- BBVA Dashboard

- Financials

- Filings

- Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

6-K Filing

Banco Bilbao Vizcaya Argentaria (BBVA) 6-KCurrent report (foreign)

Filed: 13 Feb 20, 6:20am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE13a-16 OR15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of February, 2020

Commission file number:1-10110

BANCO BILBAO VIZCAYA ARGENTARIA, S.A.

(Exact name of Registrant as specified in its charter)

BANK BILBAO VIZCAYA ARGENTARIA, S.A.

(Translation of Registrant’s name into English)

Calle Azul 4,

28050 Madrid

Spain

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form20-F or Form40-F:

Form20-F ☒ Form40-F ☐

Indicate by check mark if the registrant is submitting the Form6-K in paper as permitted by RegulationS-T Rule 101(b)(1):

Yes ☐ No ☒

Indicate by check mark if the registrant is submitting the Form6-K in paper as permitted by RegulationS-T Rule 101(b)(7):

Yes ☐ No ☒

Annual Report on the Remuneration of BBVA Directors

REFERENCE FINANCIAL YEAR2019

APPROVAL DATE OF REPORT10 FEBRUARY 2020

| Executive summary: 2019 Remuneration | 3 | |||||

| 5 | ||||||

1.1. | Newlay-out of the Annual Report on the Remuneration of BBVA Directors | 5 | ||||

1.2. | 6 | |||||

1.3. | 8 | |||||

2. Application of BBVA Directors’ Remuneration Policy in 2019 | 15 | |||||

2.1. | 16 | |||||

2.2. | 19 | |||||

2.3. | 29 | |||||

| 38 | ||||||

3.1 | 38 | |||||

3.2 | 39 | |||||

| Annex 1: Group of peer institutions used for remuneration purposes | 43 | |||||

| Annex 2: Compliance with the Model provided in Circular 2/2018 | 44 | |||||

| This English version is a translation of the original in Spanish for information purposes only. In case of a discrepancy, the Spanish original will prevail. |

| Annual Report on the Remuneration of BBVA Directors - 2019 | 2 |

Executive summary: 2019 Remuneration

Remuneration of executive directors accrued in 2019

Non-executive directors | FIXED (EUR thousand) | VARIABLE(2) | ||||||||||||||||||||||||||

| Annual Fixed Remuneration | Other items | Short term 2019 (Upfront payment, 40% 2019 AVR) | Long term 2016 (Deferred portion, 50% 2016 AVR) | |||||||||||||||||||||||||

| In kind | Other (1) | Cash (EUR thousand) | Number of shares | Cash(3) (EUR thousand) | Number of shares | |||||||||||||||||||||||

Group Executive Chairman (Carlos Torres Vila) | 2,453 | 184 | — | 636 | 126,470 | 656 | 89,158 | |||||||||||||||||||||

Chief Executive Officer (Consejero Delegado) (Onur Genç) | 2,179 | 144 | 1,160 | 571 | 113,492 | 204 | 31,086 | |||||||||||||||||||||

Head ofGlobalEconomics & Public Affairs (José ManuelGonzález-Páramo Martínez-Murillo) | 834 | 83 | — | 75 | 14,998 | 98 | 13,355 | |||||||||||||||||||||

| (1) | Fixed amounts in cash in lieu of pension, and mobility allowance. |

| (2) | To vest in the first quarter of 2020. |

| (3) | Includes update amount (Consumer Price Index (CPI) and dividends). |

Pay for performance

2019 AVR (2019 performance period)

Annual performance indicators 2019 AVR | Results | Level of achievement | ||||||||||||

| 2019 (*) | 2018 (*) | Target | % | |||||||||||

Attributable Profit excluding corporate transactions | | EUR 4.830 billion |

| | EUR 4.701 billion |

| ● | 104.6 | % | |||||

Tangible Book Value (TBV) per share | 6.50 | 5.86 | ● | 104.8 | % | |||||||||

Return on Regulatory Capital (RORC) | 8.79 | % | 8.32 | % | ● | 105.2 | % | |||||||

Efficiency ratio | 48.50 | % | 49.28 | % | ● | 101.4 | % | |||||||

Customer Satisfaction (IReNe) | 97.21 | 99.07 | ● | 97.2 | % | |||||||||

Digital Sales | 113.12 | N/A | ● | 113.1 | % | |||||||||

2016 AVR (2017–2019 performance period)

Multi-year performance | Results | Level of achievement | % reduction deferred AVR | |||||||

Economic adequacy: economic equity/ERC | 148 | % | ● | 0 | % | |||||

Fully loaded CET 1 | 11.2 | % | ● | 0 | % | |||||

LtSCD (Loan to Stable Customer Deposits) | 108 | % | ● | 0 | % | |||||

(Net Margin/Average Total Assets) — (Loan-Loss Provisions /Average Total Assets) | 1.2 | % | ● | 0 | % | |||||

Return on Equity(ROE) | 8.8 | % | ● | 0 | % | |||||

Total ShareholderReturn (TSR) | | 11th position | | ● | 30 | % | ||||

| (*) | Results approved for incentive purposes, adjusted by corporate transactions and other adjustments. |

The executive directors’individual indicators have achieved their set objectives.

Pension system contributions in 2019(in thousands of EUR):

Director | Pension system contributions | |||||||||||||||

| Retirement | Insurance premiums | DPBs adjustments 2018 | Total | |||||||||||||

Group Executive Chairman (Carlos Torres Vila) | 1,642 | 278 | (1 | ) | 1,919 | |||||||||||

Chief Executive Officer (Onur Genç) | — | 141 | — | 141 | ||||||||||||

Head of Global Economics & Public Affairs (José ManuelGonzález-Páramo Martínez-Murillo) | 250 | 150 | 4 | 404 | ||||||||||||

DPB: Discretionary Pension Benefits

| This English version is a translation of the original in Spanish for information purposes only. In case of a discrepancy, the Spanish original will prevail. |

| Annual Report on the Remuneration of BBVA Directors - 2019 | 3 |

Remuneration ofnon-executive directors (in thousands of EUR):

Fixed annual amounts

Non-executive directors | Position as a member of the Board of Directors | Position on the Committees (Member and Chair) | Other positions(1) | 2019 total | ||||||||||||

Tomás Alfaro Drake | 129 | 86 | — | 215 | ||||||||||||

José Miguel Andrés Torrecillas | 129 | 321 | 33 | 483 | ||||||||||||

Jaime Caruana Lacorte | 129 | 398 | — | 527 | ||||||||||||

Belén Garijo López | 129 | 220 | — | 348 | ||||||||||||

Sunir Kumar Kapoor | 129 | 43 | — | 172 | ||||||||||||

Carlos Loring Martínez de Irujo | 129 | 317 | — | 445 | ||||||||||||

Lourdes Máiz Carro | 129 | 124 | — | 253 | ||||||||||||

José Maldonado Ramos | 129 | 211 | — | 340 | ||||||||||||

Ana Peralta Moreno | 129 | 111 | — | 240 | ||||||||||||

Juan Pi Llorens | 129 | 311 | 53 | 493 | ||||||||||||

Susana Rodríguez Vidarte | 129 | 318 | — | 447 | ||||||||||||

Jan Verplancke | 129 | 43 | — | 172 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

Total | 1,545 | 2,503 | 87 | 4,134 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

| (1) | Remunerations for the Deputy Chair and Lead Director positions, with effects 1 May 2019. |

In addition,non-executive directors have received remuneration in kind amounting to a total of EUR 104 thousand in 2019.

System of fixed remuneration with deferred delivery of BBVA shares

Non-executive directors | Theoretical shares allocated in 2019 | Theoretical shares accumulated as of 31/12/2019 | ||||||

Tomás Alfaro Drake | 10,138 | 93,587 | ||||||

José Miguel Andrés Torrecillas | 19,095 | 55,660 | ||||||

Jaime Caruana Lacorte | 9,320 | 9,320 | ||||||

Belén Garijo López | 12,887 | 47,528 | ||||||

Sunir Kumar Kapoor | 6,750 | 15,726 | ||||||

Carlos Loring Martínez de Irujo | 17,515 | 116,391 | ||||||

Lourdes Máiz Carro | 11,160 | 34,320 | ||||||

José Maldonado Ramos | 15,328 | 94,323 | ||||||

Ana Peralta Moreno | 5,624 | 5,624 | ||||||

Juan Pi Llorens | 17,970 | 72,141 | ||||||

Susana Rodríguez Vidarte | 17,431 | 122,414 | ||||||

Jan Verplancke | 5,203 | 5,203 | ||||||

|

|

|

| |||||

Total | 148,421 | 672,237 | ||||||

|

|

|

| |||||

Shares will be delivered after they cease to be directors, for any grounds other than serious dereliction of duties.

| This English version is a translation of the original in Spanish for information purposes only. In case of a discrepancy, the Spanish original will prevail. |

| Annual Report on the Remuneration of BBVA Directors - 2019 | 4 |

ANNUAL REPORT ON THE REMUNERATION OF DIRECTORS

COMPANY NAME: Banco Bilbao Vizcaya Argentaria, S.A.

