November 6, 2007

Third-Quarter 2007 Results and

Financial Outlook

Exhibit 99.2

Agenda

Company Overview

Bob Rossiter, Chairman, CEO and President

Business Conditions

Jim Vandenberghe, Vice Chairman

Third-Quarter 2007 Results and Outlook

Matt Simoncini, Chief Financial Officer

Q and A Session

2

Company Overview

3

Company Overview

Lear has implemented a number of significant actions

to improve shareholder value

Despite challenging business conditions, we are

continuing to improve our financial results

Seating business performing well; electrical and

electronic business needs further improvement

Aggressively growing in Asia and with Asian

manufacturers globally

Priority focus on delivering superior quality and

customer service continues

4

Actions to Improve Shareholder Value*

Implementing global restructuring initiative

Refinanced 2007-2009 debt maturities

Divested Interior business; retained minority interest

in IAC joint ventures

Revitalized strategic focus on “growth”

Strategic Actions To Improve Shareholder Value Have

Improved Financial Results, Increased Financial

Flexibility And Enhanced Future Competitiveness

* Please see slide titled “Forward-Looking Statements” at the end of this presentation for further information.

5

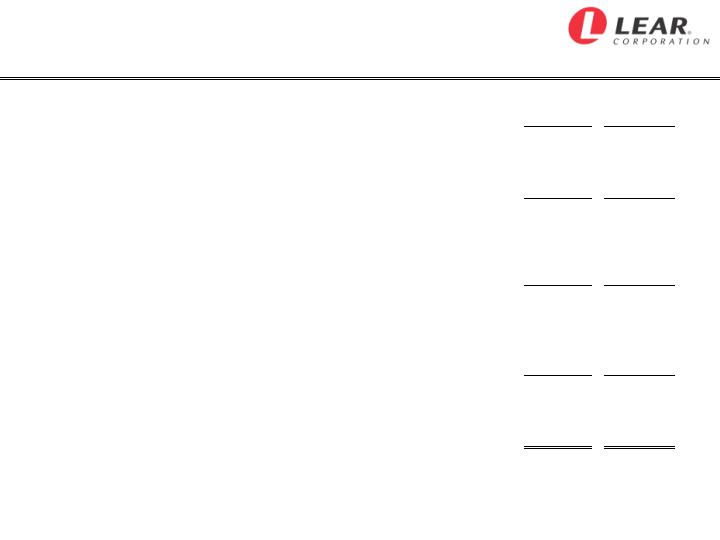

Strategic Assessment

Seating Systems*

Lear has a strong competitive position globally

Business performing well today

Market Environment

Please see slide titled “Forward-Looking Statements” at the end of this presentation for further information.

Core Strategies

Business Outlook

Core strategies support a leading competitive position globally

Leverage global leadership in systems integration

Achieve lowest cost global footprint

Expand capabilities in value-added components

Further sales growth and diversification

6

Strategic Assessment

Electrical and Electronic Segment*

Fierce global competition is depressing margins

Increasing consumer demand for electrical content in vehicles

(i.e., safety-related features, infotainment and power equipment )

Please see slide titled “Forward-Looking Statements” at the end of this presentation for further information.

