Exhibit 99.2

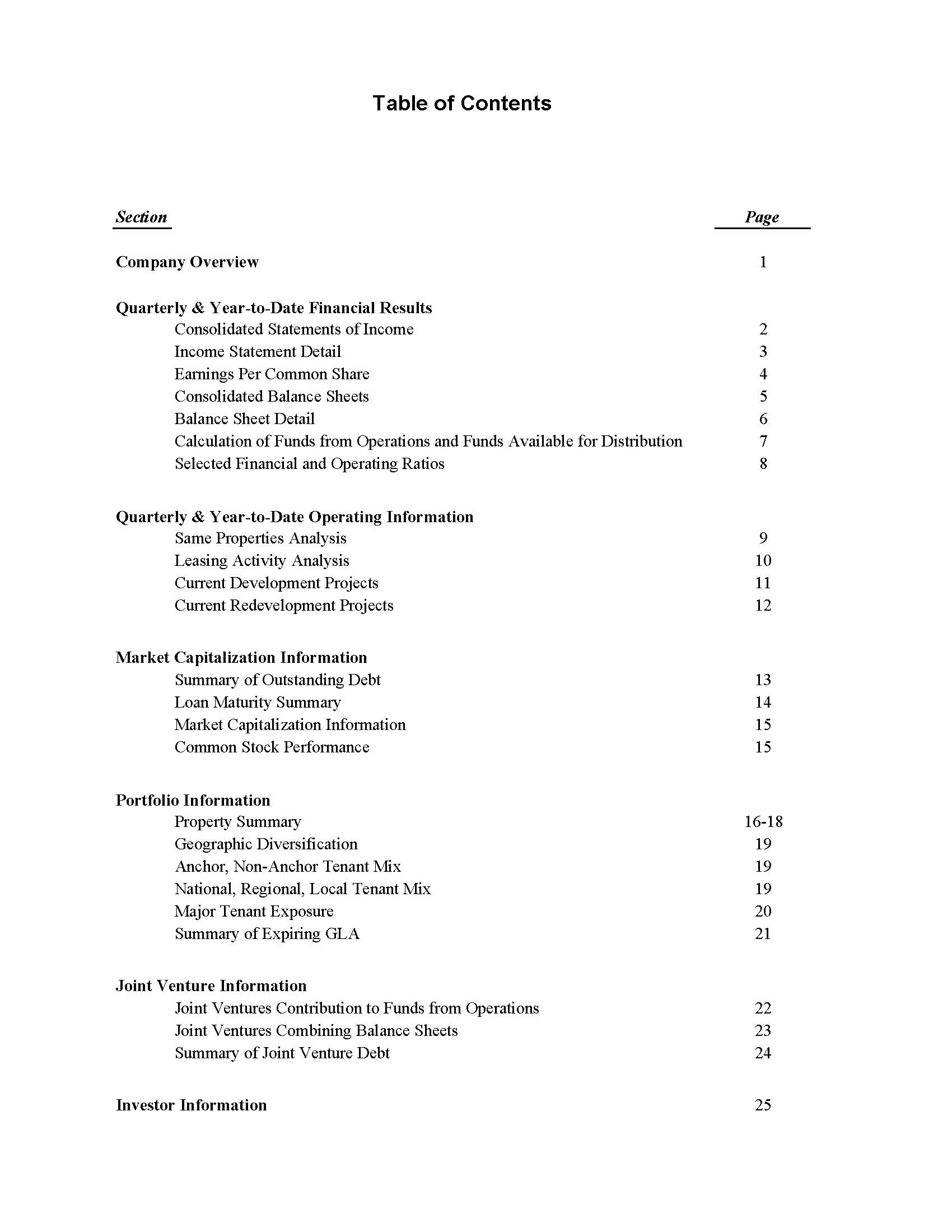

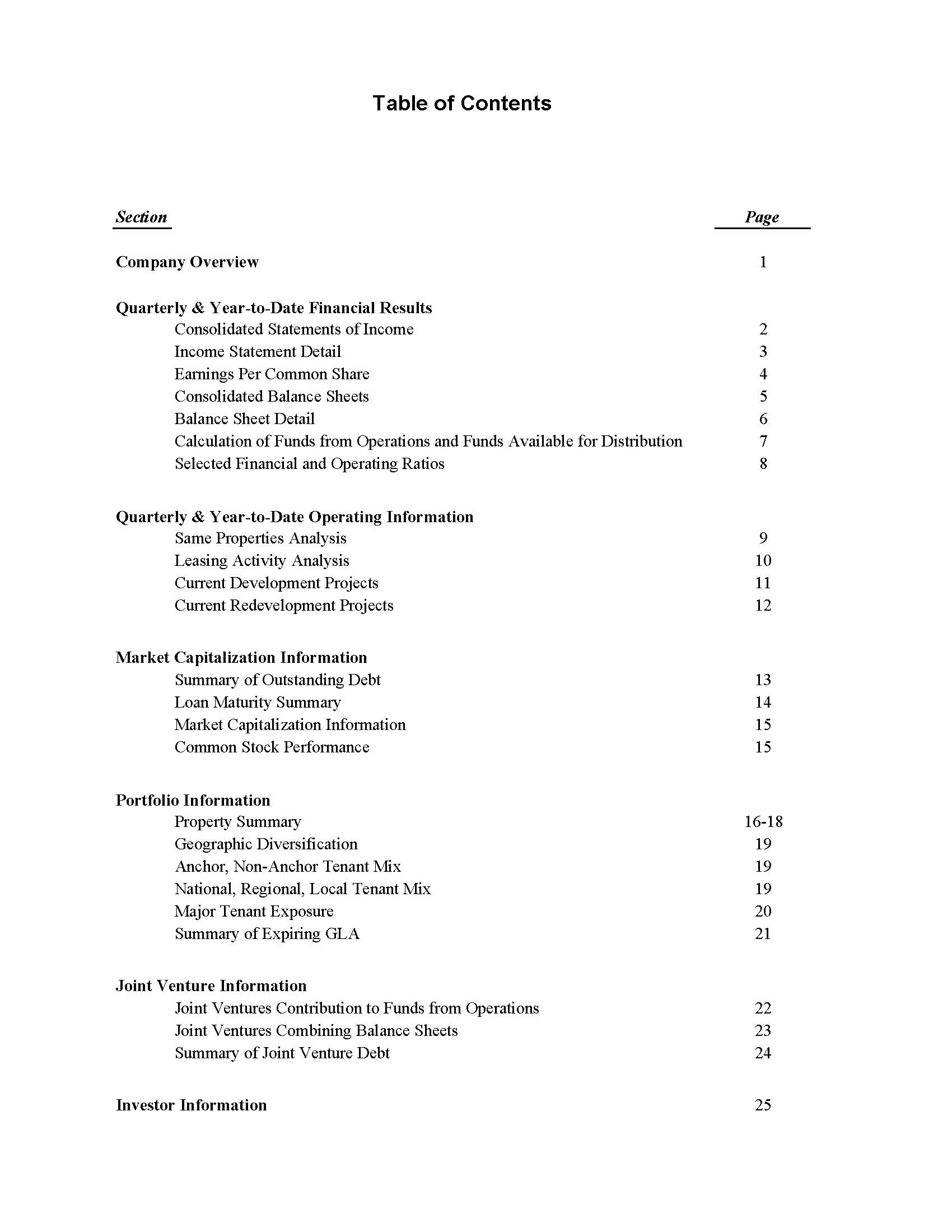

Table of Contents Section Page Company Overview 1 Consolidated Statements of Income 2 Income Statement Detail 3 Earnings Per Common Share 4 Consolidated Balance Sheets 5 Balance Sheet Detail 6 Calculation of Funds from Operations and Funds Available for Distribution 7 Selected Financial and Operating Ratios 8 Quarterly & Year-to-Date Operating Information Same Properties Analysis 9 Leasing Activity Analysis 10 Current Development Projects 11 Current Redevelopment Projects 12 Market Capitalization Information Summary of Outstanding Debt 13 Loan Maturity Summary 14 Market Capitalization Information 15 Common Stock Performance 15 Portfolio Information Property Summary 16-18 Geographic Diversification 19 Anchor, Non-Anchor Tenant Mix 19 National, Regional, Local Tenant Mix 19 Major Tenant Exposure 20 Summary of Expiring GLA 21 Joint Venture Information Joint Ventures Contribution to Funds from Operations 22 Joint Ventures Combining Balance Sheets 23 Summary of Joint Venture Debt 24 Investor Information 25 Quarterly & Year-to-Date Financial Results

COMPANY OVERVIEW Ramco-Gershenson Properties Trust (NYSE:RPT) is a self-administered and self-managed real estate investment trust primarily engaged in the business of owning, developing, acquiring, managing and leasing community shopping centers located primarily in the Midwestern, Mid-Atlantic and Southeastern United States. At September 30, 2008, the Company owned interests in 89 shopping centers with approximately 20.1 million square feet of gross leasable area located in Michigan, Florida, Georgia, Ohio, Wisconsin, Indiana, New Jersey, Maryland, North Carolina, South Carolina, Virginia, Tennessee and Illinois. The Company’s properties consist of 88 community centers and one regional mall. Ramco-Gershenson has a proven track record of generating growth through the redevelopment of its shopping center portfolio. In an effort to maximize the potential of each asset, the Company constantly reevaluates the shopping center’s position within its respective market. This effort is part of an overall approach that allows management to anticipate changes in retailing trends and tenant needs; and proactively implement solutions to boost the performance and value of the center namely through enhancement in the tenant mix, improvement of existing rental rates and occupancy growth. Ramco-Gershenson generates additional growth through the construction of new shopping centers. The Company is focused on developing community shopping centers within metropolitan markets where it currently operates or where it believes demand for additional shopping centers exist. Throughout the Company’s history, management’s experience and long-standing relationships with tenants, has allowed it to capitalize on attractive development opportunities. The Company also remains committed to the acquisition of well-located shopping centers, under appropriate market conditions, that may lend themselves to further improvements, either through strategic joint ventures or on-balance sheet transactions. Ramco-Gershenson seeks to attract investors based on the quality and performance of its assets and the experience of its management team. The Company expects to build shareholder value through the proactive management of its assets as well as the selective development and acquisition of shopping centers. The Company is listed on the New York Stock Exchange under the symbol RPT and is headquartered in Farmington Hills, Michigan. Supplemental Financial and Operating Statistics Q3 2008 Ramco-Gershenson Properties Trust (RPT) Page 1

Consolidated Statements of Income (in thousands) Three Months Ended September 30, Nine Months Ended September 30, Increase Percent Increase Percent 2008 2007 (Decrease) Change 2008 2007 (Decrease) Change Revenues: Minimum rents $ 22,467 23,905$ $ (1,438) (6.0) % 68,589$ 72,283$ $ (3,694) (5.1) % Percentage rents 21 117 (96) (82.1) 518 525 (7) (1.3) Recoveries from tenants 9,942 10,414 (472) (4.5) 31,338 32,805 (1,467) (4.5) Fees and management income (see page 3 for detail) 1,677 1,132 545 48.1 5,029 5,162 (133) (2.6) Other income (see page 3 for detail) 538 1,938 (1,400) (72.2) 1,517 3,588 (2,071) (57.7) Total revenues 34,645 37,506 (2,861) (7.6) 106,991 114,363 (7,372) (6.4) Expenses: Real estate taxes 4,481 5,051 (570) (11.3) 14,133 15,242 (1,109) (7.3) Recoverable operating expenses 5,757 5,944 (187) (3.1) 17,840 18,145 (305) (1.7) Depreciation and amortization 7,824 8,005 (181) (2.3) 23,659 24,220 (561) (2.3) Other operating 836 768 68 8.9 2,897 2,037 860 42.2 General and administrative 3,342 4,043 (701) (17.3) 11,967 10,950 1,017 9.3 Interest expense 8,685 9,887 (1,202) (12.2) 27,357 31,649 (4,292) (13.6) Total expenses 30,925 33,698 (2,773) (8.2) 97,853 102,243 (4,390) (4.3) Income from continuing operations before gain on sale of real estate assets, minority interest and earnings from unconsolidated entities 3,720 3,808 (88) (2.3) 9,138 12,120 (2,982) (24.6) Gain (loss) on sale of real estate assets (see page 3 for detail) 9,247 (107) 9,354 (8,742.1) 19,534 31,269 (11,735) (37.5) Minority interest (1,665) (1,167) (498) 42.7 (4,385) (7,183) 2,798 (39.0) Earnings from unconsolidated entities (see page 22 for detail) 283 688 (405) (58.9) 1,949 1,806 143 7.9 Income from continuing operations 11,585 3,222 8,363 259.6 26,236 38,012 (11,776) (31.0) Discontinued operations, net of minority interest: Loss on sale of real estate assets - - - - (400) - (400) 100.0 Income from operations - 62 (62) (100.0) 178 182 (4) (2.2) Income (loss) from discontinued operations - 62 (62) (100.0) (222) 182 (404) (222.0) Net Income 11,585 3,284 8,301 252.8 26,014 38,194 (12,180) (31.9) Preferred stock dividends - (593) 593 (100.0) - (2,863) 2,863 (100.0) Loss on redemption of preferred shares - - - - - (35) 35 (100.0) Net income available to common shareholders $ 11,585 2,691$ 8,894$ 330.5 % 26,014$ 35,296$ $ (9,282) (26.3) % Property Operating Expense Recovery Ratio 97.1 % 94.7 % 2.4 % 98.0 % 98.3 % (0.3) %

Income Statement Detail (in thousands) Three Months Ended September 30, Nine Months Ended September 30, Increase Percent Increase Percent 2008 2007 (Decrease) Change 2008 2007 (Decrease) Change Fees and management income: Management fees 674$ 507$ 167$ 32.9 % 2,104$ 1,463$ 641$ 43.8 % Leasing fees 413 90 323 358.9 977 487 490 100.6 Acquisition related fees - 436 (436) (100.0) 67 1,383 (1,316) (95.2) Development related fees 463 38 425 1,118.4 1,508 1,655 (147) (8.9) Other 127 61 66 108.2 373 174 199 114.4 Fee and management income 1,677$ 1,132$ 545$ 48.1 % 5,029$ 5,162$ $ (133) (2.6) % Other income: Lease termination income 130$ 1,389$ $ (1,259) (90.6) % 421$ 1,687$ $ (1,266) (75.0) % Temporary income 222 238 (16) (6.7) 473 538 (65) (12.1) Interest income 23 100 (77) (77.0) 225 733 (508) (69.3) Previous write-off of receivable 26 31 (5) (16.1) 93 333 (240) (72.1) Other 137 180 (43) (23.9) 305 297 8 2.7 Other income 538$ 1,938$ $ (1,400) (72.2) % 1,517$ 3,588$ $ (2,071) (57.7) % Gain (loss) on sale of real estate assets: FFO gain on sales 295$ 910$ $ (615) (67.6) % 706$ 1,472$ $ (766) (52.0) % Non-FFO gain (loss) on sales 8,952 (1,017) 9,969 (980.2) 18,828 29,797 (10,969) (36.8) Gain (loss) on sale of real estate assets $ 9,247 (107)$ 9,354$ (8,742.1) % 19,534$ 31,269$ $ (11,735) (37.5) %

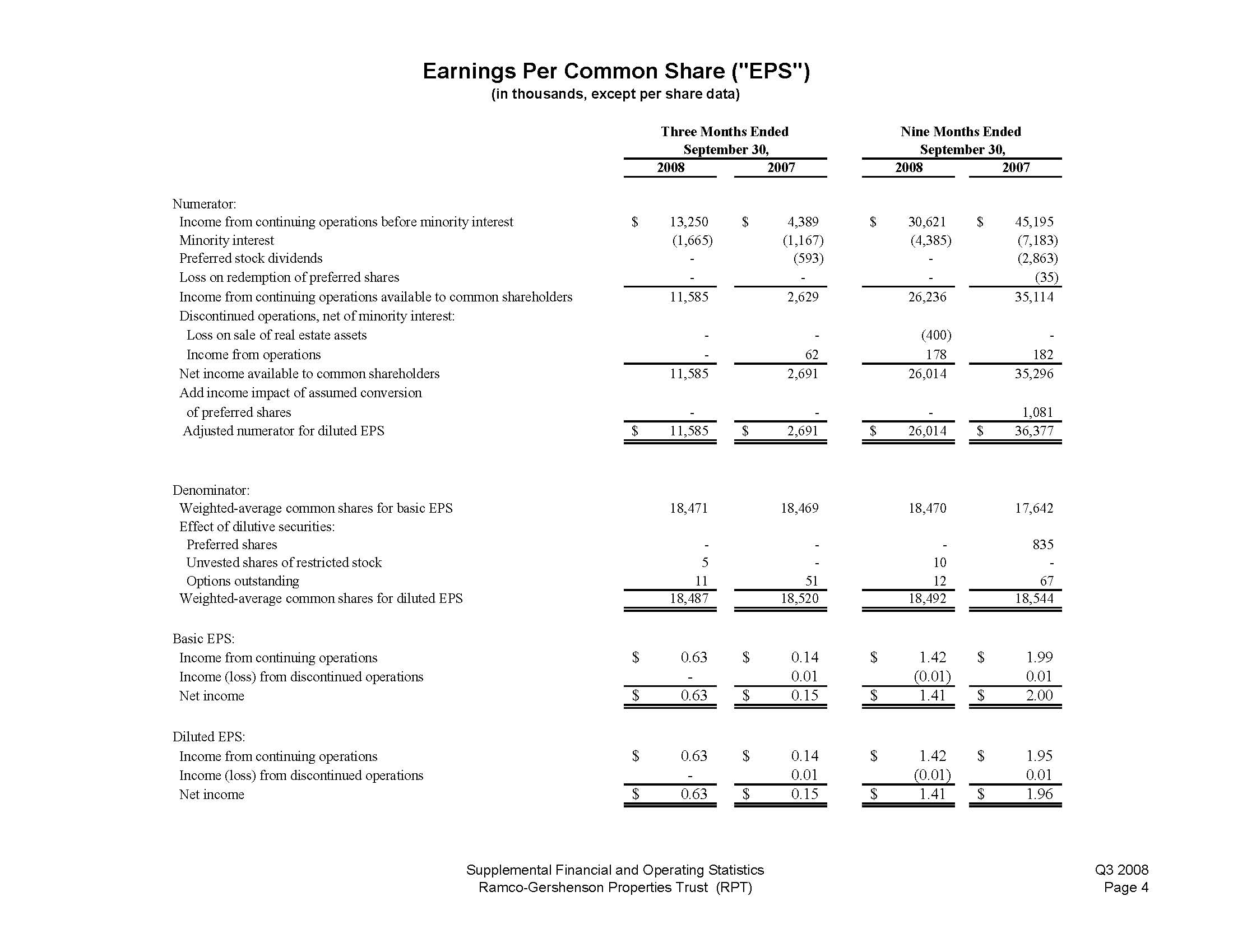

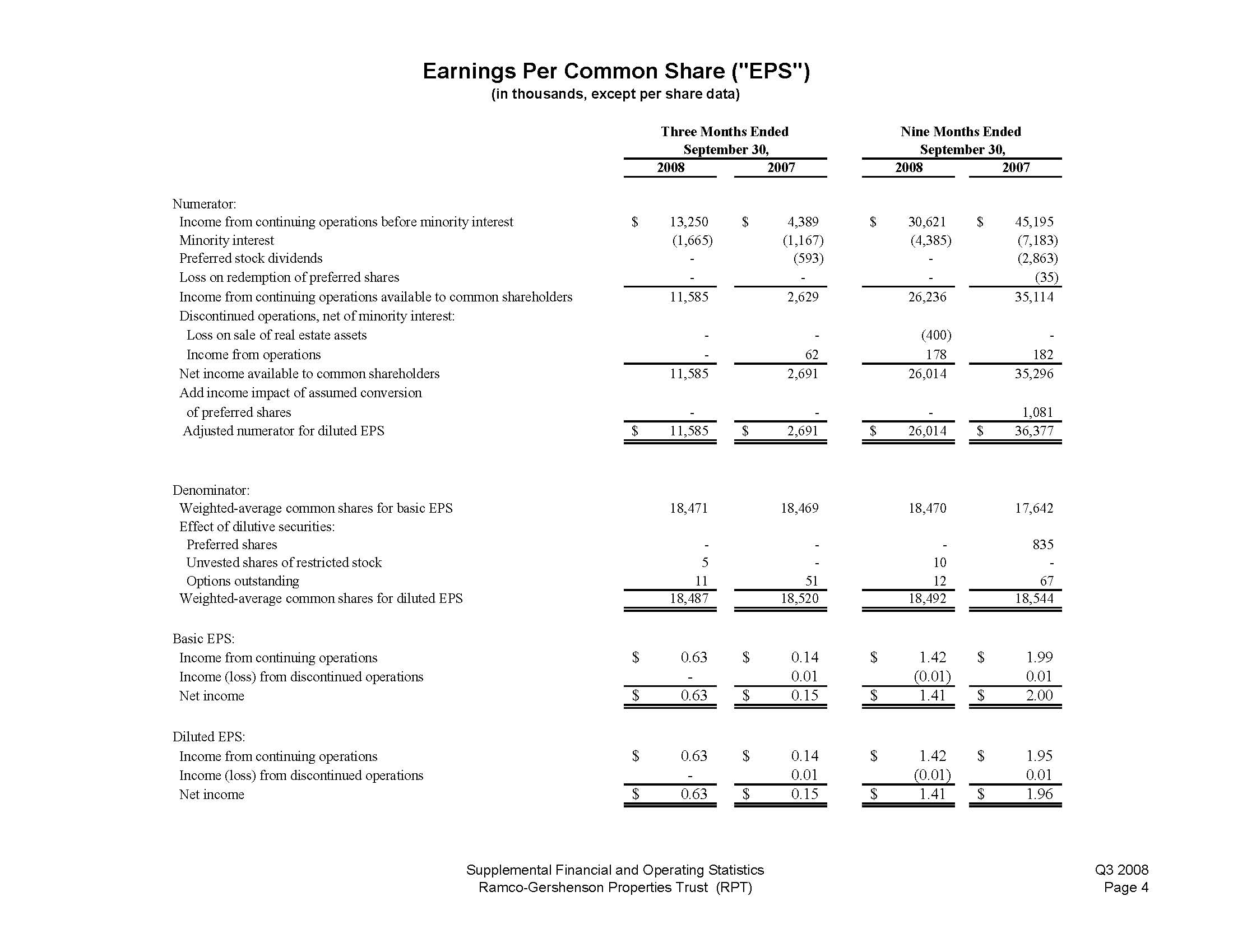

Earnings Per Common Share ("EPS") (in thousands, except per share data) Three Months Ended Nine Months Ended September 30, September 30, 2008 2007 2008 2007 Numerator: Income from continuing operations before minority interest $ 13,250 $ 4,389 $ 30,621 $ 45,195 Minority interest (1,665) (1,167) (4,385) (7,183) Preferred stock dividends - (593) - (2,863) Loss on redemption of preferred shares - - - (35) Income from continuing operations available to common shareholders 11,585 2,629 26,236 35,114 Discontinued operations, net of minority interest: Loss on sale of real estate assets - - (400) - Income from operations - 62 178 182 Net income available to common shareholders 11,585 2,691 26,014 35,296 Add income impact of assumed conversion of preferred shares - - - 1,081 Adjusted numerator for diluted EPS $ 11,585 $ 2,691 $ 26,014 $ 36,377 Denominator: Weighted-average common shares for basic EPS 18,471 18,469 18,470 17,642 Effect of dilutive securities: Preferred shares - - - 835 Unvested shares of restricted stock 5 - 10 - Options outstanding 11 51 12 67 Weighted-average common shares for diluted EPS 18,487 18,520 18,492 18,544 Basic EPS: Income from continuing operations $ 0.63 $ 0.14 $ 1.42 $ 1.99 Income (loss) from discontinued operations - 0.01 (0.01) 0.01 Net income $ 0.63 $ 0.15 $ 1.41 $ 2.00 Diluted EPS: Income from continuing operations $ 0.63 $ 0.14 $ 1.42 $ 1.95 Income (loss) from discontinued operations - 0.01 (0.01) 0.01 Net income $ 0.63 $ 0.15 $ 1.41 $ 1.96

Consolidated Balance Sheets (in thousands) September 30, June 30, March 31, December 31, 2008 2008 2008 2007 ASSETS Investment in real estate, net (see page 6 for detail) $ 821,270 $ 882,763 $ 880,142 $ 876,410 Cash and cash equivalents 7,035 6,670 15,043 14,977 Restricted cash 5,555 7,490 6,537 5,777 Accounts receivable, net (see page 6 for detail) 34,353 39,035 38,460 35,787 Equity investments in and advances to unconsolidated entities (see page 23 for detail) 98,087 93,626 94,561 117,987 Other assets, net (see page 6 for detail) 38,102 38,036 38,021 37,561 Total Assets $ 1,004,402 $ 1,067,620 $ 1,072,764 $ 1,088,499 LIABILITIES AND SHAREHOLDERS' EQUITY Mortgages and notes payable (see page 13 for detail) $ 637,770 $ 690,999 $ 691,276 $ 690,801 Accounts payable and accrued expenses 25,211 38,020 39,783 57,614 Distributions payable 9,888 9,888 9,887 9,884 Capital lease obligation 7,256 7,319 7,382 7,443 Total Liabilities 680,125 746,226 748,328 765,742 Minority Interest 40,965 40,650 41,406 41,353 SHAREHOLDERS' EQUITY Common Shares of Beneficial Interest 185 186 186 185 Additional paid-in capital 388,932 389,126 388,686 388,164 Accumulated other comprehensive income (loss) (105) 179 (2,649) (845) Cumulative distributions in excess of net income (105,700) (108,747) (103,193) (106,100) Total Shareholders' Equity 283,312 280,744 283,030 281,404 Total Liabilities and Shareholders' Equity $ 1,004,402 $ 1,067,620 $ 1,072,764 $ 1,088,499

