik Diamond Mine (40% basis)

| Financial Performance | | | | | | | | | | | | |

| (in millions of United States dollars, except where otherwise noted) | | Three months ended July 31 | | | Six months ended July 31 | |

| | | 2017 | | | 2016 | | | 2017 | | | 2016 | |

| Sales | $ | 87.6 | | $ | 76.7 | | $ | 160.9 | | $ | 149.8 | |

| Carats sold (000s) | | 1,017 | | | 673 | | | 1,516 | | | 1,727 | |

| Average price per carat sold ($/carat) | $ | 86 | | $ | 114 | | $ | 106 | | $ | 87 | |

| Cash cost of sales per carat sold(i)($/carat) | $ | 34 | | $ | 50 | | $ | 45 | | $ | 42 | |

| Gross margin | $ | 30.1 | | $ | 23.7 | | $ | 51.1 | | $ | 36.7 | |

| Gross margin (%) | | 34% | | | 31% | | | 32% | | | 25% | |

| Adjusted EBITDA(i) | $ | 52.9 | | $ | 42.0 | | $ | 93.2 | | $ | 76.5 | |

| Adjusted EBITDA margin(i)(%) | | 60% | | | 55% | | | 58% | | | 51% | |

| Depreciation and amortization | $ | 22.7 | | $ | 19.2 | | $ | 42.2 | | $ | 41.6 | |

| (i) | The terms “cash cost of sales per carat sold,” “Adjusted EBITDA” and “Adjusted EBITDA margin” do not have standardized meanings according to IFRS. See “Non-IFRS Financial Measures” for additional information. |

| Dominion Diamond Corporation | Second Quarter Fiscal 2018 Management’s Discussion & Analysis | 26 |

| Overview | Consolidated

Performance Review | Segment

Performance Review | Liquidity & Capital

Resources | Quarterly Financial

Highlights | Non-IFRS Financial

Measures | Other Information

& Advisories |

| Diamond Inventory | | | | | | | | | |

| | | | | | | | | | |

| (in millions of United States dollars, except where otherwise noted) | | | | | | | | | |

| | | | | | | | | | |

| | | July 31, 2017 | | | April 30, 2017 | | | January 31, 2017 | |

| | | | | | | | | | |

| Carats in inventory available-for-sale (000s) | | 655 | | | 1,060 | | | 628 | |

| Estimated market value of inventory available-for-sale | $ | 46 | | $ | 75 | | $ | 56 | |

| Estimated average market value per carat available-for-sale ($/carat) | $ | 70 | | $ | 71 | | $ | 89 | |

| Cost of inventory available-for-sale | $ | 27 | | $ | 44 | | $ | 38 | |

Rough diamond inventory classified as available-for-sale represents diamonds that have substantially completed the sorting and valuation process. Carats still undergoing sorting and valuation are classified as work-in-progress inventory.

The 38% decrease in carats in inventory available-for-sale from 1.1 million at April 30, 2017 to 0.7 million at July 31, 2017 reflects 0.6 million carats transferred to available-for-sale during the quarter compared to 1.0 million carats sold. As we receive rough diamonds from the Diavik Diamond Mine in periodic shipments, carats transferred to available-for-sale diamond inventory in a given period will differ from the number of carats produced by the mine in that period. At July 31, 2017, we also had approximately 0.1 million carats of rough diamond inventory that was work-in-progress (April 30, 2017 – nil carats).

The estimated market value of diamond inventory available-for-sale decreased by 39% from approximately $75 million at April 30, 2017 to approximately $46 million at July 31, 2017 as a result of strong sales in Q2 fiscal 2018. Diavik segment sales in Q2 fiscal 2018 were at an average price per carat sold of $86 as compared to an average price per carat of $71 in opening inventory. This led to a lower-than-average estimated market value per carat of $70 for the remaining goods in available-for-sale inventory at the end of the quarter. The lower-than-average estimated market value reflects increased demand for lower value white goods but a slower recovery of prices for this segment following the demonetization of the Indian rupee in November 2016 and the ensuing disruption in trading. Cost of inventory available-for-sale decreased in line with decreases in carats and market value.