Business Outlook

Core Strategies

Market Environment

Further develop system integration capabilities

Achieve lowest cost global footprint

Capitalize on emerging technologies in power distribution and

growth in value-added electronic products

Margin pressure as industry restructures and consolidates

Significant new business coming on line over next few years

Solid future opportunity by strengthening global position in

power distribution and growing electronic business

7

Update on IAC Joint Ventures

IAC provides opportunity for future success of Interior business

Industry consolidation, restructuring and business integration in this

segment is on-track

Lear positioned to participate in improving business fundamentals

IAC–Europe

Annual sales of over $1 billion

Lear holds a 34% minority interest in IAC-Europe

IAC–North America

Recently completed acquisition of Collins & Aikman’s (C&A) soft

trim business

Annual sales now total about $3 billion

Lear settled contingent liabilities and invested an additional

$32 million for its share of the C&A acquisition

Lear now holds a 19% minority interest in IAC-NA

8

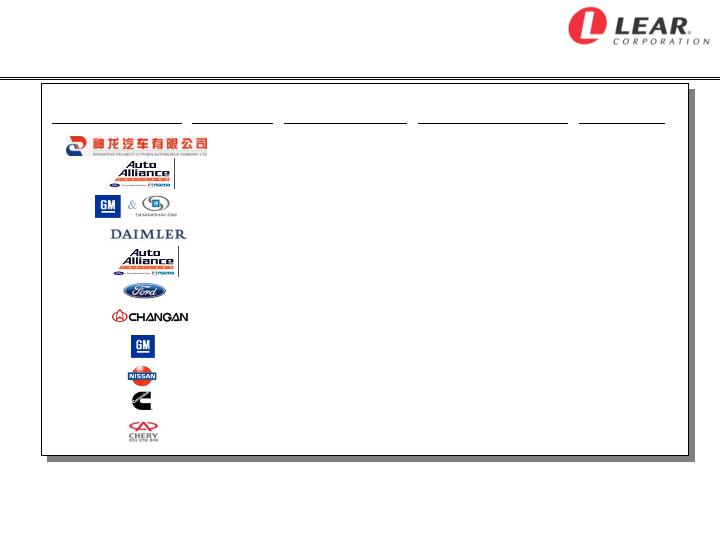

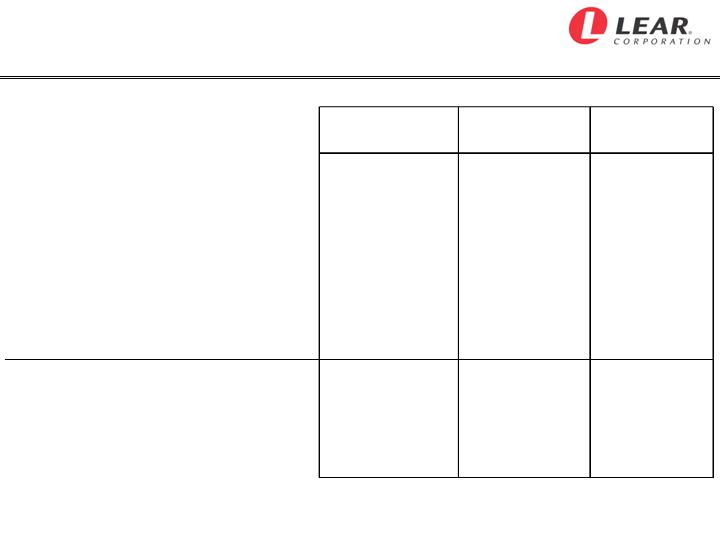

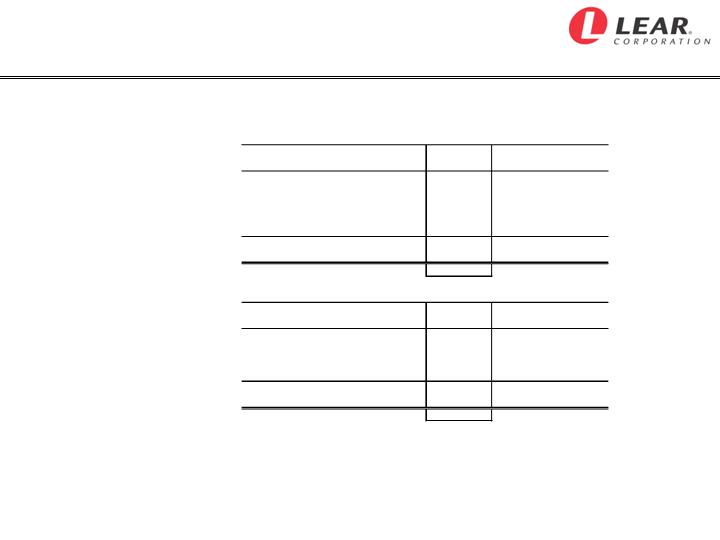

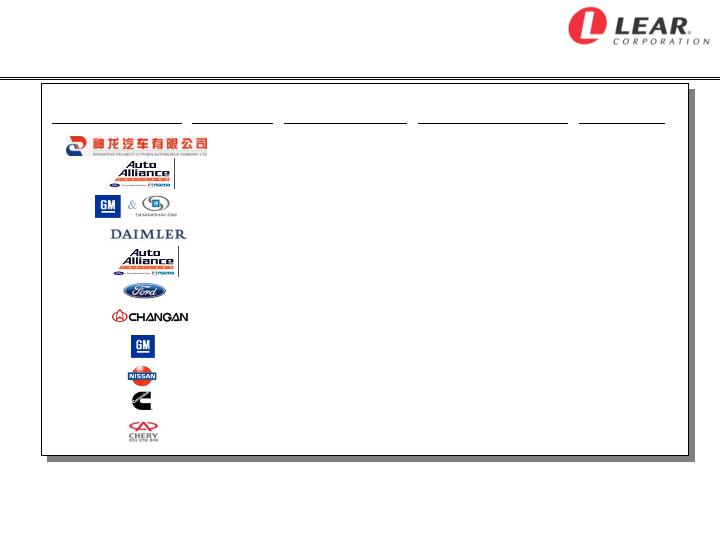

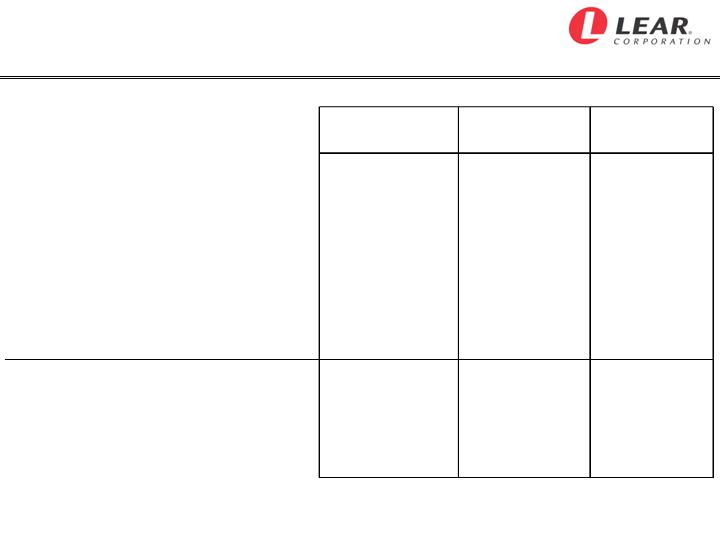

New Asian Program Awards in Third Quarter**

New Asian Business Awarded In Third Quarter

Worth About $245 Million Annually*

* Includes consolidated and non-consolidated sales.

** Please see slide titled “Forward-Looking Statements” at the end of this presentation for further information.

Automaker

Market

Lear Content

Future Vehicle

Program(s)

SOP

DPCA

China

Seats

W2/X7

2009/2011

Ford/AAT

Thai/S.Afr.

Wire Harnesses

T6 Ranger

2010/2011

*GM

China/India

Seats

M300/T300

2009/2010

DCX

China

Seats

W204/C Class

January 2008

Australia

Seat Trim/Map Pocket

Orion/Territory

November 2007

Thai/S.Afr.