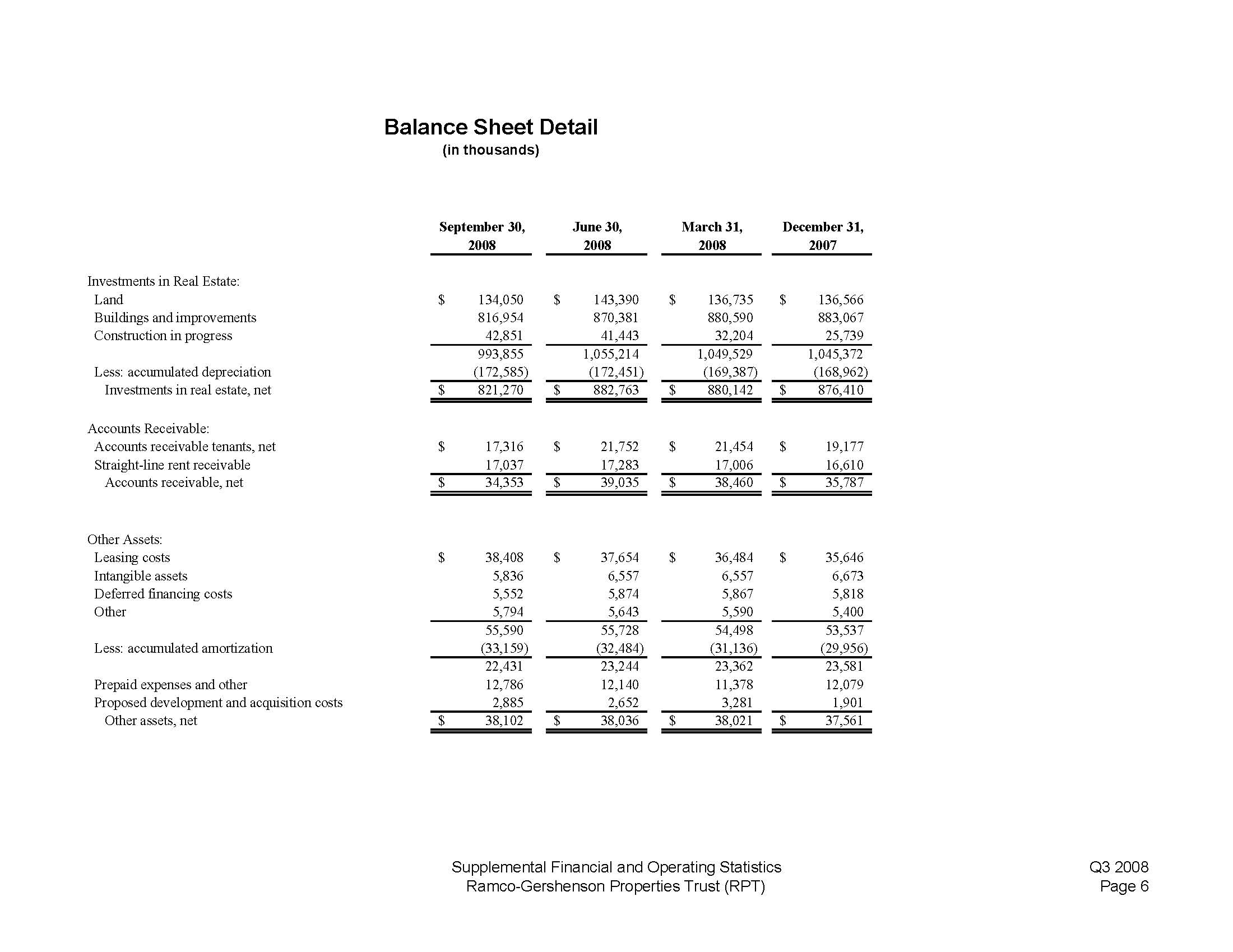

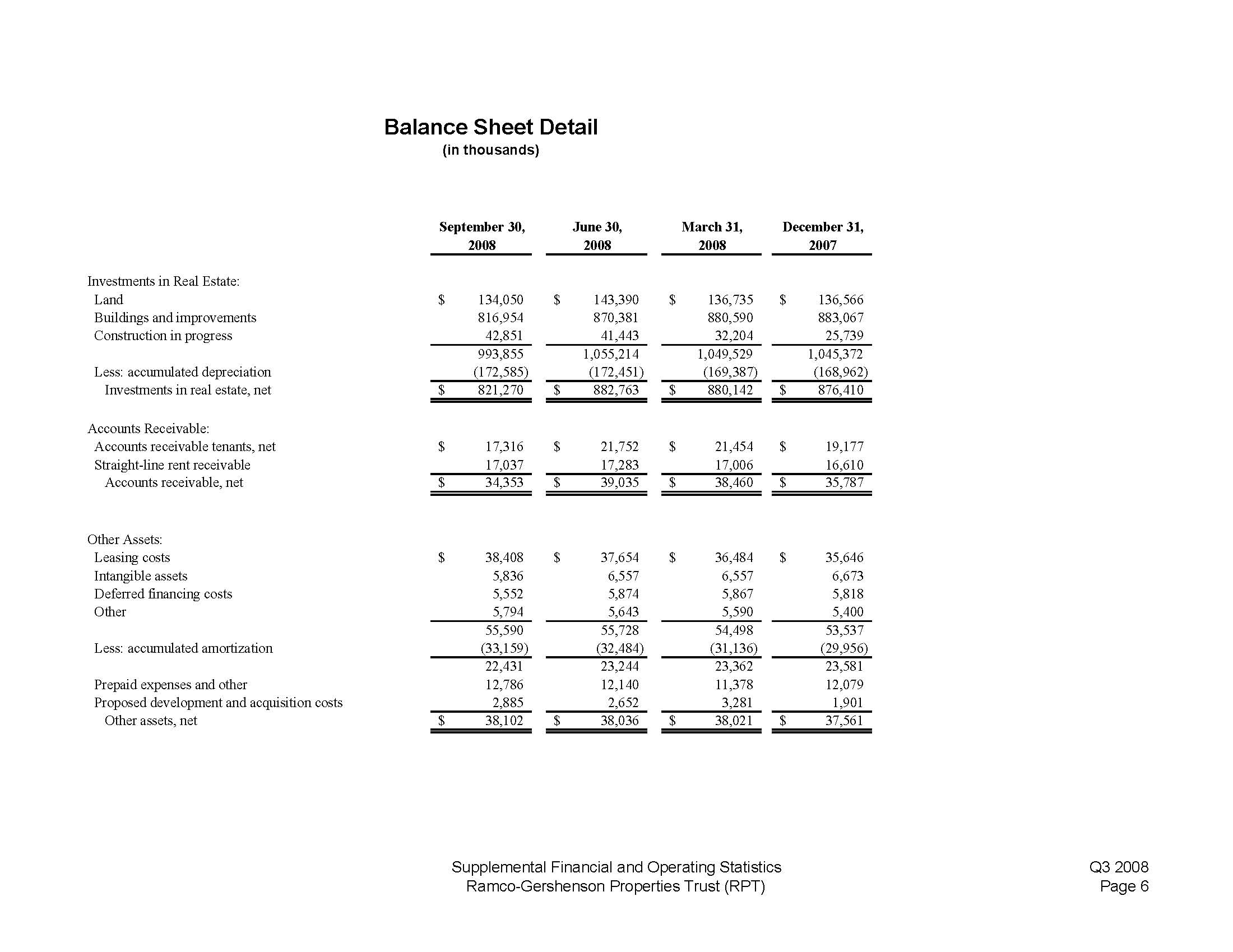

Balance Sheet Detail (in thousands) September 30, June 30, March 31, December 31, 2008 2008 2008 2007 Investments in Real Estate: Land 134,050$ $ 143,390 136,735$ 136,566$ Buildings and improvements 816,954 870,381 880,590 883,067 Construction in progress 42,851 41,443 32,204 25,739 993,855 1,055,214 1,049,529 1,045,372 Less: accumulated depreciation (172,585) (172,451) (169,387) (168,962) Investments in real estate, net 821,270$ $ 882,763 880,142$ 876,410$ Accounts Receivable: Accounts receivable tenants, net 17,316$ $ 21,752 21,454$ 19,177$ Straight-line rent receivable 17,037 17,283 17,006 16,610 Accounts receivable, net 34,353$ $ 39,035 38,460$ 35,787$ Other Assets: Leasing costs 38,408$ $ 37,654 36,484$ 35,646$ Intangible assets 5,836 6,557 6,557 6,673 Deferred financing costs 5,552 5,874 5,867 5,818 Other 5,794 5,643 5,590 5,400 55,590 55,728 54,498 53,537 Less: accumulated amortization (33,159) (32,484) (31,136) (29,956) 22,431 23,244 23,362 23,581 Prepaid expenses and other 12,786 12,140 11,378 12,079 Proposed development and acquisition costs 2,885 2,652 3,281 1,901 Other assets, net 38,102$ $ 38,036 38,021$ 37,561$

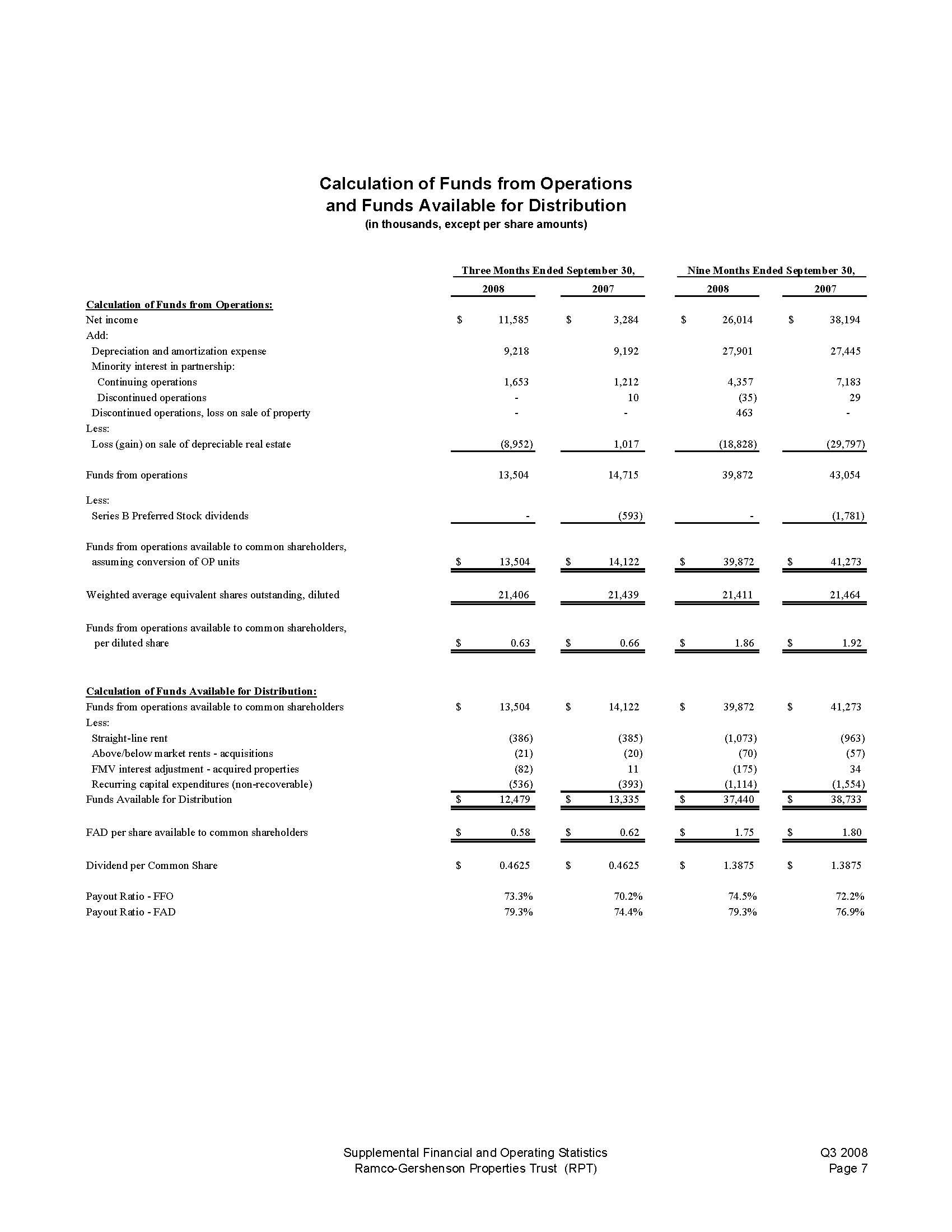

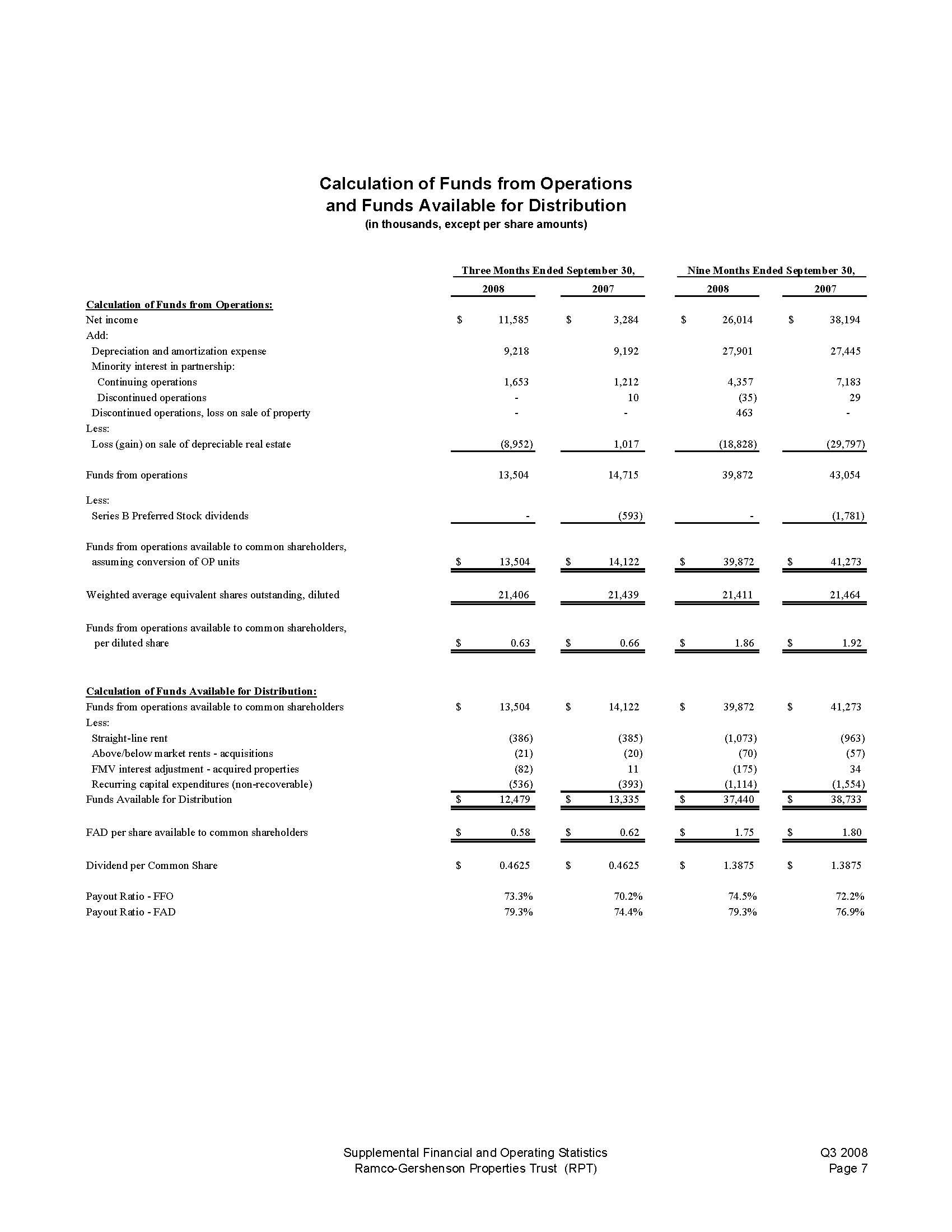

Calculation of Funds from Operations and Funds Available for Distribution (in thousands, except per share amounts) Three Months Ended September 30, Nine Months Ended September 30, 2008 2007 2008 2007 Calculation of Funds from Operations: Net income 11,585$ 3,284$ 26,014$ 38,194$ Add: Depreciation and amortization expense 9,218 9,192 27,901 27,445 Minority interest in partnership: Continuing operations 1,653 1,212 4,357 7,183 Discontinued operations - 10 (35) 29 Discontinued operations, loss on sale of property - - 463 - Less: Loss (gain) on sale of depreciable real estate (8,952) 1,017 (18,828) (29,797) Funds from operations 13,504 14,715 39,872 43,054 Less: Series B Preferred Stock dividends - (593) - (1,781) Funds from operations available to common shareholders, assuming conversion of OP units 13,504$ 14,122$ 39,872$ 41,273$ Weighted average equivalent shares outstanding, diluted 21,406 21,439 21,411 21,464 Funds from operations available to common shareholders, per diluted share 0.63$ 0.66$ 1.86$ 1.92$ Calculation of Funds Available for Distribution: Funds from operations available to common shareholders 13,504$ 14,122$ 39,872$ 41,273$ Less: Straight-line rent (386) (385) (1,073) (963) Above/below market rents - acquisitions (21) (20) (70) (57) FMV interest adjustment - acquired properties (82) 11 (175) 34 Recurring capital expenditures (non-recoverable) (536) (393) (1,114) (1,554) Funds Available for Distribution 12,479$ 13,335$ 37,440$ 38,733$ FAD per share available to common shareholders 0.58$ 0.62$ 1.75$ 1.80$ Dividend per Common Share 0.4625$ 0.4625$ 1.3875$ 1.3875$ Payout Ratio - FFO 73.3% 70.2% 74.5% 72.2% Payout Ratio - FAD 79.3% 74.4% 79.3% 76.9% Supplemental Financial and Operating Statistics Q3 2008 Ramco-Gershenson Properties Trust (RPT) Page 7

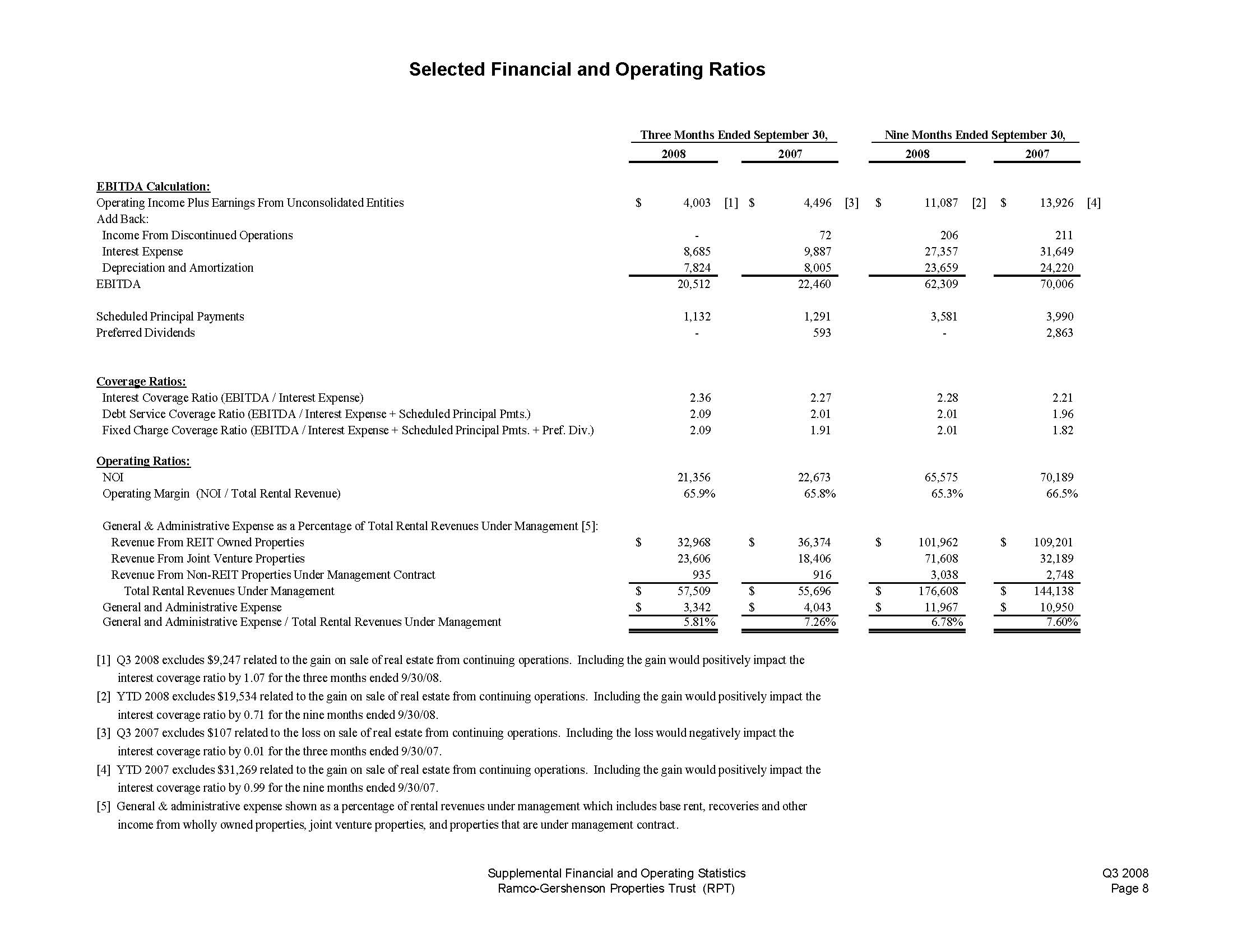

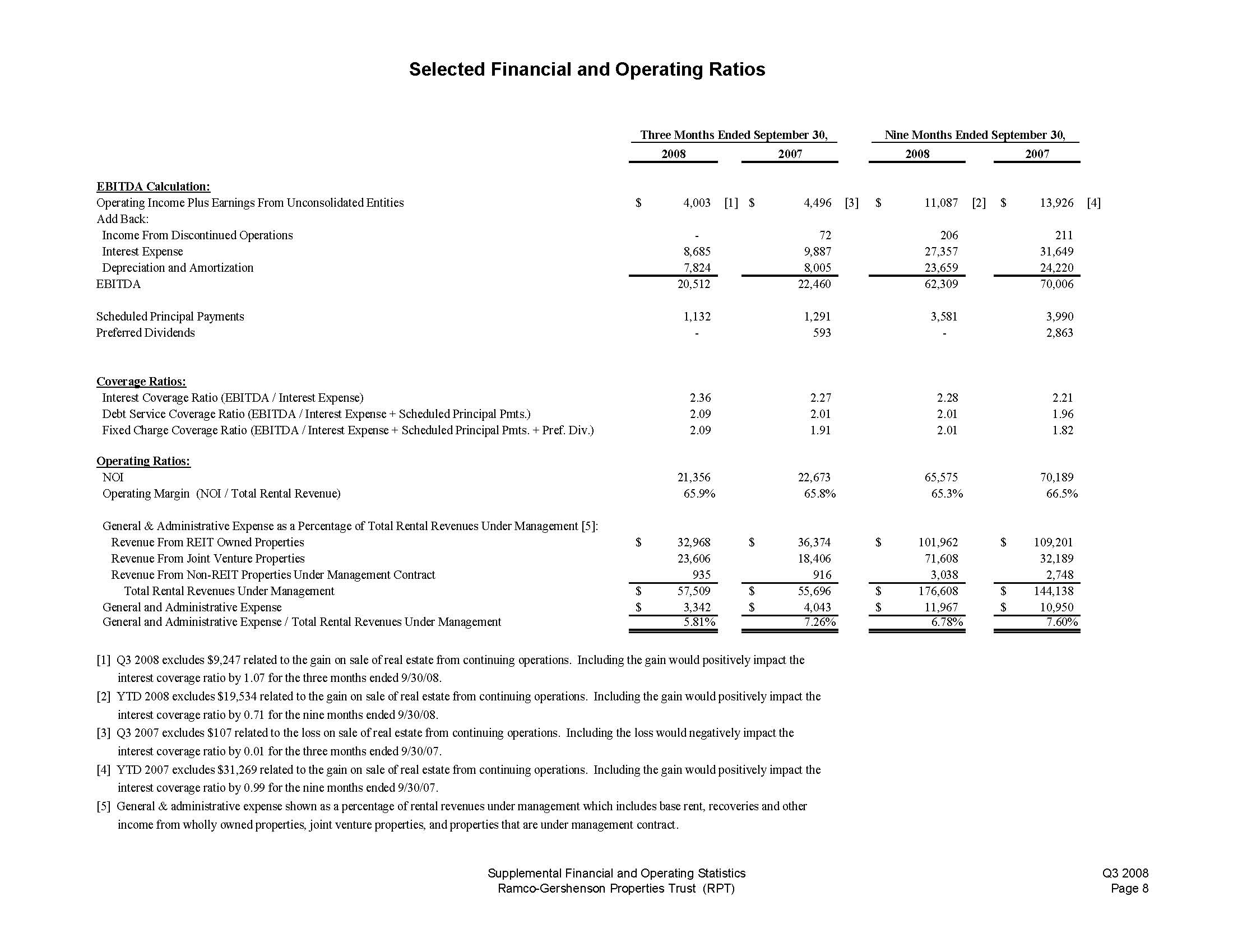

Selected Financial and Operating Ratios Three Months Ended September 30, Nine Months Ended September 30, 2008 2007 2008 2007 EBITDA Calculation: Operating Income Plus Earnings From Unconsolidated Entities $ 4,003 [1] $ 4,496 [3] $ 11,087 [2] $ 13,926 [4] Add Back: Income From Discontinued Operations - 72 206 211 Interest Expense 8,685 9,887 27,357 31,649 Depreciation and Amortization 7,824 8,005 23,659 24,220 EBITDA 20,512 22,460 62,309 70,006 Scheduled Principal Payments 1,132 1,291 3,581 3,990 Preferred Dividends - 593 - 2,863 Coverage Ratios: Interest Coverage Ratio (EBITDA / Interest Expense) 2.36 2.27 2.28 2.21 Debt Service Coverage Ratio (EBITDA / Interest Expense + Scheduled Principal Pmts.) 2.09 2.01 2.01 1.96 Fixed Charge Coverage Ratio (EBITDA / Interest Expense + Scheduled Principal Pmts. + Pref. Div.) 2.09 1.91 2.01 1.82 Operating Ratios: NOI 21,356 22,673 65,575 70,189 Operating Margin (NOI / Total Rental Revenue) 65.9% 65.8% 65.3% 66.5% General & Administrative Expense as a Percentage of Total Rental Revenues Under Management [5]: Revenue From REIT Owned Properties $ 32,968 $ 36,374 $ 101,962 $ 109,201 Revenue From Joint Venture Properties 23,606 18,406 71,608 32,189 Revenue From Non-REIT Properties Under Management Contract 935 916 3,038 2,748 Total Rental Revenues Under Management $ 57,509 $ 55,696 $ 176,608 $ 144,138 General and Administrative Expense $ 3,342 $ 4,043 $ 11,967 $ 10,950 General and Administrative Expense / Total Rental Revenues Under Management 5.81% 7.26% 6.78% 7.60% [1] Q3 2008 excludes $9,247 related to the gain on sale of real estate from continuing operations. Including the gain would positively impact the interest coverage ratio by 1.07 for the three months ended 9/30/08. [2] YTD 2008 excludes $19,534 related to the gain on sale of real estate from continuing operations. Including the gain would positively impact the interest coverage ratio by 0.71 for the nine months ended 9/30/08. [3] Q3 2007 excludes $107 related to the loss on sale of real estate from continuing operations. Including the loss would negatively impact the interest coverage ratio by 0.01 for the three months ended 9/30/07. [4] YTD 2007 excludes $31,269 related to the gain on sale of real estate from continuing operations. Including the gain would positively impact the interest coverage ratio by 0.99 for the nine months ended 9/30/07. [5] General & administrative expense shown as a percentage of rental revenues under management which includes base rent, recoveries and other income from wholly owned properties, joint venture properties, and properties that are under management contract.

Same Properties Analysis (in thousands) Three Months Ended September 30, Nine Months Ended September 30, 2008 2007 % Change 2008 2007 % Change Number of Properties [1] 51 51 0% 51 51 0% Occupancy 95.3% 96.0% -0.8% 95.3% 96.0% -0.8% REVENUE: Minimum Rents $17,647 Percentage Rent 31 Recoveries from Tenants 8,704 Other Income 166 $26,549 $17,503 0.8% $52,638 $52,324 0.6%24 29.8% 446 362 23.0%8,102 7.4% 26,879 25,288 6.3%168 -1.6% 585 654 -10.6% $25,797 2.9% $80,547 $78,628 2.4% EXPENSES: Real Estate Taxes $3,723 Property Operating and Maintenance 4,732 Other Operating 366 $8,821 OPERATING INCOME $17,727 $4,022 -7.4% $11,744 $11,708 0.3%4,327 9.4% 14,470 13,513 7.1%380 -3.7% 1,246 1,065 16.9% $8,729 1.1% $27,460 $26,287 4.5% $17,069 3.9% $53,087 $52,341 1.4% Operating Expense Recovery Ratio 102.9% 97.0% 5.9% 102.5% 100.3% 2.3% [1] Excludes joint venture properties.Note: Excludes centers under redevelopment and reflects recovery adjustments to the proper period.

