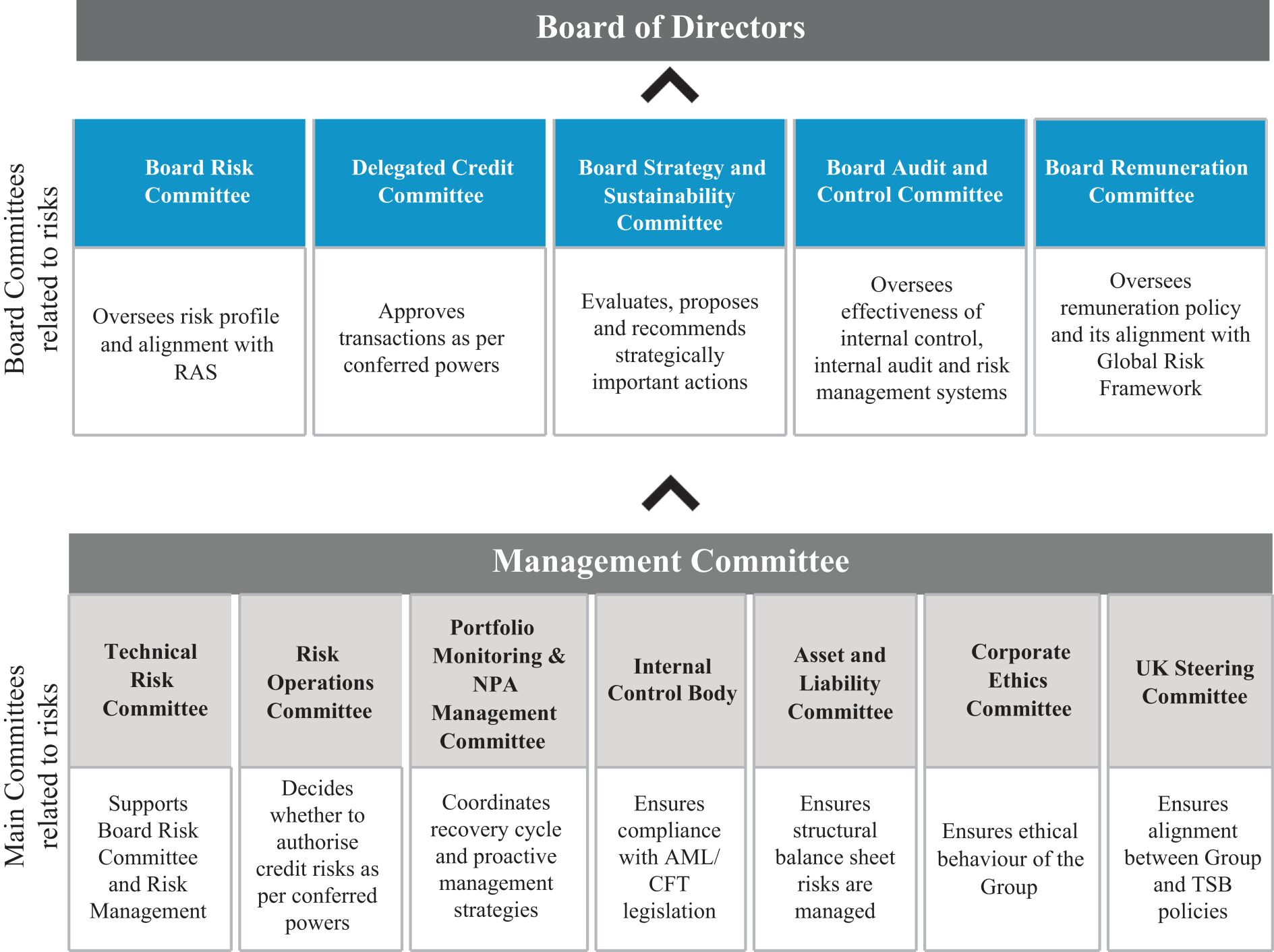

4.3.2 Risk Appetite Framework (RAF)

The risk appetite is a key element in setting the risk strategy, as it determines the scope of activity. The Group has a Risk Appetite Framework (RAF) that sets out the governance framework governing its risk appetite.

