- BBVA Dashboard

- Financials

- Filings

- Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

6-K Filing

Banco Bilbao Vizcaya Argentaria (BBVA) 6-KCurrent report (foreign)

Filed: 15 Feb 23, 1:35pm

UNITED STATES SECURITIES AND EXCHANGE

COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of February, 2023

Commission file number: 1-10110

BANCO BILBAO VIZCAYA ARGENTARIA, S.A.

(Exact name of Registrant as specified in its charter)

BANK BILBAO VIZCAYA ARGENTARIA, S.A.

(Translation of Registrant’s name into English)

Calle Azul 4,

28050 Madrid

Spain

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F X Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes No X

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes No X

| Executive summary of remunerations 2022 | 3 | |||

10 | ||||

11 | ||||

| 11 | ||||

| 12 | ||||

15 | ||||

| 15 | ||||

| 17 | ||||

| 18 | ||||

3.3.1. Items of the remuneration system for executive directors 2022 | 18 | |||

3.3.2. Main terms and conditions of the executive directors’ contracts | 21 | |||

24 | ||||

| 24 | ||||

4.2. Remuneration accrued by non-executive directors in 2022 | 27 | |||

| 29 | ||||

| 44 | ||||

| 45 | ||||

47 | ||||

60 | ||||

| 62 | ||||

| 63 | ||||

| 63 | ||||

| 64 | ||||

6.3.2. Items of the remuneration system for executive directors 2023 | 68 | |||

| 69 | ||||

| 70 | ||||

| 76 | ||||

| 78 | ||||

| 79 | ||||

| 80 | ||||

| This English version is a translation of the original in Spanish for information purposes only. In case of discrepancy the original in Spanish shall prevail. | ||

Annual Report on the Remuneration of BBVA Directors - 2022 | 2 | |

Executive summary of remunerations 2022

| 1. | Remuneration of executive directors 2022 |

The remuneration accrued by executive directors is the result of the implementation of the Directors’ Remuneration Policies approved by the General Shareholders’ Meeting.

| 1.1. | Total remuneration of executive directors for 2022: comparison with previous financial years and link to results (“Pay for Performance”) |

The remuneration of the executive directors for financial year 2022 is the result of the implementation of the Remuneration Policy approved by the General Meeting of 20 April 2021 for financial years 2021, 2022 and 2023.

Below there is comparative information on total remuneration corresponding to 2022 and 2021, including the total remuneration granted to the executive directors for each year, considering the awarded Annual Variable Remuneration (“AVR”)1 and without considering deferred variable remuneration awarded for previous years.

The result of the 2022 Annual Variable Remuneration follows from the results obtained by BBVA Group for the different Annual Performance Indicators approved by the Board of Directors at the beginning of the year for calculating this remuneration, which are detailed in section 1.1.B below.

Thus, the BBVA Group has reported an attributable profit of EUR 6,420 million, which represents an increase of 38% with respect to the previous year, and the best result in the Group’s history. The good performance is mainly due to the strong increase in core revenues, operating expenses’ management and the positive evolution of financial assets impairments. The profit amount taken into consideration for incentive purposes has been the said profit figure excluding corporate transactions (the impact of the takeover bid in Turkey and the BBVA’s branches buyback transaction in Spain); thus reaching an attributable profit, for incentive purposes, of EUR 6,381 million. This profit figure has been also the one considered for the calculation of the rest of the financial indicators for incentive purposes.

These good results come together with value creation for shareholders, with an increase of the TBV indicator (Tangible Book Value per share) at Group level of 16.64% with respect to 2021.

All of it, has allowed the Board of Directors to submit to the General Meeting the proposal for the payment of a cash dividend for 2022 financial year of EUR 0.43 per share, which represents an increase of 39% with respect to 2021 financial year. This dividend comes along with a share buyback program for a total amount of EUR 422 million, which will entail a total remuneration for shareholders of EUR 0.50 per share.

This compares with an increase of variable remuneration of 9.2% in the case of the Chair and 10.5% in the case of the Chief Executive Officer and an increase of total remuneration of 5.8% and 4.9%, respectively.

1 This Annual Variable Remuneration is not fully vested, as it includes the deferred portion (long term) which is subject to the application of ex post adjustments (including malus clauses) that could reduce or prevent its payment and, therefore, its vesting has not occurred as at the date of the Report.

| This English version is a translation of the original in Spanish for information purposes only. In case of discrepancy the original in Spanish shall prevail. | ||

Annual Report on the Remuneration of BBVA Directors - 2022 | 3 | |

| A. | Comparison 2022 and 2021 |

| (EUR thousand) | ||||

| CHAIR - Carlos Torres Vila | 2022 | 2021 | ||

Annual Fixed Remuneration | 2,924 | 2,924 | ||

Remuneration in kind | 283 | 328 | ||

Annual pension contribution 1 | 451 | 340 | ||

Annual Variable Remuneration 2 | 4,632 | 4,244 | ||

Target AVR | 3,572 | 3,572 | ||

| TOTAL | 8,290 | 7,837 | ||

| (1) | Of the agreed annual contribution 15% is recorded as “discretionary pension benefits” and, once the financial year has ended, is adjusted, upwards or downwards, depending on the result of the Annual Variable Remuneration, resulting in an increase or a reduction of the agreed contribution to the pension. In 2022, an upwards adjustment of EUR 12 thousand to the agreed contribution for 2021 has been recorded (see section 4.3 A c of this Report) while in 2021 a downwards adjustment of EUR 98 thousand to the agreed contribution of 2020 was recorded (see section 4.3 A c of the Annual Report on the Remuneration of Directors for 2021 published on the Bank’s website). |

| (2) | Total 2022 Annual Variable Remuneration in cash. Of this remuneration, 40% shall be paid in 2023 (in equal parts in cash and BBVA shares), while the remaining 60% (40% in cash and 60% in BBVA shares) has been deferred and is subject to the results of multi-year performance indicators and other ex post adjustments that may reduce it (see section 4.3 B). |

| (EUR thousand) | ||||

| CHIEF EXECUTIVE OFFICER - Onur Genç | 2022 | 2021 | ||

Annual Fixed Remuneration | 2,179 | 2,179 | ||

Remuneration in kind | 155 | 158 | ||

Other fixed allowances 1 | 1,254 | 1,254 | ||

Annual Variable Remuneration 2 | 3,562 | 3,224 | ||

Target AVR | 2,672 | 2,672 | ||

| TOTAL | 7,150 | 6,815 | ||

| (1) | Amounts paid as “cash in lieu of pension” (30% of Annual Fixed Remuneration) and annual mobility allowance. |

| (2) | Total 2022 Annual Variable Remuneration in cash. Of this remuneration, 40% shall be paid in 2023 (in equal parts in cash and BBVA shares), while the remaining 60% (40% in cash and 60% in BBVA shares) has been deferred and is subject to the results of multi-year performance indicators and other ex post adjustments that may reduce it (see section 4.3 B). |

| B. | Link between AVR and the results of the BBVA Group in 2022 (“Pay for Performance”) |

Targets for annual performance indicators for 2022 AVR were set at the beginning of the year taking into consideration the analysts’ consensus at the time, providing them with a higher level of ambition over this consensus, and in accordance with existing economic and business perspectives.

CHAIR - Carlos Torres Vila

| Level of achievement (“L.A.”) | AVR 2022 (130%) | AVR 2021 (119%) | ||||||||||||||

Annual Performance Indicators | Weight | Result 1 | Target | L.A. | Weight | Result 1 | Target | L.A. | ||||||||

Attributable profit excluding corporate transactions | 10% | EUR 6,381 M | EUR 4,661 M | 150% | 10% | EUR 5,028 M | EUR 3,070 M | 150% | ||||||||

Tangible book value (TBV) per share 2 | 15% | 7.64 | 7.28 | 115% | 15% | 6.55 | 6.78 | 97% | ||||||||

RORC | 10% | 15.26 % | 12.56% | 150% | 10% | 14.03% | 8.68% | 150% | ||||||||

Cost-to-income ratio | 10% | 43.23 % | 45.33% | 131% | 10% | 45.51% | 47.17% | 123% | ||||||||

Customer satisfaction (NPS) 3 | 10% | 108 | - | 108% | 10% | 101 | - | 101% | ||||||||

Mobilisation of sustainable financing | 10% | EUR 40,643 M | EUR 32,146 M | 150% | 10% | EUR 30,615 M | EUR 16,878 M | 120% | ||||||||

Digital sales 3 | 10% | 110 | - | 110% | 10% | 99 | - | 99% | ||||||||

Individual indicators | 25% | 130 | 00 | 130% | 25% | 120 | 100 | 120% | ||||||||