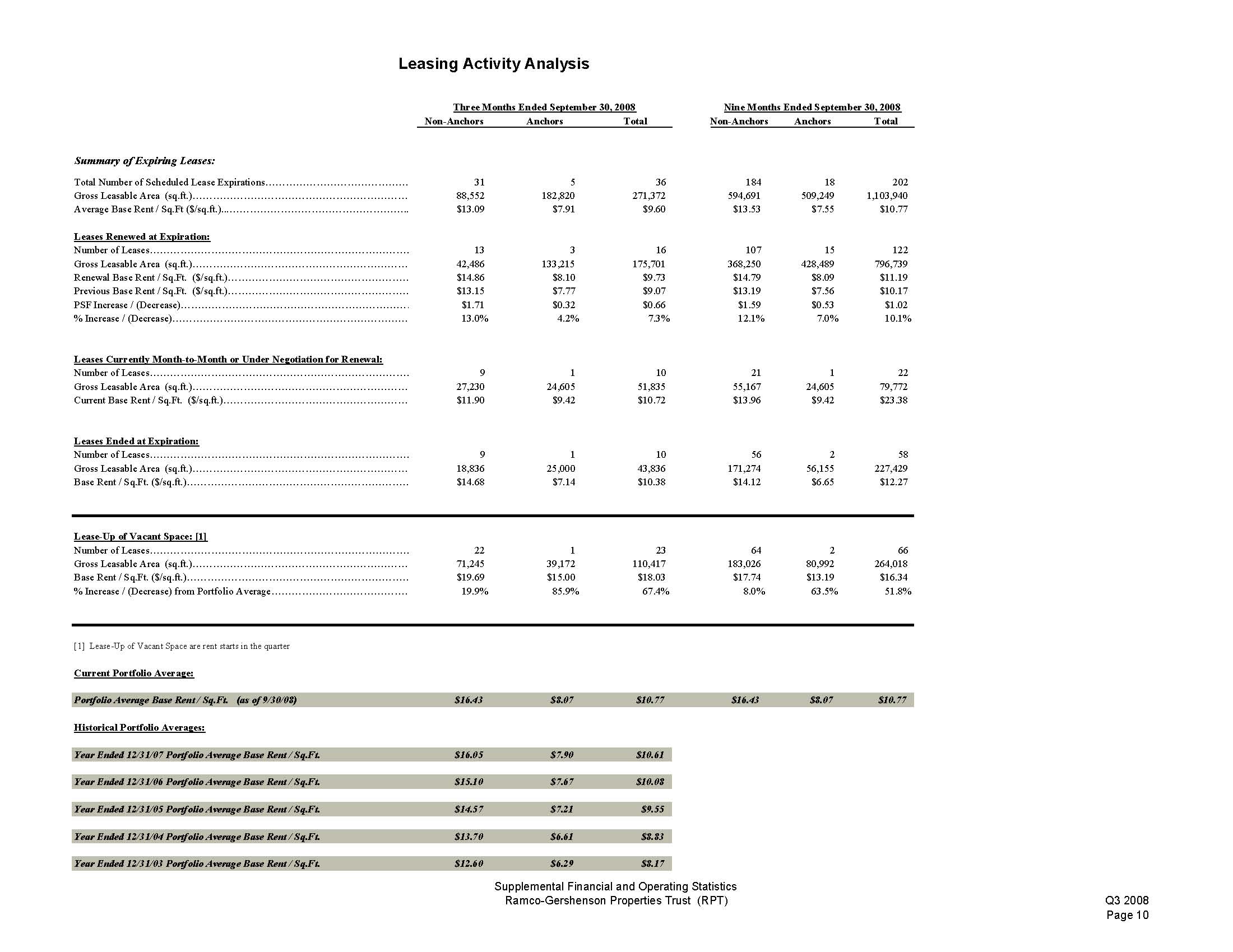

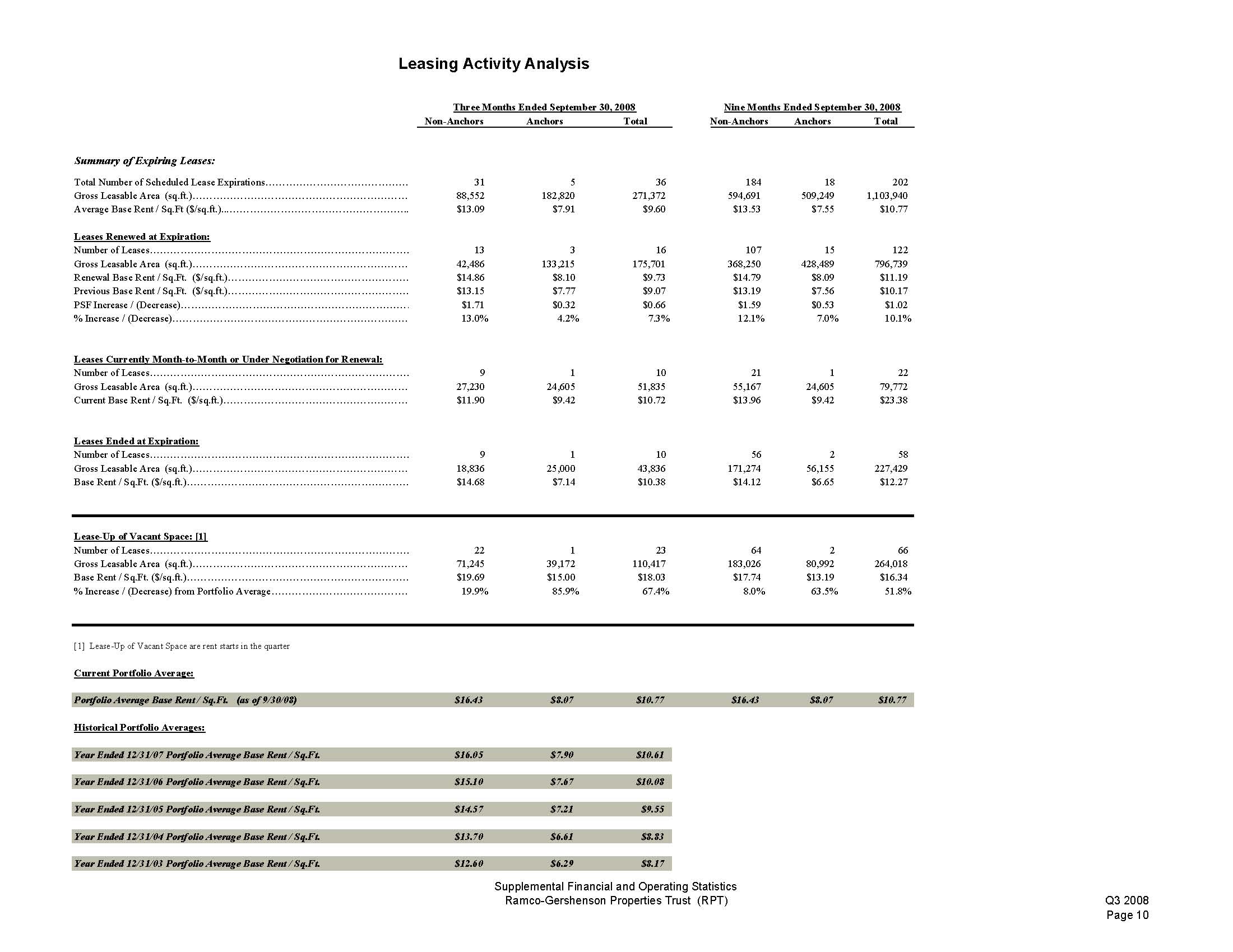

Leasing Activity Analysis Three Months Ended September 30, 2008 Nine Months Ended September 30, 2008 Non-Anchors Anchors Total Non-Anchors Anchors Total Summary of Expiring Leases: Total Number of Scheduled Lease Expirations 31 5 36 184 18 202 Gross Leasable Area (sq.ft.) 88,552 182,820 271,372 594,691 509,249 1,103,940 Average Base Rent / Sq.Ft ($/sq.ft.) $13.09 $7.91 $9.60 $13.53 $7.55 $10.77 Leases Renewed at Expiration: Number of Leases 13 3 16 107 15 122 Gross Leasable Area (sq.ft.) 42,486 133,215 175,701 368,250 428,489 796,739 Renewal Base Rent / Sq.Ft. ($/sq.ft.) $14.86 $8.10 $9.73 $14.79 $8.09 $11.19 Previous Base Rent / Sq.Ft. ($/sq.ft.) $13.15 $7.77 $9.07 $13.19 $7.56 $10.17 PSF Increase / (Decrease) $1.71 $0.32 $0.66 $1.59 $0.53 $1.02 % Increase / (Decrease) 13.0% 4.2% 7.3% 12.1% 7.0% 10.1% Leases Currently Month-to-Month or Under Negotiation for Renewal: Number of Leases 9 1 10 21 1 22 Gross Leasable Area (sq.ft.) 27,230 24,605 51,835 55,167 24,605 79,772 Current Base Rent / Sq.Ft. ($/sq.ft.) $11.90 $9.42 $10.72 $13.96 $9.42 $23.38 Leases Ended at Expiration: Number of Leases 9 1 10 56 2 58 Gross Leasable Area (sq.ft.) 18,836 25,000 43,836 171,274 56,155 227,429 Base Rent / Sq.Ft. ($/sq.ft.) $14.68 $7.14 $10.38 $14.12 $6.65 $12.27 Lease-Up of Vacant Space: [1] Number of Leases 22 1 23 64 2 66 Gross Leasable Area (sq.ft.) 71,245 39,172 110,417 183,026 80,992 264,018 Base Rent / Sq.Ft. ($/sq.ft.) $19.69 $15.00 $18.03 $17.74 $13.19 $16.34 % Increase / (Decrease) from Portfolio Average 19.9% 85.9% 67.4% 8.0% 63.5% 51.8% [1] Lease-Up of Vacant Space are rent starts in the quarter Current Portfolio Average: Portfolio Average Base Rent / Sq.Ft. (as of 9/30/08) $16.43 $8.07 $10.77 $16.43 $8.07 $10.77 Historical Portfolio Averages: Year Ended 12/31/07 Portfolio Average Base Rent / Sq.Ft. $16.05 $7.90 $10.61 Year Ended 12/31/06 Portfolio Average Base Rent / Sq.Ft. $15.10 $7.67 $10.08 Year Ended 12/31/05 Portfolio Average Base Rent / Sq.Ft. $14.57 $7.21 $9.55 Year Ended 12/31/04 Portfolio Average Base Rent / Sq.Ft. $13.70 $6.61 $8.83 Year Ended 12/31/03 Portfolio Average Base Rent / Sq.Ft. $12.60 $6.29 $8.17 Supplemental Financial and Operating Statistics Ramco-Gershenson Properties Trust (RPT) Q3 2008 Page 10

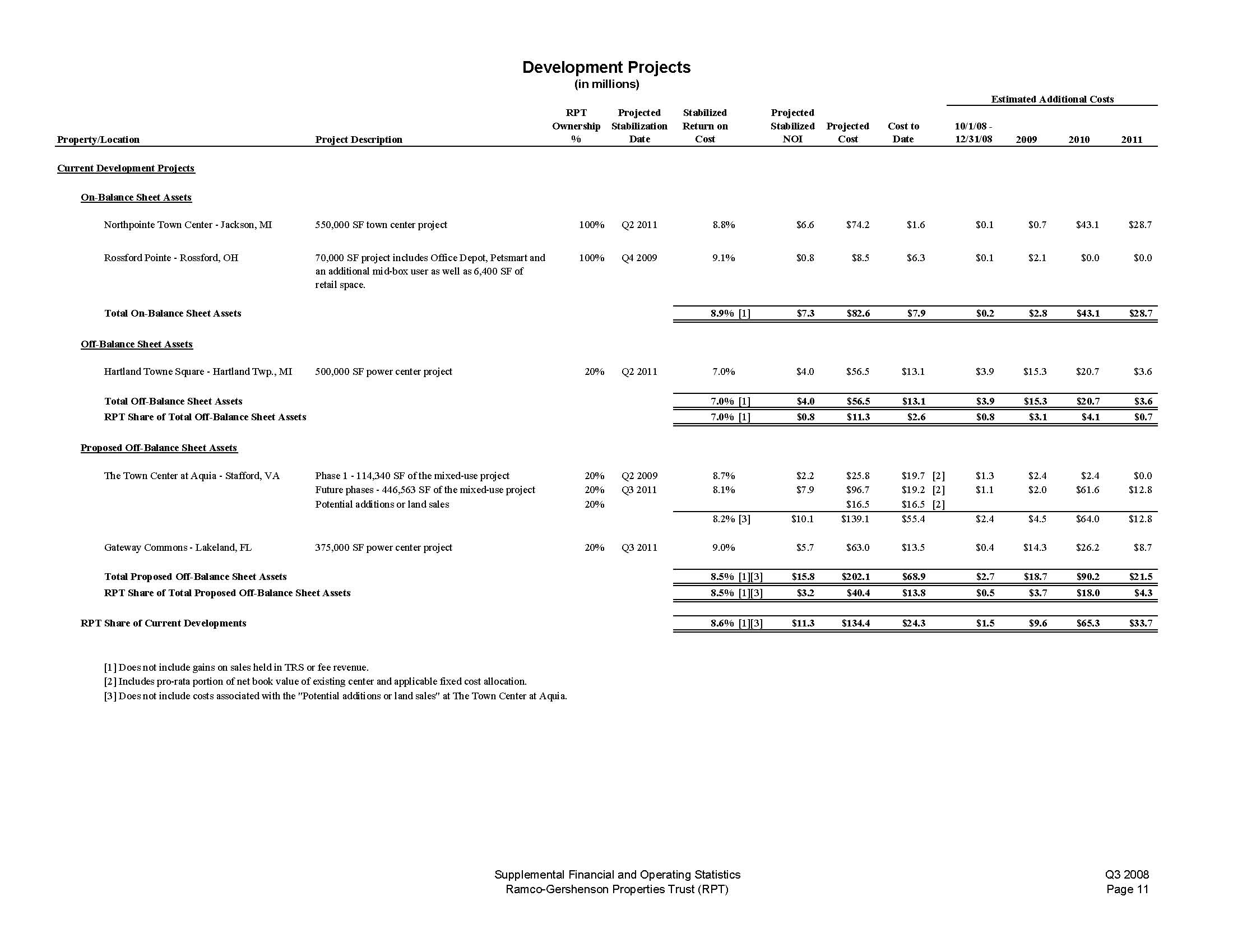

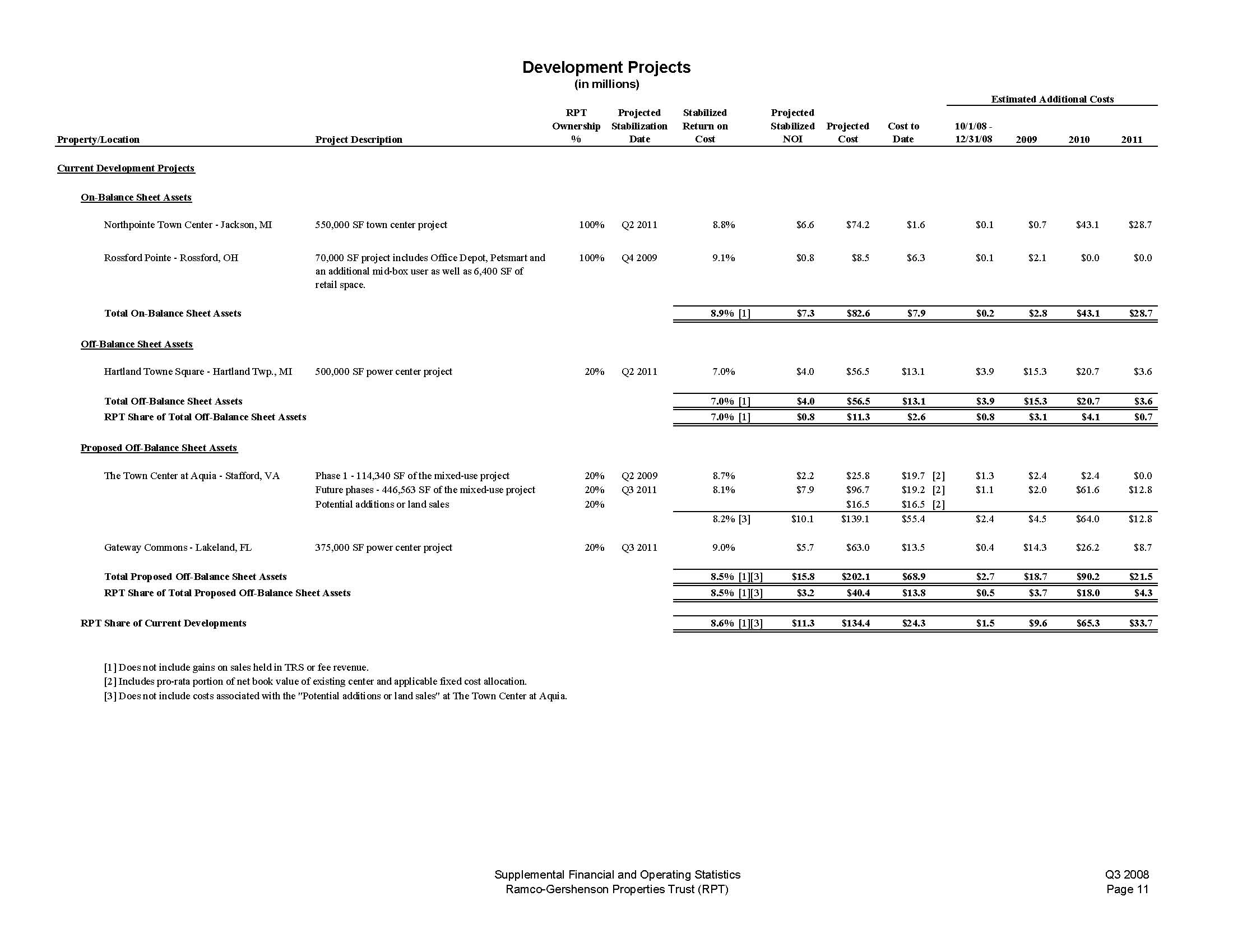

Development Projects (in millions) Estimated Additional Costs RPT Projected Stabilized Projected Ownership Stabilization Return on Stabilized Projected Cost to 10/1/08 - Property/Location Project Description % Date Cost NOI Cost Date 12/31/08 2009 2010 2011 Current Development Projects On-Balance Sheet Assets Northpointe Town Center - Jackson, MI 550,000 SF town center project 100% Q2 2011 8.8% $6.6 $74.2 $1.6 $0.1 $0.7 $43.1 $28.7 Rossford Pointe - Rossford, OH 70,000 SF project includes Office Depot, Petsmart and 100% Q4 2009 9.1% $0.8 $8.5 $6.3 $0.1 $2.1 $0.0 $0.0 an additional mid-box user as well as 6,400 SF of retail space. Total On-Balance Sheet Assets 8.9% [1] $7.3 $82.6 $7.9 $0.2 $2.8 $43.1 $28.7 Off-Balance Sheet Assets Hartland Towne Square - Hartland Twp., MI 500,000 SF power center project 20% Q2 2011 7.0% $4.0 $56.5 $13.1 $3.9 $15.3 $20.7 $3.6 Total Off-Balance Sheet Assets 7.0% [1] $4.0 $56.5 $13.1 $3.9 $15.3 $20.7 $3.6 RPT Share of Total Off-Balance Sheet Assets 7.0% [1] $0.8 $11.3 $2.6 $0.8 $3.1 $4.1 $0.7 Proposed Off-Balance Sheet Assets The Town Center at Aquia - Stafford, VA Phase 1 - 114,340 SF of the mixed-use project 20% Q2 2009 8.7% $2.2 $25.8 $19.7 [2] $1.3 $2.4 $2.4 $0.0 Future phases - 446,563 SF of the mixed-use project 20% Q3 2011 8.1% $7.9 $96.7 $19.2 [2] $1.1 $2.0 $61.6 $12.8 Potential additions or land sales 20% $16.5 $16.5 [2] 8.2% [3] $10.1 $139.1 $55.4 $2.4 $4.5 $64.0 $12.8 Gateway Commons - Lakeland, FL 375,000 SF power center project 20% Q3 2011 9.0% $5.7 $63.0 $13.5 $0.4 $14.3 $26.2 $8.7 Total Proposed Off-Balance Sheet Assets 8.5% [1][3] $15.8 $202.1 $68.9 $2.7 $18.7 $90.2 $21.5 RPT Share of Total Proposed Off-Balance Sheet Assets 8.5% [1][3] $3.2 $40.4 $13.8 $0.5 $3.7 $18.0 $4.3 RPT Share of Current Developments 8.6% [1][3] $11.3 $134.4 $24.3 $1.5 $9.6 $65.3 $33.7 [1] Does not include gains on sales held in TRS or fee revenue. [2] Includes pro-rata portion of net book value of existing center and applicable fixed cost allocation. [3] Does not include costs associated with the "Potential additions or land sales" at The Town Center at Aquia.

