UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE13a-16 OR15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of April, 2019

Commission file number:1-10110

BANCO BILBAO VIZCAYA ARGENTARIA, S.A.

(Exact name of Registrant as specified in its charter)

BANK BILBAO VIZCAYA ARGENTARIA, S.A.

(Translation of Registrant’s name into English)

Calle Azul 4,

28050 Madrid

Spain

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form20-F or Form40-F:

Form20-F ☒ Form40-F ☐

Indicate by check mark if the registrant is submitting the Form6-K in paper as permitted by RegulationS-T Rule 101(b)(1):

Yes ☐ No ☒

Indicate by check mark if the registrant is submitting the Form6-K in paper as permitted by RegulationS-T Rule 101(b)(7):

Yes ☐ No ☒

Index

BBVA Group highlights

BBVA Group highlights

(Consolidated figures)

| | | | | | | | | | | | | | | | |

| | | 31-03-19 | | | D % | | | 31-03-18 | | | 31-12-18 | |

Balance sheet (millions of euros) | | | | | | | | | | | | | | | | |

Total assets | | | 691,200 | | | | 0.8 | | | | 685,688 | | | | 676,689 | |

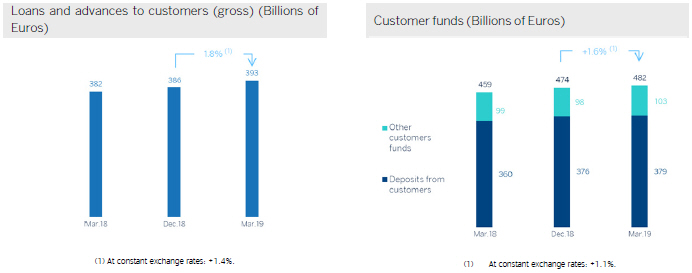

Loans and advances to customers (gross) | | | 393,321 | | | | 3.0 | | | | 381,683 | | | | 386,225 | |

Deposits from customers | | | 378,527 | | | | 5.1 | | | | 360,213 | | | | 375,970 | |

Total customer funds | | | 481,754 | | | | 4.9 | | | | 459,113 | | | | 474,120 | |

Total equity | | | 53,547 | | | | 2.9 | | | | 52,043 | | | | 52,874 | |

Income statement (millions of euros) | | | | | | | | | | | | | | | | |

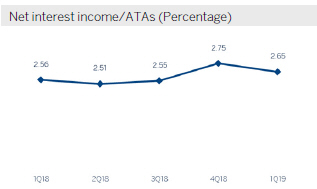

Net interest income | | | 4,420 | | | | 3.1 | | | | 4,287 | | | | 17,591 | |

Gross income | | | 6,069 | | | | 0.7 | | | | 6,026 | | | | 23,747 | |

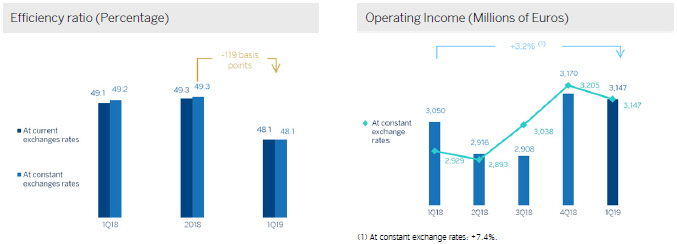

Operating income | | | 3,147 | | | | 3.2 | | | | 3,050 | | | | 12,045 | |

Net attributable profit | | | 1,164 | | | | (9.8 | ) | | | 1,290 | | | | 5,324 | |

The BBVA share and share performance ratios | | | | | | | | | | | | | | | | |

Number of shares (million) | | | 6,668 | | | | — | | | | 6,668 | | | | 6,668 | |

Share price (euros) | | | 5.09 | | | | (20.8 | ) | | | 6.43 | | | | 4.64 | |

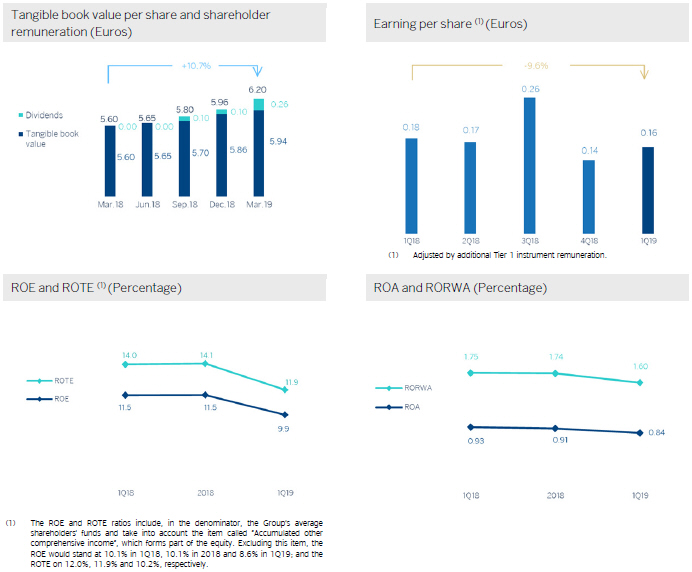

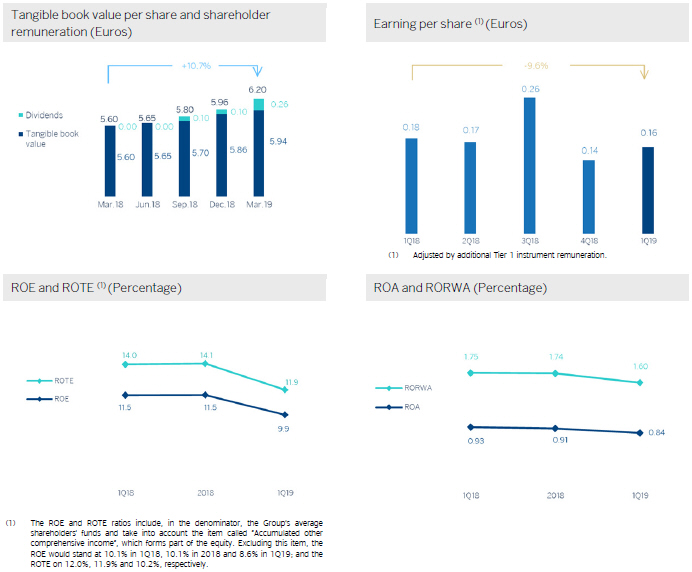

Earning per share (euros)(1) | | | 0.16 | | | | (9.7 | ) | | | 0.18 | | | | 0.76 | |

Book value per share (euros) | | | 7.20 | | | | 5.4 | | | | 6.83 | | | | 7.12 | |

Tangible book value per share (euros) | | | 5.94 | | | | 6.1 | | | | 5.60 | | | | 5.86 | |

Market capitalization (millions of euros) | | | 33,960 | | | | (20.8 | ) | | | 42,868 | | | | 30,909 | |

Yield (dividend/price; %) | | | 4.9 | | | | | | | | 3.4 | | | | 5.4 | |

Significant ratios (%) | | | | | | | | | | | | | | | | |

ROE (net attributable profit/average shareholders’ funds +/-average accumulated other comprehensive income)(2) | | | 9.9 | | | | | | | | 11.5 | | | | 11.5 | |

ROTE (net attributable profit/average shareholders’ funds excluding average intangible assets +/- average accumulated other comprehensive income)(2) | | | 11.9 | | | | | | | | 14.0 | | | | 14.1 | |

ROA (Profit or loss for the year/average total assets) | | | 0.84 | | | | | | | | 0.93 | | | | 0.91 | |

RORWA (Profit or loss for the year/average risk-weighted assets -RWA) | | | 1.60 | | | | | | | | 1.75 | | | | 1.74 | |

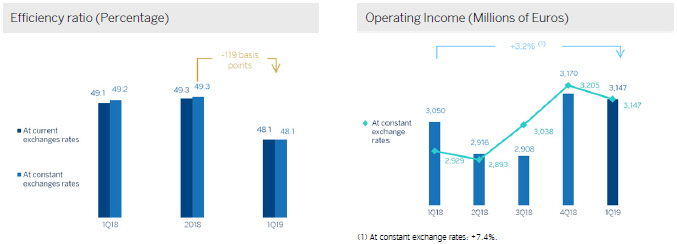

Efficiency ratio | | | 48.1 | | | | | | | | 49.4 | | | | 49.3 | |

Cost of risk | | | 1.06 | | | | | | | | 0.85 | | | | 1.01 | |

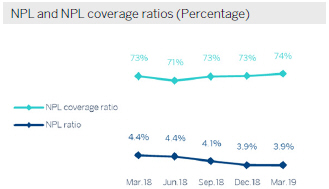

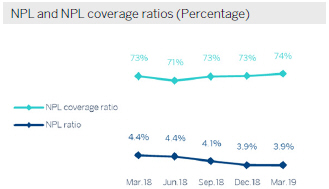

NPL ratio | | | 3.9 | | | | | | | | 4.4 | | | | 3.9 | |

NPL coverage ratio | | | 74 | | | | | | | | 73 | | | | 73 | |

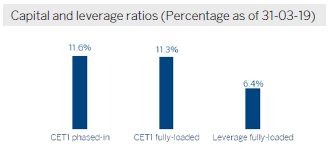

Capital adequacy ratios (%) | | | | | | | | | | | | | | | | |

CET1 fully-loaded | | | 11.3 | | | | | | | | 10.9 | | | | 11.3 | |

CET1phased-in(3) | | | 11.6 | | | | | | | | 11.1 | | | | 11.6 | |

Total ratiophased-in(3) | | | 15.2 | | | | | | | | 15.4 | | | | 15.7 | |

Other information | | | | | | | | | | | | | | | | |

Number of clients (million) | | | 75.7 | | | | 2.9 | | | | 73.6 | | | | 74.8 | |

Number of shareholders | | | 892,316 | | | | 0.2 | | | | 890,146 | | | | 902,708 | |

Number of employees | | | 125,749 | | | | (4.6 | ) | | | 131,745 | | | | 125,627 | |

Number of branches | | | 7,844 | | | | (4.3 | ) | | | 8,200 | | | | 7,963 | |

Number of ATMs | | | 31,922 | | | | 1.0 | | | | 31,602 | | | | 32,029 | |

General note: the application of accounting for hyperinflation in Argentina was performed for the first time in September 2018 with accounting effects on January 1, 2018, recording the impact of the nine months in the third quarter. In order to make the 2019 information comparable to 2018, the income statements and balance sheets of the first three quarters of 2018 have been reexpressed to reflect these impacts.

| (1) | Adjusted by additional Tier 1 instrument remuneration. |

| (2) | The ROE and ROTE ratios include, in the denominator, the Group’s average shareholders’ funds and take into account the item called “Accumulated other comprehensive income”, which forms part of the equity. Excluding this item, the ROE would stand at 8.6%, in the first quarter of 2019; 10.1%, in 2018; and 10.1%, in the first quarter of 2018; and the ROTE at 10.2%, 11.9% and 12.0%, respectively. |

| (3) | As of March 31, 2019,phased-in ratios include the temporary treatment on the impact of IFRS 9, calculated in accordance with Article 473 bis of the Capital Requirements Regulation (CRR). |

Group information

Relevant events

Results

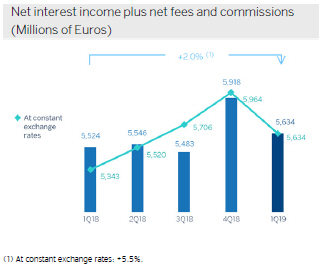

| • | | In the first quarter of 2019, the overall growth ofrecurring income is maintained, with a positive evolution in terms of net interest income in most business areas. |

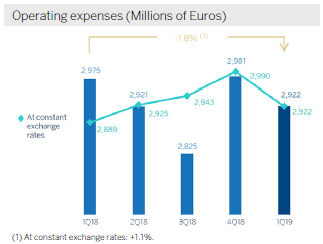

| • | | The trend of containingoperating expenses and improving the efficiency ratio compared to the same period of the previous year continues. |

