Exhibit 99.2

Quarterly Financial & Operating Supplement June 30, 2009 Ramco Gershenson Properties Trust

Table of Contents Section Page Earnings Release Company Overview 1-7 8 Quarterly & Year-to-Date Financial Results Consolidated Statements of Income 9 Income Statement Detail 10 Earnings Per Common Share 11 Consolidated Balance Sheets 12 Balance Sheet Detail 13 Calculation of Funds from Operations and Funds Available for Distribution 14 Selected Financial and Operating Ratios 15 Quarterly & Year-to-Date Operating Information Same Properties Analysis 16 Leasing Activity Analysis 17 Current Development Projects 18 Current Redevelopment Projects 19 Market Capitalization Information Summary of Outstanding Debt 20 Loan Maturity Summary 21 Market Capitalization Information 22 Common Stock Performance 22 Portfolio Information Property Summary 23-25 Geographic Diversification 26 Anchor, Non-Anchor Tenant Mix 26 National, Regional, Local Tenant Mix 26 Major Tenant Exposure 27 Summary of Expiring GLA 28 Joint Venture Information Joint Ventures Contribution to Funds from Operations 29 Joint Ventures Combining Balance Sheets 30 Summary of Joint Venture Debt 31 Investor Information 32

Ramco-Gershenson Properties Trust 31500 Northwestern Highway, Suite 300 Farmington Hills, Michigan 48334 (248) 350-9900 FAX: (248) 350-9925 Ramco-Gershenson Properties Trust Reports Financial Results for the Second Quarter 2009 FARMINGTON HILLS, Mich. – July 22, 2009 -- Ramco-Gershenson Properties Trust (NYSE:RPT) today announced results for the second quarter ended June 30, 2009. Second Quarter 2009 Highlights: Renewed 47 existing lease agreements totaling 123,063 square feet, at rents 5.7% over prior rental rates Executed 27 new leases totaling 116,143 square feet, at rents 31.6% above portfolio average Signed anchor lease agreements with Ross Dress For Less and Dollar Tree for the Marketplace of Delray in Delray Beach, FL Portfolio occupancy of 91.3%, compared to 90.9% in the first quarter of 2009 Same Center Operating expense recovery ratio of 100.2% Funds from operations (FFO) for the second quarter of 2009 was $11.3 million, or $0.52 per diluted share, compared to $13.2 million or $0.62 per diluted share for the second quarter of 2008. Excluding costs related to the Company’s recent proxy contest and its strategic review process, FFO per diluted share for the quarter would have been $0.56. Funds from operations for the six months ended June 30, 2009 was $23.2 million, or $1.08 per diluted share, compared to $26.4 million or $1.23 per diluted share for the same period in 2008. Excluding the aforementioned costs, FFO per diluted share for the six months ended June 30, 2009 would have been $1.12. The decline in adjusted FFO for the quarter and six month periods is primarily attributed to the bankruptcies of Linens ‘n Things and Circuit City for both wholly-owned and joint venture properties coupled with a reduction in development fees. Net income available to RPT common shareholders for the second quarter of 2009 was $1.6 million or $0.08 per diluted share, compared to net income available to RPT common shareholders of $3.0 million or $0.16 per diluted share for the second quarter of 2008. Net income available to RPT common shareholders for the six months ended June 30, 2009 was $3.8 million or $0.20 per diluted share, compared to $14.4 million or $0.78 per diluted share for the same period in 2008. Excluding the costs mentioned above, second quarter net income per diluted share would have been $0.12 and $0.24 for the quarter and six months, respectively. The decline in adjusted net income for the quarter and six month periods is primarily attributable to a decrease in the gain on asset sales over 2008 levels as well as the impact of the Circuit City and Linens ‘n Things closures. “During the second quarter we resolved our proxy contest and welcomed two new Board of Trustee members to the Company. Additionally, we have made significant progress with the refinancing of our $250 million credit facilities and continued to post positive leasing statistics, all of which contributed to an active and productive quarter,” said Dennis Gershenson, Chairman, President and Chief Executive Officer. “The Linens ‘n Things and Circuit City bankruptcies continue to impact many of our key operating metrics, however, we are optimistic about our planned timing for re-leasing these vacancies.

RAMCO-GERSHENSON PROPERTIES TRUST 2Q2009 Page 2 During the remainder of the year, we will continue to focus on internal growth within our core shopping center portfolio, improving our balance sheet and increasing liquidity.” Operating Portfolio Statistics As of June 30, 2009, the Company owned equity interests in 89 retail shopping centers totaling approximately 19.8 million square feet consisting of 56 wholly-owned properties and 33 properties held through joint ventures. The majority of the Company’s portfolio is concentrated in metropolitan markets with an average five-mile population base of 169,179 people and an average household income of $73,637. The average shopping center size is 222,565 square feet and contains on average more than two anchors per center insulating them from any single tenant issue. Ramco-Gershenson’s shopping centers are primarily anchored by necessity retail tenants including grocery stores, discount department stores, pharmacies and other destination oriented retailers. Eighty-two percent of the Company’s rental stream comes from a diverse line-up of national and regional tenants. No single tenant accounts for more than 3.8% of the Company’s annualized base rent and only four tenants contribute more than 2%. In the second quarter of 2009, Ramco-Gershenson’s same center net operating income (NOI) declined by 3.0% compared to the same period in 2008. The decrease was primarily the result of the vacancies created by both the Linens ‘n Things and Circuit City bankruptcies. Excluding the effect of these store closures, same center NOI would have declined 0.3%. Rent Commencements/Leasing/Occupancy During the second quarter, 18 tenants totaling 200,739 square feet took occupancy of their stores, at an average combined base rent of $10.45 per square foot. Included in this figure are 13 non-anchor tenants totaling 40,791 square feet, paying on average $16.00 per square foot, a 2.7% decrease over portfolio average rents for non-anchor space as well as five anchor tenants totaling 159,948 square feet paying on average $9.04 per square foot, an 11.3% increase above portfolio average rents for anchor space. Also during the quarter, 47 leases for existing non-anchor tenants were renewed encompassing 123,063 square feet, at an average base rent of $16.54 per square foot, an increase of 5.7% over prior rental rates. No anchor space was renewed during the quarter. Additionally, the Company signed 27 new leases in the second quarter for new tenancies that will take occupancy in subsequent periods. These new leases total 116,143 square feet, at an increase of 31.6% above combined portfolio average rents and include 76,518 square feet of non-anchor space and 39,625 square feet of anchor space. This leasing pace compares favorably to the 24 new leases signed in 2008 and the 15 leases signed in 2007, for the same period. At June 30, 2009, same center occupancy was 94.4%. Including current redevelopment projects in various stages of completion, occupancy was 91.3%, compared to 90.9% at the end of the first quarter 2009. Redevelopment As of June 30, 2009, the Company had eight value-added redevelopment projects in progress, all with commitments for the expansion or the addition of an anchor or out-lot tenant. The Company plans to spend approximately $6.9 million on these projects during the remainder of 2009. Including the Company’s pro-rata share of joint venture properties, the redevelopments are expected to produce a 12.5% stabilized return on investment.

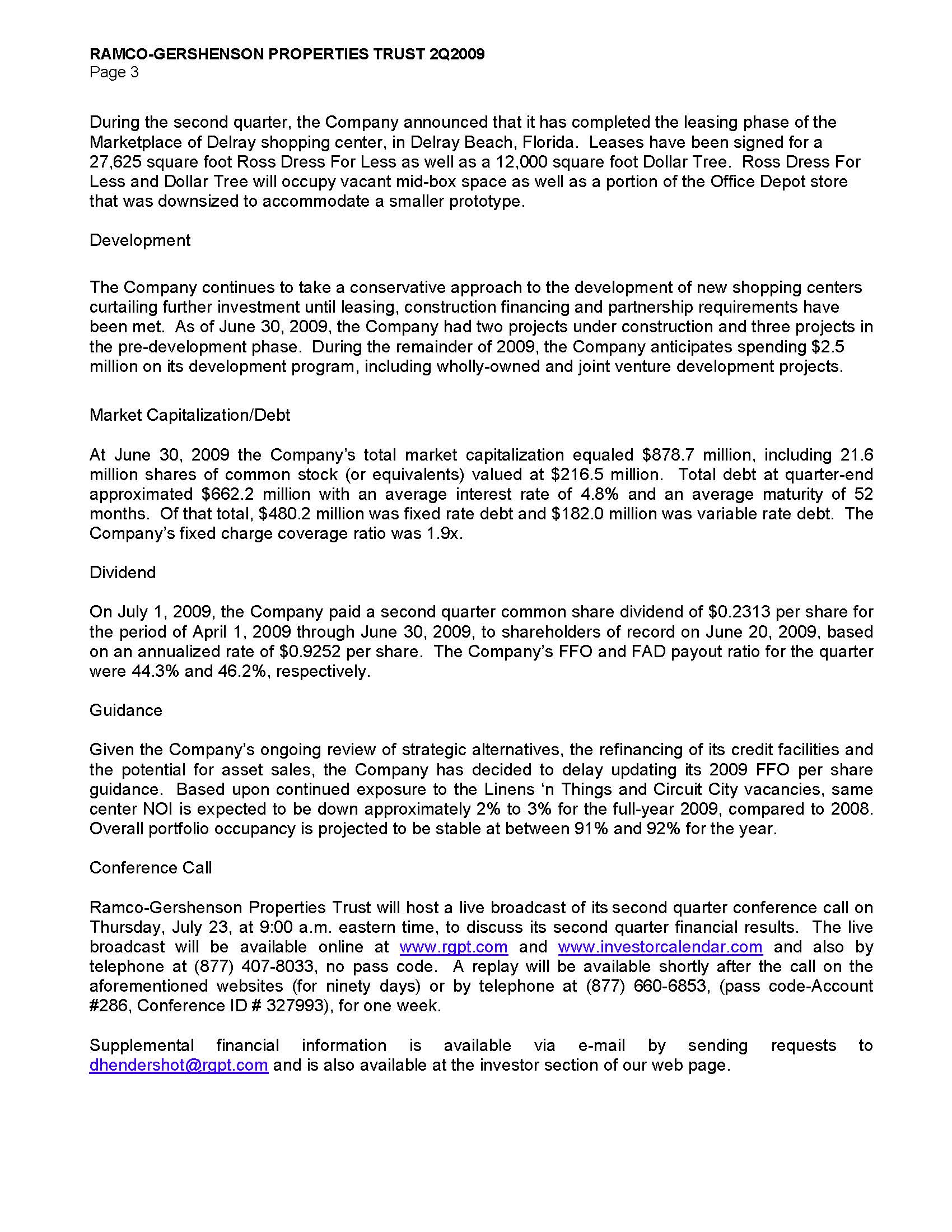

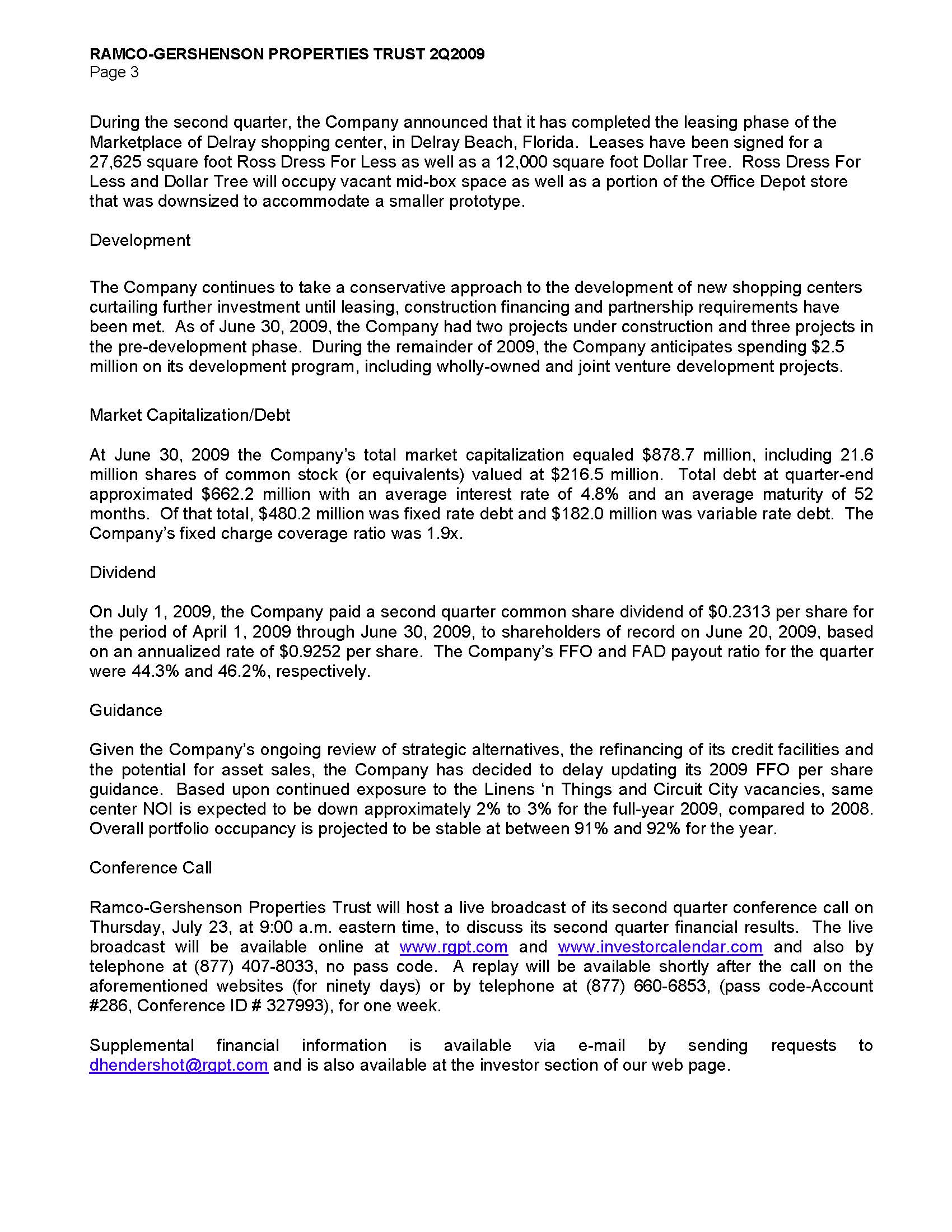

RAMCO-GERSHENSON PROPERTIES TRUST 2Q2009 Page 3 During the second quarter, the Company announced that it has completed the leasing phase of the Marketplace of Delray shopping center, in Delray Beach, Florida. Leases have been signed for a 27,625 square foot Ross Dress For Less as well as a 12,000 square foot Dollar Tree. Ross Dress For Less and Dollar Tree will occupy vacant mid-box space as well as a portion of the Office Depot store that was downsized to accommodate a smaller prototype. Development The Company continues to take a conservative approach to the development of new shopping centers curtailing further investment until leasing, construction financing and partnership requirements have been met. As of June 30, 2009, the Company had two projects under construction and three projects in the pre-development phase. During the remainder of 2009, the Company anticipates spending $2.5 million on its development program, including wholly-owned and joint venture development projects. Market Capitalization/Debt At June 30, 2009 the Company’s total market capitalization equaled $878.7 million, including 21.6 million shares of common stock (or equivalents) valued at $216.5 million. Total debt at quarter-end approximated $662.2 million with an average interest rate of 4.8% and an average maturity of 52 months. Of that total, $480.2 million was fixed rate debt and $182.0 million was variable rate debt. The Company’s fixed charge coverage ratio was 1.9x. Dividend On July 1, 2009, the Company paid a second quarter common share dividend of $0.2313 per share for the period of April 1, 2009 through June 30, 2009, to shareholders of record on June 20, 2009, based on an annualized rate of $0.9252 per share. The Company’s FFO and FAD payout ratio for the quarter were 44.3% and 46.2%, respectively. Guidance Given the Company’s ongoing review of strategic alternatives, the refinancing of its credit facilities and the potential for asset sales, the Company has decided to delay updating its 2009 FFO per share guidance. Based upon continued exposure to the Linens ‘n Things and Circuit City vacancies, same center NOI is expected to be down approximately 2% to 3% for the full-year 2009, compared to 2008. Overall portfolio occupancy is projected to be stable at between 91% and 92% for the year. Conference Call Ramco-Gershenson Properties Trust will host a live broadcast of its second quarter conference call on Thursday, July 23, at 9:00 a.m. eastern time, to discuss its second quarter financial results. The live broadcast will be available online at www.rgpt.com and www.investorcalendar.com and also by telephone at (877) 407-8033, no pass code. A replay will be available shortly after the call on the aforementioned websites (for ninety days) or by telephone at (877) 660-6853, (pass code-Account #286, Conference ID # 327993), for one week. Supplemental financial information is available via e-mail by sending requests to dhendershot@rgpt.com and is also available at the investor section of our web page.