REGISTERED OFFICE: Plaza de San Nicolás, 4, 48005 Bilbao (Biscay)

TAX ID:A-48265169

| 1. | Introduction |

| 1.1. | Newlay-out of the Annual Report on the Remuneration of BBVA Directors |

This document has been drafted in accordance with the provisions of Article 541 of the Spanish Corporate Enterprises Act and Circular 2/20181 of the Spanish National Securities Market Committee (“CNMV”), which stipulates that companies may submit their annual report on the remuneration of directors in a free format,instead of using the standardised electronic document created for this purpose, provided that the contents of the aforementioned Circular are included.

Pursuant to the above, the Board of Directors of Banco Bilbao Vizcaya Argentaria, S.A. (hereinafter “BBVA”, the “Entity” or the “Bank”), at its meeting held on 10 February 2020, on the proposal of the Remunerations Committee, has approved this Annual Report on the Remuneration of BBVA Directors (hereinafter the “Remuneration Report” or the “Report”), with the aim of disclosing complete, clear and understandable information on the remuneration policy applicable to members of the BBVA Board of Directors for the current financial year. It also includes information on how the remuneration policy was applied during the 2019 financial year and a detailed description of the individual remunerations accrued by each director throughout such financial year.

This Report, as well as the statistical appendix included in section 2.3, has been disclosed as a material event and will be put to a consultative vote, as a separate item on the agenda at the Bank’s next Annual General Shareholders’ Meeting, to be held on 13 March 2020.

Annex 2 to this report, “Alignment with the Annual Report on the Remuneration of Directors of CNMV for Listed Companies”, indicates where to find, within this document, the information set out in each section of the official format.

This document should be read in conjunction withNote 54 of the Annual Report on BBVA Group’s consolidated Annual Financial Statements for the 2019 financial year, which contains, among others, a breakdown, by director and remuneration item, of the remuneration received by directors in the 2019 financial year. These documents were made available to shareholders on the Bank’s website upon the calling of the aforementioned General Meeting (www.bbva.com).

| 1 | Circular 2/2018, of 12 June, of the National Securities Market Commission, which modifies Circular 5/2013, of 12 June, which establishes the templates for the Annual Corporate Governance Report for listed companies, savings banks and other entities that issue securities traded on official securities markets, and Circular 4/2013, of 12 June, which establishes the templates for the annual report on the remuneration of directors of listed companies and of the members of the Board of Directors and of the control commission of the savings banks that issue securities traded on official securities markets. |

| This English version is a translation of the original in Spanish for information purposes only. In case of a discrepancy, the Spanish original will prevail. |

| Annual Report on the Remuneration of BBVA Directors - 2019 | 5 |

| 1.2. | BBVA’s Remuneration Policy |

General principles of the Group Remuneration Policy

BBVA has a remuneration policy that applies generally to all employees of the Bank and the companies within its consolidated group (hereinafter the “BBVA Group” or the “Group”) which focuses on the recurrent generation of value for the Group and seeks to align the interests of its employees and shareholders with prudent risk management.

This policy was designed by the Bank’s Board of Directors as part of BBVA’s Corporate Governance System which aims to ensure proper management of the Group and is based on the following principles:

| • | creating long-term value; |

| • | rewarding results attained through prudent and responsible risk-taking; |

| • | attracting and retaining the best professionals; |

| • | offering rewards in line with level of responsibility and professional career; |

| • | ensuring internal equity and external competitiveness; |

| • | ensuring transparency of the remuneration model. |

BBVA has defined theGroup Remuneration Policy on the basis of these principles, taking into consideration the need to comply with the legal requirements that are applicable for credit institutions and the different sectors in which it operates, as well as alignment with best market practices. The Policy includes items designed to reduce exposure to excessive risks and adjust remuneration to the Group’s targets, values and long-term interests.

In this regard, the Policy addresses the following requirements:

| • | it is consistent with and promotes prudent and effective risk management, offering no incentives to take any risks beyond the level tolerated by the BBVA Group; |

| • | it is in line with the BBVA Group’s business strategy, objectives, values and long-term interests, and it includes measures to prevent conflicts of interest; |

| • | it provides a clear distinction between the criteria for determining fixed and variable remuneration; |

| • | it promotes equal treatment of all staff members without distinction based on gender or personal characteristics of any type; and |

| • | it aims to provide remuneration that is based neither exclusively nor primarily on quantitative criteria and that takes into account appropriate qualitative criteria that comply with the applicable regulations. |

As part of the Group Remuneration Policy, BBVA has a specific policy applicable to those categories of staff whose professional activities have a significant impact on the Group’s risk profile (hereinafter, the “Identified Staff”), a group including BBVA directors2 and Senior Management. This policy is in line with the regulations and recommendations applicable to remuneration schemes for these categories of staff, and, in particular, complies with the provisions of Spanish Act 10/2014, of 26 June, on the regulation, supervision and solvency of credit institutions.

| 2 | The members of the Board of Directors are subject to their own remuneration policy as described below, and are therefore excluded from the scope of the remuneration policy for the Identified Staff, even though they are identified as members of the Identified Staff by the provisions of the applicable regulations. |

| This English version is a translation of the original in Spanish for information purposes only. In case of a discrepancy, the Spanish original will prevail. |

| Annual Report on the Remuneration of BBVA Directors - 2019 | 6 |

This policy aims to further align BBVA’s remuneration practices with applicable regulations, good governance recommendations and best market practices, thereby allowing BBVA to retain its position as a benchmark for the sector in this area.

The result is an incentive scheme specifically oriented towards reducing exposure to excessive risks and aligning the remuneration of the members of the Identified Staff with the Group’s long-term targets, values and interests, on the basis of, inter alia, the following key features:

| • | Balance between fixed and variable components |

The fixed and variable components of the total remuneration will be properly balanced, in accordance with the provisions of the applicable regulation, allowing for a fully flexible policy regarding the payment of variable components, which may lead to these being reduced, as applicable, in their entirety.

In this regard, the Bank has established “target” ratios between fixed remuneration and variable remuneration, taking into account the functions undertaken and their impact on the Group’s risk profile, each being adapted to the current situation of the different countries or functions.

| • | Determination and award of variable remuneration |

The variable remuneration for members of the Identified Staff will be linked to the level of achievement ofpre-established targets, both financial andnon-financial, defined at Group, area and individual levels, which take into account the Group’s long-term interests and is based on effective risk management.

Under no circumstances will the variable remuneration limit the Group’s capacity to strengthen its capital base in accordance with regulatory requirements, and it will take into account current and future risks.

The current incentive model establishes, as a previous condition, that variable remuneration will only be paid if BBVA fulfils the capital requirements and a minimum threshold of net attributable profit determined by the Board of Directors.

Similarly, variable remuneration for the Identified Staff for each financial year will be subject toex-ante adjustments, in such a way that it will be reduced upon performance assessment in the event of a downturn in the Group’s results or other parameters, such as the degree of attainment of budgeted targets.