ANNUAL VARIABLE REMUNERATION (EUR thousand) | 4,632 | 4,244 | ||||||||||||||

| (1) | Results for incentive purposes. With regard to 2022 results, see section 4.3 B. a. |

| (2) | In the case of TBV per share there are two targets: one linked to growth (budgetary target) and another one linked to value creation which is the one used for incentive purposes (shown above). The budgetary target was EUR 6.80 per share in 2022 and EUR 6.25 per share in 2021. |

| (3) | NPS and Digital sales indicators do not have an associated target at Group level, but their targets are established at country level. The Group’s achievement for these indicators will be calculated as the weighted average over the net margin of the level of achievement obtained by the countries. |

| This English version is a translation of the original in Spanish for information purposes only. In case of discrepancy the original in Spanish shall prevail. | ||

Annual Report on the Remuneration of BBVA Directors - 2022 | 4 | |

CHIEF EXECUTIVE OFFICER - Onur Genç

| Level of achievement (“L.A.”) | AVR 2022 (133%) | AVR 2021 (121%) | ||||||||||||||

| Annual Performance Indicators | Weight | Result 1 | Target | L.A. | Weight | Result 1 | Target | L.A. | ||||||||

| Attributable profit excluding corporate transactions | 15% | EUR 6,381 M | EUR 4,661 M | 150% | 15% | EUR 5.028 M | EUR 3.070 M | 150% | ||||||||

| Tangible book value (TBV) per share 2 | 10% | 7.64 | 7.28 | 115% | 10% | 6,55 | 6,78 | 97% | ||||||||

| RORC | 10% | 15.26% | 12.56% | 150% | 10% | 14,03% | 8,68% | 150% | ||||||||

| Cost-to-income ratio | 15% | 43.23% | 45.33% | 131% | 15% | 45,51% | 47,17% | 123% | ||||||||

| Customer satisfaction (NPS) 3 | 15% | 108 | - | 108% | 15% | 101 | - | 101% | ||||||||

| Mobilisation of sustainable financing | 10% | EUR 40,643 M | EUR 32,146 M | 150% | 10% | EUR 30.615 M | EUR 16.878 M | 120% | ||||||||

| Digital sales 3 | 10% | 110 | - | 110% | 10% | 99 | - | 99% | ||||||||

| Individual indicators | 15% | 150 | 100 | 150% | 15% | 120 | 100 | 120% | ||||||||

| ANNUAL VARIABLE REMUNERATION (EUR thousand) | 3,562 | 3,224 | ||||||||||||||

| (1) | Results for incentive purposes. With regard to 2022 results, see section 4.3 B. a. |

| (2) | In the case of TBV per share there are two targets: one linked to growth (budgetary target) and another one linked to value creation which is the one used for incentive purposes (shown above). The budgetary target was EUR 6.80 per share in 2022 and EUR 6.25 per share in 2021. |

| (3) | NPS and Digital sales indicators do not have an associated target at Group level, but their targets are established at country level. The Group’s achievement for these indicators will be calculated as the weighted average over the net margin of the level of achievement obtained by the countries. |

| 1.2. | Summary of remuneration accrued2 by executive directors in 2022 |

(EUR thousand and shares)

| Director | Fixed (paid in 2022) | Variable (payable in 2023) | Deferred Variable (payable in 2023) 3 | |||||||||||||||||||||||||

| Annual Fixed Remuneration | Other items | Upfront Payment 2 2022 AVR | Deferred AVR 2021 | Deferred AVR 2019 | Deferred AVR 2018 | Deferred AVR 2017 | ||||||||||||||||||||||

| In Kind | Pension / Other 1 | Cash | Shares | Cash | Shares | Cash | Shares | Cash | Shares | Cash | Shares | |||||||||||||||||

Chair | 2,924 | 283 | 451 | 926 | 158,169 | 215 | 57,325 | 513 | 136,587 | 128 | 35,795 | 154 | 27,898 | |||||||||||||||

CEO | 2,179 | 155 | 1,254 | 712 | 121,646 | 164 | 43,552 | 460 | 122,572 | - | - | - | - | |||||||||||||||

| (1) | In the case of the Chair it includes the agreed annual contribution to cover the retirement contingency (EUR 439 thousand), plus the upward adjustment to “discretionary pension benefits” of EUR 12 thousand recorded in 2022 (see section 4.3. A. c). In the case of the CEO it includes “cash in lieu of pension” and the mobility allowance. Moreover, and pursuant to the contractual provisions described in section 4.3 A. c, the Bank has paid in 2022 annual insurance premiums to cover death and disability contingencies for an amount of EUR 473 thousand in the case of the Chair and EUR 285 thousand in the case of the CEO. |

| (2) | 40% of the 2022 Annual Variable Remuneration. |

| (3) | In 2023, the following Deferred AVR will vest to the executive directors (see section 4.3. B. c): |

| ● | First payment of the 2021 Deferred AVR (20% of the Deferred AVR 2021). |

| ● | First payment of the 2019 Deferred AVR (60% of the Deferred AVR 2019). |

| ● | Second payment of the 2018 Deferred AVR of the Chair (20% of the 2018 Deferred AVR). The CEO does not have any outstanding amounts of the 2018 Deferred AVR. |

| ● | Third and last payment of the 2017 Deferred AVR of the Chair (20% of the 2017 Deferred AVR). The CEO does not have any outstanding amounts of the 2017 Deferred AVR. |

All the cash amounts of the Deferred AVR from prior years includes the corresponding update pursuant to year-on-year CPI.

2 In accordance with Circular 4/2013 of the Spanish National Securities Market Commission (“CNMV”), for the purposes of this Report, remuneration accrued in 2022 are those fixed remuneration paid in 2022 and, in the case of variable remuneration, that with regard to which vesting has occurred by the date of the Report, once 2022 financial year has ended and it has been verified that ex post adjustments (including malus arrangements) preventing or limiting its payment to the beneficiary do not apply.

| This English version is a translation of the original in Spanish for information purposes only. In case of discrepancy the original in Spanish shall prevail. | ||

Annual Report on the Remuneration of BBVA Directors - 2022 | 5 | |

In view of the foregoing, the total monetized remuneration accrued by each executive director in 2022 is included below (see section C.1. c) of section 5 of the CNMV Statistical Appendix):

(EUR thousand)

| Director | Cash | Gross Profit of the shares | Total | |||||||||||||

Annual Fixed

| In Kind | Other items |

AVR (2022 and Deferred)

| Shares | Share price |

Gross profit of

| ||||||||||

Chair | 2,924 | 283 | - | 1,937 | 415,774 | 5.86 | 2,436 | 7,580 | ||||||||

CEO | 2,179 | 155 | 1,254 | 1,336 | 287,770 | 5.86 | 1,686 | 6,610 | ||||||||

| 1.3. | Deferred variable remuneration from previous years payable to executive directors in 2023 |

| 1.3.1. | First payment of 2021 Deferred AVR |

In accordance with the directors’ remuneration policy applicable in 2021, the first payment of this remuneration to the executive directors is due in 2023 in the following amounts (in cash and in shares):

| 2021 Deferred AVR (EUR thousand and shares) | ||||||||||||

Executive directors | Maximum amount 2021 DAVR | 2021 DAVR to be paid in 2023 1 (first payment 20%) | 2021 DAVR to be paid each year in 2024, 2025, 2026 and 2027 (20%) | |||||||||

Cash |

Shares |

Cash2 |

Shares |

Cash |

Shares | |||||||

Chair | 1,018 | 286,625 | 204 | 57,325 | 204 | 57,325 | ||||||

CEO | 774 | 217,760 | 155 | 43,552 | 155 | 43,552 | ||||||

| (1) | First payment of the 2021 Deferred AVR of the executive directors (20%). The remaining 80% is deferred and payable, in equal parts, in 2024, 2025, 2026 and 2027, the last three payments being subject to the outcome of the Multi-year Performance Indicators established for the 2021 Deferred AVR which may reduce it (ex post adjustments). |

| (2) | Amount that will be updated by applying the Consumer Price Index (“CPI”) in the amount of EUR 12 thousand for the Chair and EUR 9 thousand for the CEO. |

| 1.3.2. | First payment of 2019 Deferred AVR |

In accordance with the directors’ remuneration policy applicable in 2019, the first payment of this remuneration to executive directors is due in 2023, determined in the following amounts (cash and shares) in view of the outcome of the Multi-year Performance Indicators approved in 2019, as set forth below:

| 2019 Deferred AVR (EUR thousand and shares) | ||||||||||||||||||

| Executive directors | Maximum amount 2019 DAVR | Reduction (ex post adjustments) | Final amount 2019 DAVR | 2019 DAVR to be paid in 2023 1 (first payment 60%) | 2019 DAVR to be paid each year in 2024 and 2025 (20%) | |||||||||||||

