SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | | | | | |

¨ | | Preliminary Proxy Statement | | ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x | | Definitive Proxy Statement | | | |

¨ | | Definitive Additional Materials | | | | |

¨ | | Soliciting Material Pursuant to § 240.14a-11(c) or § 240.14a-12 | | | | |

Ivory Capital Corporation

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box)

| | | | |

x | | No fee required. |

¨ | | $125 per Exchange Act Rule 0-11(c)(1)(ii), 14a-6(i)(1), 14a-6(i)(2) or Item 22(a)(2) of Schedule 14A. |

¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | |

| | | 1. | | Title of each class of securities to which transaction applies: . |

| | | 2. | | Aggregate number of securities to which transaction applies: . |

| | | 3. | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): . |

| | | 4. | | Proposed maximum aggregate value of transaction: . |

| | | 5. | | Total fee paid: . |

| |

¨ | | Fee paid previously with preliminary materials. |

| |

¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | | |

| | |

| | | 1. | | Amount Previously Paid: $ . |

| | | 2. | | Form, Schedule or Registration Statement No.: . |

| | | 3. | | Filing Party: . |

| | | 4. | | Date Filed: . |

IVORY CAPITAL CORPORATION

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD JULY 27, 2005

To the Shareholders of Ivory Capital Corporation:

NOTICE IS HEREBY GIVEN that the annual meeting of shareholders of Ivory Capital Corporation (“Ivory”), will be held on Wednesday, July 27, 2005 at 10:00 a.m., local time, at our headquarters located at 13950 Ballantyne Corporate Place, Unit 325, Charlotte, NC 28277 for the following purposes:

| | 1. | To elect seven directors to serve until the next annual meeting of shareholders, or until their successors are duly elected and qualified; |

| | 2. | To approve the reincorporation of Ivory in the State of Delaware, to be effected pursuant to an Agreement and Plan of Merger, dated June 17, 2005, by and between Ivory and Chelsea Therapeutics International, Ltd., a newly-formed Delaware corporation and wholly owned subsidiary of Ivory (“Chelsea Delaware”), pursuant to which Ivory will merge with and into Chelsea Delaware, every nine shares of Ivory will convert into one share of Chelsea Delaware and Chelsea Delaware will survive the reincorporation merger (approval of this reincorporation proposal will constitute approval of the reincorporation merger, the Agreement and Plan of Merger and the transactions set forth therein, and the other actions and proposals described in the accompanying proxy statement under “PROPOSAL TWO—REINCORPORATION PROPOSAL”); |

| | 3. | To approve the amendment of our 2004 Stock Plan to increase the number of shares of common stock reserved for issuance thereunder from 9,770,831 to 13,467,902; |

| | 4. | To ratify the appointment of J.H. Cohn LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2005; and |

| | 5. | To transact such other business as may properly come before the meeting or any adjournment thereof. |

These items of business are more fully described in the proxy statement accompanying this notice. Only shareholders of record at the close of business on June 30, 2005 are entitled to notice of and to vote at the meeting.

All shareholders are cordially invited to attend the meeting in person. To assure your representation at the meeting, however, you are urged to mark, sign, date and return the enclosed proxy as promptly as possible in the postage-prepaid envelope enclosed for that purpose. You may revoke your proxy in the manner described in the accompanying proxy statement at any time before it has been voted at the annual meeting. Any shareholder attending the meeting may vote in person even if he or she has returned a proxy.

|

For the Board of Directors, |

IVORY CAPITAL CORPORATION |

|

| |

Simon Pedder, Ph.D. |

| President, Chief Executive Officer and Director |

Charlotte, North Carolina

July 7, 2005

Your vote is important. In order to assure your representation at the meeting, please complete, sign and date the enclosed proxy as promptly as possible and return it in the enclosed envelope.

IVORY CAPITAL CORPORATION

PROXY STATEMENT

2005 ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD JULY 27, 2005

General

The enclosed proxy is solicited on behalf of the Board of Directors of Ivory Capital Corporation (“Ivory”) for use at the annual meeting of shareholders to be held Wednesday, July 27, 2005 at 10:00 a.m., local time, at our headquarters located at 13950 Ballantyne Corporate Place, Unit 325, Charlotte, NC 28277, or at any adjournment or postponement thereof, for the purposes set forth herein and in the accompanying Notice of Annual Meeting of Shareholders. Only shareholders of record at the close of business on June 30, 2005 are entitled to notice of and to vote at the meeting. On that record date, 111,317,378 shares of our common stock were issued and outstanding.

These proxy solicitation materials were first mailed on or about July 7, 2005 to all shareholders entitled to vote at the meeting.

The purposes of the meeting are:

| | 1. | To elect seven directors to serve until the next annual meeting of shareholders, or until their successors are duly elected and qualified; |

| | 2. | To approve the reincorporation of Ivory in the State of Delaware, to be effected pursuant to an Agreement and Plan of Merger, dated June 17, 2005, by and between Ivory and Chelsea Therapeutics International, Ltd., a newly-formed Delaware corporation and wholly owned subsidiary of Ivory (“Chelsea Delaware”), pursuant to which Ivory will merge with and into Chelsea Delaware, every nine shares of Ivory will convert into one share of Chelsea Delaware and Chelsea Delaware will survive the reincorporation merger (approval of this reincorporation proposal will constitute approval of the reincorporation merger, the Agreement and Plan of Merger and the transactions set forth therein, and the other actions and proposals described in this proxy statement under “PROPOSAL TWO—REINCORPORATION PROPOSAL”); |

| | 3. | To approve the amendment of our 2004 Stock Plan to increase the number of shares of common stock reserved for issuance thereunder from 9,770,831 to 13,467,902; |

| | 4. | To ratify the appointment of J.H. Cohn LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2005; and |

| | 5. | To transact such other business as may properly come before the meeting or any adjournment thereof. |

Record Date and Shares Outstanding

Shareholders of record at the close of business on June 30, 2005 are entitled to notice of and to vote at the meeting. At the record date 111,317,378 shares of our common stock were issued and outstanding.

Revocability of Proxies

Any proxy given pursuant to this solicitation may be revoked by the person giving it at any time before it is voted. Proxies may be revoked by:

| | • | | filing with the Corporate Secretary or Assistant Corporate Secretary of Ivory at or before the taking of the vote at the meeting a written notice of revocation bearing a later date than the proxy; |

| | • | | duly executing a later-dated proxy relating to the same shares and delivering it to the Corporate Secretary or Assistant Corporate Secretary of Ivory at or before the taking of the vote at the meeting; or |

| | • | | attending the meeting and voting in person (although attendance at the meeting will not in and of itself constitute a revocation of a proxy). |

Any written notice of revocation or subsequent proxy should be delivered to Ivory Capital Corporation at 13950 Ballantyne Corporate Place, Unit 325, Charlotte, NC 28277, Attention: Corporate Secretary, or hand-delivered to the Corporate Secretary or Assistant Corporate Secretary before the taking of the vote at the meeting.

Voting

Each holder of common stock is entitled to one vote for each share held as of the record date with respect to all matters that may be considered at the meeting. Shareholders’ votes will be tabulated by persons appointed by the Board of Directors to act as inspectors of election for the meeting. In accordance with Colorado law, abstentions, withholding of authority to vote or a broker non-vote are considered shares present and entitled to vote for quorum purposes and have the same legal effect as a vote against a matter presented at the meeting.

Solicitation of Proxies

The expense of soliciting proxies in the enclosed form will be borne by Ivory. In addition, we might reimburse banks, brokerage firms, and other custodians, nominees and fiduciaries representing beneficial owners of our common stock for their expenses in forwarding soliciting materials to those beneficial owners. Proxies may also be solicited by our directors, officers or employees, personally or by telephone, telegram, facsimile or other means of communication. We do not intend to pay additional compensation for doing so.

Deadline for Receipt of Shareholder Proposals

Shareholders may present proposals for action at our 2005 annual meetings of shareholders only if they comply with the proxy rules established by the SEC, applicable Colorado law and our bylaws.