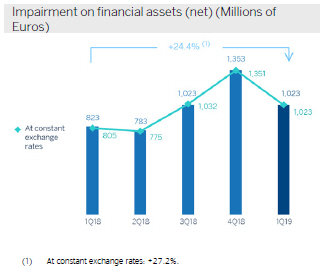

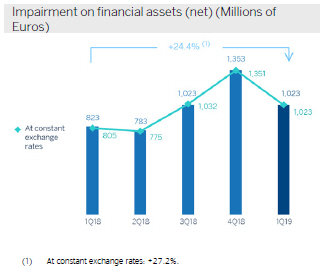

| • | | Higher impairment on financial assets (up 24.4%year-on-year), mainly as a result of the higher reserve requirements due to the impairment of specific portfolios and the updating of the macroeconomic scenarios in the United States and Turkey, were not offset by the lower needs in Spain. Nevertheless, the impairment on financial assets decreased by 24.3% compared to the last quarter of 2018. |

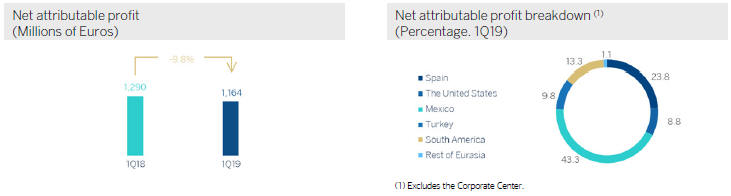

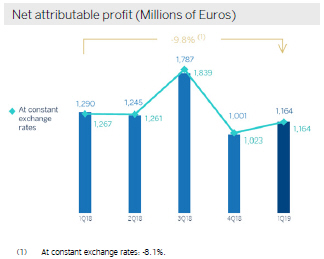

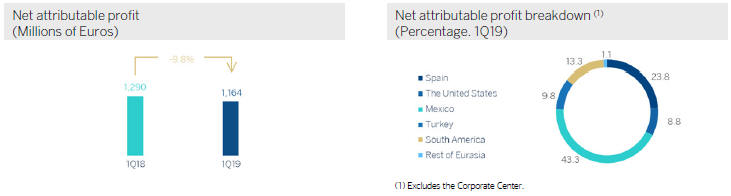

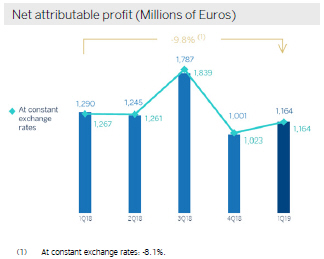

| • | | As a result, the net attributableprofitwas €1,164 million, 9.8% less than in the same period of the previous year. |

Balance sheet and business activity

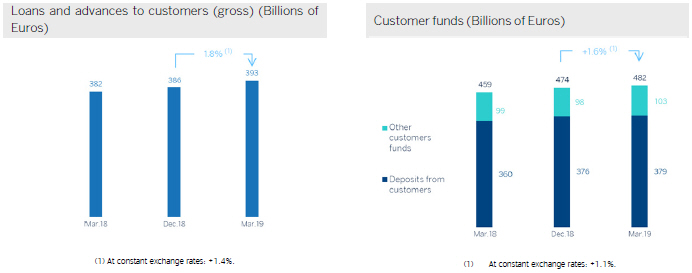

| • | | As of March 31, 2019, the number ofloans and advances to customers (gross) recorded a 1.8% growth with respect to December 31, 2018, with improved levels of activity in all business areas. |

| • | | Withinoff-balance-sheet funds, good development of investment funds and pension funds in the quarter. |

Solvency

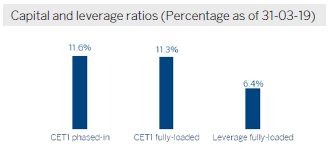

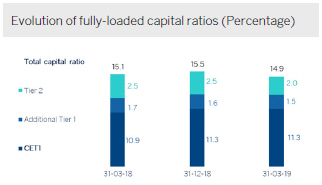

| • | | Capital position above regulatory requirements, with a fully loaded CET1ratioat 11.3%, similar to the level at the end of December 2018, which absorbs the 11 basis points impact as a result of the implementation of IFRS 16 on January 1, 2019. |

Risk management

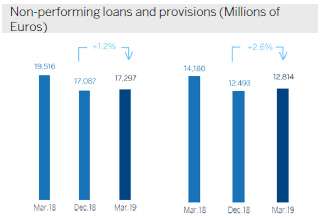

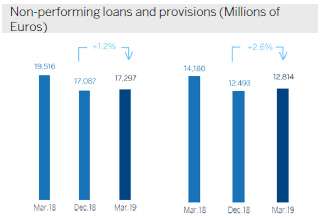

| • | | Although theNon-performing loans showed a slight rebound in the quarter (up 1.2%), the indicators of the maincredit-risk metrics remain solid: as of March 31, 2019, the NPL stood at 3.9%, coverage at 74% and the accumulated cost of risk at 1.06%. |

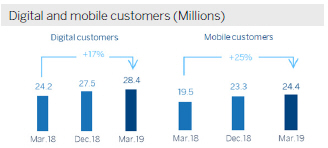

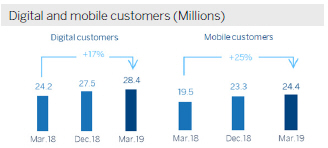

Digital customers

| • | | The Group’sdigital and mobile customer base anddigital sales continue to increase in all the geographic areas where BBVA operates with a positive impact on efficiency. |

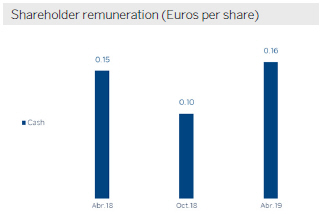

Dividends

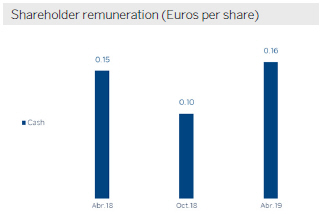

| • | | On April 10, 2019, there was a gross cash payment of €0.16 per share, corresponding to the supplementarydividend for 2018 that was approved at the General Shareholders’ Meeting held on March 15. |

Other matters of interest

| • | | IFRS 16 ‘Leases’ came into effect on January 1, 2019, a standard on leases that introduces a single lessee accounting model and will require lessees to recognize assets and liabilities of all lease contracts. The main impacts on the Group are the recognition of assets byright-of-use and liabilities per lease, amounting to €3,419m and €3,472m, respectively, and the above stated impact in terms of capital, both as of the effective date. |

| • | | In 2019, the balance sheets, income statements and ratios of the first three quarters of 2018 have been reexpressed for the Group and the business area of South America to reflect the impacts derived from the hyperinflation in Argentina as a result of the application of IAS 29 on the income and expenses as well as the assets and liabilities, in order to make the financial information of 2019 comparable to the one of 2018. This is due to the impact been registered for the first time in the third quarter 2018, with accounting effects as from January 1, 2018. |

Results

In the first quarter of 2019, BBVA Group obtained a net attributableprofit of €1,164m. This figure represents an increase of 16.2% compared to the one obtained in the last quarter of 2018, although it is 9.8% lower than in the same

quarter in the previous year(-8.1% at constant exchange rates). The good performance of recurring revenue items, particularly net interest income, as well as the evolution of operating expenses growing below gross income stand out.

Consolidated income statement: quarterly evolution

(Millions of euros)

| | | | | | | | | | | | | | | | | | | | |

| | | 2019 | | | | | | 2018 | | | | | | | |

| | | 1Q | | | 4Q | | | 3Q | | | 2Q | | | 1Q | |

Net interest income | | | 4,420 | | | | 4,692 | | | | 4,309 | | | | 4,302 | | | | 4,287 | |

Net fees and commissions | | | 1,214 | | | | 1,226 | | | | 1,173 | | | | 1,244 | | | | 1,236 | |

Net trading income | | | 426 | | | | 316 | | | | 212 | | | | 285 | | | | 410 | |

Other operating income and expenses | | | 8 | | | | (83 | ) | | | 38 | | | | 6 | | | | 92 | |

Gross income | | | 6,069 | | | | 6,151 | | | | 5,733 | | | | 5,838 | | | | 6,026 | |

Operating expenses | | | (2,922 | ) | | | (2,981 | ) | | | (2,825 | ) | | | (2,921 | ) | | | (2,975 | ) |

Personnel expenses | | | (1,553 | ) | | | (1,557 | ) | | | (1,459 | ) | | | (1,539 | ) | | | (1,565 | ) |

Other administrative expenses | | | (977 | ) | | | (1,119 | ) | | | (1,061 | ) | | | (1,087 | ) | | | (1,106 | ) |

Depreciation | | | (392 | ) | | | (305 | ) | | | (304 | ) | | | (295 | ) | | | (304 | ) |

Operating income | | | 3,147 | | | | 3,170 | | | | 2,908 | | | | 2,916 | | | | 3,050 | |

Impairment on financial assets not measured at fair value through profit or loss | | | (1,023 | ) | | | (1,353 | ) | | | (1,023 | ) | | | (783 | ) | | | (823 | ) |

Provisions or reversal of provisions | | | (144 | ) | | | (66 | ) | | | (123 | ) | | | (85 | ) | | | (99 | ) |

Other gains (losses) | | | (22 | ) | | | (183 | ) | | | (36 | ) | | | 67 | | | | 41 | |

Profit/(loss) before tax | | | 1,957 | | | | 1,568 | | | | 1,727 | | | | 2,115 | | | | 2,170 | |

Income tax | | | (559 | ) | | | (421 | ) | | | (419 | ) | | | (605 | ) | | | (617 | ) |

Profit/(loss) after tax from ongoing operations | | | 1,398 | | | | 1,147 | | | | 1,308 | | | | 1,510 | | | | 1,553 | |

Results from corporate operations(1) | | | — | | | | — | | | | 633 | | | | — | | | | — | |

Profit/(loss) for the year | | | 1,398 | | | | 1,147 | | | | 1,941 | | | | 1,510 | | | | 1,553 | |

Non-controlling interests | | | (234 | ) | | | (145 | ) | | | (154 | ) | | | (265 | ) | | | (262 | ) |

Net attributable profit | | | 1,164 | | | | 1,001 | | | | 1,787 | | | | 1,245 | | | | 1,290 | |

Net attributable profit excluding results from corporate operations | | | 1,164 | | | | 1,001 | | | | 1,154 | | | | 1,245 | | | | 1,290 | |

Earning per share (euros)(2) | | | 0.16 | | | | 0.14 | | | | 0.26 | | | | 0.17 | | | | 0.18 | |

General note: the application of accounting for hyperinflation in Argentina was performed for the first time in September 2018 with accounting effects on January 1, 2018, recording the impact of the 9 months in the third quarter. In order to make the 2019 information comparable to 2018, the income statements for the first three quarters of 2018 have been reexpressed to reflect the impacts of inflation on their income and expenses.

| (1) | Includes net capital gains from the sale of BBVA Chile. |

| (2) | Adjusted by additional Tier 1 instrument remuneration. |

Consolidated income statement

(Millions of euros)

| | | | | | | | | | | | | | | | |

| | | 1Q19 | | | D % | | | D % at constant

exchange rates | | | 1Q18 | |

Net interest income | | | 4,420 | | | | 3.1 | | | | 6.7 | | | | 4,287 | |

Net fees and commissions | | | 1,214 | | | | (1.8 | ) | | | 1.3 | | | | 1,236 | |

Net trading income | | | 426 | | | | 3.9 | | | | 8.4 | | | | 410 | |

Other operating income and expenses | | | 8 | | | | (91.3 | ) | | | (90.2 | ) | | | 92 | |

Gross income | | | 6,069 | | | | 0.7 | | | | 4.3 | | | | 6,026 | |

Operating expenses | | | (2,922 | ) | | | (1.8 | ) | | | 1.1 | | | | (2,975 | ) |

Personnel expenses | | | (1,553 | ) | | | (0.8 | ) | | | 2.1 | | | | (1,565 | ) |

Other administrative expenses | | | (977 | ) | | | (11.6 | ) | | | (8.6 | ) | | | (1,106 | ) |

Depreciation | | | (392 | ) | | | 28.9 | | | | 31.2 | | | | (304 | ) |

Operating income | | | 3,147 | | | | 3.2 | | | | 7.4 | | | | 3,050 | |

Impairment on financial assets not measured at fair value through profit or loss | | | (1,023 | ) | | | 24.4 | | | | 27.2 | | | | (823 | ) |

Provisions or reversal of provisions | | | (144 | ) | | | 45.1 | | | | 52.7 | | | | (99 | ) |

Other gains (losses) | | | (22 | ) | | | n.s. | | | | n.s. | | | | 41 | |

Profit/(loss) before tax | | | 1,957 | | | | (9.8 | ) | | | (5.3 | ) | | | 2,170 | |

Income tax | | | (559 | ) | | | (9.4 | ) | | | (5.7 | ) | | | (617 | ) |

Profit/(loss) after tax from ongoing operations | | | 1,398 | | | | (10.0 | ) | | | (5.1 | ) | | | 1,553 | |

Results from corporate operations | | | — | | | | — | | | | — | | | | — | |

Profit/(loss) for the year | | | 1,398 | | | | (10.0 | ) | | | (5.1 | ) | | | 1,553 | |

Non-controlling interests | | | (234 | ) | | | (10.8 | ) | | | 13.9 | | | | (262 | ) |

Net attributable profit | | | 1,164 | | | | (9.8 | ) | | | (8.1 | ) | | | 1,290 | |

Net attributable profit excluding results from corporate operations | | | 1,164 | | | | (9.8 | ) | | | (8.1 | ) | | | 1,290 | |

Earning per share (euros)(1) | | | 0.16 | | | | | | | | | | | | 0.18 | |

General note: the application of accounting for hyperinflation in Argentina was performed for the first time in September 2018 with accounting effects on January 1, 2018, recording the impact of the 9 months in the third quarter. In order to make the 2019 information comparable to 2018, the income statements for the first three quarters of 2018 have been reexpressed to reflect the impacts of inflation on their income and expenses.

| (1) | Adjusted by additional Tier 1 instrument remuneration. |

Unless expressly indicated otherwise, to better understand the changes in the main headings of the Group’s income statement, theyear-on-year percentage changes provided below refer toconstant exchange rates.

