- BBVA Dashboard

- Financials

- Filings

- Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

6-K Filing

Banco Bilbao Vizcaya Argentaria (BBVA) 6-KCurrent report (foreign)

Filed: 18 Mar 19, 10:44am

UNITED STATES SECURITIES AND EXCHANGE

COMMISSION

WASHINGTON, D.C. 20549

FORM6-K

REPORT OF FOREIGN ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of March, 2019

Commission file number:1-10110

BANCO BILBAO VIZCAYA ARGENTARIA, S.A.

(Exact name of Registrant as specified in its charter)

BANK BILBAO VIZCAYA ARGENTARIA, S.A.

(Translation of Registrant’s name into English)

Calle Azul 4,

28050 Madrid

Spain

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form20-F or Form40-F:

Form20-F X Form40-F

Indicate by check mark if the registrant is submitting the Form6-K in paper as permitted by RegulationS-T Rule 101(b)(1):

Yes No X

Indicate by check mark if the registrant is submitting the Form6-K in paper as permitted by RegulationS-T Rule 101(b)(7):

Yes No X

| The English language version of this report is a free translation from the original, which was prepared in Spanish. All possible care has been taken, to ensure that the translation is an accurate presentation of the original. However, in all matters of interpretation, views or opinion expressed in the original language version of the document in Spanish take precedence over the translation. |

| 1 | ||||

| 3 | ||||

Correspondence between the sections of Pillar III and the Group’s Consolidated Annual Report | 7 | |||

| 10 | ||||

| 14 | ||||

| 16 | ||||

| 19 | ||||

| 19 | ||||

| 21 | ||||

| 26 | ||||

| 30 | ||||

| 30 | ||||

| 37 | ||||

1.3. Exemptions from capital requirements at the individual orsub-consolidated level | 37 | |||

| 38 | ||||

| 38 | ||||

| 41 | ||||

| 44 | ||||

| 45 | ||||

| 47 | ||||

2.6. Procedure employed in the internal capital adequacy assessment process | 50 | |||

| 51 | ||||

| 52 | ||||

| 63 | ||||

| 138 | ||||

| 155 | ||||

| 159 | ||||

| 160 | ||||

| 163 | ||||

| 176 | ||||

| 185 | ||||

| 185 | ||||

| 187 | ||||

| 187 | ||||

| 188 | ||||

| 188 | ||||

5.2. Description of the different types of employees included in the Identified Staff | 192 | |||

| 193 | ||||

| 199 | ||||

| 200 | ||||

| 201 | ||||

5.7. Ratios between the fixed and variable remuneration of Identified Staff | 201 | |||

5.8. Quantitative information on remuneration of the Identified Staff | 202 | |||

| 206 | ||||

| 207 | ||||

| 208 | ||||

| 2 |

ACRONYM

| DESCRIPTION

| |

ALM (Asset - Liability Management) | Mechanism for managing structural balance-sheet risk for possible mismatch between assets and liabilities and for various factors (interest rate, exchange rate, liquidity, etc.) | |

AMA | Advanced method approach used by the entity for calculating the consolidated capital requirements by operational risk | |

AT1 (Additional Tier 1) | Additional Tier 1 capital consists of hybrid instruments, basically CoCos and preferred securities | |

Basel III | Set of proposals for reforming banking regulation, published starting December 16, 2010 and to be implemented in a phased approach | |

BCBS (Basel Committee on Banking Supervision) | An international forum for cooperation in banking supervision, whose mission is to enhance the quality of banking supervision at global level | |

BIS (Bank for International Settlements) | An independent international organization that promotes international financial and monetary cooperation and acts as a bank for central banks | |

CCF (Credit Conversion Factor) | The ratio between the actual amount available for a commitment that could be used and therefore, would be outstanding at the time of default, and the actual amount available for the commitment | |

CCP (Central Counterparty Clearing House) | Entity which stands between the counterparty entities, acting as a buyer against the sellers and as a seller against the buyers | |

CDS (Credit Default Swap) | A financial derivative between a Beneficiary and Guarantor by which the Beneficiary pays the Guarantor a premium in exchange for receiving protection in the case of credit events for a determined period of time | |

CET 1 (Common Equity Tier 1) | The entity’s highest-quality capital | |

Counterparty Credit Risk | This is a risk that arises from the possibility of losses derived from positions in derivatives and repos | |

Credit Risk | This is a risk arising from the possibility that one party to a financial instrument contract will fail to meet its contractual obligations for reasons of insolvency or inability to pay, and cause a financial loss for the other party | |

CRM (Credit Risk Mitigation) | A technique used to reduce the credit risk associated with one or more of the entity’s current exposures | |

CRR / CRD IV | Solvency Regulation on prudential requirements of credit institutions and investment firms (Regulation EU 575/2013) | |

CVA (Credit Valuation Adjustment) | Value Adjustments for counterparty credit risk | |

DLGD (Downturn Loss Given Default) | Loss given default at a period of stress in the economic cycle | |

D-SIB (Domestic Systemically Important Bank) | Other systemically important institutions (O-SIIs) | |

EAD (Exposure at default) | Maximum loss at the counterparty’s time of default | |

EBA (European Banking Authority) | Independent institution responsible for promoting the stability of the financial system, the transparency of markets and financial products, and protecting depositors and investors | |

EC (Economic Capital) | The amount of capital considered necessary to cover unexpected losses if actual losses are greater than expected losses | |

ECAI (External Credit Assessment Institutions) | The external credit assessment institution designated by the entity | |

EL (Expected Loss) | Ratio between the amount that is expected the amount that is expected to be lost in an exposure, due to potential default by a counterparty or dilution over aone-year period, and the amount outstanding at the time of default | |

| 3 |

ACRONYM

| DESCRIPTION

| |

FSB (Financial Stability Board) | An international body that aims to increase the efficiency and stability of the international financial sector, supervising it and making recommendations | |

FTD (First to default) | Derivative in which the two parties negotiate protection against the first default of any of the entities in the basket | |

GRM | Global Risk Management | |

GRMC | Global Risk Management Committee | |

G-SIBs (Global Systemically Important Banks) | Financial institutions that due to their large size, importance in the market and connection to each other, could trigger a serious crisis in the international financial system if they face economic problems | |

IAA (Internal Assessment Approach) | Method of internal assessment used for the calculation of securitisation exposures in the investment portfolio | |

ICAAP (Internal Capital Adequacy Assessment Process) | Internal Capital Adequacy Assessment Process | |

ILAAP (Internal Liquidity Adequacy Assessment Process) | Internal Liquidity Adequacy Assessment Process | |

IMA (Internal Model Approach) | Approach that uses internal models to calculate the exposure originated by market risk | |

IMM (Internal Model Method) | Internal model method used to calculate exposure originated by counterparty risk | |

IRB (Internal Rating-Based approach) | Internal model method used to calculate exposure originated by credit risk. This method may be broken down into two types: FIRB (Foundation IRB) and AIRB (Advanced IRB) | |

IRC (Incremental Risk Capital) | Change applied to the exposure by market risk calculated using the internal method that quantifies the risk not captured by the VaR model, specifically in migration and default events | |

LCR | Liquidity coverage ratio | |

LDA (Loss Distribution Approach) | Aggregate Loss Distribution Model: this methodology estimates the distribution of losses by operational event by convoluting the frequency distribution and the loss given default distribution of these events | |

LDP | Low Default Portfolios | |

LGD (Loss Given Default) | Loss in the event of default | |

LGD BE (Loss Given Default Best Estimate) | Loss in the “current” default portfolio | |

Liquidity Risk | The risk of an entity finding it difficult to meet its payment commitments fully and in due time; or when to meet them it has to resort to finance under burdensome terms which may harm the bank’s image or reputation | |

LMUs (Liquidity Management Units) | These are financial self-sufficient entities in BBVA Group created with the aim of preventing and limiting liquidity risk, and avoiding possible contagion from a crisis affecting only one or more of these entities | |

LR (Leverage Ratio) | This measurement estimates the relative amount of assets,off-balance-sheet obligations and contingent obligations to be paid, delivered or guaranteed, including an entity’s obligations derived from finance received, commitments acquired, derivatives contracts or repurchase agreements, but excluding the obligations that may only be executed during the entity’s liquidation, which are financed with TIER 1 capital | |

LRLGD | Long-Run Loss Given Default | |

LtSCD (Loan to Stable Customer Deposits) | A ratio that measures the relation between net lending and stable customer deposits | |

Market Risk | This is a risk due the possibility that there may be losses in the value of positions held due to movements in the market variables that affect the | |

| 4 |

ACRONYM

| DESCRIPTION

| |

valuation of financial products and assets in trading activity | ||

MREL (Minimum Required Eligible Liabilities) | Minimum requirement for own funds and eligible liabilities | |

OE (Original Exposure) | The gross amount the entity may lose if the counterparty does not comply with its contractual payment obligations, not taking into account the effect of guarantees or improvements in credit or mitigate credit risk mitigation operations | |

Operational Risk | The risk of losses caused by human errors, inadequate or faulty internal processes, system failures or external events, including external fraud, natural disasters, and faulty service provided by third parties. BBVA includes legal risk in this definition, but excludes strategic and/or business risk and reputational risk | |

ORX (Operational Risk Exchange) | Database of external operational losses | |

PD (Probability of Default) | Probability that a counterparty will default during aone-year period | |

PD-TTC (PD Through the Cycle) | Probability of default over the course of the economic cycle | |

PIT(Point-In-Time) | Approach for calculating provisions by which the PD and LGD parameters must be adapted at each moment in time | |

QCCP (Qualifying central counterparty) | A central counterparty that has either been authorized under Article 14 of Regulation (EU) No. 648/2012, or recognized under Article 25 of this regulation | |

RW (Risk Weight) | Level of risk applied to exposures (%) | |

RWAs (Risk-Weighted Assets) | The entity’s exposure to risk weighted by a percentage obtained by the applicable rule (the Standardized Approach) or internal models | |