Junction Box

T6 Ranger

2010/2011

China

Seats

CM9/V101

October 2007

India

Wire Harnesses

M300

February 2010

Nissan

Global

Wire Harnesses

Dualis

December 2007

China

Wire Harnesses

Cummins Diesel

January 2009

China

TPMS

B12/B21/B22/B23

2008/2009

China

Door Trim/Headliner

CM9

Oct-07

9

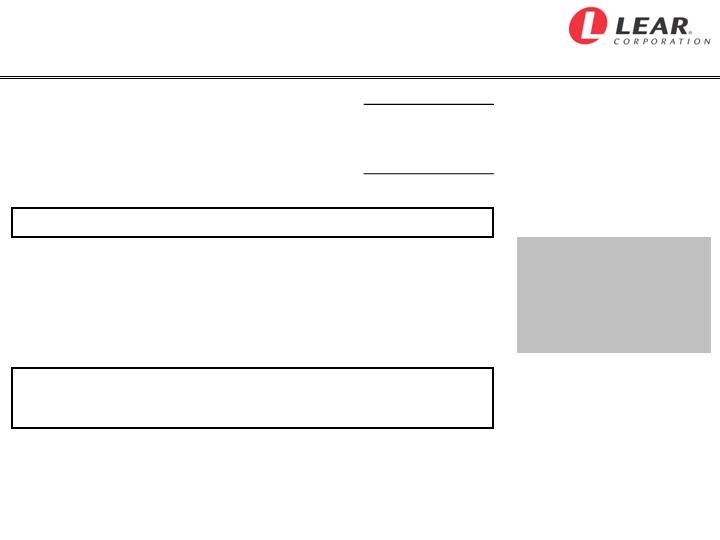

Major Customer Awards and Industry Recognition

“Supplier of the Year” for global Seating Systems

3 World Excellence Awards--

"Gold Award” at Genk, Belgium seating plant

"Silver Award” and "Recognition of Achievement for consumer-driven Six-Sigma”

at St. Thomas, Ontario Canada seating plant

“Superior Supplier Diversity” and

“Excellence in Quality” at Edinburgh, Indiana

“Outstanding Performance – Quality and Delivery”

at East London, South Africa

“Excellence in Performance” for Wire Harnesses

“Outstanding Supplier Performance Award” at Boeblingen, Germany

“Value Analysis / Value Engineering Performance Award” and

“Value Analysis Award” for most cost saving ideas generated

“Supplier Award for Successful Partnership” in Brazil

“Supplier of the Year” at Liuzhou, China

“…Most Impressive Stereo Sound in the World”

(from March 2007 review of Lear’s premium sound system in the BMW M5)

Environmental Innovation Award 2007 for SoyFoam™

(Institute for Transport Management)

Customer Awards

Industry Recognition

10

Business Conditions

11

Present Business Environment

Macro Economic Factors

Positives: U.S. interest rates and key commodity prices moderating

Risks: consumer credit, weak housing sector and high oil prices

Volatile capital markets

Industry Production

Relatively stable in North America and Europe

Full-size pick-up trucks and large SUVs down from 2004 peak

Continued growth and business development in key Asian markets

Industry Developments

Supplier consolidation and restructuring continues

New pattern UAW labor agreement in place

12

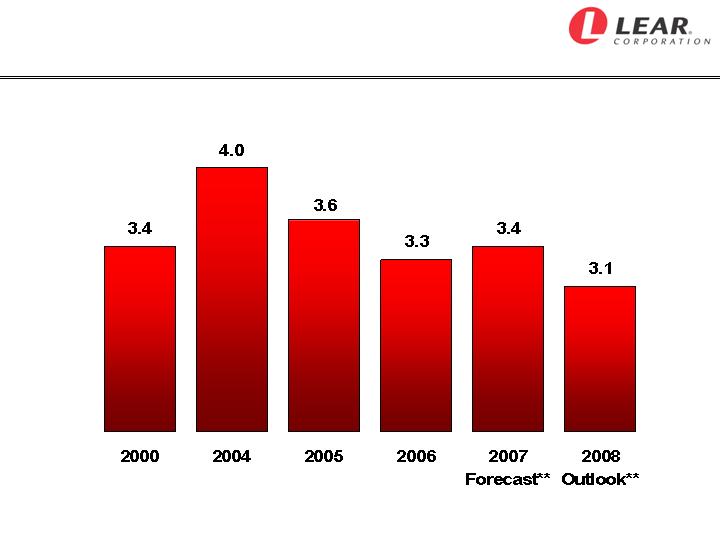

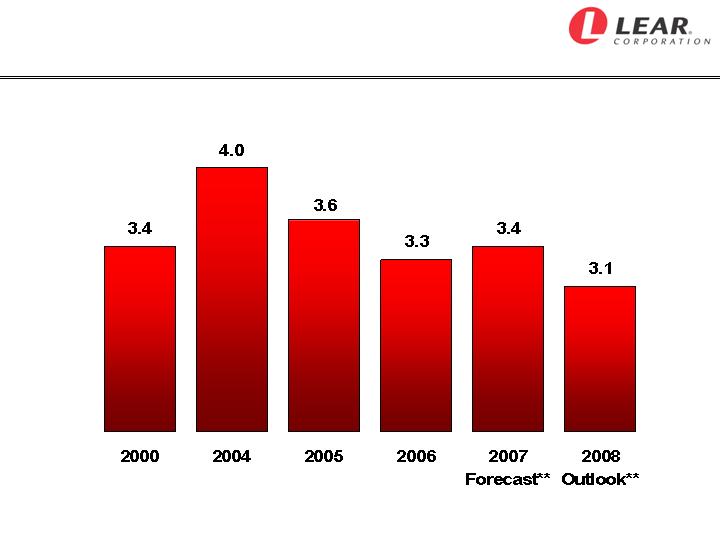

Lower Production Of Full-Size Pick-Ups And

Large SUVs In North America Since 2004 Peak*

* Please see slide titled “Forward-Looking Statements” at the end of this presentation for further information.

