Exhibit 99.1

HARRY WINSTON DIAMOND CORPORATION

MANAGEMENT PROXY CIRCULAR

For the

AnnualMeeting of Shareholders

June 9, 2011

___________________________________

April 18, 2011

TABLE OF CONTENTS

| DESCRIPTION | PAGE |

| | |

| INVITATION TO SHAREHOLDERS | 2 |

| NOTICE OF ANNUAL MEETING OF SHAREHOLDERS | 3 |

| MANAGEMENT PROXY CIRCULAR | 4 |

| Q&A ON PROXY VOTING | 4 |

| REPORTING CURRENCY | 6 |

| BUSINESS OF THE MEETING | 7 |

| Financial Statements | 7 |

| Election of Directors | 7 |

| Appointment of Auditors | 8 |

| Other Matters | 8 |

| BOARD OF DIRECTORS | 9 |

| Nominees for Election to the Board of Directors | 9 |

| Compensation of Directors | 12 |

| Director Summary Compensation Table | 13 |

| Incentive Plan Awards | 15 |

| Meetings Held and Attendance of Directors | 16 |

| Directors’ and Officer’s Liability Insurance | 16 |

| Retirement Policy | 16 |

| CORPORATE GOVERNANCE DISCLOSURE | 17 |

| REPORT OF THE AUDIT COMMITTEE | 17 |

| REPORT OF THE HUMAN RESOURCES & COMPENSATION COMMITTEE | 18 |

| REPORT OF THE NOMINATING & CORPORATE GOVERNANCE COMMITTEE | 19 |

| STATEMENT OF EXECUTIVE COMPENSATION | 20 |

| Compensation Discussion and Analysis | 20 |

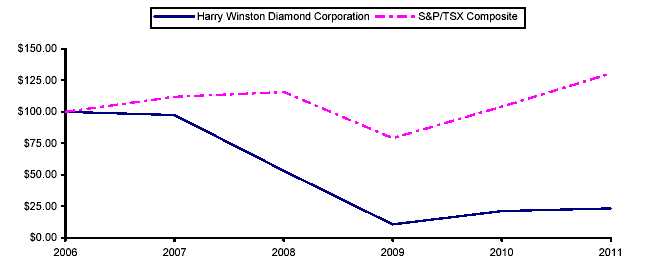

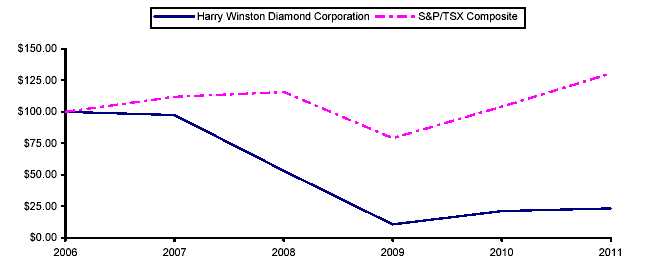

| Performance Graph | 26 |

| Option-Based Awards | 27 |

| Summary Compensation Table | 27 |

| Incentive Plan Awards | 28 |

| Pension Plan Benefits | 29 |

| Deferred Profit Sharing Plan | 29 |

| Termination and Change in Control Benefits | 29 |

| SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION PLANS | 32 |

| INDEBTEDNESS OF DIRECTORS AND EXECUTIVE OFFICERS | 34 |

| INTEREST OF INFORMED PERSONS IN MATERIAL TRANSACTIONS | 34 |

| ADDITIONAL INFORMATION | 34 |

| BOARD APPROVAL | 34 |

| SCHEDULE 1 - STATEMENT OF CORPORATE GOVERNANCE PRACTICES | 35 |

| Board of Directors | 35 |

| Majority Voting Policy | 36 |

| Board Mandate | 36 |

| Position Descriptions | 37 |

| Orientation and Continuing Education | 37 |

| Ethical Business Conduct | 37 |

| Nomination of Directors | 38 |

| Compensation | 39 |

| Board Committees | 39 |

| Assessments | 40 |

1

HARRY WINSTON DIAMOND CORPORATION

INVITATION TO SHAREHOLDERS

Dear Shareholder:

On behalf of the Board of Directors, management and employees, we invite you to attend Harry Winston Diamond Corporation's AnnualMeeting of Shareholders on Thursday, June 9, 2011.

The items of business to be considered at this Meeting are described in the Notice of Annual Meeting and Management Proxy Circular. No matter how many shares you hold, your participation at shareholders' meetings is very important. If you are unable to attend the Meeting in person, we encourage you to vote by following the voting instructions included on the proxy form.

There will be an opportunity to ask questions and meet with management, the Board of Directors and your fellow shareholders.

We look forward to seeing you at the Meeting.

Sincerely,

Robert A. Gannicott

Chairman & Chief Executive Officer

2

HARRY WINSTON DIAMOND CORPORATION

P.O. Box 4569, Station A

Toronto, Ontario M5W 4T9

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

NOTICE IS HEREBY GIVENthat an Annual Meeting of Shareholders (the “Meeting”) ofHARRY WINSTON DIAMOND CORPORATION(the “Corporation”) will be held at St. Andrews Club and Conference Center, 150 King Street West, 27thFloor, Toronto, Ontario at 10:00 a.m. (Toronto time)on Thursday, June 9, 2011, for the following purposes:

| 1. | to receive the audited consolidated financial statements of the Corporation for the fiscal year ended January 31, 2011, together with the report of the auditors thereon; |

| | |

| 2. | to elect directors; |

| | |

| 3. | to appoint auditors and authorize the directors to fix their remuneration; and |

| | |

| 4. | to transact such other business as may properly be brought before the Meeting or any adjournment thereof. |

The accompanyingManagement Proxy Circular of the Corporation provides additional information relating to the matters to be dealt with at the Meeting and forms part of this notice.

Shareholders who cannot attend the Meeting in person may vote by proxy. Instructions on how to complete and return the proxy are provided with the proxy form and are described in the Management Proxy Circular. To be valid, proxies must be received by CIBC Mellon Trust Company by mail at P.O. Box 721, Agincourt, Ontario, Canada, M1S 0A1 or by fax to 1-866-781-3111 (toll free) or 416-368-2502, no later than 5:00 p.m. (Toronto time) on June 7, 2011, or if the Meeting is adjourned, no later than 10:00 a.m. (Toronto time) on the last business day preceding the day to which the Meeting is adjourned.

BY ORDER OF THE BOARD

Lyle R. Hepburn

Corporate Secretary

April 18, 2011

3

HARRY WINSTON DIAMOND CORPORATION

MANAGEMENT PROXY CIRCULAR

All information is as of April 18, 2011 and all dollar figures are in United States dollars, unless otherwise indicated.

Q&A ON PROXY VOTING

| Q: | What am I voting on? |

| | |

| A: | Shareholders are voting on the election of directors to the Board of the Corporation, the appointment of auditors for the Corporation and authorizing the directors to fix the remuneration of the auditors. |

| | |

| Q: | Who is entitled to vote? |

| | |

| A: | If you owned your shares as at the close of business on April 18, 2011, you are entitled to vote. Each Common Share is entitled to one vote on those items of business identified in the Notice of Annual Meeting of Shareholders. |

| | |

| Q: | How do I vote? |

| | |

| A: | There are two ways you can vote. You may vote in person at the Meeting, in which case please read the instructions set out after the following question. If you do not plan to attend the Meeting and you are a registered shareholder you may sign the enclosed form of proxy appointing the named persons or some other person you choose, who need not be a shareholder, to represent you as proxyholder and vote your shares at the Meeting. If your shares are held in the name of a nominee (a bank, trust company, securities broker, trustee or other), you will have received from your nominee either a request for voting instructions or a form of proxy for the number of shares you hold. For your shares to be voted, please follow the voting instructions provided by your nominee. |

| | |

| Q: | What if I plan to attend the Meeting and vote in person? |

| | |

| A: | If you are a registered shareholder and plan to attend the Meeting and wish to vote your shares in person at the Meeting, do not complete or return the form of proxy. Your vote will be taken and counted at the Meeting. Please register with the transfer agent, CIBC Mellon Trust Company, upon arrival at the Meeting. |

| | |

| If your shares are held in the name of a nominee, the Corporation may have no record of your shareholdings or of your entitlement to vote unless your nominee has appointed you as proxyholder. Therefore, if you wish to vote in person at the Meeting, insert your own name in the space provided on the request for voting instructions or form of proxy and return it by following the instructions provided to you by your nominee. Do not complete the voting instructions on the form, as you will be voting at the Meeting. Please register with the transfer agent, CIBC Mellon Trust Company, upon arrival at the Meeting. |

| | |

| Q: | Who is soliciting my proxy? |

| | |

| A: | The enclosed form of proxy is being solicited by the management of the Corporationand the associated costs will be borne by the Corporation. The solicitation will be made primarily by mail but may also be solicited personally, by telephone, e-mail, internet, facsimile, or other means of communication by employees of the Corporation. |