SFTs | Securities financing transactions | |

SREP (Supervisory Review and Evaluation Process) | Supervisory Review and Evaluation Process | |

Structural Risk | This risk is subdivided into structural interest-rate risk (movements in interest rates that cause alterations in an entity’s net interest income and book value); and structural exchange-rate risk (exposure to variations in exchange rates originating in BBVA Group’s foreign companies and in the provision of funds to foreign branches financed in a different currency to that of the investment) | |

Synthetic securitisation | Type of operation where the loan portfolio is not typically transferred to a fund; on the contrary, the credit remains in the balance sheet of the corresponding entity, but this transfers the default risk to a third party. The objective of this type of instrument is the transmission of balance risk and capital release. Usually, the assignment of risk is usually made through a derivative (CDS) or through a financial guarantee | |

TIER I (First-level capital) | Capital made up of instruments that can absorb losses when the entity is in operation. It is composed of CET1 and AT1 | |

TIER II (Second-level capital) | Additional capital formed by instruments, basically subordinated debt, revaluation reserves and hybrid instruments, which will absorb losses when the entity is not a going concern | |

TLAC (Total Loss Absorbing Capacity) | A regulatory framework approved by the FSB with the aim of guaranteeing that G-SIBs hold a minimum level of instruments and liabilities to ensure that the essential functions of the entity may be maintained in the resolution procedures and immediately afterward, without endangering taxpayers’ funds or financial stability | |

Traditional securitisation | Operation whereby an entity is capable of transforming a series of heterogeneous and illiquid financial assets into homogeneous liquid instruments (usually debentures or bonds) that can be traded on the market, thereby transferring the risk of the assets in most cases while capturing liquidity | |

| 5 |

ACRONYM

| DESCRIPTION

| |

VaR (Value at Risk) | The measurement model that forecast the maximum loss that can be incurred by the entity’s trading portfolios stemming from market price fluctuations in a specific time horizon and at a specific level of confidence | |

| 6 |

Correspondence between the sections of Pillar III and the Group’s Consolidated Annual Report

The information included in this Report may be supplemented with the financial information contained in the Group’s Consolidated Annual Financial Statements. For this purpose, the following table presents the correspondence between the sections of the Pillar III Report and the Group’s Consolidated Annual Financial Statements.

Section

| Subsection

| Group’s Consolidated Financial Statements | Pillar III | |||

| Regulatory Environment | N/A | Introduction | ||||

| Introduction | Contents of the 2018 Prudential Relevance Report | N/A | Introduction | |||

| Composition of Capital | Note 32 | Introduction | ||||

| Corporate name and differences between the consolidated group for the purposes of the solvency regulations and accounting criteria | ||||||

| Corporate name and scope of application | Note 1.1 | 1.1.1 | ||||

| Differences in the consolidated group for the purposes of the solvency regulations and accounting criteria | N/A | 1.1.2 | ||||

General Information Requirements | Reconciliation of the Public Balance Sheet from the accounting perimeter to the regulatory perimeter | Note 32 | 1.1.3 | |||

| Main changes to the Group’s scope of consolidation in 2018 | Note 3 | 1.1.4 | ||||

| Identification of dependent institutions with capital resources below the minimum requirement. Possible impediments to capital transfer | N/A | 1.2 | ||||

| Exemptions from capital requirements at the individual orsub-consolidated level | N/A | 1.3 | ||||

Characteristics of the eligible capital resources | N/A | 2.1 | ||||

Amount of capital | Note 32 | 2.2 | ||||

| Capital Resources | IFRS9 transitional arrangements | N/A | 2.3 | |||

Bank risk profile | Note 7 | 2.4 | ||||

Breakdown of minimum capital requirements by risk type | N/A | 2.5 | ||||

Procedure employed in the internal capital adequacy assessment process | N/A | 2.6 | ||||

General risk control and management model | ||||||

| Risks | Governance and organization | Note 7.1.1 | 3.1.1 | |||

Risk Appetite Framework | Note 7.1.2 | 3.1.2 |

| 7 |

Section

| Subsection

| Group’s Consolidated Financial Statements | Pillar III

| |||

Decisions and processes | Note 7.1.3 | 3.1.3 | ||||

Assessment, monitoring and reporting | Note 7.1.4 | 3.1.4 | ||||

Infrastructure | Note 7.1.5 | 3.1.5 | ||||

Risk culture | Note 7.1.6 | 3.1.6 | ||||

Credit and counterparty credit risk | ||||||

Scope and nature of the credit risk measurement and reporting systems | Note 7.3 | 3.2.1 | ||||

Definitions and accounting methodologies | Notes 2.2.1 | 3.2.2 | ||||

Information on credit risk | N/A | 3.2.3 | ||||

Information on the standardized approach | N/A | 3.2.4 | ||||

Information on the IRB approach | N/A | 3.2.5 | ||||

Information on credit counterparty credit risk | 7.4.3 | 3.2.6 | ||||

Information on securitisations | N/A | 3.2.7 | ||||

Hedging and risk reduction policies. Supervision strategies and processes | Note 7.3.3 | 3.2.8 | ||||

Information on credit risk mitigation techniques | N/A | 3.2.9 | ||||

RWA density by geographical area | N/A | 3.2.10 | ||||

Market risk | ||||||

Scope and nature of the market risk measurement and reporting systems | Note 7.4 | 3.3.1 | ||||

Differences in the trading book for the purposes of applying the solvency regulations and accounting criteria | N/A | 3.3.2 | ||||

Standardized approach | N/A | 3.3.3 | ||||

Internal models | Note 7.4.1 | 3.3.4 | ||||

Structural risk in the equity portfolio | ||||||

Scope and nature of the structural risk in the equity portfolio measurement and reporting systems | Note 7.4.2 | 3.4.1 | ||||

Differentiation between portfolios held for sale and those held for strategic purposes | N/A | 3.4.2 | ||||

Book value and exposure of equity investments and capital instruments contained in above portfolios | N/A | 3.4.3 | ||||

Risk-weighted assets of equity investments and capital instruments | N/A | 3.4.4 | ||||

Profit and loss and adjustments for valuation of equity investments and capital instruments | Notes 41 and 49 | 3.4.5 | ||||

| Structural exchange-rate risk |

| 8 |

Section

| Subsection

| Group’s Consolidated Financial Statements | Pillar III

| |||

Scope and nature of the exchange-rate risk measurement and reporting systems | Note 7.4.2 | 3.5.1 | ||||

Interest-rate risk | ||||||

Evolution, monitoring and reporting | Note 7.4.2 | 3.6.1 | ||||

Nature of interest-rate risk and key hypothesis | N/A | 3.6.2 | ||||

Variations in interest risks | Note 7.4.2 | 3.6.3 | ||||

Liquidity risk | ||||||

Liquidity and funding strategy and planning | Note 7.5.1 | 3.7.1 | ||||

Governance and monitoring | Note 7.5.1 | 3.7.2 | ||||

Liquidity and funding performance in 2018 | Note 7.5.1 | 3.7.3 | ||||

Liquidity and funding prospects | N/A | 3.7.4 | ||||

LCR disclosure | Note 7.5.1 | 3.7.5 | ||||

Assets committed in finance transactions | Note 7.5.2 | 3.7.6 | ||||

Operational risk | ||||||

Operational risk definition | Note 7.6 | 3.8.1 | ||||

Operational risk management model | Note 7.6 | 3.8.2 | ||||

Operational risk governance | N/A | 3.8.3 | ||||

Methods used for calculating capital requirements | N/A | 3.8.4 | ||||

| Group’s operational risk profile | N/A | 3.8.5 | ||||

| Remuneration | Information on remuneration | Note 54 | 5 | |||

Information on the Corporate Governance system | Information on the Corporate Governance system | Annual Corporate Governance Report | 6 | |||

| Subsequent events | Subsequent events | Note 56 | 7 |

| 9 |

Table 1. | Geographical breakdown of relevant credit exposures for the calculation of the countercyclical capital buffer | |

Table 2. | CC2 - Reconciliation of the regulatory capital with Public Balance Sheet | |

Table 3 | EU Ll1 - Differences between the accounting and regulatory scopes of consolidation and the mapping of the financial statements categories with regulatory risk categories | |

Table 4. | EU LI2 - Main sources of the differences between regulatory original exposure amounts and carrying values in financial statements | |

Table 5. | Credit and Counterparty Risk headings of the Public Balance Sheet for OE, EAD and RWAs | |

Table 6. | Amount of capital (CC1) | |

Table 7. | Reconciliation of the Public Balance Sheet from the accounting perimeter to the regulatory perimeter | |

Table 8. | IFRS9-FL - Summary of the own funds, main capital and leverage ratios with and without the application of IFRS9 transitional arrangement or similar Expected Credit Losses (ECL) | |

Table 9. | EU OV1 Overview of RWAs | |

Table 10. | Capital requirements by risk type and exposure class | |

Table 11. | Credit Risk exposure | |

Table 12. | EUCRB-B – Total and average net amount of exposures (including counterparty credit risk) | |

Table 13. | EUCRB-C – Geographical breakdown of exposures (including counterparty credit risk) | |

Table 14. | EUCR1-C – Credit quality of exposures by geography (including counterparty credit risk) | |

Table 15. | EUCR1-A – Credit quality of exposures by exposure class and instrument (excluding counterparty credit risk) | |

Table 16. | EUCRB-D – Concentration of exposures by industry or counterparty types (excluding counterparty credit risk) | |

Table 17. | EUCR1-B – Credit quality of exposures by industry or counterparty types (excluding counterparty credit risk) | |

Table 18. | EUCRB-E – Maturity of exposures (excluding counterparty credit risk) | |

Table 19. | EUCR1-D – Ageing ofpast-due exposures | |

Table 20. | EUCR2-A – Changes in the stock of general and specific credit risk adjustments | |