Stockholder proposals to be presented at our 2006 annual meeting of shareholders must be delivered to our Corporate Secretary at our principal executive offices not earlier than April 23, 2006 nor later than May 23, 2006; provided, however, that if the date of the annual meeting is advanced more than 30 days prior to or delayed by more than 30 days after July 27, 2006, notice by the stockholder must be delivered not later than the close of business on the later of (i) the 90th day prior to such annual meeting or (ii) the 10th day following the day on which public announcement of the date of such meeting is first made.

2

PROPOSAL ONE

ELECTION OF DIRECTORS

Nominees

A board of seven directors is to be elected at the meeting. Unless a proxy is marked to withhold authority to vote, the proxy holders will vote the proxies received by them for the seven nominees named below, all of whom are currently directors and each of whom has consented to be named in this proxy statement and to serve if elected. In the event that any nominee is unable or declines to serve as a director at the time of the meeting, the proxies will be voted for any nominee designated by the Board of Directors to fill the vacancy. We do not expect that any nominee will be unable or will decline to serve as a director. The term of office of each person elected as a director will continue until the next annual meeting of stockholders or until a successor has been elected and qualified.

The Board of Directors unanimously recommends voting “FOR” the seven nominees listed below.

The name of and certain information regarding each nominee as of June 1, 2005 is set forth below, which information is based on data furnished to us by the nominees. There are no family relationships among directors, director nominees or executive officers of Ivory. Each of the directors named below have been directors of Ivory since our February 2005 merger with Chelsea Therapeutics, Inc. (“Chelsea Operating Company”). Prior to our merger with Chelsea Operating Company, the directors named below held the same positions with Chelsea Operating Company. The business address for each nominee for matters regarding Ivory is 13950 Ballantyne Corporate Place, Unit 325, Charlotte, NC 28277.

| | | | |

Name

Director Since

| | Age

| | Position(s) With Ivory

|

Simon Pedder February 2005 | | 44 | | President, Chief Executive Officer and President |

| | |

Michael Weiser February 2005 | | 42 | | Director |

| | |

Kevan Clemens(1)(2) February 2005 | | 60 | | Director |

| | |

Neil Herskowitz(1)(3) February 2005 | | 48 | | Director |

| | |

Johnson Y.N. Lau(1)(3) February 2005 | | 44 | | Director |

| | |

Jason Stein(2) February 2005 | | 32 | | Director |

| | |

David Tanen(2)(3) February 2005 | | 33 | | Director |

| (1) | Member of Audit Committee. |

| (2) | Member of Compensation Committee. |

| (3) | Member of Nominating and Corporate Governance Committee. |

Simon Pedder, Ph.D.—President, Chief Executive Officer and Director.Dr. Pedder joined Chelsea Operating Company from Hoffmann-La Roche Inc. in April 2004 where he was Vice President of Pharmaceutical Business, Oncology and an executive officer since February 2003. Prior to that he served as the Vice President, Drug Development at Hoffmann-La Roche from May 2001 until December 2002 and as Director, Pharmaceutical Business, Pharmaceutical Development and Project Management from May 1994 until May 2001. While at Hoffmann-La Roche, Dr. Pedder was in charge of the development of Pegasys and Copegus,

3

which have combined annual worldwide sales of over $1 billion, and oversaw a number of successful NDAs. Dr. Pedder has his Ph.D. in Pharmacology from the College of Medicine at the University of Saskatchewan in Canada.

Michael Weiser, M.D., Ph.D.—Chairman of the Board.Dr. Weiser served on the board of directors of Chelsea Operating Company since its inception in April 2002, and also served as Chelsea Operating Company’s President from April 2002 until October 2003. Dr. Weiser has been the Director of Research for Paramount BioScience, LLC since February 2005 and was the Director of Research of Paramount BioCapital Asset Management, Inc. from July 1998 until February 2005. Dr. Weiser currently serves as a director of Manhattan Pharmaceuticals, Inc., VioQuest Pharmaceuticals, Inc. and Hana Biosciences, Inc. all publicly traded pharmaceutical companies. He also serves as a director of ZIOPHARM, Inc., and several other privately held biotechnology companies. Dr. Weiser completed his Ph.D. in Molecular Neurobiology at Cornell University Medical College and received his M.D. from New York University School of Medicine, where he also completed a Postdoctoral Fellowship in the Department of Physiology and Neuroscience.

Kevan Clemens, Ph.D.—Director.Dr. Clemens served on the board of directors of Chelsea Operating Company since September 2004. In June 2004, Dr. Clemens retired after 30 years in the pharmaceutical industry. He was employed by Hoffmann-La Roche Inc. since May 1978, most recently as their Executive Vice President of Pharmaceutical Business. Prior to that he was Global Head of Specialty Care, Global Head of Project Management and the Head of Clinical Operations for North and South America. Previously, Dr. Clemens worked for over 20 years at Syntex as the Head of Pharmacoeconomics and in multiple positions in the sales and marketing divisions. Dr. Clemens obtained his Ph.D. in Chemistry from the University of London.

Neil Herskowitz—Director.Mr. Herskowitz served on the board of directors of Chelsea Operating Company since September 2004. He has served as the Managing Member of ReGen Partners LLC, an investment fund located in New York, and as the President of its affiliate, Riverside Claims LLC since June 1998. Mr. Herskowitz currently serves as a director of Manhattan Pharmaceuticals, Inc., a publicly traded pharmaceutical company. He also serves on the board of directors of Starting Point Services for Children, a not-for-profit corporation, and of Vacation Village, a 220-unit development in Sullivan County, New York. Mr. Herskowitz received a B.B.A. in Finance from Bernard M. Baruch College in 1978.

Johnson Y.N. Lau, M.B.B.S., M.D., F.R.C.P.—Director.Dr. Lau served on the board of directors of Chelsea Operating Company since September 2004. He currently serves as the Chairman of Kinex Pharmaceuticals, LLC, a position he has held since December 2003. Prior to that, Dr. Lau was an independent contractor from January 2003 until December 2003 and served in various capacities at Ribapharm Inc. from August 2000 until January 2003, including Chairman, President and Chief Executive Officer. Previously he was the Senior Vice President and Head of Research and Development at ICN Pharmaceuticals and Senior Director of Antiviral Therapy at Schering-Plough Research Institute. He has published over 200 scientific papers and 40 reviews and editorials in leading academic journals and was elected as a Fellow, Royal College of Physicians in 2004. Dr. Lau holds an M.B.B.S. and M.D. from the University of Hong Kong and the degrees of M.R.C.P. and F.R.C.P. from the Royal College of Physicians.

Jason Stein, M.D.—Director.Dr. Stein has served on the board of directors of Chelsea Operating Company since June 2004. Dr. Stein has served as the Senior Analyst at Paramount BioScience, LLC since February 2005 where he is responsible for medical, scientific and financial research of pharmaceutical products and technologies. Prior to that, he served as the Senior Analyst at Paramount BioCapital Asset Management, Inc. from January 2000 until February 2005. Dr. Stein is also an officer and/or director of several other privately held development-stage biotechnology companies. Dr. Stein received his B.A. from the University of Michigan and M.D. from Saba University.

David M. Tanen, J.D.—Director.Mr. Tanen served on the board of directors of Chelsea Operating Company since its inception in April 2002, and also as the Secretary for Chelsea Operating Company from April 2002 until December 2005. Mr. Tanen has served as a partner with Two Rivers Group Holdings, LLC, a venture

4

capital firm focusing on investments in pharmaceutical and other healthcare related companies, since September 2004. From July 1996 through September 2004, Mr. Tanen served as an associate director and General Counsel of Paramount BioCapital Inc., an NASD member broker/dealer. Mr. Tanen also serves as a member of the board of directors of VioQuest Pharmaceuticals, Inc. and Manhattan Pharmaceuticals, Inc., both publicly traded pharmaceutical companies, and as an officer and/or director of several other privately held development-stage biotechnology companies. Mr. Tanen received his B.A. degree from George Washington University and his J.D. degree from Fordham University School of Law.