RAMCO-GERSHENSON PROPERTIES TRUST 2Q2009 Page 4 About Ramco-Gershenson Properties Trust

Ramco-Gershenson Properties Trust, headquartered in Farmington Hills, Michigan, is a fully integrated, self-administered, publicly-traded real estate investment trust (REIT), which owns, develops, acquires, manages and leases community shopping centers, regional malls and single tenant retail properties, nationally. The Trust owns interests in 89 shopping centers totaling approximately 19.8 million square feet of gross leasable area in Michigan, Florida, Georgia, Ohio, Wisconsin, Tennessee, Indiana, New Jersey, Virginia, South Carolina, North Carolina, Maryland and Illinois. For additional information regarding Ramco-Gershenson Properties Trust visit the Trust’s website at www.rgpt.com. This press release contains forward-looking statements with respect to the operation of certain of the Trust’s properties. Management of Ramco-Gershenson believes the expectations reflected in the forward-looking statements made in this press release are based on reasonable assumptions. Certain factors could occur that might cause actual results to vary. These include general economic conditions, the strength of key industries in the cities in which the Trust’s properties are located, the performance of the Trust’s tenants at the Trust’s properties and elsewhere and other factors discussed in the Trust’s reports filed with the Securities and Exchange Commission. Ramco-Gershenson Properties Trust: Dawn Hendershot, 248-592-6202 Director of Investor Relations and Corporate Communications

RAMCO-GERSHENSON PROPERTIES TRUST 2Q2009 Page 5 Consolidated Statements of Income (in thousands) Three Months Ended June 30, Six Months Ended June 30, 2009 2008 2009 2008 Revenues: Minimum rents $ 21,215 $ 23,101 $ 42,594 $ 46,122 Percentage rents 27 133 280 497 Recoveries from tenants 9,890 10,313 20,537 21,396 Fees and management income 1,497 1,930 2,626 3,352 Other income 1,000 495 1,353 980 Total revenues 33,629 35,972 67,390 72,347 Expenses: Real estate taxes 4,697 4,805 9,407 9,652 Recoverable operating expenses 5,558 5,500 11,561 12,083 Depreciation and amortization 7,876 7,880 15,669 15,835 Other operating 656 1,013 1,920 2,061 General and administrative 5,364 4,820 9,489 8,625 Interest expense 7,904 8,893 16,008 18,672 Total expenses 32,055 32,911 64,054 66,928 Income from continuing operations before gain on sale of real estate assets and earnings from unconsolidated entities 1,574 3,061 3,336 5,419 Gain on sale of real estate assets 53 103 401 10,287 Earnings from unconsolidated entities 337 769 857 1,666 Income from continuing operations 1,964 3,933 4,594 17,372 Discontinued operations: Loss on sale of real estate assets - (463) - (463) Income from operations - 108 - 205 Loss from discontinued operations - (355) - (258) Net income 1,964 3,578 4,594 17,114 Less: Net income attributable to the noncontrolling interest in subsidiaries (401) (594) (781) (2,685) Net income attributable to Ramco-Gershenson Properties Trust ("RPT") common shareholders $ 1,563 $ 2,984 $ 3,813 $ 14,429 Amounts attributable to RPT common shareholders: Income from continuing operations $ 1,563 $ 3,291 $ 3,813 $ 14,652 Loss from discontinued operations - (307) - (223) Net income $ 1,563 $ 2,984 $ 3,813 $ 14,429 Property Operating Expense Recovery Ratio 96.4 % 100.1 % 97.9 % 98.4 %

RAMCO-GERSHENSON PROPERTIES TRUST 2Q2009 Page 6 Calculation of Funds from Operations (in thousands, except per share amounts) Three Months Ended June 30, Six Months Ended June 30, 2009 2008 2009 2008 Calculation of Funds from Operations: Net income attributable to RPT common shareholders $ 1,563 $ 2,984 $ 3,813 $ 14,429 Add: Depreciation and amortization expense 9,321 9,268 18,604 18,683 Noncontrolling interest in partnership 401 579 781 2,669 Discontinued operations, loss on sale of property - 463 - 463 Less: Gain on sale of depreciable real estate - (115) - (9,876) Funds from operations available to common shareholders, assuming conversion of OP units $ 11,285 $ 13,179 $ 23,198 $ 26,368 Weighted average equivalent shares outstanding, diluted 21,617 21,408 21,573 21,408 Funds from operations available to RPT common shareholders, per diluted share $ 0.52 $ 0.62 $ 1.08 $ 1.23 Management considers funds from operations, also known as “FFO,” an appropriate supplemental measure of the financial performance of an equity REIT. Under the NAREIT definition, FFO represents income before minority interest, excluding extraordinary items, as defined under accounting principles generally accepted in the United States of America (“GAAP ”), gains on sales of depreciable property, plus real estate related depreciation and amortization (excluding amortization of financing costs), and after adjustments for unconsolidated partnerships and joint ventures. FFO should not be considered an alternative to GAAP net income as an indication of our performance. We consider FFO as a useful measure for reviewing our comparative operating and financial performance between periods or to compare our performance to diferent REITs. However, our computation of FFO may difer from the methodology for calculating FFO utilized by other real estate companies, and therefore, may not be comparable to these other real estate companies.

RAMCO-GERSHENSON PROPERTIES TRUST 2Q2009 Page 7 Consolidated Balance Sheets (in thousands) June 30, 2009 March 31, 2009 December 31, 2008 ASSETS Investment in real estate, net $ 826,296 $ 829,006 $ 830,392 C ash and cash equivalents 7,818 7,946 5,295 Rest ricted cash 5,202 5,071 4,891 A ccounts receivable, net 33,665 33,288 40,736 Equity investments in and advances to unconsolidated entities 104,623 103,580 95,867 O ther assets, net 35,718 35,893 37,345 T otal Assets $ 1,013,322 $ 1,014,784 $ 1,014,526 LIAB ILITIES AND SHAREHOLDERS' EQUITY Mortgages and notes payable $ 662,176 $ 665,735 $ 662,601 Accounts payable and accrued expenses 30,273 25,960 26,751 Distributions payable 4,958 4,951 4,945 Capital lease obligation 7,060 7,126 7,191 Total Liabilities 704,467 703,772 701,488 SHAREHOLDERS' EQUITY Ramco-Gershenson Properties Trust ("RPT") shareholders' equity: Common Shares of Beneficial Interest 187 185 185 Additional paid-in capital 390,105 389,730 389,528 Accumulated other comprehensive loss (3,151) (3,693) (3,851) Cumulative distributions in excess of net income (117,508) (114,746) (112,671) Total RPT Shareholders' Equity 269,633 271,476 273,191 Noncontrolling interest in subsidiaries 39,222 39,536 39,847 Total Shareholders' Equity 308,855 311,012 313,038 Total Liabilities and Shareholders' Equity $ 1,013,322 $ 1,014,784 $ 1,014,526

COMPANY OVERVIEW Ramco-Gershenson Properties Trust (NYSE:RPT) is a self-administered and self-managed real estate investment trust primarily engaged in the business of owning, developing, acquiring, managing and leasing community shopping centers located primarily in the Midwestern, Mid-Atlantic and Southeastern United States. At June 30, 2009, the Company owned interests in 89 shopping centers with approximately 19.8 million square feet of gross leasable area located in Michigan, Florida, Georgia, Ohio, Wisconsin, Indiana, New Jersey, Maryland, North Carolina, South Carolina, Virginia, Tennessee and Illinois. The Company’s properties consist of 88 community centers and one regional mall. Ramco-Gershenson has a proven track record of generating growth through the management and redevelopment of its shopping center portfolio. In an effort to maximize the potential of each asset, the Company constantly reevaluates the shopping center’s position within its respective market. This effort is part of an overall approach that allows management to anticipate changes in retailing trends and tenant needs; and proactively implement solutions to boost the performance and value of the center namely through enhancement in the tenant mix, improvement of existing rental rates and occupancy growth. Ramco-Gershenson generates additional growth through the construction of new shopping centers. The Company is focused on developing community shopping centers within metropolitan markets where it currently operates or where it believes demand for additional shopping centers exist. Throughout the Company’s history, management’s experience and long-standing relationships with tenants, has allowed it to capitalize on attractive development opportunities. The Company also remains committed to the acquisition of well-located shopping centers, under appropriate market conditions, that may lend themselves to further improvements, either through strategic joint ventures or on-balance sheet transactions. Ramco-Gershenson seeks to attract investors based on the quality and performance of its assets and the experience of its management team. The Company expects to build shareholder value through the proactive management of its assets as well as the selective development and acquisition of shopping centers. The Company is listed on the New York Stock Exchange (NYSE:RPT) and is headquartered in Farmington Hills, Michigan. Supplemental Financial and Operating Statistics Q2 2009 Ramco-Gershenson Properties Trust (RPT) Page 8

Consolidated Statements of Income (in thousands) Three Months Ended June 30, Six Months Ended June 30, 2009 Increase Percent Change 2009 Increase Percent Change 2008 (Decrease) 2008 (Decrease) Revenues: Minimum rents $ 21,215 $ 23,101 $ (1,886) (8.2) % $ 42,594 $ 46,122 $ (3,528) (7.6) % Percentage rents 27 133 (106) (79.7) 280 497 (217) (43.7) Recoveries from tenants 9,890 10,313 (423) (4.1) 20,537 21,396 (859) (4.0) Fees and management income (see page 10 for detail) 1,497 1,930 (433) (22.4) 2,626 3,352 (726) (21.7) Other income (see page 10 for detail) 1,000 495 505 102.0 1,353 980 373 38.1 Total revenues 33,629 35,972 (2,343) (6.5) 67,390 72,347 (4,957) (6.9) Expenses: Real estate taxes 4,697 4,805 (108) (2.2) 9,407 9,652 (245) (2.5) Recoverable operating expenses 5,558 5,500 58 1.1 11,561 12,083 (522) (4.3) Depreciation and amortization 7,876 7,880 (4) (0.1) 15,669 15,835 (166) (1.0) Other operating 656 1,013 (357) (35.2) 1,920 2,061 (141) (6.8) General and administrative 5,364 4,820 544 11.3 9,489 8,625 864 10.0 Interest expense 7,904 8,893 (989) (11.1) 16,008 18,672 (2,664) (14.3) Total expenses 32,055 32,911 (856) (2.6) 64,054 66,928 (2,874) (4.3) Income from continuing operations before gain on sale of real estate assets and earnings from unconsolidated entities 1,574 3,061 (1,487) (48.6) 3,336 5,419 (2,083) (38.4) Gain on sale of real estate assets (see page 10 for detail) 53 103 (50) (48.5) 401 10,287 (9,886) (96.1) Earnings from unconsolidated entities (see page 29 for detail) 337 769 (432) (56.2) 857 1,666 (809) (48.6) Income from continuing operations 1,964 3,933 (1,969) (50.1) 4,594 17,372 (12,778) (73.6) Discontinued operations: Loss on sale of real estate assets - (463) 463 (100.0) - (463) 463 (100.0) Income from operations - 108 (108) (100.0) - 205 (205) (100.0) Loss from discontinued operations - (355) 355 (100.0) - (258) 258 (100.0) Net income 1,964 3,578 (1,614) (45.1) 4,594 17,114 (12,520) (73.2) Less: Net income attributable to the noncontrolling interest in subsidiaries (401) (594) 193 (32.5) (781) (2,685) 1,904 (70.9) Net income attributable to Ramco-Gershenson Properties Trust ("RPT") common shareholders $ 1,563 $ 2,984 $ (1,421) (47.6) % $ 3,813 $ 14,429 $ (10,616) (73.6) % Amounts attributable to RPT common shareholders: Income from continuing operations $ 1,563 $ 3,291 $ (1,728) (52.5) % $ 3,813 $ 14,652 $ (10,839) (74.0) % Loss from discontinued operations - (307) 307 (100.0) - (223) 223 (100.0) Net income $ 1,563 $ 2,984 $ (1,421) (47.6) % $ 3,813 $ 14,429 $ (10,616) (73.6) % Property Operating Expense Recovery Ratio 96.4 % 100.1 % (3.6) % 97.9 % 98.4 % (0.5) % Supplemental Financial and Operating Statistics Q2 2009 Ramco-Gershenson Properties Trust (RPT) Page 9