Table 21. | EUCR2-B – Changes in the stock of defaulted and impaired loans and debt securities | |

| 10 |

Table 22. | EUCR1-E –Non-performing exposures and forborne exposures | |

Table 23. | EU CR4 – Standardised approach – Credit risk exposure and credit risk mitigation effects | |

Table 24. | Standardised approach: Exposure values before the application of credit risk mitigation techniques | |

Table 25. | EU CR5 – Standardised approach | |

Table 26. | RWA flow statements of credit risk exposures under the standardised approach | |

Table 27. | Models authorized by the supervisor for use in the calculation of capital requirements | |

Table 28. | Master Scale of BBVA’s rating | |

Table 29. | EU CR6 – IRB approach – Credit risk exposures by exposure class and PD range | |

Table 30. | EU CR9 – IRB approach – Backtesting of PD per exposure class | |

Table 31. | EU CR8 – RWA flow statements of credit risk exposures under the IRB approach | |

Table 32. | EU CR10 (1) – IRB: specialised lending | |

Table 33. | EU CR10 (2) – IRB: Equity | |

Table 34. | Positions subject to counterparty credit risk in terms of OE, EAD and RWAs | |

Table 35. | Amounts of counterparty risk in the trading book | |

Table 36. | EUCCR5-A – Impact of netting and collateral held on exposure values | |

Table 37. | EU CCR1 – Analysis of CCR exposure by approach | |

Table 38. | EU CCR3 – Standardised approach – CCR exposures by regulatory portfolio and risk | |

Table 39. | EU CCR4 – IRB approach – CCR exposures by portfolio and PD scale | |

Table 40. | EUCCR5-B – Composition of collateral for exposures to CCR | |

Table 41. | EU CCR6 – Credit derivatives exposures | |

Table 42. | EU CCR2 – CVA capital charge | |

Table 43. | Variations in terms of RWAs of CVA | |

Table 44. | EU CCR8 – Exposures to CCPs | |

Table 45. | SEC1: Securitisation exposures in the investment portfolio | |

Table 46. | SEC4: Exposure to securitisation in the banking portfolio and associated regulatory capital requirements (Bank that acts as an investor) | |

| 11 |

Table 47. | SEC3: Exposure to securitisation in the banking portfolio and associated regulatory capital requirements (Bank that acts as originator or sponsor) | |

Table 48. | Breakdown of securitized balances by type of asset | |

Table 49. | Outstanding balance corresponding to the underlying assets of the Group’s originated Securitisations, in which risk transfer criteria are not fulfilled | |

Table 50. | Exposure covered with financial guarantees and other collateral calculated using the standardised and advanced approaches | |

Table 51. | Exposure covered by personal guarantees. Standardised and advanced approach | |

Table 52. | EU CR3 – CRM techniques – Overview | |

Table 53. | Breakdown of RWA density by geographical area and approach | |

Table 54. | EU MR1 – Market risk under the standardised approach | |

Table 55. | Prudent Valuation Adjustments | |

Table 56. | EU MR3 – IMA values for trading portfolios | |

Table 57. | Trading Book. VaR without smoothing by risk factors | |

Table 58. | EUMR2-A – Market risk under the IMA | |

Table 59. | EUMR2-B – RWA flow statements of market risk exposures under the IMA | |

Table 60. | Trading Book. Impact on earnings in Lehman scenario | |

Table 61. | Trading Book. Stress resampling | |

Table 62. | Breakdown of book value, EAD and RWAs of equity investments and capital instruments | |

Table 63. | Exposure in equity investments and capital instruments | |

Table 64. | Breakdown of RWAs, equity investments and capital instruments by applicable approach | |

Table 65. | Variation in RWAs for Equity Risk | |

Table 66. | Realized profit and loss from sales and settlements of equity investments and capital instruments | |

Table 67. | Valuation adjustments for latent revaluation of equity investments and capital instruments | |

Table 68. | Variations in interest rates. Impact on net interest income and economic value | |

Table 69. | Loan to Stable Customer Deposits (LtSCD) | |

| 12 |

Table 70. | LCR main LMU | |

Table 71. | Liquidity inflows. Residual maturities by contractual periods | |

Table 72. | Liquidity outflows. Residual maturities by contractual periods | |

Table 73. | Maturity of wholesale issues of Balance Euro by nature | |

Table 74. | Maturity of wholesale issues of Bancomer by nature | |

Table 75. | Maturity of wholesale issues of Compass by nature | |

Table 76. | Maturity of wholesale issues of Garanti by nature | |

Table 77. | Maturity of wholesale issues of South America by nature | |

Table 78. | EU LIQ1: LCR disclosure template | |

Table 79. | Committed assets over total assets rate | |

Table 80. | Mortgage-covered bonds | |

Table 81. | Public-covered bonds | |

Table 82. | Internationalization-covered bonds | |

Table 83. | Encumbered and unencumbered Assets | |

Table 84. | Collateral received | |

Table 85. | Sources of encumbrance | |

Table 86. | Regulatory capital for Operational Risk | |

Table 87. | LRSum - Summary reconciliation of accounting assets and exposure corresponding to the Leverage Ratio | |

Table 88. | Composition of the Remuneration Committee | |

Table 89. | Settlement and payment system for annual variable remuneration | |

Table 90. | Total remuneration of Identified Staff in 2018 | |

Table 91. | Extraordinary remuneration of the Identified Staff in 2018 | |

Table 92. | Deferred variable remuneration from periods prior to 2018 | |

Table 93. | Remunerations of identified staff in 2018 by activity areas | |

Table 94. | Number of individuals with total remuneration in excess of€1 million in 2018 | |