4

| Q: | What if I sign the form of proxy enclosed with this Management Proxy Circular? |

| | |

| A: | Signing the enclosed form of proxy gives authority to Robert A. Gannicott or Daniel Jarvis, each of whom is a director of the Corporation, or to another person you have appointed, to vote your shares at the Meeting. |

| | |

| Q: | Can I appoint someone other than these directors to vote my shares? |

| | |

| A: | Yes. Write the name of this person, who need not be a shareholder, in the blank space provided in the form of proxy. |

| | |

| It is important to ensure that any other person you appoint is attending the Meeting and is aware that he or she has been appointed to vote your shares. Proxyholders should, upon arrival at the Meeting, present themselves to a representative of CIBC Mellon Trust Company. |

| | |

| Q: | What do I do with my completed proxy? |

| | |

| A: | If you are a registered shareholder, return the proxy to the Corporation’s transfer agent, CIBC Mellon Trust Company, in the envelope provided, or by fax to (416) 368-2502, so that it arrives no later than 5:00 p.m. (Eastern Standard Time) on Tuesday, June 7, 2011 to record your vote. If your shares are held in the name of a nominee, please follow the voting instructions provided by your nominee. |

| | |

| Q: | If I change my mind, can I take back my proxy once I have given it? |

| | |

| A: | Yes. If you change your mind and wish to revoke your proxy, prepare a written statement to this effect. The statement must be signed by you or your attorney as authorized in writing or, if the shareholder is a corporation, under its corporate seal or by an officer or attorney of the corporation duly authorized. This statement must be delivered to the Corporate Secretary of the Corporation at the following address no later than 5:00 p.m. (Eastern Standard Time) on Tuesday, June 7, 2011 or to the Chairman on the day of the Meeting, June 9, 2011, or any adjournment of the Meeting. |

| | Harry Winston Diamond Corporation |

| | c/o 36 Toronto Street, Suite 1000, Toronto, ON, M5C 2C5 |

| | Attention: | Lyle R. Hepburn |

| | Fax No.: | 416-362-2230 |

| Q: | How will my shares be voted if I give my proxy? |

| | |

| A: | The persons named on the form of proxy must vote for or against or withhold from voting your shares in accordance with your directions, or you can let your proxyholder decide for you. In the absence of such directions, proxies received by management will be voted in favour of the election of directors to the Board and the appointment of auditors. |

| | |

| Q: | What if amendments are made to these matters or if other matters are brought before the Meeting? |

| | |

| A: | The persons named in the form of proxy will have discretionary authority with respect to amendments or variations to matters identified in the Notice of Annual Meeting of Shareholders and with respect to other matters which may properly come before the Meeting. As of the time of printing of this Management Proxy Circular, management of the Corporation knows of no such amendment, variation or other matter expected to come before the Meeting. If any other matters properly come before the Meeting, the persons named in the form of proxy will vote on them in accordance with their best judgment. |

5

| Q: | How many shares are entitled to vote? |

| | |

| A: | As of April 18, 2011 (the “Record Date”), there were outstanding 84,520,131 Common Shares of the Corporation. Each registered shareholder has one vote for each Common Share held at the close of business on the Record Date. |

| | |

| To the knowledge of the directors and senior officers of the Corporation, as of date hereof, the following table sets forth the parties who beneficially own, directly or indirectly, or exercise control or direction over voting securities of the Corporation: |

| | Name of Shareholder and

Municipality of Residence | Number of Common Shares

Owned, Controlled or Directed | % of Outstanding

Common Shares |

| | Vanguard Precious Metals and Mining Fund

Malvern, PA, USA | 8,850,000

| 10.5%

|

| Q: | How will the votes be counted? |

| | |

| A: | Each question brought before the Meeting is determined by a majority of votes cast on the question. In the case of equal votes, the Chairman of the Meeting is entitled to a second or casting vote. |

| | |

| Q: | Who counts the votes? |

| | |

| A: | The Corporation’s transfer agent, CIBC Mellon Trust Company, counts and tabulates the proxies. This is done independently of the Corporation to preserve the confidentiality of individual shareholder votes. Proxies are referred to the Corporation only in cases where a shareholder clearly intends to communicate with management or when it is necessary to do so to meet the requirements of applicable law. |

| | |

| Q: | If I need to contact the transfer agent, how do I reach them? |

| | |

| A: | You can contact the transfer agent by mail at: |

| | Transfer Agent and Registrar, CIBC Mellon Trust Company |

| | P.O. Box 7010, Adelaide Street Postal Station, Toronto, Ontario M5C 2W9 |

| | or by telephone: | 416-643-5500 or 1-800-387-0825 | Fax: | 416-643-5501 |

| | E-mail: | inquiries@cibcmellon.com | Website: | www.cibcmellon.com |

REPORTING CURRENCY

The reporting currency of the Corporation is the United States dollar. Dollar amounts reported in the various tables in this Management Proxy Circular have been converted from the Canadian dollar as follows:

| 1. | The Canadian currency exchange rate was obtained from the Bank of Canada closing rates for the applicable date (the “Exchange Rate”). The Exchange Rates applied were as follows: |

| | (a) | the Exchange Rate for February 1, 2010 (the “Year-Beginning Exchange Rate”) was 0.9413; |

| | (b) | the Exchange Rate for January 31 , 2011 (the “Year-End Exchange Rate”) was 0.9985; |

| | (c) | the Exchange Rate for March 31, 2011 (the “March Exchange Rate”) was 1.0314; |

| | (d) | the average Exchange Rate for the fiscal period February 1, 2010 to January 31, 2011 (the “Average Exchange Rate”) was 0.9743; and |

| | (e) | the Exchange Rate for February 1, May 1, August 1, and November 1, 2010 (the “Quarterly Exchange Rate” was 0.9413, 0.9844, 0.9725 and 0.9842, respectively. |

6

| 2. | The dollar amounts shown for DSUs granted to directors represent the Canadian dollar amount credited to their respective accounts on a quarterly basis converted using the Quarterly Exchange Rate. |

| | |

| 3. | The cash retainers paid to directors represent the Canadian dollar amount paid to them on a quarterly basis converted using the Quarterly Exchange Rate. |

| | |

| 4. | The value of shares and options held by directors was converted using the March Exchange Rate. |

| | |

| 5. | The value of RSUs granted to Named Executive Officers was converted using the Exchange Rate at the date of the grant. |

| | |

| 6. | The value of outstanding RSUs of Named Executive Officers was converted using the Year-End Exchange Rate |

| | |

| 7. | Cash compensation paid to Named Executive Officers, and in respective consulting services referred to herein, was converted using the Average Exchange Rate. |

BUSINESS OF THE MEETING

Financial Statements

The Consolidated Financial Statements for the year ended January 31, 2011 are included in the 2011 Annual Report.

Election of Directors

The Articles of the Corporation provide that the minimum number of directors shall be three and the maximum number shall be 12. There are currently nine directors. The directors of the Corporation are elected annually and hold office until the next annual meeting of shareholders or until their successors in office are duly elected or appointed, unless a director’s office is earlier vacated in accordance with the by-laws of the Corporation or theCanada Business Corporations Act, or he or she becomes disqualified to act as a director.

The Board of Directors of the Corporation (the “Board”) has fixed the number of directors to be elected at the Meeting at nine. It is proposed that the persons set out herein be nominated for election as directors of the Corporation for the ensuing year. On January 14, 2009, the Board adopted a majority voting policy. A full description of the majority voting policy is included in Schedule 1 of this Management Proxy Circular.

Management does not contemplate that any of the persons proposed to be nominated will be unable to serve as a director. If prior to the Meeting any of such nominees is unable or unwilling to serve, the persons named in the accompanying form of proxy will vote for another nominee or nominees in their discretion if additional nominations are made at the Meeting.

Unless a proxy specifies that the Common Shares it represents should be withheld from voting in respect of the election of directors or voted in accordance with the specification in the proxy, the persons named in the enclosed form of proxy intend to vote FOR the election of the nominees whose names are set out in this Management Proxy Circular.

The list of directors and their biographies can be found in this Management Proxy Circular on pages 9 to 12 (see “Nominees for Election to Board of Directors”). Information regarding Director Compensation can be found in this Management Proxy Circular on pages 12 to 15 (See “Compensation of Directors”, “Director Summary Compensation Table” and“Incentive Plan Awards). Each director's attendance at Board and Committee meetings can be found in this Management Proxy Circular on page 16 (see “Board of Directors Meetings Held and Attendance of Directors”).