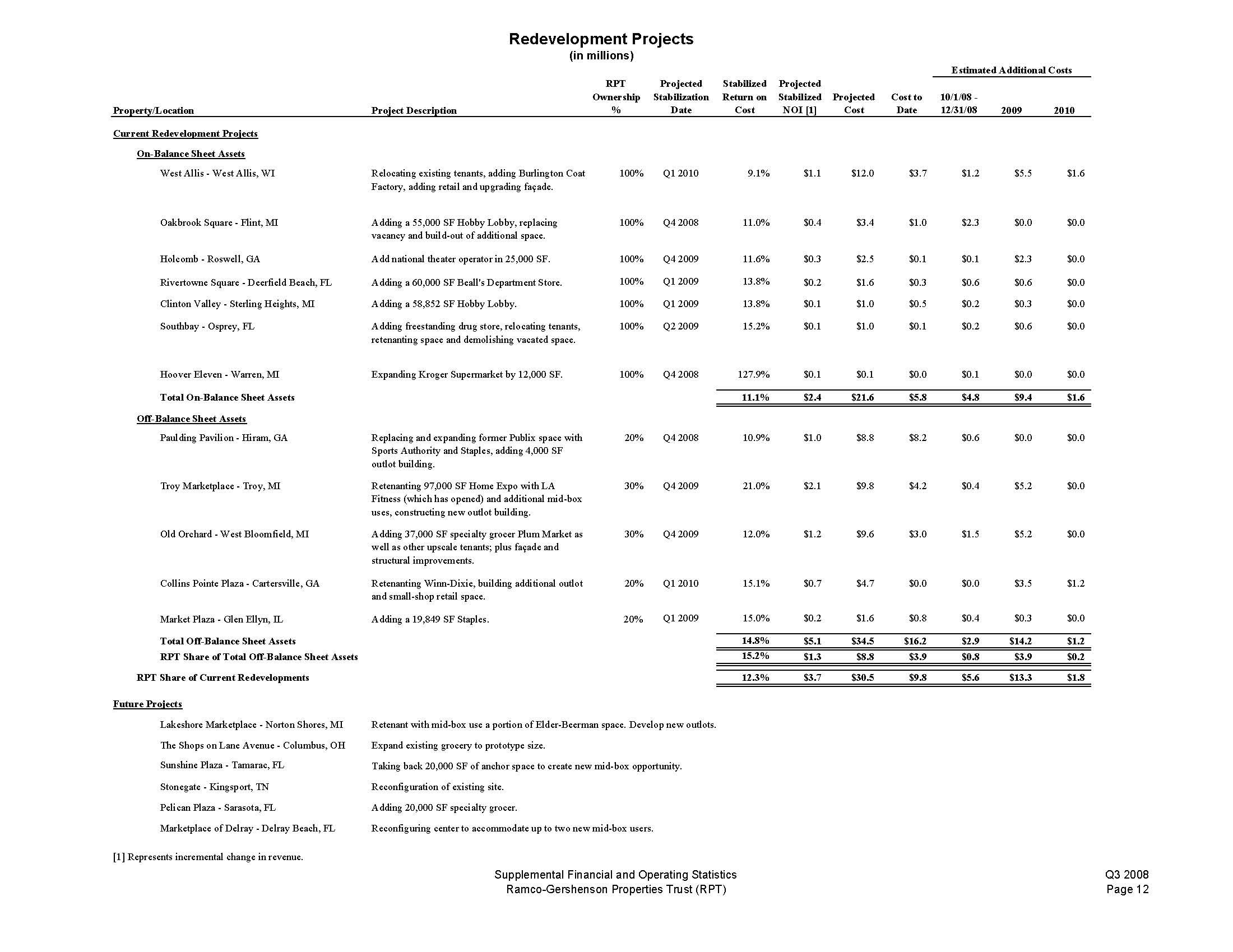

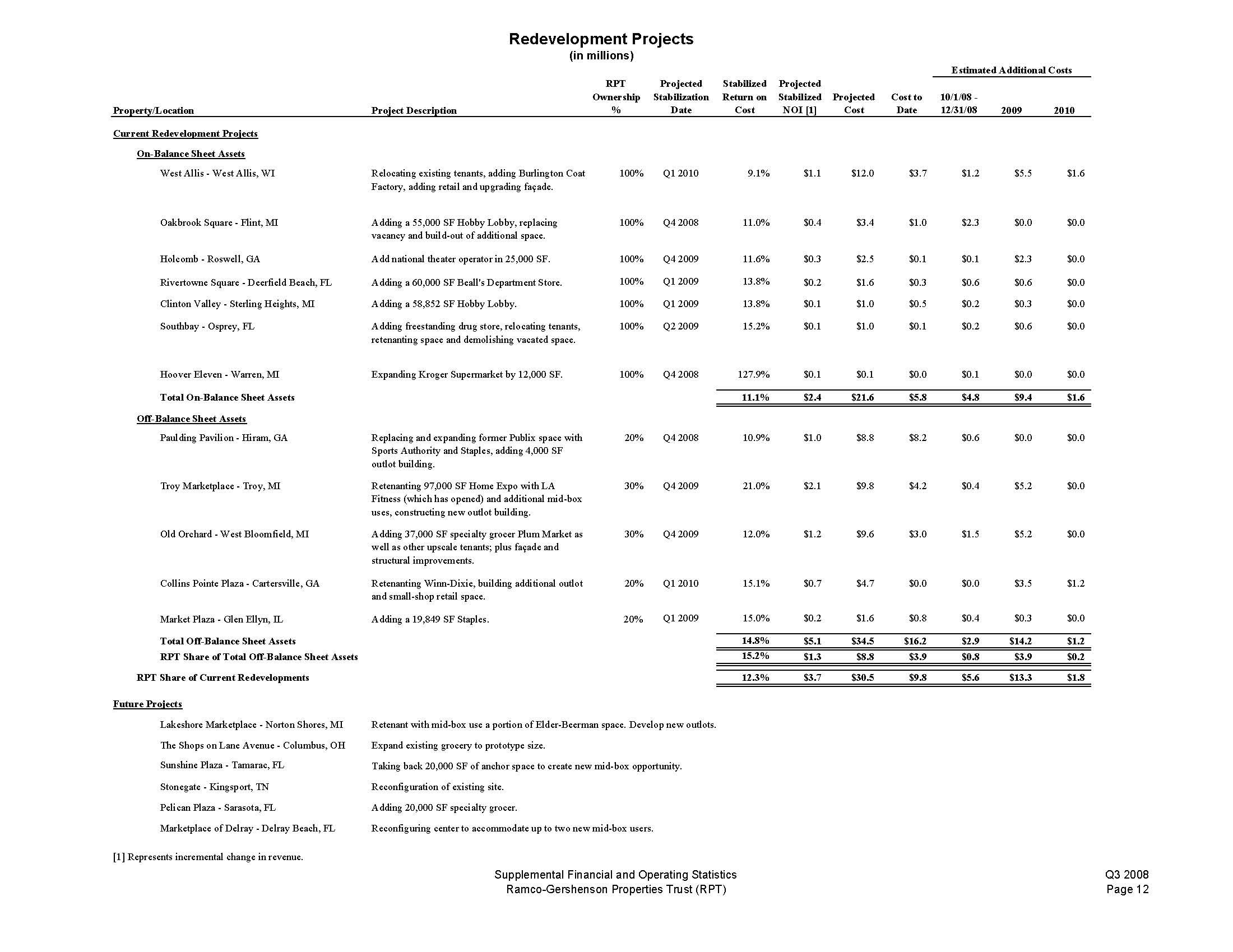

Redevelopment Projects (in millions) Estimated Additional Costs RPT Projected Stabilized Projected Ownership Stabilization Return on Stabilized Projected Cost to 10/1/08 - Property/Location Project Description % Date Cost NOI [1] Cost Date 12/31/08 2009 2010 Current Redevelopment Projects On-Balance Sheet Assets West Allis - West Allis, WI Relocating existing tenants, adding Burlington Coat 100% Q1 2010 9.1% $1.1 $12.0 $3.7 $1.2 $5.5 $1.6 Factory, adding retail and upgrading façade. Oakbrook Square - Flint, MIAdding a 55,000 SF Hobby Lobby, replacing 100% Q4 2008 11.0% $0.4 $3.4 $1.0 $2.3 $0.0 $0.0 vacancy and build-out of additional space. Holcomb - Roswell, GAAdd national theater operator in 25,000 SF. 100% Q4 2009 11.6% $0.3 $2.5 $0.1 $0.1 $2.3 $0.0 Rivertowne Square - Deerfield Beach, FL Adding a 60,000 SF Beall's Department Store. 100% Q1 2009 13.8% $0.2 $1.6 $0.3 $0.6 $0.6 $0.0 Clinton Valley - Sterling Heights, MI Adding a 58,852 SF Hobby Lobby. 100% Q1 2009 13.8% $0.1 $1.0 $0.5 $0.2 $0.3 $0.0 Southbay - Osprey, FLAdding freestanding drug store, relocating tenants, 100% Q2 2009 15.2% $0.1 $1.0 $0.1 $0.2 $0.6 $0.0 retenanting space and demolishing vacated space. Hoover Eleven - Warren, MIExpanding Kroger Supermarket by 12,000 SF. 100% Q4 2008 127.9% $0.1 $0.1 $0.0 $0.1 $0.0 $0.0 Total On-Balance Sheet Assets 11.1% $2.4 $21.6 $5.8 $4.8 $9.4 $1.6 Off-Balance Sheet Assets Paulding Pavilion - Hiram, GAReplacing and expanding former Publix space with 20% Q4 2008 10.9% $1.0 $8.8 $8.2 $0.6 $0.0 $0.0 Sports Authority and Staples, adding 4,000 SF outlot building. Troy Marketplace - Troy, MIRetenanting 97,000 SF Home Expo with LA 30% Q4 2009 21.0% $2.1 $9.8 $4.2 $0.4 $5.2 $0.0 Fitness (which has opened) and additional mid-box uses, constructing new outlot building. Old Orchard - West Bloomfield, MIAdding 37,000 SF specialty grocer Plum Market as 30% Q4 2009 12.0% $1.2 $9.6 $3.0 $1.5 $5.2 $0.0 well as other upscale tenants; plus façade and structural improvements. Collins Pointe Plaza - Cartersville, GARetenanting Winn-Dixie, building additional outlot 20% Q1 2010 15.1% $0.7 $4.7 $0.0 $0.0 $3.5 $1.2 and small-shop retail space. Market Plaza - Glen Ellyn, ILAdding a 19,849 SF Staples. 20% Q1 2009 15.0% $0.2 $1.6 $0.8 $0.4 $0.3 $0.0 Total Off-Balance Sheet Assets 14.8% $5.1 $34.5 $16.2 $2.9 $14.2 $1.2 RPT Share of Total Off-Balance Sheet Assets 15.2% $1.3 $8.8 $3.9 $0.8 $3.9 $0.2 RPT Share of Current Redevelopments 12.3% $3.7 $30.5 $9.8 $5.6 $13.3 $1.8 Future Projects Lakeshore Marketplace - Norton Shores, MI Retenant with mid-box use a portion of Elder-Beerman space. Develop new outlots. The Shops on Lane Avenue - Columbus, OH Expand existing grocery to prototype size. Sunshine Plaza - Tamarac, FL Taking back 20,000 SF of anchor space to create new mid-box opportunity. Stonegate - Kingsport, TN Reconfiguration of existing site. Pelican Plaza - Sarasota, FL Adding 20,000 SF specialty grocer. Marketplace of Delray - Delray Beach, FL Reconfiguring center to accommodate up to two new mid-box users. [1] Represents incremental change in revenue. Supplemental Financial and Operating Statistics Q3 2008 Ramco-Gershenson Properties Trust (RPT) Page 12

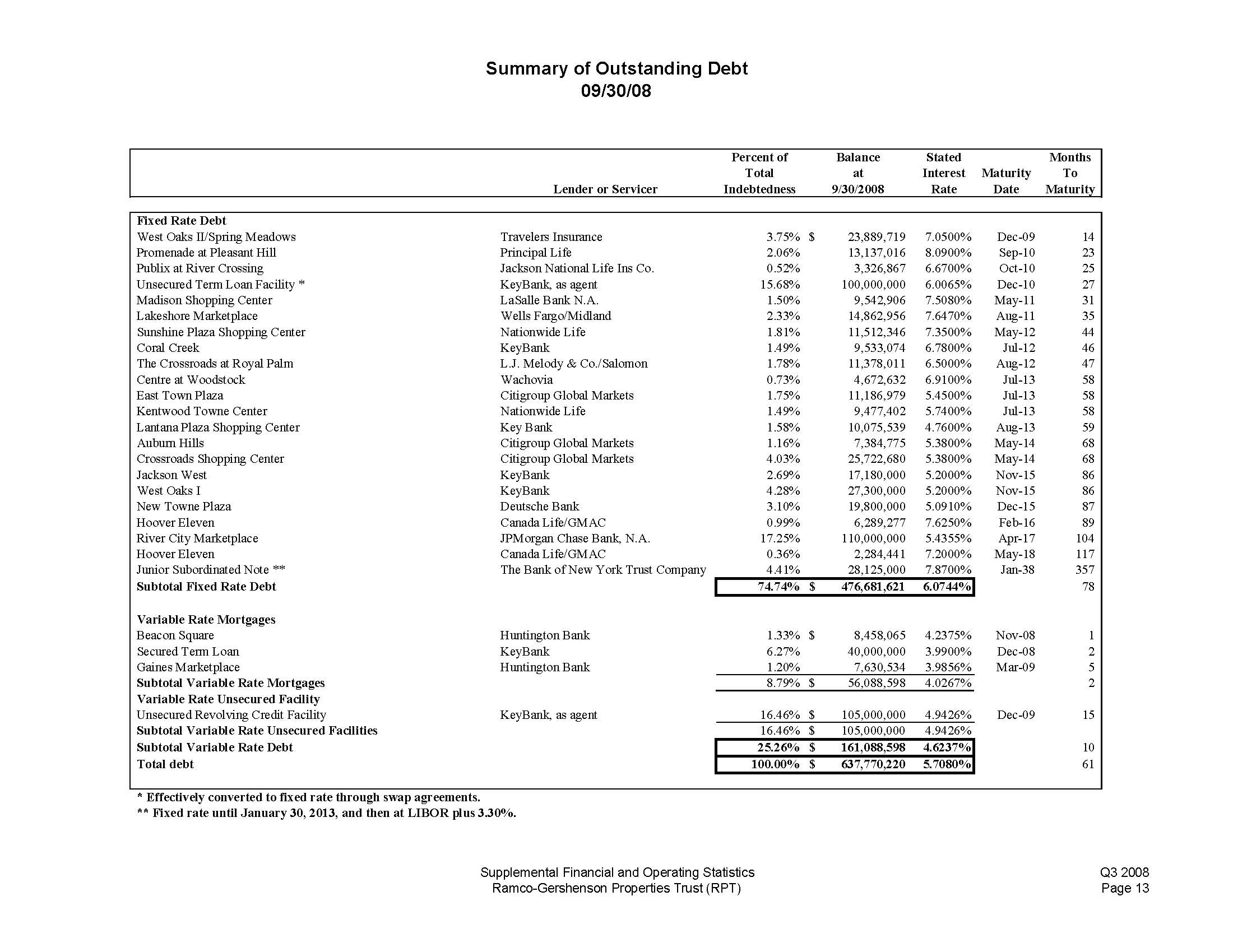

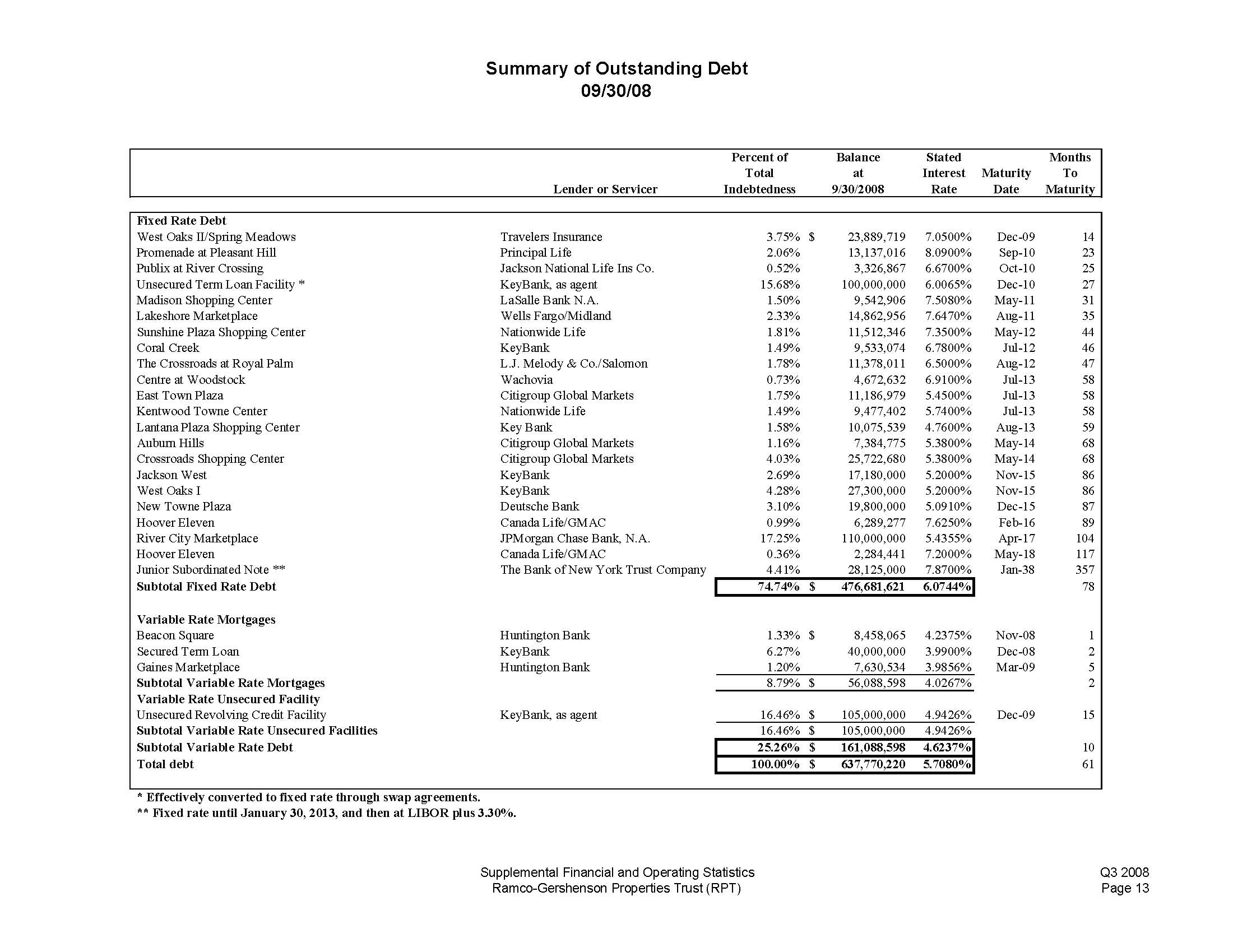

Summary of Outstanding Debt 09/30/08 Percent of Total Lender or Servicer Indebtedness Balance Stated Months at Interest Maturity To 9/30/2008 Rate Date Maturity Fixed Rate Debt West Oaks II/Spring Meadows Promenade at Pleasant Hill Publix at River Crossing Unsecured Term Loan Facility * Madison Shopping Center Lakeshore Marketplace Sunshine Plaza Shopping Center Coral Creek The Crossroads at Royal Palm Centre at Woodstock East Town Plaza Kentwood Towne Center Lantana Plaza Shopping Center Auburn Hills Crossroads Shopping Center Jackson West West Oaks I New Towne Plaza Hoover Eleven River City Marketplace Hoover Eleven Junior Subordinated Note ** Subtotal Fixed Rate Debt Variable Rate Mortgages Beacon Square Secured Term Loan Gaines Marketplace Subtotal Variable Rate Mortgages Variable Rate Unsecured Facility Unsecured Revolving Credit Facility Subtotal Variable Rate Unsecured Facilities Subtotal Variable Rate Debt Total debt Travelers Insurance Principal Life Jackson National Life Ins Co. KeyBank, as agent LaSalle Bank N.A. Wells Fargo/Midland Nationwide Life KeyBank L.J. Melody & Co./Salomon Wachovia Citigroup Global Markets Nationwide Life Key Bank Citigroup Global Markets Citigroup Global Markets KeyBank KeyBank Deutsche Bank Canada Life/GMAC JPMorgan Chase Bank, N.A. Canada Life/GMAC The Bank of New York Trust Company Huntington Bank KeyBank Huntington Bank 3.75% $ 2.06% 0.52% 15.68% 1.50% 2.33% 1.81% 1.49% 1.78% 0.73% 1.75% 1.49% 1.58% 1.16% 4.03% 2.69% 4.28% 3.10% 0.99% 17.25% 0.36% 4.41% 74.74% $ 1.33% $ 6.27% 1.20% 23,889,719 13,137,016 3,326,867 100,000,000 9,542,906 14,862,956 11,512,346 9,533,074 11,378,011 4,672,632 11,186,979 9,477,402 10,075,539 7,384,775 25,722,680 17,180,000 27,300,000 19,800,000 6,289,277 110,000,000 2,284,441 28,125,000 476,681,621 8,458,065 40,000,000 7,630,534 7.0500% 8.0900% 6.6700% 6.0065% 7.5080% 7.6470% 7.3500% 6.7800% 6.5000% 6.9100% 5.4500% 5.7400% 4.7600% 5.3800% 5.3800% 5.2000% 5.2000% 5.0910% 7.6250% 5.4355% 7.2000% 7.8700% 6.0744% 4.2375% 3.9900% 3.9856% 8.79% $ 56,088,598 4.0267% KeyBank, as agent 16.46% $ 105,000,000 4.9426% 16.46% $ 105,000,000 4.9426% 25.26% $ 161,088,598 4.6237% 100.00% $ 637,770,220 5.7080% Dec-09 14 Sep-10 23 Oct-10 25 Dec-10 27 May-11 31 Aug-11 35 May-12 44 Jul-12 46 Aug-12 47 Jul-13 58 Jul-13 58 Jul-13 58 Aug-13 59 May-14 68 May-14 68 Nov-15 86 Nov-15 86 Dec-15 87 Feb-16 89 Apr-17 104 May-18 117 Jan-38 357 78 Nov-08 1 Dec-08 2 Mar-09 5 2 Dec-09 15 10 61 * Effectively converted to fixed rate through swap agreements. ** Fixed rate until January 30, 2013, and then at LIBOR plus 3.30%. Supplemental Financial and Operating Statistics Q3 2008 Ramco-Gershenson Properties Trust (RPT) Page 13 Cumulative Scheduled Total Percentage Percentage Amortization Scheduled Scheduled of Debt of Debt Year Payments Maturities Maturities Maturing Maturing

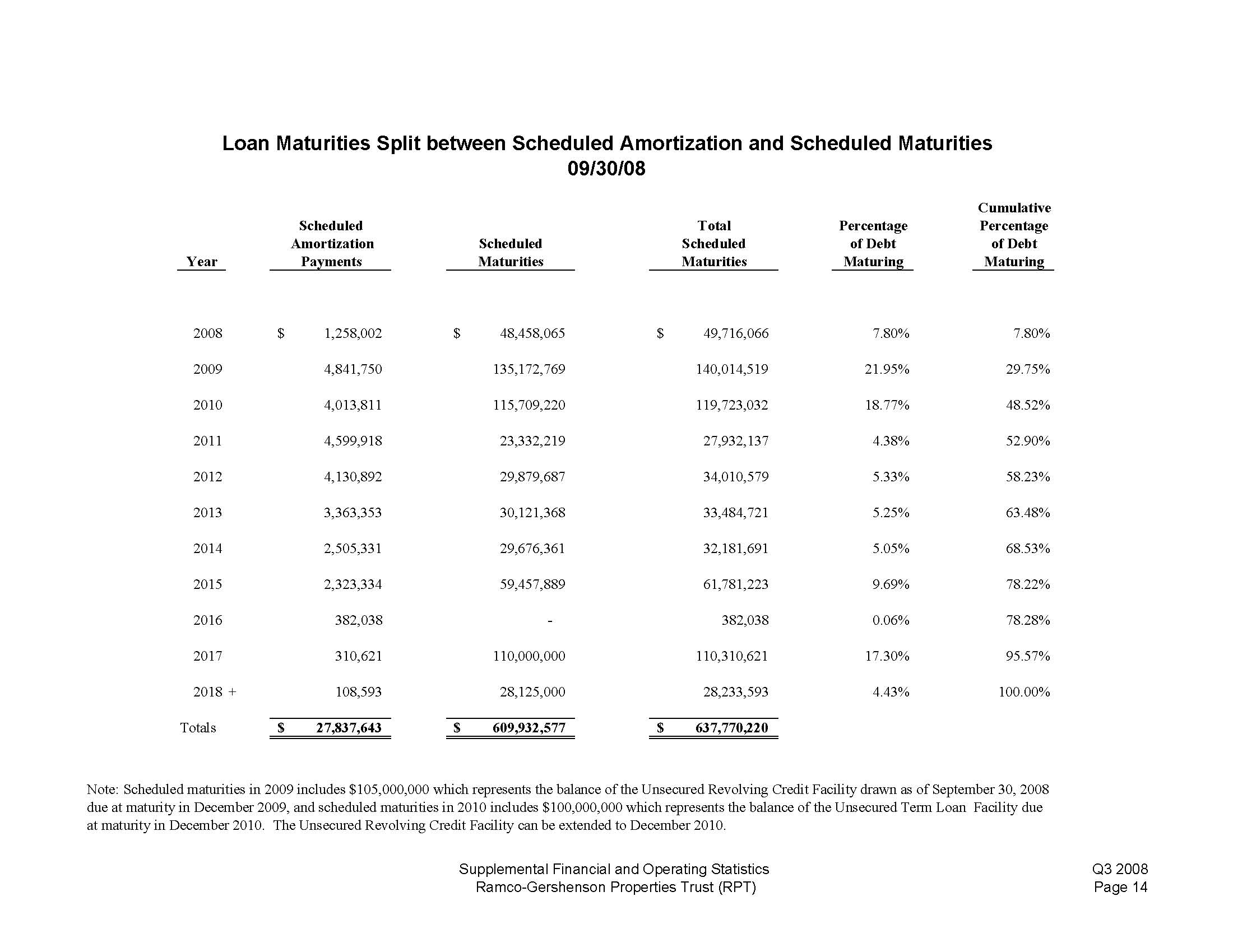

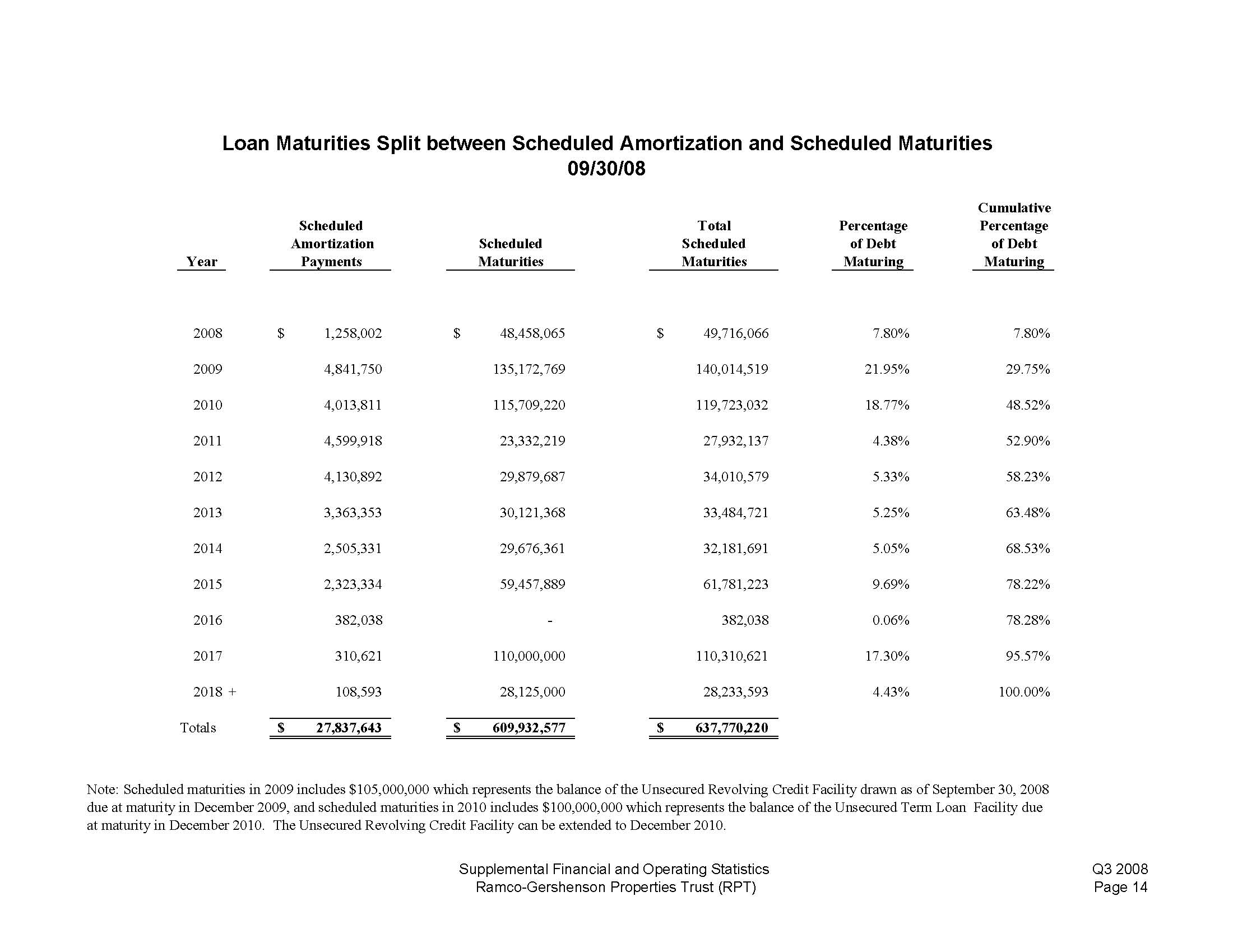

Loan Maturities Split between Scheduled Amortization and Scheduled Maturities 09/30/08 2008 $ 1,258,002 $ 48,458,065 $ 49,716,066 7.80% 7.80% 2009 4,841,750 135,172,769 140,014,519 21.95% 29.75% 2010 4,013,811 115,709,220 119,723,032 18.77% 48.52% 2011 4,599,918 23,332,219 27,932,137 4.38% 52.90% 2012 4,130,892 29,879,687 34,010,579 5.33% 58.23% 2013 3,363,353 30,121,368 33,484,721 5.25% 63.48% 2014 2,505,331 29,676,361 32,181,691 5.05% 68.53% 2015 2,323,334 59,457,889 61,781,223 9.69% 78.22% 2016 382,038 - 382,038 0.06% 78.28% 2017 310,621 110,000,000 110,310,621 17.30% 95.57% 2018 + 108,593 28,125,000 28,233,593 4.43% 100.00% Totals $ 27,837,643 $ 609,932,577 $ 637,770,220 Note: Scheduled maturities in 2009 includes $105,000,000 which represents the balance of the Unsecured Revolving Credit Facility drawn as of September 30, 2008 due at maturity in December 2009, and scheduled maturities in 2010 includes $100,000,000 which represents the balance of the Unsecured Term Loan Facility due at maturity in December 2010. The Unsecured Revolving Credit Facility can be extended to December 2010. Supplemental Financial and Operating Statistics Ramco-Gershenson Properties Trust (RPT) Q3 2008 Page 14

Market Capitalization Information 09/30/08 Debt: Shares Dollars Percentage Fixed Rate Debt $ 476,681,621 42.57% Variable Rate Debt $ 161,088,598 14.38% Total Debt $ 637,770,220 56.95% Equity: Market price Common Shares and Equivalents REIT Shares $ 22.42 86.43% 18,583,362 $ 416,638,976 37.20% OP Units 13.57% 2,918,809 $ 65,439,698 5.84% Total Common Shares and Equivalents 100.00% 21,502,171 $ 482,078,674 43.05% Total Market Capitalization $ 1,119,848,894 100.00% Common Stock Performance - 10/1/07 through 9/30/08 Q3 2008 Supplemental Financial and Operating Statistics Page 15 Ramco-Gershenson Properties Trust (RPT) Non-Anchor GLA Total Total Leased Occupancy Total PSF Anchors [2]

