- BBVA Dashboard

- Financials

- Filings

- Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

6-K Filing

Banco Bilbao Vizcaya Argentaria (BBVA) 6-KCurrent report (foreign)

Filed: 30 Jan 24, 10:54am

UNITED STATES SECURITIES AND EXCHANGE

COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of January, 2024

Commission file number: 1-10110

BANCO BILBAO VIZCAYA ARGENTARIA, S.A.

(Exact name of Registrant as specified in its charter)

BANK BILBAO VIZCAYA ARGENTARIA, S.A.

(Translation of Registrant’s name into English)

Calle Azul 4,

28050 Madrid

Spain

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F X Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes No X

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes No X

|

Main data

| BBVA GROUP MAIN DATA (CONSOLIDATED FIGURES) | ||||||||||||||||||||||||||||

| 31-12-23 | Δ % | 31-12-22 | 31-12-21 | |||||||||||||||||||||||||

| Balance sheet (millions of euros) (1) | ||||||||||||||||||||||||||||

| Total assets | 775,558 | 8.9 | 712,092 | 662,885 | ||||||||||||||||||||||||

| Loans and advances to customers (gross) | 388,912 | 5.5 | 368,588 | 330,055 | ||||||||||||||||||||||||

| Deposits from customers | 413,487 | 4.8 | 394,404 | 349,761 | ||||||||||||||||||||||||

| Total customer funds | 577,853 | 6.1 | 544,576 | 496,954 | ||||||||||||||||||||||||

| Total equity | 55,265 | 9.4 | 50,517 | 48,760 | ||||||||||||||||||||||||

| Income statement (millions of euros) (1) | ||||||||||||||||||||||||||||

| Net interest income | 23,089 | 20.7 | 19,124 | 14,686 | ||||||||||||||||||||||||

| Gross income | 29,542 | 19.4 | 24,743 | 21,066 | ||||||||||||||||||||||||

| Operating income | 17,233 | 22.7 | 14,042 | 11,536 | ||||||||||||||||||||||||

| Net attributable profit (loss) | 8,019 | 26.1 | 6,358 | 4,653 | ||||||||||||||||||||||||

| Net attributable profit (loss) excluding non-recurring impacts (1)(2) | 8,019 | 22.3 | 6,559 | 5,069 | ||||||||||||||||||||||||

| The BBVA share and share performance ratios | ||||||||||||||||||||||||||||

| Number of shares outstanding (million) | 5,838 | (3.2) | 6,030 | 6,668 | ||||||||||||||||||||||||

| Share price (euros) | 8.23 | 46.0 | 5.63 | 5.25 | ||||||||||||||||||||||||

| Adjusted earning (loss) per share (euros) (1)(2) | 1.32 | 26.8 | 1.04 | 0.71 | ||||||||||||||||||||||||

| Earning (loss) per share (euros) (1)(2) | 1.29 | 32.0 | 0.98 | 0.67 | ||||||||||||||||||||||||

| Book value per share (euros) (1)(2) | 8.86 | 13.9 | 7.78 | 6.86 | ||||||||||||||||||||||||

| Tangible book value per share (euros) (1)(2) | 8.46 | 13.9 | 7.43 | 6.52 | ||||||||||||||||||||||||

| Market capitalization (millions of euros) | 48,023 | 41.4 | 33,974 | 35,006 | ||||||||||||||||||||||||

| Dividend yield (dividend/price; %) (2)(3) | 5.7 | 6.2 | 2.6 | |||||||||||||||||||||||||

| Significant ratios (%) | ||||||||||||||||||||||||||||

Adjusted ROE (net attributable profit (loss)/average shareholders’ funds +/- average accumulated other comprehensive income) (1)(2) | 16.2 | 14.4 | 11.4 | |||||||||||||||||||||||||

Adjusted ROTE (net attributable profit (loss)/average shareholders’ funds excluding average intangible assets +/- average accumulated other comprehensive income) (1)(2) | 17.0 | 15.1 | 12.0 | |||||||||||||||||||||||||

| Adjusted ROA (profit (loss) for the period / average total assets - ATA) (1)(2) | 1.12 | 0.99 | 0.94 | |||||||||||||||||||||||||

| Adjusted RORWA (profit (loss) for the period / average risk-weighted assets - RWA) (1)(2) | 2.38 | 2.12 | 2.01 | |||||||||||||||||||||||||

| Efficiency ratio (1)(2) | 41.7 | 43.2 | 45.2 | |||||||||||||||||||||||||

| Cost of risk (1)(2) | 1.15 | 0.91 | 0.93 | |||||||||||||||||||||||||

| NPL ratio (1)(2) | 3.4 | 3.4 | 4.1 | |||||||||||||||||||||||||

| NPL coverage ratio (2) | 77 | 81 | 75 | |||||||||||||||||||||||||

| Capital adequacy ratios (%) | ||||||||||||||||||||||||||||

| CET1 fully-loaded | 12.67 | 12.61 | 12.75 | |||||||||||||||||||||||||

| CET1 phased-in (4) | 12.67 | 12.68 | 12.98 | |||||||||||||||||||||||||

| Total ratio phased-in (4) | 16.58 | 15.98 | 17.24 | |||||||||||||||||||||||||

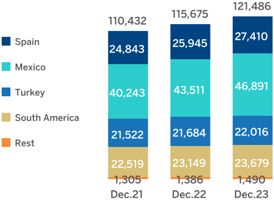

| Other information | ||||||||||||||||||||||||||||

| Number of active customers (million) | 71.5 | 6.3 | 67.3 | 60.8 | ||||||||||||||||||||||||

| Number of shareholders (5) | 742,194 | (7.4) | 801,216 | 826,835 | ||||||||||||||||||||||||

| Number of employees | 121,486 | 5.0 | 115,675 | 110,432 | ||||||||||||||||||||||||

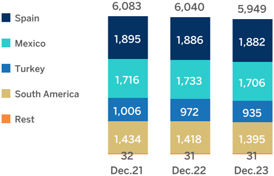

| Number of branches | 5,949 | (1.5) | 6,040 | 6,083 | ||||||||||||||||||||||||

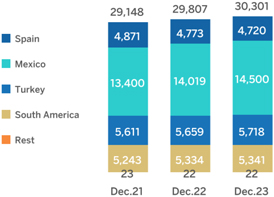

| Number of ATMs | 30,301 | 1.7 | 29,807 | 29,148 | ||||||||||||||||||||||||

(1) Balances as of 31-12-2022 restated according to IFRS 17 - Insurance contracts.

(2) For more information, see Alternative Performance Measures at the end of this report.

(3) Calculated by dividing the dividends paid in the last twelve months by the closing price of the period.

(4) Phased-in ratios include the temporary treatment on the impact of IFRS 9, calculated in accordance with Article 473 bis amendments of the Capital Requirements Regulation (CRR), introduced by the Regulation (EU) 2020/873. As of December 31, 2023, there are no differences between phased-in and fully-loaded ratios due to the aforementioned temporary treatment.

(5) See the footnote of the shareholder structure table in the Solvency chapter of this report.

| 4 | ||||

| 6 | ||||

| 7 | ||||

| 7 | ||||

| 13 | ||||

| 15 | ||||

| 18 | ||||

| 24 | ||||

| 27 | ||||

| 30 | ||||

| 34 | ||||

| 38 | ||||

| 43 | ||||

| 46 | ||||

| 47 | ||||

| 50 | ||||

| 62 | ||||

| 4 |

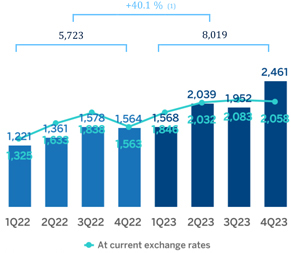

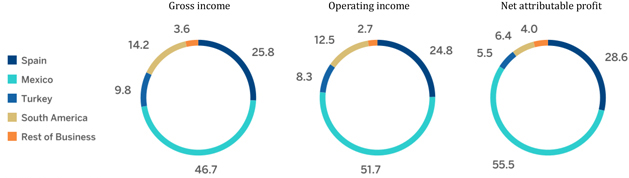

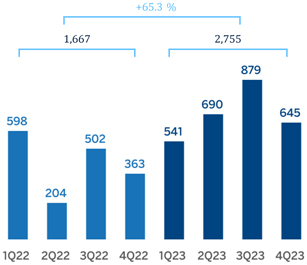

Results and business activity

The BBVA Group generated a net attributable profit of €8,019m between January and December of 2023, boosted by the performance of recurring income of the banking business, mainly the net interest income. This result means an increase of 22.3% compared to the previous year, excluding the net impact arisen from the purchase of offices in Spain in 2022 from the comparison.

These results include the recording for the total annual amount paid for the temporary tax on credit institutions and financial credit institutions for €215m, included in the other operating income and expenses line of the income statement.

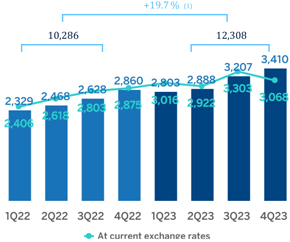

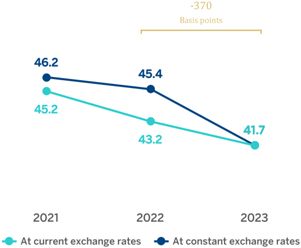

Operating expenses increased by 19.7% at Group level at constant exchange rates, largely impacted by the inflation rates observed in the countries in which the Group operates. Thanks to the remarkable growth in gross income (+30.3%), higher than the growth in expenses, the efficiency ratio stood at 41.7% as of December 31, 2023, with an improvement of 370 basis points, in constant terms, compared to the ratio recorded 12 months earlier.

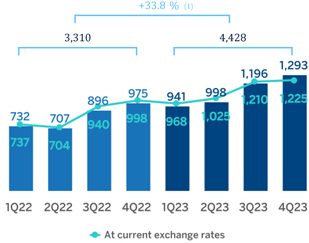

The provisions for impairment on financial assets increased (+33.8% in year-on-year terms and at constant exchange rates), with lower requirements in Turkey, which were offset by higher provisioning needs, mainly in Mexico and South America, in a context of rising interest rates and growth in the most profitable segments, in line with the Group’s strategy.