7

To the knowledge of the Corporation, no director of the Corporation is, or has been in the last 10 years, (a) a director, chief executive officer or chief financial officer of a company that (i) while that person was acting in that capacity, was the subject of a cease trade order or similar order (including a management cease trade order) or an order that denied the issuer access to any exemptions under Canadian securities legislation, for a period of more than 30 consecutive days, or (ii) after that person ceased to act in that capacity, was subject of a cease trade or similar order or an order that denied the issuer access to any exemption under Canadian securities legislation, for a period of more than 30 consecutive days which resulted from an event that occurred while that person acted in such capacity, or (b) a director or executive officer of a company that, while that person was acting in that capacity, or within a year of that person ceasing to act in that capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold its assets; or (c) become bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or become subject to or instituted any proceedings, arrangement or compromise with creditors, or had a receiver, receiver manager or trustee appointed to hold its assets.

Appointment of Auditors

Shareholders will be asked to vote for the reappointment of KPMG LLP, as auditors of the Corporation for the ensuing year, and to authorize the directors of the Corporation to fix their remuneration. A simple majority of the votes cast at the Meeting must be voted in favour thereof.

Fees paid to KPMG LLP during the years ended January 31, 2011 and 2010 were as follows:

| 2011

(US$) | 2010

(US$) |

| Audit Fees(1) | 1,622,777 | 1,589,378 |

| Audit Related Fees(2) | 162,026 | 20,102 |

| Tax Fees(3) | 121,379 | 195,602 |

| All other Fees(4) | 4,871 | 60,456 |

| Total | 1,911,053 | 1,865,538 |

| (1) | Includes audit and review services. |

| (2) | Includes SOX 404 work, IFRS audit work and various audit services required as per legal obligations. |

| (3) | Primarily tax advisory services. |

| (4) | Includes IFRS consultation and review of annual meeting materials. |

In the past the directors have negotiated with the auditors of the Corporation on an arm’s length basis to determine the fees to be paid to the auditors. Such fees have been based on the nature and complexity of the matters in question, and the time incurred by the auditors.

The Audit Committee has adopted a policy that requires pre-approval by the Audit Committee of audit services and other services within permissible categories of non-audit services greater than Cdn$100,000.

The Audit Committee has considered whether the magnitude and nature of these services is compatible with maintaining the independence of the external auditors, and has determined that the independence of the external auditors is maintained.

Other Matters

Management does not know of any other matters to be presented to the Meeting. If other matters should be properly presented at the Meeting, the persons named in the accompanying form of proxy will vote the Common Shares represented by such proxy with respect to such matters in accordance with their best judgment.

8

BOARD OF DIRECTORS

Nominees for Election to the Board of Directors

The following are the nominees for election to the Board of the Corporation:

| Name of Director | Biography |

Matthew W. Barrett(3)(5)

Director since January 15, 2008

Common Shares(2): 5,000

Stock Options: Nil

Deferred Share Units: 38,444

Value of Shares(6): US$80,549

Independent(1): Areas of Expertise

Finance and Management

International Business | Matthew W. Barrett, age 66, of Oakville, Ontario, is the former Chairman and CEO of Barclays PLC. He began his career at the Bank of Montreal in 1962 and built a career at the bank where he held a variety of management positions in international banking and treasury during his 37 year tenure. He was appointed President and Chief Operating Officer in 1987. In 1989, he was appointed Chief Executive Officer and was named Chairman and Chief Executive Officer in 1990. In 1999, Mr. Barrett accepted the position of Group Chief Executive of Barclays Bank PLC and was appointed Chairman in 2004. Mr. Barrett was previously a member of the Federal Reserve Bank of New York International Advisory Committee and previously served on the board of directors of Molson, Inc., and Seagram Corporation. He currently serves on the board of directors of Goldman Sachs Bank USA, Whittington Investments Limited, and Samuel, Son & Co. Ltd. He also serves on the Advisory Board of National Bank of Kuwait. He is an officer of the Order of Canada. |

Micheline Bouchard(4)(5)

Director since January 15, 2008

Common Shares(2)(8): 4,000

Stock Options: Nil

Deferred Share Units: 31,333

Independent(1): Areas of Expertise

Technology

International Business | Micheline Bouchard, age 63, of Montreal, Quebec, Canada, is the former President and Chief Executive Officer of ART Advanced Research Technologies, a biomedical company based in Montreal. Prior to that, Ms. Bouchard was Global Corporate Vice-President of Motorola Inc. in the US after serving as President and Chief Executive Officer of Motorola Canada in Toronto. In addition, Ms. Bouchard served as a Vice President of business development Canada and Vice President of Quebec operations during her tenure at Hewlett-Packard Canada, Ltd. She holds a Bachelor's degree in Engineering Physics and a Master's Degree in Electrical Engineering, both from Polytechnique, Montreal. She currently serves on the board of directors of Telus Corporation. She is a member of the Order of Canada. |

David Carey(4)

Director since September 1, 2010

Common Shares(2): Nil

Stock Options: Nil

Deferred Share Units: 6,298

Independent(1): Areas of Expertise

Marketing

Media and Entertainment | David Carey, age 50, of Scarsdale, New York, USA, is currently the President of Hearst Magazines. Previously, Mr. Carey was group president at Condé Nast, where he served as a member of the company’s executive committee and co-lead on all business development efforts, and in other positions at Condé Nast since 1995. Prior to that, he held business development and marketing positions at Hearst Magazines before becoming the founding publisher ofSmartMoneyin 1992. Mr. Carey currently serves on the Executive Committees of the American Advertising Federation and the Magazine Publishers of America. He is also a board member of the Young Presidents’ Organization and a member of the CUNY Graduate School of Journalism Advisory Committee. Mr. Carey is a graduate of UCLA. |

9

| Name of Director | Biography |

Robert A. Gannicott

Chairman and Chief Executive Officer

Director since June 19, 1992

Common Shares(2): 1,114,050

Stock Options: 1,126,000

Value of Shares(6): US$17,947,051

Value of Options(7): US$3,694,080

Not Independent-Management(1): Areas of Expertise

Luxury Goods Industry

Metals and Mining | Robert A. Gannicott, age 63, of Toronto, Ontario, Canada, was appointed the Chief Executive Officer of the Corporation in September 1999, and was appointed Chairman of the Board on June 22, 2004. A geologist, Mr. Gannicott has worked extensively in the Northwest Territories and in Greenland. He has chaired the OSC/CIMM Committee to establish reporting guidelines for the diamond industry. He currently serves on the board of The Canadian Polar Commission and Capricorn Resources Ltd., a wholly owned subsidiary of Cair Energy Plc. |

Noel Harwerth(3)(4)

Director since June 4, 2008

Common Shares(2): 5,000

Stock Options: Nil

Deferred Share Units: 14,783

Value of Shares(6): US$80,549

Independent(1): Areas of Expertise

Finance and Management

International Business | Noel Harwerth, age 63, of London, England, served as Chief Operating Officer of Citibank International PLC from 1998 to 2003. Prior to that, she served as Chief Tax Officer of Citigroup, Dun & Bradstreet Corporation and Kennecott Copper Corporation. She holds a Jurisdoctor degree from the University of Texas Law School. She currently serves on the board of directors of Royal & Sun Alliance Insurance, Logica Group, Impellam Group plc and is Deputy Chairman of Sumitomo Mitsubishi Banking Europe. Mrs. Harwerth was appointed by the U.K. Government to the Horserace Totalisator Board. |

Daniel Jarvis(3)(5)

Director since June 4, 2008

Common Shares(2): 4,000

Stock Options: Nil

Deferred Share Units: 24,717

Value of Shares(6): US$64,439

Independent(1): Areas of Expertise

Finance and Management

Telcom Services

Risk Management | Daniel Jarvis, age 60, of Vancouver, British Columbia, Canada, served as Vice-Chair and Chief Financial Officer of Concert Properties Ltd., a real estate development and investment firm from 2009 to 2011. From 1989 to 2007 Mr. Jarvis held a number of senior executive positions with Intrawest Corporation; including Executive Vice President and Chief Financial Officer. Mr. Jarvis was instrumental in taking Intrawest public in 1990 and guided the financial strategy of the company as it grew from a regional multi-family real estate developer to become North America's largest resort developer and a leading operator of year-round resorts. Previously, Mr. Jarvis had been Chief Financial Officer of BCE Development Corporation and Treasurer of BCE, Canada's largest telecommunications company. Mr. Jarvis has served on the boards of Concert Properties Ltd., Intrawest Corporation, BCE Development Corporation, New Brunswick Telephone Limited, the Canada Tourism Commission and BC Pavilion Corporation. He holds a Bachelor's degree in Economics from Queen’s University and an MBA from Harvard University. |