Required Vote

The seven nominees receiving the highest number of affirmative votes of the common stock present or represented and entitled to be voted for them shall be elected as directors.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT SHAREHOLDERS VOTE “FOR” THE NOMINEES SET FORTH HEREIN.

5

CORPORATE GOVERNANCE MATTERS

Composition of Our Board of Directors

Our amended and restated articles of incorporation and by-laws provide that the number of our directors shall be fixed from time to time by a resolution of the majority of our board of directors, provided that the number of directors shall not be less than three or more than seven. We currently have seven directors. Although our common stock is not listed on any of the New York Stock Exchange, American Stock Exchange or the Nasdaq Stock Market, our board of directors is composed of a majority of independent directors as required under the rules of such markets or exchanges.

Board Meetings and Committees

Our Board of Directors has an audit committee, a compensation committee and a nominating and corporate governance committee, each of which has the composition and responsibilities described below. The Board may also establish other committees from time to time to assist in the discharge of its responsibilities.

Our audit committee was established in February 2005 and is comprised of Mr. Herskowitz (Chairman), and Drs. Clemens and Lau. Our board of directors has determined that Dr. Lau qualifies as an “audit committee financial expert,” as that term is defined by SEC regulations. As indicated above, Dr. Lau has experience as the principal executive officer of a publicly held company traded on the New York Stock Exchange. The audit committee provides assistance to our Board of Directors in its oversight of the integrity of our financial statements, the qualifications and independence of our independent registered public accounting firm, the procedures undertaken by the independent registered public accounting firm and our compliance with other regulatory and legal requirements. Although our common stock is not listed on any of the New York Stock Exchange, American Stock Exchange or the Nasdaq Stock Market, applicable SEC rules require us to determine whether Dr. Lau is also an “independent director,” as that term is defined by the listing standards of one of the foregoing stock markets. We have determined that Dr. Lau is an “independent director,” as that term is defined by Rule 4200(a)(15) of the Nasdaq listing requirements.

Our compensation committee was established in February 2005 and is comprised of Drs. Clemens (Chairman) and Stein, and Mr. Tanen. The compensation committee reviews and makes recommendations to our Board of Directors concerning the compensation and benefits of our executive officers and directors, administers our stock option and employee benefit plans, and reviews general policy relating to compensation and benefits.

Our nominating and corporate governance committee was established in February 2005 and is comprised of Dr. Lau (Chairman) and Messrs. Herskowitz and Tanen. The nominating and corporate governance committee is responsible for identifying and recommending qualified nominees to serve on our board of directors as well as developing and overseeing our internal corporate governance processes.

Information Regarding Meetings

During fiscal 2004, Philip Davis served as the sole member of our Board of Directors, and accordingly, all actions were taken by written consent.

Although we do not have a formal written policy with respect to Board members’ attendance at our annual meetings of shareholders, we strongly encourage all directors to attend.

Selection of Nominees for the Board of Directors

The nominating and corporate governance committee of our Board of Directors has the responsibility for establishing the criteria for recommending which directors should stand for re-election to our Board and the selection of new directors to serve on our Board. Although the committee has not formulated any specific minimum qualifications for director candidates, it has determined that desirable characteristics include strength of character, mature judgment, career specialization, relevant technical skills, diversity and independence.

6

Code of Ethics

Our Board of Directors has adopted a code of ethics for our Chief Executive Officer, Chief Financial Officer, Chief Accounting Officer and Controller, or persons performing similar functions. We will provide copies of our code of ethics without charge upon request. To obtain a copy of our code of ethics, please send your written request to Ivory Capital Corporation, 13950 Ballantyne Corporate Place, Suite 325, Charlotte, North Carolina 28277, Attn: Vice President, Administration.

Communications with the Board of Directors

Shareholders who wish to communicate with members of the Board, including the independent directors individually or as a group, may send correspondence to them in care of our Corporate Secretary or Assistant Corporate Secretary at our principal executive offices. Such communication will be forwarded to the intended recipient(s). We currently do not intend to have our Corporate Secretary or Assistant Corporate Secretary screen this correspondence, but we may change this policy if directed by the Board due to the nature or volume of the correspondence.

Compensation Committee Interlocks and Insider Participation

No member of our compensation committee serves or in the past has served as a member of another entity’s board of directors or compensation committee, which entity has one or more executive officers serving as a member of our Board of Directors or compensation committee.

Compensation of Directors

All of our non-employee directors are reimbursed for out-of-pocket expenses incurred in attending Board and committee meetings. As compensation for their service on our Board of Directors, Dr. Clemens, Mr. Herskowitz and Dr. Lau each received an option to purchase 316,892 shares of our common stock in September 2004 and Dr. Stein, Mr. Tanen and Dr. Weiser each received an option to purchase 79,223 shares of our common stock in January 2005. Each of these option grants was made pursuant to our 2004 Stock Plan. The grants to Dr. Clemens, Mr. Herskowitz and Dr. Lau vest in equal annual installments over two years and the grants to Dr. Stein, Mr. Tanen and Dr. Weiser vest in their entirety on the first anniversary of the date of grant.

Indemnification and Limitation of Director and Officer Liability

The Colorado Business Corporation Act (the “CBCA”), which currently governs Ivory’s corporate affairs, contains provisions permitting and, in some situations, requiring Colorado corporations to provide indemnification to their officers and directors for losses and litigation expense incurred in connection with their service to the corporation. Our articles and bylaws contain provisions requiring our indemnification of our directors and officers and other persons acting in their corporate capacities.

The CBCA permits indemnification of a director of a Colorado corporation, in the case of a third-party action, if the director:

| | • | | conducted himself or herself in good faith; |

| | • | | reasonably believed that (a) in the case of conduct in his or her official capacity, his or her conduct was in the corporation’s best interest, or (b) in all other cases, his or her conduct was not opposed to the corporation’s best interest; and |

| | • | | in the case of any criminal proceeding, had no reasonable cause to believe that his or her conduct was unlawful. |

The CBCA further provides for mandatory indemnification of directors and officers who are successful on the merits or otherwise in litigation. The statute limits the indemnification that a corporation may provide to its directors in a derivative action in which the director is held liable to the corporation, or in any proceeding in which the director is held liable on the basis of his improper receipt of a personal benefit.

7

In addition, we may enter into agreements with our directors providing contractually for indemnification consistent with the articles and bylaws. The CBCA also authorizes us to purchase insurance for our directors and officers insuring them against risks as to which we may be unable lawfully to indemnify them. We have obtained limited insurance coverage for our officers and directors as well as insurance coverage to reimburse us for potential costs of our corporate indemnification of officers and directors.

As to the exculpation or indemnification of directors, officers, and controlling persons for liabilities arising under the Securities Act of 1933, we have been advised that in the opinion of the SEC such exculpation or indemnification is against public policy as expressed in the Act and is, therefore, unenforceable.

If the Reincorporation Proposal is adopted, indemnification and limitations on director and officer liability will be governed by the Delaware General Corporation Law (the “DGCL”), the Chelsea Delaware Certificate of Incorporation and the Chelsea Delaware Bylaws, as described in detail below under “PROPOSAL TWO—REINCORPORATION PROPOSAL.”

8

PROPOSAL TWO

REINCORPORATION PROPOSAL

Introduction

The following discussion summarizes certain aspects of the proposal to change the state of incorporation of Ivory from Colorado to Delaware (the “Reincorporation”). The Reincorporation will be accomplished by merging Ivory with and into its newly created, wholly-owned subsidiary, Chelsea Therapeutics International, Ltd., a Delaware corporation (“Chelsea Delaware”). On June 16, 2005, the Board of Directors of Ivory unanimously approved the Agreement and Plan of Merger attached hereto asAppendix A (the “Plan of Merger”), pursuant to which Ivory will merge with and into Chelsea Delaware, with Chelsea Delaware remaining as the surviving corporation (the “Merger”). As the surviving corporation, Chelsea Delaware will become the parent and sole shareholder of Chelsea Therapeutics, Inc., a Delaware corporation and the corporation through which substantially all business operations are conducted (“Chelsea Operating Company”).