Operational Performance

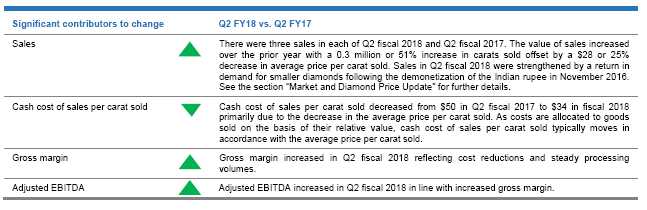

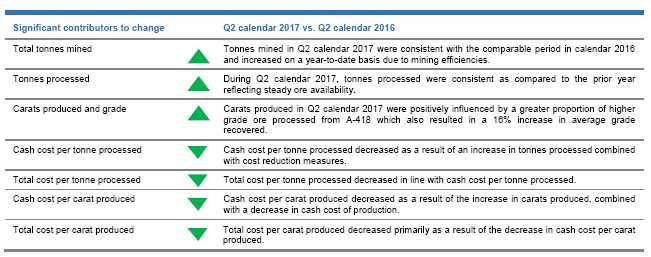

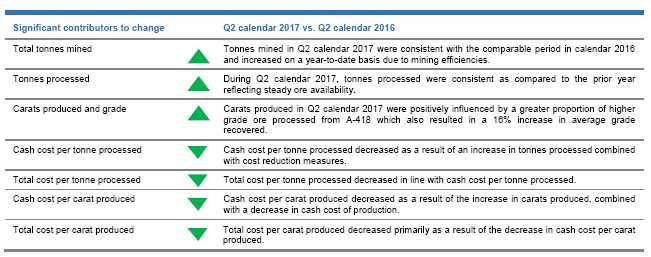

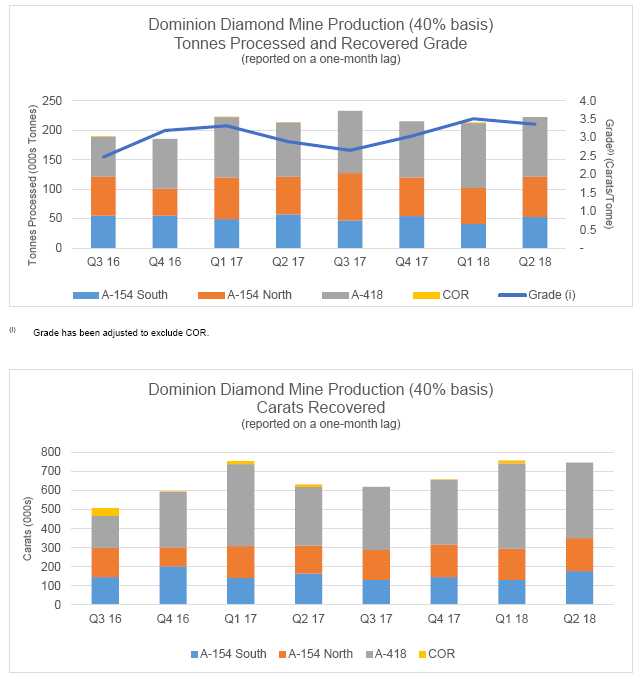

During Q2 calendar 2017, the Diavik Diamond Mine recovered, on a 40% basis, 0.7 million carats from 0.2 million tonnes processed (Q2 calendar 2016 – 0.6 million carats from 0.2 million tonnes processed). Carat production and average grade were positively influenced in Q2 calendar 2017 by the processing of a relatively high proportion of higher grade A-418 ore and by the 4% increase in the volume of tonnes processed such that carats produced increased over the comparable period of the prior year.

| | For the three months ended June 30, 2017 | | For the three months ended June 30, 2016 |

| | | | | | | | |

| | Tonnes | | | | Tonnes | | |

| | processed | Carats | Grade | | processed | Carats | Grade |

| | (000s tonnes) | (000s) | (carats/tonne) | | (000s tonnes) | (000s) | (carats/tonne) |

| | | | | | | | |

| A-154 South | 53 | 177 | 3.34 | | 57 | 164 | 2.85 |

| A-154 North | 68 | 173 | 2.54 | | 64 | 146 | 2.29 |

| A-418 | 101 | 396 | 3.92 | | 92 | 308 | 3.33 |

| COR | – | – | – | | 1 | 14 | – |

| Total | 222 | 746 | 3.36(i) | | 214 | 632 | 2.89(i) |

| (i) | Grade has been adjusted to exclude COR. |

| Dominion Diamond Corporation | Second Quarter Fiscal 2018 Management’s Discussion & Analysis | 27 |

| Overview | Consolidated

Performance Review | Segment

Performance Review | Liquidity & Capital

Resources | Quarterly Financial

Highlights | Non-IFRS Financial

Measures | Other Information

& Advisories |

| | For the six months ended June 30, 2017 | | For the six months ended June 30, 2016 |

| | | | | | | | |

| | Tonnes | | | | Tonnes | | |

| | processed | Carats | Grade | | processed | Carats | Grade |

| | (000s tonnes) | (000s) | (carats/tonne) | | (000s tonnes) | (000s) | (carats/tonne) |

| | | | | | | | |

| A-154 South | 94 | 309 | 3.30 | | 106 | 306 | 2.88 |

| A-154 North | 130 | 336 | 2.59 | | 135 | 312 | 2.32 |

| A-418 | 210 | 842 | 4.00 | | 195 | 738 | 3.79 |

| COR | 1 | 16 | – | | 1 | 30 | – |

| Total | 435 | 1,503 | 3.43(i) | | 437 | 1,386 | 3.11(i) |

| (i) | Grade has been adjusted to exclude COR. |

Mining activities in Q2 calendar 2017 were focused at the A-154 South, A-154 North and A-418 underground operations. As kimberlite mined at Diavik in both Q2 calendar 2017 and Q2 calendar 2016 was exclusively from underground sources, waste tonnes mined were minimal in both quarters.