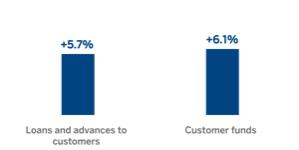

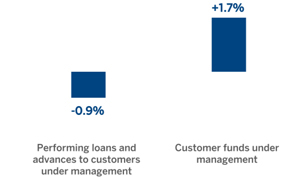

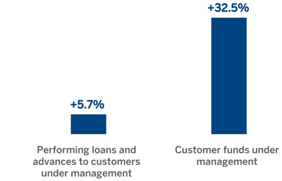

Loans and advances to customers recorded an increase of 5.7% compared to the end of December 2022, strongly favored by the evolution of retail loans (+7.2% at Group level).

Customer funds increased by 6.1% compared to the end of the previous year, thanks to both the growth in deposits from customers, which increased by 4.8% and to the increase in off-balance sheet funds, which grew by 9.5%.

LOANS AND ADVANCES TO CUSTOMERS AND TOTAL CUSTOMER FUNDS (VARIATION COMPARED TO 31-12-2022)

|

Business areas

As for the business areas evolution, excluding the effect of currency fluctuation in those areas where it has an impact, in each of them it is worth mentioning:

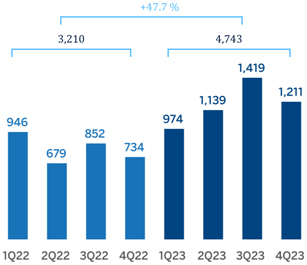

| – | Spain generated a net attributable profit of €2,755m in 2023, 65.3% higher than in the previous year, which included the net impact arisen from the purchase of offices to Merlin (-201 millions of euros). In 2023, the favorable evolution of the net interest income stands out, which continued to boost the gross income growth despite including the total annual amount paid for the temporary tax on credit institutions and financial credit institutions. |

| – | In Mexico, BBVA achieved a cumulative net attributable profit of €5,340m by the end of December 2023, representing an increase of 17.1% compared to the 2022, mainly as a result of the significant growth in net interest income, thanks to the strong boost of the activity and the improvement in the customer spread. |

| – | Turkey generated a net attributable profit of €528m during 2023, which compares positively with the accumulated result reached at the end of December 2022, both periods reflecting the impact of the application of hyperinflation accounting. |

| – | South America generated a cumulative net attributable profit of €613m at the end of the year 2023, which represents a year-on-year increase of +43.2%, driven by the good performance of recurring income (41.4%) and the area’s NTI (net trading income). |

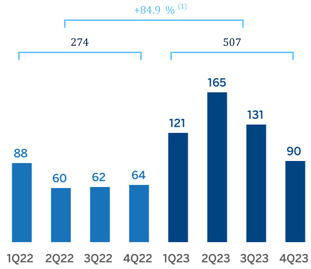

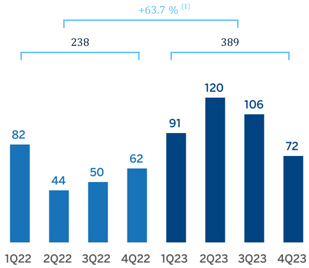

| – | Rest of Business achieved an accumulated net attributable profit of €389m during 2023, 63.7% higher than in the previous year, thanks to a favorable performance of the net interest income, and the NTI. |

The Corporate Center recorded 2023a net attributable profit of €-1,607m between January and December of 2023, compared with €-922m recorded on the same period of the previous year, mainly due to a negative contribution in the NTI line from exchange rate hedges as a result of a better than expected currency performance, in particular, the Mexican peso during the first half of the year.

Translation of this report originally issued in Spanish. In the event of a discrepancy, the Spanish-language version prevails.

| 5 |

Lastly, and for a broader understanding of the Group’s activity and results, supplementary information is provided below for the wholesale business carried out by BBVA, Corporate & Investment Banking (CIB), in the countries where it operates. CIB generated a net attributable profit of €2,253m between January and December of 2023. These results, which do not include the application of hyperinflation accounting, represent an increase of 44.5% on a year-on-year basis and reflect the contribution of the diversification of products and geographical areas, as well as the progress of the Group’s wholesale businesses in its strategy, leveraged on globality and sustainability, with the purpose of being relevant to its clients.

NET ATTRIBUTABLE PROFIT (LOSS) (MILLIONS OF EUROS) |

NET ATTRIBUTABLE PROFIT BREAKDOWN (1) (PERCENTAGE. 2023) | |||

|

| |||

General note: 2022 excludes net impact arisen from the purchase of offices in Spain. |

(1) Excludes the Corporate Center. |

Solvency

The Group’s CET1 fully-loaded ratio stood at 12.67% as of December 31, 2023, which allows to keep maintaining a large management buffer over the Group’s CET1 requirement (8.78%)1 and above the Group’s established target management range of 11.5-12.0% of CET1.

Shareholder remuneration

Regarding shareholder remuneration, a cash gross distribution in the amount of €0.39 per share on April as final dividend of 2023 and the execution of a new Share Buyback Program of BBVA for an amount of €781m, subject to the corresponding regulatory authorizations and the communication with the program specific terms and conditions before its effective start, are expected to be submitted to the relevant governing bodies for consideration. Thus, the total distribution for the year 2023 will reach €4,010m, a 50% of the net attributable profit, which represents €0.68 gross per share, taking into account the payment in cash of €0.16 gross per share paid in October 2023 as interim dividend of the year.

1 This includes the update of the countercyclical capital buffer calculated on the basis of exposure at end September 2023.

Translation of this report originally issued in Spanish. In the event of a discrepancy, the Spanish-language version prevails.

| 6 |

Economic global growth has slowed down through 2023 and, particularly, during the last months, due to the high inflation, the tightening of monetary conditions and the gradual fading of the positive effects linked to the reopening after the COVID-19 pandemic. The slowdown has been, in general, less harsh than expected, and economic activity remains relatively dynamic, particularly in the Unites States, thanks to the dynamism of the labor markets, expansionary fiscal policies and the gradual fading of supply shocks triggered by the pandemic and the war in Ukraine.

Falling commodity prices compared to the levels seen in 2022 and the improvements in production process bottlenecks have contributed to a significant moderation of inflation. which, in annual terms, reached 3.4% in the United States and 2.9% in the Eurozone in December 2023, far below the levels registered at the end of 2022 (6.5% in the United States and 9.2% in the Eurozone).

In this context, the process of interest rate hikes launched approximately two years ago seems to have reached an end. According to BBVA Research, it is most likely that inflation will keep evolving favorably in the next months, enabling the start of a gradual process of relaxation of monetary conditions around mid-2024, which would take monetary policy interest rates to around 4.50% in the United States and 3.75% (in the case of refinancing operation rates) in the Eurozone by the end of 2024. However, it cannot be ruled out that monetary policy benchmark rates might be reduced more quickly in the future, mainly if inflation evolves surprisingly on the downside. In any case, it is expected that both the U.S. Federal Reserve (“Fed”) and the European Central Bank (“ECB”) will continue taking liquidity reduction measures over 2024.

BBVA Research forecasts that global growth will be approximately 3.0% in 2024 (unchanged from the previous forecast and similar to the forecasted for the GDP growth in 2023) In the United States, strong domestic demand supports a slightly upward revision of growth forecasts for 2023, from 2.3% to 2.4%, but the restrictive monetary conditions are likely to contribute to a growth deceleration in 2024, to 1.5%, without changes from the previous forecast. In China, structural challenges to avoid a fast economic deceleration remain, but a series of stimulus measures have enabled a greater than expected dynamism of activity in the past few months, which supports an upward revision of the growth in 2023 from 4.8% to 5.2%. The GDP growth forecast for 2024 remains unchanged at 4.4%. In the Eurozone, economic activity came to a standstill in the last months, reinforcing the low growth prospects; the forecast of the GDP expansion of the region remains at 0.4% for 2023 and it has been cut from 1.0% to 0.7% for 2024.

In this context of below potential growth and still high interest rates, aggregate demand moderation will probably favor an additional inflation reduction, which, however, would remain somewhat over the inflation targets in the United States and the Eurozone until the end of 2024.

In any case, uncertainty remains high, and a number of factors could lead to more adverse scenarios unfolding. Persistently high inflation and high interest rates, due to eventual supply shocks generated by the current geopolitical turbulence, and particularly by the recent maritime trade disruptions in the Red Sea, or other factors, could trigger a deep and widespread recession, as well as new bouts of financial volatility. Moreover, the slowdown in China could end up being more severe than expected. Finally, current geopolitical turbulence might contribute to higher energy prices and new disruptions in global supply chains.

GDP GROWTH ESTIMATES IN 2023 (PERCENTAGE. YEAR-ON-YEAR VARIATION) |

Source: BBVA Research estimates.

Translation of this report originally issued in Spanish. In the event of a discrepancy, the Spanish-language version prevails.

| 7 |

Unless expressly indicated otherwise, for a better understanding of the changes under the main headings of the Group’s income statement, the rates of change provided below refer to constant exchange rates. When comparing two dates or periods in this report, the impact of changes in the exchange rates against the euro of the currencies of the countries in which BBVA operates is sometimes excluded, assuming that exchange rates remain constant. For this purpose, the average exchange rate of the currency of each geographical area of the most recent period is used for both periods, except for those countries whose economies have been considered hyperinflationary, for which the closing exchange rate of the most recent period is used.