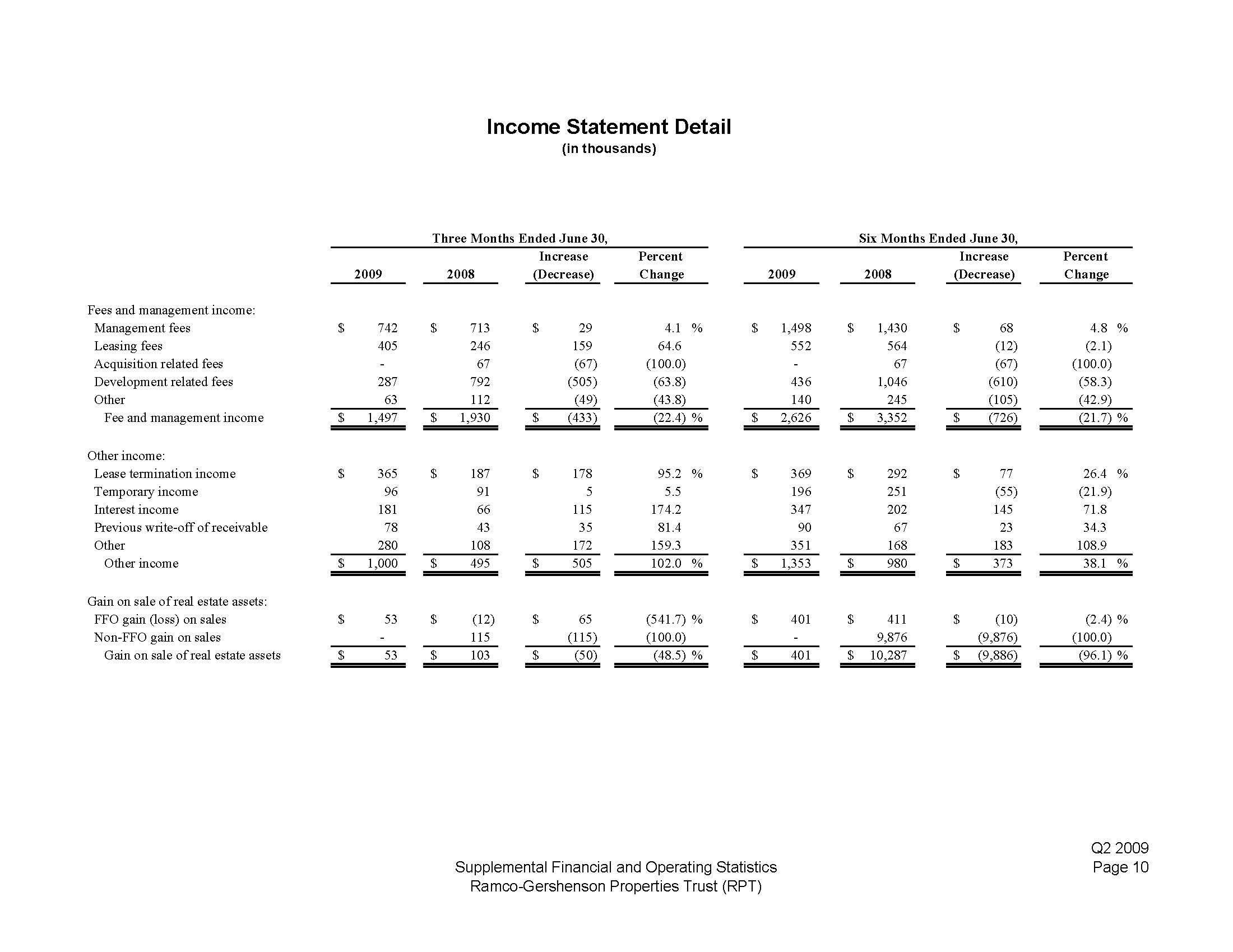

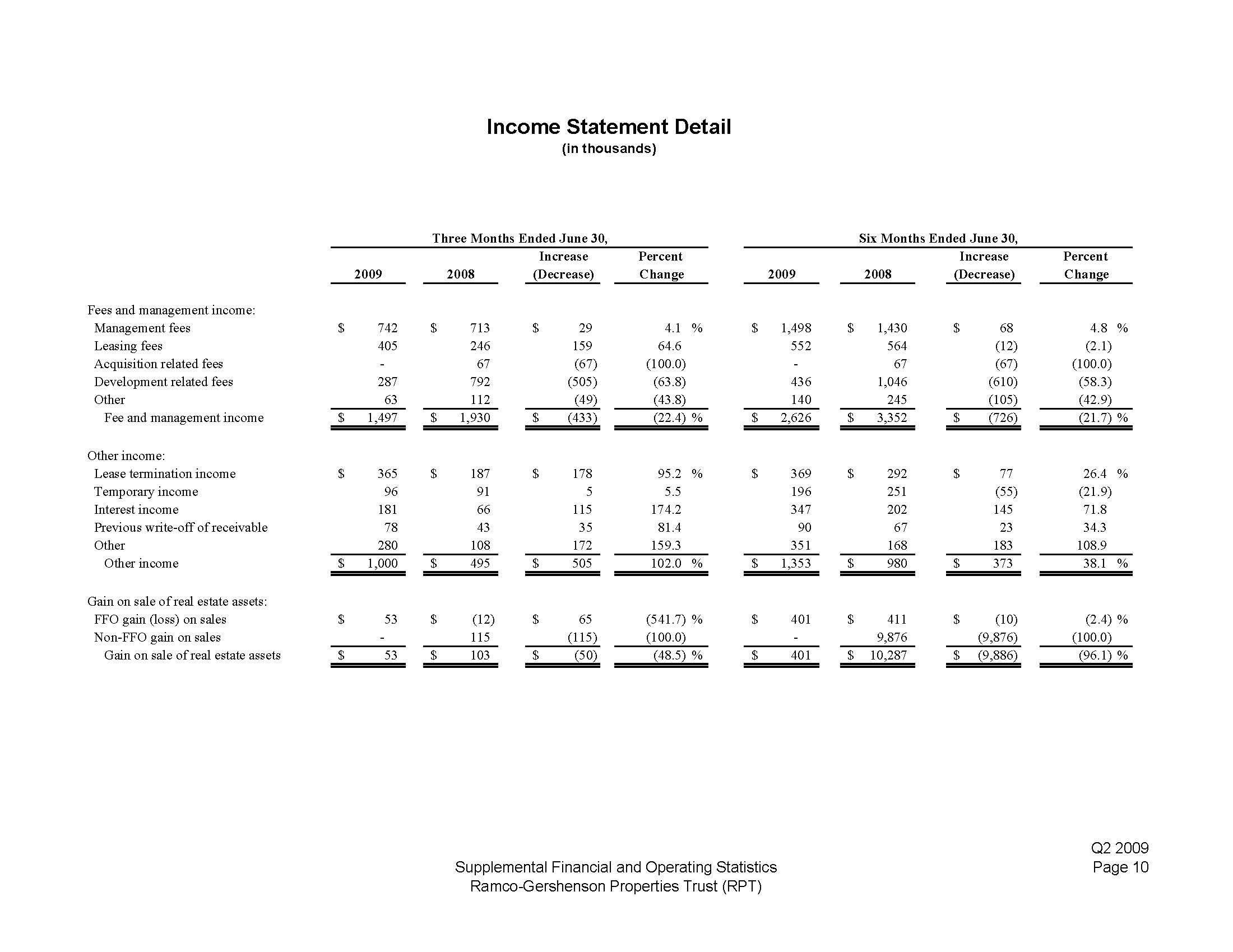

Income Statement Detail (in thousands) Three Months Ended June 30, Six Months Ended June 30, 2009 2008 Increase Percent (Decrease) Change 2009 2008 Increase Percent (Decrease) Change Fees and management income: Management fees $ 742 $ 713 $ 29 4.1 % $ 1,498 $ 1,430 $ 68 4.8 % Leasing fees 405 246 159 64.6 552 564 (12) (2.1) Acquisition related fees - 67 (67) (100.0) - 67 (67) (100.0) Development related fees 287 792 (505) (63.8) 436 1,046 (610) (58.3) Other 63 112 (49) (43.8) 140 245 (105) (42.9) Fee and management income $ 1,497 $ 1,930 $ (433) (22.4) % $ 2,626 $ 3,352 $ (726) (21.7) % Other income: Lease termination income $ 365 $ 187 $ 178 95.2 % $ 369 $ 292 $ 77 26.4 % Temporary income 96 91 5 5.5 196 251 (55) (21.9) Interest income 181 66 115 174.2 347 202 145 71.8 Previous write-off of receivable 78 43 35 81.4 90 67 23 34.3 Other 280 108 172 159.3 351 168 183 108.9 Other income $ 1,000 $ 495 $ 505 102.0 % $ 1,353 $ 980 $ 373 38.1 % Gain on sale of real estate assets: FFO gain (loss) on sales $ 53 $ (12) $ 65 (541.7) % $ 401 $ 411 $ (10) (2.4) % Non-FFO gain on sales - 115 (115) (100.0) - 9,876 (9,876) (100.0) Gain on sale of real estate assets $ 53 $ 103 $ (50) (48.5) % $ 401 $ 10,287 $ (9,886) (96.1) % Q2 2009 Supplemental Financial and Operating Statistics Page 10 Ramco-Gershenson Properties Trust (RPT)

Earnings Per Common Share ("EPS") (in thousands, except per share data) Three Months Ended June 30, Six Months Ended June 30, 2009 2008 2009 2008 Numerator: Income from continuing operations before noncontrolling interest $ 1,964 $ 3,933 $ 4,594 $ 17,372 Noncontrolling interest in subsidiaries from continuing operations (401) (642) (781) (2,720) Income from continuing operations available to RPT common shareholders 1,563 3,291 3,813 14,652 Discontinued operations, net of noncontrolling interest in subsidiaries: Loss on sale of real estate assets - (400) - (400) Income from operations - 93 - 177 Net income available to RPT common shareholders $ 1,563 $ 2,984 $ 3,813 $ 14,429 Denominator: Weighted-average common shares for basic EPS 18,699 18,478 18,654 18,477 Effect of dilutive securities: Options outstanding - 12 - 12 Weighted-average common shares for diluted EPS 18,699 18,490 18,654 18,489 Basic EPS: Income from continuing operations attributable to RPT common shareholders $ 0.08 $ 0.18 $ 0.20 $ 0.79 Income from discontinued operations attributable to RPT common shareholders - (0.02) - (0.01) Net income attributable to RPT common shareholders $ 0.08 $ 0.16 $ 0.20 $ 0.78 Diluted EPS: Income from continuing operations attributable to RPT common shareholders $ 0.08 $ 0.18 $ 0.20 $ 0.79 Income from discontinued operations attributable to RPT common shareholders - (0.02) - (0.01) Net income attributable to RPT common shareholders $ 0.08 $ 0.16 $ 0.20 $ 0.78 Supplemental Financial and Operating Statistics Q2 2009 Ramco-Gershenson Properties Trust (RPT) Page 11

Consolidated Balance Sheets (in thousands) June 30, 2009 March 31, 2009 December 31, 2008 ASSETS Investment in real estate, net (see page 13 for detail) $ 826,296 $ 829,006 $ 830,392 Cash and cash equivalents 7,818 7,946 5,295 Restricted cash 5,202 5,071 4,891 Accounts receivable, net (see page 13 for detail) 33,665 33,288 40,736 Equity investments in and advances to unconsolidated entities (see page 30 for detail) 104,623 103,580 95,867 Other assets, net (see page 13 for detail) 35,718 35,893 37,345 Total Assets $ 1,013,322 $ 1,014,784 $ 1,014,526 LIABILITIES AND SHAREHOLDERS' EQUITY Mortgages and notes payable (see page 20 for detail) $ 662,176 $ 665,735 $ 662,601 Accounts payable and accrued expenses 30,273 25,960 26,751 Distributions payable 4,958 4,951 4,945 Capital lease obligation 7,060 7,126 7,191 Total Liabilities 704,467 703,772 701,488 SHAREHOLDERS' EQUITY Ramco-Gershenson Properties Trust ("RPT") shareholders' equity: Common Shares of Beneficial Interest 187 185 185 Additional paid-in capital 390,105 389,730 389,528 Accumulated other comprehensive loss (3,151) (3,693) (3,851) Cumulative distributions in excess of net income (117,508) (114,746) (112,671) Total RPT Shareholders' Equity 269,633 271,476 273,191 Noncontrolling interest in subsidiaries 39,222 39,536 39,847 Total Shareholders' Equity 308,855 311,012 313,038 Total Liabilities and Shareholders' Equity $ 1,013,322 $ 1,014,784 $ 1,014,526 Supplemental Financial and Operating Statistics Ramco-Gershenson Properties Trust (RPT) Q2 2009 Page 12

Balance Sheet Detail (in thousands) June 30, 2009 March 31, 2009 December 31, 2008 Investment in Real Estate: Land $ 144,191 $ 144,370 $ 144,422 Buildings and improvements 833,294 832,214 813,705 Construction in progress 35,233 32,877 46,982 1,012,718 1,009,461 1,005,109 Less: accumulated depreciation (186,422) (180,455) (174,717) Investment in real estate, net $ 826,296 $ 829,006 $ 830,392 Accounts Receivable: Accounts receivable tenants, net $ 16,423 $ 15,708 $ 23,131 Straight-line rent receivable 17,242 17,580 17,605 Accounts receivable, net $ 33,665 $ 33,288 $ 40,736 Other Assets: Leasing costs $ 39,898 $ 39,418 $ 38,980 Intangible assets 5,836 5,836 5,836 Deferred financing costs 6,036 6,693 6,626 Other 5,975 5,963 5,904 57,745 57,910 57,346 Less: accumulated amortization (36,500) (35,775) (34,320) 21,245 22,135 23,026 Prepaid expenses and other 13,244 12,408 12,967 Proposed development and acquisition costs 1,229 1,350 1,352 Other assets, net $ 35,718 $ 35,893 $ 37,345 Supplemental Financial and Operating Statistics Ramco-Gershenson Properties Trust (RPT) Q2 2009 Page 13

Calculation of Funds from Operations and Funds Available for Distribution (in thousands, except per share amounts) Three Months Ended June 30, Six Months Ended June 30, 2009 2008 2009 2008 Calculation of Funds from Operations: Net income attributable to RPT common shareholders $ 1,563 $ 2,984 $ 3,813 $ 14,429 Add: Depreciation and amortization expense 9,321 9,268 18,604 18,683 Noncontrolling interest in partnership 401 579 781 2,669 Discontinued operations, loss on sale of property - 463 - 463 Less: Gain on sale of depreciable real estate - (115) - (9,876) Funds from operations available to common shareholders, assuming conversion of OP units $ 11,285 $ 13,179 $ 23,198 $ 26,368 Weighted average equivalent shares outstanding, diluted 21,617 21,408 21,573 21,408 Funds from operations available to RPT common shareholders, per diluted share $ 0.52 $ 0.62 $ 1.08 $ 1.23 Calculation of Funds Available for Distribution: Funds from operations available to RPT common shareholders $ 11,285 $ 13,179 $ 23,198 $ 26,368 Less: Straight-line rent (329) (291) (480) (687) Above/below market rents - acquisitions (8) (20) (21) (49) FMV interest adjustment - acquired properties (77) (53) (155) (93) Recurring capital expenditures (non-recoverable) (60) (245) (246) (578) Funds Available for Distribution $ 10,811 $ 12,570 $ 22,296 $ 24,961 FAD per share available to RPT common shareholders $ 0.50 $ 0.59 $ 1.03 $ 1.17 Dividend per Common Share $ 0.2313 $ 0.4625 $ 0.4626 $ 0.9250 Payout Ratio - FFO 44.3% 75.1% 43.0% 75.1% Payout Ratio - FAD 46.2% 78.8% 44.8% 79.3% Supplemental Financial and Operating Statistics Q2 2009 Ramco-Gershenson Properties Trust (RPT) Page 14 Slide 17 Selected Financial and Operating Ratios Three Months Ended June 30, Six Months Ended June 30, 2009 2008 2009 2008 EBITDA Calculation: Operating Income Plus Earnings From Unconsolidated Entities $ 1,911 [1] $ 3,830 [3] $ 4,193 [2] $ 7,085 [4] Add Back: Income From Discontinued Operations - 108 - 205 Interest Expense 7,904 8,893 16,008 18,672 Depreciation and Amortization 7,876 7,880 15,669 15,835 EBITDA 17,691 20,711 35,870 41,797 Scheduled Principal Payments 1,359 1,277 2,524 2,452 Preferred Dividends - - - - Coverage Ratios: Interest Coverage Ratio (EBITDA / Interest Expense) 2.24 2.33 2.24 2.24 Fixed Charge Coverage Ratio (EBITDA / Interest Expense + Scheduled Principal Pmts. + Pref. Div.) 1.91 2.04 1.94 1.98 Operating Ratios: NOI 20,221 22,229 40,523 44,219 Operating Margin (NOI / Total Rental Revenue) 65.0% 66.3% 63.9% 65.0% General & Administrative Expense as a Percentage of Total Rental Revenues Under Management [5]: Revenue From REIT Owned Properties $ 32,132 $ 34,042 $ 64,764 $ 68,995 Revenue From Joint Venture Properties 24,804 23,491 50,289 48,003 Revenue From Non-REIT Properties Under Management Contract 941 944 1,838 2,103 Total Rental Revenues Under Management $ 57,877 $ 58,477 $ 116,891 $ 119,101 General and Administrative Expense [6] $ 5,364 $ 4,820 $ 9,489 $ 8,625 General and Administrative Expense / Total Rental Revenues Under Management 9.27% 8.24% 8.12% 7.24% [1] [2] [3] [4] [5] [6] Q2 2009 excludes $53 related to the gain on sale of real estate from continuing operations. Including the gain would have no impact on the interest coverage ratio for the three months ended 6/30/09. YTD 2009 excludes $401 related to the gain on sale of real estate from continuing operations. Including the gain would positively impact the interest coverage ratio by 0.03 for the six months ended 6/30/09. Q2 2008 excludes $103 related to the gain on sale of real estate from continuing operations. Including the gain would positively impact the interest coverage ratio by 0.01 for the three months ended 6/30/08. YTD 2008 excludes $10,287 related to the gain on sale of real estate from continuing operations. Including the gain would positively impact the interest coverage ratio by 0.55 for the six months ended 6/30/08. General & administrative expense shown as a percentage of rental revenues under management which includes base rent, recoveries and other income from wholly owned properties, joint venture properties, and properties that are under management contract. Includes $836 of expenses related to the Company's recent proxy contest and subsequent strategic review process for the three and six months ended June 30, 2009. Supplemental Financial and Operating Statistics Ramco-Gershenson Properties Trust (RPT) Q2 2009 Page 15

Selected Financial and Operating Ratios Three Months Ended June 30, Six Months Ended June 30, 2009 2008 2009 2008 EBITDA Calculation: Operating Income Plus Earnings From Unconsolidated Entities $ 1,911 [1] $ 3,830 [3] $ 4,193 [2] $ 7,085 [4] Add Back: Income From Discontinued Operations - 108 - 205 Interest Expense 7,904 8,893 16,008 18,672 Depreciation and Amortization 7,876 7,880 15,669 15,835 EBITDA 17,691 20,711 35,870 41,797 Scheduled Principal Payments 1,359 1,277 2,524 2,452 Preferred Dividends - - - - Coverage Ratios: Interest Coverage Ratio (EBITDA / Interest Expense) 2.24 2.33 2.24 2.24 Fixed Charge Coverage Ratio (EBITDA / Interest Expense + Scheduled Principal Pmts. + Pref. Div.) 1.91 2.04 1.94 1.98 Operating Ratios: NOI 20,221 22,229 40,523 44,219 Operating Margin (NOI / Total Rental Revenue) 65.0% 66.3% 63.9% 65.0% General & Administrative Expense as a Percentage of Total Rental Revenues Under Management [5]: Revenue From REIT Owned Properties $ 32,132 $ 34,042 $ 64,764 $ 68,995 Revenue From Joint Venture Properties 24,804 23,491 50,289 48,003 Revenue From Non-REIT Properties Under Management Contract 941 944 1,838 2,103 Total Rental Revenues Under Management $ 57,877 $ 58,477 $ 116,891 $ 119,101 General and Administrative Expense [6] $ 5,364 $ 4,820 $ 9,489 $ 8,625 General and Administrative Expense / Total Rental Revenues Under Management 9.27% 8.24% 8.12% 7.24% [1] [2] [3] [4] [5] [6] Q2 2009 excludes $53 related to the gain on sale of real estate from continuing operations. Including the gain would have no impact on the interest coverage ratio for the three months ended 6/30/09. YTD 2009 excludes $401 related to the gain on sale of real estate from continuing operations. Including the gain would positively impact the interest coverage ratio by 0.03 for the six months ended 6/30/09. Q2 2008 excludes $103 related to the gain on sale of real estate from continuing operations. Including the gain would positively impact the interest coverage ratio by 0.01 for the three months ended 6/30/08. YTD 2008 excludes $10,287 related to the gain on sale of real estate from continuing operations. Including the gain would positively impact the interest coverage ratio by 0.55 for the six months ended 6/30/08. General & administrative expense shown as a percentage of rental revenues under management which includes base rent, recoveries and other income from wholly owned properties, joint venture properties, and properties that are under management contract. Includes $836 of expenses related to the Company's recent proxy contest and subsequent strategic review process for the three and six months ended June 30, 2009. Supplemental Financial and Operating Statistics Ramco-Gershenson Properties Trust (RPT) Q2 2009 Page 15

