- BBVA Dashboard

- Financials

- Filings

- Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

6-K Filing

Banco Bilbao Vizcaya Argentaria (BBVA) 6-KCurrent report (foreign)

Filed: 4 Feb 15, 12:00am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of February, 2015

Commission file number: 1-10110

BANCO BILBAO VIZCAYA ARGENTARIA, S.A.

(Exact name of Registrant as specified in its charter)

BANK BILBAO VIZCAYA ARGENTARIA, S.A.

(Translation of Registrant’s name into English)

Paseo de la Castellana, 81

28046 Madrid

Spain

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

| Form 20-F x Form 40-F ¨ |

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

| Yes ¨ No x |

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

| Yes ¨ No x |

Press release

02.04.2015

Annual results

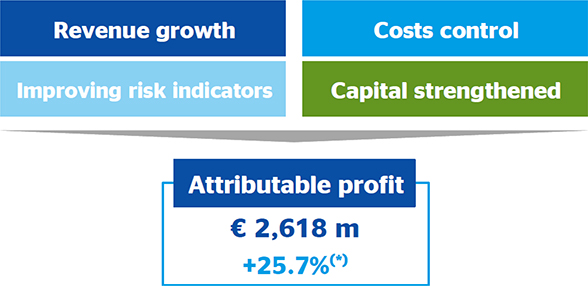

BBVA earns €2.62 billion in 2014 (+25.7%)

| ¨ | Income: For the second quarter in a row, net interest income increased in all the regions in which the BBVA Group operates. For the full year, this line totaled €15.12 billion (+3.4% at current exchange rates, +15.6% without considering currency fluctuations) |

| ¨ | Risks: Excluding the real estate business, the BBVA Group’s NPA ratio improved 53 basis points in a year, closing 2014 at 4.1%, with coverage of 65%. Loan-loss and real estate provisions dropped by over €1.6 billion compared to 2013 and to virtually half the amount registered in 2012 |

| ¨ | Capital adequacy:The core capital ratio increased to 12.0% (10.4% fully-loaded), well above the regulatory requirements |

| ¨ | Transformation:2014 has been a key year in the transformation of the bank’s business model, with the creation of the Digital Banking unit, the evolution of its distribution model and the acquisitions of Simple and Madiva startups. Cost management and the transformation plan allowed the Group to generate €340 million in savings in Spain and the Corporate Center. |

The BBVA Group posted a profit of €2.62 billion in 2014, 25.7% more than in 2013, according to the new accounting rules1, driven by the solid net interest income performance, cost control and lower loan-loss and real-estate provisions. Net income from ongoing operations, which does not include results from corporate operations, grew 53.1% to €3.08 billion year-over-year.

“It has been a difficult but good year, shaped by growing income, controlled costs and improved risk indicators”, BBVA Chairman & CEO Francisco González said. “All of this, on top of a very robust capital base, has allowed us to close the year in an astounding position to face a new cycle of growth and business transformation,” he added.

The strength of the Group’s earnings was particularly noticeable in the final stretch of the year. In the last quarter all income lines came in at the highs of the last 10 quarters. In that period, net interest income totaled €4.25 billion, gross income stood at €5.77 billion while the operating income reached €2.86 billion.

Press release

02.04.2015

2014: a good year

| * | In 2014 accounting policies for contributions to the Deposit Guarantee Fund changed. This led to a modification of certain amounts recorded in 2013 and it affected net attributable profit in 2013. For more information please refer to the reconciliation in the quarterly report and the Group’s audited financial statements. |

In 2014, net interest income grew 3.4% to €15.12 billion. Excluding the exchange rate effect, net interest income saw an increase of 15.6% year-over-year. In the last three months of 2014, this line grew across all the regions in which the BBVA Group operates for the second quarter in a row.

On the consolidated accounts, gross income totaled €21.36 billion, in line with 2013 (+0.8%) or 9.6% higher at constant exchange rates. Excluding currency fluctuations, gross income improved the spread over expenses as the year progressed. This trend, along with an excellent cost management, resulted in an operating income of €10.41 billion for the whole year (+15.8% year-over-year).

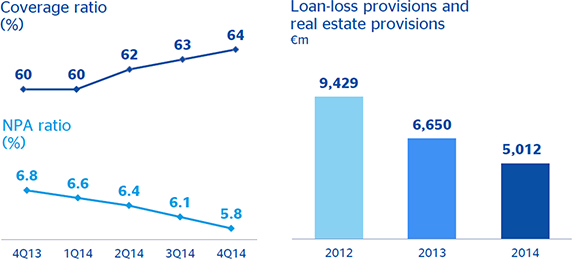

Real estate and loan-loss provisions in 2014 (€5.01 billion) dropped by over €1.6 billion compared to 2013 and to virtually half the amount registered in 2012.