** 2007 Forecast and 2008 Outlook reflects CSM Worldwide forecast/outlook.

Production of Full-Size Pick-Ups and Large SUVs in North America

(in millions of units)

13

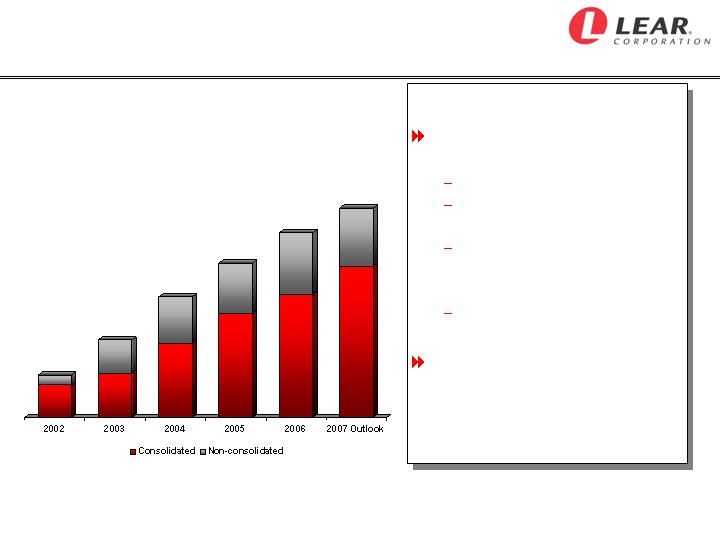

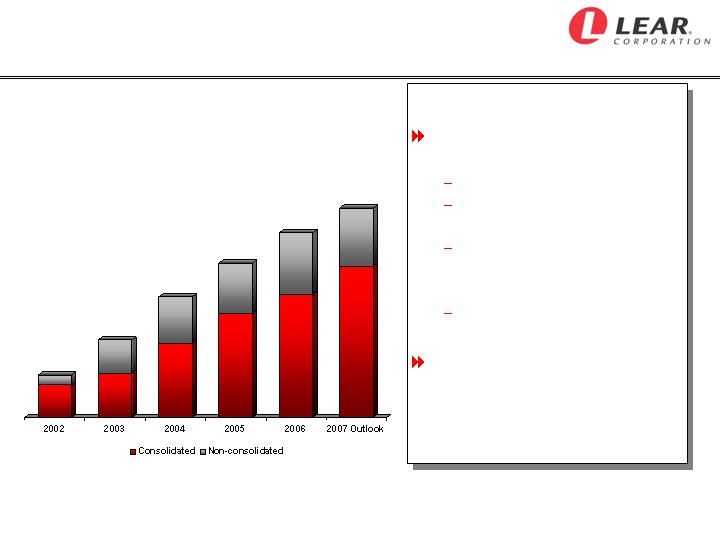

Aggressively Growing Total Asian Sales***

Total Asian Sales -- Core Businesses **

($ in millions)

2007 Highlights

Significant market position

in China:

Total sales > $700 million*

Supply 20+ OEMs on

> 100 vehicle programs

19 manufacturing facilities

with approximately 6,000

employees

Lear’s fastest growing

market

11 new facilities in China

and India supporting Ford,

Mazda, Chery, Tata, M&M,

BMW and Hyundai

* Includes consolidated and non-consolidated sales.

$500

$950

$1,450

$1,850

~$2,850

$2,200

Targeting Continued Asian Growth

** Includes sales in Asia and with Asian manufacturers globally.

*** Please see slide titled “Forward-Looking Statements” at the end of this presentation for further information.

14

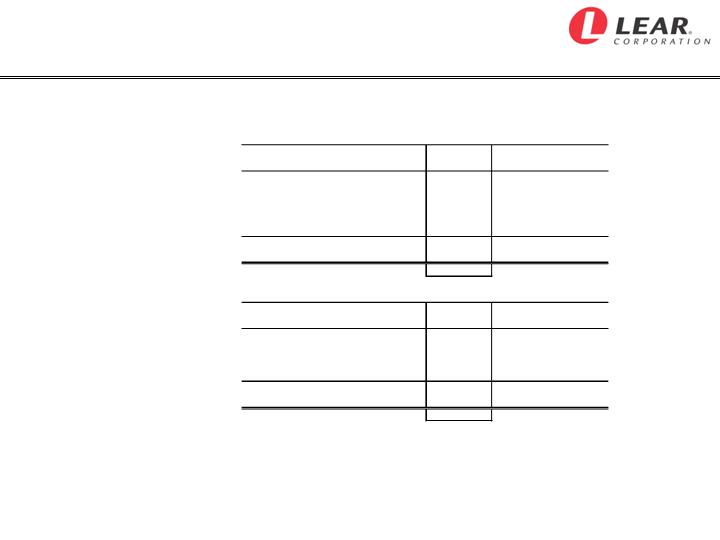

Restructuring Plan Update

$104

~$125

~

$100

0

25

50

75

100

125

150

2005

2006

2007 Outlook

~$70

~

~$125

~

~$150

~

0

50

100

150

2006

2007 Outlook

Ongoing Annual

Restructuring Investments

Estimated Annual Savings

($ in millions)

($ in millions)

$

YTD $88

$

Objectives: eliminate excess capacity, improve operating efficiency in

response to structural changes within the industry and accelerate our move

move to low-cost countries.

Present Status: closure of 17 manufacturing facilities, numerous

consolidations of administrative centers and technical locations, reduced

global headcount by over 5% and increased sourcing and engineering in

low-cost countries.

Investment: implementing a $300 million overall restructuring plan. We

now expect to invest an additional $25 million this year, bringing the total to

about $325 million.

Savings: estimated savings for 2007 and ongoing increased to reflect

additional investment and improved payback.