| 13 |

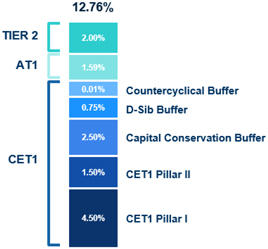

Chart 1. | Capital Requirements (fully loaded) | |

Chart 2. | Capital Ratio Evolution during 2018 | |

Chart 3. | Distribution of RWAs by risk type under Pillar I | |

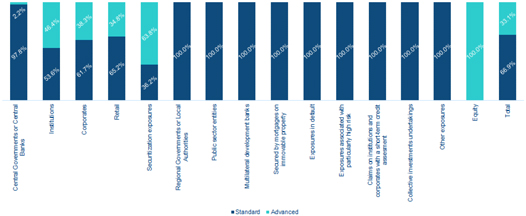

Chart 4. | Breakdown of RWAs by exposure category and method | |

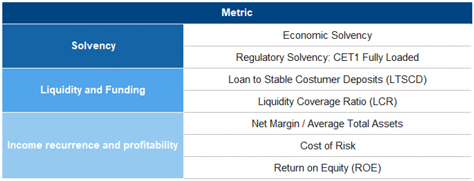

Chart 5. | BBVA’s Group Core Metrics | |

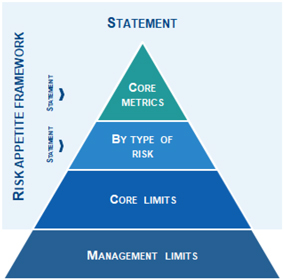

Chart 6. | Structure of Group’s BBVA Risk Appetite Framework | |

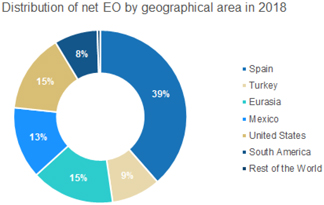

Chart 7. | Distribution by geographical area of Exposure to Credit Risk | |

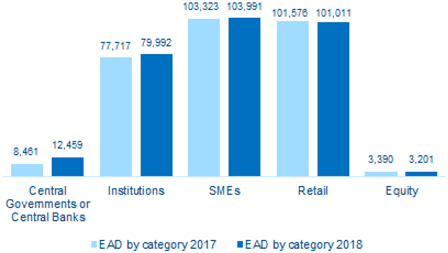

Chart 8. | Advanced Measurement Approach: EAD by obligor category | |

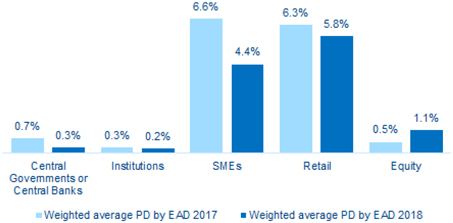

Chart 9. | Advanced Measurement Approach: Weighted average PD by EAD | |

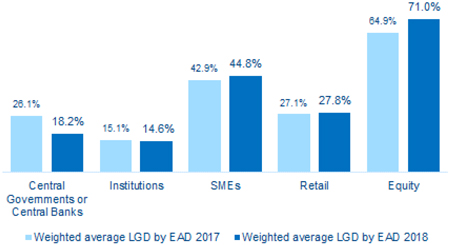

Chart 10. | Advanced Measurement Approach: Weighted average LGD by EAD | |

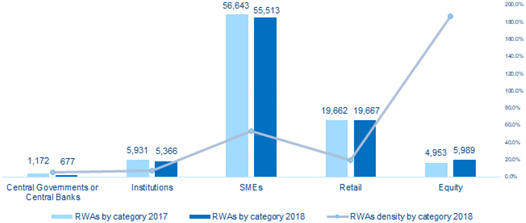

Chart 11. | Advanced Measurement Approach: RWAs by obligor category | |

Chart 12. | Comparative analysis of expected loss: retail mortgages | |

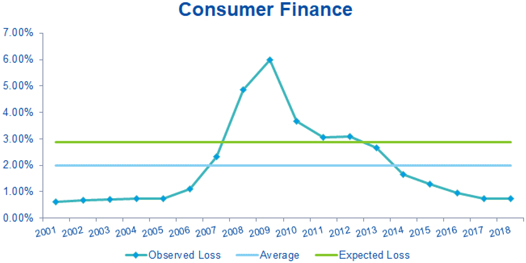

Chart 13. | Comparative analysis of expected loss: consumer finance | |

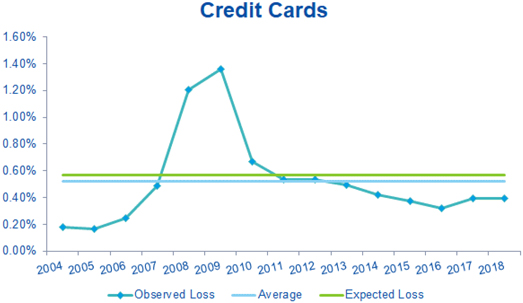

Chart 14. | Comparative analysis of expected loss: credit cards | |

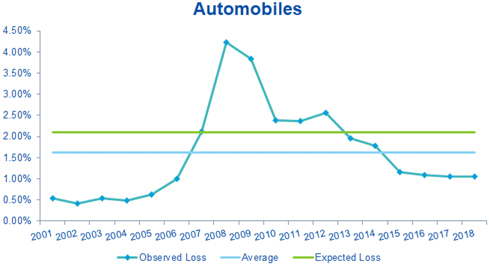

Chart 15. | Comparative analysis of expected loss: automobiles | |

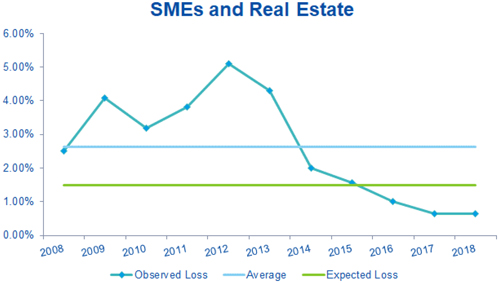

Chart 16. | Comparative analysis of expected loss: SMEs and Real Estate Developers | |

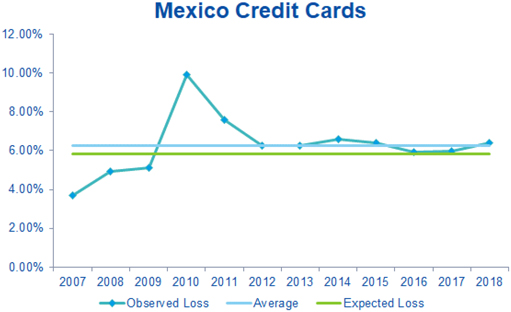

Chart 17. | Comparative analysis of expected loss: Mexico credit cards | |

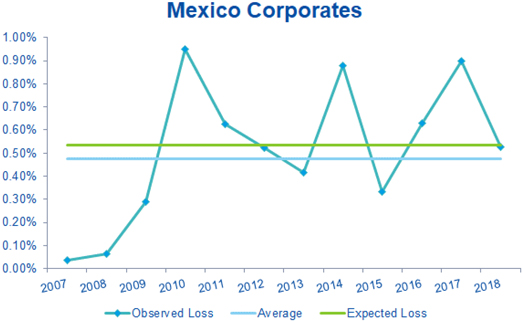

Chart 18. | Comparative analysis of expected loss: Mexico corporates | |

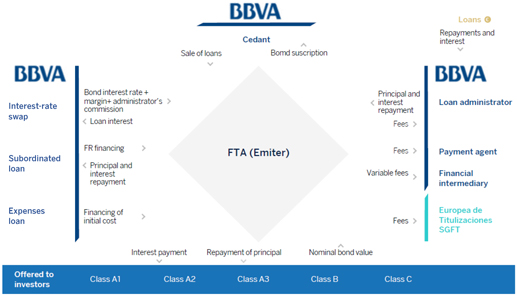

Chart 19. | Functions performed in the securitization process and Group’s level of involvement | |

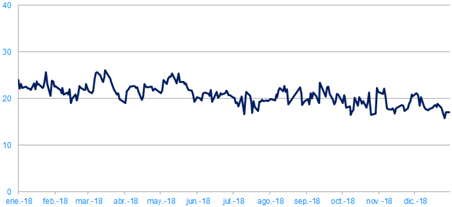

Chart 20. | Trading book. Trends in VaR without smoothing | |

Chart 21. | Trading book. Market Risk Model Validation for BBVA S.A. Hypothetical Backtesting | |

| 14 |

Chart 22. | Trading book. Market Risk Model Validation for BBVA S.A. Real Backtesting | |

Chart 23. | Trading book. Market Risk Model Validation for BBVA Bancomer. Hypothetical Backtesting | |

Chart 24. | Trading book. Market Risk Model Validation for BBVA Bancomer. Real Backtesting | |

Chart 25. | Operational risk management process | |

Chart 26. | Corporate Assurance Governance Structure | |

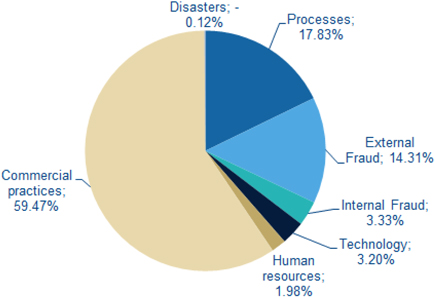

Chart 27. | Operational Risk Profile of BBVA Group | |

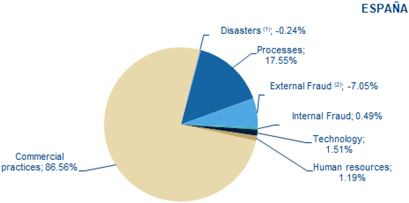

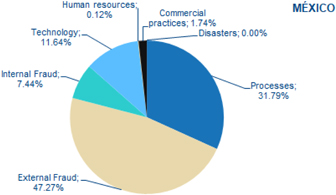

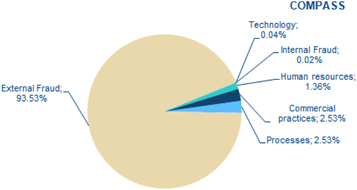

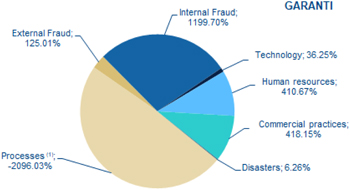

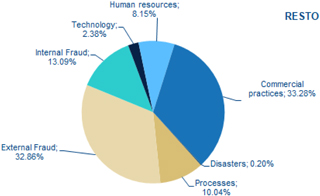

Chart 28. | Operational Risk profile by risk and country | |

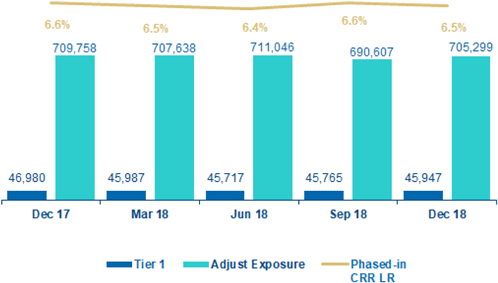

Chart 29. | Trends in the leverage ratio | |

| 15 |

BBVA is a customer-centric global financial services group founded in 1857. BBVA is present in more than 30 countries. It is a solid leader in Spain, and the biggest financial institution in Mexico; it has franchises that are leaders in South America and the Sunbelt region of the United States; and is the largest shareholder in the Turkish bank Garanti.

Its diversified business is focused on high-growth markets, and it views technology as a key sustainable competitive advantage.

Business strategy and model

During 2018, BBVA made significant progress on its transformation, firmly underpinned by the Group’s Purpose, and the six Strategic Priorities, as fundamental pillars of the Organization’s strategy.

Our vision and aspiration

BBVA is developing a transformation process needed in order to adapt itself to the new environment within the financial industry, characterized by trends validating the Group’s strategic vision. In other words, a reconfiguration of the financial services industry is taking place. Those trends are:

| · | A complex macroeconomic environment, characterized by strong regulatory pressure, low interest rates, high currency volatility, and geopolitical risks. |

| · | A highly regulated banking industry, that is, traditional banking subject to a large number of legal regulations, both globally and locally. |

| · | A shift in the needs and expectations of customers who demand higher value-added services that enable them to achieve their objectives, with a simple, transparent and immediate relationship model similar to the one they already enjoy with a number of other highly digitized industries. |

| · | Certain data that is evolving into a strategic asset. Given the large amount of data stored within organizations, the ability to interpret and make value proposals to customers is considered to be critical, provided there is customer consent under all circumstances. |

| · | Certain technological giants, with business models based on data that create ecosystems where the lines between different types of businesses are being blurred. |

| · | Greater competition because of the arrival of new players who focus on the most profitable aspects of the value chain. |

In this context, the main objective of the Group’s transformation strategy –its aspiration– is to strengthen the relationship with the clients.

Progress in BBVA’s transformation journey

BBVA advanced in fulfilment of its Purpose in 2018: to bring the age of opportunity to everyone, this is reflected in the tagline: Creating Opportunities. We want to help our customers make better financial decisions and attain their life goals; we want to be more than a bank, we want to be an engine of opportunities and have a positive impact on peoples’ lives and companies’ businesses.

In this respect, important steps were taken in the development of the six Strategic Priorities of the Group throughout the year in order to continue its advances in the transformation process. These advances were reflected in the results of key performance indicators

(KPIs).

| 16 |

Strategic priorities

| 1. | The best customer experience |

BBVA Group’s main focus is based on providing a new standard in customer experience that stands out for its simplicity, transparency and swiftness, further empowering its customers while offering them personalized advice.

| 2. | Digital sales |

BBVA’s relationship model is evolving to adapt to the growing multi-channel customer profile, which is why it is essential to foster digitalization. For this purpose, it is developing an important digital offering including products and services that let customers use the most convenient channel for them.

| 3. | New business models |

Throughout 2018, BBVA continued to consolidate itself as one of the leading banks in terms of digital transformation and activity in the entrepreneurship ecosystem. The Group is actively participating in the disruption of the financial industry in order to incorporate key findings into the Bank’s value proposition, through both the search for new digital business models as well as the leveraging of the FinTech ecosystem.

| 4. | Optimize capital allocation |

The objective of this priority is to improve the profitability and sustainability of the business while simplifying and focusing it on the most relevant activities. Throughout 2018, efforts continued to promote the correct allocation of capital and this is allowing the Group to continue improving in terms of solvency.

| 5. | Unrivalled efficiency |

In an environment of lower profitability for the financial industry, efficiency has become an essential priority in BBVA’s transformation plan. This priority is based on building a new organizational model that is as agile, simple and automated as possible.

| 6. | A first class workforce |

BBVA Group’s most important asset is its people; therefore, a first class workforce is one of the six Strategic Priorities, which entails attracting, selecting, training, developing and retainingtop-class talent.