Same Properties Analysis (in thousands) Three Months Ended June 30, 2009 Six Months Ended June 30, 2009 2009 2008 % Change 2009 2008 % Change Number of Properties [1] 49 49 0.0% 49 49 0.0% Occupancy 94.4% 93.6% 0.8% 94.4% 93.6% 0.8% REVENUE: Minimum Rents $19,228 $19,846 -3.1% $38,918 $39,402 -1.2% Percentage Rent 28 91 - -69.0% 221 303 -27.0% Recoveries from Tenants 9,388 9,095 3.2% 19,309 19,239 0.4% Other Income 475 318 49.4% 594 497 19.5% $29,120 $29,349 - -0.8% $59,042 $59,441 -0.7% EXPENSES: Real Estate Taxes $4,509 $4,230 6.6% $8,996 $8,547 5.3% Property Operating and Maintenance 4,860 4,738 2.6% 9,967 10,437 -4.5% Other Operating 430 471 -8.8% 1,071 986 8.6% $9,799 $9,439 3.8% $20,034 $19,970 0.3% OPERATING INCOME $19,321 $19,910 - -3.0% [2] $39,009 $39,471 -1.2% [2] Operating Expense Recovery Ratio 100.2% 101.4% -1.2% 101.8% 101.3% 0.5% Excludes joint venture properties. Excluding the effect of Circuit City and Linens 'n Things, the change in operating income would have been (0.3%) and 0.8% for the three and six months ended June 30, 2009, respectively. Note: Excludes centers under redevelopment and reflects recovery adjustments to the proper period. Supplemental Financial and Operating Statistics Ramco-Gershenson Properties Trust (RPT) Q2 2009 Page 16

Leasing Activity Analysis Three Months Ended June 30, 2009 Six Months Ended June 30, 2009 Non-Anchors Anchors Total Non-Anchors Anchors Total Summary of Expiring Leases: Total Number of Scheduled Lease Expirations 67 - - 67 183 17 200 Gross Leasable Area (sq.ft.) 176,740 - 176,740 532,674 676,649 1,209,323 Average Base Rent / Sq.Ft ($/sq.ft.) $14.87 $0.00 $14.87 $15.34 $6.85 $10.59 Leases Renewed at Expiration: Number of Leases 47 - 47 122 12 134 Gross Leasable Area (sq.ft.) 123,063 - 123,063 347,070 468,698 815,768 Renewal Base Rent / Sq.Ft. ($/sq.ft.) $16.54 $0.00 $16.54 $15.45 $8.10 $11.23 Previous Base Rent / Sq.Ft. ($/sq.ft.) $15.65 $0.00 $15.65 $14.90 $7.67 $10.75 PSF Increase / (Decrease) $0.89 $0.00 $0.89 $0.55 $0.43 $0.48 % Increase / (Decrease) 5.7% 0.0% 5.7% 3.7% 5.6% 4.5% Leases Currently Month-to-Month or Under Negotiation for Renewal: Number of Leases 9 - 9 20 1 21 Gross Leasable Area (sq.ft.) 27,346 - 27,346 52,602 21,786 74,388 Current Base Rent / Sq.Ft. ($/sq.ft.) $10.55 $0.00 $10.55 $14.55 $3.03 $17.58 Leases Ended at Expiration: Number of Leases 11 - 11 41 4 45 Gross Leasable Area (sq.ft.) 26,331 - 26,331 133,002 186,165 319,167 Base Rent / Sq.Ft. ($/sq.ft.) $15.76 $0.00 $15.76 $16.81 $5.22 $10.05 Rent Starts in the Quarter: Number of Leases 13 5 18 32 5 37 Gross Leasable Area (sq.ft.) 40,791 159,948 200,739 92,780 159,948 252,728 Base Rent / Sq.Ft. ($/sq.ft.) $16.00 $9.04 $10.45 $15.18 $9.04 $11.29 % Increase / (Decrease) from Portfolio Average -2.7% 11.3% -3.2% - -7.7% 11.3% 4.6% Current Portfolio Average: Portfolio Average Base Rent / Sq.Ft. (as of 6/30/09) $16.44 $8.12 $10.79 $16.44 $8.12 $10.79 Historical Portfolio Averages: Year Ended 12/31/08 Portfolio Average Base Rent / Sq.Ft. $16.51 $8.11 $10.82 Year Ended 12/31/07 Portfolio Average Base Rent / Sq.Ft. $16.05 $7.90 $10.61 Year Ended 12/31/06 Portfolio Average Base Rent / Sq.Ft. $15.10 $7.67 $10.08 Year Ended 12/31/05 Portfolio Average Base Rent / Sq.Ft. $14.57 $7.21 $9.55 Year Ended 12/31/04 Portfolio Average Base Rent / Sq.Ft. $13.70 $6.61 $8.83 Supplemental Financial and Operating Statistics Ramco-Gershenson Properties Trust (RPT)

Property/Location Project Description Current Development Projects On-Balance Sheet Assets Northpointe Town Center - Jackson, MI 200,000 SF of retail and outlots. Total On-Balance Sheet Assets Off-Balance Sheet Assets Hartland Towne Square - Hartland Twp., MI Phase 1 - sale to Meijer for 192,000 SF building, 12,000 SF of retail and outlot building. Future phases. Total Off-Balance Sheet Assets RPT Share of Total Off-Balance Sheet Assets Proposed Off-Balance Sheet Assets The Town Center at Aquia - Stafford, VA Retail development. Basis in office component. Basis in residential component. Gateway Commons - Lakeland, FL 375,000 SF power center project. Parkway Shops - Jacksonville, FL 350,000 SF power center project. Total Proposed Off-Balance Sheet Assets RPT Share of Total Proposed Off-Balance Sheet Assets RPT Share of Current Developments Development Projects (in millions) Estimated Additional Costs RPT Ownership % Projected Stabilization Date Stabilized Return on Cost [1] Projected Stabilized NOI Projected Cost Cost to Date 7/1/09 - 12/31/09 2010 2011 2012 100% Q4 2012 9.0% $3.1 $34.7 $1.2 $0.0 $0.4 $9.3 $23.8 9.0% [2] $3.1 $34.7 $1.2 $0.0 $0.4 $9.3 $23.8 20% Q4 2010 8.6% $0.5 $5.4 $2.1 $0.6 $2.7 $0.0 $0.0 20% $19.0 $19.0 8.6% [3] $0.5 $24.4 $21.1 $0.6 $2.7 $0.0 $0.0 8.6% [2][3] $0.5 $24.4 $21.1 $0.6 $2.7 $0.0 $0.0 8.6% [2][3] $0.1 $4.9 $4.2 $0.1 $0.5 $0.0 $0.0 20% Q4 2012 9.0% $4.8 $53.7 $14.8 [4] $0.8 $6.7 $14.4 $17.1 20% $29.3 $29.3 [4] 20% $15.4 $15.4 [4] 9.0% [5] $4.8 $98.4 $59.6 $0.8 $6.7 $14.4 $17.1 20% Q2 2013 9.1% $5.9 $64.7 $18.5 $1.1 $0.4 $9.2 $35.5 20% Q2 2013 8.8% $2.8 $31.4 $12.6 [6] $0.6 $0.7 $8.8 $8.7 9.0% [2][5] $13.5 $194.6 $90.7 $2.4 $7.7 $32.5 $61.3 9.0% [2][5] $2.7 $38.9 $18.1 $0.5 $1.5 $6.5 $12.3 9.0% [2][3][5] $5.9 $78.5 $23.6 $0.6 $2.5 $15.8 $36.0 [1] Percentage based on actual numbers before rounding. [2] Does not include gains on sales held in TRS or fee revenue. [3] Does not include costs associated with the "Future phases" at Hartland Towne Square. [4] Includes pro-rata portion of net book value of existing center and applicable fixed cost allocation. [5] Does not include costs associated with the office and residential components at The Town Center at Aquia. [6] Includes $6,856,775 payable on land purchased under two land contracts due in November 2010. Supplemental Financial and Operating Statistics Ramco-Gershenson Properties Trust (RPT) Q2 2009 Page 18

Redevelopment Projects (in millions) Estimated Additional Costs Stabilized Return on Cost [1] Projected Stabilized NOI [2] Projected Cost Cost to Date 7/1/09 - 12/31/09 2010 2011 10.4% $1.3 $12.8 $7.1 $2.1 $3.6 $0.0 12.0% $0.5 $4.0 $0.2 $1.0 $2.9 $0.0 12.8% $0.2 $1.8 $0.4 $0.8 $0.5 $0.0 15.2% $0.1 $1.0 $0.2 $0.8 $0.0 $0.0 11.2% $2.2 $19.5 $7.9 $4.6 $7.0 $0.0 20.6% $2.1 $10.0 $5.6 $0.4 $4.0 $0.0 11.4% $1.2 $10.3 $6.2 $2.8 $1.2 $0.0 14.3% $0.6 $4.1 $0.2 $3.9 $0.0 $0.0 15.1% $0.7 $4.7 $0.2 $0.8 $3.7 $0.0 15.6% $4.5 $29.1 $12.2 $8.0 $8.9 $0.0 15.6% [4] $1.3 $8.3 $3.6 $2.3 $2.3 $0.0 12.5% [4] $3.5 $27.8 $11.5 $6.9 $9.3 $0.0 Completed Projects RPT Ownership % Clinton Valley - Sterling Heights, MI Adding a 50,852 SF Hobby Lobby. 100% Market Plaza - Glen Ellyn, IL Adding a 19,849 SF Staples. 20% Future Projects Lakeshore Marketplace - Norton Shores, MI Retenant with mid-box use a portion of Elder 100% Sunshine Plaza - Tamarac, FL Beerman space. Develop new outlots. Taking back 20,000 SF of anchor space to create 100% Pelican Plaza - Sarasota, FL new mid-box opportunity. Adding 20,000 SF specialty grocer. 100% Rossford Pointe - Rossford, OH Opportunity to create additional mid-box retailer. 100% The Shops on Lane Avenue - Columbus, OH Expand existing grocery to prototype size. 20% Percentage based on actual numbers before rounding. Represents incremental change in revenue. Current redevelopments does not include The Town Center at Aquia, which is considered a development project by the Company. Refer to page 18 for details on The Town Center at Aquia. Does not include fees earned by RPT. Supplemental Financial and Operating Statistics Ramco-Gershenson Properties Trust (RPT) Property/Location Project Description Current Redevelopment Projects [3] On-Balance Sheet Assets West Allis - West Allis, WI Relocating existing tenants, adding Burlington Coat Factory, adding retail and upgrading façade.Holcomb - Roswell, GA Rivertowne Square - Deerfield Beach, FL Southbay - Osprey, FL Adding Studio Movie Grill in 39,668 SF. Adding a 60,000 SF Beall's Department Store. Adding freestanding CVS, relocating tenants, retenanting space and demolishing vacated space. Total On-Balance Sheet Assets Off-Balance Sheet Assets Troy Marketplace - Troy, MI Retenanting 97,000 SF Home Expo with LA Fitness (which has opened) and additional mid-box uses, constructing new outlot building. Adding 36,000 SF specialty grocer Plum Market as well as other upscale tenants; plus façade and structural improvements. The Shops at Old Orchard - W. Bloomfield, MIMarketplace of Delray - Delray Beach, FLAdding Ross Dress For Less in 27,625 SF, downsizing Office Depot from 39,776 SF to 26,500 SF, adding Dollar Tree in 12,000 SF, and retenanting retail space.Collins Pointe Plaza - Cartersville, GARetenanting Winn-Dixie, adding freestanding CVS and small-shop retail space.Total Off-Balance Sheet Assets RPT Share of Total Off-Balance Sheet Assets RPT Share of Current Redevelopments Q2 2009 Page 19

Fixed Rate Debt West Oaks II/Spring Meadows Promenade at Pleasant Hill Publix at River Crossing Parkway Shops Parkway Shops Unsecured Term Loan Facility * Madison Shopping Center Lakeshore Marketplace Sunshine Plaza Shopping Center Coral Creek The Crossroads at Royal Palm Centre at Woodstock East Town Plaza Kentwood Towne Center Lantana Plaza Shopping Center Auburn Hills Crossroads Shopping Center Jackson West West Oaks I New Towne Plaza Hoover Eleven River City Marketplace Hoover Eleven Junior Subordinated Note ** Subtotal Fixed Rate Debt Variable Rate Mortgages Beacon Square Gaines Marketplace Subtotal Variable Rate Mortgages Variable Rate Secured Facility Secured Revolving Credit Facility - Aquia Subtotal Variable Rate Secured Facilities Subtotal Variable Rate Mortgages & Secured Facilities Variable Rate Unsecured Facility Unsecured Revolving Credit Facility Subtotal Variable Rate Unsecured Facilities Subtotal Variable Rate Debt Total debt Travelers Insurance Principal Life Jackson National Life Ins Co. St. Johns land contract River City Signature land contract KeyBank, as agent LaSalle Bank N.A. Wells Fargo/Midland Nationwide Life KeyBank L.J. Melody & Co./Salomon Wachovia Citigroup Global Markets Nationwide Life Key Bank Citigroup Global Markets Citigroup Global Markets KeyBank KeyBank Deutsche Bank Canada Life/GMAC JPMorgan Chase Bank, N.A. Canada Life/GMAC The Bank of New York Trust Company Huntington Bank Huntington Bank KeyBank KeyBank, as agent 3.49% $ 23,139,073 7.0500% 1.96% 12,992,208 8.0900% 0.48% 3,203,376 6.6700% 0.71% 4,690,000 7.0000% 0.33% 2,166,775 6.0000% 15.10% 100,000,000 4.5925% 1.43% 9,445,571 7.5080% 2.22% 14,699,735 7.6470% 1.71% 11,313,802 7.3500% 1.42% 9,432,750 6.7800% 1.70% 11,252,904 6.5000% 0.67% 4,455,041 6.9100% 1.67% 11,049,754 5.4500% 1.40% 9,301,666 5.7400% 1.50% 9,937,772 4.7600% 1.10% 7,294,137 5.3800% 3.84% 25,406,968 5.3800% 2.59% 17,180,000 5.2000% 4.12% 27,300,000 5.2000% 2.99% 19,800,000 5.0910% 0.88% 5,851,137 7.6250% 16.61% 110,000,000 5.4355% 0.33% 2,171,282 7.2000% 4.25% 28,125,000 7.8700% 72.52% $ 480,208,952 5.7839% - - 1.10% $ 7,279,651 3.0694% 1.12% 7,387,357 5.2500% 2.21% $ 14,667,008 4.1677% - - 6.04% $ 40,000,000 3.5700% 6.04% $ 40,000,000 3.5700% 8.26% $ 54,667,008 3.7304% - 19.22% $ 127,300,000 1.6739% 19.22% $ 127,300,000 1.6739% 27.48% $ 181,967,008 2.2917% 100.00% $ 662,175,960 4.8243% Dec-09 5 Sep-10 14 Oct-10 16 Nov-10 17 Nov-10 17 Dec-10 18 May-11 22 Aug-11 25 May-12 35 Jul-12 37 Aug-12 38 Jul-13 49 Jul-13 49 Jul-13 49 Aug-13 50 May-14 59 May-14 59 Nov-15 77 Nov-15 77 Dec-15 78 Feb-16 80 Apr-17 94 May-18 108 Jan-38 348 69 - - Nov-09 4 Jun-11 23 14 - - Dec-09 6 - 8 - Dec-09 6 - 6 52 Summary of Outstanding Debt 06/30/09 * Effectively converted to fixed rate through swap agreements. ** Fixed rate until January 30, 2013, and then at LIBOR plus 3.30%. Supplemental Financial and Operating Statistics Q2 2009 Ramco-Gershenson Properties Trust (RPT) Page 20