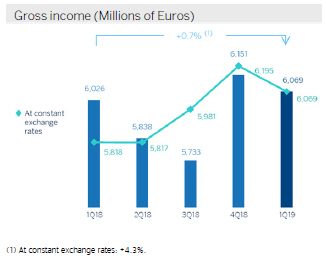

Gross income

Gross income increased by 4.3%year-on-year, supported by the positive performance of net interest income.

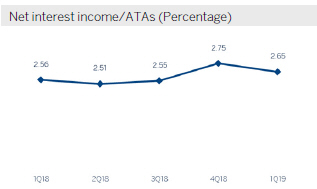

Net interest income registered a growth of 6.7%year-on-year, with increases in all business areas due to lower financing costs, except for Spain and Rest of Eurasia, which are more influenced by the interest rate situation in the Eurozone.

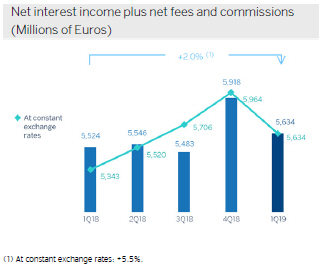

On the other hand, cumulativenet fees and commissions (up 1.3%year-on-year) also increased, thanks to their adequate diversification.

As a result, themore recurring revenue items (net interest income plus net fees and commissions) increased by 5.5%year-on-year.

NTI between January and March 2019 was 8.4% higher than the figure obtained in the same quarter of 2018, supported byone-off transactions and in general by gains deriving from securities portfolio management, particularly in the United States and South America.

Other operating income and expenses decreased by 90.2%year-on-year, mainly as a result of higher levels of inflation. However, the net contribution of the insurance business grew by 10.3%year-on-year.

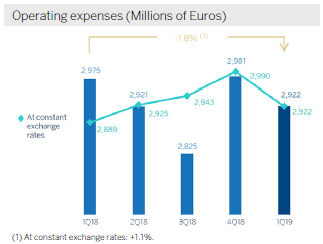

Operating income

Operating expenses in the first quarter of 2019 registered a growth of 1.1%year-on-year, considerably below the inflation rate recorded in the main countries where BBVA is present (down 1.8% at current exchange rates). The Group continues to apply strict cost discipline in all areas of the Group.

As a consequence of this evolution of operating expenses, theefficiency ratio continued to improve and stood at 48.1%, below the level reached at the end of 2018 (49.3%), whileoperating income registered an increase of 7.4%year-on-year.

Provisions and other

Impairment on financial assets not measured at fair value through profit or loss(impairment on financial assets) in the first three months of 2019 decreased by 24.3% compared to the fourth quarter of 2018, while it increased 27.2% compared to the first quarter of the same year. By business areas, there were higher loan-loss provisions in the United States due to the deterioration of some specific customers in the commercial portfolio and some write-offs in consumer, and in Turkey due to the deterioration of wholesale client portfolios. In addition, both countries are also located in geographic areas affected by the update of the macroeconomic outlook. On the contrary, Spain recognized lower loan-loss provisions, and Mexico remained at similar levels compared to the first quarter of last year.

Finally, the headingprovisions or reversal of provisions(hereinafter, “provisions”) was 52.7% above the figure recognized in the same quarter of 2018.

Results

As a result of the above,the Group’s net attributable profit in the first quarter of 2019 was 8.1% below that obtained in the same period of the previous year, characterized by stable levels of recurring revenue that were negatively impacted by higher loan-loss provisions.

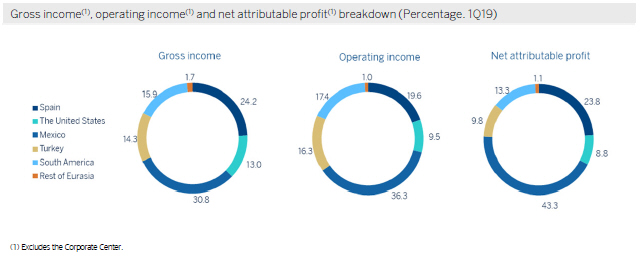

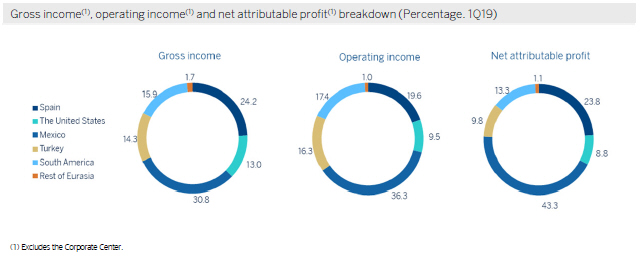

Bybusiness area, Spain generated net attributable profit of €345m, the United States €127m, Mexico recognized a profit of €627m, Turkey contributed €142m, South America €193m, and Rest of Eurasia €16m.

Balance sheet and business activity

The most relevantaspects of the Group’s balance sheet and business activity as of March 31, 2019 is summarized below:

| • | | Loans and advances to customers (gross) registered a growth of 1.8% in the quarter (up 1.4% at constant exchange rates), in all business areas, especially in Turkey, South America and Rest of Eurasia. |

| • | | Non-performing loans continued to decreaseyear-on-year (down 11.4%), thanks to the positive performance showed, especially in Spain and, to a lesser extent, Rest of Eurasia. However, there was a slight rebound of 1.2% in the quarter due to increases in the United States, Turkey and, to a lesser extent, South America. |

| • | | In terms of customerdeposits, time deposits decreased by 3.3% in the quarter (down 12.6%year-on-year), offset by an increase of 2.7% in demand deposits in the quarter (up 10.7%year-on-year), particularly in Spain and, to a lesser extent, the United States. |

| • | | Withinoff-balance sheet funds, both investment funds and pension funds showed a positive trend in this quarter. |

| • | | In tangible assets, the balance as of March 31, 2019 is affected by the impact of the implementation of IFRS 16 “Leases”, which entails an increase of 44.0% compared to the end of the previous fiscal year. |

Consolidated balance sheet

(Millions of euros)

| | | | | | | | | | | | | | | | |

| | | 31-03-19 | | | D % | | | 31-12-18 | | | 31-03-18 | |

Cash, cash balances at central banks and other demand deposits | | | 50,059 | | | | (14.0 | ) | | | 58,196 | | | | 43,167 | |

Financial assets held for trading | | | 92,366 | | | | 2.5 | | | | 90,117 | | | | 94,745 | |

Non-trading financial assets mandatorily at fair value through profit or loss | | | 5,535 | | | | 7.8 | | | | 5,135 | | | | 4,360 | |

Financial assets designated at fair value through profit or loss | | | 1,311 | | | | (0.2 | ) | | | 1,313 | | | | 1,330 | |

Financial assets at fair value through accumulated other comprehensive income | | | 60,204 | | | | 6.9 | | | | 56,337 | | | | 59,212 | |

Financial assets at amortized cost | | | 433,008 | | | | 3.2 | | | | 419,660 | | | | 417,646 | |

Loans and advances to central banks and credit institutions | | | 15,787 | | | | 20.5 | | | | 13,103 | | | | 17,751 | |

Loans and advances to customers | | | 380,799 | | | | 1.8 | | | | 374,027 | | | | 367,986 | |

Debt securities | | | 36,421 | | | | 12.0 | | | | 32,530 | | | | 31,909 | |

Investments in subsidiaries, joint ventures and associates | | | 1,587 | | | | 0.6 | | | | 1,578 | | | | 1,395 | |

Tangible assets | | | 10,408 | | | | 44.0 | | | | 7,229 | | | | 7,238 | |

Intangible assets | | | 8,383 | | | | 0.8 | | | | 8,314 | | | | 8,203 | |

Other assets | | | 28,338 | | | | (1.6 | ) | | | 28,809 | | | | 48,392 | |

Total assets | | | 691,200 | | | | 2.1 | | | | 676,689 | | | | 685,688 | |

Financial liabilities held for trading | | | 80,818 | | | | 0.1 | | | | 80,774 | | | | 86,767 | |

Other financial liabilities designated at fair value through profit or loss | | | 7,846 | | | | 12.2 | | | | 6,993 | | | | 6,075 | |

Financial liabilities at amortized cost | | | 520,464 | | | | 2.2 | | | | 509,185 | | | | 497,298 | |

Deposits from central banks and credit institutions | | | 64,427 | | | | 8.7 | | | | 59,259 | | | | 63,031 | |

Deposits from customers | | | 378,527 | | | | 0.7 | | | | 375,970 | | | | 360,213 | |

Debt certificates | | | 62,365 | | | | 2.1 | | | | 61,112 | | | | 60,866 | |

Other financial liabilities | | | 15,144 | | | | 17.9 | | | | 12,844 | | | | 13,188 | |

Liabilities under insurance and reinsurance contracts | | | 10,577 | | | | 7.6 | | | | 9,834 | | | | 9,624 | |

Other liabilities | | | 17,948 | | | | 5.4 | | | | 17,029 | | | | 33,881 | |

Total liabilities | | | 637,653 | | | | 2.2 | | | | 623,814 | | | | 633,645 | |

Non-controlling interests | | | 5,718 | | | | (0.8 | ) | | | 5,764 | | | | 6,665 | |

Accumulated other comprehensive income | | | (6,656 | ) | | | (7.8 | ) | | | (7,215 | ) | | | (6,195 | ) |

Shareholders’ funds | | | 54,485 | | | | 0.3 | | | | 54,326 | | | | 51,573 | |

Total equity | | | 53,547 | | | | 1.3 | | | | 52,874 | | | | 52,043 | |

Total liabilities and equity | | | 691,200 | | | | 2.1 | | | | 676,689 | | | | 685,688 | |

Memorandum item: | | | | | | | | | | | | | | | | |

Guarantees given | | | 46,406 | | | | (2.3 | ) | | | 47,574 | | | | 47,519 | |

General note: the application of accounting for hyperinflation in Argentina was performed for the first time in September 2018 with accounting effects on January 1, 2018, recording the impact of the nine months in the third quarter. In order to make the 2019 information comparable to 2018, the balance sheet of the first three quarters of 2018 has been reexpressed to reflect the impacts of inflation on its assets and liabilities.