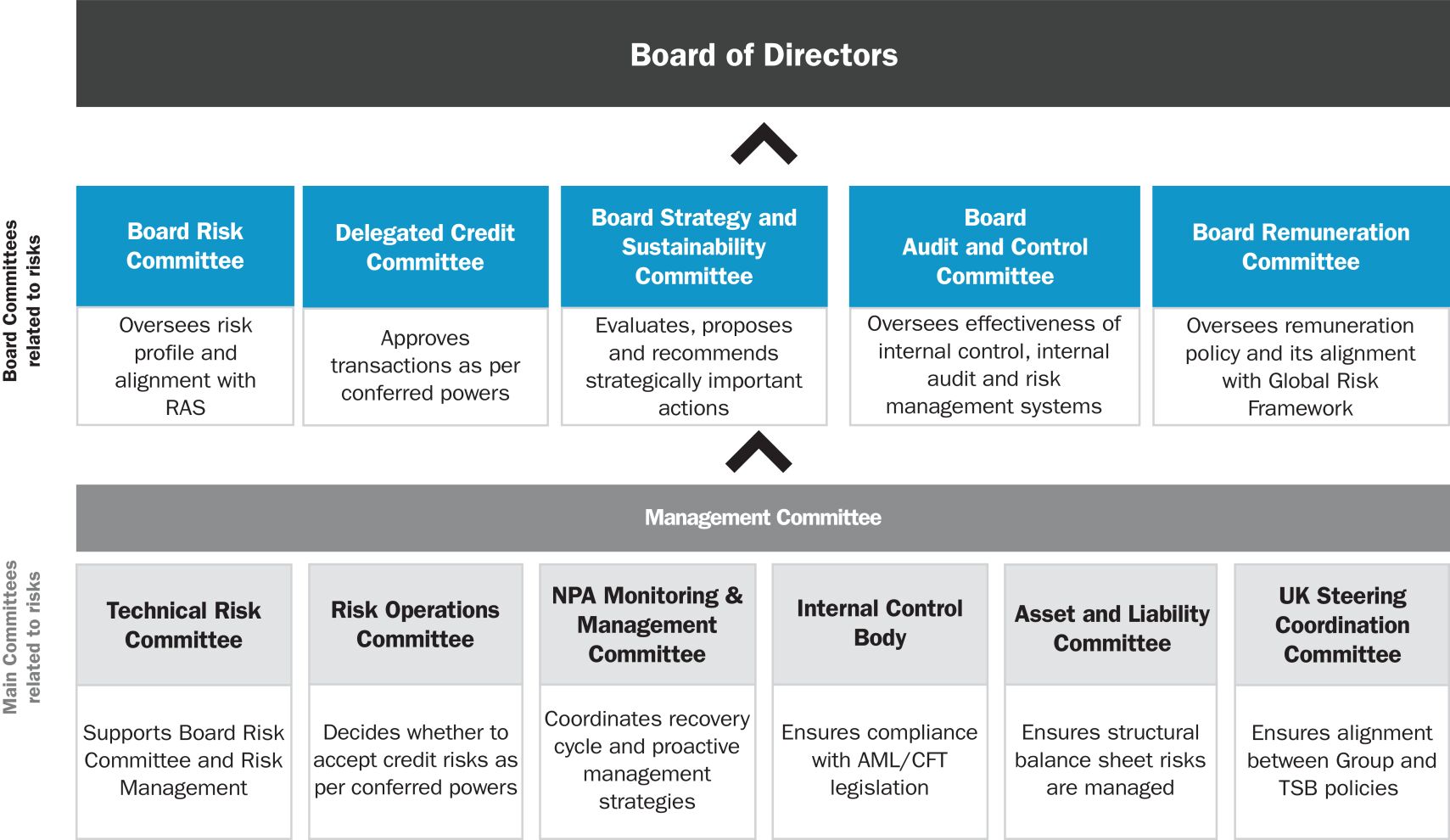

Consequently, the RAF establishes the structure and mechanisms associated with the governance, definition, disclosure, management, measurement, monitoring and control of the Group’s risk appetite established by the Board of Directors of Banco de Sabadell, S.A.

Effective implementation of the RAF requires an adequate combination of policies, processes, controls, systems and procedures that enable a set of defined targets and objectives to not only be achieved, but to be done so in an effective and continuous way.

The RAF covers all of the Group’s business lines and units, in accordance with the proportionality principle, and it is designed to enable suitably informed decisions to be made, taking into account the material risks to which it is exposed, including both financial and non-financial risks.

The RAF is aligned with the Group’s strategy and with the strategic planning and budgeting processes, the internal capital and liquidity adequacy assessments, the Recovery Plan and the remuneration framework, among other things, and it takes into account the material risks to which the Group is exposed, as well as their impact on stakeholders such as shareholders, customers, investors, employees and the general public.

4.3.3 Risk Appetite Statement (RAS)

The RAS is a key element in determining the Institution’s risk strategies. It establishes qualitative expressions and quantitative limits for the different risks that the Institution is willing to accept, or seeks to avoid, in order to achieve its business objectives. Depending on the nature of each risk, the RAS includes both qualitative aspects and quantitative metrics, which are expressed in terms of capital, asset quality, liquidity, profitability or any other measure deemed to be relevant. The RAS is therefore a key element in setting the risk strategy, as it determines the area of activity.

Qualitative aspects of the RAS

The Group’s RAS includes the definition of a set of qualitative aspects, which essentially help to define the Group’s position with regard to certain risks, especially when those risks are difficult to quantify.

These qualitative aspects complement the quantitative metrics, establish the general tone of the Group’s approach to risk-taking and define the reasons for taking or avoiding certain types of risks, products, geographical exposures and other matters.

Quantitative aspects of the RAS

The set of quantitative metrics defined in the RAS are intended to provide objective elements with which to compare the Group’s situation against the goals or challenges proposed at the risk management level. These quantitative metrics follow a hierarchical structure, as established in the RAF, with three levels: board (or first-tier) metrics, executive (or second-tier) metrics and operational (or third-tier) metrics.

Each of these levels has its own approval, monitoring and action arrangements that should be followed in the event a threshold is ruptured.

In order to gradually detect possible situations of deterioration of the risk position and thus be able to monitor and control it more effectively, the RAS sets out a system of thresholds associated with the quantitative metrics. These thresholds reflect the desirable levels of risk for each metric, as well as the levels that should be avoided. A rupture of these thresholds can trigger the activation of remediation plans designed to rectify the situation.

These thresholds are established to reflect different levels of severity, making it possible to take preventive action before excessive levels are reached. Some or all of the thresholds will be established for a given metric, depending on the nature of that metric and its hierarchical level within the structure of RAS metrics.

4.3.4 Specific policies for the different material risks

The various policies in place for each of the risks, together with the operating and conceptual procedures and manuals that form part of the set of regulations of the Group and its subsidiaries, are tools on which the Group and subsidiaries rely to expand on the more specific aspects of each risk.

A-297