Quarterly evolution of results

The result achieved by the BBVA Group in the fourth quarter of 2023 was €2,058m, 26.1% above the previous quarter with the following trends standing out:

| – | In the recurring income, stability of net interest income (-0.1%) and good evolution of net fees and commissions (+10.8%). |

| – | Favorable evolution of NTI (+45.0%), with Mexico and South America standing out. |

| – | The results under the “Other operating income and expenses” line improved compared to the previous quarter, despite the contribution to the Deposit Guarantee Fund (FGD, for its acronym in Spanish) in Spain, mainly thanks to the lower hyperinflation adjustment in Turkey, whose quarterly inflation rate decreased considerably. |

| CONSOLIDATED INCOME STATEMENT: QUARTERLY EVOLUTION (MILLIONS OF EUROS) | ||||||||||||||||||||||||||||||||||

| 2023 | 2022 | |||||||||||||||||||||||||||||||||

| 4Q | 3Q | 2Q | 1Q | 4Q | 3Q | 2Q | 1Q | |||||||||||||||||||||||||||

Net interest income | 5,246 | 6,434 | 5,768 | 5,642 | 5,334 | 5,252 | 4,595 | 3,943 | ||||||||||||||||||||||||||

Net fees and commissions | 1,694 | 1,685 | 1,470 | 1,439 | 1,328 | 1,385 | 1,413 | 1,247 | ||||||||||||||||||||||||||

Net trading income | 753 | 658 | 334 | 438 | 269 | 573 | 516 | 580 | ||||||||||||||||||||||||||

Other operating income and expenses | (255) | (820) | (383) | (561) | (443) | (372) | (501) | (374) | ||||||||||||||||||||||||||

Gross income | 7,438 | 7,956 | 7,189 | 6,958 | 6,489 | 6,838 | 6,022 | 5,395 | ||||||||||||||||||||||||||

Operating expenses | (3,068) | (3,303) | (2,922) | (3,016) | (2,875) | (2,803) | (2,618) | (2,406) | ||||||||||||||||||||||||||

Personnel expenses | (1,693) | (1,756) | (1,530) | (1,551) | (1,547) | (1,471) | (1,344) | (1,238) | ||||||||||||||||||||||||||

Other administrative expenses | (1,025) | (1,169) | (1,054) | (1,127) | (990) | (993) | (935) | (855) | ||||||||||||||||||||||||||

Depreciation | (349) | (378) | (337) | (339) | (338) | (338) | (340) | (313) | ||||||||||||||||||||||||||

Operating income | 4,370 | 4,654 | 4,267 | 3,942 | 3,614 | 4,035 | 3,404 | 2,989 | ||||||||||||||||||||||||||

Impairment on financial assets not measured at fair value through profit or loss | (1,225) | (1,210) | (1,025) | (968) | (998) | (940) | (704) | (737) | ||||||||||||||||||||||||||

Provisions or reversal of provisions | (163) | (81) | (115) | (14) | (50) | (129) | (64) | (48) | ||||||||||||||||||||||||||

Other gains (losses) | (49) | 2 | 50 | (16) | (6) | 19 | (3) | 20 | ||||||||||||||||||||||||||

Profit (loss) before tax | 2,932 | 3,365 | 3,178 | 2,944 | 2,559 | 2,985 | 2,634 | 2,225 | ||||||||||||||||||||||||||

Income tax | (799) | (1,226) | (1,028) | (950) | (850) | (1,005) | (680) | (903) | ||||||||||||||||||||||||||

Profit (loss) for the period | 2,133 | 2,139 | 2,150 | 1,994 | 1,709 | 1,980 | 1,954 | 1,321 | ||||||||||||||||||||||||||

Non-controlling interests | (75) | (56) | (118) | (148) | (146) | (143) | (120) | 3 | ||||||||||||||||||||||||||

Net attributable profit (loss) excluding non-recurring impacts | 2,058 | 2,083 | 2,032 | 1,846 | 1,563 | 1,838 | 1,834 | 1,325 | ||||||||||||||||||||||||||

Discontinued operations and Other (1) | — | — | — | — | — | — | (201) | — | ||||||||||||||||||||||||||

Net attributable profit (loss) | 2,058 | 2,083 | 2,032 | 1,846 | 1,563 | 1,838 | 1,633 | 1,325 | ||||||||||||||||||||||||||

Adjusted earning (loss) per share (euros) (2) | 0.34 | 0.34 | 0.34 | 0.30 | 0.25 | 0.29 | 0.29 | 0.21 | ||||||||||||||||||||||||||

Earning (loss) per share (euros) (2) | 0.33 | 0.33 | 0.33 | 0.29 | 0.24 | 0.28 | 0.24 | 0.19 | ||||||||||||||||||||||||||

General note: 2022 figures have been restated according to IFRS 17 - Insurance contracts.

(1) Includes the net impact arisen from the purchase of offices in Spain in the second quarter of 2022 for €-201m.

(2) Adjusted by additional Tier 1 instrument remuneration. For more information, see Alternative Performance Measures at the end of this report.

Translation of this report originally issued in Spanish. In the event of a discrepancy, the Spanish-language version prevails.

| 8 |

Year-on-year performance of results

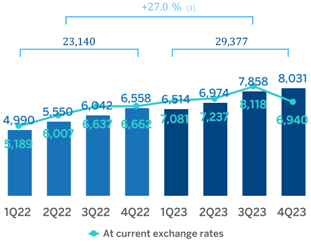

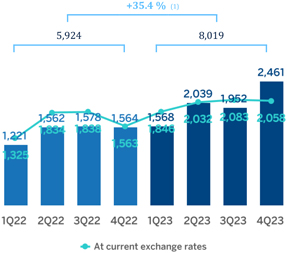

The BBVA Group generated a net attributable profit of €8,019m between January and December of 2023, boosted by the performance of recurring income of the banking business, mainly the net interest income, which grew at a rate of 28.6%. This result means an increase of 35.4% compared to the previous year, excluding the net impact arisen from the purchase of offices in Spain in 2022 from the comparison.

It should to be noted that 2023 results include the recording for the total annual amount paid for the temporary tax on credit institutions and financial credit institutions2 for €215m, included in the other operating income and expenses line of the income statement. The estimated impact corresponding to the year 2024 is €285 million and will be recorded on the first quarter of 2024 in such caption of the consolidated income statement.

CONSOLIDATED INCOME STATEMENT (MILLIONS OF EUROS)

| ||||||||||||||||

| Δ % at constant | ||||||||||||||||

| 2023 | Δ % | exchange rates | 2022 | |||||||||||||

Net interest income | 23,089 | 20.7 | 28.6 | 19,124 | ||||||||||||

Net fees and commissions | 6,288 | 17.0 | 21.3 | 5,372 | ||||||||||||

Net trading income | 2,183 | 12.6 | 31.8 | 1,938 | ||||||||||||

Other operating income and expenses | (2,018) | 19.4 | (4.9) | (1,691) | ||||||||||||

Gross income | 29,542 | 19.4 | 30.3 | 24,743 | ||||||||||||

Operating expenses | (12,308) | 15.0 | 19.7 | (10,701) | ||||||||||||

Personnel expenses | (6,530) | 16.6 | 22.2 | (5,601) | ||||||||||||

Other administrative expenses | (4,375) | 16.0 | 21.3 | (3,773) | ||||||||||||

Depreciation | (1,403) | 5.6 | 5.1 | (1,328) | ||||||||||||

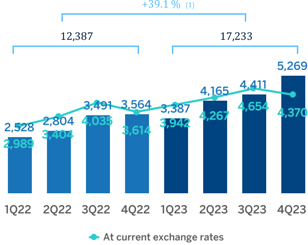

Operating income | 17,233 | 22.7 | 39.1 | 14,042 | ||||||||||||

Impairment on financial assets not measured at fair value through profit or loss | (4,428) | 31.1 | 33.8 | (3,379) | ||||||||||||

Provisions or reversal of provisions | (373) | 28.3 | 64.8 | (291) | ||||||||||||

Other gains (losses) | (13) | n.s. | n.s. | 30 | ||||||||||||

Profit (loss) before tax | 12,419 | 19.4 | 40.0 | 10,402 | ||||||||||||

Income tax | (4,003) | 16.4 | 33.0 | (3,438) | ||||||||||||

Profit (loss) for the period | 8,416 | 20.8 | 43.6 | 6,965 | ||||||||||||

Non-controlling interests | (397) | (2.1) | n.s. | (405) | ||||||||||||

Net attributable profit (loss) excluding non-recurring impacts | 8,019 | 22.3 | 35.4 | 6,559 | ||||||||||||

Discontinued operations and Other (1) | — | — | — | (201) | ||||||||||||

Net attributable profit (loss) | 8,019 | 26.1 | 40.1 | 6,358 | ||||||||||||

Adjusted earning (loss) per share (euros) (2) | 1.32 | 1.04 | ||||||||||||||

Earning (loss) per share (euros) (2) | 1.29 | 0.98 | ||||||||||||||

General note: 2022 figures have been restated according to IFRS 17 - Insurance contracts.

(1) Includes the net impact arisen from the purchase of offices in Spain in the second quarter of 2022 for €-201m.

(2) Adjusted by additional Tier 1 instrument remuneration. For more information, see Alternative Performance Measures at the end of this report.

The accumulated net interest income as of December 31, 2023 was higher than in the same period of the previous year (+28.6%), with increases in all business areas, with a customer spread improvement in the main areas and higher performing loan volumes. The good evolution in Spain, Mexico and South America is noteworthy.

Positive evolution in the net fees and commissions line, which increased by 21.3% year-on-year due to favorable performance in payment systems and, to a lesser extent, asset management. By business areas, Turkey´s and Mexico´s contribution stands out.

2 In compliance with Law 38/2022, of December 27, which establishes the obligation to pay a patrimonial benefit of a public and non-taxable nature during the years 2023 and 2024 for credit institutions that operate in Spanish territory whose sum of total interest income and fee and commission income corresponding to the year 2019 is equal to or greater than €800m.