| (i) | The terms “cash cost per tonne processed,” “total cost per tonne processed,” “cash cost per carat produced” and “total cost per carat produced” do not have standardized meanings according to IFRS. See “Non-IFRS Financial Measures” for additional information. |

| | |

| (ii) | Grade has been adjusted to exclude COR. |

| Dominion Diamond Corporation | Second Quarter Fiscal 2018 Management’s Discussion & Analysis | 28 |

| Overview | Consolidated

Performance Review | Segment

Performance Review | Liquidity & Capital

Resources | Quarterly Financial

Highlights | Non-IFRS Financial

Measures | Other Information

& Advisories |

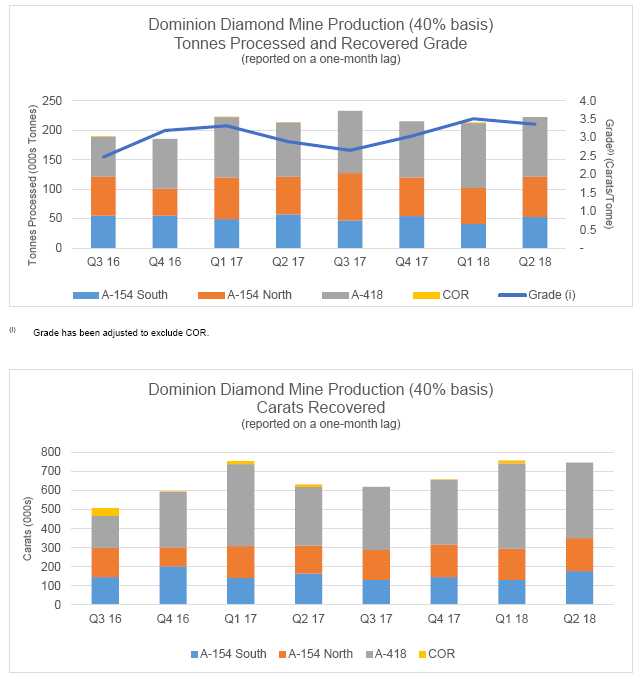

The charts below show our 40% share of Diavik Diamond Mine tonnes processed, recovered grade and carats produced for the eight most recent calendar quarters. The production mix has remained relatively consistent, with carat production largely driven by changes in processing volumes.

| Dominion Diamond Corporation | Second Quarter Fiscal 2018 Management’s Discussion & Analysis | 29 |

| Overview | Consolidated

Performance Review | Segment

Performance Review | Liquidity & Capital

Resources | Quarterly Financial

Highlights | Non-IFRS Financial

Measures | Other Information

& Advisories |

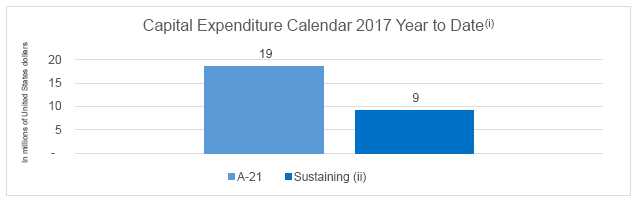

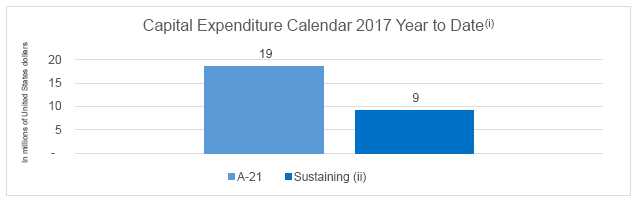

Capital Expenditure

The chart below sets out the year to date capital expenditure by project for calendar 2017 at the Diavik Diamond Mine (40% basis). Capital expenditure in Q2 calendar 2017 included $4.9 million of sustaining capital and $9.4 million of growth capital. Capital expenditure includes development projects, underground development and sustaining capital, and is presented on an accrual basis. There may be differences in timing between the recording of capital expenditure on an accrual basis for accounting purposes and the date of cash payment.

| (ii) | Presented on an accrual basis. |

| | |

| (iii) | Sustaining includes underground mine development. |

| Project | Update |

| | |

A-21 | In Q2 calendar 2017, the curtain grouting and cutter soil mixing scopes for the dike cut-off wall were completed and jet grouting began. Jet grouting is the final significant construction step prior to de-watering. The forecast start of both de-watering and pre-stripping are ahead of the baseline schedule. The project remains on budget overall; however, approximately $17 million in expenditures (100% basis) are expected to be brought forward from calendar 2018 into calendar 2017 due to the accelerated schedule. |

| | |

| Sustaining | Expenditure primarily related to continued underground development. |

Safety performance was strong with no lost time injuries during Q2 calendar 2017, resulting in an LTIFR of 0.00 (Q2 calendar 2016 – no lost time injuries for an LTIFR of 0.00) .

In Q2 calendar 2017, there were no significant environmental incidents at the Diavik Diamond Mine.

| Dominion Diamond Corporation | Second Quarter Fiscal 2018 Management’s Discussion & Analysis | 30 |

| Overview | Consolidated

Performance Review | Segment

Performance Review | Liquidity & Capital

Resources | Quarterly Financial

Highlights | Non-IFRS Financial

Measures | Other Information

& Advisories |