The Merger will also have the effect of Ivory Capital Corporation changing its corporate name to “Chelsea Therapeutics International, Ltd.” (the “Name Change”). In addition, subject to the rights of dissenters as described below, the Plan of Merger provides that each share of Ivory common stock will be converted into the right to receive one-ninth (1/9th) of a share of Chelsea Delaware common stock (the “Share Exchange”). Fractional shares of Chelsea Delaware common stock will not be issued in the Share Exchange. In lieu thereof, holders of Ivory common stock who would otherwise be entitled to receive a fractional share of Chelsea Delaware common stock, after aggregating all such shares issuable in the Merger, will receive a cash payment equal to the fair market value of such fractional share as of the effective date of the Merger. Ivory common stock is currently listed for trading on the OTC Bulletin Board under the symbol “IVRC.” After the Merger, Chelsea Delaware common stock bill continue to be traded on the OTC Bulletin Board, without interruption, under the symbol “IVRC.” After the Merger, we intend to explore the listing of Chelsea Delaware common stock on a national stock exchange. In the event we are successful in listing the Chelsea Delaware common stock on a national exchange, we will consider amending the trading symbol at that time.

Each of the actions and agreements described in this Proposal Two, including without limitation the Reincorporation, the Plan of Merger, the Merger, the Share Exchange, and the Name Change are referred to herein collectively as the “Reincorporation Proposal.”

It is anticipated that the Merger will become effective as soon as practicable following shareholder approval. However, the Plan of Merger provides that the Merger may be abandoned prior to the effective time thereof, either before or after shareholder approval, by our Board of Directors. In the event the Merger is abandoned, the existing articles of incorporation and bylaws of Ivory would remain in effect.

The following discussion is not a complete statement of the terms of the Plan of Merger, the provisions affecting, and differences between, your rights as a shareholder of Ivory and your rights as a shareholder of Chelsea Delaware, or any other aspect of the Reincorporation Proposal. The discussion is qualified in its entirety by reference to the Plan of Merger, the proposed Amended and Restated Certificate of Incorporation of Chelsea Delaware (the “Chelsea Delaware Certificate of Incorporation”), the form of which is attached hereto asAppendix B, and the proposed Amended and Restated Bylaws of Chelsea Delaware (the “Chelsea Delaware Bylaws”), the form of which is attached hereto asAppendix C.

Throughout this proxy statement, the terms “Ivory” and the “Company,” as well as terms such as “we,” “us” or “our,” refer to Ivory Capital Corporation, the existing Colorado corporation, and the term “Chelsea Delaware” refers to Chelsea Therapeutics International, Ltd., the new Delaware corporation and surviving entity in the proposed reincorporation.

SHAREHOLDERS ARE URGED TO READ CAREFULLY THIS SECTION OF THE PROXY STATEMENT, INCLUDING THE RELATED APPENDICES REFERENCED HEREIN AND ATTACHED TO THIS PROXY STATEMENT, BEFORE VOTING ON THE REINCORPORATION PROPOSAL.

9

Principal Reasons for the Reincorporation

Operations of Chelsea Operating Company

On February 11, 2005, Ivory completed its acquisition of Chelsea Operating Company by causing its wholly owned subsidiary to merge with and into Chelsea Operating Company, with Chelsea Operating Company remaining as the surviving corporation and a wholly owned subsidiary of Ivory. As a result of this merger:

| | • | | Ivory, which had no material operations immediately prior to the merger, acquired the business of Chelsea Operating Company, which since April 2002 has been engaged in the acquisition and development of innovative products for the treatment of a variety of human diseases; |

| | • | | each outstanding share of common stock and Series A Preferred Stock of Chelsea Operating Company was converted into approximately 10.56 shares of common stock of Ivory and outstanding options and warrants to purchase either common stock or Series A Preferred Stock of Chelsea Operating Company were assumed by Ivory and converted into options and warrants to purchase shares of Ivory common stock at the same ratio; |

| | • | | a change of control of Ivory resulted, with the former stockholders of Chelsea Operating Company owning approximately 96.75% of Ivory’s voting securities assuming the conversion of all outstanding options and warrants; and |

| | • | | the individuals who comprised the board of directors and officers of Chelsea Operating Company replaced all of the existing directors and officers of Ivory. |

Following the February 2005 merger transaction with Chelsea Operating Company, Ivory moved its executive offices to Charlotte, North Carolina (the location of Chelsea Operating Company’s executive offices) and no longer has any other connection with Colorado. Having adopted the business of Chelsea Operating Company, we believe changing our corporate name to “Chelsea Therapeutics International, Ltd.” will be more reflective of the business in which we are now engaged.

Prominence, Predictability and Flexibility of Delaware Law

Reincorporating under Delaware law is advisable because Delaware is a nationally recognized leader in adopting and implementing comprehensive and flexible corporate laws. The DGCL, which has governed the affairs of Chelsea Operating Company since its inception, is frequently revised and updated to accommodate changing legal and business needs. Given the recent changes in the composition of our management and board of directors, and the fact that substantially all of our operations are conducted through our Delaware subsidiary, Chelsea Operating Company, we think it will be beneficial to Ivory and its shareholders to obtain the benefits of Delaware corporate law.

Delaware has also established a specialized court, the Court of Chancery, having exclusive jurisdiction over matters relating to the DGCL. The Chancery Court has no jurisdiction over criminal and tort cases, and corporate cases are heard by judges, without juries, who have many years of experience with corporate issues. Traditionally, this has meant that the Delaware courts are able in most cases to process corporate litigation relatively quickly and effectively. By comparison, many states, including Colorado, do not have a specialized judiciary over matters relating to corporate issues.

Delaware courts have developed considerable expertise in dealing with corporate legal issues and produced a substantial body of case law construing Delaware corporate laws, with multiple cases concerning areas that no Colorado court has considered. Because our judicial system is based largely on legal precedents, the abundance of Delaware case law should serve to enhance the relative clarity and predictability of many areas of corporate law, which should offer added advantages to Ivory by allowing our board of directors and management to make corporate decisions and take corporate actions with greater assurance as to the validity and consequences of those decisions and actions.

10

Both Colorado and Delaware law permit a corporation to include a provision in its certificate or articles of incorporation which reduces or limits the monetary liability of directors for breaches of fiduciary duty in certain circumstances. The increasing frequency of claims and litigation directed against directors and officers has greatly expanded the risks facing directors and officers of corporations in exercising their respective duties. The amount of time and money required to respond to such claims and to defend such litigation can be substantial. We desire to reduce these risks to our directors and officers and to limit situations in which monetary damages can be recovered against directors so that we may continue to attract and retain qualified directors who otherwise might be unwilling to serve because of the risks involved. We believe that, in general, Delaware law provides greater protection to directors than Colorado law and that Delaware case law regarding a corporation’s ability to limit director liability is more developed and provides more guidance than Colorado law.