10

| Name of Director | Biography |

Jean-Marc Loubier(3)

Director since December 9, 2010

Common Shares(2): Nil

Stock Options: Nil

Deferred Share Units: 2,762

Independent(1): Areas of Expertise

Global Management and

International Business

Brand and Product Management

Retail

Luxury | Jean-Marc Loubier, age 55, of Paris, France, is the Chief Executive Officer of HKL Holdings, a company conducting reorganizations and facilitating repositioning processes of international companies in Europe and Asia. Mr. Loubier is a non-executive independent director of Trinity Ltd. and participated in the process of the company listing on the Hong Kong Stock Exchange in November of 2009. Prior to joining HKL, Mr. Loubier was the Chief Executive Officer of ESCADA AG, a company listed on the Frankfurt Stock Exchange, from June 2007 to June 2008 and was a member of its supervisory board and chairman of its strategy committee since November 2006. He had held key managing positions for 16 years in the LVMH Group. Mr. Loubier joined Louis Vuitton Malletier in 1990 as Director of Communications, and was later the Executive Vice President until 2000. He was the President and Chief Executive Officer of Celine from 2000 to 2006. Mr. Loubier was a board member of Comite Colbert, French Association of Luxury Companies from 2000 to 2006. Mr. Loubier has profound international experience in the luxury, fashion and retail industries. Mr. Loubier graduated from Institut d’ Etudes Politiques de Paris, France, and obtained a Master of Business Administration degree from HEC (Hautes Etudes Commerciales), France, in 1983. |

Laurent E. Mommeja(4)(5)

Director since June 22, 2004

Common Shares(2): Nil

Stock Options: Nil

Deferred Share Units: 10,864

Independent(1): Areas of Expertise

International Business

Luxury Goods Industry

Marketing | Laurent E. Mommeja, age 55, of Paris, France, has extensive marketing experience in the luxury goods industry. He currently sits on the Management Board of Emile Hermes SARL the Active Partner of Hermes International SCA. He was the Managing Director of Hermès Maison and President of La Compagnie des Arts de la Table, a subsidiary of Hermès International. Previously, he was the Europe and Middle East Director of Hermès International. Prior to that, Mr. Mommeja lived in the United States for 14 years where his last assignment for 8 years was President and CEO of Hermès Paris Inc., the US subsidiary of Hermès International. Mr. Mommeja has had assignments in various different countries during his 29 years with Hermès. He also sits on the boards of Emile Hermès SARL, Hermès Sellier SA and Alain Ducasse Group. |

J. Roger B. Phillimore

Director since November 17, 1994

Common Shares(2): 25,000

Stock Options: 90,000

Deferred Share Units: 51,136

Value of Shares(6): US$402,743

Value of Options(7): US$0

Not Independent(1): Areas of Expertise

International Business

Metals and Mining | J. Roger B. Phillimore, age 61, of London, England, is a corporate director and advisor to companies primarily in the natural resource industry. He is the Chairman of Lonmin plc, a mining corporation based in Britain. Prior to 1993, he was Joint Managing Director of Minorco S.A. |

| (1) | “Independent” refers to the standards of independence established under Section 1.2 of Canadian Securities Administrators’ (“CSA”) National Instrument 58-101 – Disclosure of Corporate Governance Practices, Section 1.4 of the CSA National Instrument 52-110 – Audit Committees and Section 303A.02 of the New York Stock Exchange Listed Company Manual, Section 301 of theSarbanes-Oxley Act of 2002(“SOX”). The Board, in its annual review of Director independence, considers employment status of the Director (and his or her spouse and children, if applicable), other board memberships, company shareholdings and business relationships, to determine whether there are any circumstances which might interfere with a Director’s ability to exercise independent judgment. J. Roger B. Phillimore is not independent because of his previous consulting arrangement with the Corporation which terminated on January 31, 2010. He will remain so until January 31, 2014. |

11

| (2) | “Common Shares” refers to the number of Common Shares of the Corporation owned by each nominee for election as director and includes all Common Shares beneficially owned, directly or indirectly, or over which such nominee exercised control or direction. Such information, not being within the knowledge of the Corporation, has been furnished by the respective directors individually. |

| (3) | Member of the Audit Committee. |

| (4) | Member of the Human Resources & Compensation Committee. |

| (5) | Member of the Nominating & Corporate Governance Committee. |

| (6) | “Value of Shares” represents the total market value of the Common Shares and deferred share units (“DSUs”) held by each nominee. Value is determined by multiplying the number of Common Shares and DSUs held by each nominee as of March 31, 2011 by the closing price of the Corporation’s Common Shares on the TSX on such date (Cdn$15.62) (in this section the “Closing Price”), converted at the March Exchange Rate. |

| (7) | “Value of Options” represents the total market value of the unexercised stock options held by each nominee. The value is determined by multiplying the number of unexercised options held by each nominee as of March 31, 2011 by the difference between the Closing Price on the TSX and the exercise price of such options, converted at the March Exchange Rate. |

| (8) | Micheline Bouchard acquired 4,000 Common Shares on April 8, 2011 at an average purchase price of Cdn$16.7318 per common share, and accordingly no value was attributed as of March 31, 2011. |

Compensation of Directors

The Board, on the recommendation of the Nominating & Corporate Governance Committee, reviews and approves changes to the Corporation’s director compensation arrangements from time to time to ensure they remain competitive in light of the time commitments required from directors and aligned directors’ interests with those of the Shareholders. Directors who are not officers or employees of the Corporation or any of its subsidiaries are compensated for their services as directors through a combination of retainer and meeting fees and DSUs.

The Corporation's policy with respect to directors' compensation was developed by the Nominating & Corporate Governance Committee with reference to comparative data and guidance from the Corporation's compensation consultants, Meridian Compensation Partners LLC, previously Hewitt Associates LLC (“Meridian”). The directors’ compensation, currently payable in four equal quarterly installments, for the fiscal year ended January 31, 2011 (“Fiscal 2011”) was as follows:

- Cash retainer of Cdn$60,000, all or portions of 25%, 50% or 75% of which, at the election of a director, may be taken in the form of DSUs (see “Deferred Share Unit Plan” on page 14)

- Annual Chairman's retainer for Audit Committee of Cdn$15,000, and annual Chairman's retainer for other committees of Cdn$5,000

- Initial grant of 2,500 DSUs

- Annual grant of 1,500 DSUs

- Meeting fees of Cdn$1,500 for Board and Committee meetings, with an additional Cdn$1,500 for directors traveling from outside the province, in the case of meetings in Ontario, or directors required to travel to meetings outside Ontario and outside their place of residence

- Reimbursement of meeting expenses

The directors’ compensation was thoroughly reviewed on April 5, 2004 and was, at that time, instituted essentially in the same form as it exists today, with the exception of the initial and annual DSU grants which were increased by 500 on January 16, 2007. At the time of the review of directors’ compensation, the value of a DSU was approximately Cdn$41.20 and at the time of the quarterly grants in Fiscal 2011 averaged approximately Cdn$11.87. Accordingly, the directors’ compensation has declined since its institution in 2004.

No changes in the amount of director compensation (annual cash retainers and annual DSU grants) have been made since 2007.On April 6, 2011, the Nominating & Corporate Governance Committee recommended, and the Board approved, an annual retainer of Cdn$20,000 for the Lead Director, and increased the annual retainer for the Chairman of the Human Resources & Compensation Committee from Cdn$5,000 to Cdn$10,000. The Nominating & Corporate Governance Committee also asked Meridian to review the current total compensation opportunity for directors and provide a recommendation to the Committee.

12

Director Summary Compensation Table

The following table sets forth the compensation awarded, paid to or earned by the directors of the Corporation during Fiscal 2011. Directors of the Corporation who are also officers or employees of the Corporation are not compensated for service on the Board.