BBVA Group has developed new people management models and new ways of working which have enabled the Bank to keep transforming its operational model, but have also promoted cultural transformation and have favoured the ability to become a purpose-driven company, or, in other words, a company where staff guide their actions according to the Values, and are genuinely inspired and motivated by the same Purpose.

Highlights

BBVA Group’s net attributable profit for 2018,€5,32 billion, includes the capital gains from the sale of BBVA Chile.

Once more, there was a notably good performance of the more recurring revenue, and control of operating expenses.

Management of liquidity and funding in BBVA aims to finance the recurring growth of the banking business at suitable maturities and costs, using a wide range of instruments that

| 17 |

provide access to a large number of alternative sources of finance, always in compliance with current regulatory requirements.

The level of the BBVA Group’s liquidity coverage ratio (LCR) remained comfortably above 100% throughout 2018, without including liquidity transfers between subsidiaries; in other words, no kind of excess liquidity in the subsidiaries abroad is considered in the calculation of the consolidated ratio. As of December 31, 2018, the LCR stood at 127%. Although this requirement is only established at Group level, the minimum level is easily exceeded in all the subsidiaries.

BBVA Group’s risk quality metrics have continued to perform positively throughout the year. Since the end of 2017,non-performing loans continued their declining trend, been reduced 16.6% and the Group’snon-performing loan ratio recorded a further improvement strongly influenced by the decline innon-performing loans.

As regards solvency, BBVA Group’s fully-loaded CET1 ratio stood at 11.3% at the end of December 2018, in line with the target of 11%. This ratio has increased by 30 basis points since the end of 2017, leveraged on organic earning generation and reduction of risk weighted asset capital consumption.

The following sections present details related to the Group’s solvency. The Management Report, which is attached to the BBVA Group Consolidated Financial Statements, presents the main indicators of the Group’s activity and profitability.

| 18 |

Regulatory environment in 2018

Contents of the 2018 Prudential Relevance Report

Composition of Capital

Regulatory environment in 2018

As a Spanish credit institution, BBVA is subject to Directive 2013/36/EU of the European Parliament and of the Council dated June 26, 2013, on access to the activity of credit institutions and investment firms (“Directive CRD IV”) amending Directive 2002/87/EC and repealing Directives 2006/48/EC and 2006/49/EC by means of which the EU began, as of January 1 2014, to implement the capital reforms agreed within the framework of Basel III, thus establishing a period of gradual implementation for certain requirements until January 1 2019.

The major regulation governing the solvency of credit institutions is Regulation (EU) No 575/2013 of the European Parliament and of the Council dated June 26, 2013, on prudential requirements for credit institutions and investment firms, amending Regulation (EU) No 648/2012 (“CRR” and, jointly with Directive CRD IV and any other CRD IV implementation measure, “CRD IV”), which is complemented by several binding Regulatory Technical Standards that apply directly to EU member states, there being no need to implement national measures.

Directive CRD IV was transposed to Spanish national law by means of RoyalDecree-Law 14/2013 dated November 29(“RD-L 14/2013”), Law 10/2014, Royal Decree 84/2015 dated February 13 (“RD 84/2015”), Bank of Spain Circular 2/2014 dated January 31 and Circular 2/2016 dated February 2 (“Bank of Spain Circular 2/2016”).

Regulatory changes

BIS III Reform: in order to strike a balance between risk sensitivity, simplicity and comparability, the Basel Committee has reformed the Basel III framework. The main amendments are focused on internal models, the standard credit risk method, the market risk framework, operational risk and capital floors in the advanced measurement approach based on the standardized approach. The reform has been approved by the Basel Committee meeting on December 8, 2017, with an implementation date of January 1, 2022. In the case of capital floors, its introduction is gradual over a period of 5 years, from a floor of 50% on January 1, 2022 to 72.5% on January 1, 2027. The Committee also introduced an additional leverage ratio for global systemically important banks(G-SIBs).

CE reforms and provisions: in Europe, on November 23, 2016 the European Commission published a new reform package amending both the prudential banking regime (CRR) and the resolution regime (Bank Recovery and Resolution Directive, BRRD). This revision includes the implementation of international standards into European legislation (regulation later than 2010 adopted by the Basel Committee – except for standards approved in December, 2017 – and the total loss absorbing capacity (TLAC)), the final design of the Minimum Requirement for own funds and Eligible Liabilities (MREL) along with a package of technical improvements. At the same time, a proposal of directive has also been put forward to harmonize the hierarchy of senior debt creditors within the European Union. This directive was approved in December 2017.

| 19 |

As of today discussions continue within the European Council and Parliament with the aim of reaching an agreement on the texts that will be the subject of negotiation between the European Commission, the European Council and the European Parliament. In this respect, in December 2018 they reached an agreement on the main points of the reform. However, on December 27, 2017 the Official Journal of the European Union (OJEU) published the agreement reached by the fast-track procedure relating to the following three aspects of the reform:

| 1. | A transitional period of 5 years (2018-2022) during which the banks will be allowed to mitigate partially the negative impact of the increased provisions under the new IFRS 9 accounting standard on their CET1 capital, in accordance with the provisions of Regulation (EU) 2017/2395 (article 473bis of Regulation (EU) No. 575/2013), to which BBVA Group has adhered voluntarily. In this regard and during that transitional period, information detailing the impact of not applying those transitory arrangements will be reported. For these purposes, EBA has published guidelines that specify the uniform format that should be used to disclose the information required during the transitional period (EBA/GL/2018/01). |

In this report, thephased-in capital ratios as of December 2018 are calculated taking into account the aforementioned transitional IFRS 9 treatment, whereas the fully loaded capital ratios incorporate the full impact of these new accounting regulations.

| 2. | An additional period of three years (2018-2020) during which exposure with respect to central governments or central banks of the Member States denominated and financed in a currency of another Member State remains exempt from calculation of threshold to large exposures. |

| 3. | Creation of a new category of subordinated senior debt in the hierarchy of bank creditors that will be eligible for the purposes of TLAC. |

Reform of the securitisation framework: with respect to securitisations, the European Commission published a proposal in 2015 aimed to facilitate the development of a securitisation market in Europe. The package consisted of two draft Regulations:

| 1. | Securitisation Regulation: combines the rules applicable to all the securitisations including high-quality securitisation (simple, transparent and standardized (STS) securitisation), which is now dispersed across several legal provisions. This rationalizes and simplifies the existing rules and establishes a general system for defining STS securitisation. |

| 2. | Text modifying the CRR with respect to the capital requirements for securitisation positions. Gives a more risk-sensitive treatment to STS securitisations. |

These two regulations were published in the OJEU on December 28, 2017, with an application date of January 1, 2019 for securitisations issued as of that date. For securitisations made before January 2019, entities will continue to apply the current regime until December 31, 2019.

Management and framework of NPLs: in July 2017, the European Council published a package of measures to addressnon-performing loan assets (NPL) in Europe. For this purpose, the European Central Bank (ECB) has established supervisory expectations for Pillar II on prudential provisions fornon-performing loan exposures classified as such as of April 1, 2018. Its application date is from 2021 SREP exercise onwards (“Supervisory Review and Examination Process”). The supervisory expectations on prudential provisions applicable to stock(non-performing loan exposures classified as such before April 1, 2018) will be treated by the ECB within the individual dialog with each bank.

Meanwhile, the EC is working on a Pillar I proposal for a regulation modifying the CRR with regard to the minimum coverage of losses arising fromnon-performing loan exposures.

| 20 |

After a negotiation period between the EC, the European Council and the European Parliament, an agreement has been reached in December 2018 that is expected to be applicable throughout 2019. With regard to transparency, the European Banking Authority (EBA) has released guidelines on the NPLs information disclosure that will apply as of December 31, 2019, and guidelines regarding the NPLs management that will be applicable as of June 30, 2019.

Changes in the Pillar III disclosure framework: the Basel Pillar III framework is being revised by the Basel Committee on Banking Supervision (BCBS), which has divided the process into three phases.

| · | Phase I: the disclosure requirements of the first phase of review were published in January 2015, and they replace the disclosure requirements published in 2014 (modified in July 2009). It includes standardized templates related to credit and market risks, as well as the distinction between the accounting perimeter and regulatory perimeter. |

| · | Phase II: on a second phase, the BCBS has reviewed the disclose requirements collected on the Basel rules that are currently in force and has consolidated them under the document “Disclosure requirements for the Third Pillar – consolidated and enhanced framework”, published in March 2017. It includes standardized templates related to countercyclical buffer, prudent valuation, LCR, etc. |

| · | Phase III: as of December, 11, 2018, BCBS has published the requirements of the third phase of revision of the Pillar 3 framework under the document “Disclosure requirements for the Third Pillar – updated framework”, which includes, among others, new information disclosure requirements derived from the conclusion of the Basel III reforms. |

The disclosure requirements for the first phase of the review of Pillar 3 entered into force in December 2017, while the disclosure requirements for the second phase have different implementation dates, with the first phase coinciding with the close of 2017. Furthermore, the implementation date of the third phase is, in general, on January 1, 2022, with the exception of certain forms that have been moved forward to the end of 2020.