The annual variable remuneration for the Identified Staff, like that of executive directors, is based on an incentive awarded annually, which reflects their performance measured on the basis of achieved targets, and will be calculated on the basis of:

| • | annual performance indicators (financial andnon-financial), which take into account current and future risks, as well as the strategic priorities defined by the Group; |

| • | the corresponding scales of achievement, according to the weight assigned to each indicator; and |

| • | a “target” annual variable remuneration, which represents the amount of annual variable remuneration if 100% ofpre-established targets are met. |

| This English version is a translation of the original in Spanish for information purposes only. In case of a discrepancy, the Spanish original will prevail. |

| Annual Report on the Remuneration of BBVA Directors - 2019 | 7 |

| • | Specific settlement and payment system |

The annual variable remuneration for the Identified Staff, determined as set out above, shall vest, if conditions are met, subject to the settlement and payment rules listed below, with certain particularities applicable to executive directors and members of Senior Management:

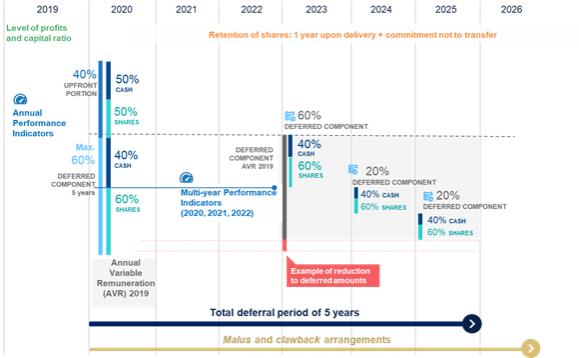

| o | 40% of the annual variable remuneration for members of the Identified Staff and 60% for executive directors, Senior Management and those members of the Identified Staff with particularly high variable remuneration amountswill be deferred fora period of three years for members of the Identified Staff and for five years for executive directors and Senior Management. |

| o | 50% of the annual variable remuneration (both the upfront payment and the deferred payment)will be established in BBVA shares. For executive directors and members of Senior Management, this percentage will be set at 50% for the upfront payment and 60% for the deferred portion. |

| o | The deferred portion of the annual variable remuneration may be reduced(ex-post adjustments), even in its entirety, but never increased, based on the results ofmulti-year indicators. These indicators are aligned with the Group’s solvency, liquidity, profitability and recurrence of results, taking as target the threshold considered by the Board of Directors for each of these parameters over a time frame of three years. |

| o | Theshares received as annual variable remuneration shall bewithheld for a period of one year after delivery (except for those shares which sale would be required to honour the payment of taxes accruing on the shares delivered) and will not be subject to update. |

| o | Furthermore, the total the annual variable remuneration for members of the Identified Staff will be subject to malus and clawback arrangements over the entire period of deferral and withholding of shares, the full content of which is set out in BBVA Directors’ Remuneration Policy. |

| o | Nopersonal hedging strategies or insurance may be used in connection with the remuneration and responsibility that may undermine the effects of alignment with sound risk management. |

| o | Finally, the variable component of the remuneration for a financial year will be limited to 100% of the fixed componentof total remuneration (unless the General Shareholders’ Meeting resolves to increase this limit up to a maximum of 200%). |

Therefore, BBVA has been gradually implementing a sound and consistent remuneration policy, which is aligned with the Entity’s long-term interests, shareholders’ interests and prudent risk management.

| 1.3. | BBVA Directors’ Remuneration Policy |

Based on the same principles and outline that guide the Group Remuneration Policy, as described in the previous section, BBVA has a specific remuneration policy for its directors, whose most recent update was approved by the General Shareholders Meeting held on 15 March 2019 for the years 2019, 2020 and 2021 (the “Directors’ Remuneration Policy” or the “Policy”), by 94.83% of favourable votes.

Therefore, during 2019, on the proposal of the Remunerations Committee, the Board of Directors submitted to the General Shareholders’ Meeting an updated Directors’ Remuneration Policy, in order to include the contractual conditions for the Group Executive Chairman and Chief Executive Officer

| This English version is a translation of the original in Spanish for information purposes only. In case of a discrepancy, the Spanish original will prevail. |

| Annual Report on the Remuneration of BBVA Directors - 2019 | 8 |

(Consejero Delegado) as a result from their appointments in December 2018, as well as to add certain technical improvements, while maintaining the established remuneration system.

This Policy is designed in accordance with corporate legislation and specific regulations applicable to financial institutions, and is in line with the Entity’s Bylaws, also taking into account the best practices and recommendations on this matter both at local and international levels.

In accordance with the Bank’s Bylaws, the Policy distinguishes between the remuneration system applicable tonon-executive directors and the system applicable to executive directors.

The remuneration system fornon-executive directors, in accordance with Article 33 bis of the Bylaws, is based on the criteria of responsibility, dedication and incompatibilities inherent to the role that they undertake and consists of afixed remunerationwhich comprises the following items:

| • | An annual allocation in cash, to be determined by the Board of Directors taking into account the conditions applicable to each director and the roles and responsibilities attributed by the Board and their membership to the various committees, which may give rise to different remunerations for each of thenon-executive directors. The Board is also responsible for determining the frequency and method of payment of these remuneration. |

| • | The insurance and pension systems in force at any given time. |

| • | A deferred remuneration in shares, approved by the General Shareholders’ Meeting and implemented through the annual allocation of a number of BBVA’s “theoretical shares” to eachnon-executive director, corresponding to 20% of the annual cash remuneration received the previous financial year. These BBVA shares will be delivered, where applicable, after they cease to be directors for any grounds other than serious dereliction of their duties. |

The remuneration system forexecutive directors is defined in accordance with best market practices, which items are set out in Article 50 bis of the Bylaws and correspond to those generally applicable to members of the Bank’s Senior Management.

The remuneration system for executive directors comprises the following items:

| • | A fixed remuneration, which takes into account their level of responsibility and the functions carried out, and constitutes a relevant part of their total compensation. Fixed remuneration comprises the salary (the “Annual Fixed Remuneration”), and may include other fixed remuneration components, such as benefits or remuneration in kind, in line with those that may be recognized to Senior Management. |

| • | A variable remuneration, whose amount will be determined on the basis of the level of achievement ofpre-established targets, linked to the Group’s results, long-term value creation and performance of the functions carried out (the “Annual Variable Remuneration”). This remuneration will be subject to the same settlement and payment system applicable to the rest of the Identified Staff, in a manner consistent with effective risk management, with the specific features applicable to executive directors. |

| • | The incentive systems that may generally be established for Senior Management. |

| • | A welfare portion, which may include appropriate pension systems and insurance. |

The Directors’ Remuneration Policy also establishes “target” ratios between the Annual Fixed Remuneration and the target Annual Variable Remuneration of BBVA’s executive directors, which take into account the functions carried out by each executive director and their impact on the Group’s risk profile, and are aligned with the ratios established, in general terms, for the remaining Identified Staff members.

| This English version is a translation of the original in Spanish for information purposes only. In case of a discrepancy, the Spanish original will prevail. |

| Annual Report on the Remuneration of BBVA Directors - 2019 | 9 |

The “target” ratios for executive directors, for the term of the Policy, are as follows:

Executive Director | Position | Annual Fixed Remuneration | Target Annual Variable Remuneration | |||||||

Carlos Torres Vila | Group Executive Chairman | 45 | % | 55 | % | |||||

Onur Genç | Chief Executive Officer | 45 | % | 55 | % | |||||

José ManuelGonzález-Páramo Martínez-Murillo | Head of Global Economics & Public Affairs(GE&PA) | 70 | % | 30 | % | |||||

Once the amount of the Annual Variable Remuneration of each executive director is determined, it will be subject to the same settlement and payment system applicable to the Identified Staff, with certain particularities applicable to executive directors as described above.

Additionally, upon receipt of the shares, executive directors may not transfer a number of shares equivalent to twice their Annual Fixed Remuneration for at least three years after their delivery.

Settlement and payment system for 2019 Annual Variable Remuneration

Main conditions of the executive directors’ contracts

Each executive director’s remuneration, rights and financial compensation will be determined in accordance with their responsibility, the functions they carry out and the level of achievement of the objectives and are competitive with those of equivalent functions in major comparable institutions. Such conditions are contained in their respective contracts, which are approved by the Board of Directors at the proposal of the Remunerations Committee.

| This English version is a translation of the original in Spanish for information purposes only. In case of a discrepancy, the Spanish original will prevail. |

| Annual Report on the Remuneration of BBVA Directors - 2019 | 10 |

Under the Policy, the main conditions of the executive directors’ contracts are the following:

| • | They have an indefinite duration. |

| • | They do not establish any notice period, or tenure or loyalty clauses. |

| • | They may contain a welfare portion, according to the individual conditions of each executive director, including appropriate pension systems and insurance. |

| • | They include a post-contractualnon-competition clause. |

| • | They do not include commitments to pay severance indemnity. |

The Bank has undertaken provision commitments to cover the retirement contingencies of the Group Executive Chairman and the Head of GE&PA. These include the following main features, which are in line with those applicable to the rest of Senior Management:

| • | They are established as defined-contribution schemes, according to which the annual contributions to be made to cover retirement are set in advance. |

| • | They do not provide for the possibility of receiving the retirement pension in advance. |

| • | 15% of the agreed annual contributions will be considered “discretionary pension benefits”, pursuant to the applicable regulations. |