Cash |

Shares |

Cash |

Shares |

Cash 2 |

Shares |

Cash |

Shares | |||||||||||

Chair | 763 | 227,645 | 0% | 763 | 227,645 | 458 | 136,587 | 153 | 45,529 | |||||||||

CEO |

685 |

204,288 |

685 |

204,288 |

411 |

122,572 | 137 |

40,858 | ||||||||||

| (1) | First payment of 2019 Deferred AVR of the executive directors (60%). The remaining 40% is deferred and payable, in equal parts, in 2024 and 2025. |

| (2) | This amount will be updated by applying the CPI in the amount of EUR 55 thousand for the Chair and EUR 49 thousand for the CEO. |

| This English version is a translation of the original in Spanish for information purposes only. In case of discrepancy the original in Spanish shall prevail. | ||

Annual Report on the Remuneration of BBVA Directors - 2022 | 6 | |

The result obtained for each of the 2019 DAVR Multi-year Performance Indicators, as well as the threshold set for the possible reduction of each of them, which has served to determine its final amount, are detailed below:

| 2019 Deferred AVR (long-term measurement period 2020–2022) | ||||||||||||

2019 DAVR Multi-year Performance | Solvency | Liquidity | Profitability | |||||||||

Fully-loaded CET1 | LtSCD (Loan-to-stable customer deposits) | LCR (Liquidity Coverage Ratio) | (Net Margin – Loan-Loss Provisions)/Average Total Assets | ROE (Return on Equity) | TSR (Total Shareholder Return) | |||||||

| Weighting | 40% | 10% | 10% | 10% | 20% | 10% | ||||||

| Threshold for no reduction | ≥ 9.89% | ≤ 140% | ≥ 105% | ≥ 0.20% | ≥ 2.0% | 1st to 8th | ||||||

| Result | 12.32%

| 102%

| 159%

| 1.26%

| 10.7%

| 3rd

| ||||||

% reduction DAVR | 0% | 0% | 0% | 0% | 0% | 0% | ||||||

With respect to the TSR indicator, which tracks total return for shareholders, the evolution of the indicator has been compared to that of the peer group approved by the Board of Directors in 2020 and set forth in Appendix 2 over the three-year period running from 1 January 2020 to 31 December 2022.

| 1.3.3. | Second payment of 2018 Deferred AVR |

In accordance with the directors’ remuneration policy applicable in 2018, the amount of this remuneration was determined in financial year 2022 in view of the result of the Multi-year Performance Indicators approved in 2018, as reported in the Annual Report on the Remuneration of Directors for financial year 2021. The second payment of this deferred remuneration is due to the Chair in 2023, in the following amounts (in cash and in shares):

| 2018 Deferred AVR (EUR thousand and shares) | ||||||||||||||||||||||

| Executive director | Maximum amount 2018 DAVR | Reduction (ex post adjustments) | Final amount 2018 DAVR | 2018 DAVR paid in 2022 (first payment 60%) | 2018 DAVR to be paid in 2023 1 (second payment 20%) | 2018 DAVR to be paid in 2024 (third payment 20%) | ||||||||||||||||

| Cash | Shares | Cash | Shares | Cash 2 | Shares | Cash 3 | Shares | Cash | Shares | |||||||||||||

Chair | 574 | 180,785 | -1% | 569 | 178,977 | 341 | 107,386 | 114 | 35,795 | 114 | 35,795 | |||||||||||

| (1) | Second payment of 2018 Deferred AVR of the Chair (20%) (with the remaining 20% due in 2024). The CEO does not have any outstanding 2018 Deferred AVR. |

| (2) | Amount already updated in 2022 by applying the CPI in the amount of EUR 23 thousand. |

| (3) | This amount will be updated by applying the CPI in the amount of EUR 15 thousand. |

| 1.3.4. | Third and final payment of 2017 Deferred AVR |

In accordance with the directors’ remuneration policy applicable in 2017, the amount of this remuneration was determined in financial year 2021 in view of the result of the Multi-year Performance Indicators approved in 2017, as reported in the Annual Report on the Remuneration of Directors for financial year 2020. The third and final payment of this deferred remuneration is due to the Chair in 2023, in the following amounts (in cash and in shares):

| 2017 Deferred AVR (EUR thousand and shares) | ||||||||||||||||||||||

| Executive director | Maximum amount 2017 DAVR | Reduction (ex post adjustments) | Final amount 2017 DAVR | 2017 DAVR paid in 2021 (first payment 60%) | 2017 DAVR paid in 2022 (second payment 20%) | 2017 DAVR to be payment of 20%) | ||||||||||||||||

| Cash | Shares | Cash | Shares | Cash2 | Shares | Cash3 | Shares | Cash 4 | Shares | |||||||||||||

Chair | 675 | 139,488 | 0% | 675 | 139,488 | 405 | 83,692 | 135 | 27,898 | 135 | 27,898 | |||||||||||

| (1) | Third and last payment of 2017 Deferred AVR of the Chair (20%). The CEO does not have any outstanding 2017 Deferred AVR. |

| (2) | Amount already updated in 2021 by applying the CPI in the amount of EUR 6 thousand. |

| (3) | Amount already updated in 2022 by applying the CPI in the amount of EUR 11 thousand. |

| (4) | Amount to be updated by applying the CPI in the amount of EUR 19 thousand. |

| This English version is a translation of the original in Spanish for information purposes only. In case of discrepancy the original in Spanish shall prevail. | ||

Annual Report on the Remuneration of BBVA Directors - 2022 | 7 | |

| 2. | Remuneration of non-executive directors 2022 |

The remuneration accrued by non-executive directors in 2022 is the result of applying the Directors’ Remuneration Policy approved by the General Meeting of 20 April 2021. The amounts pertaining to the positions of member of the Board, member and chair of the Board committees, and Deputy Chair and Lead Director have not been raised since 2007, although they have been redistributed.

| 2.1. | Fixed annual allowance 2022 |

(EUR thousand)

| Non-executive directors | Board of Directors | Executive Committee | Audit Committee | Risk and Compliance Committee | Remuneration Committee | Appointments

| Technology

| Other (1) | Total | |||||||||||

2022

| 2021

| |||||||||||||||||||

José Miguel Andrés Torrecillas | 129 | 167 | 66 | 115 | 50 | 527 | 527 | |||||||||||||

Jaime Caruana Lacorte | 129 | 167 | 165 | 107 | 567 | 567 | ||||||||||||||

Raúl Galamba de Oliveira | 129 | 107 | 43 | 53 | 332 | 278 | ||||||||||||||

Belén Garijo López | 129 | 66 | 107 | 46 | 349 | 349 | ||||||||||||||

Connie Hedegaard (2) | 107 | 107 | 0 | |||||||||||||||||

Sunir Kumar Kapoor (3) | 32 | 11 | 43 | 172 | ||||||||||||||||

Lourdes Máiz Carro | 129 | 66 | 43 | 238 | 238 | |||||||||||||||

José Maldonado Ramos | 129 | 167 | 46 | 342 | 342 | |||||||||||||||

Ana Peralta Moreno | 129 | 66 | 43 | 238 | 238 | |||||||||||||||

Juan Pi Llorens | 129 | 214 | 46 | 43 | 27 | 458 | 512 | |||||||||||||

Ana Revenga Shanklin | 129 | 107 | 29 | 264 | 236 | |||||||||||||||

Susana Rodríguez Vidarte | 129 | 167 | 107 | 46 | 449 | 449 | ||||||||||||||

Carlos Salazar Lomelín | 129 | 43 | 172 | 172 | ||||||||||||||||

Jan Verplancke | 129 | 43 | 43 | 214 | 214 | |||||||||||||||

Total (4) | 1,684 | 667 | 431 | 642 | 278 | 301 | 168 | 130 | 4,300 | 4,293 | ||||||||||

| (1) | Amounts received in 2022 and 2021 by José Miguel Andrés Torrecillas, in his capacity as the Deputy Chair of the Board of Directors, by Juan Pi Llorens, in his capacity as Lead Director (until 28 April 2022) and by Raúl Galamba de Oliveira (from his appointment as Lead Director on 28 April 2022). |

| (2) | Director appointed by the General Meeting of 18 March 2022. Remuneration received based on the date of acceptance of the position. |

| (3) | Director who left office on 18 March 2022. Remuneration for the term of office in 2022. |

| (4) | Includes amounts corresponding to membership of the Board and its various committees during the 2022 and 2021 financial years. |