15

New Pattern UAW Labor Agreement

New pattern UAW contract reached without a major production disruption

Major contract provisions significantly improve automaker competitiveness

and preserve union benefits

Agreements include an innovative VEBA trust for retiree health care

liability, a second-tier wage and benefit structure and restrictions on further

outsourcing

We intend to maintain a fully-competitive wage and benefit structure going

forward

We do not see a fundamental change in the overall sourcing patterns for

our core seating, electrical distribution and electronic products

16

Third-Quarter 2007

Results and Outlook

17

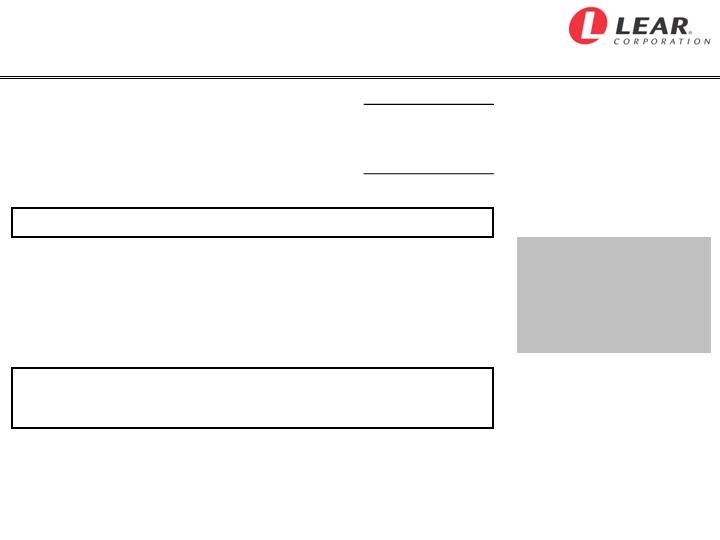

Third-Quarter special items include:

Costs related to restructuring actions

Costs related to AREP merger transaction

Settlement of transaction-related items from divestiture of Interior

business

Third-Quarter core operating earnings were $170 million, up $70 million

from a year ago, reflecting:

Favorable cost performance and operating efficiencies

Net savings from restructuring initiative

Benefit of new business outside of North America

Full-Year outlook increased to reflect lower production risk and more

favorable operating performance:

Core operating earnings increased to $680 million range

Free cash flow now expected in the $350 million range

Financial Summary*

* Core operating earnings represent income before interest, other expense, income taxes, restructuring costs and other special items, excluding the

divested Interior business. Free cash flow represents net cash provided by operating activities before the net change in sold accounts receivable, less

capital expenditures. Please see slides titled “Non-GAAP Financial Information” and “Forward Looking Statements” at the end of this presentation for

further information.

18

Third Quarter 2007

Industry Environment

Third Quarter

Third Quarter

2007

2007 vs. 2006

North American Production

Industry

3.5 mil

Up 4%

Big Three

2.2 mil

Up 1%

Lear's Top 15 Platforms

1.1 mil

Down 1%

European Production

Industry

4.3 mil

Up 2%

Lear's Top 5 Customers

2.2 mil

Up 2%

Key Commodities (Quarterly Average)

vs. Prior Quarter

Steel (Hot Rolled)

Down 6%

Down 15%

Crude Oil

Up 16%

Up 7%

Copper

Flat

Down 1%

19

Third Quarter 2007

Reported Financial Results

20

* Please see slides titled “Non-GAAP Financial Information” at the end of this presentation for further information.

(in millions, except net income per share)

Third

Quarter 2007

Third

Quarter 2006

3Q '07

B/(W) 3Q '06

Net Sales

$3,574.6

$4,069.7

($495.1)

Income Before Interest, Other Expense and

Income Taxes*

$108.0

$28.8

$79.2

Pretax Income (Loss)

$60.1

($65.9)

$126.0

Net Income (Loss)

$41.0

($74.0)

$115.0

Net Income (Loss) Per Share

$0.52

($1.10)

$1.62

SG&A % of Net Sales

4.5

%

3.9

%

(0.6)

pts.

Interest Expense

$47.5

$56.6

$9.1

Depreciation / Amortization

$70.7

$98.1

$27.4

Other Expense, Net

$17.5

$9.4

($8.1)

Third Quarter 2007

Restructuring Costs and Other Special Items*

21

* Please see slides titled “Non-GAAP Financial Information” at the end of this presentation for further information.

Third Quarter

(in millions)

Income Before

Interest, Other

Expense and

Income Taxes

Reported Results

2007 Total Company

$ 108.0

Reported Results Include the Following Items:

COGS

SG&A

Costs related to restructuring actions

$ 37.3

35.3

$

2.0

$

Costs related to merger transaction

25.1

-

25.1

2007 Core Operating Earnings

170.4

$

2006 Core Operating Earnings

100.1

$

Income Statement Category

Third Quarter 2007

Net Sales Changes and Margin Impact Versus Prior Year

22

Net Sales

Margin

Performance Factor

Change

Impact

Comments

(in millions)

Industry Production /

Platform Mix / Net Pricing

$ (64)

Negative

Primarily industry pricing and unfavorable

platform mix in North America offset in part

by favorable industry production

Global New Business

174

Positive

Mainly seating programs outside North

America

F/X Translation

149

Neutral

Euro up 8%, Canadian dollar up 7%

Acquisition / Divestiture

(754)

Positive

Divestiture of Interior business

Performance

Positive

Favorable operating performance in core

businesses, including benefits from

restructuring actions and efficiency actions

Third Quarter 2007

Business Segment Results***

23

* Reported segment earnings represent income (loss) before interest, other expense and income taxes.

** Adjusted earnings and margin exclude restructuring costs and other special items as follows – in the third quarter of 2007, adjustments for seating -

$19.5M, electrical and electronic - $9.8M, HQ - $33.1M and core business and total company - $62.4M and in the third quarter of 2006, adjustments for

seating - $7.8M, electrical and electronic - $7.1M, HQ - $0.6M, core business - $15.5M and total company - $17.4M.

*** Please see slides titled “Non-GAAP Financial Information” at the end of this presentation for further information.

($ in millions)

Seating

Margin

Margin

Net Sales

2,881.4

$

2,633.0

$

Reported Segment Earnings*

181.2

$

6.3%

125.6

$

4.8%

Adjusted Earnings**

200.7

$

7.0%

133.4

$

5.1%

Electrical and Electronic

Net Sales

693.2

$

682.6

$

Reported Segment Earnings*

4.0

$

0.6%

16.4

$

2.4%

Adjusted Earnings**

13.8

$

2.0%

23.5

$

3.4%

Headquarters Costs

Reported Segment Earnings*

(77.2)

$

(57.4)

$

Adjusted Earnings**

(44.1)

$

(56.8)

