- BBVA Dashboard

- Financials

- Filings

- Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

6-K Filing

Banco Bilbao Vizcaya Argentaria (BBVA) 6-KCurrent report (foreign)

Filed: 11 Feb 22, 10:45am

UNITED STATES SECURITIES AND EXCHANGE

COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of February, 2022

Commission file number: 1-10110

BANCO BILBAO VIZCAYA ARGENTARIA, S.A.

(Exact name of Registrant as specified in its charter)

BANK BILBAO VIZCAYA ARGENTARIA, S.A.

(Translation of Registrant’s name into English)

Calle Azul 4,

28050 Madrid

Spain

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F X Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes No X

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes No X

Banco Bilbao Vizcaya Argentaria, S.A. (“BBVA”), in compliance with the Securities Market legislation, hereby communicates the following:

OTHER RELEVANT INFORMATION

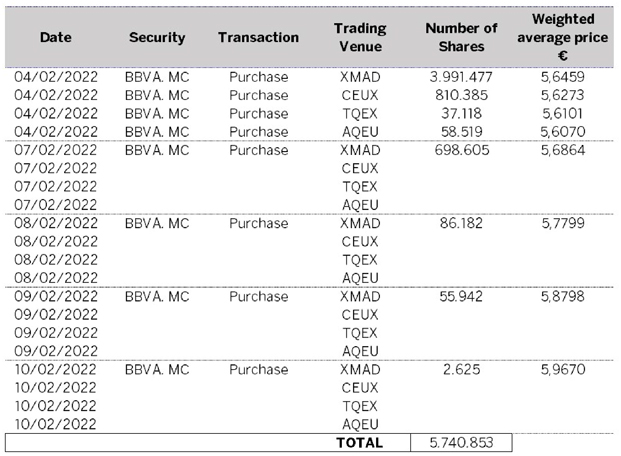

Further to the notice of inside information of 19 November 2021, with registration number 1182, relating to the execution of the first tranche of the buyback programme of own shares approved by the Board of Directors of BBVA (the “First Tranche”), and pursuant to article 5 of Regulation (EU) no. 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse, and to articles 2.2 and 2.3 of Commission Delegated Regulation (EU) 2016/1052, of 8 March 2016, BBVA informs –on the basis of the information received from J.P. Morgan AG as the First Tranche manager– that it has carried out the following transactions over BBVA shares in execution of the First Tranche between 4 and 10 February 2022 (both inclusive):

The number of shares purchased to date as a result of the execution of the First Tranche amounts to 183.267.278, which represent 64% of the maximum cash amount.

Date Security Transaction Trading Venue Number of Shares Weighted average price € 04/02/2022 BBVA. MC Purchase XMAD 3,991.477 5,6459 04/02/2022 BBVA. MC Purchase CEUX 810.385 5,6273 04/02/2022 BBVA. MC Purchase TQEX 37.118 5,6101 04/02/2022 BBVA. MC Purchase AQEU 58.519 5,6070 07/02/2022 BBVA. MC Purchase XMAD 698.605 5,6864 07/02/2022 CEUX 07/02/2022 TQEX 07/02/2022 AQEU 08/02/2022 BBVA. MC Purchase XMAD 86.182 5,7799 08/02/2022 CEUX 08/02/2022 TQEX 08/02/2022 AQEU 09/02/2022 BBVA. MC Purchase XMAD 55.942 5,8798 09/02/2022 CEUX 09/02/2022 TQEX 09/02/2022 AQEU 10/02/2022 BBVA. MC Purchase XMAD 2.625 5,9670 10/02/2022 CEUX 10/02/2022 TQEX 10/02/2022 AQEU TOTAL 5,740.853

Issuer name: Banco Bilbao Vizcaya Argentaria, S.A. - LEI K8MS7FD7N5Z2WQ51AZ71

ISIN Code of the ordinary shares of BBVA: ES0113211835

Detailed information regarding the transactions carried out within the referred period is attached as Annex I.

Madrid, 11 February 2022

ANNEX 1

Detailed information on each of the transactions carried out in execution of the First Tranche between 4 and 10 February 2022 (both inclusive)

https://shareholdersandinvestors.bbva.com/the-share/significant-events/#2022

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Banco Bilbao Vizcaya Argentaria, S.A. | ||||||

Date: February 11, 2022 | ||||||

By: /s/ Antonio Borraz Peralta | ||||||

| ||||||

Name: Antonio Borraz Peralta | ||||||

Title: Assets and Liabilities Management Director | ||||||