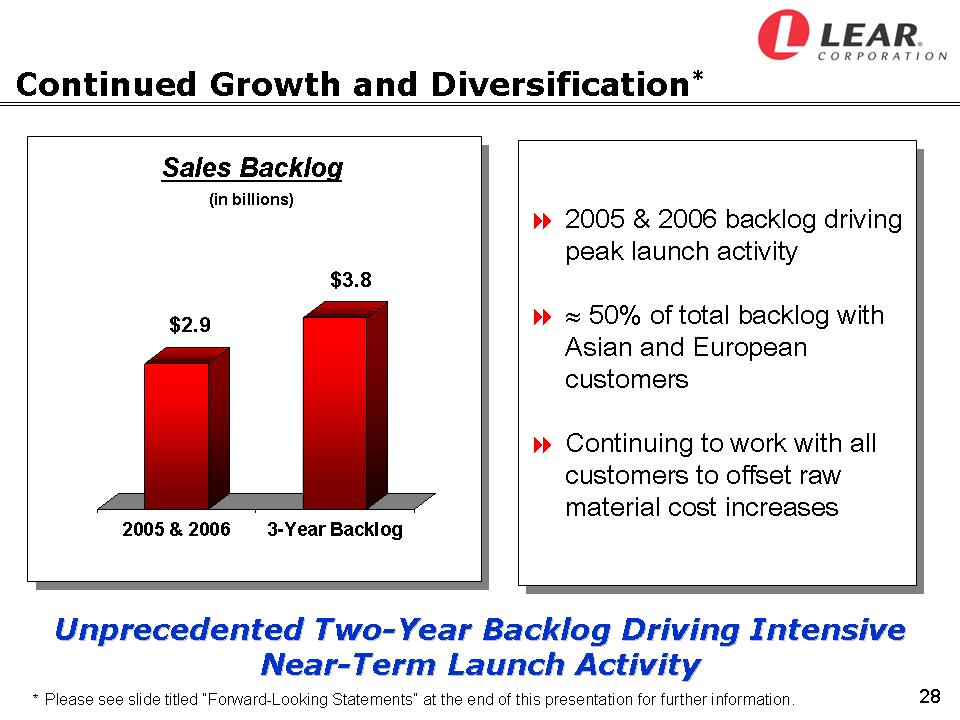

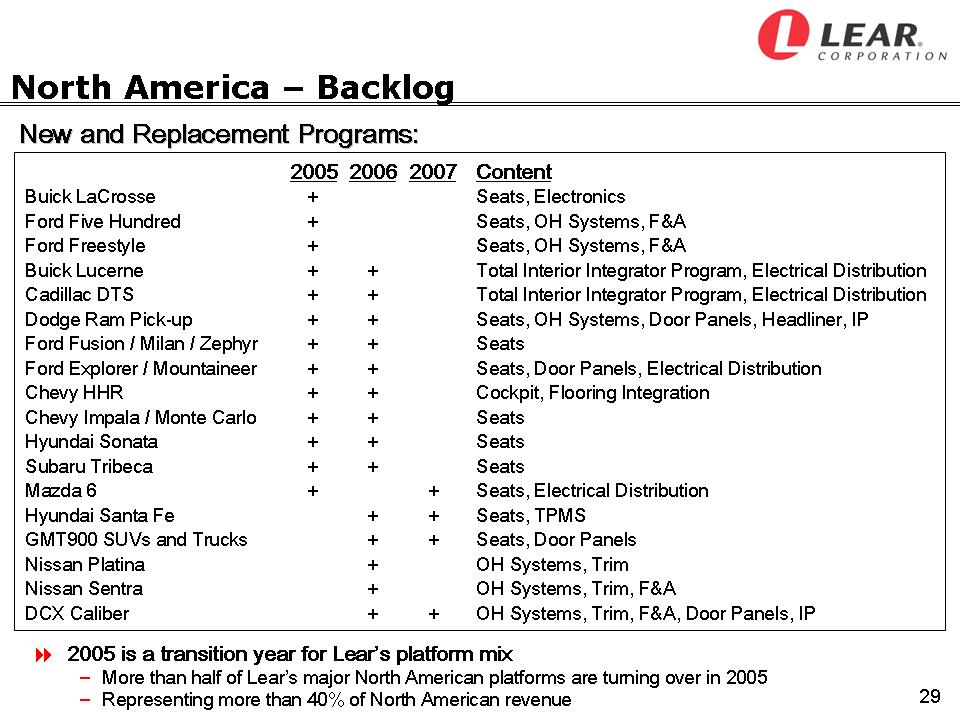

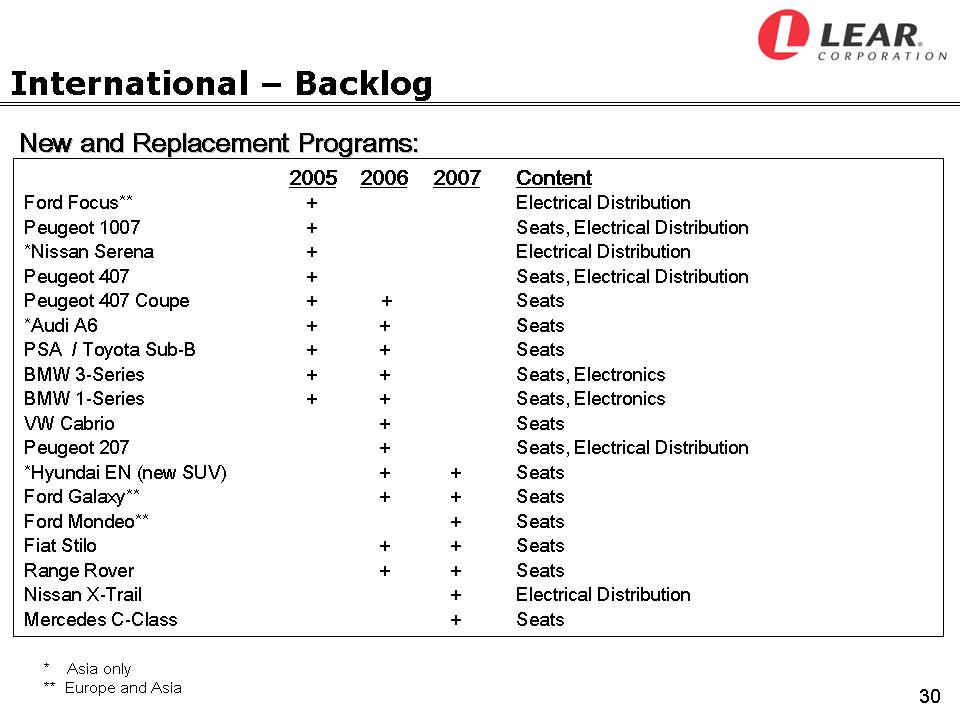

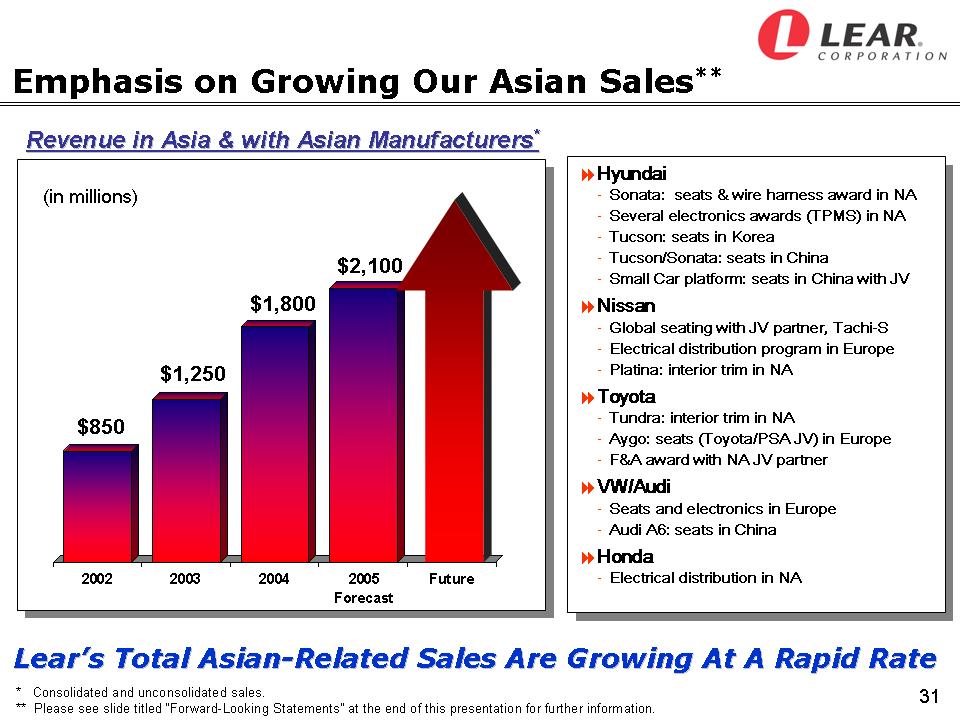

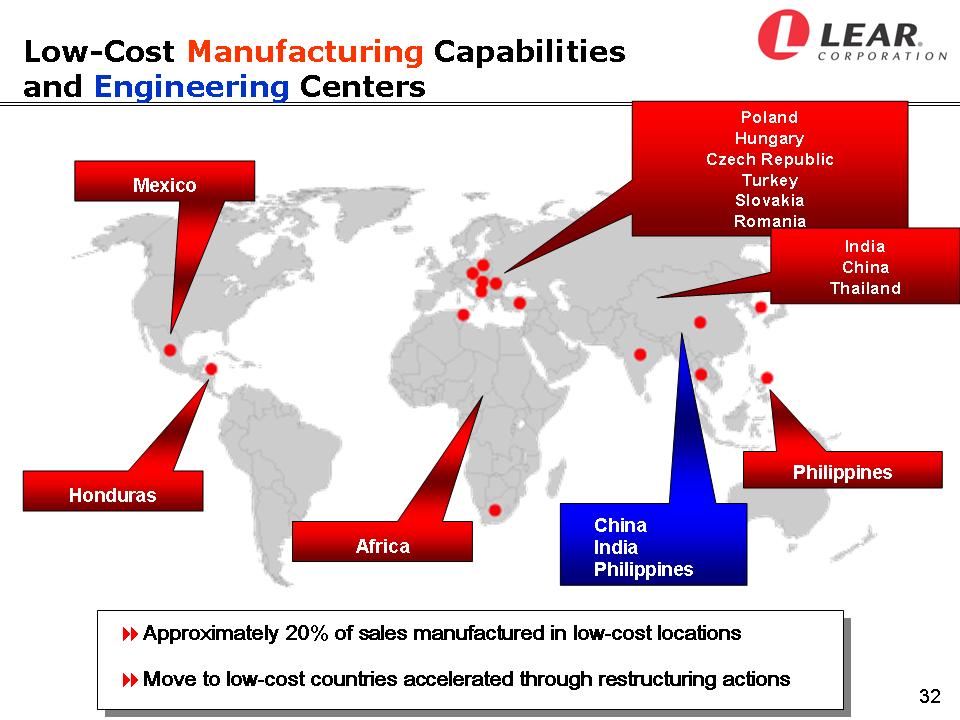

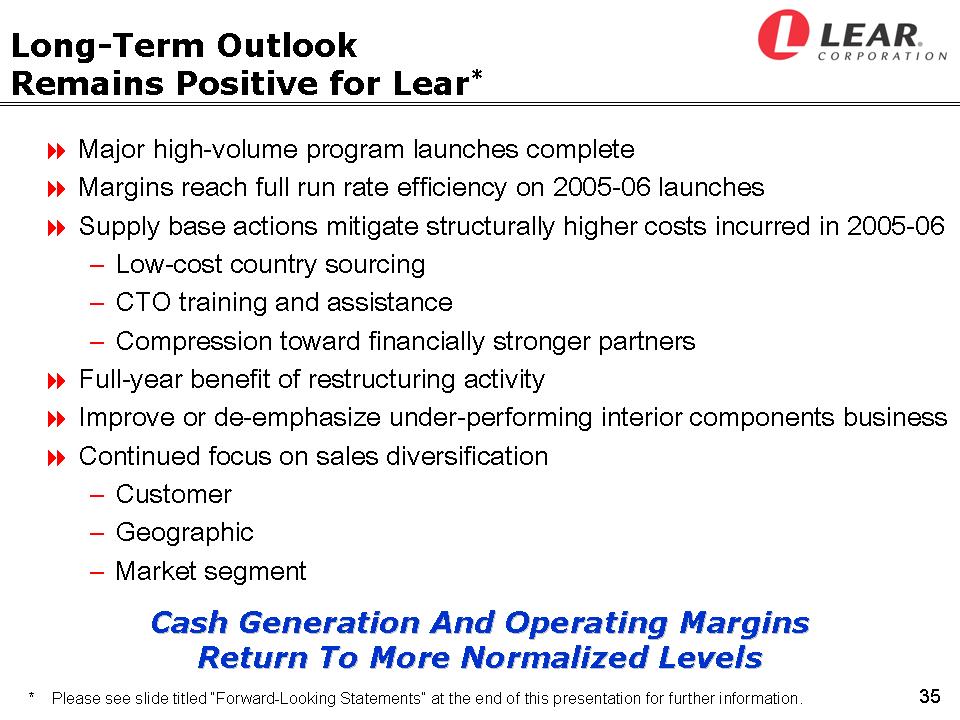

| This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including statements regarding anticipated financial results. Actual results may differ materially from anticipated results as a result of certain risks and uncertainties, including but not limited to, general economic conditions in the markets in which the Company operates, fluctuations in the production of vehicles for which the Company is a supplier, labor disputes involving the Company or its significant customers or suppliers or that otherwise affect the Company, the