Name |

Fees

Earned

(US$)(4) | Share-

Based

Awards

(US$) | Option-

Based

Awards

(US$) | Non-Equity

Incentive Plan

Compensation

(US$) |

Pension

Value

(US$) |

All Other

Compensation

(US$) |

Total

(US$) |

| Matthew W. Barrett | 84,275 | 17,290 | Nil | Nil | Nil | Nil | 101,565 |

| Thomas M. Boehlert(1) | 33,613 | 7,812 | Nil | Nil | Nil | Nil | 41,425 |

| Micheline Bouchard | 92,557 | 17,290 | Nil | Nil | Nil | Nil | 109,847 |

| David Carey(2) | 37,997 | 24,847 | Nil | Nil | Nil | Nil | 62,844 |

| Noel Harwerth | 101,569 | 17,290 | Nil | Nil | Nil | Nil | 118,859 |

| Daniel Jarvis | 103,030 | 17,290 | Nil | Nil | Nil | Nil | 120,320 |

| Jean-Marc Loubier(3) | 16,076 | 14,349 | Nil | Nil | Nil | Nil | 30,425 |

| Laurent E. Mommeja | 87,685 | 17,290 | Nil | Nil | Nil | Nil | 104,975 |

| J. Roger B. Phillimore | 77,455 | 17,290 | Nil | Nil | Nil | Nil | 94,745 |

| (1) | Resigned as a member of the Board on September 28, 2010. All director compensation payable to Mr. Boehlert was paid to his employer, Kinross Gold Corporation (“Kinross”). |

| (2) | Elected to the Board on September 1, 2010. |

| (3) | Elected to the Board on December 9, 2010. |

| (4) | Fees Earned are converted at the Average Exchange Rate. |

The breakdown of the Fees Earned for the non-executive directors and the percentage of the Total Fees taken in DSUs is as follows (all amounts converted to US dollars using the Average Exchange Rate):

Directors |

Board

Retainer

(US$) | Committee

Chair

Retainer

(US$) |

Board

Meeting Fees

(US$) |

Committee

Meeting Fees

(US$) |

Travel Fees

(US$) |

Total Fees

Earned

(US$) |

% and Value of Retainer &

Meeting Fees Taken in DSUs |

| % | (US$) |

| Matthew W. Barrett(1) | 58,457 | 2,436 | 10,230 | 11,691 | 1,461 | 84,275 | 100 | 84,275 |

| Thomas M. Boehlert(2) | 29,228 | N/A | 4,385 | N/A | Nil | 33,613 | 100 | 33,613 |

| Micheline Bouchard | 58,457 | 4,871 | 13,153 | 10,230 | 5,846 | 92,557 | 0 | Nil |

| David Carey(3) | 29,228 | N/A | 5,847 | 1,461 | 1,461 | 37,997 | 100 | 37,997 |

| Noel Harwerth(4) | 58,457 | 10,961 | 13,153 | 11,691 | 7,307 | 101,569 | 25 | 25,392 |

| Daniel Jarvis(5) | 58,457 | 10,961 | 13,153 | 13,152 | 7,307 | 103,030 | 50 | 51,515 |

| Jean-Marc Loubier(6) | 14,615 | N/A | 1,461 | N/A | Nil | 16,076 | 50 | 8,038 |

| Laurent E. Mommeja | 58,457 | N/A | 13,153 | 8,768 | 7,307 | 87,685 | 0 | Nil |

| J. Roger B. Phillimore | 58,457 | N/A | 13,153 | N/A | 5,845 | 77,455 | 0 | Nil |

| (1) | Chair of the Nominating & Corporate Governance Committee until June 2, 2010. |

| (2) | Resigned as a member of the Board on September 28, 2010. All director compensation payable to Mr. Boehlert was paid to his employer, Kinross. |

| (3) | Elected to the Board on September 1, 2010. |

| (4) | Elected the Chair of the Audit Committee on June 2, 2010. |

| (5) | Chair of the Audit Committee until June 2, 2010. Elected the Chair of the Nominating & Corporate Governance Committee on June 2, 2010. |

| (6) | Elected to the Board on December 9, 2010. Effective February 1, 2011, Mr. Loubier has elected to take 100% of his director compensation in DSUs. |

13

Deferred Share Unit Plan

Effective as of February 1, 2004, the Corporation adopted a Deferred Share Unit Plan (the “DSU Plan”) for its directors. On September 1, 2010, the DSU Plan was amended to be compliant with the requirements of Section 409A of the United States Internal Revenue Code of 1986, as amended, and regulations and guidance issued thereunder.

DSUs granted under the DSU Plan vest immediately, but are only redeemable upon retirement from the Board, or upon death. Directors may also elect to take all or a portion of their annual retainer and meeting fees in the form of DSUs. When a dividend is paid on the Corporation’s Common Shares, each director’s DSU account is allocated additional DSUs equal in value to the dividend paid on an equivalent number of the Corporation’s Common Shares. The value of the DSUs credited to a director is payable after he or she ceases to serve as a director of the Corporation. The value is calculated by multiplying the number of DSUs in the director’s account by the market value of a Common Share of the Corporation at the time of payment. With the introduction of the DSU Plan, a decision was made to discontinue stock option grants to the non-executive directors.

During Fiscal 2011, non-executive directors received an annual grant of 1,500 DSUs under the DSU Plan. Non-executive directors receive an initial grant of 2,500 DSUs when they are first appointed to the Board, and an annual grant of 1,500 DSUs, both payable quarterly.

Evaluation of Board Performance

An annual formal Board, Committee and individual director evaluation, including a peer review, is conducted. This evaluation is conducted firstly by having Board members complete a written survey which is designed to assess the Board’s effectiveness as a whole, and the effectiveness and contribution of its committees and individual directors. These surveys are sent to the Lead Director, and a summary of the responses is compiled. At the Board meeting in January, 2011, the Lead Director summarized the results of the survey for fiscal 2011.

Share Ownership Guidelines

The Corporation has adopted share ownership guidelines for directors, which require each director to own Common Shares of the Corporation, or hold awarded DSUs, having an aggregate cost basis of Cdn$200,000 within five years of joining the Board. All of the directors have complied with the share ownership guidelines, with the exception of David Carey and Jean-Marc Loubier, who are in the process of complying, both of whom were elected to the Board in 2010. The following table sets forth the equity ownership of each director in the Corporation as of January 31, 2011:

Directors

| Years of Service

| Value of Common Shares

(Cdn$)(1) | Value of DSUs

(Cdn$)(1) | Total

(Cdn$) |

| Matthew W. Barrett | 3 Years | 54,150 | 412,287 | 466,437 |

| Micheline Bouchard(2) | 3 Years | N/A | 335,275 | 335,275 |

| David Carey(3) | 7 Months | N/A | 57,377 | 57,377 |

| Robert A. Gannicott | 17 Years | 8,960,417 | N/A | 8,960,417 |

| Noel Harwerth | 3 Years | 54,150 | 156,039 | 210,189 |

| Daniel Jarvis(4) | 3 Years | 10,830 | 263,624 | 274,454 |

| Jean-Marc Loubier(3) | 4 Months | N/A | 19,082 | 19,082 |

| Laurent E. Mommeja(5) | 7 Years | N/A | 113,596 | 113,596 |

| J. Roger B. Phillimore | 16 Years | 270,750 | 549,742 | 820,492 |

| (1) | Based on the last trade of the Common Shares on the TSX prior to the close of business on January 31, 2011, of Cdn$10.83. |

| (2) | Micheline Bouchard acquired 4,000 Common Shares of the Corporation on April 8, 2011. |

| (3) | In the process of complying with the share ownership guidelines. |

| (4) | Daniel Jarvis acquired an additional 3,000 Common Shares of the Corporation on March 28, 2011. |

| (5) | Mr. Mommeja has qualified with the share ownership guidelines of the Corporation, as his adjusted cost base of his DSUs is the sum of Cdn$314,600. |

14

Incentive Plan Awards

Outstanding Share-Based Awards and Option-Based Awards

Name | Option-Based Awards | Share-Based Awards |

Number of

Securities

Underlying

Unexercised

Options

(#) |

Option

Exercise

Price

(Cdn$) |

Option

Expiration

Date

(M/D/Y) |

Value of

Unexercised In-

the-Money

Options

(US$)(1) | Number of

Shares or

Units of Shares

that Have Not

Vested

(#) | Market or Payout

Value of Share-

Based Awards

that Have Not

Vested

(US$) |

| Matthew W. Barrett | Nil | N/A | N/A | N/A | Nil | Nil |

| Thomas M. Boehlert | Nil | N/A | N/A | N/A | Nil | Nil |

| Micheline Bouchard | Nil | N/A | N/A | N/A | Nil | Nil |

| David Carey | Nil | N/A | N/A | N/A | Nil | Nil |

| Noel Harwerth | Nil | N/A | N/A | N/A | Nil | Nil |

| Daniel Jarvis | Nil | N/A | N/A | N/A | Nil | Nil |

| Jean-Marc Loubier | Nil | N/A | N/A | N/A | Nil | Nil |

| Laurent E. Mommeja | Nil | N/A | N/A | N/A | Nil | Nil |

| J. Roger B. Phillimore | 65,000

25,000 | 23.35

26.45 | 02/05/2012

04/17/2013 | Nil

Nil | Nil | Nil |

| (1) | Based on the last trade of the Common Shares on the TSX prior to the close of business on January 31, 2011, of Cdn$10.83. |