Loan Maturities Split between Scheduled Amortization and Scheduled Maturities 06/30/09 Year Scheduled Amortization Payments Scheduled Maturities Total Scheduled Maturities Percentage of Debt Maturing Cumulative Percentage of Debt Maturing 2009 $ 2,789,917 $ 197,193,984 $ 199,983,901 30.20% 30.20% 2010 4,170,351 122,565,995 126,736,347 19.14% 49.34% 2011 4,651,077 30,420,169 35,071,246 5.30% 54.64% 2012 4,130,892 29,879,687 34,010,579 5.14% 59.77% 2013 3,363,353 30,121,368 33,484,721 5.06% 64.83% 2014 2,505,331 29,676,361 32,181,691 4.86% 69.69% 2015 2,323,334 59,457,889 61,781,223 9.33% 79.02% 2016 382,038 - 382,038 0.06% 79.08% 2017 310,621 110,000,000 110,310,621 16.66% 95.74% 2018 108,593 - 108,593 0.02% 95.75% 2019 + - 28,125,000 28,125,000 4.25% 100.00% Totals $ 24,735,507 $ 637,440,453 $ 662,175,960 Note: Scheduled maturities in 2009 includes $127,300,000 which represents the balance of the Unsecured Revolving Credit Facility drawn as of June 30, 2009 due at maturity in December 2009, and scheduled maturities in 2010 includes $100,000,000 which represents the balance of the Unsecured Term Loan Facility due at maturity in December 2010. The Unsecured Revolving Credit Facility can be extended to December 2010. Supplemental Financial and Operating Statistics Q2 2009 Ramco-Gershenson Properties Trust (RPT) Page 21

Market Capitalization Information 06/30/09 Debt: Shares Dollars Percentage Fixed Rate Debt $ 480,208,952 54.65% Variable Rate Debt $ 181,967,008 20.71% Total Debt $ 662,175,960 75.36% Equity: Common Shares and Equivalents REIT Shares Market price $ 10.01 86.51% 18,710,476 $ 187,291,865 21.32% OP Units 13.49% 2,918,574 $ 29,214,926 3.32% Total Common Shares and Equivalents 100.00% 21,629,050 $ 216,506,791 24.64% Total Market Capitalization $ 878,682,750 100.00% Common Stock Performance - 07/01/08 through 06/30/09 Supplemental Financial and Operating Statistics Ramco-Gershenson Properties Trust (RPT) Q2 2009 Page 22