Regarding the Group Executive Chairman, the Bank has made the following commitments:

Retirement, death and disability contingencies:

| • | He is entitled to a retirement benefit when he reaches the legally established retirement age, which amount shall result from the sum of the contributions made by the Bank and their corresponding yields up to said date; to be paid as either income or capital, provided that his leave is not due to serious breach of his duties. In the event the contractual relationship terminates before he reaches retirement age for reason other than the aforementioned, he will retain the right to this benefit, which will be calculated on the basis of the total contributions made by the Bank to that date, plus the corresponding cumulative yield, without the Bank having to make any additional contributions. |

| • | The annual contribution to this system was determined as a result of the transformation of the former “defined-benefit” system in a “defined-contribution” system, and stands at EUR 1,642 thousand. |

| • | The Board of Directors may update the amount of its annual contribution to this retirement benefit during the term of the Policy, in the same way and under the same terms as it may update the Annual Fixed Remuneration. |

| • | 15% of the agreed annual contribution to the pension commitments will be based on variable components and will be considered “discretionary pension benefits” and are subject share delivery, retention and clawback conditions established for these types of benefits in applicable regulations, as well as any conditions concerning variable remuneration that may be applicable in accordance with the Policy. |

| • | In the event of death while in office, the Chairman is entitled to an annual widow’s pension and an annual orphan’s pension for each of his children until they reach 25 years of age, of an amount equivalent to 70% and 25% (40% in the event of total orphanhood), respectively, of the Annual Fixed Remuneration, paid from the total fund accumulated for the retirement pension at that time, with the Bank assuming the corresponding annual insurance premiums to top up the benefits coverage. |

| • | The cumulative benefits of the widow’s and orphan’s pension may not exceed 150% of the Annual Fixed Remuneration. |

| This English version is a translation of the original in Spanish for information purposes only. In case of a discrepancy, the Spanish original will prevail. |

| Annual Report on the Remuneration of BBVA Directors - 2019 | 11 |

| • | He is also acknowledged the right to receive an annual pension in the event of total or absolute permanent disability while in office, of an amount equivalent to the Annual Fixed Remuneration, which will revert to his spouse and children in the event of death in the percentages described above, and with said reversion limited in any case to the disability pension itself. Payment shall be made firstly from the total fund accumulated for the retirement pension at that time, with the Bank assuming the corresponding annual insurance premiums in order to top up the benefits coverage. |

As regards theChief Executive Officer, the Bank has not undertaken any retirement commitments, but has made commitments to cover disability and death contingencies, in the terms detailed below:

Death and disability contingencies:

| • | In the event of death while in office, the Chief Executive Officer is entitled to an annual widow’s pension and an annual orphan’s pension for each of his children until they reach 25 years of age, the equivalent of 50% and 20% (30% in the event of total orphaning), respectively, of the Annual Fixed Remuneration for the previous 12 months, with the Bank assuming the corresponding annual insurance premiums to guarantee the benefits coverage. |

| • | The cumulative benefits of the widow’s and orphan’s pension may not exceed 100% of the Annual Fixed Remuneration for the previous 12 months. |

| • | He is also eligible to receive an annual pension in the event of total or absolute permanent disability while in office, of an amount equivalent to 62% of the Annual Fixed Remuneration of the previous 12 months, which will revert to his spouse and children in the event of death in the percentages described above, and with said reversion limited in any case to the disability pension itself, with the Bank assuming the corresponding annual insurance premiums in order to guarantee the benefits coverage. |

TheHead of GE&PA’s pension framework to cover death and disability contingencies is as follows:

Retirement, death and disability contingencies:

| • | He is eligible to receive a retirement pension when he reaches the legal retirement age, which amount shall result from the cumulative annual contributions and their corresponding yields up to said date. For this purpose, the contributions regime for each financial year will be the result of applying 30% to the Annual Fixed Remuneration. |

| • | He will be entitled to receive, when he reaches retirement age, as either income or capital, the benefits resulting from the contributions made by the Bank in the terms mentioned above, provided that his leave is not due to serious breach of his duties. In the event that contractual termination is due to voluntary leave before retirement, the benefits will be limited to 50% of the contributions made by the Bank to that date. The Bank’s contributions will, in any case, cease at the time of termination. |

| • | 15% of the aforementioned agreed annual contributions to the pension commitments will be based on variable components and will be considered “discretionary pension benefits” and are subject to share delivery, retention and clawback conditions established for these types of benefits in applicable regulations, as well as any conditions concerning variable remuneration that may be applicable in accordance with the Policy. |

| • | In the event of death while in office, he is entitled to an annual widow’s pension and an annual orphan’s pension for each of his children until they reach 25 years of age, the equivalent of 50% and 20% (30% in the event of total orphaning) respectively of the Annual Fixed Remuneration for the previous 12 months, paid from the total fund accumulated for the retirement pension at that time, with the Bank assuming the corresponding annual insurance premiums in order to top up the benefits coverage. |

| This English version is a translation of the original in Spanish for information purposes only. In case of a discrepancy, the Spanish original will prevail. |

| Annual Report on the Remuneration of BBVA Directors - 2019 | 12 |

| • | The cumulative benefits of the widow’s and orphan’s pension may not exceed 100% of the Annual Fixed Remuneration for the previous 12 months. |

| • | He is also eligible to receive an annual pension in the event of total or absolute permanent disability while in office, of an amount equivalent to 46% of the Annual Fixed Remuneration of the previous 12 months, which will revert to his spouse and children in the event of death in the percentages described above, and with said reversion limited in any case to the disability pension itself. Payment will be made firstly from the total fund accumulated for the retirement pension at that time, with the Bank assuming the corresponding annual insurance premiums to top up the benefits coverage. |

Other commitments entered into with executive directors:

In the case of theChief Executive Officer, both the Policy and his contract grant him the following additional fixed remuneration, in view of his role as an international senior executive:

| • | an annual cash amount, in lieu of a retirement pension(“cash in lieu of pension”), the equivalent of 30% of the Annual Fixed Remuneration in force at any given time; and |

| • | an annual cash amount asa mobility allowance, in line with commitments undertaken with other expatriate members of the Bank’s Senior Management, the amount of which has been established as EUR 600 thousand per year. |

For executive directors, the contractual framework also establishes apost-contractnon-competition clause lasting for two years from termination of duties as BBVA executive directors, for which the Bank will award remuneration to an amount equivalent to their Annual Fixed Remuneration for each year of thenon-compete agreement, paid monthly, provided that the executive directors do not leave their positions due to retirement, disability or serious dereliction of duties.

Decision-making process for the approval of the Policy

Within the framework of BBVA’s Bylaws, the Regulations of the Board provide that the Board is responsible for making decisions regarding directors’ remuneration and, for executive directors, the remuneration for their executive functions and other conditions that their contracts must fulfil, in accordance with the remuneration policy approved by the General Meeting.

Among the elements of the Bank’s Corporate Governance System, BBVA’s Board of Directors has set up several committees to assist it in matters within its remit in order to better perform its functions. Among these, the Remunerations Committee assists the Board on issues regarding remuneration that fall within its remit, in particular those relating to the remuneration of directors, senior managers and remaining members of the Identified Staff, ensuring adherence to the remuneration policies established by the Bank.

This Committee comprises a minimum of three members appointed by the Board. All members must benon-executive directors and the majority must be independent directors, including the Chairman.

| This English version is a translation of the original in Spanish for information purposes only. In case of a discrepancy, the Spanish original will prevail. |

| Annual Report on the Remuneration of BBVA Directors - 2019 | 13 |

Below are the names, positions and statuses of the directors that comprise the Remunerations Committee as of the date of this Report:

Name and surnames | Position | Status | ||

| Belén Garijo López | Chair | Independent | ||

| Tomás Alfaro Drake | Member | External | ||

| Carlos Loring Martínez de Irujo(*) | Member | External | ||

| Lourdes Máiz Carro | Member | Independent | ||

| Ana Peralta Moreno | Member | Independent |

| (*) | Risk and Compliance Committee member |

Thus, BBVA’s Corporate Governance System is configured so that remuneration proposals, submitted to the Board of Directors for consideration, as the Directors’ Remuneration Policy, generally originate from the Remunerations Committee, which previously analyses, debates and determines them.