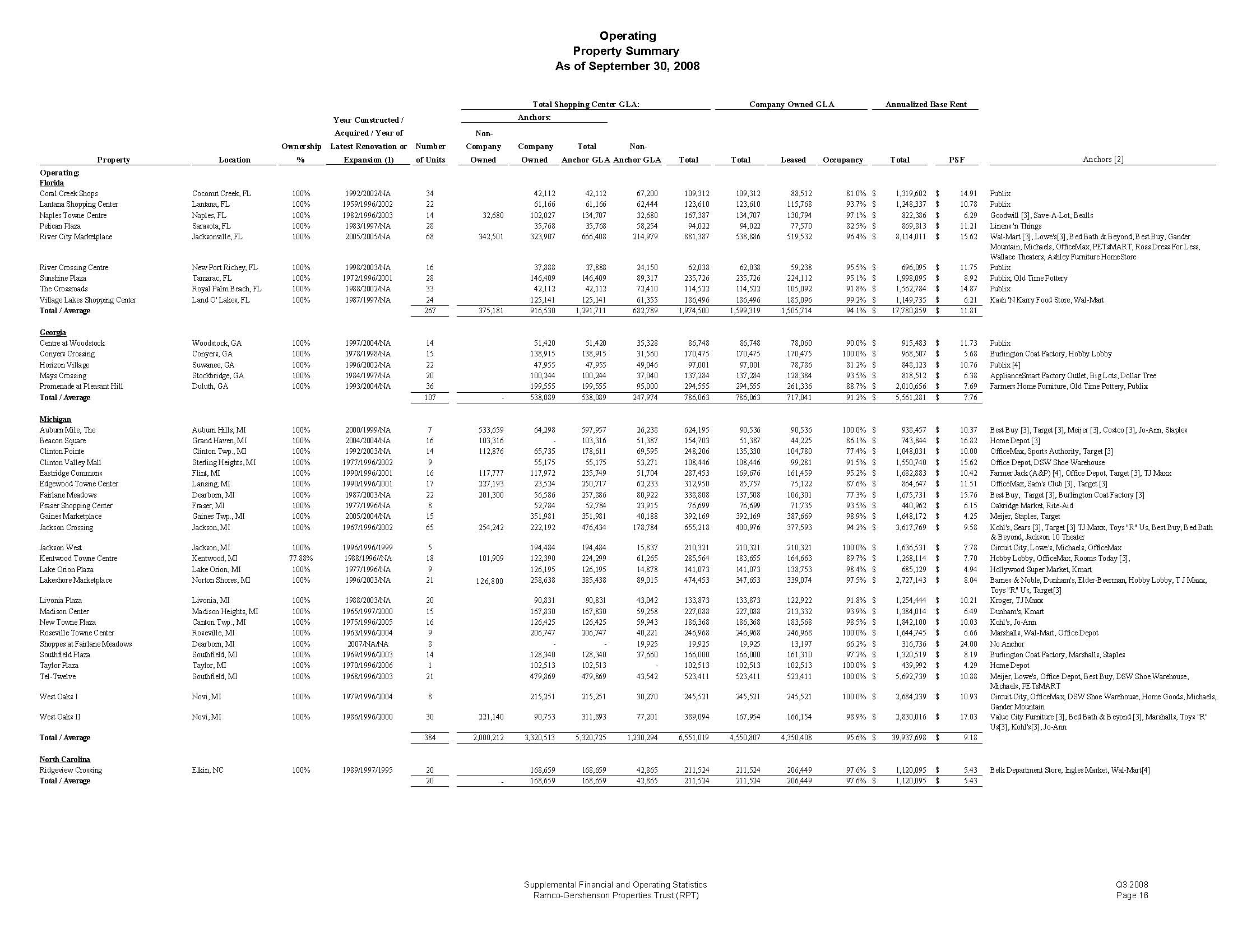

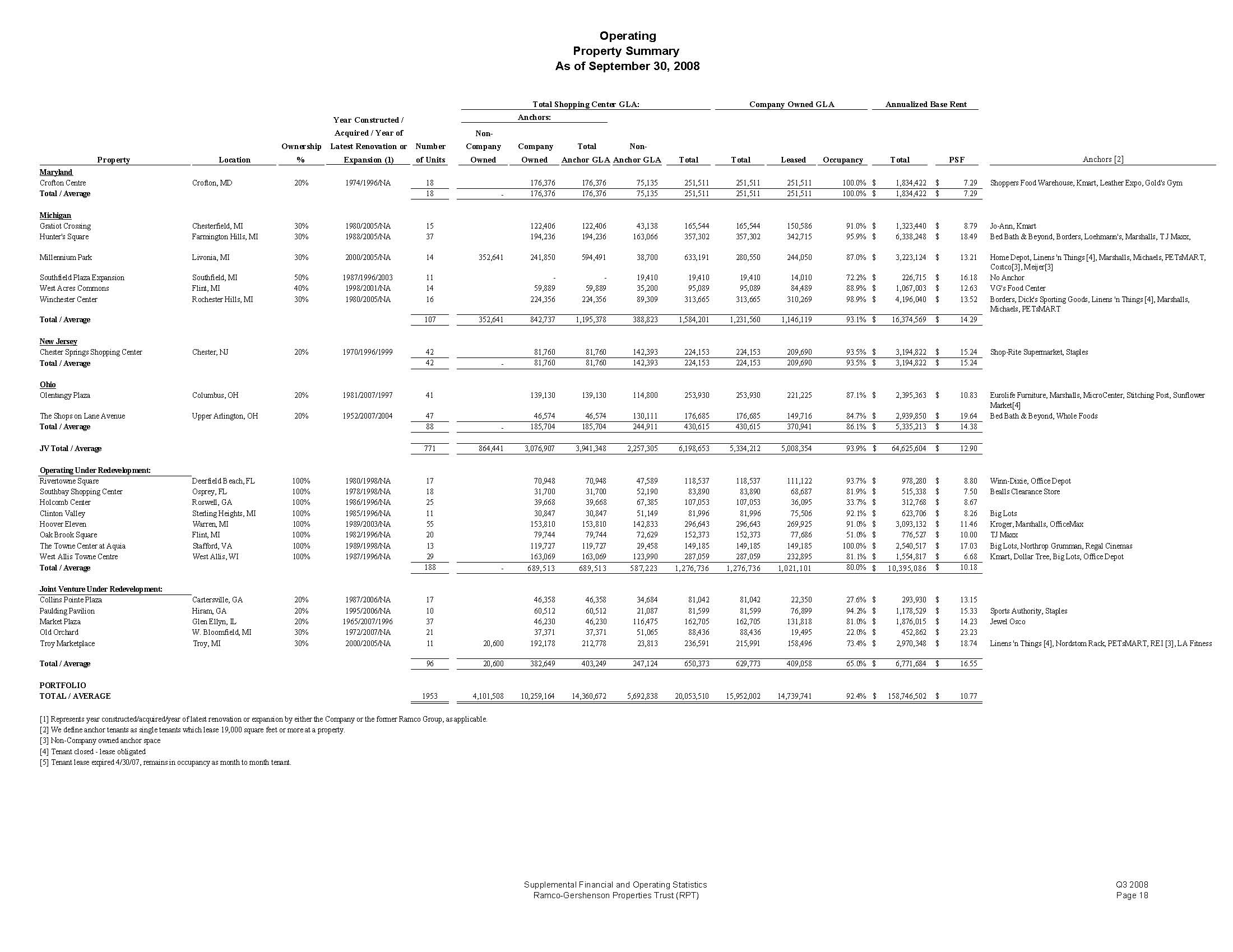

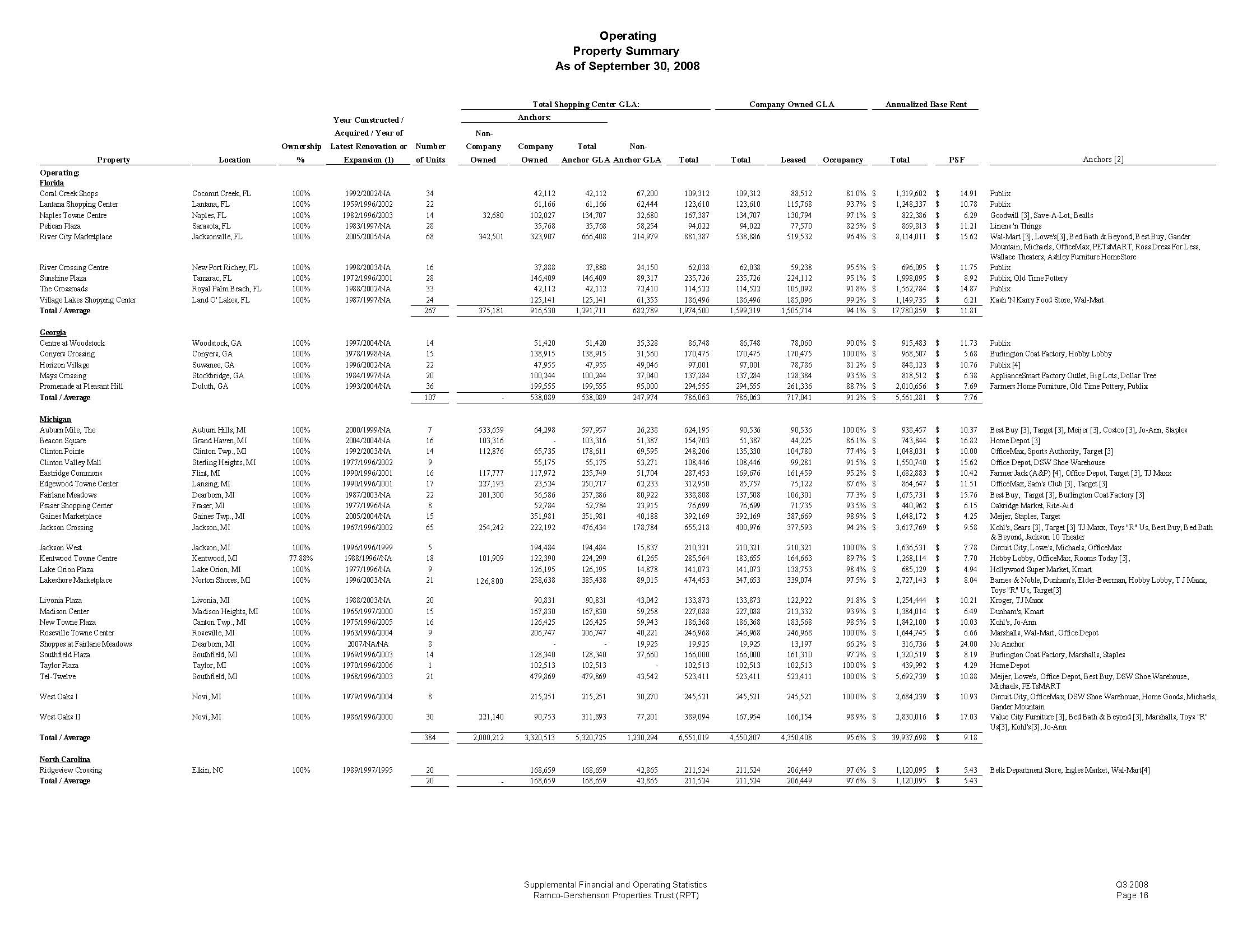

Operating Property Summary As of September 30, 2008 Total Shopping Center GLA: Company Owned GLA Annualized Base Rent Year Constructed / Anchors: Acquired / Year of Non-Ownership Latest Renovation or Number Company Company Total Property Location % Expansion (1) of UnitsOwned Owned Anchor GLA Operating: Florida Coral Creek Shops Coconut Creek, FL 100% 1992/2002/NA 34 Lantana Shopping Center Lantana, FL 100% 1959/1996/2002 22 Naples Towne Centre Naples, FL 100% 1982/1996/2003 14 Pelican Plaza Sarasota, FL 100% 1983/1997/NA 28 River City Marketplace Jacksonville, FL 100% 2005/2005/NA 68 River Crossing Centre New Port Richey, FL 100% 1998/2003/NA 16 Sunshine Plaza Tamarac, FL 100% 1972/1996/2001 28 The Crossroads Royal Palm Beach, FL 100% 1988/2002/NA 33 Village Lakes Shopping Center Land O' Lakes, FL 100% 1987/1997/NA 24 42,112 42,112 67,200 109,312 109,312 88,512 81.0% $ 1,319,602 $ 14.91 Publix 61,166 61,166 62,444 123,610 123,610 115,768 93.7% $ 1,248,337 $ 10.78 Publix 32,680 102,027 134,707 32,680 167,387 134,707 130,794 97.1% $ 822,386 $ 6.29 Goodwill [3], Save-A-Lot, Bealls 35,768 35,768 58,254 94,022 94,022 77,570 82.5% $ 869,813 $ 11.21 Linens 'n Things 342,501 323,907 666,408 214,979 881,387 538,886 519,532 96.4% $ 8,114,011 $ 15.62Wal-Mart [3], Lowe's[3], Bed Bath & Beyond, Best Buy, Gander Mountain, Michaels, OfficeMax, PETsMART, Ross Dress For Less, Wallace Theaters, Ashley Furniture HomeStore 37,888 37,888 24,150 62,038 62,038 59,238 95.5% $ 696,095 $ 11.75 Publix 146,409 146,409 89,317 235,726 235,726 224,112 95.1% $ 1,998,095 $ 8.92 Publix, Old Time Pottery 42,112 42,112 72,410 114,522 114,522 105,092 91.8% $ 1,562,784 $ 14.87 Publix 125,141 125,141 61,355 186,496 186,496 185,096 99.2% $ 1,149,735 $ 6.21 Kash 'N Karry Food Store, Wal-Mart Total / Average267 375,181 916,530 1,291,711 682,789 1,974,500 1,599,319 1,505,714 94.1% $ 17,780,859 $ 11.81 Georgia Centre at Woodstock Woodstock, GA 100% 1997/2004/NA 14 51,420 51,420 35,328 86,748 86,748 78,060 90.0% $ 915,483 $ 11.73 Publix Conyers Crossing Conyers, GA 100% 1978/1998/NA 15 138,915 138,915 31,560 170,475 170,475 170,475 100.0% $ 968,507 $ 5.68 Burlington Coat Factory, Hobby Lobby Horizon Village Suwanee, GA 100% 1996/2002/NA 22 47,955 47,955 49,046 97,001 97,001 78,786 81.2% $ 848,123 $ 10.76 Publix [4] Mays Crossing Stockbridge, GA 100% 1984/1997/NA 20 100,244 100,244 37,040 137,284 137,284 128,384 93.5% $ 818,512 $ 6.38 ApplianceSmart Factory Outlet, Big Lots, Dollar Tree Promenade at Pleasant Hill Duluth, GA 100% 1993/2004/NA 36 199,555 199,555 95,000 294,555 294,555 261,336 88.7% $ 2,010,656 $ 7.69 Farmers Home Furniture, Old Time Pottery, Publix Total / Average107 -538,089 538,089 247,974 786,063 786,063 717,041 91.2% $ 5,561,281 $ 7.76 Michigan Auburn Mile, The Auburn Hills, MI 100% 2000/1999/NA 7 533,659 64,298 597,957 26,238 624,195 90,536 90,536 100.0% $ 938,457 $ 10.37 Best Buy [3], Target [3], Meijer [3], Costco [3], Jo-Ann, Staples Beacon Square Grand Haven, MI 100% 2004/2004/NA 16 103,316 - 103,316 51,387 154,703 51,387 44,225 86.1% $ 743,844 $ 16.82 Home Depot [3] Clinton Pointe Clinton Twp., MI 100% 1992/2003/NA 14 112,876 65,735 178,611 69,595 248,206 135,330 104,780 77.4% $ 1,048,031 $ 10.00 OfficeMax, Sports Authority, Target [3] Clinton Valley Mall Sterling Heights, MI 100% 1977/1996/2002 9 55,175 55,175 53,271 108,446 108,446 99,281 91.5% $ 1,550,740 $ 15.62 Office Depot, DSW Shoe Warehouse Eastridge Commons Flint, MI 100% 1990/1996/2001 16 117,777 117,972 235,749 51,704 287,453 169,676 161,459 95.2% $ 1,682,883 $ 10.42 Farmer Jack (A&P) [4], Office Depot, Target [3], TJ Maxx Edgewood Towne Center Lansing, MI 100% 1990/1996/2001 17 227,193 23,524 250,717 62,233 312,950 85,757 75,122 87.6% $ 864,647 $ 11.51 OfficeMax, Sam's Club [3], Target [3] Fairlane Meadows Dearborn, MI 100% 1987/2003/NA 22 201,300 56,586 257,886 80,922 338,808 137,508 106,301 77.3% $ 1,675,731 $ 15.76 Best Buy, Target [3], Burlington Coat Factory [3] Fraser Shopping Center Fraser, MI 100% 1977/1996/NA 8 52,784 52,784 23,915 76,699 76,699 71,735 93.5% $ 440,962 $ 6.15 Oakridge Market, Rite-Aid Gaines Marketplace Gaines Twp., MI 100% 2005/2004/NA 15 351,981 351,981 40,188 392,169 392,169 387,669 98.9% $ 1,648,172 $ 4.25 Meijer, Staples, Target Jackson Crossing Jackson, MI 100% 1967/1996/2002 65 254,242 222,192 476,434 178,784 655,218 400,976 377,593 94.2% $ 3,617,769 $ 9.58 Kohl's, Sears [3], Target [3] TJ Maxx, Toys "R" Us, Best Buy, Bed Bath & Beyond, Jackson 10 Theater Jackson West Jackson, MI 100% 1996/1996/1999 5 194,484 194,484 15,837 210,321 210,321 210,321 100.0% $ 1,636,531 $ 7.78 Circuit City, Lowe's, Michaels, OfficeMax Kentwood Towne Centre Kentwood, MI 77.88% 1988/1996//NA 18 101,909 122,390 224,299 61,265 285,564 183,655 164,663 89.7% $ 1,268,114 $ 7.70 Hobby Lobby, OfficeMax, Rooms Today [3], Lake Orion Plaza Lake Orion, MI 100% 1977/1996/NA 9 126,195 126,195 14,878 141,073 141,073 138,753 98.4% $ 685,129 $ 4.94 Hollywood Super Market, Kmart Lakeshore Marketplace Norton Shores, MI 100% 1996/2003/NA 21 126,800 258,638 385,438 89,015 474,453 347,653 339,074 97.5% $ 2,727,143 $ 8.04 Barnes & Noble, Dunham's, Elder-Beerman, Hobby Lobby, T J Maxx, Toys "R" Us, Target[3] Livonia Plaza Livonia, MI 100% 1988/2003/NA 20 90,831 90,831 43,042 133,873 133,873 122,922 91.8% $ 1,254,444 $ 10.21 Kroger, TJ Maxx Madison Center Madison Heights, MI 100% 1965/1997/2000 15 167,830 167,830 59,258 227,088 227,088 213,332 93.9% $ 1,384,014 $ 6.49 Dunham's, Kmart New Towne Plaza Canton Twp., MI 100% 1975/1996/2005 16 126,425 126,425 59,943 186,368 186,368 183,568 98.5% $ 1,842,100 $ 10.03 Kohl's, Jo-Ann Roseville Towne Center Roseville, MI 100% 1963/1996/2004 9 206,747 206,747 40,221 246,968 246,968 246,968 100.0% $ 1,644,745 $ 6.66 Marshalls, Wal-Mart, Office Depot Shoppes at Fairlane Meadows Dearborn, MI 100% 2007/NA/NA 8 - - 19,925 19,925 19,925 13,197 66.2% $ 316,736 $ 24.00 No Anchor Southfield Plaza Southfield, MI 100% 1969/1996/2003 14 128,340 128,340 37,660 166,000 166,000 161,310 97.2% $ 1,320,519 $ 8.19 Burlington Coat Factory, Marshalls, Staples Taylor Plaza Taylor, MI 100% 1970/1996/2006 1 102,513 102,513 - 102,513 102,513 102,513 100.0% $ 439,992 $ 4.29 Home Depot Tel-Twelve Southfield, MI 100% 1968/1996/2003 21 479,869 479,869 43,542 523,411 523,411 523,411 100.0% $ 5,692,739 $ 10.88 Meijer, Lowe's, Office Depot, Best Buy, DSW Shoe Warehouse, Michaels, PETsMART West Oaks I Novi, MI 100% 1979/1996/2004 8 215,251 215,251 30,270 245,521 245,521 245,521 100.0% $ 2,684,239 $ 10.93 Circuit City, OfficeMax, DSW Shoe Warehouse, Home Goods, Michaels, Gander Mountain West Oaks II Novi, MI 100% 1986/1996/2000 30 221,140 90,753 311,893 77,201 389,094 167,954 166,154 98.9% $ 2,830,016 $ 17.03 Value City Furniture [3], Bed Bath & Beyond [3], Marshalls, Toys "R" Us[3], Kohl's[3], Jo-Ann Total / Average 384 2,000,212 3,320,513 5,320,725 1,230,294 6,551,019 4,550,807 4,350,408 95.6% $ 39,937,698 $ 9.18 North Carolina Ridgeview Crossing Elkin, NC 100% 1989/1997/1995 20 168,659 168,659 42,865 211,524 211,524 206,449 97.6% $ 1,120,095 $ 5.43 Belk Department Store, Ingles Market, Wal-Mart[4] Total / Average 20 - 168,659 168,659 42,865 211,524 211,524 206,449 97.6% $ 1,120,095 $ 5.43 Non-Anchor GLA Total Total Leased Occupancy Total PSF Anchors [2]