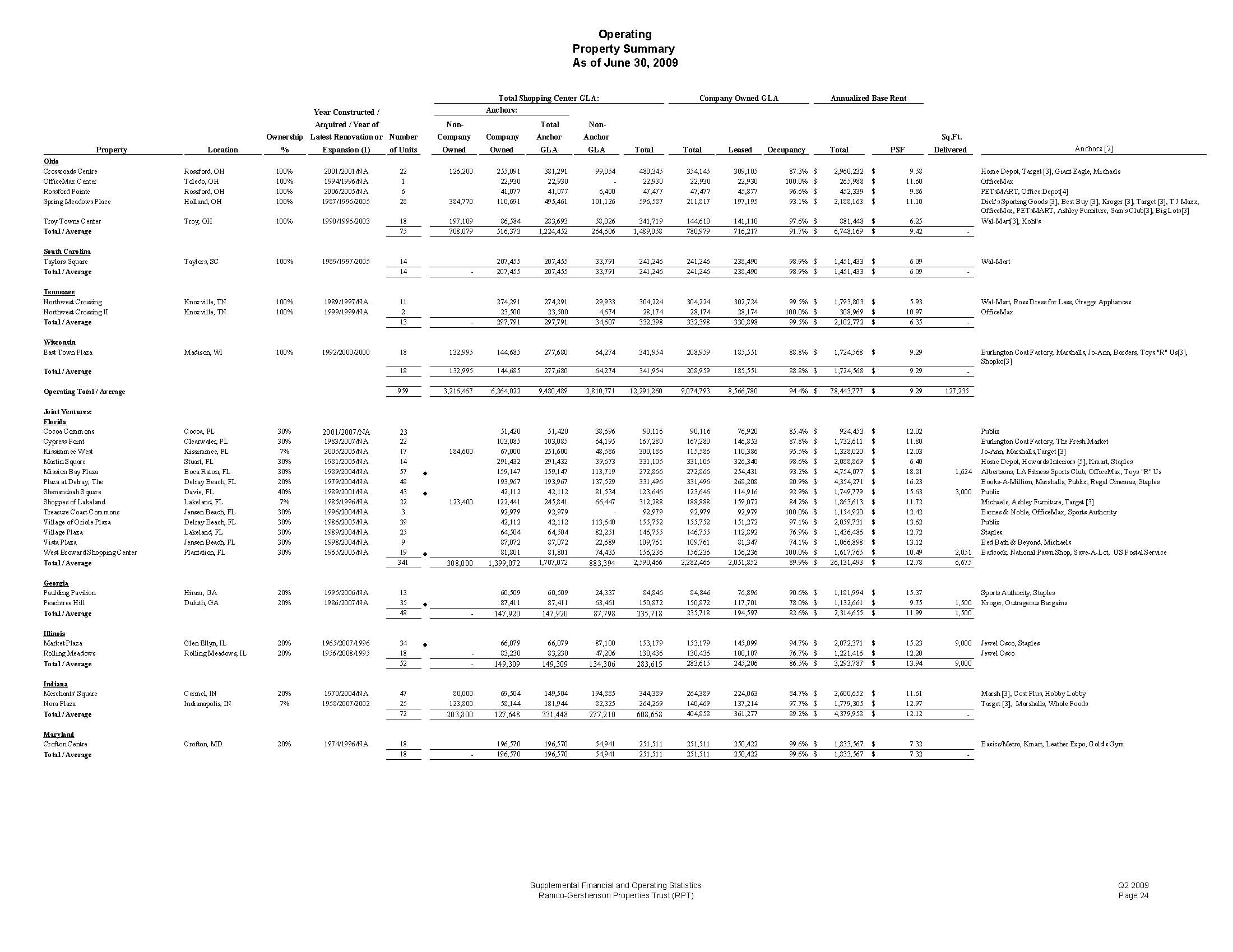

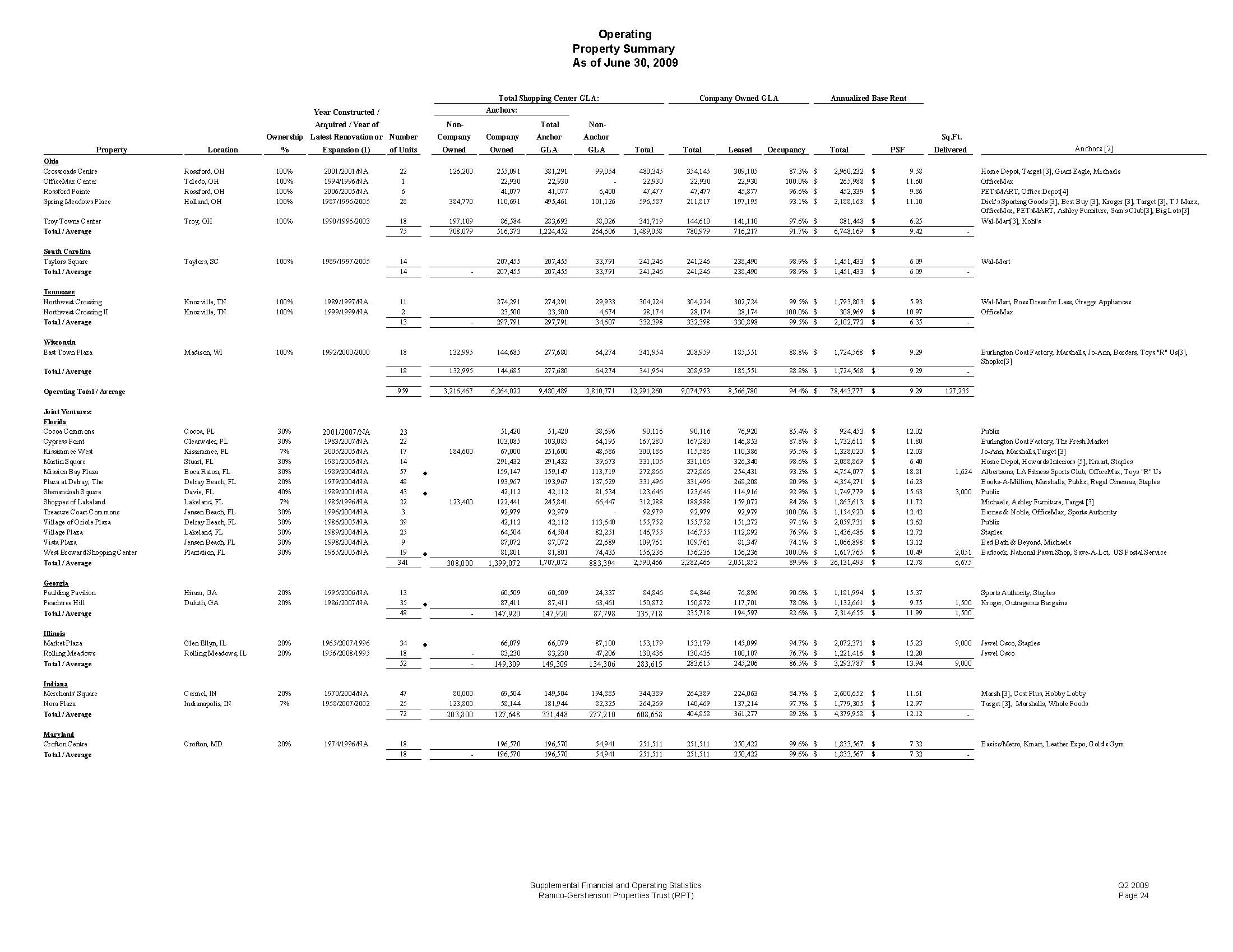

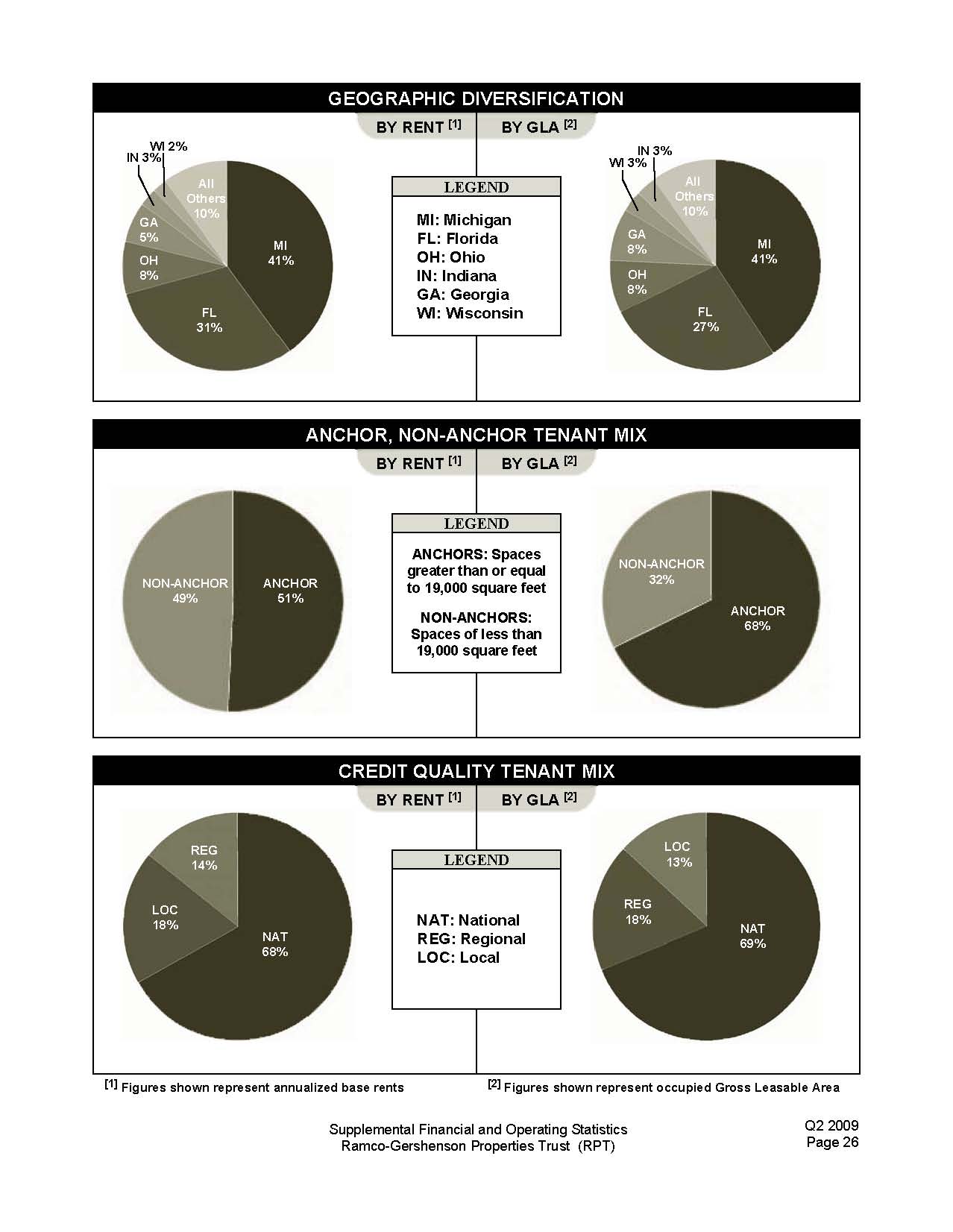

Operating Property Summary As of June 30, 2009 Total Shopping Center GLA: Company Owned GLA Annualized Base Rent Property Location Ownership % Year Constructed / Acquired / Year of Latest Renovation or Expansion (1) Number of Units Anchors: Non Anchor GLA Total Total Leased Occupancy Total PSF Sq.Ft. Delivered Anchors [2] Non- Company Owned Company Owned Total Anchor GLA Operating: Florida Coral Creek Shops Coconut Creek, FL 100% 1992/2002/NA 34 42,112 42,112 67,200 109,312 109,312 92,737 84.8% $ 1,390,483 $ 14.99 Publix Lantana Shopping Center Lantana, FL 100% 1959/1996/2002 22 61,166 61,166 62,444 123,610 123,610 113,968 92.2% $ 1,184,193 $ 10.39 Publix Naples Towne Centre Naples, FL 100% 1982/1996/2003 14 32,680 102,027 134,707 32,680 167,387 134,707 123,618 91.8% $ 737,205 $ 5.96 Goodwill [3], Save-A-Lot, Bealls Pelican Plaza Sarasota, FL 100% 1983/1997/NA 26 • 35,768 35,768 57,389 93,157 93,157 81,352 87.3% $ 848,931 $ 10.88 3,335 Linens 'N Things [6] River City Marketplace Jacksonville, FL 100% 2005/2005/NA 70 • 342,501 323,907 666,408 221,448 887,856 545,355 528,958 97.0% $ 8,178,010 $ 15.68 7,314 Wal-Mart [3], Lowe's[3], Bed Bath & Beyond, Best Buy, Gander Mountain, River Crossing Centre New Port Richey, FL 100% 1998/2003/NA 16 37,888 37,888 24,150 62,038 62,038 62,038 100.0% $ 758,063 $ 12.22 Michaels, OfficeMax, PETsMART, Ross Dress For Less, Wallace Theaters, Ashley Furniture HomeStore Publix Sunshine Plaza Tamarac, FL 100% 1972/1996/2001 28 146,409 146,409 89,317 235,726 235,726 230,012 97.6% $ 2,038,033 $ 8.86 Publix, Old Time Pottery The Crossroads Royal Palm Beach, FL 100% 1988/2002/NA 35 42,112 42,112 77,980 120,092 120,092 104,600 87.1% $ 1,601,392 $ 15.31 Publix Village Lakes Shopping Center Land O' Lakes, FL 100% 1987/1997/NA 24 • 125,141 125,141 61,355 186,496 186,496 180,599 96.8% $ 1,086,741 $ 6.06 1,400 Sweet Bay, Wal-Mart Total / Average 269 375,181 916,530 1,291,711 693,963 1,985,674 1,610,493 1,517,882 94.2% $ 17,823,051 $ 11.84 12,049 Georgia Centre at Woodstock Woodstock, GA 100% 1997/2004/NA 14 51,420 51,420 35,328 86,748 86,748 77,148 88.9% $ 787,779 $ 11.31 7,488 Publix Conyers Crossing Conyers, GA 100% 1978/1998/NA 15 138,915 138,915 31,560 170,475 170,475 170,475 100.0% $ 956,411 $ 5.61 Burlington Coat Factory, Hobby Lobby Horizon Village Suwanee, GA 100% 1996/2002/NA 22 47,955 47,955 49,046 97,001 97,001 81,302 83.8% $ 841,765 $ 10.35 Publix [4] Mays Crossing Stockbridge, GA 100% 1984/1997/2007 20 • 100,244 100,244 37,040 137,284 137,284 129,784 94.5% $ 829,759 $ 6.46 1,400 ApplianceSmart Factory Outlet, Big Lots, Dollar Tree Promenade at Pleasant Hill Duluth, GA 100% 1993/2004/NA 34 199,555 199,555 82,076 281,631 281,631 255,625 90.8% $ 1,870,778 $ 7.32 Farmers Home Furniture, Old Time Pottery, Publix Total / Average 105 - 538,089 538,089 235,050 773,139 773,139 714,334 92.4% $ 5,286,491 $ 7.49 8,888 Michigan Auburn Mile, The Auburn Hills, MI 100% 2000/1999/NA 7 533,659 64,298 597,957 26,238 624,195 90,536 90,536 100.0% $ 944,457 $ 10.43 Best Buy [3], Target [3], Meijer [3], Costco [3], Jo-Ann, Staples Beacon Square Grand Haven, MI 100% 2004/2004/NA 16 103,316 - 103,316 51,387 154,703 51,387 44,332 86.3% $ 749,589 $ 16.91 Home Depot [3] Clinton Pointe Clinton Twp., MI 100% 1992/2003/NA 14 • 112,876 65,735 178,611 69,595 248,206 135,330 123,280 91.1% $ 1,086,112 $ 10.09 15,675 OfficeMax, Sports Authority, Target [3] Clinton Valley Sterling Heights, MI 100% 1985/1996/2009 11 50,852 50,852 51,149 102,001 102,001 83,324 81.7% $ 574,202 $ 6.89 Hobby Lobby Clinton Valley Mall Sterling Heights, MI 100% 1977/1996/2002 8 55,175 55,175 44,106 99,281 99,281 99,281 100.0% $ 1,586,596 $ 15.98 Office Depot, DSW Shoe Warehouse Eastridge Commons Flint, MI 100% 1990/1996/2001 16 117,777 117,972 235,749 51,704 287,453 169,676 158,526 93.4% $ 1,645,612 $ 10.38 Farmer Jack (A&P) [4], Office Depot[4], Target [3], TJ Maxx Edgewood Towne Center Lansing, MI 100% 1990/1996/2001 17 227,193 23,524 250,717 62,233 312,950 85,757 75,122 87.6% $ 855,522 $ 11.39 OfficeMax, Sam's Club [3], Target [3] Fairlane Meadows Dearborn, MI 100% 1987/2003/NA 22 201,300 56,586 257,886 80,922 338,808 137,508 120,901 87.9% $ 1,642,417 $ 13.58 Best Buy, Citi Trends, Target [3], Burlington Coat Factory [3] Fraser Shopping Center Fraser, MI 100% 1977/1996/NA 8 32,384 32,384 39,163 71,547 71,547 51,335 71.8% $ 309,682 $ 6.03 Oakridge Market Gaines Marketplace Gaines Twp., MI 100% 2004/2004/NA 15 351,981 351,981 40,188 392,169 392,169 387,669 98.9% $ 1,648,734 $ 4.25 Meijer, Staples, Target Hoover Eleven Warren, MI 100% 1989/2003/NA 47 153,810 153,810 130,960 284,770 284,770 268,050 94.1% $ 3,002,976 $ 12.65 30,690 Kroger, Marshalls, OfficeMax Jackson Crossing Jackson, MI 100% 1967/1996/2002 63 • 254,242 222,192 476,434 176,546 652,980 398,738 365,100 91.6% $ 3,419,546 $ 9.47 4,134 Kohl's, Sears [3], Target [3], TJ Maxx, Toys "R" Us, Best Buy, Bed Bath & Jackson West Jackson, MI 100% 1996/1996/1999 5 194,484 194,484 15,837 210,321 210,321 210,321 100.0% $ 1,357,418 $ 7.11 19,483 Beyond, Jackson 10 Theater Lowe's, Michaels, OfficeMax Kentwood Towne Centre Kentwood, MI 77.88% 1988/1996//NA 16 101,909 122,390 224,299 50,473 274,772 172,863 152,663 88.3% $ 1,011,836 $ 6.63 Hobby Lobby, OfficeMax, Rooms Today [3] Lake Orion Plaza Lake Orion, MI 100% 1977/1996/NA 9 126,195 126,195 14,878 141,073 141,073 138,753 98.4% $ 565,129 $ 4.07 Hollywood Super Market, Kmart Lakeshore Marketplace Norton Shores, MI 100% 1996/2003/NA 21 126,800 258,638 385,438 89,015 474,453 347,653 339,074 97.5% $ 2,727,144 $ 8.04 Barnes & Noble, Dunham's, Elder-Beerman, Hobby Lobby, T J Maxx, Toys Livonia Plaza Livonia, MI 100% 1988/2003/NA 20 90,831 90,831 43,042 133,873 133,873 122,922 91.8% $ 1,278,951 $ 10.40 "R" Us, Target[3] Kroger, TJ Maxx Madison Center Madison Heights, MI 100% 1965/1997/2000 15 167,830 167,830 59,258 227,088 227,088 185,832 81.8% $ 1,200,842 $ 6.46 Kmart New Towne Plaza Canton Twp., MI 100% 1975/1996/2005 16 126,425 126,425 53,998 180,423 180,423 174,298 96.6% $ 1,787,264 $ 10.25 Kohl's, Jo-Ann Oak Brook Square Flint, MI 100% 1982/1996/NA 20 79,744 79,744 72,629 152,373 152,373 141,830 93.1% $ 1,194,786 $ 8.42 TJ Maxx, Hobby Lobby Roseville Towne Center Roseville, MI 100% 1963/1996/2004 9 206,747 206,747 40,221 246,968 246,968 246,968 100.0% $ 1,695,513 $ 6.87 Marshalls, Wal-Mart, Office Depot[4] Shoppes at Fairlane Meadows Dearborn, MI 100% 2007/NA/NA 8 - - - 19,925 19,925 19,925 13,197 66.2% $ 321,538 $ 24.36 Southfield Plaza Southfield, MI 100% 1969/1996/2003 14 128,339 128,339 37,660 165,999 165,999 163,749 98.6% $ 1,358,539 $ 8.30 Burlington Coat Factory, Marshalls, Staples Taylor Plaza Taylor, MI 100% 1970/1996/2006 1 102,513 102,513 - 102,513 102,513 102,513 100.0% $ 439,992 $ 4.29 Home Depot Tel-Twelve Southfield, MI 100% 1968/1996/2005 21 479,869 479,869 43,542 523,411 523,411 520,411 99.4% $ 5,616,518 $ 10.79 Meijer, Lowe's, Office Depot, Best Buy, DSW Shoe Warehouse, Michaels, West Oaks I Novi, MI 100% 1979/1996/2004 8 215,251 215,251 30,270 245,521 245,521 245,521 100.0% $ 2,123,823 $ 10.15 36,316 PETsMART OfficeMax, DSW Shoe Warehouse, Home Goods, Michaels, Gander West Oaks II Novi, MI 100% 1986/1996/2000 30 221,140 90,753 311,893 77,201 389,094 167,954 166,979 99.4% $ 2,890,789 $ 17.31 Mountain Value City Furniture [3], Bed Bath & Beyond [3], Marshalls, Toys "R" Us[3], Kohl's[3], Jo-Ann Total / Average 457 2,000,212 3,584,518 5,584,730 1,472,140 7,056,870 5,056,658 4,792,487 94.8% $ 43,035,526 $ 9.18 106,298 North Carolina Ridgeview Crossing Elkin, NC 100% 1989/1997/1995 8 58,581 58,581 12,340 70,921 70,921 70,921 100.0% $ 271,767 $ 3.83 Belk Department Store, Ingles Market Supplemental Financial and Operating Statistics Q2 2009 Ramco-Gershenson Properties Trust (RPT) Page 24

Operating Property Summary As of June 30, 2009 Total Shopping Center GLA: Company Owned GLA Annualized Base Rent Property Location Ownership % Year Constructed / Acquired / Year of Latest Renovation or Expansion (1) Number of Units Anchors: Non Anchor GLA Total Total Leased Occupancy Total PSF Sq.Ft. Delivered Anchors [2] Non Company Owned Company Owned Total Anchor GLA Ohio Crossroads Centre Rossford, OH 100% 2001/2001/NA 22 126,200 255,091 381,291 99,054 480,345 354,145 309,105 87.3% $ 2,960,232 $ 9.58 Home Depot, Target [3], Giant Eagle, Michaels OfficeMax Center Toledo, OH 100% 1994/1996/NA 1 22,930 22,930 - 22,930 22,930 22,930 100.0% $ 265,988 $ 11.60 OfficeMax Rossford Pointe Rossford, OH 100% 2006/2005/NA 6 41,077 41,077 6,400 47,477 47,477 45,877 96.6% $ 452,339 $ 9.86 PETsMART, Office Depot[4] Spring Meadows Place Holland, OH 100% 1987/1996/2005 28 384,770 110,691 495,461 101,126 596,587 211,817 197,195 93.1% $ 2,188,163 $ 11.10 Dick's Sporting Goods [3], Best Buy [3], Kroger [3], Target [3], T J Maxx, Troy Towne Center Troy, OH 100% 1990/1996/2003 18 197,109 86,584 283,693 58,026 341,719 144,610 141,110 97.6% $ 881,448 $ 6.25 OfficeMax, PETsMART, Ashley Furniture, Sam's Club[3], Big Lots[3] Wal-Mart[3], Kohl's Total / Average 75 708,079 516,373 1,224,452 264,606 1,489,058 780,979 716,217 91.7% $ 6,748,169 $ 9.42 - - South Carolina Taylors Square Taylors, SC 100% 1989/1997/2005 14 207,455 207,455 33,791 241,246 241,246 238,490 98.9% $ 1,451,433 $ 6.09 Wal-Mart Total / Average 14 207,455 207,455 33,791 241,246 241,246 238,490 98.9% $ 1,451,433 $ 6.09 - - Tennessee Northwest Crossing Knoxville, TN 100% 1989/1997/NA 11 274,291 274,291 29,933 304,224 304,224 302,724 99.5% $ 1,793,803 $ 5.93 Wal-Mart, Ross Dress for Less, Greggs Appliances Northwest Crossing II Knoxville, TN 100% 1999/1999/NA 2 23,500 23,500 4,674 28,174 28,174 28,174 100.0% $ 308,969 $ 10.97 OfficeMax Total / Average 13 297,791 297,791 34,607 332,398 332,398 330,898 99.5% $ 2,102,772 $ 6.35 - - Wisconsin East Town Plaza Madison, WI 100% 1992/2000/2000 18 132,995 144,685 277,680 64,274 341,954 208,959 185,551 88.8% $ 1,724,568 $ 9.29 Burlington Coat Factory, Marshalls, Jo-Ann, Borders, Toys "R" Us[3], Shopko[3] Total / Average 18 132,995 144,685 277,680 64,274 341,954 208,959 185,551 88.8% $ 1,724,568 $ 9.29 - Operating Total / Average 959 3,216,467 6,264,022 9,480,489 2,810,771 12,291,260 9,074,793 8,566,780 94.4% $ 78,443,777 $ 9.29 127,235 Joint Ventures: Florida Cocoa Commons Cocoa, FL 30% 2001/2007/NA 23 51,420 51,420 38,696 90,116 90,116 76,920 85.4% $ 924,453 $ 12.02 Publix Cypress Point Clearwater, FL 30% 1983/2007/NA 22 103,085 103,085 64,195 167,280 167,280 146,853 87.8% $ 1,732,611 $ 11.80 Burlington Coat Factory, The Fresh Market Kissimmee West Kissimmee, FL 7% 2005/2005/NA 17 184,600 67,000 251,600 48,586 300,186 115,586 110,386 95.5% $ 1,328,020 $ 12.03 Jo-Ann, Marshalls,Target [3] Martin Square Stuart, FL 30% 1981/2005/NA 14 291,432 291,432 39,673 331,105 331,105 326,340 98.6% $ 2,088,869 $ 6.40 Home Depot, Howards Interiors [5], Kmart, Staples Mission Bay Plaza Boca Raton, FL 30% 1989/2004/NA 57 • 159,147 159,147 113,719 272,866 272,866 254,431 93.2% $ 4,754,077 $ 18.81 1,624 Albertsons, LA Fitness Sports Club, OfficeMax, Toys "R" Us Plaza at Delray, The Delray Beach, FL 20% 1979/2004/NA 48 193,967 193,967 137,529 331,496 331,496 268,208 80.9% $ 4,354,271 $ 16.23 Books-A-Million, Marshalls, Publix, Regal Cinemas, Staples Shenandoah Square Davie, FL 40% 1989/2001/NA 43 • 42,112 42,112 81,534 123,646 123,646 114,916 92.9% $ 1,749,779 $ 15.63 3,000 Publix Shoppes of Lakeland Lakeland, FL 7% 1985/1996/NA 22 123,400 122,441 245,841 66,447 312,288 188,888 159,072 84.2% $ 1,863,613 $ 11.72 Michaels, Ashley Furniture, Target [3] Treasure Coast Commons Jensen Beach, FL 30% 1996/2004/NA 3 92,979 92,979 - 92,979 92,979 92,979 100.0% $ 1,154,920 $ 12.42 Barnes & Noble, OfficeMax, Sports Authority Village of Oriole Plaza Delray Beach, FL 30% 1986/2005/NA 39 42,112 42,112 113,640 155,752 155,752 151,272 97.1% $ 2,059,731 $ 13.62 Publix Village Plaza Lakeland, FL 30% 1989/2004/NA 25 64,504 64,504 82,251 146,755 146,755 112,892 76.9% $ 1,436,486 $ 12.72 Staples Vista Plaza Jensen Beach, FL 30% 1998/2004/NA 9 87,072 87,072 22,689 109,761 109,761 81,347 74.1% $ 1,066,898 $ 13.12 Bed Bath & Beyond, Michaels West Broward Shopping Center Plantation, FL 30% 1965/2005/NA 19 • 81,801 81,801 74,435 156,236 156,236 156,236 100.0% $ 1,617,765 $ 10.49 2,051 Badcock, National Pawn Shop, Save-A-Lot, US Postal Service Total / Average 341 308,000 1,399,072 1,707,072 883,394 2,590,466 2,282,466 2,051,852 89.9% $ 26,131,493 $ 12.78 6,675 Georgia Paulding Pavilion Hiram, GA 20% 1995/2006/NA 13 60,509 60,509 24,337 84,846 84,846 76,896 90.6% $ 1,181,994 $ 15.37 Sports Authority, Staples Peachtree Hill Duluth, GA 20% 1986/2007/NA 35 • 87,411 87,411 63,461 150,872 150,872 117,701 78.0% $ 1,132,661 $ 9.75 1,500 Kroger, Outrageous Bargains Total / Average 48 147,920 147,920 87,798 235,718 235,718 194,597 82.6% $ 2,314,655 $ 11.99 1,500 Illinois Market Plaza Glen Ellyn, IL 20% 1965/2007/1996 34 • 66,079 66,079 87,100 153,179 153,179 145,099 94.7% $ 2,072,371 $ 15.23 9,000 Jewel Osco, Staples Rolling Meadows Rolling Meadows, IL 20% 1956/2008/1995 18 - 83,230 83,230 47,206 130,436 130,436 100,107 76.7% $ 1,221,416 $ 12.20 Jewel Osco Total / Average 52 - 149,309 149,309 134,306 283,615 283,615 245,206 86.5% $ 3,293,787 $ 13.94 9,000 Indiana Merchants' Square Carmel, IN 20% 1970/2004/NA 47 80,000 69,504 149,504 194,885 344,389 264,389 224,063 84.7% $ 2,600,652 $ 11.61 Marsh [3], Cost Plus, Hobby Lobby Nora Plaza Indianapolis, IN 7% 1958/2007/2002 25 123,800 58,144 181,944 82,325 264,269 140,469 137,214 97.7% $ 1,779,305 $ 12.97 Target [3], Marshalls, Whole Foods Total / Average 72 203,800 127,648 331,448 277,210 608,658 404,858 361,277 89.2% $ 4,379,958 $ 12.12 - - Maryland Crofton Centre Crofton, MD 20% 1974/1996/NA 18 196,570 196,570 54,941 251,511 251,511 250,422 99.6% $ 1,833,567 $ 7.32 Basics/Metro, Kmart, Leather Expo, Gold's Gym Supplemental Financial and Operating Statistics Q2 2009 Ramco-Gershenson Properties Trust (RPT) Page 25