Translation of this report originally issued in Spanish. In the event of a discrepancy, the Spanish-language version prevails.

| 9 |

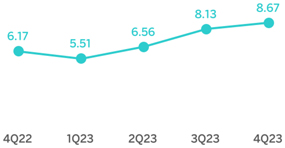

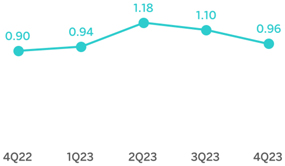

NET INTEREST INCOME / AVERAGE TOTAL ASSETS (PERCENTAGE AT CONSTANT EXCHANGE RATES) |

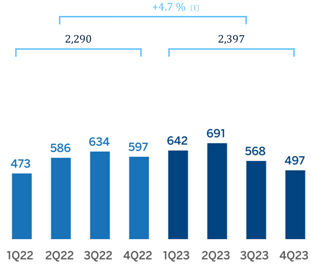

NET INTEREST INCOME PLUS NET FEES AND COMMISSIONS (MILLIONS OF EUROS AT CONSTANT EXCHANGE RATES) | |||

|

|  | ||

(1) At current exchange rates: +19.9%. | ||||

At the end of December 2023, NTI grew by 31.8%, with a positive performance of this line in all business areas, favored by the results of the Global Markets unit, which offset the negative results recorded on the Corporate Center.

The other operating income and expenses line accumulated as of December 31, 2023, a result that compares negatively with last year, mainly due to the higher negative adjustment for hyperinflation in Argentina. This line also includes the contribution to the public protection schemes for bank deposits in Spain, which in 2023 was lower than the previous year’s contribution, and the recording of €215m, corresponding to the total annual amount paid for the temporary tax on credit institutions and financial credit establishments, also in Spain.

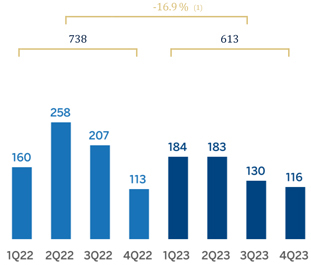

GROSS INCOME (MILLIONS OF EUROS AT CONSTANT EXCHANGE RATES) |

|

(1) At current exchange rates: +19.4%. |

On a year-on-year basis, operating expenses increased by 19.7% at the Group level. This increase is largely impacted by the inflation rates observed in the countries in which the Group operates, which, on the one hand, have been affected by the measures implemented by the Group in 2023 to compensate the loss of purchasing power of the workforce and, on the other hand, have had an effect in general expenses.

Thanks to the remarkable growth in gross income (+30.3%), the efficiency ratio stood at 41.7% as of December 31, 2023, with an improvement of 370 basis points compared to the ratio recorded 12 months earlier, highlighting the evolution in Rest of Business and Spain.

Translation of this report originally issued in Spanish. In the event of a discrepancy, the Spanish-language version prevails.

| 10 |

OPERATING EXPENSES (MILLIONS OF EUROS AT CONSTANT |

EFFICIENCY RATIO (PERCENTAGE)

| |||

|

|  | ||

| (1) At current exchange rates: +15.0%. | ||||

The impairment on financial assets not measured at fair value through profit or loss (impairment on financial assets) at the end of December 2023 was 33.8% higher than in the same period of the previous year, with lower requirements in Turkey, which were offset by higher provisioning needs, mainly in Mexico and South America, in a context of rising interest rates and growth in the most profitable segments, in line with the Group’s strategy.

OPERATING INCOME (MILLIONS OF EUROS AT CONSTANT EXCHANGE RATES) |

|

| (1) At current exchange rates: +22.7%. |

IMPAIRMENT ON FINANCIAL ASSETS (MILLIONS OF EUROS AT CONSTANT EXCHANGE RATES) |

|

| (1) At current exchange rates: +31.1%. |

The provisions or reversal of provisions line (hereinafter, provisions) registered at the end of December 2023 higher provisions compared to the same period of the previous year, mainly originated from Spain and Turkey.

On the other hand, the other gains (losses) line closed December 2023 with a balance of €-13m, which compares unfavorably with the positive result of the previous year.

As a result of the above, the BBVA Group generated a net attributable profit of €8,019m between January and December of the year 2023, which compares very positively with the result for the previous year (+35.4%, excluding the net impact arisen from the purchase of offices in Spain in 2022). These solid results are supported by the favorable evolution of the banking business recurring income, which offset higher operating expenses and the increase in provisions for impairment losses on financial assets.

The cumulative net attributable profits, in millions of euros, at the end of December 2023 for the business areas that compose the Group were as follows: €2,755m in Spain, €5,340m in Mexico, €528m in Turkey, €613m in South America and €389m in Rest of Business.

Translation of this report originally issued in Spanish. In the event of a discrepancy, the Spanish-language version prevails.

| 11 |

NET ATTRIBUTABLE PROFIT (LOSS) (MILLIONS OF EUROS AT CONSTANT EXCHANGE RATES) |

NET ATTRIBUTABLE PROFIT (LOSS) EXCLUDING NON- RECURRING IMPACTS (MILLIONS OF EUROS AT CONSTANT EXCHANGE RATES) | |||

|  | |||

| (1) At current exchange rates: +26.1% | General note: non-recurring impacts include the net impact arisen from the purchase of offices in Spain in 2Q22.

(1) At current exchange rates: +22.3%. | |||

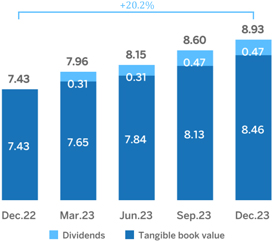

The Group’s excellent performance has also allowed to accelerate value creation, as reflected in the growth of the tangible book value per share and dividends, which at the end of December 2023 was 20.2% higher than in the same period of the previous year.

TANGIBLE BOOK VALUE PER SHARE AND DIVIDENDS (EUROS) |

|

| General note: replenishing dividends paid in the period. For more information, see Alternative Performance Measures at the end of this report. |

EARNING (LOSS) PER SHARE (1) (EUROS) |

|

General note: adjusted by additional Tier 1 instrument remuneration. Adjusted EPS excludes, in addition, the net impact arisen from the purchase of offices in Spain in 2Q22. For more information, see Alternative Performance Measures at the end of this report (1) The accumulated EPS stands at €0.98 and €1.29 in 2022 and 2023, respectively. |

Translation of this report originally issued in Spanish. In the event of a discrepancy, the Spanish-language version prevails.

| 12 |

Lastly, the Group’s profitability indicators improved in year-on-year terms supported by the favorable performance of results.

ROE (1) AND ROTE (1) (PERCENTAGE)

|

|

ROA (1) AND RORWA (1) (PERCENTAGE)

|

|

(1) The ratio of 2021 excludes the results generated by BBVA USA and the rest of the companies in the United States until its sale to PNC on June 1, 2021 and the net cost related to the restructuring process. The ratio of 2022 excludes the net impact arisen from the purchase of offices in Spain.

Translation of this report originally issued in Spanish. In the event of a discrepancy, the Spanish-language version prevails.

| 13 |

Balance sheet and business activity

The most relevant aspects related to the evolution of the Group’s balance sheet and business activity as of December 31, 2023 are summarized below:

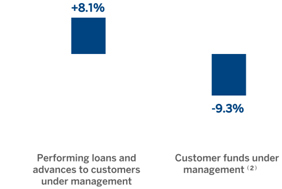

| – | Loans and advances to customers recorded an increase of 5.7% compared to the end of December 2022, strongly favored by the evolution of retail loans (+7.2% at Group level), supported by both the good performance of credit cards and consumer loans (+13.7% overall at Group level) in all geographical areas, and mortgage loans, specially in Mexico. On the other hand, business loans (+3.2%) showed a positive dynamic, originating mainly in Mexico and in Rest of Business, and loans to the public sector grew (+11.4%) thanks to the performance of Mexico and Spain. |

| – | Customer funds increased by 6.1% compared to the end of the previous year, thanks to both the growth in deposits from customers, which increased by 4.8% due to the positive evolution of time deposits in all business areas, and to the increase in off-balance sheet funds, which grew by 9.5%, favored by the the evolution of mutual funds and customer portfolios, with the good performance in Mexico and Spain being noteworthy. |

CONSOLIDATED BALANCE SHEET (MILLIONS OF EUROS)

| ||||||||||||

| 31-12-23 | Δ % | 31-12-22 | ||||||||||

Cash, cash balances at central banks and other demand deposits | 75,416 | (5.4) | 79,756 | |||||||||

Financial assets held for trading | 141,042 | 27.4 | 110,671 | |||||||||

Non-trading financial assets mandatorily at fair value through profit or loss | 8,737 | 26.8 | 6,888 | |||||||||

Financial assets designated at fair value through profit or loss | 955 | 4.6 | 913 | |||||||||

Financial assets at fair value through accumulated other comprehensive income | 62,205 | (4.8) | 65,374 | |||||||||

Financial assets at amortized cost | 451,732 | 9.0 | 414,421 | |||||||||

Loans and advances to central banks and credit institutions | 24,627 | 20.5 | 20,431 | |||||||||

Loans and advances to customers | 377,643 | 5.7 | 357,351 | |||||||||

Debt securities | 49,462 | 35.0 | 36,639 | |||||||||

Investments in joint ventures and associates | 976 | 6.6 | 916 | |||||||||

Tangible assets | 9,253 | 5.9 | 8,737 | |||||||||

Intangible assets | 2,363 | 9.6 | 2,156 | |||||||||

Other assets | 22,878 | 2.8 | 22,259 | |||||||||

Total assets | 775,558 | 8.9 | 712,092 | |||||||||

Financial liabilities held for trading | 121,715 | 27.3 | 95,611 | |||||||||

Other financial liabilities designated at fair value through profit or loss | 13,299 | 25.7 | 10,580 | |||||||||

Financial liabilities at amortized cost | 557,589 | 5.4 | 529,172 | |||||||||

Deposits from central banks and credit institutions | 60,349 | (7.5) | 65,258 | |||||||||

Deposits from customers | 413,487 | 4.8 | 394,404 | |||||||||

Debt certificates | 68,707 | 24.0 | 55,429 | |||||||||

Other financial liabilities | 15,046 | 6.9 | 14,081 | |||||||||

Liabilities under insurance and reinsurance contracts | 12,110 | 19.5 | 10,131 | |||||||||

Other liabilities | 15,580 | (3.1) | 16,081 | |||||||||

Total liabilities | 720,293 | 8.9 | 661,575 | |||||||||

Non-controlling interests | 3,564 | (1.6) | 3,623 | |||||||||

Accumulated other comprehensive income | (16,254) | (7.9) | (17,642) | |||||||||

Shareholders’ funds | 67,955 | 5.3 | 64,535 | |||||||||

Total equity | 55,265 | 9.4 | 50,517 | |||||||||

Total liabilities and equity | 775,558 | 8.9 | 712,092 | |||||||||

Memorandum item: | ||||||||||||

Guarantees given | 60,019 | 8.8 | 55,182 | |||||||||

General note: 2022 figures have been restated according to IFRS 17 - Insurance contracts.