Reincorporation Merger; Effect on Company Stock

In accordance with the Plan of Merger, if the shareholders approve the Reincorporation Proposal and the Merger is effected,

| | • | | Ivory will be merged with and into Chelsea Delaware, Chelsea Delaware will remain as the surviving corporation and Ivory’s existence as a Colorado corporation will cease; |

| | • | | pursuant to the Share Exchange, each holder of outstanding Ivory common stock will receive one share of Chelsea Delaware common stock for every nine shares of Ivory common stock held by such holder; |

| | • | | all outstanding options, warrants and other rights to purchase shares of Ivory common stock will automatically convert into an option, warrant or right to purchase one-ninth (1/9th) of the number of shares of Chelsea Delaware common stock at a purchase price equal to nine times the purchase price of such option, warrant or other right to purchase Ivory common stock; |

| | • | | the name of the surviving corporation will be “Chelsea Therapeutics International, Ltd.” and the OTC Bulletin Board trading symbol for the surviving corporation will be “IVRC.” |

The Reincorporation will not result in any change in our business, management, fiscal year, assets or liabilities or location of our principal offices and facilities. The seven directors who will be elected at the annual meeting will become the directors of Chelsea Delaware. All employee benefit, stock option and incentive plans of Ivory will be assumed and continued by Chelsea Delaware, and each option or right issued pursuant to such plans will automatically be converted into an option or right to purchase shares of Chelsea Delaware common stock on the same terms and subject to the same conditions, subject to appropriate adjustment to reflect the ratio of the Share Exchange. Shareholders should note that approval of the Reincorporation Proposal will also constitute approval of the assumption of these plans by Chelsea Delaware, as well as the assumption and continuance by Chelsea Delaware of all other employee benefit arrangements Ivory currently has in effect.

As noted above, after the Merger, the shares of Chelsea Delaware common stock will continue to be traded, without interruption, on the OTC Bulletin Board, under the trading symbol “IVRC.” After the Merger, we intend to explore the listing of Chelsea Delaware common stock on a national stock exchange. In the event we are successful in listing the Chelsea Delaware common stock on a national exchange, we will consider amending the trading symbol at that time.

We believe that the Merger and other aspects of the Reincorporation Proposal will not affect any material contracts Ivory, Chelsea Operating Company or Chelsea Delaware has with third parties and that Ivory’s rights and obligations under such material contractual arrangements will continue and be assumed by Chelsea Delaware.

Charter Instruments

If the Reincorporation Proposal is approved, the certificate of incorporation and bylaws of Chelsea Delaware, in substantially the forms attached hereto asAppendices B and C, will govern the surviving corporation following the Merger.

11

Post-Merger Board of Directors and Officers

The post-Merger Board of Directors of Chelsea Delaware will be composed of the current directors of Ivory. The persons who serve as officers of Ivory at the effective time of the Reincorporation will serve as the officers of Chelsea Delaware after the Reincorporation.

Comparative Rights of Holders of Ivory Stock and Chelsea Delaware Stock

If the Reincorporation Proposal is approved by the requisite shareholder vote at the annual meeting, the holders of Ivory capital stock, whose rights are currently governed by the CBCA and Ivory’s Articles of Incorporation and Bylaws, will become stockholders of Chelsea Delaware, which is governed by the DGCL. Accordingly, following the Reincorporation, their rights will be governed in accordance with the DGCL and the Chelsea Delaware Certificate of Incorporation and Chelsea Delaware Bylaws. Certain differences in the rights of shareholders arise from distinctions between the CBCA and the DGCL, as well as from Ivory’s charter instruments as compared to Chelsea Delaware’s charter instruments. The following is a brief description of those differences. This discussion is not intended to be a complete statement of the differences, but rather a summary of the more significant differences affecting the rights of such shareholders and certain important similarities. The identification of certain provisions or differences is not meant to indicate that other equally or more significant differences do not exist. The following summary discussion is qualified in its entirety by reference to the CBCA, DGCL, Ivory’s Articles of Incorporation and Bylaws, the Chelsea Delaware Certificate of Incorporation and the Chelsea Delaware Bylaws, to which you are referred.

Authorized Capital Stock

Colorado.Ivory’s Articles of Incorporation authorize the issuance of up to 810,000,000 shares of capital stock, 800,000,000 of which are designated as common stock, no par value per share, and 10,000,000 of which are designated as preferred stock, no par value per share. As of the Record Date (i) there were 111,317,378 shares of Ivory’s common stock issued and outstanding, and (ii) no shares of Ivory’s preferred stock issued and outstanding. Ivory’s articles of incorporation provide that the Board of Directors with broad authority to designate one or more series of preferred stock, fix the number of shares for each such series and determine the rights and restrictions of each such series.

Delaware.The Chelsea Delaware Certificate of Incorporation authorizes the issuance of up to 45,000,000 shares common stock, with $0.0001 par value per share, and 5,000,000 shares of preferred stock with $0.0001 par value per share. As of the Record Date (i) there were 100 shares of Chelsea Delaware’s common stock issued and outstanding, all of which are held by Ivory and all of which will be cancelled in connection with the Merger, and (ii) no shares of Chelsea Delaware’s preferred stock issued and outstanding. The Chelsea Delaware Certificate of Incorporation also provides the Board of Directors with broad authority to designate one or more series of preferred stock, fix the number of shares for each such series and determine the respective rights and restrictions of each such series.

The Board of Directors has no immediate plans to issue any additional shares of common stock (other than through the exercise of options and warrants) or preferred stock either before or after the Merger. However, the large number of authorized and unissued shares provided for in the Chelsea Delaware Certificate of Incorporation will provide Chelsea Delaware with the flexibility to undertake various types of transactions after the Merger, including stock splits, financings, increases in the shares reserved for issuance pursuant to stock option and other incentive plans, acquisitions and other corporate transactions not yet determined. The additional shares available for future issuance could also be uses by Chelsea Delaware to oppose a hostile takeover attempt or delay or prevent changes in control or management. For example, without further stockholder approval, the Chelsea Delaware Board of Directors could sell shares of preferred stock to investors that oppose a takeover or favor the current Board of Directors. Although we are not aware of any hostile takeover attempt, shareholders should be aware that such additional authorized shares could be used to deter or prevent changes in control of Chelsea Delaware.

12

Number and Classes of Directors

Colorado.The CBCA requires a corporation to have at least one director and requires that the number of persons constituting a corporation’s board of directors, whether a specific number or a range of size, be fixed by or in accordance with the bylaws. Colorado law permits either the board of directors or the shareholders to amend the provision in the bylaws that establishes the number of directors. The CBCA permits staggered terms for directors divided into two or three groups if the articles so provide. Ivory’s Bylaws provide that the Board of Directors shall comprise at least three (3) directors, and not more than seven (7) directors, the number determined from time to time by the Directors. Ivory has seven directors as of the Record Date. Ivory’s charter documents do not provide for staggered terms for directors.

Delaware.The DGCL requires a corporation to have one or more directors, the number of directors to be fixed by, or in the manner provided in, the bylaws or by the certificate of incorporation. The DGCL permits staggered terms for directors divided into two or three groups if the certificate of incorporation, the initial bylaws, or bylaws adopted by the stockholders of the corporation so provide. Chelsea Delaware’s charter documents do not provide for staggered terms for directors.

The Chelsea Delaware Bylaws provide that Chelsea Delaware shall have at least five directors, and not more than nine directors, the number to be determined from time to time by resolution of the board. Upon completion of the Merger, the size of the Chelsea Delaware Board of Directors will be set at seven and such Board of Directors will be comprised of Ivory’s current Board of Directors, assuming they are re-elected at the annual meeting.

Removal of Directors

Colorado.Under the CBCA, shareholders may remove a director with or without cause if the corporation’s articles do not provide otherwise and if the number of votes cast in favor of removal exceeds the number of votes cast against removal. If, however, a director was elected by a “voting group” of shareholders, only the shareholders of that voting group may vote to remove the director. A “voting group” is all the shares of one or more classes or series entitled to vote together pursuant to the CBCA or a corporation’s articles. Ivory’s Articles of Incorporation do not limit a shareholder’s right to vote to remove a director without cause. Ivory’s Bylaws provide that the directors of Ivory may be removed at any time, with or without cause, in the manner provided in the CBCA.

Delaware.Under the DGCL, the general rule is that any director or the entire board of directors may be removed, with or without cause, by the holders of a majority of the shares then entitled to vote at an election of directors. Chelsea Delaware’s Bylaws provide that the directors of Chelsea Delaware may be removed at any time, with or without cause, by the affirmative vote of holders of at least a majority of the voting shares entitled to vote at an election of directors.