In addition, in 2022, the Bank paid remuneration in kind for non-executive directors in the aggregate total amount of EUR 110 thousand.

| This English version is a translation of the original in Spanish for information purposes only. In case of discrepancy the original in Spanish shall prevail. | ||

Annual Report on the Remuneration of BBVA Directors - 2022 | 8 | |

| 2.2. | Fixed remuneration system with deferred delivery of BBVA shares |

Through the implementation of this system, the number of theoretical shares allocated to each non-executive director in 2022 is equal to 20% of the annual fixed allowance in cash received by each director in 2021 based on the average closing price of the BBVA share during the 60 trading sessions prior to the General Meeting of 18 March 2022, which was EUR 5.47 per share. Under the terms of the Policy, BBVA shares will only be delivered after the director ceases to hold such office, provided that this is not due to a serious dereliction of duties.

| 2022 | 2021 | |||||||

| Non-executive directors | Theoretical shares allocated | Theoretical shares accumulated as at 31 December | Theoretical shares allocated | Theoretical shares accumulated as at 31 December | ||||

José Miguel Andrés Torrecillas | 19,253 | 118,025 | 22,860 | 98,772 | ||||

Jaime Caruana Lacorte | 20,733 | 77,705 | 25,585 | 56,972 | ||||

Raúl Galamba de Oliveira | 10,177 | 19,677 | 9,500 | 9,500 | ||||

Belén Garijo López | 12,741 | 90,589 | 15,722 | 77,848 | ||||

Connie Hedegaard (1) | 0 | 0 | 0 | 0 | ||||

Sunir Kumar Kapoor(2) | 6,270 | 0 | 7,737 | 30,652 | ||||

Lourdes Máiz Carro | 8,696 | 64,356 | 10,731 | 55,660 | ||||

José Maldonado Ramos | 12,493 | 136,477 | 15,416 | 123,984 | ||||

Ana Peralta Moreno | 8,696 | 35,092 | 10,731 | 26,396 | ||||

Juan Pi Llorens | 18,703 | 134,599 | 23,079 | 115,896 | ||||

Ana Revenga Shanklin | 8,611 | 16,179 | 7,568 | 7,568 | ||||

Susana Rodríguez Vidarte | 16,400 | 177,775 | 20,237 | 161,375 | ||||

Carlos Salazar Lomelín | 6,270 | 11,912 | 5,642 | 5,642 | ||||

Jan Verplancke | 7,835 | 29,251 | 9,024 | 21,416 | ||||

Total(3) | 156,878 | 911,637 | 183,832 | 791,681 | ||||

| (1) | Director appointed by the General Meeting held on 18 March 2022, therefore the allocation of theoretical shares is not due until 2023. |

| (2) | Director who left office on 18 March 2022. In application of the system, he received a total of 36,922 BBVA shares after his departure, which is equivalent to the total number of theoretical shares accumulated up to that date. |

| (3) | The price at which the shares were allocated in 2022 and 2021 was EUR 5.47 and EUR 4.44 per share, respectively. |

| This English version is a translation of the original in Spanish for information purposes only. In case of discrepancy the original in Spanish shall prevail. | ||

Annual Report on the Remuneration of BBVA Directors - 2022 | 9 | |

ANNUAL REPORT ON THE REMUNERATION OF DIRECTORS

COMPANY NAME: Banco Bilbao Vizcaya Argentaria, S.A.

REGISTERED OFFICE: Plaza de San Nicolás, número 4, 48005, Bilbao (Bizkaia)

Tax identification number (NIF): A-48265169

| 1. | Introduction |

This report has been prepared in accordance with the provisions of Article 541 of the Consolidated text of the Spanish Corporate Enterprises Act, approved by Royal Legislative Decree 1/2010, of 2 July, and with the provisions of Circular 4/20133 of the Spanish National Securities Market Commission (“CNMV”) .

The Board of Directors of Banco Bilbao Vizcaya Argentaria, S.A. (“BBVA”, the “Institution”, the “Company” or the “Bank”), at its meeting held on 9 February 2023, on the proposal of the Remuneration Committee, has approved this Annual Report on the Remuneration of BBVA Directors (the “Report”), the purpose of which is to disclose complete, clear and comprehensible information on the remuneration policy applicable to the members of the BBVA Board of Directors for the current financial year (2023), together with a global summary of how the policy was applied during the financial year last ended (2022) and a breakdown of the individual remuneration of each type accrued by each director during such financial year.

The BBVA Directors’ Remuneration Policy applicable in 2022 was the one approved at the General Shareholders’ Meeting held on 20 April 2021 (the “Directors’ Remuneration Policy” or the “Policy”).

The BBVA Board of Directors, at the proposal of the Remuneration Committee, has approved a new remuneration policy for BBVA directors, which will be submitted to the Annual General Shareholders’ Meeting of the Company, for its application during the financial years 2023, 2024, 2025 and 2026.

This Report also includes information on the BBVA Group’s General Remuneration Policy applicable during the 2022 financial year, which is based on the same principles as those governing the BBVA Directors’ Remuneration Policy and which also sets forth the special provisions applicable to the categories of staff whose professional activities have a material impact on the risk profile of BBVA and/or its Group (the “Identified Staff”), including members of BBVA Senior Management.

This Report, together with the statistical appendix included in section 5, has been disclosed as other material information simultaneously with the annual corporate governance report and will be submitted to a consultative vote as a separate item on the agenda at the 2023 Annual General Shareholders’ Meeting. This report is also included by reference, in a separate section, in the management report accompanying the annual financial statements of BBVA and the consolidated annual financial statements of the BBVA Group for the 2022 financial year.

Appendix 3, “Alignment with the Template set out in Circular 4/2013”, specifies the location in this Report of the information set out in each section of the standard electronic template published by the CNMV.

3 Circular 4/2013, of 12 June, of the National Securities Market Commission, establishing the templates of the annual report on the remuneration of directors of listed companies and of the members of boards of directors and control committees of savings banks that issue securities admitted to trading on official securities markets (the “CNMV Circular 4/2013”).

| This English version is a translation of the original in Spanish for information purposes only. In case of discrepancy the original in Spanish shall prevail. | ||

Annual Report on the Remuneration of BBVA Directors - 2022 | 10 | |

This document should be read in conjunction with the BBVA Directors’ Remuneration Policy approved by the General Meeting in 2021, with the proposal of the new BBVA directors’ remuneration policy submitted for approval to the Annual General Shareholders’ Meeting which will foreseeably be held on 17 March 2023, as well as with Note 54 of the Report of the BBVA Group’s consolidated Annual Financial Statements for 2022 financial year, which discloses, individually and by item, the directors’ remuneration for 2022. These documents, as well as this Report, are available on the Bank’s website as of the call of the referred General Meeting (www.bbva.com).

| 2. | BBVA Group’s General Remuneration Policy |

BBVA has a BBVA Group’s General Remuneration Policy that is generally applicable to all employees and senior managers of BBVA and the companies that comprise its group (the “BBVA Group” or the “Group”) and which is geared towards the recurrent creation of value for the Group, the furtherance of the strategy defined by the Group and the alignment of the interests of its employees and shareholders with prudent risk management (the “Group’s General Remuneration Policy”).

This policy is one of the elements devised by the Board of Directors, as part of the Bank’s Corporate Governance System, to promote proper management and oversight of the Institution and its Group, and is based on the following principles:

| ● | long-term value creation; |

| ● | achieving results through prudent and responsible risk-taking; |

| ● | attracting and retaining the best talent; |

| ● | rewarding level of responsibility and professional career; |

| ● | ensuring internal equity and external competitiveness; |

| ● | ensuring equal pay for men and women; and |

| ● | ensuring the transparency of the remuneration model. |

On the basis of these principles, BBVA has defined the Group’s General Remuneration Policy, taking into account, not only compliance with the legal requirements applicable to credit institutions and the various sectors in which the Group operates, but also the alignment with best market practices. As such, elements have been included in this Policy that are aimed at reducing exposure to excessive risks and aligning remuneration with the Group’s business strategy and its long-term objectives, values and interests.

