In addition to the results reported in accordance with accounting principles generally accepted in the United States (“GAAP”) included throughout this

presentation, the Company has provided information regarding “income before interest, other expense, income taxes, restructuring costs and other special

items, excluding the divested Interior business” (core operating earnings), “pretax income before restructuring costs and other special items” and “free

cash flow” (each, a non-GAAP financial measure). Other expense includes, among other things, non-income related taxes, foreign exchange gains and

losses, discounts and expenses associated with the Company’s asset-backed securitization and factoring facilities, minority interests in consolidated

subsidiaries, equity in net income of affiliates and gains and losses on the sale of assets. Free cash flow represents net cash provided by operating

activities before the net change in sold accounts receivable, less capital expenditures. The Company believes it is appropriate to exclude the net change

in sold accounts receivable in the calculation of free cash flow since the sale of receivables may be viewed as a substitute for borrowing activity.

Management believes the non-GAAP financial measures used in this presentation are useful to both management and investors in their analysis of the

Company’s financial position and results of operations. In particular, management believes that core operating earnings and pretax income before

restructuring costs and other special items are useful measures in assessing the Company’s financial performance by excluding certain items (including

those items that are included in other expense) that are not indicative of the Company’s core operating earnings or that may obscure trends useful in

evaluating the Company’s continuing operating activities. Management also believes that these measures are useful to both management and investors in

their analysis of the Company’s results of operations and provide improved comparability between fiscal periods. Management believes that free cash flow

is useful to both management and investors in their analysis of the Company’s ability to service and repay its debt. Further, management uses these non-

GAAP financial measures for planning and forecasting in future periods.

Core operating earnings, pretax income before restructuring costs and other special items and free cash flow should not be considered in isolation or as a

substitute for pretax income (loss), net income (loss), cash provided by operating activities or other income statement or cash flow statement data prepared in accordance with GAAP or as a measure of profitability or liquidity. In addition, the calculation of free cash flow does not reflect cash used to service debt and therefore, does not reflect funds available for investment or other discretionary uses. Also, these non-GAAP financial measures, as determined and

presented by the Company, may not be comparable to related or similarly titled measures reported by other companies.

Set forth on the following slides are reconciliations of these non-GAAP financial measures to the most directly comparable financial measures calculated

and presented in accordance with GAAP. Given the inherent uncertainty regarding special items, other expense and the net change in sold accounts

receivable in any future period, a reconciliation of forward-looking financial measures to the most directly comparable financial measures calculated and

presented in accordance with GAAP is not feasible. The magnitude of these items, however, may be significant.