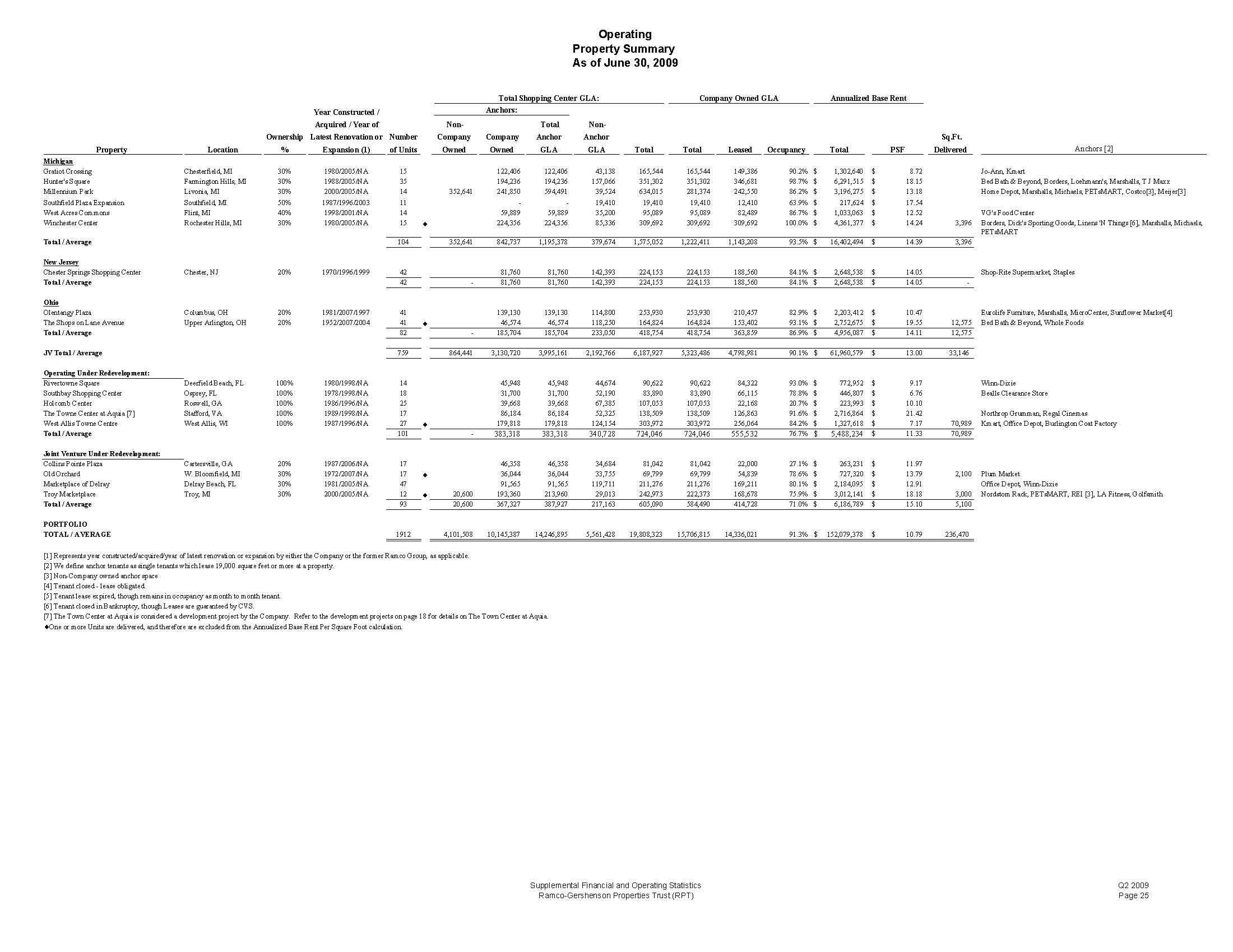

Operating Property Summary As of June 30, 2009 Total Shopping Center GLA: Company Owned GLA Annualized Base Rent Property Location Ownership % Year Constructed / Acquired / Year of Latest Renovation or Expansion (1) Number of Units Anchors: Non Anchor GLA Total Total Leased Occupancy Total PSF Sq.Ft. Delivered Anchors [2] Non Company Owned Company Owned Total Anchor GLA Michigan Gratiot Crossing Chesterfield, MI 30% 1980/2005/NA 15 122,406 122,406 43,138 165,544 165,544 149,386 90.2% $ 1,302,640 $ 8.72 Jo-Ann, Kmart Hunter's Square Farmington Hills, MI 30% 1988/2005/NA 35 194,236 194,236 157,066 351,302 351,302 346,681 98.7% $ 6,291,515 $ 18.15 Bed Bath & Beyond, Borders, Loehmann's, Marshalls, T J Maxx Millennium Park Livonia, MI 30% 2000/2005/NA 14 352,641 241,850 594,491 39,524 634,015 281,374 242,550 86.2% $ 3,196,275 $ 13.18 Home Depot, Marshalls, Michaels, PETsMART, Costco[3], Meijer[3] Southfield Plaza Expansion Southfield, MI 50% 1987/1996/2003 11 - - 19,410 19,410 19,410 12,410 63.9% $ 217,624 $ 17. 54 West Acres Commons Flint, MI 40% 1998/2001/NA 14 59,889 59,889 35,200 95,089 95,089 82,489 86.7% $ 1,033,063 $ 12.52 VG's Food Center Winchester Center Rochester Hills, MI 30% 1980/2005/NA 15 • 224,356 224,356 85,336 309,692 309,692 309,692 100.0% $ 4,361,377 $ 14.24 3,396 Borders, Dick's Sporting Goods, Linens 'N Things [6], Marshalls, Michaels, PETsMART Total / Average 104 352,641 842,737 1,195,378 379,674 1,575,052 1,222,411 1,143,208 93.5% $ 16,402,494 $ 14.39 3,396 New Jersey Chester Springs Shopping Center Chester, NJ 20% 1970/1996/1999 42 81,760 81,760 142,393 224,153 224,153 188,560 84.1% $ 2,648,538 $ 14.05 Shop-Rite Supermarket, Staples Total / Average 42 - 81,760 81,760 142,393 224,153 224,153 188,560 84.1% $ 2,648,538 $ 14.05 - Ohio Olentangy Plaza Columbus, OH 20% 1981/2007/1997 41 139,130 139,130 114,800 253,930 253,930 210,457 82.9% $ 2,203,412 $ 10.47 Eurolife Furniture, Marshalls, MicroCenter, Sunflower Market[4] The Shops on Lane Avenue Upper Arlington, OH 20% 1952/2007/2004 41 • 46,574 46,574 118,250 164,824 164,824 153,402 93.1% $ 2,752,675 $ 19.55 12,575 Bed Bath & Beyond, Whole Foods Total / Average 82 - 185,704 185,704 233,050 418,754 418,754 363,859 86.9% $ 4,956,087 $ 14.11 12,575 JV Total / Average 759 864,441 3,130,720 3,995,161 2,192,766 6,187,927 5,323,486 4,798,981 90.1% $ 61,960,579 $ 13.00 33,146 Operating Under Redevelopment: Rivertowne Square Deerfield Beach, FL 100% 1980/1998/NA 14 45,948 45,948 44,674 90,622 90,622 84,322 93.0% $ 772,952 $ 9.17 Winn-Dixie Southbay Shopping Center Osprey, FL 100% 1978/1998/NA 18 31,700 31,700 52,190 83,890 83,890 66,115 78.8% $ 446,807 $ 6.76 Bealls Clearance Store Holcomb Center Roswell, GA 100% 1986/1996/NA 25 39,668 39,668 67,385 107,053 107,053 22,168 20.7% $ 223,993 $ 10.10 The Towne Center at Aquia [7] Stafford, VA 100% 1989/1998/NA 17 86,184 86,184 52,325 138,509 138,509 126,863 91.6% $ 2,716,864 $ 21.42 Northrop Grumman, Regal Cinemas West Allis Towne Centre West Allis, WI 100% 1987/1996/NA 27 • 179,818 179,818 124,154 303,972 303,972 256,064 84.2% $ 1,327,618 $ 7.17 70,989 Kmart, Office Depot, Burlington Coat Factory Total / Average 101 383,318 383,318 340,728 724,046 724,046 555,532 76.7% $ 5,488,234 $ 11.33 70,989 Joint Venture Under Redevelopment: Collins Pointe Plaza Cartersville, GA 20% 1987/2006/NA 17 46,358 46,358 34,684 81,042 81,042 22,000 27.1% $ 263,231 $ 11.97 Old Orchard W. Bloomfield, MI 30% 1972/2007/NA 17 • 36,044 36,044 33,755 69,799 69,799 54,839 78.6% $ 727,320 $ 13.79 2,100 Plum Market Marketplace of Delray Delray Beach, FL 30% 1981/2005/NA 47 91,565 91,565 119,711 211,276 211,276 169,211 80.1% $ 2,184,095 $ 12.91 Office Depot, Winn-Dixie Troy Marketplace Troy, MI 30% 2000/2005/NA 12 • 20,600 193,360 213,960 29,013 242,973 222,373 168,678 75.9% $ 3,012,141 $ 18.18 3,000 Nordstom Rack, PETsMART, REI [3], LA Fitness, Golfsmith Total / Average 93 20,600 367,327 387,927 217,163 605,090 584,490 414,728 71.0% $ 6,186,789 $ 15.10 5,100 PORTFOLIO TOTAL / AVERAGE 1912 4,101,508 10,145,387 14,246,895 5,561,428 19,808,323 15,706,815 14,336,021 91.3% $ 152,079,378 $ 10.79 236,470 Represents year constructed/acquired/year of latest renovation or expansion by either the Company or the former Ramco Group, as applicable. We define anchor tenants as single tenants which lease 19,000 square feet or more at a property. No n-Company owned anchor space Tenant closed - lease obligated. Tenant lease expired, though remains in occupancy as month to month tenant. Tenant closed in Bankruptcy, though Leases are guaranteed by CVS. The Town Center at Aquia is considered a development project by the Company. Refer to the development projects on page 18 for details on The Town Center at Aquia. •One or more Units are delivered, and therefore are excluded from the Annualized Base Rent Per Square Foot calculation. Supplemental Financial and Operating Statistics Q2 2009 Ramco-Gershenson Properties Trust (RPT) Page 25

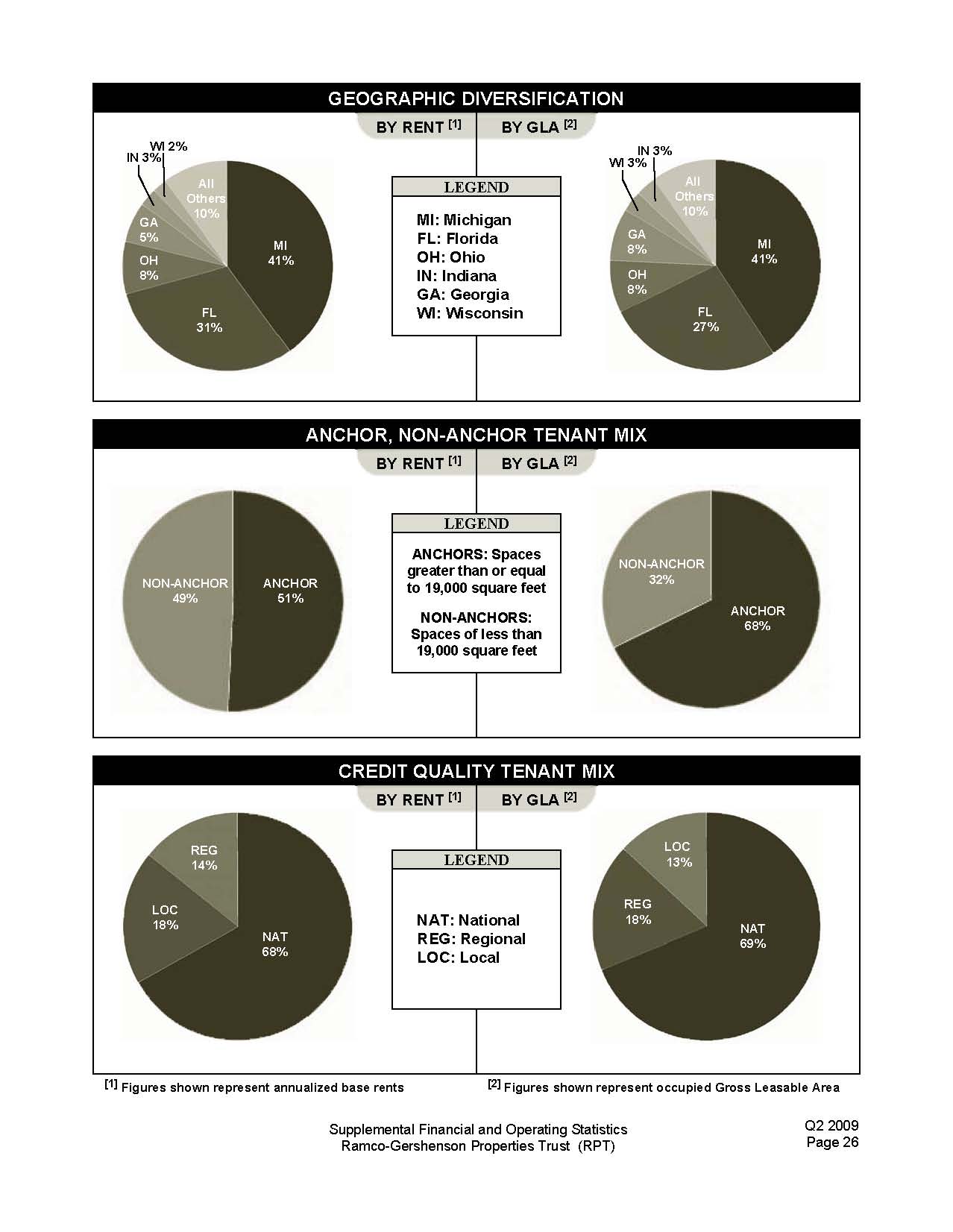

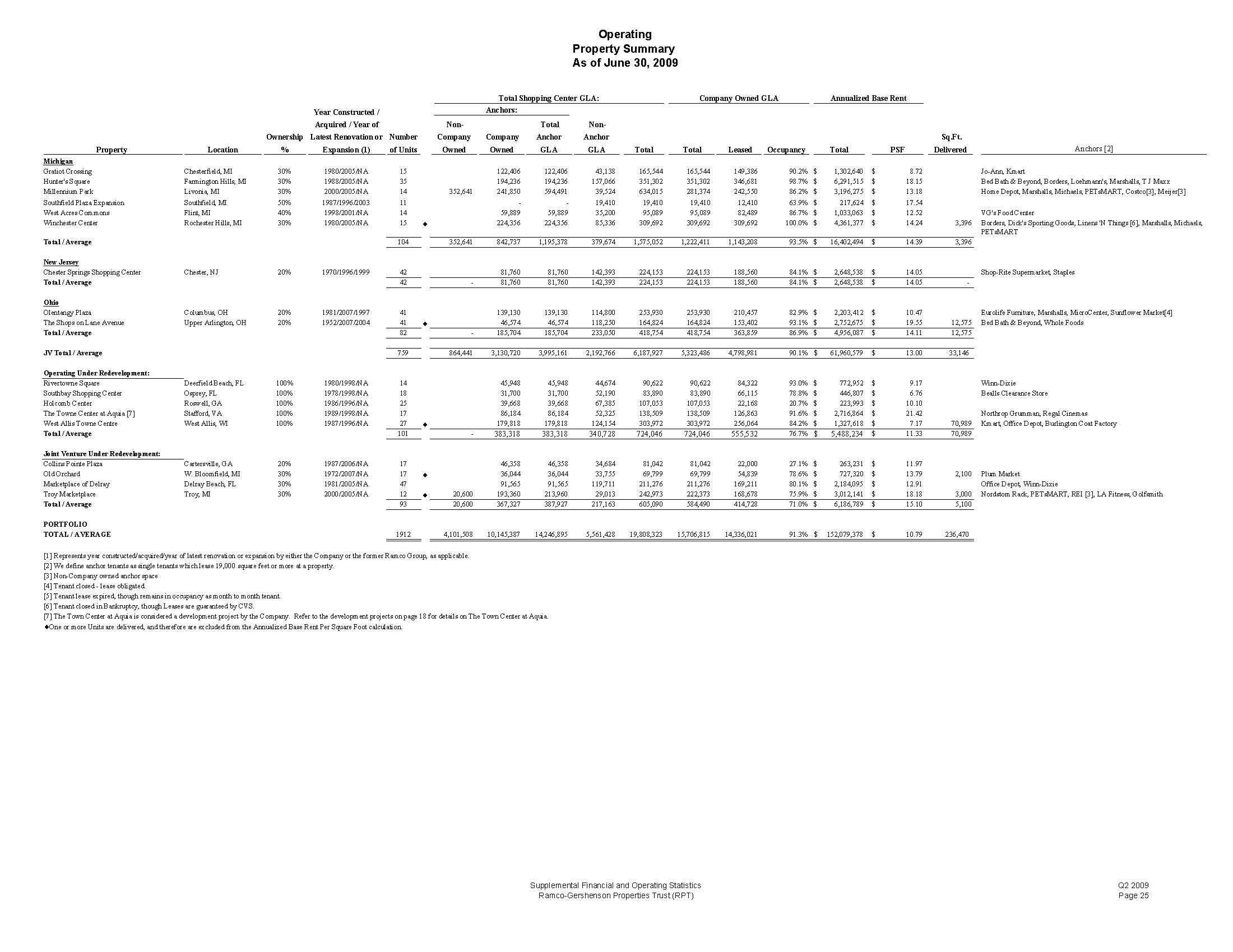

GEOGRAPHIC DIVERSIFICATION ANCHOR, NON-ANCHOR TENANT MIX CREDIT QUALITY TENANT MIX BY RENT [1] BY GLA [2] LEGEND NAT: National REG: Regional LOC: Local [1] Figures shown represent annualized base rents [2] Figures shown represent occupied Gross Leasable Area Supplemental Financial and Operating Statistics Ramco-Gershenson Properties Trust (RPT) Q2 2009 Page 26

Major Tenant Exposure* as of June 30, 2009 Annualized Base Rent in Place at 06/30/09 % of Total % of Base Rental Lease Name Number of Leases Leased GLA as of Company Owned Total Annualized Annualized Base Revenue as of 06/30/09 06/30/09 (Sq.Ft.) GLA Base Rent Rent/Square Foot T.J. Maxx/Marshalls 19 611,154 3.89% $5,738,487 $9.39 3.77% Publix 12 574,794 3.66% 4,534,891 $7.89 2.98% Home Depot 4 487,203 3.10% 3,259,492 $6.69 2.14% OfficeMax 12 273,720 1.74% 3,065,968 $11.20 2.01% Kmart 6 618,341 3.94% 2,717,603 $4.39 1.78% Wal-Mart 4 636,257 4.05% 2,675,565 $4.21 1.76% Jo-Ann 6 218,976 1.39% 2,378,777 $10.86 1.56% Dollar Tree 25 265,516 1.69% 2,343,291 $8.83 1.54% Staples 10 224,292 1.43% 2,277,886 $10.16 1.50% Michaels 9 199,724 1.26% 2,222,989 $11.13 1.46% PETsMART 7 160,428 1.02% 2,160,407 $13.47 1.42% Best Buy 4 141,895 0.90% 1,953,758 $13.77 1.28% Gander Mountain 2 159,791 1.02% 1,899,745 $11.89 1.25% Bed Bath & Beyond 6 155,799 0.99% 1,847,234 $11.86 1.21% Lowe's Home Centers 2 270,394 1.71% 1,822,956 $6.74 1.20% 128 4,998,284 31.80% $40,899,049 $8.18 26.86% *Based upon percentage of annualized base rent.