$

Core Business

Net Sales

3,574.6

$

3,315.6

$

Reported Earnings*

108.0

$

3.0%

84.6

$

2.6%

Adjusted Earnings**

170.4

$

4.8%

100.1

$

3.0%

Total Company

Net Sales

3,574.6

$

4,069.7

$

Reported Earnings*

108.0

$

3.0%

28.8

$

0.7%

Adjusted Earnings**

170.4

$

4.8%

46.2

$

1.1%

2007

2006

Third Quarter

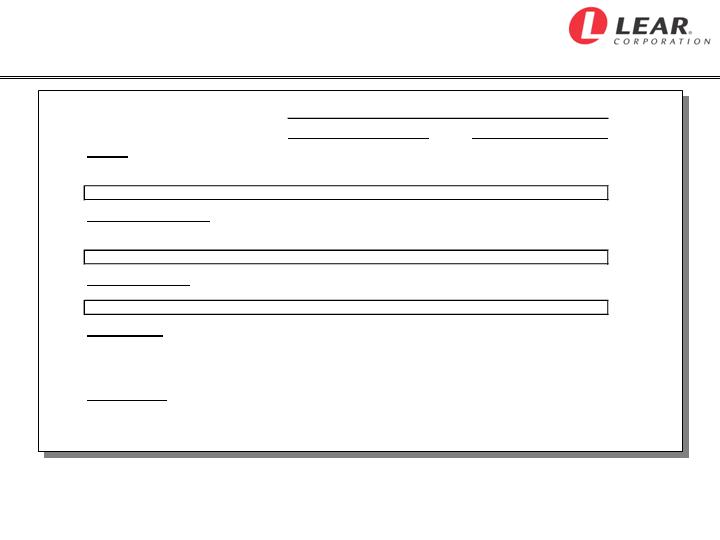

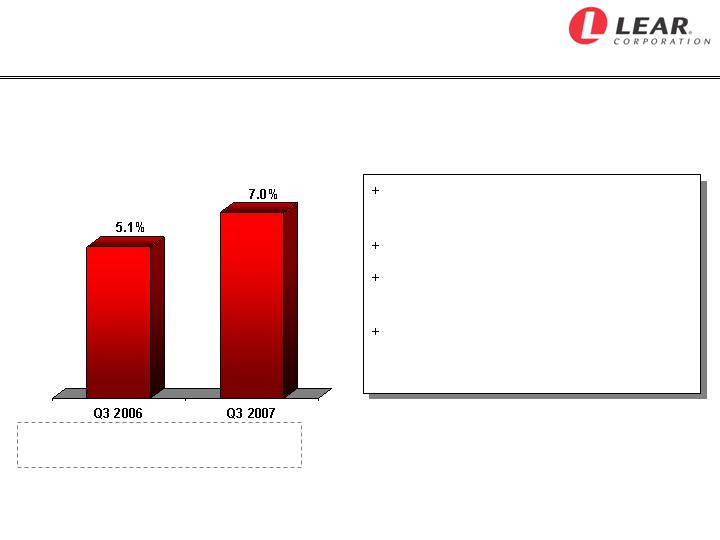

Third Quarter 2007

Seating Segment Performance*

Explanation of

Year-to-Year Change

Favorable cost performance from

restructuring

On-going efficiency actions

Margin improvement actions,

including selective vertical integration

Benefit of new business, primarily

outside of North America

* Please see slides titled “Non-GAAP Financial Information” at the end of this presentation for further information.

Adj. Seg.

Earnings

(in millions)

$133.4 $200.7

Adjusted Seating Margin

24

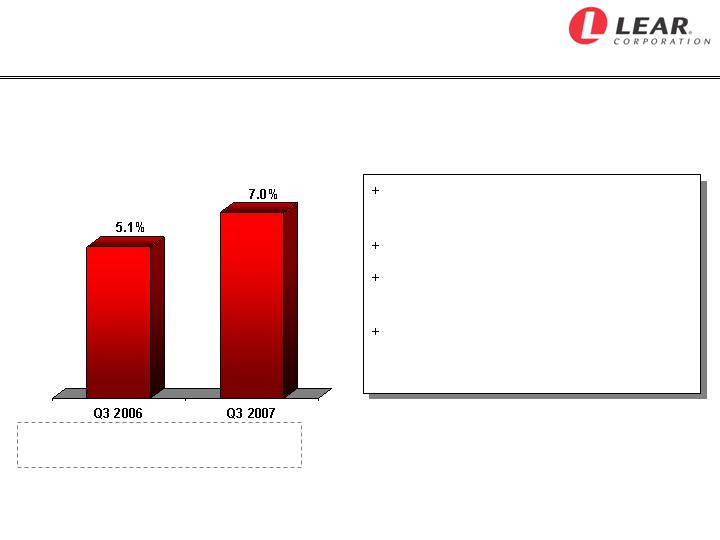

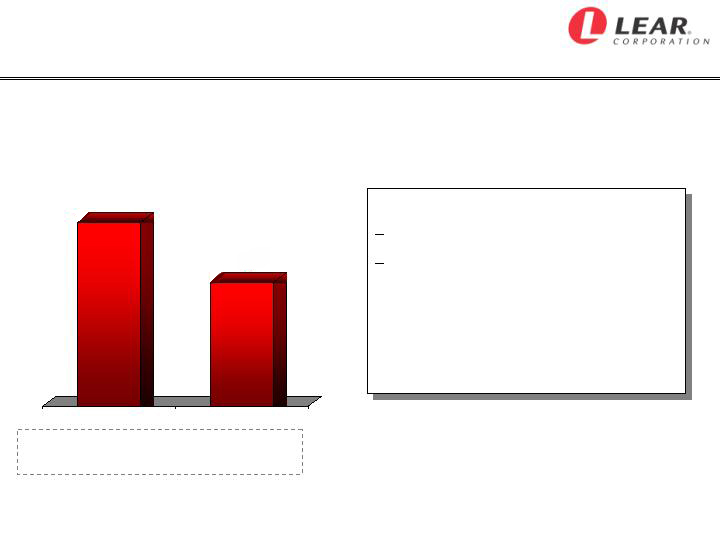

Third Quarter 2007

Electrical and Electronic Segment Performance*

Explanation of

Year-to-Year Change

Unfavorable net pricing

Roll-off of several large programs

in North America

+ Slightly lower copper prices and

favorable prior period recovery

3.4%

2.0%

Q3 2006

Q3 2007

Adj. Seg.