Incentive Plan Awards – Value Vested or Earned During the Year

Name |

Option-Based Awards – Value

Vested During the Year

(US$) |

Share-Based Awards – Value

Vested During the Year

(US$)(1) | Non-Equity Incentive Plan

Compensation – Value Earned

During the Year

(US$) |

| Matthew W. Barrett | Nil | 17,290 | Nil |

| Thomas M. Boehlert | Nil | 7,812 | Nil |

| David Carey | Nil | 24,847 | Nil |

| Micheline Bouchard | Nil | 17,290 | Nil |

| Noel Harwerth | Nil | 17,290 | Nil |

| Daniel Jarvis | Nil | 17,290 | Nil |

| Jean-Marc Loubier | Nil | 14,349 | Nil |

| Laurent E. Mommeja | Nil | 17,290 | Nil |

| J. Roger B. Phillimore | Nil | 17,290 | Nil |

| (1) | These amounts represent the annual grants of DSUs converted at the Quarterly Exchange Rate, and do not include director compensation the directors have elected to take in the form of DSUs. |

15

Meetings Held and Attendance of Directors

The information presented below reflects meetings of the Board and Committees held and attendance of the directors proposed for election for Fiscal 2011. Robert A. Gannicott and J. Roger B. Phillimore, were not members of any of the Corporation's Committees during the year.

Summary of Board and Committee Meetings Held

|

Scheduled Meetings | Unscheduled Meetings

(called on short notice) |

Total |

| Board of Directors | 7 | 2 | 9 |

| Audit Committee | 5 | 0 | 5 |

| Nominating & Corporate Governance Committee | 3 | 0 | 3 |

| Human Resources & Compensation Committee | 3 | 1 | 4 |

Summary of Attendance of Directors

|

Board Meetings

Attended | Committee Meetings Attended |

Audit | Nominating &

Corporate Governance | Human Resources

& Compensation |

| Matthew W. Barrett(1) | 7 of 9 | 5 of 5 | 3 of 3 | N/A |

| Micheline Bouchard | 9 of 9 | N/A | 3 of 3 | 4 of 4 |

| David Carey(2)(3) | 4 of 5 | N/A | N/A | 1 of 1 |

| Robert A. Gannicott | 9 of 9 | N/A | N/A | N/A |

| Noel Harwerth(3)(4) | 9 of 9 | 5 of 5 | 1 of 1 | 2 of 2 |

| Daniel Jarvis(3)(4) | 9 of 9 | 5 of 5 | 2 of 2 | 2 of 2 |

| Jean-Marc Loubier(5) | 1 of 1 | N/A | N/A | N/A |

| Laurent E. Mommeja(4) | 9 of 9 | N/A | 2 of 2 | 4 of 4 |

| J. Roger B. Phillimore | 9 of 9 | N/A | N/A | N/A |

| (1) | One of the Board meetings missed by Mr. Barrett was an unscheduled meeting. |

| (2) | Elected to the Board on September 1, 2010. |

| (3) | The Human Resources & Compensation Committee consisted of the following members on February 1, 2010: Micheline Bouchard, Daniel Jarvis and Laurent E. Mommeja. On June 2, 2010, the Committee was reconstituted and Noel Harwerth took the place of Daniel Jarvis. On September 1, 2010 the number of Committee members was increased from three to four and David Carey was appointed to the Committee. |

| (4) | The Nominating & Corporate Governance Committee consisted of the following members on February 1, 2010: Micheline Bouchard, Matthew W. Barrett and Noel Harwerth. On June 2, 2010, the Committee was reconstituted and the number of Committee members was increased from three to four. Noel Harwerth resigned as a member of the Committee and Laurent Mommeja and Daniel Jarvis were appointed members of the Committee. |

| (5) | Elected to the Board on December 9, 2010 and was elected a member of the Audit Committee on January 12, 2011, however no meetings of the Audit Committee have been held since his appointment. |

Directors’ and Officer’s Liability Insurance

The Corporation maintains a directors' and officers' liability insurance program with a total limit of US$60,000,000 that is subject to deductibles between US$100,000 and US$250,000. The policy is renewed annually. The current policy has an annual premium of US$626,640 and expires September 30, 2011.

The policy provides protection to directors and officers against liability incurred by them in their capacities as directors and officers of the Corporation and its subsidiaries. The policy also provides protection to the Corporation for claims made against directors and officers for whom the Corporation has granted directors and officers indemnity, as is required or permitted under applicable statutory or by-law provisions.

Retirement Policy

The Corporation does not have a retirement policy in place for the directors.

16

CORPORATE GOVERNANCE DISCLOSURE

The Corporation is listed on the TSX and on the New York Stock Exchange (the “NYSE”). The Corporation is required to comply with theSarbanes-Oxley Act of 2002, the rules adopted by the United States Securities and Exchange Commission (“SEC”) pursuant to that Act, and the NYSE corporate governance rules as they apply to foreign private issuers. The Canadian Securities Administrators (“CSA”) has also adopted rules relating to audit committees and disclosure of corporate governance practices under National Instrument 52-110 – Audit Committees (“NI52-110”) and National Instrument 58-101 –Disclosure of Corporate Governance Practices (“NI58-101”).

The Corporation has complied with Section 5.1 of NI52-110, and the disclosure required by Form 52-110F1 is included in the Corporation’s Annual Information Form under Item 8 – Audit Committee.

The Corporation has amended its governance practice as regulatory changes have come into effect in recent years and will continue to follow regulatory changes and consider amendments to its governance practices as appropriate. The disclosure required pursuant to Form 58-101F1 of NI58-101 is set out in Schedule 1 of this Management Proxy Circular.

REPORT OF THE AUDIT COMMITTEE

The Audit Committee is appointed by the Board to assist the Board in fulfilling its oversight responsibilities with respect to the integrity of financial statements, compliance with legal and regulatory requirements, the qualifications of the independent auditors and their performance, the performance of the internal audit function.

In the fiscal year, both the Audit Committee and the Nominating & Corporate Governance Committee reviewed the Audit Committee Charter and made recommendations to update it in accordance with best practices and with applicable laws and rules of the stock exchanges on which the Corporation's securities are listed. These recommendations were approved by the Audit Committee on December 9, 2010, and by the Nominating & Corporate Governance Committee on January 12, 2011. The Charter is attached as Appendix 1 to the Corporation’s Annual Information Form, and is available on the Corporation's website.

To assist in the timely fulfillment of its Charter, the Audit Committee approved a detailed Work Plan for the fiscal year. The Work Plan prescribed actions to be taken at each of the scheduled meetings of the Committee. In the course of following the Work Plan, the Committee:

- reviewed with management and the independent auditors the Corporation’s Quarterly and Annual Financial Statements and Management’s Discussion and Analysis. The Committee approved the Corporation’s Quarterly Financial Statements and accompanying Management’s Discussion and Analysis, and approved and recommended for approval by the Board the Annual Financial Statement and Annual Management’s Discussion and Analysis. The Committee concluded that these documents were complete, and fairly presented in accordance with generally accepted accounting principals that were consistently applied;

- arranged for and reviewed the reports provided to the Committee by management and the independent auditors on the Corporation’s internal control environment as it pertains to the Corporation’s financial reporting process and controls;

- reviewed and discussed significant financial risks or exposures and assessed the steps management had taken to monitor, control, report and mitigate such risks to the Corporation;

- reviewed the effectiveness of the overall process for identifying the principal risks affecting the achievement of business plans, and provided the Committee’s view to the Board;

- reviewed legal and regulatory matters that could have a material impact on the interim or annual financial statements, related corporation compliance policies, and programs and reports received from regulators or governmental agencies;

- reviewed policies and practices with respect to hedging activities;

- met on a regular basis with the independent auditors without management present, and arranged for the independent auditors to be available to attend Committee meetings;

17

- reviewed and discussed with the independent auditors all significant relationships that the independent auditors and their affiliates had with the Corporation and its affiliates in order to determine independence;

- reviewed and evaluated the performance of the independent auditors and the lead partner of the independent auditors’ team, made a recommendation to the Board regarding the reappointment of the independent auditors at the annual meeting of the Corporation’s shareholders, the terms of engagement of the independent auditors, together with their proposed fees, independent audit plans and results, and the engagement of the independent auditors to perform non-audit services, together with the fees therefor, and the impact thereof, on the independence of the independent auditors;

- reviewed the Internal Audit Department Charter and submitted it to the Nominating & Corporate Governance Committee for approval; and

- approved its report for disclosure in this Management Proxy Circular.