Filling Vacancies on the Board of Directors

Colorado.Under the CBCA, unless the articles of incorporation provide otherwise, any vacancy on the board of directors, including a vacancy resulting from an increase in the number of directors, may be filled by the shareholders or the board of directors. If the number of directors remaining in office constitute fewer than a quorum of the board, the remaining board members may fill the vacancy by the affirmative vote of a majority of all the directors remaining in office. If the vacant office was held by a director elected by a voting group, and if any remaining directors were elected by such voting group, only such directors may vote to fill the vacancy if it is filled by directors, or, if it is filled by the shareholders, only such voting group may vote to fill the vacancy. Ivory’s Articles of Incorporation do not alter these procedures.

Delaware.Under the DGCL, unless the certificate of incorporation or bylaws provide otherwise, vacancies may be filled by a majority of the directors then in office, although less than a quorum, or by a sole remaining director. Whenever the holders of any class of stock or series are entitled to elect one or more directors by the

13

certificate of incorporation, vacancies may be filled by a majority of the directors elected by such class, or by a sole remaining director. Neither the Chelsea Delaware Certificate of Incorporation nor the Chelsea Delaware Bylaws alter these provisions, which means vacancies on the Chelsea Delaware Board of Directors can be filled by the a majority of the directors then in office, although less than a quorum, or by a sole remaining director.

Shareholder Power to Call Special Meeting of Shareholders

Colorado.Under the CBCA and Ivory’s bylaws, a special meeting of shareholders may be called by Ivory’s President, the Ivory Board of Directors, or shareholders representing at least ten percent of the votes entitled to be cast on any proposed issue by delivering a signed and dated written demand to the corporation stating the purpose for the meeting.

Delaware.Under the DGCL, a special meeting of the stockholders may be called by the board of directors or by such other persons as may be authorized by the certificate of incorporation or by the bylaws. The Chelsea Delaware Certificate of Incorporation and Chelsea Delaware Bylaws provide that only the Chelsea Delaware Board of Directors or the holders of a majority of outstanding stock can call a special meeting of stockholders.

Right to Inspect Corporate Records

Colorado.Under the CBCA, a shareholder is entitled to inspect, upon five days written notice to the corporation (i) the articles of incorporation, (ii) the bylaws, (iii) all minutes of shareholders’ meetings and records of all action taken by shareholders without a meeting, for the past three years, (iv) all written communications within the past three years to shareholders, (v) the names and business addresses of current directors and officers, (vi) the most recent corporate report, and (vii) the annual and published financial statements for the past three years. In addition, in some circumstances a shareholder is entitled to inspect excerpts from board, shareholder and committee minutes, accounting records and the corporation’s share register. A shareholder may only inspect these additional corporate records if he or she has been a shareholder for at least three months preceding his or her demand or holds at least 5% of all the outstanding shares of any class of shares, and if such demand is made in good faith and for a proper purpose. The requested corporate records, must be described with reasonable particularity and relate to the stated purpose.

Delaware.Under the DGCL, any stockholder shall, upon written demand under oath stating the purpose thereof, have the right to inspect (i) the corporation’s stock ledger, a list of its stockholders, and its other books and records, and (ii) to a limited extent, a subsidiary’s books and records.

Dissenter/Appraisal Rights

Colorado.Under Colorado law, a shareholder is entitled to dissent and obtain payment of the fair value of his or her shares in the event of a consummation of (i) a plan of merger if shareholder approval is required or if the corporation is merging into its parent, (ii) a plan of share exchange if the corporation is acquired, (iii) a sale, lease, exchange or disposition of all, or substantially all of the corporate property, or the property of an entity controlled by the corporation, if shareholder approval is required, (iv) a reverse split that reduces the number of shares owned to a fraction or to scrip, or (v) any corporate action to the extent provided by the bylaws or a board resolution. A shareholder is not entitled to dissenter’s rights with respect to a merger, share exchange or asset disposition if (i) the shares were listed either on a national securities exchange or national market system, or were held of record by more than 2,000 holders and (ii) if such shareholders receive only shares of the surviving corporation, shares of any other corporation that are either listed on a national securities exchange or national market system or were held of record by more than 2,000 holders, or cash in lieu of fractional shares of such corporations. To exercise such appraisal rights, a shareholder must: (i) have been a record holder of the shares as to which he or she seeks relief on the record date, (ii) cause the corporation to receive written notice of his or her intent to demand payment before the vote is taken, (iii) not have voted his or her shares in favor of the proposal, and (iv) respond to the dissenters’ notice delivered by the corporation to the shareholders. As described below, Ivory’s shareholders are entitled to dissenters’ rights in connection with the Merger.

14

Delaware.Under Delaware law, a stockholder is entitled to dissent and obtain payment of the fair value of his or her shares if the stockholder has continuously held such shares through the effective date of the merger or consolidation, has neither voted in favor of the merger or consolidation, nor consented thereto in writing, and has perfected his or her appraisal rights. Dissenters rights for any class or series of stock are not available if a corporation’s stock is either (i) listed on a national securities exchange or designated as a national market system security, or (ii) held of record by more than 2,000 holders, provided that such stockholders receive (i) only shares of the surviving corporation, (ii) shares of any other corporation that are either listed on a national securities exchange, designated as a national market system security, or are held of record by more than 2,000 holders, or (iii) cash in lieu of fractional shares of such corporations. Further, no dissenter’s rights are available to stockholders of a corporation surviving a merger if no vote of the stockholders of the surviving corporation is required to approve the merger under certain provisions of Delaware law.

Limitations on Director Liability

Colorado.The CBCA allows a corporation to include in its articles of incorporation a provision that eliminates or limits the personal liability of a director to the corporation or its shareholders for monetary damages for a breach of a fiduciary duty as a director, except for (i) any breach of the director’s duty of loyalty, (ii) acts or omissions not in good faith or that involve intentional misconduct or a knowing violation of law, (iii) distributions that are illegal under applicable law, (iv) any transaction from which the director derived an improper personal benefit, or (v) any act or omission occurring prior to the date when the provision in the charter eliminating or limiting liability became effective. Ivory’s Articles of Incorporation eliminates director liability to the fullest extent permissible under Colorado law.

Delaware.The Chelsea Delaware Certificate of Incorporation and Chelsea Delaware Bylaws also eliminate the liability of directors to the corporation or its shareholders for monetary damages for breach of fiduciary duty as a director to the fullest extent permissible under Delaware law, as amended from time to time. Under Delaware law, such provision may not eliminate or limit director monetary liability for (i) breaches of the director’s duty of loyalty to the corporation or its shareholders, (ii) acts or omission not in good faith or involving intentional misconduct or knowing violations of law, (iii) the payment of unlawful dividends or unlawful stock repurchases or redemptions, (iv) transactions in which the director received an improper personal benefit, or (v) any act or omission occurring prior to the date when such provision became effective.

Indemnification

Colorado.Ivory’s Articles of Incorporation provide that Ivory may indemnify any director, officer, employer, fiduciary, or agent of Ivory to the full extent permitted by the CBCA. The CBCA provides that, unless the articles of incorporation provide otherwise, a corporation must indemnify a director or officer who was wholly successful, on the merits or otherwise, in a legal proceeding to which such director or officer was a party due to his or her position or former position with the corporation. A corporation may also indemnify a person made a party to a legal proceeding due to his or her current or former position as a director of the corporation if such director acted in good faith, had no reasonable cause to believe his or her conduct was unlawful, and if acting in an official capacity, acted in the corporation’s best interest, or if acting in an unofficial capacity, acted in a manner not opposed to the corporation’s best interests. A corporation may not indemnify a director in connection with a proceeding by or in the right of the corporation in which the director was adjudged liable to the corporation, or in any other proceeding in which the director was adjudged liable on the basis of deriving an improper personal benefit. The CBCA permits corporations to indemnify officers, employees, fiduciaries and agents to the same extent as directors.