As part of the decision-making process for remuneration matters, the Remunerations Committee is assisted by the Risk and Compliance Committee, which, in accordance with its Regulations, participates in the process of establishing the remuneration policy, verifying that it is consistent with sound and effective risk management and it does not provide incentives to undertake risks exceeding the levels tolerated by the Entity.

In order to perform its functions adequately, the Committee is assisted by the Bank’s internal services and also has access to external advice as necessary to form opinions on matters within its remit.

In order to update the Directors’ Remuneration Policy in 2019, in addition to the advice of BBVA’s internal services, the Committee was assisted in 2019 by two leading and independent consultancy firms on the remuneration for directors and senior managers:Willis Towers Watson, for analyses and market comparisons, and J&A Garrigues, S.L.P, for the legal analysis regarding the Policy.

In the determination of the Policy and, in particular, the main contractual conditions contained therein for the Group Executive Chairman and Chief Executive Officer, the Remunerations Committee analysed the remunerations in place for similar positions in comparable financial institutions, which make up BBVA’s peer group for remuneration purposes(included inAnnex 1).

Finally, in accordance with the provisions of Article 529 novodecies of the Spanish Corporate Enterprises Act, the Directors’ Remuneration Policy was submitted, as a separate item in the agenda, to the Bank’s General Shareholders’ Meeting held on 15 March 2019, and approved by 94.83% of favourable votes.

This Policy is fully aligned with regulatory requirements and is available on the Entity’s website under “Corporate Governance and Remuneration Policy” at the following link:https://shareholdersandinvestors.bbva.com/wp-content/uploads/2019/02/9.BBVA_Directors_Remuneration_Policy.pdf

All of the above guarantees an appropriate decision-making process regarding remuneration, as reflected in the Remunerations Committee Report accompanying the BBVA Directors’ Remuneration Policy, documents that were made available to shareholders prior to their approval by the General Shareholders’ Meeting.

| This English version is a translation of the original in Spanish for information purposes only. In case of a discrepancy, the Spanish original will prevail. |

| Annual Report on the Remuneration of BBVA Directors - 2019 | 14 |

| 2. | Application of BBVA Directors’ Remuneration Policy in 2019 |

The remuneration policy applied to BBVA directors during the closed financial year (2019) was approved by the Bank’s Annual General Shareholders’ Meeting held on 15 March 2019. The outline and principal characteristics of this are described in section1.3 above.

Below is a description of how this Policy was applied in 2019 and the corresponding remuneration of each director; and, in the case of executive directors, the link between their remuneration and the results obtained during the financial year.

The process in place at BBVA to apply the Directors’ Remuneration Policy and determine each director’s individual remuneration is directed and supervised by theRemunerations Committee, and has carried out, in 2019, the following actions, inter alia, submitting the corresponding proposals to theBoard of Directors for approval, where appropriate:

| • | BBVA Directors’ Remuneration Policy |

The Remunerations Committee analysed the approach for updating the BBVA Directors’ Remuneration Policy approved by General Meeting held in 2017. This update included the new contractual conditions for the Group Executive Chairman and the Chief Executive Officer as a result of their appointments in December 2018, as well as certain additional technical improvements, while the remuneration system established in the previous remuneration policy was maintained in general terms.

In February 2019, the Remunerations Committee submitted to the Board of Directors the proposal to update the BBVA Directors’ Remuneration Policy for the 2019, 2020 and 2021 financial years, along with the specific report on the Policy drawn up by this Committee and the proposal of the maximum number of shares to be delivered to the executive directors in the application of this Policy, all of which was submitted to the General Meeting held on 15 March 2019, which approved the Policy with a favourable vote of 94.83%.

As previously mentioned, in order to perform its functions adequately, the Committee is assisted by the Bank’s internal services as well as external advice it considered necessary in order to form opinions on matters within its remit.

| • | Remuneration matters fornon-executive directors |

In accordance with the statutory framework and the Directors’ Remuneration Policy, the Committee analysed, during 2019, the remuneration allocated tonon-executive directors for their Board membership, their membership to its various committees and for carrying out any other duties or responsibilities within the Board, in light of the changes made to the BBVA Corporate Governance System in 2019.

Therefore, the Committee submitted to the Board the proposals for establishing remuneration for the roles of Lead Director and Deputy Chair of the Board of Directors, and reviewing the remuneration for the roles of member and chair of the various Board committees, as a result of the redistribution of the functions of certain committees implemented during the financial year. This resulted in the amounts set out in section 2.1 below.

| This English version is a translation of the original in Spanish for information purposes only. In case of a discrepancy, the Spanish original will prevail. |

| Annual Report on the Remuneration of BBVA Directors - 2019 | 15 |

| • | Remuneration matters for executive directors |

With regard to the remuneration matters for executive directors, in accordance with the BBVA Directors’ Remuneration Policy, the Committee has undertaken, among others, the following actions during the 2019 financial year, submitting the relevant proposals to the Board:

| • | It proposed the amendment of the Chairman’s contract and the approval of the Chief Executive Officer’s contract to bring them in line with their new functions and roles; and determined their remuneration conditions (i.e. Annual Fixed Remuneration, target Annual Variable Remuneration, pension system and other remunerations) for the 2019 financial year, in accordance with the contractual framework for executive directors and the Directors’ Remuneration Policy approved by the General Meeting. |

| • | It determined the annual performance indicators for calculating the 2019 Annual Variable Remuneration for executive directors, as well as the multi-year performance indicators for the deferred portion of the Annual Variable Remuneration for 2019, as well as the rules for updating the cash portion of such remuneration (which would also apply to the rest of the Identified Staff). |

| • | It determined the minimum thresholds for Attributable Profit and Capital Ratio and their associated scales for the accrual of the 2019 Annual Variable Remuneration, in line with those applied for the rest of the employees. |

| • | It determined the target and scales of achievement associated with the annual performance indicators for executive directors for the 2019 Annual Variable Remuneration. |

All of the above activities carried out by the Committee, together with other matters within its remit, have been included in the report on the activity of the Remunerations Committee for 2019, which is made available to all shareholders on the Bank’s website (www.bbva.com).

| 2.1. | Remuneration ofnon-executive directors 2019 |

In accordance with the provisions of the Bank’s Bylaws, and as mentioned in section1.3 above, the Directors’ Remuneration Policy distinguishes between the remuneration system applicable tonon-executive directors and that applicable to executive directors.

Remuneration system fornon-executive directors

As mentioned above, the remuneration system fornon-executive directors is based on the criteria ofresponsibility,dedication andincompatibilitiesrelating to the role that they undertake and consistsexclusively of a fixed remuneration that comprises the following items:

| This English version is a translation of the original in Spanish for information purposes only. In case of a discrepancy, the Spanish original will prevail. |

| Annual Report on the Remuneration of BBVA Directors - 2019 | 16 |

Item | Payment | Maximum amount | Adjustments/ condition | |||

A. Fixed annual amount for the role of Board member and member of the various committees, as appropriate, and for carrying out any other duties or responsibilities within the Corporate Governance System | Monthly cash payments |

Overall limit approved by the General Meeting: EUR 6 million per year | N/A | |||

B. Remuneration in kind (e.g. casualty and healthcare insurance policies) |

The Bank pays the corresponding premiums that are allocated to the directors as remuneration in kind | N/A | ||||

C. Remuneration system withdeferred delivery of BBVA shares | Fixed annual allocation of a number of “theoretical shares”, to vest after they cease to be directors | 20% of the total cash remuneration received during previous financial year | Shares will not be delivered in the event of termination of directorship not due to serious dereliction of duties | |||

Fixed annual amounts approved

Position | In thousands of EUR | |||

Member of the Board of Directors | 129 | |||

Member of the Executive Committee | 167 | |||

Chair of the Audit Committee | 165 | |||

Member of the Audit Committee | 66 | |||

Chair of the Risk and Compliance Committee | 214 | |||

Member of the Risk and Compliance Committee | 107 | |||

Chair of the Remunerations Committee | 107 | |||

Member of the Remunerations Committee | 43 | |||

Chairman of the Appointments and Corporate Governance Committee | 115 | |||

Member of the Appointments and Corporate Governance Committee | 46 | |||

Chair of the Technology and Cybersecurity Committee | 107 | |||

Member of the Technology and Cybersecurity Committee | 43 | |||

Role of Deputy Chair | 50 | |||

Role of Lead Director | 80 | |||

These amounts were approved by the Board of Directors on 29 May 2019, at the proposal of the Remunerations Committee, following analysis of relevant market comparisons.