Loans and advances to customers

(Millions of euros)

| | | | | | | | | | | | | | | | |

| | | 31-03-19 | | | D % | | | 31-12-18 | | | 31-03-18 | |

Public sector | | | 29,138 | | | | 2.2 | | | | 28,504 | | | | 28,176 | |

Individuals | | | 171,947 | | | | 0.8 | | | | 170,501 | | | | 169,541 | |

Mortgages | | | 111,772 | | | | 0.2 | | | | 111,528 | | | | 112,979 | |

Consumer | | | 36,159 | | | | 3.5 | | | | 34,939 | | | | 33,335 | |

Credit cards | | | 13,644 | | | | 1.0 | | | | 13,507 | | | | 13,263 | |

Other loans | | | 10,371 | | | | (1.5 | ) | | | 10,527 | | | | 9,963 | |

Business | | | 175,678 | | | | 2.8 | | | | 170,872 | | | | 165,398 | |

Non-performing loans | | | 16,559 | | | | 1.3 | | | | 16,348 | | | | 18,569 | |

Loans and advances to customers (gross) | | | 393,321 | | | | 1.8 | | | | 386,225 | | | | 381,683 | |

Loan-loss provisions | | | (12,522 | ) | | | 2.7 | | | | (12,199 | ) | | | (13,697 | ) |

Loans and advances to customers | | | 380,799 | | | | 1.8 | | | | 374,027 | | | | 367,986 | |

Customer funds

(Millions of euros)

| | | | | | | | | | | | | | | | |

| | | 31-03-19 | | | D % | | | 31-12-18 | | | 31-03-18 | |

Deposits from customers | | | 378,527 | | | | 0.7 | | | | 375,970 | | | | 360,213 | |

Of which current accounts | | | 267,614 | | | | 2.7 | | | | 260,573 | | | | 239,360 | |

Of which time deposits | | | 104,698 | | | | (3.3 | ) | | | 108,313 | | | | 113,469 | |

Other customer funds | | | 103,227 | | | | 5.2 | | | | 98,150 | | | | 98,900 | |

Mutual funds and investment companies | | | 64,928 | | | | 5.8 | | | | 61,393 | | | | 62,819 | |

Pension funds | | | 35,071 | | | | 3.7 | | | | 33,807 | | | | 33,604 | |

Otheroff-balance sheet funds | | | 3,228 | | | | 9.5 | | | | 2,949 | | | | 2,477 | |

Total customer funds | | | 481,754 | | | | 1.6 | | | | 474,120 | | | | 459,113 | |

Solvency

Capital base

BBVA’sfully-loaded CET1 ratio stood at 11.3% at the end of March 2019. This ratio includes the impact of-11 basis points for the first application of the IFRS 16 standard, which entered into force on January 1, 2019. Excluding this effect, the ratio increased by +12 basis points, supported by the recurring organic capital generation and the positive evolution of the markets.

Risk-weighted assets (RWAs) fully-loaded increased in the quarter by €12,368m, due to the implementation of IFRS 16, the evolution of foreign currencies, mainly the appreciation of the US dollar and the growth of the activity in emerging economies.

Capital base

(Millions of euros)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | CRD IVphased-in | | | CRD IV fully-loaded | |

| | | 31-03-19 (1)

| | | 31-12-18 | | | 31-03-18 | | | 31-03-19 (1)

| | | 31-12-18 | | | 31-03-18 | |

Common Equity Tier 1 (CET 1) | | | 41,756 | | | | 40,313 | | | | 39,858 | | | | 40,983 | | | | 39,571 | | | | 38,899 | |

Tier 1 | | | 47,427 | | | | 45,947 | | | | 45,987 | | | | 46,511 | | | | 45,047 | | | | 44,795 | |

Tier 2 | | | 7,336 | | | | 8,756 | | | | 8,397 | | | | 7,288 | | | | 8,861 | | | | 8,423 | |

Total Capital (Tier 1 + Tier 2) | | | 54,764 | | | | 54,703 | | | | 54,384 | | | | 53,799 | | | | 53,907 | | | | 53,218 | |

Risk-weighted assets | | | 360,689 | | | | 348,264 | | | | 358,941 | | | | 361,173 | | | | 348,804 | | | | 358,315 | |

CET1 (%) | | | 11.6 | | | | 11.6 | | | | 11.1 | | | | 11.3 | | | | 11.3 | | | | 10.9 | |

Tier 1 (%) | | | 13.1 | | | | 13.2 | | | | 12.8 | | | | 12.9 | | | | 12.9 | | | | 12.5 | |

Tier 2 (%) | | | 2.0 | | | | 2.5 | | | | 2.3 | | | | 2.0 | | | | 2.5 | | | | 2.4 | |

Total capital ratio (%) | | | 15.2 | | | | 15.7 | | | | 15.2 | | | | 14.9 | | | | 15.5 | | | | 14.9 | |

General note: the main difference between thephased-in and fully loaded ratios arises from the temporary treatment of the impact of IFRS9, to which the BBVA Group has adhered voluntarily (in accordance with Article 473bis of the CRR).

Regarding capitalissuances, BBVA S.A. conducted two capital issuances: the issuance of preferred securities that may be converted into ordinary BBVA shares (CoCos), registered in the Spanish Securities Market Commission (CNMV) for €1,000m, with an annual coupon of 6.0% and an amortization option from the fifth year; and a Tier 2 subordinated debt issue of €750m, with a maturity period of 10 years, amortization option in the fifth year, and a coupon of 2.575%. These issuances, pending receipt of ECB computability authorization, are not included in the capital ratios as of March 2019, but would have an impact of +28 basis points in Tier 1 and +21 basis points in Tier 2.

In the first quarter of 2019, the Group continued with its program to meet theminimum requirement for own funds and eligible liabilities (MREL) published in May 2018, closing the public issuance of seniornon-preferred debt for a total of €1,000m. BBVA estimates that complies with the MREL requirement.

In addition, early amortization options were implemented for two issuances: the issuance of contingent convertible bond (CoCos) for €1,500m with a coupon of 7% issued in February 2014, and another Tier 2 subordinated debt issuance for €1,500m with a coupon of 3.5% issued in April 2014 and amortized in April 2019.

Regarding shareholder remuneration, on April 10, 2019, BBVA paid a final cash dividend of €0.16 per share for the fiscal year 2018, in line with the Group’s dividend policy of maintaining apay-out ratio of35-40% of recurring profit. During the first quarter, this final dividend does not have any impact on the solvency ratio of the Group, as it is already incorporated as of December 2018.

Thephased-in CET1ratio stood at 11.6% as of March 31, 2019, taking into account the impact of the IFRS 9 standard. Tier 1 capital stood at 13.1% and Tier 2 at 2.0%, resulting in atotal capital ratio of 15.2%.

These levels are above the requirements established by the supervisor in its SREP letter, applicable in 2019. Since March

1, 2019, at consolidated level, this requirement has been established at 9.26% for the CET1 ratio and 12.76% for the total capital ratio. Its variation compared to 2018 is explained by the end of the transitional period for implementation of capital conservation buffers and the capital buffer applicable to Other Systemically Important Institutions, as well as the progression of the countercyclical capital buffer. For its part, the CET1 of Pillar 2 (P2R) requirement remains unchanged at 1.5%.

Finally, the Group’sleverage ratio maintained a solid position, at 6.4% fully-loaded (6.6%phased-in), which is still the highest among its peer group.

Ratings

At present, all agencies assign to BBVA a category “A” rating, with no variation in the first three months of 2019. These ratings are detailed in the following table: Ratings

| | | | | | | | | | | | |

Rating agency | | Long term | | | Short term | | | Outlook | |

| DBRS | | | A (high) | | | | R-1 (middle) | | | | Stable | |

| Fitch | | | A- | | | | F-2 | | | | Negative | |

| Moody’s(1) | | | A3 | | | | P-2 | | | | Stable | |

| Scope Ratings | | | A+ | | | | S-1+ | | | | Stable | |

| Standard & Poor’s | | | A- | | | | A-2 | | | | Negative | |

| (1) | Additionally, Moody’s assigns an A2 rating to BBVA’s long term deposits. |

Risk management

Credit risk

BBVA Group’s risk metrics show the following evolution in the first quarter of 2019:

| • | | Credit risk increased by 1.2% in the quarter at current exchange rates (up 0.6% at constant exchange rates), with generalized growth in all areas except Turkey, which remains flat, impacted by the exchange rate evolution (up 2.1% at constant rates). The United States, which was positively impacted by the dollar evolution, grew 1.0% at current exchange rates and contracted 0.9% at constant exchange rates. |

| • | | Balance ofnon-performing loans registered a decrease of 11.4%year-on-year, although they increased by 1.2% in the quarter (0.6% in constant terms). Good performance in Spain during the first quarter (down 2.8%) which does not offset the increase of NPLs in other areas, especially the United States and Turkey. |

| • | | TheNPL ratio stood at 3.9% as of March 31, 2019, stable with respect to the ratio registered at the end of December 2018. However, it decreased by 47 basis points compared to the end of March 2018. |

| • | | Loan-loss provisionsincreased by 2.6% in the quarter (2.4% at constant exchange rates). |

| • | | TheNPL coverage ratio stood at 74% at the end of the quarter, an improvement of 97 basis points in the first three months of 2019 and 142 basis points higher than the end of March 2018. |

| • | | The accumulatedcost of risk as of March 31, 2019 was 1.06%, which is a slight increase of 5 basis points compared to the end of 2018. |

Credit risk(1)

(Millions of euros)

| | | | | | | | | | | | | | | | | | | | |

| | | 31-03-19 | | | 31-12-18 | | | 30-09-18 | | | 30-06-18 (2)

| | | 31-03-18 (2)

| |

Credit risk | | | 439,152 | | | | 433,799 | | | | 428,318 | | | | 451,587 | | | | 442,446 | |

Non-performing loans | | | 17,297 | | | | 17,087 | | | | 17,693 | | | | 19,654 | | | | 19,516 | |

Provisions | | | 12,814 | | | | 12,493 | | | | 12,890 | | | | 13,954 | | | | 14,180 | |

NPL ratio (%) | | | 3.9 | | | | 3.9 | | | | 4.1 | | | | 4.4 | | | | 4.4 | |

NPL coverage ratio (%) | | | 74 | | | | 73 | | | | 73 | | | | 71 | | | | 73 | |

| (1) | Include gross loans and advances to customers plus guarantees given. |

| (2) | Figures without considering the classification ofnon-current assets held for sale. |

Non-performing loans evolution

(Millions of euros)

| | | | | | | | | | | | | | | | | | | | |

| | | 1Q19(1)

| | | 4Q18 | | | 3Q18 | | | 2Q18(2)

| | | 1Q18(2)

| |

Beginning balance | | | 17,087 | | | | 17,693 | | | | 19,654 | | | | 19,516 | | | | 20,492 | |

Entries | | | 2,342 | | | | 3,019 | | | | 2,168 | | | | 2,596 | | | | 2,060 | |

Recoveries | | | (1,408 | ) | | | (1,560 | ) | | | (1,946 | ) | | | (1,655 | ) | | | (1,748 | ) |

Net variation | | | 934 | | | | 1,459 | | | | 222 | | | | 942 | | | | 311 | |

Write-offs | | | (769 | ) | | | (1,693 | ) | | | (1,606 | ) | | | (863 | ) | | | (923 | ) |

Exchange rate differences and other | | | 45 | | | | (372 | ) | | | (576 | ) | | | 59 | | | | (365 | ) |

Period-end balance | | | 17,297 | | | | 17,087 | | | | 17,693 | | | | 19,654 | | | | 19,516 | |

Memorandum item: | | | | | | | | | | | | | | | | | | | | |

Non-performing loans | | | 16,559 | | | | 16,348 | | | | 17,045 | | | | 18,627 | | | | 18,569 | |

Non performing guarantees given | | | 738 | | | | 739 | | | | 649 | | | | 1,027 | | | | 947 | |

| (2) | Figures without considering the classification ofnon-current assets held for sale. |

Structural risks

Liquidity and funding

Management ofliquidity and funding in BBVA aims to finance the recurring growth of the banking business at suitable maturities and costs, using a wide range of instruments that provide access to a large number of alternative sources of financing, always in compliance with current regulatory requirements.

Due to its subsidiary-based management model, BBVA is one of the few major European banks that follows the Multiple Point of Entry (MPE) resolutionstrategy: the parent company sets the liquidity and risk policies, but the subsidiaries are self-sufficient and responsible for managing their own liquidity (taking deposits or accessing the market with their own rating), without fund transfer or financing occurring between either the parent company and the subsidiaries, or between different subsidiaries. This strategy limits the spread of a liquidity crisis among the Group’s different areas, and ensures that the cost of liquidity and financing is correctly reflected in the price formation process.