Delaware.The Chelsea Delaware Certificate of Incorporation also provides that Chelsea Delaware will indemnify officers, directors, employees and agents to the fullest extent permitted by law. Delaware law generally permits a corporation to indemnify its former and current directors, officers, employees or agents for expenses and losses, including attorney’s fees, actually and or reasonably incurred in connection with an action,

15

suit or proceeding if the person acted in good faith, in a manner the person reasonably believed to be in or not opposed to the best interests of the corporation, and had no reasonable cause to believe the person’s conduct was unlawful, provided there is such a determination by a majority vote of a disinterested directors, even though less than a quorum, by independent legal counsel or by the stockholders.

Amendment of Articles/Certificate and Bylaws

Colorado.The CBCA provides that the board of directors may amend the articles prior to the issuance of shares, and thereafter the board of directors may make certain amendments to the articles without shareholder approval, including deleting the names of the initial directors and initial registered agent. Other amendments must be proposed by the board of directors or by the holders of at least 10% of the shares entitled to vote on such amendments, and, unless the articles or bylaws adopted by the shareholders provide otherwise, be approved by the shareholders by a majority vote of all shares entitled to vote. Shareholders are entitled to vote as a voting group on certain amendments that would affect the rights of such voting group. The board of directors may amend Ivory’s Bylaws at any meeting of directors at which a quorum is present.

Delaware.The DGCL provides that, before a corporation has received payment for any of its stock, a majority of the incorporators or directors, if named in the original certificate, may amend the certificate of incorporation. Thereafter, if a corporation has received payment for any of its capital stock, an amendment requires the affirmative vote of a majority of the outstanding stock entitled to vote thereon. If the rights of a class of shareholders are affected by the amendment, the holders of the outstanding shares of such class shall be entitled to vote whether or not entitled to vote thereon by the certificate of incorporation. The DGCL provides that whenever the certificate of incorporation requires a vote of greater number or proportion than Delaware law, an amendment altering such provision requires such greater vote. The DGCL provides that, before a corporation has received payment for any of its stock, a majority of the incorporators or directors, if named in the original certificate, may amend the bylaws. After a corporation has received payment for any of its capital stock, the power to amend or repeal the bylaws shall be in the stockholders entitled to vote, unless the certificate of incorporation confers the power upon the directors. The Chelsea Delaware Certificate of Incorporation does not require a higher shareholder vote for amendment of the certificate. The Chelsea Delaware Certificate of Incorporation does confer the power to amend and alter the Chelsea Delaware Bylaws upon the directors.

Actions by Shareholders Without a Meeting

Colorado.The CBCA provides that, unless the article provide otherwise, actions required or permitted to be taken at annual or special meetings of the Company’s shareholders can be taken without a meeting if all the shareholders who would have been entitled to vote upon the action if such meeting were held shall consent in writing to such corporate action being taken. Ivory’s Articles of Incorporation do not limit the ability of shareholders to act by written consent.

Delaware.Under the DGCL, unless otherwise provided in the certificate of incorporation, any action required or permitted to be taken at annual or special meetings of the stockholders can be taken without a meeting, prior notice or vote, if a consent, setting forth the action, is signed by the holders of outstanding stock having not less than the minimum number of votes that would be necessary to authorize or take such action at a meeting at which all shares entitled to vote thereon were present and voted. The Chelsea Delaware Certificate of Incorporation does not alter this provision.

Actions by Directors Without a Meeting

Colorado.The CBCA provides that, unless the bylaws require certain actions to be voted upon at a meeting of the board of directors, any action required or permitted to be taken at a board of directors meeting can be taken by written action if signed by all of the directors. Ivory’s Bylaws do not alter this provision.

16

Delaware.The DGCL provides that, unless otherwise restricted by the certificate of incorporation or bylaws, any action required or permitted to be taken at any meeting of the board of directors may be taken without a meeting if all members of the board consent to the action in writing. The Chelsea Delaware Certificate of Incorporation and Chelsea Delaware Bylaws do not alter this provision.

Takeover Statutes/ Anti-Greenmail Provisions

Colorado. The CBCA does not contain provisions designed to deter takeovers of public corporations, nor does it contain an anti-greenmail provision.

Delaware.Section 203 of the DGCL prevents a “business combination” between an “interested stockholder” and a Delaware corporation for a period of three years after such stockholder became an interested stockholder, unless certain conditions are met. The Delaware statute defines a business combination as any merger or consolidation, any sale, lease, exchange or other disposition of 10% or more of a corporation’s assets, or any transaction (subject to certain exceptions) which results in the transfer of stock of a corporation to the interested stockholder, increases his proportionate ownership of a corporation’s stock or results in such interested stockholder receiving the benefit of any loans, advances, guarantees, pledges or other financial benefits provided by or through the corporation. The Delaware statute defines an interested stockholder as (subject to certain exceptions) any person who is the owner of 15% or more of the outstanding voting stock of the corporation or a person who is an affiliate or associate of the corporation who became the owner of 15% or more of the outstanding voting stock of the corporation within the three-year period prior to the date on which it is sought to determine whether such stockholder is interested. A business combination is exempt from the effect of the statute if, among other things, either (i) prior to the date the stockholder became interested, the board of directors approved either the business combination or the transaction that resulted in the stockholder becoming interested, (ii) upon consummation of the transaction that resulted in the stockholder becoming interested, such stockholder owned at least 85% of the corporation’s voting stock at the time the transaction consummated, or (iii) on or after the date the stockholder becomes interested, the business combination is approved by the board of directors and authorized at an annual or special meeting of stockholders by the affirmative vote of at least two-thirds of the outstanding voting stock not owned by the interested stockholder.

The anti-takeover statute provides that the certificate of incorporation of a Delaware corporation may provide that the corporation expressly elects not to be governed by the statute. Chelsea Delaware will be governed by the anti-takeover statute, except that the Chelsea Delaware Certificate of Incorporation provides that Jason Stein, Michael Weiser, the Rosenwald 2000 Family Trust, the Lindsay A. Rosenwald 2000 (Delaware) Irrevocable Indenture of Trust, the Lindsay A. Rosenwald Alaska Irrevocable Indenture of Trust, the Lindsay A. Rosenwald Rhode Island Irrevocable Indenture of Trust, or the Lindsay A. Rosenwald Nevada Irrevocable Indenture of Trust, or any successor to all or substantially all of their assets, or any successor to all or substantially all of their assets, or any affiliate thereof, or any person or entity to which any of the foregoing stockholders transfers shares of Chelsea Delaware voting stock in a transaction other than an underwritten, broadly distributed public offering, regardless of the total percentage of Chelsea Delaware voting stock owned by such stockholder or such person or entity, shall not be deemed an “interested stockholder” for purposes of Section 203 of the Delaware General Corporation Law.

Reincorporating in Delaware and subjecting the Company to the anti-takeover statute, with the exception of the stockholders specifically excluded from the definition of an “interested stockholder”, will make it more difficult for a person who seeks to acquire control of Chelsea Delaware or to effect a business combination with Chelsea Delaware, such as a tender offer, to do so without management’s approval, thereby making it more difficult to remove existing management of Chelsea Delaware. The Delaware statute could, therefore, potentially have an adverse impact on stockholders who wish to participate in any such tender offer or other transactions even where such transaction may be favorable to the interests of the stockholders.

The Reincorporation could have the effect of discouraging hostile tender offers, proxy contests or other transactions by forcing potential acquirors to negotiate with incumbent management. The disadvantages to

17

stockholders of the Reincorporation in Delaware include reducing the likelihood that a hostile tender offer at a premium over market price for Chelsea Delaware shares will be made. The Reincorporation will have a practical effect on stockholders by making it more difficult to remove existing management without such management’s approval.