Thus, pursuant to the foregoing principles the BBVA Group’s General Remuneration Policy:

| ✓ | contributes to the business strategy of BBVA and its Group, and to the achievement of its objectives, values, interests, value creation and long-term sustainability; |

| ✓ | is compatible with and promotes prudent and effective risk management and does not provide incentives for risk-taking that exceeds the level tolerated by the Institution or the Group, in a manner that is consistent with BBVA Group’s risk strategy and culture; |

| This English version is a translation of the original in Spanish for information purposes only. In case of discrepancy the original in Spanish shall prevail. | ||

Annual Report on the Remuneration of BBVA Directors - 2022 | 11 | |

| ✓ | is clear, comprehensible and transparent, with a simple wording that enables understanding of the various elements that make up the remuneration system and the conditions for its award, vesting and payment. To that end, it clearly distinguishes between the criteria for determining fixed remuneration and variable remuneration; |

| ✓ | is gender-neutral, as it provides for equal compensation for the same duties, or duties of equal value, and does not establish any difference or discrimination on the basis of gender; |

| ✓ | includes measures to avoid conflicts of interest, promoting the independence of judgement of persons involved in decision-making and in the oversight and control of management and the establishment of remuneration systems; and |

| ✓ | endeavours that remuneration is not based solely, or primarily, on quantitative criteria, but also takes into account appropriate qualitative criteria that reflect compliance with applicable regulations, and corporate culture and values. |

The BBVA Group’s General Remuneration Policy was last updated by the Board of Directors, at the proposal of the Remuneration Committee and following the analysis by the Risk and Compliance Committee, on 30 June 2021. A new update of this policy is planned for 2023 to incorporate into the variable remuneration model for the Identified Staff the new features introduced in the new BBVA directors’ remuneration policy which will be submitted for approval at the Annual General Shareholders’ Meeting.

2.2. Special provisions applicable to the Identified Staff

The BBVA Group’s General Remuneration Policy includes a section containing the specific rules applicable to the Identified Staff of BBVA and its Group, which includes members of the Board of Directors4 and BBVA Senior Management. These rules have been established in accordance with the regulations and recommendations applicable to the remuneration schemes of such staff and, in particular, with the provisions of Act 10/2014, of 26 June, on the regulation, supervision and solvency of credit institutions and its implementing regulations.

These rules aim to further align BBVA’s remuneration practices with applicable regulations, good governance recommendations and best market practices.

The result is an incentive scheme that is geared towards aligning the remuneration of the members of the Identified Staff with the Group’s long-term objectives, values and interests, with the creation of value, and with prudent risk management on the basis of, inter alia, the following key features:

| ● | Balance between fixed and variable remuneration |

The fixed and variable components of total remuneration must be appropriately balanced, ensuring that the policy is fully flexible with regard to payment of the variable components such that these components may be reduced, even to zero.

4 The remuneration of the members of the BBVA Board of Directors is governed by a specific remuneration policy, as described below in this Report. Thus, directors are expressly excluded from the scope of application of the BBVA Group’s General Remuneration Policy, although they are members of the Identified Staff by virtue of applicable law and regulations.

| This English version is a translation of the original in Spanish for information purposes only. In case of discrepancy the original in Spanish shall prevail. | ||

Annual Report on the Remuneration of BBVA Directors - 2022 | 12 | |

For these purposes, the Bank has defined “target” ratios between the main components of the fixed and variable remuneration, taking into account both the duties carried out and their impact on the risk profile. To strengthen the independence and objectivity of control functions, the fixed components of their remuneration have a greater weight than the variable components, which are mainly connected to the functions’ own targets.

| ● | Limitation on variable remuneration |

The variable component of remuneration for a given financial year shall be limited to a maximum amount of 100% of the fixed component of total remuneration, unless the General Shareholders’ Meeting resolves to increase this percentage up to a maximum of 200%.

| ● | Prohibition on hedging strategies |

The use of personal hedging strategies and insurance relating to variable remuneration and liability that could undermine the effects of alignment with prudent risk management is prohibited.

Rules for the accrual, award, vesting and payment of 2022 Annual Variable Remuneration

● Accrual and award of Annual Variable Remuneration

In order to ensure alignment with results and long-term sustainability, the annual variable remuneration of the Identified Staff (including executive directors and the rest of the members of Senior Management) will not accrue, or will accrue in a reduced amount, if certain profit and capital ratio levels, as determined by the Board of Directors, are not achieved. These levels shall also be applicable to the rest of the workforce.

Likewise, the annual variable remuneration will be reduced in the event that, at the time of each beneficiary’s performance assessment, there has been a downturn in the Group’s results or other parameters, such as the level of achievement of budgeted targets.

The annual variable remuneration of members of the Identified Staff, as well as that of the other employees of BBVA Group, consists of an annual incentive that reflects performance as measured through the achievement of certain targets that are aligned with the risk incurred, and is calculated on the basis of:

(i) annual performance indicators (financial and non-financial), which take into account current and future risks as well as the strategic priorities defined by the Group (the “Annual Performance Indicators”);

(ii) the scales of achievement that may be established according to the weighting assigned to each indicator and based on the targets set for each of them; and

(iii) a target annual variable remuneration, representing the amount of the annual variable remuneration in the event that 100% of the previously established targets are met (the “Target Annual Variable Remuneration” or the “Target AVR”).

The amount to be received as annual variable remuneration by applying the corresponding scales of achievement may range from 0% to 150% of the Target Annual Variable Remuneration. The resulting amount will constitute the annual variable remuneration of each beneficiary (the “Annual Variable Remuneration” or “AVR”).

|

| This English version is a translation of the original in Spanish for information purposes only. In case of discrepancy the original in Spanish shall prevail. | ||

Annual Report on the Remuneration of BBVA Directors - 2022 | 13 | |

The financial Annual Performance Indicators are aligned with the most relevant management metrics for the Bank, while the non-financial Annual Performance Indicators are related to the strategic targets defined at the Group level, the area level and for each individual beneficiary.

In no event will variable remuneration limit the Group’s capacity to strengthen its capital base in accordance with regulatory requirements, and it will take into account current and future risks as well as the cost of the necessary capital and liquidity, reflecting performance that is sustainable and commensurate to risk.

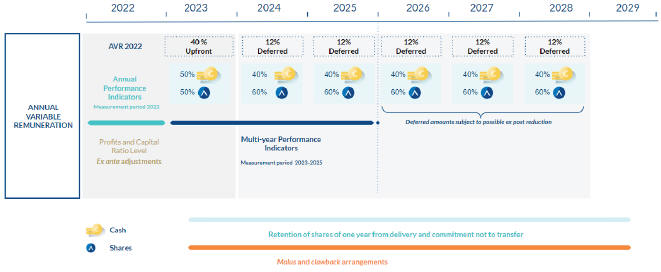

● Upfront payment

Once awarded, 60% of the Annual Variable Remuneration of the Identified Staff — 40% in the case of members of the Identified Staff with particularly high variable remuneration and members of BBVA Senior Management — will vest and be paid, if the relevant conditions are met, as a general rule, during the first four months of the financial year (the “Upfront Portion”).

● Deferral rules

40% of the Annual Variable Remuneration — 60% for members of the Identified Staff with particularly high variable remuneration and members of BBVA Senior Management — will be deferred for a period of 4 years (the “Deferred Portion”, the “Deferred AVR” or the “DAVR”). In the case of members of BBVA Senior Management, the deferral period shall be 5 years.

● Payment in shares or instruments

50% of the Annual Variable Remuneration, including both the Upfront Portion and the Deferred Portion, shall be settled in BBVA shares or in instruments linked to BBVA shares. For members of BBVA Senior Management, 50% of the Upfront Portion and 60% of the Deferred Portion shall be settled in BBVA shares.

● Retention period

The shares or instruments awarded as Annual Variable Remuneration, both for the Upfront Portion and the Deferred Portion, shall be withheld for a one-year period following delivery. The foregoing shall not apply to those shares or instruments the sale of which would be required to honour the payment of taxes accruing on delivery.

● Ex post adjustments to the Deferred Portion

To ensure that the process of assessing the results to which the Annual Variable Remuneration is linked falls within a multi-year framework that considers long-term results, and to ensure also that the Annual Variable Remuneration is effectively paid over a period that takes into account the economic cycle of the Bank and its risks, the Annual Variable Remuneration of the Identified Staff will be subject to ex post adjustments aligned with prudent risk management and linked to the results of multi-year performance indicators.

Thus, the Deferred AVR of members of the Identified Staff may be reduced, though never increased, based on the results of indicators that are aligned with the Group’s core metrics for risk control and management, related to solvency, liquidity, profitability and value creation (the “Multi-year Performance Indicators”).