Translation of this report originally issued in Spanish. In the event of a discrepancy, the Spanish-language version prevails.

| 14 |

LOANS AND ADVANCES TO CUSTOMERS (MILLIONS OF EUROS)

|

| |||||||||||||||||||

| 31-12-23 | Δ % | 31-12-22 | ||||||||||||||||||

| Public sector | 23,269 | 11.4 | 20,884 | |||||||||||||||||

| Individuals | 168,123 | 7.2 | 156,838 | |||||||||||||||||

Mortgages | 93,358 | 2.0 | 91,569 | |||||||||||||||||

Consumer | 39,074 | 8.6 | 35,965 | |||||||||||||||||

Credit cards | 21,609 | 24.3 | 17,382 | |||||||||||||||||

Other loans | 14,082 | 18.1 | 11,921 | |||||||||||||||||

| Business | 183,076 | 3.2 | 177,374 | |||||||||||||||||

| Non-performing loans | 14,444 | 7.0 | 13,493 | |||||||||||||||||

Loans and advances to customers (gross) | 388,912 | 5.5 | 368,588 | |||||||||||||||||

Allowances (1) | (11,269) | 0.3 | (11,237) | |||||||||||||||||

Loans and advances to customers | 377,643 | 5.7 | 357,351 | |||||||||||||||||

(1) Allowances include valuation adjustments for credit risk throughout the expected residual life in those financial instruments that have been acquired (mainly originating from the acquisition of Catalunya Banc, S.A.). As of December 31, 2023 and December 31, 2022 the remaining amount was €142m and €190m, respectively.

LOANS AND ADVANCES TO CUSTOMERS (BILLIONS OF EUROS)

| CUSTOMER FUNDS (BILLIONS OF EUROS)

| |||

(1) At constant exchange rates: +7.9%. |

| |||

(1) At constant exchange rates: +8.6%. | ||||

CUSTOMER FUNDS (MILLIONS OF EUROS)

|

| |||||||||||||||||||

| 31-12-23 | Δ % | 31-12-22 | ||||||||||||||||||

| Deposits from customers | 413,487 | 4.8 | 394,404 | |||||||||||||||||

Current accounts | 317,543 | 0.5 | 316,082 | |||||||||||||||||

Time deposits | 91,524 | 21.0 | 75,646 | |||||||||||||||||

Other deposits | 4,420 | 65.2 | 2,676 | |||||||||||||||||

| Other customer funds | 164,367 | 9.5 | 150,172 | |||||||||||||||||

Mutual funds and investment companies and customer portfolios (1) | 131,849 | 21.0 | 108,936 | |||||||||||||||||

Pension funds | 28,326 | (26.7) | 38,653 | |||||||||||||||||

Other off-balance sheet funds | 4,192 | 62.4 | 2,582 | |||||||||||||||||

Total customer funds | 577,853 | 6.1 | 544,576 | |||||||||||||||||

(1) Includes the customer portfolios in Spain, Mexico, Colombia (preliminary data) and Peru.

Translation of this report originally issued in Spanish. In the event of a discrepancy, the Spanish-language version prevails.

| 15 |

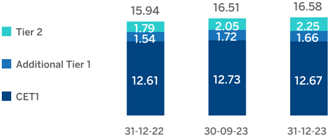

Capital base

The BBVA Group’s strong results during the quarter, which are in line with those of the third quarter, contributed to the consolidated CET1 fully-loaded ratio to reach 12.67% as of December 31, 2023, which allows to keep maintaining a large management buffer over the Group’s CET1 requirement (8.78%)3 and above the Group’s established target management range of 11.5-12.0% of CET1.

During the fourth quarter of the year, the CET1 ratio decreased by 6 basis points. The strong generation of profit, net of dividends and remuneration of capital instruments, generated a contribution of 25 basis points in the CET1 ratio, which allowed it to partially absorb the growth of risk-weighted assets (RWA) derived from the increase in activity in the quarter (consumption of 36 basis points, including the operational risk update), in line with the Group’s strategy of promoting profitable growth. On the other hand, among the other impacts, it is worth highlighting those associated with market variables, where the negative evolution of some currencies in the quarter stands out (mainly the devaluation of the Argentinian peso), more than offset by the positive evolution of the fixed income portfolios valuation and the compensation in equity of the negative effect on results due to the monetary loss given by the net monetary position in hyperinflationary economies.

The consolidated fully-loaded additional Tier 1 capital (AT1) stood at 1.66% as of December 31, 2023, resulting in a 6 basis points decrease from the previous quarter, mainly due to the RWA increase and the U.S. dollar depreciation.

On the other hand, the consolidated fully-loaded Tier 2 ratio at the end of December 2023 stood at 2.25%, with an increase of 20 basis points in the quarter, mainly due to the issuance of a subordinated bond in Spain for USD 750m. Thus, the total fully-loaded capital ratio stood at 16.58%.

Following the latest SREP (Supervisory Review and Evaluation Process) decision, the ECB has informed to the Group that, with effect from January 1, 2024, it will have to maintain a total capital ratio of 13.25% and a CET1 capital ratio of 9.09% at the consolidated level, which includes the consolidated Pillar 2 requirement of 1.68% (of which at least 1.02% shall be met with CET1), of which 0.18% is determined on the basis of the ECB’s prudential provisioning expectation and shall be met with CET1.

It is worth mentioning that, with effect from January 1, 2023, the application of part of the transitional effects applied by the Group in the determination of the phased-in ratio has ended, so that as of December 31, 2023, this ratio coincides with the fully-loaded ratio.

| FULLY-LOADED CAPITAL RATIOS (PERCENTAGE) |

|

CAPITAL BASE (MILLIONS OF EUROS)

|

| |||||||||||||||||||||||

| CRD IV phased-in | CRD IV fully-loaded | |||||||||||||||||||||||

| 31-12-23 (1) (2) | 30-09-23 | 31-12-22 | 31-12-23 (1) (2) | 30-09-23 | 31-12-22 | |||||||||||||||||||

Common Equity Tier 1 (CET1) | 46,104 | 45,567 | 42,738 | 46,104 | 45,567 | 42,484 | ||||||||||||||||||

Tier 1 | 52,138 | 51,735 | 47,931 | 52,138 | 51,735 | 47,677 | ||||||||||||||||||

Tier 2 | 8,182 | 7,350 | 5,930 | 8,182 | 7,350 | 6,023 | ||||||||||||||||||

Total capital (Tier 1 + Tier 2) | 60,320 | 59,085 | 53,861 | 60,320 | 59,085 | 53,699 | ||||||||||||||||||

Risk-weighted assets | 363,916 | 357,972 | 337,066 | 363,916 | 357,972 | 336,884 | ||||||||||||||||||

CET1 (%) | 12.67 | 12.73 | 12.68 | 12.67 | 12.73 | 12.61 | ||||||||||||||||||

Tier 1 (%) | 14.33 | 14.45 | 14.22 | 14.33 | 14.45 | 14.15 | ||||||||||||||||||

Tier 2 (%) | 2.25 | 2.05 | 1.76 | 2.25 | 2.05 | 1.79 | ||||||||||||||||||

Total capital ratio (%) | 16.58 | 16.51 | 15.98 | 16.58 | 16.51 | 15.94 | ||||||||||||||||||

(1) The difference between the phased-in and fully-loaded ratios arises from the temporary treatment of certain capital items, mainly of the impact of IFRS 9, to which the BBVA Group has adhered voluntarily (in accordance with article 473bis of the CRR and the subsequent amendments introduced by the Regulation (EU) 2020/873). As of December 31, 2023, there are no differences between phased-in and fully-loaded ratios due to the aforementioned temporary treatment.

(2) Preliminary data.

3 This includes the update of the countercyclical capital buffer calculated on the basis of exposure at end September 2023.

Translation of this report originally issued in Spanish. In the event of a discrepancy, the Spanish-language version prevails.

| 16 |

Regarding shareholder remuneration, which includes cash payments and the remuneration resulting from the execution of the share buyback programs that the Group may execute, a cash gross distribution in the amount of €0.39 per share on April as final dividend of 2023 and the execution of a new Share Buyback Program of BBVA for an amount of €781m, subject to the corresponding regulatory authorizations and the communication with the program specific terms and conditions before its effective start, are expected to be submitted to the relevant governing bodies for consideration. Thus, the total distribution for the year 2023 will reach €4,010m, a 50% of the net attributable profit, which represents €0.68 per share, taking into account the payment in cash of €0.16 gross per share paid in October 2023 as interim dividend of the year.

During the year 2023, BBVA has executed two share buyback programs. The first program was announced on February 1, 2023 for a maximum amount of €422m and was part of the ordinary application of the shareholder remuneration policy of the year 2022. On April 21, 2023, BBVA announced the completion of this, having acquired 64,643,559 own shares between March 20 and April 20, 2023, representing approximately 1.07% of BBVA’s share capital as of said date. The shares acquired in the execution of this first share buyback program were redeemed on June 2, 2023. The second program, which is considered extraordinary shareholder remuneration and thus is not included in the ordinary remuneration policy, was announced on July 28, 2023, for a maximum amount of €1,000m. On November 29, 2023, BBVA announced the completion of this, having acquired 127,532,625 own shares between October 2 and November 29, 2023, representing approximately 2.14% of BBVA’s share capital as of said date. The shares acquired in the execution of this second share buyback program were redeemed on December 19, 2023. Thus, the total amount disbursed in both share buyback programs stands at €1,422m.