Non-GAAP Financial Information

29

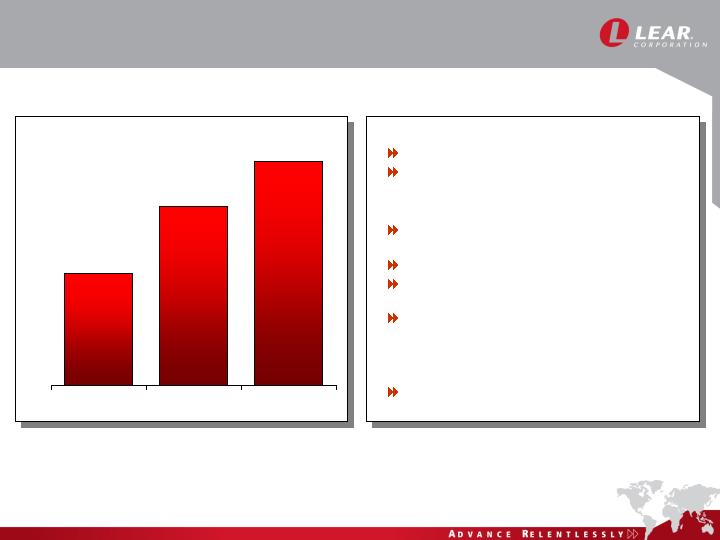

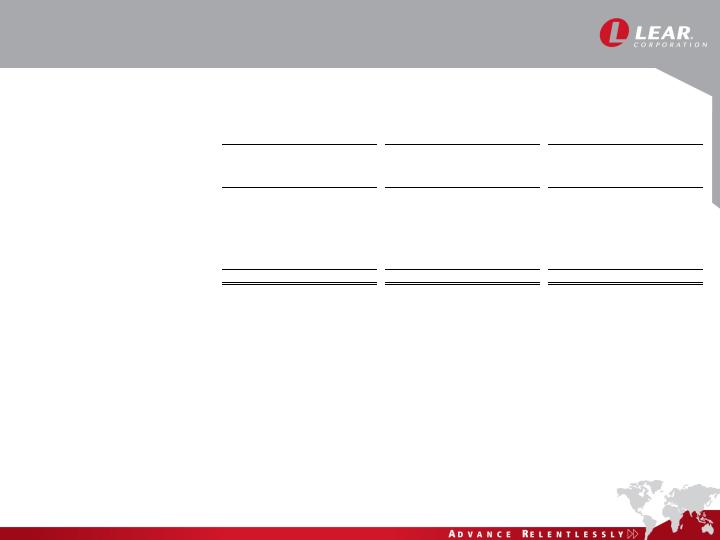

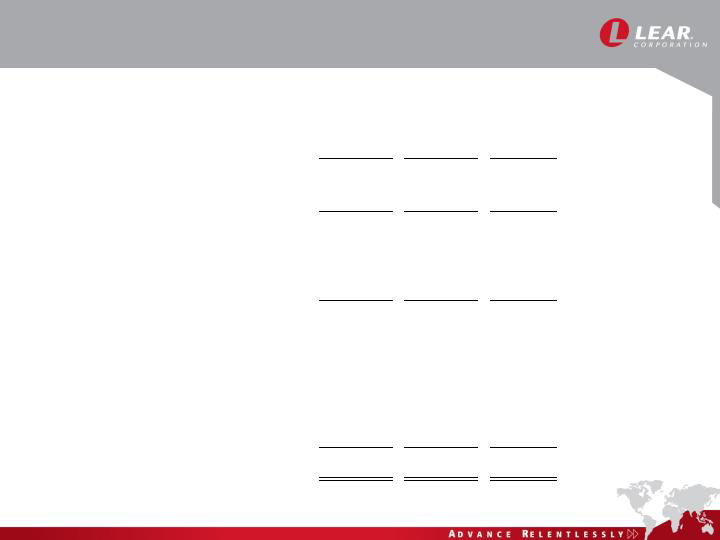

Non-GAAP Financial Information

Core Operating Earnings

(in millions)

2007

2006

2005

Pretax income (loss)

$ 331.4

$ (655.5)

$ (1,187.2)

Divestiture of Interior business

10.7

636.0

-

Interest expense

199.2

209.8

183.2

Other expense, net *

32.5

87.8

96.6

Income (loss) before interest, other

expense and income taxes

$ 573.8

$ 278.1

$ (907.4)

Restructuring costs and other special items -

Costs related to interior divestiture (COS and SG&A)

10.0

-

-

Costs related to restructuring actions

181.8

105.6

106.3

Costs related to merger transaction

34.9

-

-

U.S. salaried pension plan curtailment gain

(36.4)

-

-

Goodwill and fixed asset impairment charges

-

12.9

1,095.1

Litigation charges

-

-

30.5

Less: Interior business

(15.6)

161.2

76.5

Income before interest, other expense,

income taxes, restructuring costs and other

special items, excluding the divested

Interior business

$ 748.5

$ 557.8

$ 401.0

(core operating earnings)

* Includes minority interests in consolidated subsidiaries and equity in net income of affiliates.