Earnings

(in millions)

$23.5 $13.8

Adjusted

Electrical and Electronic Margin

* Please see slides titled “Non-GAAP Financial Information” at the end of this presentation for further information.

25

Third Quarter 2007

Free Cash Flow*

* Free Cash Flow represents net cash provided by operating activities ($62.0 million for the three months and $309.5 million for

the nine months ended 9/29/07) before net change in sold accounts receivable ($74.6 million for the three months and $67.3

million for the nine months ended 09/29/07) (Cash from Operations), less capital expenditures. Please see slides titled “Non-

GAAP Financial Information” at the end of this presentation for further information.

Third

Quarter 2007

Nine Months

2007

Net Income

$ 41.0

$ 214.5

Depreciation / Amortization

70.7

220.9

Working Capital / Other

24.9

(58.6)

Cash from Operations

$ 136.6

$ 376.8

Capital Expenditures

(45.8)

(114.1)

Free Cash Flow

$ 90.8

$ 262.7

(in millions)

26

2007 Outlook

Full-Year Production Assumptions*

Full-Year

Change from

2007 Outlook

Prior Year

North American Production

Total Industry

~ 15.0 mil

~

down 2%

Big Three

~ 9.4 mil

~

down 6%

Lear's Top 15 Platforms

~ 4.5 mil

~

down 8%

European Production

Total Industry

~ 19.7 mil

~

up 3%

Lear's Top 5 Customers

~10.1 mil

~

up 3%

Euro

$1.35 / Euro

up 8%

* Please see slide titled “Forward-Looking Statements” at the end of this presentation for further information.

27

2007 Outlook

Full-Year Financial Forecast*

2007 Full-Year

Financial Forecast

for Core Businesses

Net Sales

~ $15 billion

~

Core Operating Earnings

~ $680 million

~

Income before interest, other expense,

income taxes, restructuring

costs and other special items

Interest Expense

~ $200 million

~

Pretax Income

~ $430 million

~

before restructuring costs

and other special items

Estimated Tax Expense

~ $135 million

~

**

Pretax Restructuring Costs

~ $125 million

~

Capital Spending

~ $200 million

~

Depreciation and Amortization

~ $300 million

~

Free Cash Flow

~ $350 million

~

** Subject to actual mix of earnings by country.

* Please see slides titled “Non-GAAP Financial Information” and “Forward-Looking Statements” at the end of this presentation for

further information.

28

Preliminary 2008 Outlook*

Industry Production Preliminary 2008 Assessment

North America - Generally in-line with 2007 outlook

Europe - Up slightly from 2007 outlook

Lear Factors

Sales Backlog - About $300 million

N.A. Platform Mix - Negative, reflecting lower production of

�� full-size pick-up trucks and large SUVs

Selected 2008 Financial Metrics

Net Sales - About flat with 2007 outlook

Core Operating Earnings - Generally in-line with 2007 outlook

(excluding restructuring-related costs)

* Please see slide titled “Forward-Looking Statements” at the end of this presentation for further information.

29

Summary and Outlook*

Lear is financially sound

Nine months financial results show solid improvement

Full-year 2007 earnings and cash flow forecast increased

Making progress on strategic priorities

Completed divestiture of Interior business

Expanding in Asia and growing Asian sales globally

Implementing global restructuring initiative

Actively evaluating options to strengthen and grow our

Electrical and Electronic business

Preliminary 2008 financial outlook in-line with 2007

Despite lower forecast production for full-size pick-ups and

large SUVs in North America

Longer-term outlook for Lear continues to be positive

Please see slide titled “Forward-Looking Statements” at the end of this presentation for further information.

30

ADVANCE RELENTLESSLY™

www.lear.com

LEA

NYSE

Listed

R

31

In addition to the results reported in accordance with accounting principles generally accepted in the United States (“GAAP”) included

throughout this presentation, the Company has provided information regarding “income before interest, other expense and income taxes,”

“income before interest, other expense, income taxes, restructuring costs and other special items, excluding the divested Interior business”

(core operating earnings), “pretax income before restructuring costs and other special items” and “free cash flow” (each, a non-GAAP

financial measure). Other expense includes, among other things, state and local non-income taxes, foreign exchange gains and losses,

fees associated with the Company’s asset-backed securitization and factoring facilities, minority interests in consolidated subsidiaries,

equity in net income of affiliates and gains and losses on the sale of assets. Free cash flow represents net cash provided by operating

activities before the net change in sold accounts receivable, less capital expenditures. The Company believes it is appropriate to exclude

the net change in sold accounts receivable in the calculation of free cash flow since the sale of receivables may be viewed as a substitute

for borrowing activity.

Management believes the non-GAAP financial measures used in this presentation are useful to both management and investors in their

analysis of the Company’s financial position and results of operations. In particular, management believes that income before interest, other

expense and income taxes, core operating earnings and pretax income before restructuring costs and other special items are useful

measures in assessing the Company’s financial performance by excluding certain items (including those items that are included in other

expense) that are not indicative of the Company's core operating earnings or that may obscure trends useful in evaluating the Company’s

continuing operating activities. Management also believes that these measures are useful to both management and investors in their

analysis of the Company's results of operations and provide improved comparability between fiscal periods. Management believes that free

cash flow is useful to both management and investors in their analysis of the Company’s ability to service and repay its debt. Further,

management uses these non-GAAP financial measures for planning and forecasting in future periods.

Income before interest, other expense and income taxes, core operating earnings, pretax income before restructuring costs and other

special items and free cash flow should not be considered in isolation or as a substitute for pretax income (loss), net income (loss), cash

provided by operating activities or other income statement or cash flow statement data prepared in accordance with GAAP or as a measure

of profitability or liquidity. In addition, the calculation of free cash flow does not reflect cash used to service debt and therefore, does not

reflect funds available for investment or other discretionary uses. Also, these non-GAAP financial measures, as determined and presented

by the Company, may not be comparable to related or similarly titled measures reported by other companies.