The most relevant aspects of the share buyback programs are summarized below:

EXECUTION OF THE PROGRAMS FOR THE BUYBACK OF SHARES IN 2023

| ||||||||||||||||||||||||

| Start date | Completion date | | Redemption date | | | Number of shares |

| | % of share capital* |

| | Disbursement (millions of euros) | | |||||||||||

First program | March 20 | April 21 | June 2 | 64,643,559 | 1.07 | 422 | ||||||||||||||||||

Second program | October 2 | November 29 | December 19 | 127,532,625 | 2.14 | 1,000 | ||||||||||||||||||

Total | 192,176,184 | 1,422 | ||||||||||||||||||||||

*As of the date of the program closure.

As a consequence of the share buyback program described above, and once the Group has carried out the aforementioned share capital reductions, BBVA’s share capital as of December 31, 2023, stood at €2,860,590,786.20 divided into 5,837,940,380 shares, at €0.49 par value each.

SHAREHOLDER STRUCTURE (31-12-23)

| ||||||||||||||||

| Shareholders | Shares outstanding | |||||||||||||||

| Number of shares | Number | % | Number | % | ||||||||||||

Up to 500 | 315,389 | 42.5 | 58,447,373 | 1.0 | ||||||||||||

501 to 5,000 | 334,638 | 45.1 | 592,992,044 | 10.2 | ||||||||||||

5,001 to 10,000 | 49,539 | 6.7 | 347,292,314 | 5.9 | ||||||||||||

10,001 to 50,000 | 38,423 | 5.2 | 733,832,231 | 12.6 | ||||||||||||

50,001 to 100,000 | 2,720 | 0.4 | 185,938,321 | 3.2 | ||||||||||||

100,001 to 500,000 | 1,228 | 0.2 | 218,487,412 | 3.7 | ||||||||||||

More than 500,001 | 257 | 0.03 | 3,700,950,685 | 63.4 | ||||||||||||

Total | 742,194 | 100 | 5,837,940,380 | 100 | ||||||||||||

Note: in the case of shares kept by investors through a custodian placed outside Spain, only the custodian will be considered as a shareholder, which is who appears registered in the accounting record of book entries, so the number of shareholders stated does not consider those indirect holders.

With regard to MREL4 (Minimum Requirement for own funds and Eligible Liabilities) requirements, as of December 31, 2023, the requirement of own funds and eligible liabilities equals to 21.46% of the total RWA of its resolution group (the “MREL in RWA”), being the subordination requirement of the Group´s total RWA (the “subordination requirement in RWA”) 13.50% at the subconsolidated level56 Given the own funds and eligible liabilities structure of the resolution group, as of December 31, 2023, the preliminary MREL in RWA ratio and the preliminary subordination requirement in RWA ratio stand at 26.36% and at 21.84%, respectively7, complying with both mentioned requirements.

In addition, BBVA must reach, as of December 31, 2023, an amount of own funds and eligible liabilities in terms of the total exposure considered for calculating the leverage ratio of 7.27% (the “MREL in LR”), of which 5.61% in terms of the total exposure considered for calculating the leverage ratio shall be met with subordinated instruments (the “subordination requirement in LR”). Given the own funds and eligible liabilities structure of the resolution group, as of December 31, 2023, the preliminary MREL in LR ratio and the preliminary subordination requirement in LR ratio stand at 11.10% and at 9.20%, respectively, complying with both requirements.

4 BBVA must maintain this requirement from January 1, 2022 onwards.

5 In accordance with the resolution strategy MPE (“Multiple Point of Entry”) of the BBVA Group, established by the SRB, the resolution group is made up of Banco Bilbao Vizcaya Argentaria, S.A. and subsidiaries that belong to the same European resolution group. As of December 31, 2023, the total RWA of the resolution group amounted to €214,757m and the total exposure considered for the purpose of calculating the leverage ratio amounted to €509,996m.

6 The MREL in RWA and the subordination requirement in RWA do not include the applicable combined capital buffer requirement that, according to the current regulations and the supervising criteria, would be of 3.35%, taking into account the exposures as of September 2023 subject to the calculation of the countercyclical buffer.

7 Own resources and eligible liabilities to meet, both with MREL in RWA and subordination requirement in RWA and with the combined capital buffer requirement applicable.

Translation of this report originally issued in Spanish. In the event of a discrepancy, the Spanish-language version prevails.

| 17 |

With the aim of reinforcing compliance with these requirements, BBVA has made several debt issues during 2023. For more information on made issues, see “Structural risks” section within the “Risk management” chapter.

It should be noted that on June 14, 2023 the Group disclosed the receipt of a new communication from the Bank of Spain regarding its MREL requirement, established by the Single Resolution Board (hereinafter “SRB”). In accordance with this communication, BBVA has to reach, starting January 1, 2024, an MREL in RWA equal to 22.11%, considering the exposures subject to the calculation of the countercyclical buffer8 as of September 2023. Given the own funds and eligible liabilities structure of the resolution group, as of December 31, 2023 the MREL in RWA would already comply with the aforementioned requirement.

Lastly, as of December 31, 2023, the Group’s fully-loaded leverage ratio stood at 6,5%9.

Ratings

During the year 2023, BBVA’s rating has continued to demonstrate its strength and all agencies have maintained their rating in the A category. DBRS in March, Fitch in September and Moody’s in October confirmed the rating of BBVA at A (high), A- and A3, respectively, all three with a stable outlook. Additionally, S&P has maintained BBVA’s ratings unchanged during the year at A, with a stable outlook. The following table shows the credit ratings and outlook assigned by the agencies:

RATINGS

| ||||||||

Rating agency | Long term (1) | Short term | Outlook | |||||

DBRS | A (high) | R-1 (middle) | Stable | |||||

Fitch | A- | F-2 | Stable | |||||

Moody’s | A3 | P-2 | Stable | |||||

Standard & Poor’s | A | A-1 | Stable | |||||

(1) Ratings assigned to long term senior preferred debt. Additionally, Moody’s and Fitch assign A2 and A- rating, respectively, to BBVA’s long term deposits.

8 BBVA published on September 29, 2023 that it had received a resolution from the Bank of Spain related to the revision of the identification of BBVA as Other Systemically Important Institution (hereinafter referred to as O-SII) and the corresponding capital buffer establishment. According to this resolution the O-SII capital buffer would increase by 25 basis points compared to the previous year applicable buffer, which stands at 100 basis points (1%) by January 1, 2024. This increase is due to the adaptation of the Bank of Spain’s methodology for the determination of the OSII capital buffers in line with the revision of the methodological framework established by the European Central Bank.

9 The Group’s leverage ratio is provisional at the date of release of this report.

Translation of this report originally issued in Spanish. In the event of a discrepancy, the Spanish-language version prevails.

| 18 |

Credit risk

Throughout the year, the persistent inflation, the Central Bank rates increases and the uncertainty surrounding economic growth have been the main factors that have impacted the markets, affecting to a greater or lesser extent depending on the region to the credit demand reduction and causing a strain on the payment capacity of families and companies.

Uncertainty continues to be high, and the geopolitical turbulence at the time of drafting of this report could contribute to a rebound in energy prices, and therefore, increase the biases towards more negative scenarios, with higher interest rates, persisting inflation and a greater than expected economic slowdown.

By region, the evolution during the year has been uneven. In Spain, although economy continued slowing down during the year 2023, the level of household debt is far from its all-time highs, favored by the dynamism of the labor market. In Mexico, the improvements in the growth outlook due to the dynamism of private consumption and the effect of the relocation of industrial production (nearshoring) is positively impacting the labor market. The uncertainty in Turkey continues, although growth remains solid. Despite changes in economic policy, system quality indicators remain at low levels. Finally, in general, growth has been less dynamic in South America, in a context of high inflation and interest rates, negative effects related to the slowdown in China, as well as adverse climatic factors and social conflicts, affecting the economic situation of families and companies.

Calculation of expected losses due to credit risk

For the estimation of expected losses, the models include individual and collective estimates, taking into account the macroeconomic forecasts in accordance with IFRS 9. Thus, the estimate at the end of the year includes the effect on expected losses of updating macroeconomic forecasts, which take into account the current global environment.

Additionally, the Group may complement the expected losses either by the consideration of additional risk drivers, the incorporation of sectorial particularities or that may affect a set of operations or borrowers, following a formal internal process established for the purpose.

Thus, in Spain, the severity of certain specific operations considered unlikely to pay was reviewed upwards because of different reasons to non-performing loans, with a remaining adjustment as of December 31, 2023 of €227 million, with a €161 million decrease compared with the end of the year 2022 mainly as a result of the annual model review process. In addition, due to the earthquakes that affected an area in the south of Turkey, during the month of February 2023 the classification of the credit exposure recorded in the five most affected cities was reviewed, which led to its reclassification to Stage 2. As of December 31, 2023 the amounts recorded in Stage 2 amounted to €273 million on-balance sheet and €406 million off-balance sheet exposure, with allowances for losses of approximately €25 million at contract level.

On the other hand, as of December 31, 2023, the complementary adjustments pending allocation to specific operations or customers are not significant, after the utilization and/or release of most of the adjustments during 2023. As of December 31, 2022, the complementary adjustments pending allocation to specific operations or customers totaled €302m, of which €163m corresponded to Spain, €92m to Mexico, €25m to Peru, €6m to Rest of Business of the Group, €11m to Colombia and €5m to Chile.