The Committee is satisfied that it has appropriately fulfilled its mandate for Fiscal 2011.

This report has been approved by the members of the Audit Committee: Noel Harwerth (Chair), Matthew W. Barrett, Daniel Jarvis and Jean-Marc Loubier.

REPORT OF THE HUMAN RESOURCES & COMPENSATION COMMITTEE

The primary functions of the Human Resources & Compensation Committee are to assist the Board in carrying out its responsibilities by reviewing compensation and human resources issues and to make recommendations to the Board as appropriate.

In 2011, both the Human Resources & Compensation Committee and the Nominating & Corporate Governance Committee reviewed the Human Resources & Compensation Committee Charter and made recommendations to update it in accordance with best practices and with applicable laws and rules of the stock exchanges on which the Corporation's securities are listed. These recommendations were approved by the Human Resources & Compensation Committee and the Nominating & Corporate Governance Committee on January 12, 2011. The Charter is available on the Corporation's website.

To assist in the timely fulfillment of its Charter, the Human Resources & Compensation Committee approved a detailed Work Plan for 2010. The Work Plan prescribed actions to be taken at each of the scheduled meetings of the Committee. In the course of following the Work Plan, the Committee:

- reviewed and submitted to the Board:

- the Corporation’s overall executive compensation strategy;

- the corporate compensation plan and benefit plans including proposed salary ranges, merit increases, annual incentive bonuses, stock options, Restricted Share Units, long term incentive plan and any other form of compensation;

- the Chief Executive Officer’s recommendation for salaries, annual incentive bonuses, budgets, organization and manpower plans, and succession planning for the Chief Executive Officer and his direct reports;

- performance appraisals and overall compensation as recommended by the Chief Executive Officer for senior officers earning in excess of Cdn$250,000;

- after consultation with the Chief Executive Officer, the appointment of new officers;

- the objectives, performance appraisal and compensation of the Chief Executive Officer;

- the consultant’s performance and re-appointment;

- the metrics for the balanced scorecard for Fiscal 2011 for determining the short term incentive program for the Chief Executive Office and his direct reports;

- approved and reported to the Board the terms of new employment contracts with senior management, including termination benefits;

18

- reviewed and assessed management development programs to enhance individual effectiveness and preparedness for greater responsibilities;

- reviewed its performance, and reported to the Board thereon;

- reviewed, and recommended to the Board, the“Compensation Discussion and Analysis”included in this Management Proxy Circular; and

- approved its report for disclosure in this Management Proxy Circular;

The Committee is satisfied that it has appropriately fulfilled its mandate for Fiscal 2011.

This report has been approved by the members of Human Resources & Compensation Committee: Micheline Bouchard (Chair), David Carey, Noel Harwerth and Laurent E. Mommeja.

REPORT OF THE NOMINATING & CORPORATE GOVERNANCE COMMITTEE

The mandate of the Nominating & Corporate Governance Committee is to manage the corporate governance system for the Board, to assist the Board in fulfilling its duty to meet the applicable legal, regulatory and self-regulatory business principles and applicable codes of best practice of corporate behaviour and conduct for comparable issuers and to recommend to the Board the director nominees to be put before the shareholders at each annual meeting.

In 2011, the members of the Nominating & Corporate Governance Committee reviewed its Charter and made recommendations to update it in accordance with best practices and with applicable laws and rules of the stock exchanges on which the Corporation's securities are listed. These recommendations were approved by the Board on January 13, 2011. The Charter is available on the Corporation's website.

To assist in the timely fulfillment of its Charter, the Nominating & Corporate Governance Committee approved a detailed Work Plan for 2010. The Work Plan prescribed actions to be taken at each of the scheduled meetings of the Committee. In the course of following the Work Plan, the Committee:

- developed and recommended to the Board a corporate governance system and monitored the effectiveness of the corporate governance system regularly and recommended changes to the Board;

- reviewed the relationship between management and the Board and recommended changes to the Board;

- reviewed polices governing Board size, composition, selection criteria, nominating process, succession planning and retirement age;

- reviewed director compensation and made recommendations to the Board;

- developed, reviewed and approved:

- Charter for the Audit Committee;

- Charter for the Human Resources & Compensation Committee;

- Internal Audit Department Charter;

- Guidelines and responsibilities for the Board of Directors;

- Guidelines and responsibilities for the Lead Director of the Board;

- Guidelines and responsibilities for the Chairman of the Board and Chief Executive Officer;

- Guidelines and responsibilities for Committee Chairs;

- Corporate Governance Guidelines;

- Policy on Corporate Disclosure, Confidentiality and Employee Trading;

- Policy on Insider Trading;

- Corporate Security Policy;

- Whistleblower Protection Policy; and

- Code of Ethics and Business Conduct;

- reviewed the DSU policy and awarded DSUs;

- prepared for disclosure to shareholders a report which describes the Corporation’s governance practices;

19

- identified individuals qualified to become new directors and recommended to the Board new nominees for election by shareholders based on selection criteria and individual characteristics;

- recommended to the Board the allocation and removal of Board members to the various Committees of the Board;

- reviewed, approved and reported to the Board on directors and officers insurance;

- oversaw the evaluation of the Board by considering the effectiveness of the Board as a whole, the Committees of the Board and the contribution of individual members;

- reviewed any significant ethics related contraventions of regulation or policies;

- determined orientation and education programs for new Board members and continued development of all members of the Board;

- reviewed its performance, and reported to the Board thereon; and

- approved its report for disclosure in this Management Proxy Circular.

The Committee is satisfied that it has appropriately fulfilled its mandate for Fiscal 2011.

This report has been approved by the members of the Nominating & Corporate Governance Committee: Daniel Jarvis (Chair), Matthew W. Barrett, Micheline Bouchard and Laurent E. Mommeja.

STATEMENT OF EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

The following Compensation Discussion and Analysis describes and explains the significant elements of the Corporation’s compensation programs, with particular emphasis on the process for determining compensation payable to the Chief Executive Officer, Chief Financial Officer, and the three most highly compensated executive officers (other than the Chief Executive Officer and Chief Financial Officer), during the most recently completed financial year (collectively, the “Named Executive Officers”).

Overview of Compensation Programs

The objectives of the Corporation’s compensation programs are to attract, retain and motivate highly qualified executive officers who will drive the success of the Corporation, while at the same time promoting a greater alignment of interests between such executive officers and the Corporation’s shareholders. The Corporation’s compensation programs are designed to recruit and retain key individuals and reward individual and company performance with compensation that has mid and long-term growth potential, while recognizing that the executives work as a team to achieve corporate results.

The current compensation program is comprised of the following main components:

- base salary

- annual incentive

- long term incentive

- benefits

The Human Resources & Compensation Committee (the “Compensation Committee”) annually reviews each component and relevant competitive factors and makes its determinations based on corporate, business unit and individual performance, taking into account leadership abilities, retention risk and succession plans.

1.Base Salaries –An important element of the Corporation’s compensation program is base salary. The Corporation’s view is that a competitive base salary is a necessary element for retaining qualified executive officers. The amount payable to an executive officer as base salary is determined primarily by market survey data and internal position comparisons (see “Determination of Compensation” on page 22).

20

2.Annual Incentives– A key objective of the executive compensation strategy is to encourage and recognize strong levels of performance by linking achievement of specific goals with variable cash compensation in the form of annual incentive awards. Target annual incentive awards range from 30% to 100% of base salary for the executive group. Actual annual incentive or bonus compensation for the Chief Executive Officer is determined on the basis of an overall assessment based on achieving specified mining segment and consolidated financial targets for up to approximately 90% of the award, and 10% of bonus compensation is based on his individual performance. Actual bonus compensation for the other executive officers is determined on the basis of an overall assessment based on achieving specified mining or retail segment or consolidated financial targets depending on the responsibilities of the executive for up to approximately 80% of the award calculated on audited financial statements or other objective measures relating to their specific areas of responsibility, and 20% of the award is based on individual performance. More detail is set out in this Management Proxy Circular on pages 24 and 25 (see “Performance Goals of Named Executive Officers”).

3. Long Term Incentives

(a) RSUs and Changes in Enterprise Value of HWI -On April 5, 2004, the Corporation adopted a Restricted Share Unit Plan (the “2004 RSU Plan”) for employees under which executive officers and other employees of the Corporation and its subsidiaries may be granted restricted share units (“RSUs”) by the Compensation Committee. In Fiscal 2010, the Corporation moved towards implementing a long term incentive plan utilizing stock options, and decided to discontinue the use of RSUs under the 2004 RSU Plan, except for awards made to Mr. Mayne in accordance with his employment contract (see Footnote No. 5 under “Summary Compensation Table” on page 27). The employment contract with Alan Mayne will be terminated on April 30, 2011.