30

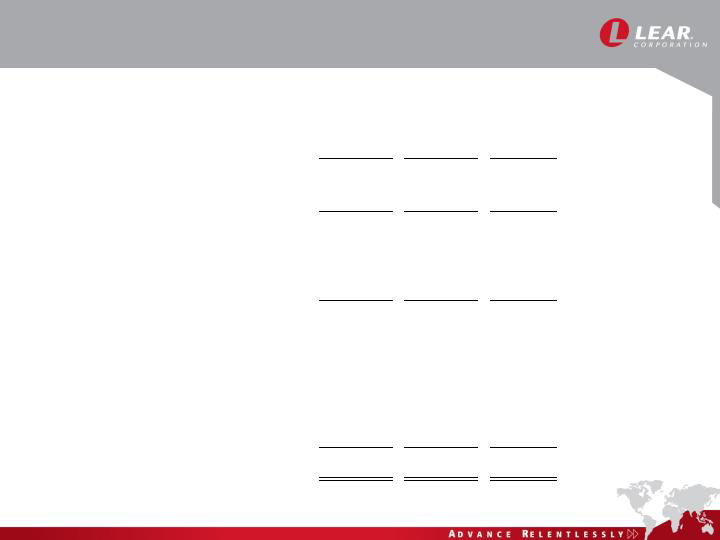

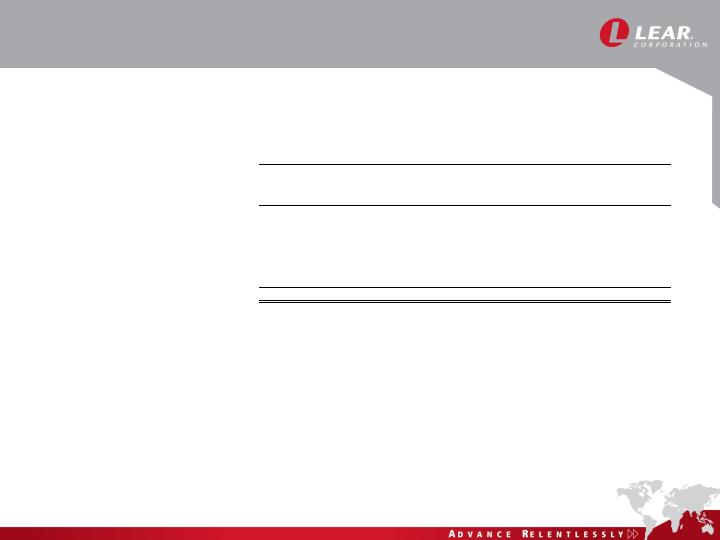

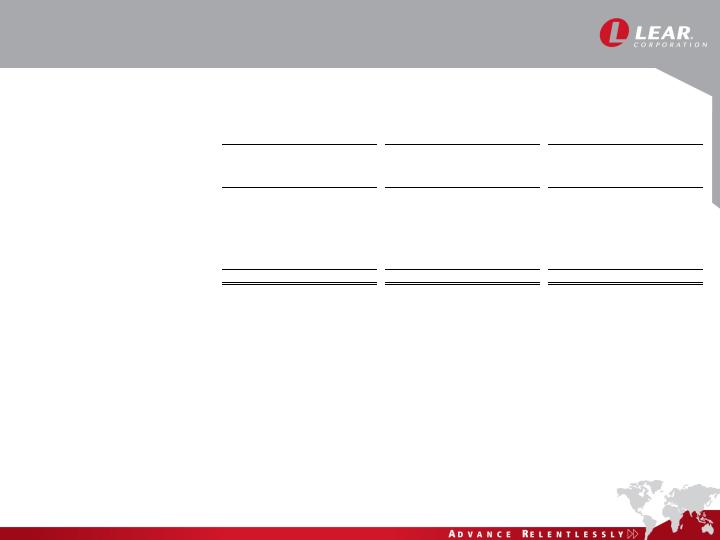

Non-GAAP Financial Information

Segment Earnings Reconciliation

(in millions)

2007

2006

2005

Seating

$ 758.7

$ 604.0

$ 323.3

Electrical and electronic

40.8

102.5

180.0

Interior

8.2

(183.8)

(191.1)

Segment earnings

807.7

522.7

312.2

Corporate and geographic

headquarters and elimination of

intercompany activity

(233.9)

(241.7)

(206.8)

Income before goodwill impairment

charges, divestiture of Interior

business, interest, other expense

and income taxes

$ 573.8

$ 281.0

$ 105.4

Goodwill impairment charges

-

2.9

1,012.8

Divestiture of Interior business

10.7

636.0

-

Interest expense

199.2

209.8

183.2

Other expense, net

32.5

87.8

96.6

Pretax income (loss)

$ 331.4

$ (655.5)

$ (1,187.2)