Company's ability to achieve cost reductions that offset or exceed customer-mandated selling price reductions, the outcome of customer productivity negotiations, the impact and timing of program launch costs, the costs and timing of facility closures, business realignment or similar actions, increases in the Company's warranty or product liability costs, risks associated with conducting business in foreign countries, competitive conditions impacting the Company's key customers, raw material cost and availability, the Company's ability to mitigate the significant impact of recent increases in raw material, energy and commodity costs, the outcome of legal or regulatory proceedings to which the Company is or may become a party, unanticipated changes in free cash flow, the finalization of the Company's restructuring plan, potential impairment or other charges related to the implementation of the Company's business strategy or adverse industry conditions and other risks described from time to time in the Company's Securities and Exchange Commission filings. This presentation also contains information on the Company's sales backlog. The Company's incremental sales backlog reflects: anticipated net sales from awarded new programs, less net sales from phased-out and cancelled programs. The calculation of backlog does not reflect customer price reductions on existing or newly-awarded programs. The three-year backlog may be impacted by various assumptions embedded in the calculation, including vehicle production levels on new and replacement programs, foreign exchange rates and the timing of program launches. In addition, the third-quarter and full-year 2005 per share earnings guidance is based on an assumed 67 million shares outstanding. The third-quarter and full-year assumed shares exclude 4.8 million shares related to the Company's outstanding convertible debt, as well as outstanding options and restricted stock units, as inclusion at the mid-point of the guidance ranges would have resulted in antidilution. The forward-looking statements in this presentation, including the Company's financial outlook, are made as of the date hereof, and the Company does not assume any obligation to update them to reflect events, new information or circumstances occurring after the date hereof. Forward-Looking Statements |