Contents of the 2018 Prudential Relevance Report

Article 13 of the CRR establishes that the parent entities of the European Union are subject based on their consolidated situation to the disclosure requirements contained in the Part Eight of the CRR.

This report includes the prudential information of BBVA consolidated group as of December 31, 2018. This report has been prepared in compliance with the requirements set by Part Eight of the CRR, as well as any applicable guideline published by the European Banking Authority.

Furthermore, the data published in the Prudential Relevance Report (Pillar III) was prepared in accordance with internal control processes described in the “Corporate Policies for Preparing Financial and Annual Information in the BBVA Group”. These policies ensure that the information included in Pillar III is subject to the internal control framework defined by the Group, as well as adequate internal and external revision (by an independent expert), in compliance with the Guidelines on disclosure requirements under Part Eight of Regulation (EU) No.575/2013 (EBA/GL/2016/11).

In general, the following EBA guidelines are highlighted:

| · | Guidelines on materiality, proprietary information, and confidentiality, and on the frequency of disclosure of information according to Article 432, sections 1 and 2, and Article 433 of Regulation (EU) No. 575/2013 (EBA/GL/2014/14). These guidelines detail the process and the criteria to be followed regarding the principles |

| 21 |

of materiality, proprietary information, confidentiality and the right to omit information. They also provide guidance for entities to evaluate the need to publish information more frequently than the annual. The Executive Commission of the Bank of Spain adopted these guidelines in February 2015. |

| · | Guidelines on disclosure requirements under Part Eight of Regulation (EU) No. 575/2013 (EBA/GL/2016/11). These guidelines provide guidance in relation to the information that entities must disclose in application of the corresponding articles of the Part Eight and with the presentation of said information. The Executive Commission of the Bank of Spain adopted these guidelines in October 2017. |

| · | Guidelines on LCR disclosure to complement the information on liquidity risk management in accordance with Article 435 of Regulation (EU) No. 575/2013 (EBA/GL/2017/01). These guidelines specify the general framework for the disclosure of information on risk management under Article 435 of Regulation (EU) No. 575/20132 in relation to liquidity risk, establishing a harmonised structure for the disclosure of the information required by Article 435, point 1 of said Regulation. The Executive Commission of the Bank of Spain adopted these guidelines in July 2017. |

| · | Guidelines on disclosure of encumbered and unencumbered assets in accordance with Article 443 of Regulation (EU) No. 575/2013 (EBA/GL/2014/03). The Executive Commission of the Bank of Spain adopted these guidelines in September 2014. |

| · | Guidelines on uniform disclosure of information under Article 473a of Regulation (EU) No 575/2013 with regard to the transitional provisions for mitigating the impact on own funds from the introduction of IFRS 9 (EBA/GL/2018/01). The Executive Committee of the Bank of Spain has adopted these guidelines in February 2018. |

| · | Guidelines on appropriate remuneration policies under Articles 74, paragraph 3, and 75, paragraph 2, of Directive 2013/36/EU and disclosure of information under Article 450 of Regulation (EU) No 575/2013 (EBA/GL/2015/22). The Executive Commission of the Bank of Spain adopted these guidelines in July 2016. |

Annex V of this report, available on the Group’s website, gathers the correspondence of the articles of Part Eight CRR on information disclosure with the different headings of the document (or other public documents) where the required information is located.

In an exercise of transparency, as of December 31, 2018, BBVA includes the following standard templates on disclosure of information recommended by the different regulators. They can be seen in the following table:

| 22 |

Disclosure requirements

Template | Guidelines on disclosure requirements EBA/GL/2016/11 | Pillar III Section | ||

| EU-OV1 | Overview of RWAs | 2.5 | ||

| EU-LI1 | Differences between the accounting and regulatory scopes of consolidation and the mapping of financial statement categories with regulatory risk categories | 1.1.3 | ||

| EU-LI2 | Main sources of the differences between the regulatory exposure amounts and carrying values in financial statements | 1.1.3 | ||

| EU-LI3 | Outline of the differences in the scopes of consolidation (entity by entity) | Pillar III Annexes | ||

| EU-INS1 | Non-deducted participations in insurance undertakings | N/A | ||

| EU-CR1-A | Credit quality of exposures by exposure class and instrument | 3.2.3.4 | ||

| EU-CRB-B | Total and average net amount of exposures | 3.2.3.2 | ||

| EU-CRB-C | Geographical breakdown of exposures | 3.2.3.3 | ||

| EU-CR1-C | Credit quality of exposures by geography | 3.2.3.3 | ||

| EU-CRB-D | Concentration of exposures by industry or counterparty types | 3.2.3.5 | ||

| EU-CR1-B | Credit quality of exposures by industry or counterparty types | 3.2.3.5 | ||

| EU-CRB-E | Maturity of exposures | 3.2.3.6 | ||

| EU-CR1-D | Ageing ofpast-due exposures | 3.2.3.6 | ||

| EU-CR2-A | Changes in the stock of general and specific credit risk adjustments | 3.2.3.8 | ||

| EU-CR2-B | Changes in the stock of defaulted and impaired loans and debt securities | 3.2.3.8 | ||

| EU-CR1-E | Non-performing exposures and forborne exposures | 3.2.3.9 | ||

| EU-CR4 | Standardized approach: credit risk exposure and credit risk mitigation effects | 3.2.4.3 | ||

| EU-CR5 | Standardized approach | 3.2.4.3 | ||

| EU-CR6 | IRB approach: credit risk exposures by exposure class and PD range | 3.2.5.2 | ||

| EU-CR9 | IRB approach: backtesting of PD per exposure class | 3.2.5.2 | ||

| EU-CR8 | RWA flow statements of credit risk exposures under the IRB approach | 3.2.5.2 | ||

| EU-CR10 (1) | IRB: specialized lending | 3.2.5.4 | ||

| EU-CR10 (2) | IRB: equity | 3.2.5.5 | ||

| EU-CCR5-A | Impact of netting and collateral held on exposure values | 3.2.6.2 | ||

| EU-CCR1 | Analysis of counterparty credit risk exposures by approach | 3.2.6.2 | ||

| EU-CCR3 | Standardized approach: counterparty credit risk exposures by regulatory portfolio and risk | 3.2.6.2.1 | ||

| EU-CCR4 | IRB approach: counterparty credit risk exposure by portfolio and PD scale | 3.2.6.2.2 | ||

| EU-CCR5-B | Composition of collateral for exposures to counterparty credit risk | 3.2.6.2.3 | ||

| EU-CCR7 | RWA flow statements of CCR exposures under the IMM | N/A |

| 23 |

| EU-CCR6 | Credit derivatives exposures | 3.2.6.2.4 | ||

| EU-CCR2 | Credit valuation adjustment (CVA) capital charge | 3.2.6.3 | ||

| EU-CCR8 | Exposures to central counterparty clearing houses | 3.2.6.4 | ||

| EU-CR3 | Credit risk mitigation techniques overview | 3.2.8.3 | ||

| EU-MR1 | Market risk under the standardized approach | 3.3.3 | ||

| EU-MR3 | IMA values for trading portfolios | 3.3.4.2.2 | ||

| EU-MR2-A | Market risk under the internal model approach (IMA) | 3.3.4.2.2 | ||

| EU-MR2-B | RWA flow statements of market risk exposures under the IMA approach | 3.3.4.2.2 | ||

| EU-MR4 | Trading book. Validation of the Market Risk Measurement Model | 3.3.4.2.3 | ||

Template | Guidelines on disclosure of liquidity information (EBA/GL/2017/01) | Pillar III Section | ||

| EU- LIQ1 | Guidelines on disclosure of Liquidity information | 3.7.5 | ||

Template | RTS on Asset Encumbrance Disclosure (EBA/RTS/2017/03) | Pillar III Section | ||

| Encumbered and unencumbered assets | 3.7.6 | |||

| Collateral received | 3.7.6 | |||

| Sources of encumbrance | 3.7.6 | |||

Template | Guidelines with regard to the transitional provisions for mitigating the impact on own funds from IFRS9 (EBA/GL/ 2018/01) | Pillar III Section | ||

| IFRS9 - FL | Comparison of own funds and capital leverage ratios of entities with and without the application of the transitional arrangements of IFRS9 or similar Expected Credit Losses (ECL) | 2.3 | ||

Template | Guidelines on prudent valuation adjustments (EBA/RTS/2014/06) | Pillar III Section | ||

| Prudent Valuation Adjustments | 3.3.4.2.1 | |||

Template | Leverage Ratio - Commission Implementing Regulation (EU) 2016/200 | Pillar III Section | ||

| LRSum | Summary of the reconciliation of accounting assets and exposure corresponding to the Leverage Ratio | 4.1 | ||

| LRCom | Common Leverage Ratio disclosure table | Pillar III Annexes | ||

| LRSpl | Breakdown of balance-sheet exposures | Pillar III Annexes | ||

| 24 |

Template | Own Fund requirements - Commission Implementing Regulation (EU) 1424/2013 | Pillar III Section | ||

| Template for presenting the main characteristics of capital instruments | Pillar III Annexes | |||

| Template with information on temporary own funds | Pillar III Annexes | |||

Template | Anticyclical capital buffer Commission Delegated Regulation (EU) 2015/1555 | Pillar III Section | ||

| Distribution by geographic areas of the credit exposure for calculation of the countercyclical capital buffer | Introduction | |||

| Amount of the countercyclical capital buffer specific to each entity | Introduction | |||

Template | Disclose requirements for the Third Pillar – consolidated and enhanced framework | Pillar III Section | ||

| SEC1 | Securitisation exposure in the investment portfolio | 3.2.7.5 | ||

| SEC4 | Exposure to securitisation in the banking portfolio and associated regulatory capital requirements (bank that acts as investor) | 3.2.7.6 | ||

| SEC3 | Exposure to securitisation in the banking portfolio and associated regulatory capital requirements (bank that acts as originator or sponsor) | 3.2.7.7.2 | ||

Template | Disclosure requirements for the Third Pillar – updated framework | Pillar III Section | ||

| CC1 | Template with information on temporary own funds (CC1) | Pillar III Annexes | ||

| CC2 | Reconciliation of the regulatory capital with the Public Balance Sheet | 1.1.3 | ||

| 25 |

Capital requirements

The regulations require institutions to have a higher and better quality capital level, increase capital deductions and review the requirements associated with certain assets. Unlike the previous framework, the minimum capital requirements are complemented with requirements for capital buffers and others relating to liquidity and leverage. Bank capital under CRD IV mainly comprises of the elements described in section 2.1 herein.