Risk indicators continued to improve. The BBVA Group’s NPA ratio ended the year at 5.8% (one percentage point less than a year earlier). The coverage ratio also improved to 64%. If we exclude the real-estate business, the NPA ratio fell 53 basis points in a year, leaving it at 4.1%, with coverage of 65%.

As for the bank’s business activity, new loan production grew across virtually all regions. In Spain, net lending to customers grew 0.3% in Q4-14, quarter-over-quarter, coming in at €169.2 billion (balance as of end of December).

Press release

02.04.2015

Improvement in risk indicators

BBVA’s capital adequacy levels easily surpassed regulatory requirements. The core capital ratio increased to 12.0% at the end of the year, or 10.4% fully-loaded, which factors in future regulatory impacts. The fully-loaded leverage ratio stood at 5.9%.

BBVA announced several M&A deals, which are expected to be closed in the first half of 2015. In Spain, it won the auction for Catalunya Banc. In Turkey, it announced that it was increasing its stake in Garanti to 39.9%, which will make it the largest shareholder. In China, the bank reached an agreement to sell its stake (29.68%) in Citic International Financial Holdings Ltd. (CIFH) to China Citic Bank (CNCB), and in 2015 it also announced a plan to sell a 4.9% stake in CNCB.

In 2014, BBVA accelerated its digital transformation, as it achieved important milestones such as the creation of its Digital Banking unit, the evolution of its distribution model, the innovation in products and processes and the focus on new digital businesses through the respective acquisitions of Simple and Madiva startups. The progress made in the transformation plan allowed the Group to generate €340 million in savings in Spain and the Corporate Center.

As for the performance of the respective business areas, BBVA President and COO Ángel Cano pointed out, “the net attributable profit growth across all our regions at constant exchange rates, which makes us optimistic about 2015.”

In thebanking business in Spain,recovering activity and controlled costs drove income lines across the board. In cumulative terms, net interest income registered virtually the same performance as the previous year (-0.2%), while gross and operating income increased 12.3% and 31.0%, respectively. The NPA ratio improved to 6.0% at the end of December, with coverage ratio of 45%. Both the net entries to NPAs as well as non-performing loans fell significantly during the year (-91% and -8.8%, respectively). Net attributable profit for the area was €1.03 billion in 2014, more than two times that of 2013.

Press release

02.04.2015

The real estate business in Spain continued to reduce its net exposure to the sector (-14% in twelve months). Revenue increased 18% year-over-year to €1.93 billion. The market saw an upbeat trend, with a nascent recovery in prices and demand. Losses in this business narrowed by 30% to €-876 million.

To better explain the business performance of regions with currencies other than the euro, the exchange rates described below refer to constant exchange rates.

In theUnited States, banking activity rose 12.2% both in lending, and customer funds. All income lines increased in the last three months compared to the year earlier period. Net interest income grew for the fourth straight quarter, thanks to a robust activity. The region’s risk indicators continued to improve, with NPA ratio standing at 0.9% at the end of December, and coverage of 167%. The United States posted net attributable profit of €428 million in 2014 (+8.9%).

InEurasia, Turkey was once again the key, with double-digit income growth. Lower provisions and the recovery in the wholesale banking business also contributed to a net attributable profit of €565 million for the area (+36.3%).

Solid business activity in Mexicodrove notable growth rates in the income statement, both in terms of margins and profit. BBVA Bancomer consolidated its position as the leading bank in the country in terms of size, shares of assets and liabilities, risk management, efficiency and profitability. The NPA ratio moved downward to 2.9% in December, down from 3.6% the previous December, with coverage ratio of 114%. In 2014 Mexico earned €1.92 billion (+10.7%).

South Americawas once again the most dynamic region in terms of business activity, with growth of over 20% in both lending and customer funds. Strong recurrent earnings helped to offset the impact of hyperinflation in Venezuela and allowed income to increase across the board. At the end of the year, the NPA ratio came in at the same 2.1% registered in Dec. 2013 and 2012, with coverage ratio of 138%. The region posted €1 billion in profit last year (+6.3% vs. 2013). If we exclude Venezuela from the year-over-year comparison, profit would have grown 13.1%.

Press release

02.04.2015

Contact details:

BBVA Corporate Communications

Tel. +34 91 374 40 10

comunicacion.corporativa@bbva.com

For more financial information about BBVA visit:

http://shareholdersandinvestors.bbva.com

| 1 | Following the adoption of IFRIC 21 on levies by the IFRS interpretations Committee, in 2014 there was a change in accounting policy with respect to contributions made to the Deposit Guarantee Fund. According to the International Accounting Standards said change has been applied retroactively restating certain amounts presented for comparative purposes from prior year. |