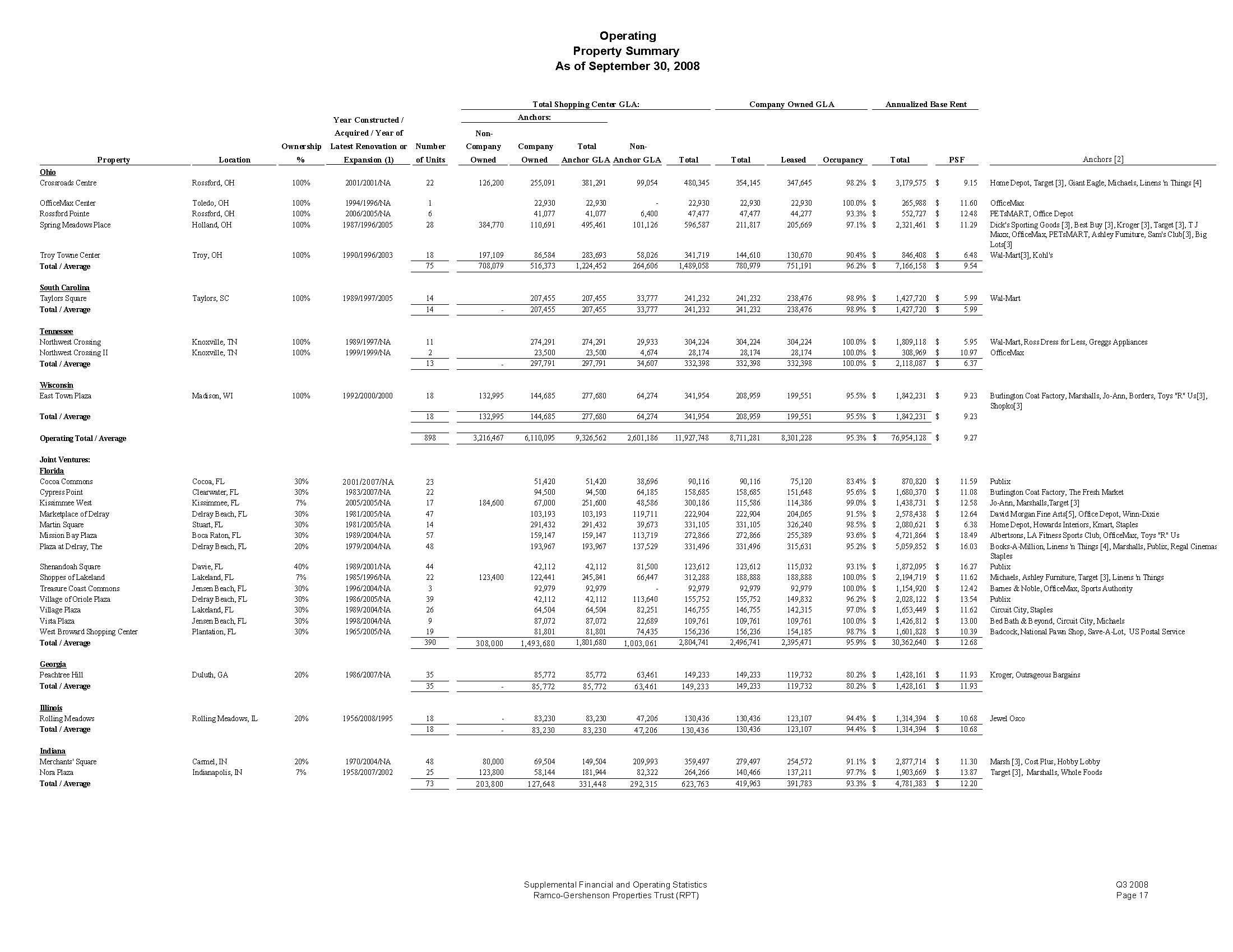

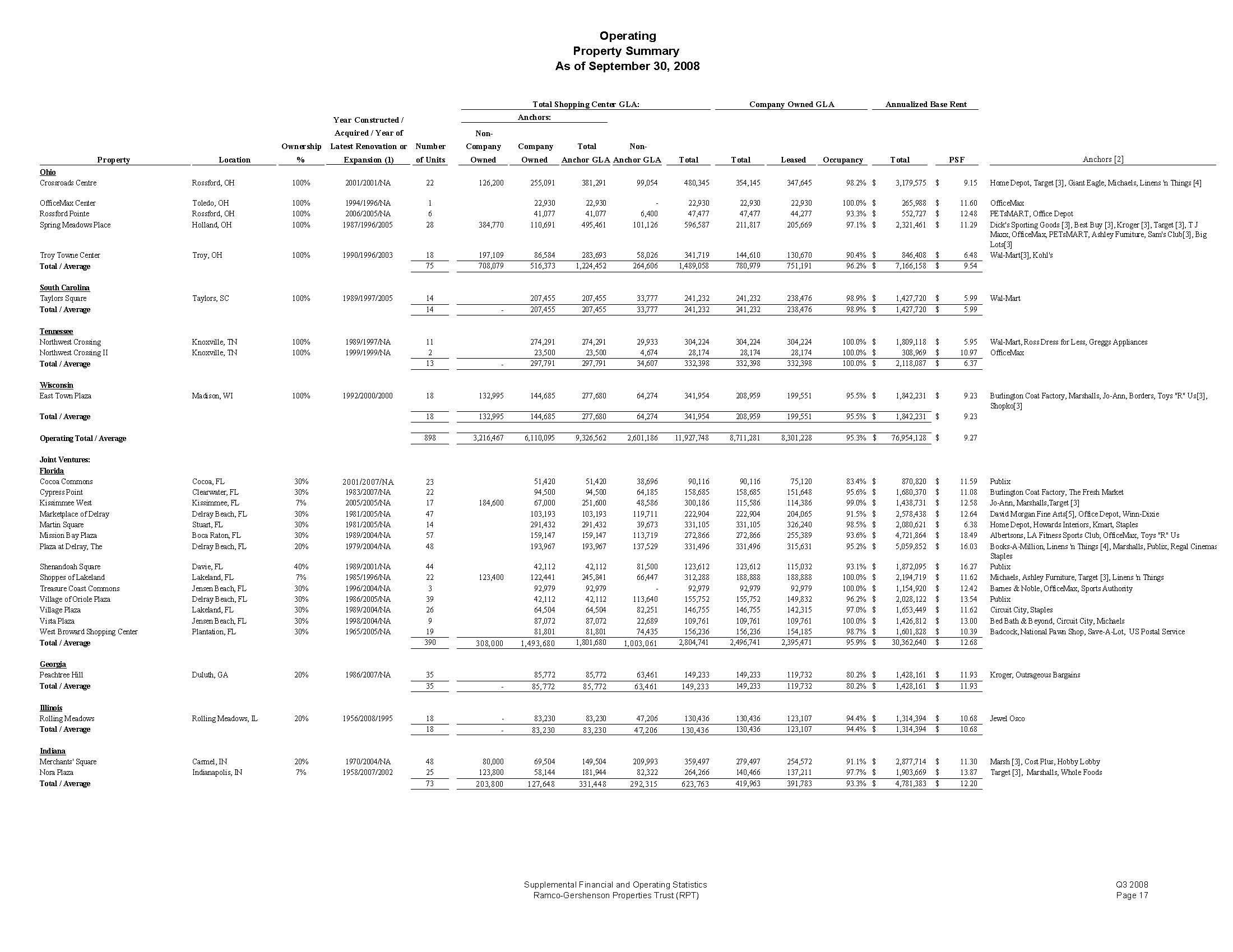

Operating Property Summary As of September 30, 2008 Total Shopping Center GLA: Company Owned GLA Annualized Base Rent Year Constructed / Anchors: Acquired / Year of Non-Ownership Latest Renovation or Number Company Company Total Property Location % Expansion (1) of UnitsOwned Owned Anchor GLA Ohio Crossroads Centre Rossford, OH 100% 2001/2001/NA 22 126,200 255,091 381,291 99,054 480,345 354,145 347,645 98.2% $ 3,179,575 $ 9.15 Home Depot, Target [3], Giant Eagle, Michaels, Linens 'n Things [4] OfficeMax Center Toledo, OH 100% 1994/1996/NA 1 22,930 22,930 - -22,930 22,930 22,930 100.0% $ 265,988 $ 11.60 OfficeMax Rossford Pointe Rossford, OH 100% 2006/2005/NA 6 41,077 41,077 6,400 47,477 47,477 44,277 93.3% $ 552,727 $ 12.48 PETsMART, Office Depot Spring Meadows Place Holland, OH 100% 1987/1996/2005 28 384,770 110,691 495,461 101,126 596,587 211,817 205,669 97.1% $ 2,321,461 $ 11.29 Dick's Sporting Goods [3], Best Buy [3], Kroger [3], Target [3], T J Maxx, OfficeMax, PETsMART, Ashley Furniture, Sam's Club[3], Big Lots[3] Troy Towne Center Troy, OH 100% 1990/1996/2003 18 197,109 86,584 283,693 58,026 341,719 144,610 130,670 90.4% $ 846,408 $ 6.48 Wal-Mart[3], Kohl's Total / Average 75 708,079 516,373 1,224,452 264,606 1,489,058 780,979 751,191 96.2% $ 7,166,158 $ 9.54 South Carolina Taylors Square Taylors, SC 100% 1989/1997/2005 14 207,455 207,455 33,777 241,232 241,232 238,476 98.9% $ 1,427,720 $ 5.99 Wal-Mart Total / Average 14 -207,455 207,455 33,777 241,232 241,232 238,476 98.9% $ 1,427,720 $ 5.99 Tennessee Northwest Crossing Knoxville, TN 100% 1989/1997/NA 11 274,291 274,291 29,933 304,224 304,224 304,224 100.0% $ 1,809,118 $ 5.95 Wal-Mart, Ross Dress for Less, Greggs Appliances Northwest Crossing II Knoxville, TN 100% 1999/1999/NA 2 23,500 23,500 4,674 28,174 28,174 28,174 100.0% $ 308,969 $ 10.97 OfficeMax Total / Average 13 -297,791 297,791 34,607 332,398 332,398 332,398 100.0% $ 2,118,087 $ 6.37 Wisconsin East Town Plaza Madison, WI 100% 1992/2000/2000 18 132,995 144,685 277,680 64,274 341,954 208,959 199,551 95.5% $ 1,842,231 $ 9.23 Burlington Coat Factory, Marshalls, Jo-Ann, Borders, Toys "R" Us[3], Shopko[3] Total / Average 18 132,995 144,685 277,680 64,274 341,954 208,959 199,551 95.5% $ 1,842,231 $ 9.23 Operating Total / Average 898 3,216,467 6,110,095 9,326,562 2,601,186 11,927,748 8,711,281 8,301,228 95.3% $ 76,954,128 $ 9.27 Joint Ventures: Florida Cocoa Commons Cocoa, FL 30% 2001/2007/NA 23 Cypress Point Clearwater, FL 30% 1983/2007/NA 22 Kissimmee West Kissimmee, FL 7% 2005/2005/NA 17 Marketplace of Delray Delray Beach, FL 30% 1981/2005/NA 47 Martin Square Stuart, FL 30% 1981/2005/NA 14 Mission Bay Plaza Boca Raton, FL 30% 1989/2004/NA 57 Plaza at Delray, The Delray Beach, FL 20% 1979/2004/NA 48 Shenandoah Square Davie, FL 40% 1989/2001/NA 44 Shoppes of Lakeland Lakeland, FL 7% 1985/1996/NA 22 Treasure Coast Commons Jensen Beach, FL 30% 1996/2004/NA 3 Village of Oriole Plaza Delray Beach, FL 30% 1986/2005/NA 39 Village Plaza Lakeland, FL 30% 1989/2004/NA 26 Vista Plaza Jensen Beach, FL 30% 1998/2004/NA 9 West Broward Shopping Center Plantation, FL 30% 1965/2005/NA 19 51,420 51,420 38,696 90,116 90,116 75,120 83.4% $ 870,820 $ 11.59 Publix 94,500 94,500 64,185 158,685 158,685 151,648 95.6% $ 1,680,370 $ 11.08 Burlington Coat Factory, The Fresh Market 184,600 67,000 251,600 48,586 300,186 115,586 114,386 99.0% $ 1,438,731 $ 12.58 Jo-Ann, Marshalls,Target [3] 103,193 103,193 119,711 222,904 222,904 204,065 91.5% $ 2,578,438 $ 12.64 David Morgan Fine Arts[5], Office Depot, Winn-Dixie 291,432 291,432 39,673 331,105 331,105 326,240 98.5% $ 2,080,621 $ 6.38 Home Depot, Howards Interiors, Kmart, Staples 159,147 159,147 113,719 272,866 272,866 255,389 93.6% $ 4,721,864 $ 18.49 Albertsons, LA Fitness Sports Club, OfficeMax, Toys "R" Us 193,967 193,967 137,529 331,496 331,496 315,631 95.2% $ 5,059,852 $ 16.03 Books-A-Million, Linens 'n Things [4], Marshalls, Publix, Regal Cinemas Staples 42,112 42,112 81,500 123,612 123,612 115,032 93.1% $ 1,872,095 $ 16.27 Publix 123,400 122,441 245,841 66,447 312,288 188,888 188,888 100.0% $ 2,194,719 $ 11.62 Michaels, Ashley Furniture, Target [3], Linens 'n Things 92,979 92,979 - 92,979 92,979 92,979 100.0% $ 1,154,920 $ 12.42 Barnes & Noble, OfficeMax, Sports Authority 42,112 42,112 113,640 155,752 155,752 149,832 96.2% $ 2,028,122 $ 13.54 Publix 64,504 64,504 82,251 146,755 146,755 142,315 97.0% $ 1,653,449 $ 11.62 Circuit City, Staples 87,072 87,072 22,689 109,761 109,761 109,761 100.0% $ 1,426,812 $ 13.00 Bed Bath & Beyond, Circuit City, Michaels 81,801 81,801 74,435 156,236 156,236 154,185 98.7% $ 1,601,828 $ 10.39 Badcock, National Pawn Shop, Save-A-Lot, US Postal Service Total / Average 390 308,000 1,493,680 1,801,680 1,003,061 2,804,741 2,496,741 2,395,471 95.9% $ 30,362,640 $ 12.68 Georgia Peachtree Hill Duluth, GA 20% 1986/2007/NA 35 85,772 85,772 63,461 149,233 149,233 119,732 80.2% $ 1,428,161 $ 11.93 Kroger, Outrageous Bargains Total / Average 35 - 85,772 85,772 63,461 149,233 149,233 119,732 80.2% $ 1,428,161 $ 11.93 Illinois Rolling Meadows Rolling Meadows, IL 20% 1956/2008/1995 18 - 83,230 83,230 47,206 130,436 130,436 123,107 94.4% $ 1,314,394 $ 10.68 Jewel Osco Total / Average 18 - 83,230 83,230 47,206 130,436 130,436 123,107 94.4% $ 1,314,394 $ 10.68 Indiana Merchants' Square Carmel, IN 20% 1970/2004/NA 48 80,000 69,504 149,504 209,993 359,497 279,497 254,572 91.1% $ 2,877,714 $ 11.30 Marsh [3], Cost Plus, Hobby Lobby Nora Plaza Indianapolis, IN 7% 1958/2007/2002 25 123,800 58,144 181,944 82,322 264,266 140,466 137,211 97.7% $ 1,903,669 $ 13.87 Target [3], Marshalls, Whole Foods Total / Average 73 203,800 127,648 331,448 292,315 623,763 419,963 391,783 93.3% $ 4,781,383 $ 12.20 Non-Anchor GLA Total Total Leased Occupancy Total PSF Anchors [2]

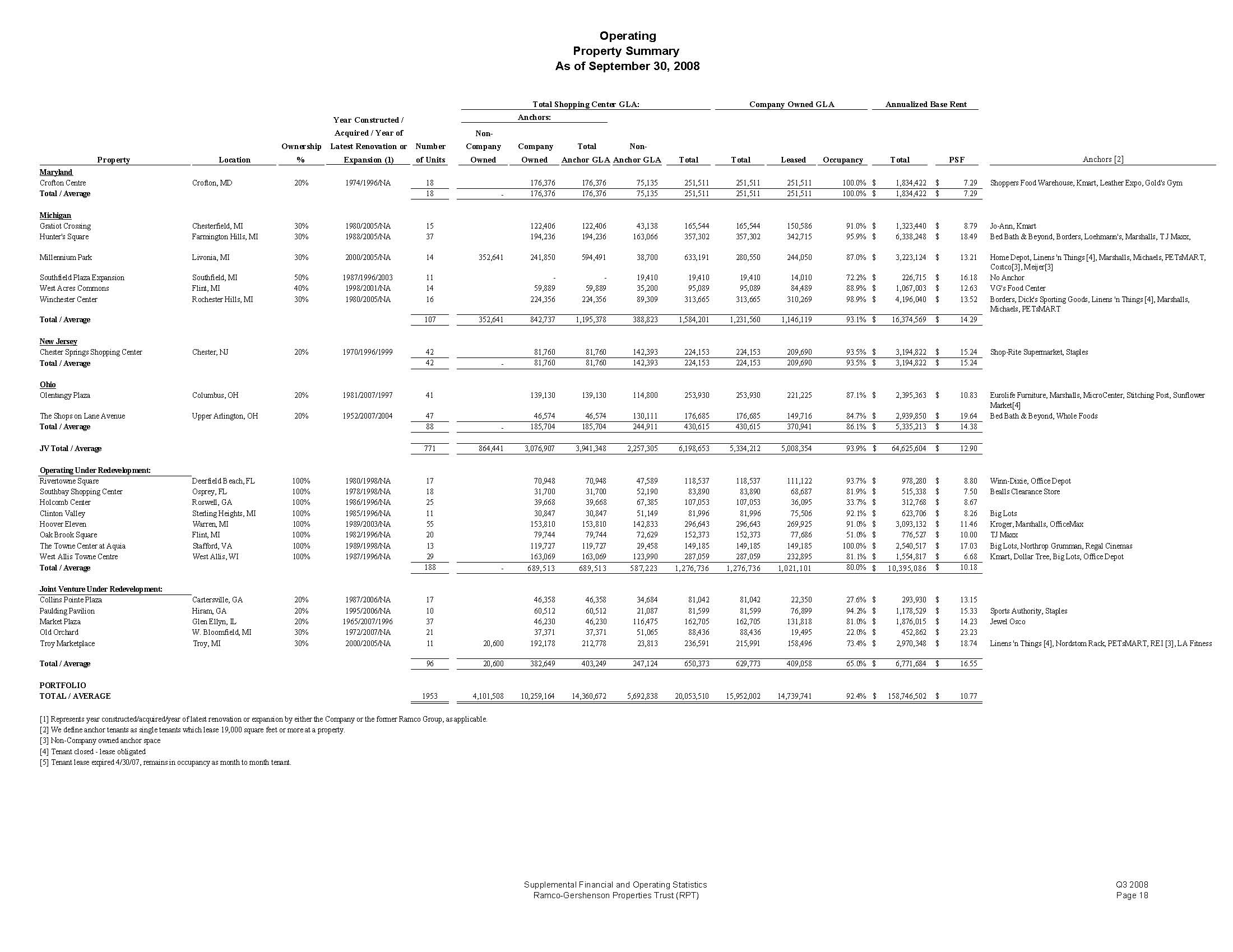

Operating Property Summary As of September 30, 2008 Total Shopping Center GLA: Company Owned GLA Annualized Base Rent Year Constructed / Anchors: Acquired / Year of Non-Ownership Latest Renovation or Number Company Company Total Property Location % Expansion (1) of UnitsOwned Owned Anchor GLA Maryland Crofton Centre Crofton, MD 20% 1974/1996/NA 18 176,376 176,376 75,135 251,511 251,511 251,511 100.0% $ 1,834,422 $ 7.29 Shoppers Food Warehouse, Kmart, Leather Expo, Gold's Gym Total / Average 18 - -176,376 176,376 75,135 251,511 251,511 251,511 100.0% $ 1,834,422 $ 7.29 Michigan Gratiot Crossing Chesterfield, MI 30% 1980/2005/NA 15 122,406 122,406 43,138 165,544 165,544 150,586 91.0% $ 1,323,440 $ 8.79 Jo-Ann, Kmart Hunter's Square Farmington Hills, MI 30% 1988/2005/NA 37 194,236 194,236 163,066 357,302 357,302 342,715 95.9% $ 6,338,248 $ 18.49 Bed Bath & Beyond, Borders, Loehmann's, Marshalls, T J Maxx, Millennium Park Livonia, MI 30% 2000/2005/NA 14 352,641 241,850 594,491 38,700 633,191 280,550 244,050 87.0% $ 3,223,124 $ 13.21 Home Depot, Linens 'n Things [4], Marshalls, Michaels, PETsMART, Costco[3], Meijer[3] Southfield Plaza Expansion Southfield, MI 50% 1987/1996/2003 11 - - 19,410 19,410 19,410 14,010 72.2% $ 226,715 $ 16.18 No Anchor West Acres Commons Flint, MI 40% 1998/2001/NA 14 59,889 59,889 35,200 95,089 95,089 84,489 88.9% $ 1,067,003 $ 12.63 VG's Food Center Winchester Center Rochester Hills, MI 30% 1980/2005/NA 16 224,356 224,356 89,309 313,665 313,665 310,269 98.9% $ 4,196,040 $ 13.52 Borders, Dick's Sporting Goods, Linens 'n Things [4], Marshalls, Michaels, PETsMART Total / Average 107 352,641 842,737 1,195,378 388,823 1,584,201 1,231,560 1,146,119 93.1% $ 16,374,569 $ 14.29 New Jersey Chester Springs Shopping Center Chester, NJ 20% 1970/1996/1999 42 81,760 81,760 142,393 224,153 224,153 209,690 93.5% $ 3,194,822 $ 15.24 Shop-Rite Supermarket, Staples Total / Average 42 - 81,760 81,760 142,393 224,153 224,153 209,690 93.5% $ 3,194,822 $ 15.24 Ohio Olentangy Plaza Columbus, OH 20% 1981/2007/1997 41 139,130 139,130 114,800 253,930 253,930 221,225 87.1% $ 2,395,363 $ 10.83 Eurolife Furniture, Marshalls, MicroCenter, Stitching Post, Sunflower Market[4] The Shops on Lane Avenue Upper Arlington, OH 20% 1952/2007/2004 47 46,574 46,574 130,111 176,685 176,685 149,716 84.7% $ 2,939,850 $ 19.64 Bed Bath & Beyond, Whole Foods Total / Average 88 - 185,704 185,704 244,911 430,615 430,615 370,941 86.1% $ 5,335,213 $ 14.38 JV Total / Average 771 864,441 3,076,907 3,941,348 2,257,305 6,198,653 5,334,212 5,008,354 93.9% $ 64,625,604 $ 12.90 Operating Under Redevelopment: Rivertowne Square Deerfield Beach, FL 100% 1980/1998/NA 17 70,948 70,948 47,589 118,537 118,537 111,122 93.7% $ 978,280 $ 8.80 Winn-Dixie, Office Depot Southbay Shopping Center Osprey, FL 100% 1978/1998/NA 18 31,700 31,700 52,190 83,890 83,890 68,687 81.9% $ 515,338 $ 7.50 Bealls Clearance Store Holcomb Center Roswell, GA 100% 1986/1996/NA 25 39,668 39,668 67,385 107,053 107,053 36,095 33.7% $ 312,768 $ 8.67 Clinton Valley Sterling Heights, MI 100% 1985/1996/NA 11 30,847 30,847 51,149 81,996 81,996 75,506 92.1% $ 623,706 $ 8.26 Big Lots Hoover Eleven Warren, MI 100% 1989/2003/NA 55 153,810 153,810 142,833 296,643 296,643 269,925 91.0% $ 3,093,132 $ 11.46 Kroger, Marshalls, OfficeMax Oak Brook Square Flint, MI 100% 1982/1996/NA 20 79,744 79,744 72,629 152,373 152,373 77,686 51.0% $ 776,527 $ 10.00 TJ Maxx The Towne Center at Aquia Stafford, VA 100% 1989/1998/NA 13 119,727 119,727 29,458 149,185 149,185 149,185 100.0% $ 2,540,517 $ 17.03 Big Lots, Northrop Grumman, Regal Cinemas West Allis Towne Centre West Allis, WI 100% 1987/1996/NA 29 163,069 163,069 123,990 287,059 287,059 232,895 81.1% $ 1,554,817 $ 6.68 Kmart, Dollar Tree, Big Lots, Office Depot Total / Average 188 - 689,513 689,513 587,223 1,276,736 1,276,736 1,021,101 80.0% $ 10,395,086 $ 10.18 Joint Venture Under Redevelopment: Collins Pointe Plaza Cartersville, GA 20% 1987/2006/NA 17 46,358 46,358 34,684 81,042 81,042 22,350 27.6% $ 293,930 $ 13.15 Paulding Pavilion Hiram, GA 20% 1995/2006/NA 10 60,512 60,512 21,087 81,599 81,599 76,899 94.2% $ 1,178,529 $ 15.33 Sports Authority, Staples Market Plaza Glen Ellyn, IL 20% 1965/2007/1996 37 46,230 46,230 116,475 162,705 162,705 131,818 81.0% $ 1,876,015 $ 14.23 Jewel Osco Old Orchard W. Bloomfield, MI 30% 1972/2007/NA 21 37,371 37,371 51,065 88,436 88,436 19,495 22.0% $ 452,862 $ 23.23 Troy Marketplace Troy, MI 30% 2000/2005/NA 11 20,600 192,178 212,778 23,813 236,591 215,991 158,496 73.4% $ 2,970,348 $ 18.74 Linens 'n Things [4], Nordstom Rack, PETsMART, REI [3], LA Fitness Total / Average 96 20,600 382,649 403,249 247,124 650,373 629,773 409,058 65.0% $ 6,771,684 $ 16.55 PORTFOLIO TOTAL / AVERAGE 1953 4,101,508 10,259,164 14,360,672 5,692,838 20,053,510 15,952,002 14,739,741 92.4% $ 158,746,502 $ 10.77 [1] Represents year constructed/acquired/year of latest renovation or expansion by either the Company or the former Ramco Group, as applicable. [2] We define anchor tenants as single tenants which lease 19,000 square feet or more at a property. [3] Non-Company owned anchor space [4] Tenant closed - lease obligated [5] Tenant lease expired 4/30/07, remains in occupancy as month to month tenant.

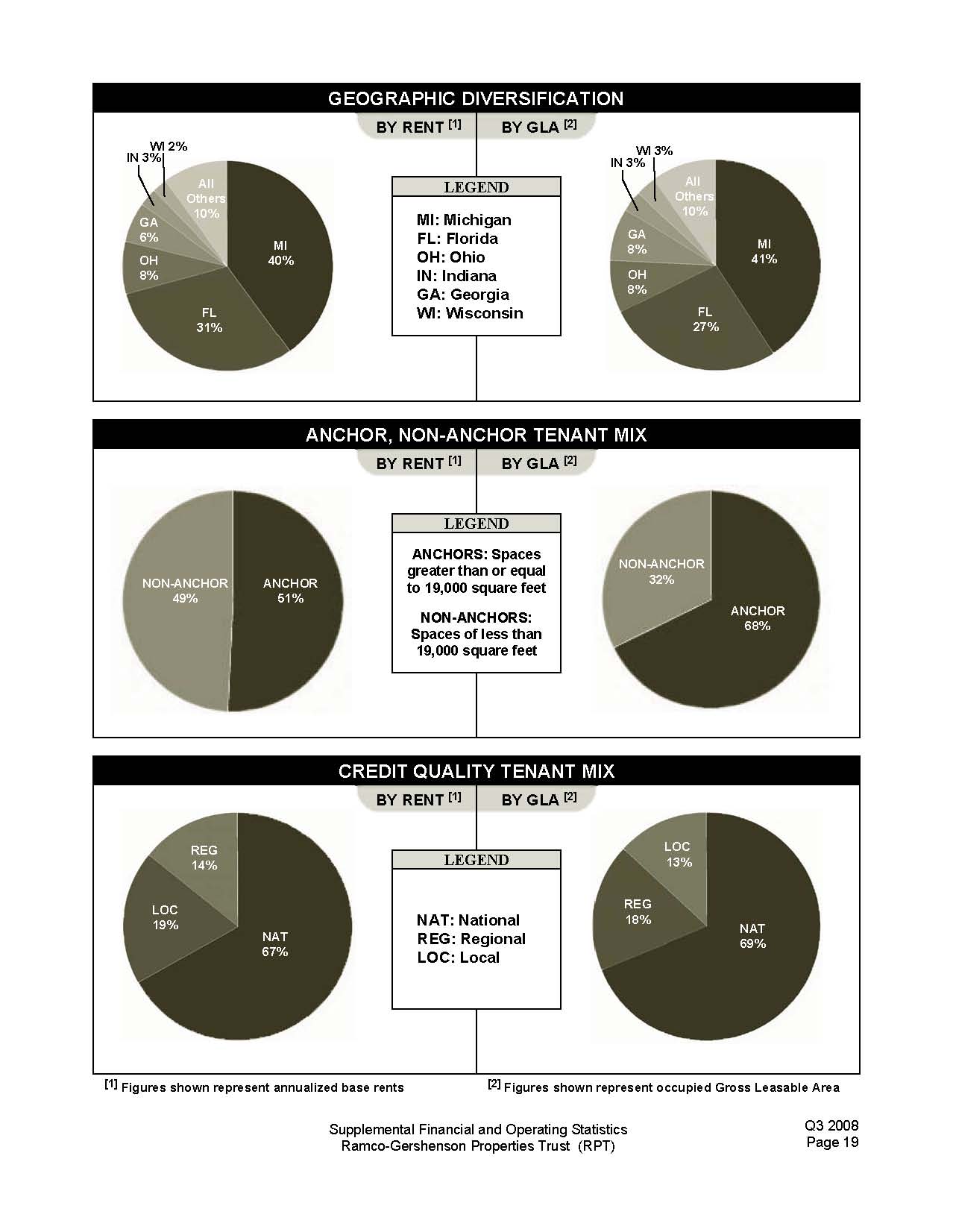

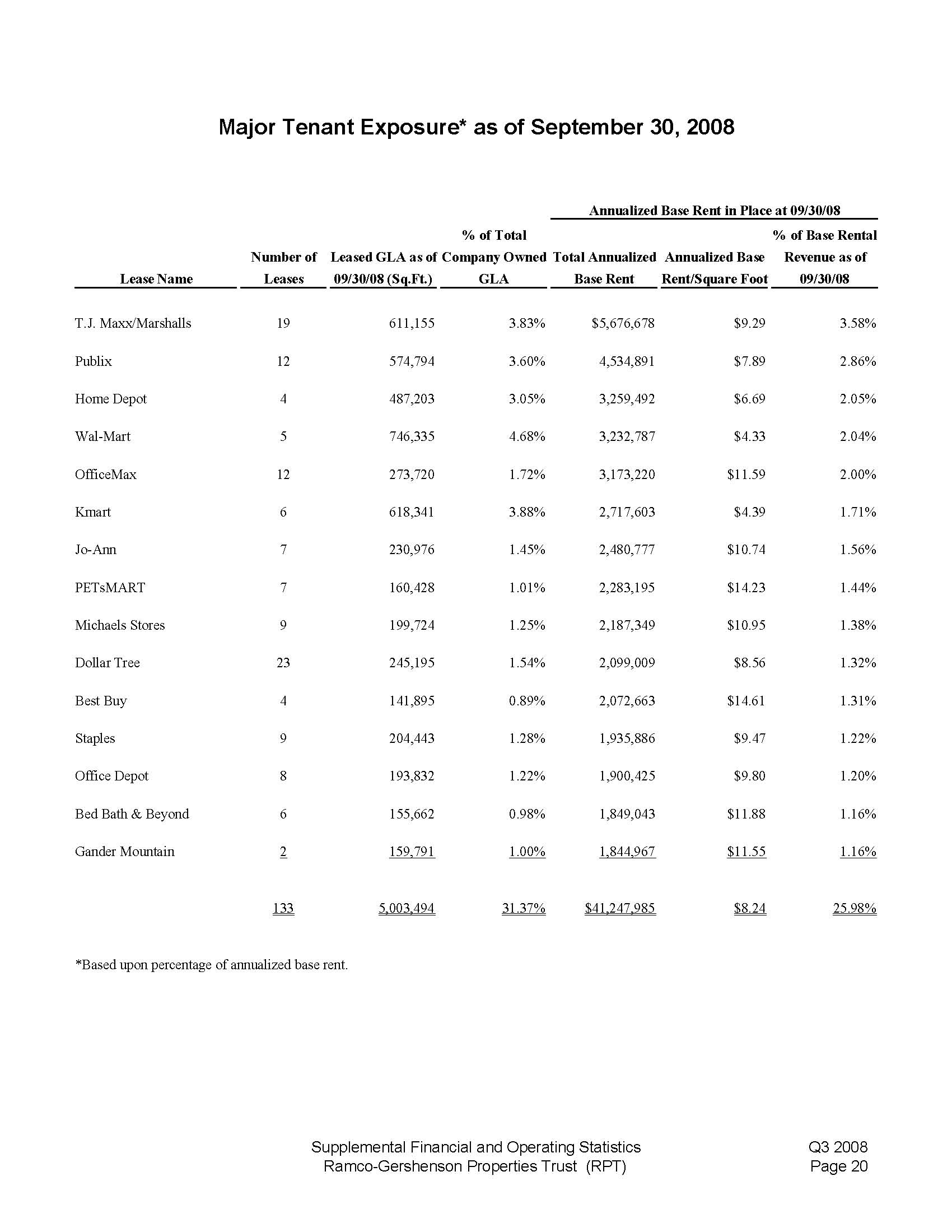

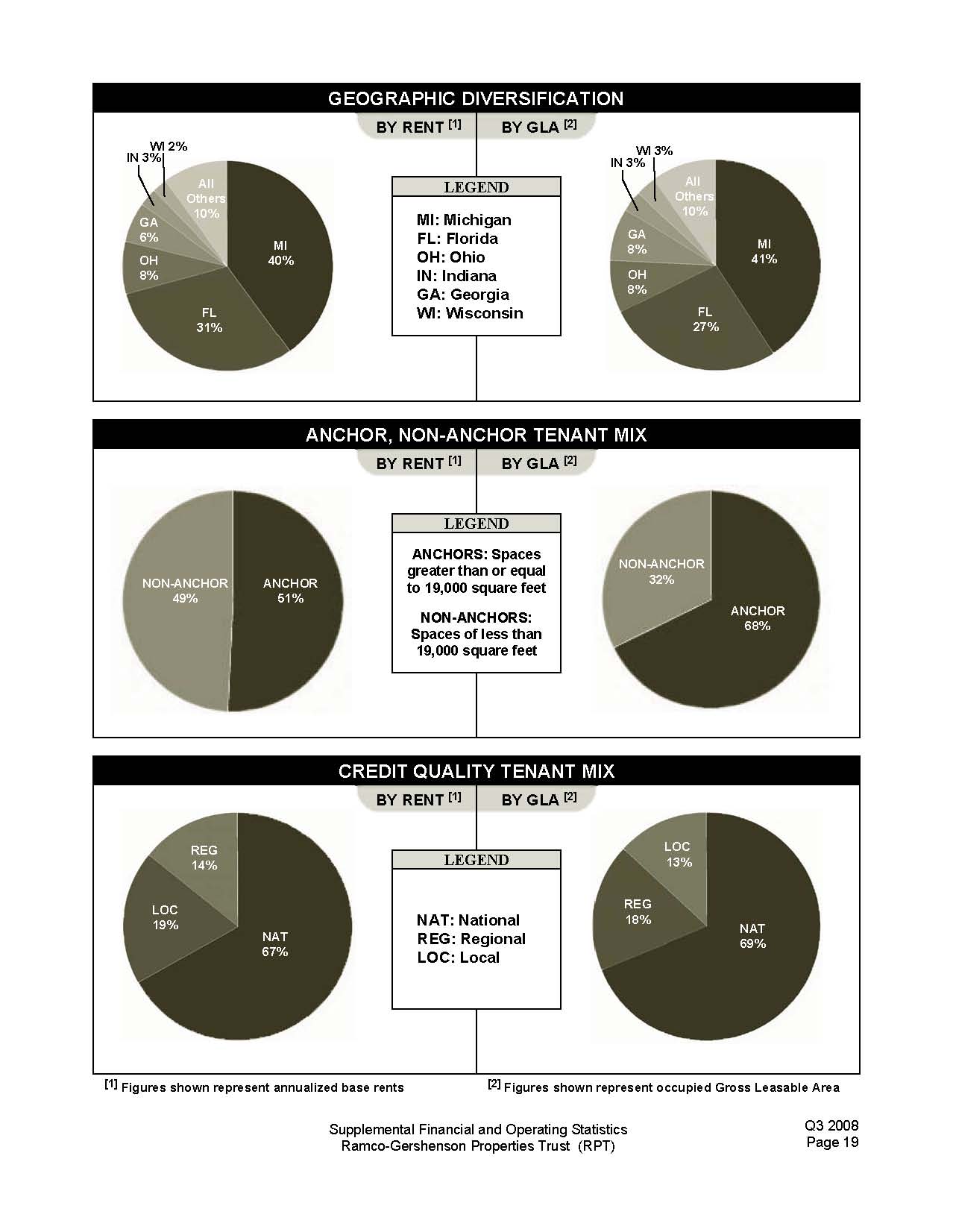

[1] Figures shown represent annualized base rents [2] Figures shown represent occupied Gross Leasable Area Supplemental Financial and Operating Statistics Q3 2008 Ramco-Gershenson Properties Trust (RPT) Page 19 Major Tenant Exposure* as of September 30, 2008 Annualized Base Rent in Place at 09/30/08 % of Total % of Base Rental Number of Leased GLA as of Company Owned Total Annualized Annualized Base Revenue as of Lease Name Leases 09/30/08 (Sq.Ft.) GLA Base Rent Rent/Square Foot 09/30/08 T.J. Maxx/Marshalls 19 611,155 3.83% $5,676,678 $9.29 3.58% Publix 12 574,794 3.60% 4,534,891 $7.89 2.86% Home Depot 4 487,203 3.05% 3,259,492 $6.69 2.05% Wal-Mart 5 746,335 4.68% 3,232,787 $4.33 2.04% OfficeMax 12 273,720 1.72% 3,173,220 $11.59 2.00% Kmart 6 618,341 3.88% 2,717,603 $4.39 1.71% Jo-Ann 7 230,976 1.45% 2,480,777 $10.74 1.56% PETsMART 7 160,428 1.01% 2,283,195 $14.23 1.44% Michaels Stores 9 199,724 1.25% 2,187,349 $10.95 1.38% Dollar Tree 23 245,195 1.54% 2,099,009 $8.56 1.32% Best Buy 4 141,895 0.89% 2,072,663 $14.61 1.31% Staples 9 204,443 1.28% 1,935,886 $9.47 1.22% Office Depot 8 193,832 1.22% 1,900,425 $9.80 1.20% Bed Bath & Beyond 6 155,662 0.98% 1,849,043 $11.88 1.16% Gander Mountain 2 159,791 1.00% 1,844,967 $11.55 1.16% 133 5,003,494 31.37% $41,247,985 $8.24 25.98% *Based upon percentage of annualized base rent. Supplemental Financial and Operating Statistics Q3 2008 Ramco-Gershenson Properties Trust (RPT) Page 19