Summary of Expiring GLA All Leases Annualized Base Rent in Place at 06/30/09 Lease Expiration Year Number of Leases Expiring GLA Under Expiring Leases % of Company Owned GLA Total Annualized Base Rent % of Annualized Base Rent Annualized Base Rent per Square Foot Sq.Ft. Delivered 2009 • 124 458,691 3.20% $4,762,835 3.13% $13.06 93,977 2010 • 240 1,218,816 8.50% 14,653,033 9.64% 12.12 9,543 2011 283 1,384,045 9.65% 18,147,597 11.93% 13.11 2012 • 257 1,492,122 10.4 1% 17,379,799 11.43% 11.67 2,317 2013 • 200 1,618,145 11.29% 19,167,660 12.60% 11.86 1,400 2014 • 153 1,517,261 10.58% 13,441,711 8.84% 9.06 34,035 2015 54 838,940 5.85% 9,140,813 6.01% 10.90 2016 • 69 1,341,537 9.36% 13,531,443 8.90% 10.10 1,400 2017 45 763,530 5.33% 10,254,993 6.74% 13.43 2018 38 780,865 5.45% 7,826,245 5.15% 10.02 2019+ • 68 2,922,069 20.38% 23,773,249 15.63% 8.41 93,798 Total 1,531 14,336,021 100.00% $152,079,378 100.00% $10.79 236,470 All Anchor Leases Lease Expiration Year Number of Leases Expiring GLA Under Expiring Leases % of Company Owned GLA Total Annualized Base Rent % of Annualized Base Rent Annualized Base Rent per Square Foot Sq.Ft. Delivered 2009 • 6 156,880 1.6 1% $707,715 0.91% $10.05 86,489 2010 13 525,320 5.39% 4,112,170 5.29% 7.83 2011 15 485,334 4.98% 3,856,797 4.96% 7.95 2012 17 742,271 7.62% 4,478,350 5.76% 6.03 2013 27 1,069,912 10.99% 9,140,683 11.75% 8.54 2014 22 1,036,465 10.64% 6,214,857 7.99% 6.00 2015 18 643,264 6.61% 6,030,285 7.75% 9.37 2016 26 1,097,217 11.27% 8,972,654 11.54% 8.18 2017 17 646,197 6.64% 7,965,746 10.24% 12.33 2018 13 652,123 6.70% 5,817,780 7.48% 8.92 2019+ • 35 2,682,241 27.55% 20,481,344 26.33% 7.84 70,989 Total 209 9,737,224 100.00% $77,778,381 100.00% $8.12 157,478 All Non-Anchor Leases Lease Expiration Year Number of Leases Expiring GLA Under Expiring Leases % of Company Owned GLA Total Annualized Base Rent % of Annualized Base Rent Annualized Base Rent per Square Foot Sq.Ft. Delivered 2009 • 118 301,811 6.56% $4,055,120 5.46% $13.78 7,488 2010 • 227 693,496 15.08% 10,540,863 14.19% 15.41 9,543 2011 268 898,711 19.54% 14,290,799 19.23% 15.90 2012 • 240 749,851 16.31% 12,901,449 17.36% 17.26 2,317 2013 • 173 548,233 11.92% 10,026,977 13.50% 18.34 1,400 2014 • 131 480,796 10.45% 7,226,854 9.73% 16.18 34,035 2015 36 195,676 4.25% 3,110,528 4.19% 15.90 2016 • 43 244,320 5.31% 4,558,789 6.14% 18.77 1,400 2017 28 117,333 2.55% 2,289,248 3.08% 19.51 2018 25 128,742 2.80% 2,008,465 2.70% 15.60 2019+ • 33 239,828 5.23% 3,291,905 4.42% 15.17 22,809 Total 1,322 4,598,797 100.00% $74,300,997 100.00% $16.44 78,992 • One or more Units are delivered, and therefore are excluded from the Annualized Base Rent Per Square Foot calculation. Supplemental Financial and Operating Statistics Q2 2009 Ramco-Gershenson Properties Trust (RPT) Page 28

Joint Ventures Contribution to Funds from Operations (in thousands) For Six Months Ended June 30, 2009 Ramco/Lion Ramco 450 Ramco 191 Ramco Ramco Hartland River City Southfield Venture LP Venture LLC Venture LLC HHF KL LLC HHF NP LLC Towne Square North Ind Plaza Expansion Consolidated Consolidated Consolidated Consolidated Indianapolis, IN Hartland, MI Jacksonville, FL Southfield, MI West Acres Commons Flint, MI Shenandoah Square Davie, FL Ramco Consolidated Interest Total revenue $ 26,941 $ 16,310 $ 901 $ 2,363 $ 1,316 $ 116 $ - $ 142 $ 767 $ 1,433 $ 12,756 Operating expense 8,805 5,990 247 698 506 69 3 53 255 606 $ 4,358 Depreciation and amortization 7,042 5,308 362 645 331 87 1 19 140 290 $ 3,514 Interest expense 8,029 6,339 82 - - - - 30 355 442 $ 4,027 Total expenses 23,876 17,637 691 1,343 837 156 4 102 750 1,338 11,899 Net income (loss) $ 3,065 $ (1,327) $ 210 $ 1,020 $ 479 $ (40) $ (4) $ 40 $ 17 $ 95 $ 857 Ramco ownership interest 30% 20% 20% 7% 7% 20% 5% 50% 40% 40% Ramco's share of net income (loss) $ 920 $ (266) $ 42 $ 71 $ 33 $ (8) $ - $ 20 $ 7 $ 38 $ 857 Add: depreciation expense 2,020 1,005 68 45 23 - - 10 55 114 3,340 Funds from operations contributed $ 2,940 $ 739 $ 110 $ 116 $ 56 $ (8) $ - $ 30 $ 62 $ 152 $ 4,197 by joint ventures For Three Months Ended June 30, 2009 Ramco/Lion Ramco 450 Ramco 191 Ramco Ramco Hartland River City Southfield West Acres Venture LP Venture LLC Venture LLC HHF KL LLC HHF NP LLC Towne Square North Ind Plaza Commons Consolidated Consolidated Consolidated Consolidated Indianapolis, IN Hartland, MI Jacksonville, FL Southfield, MI Flint, MI Shenandoah Square Davie, FL Ramco Consolidated Interest Total revenue $ 13,319 $ 7,958 $ 454 $ 1,185 $ 661 $ 97 $ - $ 70 $ 394 $ 666 $ 6,286 Operating expense 4,326 3,074 126 341 233 64 1 28 125 334 $ 2,189 Depreciation and amortization 3,503 2,609 183 320 167 43 1 9 70 121 $ 1,733 Interest expense 4,032 3,207 43 - - - - - 15 178 222 $ 2,027 Total expenses 11,861 8,890 352 661 400 107 2 52 373 677 5,949 Net income (loss) $ 1,458 $ (932) $ 102 $ 524 $ 261 $ (10) $ (2) $ 18 $ 21 $ (11) $ 337 Ramco ownership interest 30% 20% 20% 7% 7% 20% 5% 50% 40% 40% Ramco's share of net income (loss) $ 437 $ (186) $ 20 $ 37 $ 18 $ (2) $ - $ 9 $ 8 $ (4) $ 337 Add: depreciation expense 1,008 490 35 22 12 - - 5 27 47 1,646 Funds from operations contributed $ 1,445 $ 304 $ 55 $ 59 $ 30 $ (2) $ - $ 14 $ 35 $ 43 $ 1,983 by joint ventures

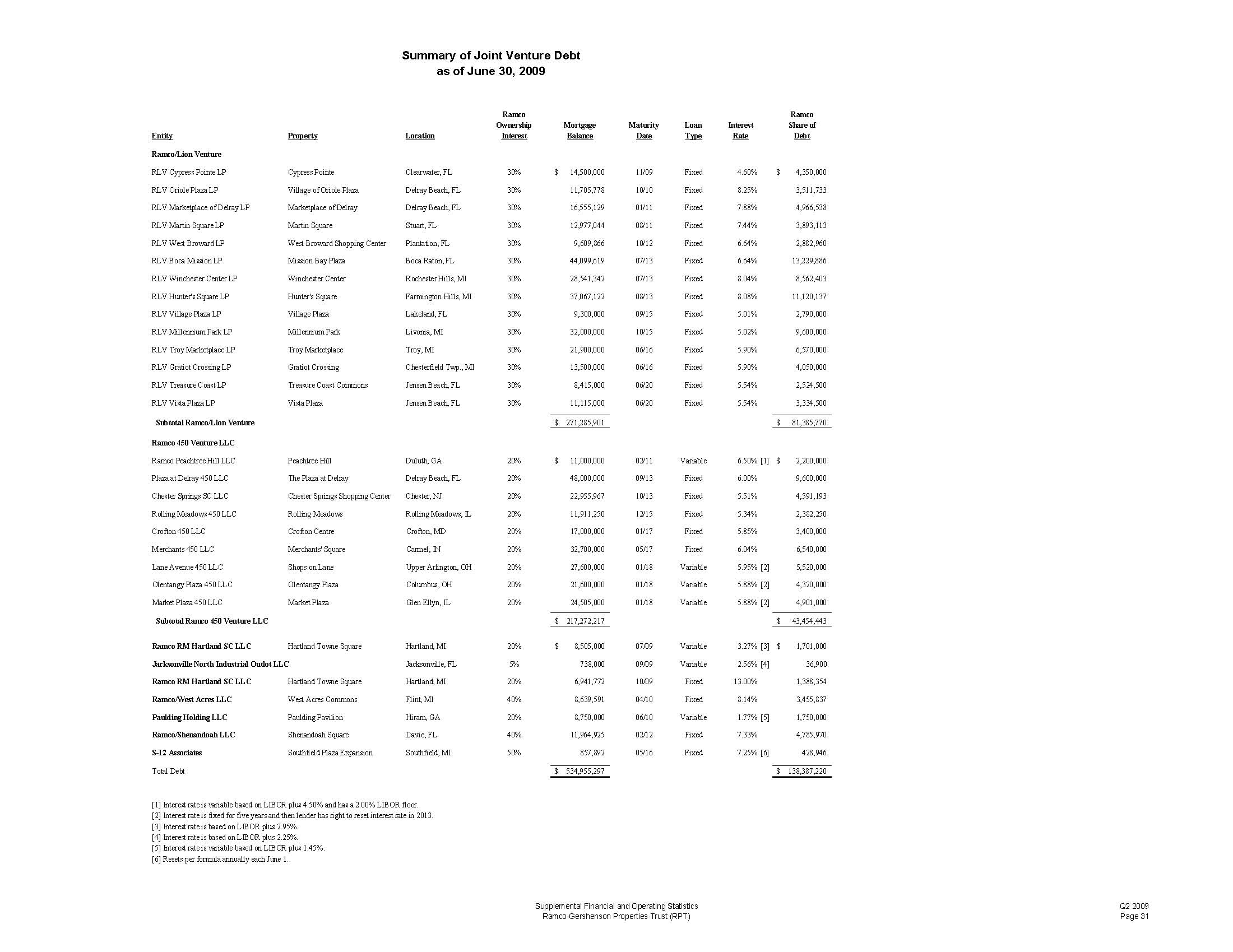

Joint Ventures Combining Balance Sheets as of June 30, 2009 (in thousands) Ramco/Lion Venture LP Ramco/Lion Venture LP Consolidated Ramco 450 Venture LLC Ramco 450 Venture LLC Consolidated Ramco 191 Venture LLC Ramco 191 Venture LLC Consolidated Ramco Ramco Ramco RM HHF KL LLC HHF NP LLC Hartland SC LLC Ramco Ramco Hartland HHF KL LLC HHF NP LLC Towne Square Consolidated Indianapolis, IN Hartland, MI Ramco Jacksonville S-12 North Industrial LLC Associates River City Southfield North Ind Plaza Expansion Jacksonville, FL Southfield, MI Ramco/ West Acres LLC West Acres Commons Flint, MI Ramco/ Shenandoah LLC Shenandoah Square Davie, FL Ramco Equity Investment ASSETS Investment in real estate Land $ 76,891 $ 51,760 $ 2,879 $ 7,600 $ 4,019 $ 7,387 $ 1,127 $ 50 $ 1,118 $ 1,653 Buildings and improvements 457,615 302,036 19,432 44,588 23,510 - - - 446 10,104 15,188 Construction in progress 6,247 1,779 453 14 - 11,433 97 - - - Intangible assets, net 14,440 8,131 856 1,164 533 2,107 30 29 40 235 555,193 363,706 23,620 53,366 28,062 20,927 1,254 525 11,262 17,076 Less: accumulated depreciation (41,390) (14,044) (878) (2,306) (1,103) - - (147) (1,976) (2,913) Investments in real estate, net 513,803 349,662 22,742 51,060 26,959 20,927 1,254 378 9,286 14,163 Cash and cash equivalents 10,220 11,213 634 509 553 25 13 137 328 878 Accounts receivable, net 9,838 3,356 284 245 - 33 - 45 115 316 Other assets, net 2,746 1,461 120 13 247 - - 109 93 182 Total Assets $ 536,607 $ 365,692 $ 23,780 $ 51,827 $ 27,759 $ 20,985 $ 1,267 $ 669 $ 9,822 $ 15,539 LIABILITIES AND SHAREHOLDERS' EQUITY Mortgages and notes payable $ 271,286 $ 217,272 $ 8,750 $ - $ - $ 15,447 $ 738 $ 858 $ 8,639 $ 11,965 Accounts payable and accrued expenses 16,451 9,614 227 647 507 1,868 - 251 246 489 287,737 226,886 8,977 647 507 17,315 738 1,109 8,885 12,454 ACCUMULATED EQUITY (DEFICIT) 248,870 138,806 14,803 51,180 27,252 3,670 529 (440) 937 3,085 Total Liabilities and Accumulated Equity $ 536,607 $ 365,692 $ 23,780 $ 51,827 $ 27,759 $ 20,985 $ 1,267 $ 669 $ 9,822 $ 15,539 EQUITY INVESTMENTS IN AND ADVANCES TO UNCONSOLIDATED AFFILIATES Equity Investments in Unconsolidated Entities $ 69,888 $ 15,699 $ 3,410 $ 2,817 $ 1,948 $ 719 $ 10 $ 927 $ 333 $ 1,192 $ 96,943 Advances to Unconsolidated Entities - - - - - 6,942 738 - - - 7,680 Total Equity Investments in and Advances to Unconsolidated Entities $ 69,888 $ 15,699 $ 3,410 $ 2,817 $ 1,948 $ 7,661 $ 748 $ 927 $ 333 $ 1,192 $ 104,623 Supplemental Financial and Operating Statistics Q2 2009 Ramco-Gershenson Properties Trust (RPT) Page 30