Set forth on the following slides are reconciliations of these non-GAAP financial measures to the most directly comparable financial

measures calculated and presented in accordance with GAAP. Given the inherent uncertainty regarding special items, other expense and

the net change in sold accounts receivable in any future period, a reconciliation of forward-looking financial measures to the most directly

comparable financial measures calculated and presented in accordance with GAAP is not feasible. The magnitude of these items, however,

may be significant.

Non-GAAP Financial Information

32

Non-GAAP Financial Information

Core Operating Earnings

Three Months

(in millions)

Q3 2007

Q3 2006

Pretax income (loss)

$ 60.1

$ (65.9)

Divestiture of Interior business

(17.1)

28.7

Interest expense

47.5

56.6

Other expense, net *

17.5

9.4

Income before interest, other expense and income taxes

$ 108.0

$ 28.8

Costs related to restructuring actions

37.3

17.4

Costs related to merger transaction

25.1

-

Income before interest, other expense, income taxes,

restructuring costs and other special items

170.4

$

46.2

$

Less: Interior business

-

53.9

Income before interest, other expense, income taxes, restructuring

costs and other special items, excluding the divested Interior

business

$ 170.4

$ 100.1

(core operating earnings)

* Includes minority interests in consolidated subsidiaries and equity in net income of affiliates.

33

Non-GAAP Financial Information

Segment Earnings Reconciliation

Three Months

(in millions)

Q3 2007

Q3 2006

Seating

$ 181.2

$ 125.6

Electrical and electronic

4.0

16.4

Interior

-

(55.8)

Segment earnings

185.2

86.2

Corporate and geographic headquarters and elimination of

intercompany activity

(77.2)

(57.4)

Income before interest, other expense and income taxes

$ 108.0

$ 28.8

Divestiture of Interior business

(17.1)

28.7

Interest expense

47.5

56.6

Other expense, net

17.5

9.4

Pretax income (loss)

$ 60.1

$ (65.9)

34

Non-GAAP Financial Information

Adjusted Segment Earnings

35

Three Months Q3 2007

Electrical and

HQ/

Core

Total

(in millions)

Seating

Electronic

Other

Businesses

Interior

Company

Segment earnings

181.2

$

4.0

$

(77.2)

$

108.0

$

-

$

108.0

$

Costs related to restructuring actions

19.5

9.8

8.0

37.3

-

37.3

Costs related to merger transaction

-

-

25.1

25.1

-

25.1

Adjusted segment earnings

200.7

$

13.8

$

(44.1)

$

170.4

$

-

$

170.4

$

Three Months Q3 2006

Electrical and

HQ/

Core

Total

(in millions)

Seating

Electronic

Other

Businesses

Interior

Company

Segment earnings

125.6

$

16.4

$

(57.4)

$

84.6

$

(55.8)

$

28.8

$

Costs related to restructuring actions

7.8

7.1

0.6

15.5

1.9

17.4

Adjusted segment earnings

133.4

$

23.5

$

(56.8)

$

100.1

$

(53.9)

$

46.2

$

Non-GAAP Financial Information

Cash from Operations and Free Cash Flow

36

Three Months

Nine Months

(in millions)

Q3 2007

Q3 2007

Net cash provided by operating activities

$ 62.0

$ 309.5

Net change in sold accounts receivable

74.6

67.3

Net cash provided by operating activities

before net change in sold accounts receivable

(cash from operations)

136.6

376.8

Capital expenditures

(45.8)

(114.1)

Free cash flow

$ 90.8

$ 262.7

Forward-Looking Statements

This presentation contains forward-looking statements within the meaning of the Private Securities

Litigation Reform Act of 1995, including statements regarding anticipated financial results and liquidity.

Actual results may differ materially from anticipated results as a result of certain risks and uncertainties,

including but not limited to, general economic conditions in the markets in which the Company operates,

including changes in interest rates or currency exchange rates, the financial condition of the Company’s

customers or suppliers, fluctuations in the production of vehicles for which the Company is a supplier, the

loss of business with respect to, or the lack of commercial success of, a vehicle model for which the

Company is a significant supplier, disruptions in the relationships with the Company’s suppliers, labor

disputes involving the Company or its significant customers or suppliers or that otherwise affect the

Company, the Company's ability to achieve cost reductions that offset or exceed customer-mandated

selling price reductions, the outcome of customer productivity negotiations, the impact and timing of

program launch costs, the costs, timing and success of restructuring actions, increases in the Company's

warranty or product liability costs, risks associated with conducting business in foreign countries,

competitive conditions impacting the Company's key customers and suppliers, raw material costs and

availability, the Company's ability to mitigate the significant impact of increases in raw material, energy and

commodity costs, the outcome of legal or regulatory proceedings to which the Company is or may become

a party, unanticipated changes in cash flow, including the Company’s ability to align its vendor payment

terms with those of its customers and other risks described from time to time in the Company's Securities

and Exchange Commission filings.

This presentation also contains information on the Company’s sales backlog. The Company’s incremental

sales backlog reflects: anticipated net sales from formally awarded new programs and open replacement

programs, less phased-out and cancelled programs. The calculation of backlog does not reflect customer

price reductions on existing or newly awarded programs. The backlog may be impacted by various

assumptions embedded in the calculation, including vehicle production levels on new and replacement

programs, foreign exchange rates and the timing of major program launches. Lear’s preliminary 2008

sales backlog is based on an exchange rate of $1.40/per Euro and industry production assumptions: in

North America, generally in line with 15.0 million units in 2007; and in Europe, up slightly from 19.7 million

units in 2007.

The forward-looking statements in this presentation are made as of the date hereof, and the Company

does not assume any obligation to update, amend or clarify them to reflect events, new information or

circumstances occurring after the date hereof.

37