In September, 2010, the Corporation implemented a new Long Term Incentive (“LTI”) plan for selected executives of the Corporation and Harry Winston Inc. (“HWI”), other than the Chief Executive Officer of the Corporation and the President and Chief Executive Officer of HWI. The objective was to devise a multi-year plan which was: market-based; fair and equitable to the executives of both the Corporation and HWI; simple to administer; and, understandable to the recipient. The award amount paid is based on the underlying equivalent enterprise value of the Corporation or HWI, as applicable, yet is settled in cash (in keeping with the principle of careful stewardship of the use of our common shares).

Under the new plan, the initial determination of a LTI award for both an executive of the Corporation and a HWI executive is based on the executive’s salary multiplied by an appropriate LTI multiplier. In Fiscal 2011, Management applied three multipliers for the executives of the Corporation, two of which were used for the HWI Executives. These were 1.15 (Chief Financial Officer or Executive Vice-President of the Corporation), 0.70 (Senior Vice-presidents of the Corporation and HWI), and 0.50 (Vice-Presidents of the Corporation and HWI). The LTI multiplier is derived from current North American market competitive practices for comparable executive levels based on market analysis conducted by Meridian with consideration also for internal equity and the Corporation’s organizational structure. The initial size of the award was adjusted down by 25% in 2010 in consideration of the performance of the Corporation in the prior year and uncertainty of business conditions at the time of the grant. Once the initial determination is made, the executive would receive an award which represents a notional or bookkeeping account, the amount of which adjusts with changes in (a) the Corporation’s share price (for the Corporation’s executives) or (b) the enterprise value of HWI (for HWI’s executives) from the time the award was made to the time of payment and vesting. The awards would vest, in both cases, equally over a period of 3 years. Earlier vesting can also occur in the case of death, retirement or Change of Control.

(b) Stock Options - The Corporation implemented a LTI plan at the beginning of Fiscal 2010, which set out guidelines for granting stock options under the Corporation’s Stock Option Plan, based on the Corporation’s performance and economic conditions. Under the stock option LTI plan, grants to selected officers (including Named Executive Officers) are in two parts: a fixed part and a performance based part. The size of the performance based part of the grant is derived from historical performance of the Corporation measured against target. The options have a ten-year term and an exercise price equal to market price at the time of grant. The granting of stock options under the Stock Option Plan commenced in Fiscal 2010. The overall size of option grants are made with reference to a targeted value for each position and based on a value of the grant using the Black Scholes valuation model.

21

Currently, stock options are only granted to the Chief Executive Officer of the Corporation.In Fiscal 2011, a total of 300,000 stock options were granted at an exercise price of $12.35, such option grant represents 0.004% of the outstanding shares of the Corporation on January 31, 2011. Additional information regarding the Corporation’s LTIP can be found in this Management Proxy Circular on pages 32 to 34 (see “Securities Authorized for Issuance under Equity Compensation Plans”).

(c) HWI CEO Plan–On January 4, 2010, Mr. Frederic de Narp commenced employment as President and Chief Executive Officer of HWI. Mr. de Narp’s employment contract provides for a specific LTI program (the “HWI Executive Plan”). Under the HWI Executive Plan, HWI maintains a long term incentive plan account (“LTIP Account”) for Mr. de Narp. For HWI’s fiscal year ending January 31, 2011, and for subsequent fiscal years, the LTIP Account will be debited or credited with an amount equal to 5% of the Profit Results. For the purposes of the HWI Executive Plan, “Profit Results” means the gross profit, minus selling, general and administrative (“SG&A”) expenses of HWI and its subsidiaries on a consolidated basis for a fiscal year for which the LTIP Account is being debited or credited, less the cost of capital for that fiscal year. This calculation may produce a positive or negative number. If the Profit Results generate a negative amount for fiscal years ended January 31, 2011 or 2012, this negative amount will not be applied to reduce any balance in the LTIP Account. The amount debited or credited to the LTIP Account will be determined within 90 days of the end of each fiscal year if Mr. de Narp is then employed by HWI. Commencing April 30, 2012, and on each subsequent April 30th, HWI will pay Mr. de Narp one-third of the balance of the LTIP Account, provided he is then employed by HWI. The HWI Executive Plan will be in effect until the fiscal year ending January 31, 2015, at which time the arrangement will be subject to review by either Mr. de Narp or HWI, and failing any resolution of the matter within 30 days of either party requesting a review, the HWI Executive Plan would, at the request of the party requesting a review, terminate. Mr. de Narp would then be entitled to participate in any incentive program implemented from time to time by HWI for its senior executives. If the HWI Executive Plan terminates after January 31, 2015, the balance remaining in the LTIP Account will be paid in three equal tranches on April 30, 2015, 2016 and 2017, provided Mr. de Narp is then employed by HWI on such dates.

4. Benefits – Benefits for the Named Executive Officers, including life insurance, health and dental plans, and short and long term disability plans, in Canada a deferred profit sharing plan and in the US 401 K plans in the US are maintained at a level that is considered competitive and similar to what all employees receive.

Determination of Compensation

The Corporation’s policy for determining executive compensation is based on the following fundamental principles:

- Management’s fundamental objective is to maximize long term shareholder value;

- Equitable balance among internal peers;

- Performance is an important determinant of pay for executive officers; and

- Recruitment and retention of key employees.

Compensation Elements

To support a strong pay-for-performance orientation, linking each executive to achievement of business results, the Corporation’s compensation strategy provides an appropriate balance of fixed and variable (at-risk) compensation with cash and non-cash (equity) rewards, and short and, for some executives, long term incentives. The overall weighting of total compensation elements reflects the degree to which executives at each different level should assume greater compensation risk and reward, reflected by increasing levels of variable compensation. Executives at all levels would have a mix, and weighting, of fixed and variable compensation. However, the executives at the higher levels would have more compensation at risk and, therefore, receive higher resulting rewards when company performance exceeds targets and lower awards when performance falls short of targets.

22

For each executive, the compensation elements are as follows: base salary will generally be market-based (targeted at the market median); short term (or annual) incentive opportunity will be a market-based percentage of base salary depending on executive level.

Competitive Positioning of Compensation

The Corporation’s executive compensation strategy is both market-based and performance-based to: (a) support the Corporation’s business priorities, growth and profitability and (b) to allow the Corporation to attract and retain key talent for the business. Subject to the discretion of the Compensation Committee and the Board, the Corporation’s strategy is to compensate its senior executive group, i.e., Vice President and above, at a total compensation level that is at median levels (or exceeds median if performance warrants) of external total compensation practice, as measured by compensation surveys for comparable executive positions.

External compensation surveys are used to measure total compensation competitiveness. General industry survey data is used to measure compensation competitiveness for both business segments of the Corporation, and retail/wholesale and luxury goods company survey data is used to measure compensation competitiveness for the retail group. Combined data for both groups is further reviewed by the compensation consulting company retained by the Compensation Committee of the Board, who will validate and add to the data in order to determine overall external competitive compensation practice.

The overall intent of the Corporation is to provide appropriate total compensation opportunity that is competitive with the market in which the Corporation must compete for talent. Competitive information is from external survey data, including date from the Towers Watson’s 2010 Executive Compensation databases for General Industry and Retail/Wholesale companies, the 2010 Salary.com/ICR Luxury Goods Compensation Survey and Aon Hewitt’s Total Compensation MeasurementTM (TCMTM) database. When possible, the data is size-adjusted to reflect compensation levels at companies ofsimilar size as the Corporation.While the external compensation survey data covers many of the Corporation’s executive positions and captures positions with comparable responsibilities and scope, it is not practical to secure directly relevant matches for every position. Where specific data is not available for a specific position, its external competitiveness will be determined through comparison to existing data for a comparable internal position, and/or inference or regression analysis, as assisted by the compensation consultants.

Subject to the discretion of the Compensation Committee and the Board, the Corporation seeks to position total compensation for its executives, including base salary and annual short term, and long term incentives, approximating the median market data for positions with equivalent responsibilities and scope.

Independent Consultant

The Compensation Committee engaged Meridian Compensation Partners LLC as an independent consultant to provide the Committee with support on determining levels of executive compensation. Meridian provided such services for the fiscal periods of the Corporation commencing February 1, 2006 to February 1, 2011, including:

- Compensation philosophy development;

- Market data and other market intelligence, including benchmarking analysis of executive pay levels;

- Compensation plan design support;

- Governance and regulatory practices/requirements input; and

- Assistance in facilitating the management of executive compensation and the execution of the Committee’s mandate.