31

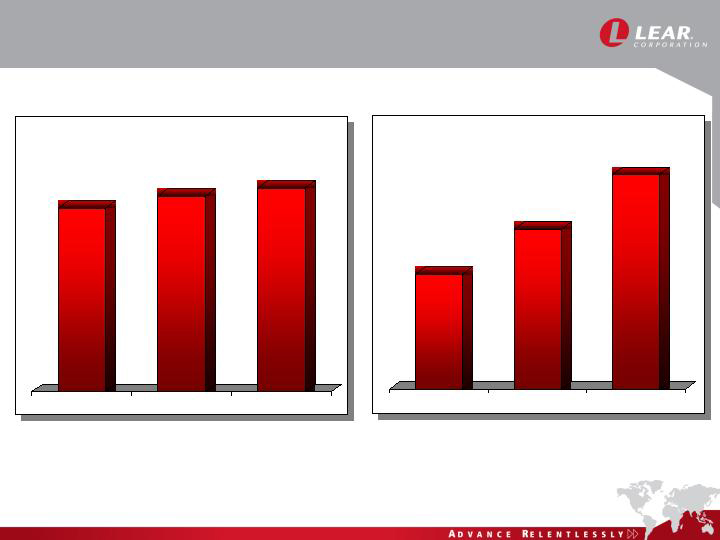

Non-GAAP Financial Information

Adjusted Segment Earnings

2007

2006

2005

Electrical and

Electrical and

Electrical and

Seating

Electronic

Seating

Electronic

Seating

Electronic

Sales

12,206.1

$

3,100.0

$

11,624.8

$

2,996.9

$

11,035.0

$

2,956.6

$

Segment earnings

758.7

$

40.8

$

604.0

$

102.5

$

323.3

$

180.0

$

Costs related to restructuring actions

91.6

70.2

41.7

44.8

33.0

39.0

Litigation charges

-

-

-

-

30.5

-

Adjusted segment earnings

850.3

$

111.0

$

645.7

$

147.3

$

386.8

$

219.0

$

32

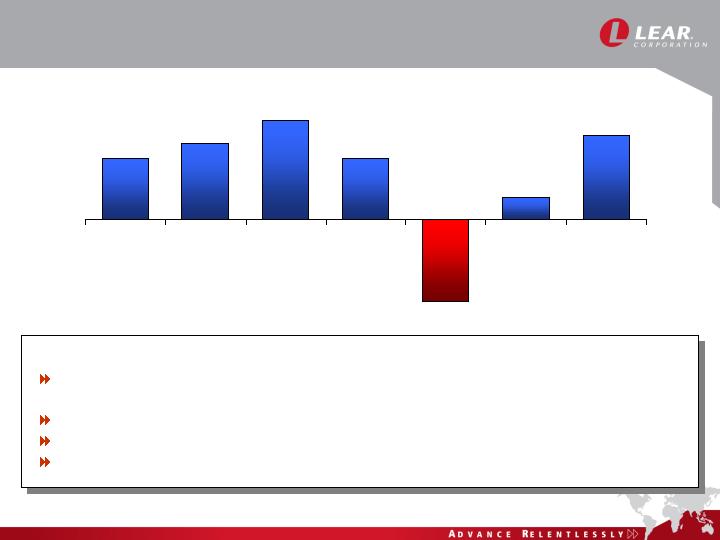

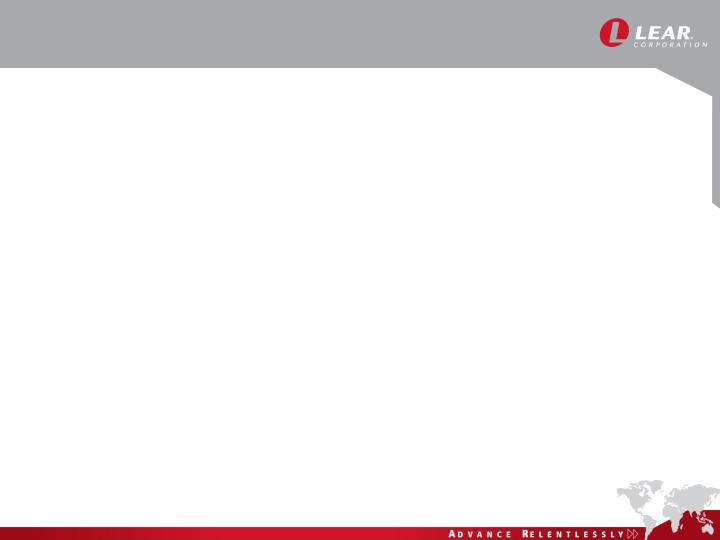

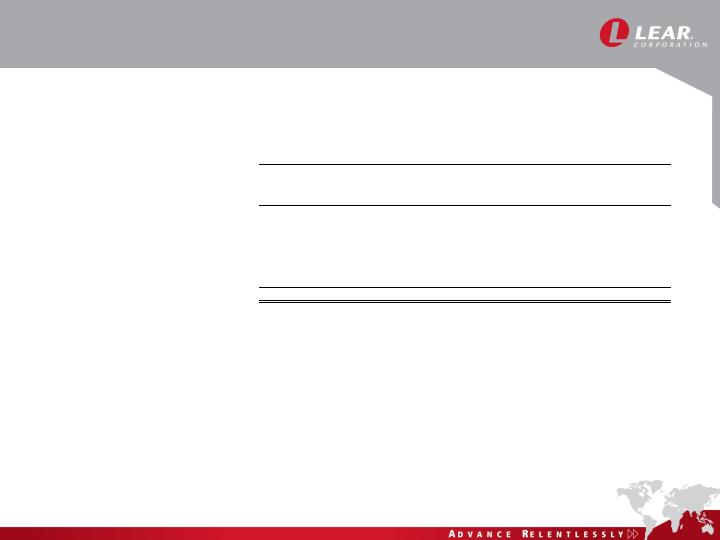

Non-GAAP Financial Information

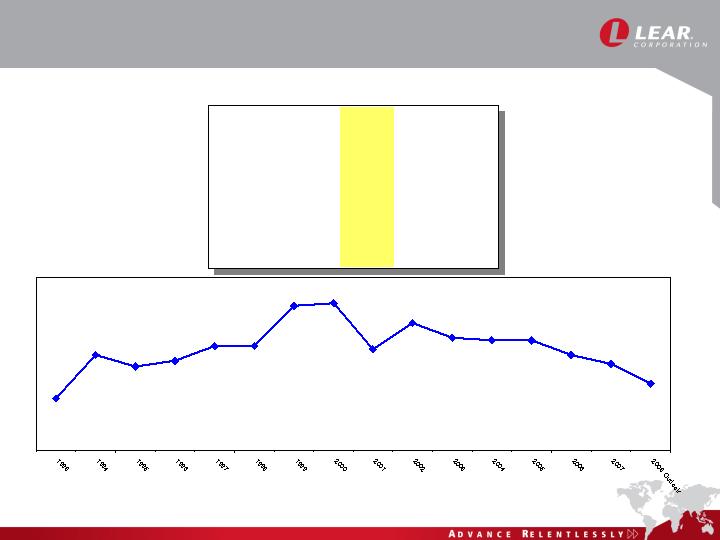

Cash from Operations and Free Cash Flow

(in millions)

2007

2006

2005

2004

2003

2002

2001

Net cash provided by operating activities

466.9

$

285.3

$

560.8

$

675.9

$

586.3

$

545.1

$

829.8

$

Net change in sold accounts receivable

168.9

178.0

(411.1)

70.4

298.1

122.2

(245.0)

Net cash provided by operating

activities before net change in

sold accounts receivable

(cash from operations)

635.8

463.3

149.7

746.3

884.4

667.3

584.8

Capital expenditures

(202.2)

(347.6)

(568.4)

(429.0)

(375.6)

(272.6)

(267.0)

Free cash flow

433.6

$

115.7

$

(418.7)

$

317.3

$

508.8

$

394.7

$

317.8

$

33

Forward-Looking Statements

This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of

1995, including statements regarding anticipated financial results and liquidity. Actual results may differ materially from

anticipated results as a result of certain risks and uncertainties, including but not limited to, general economic conditions in

the markets in which the Company operates, including changes in interest rates or currency exchange rates, the financial

condition of the Company’s customers or suppliers, changes in the Company’s current vehicle production estimates,