| This English version is a translation of the original in Spanish for information purposes only. In case of a discrepancy, the Spanish original will prevail. |

| Annual Report on the Remuneration of BBVA Directors - 2019 | 17 |

Details of the individual remuneration accrued by eachnon-executive director in 2019 under this remuneration system:

| A. | Fixed annual amounts |

The remuneration received by eachnon-executive director during 2019 (in thousands of EUR) was as follows:

| Board of Directors | Executive Committee | Audit Committee | Risk and Compliance Committee | Remunerations Committee | Appointments and Corporate Governance Committee | Technology and Cybersecurity Committee | Other positions (1) | Total | ||||||||||||||||||||||||||||

Tomás Alfaro Drake | 129 | 43 | 43 | 214 | ||||||||||||||||||||||||||||||||

José Miguel Andrés Torrecillas | 129 | 104 | 107 | 111 | 33 | 483 | ||||||||||||||||||||||||||||||

Jaime Félix Caruana Lacorte | 129 | 167 | 110 | 107 | 14 | 527 | ||||||||||||||||||||||||||||||

Belén Garijo López | 129 | 68 | 107 | 45 | 348 | |||||||||||||||||||||||||||||||

Sunir Kumar Kapoor | 129 | 43 | 172 | |||||||||||||||||||||||||||||||||

Carlos Loring Martínez de Irujo | 129 | 167 | 107 | 43 | 445 | |||||||||||||||||||||||||||||||

Lourdes Máiz Carro | 129 | 68 | 43 | 14 | 253 | |||||||||||||||||||||||||||||||

José Maldonado Ramos | 129 | 167 | 45 | 340 | ||||||||||||||||||||||||||||||||

Ana Peralta Moreno | 129 | 68 | 43 | 240 | ||||||||||||||||||||||||||||||||

Juan Pi Llorens | 129 | 24 | 214 | 31 | 43 | 53 | 493 | |||||||||||||||||||||||||||||

Susana Rodríguez Vidarte | 129 | 167 | 107 | 45 | 447 | |||||||||||||||||||||||||||||||

Jan Verplancke | 129 | 43 | 172 | |||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||

Total (2) | 1,545 | 667 | 442 | 642 | 278 | 289 | 186 | 87 | 4,134 | |||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||

| (1) | Amounts received during the 2019 financial year by José Miguel Andrés Torrecillas, in his capacity as Deputy Chair of the Board of Directors, and by Juan Pi Llorens, in his capacity as Lead Director, positions for which they were appointed by resolution of the Board of Directors on 29 April 2019. |

| (2) | Including the amounts corresponding to the positions of member of the Board and of the various committees during the 2019 financial year. By resolution of the Board of Directors on 29 April 2019, the functions of some Board committees were redistributed, hence their remunerations were also adapted to these changes in some cases. |

These amounts are reflected, for eachnon-executive director, in section (a). i. “Remuneration accrued in cash”, “Fixed remuneration” and “Remuneration for membership on Board Committees” of the CNMV statistical Appendix, included as section 2.3 of this Report.

| B. | Remuneration in kind |

During the 2019 financial year, EUR 104 thousand was paid out in casualty and healthcare insurance premiums fornon-executive directors.

These amounts are reflected, for eachnon-executive director, in section “Other Items” of the CNMV statistical Appendix, included as section 2.3 of this Report.

| C. | Remuneration system with deferred delivery of BBVA shares |

In execution of the remuneration system with deferred delivery of shares approved by the General Shareholders’ Meeting held on 18 March 2006 and extended by the General Shareholders’ Meetings held on 11 March 2011 and 11 March 2016, in the 2019 financial year, by resolution of the Board of Directors, thenon-executive directors who are beneficiaries of this system have been allocated the “theoretical

| This English version is a translation of the original in Spanish for information purposes only. In case of a discrepancy, the Spanish original will prevail. |

| Annual Report on the Remuneration of BBVA Directors - 2019 | 18 |

shares” corresponding to 20% of the total cash remuneration received by each of them in the 2018 financial year, broken down as follows:

| Theoretical shares allocated in 2019 | Theoretical shares accumulated as of 31 December 2019 | |||||||

Tomás Alfaro Drake | 10,138 | 93,587 | ||||||

José Miguel Andrés Torrecillas | 19,095 | 55,660 | ||||||

Jaime Caruana Lacorte | 9,320 | 9,320 | ||||||

Belén Garijo López | 12,887 | 47,528 | ||||||

Sunir Kumar Kapoor | 6,750 | 15,726 | ||||||

Carlos Loring Martínez de Irujo | 17,515 | 116,391 | ||||||

Lourdes Máiz Carro | 11,160 | 34,320 | ||||||

José Maldonado Ramos | 15,328 | 94,323 | ||||||

Ana Peralta Moreno | 5,624 | 5,624 | ||||||

Juan Pi Llorens | 17,970 | 72,141 | ||||||

Susana Rodríguez Vidarte | 17,431 | 122,414 | ||||||

Jan Verplancke | 5,203 | 5,203 | ||||||

|

|

|

| |||||

Total | 148,421 | 672,237 | ||||||

|

|

|

| |||||

BBVA has no option plans in favour of its directors. In order to comply with the CNMV official statistical appendix, these “theoretical shares” have been likened to “options”, without prejudice to the fact that they do not constitute such an instrument. These shares will only vest only after they cease to benon-executive directors for any reason other than serious dereliction of duties. These shares are reflected in section “ii. Table showing the roll forward from remuneration systems based on shares” of the CNMV statistical Appendix, included as section 2.3 of this Report.

Variations in Board remuneration thousands of EUR (in aggregate) | 2019 | 2018 | ||||||

Fixed annual allocation for Board member and of the committees | 4,134 | 3,868 | ||||||

Remuneration in kind | 104 | 107 | ||||||

Total | 4,238 | 3,975 | ||||||

Year-on-year variation:

As indicated above, the variation in the remuneration ofnon-executive directors with respect to financial year 2018 is due to changes introduced in the Bank’s Corporate Governance System, resulting from the determination of a fixed remuneration for the positions of Deputy Chair and Lead Director and the reorganisation of the roles and responsibilities of some Board committees.

Non-executive directorshave not received variable remuneration or any remuneration for any other item not included in this section.

| 2.2. | Remuneration for executive directors 2019 |

Remuneration system for executive directors

The remuneration system for executive directors is defined in accordance with best market practices, its main items are set out in Article 50 bis of the Bank’s Bylaws and correspond to those generally applicable to members of BBVA’s Senior Management. This system is included in the BBVA Directors’ Remuneration Policy and consists of the following items:

| This English version is a translation of the original in Spanish for information purposes only. In case of a discrepancy, the Spanish original will prevail. |

| Annual Report on the Remuneration of BBVA Directors - 2019 | 19 |

Item | Allocation Criteria | Payment | Amount | Adjustments/ | Remuneration Element | |||||

A. Annual Fixed Remuneration (“AFR”) | functions assigned and level of responsibility

Competitive in the market | Monthly cash payments | Chairman: EUR 2,453 thousand | N/A | Fixed | |||||

Chief Executive Officer: EUR 2,179 thousand | ||||||||||

Head of GE&PA: EUR 834 thousand | ||||||||||

| B. Benefits and remuneration in kind (e.g. healthcare insurance policies, other policies) | In line with those applicable to Senior Management | Allowances and premiums or payments made by the Bank, attributed as remuneration in kind | For a breakdown of this item, see the table below. | N/A | Fixed | |||||

| C. Annual Variable Remuneration (AVR) | Result of annual performance indicators (financial andnon-financial), according topre-established objectives*, scales of achievement and weighting, and based on a “target” AVR. The AVR includes both ashort term and along term portions: | A maximum of200% of the fixed remuneration, as agreed by the General Meeting in 2019 | • Ex ante adjustments: profit thresholds and capital ratios/other parameters such as the level of achievement of budgeted targets

• 1-year withholding of shares

• Prohibition of hedging or insurance

• Ex post adjustments: the result of multi-year performance indicators (downwards adjustments only)

• Updates to the Deferred Portion paid in cash Malusandclawback clauses

(1) Additional requirements for holding shares | Variable | ||||||

| Short term | *Targets aligned withmanagement metrics, Group strategic metrics and metrics specific to each executive director | 40% of AVR: Upfront Payment (50% in cash and 50% in BBVA shares) | 40% of AVR | |||||||