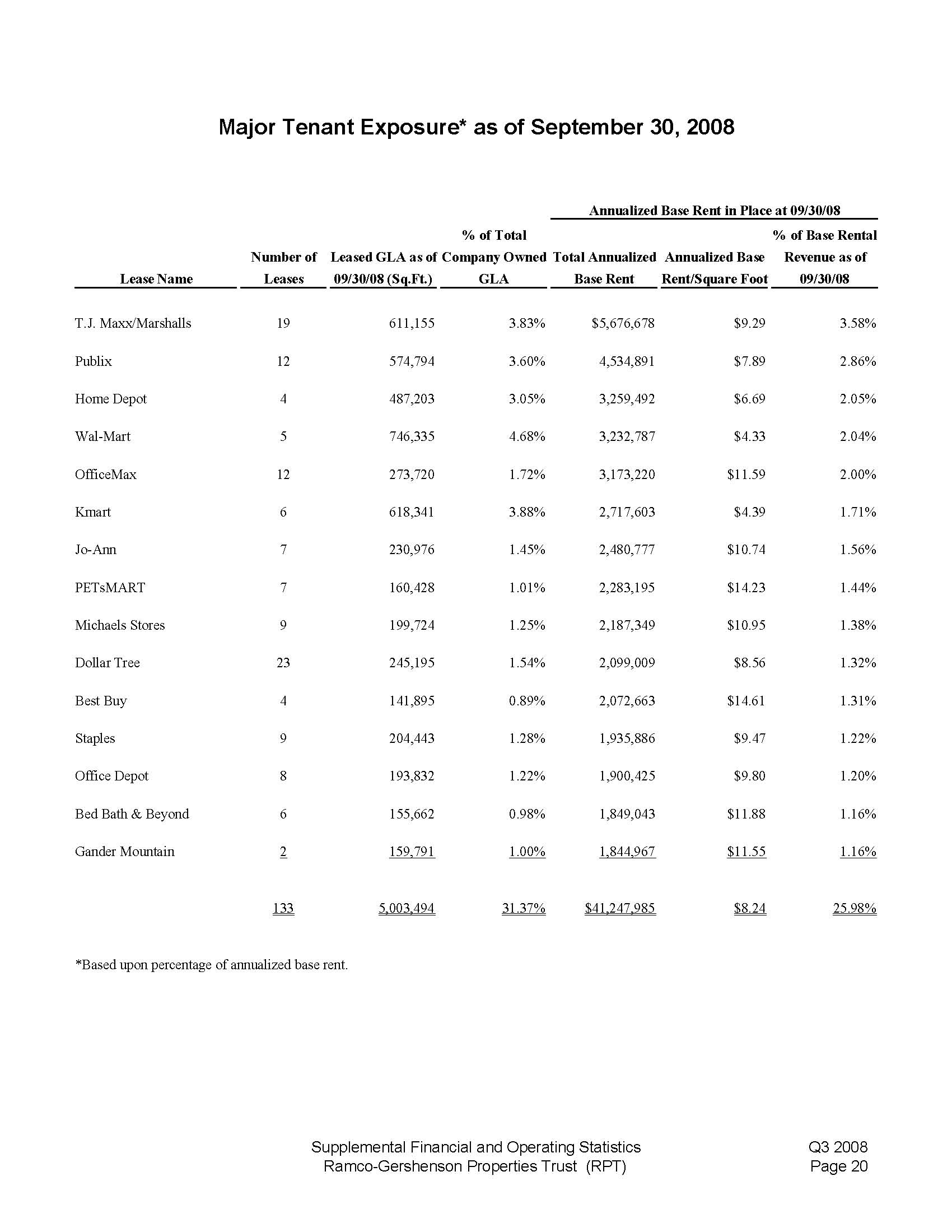

Major Tenant Exposure* as of September 30, 2008 Annualized Base Rent in Place at 09/30/08 % of Total % of Base Rental Number of Leased GLA as of Company Owned Total Annualized Annualized Base Revenue as of Lease Name Leases 09/30/08 (Sq.Ft.) GLA Base Rent Rent/Square Foot 09/30/08 T.J. Maxx/Marshalls 19 611,155 3.83% $5,676,678 $9.29 3.58% Publix 12 574,794 3.60% 4,534,891 $7.89 2.86% Home Depot 4 487,203 3.05% 3,259,492 $6.69 2.05% Wal-Mart 5 746,335 4.68% 3,232,787 $4.33 2.04% OfficeMax 12 273,720 1.72% 3,173,220 $11.59 2.00% Kmart 6 618,341 3.88% 2,717,603 $4.39 1.71% Jo-Ann 7 230,976 1.45% 2,480,777 $10.74 1.56% PETsMART 7 160,428 1.01% 2,283,195 $14.23 1.44% Michaels Stores 9 199,724 1.25% 2,187,349 $10.95 1.38% Dollar Tree 23 245,195 1.54% 2,099,009 $8.56 1.32% Best Buy 4 141,895 0.89% 2,072,663 $14.61 1.31% Staples 9 204,443 1.28% 1,935,886 $9.47 1.22% Office Depot 8 193,832 1.22% 1,900,425 $9.80 1.20% Bed Bath & Beyond 6 155,662 0.98% 1,849,043 $11.88 1.16% Gander Mountain 2 159,791 1.00% 1,844,967 $11.55 1.16% 133 5,003,494 31.37% $41,247,985 $8.24 25.98% *Based upon percentage of annualized base rent. Supplemental Financial and Operating Statistics Q3 2008 Ramco-Gershenson Properties Trust (RPT) Page 20

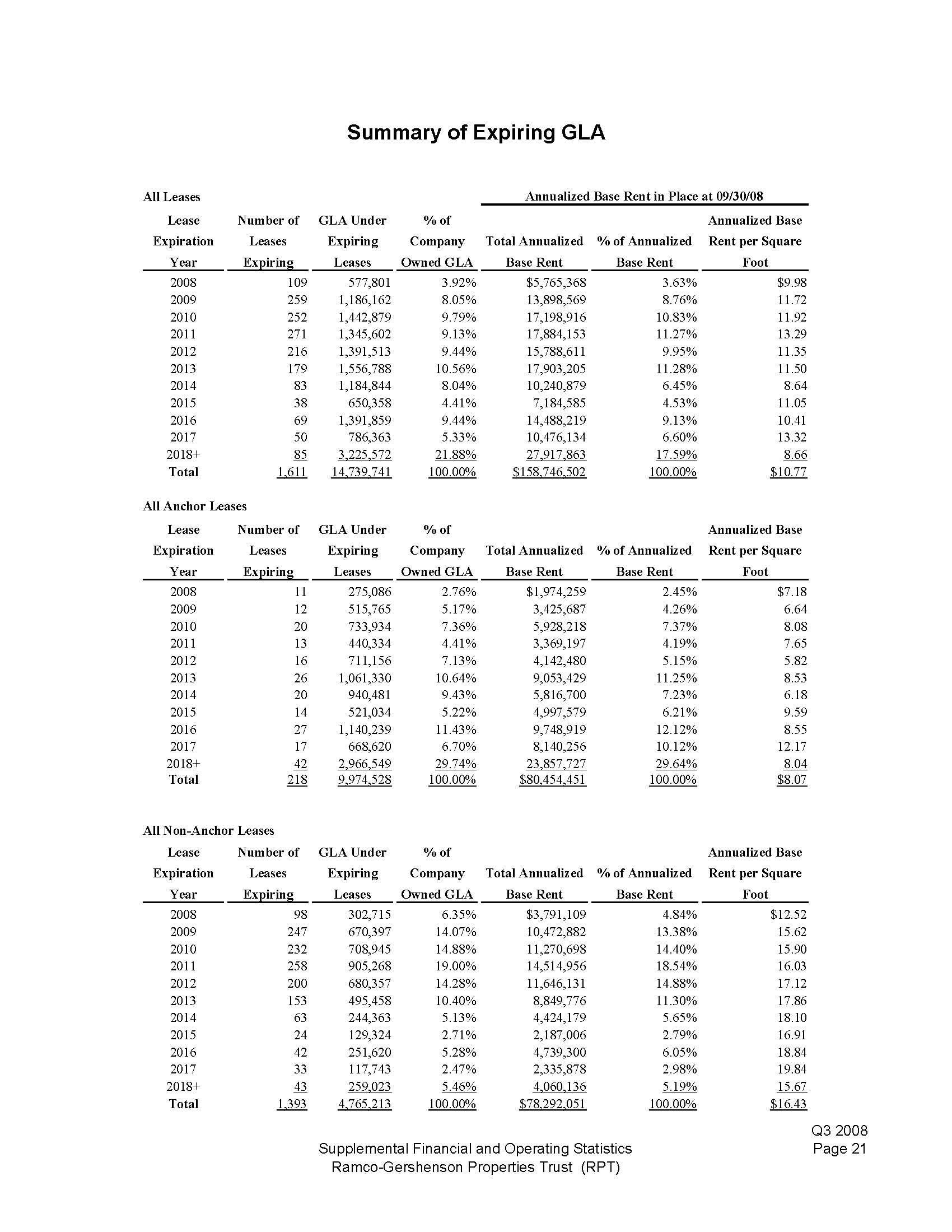

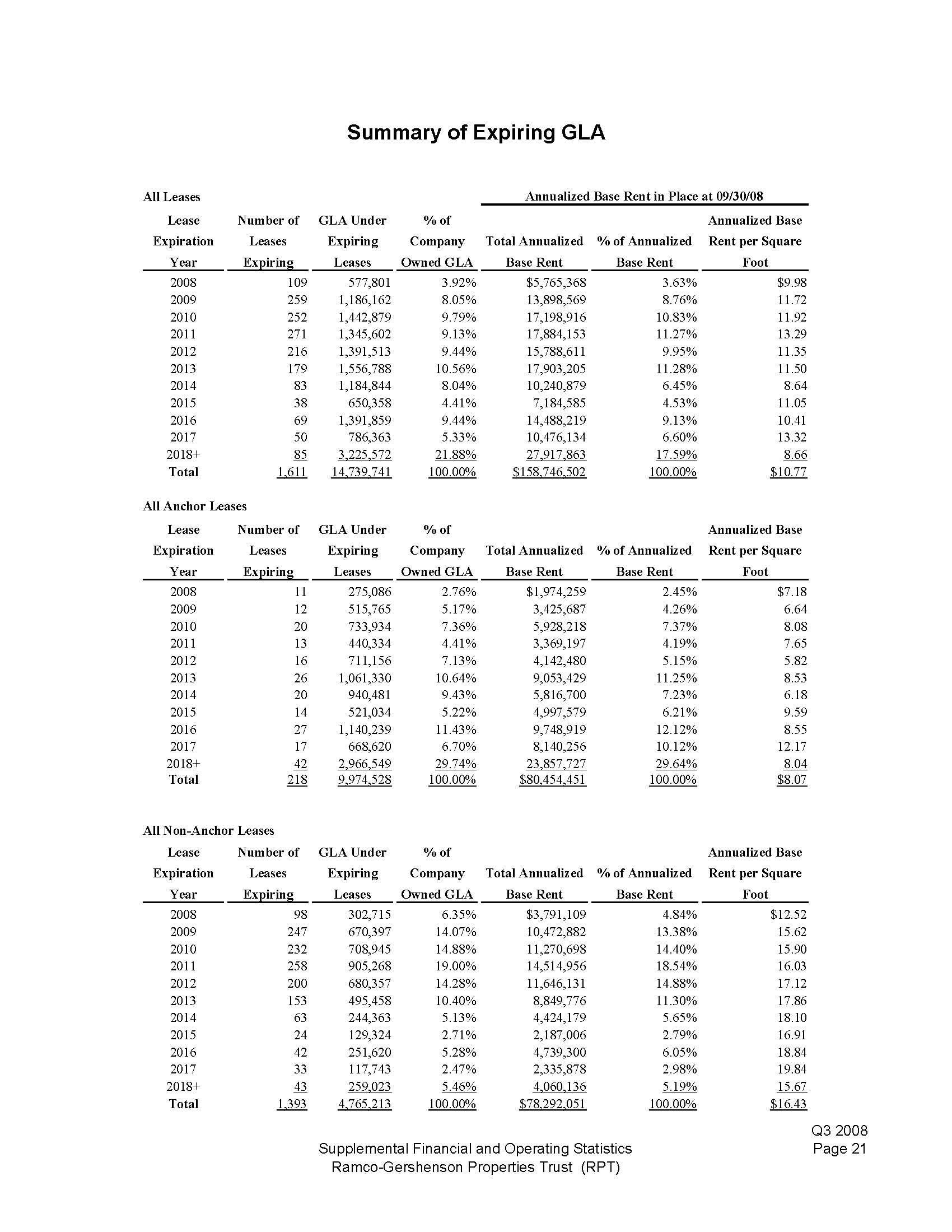

Summary of Expiring GLA All Leases Annualized Base Rent in Place at 09/30/08 Lease Number of GLA Under % of Annualized Base Expiration Leases Expiring Company Total Annualized % of Annualized Rent per Square Year Expiring Leases Owned GLA Base Rent Base Rent Foot 2008 109 577,801 3.92% $5,765,368 3.63% $9.98 2009 259 1,186,162 8.05% 13,898,569 8.76% 11.72 2010 252 1,442,879 9.79% 17,198,916 10.83% 11.92 2011 271 1,345,602 9.13% 17,884,153 11.27% 13.29 2012 216 1,391,513 9.44% 15,788,611 9.95% 11.35 2013 179 1,556,788 10.56% 17,903,205 11.28% 11.50 2014 83 1,184,844 8.04% 10,240,879 6.45% 8.64 2015 38 650,358 4.41% 7,184,585 4.53% 11.05 2016 69 1,391,859 9.44% 14,488,219 9.13% 10.41 2017 50 786,363 5.33% 10,476,134 6.60% 13.32 2018+ 85 3,225,572 21.88% 27,917,863 17.59% 8.66 Total 1,611 14,739,741 100.00% $158,746,502 100.00% $10.77 All Anchor Leases Lease Number of GLA Under % of Annualized Base Expiration Leases Expiring Company Total Annualized % of Annualized Rent per Square Year Expiring Leases Owned GLA Base Rent Base Rent Foot 2008 11 275,086 2.76% $1,974,259 2.45% $7.18 2009 12 515,765 5.17% 3,425,687 4.26% 6.64 2010 20 733,934 7.36% 5,928,218 7.37% 8.08 2011 13 440,334 4.41% 3,369,197 4.19% 7.65 2012 16 711,156 7.13% 4,142,480 5.15% 5.82 2013 26 1,061,330 10.64% 9,053,429 11.25% 8.53 2014 20 940,481 9.43% 5,816,700 7.23% 6.18 2015 14 521,034 5.22% 4,997,579 6.21% 9.59 2016 27 1,140,239 11.43% 9,748,919 12.12% 8.55 2017 17 668,620 6.70% 8,140,256 10.12% 12.17 2018+ 42 2,966,549 29.74% 23,857,727 29.64% 8.04 Total 218 9,974,528 100.00% $80,454,451 100.00% $8.07 All Non-Anchor Leases Lease Number of GLA Under % of Annualized Base Expiration Leases Expiring Company Total Annualized % of Annualized Rent per Square Year Expiring Leases Owned GLA Base Rent Base Rent Foot 2008 98 302,715 6.35% $3,791,109 4.84% $12.52 2009 247 670,397 14.07% 10,472,882 13.38% 15.62 2010 232 708,945 14.88% 11,270,698 14.40% 15.90 2011 258 905,268 19.00% 14,514,956 18.54% 16.03 2012 200 680,357 14.28% 11,646,131 14.88% 17.12 2013 153 495,458 10.40% 8,849,776 11.30% 17.86 2014 63 244,363 5.13% 4,424,179 5.65% 18.10 2015 24 129,324 2.71% 2,187,006 2.79% 16.91 2016 42 251,620 5.28% 4,739,300 6.05% 18.84 2017 33 117,743 2.47% 2,335,878 2.98% 19.84 2018+ 43 259,023 5.46% 4,060,136 5.19% 15.67 Total 1,393 4,765,213 100.00% $78,292,051 100.00% $16.43 Q3 2008 Supplemental Financial and Operating Statistics Page 21 Ramco-Gershenson Properties Trust (RPT)

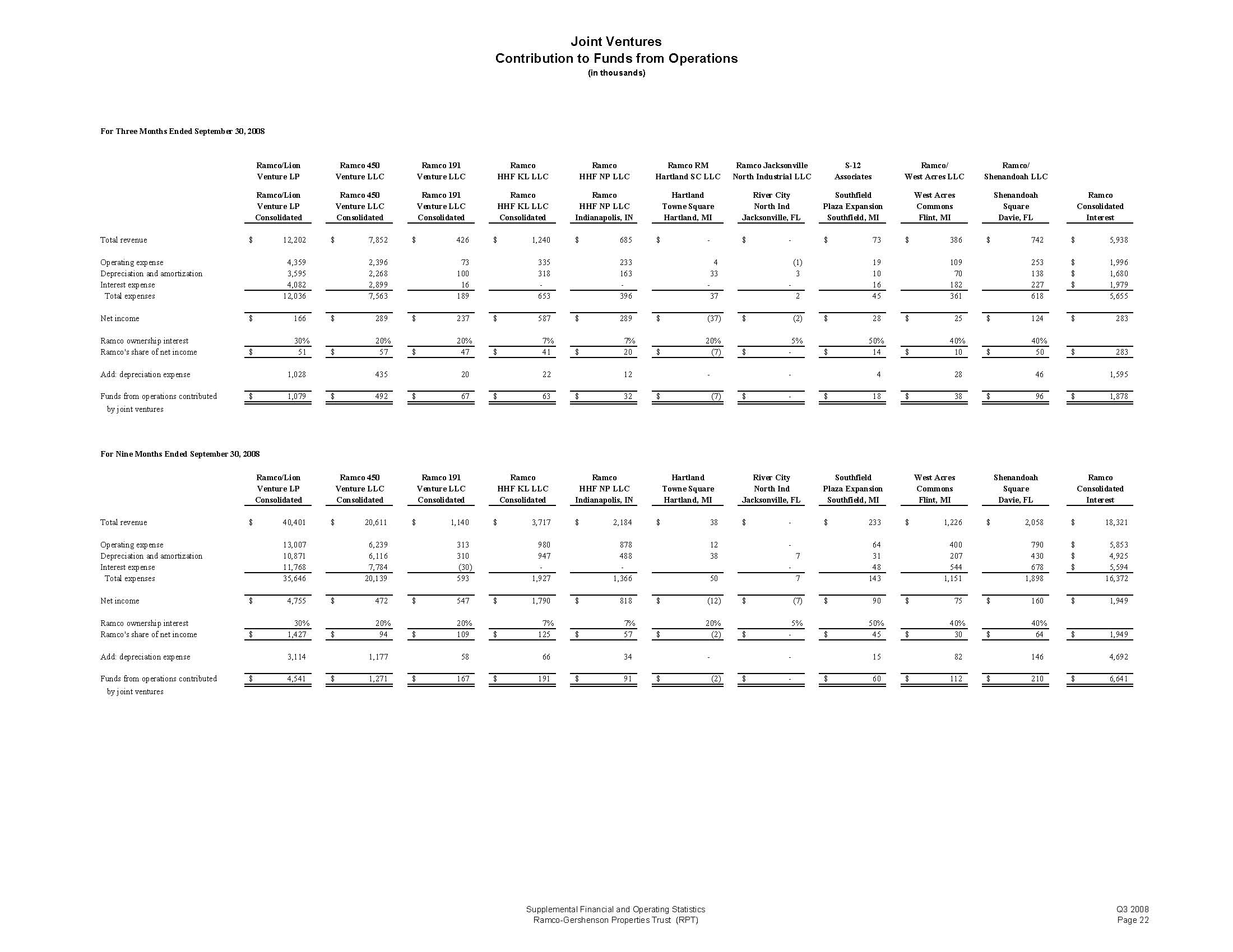

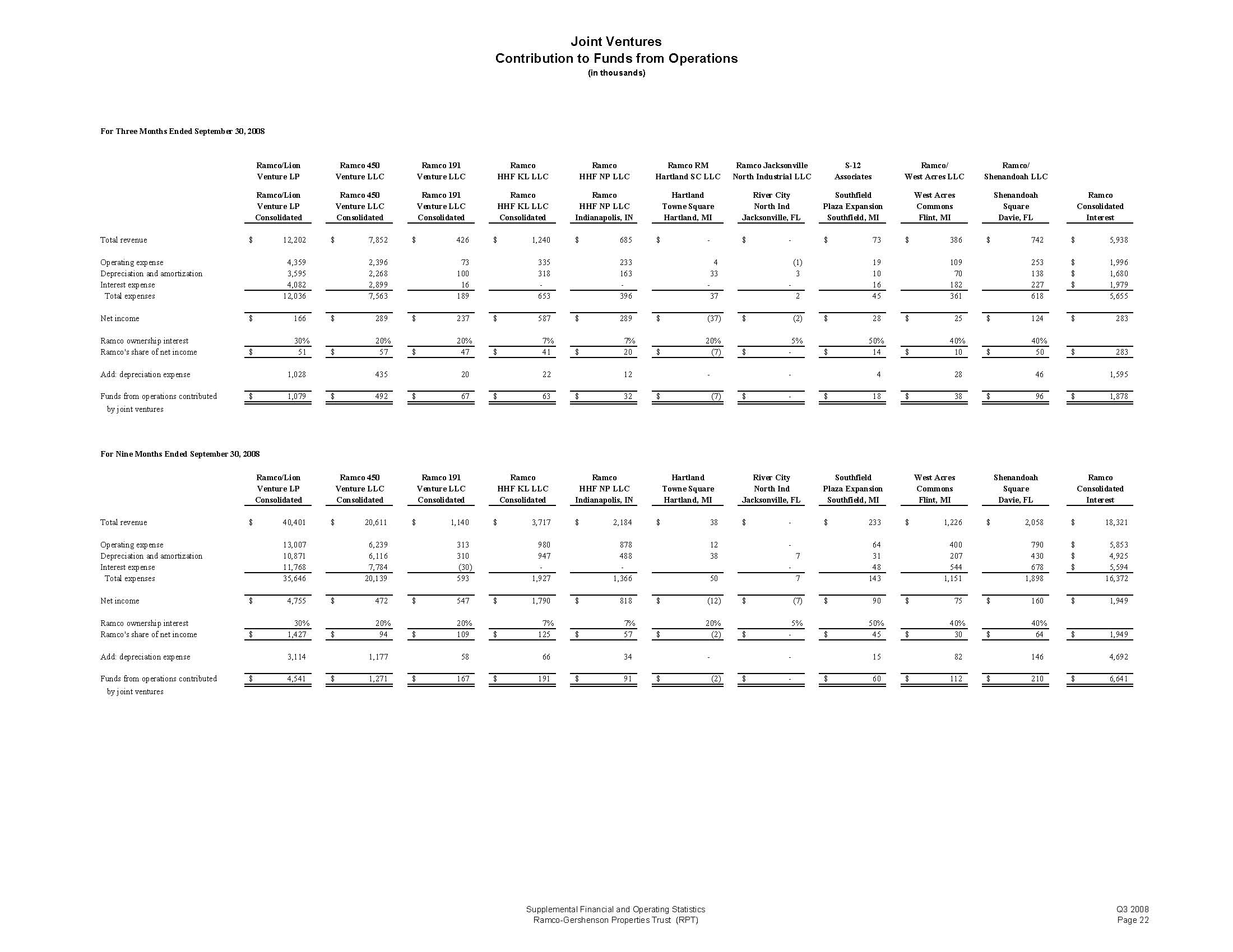

Joint Ventures Contribution to Funds from Operations (in thousands) For Three Months Ended September 30, 2008 Ramco/Lion Ramco 450 Ramco 191 Ramco Ramco Ramco RM Ramco Jacksonville S-12 Ramco/ Ramco/ Venture LP Venture LLC Venture LLC HHF KL LLC HHF NP LLC Hartland SC LLC North Industrial LLC Associates West Acres LLC Shenandoah LLC Ramco/Lion Ramco 450 Ramco 191 Ramco Ramco Hartland River City Southfield West Acres Shenandoah Ramco Venture LP Venture LLC Venture LLC HHF KL LLC HHF NP LLC Towne Square North Ind Plaza Expansion Commons Square Consolidated Consolidated Consolidated Consolidated Consolidated Indianapolis, IN Hartland, MI Jacksonville, FL Southfield, MI Flint, MI Davie, FL Interest Total revenue 12,202$ 7,852$ 426$ 1,240$ 685$ $ - - -$ 73$ 386$ 742$ 5,938$ Operating expense 4,359 2,396 73 335 233 4 (1) 19 109 253 $ 1,996 Depreciation and amortization 3,595 2,268 100 318 163 33 3 10 70 138 $ 1,680 Interest expense 4,082 2,899 16 - - - - 16 182 227 $ 1,979 Total expenses 12,036 7,563 189 653 396 37 2 45 361 618 5,655 Net income 166$ 289$ 237$ 587$ 289$ $ (37) (2)$ 28$ 25$ 124$ 283$ Ramco ownership interest 30% 20% 20% 7% 7% 20% 5% 50% 40% 40% Ramco's share of net income 51$ 57$ 47$ 41$ 20$ $ (7) -$ 14$ 10$ 50$ 283$ Add: depreciation expense 1,028 435 20 22 12 - - - 4 28 46 1,595 Funds from operations contributed 1,079$ 492$ 67$ 63$ 32$ $ (7) -$ 18$ 38$ 96$ 1,878$ by joint ventures For Nine Months Ended September 30, 2008 Ramco/Lion Ramco 450 Ramco 191 Ramco Ramco Hartland River City Southfield West Acres Shenandoah Ramco Venture LP Venture LLC Venture LLC HHF KL LLC HHF NP LLC Towne Square North Ind Plaza Expansion Commons Square Consolidated Consolidated Consolidated Consolidated Consolidated Indianapolis, IN Hartland, MI Jacksonville, FL Southfield, MI Flint, MI Davie, FL Interest Total revenue 40,401$ 20,611$ 1,140$ 3,717$ 2,184$ 38$ -$ 233$ 1,226$ 2,058$ 18,321$ Operating expense 13,007 6,239 313 980 878 12 - 64 400 790 $ 5,853 Depreciation and amortization 10,871 6,116 310 947 488 38 7 31 207 430 $ 4,925 Interest expense 11,768 7,784 (30) - - - 48 544 678 $ 5,594 Total expenses 35,646 20,139 593 1,927 1,366 50 7 143 1,151 1,898 16,372 Net income 4,755$ 472$ 547$ 1,790$ 818$ $ (12) (7)$ 90$ 75$ 160$ 1,949$ Ramco ownership interest 30% 20% 20% 7% 7% 20% 5% 50% 40% 40% Ramco's share of net income 1,427$ 94$ 109$ 125$ 57$ $ (2) -$ 45$ 30$ 64$ 1,949$ Add: depreciation expense 3,114 1,177 58 66 34 - - - 15 82 146 4,692 Funds from operations contributed 4,541$ 1,271$ 167$ 191$ 91$ $ (2) -$ 60$ 112$ 210$ 6,641$ by joint ventures Supplemental Financial and Operating Statistics Q3 2008 Ramco-Gershenson Properties Trust (RPT) Page 22