● Malus and clawback arrangements

The entire Annual Variable Remuneration of the members of the Identified Staff, both the part in cash and the part in BBVA shares or instruments linked to BBVA shares, will be subject to reduction and recovery arrangements (malus and clawback) during the entire period of deferral and retention of the shares or instruments.

|

As a result, the BBVA Group has been implementing a robust and consistent remuneration policy over time that contributes to its business strategy and sustainable performance and that is aligned with the long-term interests of the Bank, the interests of its shareholders and prudent risk management.

| This English version is a translation of the original in Spanish for information purposes only. In case of discrepancy the original in Spanish shall prevail. | ||

Annual Report on the Remuneration of BBVA Directors - 2022 | 14 | |

| 3. | Directors’ Remuneration Policy applicable in 2022 |

The remuneration policy applicable to members of the Board of Directors is based on the same principles that govern the BBVA Group’s General Remuneration Policy and, in the case of executive directors, shares the same variable remuneration scheme set forth therein which has been described in the previous section albeit with certain specificities due to their status as directors.

The Directors’ Remuneration Policy applicable in 2022 financial year was approved by the General Shareholders’ Meeting held on 20 April 2021 and is available on the Bank’s website5.

This Policy has been designed in accordance with corporate legislation and the specific regulations applicable to credit institutions and in accordance with the provisions of the Bylaws, while also taking into account best remuneration practices and recommendations, both local and international.

The Policy distinguishes between the remuneration system applicable to the directors in their capacity as such (non-executive directors) and that applicable to executive directors (those who perform management duties at the Institution), and contains various measures to promote prudent management of risks and align remuneration with the long-term interests of the Institution.

3.1. Decision-making process for approval of the Policy

In accordance with the Regulations of the Board of Directors of BBVA, one of the Board’s functions is to approve the directors’ remuneration policy so that it may be submitted to the General Shareholders’ Meeting.

Meanwhile, the Remuneration Committee assists the Board in matters of remuneration, and is responsible for proposing to the Board of Directors, for its submission to the General Shareholders’ Meeting, the director’s remuneration policy, together with its corresponding report.

In addition, as part of the decision-making process in remuneration matters, the Remuneration Committee works alongside the Risk and Compliance Committee, which is also involved in establishing the remuneration policy to ensure that it is consistent with sound and effective risk management and does not provide incentives for risk-taking that exceeds the level tolerated by the Institution.

Moreover, the Remuneration Committee is also tasked with ensuring compliance with the remuneration policies established by the Company and reviewing them periodically, proposing, where appropriate, any modifications that it deems necessary to ensure, inter alia, that they are adequate for the purposes of attracting and retaining the best talent, that they contribute to the creation of long-term value and adequate risk management and control, and that they address the principle of equal pay.

In 2021, new regulations governing remuneration that came into force during the financial year, together with developments in market practice, the outcome of dialogue between BBVA and its investors and the very nature of the Bank’s Corporate Governance System, led the Remuneration Committee to review the directors’ remuneration policy and the remuneration system as a whole.

5www.bbva.com

| This English version is a translation of the original in Spanish for information purposes only. In case of discrepancy the original in Spanish shall prevail. | ||

Annual Report on the Remuneration of BBVA Directors - 2022 | 15 | |

To this end, the Remuneration Committee was assisted by the Bank’s internal services and also relied on the independent advice of two leading firms on the remuneration of directors and senior managers, namely: WTW, with respect to market analysis and peer comparisons, and J&A Garrigues, S.L.P., with respect to legal analysis of the Policy.

In the establishment of the Policy, the Remuneration Committee analysed the remuneration payable by the main comparable financial institutions in BBVA’s peer group for remuneration purposes to individuals holding similar positions, as well as market practice in relation to variable remuneration models in the case of the Chair and the Chief Executive Officer.

Lastly, pursuant to Articles 511 bis and 529 novodecies of the Spanish Corporate Enterprises Act, the Directors’ Remuneration Policy applicable in 2021, 2022 and 2023 financial years was submitted, as a separate item on the agenda, for the approval of the Bank’s General Shareholders’ Meeting held on 20 April 2021, which approved it with a majority vote in favour (93.59%).

As part of the governance and supervision model of the Policy, the Remuneration Committee is empowered to propose to the Board of Directors for approval or, where applicable, submission to the General Meeting where required by law, the implementation of all amendments or derogations to the Policy that may be necessary during its term.

The BBVA Directors’ Remuneration Policy in force for the 2022 financial year is available on the Bank’s website: www.bbva.com.

| This English version is a translation of the original in Spanish for information purposes only. In case of discrepancy the original in Spanish shall prevail. | ||

Annual Report on the Remuneration of BBVA Directors - 2022 | 16 | |

3.2. Remuneration system for non-executive directors 2022

In accordance with Article 33º bis of the Bylaws, the remuneration system for non-executive directors is based on the criteria of responsibility, dedication and incompatibilities inherent to the role they undertake, and consists of fixed remuneration only, comprising the following items:

| Item | Payment | Other characteristics | ||

| Annual fixed allowance | Monthly and in cash for the position of member of the Board and of the different committees and, if so, for the performance of other duties (such as the position of Lead Director or Deputy Chair) | Overall limit approved by the General Meeting: EUR 6 million per year | ||

| Remuneration in kind | The Bank pays the corresponding premiums (healthcare and accident insurance policies) that are allocated to the directors as remuneration in kind | See amounts for 2022 in section 4.2. A and B below | ||

| Fixed remuneration system with deferred delivery of BBVA shares | Annual allocation of a number of theoretical shares of BBVA, with effective delivery after the director ceases to hold such office for any reason other than a serious dereliction of duties | Allocation equal to 20% of the annual fixed allowance in cash received during the previous financial year | ||

Amounts corresponding to the annual fixed allowance approved by the Board of Directors

| Role | EUR thousand | |

Member of the Board of Directors | 129 | |

Member of the Executive Committee | 167 | |

Chair of the Audit Committee | 165 | |

Member of the Audit Committee | 66 | |

Chair of the Risk and Compliance Committee | 214 | |

Member of the Risk and Compliance Committee | 107 | |

Chair of the Remuneration Committee | 107 | |

Member of the Remuneration Committee | 43 | |

Chair of the Appointments and Corporate Governance Committee | 115 | |

Member of the Appointments and Corporate Governance Committee | 46 | |

Chair of the Technology and Cybersecurity Committee* | 107 | |

Member of the Technology and Cybersecurity Committee | 43 | |

Deputy Chair | 50 | |

Lead Director | 80 | |

*At the date of this Report, the position of Chair of the Technology and Cybersecurity Committee is not remunerated as the Chair of the Board of Directors holds this position.

These amounts were approved by the Board of Directors on 29 May 2019, on the proposal of the Remuneration Committee, following analysis of the corresponding market comparisons. Without prejudice to the reallocation of amounts to adapt them to the functions of each Committee/position, no increases have taken place since 2007.

| This English version is a translation of the original in Spanish for information purposes only. In case of discrepancy the original in Spanish shall prevail. | ||

Annual Report on the Remuneration of BBVA Directors - 2022 | 17 | |

3.3. Remuneration system for executive directors 2022

Executive directors have their own remuneration system that is defined in accordance with best market practices. Its items are set out in Article 50º bis of the Bylaws and are the same as those that are generally applicable to BBVA Senior Management.

| 3.3.1. | Items of the remuneration system for executive directors 2022 |

| Item | Allocation criteria | Payment | Reference / Amount | Adjustments / Condition | ||||

| Annual Fixed Remuneration (“AFR”) | • Assigned duties and level of responsibility

• Competitive in the market | In cash, monthly payments | Chair (Carlos Torres Vila): EUR 2,924 thousand CEO (Onur Genç): EUR 2,179 thousand | N/A | ||||

| Remuneration in kind | In line with that granted to Senior Management | Allowances and premiums or payments made by the Bank and allocated as remuneration in kind | See breakdown of amounts for 2022 in section 4.3. A. b) | N/A | ||||

| Contribution to pension systems | As per contract and Policy (contingencies of retirement, death and disability) | At the time of the contingency (in the form of income or capital in the case of the retirement pension) | Chair: Annual contribution to the pension of EUR 439 thousand, plus premiums for death and disability coverage

See breakdown of amounts for premiums in 2022 in section 4.3. A c) | Terms set forth in his contract and, in any case, provided that he is not removed from office due to serious dereliction of duties | ||||

CEO: No retirement pension. The Bank pays premiums for death and disability insurance

See breakdown of amounts for premiums in 2022 in section 4.3. A c) | Terms set forth in his contract. | |||||||

| Other fixed allowances | As per contract and Policy | Monthly payment | CEO: cash in lieu of pension (30% of AFR) and mobility allowance (EUR 600 thousand) | N/A | ||||

| Annual Variable Remuneration (“AVR”) | Annual award based on the results of Annual Performance Indicators (financial and non-financial), as per the pre-established targets, scales of achievement and weightings, which will be equal to the Target AVR if 100% of the targets set are achieved | In cash and shares (more than 50% in shares)

40% upfront and 60% deferred over 5 years, subject to ex post adjustments | Chair Target AVR: EUR 3,572 thousand CEO Target AVR: EUR 2,672 thousand

• Scales of achievement limited to 150% of Target AVR

• Maximum of 200% of fixed remuneration, as resolved by the General Meeting

See breakdown of the amount of the AVR for 2022 in section 4.3. B a) | • Ex post adjustments: possible downward adjustment of Deferred AVR pursuant to the result of Muti-year Performance Indicators

• Malus and clawback arrangements for 100% of the AVR

• One-year retention of shares delivered | ||||

| Non-compete arrangement | As per contract and Policy | Monthly payment during the non-compete period, after the executive director ceases to hold such office | 2 times the AFR (one for each year of the term of the arrangement) | Terms set forth in their contracts and provided that termination of office is not due to retirement, disability or serious dereliction of duties | ||||

| This English version is a translation of the original in Spanish for information purposes only. In case of discrepancy the original in Spanish shall prevail. | ||

Annual Report on the Remuneration of BBVA Directors - 2022 | 18 | |

In addition, in the same way as for the other members of the Identified Staff, the Policy establishes that fixed and variable components must be appropriately balanced in the total remuneration of executive directors.