BBVA Group’s credit risk indicators

The evolution of the Group’s main credit risk indicators is summarized below:

| – | Credit risk increased in the fourth quarter of the year by 0.9% (+2.9% in constant terms), with generalized growth at constant exchange rates in all geographic areas except in Spain, which had a flat evolution. |

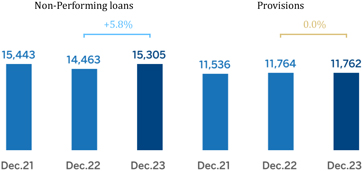

| – | Non-performing loans presented an increase of 3.0% at the Group level between September and December 2023 (+4.5% in constant terms), with general increases in all geographical areas except in Turkey, due to the effect of exchange rates, focused on retail portfolios, and in some singular clients in Rest of Business and in Mexico. Compared to the end of the previous year, the balance of non-performing loans increased by 5.8% (+7,7% at constant exchange rates), focused on retail portfolio in South America, Mexico, Spain and, to a lesser extent, Rest of Business, affected by singular customers inflows. |

NON-PERFORMING LOANS AND PROVISIONS (MILLIONS OF EUROS)

| ||||||||||||||||

Translation of this report originally issued in Spanish. In the event of a discrepancy, the Spanish-language version prevails.

| 19 |

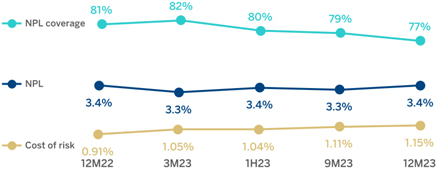

| – | The NPL ratio rose to 3.4% as of December 31, 2023, which represents an increase of 7 basis points compared to the previous quarter, despite the stable evolution in the last twelve months. |

| – | The NPL coverage ratio ended the quarter at 77%, 221 basis points below the previous quarter and 449 basis points lower than in the end of 2022, as a result of the non-performing loan increase throughout the year with coverage ratios that remain practically stable compared to those of the previous quarter (+0.1%) and of December 2022 (0.0%). |

| – | The cumulative cost of risk as of December 31, 2023 stood at 1.15%, which is above the previous quarter, mainly due to the higher requirements in Spain, affected by the impact of the annual review exercise of models parameters for the losses estimation, and, to a lesser extent, in Colombia and Peru, which continue to be affected by the macroeconomic environment worsening. |

NPL AND NPL COVERAGE RATIOS AND COST OF RISK (PERCENTAGE)

|

CREDIT RISK (1) (MILLIONS OF EUROS)

|

| 31-12-23 | 30-09-23 | 30-06-23 | 31-03-23 | 31-12-22 | ||||||||||||||||

Credit risk | 448,840 | 444,984 | 436,174 | 428,423 | 423,669 | |||||||||||||||

Stage 1 | 392,528 | 394,329 | 386,711 | 377,908 | 371,930 | |||||||||||||||

Stage 2 (2) | 41,006 | 35,791 | 34,772 | 36,373 | 37,277 | |||||||||||||||

Stage 3 (non-performing loans) | 15,305 | 14,864 | 14,691 | 14,141 | 14,463 | |||||||||||||||

Provisions | 11,762 | 11,751 | 11,697 | 11,661 | 11,764 | |||||||||||||||

Stage 1 | 2,142 | 2,143 | 2,107 | 2,062 | 2,067 | |||||||||||||||

Stage 2 | 2,170 | 2,198 | 2,181 | 2,243 | 2,111 | |||||||||||||||

Stage 3 (non-performing loans) | 7,450 | 7,410 | 7,409 | 7,357 | 7,586 | |||||||||||||||

NPL ratio (%) | 3.4 | 3.3 | 3.4 | 3.3 | 3.4 | |||||||||||||||

NPL coverage ratio (%) (3) | 77 | 79 | 80 | 82 | 81 | |||||||||||||||

(1) Includes gross loans and advances to customers plus guarantees given.

(2) Increase affected by the annual review of the models, mainly in BBVA, S.A.

(3) The NPL coverage ratio includes the valuation adjustments for credit risk throughout the expected residual life in those financial instruments that have been acquired (mainly originating from the acquisition of Catalunya Banc, S.A.). If these valuation corrections had not been taken into account, the NPL coverage ratio would have stood at 76% as of December 31, 2023 and 80% as of December 31, 2022.

NON-PERFORMING LOANS EVOLUTION (MILLIONS OF EUROS)

|

| 4Q23 (1) | 3Q23 | 2Q23 | 1Q23 | 4Q22 | ||||||||||||||||||||||||||||||||

Beginning balance | 14,864 | 14,691 | 14,141 | 14,463 | 15,162 | |||||||||||||||||||||||||||||||

Entries | 3,038 | 2,898 | 2,875 | 2,256 | 2,332 | |||||||||||||||||||||||||||||||

Recoveries | (1,373) | (1,538) | (1,394) | (1,489) | (1,180) | |||||||||||||||||||||||||||||||

Net variation | 1,665 | 1,360 | 1,481 | 767 | 1,152 | |||||||||||||||||||||||||||||||

Write-offs | (983) | (830) | (877) | (1,081) | (928) | |||||||||||||||||||||||||||||||

Exchange rate differences and other | (241) | (357) | (54) | (8) | (923) | |||||||||||||||||||||||||||||||

Period-end balance | 15,305 | 14,864 | 14,691 | 14,141 | 14,463 | |||||||||||||||||||||||||||||||

Memorandum item: | ||||||||||||||||||||||||||||||||||||

Non-performing loans | 14,444 | 13,947 | 13,787 | 13,215 | 13,493 | |||||||||||||||||||||||||||||||

Non performing guarantees given | 862 | 918 | 905 | 926 | 970 | |||||||||||||||||||||||||||||||

(1) Preliminary data.

Translation of this report originally issued in Spanish. In the event of a discrepancy, the Spanish-language version prevails.

| 20 |

Structural risks

Liquidity and funding

Liquidity and funding management at BBVA promotes the financing of the recurring growth of the banking business at suitable maturities and costs using a wide range of funding sources. BBVA’s business model, risk appetite framework and funding strategy are designed to reach a solid funding structure based on stable customer deposits, mainly retail (granular). As a result of this model, deposits have a high degree of assurance in each geographical area, close to 55% in Spain and Mexico. It is important to note that, given the nature of BBVA’s business, lending is mainly financed through stable customer funds.

One of the key elements in the BBVA Group’s liquidity and funding management is the maintenance of large high-quality liquidity buffers in all geographical areas. In this respect, the Group has maintained during the last 12 months an average volume of high quality liquid assets (HQLA) of €130.77 billion, of which 97% corresponds to maximum quality assets (level 1 in the liquidity coverage ratio, LCR).

Due to its subsidiary-based management model, BBVA is one of the few major European banks that follows the Multiple Point of Entry (MPE) resolution strategy: the parent company sets the liquidity policies, but the subsidiaries are self-sufficient and responsible for managing their own liquidity and funding (taking deposits or accessing the market with their own rating). This strategy limits the spread of a liquidity crisis among the Group’s different areas and ensures the adequate transmission of the cost of liquidity and financing to the price formation process.

The BBVA Group maintains a solid liquidity position in every geographical area in which it operates, with ratios well above the minimum required:

| – | The LCR requires banks to maintain a volume of high-quality liquid assets sufficient to withstand liquidity stress for 30 days. BBVA Group’s consolidated LCR remained comfortably above 100% during 2022 and stood at 149% as of December 31, 2023. It should be noted that, given the MPE nature of BBVA, this ratio limits the numerator of the LCR for subsidiaries other than BBVA S.A. to 100% of its net outflows. Therefore, the resulting ratio is below that of the individual units (the LCR of the main components reaches 178% in BBVA, S.A., 192% in Mexico and 212% in Turkey). Without considering this restriction, the Group’s LCR ratio would reach 193%. |

| – | The net stable funding ratio (NSFR) requires banks to maintain a stable funding profile in relation to the composition of their assets and off-balance sheet activities. The BBVA Group’s NSFR ratio stood at 131% as of December 31, 2023. |

The breakdown of these ratios in the main geographical areas in which the Group operates is shown below:

LCR AND NSFR RATIOS (PERCENTAGE. 31-12-23)

| ||||||||

| BBVA, S.A. | Mexico | Turkey | South America | |||||

LCR | 178% | 192% | 212% | All countries >100 | ||||

NSFR | 120% | 140% | 178% | All countries >100 | ||||

In addition to the above, the most relevant aspects related to the main geographical areas are the following:

| – | BBVA, S.A. has maintained a strong position with a large high-quality liquidity buffer, having repaid almost the entire TLTRO III program. During 2023, commercial activity has provided liquidity to the balance sheet mainly due to the good evolution of customer deposits in the last quarter of the year, with growth greater than that of lending activity. This performance is partially by the end of year seasonal component. On the other hand, in December 2022 the Bank started the repayment of the TLTRO III program for an amount of €12 billion, plus an additional repayment of €12 billion between February and March 2023 and another one of €11 billion in June 2023, which together represent more than the 90% of the original amount, maintaining at all times the regulatory liquidity metrics well above the established minimums. |

| – | BBVA Mexico shows a solid liquidity situation, which has contributed to an efficient management of the cost of funds in an environment of rising interest rates. During the year, however, commercial activity has drained liquidity due to a sustained loan growth that has been greater than the fund growth. However, the change in the trend of the evolution of deposits stands out, which had kept a negative performance during the year due to transfers to off-balance sheet funds and which in the last quarter of the year show a significant increase mainly thanks to the seasonal inflows at the end of the year, |

| – | In Turkey, during 2023, the lending gap in local currency has been reduced, due to a greater growth in deposits than in loans, while the lending gap in foreign currency has increased due to higher reductions in deposits. Garanti BBVA continues to maintain a stable liquidity position with comfortable ratios. On the other hand, the Central Bank of Turkey has promoted a gradual change of FX protected scheme to standard deposits in Turkish lira, specially in the second half of the year, as an additional step on dedollarization process of the economy. |

| – | In South America, the liquidity situation remains adequate throughout the region. In Argentina, liquidity in the system continues to increase, as well as in BBVA due to a higher growth in deposits than in loans in local currency and no significant variations in foreign currency. In BBVA Colombia, the credit gap declined due to a higher volume of deposits together with a slowdown in lending growth. BBVA Peru maintains solid liquidity levels, showing a reduction in the credit gap throughout the year thanks to a growth in deposits higher than in lending activity, affected by the expiration of loans covered by COVID-19 programs. |

Translation of this report originally issued in Spanish. In the event of a discrepancy, the Spanish-language version prevails.

