- BBVA Dashboard

- Financials

- Filings

- Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

6-K Filing

Banco Bilbao Vizcaya Argentaria (BBVA) 6-KCurrent report (foreign)

Filed: 3 Aug 15, 12:00am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of July, 2015

Commission file number: 1-10110

BANCO BILBAO VIZCAYA ARGENTARIA, S.A.

(Exact name of Registrant as specified in its charter)

BANK BILBAO VIZCAYA ARGENTARIA, S.A.

(Translation of Registrant’s name into English)

Paseo de la Castellana, 81

28046 Madrid

Spain

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F x Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes ¨ No x

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes ¨ No x

07.31.2015

January – June 2015

Results: BBVA earns €2.76 billion

in the first half of the year

| • | Activity: The BBVA Group’s gross lending to customers increased 11% in the last year. In Spain, new production for loans to SMEs, consumer loans and mortgages grew |

| • | Results:Excluding Venezuela, margins grew at double-digit rates year-over-year in the first half. Operating income increased to €2.97 billion in the second quarter, the highest level in 10 quarters |

| • | Risks: BBVA Group’s NPL ratio stood at 6.1% in June vs. 6.4% a year ago, with coverage of 72% (excluding Catalunya Banc, the NPL ratio stood at 5.5%, with coverage of 65%) |

| • | Capital adequacy:BBVA shows a high-quality, solid capital position, with CET1 ratios of 12.3% (phased-in) and 10.4% (fully-loaded) at the close of the first half |

| • | Corporate operations:The sale of a 0.8% stake in CNCB and the integration of Catalunya Banc generated gains of €144 million in the quarter. Furthermore, in July BBVA increased its stake in Garanti, Turkey’s best bank, to 39.9%, in a market with extraordinary growth potential |

BBVA more than doubled its net attributable profit in the first half compared to the same period a year earlier, totaling €2.76 billion (+107.7%). Without including the results from corporate operations (CNCB and Catalunya Banc), net income grew 52.9% year-over-year between January and June to €2.03 billion thanks to strong recurring banking revenues.

“Robust activity and an excellent margin performance confirm the profit growth cycle continues,” pointed out BBVA President & COO Carlos Torres Vila.

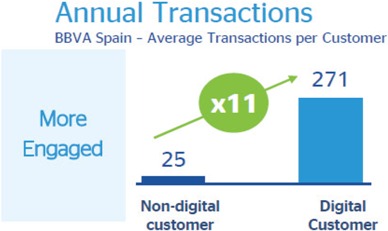

As for the digital transformation, BBVA continued to increase its digital customer base. Customers who interact with the bank digitally totaled 13.5 million at the end of June, of which 7 million are banking through their cell phones.

07.31.2015

Digital customers increase their interaction with the bank exponentially. For example, in Spain, the annual average number of transactions of a digital customer is eleven times more than that of a traditional one.

In turn, this translates into greater digital sales. In the first six months of 2015, the number of new consumer loans through digital channels grew to 17.9% of the total, up from 9.3% in January.

BBVA’s digital transformation aims to improve the lives of customers through better solutions for their needs, more convenience in their relationship with the bank, and a simpler offer. In order to achieve this goal, Carlos Torres Vila underscored that the priorities for the management are as follows:

1) New standard in customer experience.

07.31.2015

2) Drive digital sales.

3) New business models.

4) Optimize capital allocation.

5) Unrivaled efficiency.

6). Develop and inspire a first-class workforce.

Results

In order to properly address the second quarter figures, data will be explained without including Venezuela. The exchange rate –known as SIMADI– applied to the results this year for Venezuela (197 strong bolivars per dollar at the end of June) constitutes a 95% reduction compared to the exchange rate previously used and, therefore, it distorts the comparison with the previous year.

Quarterlynet interest income(NII) rose 12.4% year-over-year at constant exchange rates to €3.81 billion. NII grew across the Group’s footprint –at constant exchange rates– thanks to a solid activity and despite the low-interest rate environment.

On top of the outstanding trend in recurring revenue –NII plus net fees and commissions-, two more items added to the positive impact: the Telefónica dividend and the results of net trading income. All of this raised the quarterly gross income in the quarter by 10.6% year-over-year at constant exchange rates, to €5.9 billion.

The difference between costs and gross revenue allowed the bank to generate its highest operating income of the last ten quarters, €2.97 billion.

The bank booked €1.18 billion for loan-loss and real-estate provisions. This figure is slightly lower than that of the previous quarter and virtually in line with that of the same quarter a year earlier. Loan-loss and real-estate provisions in Spain dropped while the rest of geographical regions saw a greater contribution as activity intensified.