The most relevant aspects affecting the elements making up minimum capital requirements and risk-weighted assets are detailed in greater depth in section 2.4 of this document.

In this regard, article 92 of the CRR establishes that credit institutions must maintain at all times the following own funds requirements:

| a) | Common Equity Tier 1 capital ratio of 4.5%, obtained as Common Equity Tier 1 capital expressed as a percentage along the total amount of risk-weighted assets. |

| b) | Tier 1 capital ratio of 6%, calculated as the percentage between the Tier 1 capital expressed as a percentage along the total amount of risk-weighted assets. |

| c) | Total capital ratio of 8%, expressed as the percentage of the own funds along the total amount risk-weighted assets. |

Notwithstanding the application of the Pillar 1 requirement, CRD IV allows competent authorities to require that credit institutions maintain more own funds than the Pillar 1 requirements to cover risks other than those already covered by the Pillar 1 requirement (this power of the competent authority is commonly known as Pillar 2).

Furthermore, in accordance with CRD IV, credit institutions must comply with the “combined requirement of capital buffers” from 2016 onwards. The “combined buffer requirement” has incorporated five new capital buffers: (i) the capital conservation buffer; (ii) the buffer for global systemically important banks (the“G-SIB buffer”); (iii) the countercyclical capital buffer specific to each bank; (iv) the buffer for other systemically important financial institutions (the“D-SIB buffer”); and (v) the buffer against systemic risks. The “combined capital buffer requirement” must be met with Common Equity Tier 1 capital (“CET1”) in addition to that which is provided to meet the minimum capital required by “Pillar 1” and “Pillar 2”.

Both the capital conservation buffer as well as theG-SIB buffer (where appropriate) will apply to credit institutions, as it establishes a percentage over 0%.

The buffer for global systemically important banks applies to those institutions on the list of global systemically important banks, which is updated annually by the Financial Stability Board (“FSB”). Given that BBVA is not considered asG-SIB since November 2015 (effective January 1, 2017), this buffer does not apply to BBVA.

For more details on the quantitative indicators for assessing the global systemically important banks, see the document“G-SIBs Information” in the sectionShareholders and Investors / Financial Information on the BBVA Group website.

The Bank of Spain has extensive discretionary powers as regards the countercyclical capital buffer peculiar to each bank, the buffer for other systemically important financial institutions (which are those institutions considered to be systemically important local financial institutions“D-SIB”) and the buffer against systemic risks (to prevent or avoid systemic or macroprudential risks). The European Central Bank (ECB) has the powers to issue recommendations in this respect following the entry into force on November, 4, 2014 of the Single Supervisory Mechanism (SSM).

| 26 |

In December 2015, the Bank of Spain agreed to set the countercyclical capital buffer that applies to credit exposures in Spain at 0% as of January 1 2017. These percentages will be reviewed every quarter, as the Bank of Spain decided in December 2018 to keep the countercyclical capital buffer at 0% for the first quarter of 2019.

As far as BBVA is concerned, after the supervisory review and evaluation process (“SREP”) conducted in 2018, ECB has notified on February, 14, 2019, that BBVA Group , as of March, 1, 2019 maintain aphased-in, fully loaded ratio (given that the transitional period of capital buffers has ended in December 2018) (i) CET1 of 9.26% at the consolidated level and 8.53% at the individual level and (ii) a total capital ratio of 12.76% at the consolidated level and 12.03% at the individual level.

The consolidated total capital requirement includes: i) the minimum capital requirement of Common Equity Tier 1 (CET1) of Pillar 1 (4.5%); ii) the capital requirement of Additional Tier 1 (AT1) of Pillar 1 (1.5%); iii) the capital requirement of Tier 2 of Pillar 1 (2%); iv) the CET1 requirement of Pillar 2 (1.5%), which remains at the same level as established after the last SREP; v) the capital conservation buffer (2.5% of CET1); vi) the capital buffer for Other Systemically Important Institutions(O-SIIs) (0.75% of CET1); and vii) the countercyclical capital buffer (0.01% of CET1).

CHART 1. Capital Requirements (Fully loaded)

As of December 31, 2018, BBVA maintains fully loaded CET1 ratio and total ratio of 11.3% and 15.5%, respectively (inphased-in terms, CET1 and total ratio of 11.6% and 15.7%, respectively) reinforcing its equity position in the Group.

The following table presents the distribution by geographic areas of the credit exposure for calculation of the countercyclical capital buffer:

| 27 |

TABLE 1. Distribution by geographic areas of the credit exposure for calculation of the countercyclical capital buffer

| Million euros | ||||||||||||||||||||||||||||||||||||||||||||||||

| General credit | Trading book exposure | Securitisation | Own funds requirements | |||||||||||||||||||||||||||||||||||||||||||||

Exposure value for | Exposure value for IRB | Sum of long and short position | Trading book exposure value for internal models | Exposure value for SA | Exposures value for IRB | Of which: General credit | Of which: Trading book exposures | Of which: Securitisation | Total | Own funds requirements weights | Countercyclical capital buffer rate | |||||||||||||||||||||||||||||||||||||

| Geographical breakdown | ||||||||||||||||||||||||||||||||||||||||||||||||

| Sweden | 36 | 193 | – | 5 | – | – | 6 | 0 | – | 7 | 0.0% | 2.0% | ||||||||||||||||||||||||||||||||||||

| Norway | 20 | 16 | – | 10 | – | – | 1 | 0 | – | 1 | 0.0% | 2.0% | ||||||||||||||||||||||||||||||||||||

| Slovakia | 6 | 153 | – | – | – | – | 17 | – | – | 17 | 0.1% | 1.3% | ||||||||||||||||||||||||||||||||||||

| Iceland | 0 | 0 | – | – | – | 0 | 0 | – | 0 | 0.0% | 1.3% | |||||||||||||||||||||||||||||||||||||

| Lithuania | 0 | 0 | – | – | – | – | 0 | – | – | 0 | 0.0% | 0.5% | ||||||||||||||||||||||||||||||||||||

| United Kingdom | 526 | 5,214 | 8 | 116 | – | – | 198 | 4 | – | 202 | 1.0% | 1.0% | ||||||||||||||||||||||||||||||||||||

| Czech Republic | 2 | 5 | – | – | – | – | 0 | – | – | – | 0.0% | 1.0% | ||||||||||||||||||||||||||||||||||||

| Hong Kong | 51 | 1,175 | – | – | – | – | 16 | – | – | 16 | 0.1% | 1.9% | ||||||||||||||||||||||||||||||||||||

| Total countries with countercyclical capital buffer stablished | 641 | 6,757 | 8 | 131 | – | – | 239 | 5 | – | 243 | 1.2% | |||||||||||||||||||||||||||||||||||||

| Peru | 20,485 | 568 | 3,579 | – | – | – | 940 | 2 | – | 943 | 4.5% | – | ||||||||||||||||||||||||||||||||||||

| Germany | 268 | 4,370 | 1 | 74 | – | – | 165 | 2 | – | 167 | 0.8% | – | ||||||||||||||||||||||||||||||||||||

| Argentina | 8,174 | 209 | 1,452 | 0 | – | – | 340 | 14 | – | 353 | 1.7% | – | ||||||||||||||||||||||||||||||||||||

| Spain | 30,606 | 167,840 | 31 | 7 | – | 5,593 | 5,230 | 5 | 431 | 5,666 | 27.2% | – | ||||||||||||||||||||||||||||||||||||

| United States | 80,901 | 13,231 | 6,741 | 73 | 4,595 | – | 4, 448 | 8 | 368 | 4,824 | 23.2% | – | ||||||||||||||||||||||||||||||||||||

| France | 974 | 6,906 | 0 | 86 | – | – | 220 | 4 | – | 224 | 1.1% | – | ||||||||||||||||||||||||||||||||||||

| Italy | 248 | 6,358 | – | 23 | – | – | 209 | 1 | – | 210 | 1.0% | – | ||||||||||||||||||||||||||||||||||||

| Mexico | 43,202 | 37,528 | 50 | 254 | 28 | – | 3,200 | 24 | 2 | 3,226 | 15.5% | – | ||||||||||||||||||||||||||||||||||||

| Portugal | 4,448 | 663 | 11 | 1 | – | – | 273 | 0 | – | 273 | 1.3% | – | ||||||||||||||||||||||||||||||||||||

Turkey | 56,603 | 566 | 11,347 | 0 | – | – | 2,829 | 2 | – | 2,831 | 13.6% | – | ||||||||||||||||||||||||||||||||||||

| Colombia | 14,291 | 622 | 36,276 | 3 | – | – | 761 | 7 | – | 768 | 3.7% | – | ||||||||||||||||||||||||||||||||||||

| Total countries without countercyclical capital buffer but with own funds requirements greater than 1% | 260,200 | 238,859 | 59,489 | 521 | 4,623 | 5,593 | 18,616 | 67 | 800 | 19,484 | 93.6% | |||||||||||||||||||||||||||||||||||||

| Other areas | 12,344 | 15,032 | 145 | 194 | – | – | 1,084 | 5 | – | 1,090 | 5.2% | – | ||||||||||||||||||||||||||||||||||||

| Total countries without countercyclical capital buffer but with own funds requirements less than 1% | 12,344 | 15,032 | 145 | 194 | – | – | 1,084 | 5 | – | 1,090 | 5.2% | |||||||||||||||||||||||||||||||||||||

| Total | 273,186 | 260,649 | 59,642 | 846 | 4,623 | 5,593 | 19,939 | 78 | 800 | 20,817 | 100% | |||||||||||||||||||||||||||||||||||||

(1) Credit exposures exclude exposures to Central Governments or Central Banks, Regional Governments or Local Authorities, Public sector entities, Multilateral Development Banks, International Organizations and Institutions in accordance with art. 140.4 of Directive 2013/36/EU.

| Million euros | ||||

| Total risk exposure amount | 348,264 | |||

| Institution specific countercyclical buffer rate(2) | 0.01% | |||

| Institution specific countercyclical buffer requirement | 45 | |||

(2) Countercyclical buffer calculated as of December 2018 in accordance with Commission Delegated Regulation (EU) 2015/1555

| 28 |

Leverage Ratio

In order to provide the financial system with a metric that serves as a backstop to capital levels, irrespective of the credit risk, a measure complementing all the other capital indicators has been incorporated into Basel III and transposed to the solvency regulations. This measure, the leverage ratio, can be used to estimate the percentage of the assets financed with Tier 1 capital.