The financial soundness of the Group’s banks continues to be based on the funding of lending activity, fundamentally through the use of stable customer funds. During the first quarter of 2019,liquidity conditions remained comfortable across all countries in which the BBVA Group operates:

| • | | In the Eurozone, the liquidity situation remains comfortable, and the credit gap was stable throughout the first quarter. |

| • | | In the United States, the liquidity situation is adequate. The credit gap decreased in the quarter, due mainly to the increase in deposits as a result of the deposit growth campaigns launched and seasonal fluctuations in the first quarter of the year. |

| • | | In Mexico, a solid liquidity position has been maintained. The credit gap increased slightly in the first quarter of the year, affected by the seasonal outflow of deposits, while the loan portfolio remained virtually flat in the quarter. |

| • | | In Turkey, positive liquidity situation, with an adequate buffer against a possible liquidity stress scenario. The overall credit gap remained virtually flat, with the larger gap in Turkish lira due to the increase in loans being offset by a reduction in the credit gap in foreign currency, due to an increase in deposits. |

| • | | In South America, the liquidity situation remains comfortable throughout the region. In Argentina, despite market volatility, the liquidity situation remains adequate. |

The BBVA Group’s liquidity coverage ratio (LCR) remained comfortably above 100% throughout the first quarter of 2019, and stood at 127% as of March 31, 2019. All subsidiaries remained comfortably above 100% (Eurozone, 144%; Mexico, 151%; Turkey, 208%; and the United States, 145%). For the calculation of the ratio, it is assumed that there is no transfer of liquidity among subsidiaries; i.e. no kind of excess liquidity levels in foreign subsidiaries are considered in the calculation of the consolidated ratio. When considering these excess liquidity levels, the ratio would stand at 155% (28 percentage points above 127%).

Wholesalefinancing markets in which the Group operates remained stable, even in the case of Turkey, where the higher volatility at the end of March due to the local elections did not affect its financing.

The maintransactionscarried out by the entities of the BBVA Group during the first quarter of 2019 were as follows:

| • | | BBVA S.A. issued seniornon-preferred debt for €1 billion, with a fixed-rate coupon of 1.125% over a five-year period; an issue of preferred securities which may be converted into ordinary BBVA shares (CoCos), registered in the Spanish Securities Market Commission (CNMV) for €1 billion, with an annual coupon of 6.0% and an amortization option from the fifth year; and a Tier 2 subordinated debt issue for €750m, with a maturity period of 10 years, amortization option in the fifth year and a coupon of 2.575%. |

| • | | In addition, early amortization options have been implemented for the issue of CoCos for €1.5 billion with a coupon of 7% issued in February 2014, and another for Tier 2 subordinated debt for €1.5 billion with a 3.5% coupon issued in April 2014 and amortized in April 2019. |

| • | | In Turkey, Garanti issued a five-year Diversified Payment Rights (DPR) for US$150m. |

| • | | Finally, BBVA in Argentina issued negotiable instruments on the local market for an amount equivalent to €33m, while in Chile, Forum issued a bond on the local market for an amount equivalent to €108m. |

Foreign exchange

Foreign exchangerisk management of BBVA’s long-term investments, principally stemming from its overseas franchises, aims to preserve the Group’s adequacy capital ratios and to ensure the stability of its income statement.

In the first quarterof 2019, the Turkish lira (down 4.5%) and the Argentine peso (down 11.6%) depreciated against the euro, while the Mexican peso (up 3.7%) and the US dollar (up 1.9%) appreciated compared to the end of 2018. BBVA has maintained its policy of actively hedging its main investments in emerging markets, covering on average between 30% and 50% of annual earnings and around 70% of the CET1 capital ratio excess. Based on this policy, the sensitivity of the CET1 ratio to the depreciation of 10% against the euro by the main emerging-market currencies stood at-3 basis points for the Mexican peso and-2 basis points for the Turkish lira. In the case of the US dollar, the sensitivity is approximately +11 basis points to a depreciation of 10% against the euro, as a result of RWAs denominated in US dollars outside the United States. At the end of March 2019, the coverage level for expected earnings in 2019 stood at 75% for Mexico and 30% for Turkey.

Interest rates

The aim of managinginterest-raterisk is to maintain sustained growth of net interest income in the short- and medium-term, irrespective of interest rate fluctuations, while controlling the impact on capital through the valuation of the portfolio of financial assets at fair value through profit or loss.

The Group’s banks maintain fixed-income portfolios to manage their balance sheet structure. In the first quarter of 2019, the results of this management were satisfactory, with limited risk strategies maintained in all the Group’s banks.

In Turkey, there was an increase in market volatility prior to the local elections held on March 31, which led the Central Bank of the Republic of Turkey (CBRT) to raise the cost of financing to stabilize the Turkish lira. However, this did not have any impact on the balance sheet structure. In this context, the management of the customer spread was very positive, thanks to the efforts made to reduce the cost of funding, which enabled good net interest income growth in the quarter, despite a lower contribution of inflation-linked bonds compared to previous quarters.

Finally, with regard to themonetary policies pursued by central banks in the main countries where BBVA operates, in the first quarter of 2019, it should be noted that:

| • | | The interest rate of 0% and deposit facility rate of-0.40% were maintained in the Eurozone. The ECB indicated at its meeting in March that it would delay rate increases until at least December 2019, lowering its growth and inflation forecasts for the year. In addition, it announced a new round of liquidity injections (TLDRO III) starting from September. |

| • | | In the United States, the Fed decided to pause the normalization process in the face of increased downside risks, mainly due to the weakness of the global economy, and the absence of inflationary pressures, keeping interest rates stable at 2.5% at its March meeting. |

| • | | In Mexico, Banxico decided to maintain its monetary policy rate at 8.25%, considering that this position is consistent with meeting its target inflation rate. |

| • | | In Turkey, the Central Bank of the Republic of Turkey (CBRT) maintained rates at 24.00% during the first quarter, raising the average cost of financing to 25.50% at the end of March to stabilize the Turkish lira, before returning to 24.00% at the beginning of April. |

| • | | In South America, the monetary authorities of Colombia and Peru maintained their respective reference rates during the quarter the same as at the end of 2018, while in Argentina, interest rates rose to 68.16% at the end of the quarter, with the aim of avoiding an increase in the monetary base and halting the rise in inflation. |

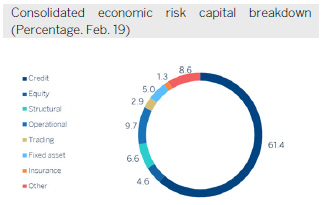

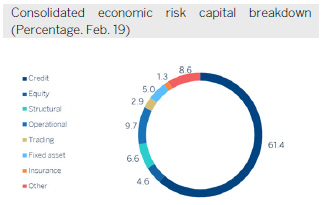

Economic capital

Economic risk capital (ERC) consumption at the end of February 2019, in consolidated terms, stood at €28,722 million, a decrease of 7.9% compared to the end of December 2018 (down 8.4% at constant exchange rates). This decrease is mainly focused on eliminating ERC consumption through goodwill and equity, as this will be considered a deduction of assets used in the calculation of the Group’s solvency.

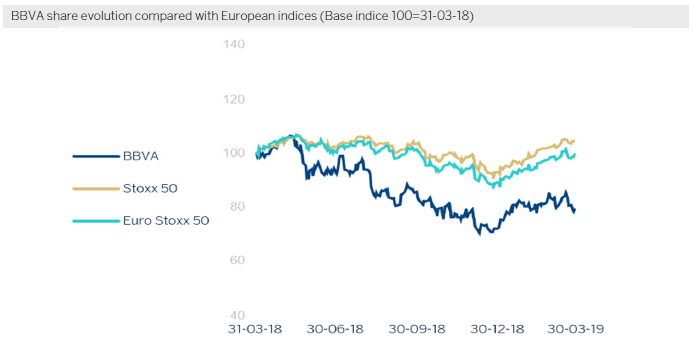

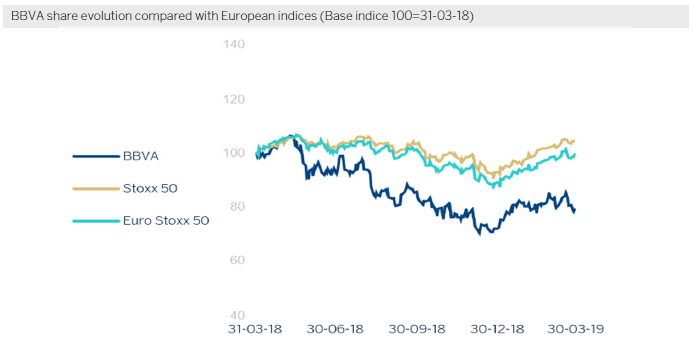

The BBVA share

The majorstock marketindices improved during the first quarter of 2019. In Europe, the Stoxx 50 and Euro Stoxx 50 rose 12.9% and 11.7%, respectively, while in Spain the Ibex 35 index rose 8.2%. Over the same period in the United States, the S&P 500 index rose 13.1%, marking the largest quarterly increase since the third quarter of 2009.

Banking sectorperformance in particular was also positive in the quarter, although to a lesser extent than the general market indices. Furthermore, the Stoxx European Banks index, which includes the United Kingdom, rose 4.5%, while the Euro Stoxx Banks index for the eurozone rose 7.1%. In the United States, the S&P Regional Banks Select Industry Index grew 9.6% in comparison to the close of the 2018.

On the other hand, theBBVA share performed slightly better than those of the European banking sector and Ibex 35 during the first quarter of 2019, with the share price increasing 9.9% to €5.09 at the close of the quarter.

| | | | |

| The BBVA share and share performance ratios |

| | | | | | | | |

| | | 31-03-19 | | | 31-12-18 | |

Number of shareholders | | | 892,316 | | | | 902,708 | |

Number of shares issued | | | 6,667,886,580 | | | | 6,667,886,580 | |

Daily average number of shares traded | | | 23,536,617 | | | | 35,909,997 | |

Daily average trading (millions of euros) | | | 122 | | | | 213 | |

Maximum price (euros) | | | 5.55 | | | | 7.73 | |

Minimum price (euros) | | | 4.51 | | | | 4.48 | |

Closing price (euros) | | | 5.09 | | | | 4.64 | |

Book value per share (euros) | | | 7.20 | | | | 7.12 | |

Tangible book value per share (euros) | | | 5.94 | | | | 5.86 | |

Market capitalization (millions of euros) | | | 33,960 | | | | 30,909 | |

Yield (dividend/price; %)(1) | | | 4.9 | | | | 5.4 | |

| (1) | Calculated by dividing shareholder remuneration over the last twelve months by the closing price of the period. |

Regardingshareholder remuneration, on April 10, 2019 BBVA paid in cash a gross amount of €0.16 per share as a final dividend for the 2018 fiscal year, which represents a 7% increase compared to April 2018. Thus, the total dividend for the 2018 fiscal year amount to €0.26 gross per share, with a payoutof 37% of net attributable profit, excluding the gains of the sale of BBVA Chile. BBVA will continue to pay out between 35% and 40% of its yearly earnings in dividends, with 100% cash remuneration.

As of March 31, 2019, the number of BBVAshares remained at 6,668 million, held by 892,316shareholders, of whom 44.73% are Spanish residents and the other 55.27% arenon-residents.

Shareholder structure

(31-03-2019)

| | | | | | | | | | | | | | | | |

| | | Shareholders | | | Shares | |

Number of shares | | Number | | | % | | | Number | | | % | |

Up to 150 | | | 177,281 | | | | 19.9 | | | | 12,565,086 | | | | 0.2 | |

151 to 450 | | | 177,739 | | | | 19.9 | | | | 48,727,280 | | | | 0.7 | |

451 to 1800 | | | 280,798 | | | | 31.5 | | | | 274,676,758 | | | | 4.1 | |

1,801 to 4,500 | | | 134,826 | | | | 15.1 | | | | 384,055,358 | | | | 5.8 | |

4,501 to 9,000 | | | 62,727 | | | | 7.0 | | | | 395,229,468 | | | | 5.9 | |

9,001 to 45,000 | | | 52,468 | | | | 5.9 | | | | 910,481,356 | | | | 13.7 | |

More than 45,001 | | | 6,477 | | | | 0.7 | | | | 4,642,151,274 | | | | 69.6 | |

| | | | | | | | | | | | | | | | |

Total | | | 892,316 | | | | 100.0 | | | | 6,667,886,580 | | | | 100.0 | |

| | | | | | | | | | | | | | | | |

BBVAshares are included on the main stock market indices, including the Ibex 35, Euro Stoxx 50 and Stoxx 50, with a weighting of 7.0%, 1.4% and 0.9% respectively at the close of March 2019. They also form part of several sector indices, including the Euro Stoxx Banks, with a weighting of 8.5%, and the Stoxx Banks, with a weighting of 4.0%.