At current exchange rates, net profit in the second quarter excluding Venezuela and corporate operations (CNCB and Catalunya Banc) increased 57.8% to €1.08 billion. Including corporate operations, earnings increased to €1.23 billion (+78.8% year-over-year). Lastly, if the contribution from Venezuela is added, the BBVA Group posted €1.22 billion in earnings between April and June (+73.5% year-over-year).

07.31.2015

As forrisk management, the indicators continued to show a positive trend. The BBVA Group’s NPL ratio ended June at 6.1% (vs. 6.4% a year ago), with coverage ratio of 72%. Excluding Catalunya Banc, the non-performing loan ratio stood at 5.5% in June, with stable coverage at 65%.

BBVA’scapital adequacy reflected a solid capital position, clearly above regulatory requirements. The CET1 ratio ended June at 12.3% according to current European regulations (CRD IV). Under fully-loaded criteria the ratio came in at 10.4%. BBVA’s capital also stands out for its excellent quality, with a leverage ratio of 5.9% (fully-loaded) as of June 30th.

On thebalance sheet, gross customer lending in the BBVA Group increased 11% in the last year, up to €393.16 billion. On the other hand, customer deposits totaled €363.37 billion (+13.3%), with growth across the board, in line with previous quarters.

In the first half of the year, new loan production grew strongly in Spain from a year earlier, especially in segments such as SMEs (+30%), consumer (+35%) and mortgages (+36%).

Below we detail the main aspects of the accounts for each business unit.

Thebanking business in Spain benefited from the country’s improved economic growth outlook. The franchise registered considerable increases in new operations, leading to a stable performance of the loan book in the quarter if we exclude Catalunya Banc from the comparison. Between April and June, recurring revenue (net interest income plus net fees and commissions) increased 9.3% from a year earlier to €1.45 billion. Gross income and operating income grew during the same period at a double-digit pace (18.0% and 22.8%, respectively). With Catalunya Banc integrated into the franchise, the NPL ratio came in at 6.8%, with coverage of 62%. Without taking into account this integration, NPL for June stood at 5.9%. Spain earned €809 million (+33.1% year-over-year) for the full half. Second-quarter profit (€462 million) more than doubled that of the same period a year ago.

As forreal estate activity in Spain, BBVA continued to reduce its exposure, dropping 12.6% -or 4.7% less with Catalunya Banc- compared to a year ago. The bank’s strategy is still to maximize the value on real-estate sales and generate capital gains. In the first half, the bank managed to narrow losses from the unit 35% to €-300 million from €-465 million a year earlier.

To better explain the business performance of the regions that do not use the euro, the exchange rates described below refer to constant exchange rates.

The United States posted growth in lending (+12.9% year-over-year) and customer resources (+9.0%). Between April and June, the greater revenue and the good cost trend resulted in operating income that was 15.6% higher year-over-year. Risk indicators remained stable, with the same NPL ratio at the close of June (0.9%) as we saw a year ago. The U.S. unit posted a profit of €286 million (+18.8%) between January and June.

07.31.2015

The robust activity inMexico resulted in year-over-year growth of 13.0% in lending and 9.7% in customer resources. Recurring revenue totaled €1.71 billion in the second quarter, an increase of 9.4% from a year earlier. Mexico repeated in June the same NPL ratio (2.8%) and coverage (116%) as it did in March. Mexico posted a profit of €1.04 billion (+8.6%) in the first half.

South America –without Venezuela– registered lending growth of 12.2% and customer resources rose 14.5%. The higher activity volume had an impact on topline results, with year-over-year increases of nearly 10% for all margins. Risk indicators held steady, with an NPL ratio of 2.3% and coverage of 120%. Net attributable profit totaled €465 million (+8.4%) between January and June. Including Venezuela, profit totaled €474 million.

InTurkey, Garanti took advantage of its dynamic domestic market to widen the customer spread and generate a 23.6% increase in net interest income plus commissions in the first six months of the year. Turkey posted a profit of €174 million (+8.9% year-over-year). Furthermore, in July BBVA increased its stake in Garanti, Turkey’s best bank, to 39.9%, in a market with extraordinary growth potential.

Contact details:

BBVA Corporate Communications

Tel. +34 91 374 4010

comunicacion.corporativa@bbva.com

For more financial information about BBVA visit:

http://shareholdersandinvestors.bbva.com

For more BBVA news visit:http://press.bbva.com/

07.31.2015

About BBVA

BBVA is a customer-centric global financial services group founded in 1857. The Group has a solid position in Spain, it is the largest financial institution in Mexico and it has leading franchises in South America and the Sunbelt Region of the United States. Its diversified business is focused on high-growth markets and it relies on technology as a key sustainable competitive advantage. Corporate responsibility is at the core of its business model. BBVA fosters financial education and inclusion, and supports scientific research and culture. It operates with the highest integrity, a long-term vision and applies the best practices. The Group is present in the main sustainability indexes.