Although the carrying amount of the assets used in this ratio is adjusted to reflect the bank’s current or potential leverage with a given balance-sheet position, the leverage ratio is intended to be an objective measure that may be reconciled with the financial statements.

As of December 31, 2018, BBVA Group had a Leverage Ratio of 6.4% (fully loaded), and aphased-in ratio of 6.5%, above the minimum requirement set at 3%, and continuing to compare very favourably with the rest of its peer group.

| 29 |

| 1. | General information requirements |

| 1.1. | Corporate name and differences between the consolidated group for the purposes of the solvency regulations and accounting criteria |

| 1.1.1. | Corporate name and scope of application |

| 1.1.2. | Differences in the consolidated group for the purposes of the solvency regulations and accounting criteria |

| 1.1.3. | Reconciliation of the Public Balance Sheet from the accounting perimeter to the regulatory perimeter |

| 1.1.4. | Main changes to the Group’s scope of consolidation in 2018 |

| 1.2. | Identification of dependent institutions with capital resources below the minimum requirement. Possible impediments to capital transfer |

| 1.3. | Exemptions from capital requirements at the individual orsub-consolidated level |

| 1.1. | Corporate name and differences between the consolidated group for the purposes of the solvency regulations and accounting criteria |

| 1.1.1. | Corporate name and scope of application |

Banco Bilbao Vizcaya Argentaria, S.A. (hereinafter “the Bank” or “BBVA”) is aprivate-law entity subject to the laws and regulations governing banking entities operating in Spain. It carries out its activity through branches and agencies across the country and abroad.

The Bylaws and other public information are available for consultation at its registered address (Plaza San Nicolás, 4 Bilbao) and on its corporate website (www.bbva.com).

The Solvency Regulations are applicable at the consolidated level for the whole Group.

| 1.1.2. | Differences in the consolidated group for the purposes of the solvency regulations and accounting criteria |

BBVA Group’s Consolidated Annual Report are presented in accordance with the International Financial Reporting Standards as adopted by the European Union(“EU-IFRS”) in effect as of December 31, 2018, taking into consideration Bank of Spain Circular 4/2017, and its successive amendments, and other provisions of the regulatory financial reporting framework applicable to the Group in Spain.

The BBVA Group’s Consolidated Annual Report for 2018 are posted according to the models included in Circular 3/2018 of the Spanish Securities and Investment Board, with the aim of adapting the content of public financial information of credit institutions to the terminology and formats of financial statements established as mandatory by the European Union for credit institutions.

Based on accounting criteria, companies are considered to form part of a consolidated group when the controlling institution holds or can hold, directly or indirectly, control of them. An institution is understood to control another entity when it is exposed, or is entitled to, variable returns because of its involvement in the subsidiary and has the capacity to influence those returns through the power it exercises on the subsidiary. For such control to exist, the following aspects must be fulfilled:

| 30 |

| a) | Power: an investor has power over a subsidiary when it has current rights that provide it with the capacity to direct its relevant activities, i.e. those that significantly affect the returns of the subsidiary. |

| b) | Returns: an investor is exposed, or is entitled to variable returns, as a result of its involvement in the subsidiary when the returns obtained by the investor for such involvement may vary based on the economic performance of the subsidiary. Investor returns may be positive only, negative only or both positive and negative. |

| c) | Relationship between power and returns: An investor has control over a subsidiary when it not only has power over the subsidiary and is exposed, or is entitled to, variable returns for its involvement in the subsidiary, but also has the capacity to use its power to influence the returns it obtains due to its involvement in the subsidiary. |

Therefore, in drawing up the Group’s Consolidated Annual Report, all dependent companies and consolidated structured entities have been consolidated by applying the full consolidation method.

Jointly-controlled entities, as well as joint ventures (those over which joint control arrangements are in place), are valued using the equity method.

The list of all the companies forming part of BBVA Group is included in the appendices to the Group’s Consolidated Annual Report.

For the purposes of solvency regulations, the following subsidiaries form part of the consolidated group, as defined in article 18 of CRR:

| · | Credit institutions |

| · | Investment firms |

| · | Financial institutions |

A financial institution is a company, different than an institution (credit institution or investment firm), whose main activity consists of acquiring holdings or performing one or more of the following activities:

| ○ | Loans, including in particular consumer finance, credit agreements relating to immovable property, recourse andnon-recourse factoring, and financing of commercial transactions (including forfaiting) |

| ○ | Financial leasing |

| ○ | Payment services |

| ○ | Issuing and managing other payment channels (e.g. traveller’s cheques and bank cheques) |

| ○ | Granting of guarantees and commitments |

| ○ | Trading on their own account or on behalf of customers on any of the following instruments: |

| - | Money market instruments (cheques, bills, certificates of deposit etc.) |

| - | Foreign currency |

| - | Financial futures and options |

| 31 |

| - | Foreign-exchange or interest-rate instruments |

| - | Marketable securities |

| ○ | Participating in the issuance of securities and the provision of corresponding services |

| ○ | Advising companies with regard to capital structure, industrial strategy and related matters, as well as advice and services for mergers and acquisitions of companies |

| ○ | Brokerage in the interbank markets |

| ○ | Managing or advising on equity management |

| ○ | Custody and administration of marketable securities |

| ○ | Issuance of electronic money |

This definition includes financial holding companies, mixed financial holding companies, payment institutions and asset management firms, but excludes pure industrial holding companies, insurance companies, insurance holding companies and mixed insurance holding companies.

| · | Auxiliary services companies: a company whose main activity is holding or management of property, management of computing services or any other similar activity of an auxiliary nature with regard to the main activity of one or more institutions (credit institution or investment firm). |

Therefore, for the purposes of calculating solvency requirements, and hence the drawing up of this Prudential Relevance Report, the scope of consolidated entities is different from the scope defined for the purposes of drawing up the Group’s Consolidated Financial Statements.

The effect of the difference between the two regulations is basically due to:

| · | The difference between the balances contributed by entities (largely insurance entities) that are consolidated in the Group’s Consolidated Annual Report by the full consolidation method and consolidated for the purposes of solvency by applying the equity method. |

| · | The inclusion of the balance from institutions (mainly financial) that are consolidated by the equity method at the accounting level but for purposes of solvency by the proportional integration method. |

The details of these companies are available in Annexes of the file Pillar III 2018 Annexes, available in the section forShareholders and Investors/Financial Information on the Group’s website.

| 32 |

| 1.1.3 | Reconciliation of the Public Balance Sheet from the accounting perimeter to the regulatory perimeter |

This section includes an exercise in transparency aimed at offering a clear view of the process of reconciliation between the book balances reported in the Public Balance Sheet (attached to the Group’s Consolidated Annual Report) and the book balances this report uses (regulatory scope), revealing the main differences between both scopes.

Table 2: CC2 – Reconciliation of the regulatory capital with Public balance sheet

| Million Euros | ||||||||||||

Public Balance Sheet Headings | Public Balance Sheet | Regulatory balance sheet | Referece to template CCl | |||||||||

| Cash, cash balances at central banks and other demand deposits | 58,196 | 58,296 | ||||||||||

| Financial assets held for trading | 90,117 | 91,394 | ||||||||||

| Non-trading financial assets mandatorily at fair value through profit or loss | 5,135 | 2,367 | ||||||||||

| Financial assets designated at fair value through profit or loss | 1,313 | – | ||||||||||

| Financial assets at fair value through accumulated other comprehensive income | 56,337 | 42,019 | ||||||||||

| Financial assets at amortized cost | 419,660 | 413,974 | ||||||||||

| Hedging derivatives | 2,892 | 2,805 | ||||||||||

| Fair value changes of the hedged items in portfolio hedges of interest rate risk | (21) | (21) | ||||||||||

| Investments in subsidiaries, joint ventures and associates | 1,578 | 4,085 | ||||||||||

| Assets under insurance and reinsurance contracts | 366 | – | ||||||||||

| Tangible assets | 7,229 | 6,940 | ||||||||||

| Intangible assets | 8,314 | 8,203 | g) | |||||||||

| Tax assets | 18,100 | 17,722 | ||||||||||

Of which: deferred tax assets | 1,260 | 1,260 | h) | |||||||||

| Other assets | 5,472 | 7,334 | ||||||||||

| Non-current assets and disposal groups held for sale | 2,001 | 2,001 | ||||||||||

| Total Assets | 676,689 | 657,119 | ||||||||||

| Financial liabilities held for trading | 80,774 | 81,140 | ||||||||||

| Other financial liabilities designated at fair value through profit or loss | 6, 993 | 2, 858 | ||||||||||

| Financial liabilities at amortized cost | 509,185 | 504,968 | p) q) t) | |||||||||

| Hedging derivatives | 2, 680 | 2, 468 | ||||||||||