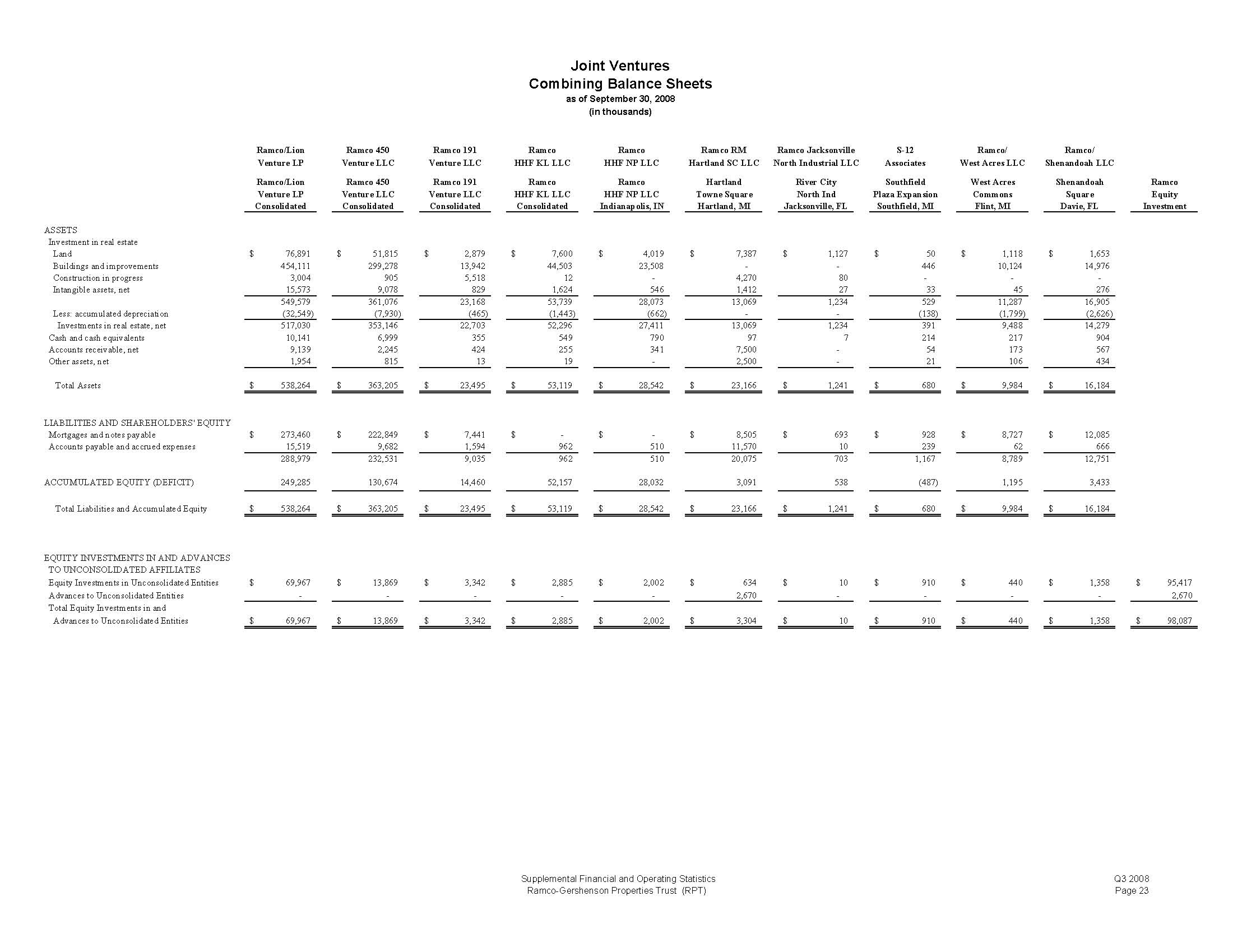

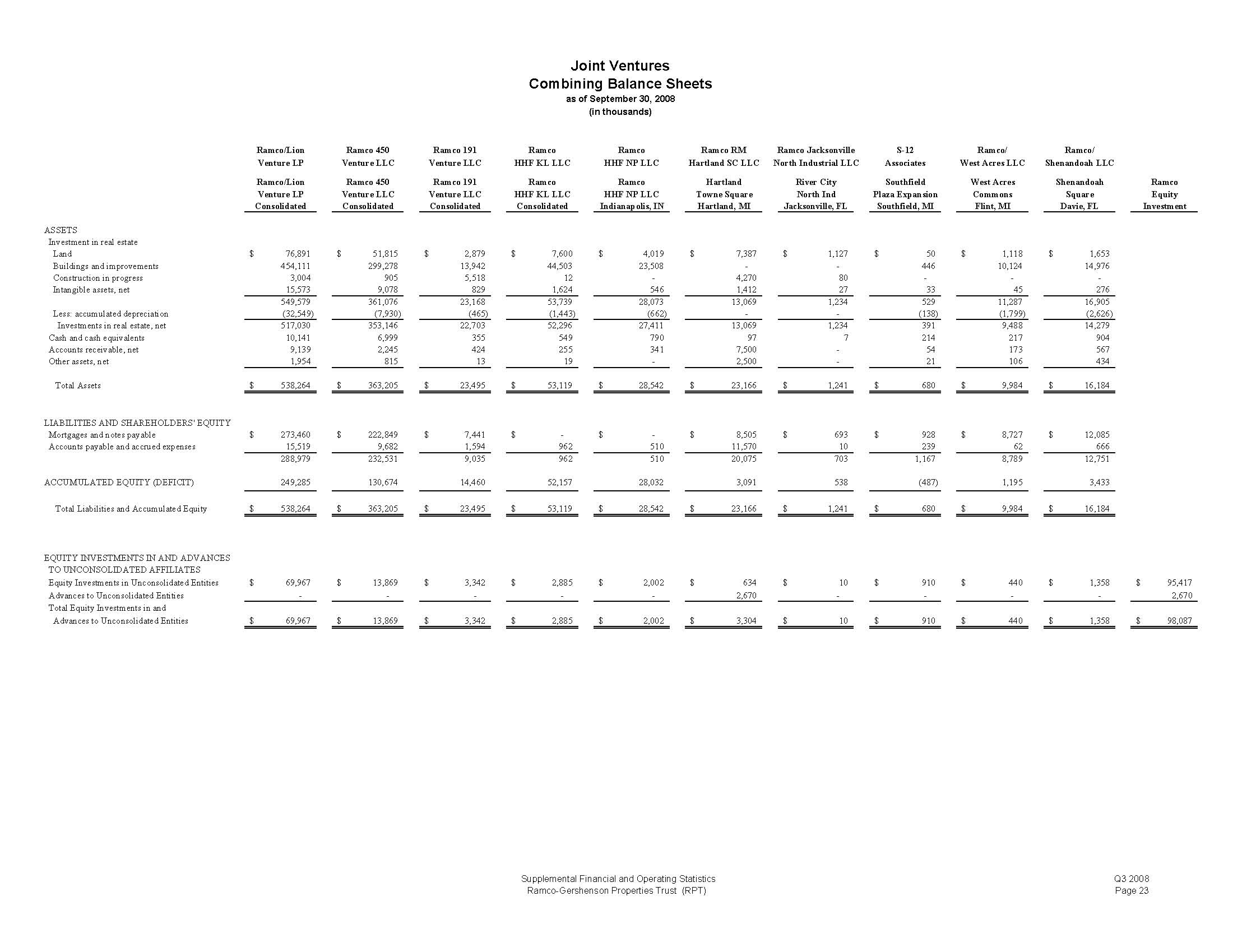

Joint Ventures Combining Balance Sheets as of September 30, 2008 (in thousands) Ramco/Lion Ramco 450 Ramco 191 Ramco Ramco Ramco RM Ramco Jacksonville S-12 Ramco/ Ramco/ Venture LP Venture LLC Venture LLC HHF KL LLC HHF NP LLC Hartland SC LLC North Industrial LLC Associates West Acres LLC Shenandoah LLC Ramco/Lion Ramco 450 Ramco 191 Ramco Ramco Hartland River City Southfield West Acres Shenandoah Ramco Venture LP Venture LLC Venture LLC HHF KL LLC HHF NP LLC Towne Square North Ind Plaza Expansion Commons Square Equity Consolidated Consolidated Consolidated Consolidated Indianapolis, IN Hartland, MI Jacksonville, FL Southfield, MI Flint, MI Davie, FL Investment ASSETS Investment in real estate Land 76,891$ 51,815$ 2,879$ 7,600$ 4,019$ 7,387$ 1,127$ 50$ 1,118$ 1,653$ Buildings and improvements 454,111 299,278 13,942 44,503 23,508 - - - 446 10,124 14,976 Construction in progress 3,004 905 5,518 12 - 4,270 80 - - - Intangible assets, net 15,573 9,078 829 1,624 546 1,412 27 33 45 276 549,579 361,076 23,168 53,739 28,073 13,069 1,234 529 11,287 16,905 Less: accumulated depreciation (32,549) (7,930) (465) (1,443) (662) - - - (138) (1,799) (2,626) Investments in real estate, net 517,030 353,146 22,703 52,296 27,411 13,069 1,234 391 9,488 14,279 Cash and cash equivalents 10,141 6,999 355 549 790 97 7 214 217 904 Accounts receivable, net 9,139 2,245 424 255 341 7,500 - 54 173 567 Other assets, net 1,954 815 13 19 - 2,500 - 21 106 434 Total Assets 538,264$ 363,205$ 23,495$ 53,119$ 28,542$ 23,166$ 1,241$ 680$ 9,984$ 16,184$ LIABILITIES AND SHAREHOLDERS' EQUITY Mortgages and notes payable 273,460$ 222,849$ 7,441$ $ - - -$ 8,505$ 693$ 928$ 8,727$ 12,085$ Accounts payable and accrued expenses 15,519 9,682 1,594 962 510 11,570 10 239 62 666 288,979 232,531 9,035 962 510 20,075 703 1,167 8,789 12,751 ACCUMULATED EQUITY (DEFICIT) 249,285 130,674 14,460 52,157 28,032 3,091 538 (487) 1,195 3,433 Total Liabilities and Accumulated Equity 538,264$ 363,205$ 23,495$ 53,119$ 28,542$ 23,166$ 1,241$ 680$ 9,984$ 16,184$ EQUITY INVESTMENTS IN AND ADVANCES TO UNCONSOLIDATED AFFILIATES Equity Investments in Unconsolidated Entities 69,967$ 13,869$ 3,342$ 2,885$ 2,002$ 634$ 10$ 910$ 440$ 1,358$ 95,417$ Advances to Unconsolidated Entities - - - - - 2,670 - - - - 2,670 Total Equity Investments in and Advances to Unconsolidated Entities 69,967$ 13,869$ 3,342$ 2,885$ 2,002$ 3,304$ 10$ 910$ 440$ 1,358$ 98,087$

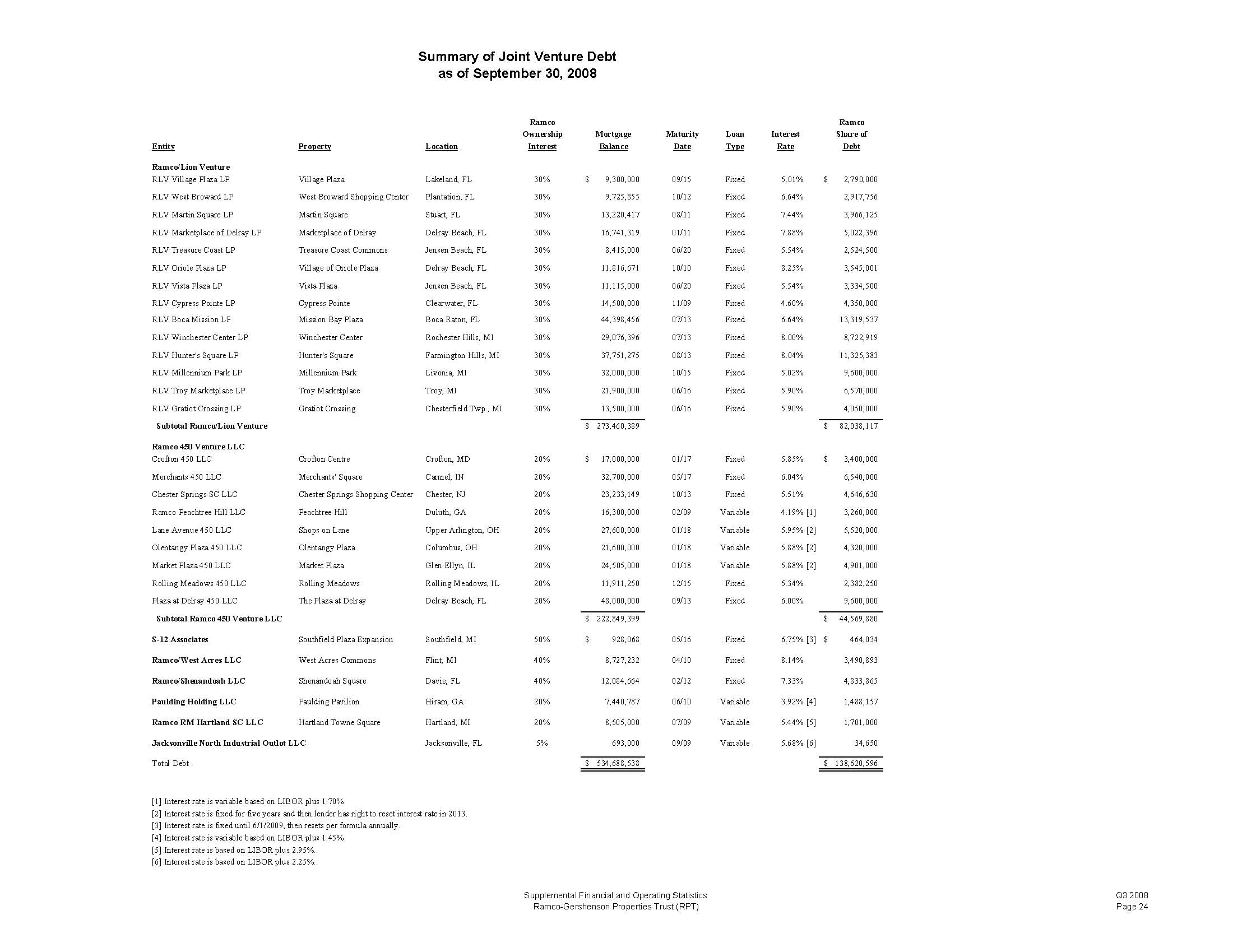

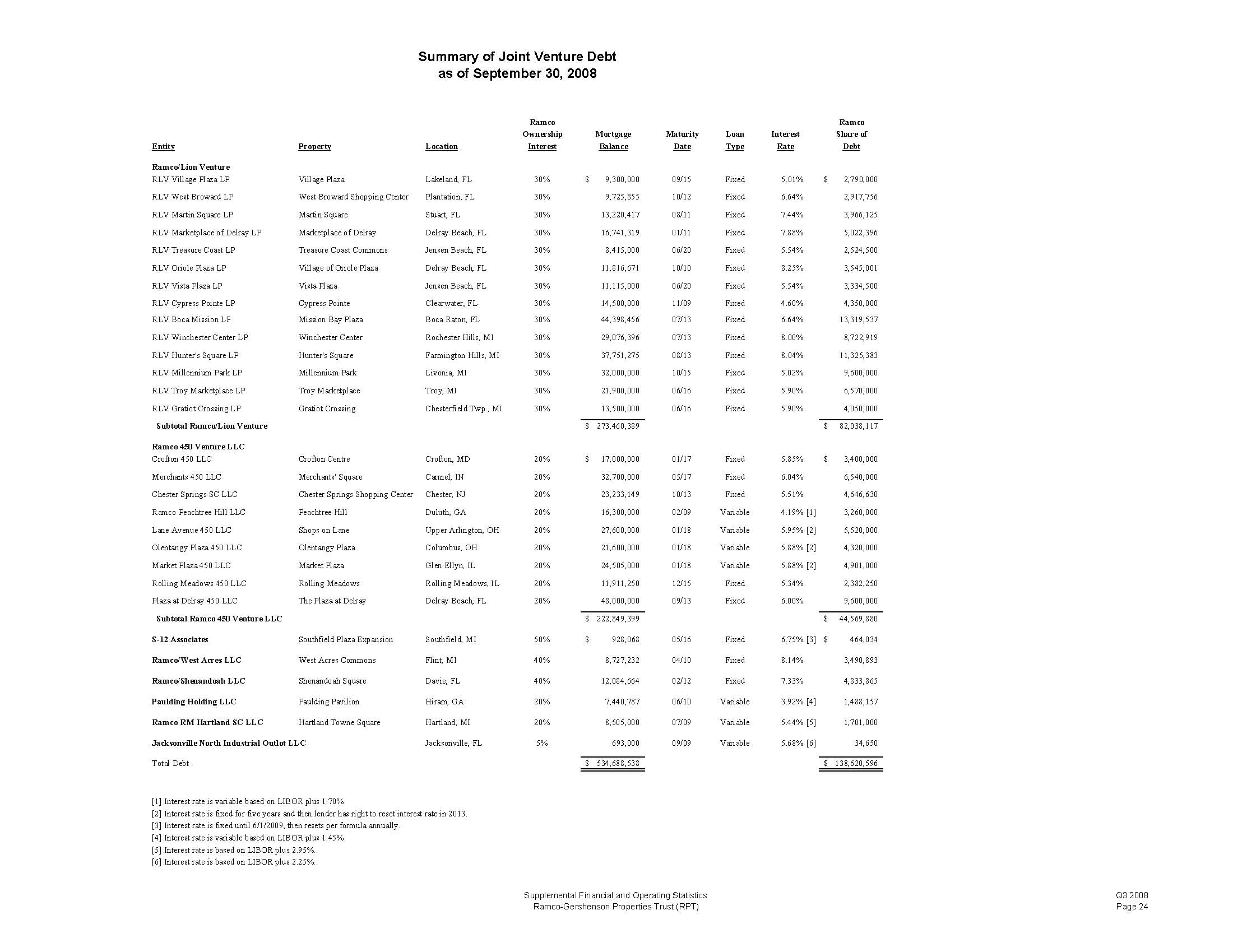

Summary of Joint Venture Debt as of September 30, 2008 Ramco Ramco Ownership Mortgage Maturity Loan Interest Share of Entity Property Location Interest Balance Date Type Rate Debt Ramco/Lion Venture RLV Village Plaza LP Village Plaza Lakeland, FL 30% $ 9,300,000 09/15 Fixed 5.01% $ 2,790,000 RLV West Broward LP West Broward Shopping Center Plantation, FL 30% 9,725,855 10/12 Fixed 6.64% 2,917,756 RLV Martin Square LP Martin Square Stuart, FL 30% 13,220,417 08/11 Fixed 7.44% 3,966,125 RLV Marketplace of Delray LP Marketplace of Delray Delray Beach, FL 30% 16,741,319 01/11 Fixed 7.88% 5,022,396 RLV Treasure Coast LP Treasure Coast Commons Jensen Beach, FL 30% 8,415,000 06/20 Fixed 5.54% 2,524,500 RLV Oriole Plaza LP Village of Oriole Plaza Delray Beach, FL 30% 11,816,671 10/10 Fixed 8.25% 3,545,001 RLV Vista Plaza LP Vista Plaza Jensen Beach, FL 30% 11,115,000 06/20 Fixed 5.54% 3,334,500 RLV Cypress Pointe LP Cypress Pointe Clearwater, FL 30% 14,500,000 11/09 Fixed 4.60% 4,350,000 RLV Boca Mission LP Mission Bay Plaza Boca Raton, FL 30% 44,398,456 07/13 Fixed 6.64% 13,319,537 RLV Winchester Center LP Winchester Center Rochester Hills, MI 30% 29,076,396 07/13 Fixed 8.00% 8,722,919 RLV Hunter's Square LP Hunter's Square Farmington Hills, MI 30% 37,751,275 08/13 Fixed 8.04% 11,325,383 RLV Millennium Park LP Millennium Park Livonia, MI 30% 32,000,000 10/15 Fixed 5.02% 9,600,000 RLV Troy Marketplace LP Troy Marketplace Troy, MI 30% 21,900,000 06/16 Fixed 5.90% 6,570,000 RLV Gratiot Crossing LP Gratiot Crossing Chesterfield Twp., MI 30% 13,500,000 06/16 Fixed 5.90% 4,050,000 Subtotal Ramco/Lion Venture $ 273,460,389 $ 82,038,117 Ramco 450 Venture LLC Crofton 450 LLC Crofton Centre Crofton, MD 20% $ 17,000,000 01/17 Fixed 5.85% $ 3,400,000 Merchants 450 LLC Merchants' Square Carmel, IN 20% 32,700,000 05/17 Fixed 6.04% 6,540,000 Chester Springs SC LLC Chester Springs Shopping Center Chester, NJ 20% 23,233,149 10/13 Fixed 5.51% 4,646,630 Ramco Peachtree Hill LLC Peachtree Hill Duluth, GA 20% 16,300,000 02/09 Variable 4.19% [1] 3,260,000 Lane Avenue 450 LLC Shops on Lane Upper Arlington, OH 20% 27,600,000 01/18 Variable 5.95% [2] 5,520,000 Olentangy Plaza 450 LLC Olentangy Plaza Columbus, OH 20% 21,600,000 01/18 Variable 5.88% [2] 4,320,000 Market Plaza 450 LLC Market Plaza Glen Ellyn, IL 20% 24,505,000 01/18 Variable 5.88% [2] 4,901,000 Rolling Meadows 450 LLC Rolling Meadows Rolling Meadows, IL 20% 11,911,250 12/15 Fixed 5.34% 2,382,250 Plaza at Delray 450 LLC The Plaza at Delray Delray Beach, FL 20% 48,000,000 09/13 Fixed 6.00% 9,600,000 Subtotal Ramco 450 Venture LLC $ 222,849,399 $ 44,569,880 S-12 Associates Southfield Plaza Expansion Southfield, MI 50% $ 928,068 05/16 Fixed 6.75% [3] $ 464,034 Ramco/West Acres LLC West Acres Commons Flint, MI 40% 8,727,232 04/10 Fixed 8.14% 3,490,893 Ramco/Shenandoah LLC Shenandoah Square Davie, FL 40% 12,084,664 02/12 Fixed 7.33% 4,833,865 Paulding Holding LLC Paulding Pavilion Hiram, GA 20% 7,440,787 06/10 Variable 3.92% [4] 1,488,157 Ramco RM Hartland SC LLC Hartland Towne Square Hartland, MI 20% 8,505,000 07/09 Variable 5.44% [5] 1,701,000 Jacksonville North Industrial Outlot LLC Jacksonville, FL 5% 693,000 09/09 Variable 5.68% [6] 34,650 Total Debt $ 534,688,538 $ 138,620,596 [1] Interest rate is variable based on LIBOR plus 1.70%. [2] Interest rate is fixed for five years and then lender has right to reset interest rate in 2013. [3] Interest rate is fixed until 6/1/2009, then resets per formula annually. [4] Interest rate is variable based on LIBOR plus 1.45%. [5] Interest rate is based on LIBOR plus 2.95%. [6] Interest rate is based on LIBOR plus 2.25%. Supplemental Financial and Operating Statistics Q3 2008 Ramco-Gershenson Properties Trust (RPT) Page 24

INVESTOR INFORMATION Inquiries Ramco-Gershenson Properties Trust welcomes any questions or comments from shareholders, analysts, investment managers, media or prospective investors. Please address all inquiries to our Investor Relations Department: Dawn L. Hendershot Director of Investor Relations and Corporate Communications Ramco-Gershenson Properties Trust 31500 Northwestern Highway, Suite 300 Farmington Hills, MI 48334 Phone: (248) 592-6202 FAX: (248) 592-6203 E-mail: dhendershot@rgpt.com Website: www.rgpt.com Ticker: NYSE:RPT Research Coverage Cantor Fitzgerald Philip Martin 312.469.7485 Deutsche Bank Securities Inc. Louis W. Taylor 203.863.2381 RBC Capital Markets Richard C. Moore, CFA 440.715.2646 Stifel Nicolaus David M. Fick, CPA Nathan Isbee 443.224.1308 443.224.1346 Our Supplemental Financial Package is available via e-mail and is also featured on our corporate website at www.rgpt.com. If you would like to receive this document electronically each quarter, please e-mail: dhendershot@rgpt.com. Supplemental Financial and Operating Statistics Q3 2008 Ramco-Gershenson Properties Trust (RPT) Page 25