07.31.2015

BBVA Group highlights

(Consolidated figures)

| 30-06-15 | D% | 30-06-14 | 31-12-14 | |||||||||||||

Balance sheet (million euros) | ||||||||||||||||

Total assets | 689,071 | 11.7 | 617,131 | 651,511 | ||||||||||||

Loans and advances to customers (gross) | 393,158 | 11.0 | 354,202 | 366,536 | ||||||||||||

Deposits from customers | 363,373 | 13.3 | 320,796 | 330,686 | ||||||||||||

Other customer funds | 128,323 | 17.9 | 108,841 | 115,275 | ||||||||||||

Total customer funds | 491,695 | 14.4 | 429,637 | 445,961 | ||||||||||||

Total equity | 50,997 | 8.8 | 46,867 | 51,609 | ||||||||||||

Income statement (million euros) | ||||||||||||||||

Net interest income | 7,521 | 6.9 | 7,038 | 15,116 | ||||||||||||

Gross income | 11,554 | 11.4 | 10,368 | 21,357 | ||||||||||||

Operating income | 5,836 | 14.6 | 5,093 | 10,406 | ||||||||||||

Income before tax | 3,046 | 44.4 | 2,109 | 4,063 | ||||||||||||

Net attributable profit | 2,759 | 107.7 | 1,328 | 2,618 | ||||||||||||

Data per share and share performance ratios | ||||||||||||||||

Share price (euros) | 8.79 | (5.6 | ) | 9.31 | 7.85 | |||||||||||

Market capitalization (million euros) | 55,436 | 1.2 | 54,804 | 48,470 | ||||||||||||

Net attributable profit per share (euros)(1) | 0.43 | 101.0 | 0.21 | 0.42 | ||||||||||||

Book value per share (euros) | 8.28 | 3.7 | 7.98 | 8.01 | ||||||||||||

P/BV (Price/book value; times) | 1.1 | 1.2 | 1.0 | |||||||||||||

Significant ratios (%) | ||||||||||||||||

ROE (Net attributable profit/average equity) | 9.8 | 5.8 | 5.6 | |||||||||||||

ROTE (Net attributable profit/average tangible equity) | 11.4 | 6.7 | 6.5 | |||||||||||||

ROA (Net income/average total assets) | 0.77 | 0.52 | 0.50 | |||||||||||||

RORWA (Net income/average risk-weighted assets) | 1.45 | 0.93 | 0.90 | |||||||||||||

Efficiency ratio | 49.5 | 50.9 | 51.3 | |||||||||||||

Cost of risk | 1.16 | 1.24 | 1.25 | |||||||||||||

NPL ratio | 6.1 | 6.4 | 5.8 | |||||||||||||

NPL coverage ratio | 72 | 62 | 64 | |||||||||||||

Capital adequacy ratios (%)(2) | ||||||||||||||||

CET1 | 12.3 | 11.6 | 11.9 | |||||||||||||

Tier I | 12.3 | 11.6 | 11.9 | |||||||||||||

Total ratio | 15.5 | 14.7 | 15.1 | |||||||||||||

Other information | ||||||||||||||||

Number of shares (millions) | 6,305 | 7.1 | 5,887 | 6,171 | ||||||||||||

Number of shareholders | 940,619 | (1.4 | ) | 954,325 | 960,397 | |||||||||||

Number of employees(3) | 114,228 | 4.4 | 109,450 | 108,770 | ||||||||||||

Number of branches(3) | 8,135 | 10.5 | 7,359 | 7,371 | ||||||||||||

Number of ATMs(3) | 24,337 | 13.8 | 21,383 | 22,159 | ||||||||||||

General note: The financial information included in this document with respect to the stake in Garanti Group is presented as continuous with previous years, and integrated in the proportion corresponding to the Group’s percentage holding at 30-6-2015. For the reconciliation of the BBVA Group’s consolidated financial statements, see pages 42 and 43.

| (1) | Adjusted by additional Tier I instrument remuneration. |

| (2) | The capital ratios are calculated under CRD IV, applying a 40% phase in for 2015. |

| (3) | Excluding Garanti. |

07.31.2015

Consolidated income statement: quarterly evolution(1)

