In addition to the results reported in accordance with accounting principles generally accepted in the United States (“GAAP”) included throughout this

presentation, the Company has provided information regarding “income before interest, other (income) expense and income taxes,” “income before

interest, other (income) expense, income taxes, restructuring costs and other special items, excluding the divested Interior business” (core operating

earnings), “pretax income before restructuring costs and other special items,” “free cash flow” and “net debt” (each, a non-GAAP financial measure).

Other (income) expense includes, among other things, state and local non-income taxes, foreign exchange gains and losses, fees associated with the

Company’s asset-backed securitization and factoring facilities, minority interests in consolidated subsidiaries, equity in net income of affiliates and gains

and losses on the sale of assets. Free cash flow represents net cash provided by operating activities before the net change in sold accounts receivable,

less capital expenditures. The Company believes it is appropriate to exclude the net change in sold accounts receivable in the calculation of free cash

flow since the sale of receivables may be viewed as a substitute for borrowing activity. Net debt represents total debt plus utilization under the Company’s

securitization and factoring facilities, less cash and cash equivalents.

Management believes the non-GAAP financial measures used in this presentation are useful to both management and investors in their analysis of the

Company’s financial position and results of operations. In particular, management believes that income before interest, other (income) expense and

income taxes, core operating earnings and pretax income before restructuring costs and other special items are useful measures in assessing the

Company’s financial performance by excluding certain items (including those items that are included in other expense) that are not indicative of the

Company's core operating earnings or that may obscure trends useful in evaluating the Company’s continuing operating activities. Management also

believes that these measures are useful to both management and investors in their analysis of the Company's results of operations and provide improved

comparability between fiscal periods. Management believes that free cash flow is useful to both management and investors in their analysis of the

Company’s ability to service and repay its debt. Management believes that net debt provides useful information regarding the Company’s financial

condition. Further, management uses these non-GAAP financial measures for planning and forecasting in future periods.

Income before interest, other (income) expense and income taxes, core operating earnings, pretax income before restructuring costs and other special

items, free cash flow and net debt should not be considered in isolation or as a substitute for pretax income (loss), net income (loss), cash provided by

operating activities, total debt or other balance sheet, income statement or cash flow statement data prepared in accordance with GAAP or as a measure

of profitability or liquidity. In addition, the calculation of free cash flow does not reflect cash used to service debt and therefore, does not reflect funds

available for investment or other discretionary uses. Also, these non-GAAP financial measures, as determined and presented by the Company, may not

be comparable to related or similarly titled measures reported by other companies.

Set forth on the following slides are reconciliations of these non-GAAP financial measures to the most directly comparable financial measures calculated

and presented in accordance with GAAP. Given the inherent uncertainty regarding special items, other (income) expense and the net change in sold

accounts receivable in any future period, a reconciliation of forward-looking financial measures to the most directly comparable financial measures

calculated and presented in accordance with GAAP is not feasible. The magnitude of these items, however, may be significant.

Non-GAAP Financial Information

30

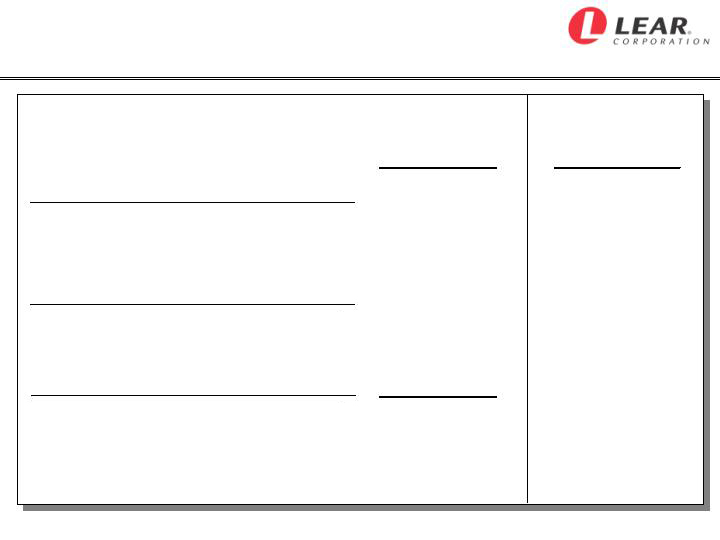

Non-GAAP Financial Information

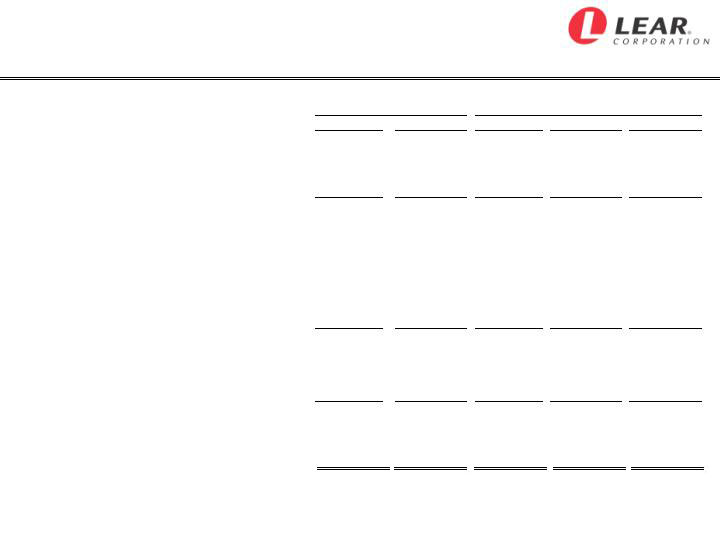

Core Operating Earnings

Three Months Ended

Full Year

(in millions)

Q4 2007

Q4 2006

2007

2006

2005

Pretax income (loss)

$ 45.1

$ (635.9)

$ 331.4

$ (655.5)

$ (1,187.2)

Divestiture of Interior business

2.9

607.3

10.7

636.0

-

Interest expense

48.9

52.3

199.2

209.8

183.2

Other (income) expense, net *

(10.3)

61.1

32.5

87.8

96.6

Income (loss) before interest, other (income)

expense and income taxes

$ 86.6

$ 84.8

$ 573.8

$ 278.1

$ (907.4)

Costs related to divestiture (COS and SG&A)

-

-

10.0

-

-

Costs related to restructuring actions

93.9

44.0

181.8

105.6

106.3

Costs related to merger transaction

(1.9)

-

34.9

-

-

U.S. salaried plan curtailment gain

-

-

(36.4)

-

-

Goodwill and fixed asset impairment charges

-

0.8

-

12.9

1,095.1

Litigation charges

-

-

-

-

30.5

Income before interest, other (income)

expense, income taxes, restructuring costs

and other special items

178.6

$

129.6

$

764.1

$

396.6

$

324.5

$

Less: Interior business

-

31.5

(15.6)

161.2

76.5

Income before interest, other (income) expense,

income taxes, restructuring costs and other

special items, excluding the divested

Interior business

$ 178.6

$ 161.1

$ 748.5

$ 557.8

$ 401.0

(core operating earnings)

* Includes minority interests in consolidated subsidiaries and equity in net income of affiliates.

31