| 21 |

The main wholesale financing transactions carried out by the BBVA Group during 2023 are listed below:

| Issuer | Type of issue | Date of issue

| Nominal (millions)

| Currency

| Coupon

| Early redemption

| Maturity date

| |||||||

BBVA, S.A. | Senior non-preferred

| Jan-23

| 1,000

| EUR

| 4.625%

| Jan-30

| Jan-31

| |||||||

| Covered bonds | Jan-23 | 1,500 | EUR | 3.125% | — | Jul-27 | ||||||||

| Senior preferred | May-23 | 1,000 | EUR | 4.125% | May-25 | May-26 | ||||||||

| Tier 2 | Jun-23 | 750 | EUR | 5.570% | Jun-Sep 28 | Sep-33 | ||||||||

| AT1 | Jun-23 | 1,000 | EUR | 8.375% | Dec-28 | Perpetual | ||||||||

| Tier 2 | Aug-23 | 300 | GBP | 8.250% | Aug-Nov 28 | Nov-33 | ||||||||

| AT1 | Sep-23 | 1,000 | USD | 9.375% | Sep-29 | Perpetual | ||||||||

| Tier 2 | Nov-23 | 750 | USD | 7.883% | Nov-33 | Nov-34 | ||||||||

BBVA in Mexico | Senior (Tranche 1) - Green bond

| Feb-23 | 8,689 | MXN | TIIE day 1 + 32 basis points

| — | Feb-27 | |||||||

| Senior (Tranche 2) | Feb-23 | 6,131 | MXN | 9.540% | — | Feb-30 | ||||||||

| Tier 2 | Jun-23 | 1,000 | USD | 8.450% | Jun-33 | Jun-38 | ||||||||

| Senior (Tranche 1) | Nov-23 | 9,900 | MXN | TIIE day 1 + 32 basis points

| — | Apr-27 | ||||||||

| Senior (Tranche 2) | Nov-23 | 3,600 | MXN | 10.240% | — | Nov-30 | ||||||||

Additionally, in June 2023, BBVA, S.A. completed a securitization of a portfolio of car loans for an amount of €804m.

In January 2024, BBVA, S.A. has carried out a public senior bond issue for €1,250m with a maturity of 10 years and a coupon of 3,875%. Moreover, BBVA, S.A. has announced its irrevocable decision to amortize an issue of Tier 2 subordinated bonds issued in February 2019, for an amount of €750m, on February 22, 2024. On the other hand, BBVA Mexico has issued Tier 2 bonds for USD 900m with a maturity of 15 years and early repayment option in 10 years with a coupon of 8,125%.

In Turkey, Garanti BBVA renewed in June a syndicated loan associated to environmental, social and corporate governance (ESG) criteria, consisting of two separate tranches of USD199m and €218.5m, both maturing in one year. In December, Garanti BBVA announced the renovation of the 100% of the maturity of a syndicated loan of USD 259.5m and €142.5m with a maturity of 367 days, also linked to ESG criteria. The total loan cost was SOFR + 3.50% for the tranche in USD and Euribor + 3.25% for the tranche in euros.

BBVA Colombia announced the launch of the first blue bond in Colombia, together with the International Finance Corporation (IFC), for an amount of USD 50m in its first tranche. Later, in October, the second tranche of the operation was disbursed for an amount of USD 67m.

Foreign exchange

Foreign exchange risk management aims to reduce both the sensitivity of the capital ratios and the net attributable profit variability to currency fluctuations.

The performance of the Group’s main currencies during 2023 has been very uneven. Due to its relevance for the Group, it should be noted the strength of the Mexican peso, which has appreciated 11.4% against the euro. The other currency which stands out was the Colombian peso (+21.5%). On the other hand, the depreciation of both the Turkish lira (-38.9%), mainly concentrated in June after the elections, and the Argentinian peso (-78.9%) intensified in the last quarter of the year after the measures enacted by the new government , stands out. In both cases, the currencies have been pressured by the negative dynamism of inflation. The rest of currencies evolved moderately during the year: the Peruvian sol (+-1.1%), the U.S. dollar (+-3.5%) and the Chilean peso (-6.2%).

Translation of this report originally issued in Spanish. In the event of a discrepancy, the Spanish-language version prevails.

| 22 |

EXCHANGE RATES (EXPRESSED IN CURRENCY/EURO) | ||||||||||||||||

| Year-end exchange rates | Average exchange rates | |||||||||||||||||||

31-12-23 | Δ % on

31-12-22 | Δ % on

30-09-23 |

2023 | Δ % on 2022 | ||||||||||||||||

U.S. dollar | 1.1050 | (3.5) | (4.1) | 1.0815 | (2.6) | |||||||||||||||

Mexican peso | 18.7231 | 11.4 | (1.2) | 19.1866 | 10.4 | |||||||||||||||

Turkish lira (1) | 32.6531 | (38.9) | (11.0) | — | — | |||||||||||||||

Peruvian sol | 4.1042 | (1.1) | (2.6) | 4.0404 | (0.2) | |||||||||||||||

Argentine peso (1) | 892.81 | (78.9) | (58.5) | — | — | |||||||||||||||

Chilean peso | 977.47 | (6.2) | (1.7) | 908.35 | 1.0 | |||||||||||||||

Colombian peso | 4,223.37 | 21.5 | 2.5 | 4,679.22 | (4.5) | |||||||||||||||

(1) According to IAS 21 “The effects of changes in foreign exchange rates”, the year-end exchange rate is used for the conversion of the Turkey and Argentina income statement.

In relation to the hedging of the capital ratios, BBVA covers, in aggregate, 70% of its subsidiaries’ capital excess. The sensitivity of the Group’s CET1 fully-loaded ratio to 10% depreciations in major currencies is estimated at: +17 basis points for the U.S. dollar, -9 basis points for the Mexican peso and -4 basis points for the Turkish lira10. With regard to the hedging of results, BBVA hedges between 40% and 50% of the aggregate net attributable profit it expects to generate in the next 12 months. For each currency, the final amount hedged depends on its expected future evolution, the costs and the relevance of the incomes related to the Group’s results as a whole.

Interest rate

Interest rate risk management seeks to limit the impact that BBVA may suffer, both in terms of net interest income (short-term) and economic value (long-term), from adverse movements in the interest rate curves in the various currencies in which the Group operates. BBVA carries out this work through an internal procedure, pursuant to the guidelines established by the European Banking Authority (EBA), with the aim of analyzing the potential impact that could derive from a range of scenarios on the Group’s different balance sheets.

The model is based on assumptions intended to realistically mimic the behavior of the balance sheet. The assumptions regarding the behavior of accounts with no explicit maturity and prepayment estimates are specially relevant. These assumptions are reviewed and adapted at least once a year, to take into account any changes in observed behavior.

At the aggregate level, BBVA continues to have a positive sensitivity toward interest rate increases in the net interest income.

The first quarters of 2023 were characterized by a persistent high level of inflation, which, together with the strong growth indicators, served as reason for both the ECB and the Fed to consolidate their hawkish messages of high interest rates for a longer time. This positioning from monetary authorities contributed the sovereign curves to certain rises. However, in the last quarter of the year, decreasing inflation data and expectations converging towards central bank objectives, together with the weakening of some macroeconomic indicators, suggest that the rate hike cycle has come to an end in Europe and in the United States and have led the market to discount rate drops by mid-2024. This has triggered a fall in sovereign bond profitability and has caused a positive performance in most debt portfolios of the Group. Other peripheral rate curve spreads remain supported. In Mexico, the rate hike cycle is considered to be over, while in most countries of South America, interest rate cuts have started taking place. On the contrary, the Central Bank of Turkey has continued the tightening of its monetary policy launched in June with significant rate hikes.

By area, the main features are:

| – | Spain has a balance sheet characterized by a lending portfolio with high proportion of variable-rate loans (mortgages and corporate lending) and liabilities composed mainly by customer demand deposits. The ALCO portfolio acts as a management lever and hedge for the balance sheet, mitigating its sensitivity to interest rate fluctuations. In an environment of high rates, currently close to their market-predicted terminal rates, the interest rate risk profile of the balance sheet has been reduced during the year. |

On the other hand, the ECB left rates unchanged in the last quarter of the year, bringing the benchmark interest rate to 4.5%, the marginal deposit facility rate at 4.0% and the marginal loan facility rate at 4.75% as of December 31, 2023. The market expects there to be a first rate drop in the first half of 2024 and, in this environment, the Euribor 6 and 12 month reference rates fell in the fourth quarter of 2023, starting to reflect these expectations, while shorter term benchmark rates remained broadly stable. All in all, the customer spread benefited in 2023 from asset repricing and the containment in the cost of deposits, yet at a slower pace during the last quarter of the year. |

| – | Mexico continues to show a balance between fixed and variable interest rates balances, which results in a limited sensitivity to interest rates fluctuations. In terms of assets that are most sensitive to interest rate changes, the commercial portfolio stood out, while consumer loans and mortgages are mostly at a fixed rate. With regard to customer funds, the high proportion of non-interest bearing deposits, which are insensitive to interest rate movements, should be highlighted. The ALCO portfolio is invested primarily in fixed-rate sovereign bonds with limited maturities. The monetary policy rate stood at 11.25%, 75 basis points above the end-of-year level of 2022, but has remained stable since March 2023. Regarding customer spread, there has been an improvement during 2023, favored by both the containment of the cost of deposits and the positive evolution of the loan yield. |

10 This sensitivity does not include the cost of capital hedges, which are currently estimated at 3 basis points per quarter for Mexican peso and 3 basis points per quarter for Turkish lira.

Translation of this report originally issued in Spanish. In the event of a discrepancy, the Spanish-language version prevails.

| 23 |

| – | In Turkey, the sensitivity of deposits is offset by the ALCO portfolio and loans (fixed rate and relatively short-term). The sensitivity of the net interest income remains very limited thanks to the different efforts carried out by the Bank. The CBRT has recently increased monetary policy rates, taking interest rates from 8.5% to 42.5% by the end of 2023. In terms of customer spread, it has worsened due to the evolution of the deposit costs linked to regulatory requirements, despite the high profitability of loans. |

| – | In South America, the interest rate risk profile remains low as most countries in the area have a fixed/variable composition and maturities that are very similar for assets and liabilities, with limited net interest income sensitivity. In addition, the balance sheets |