Finally, BBVA maintains a significant presence on a number of internationalsustainability indices or ESG (Environmental, Social and Governance) indices, which evaluate companies’ performance in these areas. This presence is summarized in the following table:

Responsible banking

At BBVA we have a differential bankingmodel, that we refer to as responsible banking, based on seeking out a return adjusted to principles, strict legal compliance, best practices and the creation of long-term value for all stakeholders. The four pillars of BBVA’s responsible banking model are as follows:

| • | | Balanced relationships with its customers, based on transparency, clarity and responsibility. |

| • | | Sustainable finance to combat climate change, respect human rights and achieve the United Nations Sustainable Development Goals (SDGs). |

| • | | Responsible practices with employees, suppliers and other stakeholders. |

| • | | Community investment to promote social change and create opportunities for all. |

In 2018, BBVA announced its2025 Pledge. This sets out the Bank’s strategy for climate change and sustainable development, working toward meeting the United Nations Sustainable Development Goals (SDGs) and the Paris Agreement on climate change. The pledge is an eight-year commitment based on three lines of action:

| • | | To finance: BBVA is pledging to mobilize €100 billion in green and social finance, sustainable infrastructures and agribusiness, social entrepreneurship and financial inclusion. |

| • | | To manage the environmental and social risks associated with the Group’s activity in order to minimize its potential direct and indirect negative impacts. BBVA pledges that 70% of energy used by the Group will be renewable by 2025, increasing to 100% in 2030, as well as to reduce CO2 emissions by 68% compared to 2015. |

| • | | To engage all stakeholders to collectively promote the financial sector’s contribution to sustainable development. |

In 2018, the first year of the Pledge, €11,815m was mobilized forsustainable financing. In the first quarter of 2019, BBVA continued to be very active in sustainable corporate financing, mainly in loans with profit margins linked to the borrower’s performance in terms of ESG (Environmental, Social and Governance) criteria, certified by an independent expert. BBVA was also part of the working group preparing Sustainability Linked Loan Principles (SLLP), the new market standards for this financial instrument,which were published in March.

In terms of mitigating social and environmental risks, in the first quarter of 2019, BBVA updated its sector norms setting out the due diligence to be performed in accordance with four

sectors of special environmental and social impact: mining, energy, infrastructure andagribusiness. These standards provide clear guidance on the procedures to follow when managing customers and transactions in these sectors. As a result of discussions with stakeholders and in order to meet expectations, stricter restrictions have been incorporated:

| • | | In the energy sector, the coal threshold for BBVA customers’ energy mix has beenreduced from 40% to 35%. |

| • | | Transporting of tar sands has been explicitly added to the list of prohibited activities, as well as to the existing exploration and production activities. BBVA’s exposure in financing projects of exploration, production and transportation of tar sands was zero by the close of the first quarter of 2019, and no projects of this nature are being considered. |

| • | | In the energy and agriculture sectors, reference to biofuels as an alternative in the fight against climate change, which appeared in a previous version of the standards, has been removed. |

| • | | New restrictions relating to tobacco advertising have been incorporated. |

As part of its objective to engage its stakeholders, BBVA continues to participate in various initiatives at the heart of sectoral associations such as the AEB (Asociación Española de Banca — Spanish banking association) or the EBF (European Banking Federation), where the Bank presides over the sustainable finance group and participates in working groups related to this matter, as well as collaborating in consultations on taxonomy, regulation, disclosure and other objectives of the European Commission action plan on sustainable finance.

Regarding responsible practice, BBVA updated its action plan on human rights matters in February 2019, which, combined with the renewed human rights commitment, allows closer monitoring of actions identified during a due diligence process conducted due to the potential special impact on human rights.

In terms of community investment, BBVA allocated €104.5m to social initiatives in 2018, which benefited more than 8 million people. This figure represents approximately 2% of the net attributable profit for that financial year. Through social programs, BBVA acts as an engine of opportunities for people, and seeks to have a positive impact on their lives, with regard to vulnerable people in particular. BBVA’s investment in social programs is channelled through its local banks within the Group, and through its corporate foundations.

Business areas

This section presents and analyzes the most relevant aspects of the Group’s different business areas. Specifically, for each one of them, it shows a summary of the income statement and balance sheet, the business activity figures and the most significant ratios.

In 2019, BBVA Group’s business areasreporting structure of the BBVA Group’s business areas differs from the one presented at the end of the 2018, as a result of the integration of theNon-Core Real Estate business area into Banking Activity in Spain, now reported as “Spain”. In order to make the 2019 information comparable to 2018, the figures for both areas have been reexpressed. BBVA Group’s business areas are summarized below:

| • | | Spain mainly includes the banking and insurance businesses that the Group carries out in Spain. |

| • | | The United States includes the Group’s business activity in the country through BBVA Compass group and BBVA’s New York branch. |

| • | | Mexico includes the Group’s banking and insurance businesses in this country as well as the activity of BBVA Bancomer’s branch in Houston. |

| • | | Turkey reports the activity of Garanti group that is mainly carried out in this country and, to a lesser extent, in Romania and the Netherlands. |

| • | | South America basically includes the Group’s banking and insurance businesses in the region. |

| • | | Rest of Eurasia includes the banking business activity carried out by the Group in Europe, excluding Spain, and in Asia. |

The Corporate Center contains the Group’s holding function, including: the costs of the head offices with a corporate function; management of structural exchange rate positions; some equity instruments issuances to ensure an adequate management of the Group’s global solvency. It also includes portfolios whose management is not linked to customer relationships, such as industrial holdings; certain tax assets and liabilities; funds due to commitments to employees; goodwill and other intangible assets.

Theinformation by business area is based on units at the lowest level and/or companies that comprise the e Group, which are assigned to the different areas according to the main region or company group in which they carry out their activity.

As usual, in the case of the different business areas in America and Turkey, the results of applying constantexchange rates are given as well as theyear-on-year variations at current exchange rates.

Major income statement items by business area

(Millions of euros)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Business areas | | | | | | | |

| | | BBVA Group | | | Spain | | | The

United

States | | | Mexico | | | Turkey | | | South

America | | | Rest of

Eurasia | | | S

Business

areas | | | Corporate

Center | |

31-03-19 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net interest income | | | 4,420 | | | | 882 | | | | 615 | | | | 1,500 | | | | 695 | | | | 760 | | | | 39 | | | | 4,491 | | | | (71 | ) |

Gross income | | | 6,069 | | | | 1,497 | | | | 804 | | | | 1,902 | | | | 884 | | | | 985 | | | | 103 | | | | 6,176 | | | | (107 | ) |

Operating income | | | 3,147 | | | | 683 | | | | 331 | | | | 1,268 | | | | 571 | | | | 606 | | | | 34 | | | | 3,493 | | | | (346 | ) |

Profit/(loss) before tax | | | 1,957 | | | | 482 | | | | 160 | | | | 877 | | | | 368 | | | | 417 | | | | 23 | | | | 2,327 | | | | (370 | ) |

Net attributable profit | | | 1,164 | | | | 345 | | | | 127 | | | | 627 | | | | 142 | | | | 193 | | | | 16 | | | | 1,450 | | | | (286 | ) |

31-03-18(1)(2) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net interest income | | | 4,287 | | | | 927 | | | | 524 | | | | 1,317 | | | | 753 | | | | 791 | | | | 43 | | | | 4,355 | | | | (67 | ) |

Gross income | | | 6,026 | | | | 1,588 | | | | 699 | | | | 1,711 | | | | 996 | | | | 1,008 | | | | 126 | | | | 6,127 | | | | (102 | ) |

Operating income | | | 3,050 | | | | 744 | | | | 264 | | | | 1,138 | | | | 641 | | | | 523 | | | | 54 | | | | 3,365 | | | | (314 | ) |

Profit/(loss) before tax | | | 2,170 | | | | 577 | | | | 252 | | | | 782 | | | | 519 | | | | 345 | | | | 71 | | | | 2,546 | | | | (376 | ) |

Net attributable profit | | | 1,290 | | | | 404 | | | | 196 | | | | 567 | | | | 200 | | | | 157 | | | | 48 | | | | 1,572 | | | | (282 | ) |

| (1) | The impact derived from the accounting for hyperinflation in Argentina for the first nine months of 2018 was recorded for the first time in the third quarter of the year, with accounting effects on January 1, 2018. In order to make the 2019 information comparable to 2018, the income statements for the first three quarters of the 2018 fiscal year have been reexpressed to reflect the impacts of inflation on their income and expenses. |

| (2) | The income statements for 2018 were reexpressed due to changes in the reallocation of some expenses related to global projects and activities between the Corporate Center and the business areas incorporated in 2019. |

Major balance-sheet items and risk-weighted assets by business area

(Millions of euros)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | Business areas | | | | | | | | | | | | | | | | |

| | | BBVA

Group | | | Spain | | | The

United

States | | | Mexico | | | Turkey | | | South

America | | | Rest of

Eurasia | | | S

Business

areas | | | Corporate

Center | | | Deletions | |

31-03-19 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Loans and advances to customers | | | 380,799 | | | | 170,893 | | | | 61,403 | | | | 53,480 | | | | 42,025 | | | | 35,691 | | | | 18,257 | | | | 381,748 | | | | 551 | | | | (1,500 | ) |

Deposits from customers | | | 378,527 | | | | 181,723 | | | | 65,165 | | | | 50,904 | | | | 40,544 | | | | 37,236 | | | | 5,065 | | | | 380,638 | | | | 280 | | | | (2,391 | ) |

Off-balance sheet funds | | | 103,227 | | | | 64,225 | | | | — | | | | 22,744 | | | | 3,370 | | | | 12,481 | | | | 407 | | | | 103,227 | | | | — | | | | — | |

Total assets/liabilities and equity | | | 691,200 | | | | 356,552 | | | | 85,160 | | | | 101,738 | | | | 67,130 | | | | 57,031 | | | | 20,582 | | | | 688,193 | | | | 16,075 | | | | (13,068 | ) |

Risk-weighted assets | | | 360,689 | | | | 107,935 | | | | 64,969 | | | | 54,794 | | | | 58,526 | | | | 44,964 | | | | 16,004 | | | | 347,191 | | | | 13,498 | | | | — | |

31-12-18(1) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Loans and advances to customers | | | 374,027 | | | | 170,438 | | | | 60,808 | | | | 51,101 | | | | 41,478 | | | | 34,469 | | | | 16,598 | | | | 374,893 | | | | 990 | | | | (1,857 | ) |

Deposits from customers | | | 375,970 | | | | 183,414 | | | | 63,891 | | | | 50,530 | | | | 39,905 | | | | 35,842 | | | | 4,876 | | | | 378,456 | | | | 36 | | | | (2,523 | ) |

Off-balance sheet funds | | | 98,150 | | | | 62,559 | | | | — | | | | 20,647 | | | | 2,894 | | | | 11,662 | | | | 388 | | | | 98,150 | | | | — | | | | — | |

Total assets/liabilities and equity | | | 676,689 | | | | 354,901 | | | | 82,057 | | | | 97,432 | | | | 66,250 | | | | 54,373 | | | | 18,834 | | | | 673,848 | | | | 16,281 | | | | (13,440 | ) |

Risk-weighted assets | | | 348,264 | | | | 104,125 | | | | 64,175 | | | | 53,177 | | | | 56,486 | | | | 42,724 | | | | 15,464 | | | | 336,151 | | | | 12,113 | | | | — | |

| (1) | The impact derived from the accounting for hyperinflation in Argentina for the first nine months of 2018 was recorded for the first time in the third quarter of the year, with accounting effects on January 1, 2018. In order to make the 2019 information comparable to the 2018, the balance sheets of the first three quarters of the 2018 have been reexpressed to reflect the impacts of inflation on their assets and liabilities. |

Since 2019, a column has been added, which includes thedeletions and balance sheet adjustments between different business areas, especially in terms of the relationship between the areas in which the parent company operates, i.e. Spain, Rest of Eurasia and Corporate Center. In previous years, these deletions were allocated to the different areas, mainly in Banking Activity in Spain. Accordingly, the figures from the previous year have been reexpressed to show comparable series.