Interested Director Transactions

Under both Delaware and Colorado law, contracts or transactions in which one or more of a corporation’s directors has an interest are generally not void or voidable because of such interest provided that certain conditions, such as obtaining the required approval and fulfilling the requirements of good faith and full disclosure, are met. With certain exceptions, the conditions are similar under Delaware and Colorado law. To authorize or ratify the transaction, under Colorado law (i) either the shareholders or the disinterested members of the board of directors must approve any such contract or transaction in good faith after full disclosure of the material facts, or (ii) the contract or transaction must have been fair as to the corporation. The same requirements apply under Delaware law, except that the fairness requirement is tested as of the time the transaction is authorized, ratified or approved by the board, the shareholders or a committee of the board. Under both Colorado and Delaware law, if board approval is sought, the contract or transaction must be approved by a majority vote of the disinterested directors (though less than a majority of a quorum), except that interested directors may be counted for purposes of establishing a quorum.

Dissolution

Colorado. If the board of directors initially approves the dissolution proposal, unless the articles of incorporation, bylaws, or the board of directors require a greater vote, the proposal must be approved by each voting group entitled to vote separately on the proposal by a majority of all the votes entitled to be cast on the proposal by that voting group. Under Colorado law, shareholders may only initiate dissolution by way of a judicial proceeding. Ivory’s Articles of Incorporation and Bylaws do not alter this provision.

Delaware. If a majority of the board of directors initially approves the dissolution proposal, the proposal must be approved by a majority of the outstanding stock of the corporation entitled to vote thereon. Dissolution of a corporation may also be authorized without director action if all the stockholders entitled to vote thereon consent in writing.

Appraisal Rights/Dissenter’s Rights

Set forth below is a summary of dissenters’ rights available to Ivory’s shareholders relating to the Reincorporation Proposal. This summary is not intended to be a complete statement of applicable Colorado law and is qualified in its entirety by reference to Article 113 of the CBCA, set forth in its entirety asAppendix D.

Right to Dissent.

Shareholders of Ivory are entitled to dissent from the Merger and Reincorporation Proposal and obtain payment of the fair value of their shares if and when the Merger is completed. A shareholder entitled to dissent and to obtain payment for their shares under Article 113 of the CBCA may not challenge the corporate action (i.e. the Reincorporation Proposal) creating the right to dissent unless the action is unlawful or fraudulent with respect to the shareholder or the corporation.

Under Section 7-113-103 of the CBCA, a record shareholder may assert dissenters’ rights as to fewer than all the shares registered in the record shareholder’s name only if the record shareholder dissents with respect to all shares beneficially owned by any one person and causes the corporation to receive written notice which states such dissent and the name, address and federal taxpayer identification number, if any, of each person on whose behalf the record shareholder asserts.

18

Section 7-113-103(2) of the CBCA provides that a beneficial shareholder may asset dissenters’ rights as to the shares held on the beneficial shareholder’s behalf only if (a) the beneficial shareholder causes the corporation to receive the record shareholder’s written consent to the dissent no later than the time the beneficial shareholder asserts dissenters’ rights, and (b) the beneficial shareholder dissents with respect to all shares beneficially owned by the beneficial shareholder.

Ivory will require that, when a record shareholder dissents with respect to the shares held by any one or more beneficial shareholders, each such beneficial shareholder must certify to Ivory that that beneficial shareholder and the record shareholder or record shareholders of all shares owned beneficially by the beneficial shareholder have asserted, or will timely assert, dissenters’ rights as to all such shares as to which there is no limitation on the ability to exercise dissenters’ rights.

Procedure for Exercise of Dissenters’ Rights.

Ivory shareholders are entitled to assert dissenters’ rights under Article 113 of the CBCA with respect to the Reincorporation Proposal. An Ivory shareholder who wishes to assert dissenters’ rights must (a) cause Ivory to receive, before the vote is taken on the Reincorporation Proposal, written notice of the shareholder’s intention to demand payment for the shareholder’ shares if the Reincorporation is effectuated; and (b) not vote the shares in favor of the Reincorporation Proposal.A shareholder who does not satisfy the foregoing requirements will not be entitled to demand payment for his or her shares under Article 113 of the CBCA.

If the Reincorporation Proposal is authorized, Ivory must give a written notice to dissenters who are entitled to demand payment for their shares. The notice required to be given by Ivory must be given no later than 10 days after the effective date of the Merger (the “Effective Date”) and (a) state that the Reincorporation Proposal was authorized and state the Effective Date or proposed Effective Date; (b) inform holders of uncertificated shares to what extent transfer of the shares will be restricted after a payment demand is received; (c) supply a form for demanding payment, which form will request a dissenter to state an address to which payment is to be made; (d) set the date by which Ivory must receive the payment demand, which date must not be less than 30 days after the date the notice is given; (e) state that if a record shareholder dissents with respect to the shares held by any one or more beneficial shareholders, each such beneficial shareholder must certify to Ivory that the beneficial shareholder and the record shareholder or record shareholders of all shares owned beneficially by the beneficial shareholder have asserted, or will timely assert, dissenters’ rights as to all such shares as to which there is no limitation of the ability to exercise dissenters’ rights; and (f) be accompanied by a copy of Article 113 of the CBCA.

A shareholder who is given a dissenters’ notice to assert dissenters’ rights and who wishes to exercise dissenters’ rights must, in accordance with the terms of the dissenters’ notice, cause Ivory to receive a payment demand, which may be a payment demand form supplied by Ivory, duly completed, or some other acceptable writing. A shareholder who demands payment in accordance with the foregoing retains all rights of a shareholder, except the right to transfer the shares, until the Effective Date, and has only the right to receive payment for the shares after the Effective Date. The demand for payment is irrevocable, except that if the Effective Date does not occur within 60 days after the date set by Ivory by which it must receive the payment demand, Ivory must release the transfer restrictions imposed on uncertificated shares. If the Effective Date occurs more than 60 days after the date set by Ivory, by which it must receive the payment demand, then Ivory must send a new dissenters’ notice.A shareholder who does not demand payment as required by the date or dates set in the dissenters’ notice is not entitled to payment for his or her shares.

At the Effective Date or upon a receipt of a payment demand, whichever is later, Ivory will pay each dissenter who complied with the notice requirements discussed above Ivory’s estimate of the fair value of the dissenter’s shares, plus accrued interest. Payment will be accompanied by Ivory’s audited balance sheet as of the end of its most recent fiscal year, an income statement for that year, an audited statement of changes in

19

shareholders’ equity for that year and an audited statement of cash flow for that year, as well as the latest available financial statements for the interim period, which interim financial statements need not be audited. Payment will also be accompanied by a statement of Ivory’s estimate of the fair value of the shares and an explanation of how the interest was calculated, along with a statement of the dissenter’s right to demand payment if the dissenter is dissatisfied with the payment and a copy of Article 113 of the CBCA.

If a dissenter is dissatisfied with the payment, the dissenter may give notice to Ivory in writing of the dissenter’s estimate of fair value of the dissenter’s shares and of the amount of interest due and may demand payment of such estimate, less any payment made prior to such notice, or the dissenter may reject Ivory’s offer and demand payment of the fair value of the shares and interest due if: (a) the dissenter believes that the amount paid or offered is less than the fair value of the shares or that the interest was incorrectly calculated; (b) Ivory fails to make payment within 60 days after the date set by Ivory by which it must receive the payment demand; or (c) Ivory does not release the transfer restrictions imposed on uncertificated shares, then Ivory must send a new dissenters’ notice.A dissenter waives the right to demand payment under this paragraph unless the dissenter causes Ivory to receive the notice required within 30 days after Ivory made or offered payment for the shares of the dissenter.

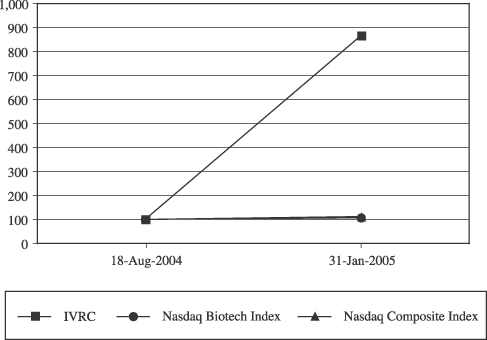

Judicial Appraisal of Shares.