fluctuations in the production of vehicles for which the Company is a supplier, the loss of business with respect to, or the

lack of commercial success of, a vehicle model for which the Company is a significant supplier, disruptions in the

relationships with the Company’s suppliers, labor disputes involving the Company or its significant customers or suppliers or

that otherwise affect the Company, the outcome and duration of the American Axle strike, the Company's ability to achieve

cost reductions that offset or exceed customer-mandated selling price reductions, the outcome of customer productivity

negotiations, the impact and timing of program launch costs, the costs, timing and success of restructuring actions,

increases in the Company's warranty or product liability costs, risks associated with conducting business in foreign

countries, competitive conditions impacting the Company's key customers and suppliers, the cost and availability of raw

materials and energy, the Company's ability to mitigate any increases in raw material, energy and commodity costs, the

outcome of legal or regulatory proceedings to which the Company is or may become a party, unanticipated changes in cash

flow, including the Company’s ability to align its vendor payment terms with those of its customers, the Company’s ability to

access capital markets on commercially reasonable terms and other risks described from time to time in the Company's

Securities and Exchange Commission filings. In particular, the Company’s financial outlook for 2008 is based on several

factors, including the Company’s current vehicle production and raw material pricing assumptions. The Company’s actual

financial results could differ materially as a result of significant changes in these factors.

The forward-looking statements in this presentation are made as of the date hereof, and the Company does not assume any

obligation to update, amend or clarify them to reflect events, new information or circumstances occurring after the date

hereof.

34