Macro and industry trends

World GDP grew by 3.8% in 2018, despite the slowdown in the second half of the year. In the first quarter of 2019,global growth moderated due to manufacturing and trade weaknesses. However, the service sector and employment remain robust. The cyclical slowdown in the United States and China’s moderation trend have been accompanied by an unexpected slowdown in Europe, affected by global trade tensions and idiosyncratic factors (such as regulatory changes in the automobile sector, protests in France and, mainly, Brexit).

In light of greater cyclical weakness and in the absence of inflationary pressures, main central banks have reacted with more accommodativemonetary policies. The United States Federal Reserve (Fed), after raising benchmark interest rates to 2.50% in December, has signaled a pause that is likely to continue until the end of 2019, and will put an end to the reduction in its balance earlier than expected. The European Central Bank, after completing the asset purchase program in December and in the face of weak economic activity, has announced a new round of liquidity auctions, delaying the interest rates increase, which is no longer expected untilmid-2020 at the earliest. Furthermore, the Chinese authorities have been adopting fiscal and monetary stimuli following recent signs of weakening activity. Thus, interest rates will remain low for longer in the developed economies, allowing emerging countries to gain room for maneuver. These stimuli are a factor supporting growth, but amoderation on growth rates is expected for the coming quarters.

Spain

The Spanish economy grew by 2.6% in 2018, above the euro area (1.8%). In the first quarter of 2019, growth remains strong due to the good performance of public and private consumption, while exports and investment in machinery and equipment are slowing down. In the coming quarters the economy will grow at a lower pace due to the exhaustion of the fiscal stimulus and the global weakness, while uncertainty about economic policy will continue to have a negative impact on activity.

Regarding the banking sector, the system’sde-leveraging and the improvement of asset quality indicators (NPL of 5.8% in January 2019) continued. Profitability remains under pressure (ROE at the close of 2018 stands at 5.4%) due to the low interest rate environment and lower business volumes. Spanish banks continue to have high levels of solvency and liquidity.

United States

The United States grew 2.9% in 2018, its unemployment rate fell below 4% and the Fed increased rates to 2.50%. Growth is being moderated by increased interest rates, the global slowdown, the exhaustion of the fiscal stimulus and political uncertainty. Some financial indicators show an increase in the risk of recession, but the economy maintains a good growth rate, especially in consumption. The pause in interest rate rises is a supporting factor.

The most recent bank activity figures show that credit and deposits are growing at rates of 5.2% and 3.3% respectively. Delinquencies continued to fall. In the fourth quarter of 2018, the NPL ratio was 1.57%.

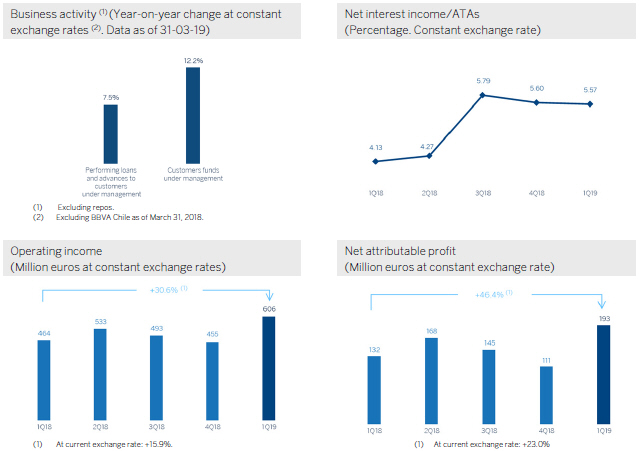

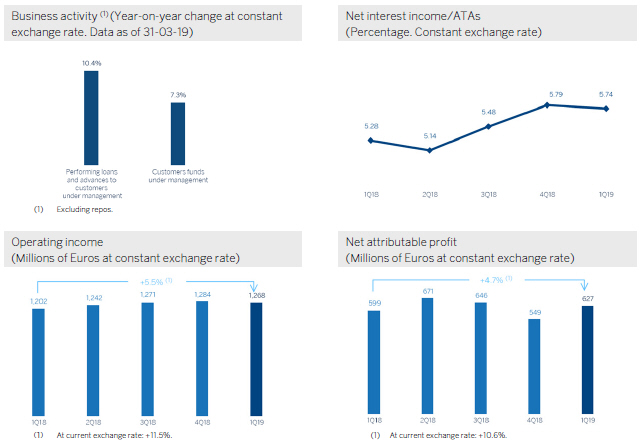

Mexico

As of the end of 2018, the economy closed with a rate of growth of 2%. In the first months of 2019, the service sector was resilient and private consumption gave positive signs following the weakness of the fourth quarter of 2018. However, private investment remains weak while the manufacturing sector and exports are moderating. The central bank continues with its restrictive bias; however, good figures for inflation and the exchange rate would allow interest rates to be cut to mitigate the foreseeable slowdown in growth.

The banking system continues to grow inyear-on-year terms. With figures as of February 2019, loans and deposits grew by 9.4% and 8.5%, respectively, showing growth in all segments. Delinquencies remain contained (2.11%, compared to 2.20% twelve months earlier) while capital indicators remain at comfortable levels.

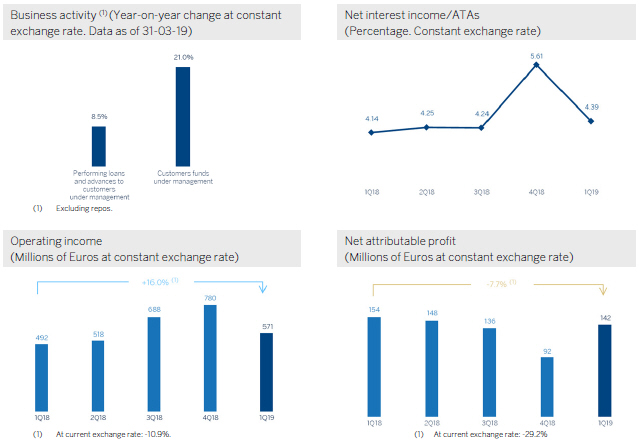

Turkey

The economy grew 2.6% in 2018, after registering two consecutive quarters of decline. Consumption and investment registered a sharp contraction, partially offset by external demand. Although activity kept falling at the beginning of the year, it seems to have reached a bottom. Interest rates will remain high until exchange rate pressure is resolved and inflation moderates. The Government has announced a new economic plan, some of the measures include the capitalization of the banking system and the strengthening of the asset quality.

As of the end of the first quarter of 2019, the banking system showed high growth rates. Total credit in the system (adjusted for the exchange rate effect) grew 18.1% with growth in all portfolios, driven especially by public banks after the government’s package of measures to support SMEs. The NPL ratio of the system is 4.1%.

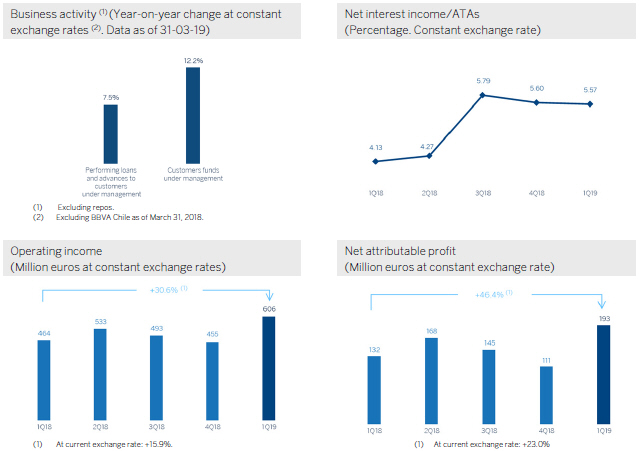

Argentina

The economy registered a sharp contraction in 2018 (GDP fell by 2.5%) following the exchange rate crisis and a severe drought. But the end of the first quarter presents signs of a lukewarm recovery in activity, while the IMF has approved an additional US$ 10.8 billion loan after favorably completing the third review of its support program. Inflation remains high and with strong inertia due to the impact of exchange rate depreciation, despite a more contractionary monetary policy. In the financial system, loans and deposits are growing at high rates, with a notable influence of the high inflation. As of January 2019, profitability indicators are very high (ROE: 37% and ROA: 4.2%) and delinquencies remain contained, with a NPL ratio of 3.2%.

Colombia

The Colombian economy grew by 2.6% in 2018. Growth continued in the first quarter of 2019, supported by private consumption and public spending, while investment has not taken off. With weak demand and low inflation (about 3%), the central bank has held interest rates at 4.25% and it is not expected to increase them in the short term. In Colombia, as of January 2019, the system’s total credit grew by 5.9%year-on-year, with a NPL ratio of 4.7%. Since January 2018, total deposits increased 4.7%.

Peru

After growing by 4% in 2018, growth is moderating mainly explained by the primary sector, construction and the recent fall in public investment. The central bank has held interest rates at 2.75%, which implies an expansionary bias for monetary policy. Interest rates are expected to rise in the coming months. The banking system presents moderateyear-on-year growth rates in loans and deposits (+9.3% and +5.7% respectively, as of January 2019), with reasonably high profitability levels (ROE: 18.5%, ROA: 2.7%).

End of period interest rates

(Percentage)

| | | | | | | | | | | | | | | | | | | | |

| | | 2019

1Q | | | 4Q | | | 2018

3Q | | | 2Q | | | 1Q | |

Official ECB rate | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | 0.00 | |

Euribor 3 months | | | (0.31 | ) | | | (0.31 | ) | | | (0.32 | ) | | | (0.32 | ) | | | (0.33 | ) |

Euribor 1 year | | | (0.11 | ) | | | (0.13 | ) | | | (0.17 | ) | | | (0.18 | ) | | | (0.19 | ) |

USA Federal rates | | | 2.43 | | | | 2.40 | | | | 2.18 | | | | 1.91 | | | | 1.67 | |

TIIE (Mexico) | | | 8.52 | | | | 8.41 | | | | 8.11 | | | | 7.93 | | | | 7.83 | |

CBRT (Turkey) | | | 25.50 | | | | 24.06 | | | | 24.01 | | | | 17.77 | | | | 12.75 | |

Exchange rates

(Expressed in currency/euro)

| | | | | | | | | | | | | | | | | | | | |

| | | Year-end exchange rates | | | | | | Average exchange rates | |

| | | 31-03-19 | | | D % on

31-03-18 | | | D % on

31-12-18 | | | 1Q19 | | | D % on

1Q18 | |

Mexican peso | | | 21.6910 | | | | 3.8 | | | | 3.7 | | | | 21.8057 | | | | 5.6 | |

U.S. dollar | | | 1.1235 | | | | 9.7 | | | | 1.9 | | | | 1.1358 | | | | 8.2 | |

Argentine peso | | | 48.9734 | | | | (49.3 | ) | | | (11.6 | ) | | | 48.9734 | | | | (49.3 | ) |

Chilean peso | | | 765.20 | | | | (2.5 | ) | | | 4.0 | | | | 757.96 | | | | (2.3 | ) |

Colombian peso | | | 3,585.02 | | | | (4.5 | ) | | | 4.5 | | | | 3,561.35 | | | | (1.5 | ) |

Peruvian sol | | | 3.7275 | | | | 6.7 | | | | 3.6 | | | | 3.7738 | | | | 5.4 | |

Turkish lira | | | 6.3446 | | | | (22.8 | ) | | | (4.5 | ) | | | 6.1102 | | | | (23.2 | ) |

| | | | | | | | | | |

Spain | | | | | | |

| | | | | | | | | | |

| | | Highlights | | | | | | |

| | • | | Positive trend of activity, especially in high profitable segments. | | | | | | |

| | • | | Net Interest income affected by lower ALCO contribution and the impact of IFRS 16. | | | | | | |

| | • | | Significant reduction in operating expenses. | | | | | | |

| | • | | Continues improvement in Credit risk indicators. | | | | | | |

Financial statements and relevant business indicators

(Millions of euros and percentage)

| | | | | | | | | | | | |

Income statement | | 1Q19 | | | D % | | | 1Q18 | |

Net interest income | | | 882 | | | | (4.9 | ) | | | 927 | |

Net fees and commissions | | | 414 | | | | 0.3 | | | | 412 | |

Net trading income | | | 108 | | | | (35.2 | ) | | | 167 | |

Other operating income and expenses | | | 94 | | | | 14.0 | | | | 82 | |

of which Insurance activities(1) | | | 130 | | | | 13.5 | | | | 114 | |

Gross income | | | 1,497 | | | | (5.7 | ) | | | 1,588 | |

Operating expenses | | | (814 | ) | | | (3.5 | ) | | | (844 | ) |

Personnel expenses | | | (472 | ) | | | (1.6 | ) | | | (480 | ) |

Other administrative expenses | | | (223 | ) | | | (22.5 | ) | | | (287 | ) |

Depreciation | | | (119 | ) | | | 55.7 | | | | (77 | ) |

Operating income | | | 683 | | | | (8.2 | ) | | | 744 | |

Impairment on financial assets not measured at fair value through profit or loss | | | (78 | ) | | | (37.9 | ) | | | (125 | ) |