To this end, the Directors’ Remuneration Policy establishes the theoretical relative proportion between the main fixed and variable components of the remuneration of BBVA’s executive directors (“target ratios”), that take into account both the role carried out by executive directors and their impact on the risk profile of the Group, and are aligned with the proportions for this ratio generally established for the rest of the members of the Identified Staff:

| Executive director | Annual Fixed Remuneration | Target Annual Variable Remuneration | ||

| Chair | 45% | 55% | ||

| CEO | 45% | 55% | ||

The Annual Variable Remuneration that is awarded to each executive director in each financial year shall be calculated in accordance with the rules set out in the Policy for this purposes and shall be subject to the same vesting and payment rules applicable to the Annual Variable Remuneration of the Identified Staff described in section 2.2. above, albeit with certain specificities due to their status as directors. Thus, in order to align remuneration with effective risk management:

● The Upfront Portion (40%) of the AVR will vest and be paid, if the relevant conditions are met, in the first quarter of the financial year, while the remaining 60% will be deferred over a period of 5 years — the Deferred Portion — and will be paid, if the relevant conditions are met, after each of the 5 years of deferral, in an amount equal to 20% of the Deferred AVR each year.

● The Upfront Portion of the AVR will be paid in equal parts cash and BBVA shares, while 60% of the Deferred Portion will be paid in BBVA shares and the remaining 40% will be paid in cash.

● The Deferred Portion of the AVR may be reduced, but never increased, based on the results of pre-established Multi-year Performance Indicators.

The Multi-year Performance Indicators, which relate to solvency, liquidity, profitability and the creation of value, help to ensure that the remuneration system for executive directors is consistent with the Group’s risk strategy and long-term performance. Following the end of the third year of deferral, the results of the Multi-year Performance Indicators will determine whether any potential ex post downward adjustments need to be made to the Deferred Portion of the AVR that remains outstanding.

● Moreover, the full amount of the Annual Variable Remuneration for executive directors (both the part in cash and the part in shares) will be subject to malus and clawback arrangements on the same terms as those applicable to the rest of the Identified Staff.

The malus and clawback arrangements will be triggered in the event of a downturn in the financial performance of the Bank as a whole, or of a particular unit or area thereof, or of the exposures generated by an executive director, when such downturn in financial performance arises from a set of circumstances set out in the Policy. In addition, such clauses may also be triggered in the event that any such circumstances cause significant reputational damage to the Bank, regardless of the financial impact caused.

● The BBVA shares delivered as Annual Variable Remuneration, both for the Upfront Portion and the Deferred Portion, shall be withheld for a one-year period following their delivery. The foregoing shall not apply to those shares the sale of which may be required in order to honour the payment of taxes accruing on delivery.

|

| This English version is a translation of the original in Spanish for information purposes only. In case of discrepancy the original in Spanish shall prevail. | ||

Annual Report on the Remuneration of BBVA Directors - 2022 | 19 | |

| ● | The use of personal hedging strategies and insurance relating to variable remuneration and liability that could undermine the effects of alignment with prudent risk management is prohibited. |

| ● | The variable component of the remuneration for a financial year shall be limited to a maximum amount of 100% of the fixed component of total remuneration, unless the BBVA General Shareholders’ Meeting resolves to increase this percentage, up to a maximum of 200%, all in accordance with the procedure and requirements set forth in applicable law and regulations. |

The Policy also includes further restrictions on the transferability of shares derived from variable remuneration, in line with the provisions of Recommendation 62 of the CNMV’s Good Governance Code of Listed Companies.

Thus, executive directors may not transfer shares derived from the settlement of variable remuneration until a period of at least three years has elapsed, unless the director in question maintains, at the time of the transfer, through the ownership of shares, options or other financial instruments, a net economic exposure to the variation in the prices of the shares for a market value equal to at least twice his Annual Fixed Remuneration. The foregoing shall not apply to any shares that the director needs to dispose of in order to cover the costs associated with their acquisition or, subject to approval by the Remuneration Committee, in the event of extraordinary situations that require it.

The rules for the accrual, award, vesting and payment of the Annual Variable Remuneration of executive directors are illustrated in the figure provided below as an example, using financial year 2022 as a reference:

| This English version is a translation of the original in Spanish for information purposes only. In case of discrepancy the original in Spanish shall prevail. | ||

Annual Report on the Remuneration of BBVA Directors - 2022 | 20 | |

3.3.2. Main terms and conditions of the executive directors’ contracts

The remuneration, economic rights and compensation of each executive director are determined on the basis of their level of responsibility and the duties they perform, and are competitive in comparison to those of equivalent functions at the group of main peer institutions. These terms and conditions are reflected in their respective contracts, which are approved by the Board of Directors on the proposal of the Remuneration Committee.

Pursuant to the Policy, the main characteristics of the executive directors’ contracts are as follows:

| ● | They have an indefinite term. |

| ● | They do not establish any prior notice period, tenure or loyalty clauses. |

| ● | They include a post-contractual non-compete clause. |

| ● | They do not include commitments to make severance payments. |

| ● | They include a welfare portion, according to the individual circumstances of each executive director, including appropriate insurance and pension systems. |

Pension commitments undertaken in favour of the executive directors

The Bank has undertaken pension commitments to cover the contingency of retirement of the Chair. These commitments have the following main characteristics, in line with those undertaken for the other members of the Bank’s Senior Management:

| ● | They consist of defined-contribution systems whereby the annual pension contributions made to cover the contingency of retirement are established in advance (15% of the Annual Fixed Remuneration). |

| ● | They do not provide for the possibility of receiving the retirement pension in advance. |

| ● | They stipulate that 15% of the agreed annual contributions qualify as “discretionary pension benefits”, as set forth in applicable regulations, and therefore, they will be variable. |

The Bank has not undertaken any retirement commitments in favour of the Chief Executive Officer, instead paying him an annual sum in cash (“cash in lieu of pension”) equal to 30% of his Annual Fixed Remuneration.

In addition, the Bank has undertaken commitments in favour of both the Chair and the Chief Executive Officer to cover the contingencies of disability and death, on the terms set out below.

| This English version is a translation of the original in Spanish for information purposes only. In case of discrepancy the original in Spanish shall prevail. | ||

Annual Report on the Remuneration of BBVA Directors - 2022 | 21 | |

Commitments undertaken with the Chair

The Directors’ Remuneration Policy approved in 2021 and applicable throughout 2022 made the following significant changes to the Chair’s pension system:

| ● | Significant reduction in the annual contribution made to cover the contingency of retirement, which was reduced from EUR 1,642 thousand to EUR 439 thousand, thereby representing 15% of his Annual Fixed Remuneration. |

| ● | Reduction in coverage levels (% of AFR) for the contingencies of death and disability. |

Contingency of retirement

| ● | The Chair is entitled to a retirement pension upon reaching the retirement age established by law. The amount of this pension will be equal to the sum of the contributions made by the Bank and their corresponding yields up to that date. If the contractual relationship is terminated before he reaches retirement age for reasons other than serious dereliction of duties, he will remain entitled to the benefit, which will be calculated on the basis of all contributions made by the Bank up to that date plus the corresponding cumulative yield, without the Bank being required to make any additional contributions as of that date. |

| ● | The annual agreed contribution amounts to EUR 439 thousand (15% of his Annual Fixed Remuneration). |

| ● | Meanwhile, 15% of the annual contribution will be based on variable components and considered “discretionary pension benefits”, subject to the conditions on delivery in shares, retention and reduction and clawback established for this type of remuneration in the applicable law and regulations. |

| ● | The benefit may be received in the form of income or capital. |

| ● | Receipt of the benefit is conditional on his cessation of office not being due to a serious dereliction of duties. |