(Million euros)

| 2015 | 2014 | |||||||||||||||||||||||

| 2Q | 1Q | 4Q | 3Q | 2Q | 1Q | |||||||||||||||||||

Net interest income | 3,858 | 3,663 | 4,248 | 3,830 | 3,647 | 3,391 | ||||||||||||||||||

Net fees and commissions | 1,140 | 1,077 | 1,168 | 1,111 | 1,101 | 985 | ||||||||||||||||||

Net trading income | 650 | 775 | 514 | 444 | 426 | 751 | ||||||||||||||||||

Dividend income | 194 | 42 | 119 | 42 | 342 | 29 | ||||||||||||||||||

Income by the equity method | 18 | 3 | 3 | 31 | 16 | (14 | ) | |||||||||||||||||

Other operating income and expenses | 62 | 73 | (287 | ) | (234 | ) | (215 | ) | (90 | ) | ||||||||||||||

Gross income | 5,922 | 5,632 | 5,765 | 5,223 | 5,317 | 5,051 | ||||||||||||||||||

Operating expenses | (2,942 | ) | (2,776 | ) | (2,905 | ) | (2,770 | ) | (2,662 | ) | (2,613 | ) | ||||||||||||

Personnel expenses | (1,538 | ) | (1,460 | ) | (1,438 | ) | (1,438 | ) | (1,359 | ) | (1,375 | ) | ||||||||||||

General and administrative expenses | (1,106 | ) | (1,024 | ) | (1,147 | ) | (1,037 | ) | (1,017 | ) | (959 | ) | ||||||||||||

Depreciation and amortization | (299 | ) | (291 | ) | (320 | ) | (296 | ) | (286 | ) | (279 | ) | ||||||||||||

Operating income | 2,980 | 2,857 | 2,860 | 2,453 | 2,655 | 2,438 | ||||||||||||||||||

Impairment on financial assets (net) | (1,089 | ) | (1,119 | ) | (1,168 | ) | (1,142 | ) | (1,073 | ) | (1,103 | ) | ||||||||||||

Provisions (net) | (164 | ) | (230 | ) | (513 | ) | (199 | ) | (298 | ) | (144 | ) | ||||||||||||

Other gains (losses) | (123 | ) | (66 | ) | (201 | ) | (136 | ) | (191 | ) | (173 | ) | ||||||||||||

Income before tax | 1,604 | 1,442 | 978 | 976 | 1,092 | 1,017 | ||||||||||||||||||

Income tax | (429 | ) | (386 | ) | (173 | ) | (243 | ) | (292 | ) | (273 | ) | ||||||||||||

Net income from ongoing operations | 1,175 | 1,056 | 805 | 733 | 800 | 744 | ||||||||||||||||||

Results from corporate operations (2) | 144 | 583 | — | — | — | — | ||||||||||||||||||

Net income | 1,319 | 1,639 | 805 | 733 | 800 | 744 | ||||||||||||||||||

Non-controlling interests | (97 | ) | (103 | ) | (116 | ) | (132 | ) | (95 | ) | (120 | ) | ||||||||||||

Net attributable profit | 1,223 | 1,536 | 689 | 601 | 704 | 624 | ||||||||||||||||||

Net attributable profit (excluding results from corporate operations) | 1,078 | 953 | 689 | 601 | 704 | 624 | ||||||||||||||||||

Basic earnings per share (euros) (3) | 0.19 | 0.24 | 0.11 | 0.09 | 0.11 | 0.10 | ||||||||||||||||||

| (1) | Financial statements with the revenues and expenses of the Garanti Group consolidated in proportion to the percentage of the Group’s stake. |

| (2) | 2015 includes the capital gains from the various sale operations equivalent to 6.34% of BBVA Group’s stake in CNCB and the badwill from Cx operation. |

| (3) | Adjusted by additional Tier I instrument remuneration. |

07.31.2015

Consolidated income statement(1)

(Million euros)

| 1H15 | D% | D% at constant exchange rates | 1H14 | |||||||||||||

Net interest income | 7,521 | 6.9 | 11.4 | 7,038 | ||||||||||||

Net fees and commissions | 2,216 | 6.2 | 4.7 | 2,086 | ||||||||||||

Net trading income | 1,425 | 21.1 | 25.2 | 1,176 | ||||||||||||

Dividend income | 236 | (36.3 | ) | (36.8 | ) | 371 | ||||||||||

Income by the equity method | 21 | n.m. | n.m. | 1 | ||||||||||||

Other operating income and expenses | 135 | n.m. | 129.3 | (305 | ) | |||||||||||