Provisions or reversal of provisions and other results | | | (123 | ) | | | 194.7 | | | | (42 | ) |

Profit/(loss) before tax | | | 482 | | | | (16.5 | ) | | | 577 | |

Income tax | | | (137 | ) | | | (20.7 | ) | | | (172 | ) |

Profit/(loss) for the year | | | 345 | | | | (14.7 | ) | | | 405 | |

Non-controlling interests | | | (1 | ) | | | (7.4 | ) | | | (1 | ) |

Net attributable profit | | | 345 | | | | (14.7 | ) | | | 404 | |

| (1) | Includes premiums received net of estimated technical insurance reserves. |

| | | | | | | | | | | | |

Balance sheets | | 31-03-19 | | | D % | | | 31-12-18 | |

Cash, cash balances at central banks and other demand deposits | | | 18,875 | | | | (33.9 | ) | | | 28,545 | |

Financial assets designated at fair value | | | 113,735 | | | | 6.0 | | | | 107,320 | |

of which loans and advances | | | 30,715 | | | | 1.6 | | | | 30,222 | |

Financial assets at amortized cost | | | 199,111 | | | | 1.9 | | | | 195,467 | |

of which loans and advances to customers | | | 170,893 | | | | 0.3 | | | | 170,438 | |

Inter-area positions | | | 13,173 | | | | (6.1 | ) | | | 14,026 | |

Tangible assets | | | 3,530 | | | | 172.9 | | | | 1,294 | |

Other assets | | | 8,129 | | | | (1.5 | ) | | | 8,249 | |

Total assets/liabilities and equity | | | 356,552 | | | | 0.5 | | | | 354,901 | |

Financial liabilities held for trading and designated at fair value through profit or loss | | | 70,283 | | | | (1.1 | ) | | | 71,033 | |

Deposits from central banks and credit institutions | | | 46,697 | | | | 1.7 | | | | 45,914 | |

Deposits from customers | | | 181,723 | | | | (0.9 | ) | | | 183,414 | |

Debt certificates | | | 31,490 | | | | 0.4 | | | | 31,352 | |

Inter-area positions | | | — | | | | — | | | | — | |

Other liabilities | | | 17,756 | | | | 22.3 | | | | 14,519 | |

Economic capital allocated | | | 8,602 | | | | (0.8 | ) | | | 8,670 | |

| | | |

Relevant business indicators | | 31-03-19 | | | D % | | | 31-12-18 | |

Performing loans and advances to customers under management(1) | | | 166,802 | | | | 0.2 | | | | 166,396 | |

Non-performing loans | | | 9,794 | | | | (2.8 | ) | | | 10,073 | |

Customer deposits under management(1) | | | 181,283 | | | | (0.9 | ) | | | 182,984 | |

Off-balance sheet funds(2) | | | 64,225 | | | | 2.7 | | | | 62,559 | |

Risk-weighted assets | | | 107,935 | | | | 3.7 | | | | 104,125 | |

Efficiency ratio (%) | | | 54.4 | | | | | | | | 55.9 | |

NPL ratio (%) | | | 4.9 | | | | | | | | 5.1 | |

NPL coverage ratio (%) | | | 58 | | | | | | | | 57 | |

Cost of risk (%) | | | 0.18 | | | | | | | | 0.21 | |

| (2) | Includes mutual funds, pension funds and otheroff-balance sheet funds. |

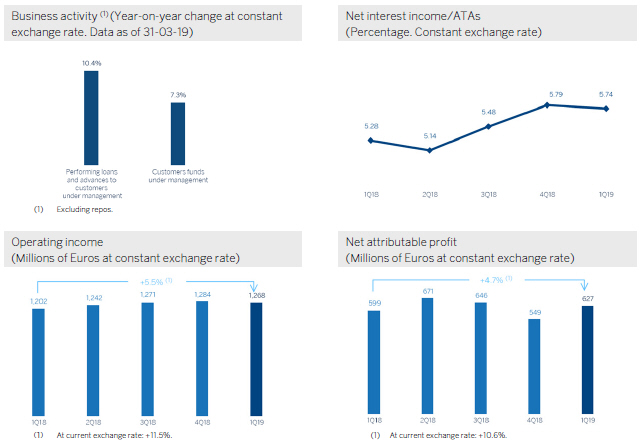

Activity

The most relevant aspects related to the area’s activity during the first quarter of 2019 were:

| • | | As of March 31, 2019Lending (performing loans under management) stood at a similar level than the one registered on December 31, 2018 (up 0.2%). We highlight the positive evolution of consumer loans and credit cards (up 3.4%) as well as lending tomedium-sized enterprises (up 2.1%) that offset the reduction in mortgage loans (down 0.5%). Inyear-on-year terms, lending activity grew by 1.8%. |

| • | | In terms of asset quality,non-performing loans showed a downward trend over the quarter, with a positive effect on the NPL ratio which stood at 4.9% as of March 31, 2019 (5.1% as of December 31, 2018), mainly explained by a lower level of NPLs in the mortgage portfolios. The NPL coverage ratio stood at 58%, above the closing of 2018. |

| • | | Regarding customerdeposits under management, it is important to highlight the good performance of demand deposits, which increased by 2.5% in the quarter (up 13.3%year-on-year), representing more than 80% of total deposits by March 2019. On the other hand, time deposits continued their downward trend (down 13.2% in the quarter, down 19.1%year-on-year). Overall, total deposits remained flat during the quarter while increasing by 5.2% in the last twelve months. |

| • | | Off-balance sheet funds showed a mild recovery (up 2.7% since December 31, 2018 and up 1.9%year-on-year), particularly evident in investment funds as a result of a good market performance during the quarter. |

Results

In the first quarter of 2019, the net attributable profit of BBVA in Spain stood at €345m, a 14.7% decline compared to the same quarter of 2018 but an increase of 11.7% compared to the previous quarter. The main highlights of the area’s income statement are:

| • | | Net interest income decreased by 4.9%year-on-year, strongly influenced by a lower contribution from the ALCO portfolio and the effect of the implementation of IFRS 16. |

| • | | Net fees and commissions remained stableyear-on-year (up 0.3%). |

| • | | LowerNTI contribution (down 35.2% compared to the same quarter of 2018) due to uneven market performance in the quarter and lower portfolio sales. |

| • | | Growth inother operating income and expenses (up 14.0%year-on-year) was mainly due to the good performance of net earnings from the insurance business which showed an increase of 13.5%. |

| • | | Operating expenses decreased by 3.5% in the last twelve months, remaining flat over the last three months. Thus, theefficiencyratio stood at 54.4%, improving compared to the end of 2018. |

| • | | Decline in impairment on financial assets (down 37.9%year-on-year) as a result of lower loan-loss provisions of real-estate developer loans previously allocated to the former Non Core Real Estate area. As a result, the cumulative cost of risk stood at 0.18% as of March 31, 2019. |

| • | | Finally,provisions (net) and other gains (losses) showed ayear-on-year increase due mainly to the positive valuation of assets in the former Non Core Real Estate area during the first quarter of last year. |

| | | | | | | | | | |

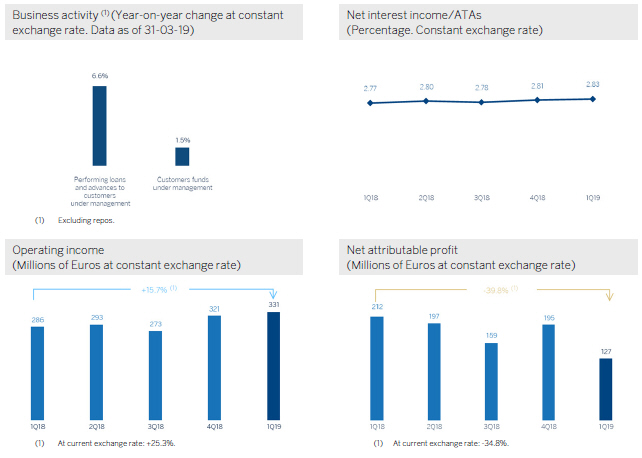

The United States | | | | | | |

| | | | | | | | | | |

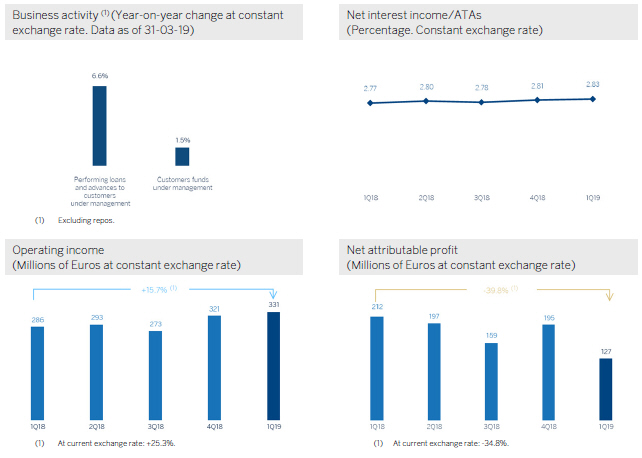

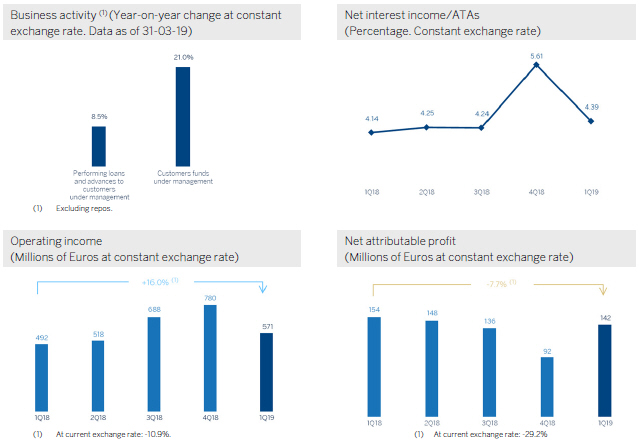

| | | Highlights | | | | | | |

| | • | | Good performance in consumer and commercial segments activity. | | | | | | |

| | • | | Net interest income increase, main lever of results and of customer spreads. | | | | | | |

| | • | | Operating expenses growth below the inflation rate, efficiency improvement. | | | | | | |

| | • | | Net attributable profit affected by impairment on financial assets associated to the macroeconomic environment, to specific customers and to write-offs in consumer. | | | | | | |

Financial statements and relevant business indicators

(Millions of euros and percentage)

| | | | | | | | | | | | | | | | |

Income statement | | 1Q19 | | | D % | | | D % (1) | | | 1Q18 | |

Net interest income | | | 615 | | | | 17.4 | | | | 8.4 | | | | 524 | |

Net fees and commissions | | | 151 | | | | 2.1 | | | | (5.7 | ) | | | 148 | |

Net trading income | | | 41 | | | | 67.3 | | | | 54.0 | | | | 24 | |

Other operating income and expenses | | | (3 | ) | | | n.s. | | | | n.s. | | | | 3 | |

Gross income | | | 804 | | | | 15.1 | | | | 6.3 | | | | 699 | |

Operating expenses | | | (473 | ) | | | 8.8 | | | | 0.5 | | | | (434 | ) |

Personnel expenses | | | (278 | ) | | | 10.4 | | | | 1.9 | | | | (252 | ) |

Other administrative expenses | | | (140 | ) | | | (0.6 | ) | | | (8.2 | ) | | | (141 | ) |

Depreciation | | | (55 | ) | | | 31.1 | | | | 21.2 | | | | (42 | ) |

Operating income | | | 331 | | | | 25.3 | | | | 15.7 | | | | 264 | |