Contingency of disability or death

| ● | Death while serving in his role will entitle his widow to an annual widow’s pension and each of his children to an orphan’s pension, until they reach the age of 25, in an amount equal to 50% and 20% (40% in the case of full orphaning), respectively, of his Annual Fixed Remuneration. |

| ● | These pensions would be paid from the total fund accumulated for the retirement pension at that time, with the Bank assuming the amount of the corresponding annual insurance premiums to complete the benefit coverage. The cumulative benefits of the widow’s and orphan’s pension may not exceed 150% of the Annual Fixed Remuneration. |

| ● | In the event of total or absolute permanent disability while in office, he will be entitled to receive an annual pension equal to 60% of his Annual Fixed Remuneration. |

| ● | Payment of this pension shall be made, firstly, from the total fund accumulated for the retirement pension at that time, with the Bank assuming the corresponding annual insurance premiums to top up the pension coverage. |

| ● | In the event of death while in a situation of disability, his widow will be entitled to an annual widow’s pension and each of his children will be entitled to an annual orphan’s pension until they reach the age of 25, for an amount equivalent to 85% and 35% (40% in the event of total orphaning), respectively, of the disability pension that the deceased was receiving at that time. Such reversion will be in any case limited to 150% of the disability pension itself. |

| This English version is a translation of the original in Spanish for information purposes only. In case of discrepancy the original in Spanish shall prevail. | ||

Annual Report on the Remuneration of BBVA Directors - 2022 | 22 | |

Commitments undertaken with the Chief Executive Officer

The Bank has not undertaken any retirement commitments in favour of the Chief Executive Officer, although his contract gives him the right to receive an annual sum in cash (cash in lieu of pension) in an amount equal to 30% of his Annual Fixed Remuneration.

Contingency of disability or death

|

● In the event of death while in office, his widow will be entitled to an annual widow’s pension and each of his children will be entitled to an annual orphan’s pension until they reach the age of 25, for an amount equivalent to 50% and 20% (30% in the event of total orphaning), respectively, of the Annual Fixed Remuneration of the previous 12 months, with the Bank assuming the corresponding annual insurance premiums to guarantee the benefit coverage. The cumulative benefits of the widow’s and orphan’s pension may not exceed 100% of the Annual Fixed Remuneration for the previous 12 months.

|

● In the event of total or absolute permanent disability while in office, he will be entitled to receive an annual pension in an amount equal to 62% of his Annual Fixed Remuneration for the previous 12 months. This pension will revert to his spouse and children in the event of death in the percentages cited above but shall be limited in all cases to 100% of the disability pension, with the Bank assuming the amount of the corresponding annual insurance premiums to guarantee the benefit coverage.

|

Other terms and conditions of the executive directors’ contracts

| ● | Additional allowance to the Chief Executive Officer’s fixed remuneration |

In view of his status as an international senior executive, the Chief Executive Officer’s contract provides that he is entitled to an annual cash sum as a mobility allowance, in line with any commitments that may be made in favour of other expatriate members of Senior Management. This allowance amounts to EUR 600 thousand per year.

| ● | Post-contractual non-compete arrangements |

Lastly, the executive directors’ contracts also include a post-contractual non-compete arrangement running for two years from the time they cease to serve as BBVA executive directors. As consideration, the executive directors will receive compensation, payable monthly, in an amount equal to their Annual Fixed Remuneration for each year in which the non-compete arrangement remains in effect, provided that their cessation as executive directors is not due to their retirement, disability or serious dereliction of duties.

| ● | Termination of the contractual relationship |

The contracts of executive directors do not include the right to a severance payment in the event of termination of their contractual relationship.

| This English version is a translation of the original in Spanish for information purposes only. In case of discrepancy the original in Spanish shall prevail. | ||

Annual Report on the Remuneration of BBVA Directors - 2022 | 23 | |

| 4. | Result of the implementation of the Policy in 2022 |

The Directors’ Remuneration Policy in effect during the financial year last ended (2022) was approved at the Bank’s Annual General Shareholders’ Meeting held on 20 April 2021. The outline and main characteristics of the Policy have been set forth in section 3 above.

The way in which the Policy was implemented in 2022 is detailed below, following the procedure established for this purpose in the Policy itself and in the Regulations of the Board of Directors and the Remuneration Committee. No deviations from the same occurred during the financial year. No temporary derogations were made to the Policy either, in accordance with the procedure set forth therein, given the absence of any circumstances that would advise or justify this.

The process followed to implement the Directors’ Remuneration Policy and to determine the individual remuneration of directors was led and overseen directly by the Remuneration Committee. During the 2022 financial year, this Committee took the actions detailed below, among others, submitting to the Board of Directors the corresponding resolution proposals as and when necessary.

4.1. Activity of the Corporate Bodies in 2022

Implementation, supervision and monitoring of the Directors’ Remuneration Policy

During the 2022 financial year, the Remuneration Committee and the Board of Directors have carried out the necessary actions to implement, supervise and monitor the provisions of the Directors’ Remuneration Policy.

To this end, the Board of Directors has analysed the remuneration matters pertaining to directors, approving the following resolutions, in accordance with the proposals submitted, in each case, by the Remuneration Committee and based on the prior analysis, discussion and interaction carried out by this Committee with the executive level:

● Remuneration matters for non-executive directors |

Pursuant to the Bylaws framework and the Directors’ Remuneration Policy, in accordance with the fixed remuneration system with deferred delivery of shares applicable to non-executive directors, the Board of Directors approved the allocation of a number of theoretical shares to each non-executive director beneficiary of the system, with this allocation corresponding to 20% of the annual fixed allowance in cash received in the previous financial year. The Board of Directors also approved, under this same system, the settlement and delivery to the non-executive director who left office on 18 March 2022, of the total theoretical shares he had accumulated up to that date under the system. |

● Remuneration matters for executive directors |

With regard to the remuneration of executive directors, the Board of Directors, on the proposal of the Remuneration Committee: |

● Approved the award of the executive directors’ AVR for 2021, in view of the results of the pre-defined Annual Performance Indicators and in accordance with the corresponding targets, scales of achievement and weightings approved by the Board of Directors at the time, as well as payment of the Upfront Portion of the AVR for 2021, which was payable in 2022. |

| This English version is a translation of the original in Spanish for information purposes only. In case of discrepancy the original in Spanish shall prevail. | ||

Annual Report on the Remuneration of BBVA Directors - 2022 | 24 | |

● Approved the thresholds and scales of achievement associated with the Multi-year Performance Indicators for the 2021 Deferred AVR of the executive directors, as well as the comparison group for measuring the Total Shareholder Return (“TSR”) indicator.

● Approved the amount of the executive directors’ Deferred AVR for 2018, in view of the results of the pre-defined Multi-year Performance Indicators and in accordance with the corresponding targets, scales of achievement and weightings approved by the Board of Directors at the time.

● Approved the payment to the executive directors of the Deferred AVR for the 2018 financial year and to the Chair of the Deferred AVR for the 2017 financial year that corresponded in 2022 in accordance with the remuneration policies applicable in those years to each of them, once the Audit Committee and the Appointments and Corporate Governance Committee, within the scope of their respective powers and the Board itself, verified that the malus clause provided for in the applicable remuneration policies did not apply. It also determined the amount corresponding to the update of the cash portion of such remunerations payable in 2022.

● Approved the minimum thresholds for Attributable Profit and the Capital Ratio to accrue the 2022 AVR of executive directors, in line with those applied for the rest of the BBVA staff.

● Approved the Annual Performance Indicators for the 2022 AVR and their respective weightings, as well as the Multi-year Performance Indicators corresponding to the Deferred Portion of the 2022 AVR and its weightings, with the prior analysis of the Risk and Compliance Committee in the case of the latter, which are also applicable to the rest of the Identified Staff, including Senior Management members.

● Approved the targets and scales of achievement associated with the Annual Performance Indicators for the 2022 AVR of the executive directors.

● Supervision of the implementation of the remuneration policies

In addition, following an analysis by the Remuneration Committee, the Board of Directors also analysed the result of the internal, central and independent assessment carried out by the Internal Audit area on the implementation of the BBVA Directors’ Remuneration Policy and the BBVA Group’s General Remuneration Policy during financial year 2021.

● Information on the identification process of the Identified Staff