Long term

(5 years) | Targets aligned with Group’score risk management and control metrics, related to solvency, capital, liquidity, financing, profitability, share performance and recurrence of results, measured over a3-year period | 60% of AVR: Deferred Portion (60% in shares and 40% in cash), to be received after the multi-year performance assessment (for the first 3 years of deferral), 60% of the resulting amount after the third year, 20% after the fourth and 20% remaining after the fifth year of deferral | A maximumof 60% of AVR | |||||||

| D. Contribution to pension and insurance systems | Set forth contractually and in the Policy (retirement contingencies; death and disability) | Upon the occurrence of the contingency, either in income or capital | Chairman: Annual defined contribution of EUR 1,642 thousand plus death and disability premiums | Conditions laid out in their contracts and, in any case, provided that they do not cease as directors for serious dereliction of duties | Fixed

(except 15% of pension contributions, which are considered “discretionary pension benefits”) | |||||

Chief Executive Officer: No retirement pension, just death and disability premiums | ||||||||||

Head of GE&PA: Annual defined contribution of 30% Annual Fixed Remuneration plus death and disability premiums | ||||||||||

| This English version is a translation of the original in Spanish for information purposes only. In case of a discrepancy, the Spanish original will prevail. |

| Annual Report on the Remuneration of BBVA Directors - 2019 | 20 |

Item | Allocation Criteria | Payment | Amount | Adjustments/ | Remuneration Element | |||||

| E. Other commitments | Set forth contractually and in the Policy | Monthly payment | Chief Executive Officer: Cashin lieu of a pension (30% of Annual Fixed Remuneration) and international mobility allowance of EUR 600 thousand per year | N/A | Fixed | |||||

| F.Non-competition clause | Set forth contractually and in the Policy | Monthly payment during the period ofnon-competition, following termination of contract | Two times AFR(one for each year of thenon-competition period) | Conditions laid out in their contracts, and in any case provided that they do not do not cease as directors for retirement, disability or serious dereliction of duties | Fixed | |||||

| (1) | Upon receipt of the shares, executive directors may not transfer a number of shares equivalent to twice their Annual Fixed Remuneration for at least three years after their delivery. |

Details of individual remuneration accrued by executive directors in 2019 under this system:

| A. | 2019 Annual Fixed Remuneration |

In accordance with the procedure laid out in the Policy, the Board of Directors, on the proposal of the Remunerations Committee, and on the basis of market analyses and comparisons drawn up by independent consultants, approved the amounts of the Annual Fixed Remuneration for the executive directors, as stated in section 4.2 of the BBVA Directors’ Remuneration Policy.

The executive directors therefore received the following remunerations in 2019:

Annual Fixed Remuneration for executive directors (thousands of EUR)

Group Executive Chairman | 2,453 | |||

Chief Executive Officer | 2,179 | |||

Head of GE&PA | 834 |

These Annual Fixed Remuneration amounts are reflected in section “a).i. Remuneration accrued in cash”, “Salary” of the executive directors in the CNMV statistical Appendix, included as section 2.3 of this Report.

Year-on-year variation:

The Annual Fixed Remuneration of the Chairman and Chief Executive Officer received in 2019 cannot be compared to the amount received the previous financial year, since both were appointed by the Board of Directors on 20 December 2018 and therefore their remuneration for 2018 was entirely associated with their former positions and functions. In the case of the Head of GE&PA, there was noyear-on-year change of Annual Fixed Remuneration between 2018 and 2019.

| B. | Benefits and other remuneration in kind |

Executive directors are beneficiaries of healthcare insurance policies subscribed by the Bank, who covers the corresponding premiums that are allocated to directors as remuneration in kind.

In addition, all executive directors are eligible for the benefits that apply to the Bank’s Senior Management.

The amounts paid in 2019 for these items are as follows:

In kind and other benefits (thousands of EUR)

Group Executive Chairman | 184 | |||

Chief Executive Officer | 144 | |||

Head of GE&PA | 83 |

| This English version is a translation of the original in Spanish for information purposes only. In case of a discrepancy, the Spanish original will prevail. |

| Annual Report on the Remuneration of BBVA Directors - 2019 | 21 |

These amounts are reflected in section “a).i. Remuneration accrued in cash” “Other Items” of the CNMV statistical Appendix, included as section 2.3 of this Report.

| C. | 2019 Annual Variable Remuneration |

As described in section1.3 above, the Annual Variable Remuneration (“AVR”) for executive directors is based on an incentive awarded annually, which reflects their performance measured on the basis of achieved targets associated with annual performance indicators.

To calculate the Annual Variable Remuneration for 2019, the followingannual performance indicators and their weightings were used, as approved at the beginning of the year by the Board of Directors, at the proposal of the Remunerations Committee.

| • | Short term: |

| Weighting | ||||||||||||||

Rate | Annual performance indicators 2019 AVR | Group Executive Chairman | Chief Executive Officer | Head of GE&PA | ||||||||||

Financial indicators | Attributable Profit excluding corporate transactions | 10 | % | 20 | % | 10 | % | |||||||

Tangible Book Value per share | 10 | % | 10 | % | 10 | % | ||||||||

Return on Regulatory Capital (RORC) | 15 | % | 15 | % | 15 | % | ||||||||

Efficiency Ratio | 15 | % | 15 | % | 10 | % | ||||||||

Non-financial indicators | Customer Satisfaction (IReNe) | 10 | % | 15 | % | 15 | % | |||||||

Digital sales | 10 | % | 10 | % | 10 | % | ||||||||

Individual indicators | 30 | % | 15 | % | 30 | % | ||||||||

These indicators are associated with scales of achievement, approved by the Board at the proposal of the Remunerations Committee, which take into account budgetary compliance in the case of financial indicators. These scales are based on the “target” Annual Variable Remuneration associated with each indicator, which represents the amount of Annual Variable Remuneration if pre-established targets are met at 100%.

Pay for performance 2019 Annual Variable Remuneration

The Annual Variable Remuneration for each executive director is linked to the BBVA Group’s results and varies accordingly.

During the 2019 financial year, the BBVA Group achieved a profit without extraordinary items of EUR 4.83 billion, an increase of 2.7% compared to the 2018 financial year. This result is due, among other reasons, to the increase in recurring revenue and to the containment of operating costs.

This profit is the figure that has been approved for incentive purposes and does not include the negative impact of EUR 1.318 billion resulting from the accounting of the deterioration in the valuation of the BBVA USA goodwill, as this was exclusively a result of the application of accounting regulations. Therefore, it does not affect tangible net equity, capital and liquidity, the ability to distribute dividends or the amount to pay in dividends by the BBVA Group.

Consequently, the outcome and evolution of the annual performance indicators of 2019 Annual Variable Remuneration has represented an improvement from the previous year in the four financial indicators (Attributable Profit, RORC, Efficiency Ratio and Tangible Book Value), which have reached a higher result than the objective set by the Board for the financial year.

| This English version is a translation of the original in Spanish for information purposes only. In case of a discrepancy, the Spanish original will prevail. |

| Annual Report on the Remuneration of BBVA Directors - 2019 | 22 |

In relation to non-financial indicators, a new key management indicator, Digital Sales, was taken into account in the Annual Variable Remuneration calculations for the first time in 2019, reaching 113.12 points. The Customer Satisfaction Index (IReNe), meanwhile, was slightly below the targets.