Gross income | 11,554 | 11.4 | 10.7 | 10,368 | ||||||||||||

Operating expenses | (5,718 | ) | 8.4 | 6.6 | (5,275 | ) | ||||||||||

Personnel expenses | (2,998 | ) | 9.6 | 6.6 | (2,734 | ) | ||||||||||

General and administrative expenses | (2,130 | ) | 7.8 | 7.4 | (1,976 | ) | ||||||||||

Depreciation and amortization | (590 | ) | 4.5 | 4.0 | (565 | ) | ||||||||||

Operating income | 5,836 | 14.6 | 14.9 | 5,093 | ||||||||||||

Impairment on financial assets (net) | (2,208 | ) | 1.5 | 1.2 | (2,177 | ) | ||||||||||

Provisions (net) | (394 | ) | (11.1 | ) | (5.8 | ) | (443 | ) | ||||||||

Other gains (losses) | (188 | ) | (48.3 | ) | (48.3 | ) | (365 | ) | ||||||||

Income before tax | 3,046 | 44.4 | 44.2 | 2,109 | ||||||||||||

Income tax | (815 | ) | 44.1 | 49.3 | (566 | ) | ||||||||||

Net income from ongoing operations | 2,231 | 44.5 | 42.5 | 1,544 | ||||||||||||

Results from corporate operations(2) | 727 | — | — | — | ||||||||||||

Net income | 2,958 | 91.6 | 88.9 | 1,544 | ||||||||||||

Non-controlling interests | (200 | ) | (7.3 | ) | 14.3 | (215 | ) | |||||||||

Net attributable profit | 2,759 | 107.7 | 98.3 | 1,328 | ||||||||||||

Net attributable profit (excluding results from corporate operations) | 2,031 | 52.9 | 46.0 | 1,328 | ||||||||||||

Basic earnings per share (euros)(3) | 0.43 | 0.21 | ||||||||||||||

| (1) | Financial statements with the revenues and expenses of the Garanti Group consolidated in proportion to the percentage of the Group’s stake. |

| (2) | 2015 includes the capital gains from the various sale operations equivalent to 6.34% of BBVA Group’s stake in CNCB and the badwill from Cx operation. |

| (3) | Adjusted by additional Tier I instrument remuneration. |

07.31.2015

Consolidated income statement of BBVA Group excluding Venezuela (1)

(Million euros)

| 1H15 | D% | D% at constant exchange rates | 1H14 | |||||||||||||

Net interest income | 7,427 | 17.9 | 10.8 | 6,298 | ||||||||||||

Net fees and commissions | 2,202 | 11.1 | 4.4 | 1,982 | ||||||||||||

Net trading income | 1,336 | 21.9 | 17.9 | 1,095 | ||||||||||||

Other income/expenses | 462 | 3.7 | 0.2 | 446 | ||||||||||||

Gross income | 11,426 | 16.4 | 9.8 | 9,821 | ||||||||||||

Operating expenses | (5,684 | ) | 12.7 | 6.3 | (5,042 | ) | ||||||||||

Operating income | 5,742 | 20.2 | 13.6 | 4,779 | ||||||||||||

Impairment on financial assets (net) | (2,199 | ) | 4.4 | 0.9 | (2,105 | ) | ||||||||||

Provisions (net) and other gains (losses) | (551 | ) | (28.5 | ) | (29.3 | ) | (771 | ) | ||||||||

Income before tax | 2,992 | 57.3 | 42.6 | 1,902 | ||||||||||||

Income tax | (778 | ) | 58.1 | 43.8 | (492 | ) | ||||||||||

Net income from ongoing operations | 2,215 | 57.0 | 42.2 | 1,410 | ||||||||||||

Results from corporate operations (2) | 727 | — | — | — | ||||||||||||

Net income | 2,942 | 108.6 | 88.9 | 1,410 | ||||||||||||

Non-controlling interests | (192 | ) | 23.5 | 12.7 | (156 | ) | ||||||||||

Net attributable profit | 2,749 | 119.2 | 98.3 | 1,254 | ||||||||||||

Net attributable profit (excluding results from corporate operations) | 2,022 | 61.2 | 45.9 | 1,254 | ||||||||||||

| (1) | Financial statements with the revenues and expenses of the Garanti Group consolidated in proportion to the percentage of the Group’s stake. |

| (2) | 2015 includes the capital gains from the various sale operations equivalent to 6.34% of BBVA Group’s stake in CNCB and the badwill from Cx operation. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Banco Bilbao Vizcaya Argentaria, S.A. | ||||||

| Date: July 31 , 2015 | By: | /s/ María Ángeles Peláez | ||||

| Name: | María Ángeles Peláez | |||||

| Title: | Authorized Representative | |||||