Press release

02.04.2015

Adjusted income statement Group(m€)

| Growth | ||||||||||||||||

| 12M14/12M13 | ||||||||||||||||

BBVA Group | 12M14 | Abs. | % | % constant | ||||||||||||

Net interest Income | 15,116 | +503 | 3.4 | 15.6 | ||||||||||||

Gross Income | 21,357 | +166 | 0.8 | 9.6 | ||||||||||||

Operating income | 10,406 | +416 | 4.2 | 15.8 | ||||||||||||

Income Before Tax | 4,063 | +1,519 | 59.7 | n.s. | ||||||||||||

Nl ex corporate operations | 3,082 | 1,068 | 53.1 | n.s. | ||||||||||||

Corporate Operations Income | 0 | -823 | n.s. | n.s. | ||||||||||||

Net Attributable Profit | 2,618 | +535 | 25.7 | 54.6 | ||||||||||||

Adjusted income statement Spain(m€)

| Growth | ||||||||||||

| 1 2M14/12M1 3 | ||||||||||||

Banking activity in Spain | 12M14 | Abs. | % | |||||||||

Net interest Income | 3,830 | -8 | -0.2 | |||||||||

Gross Income | 6,622 | +725 | 12.3 | |||||||||

Operating income | 3,777 | +894 | 31.0 | |||||||||

Income Before Tax | 1,463 | +1,440 | n.s. | |||||||||

Net Attributable Profit | 1,028 | +584 | n.s. | |||||||||

Press release

02.04.2015

2013 P&L: figures restated following the change made in accounting policy relating to the DGF €m

BBVA Group | 2014 | 2013 | Adjustment | Adjusted 2013 | ||||||||||||

Net interest income | 15.116 | 14.613 | 14.613 | |||||||||||||

Fees | 4.365 | 4.431 | 4.431 | |||||||||||||

Net trading income | 2.135 | 2.527 | 2.527 | |||||||||||||

Other incomes | -260 | -175 | -206 | -381 | ||||||||||||

Gross income | 21.357 | 21.397 | -206 | 21.190 | ||||||||||||

Costs | -10.951 | -11.201 | -11.201 | |||||||||||||

Operating income | 10.406 | 10.196 | -206 | 9.989 | ||||||||||||

Impairment losses | -4.486 | -5.776 | -5.776 | |||||||||||||

Provisions | -1.155 | -630 | -630 | |||||||||||||

Non-ordinary profits | -701 | -1.040 | -1.040 | |||||||||||||

Income before tax | 4.063 | 2.750 | -206 | 2.544 | ||||||||||||

Tax | -981 | -593 | 62 | -531 | ||||||||||||

Net income ex corporate operations | 3.082 | 2.158 | -144 | 2.013 | ||||||||||||

Corporate operations income | 0 | 823 | 823 | |||||||||||||

Minorities | -464 | -753 | -753 | |||||||||||||

Net attributable profit | 2.618 | 2.228 | -144 | 2.083 | ||||||||||||

2013 P&L: figures restated following the change made in accounting policy relating to the DGF €m

Banking activity in Spain | 2014 | 2013 | Adjustment | Adjusted 2013 | ||||||||||||

Net interest income | 3,830 | 3,838 | 3,838 | |||||||||||||

Fees | 1,454 | 1,376 | 1,376 | |||||||||||||

Net trading income | 1,149 | 807 | 807 | |||||||||||||

Other incomes | 189 | 82 | -206 | -124 | ||||||||||||

Gross income | 6,622 | 6,103 | -206 | 5,897 | ||||||||||||

Costs | -2,845 | -3,014 | -3,014 | |||||||||||||

Operating income | 3,777 | 3,088 | -206 | 2,882 | ||||||||||||

Impairment losses | -1,690 | -2,577 | -2,577 | |||||||||||||

Provisions | -623 | -315 | -315 | |||||||||||||

Non-ordinary profits | 0 | 34 | 34 | |||||||||||||

Income before tax | 1,463 | 230 | -206 | 24 | ||||||||||||

Tax | -431 | -62 | 62 | 0 | ||||||||||||

Net income ex corporate operations | 1,032 | 608 | -144 | 464 | ||||||||||||

Corporate operations income | 0 | 440 | 440 | |||||||||||||

Minorities | -4 | -20 | -20 | |||||||||||||

Net attributable profit | 1,028 | 589 | -144 | 444 | ||||||||||||

Press release

02.04.2015

About BBVA

BBVA is a customer-centric global financial services group founded in 1857. The Group has a solid position in Spain, it is the largest financial institution in Mexico and it has leading franchises in South America and the Sunbelt Region of the United States. Its diversified business is focused on high-growth markets and it relies on technology as a key sustainable competitive advantage. Corporate responsibility is at the core of its business model. BBVA fosters financial education and inclusion, and supports scientific research and culture. It operates with the highest integrity, a long-term vision and applies the best practices. The Group is present in the main sustainability indexes.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Banco Bilbao Vizcaya Argentaria, S.A. | ||||||

| Date: February 4, 2015 | By: | /s/ María Ángeles Peláez | ||||

| Name: María Ángeles Peláez | ||||||

| Title: Authorized Representative | ||||||