The results of the above indicators has set the following levels of achievement:

Annual performance indicators 2019 AVR | Results | Level of achievement | ||||||||||||

| 2019 (*) | 2018 (*) | Target | % | |||||||||||

Attributable Profit excluding corporate transactions | | EUR 4.830 billion | | | EUR 4.701 billion | | ● | 104.6 | % | |||||

Tangible Book Value (TBV) per share | 6.50 | 5.86 | ● | 104.8 | % | |||||||||

Return on Regulatory Capital (RORC) | 8.79 | % | 8.32 | % | ● | 105.2 | % | |||||||

Efficiency ratio | 48.50 | % | 49.28 | % | ● | 101.4 | % | |||||||

Customer Satisfaction (IReNe) | 97.21 | 99.07 | ● | 97.2 | % | |||||||||

Digital Sales | 113.12 | N/A | ● | 113.1 | % | |||||||||

| (*) | Results approved for incentive purposes adjusted for corporate transactions and other adjustments |

With regard to theindividual indicatorsof the Chairman and of the Chief Executive Officer, who have been assessed by the Board -since they are under the direct authority of this body-, at the proposal of the Remunerations Committee, indicators reflecting their different responsibilities have been taken into account. Thus, for the Chairman, the level of achievement of indicators relating to Talent and Culture, sustainability and strategic transformation have been considered; while for the Chief Executive Officer, indicators related to competitive dynamics, culture and values, finance and risk and strategic transformation have been considered. For the Head of GE&PA, indicators related to the strategic impact of units integrated into the scope of GE&PA have been taken into account, among others. The degree of achievement of these indicators has been positive overall, having achieved the goals set for the financial year.

individual indicators 2019 AVR: Specific dimensions associated to each position

Group Executive Chairman | Chief Executive Officer | Head of GE&PA | Achievement of targets | |||

| Talent and Culture: employees’ engagement index | Competitive dynamics:ROE and efficiency | Area indicator: strategy | ● | |||

| Sustainability: responsible banking synthetic index | Culture and Values:employees’ engagement index | Area indicator: efficiency | ● | |||

| Strategic transformation | Finance and Risk:Capital | Internal client feedback | ● | |||

| Strategic transformation | Culture and values:360º evaluation | ● | ||||

Likewise, for the assessment of the individual indicators, the Remunerations Committee and the Board of Directors have considered the performance assessment of the Chairman and the Chief Executive Officer carried out by the Board, which has been very positive in both cases.

Following year-end 2019, and having met theminimum thresholds for Attributable Profit and Capital Ratio which were established by the Board, among theex-ante adjustments included in the Policy for the accrual of Annual Variable Remuneration, and in light of the above results, the Board, at the proposal of the Remunerations Committee, has determined the following amounts for the 2019 Annual Variable Remuneration for each executive director:

| This English version is a translation of the original in Spanish for information purposes only. In case of a discrepancy, the Spanish original will prevail. |

| Annual Report on the Remuneration of BBVA Directors - 2019 | 23 |

2019 Annual Variable Remuneration for executive directors

Executive directors | 2019 AVR (thousands of EUR) | Variation with respect to 2018 AVR | ||||||

Group Executive Chairman | 3,180 | N/A | ||||||

Chief Executive Officer | 2,854 | N/A | ||||||

Head of GE&PA | 377 | -5.4 | % | |||||

The Annual Variable Remuneration of the Chairman and Chief Executive Officer for 2019 cannot be compared to the amount from the previous financial year, since both were appointed by the Board of Directors on 20 December 2018 and therefore their remuneration for 2018 was entirely associated with their former positions and functions.

Settlement and payment system for 2019 Annual Variable Remuneration

To determine the share component of both the Upfront Payment and the Deferred Portion, pursuant to the system set out in the Policy and explained in the previous section, the average closing price of BBVA share during the trading sessions between 15 December 2019 and 15 January 2020, both inclusive, is taken as a reference, which was EUR 5.03 per share.

Based on the above, the amounts for the Upfront Payment and for the Deferred Portion of 2019 Annual Variable Remuneration, for each executive director, are:

Executive director | UPFRONT PAYMENT: 40% 2019 AVR Paid in 2020 | DEFERRED PORTION: Maximum 60% 2019 AVR | ||||||||||||||||||||||||||||||

| Cash (50%) (thousands EUR) | Number of shares (50%) | Cash (40%) (thousands of EUR) | Number of shares (60%) | |||||||||||||||||||||||||||||

| 2023 | 2024 | 2025 | 2023 | 2024 | 2025 | |||||||||||||||||||||||||||

Group Executive Chairman | 636 | 126,470 | 458 | 153 | 153 | 136,587 | 45,529 | 45,529 | ||||||||||||||||||||||||

Chief Executive Officer | 571 | 113,492 | 411 | 137 | 137 | 122,572 | 40,858 | 40,858 | ||||||||||||||||||||||||

Head of GE&PA | 75 | 14,998 | 54 | 18 | 18 | 16,198 | 5,400 | 5,400 | ||||||||||||||||||||||||

The amounts for the Upfront Payment of the executive directors’ Annual Variable Remuneration are reflected in section “a). i. Remuneration accrued in cash” “Short-term variable remuneration” of the CNMV statistical Appendix, included in section 2.3 of this Report.

The Deferred Portion of 2019 Annual Variable Remuneration (long term) is subject to theex post adjustments outlined in the Policy, and therefore the amount finally accrued will depend on the degree of compliance with the following multi-year performance indicators, approved by the Board in 2019, at the proposal of the Remunerations Committee, following an analysis by the Risk and Compliance Committee:

Multi-year performance indicators | Weighting | |||

Fully Loaded Common Equity Tier 1 (CET 1) | 40 | % | ||

Loan to Stable Customer Deposits (LtSCD) | 10 | % | ||

Liquidity Coverage Ratio (LCR) | 10 | % | ||

Return on Equity (ROE) | 20 | % | ||

(Net Margin — Loan-Loss Provisions)/Average Total Assets | 10 | % | ||

Total Shareholder Return (TSR) | 10 | % | ||

| This English version is a translation of the original in Spanish for information purposes only. In case of a discrepancy, the Spanish original will prevail. |

| Annual Report on the Remuneration of BBVA Directors - 2019 | 24 |

With respect to the TSR indicator, evolution of the total return for the Bank’s shareholders will be compared with the evolution of that same indicator over the three-year period (1 January 2020 to 31 December 2022), for the peer group approved by the Board at the proposal of the Remunerations Committee (Annex 1).

The vesting scale of the TSR indicator shall determine the reduction of deferred amounts associated with this indicator when, after the three-year measurement period, its result determines thatBBVA’s position is below the median of the peer group.

Thus, if the objectives set for each of the above indicators are not met in the first three years of the deferment period, the Deferred Portion of 2019 Annual Variable Remuneration may be reduced, even in its entirety. Under no circumstances, however, may the amounts initially deferred (indicated in the table above) be increased.

The 2019 Annual Variable Remuneration will, in all cases, be subject to the remaining conditions of the settlement and payment system provided for in the Policy, and will be paid, provided all relevant conditions are met, in accordance with the following calendar: 60% of the Deferred Portion in 2023; 20% in 2024; and 20% in 2025.

Finally, at the closing of the 2019 financial year, in addition to the Deferred Portion of 2019 Annual Variable Remuneration mentioned above, 60% of the Annual Variable Remuneration corresponding to financial years 2017 and 2018 is deferred and pending payment to the executive directors, and will be delivered in upcoming financial years, provided conditions are met, following the conditions set forth in the remuneration policies applicable to previous financial years.

| • | Long-term: Other variable remuneration accrued by the executive directors in 2019 |

2016 Deferred Annual Variable Remuneration, to be paid in 2020

Pursuant to the remuneration policies applicable to executive directors for 20163, 50% of the Annual Variable Remuneration for executive directorswas deferred for 3 years, in accordance with the settlement and payment system applicable at that time.

Executive directors | Maximum amount of Deferred Portion of 2016 AVR (to be paid in 2020) | |||||||

| Cash (thousands of EUR) | Number of shares | |||||||

Group Executive Chairman (*) (Carlos Torres Vila) | 591 | 91,915 | ||||||

Chief Executive Officer (*) (Onur Genç) | 124 | 32,047 | ||||||

Head of GE&PA (José Manuel González-Páramo) | 89 | 13,768 | ||||||

| (*) | Amounts associated with their previous positions as Chief Executive Officer of BBVA and President & CEO of BBVA Compass (currently BBVA USA), respectively. |

| 3 | In 2016, BBVA Directors’ Remuneration Policy approved by the General Shareholders’ Meeting held on 13 March 2015 and the Remuneration Policy for the Identified Staff approved in 2015 were applicable. |

| This English version is a translation of the original in Spanish for information purposes only. In case of a discrepancy, the Spanish original will prevail. |

| Annual Report on the Remuneration of BBVA Directors - 2019 | 25 |

These amounts were subject to compliance with the following multi-year performance indicators, which were approved by the Board of Directors in 2016 for a three-year performance period (2017-2019):

Multi-year performance indicators for 2016 AVR | Weighting | |||||

SOLVENCY | Economic adequacy (Economic Equity/ERC) | 20 | % | |||

Fully loaded CET 1 | 20 | % | ||||

LIQUIDITY | LtSCD (Loans to Stable Customer Deposits) | 20 | % | |||

PROFITABILITY | (Operating Income/Average Total Assets) – (Loan-Loss Provisions)/Average Total Assets) | 10 | % | |||

Return on Equity (ROE) | 20 | % | ||||

Total Shareholder Return (TSR) | 10 | % | ||||