SCHEDULE 14A

PROXY STATEMENT

PURSUANT TO SECTION 14(A) OF THE SECURITIES EXCHANGE ACT OF 1934

(Amendment No. 1)

Filed by Registrant [X]

Filed by Party other than the Registrant

Check the appropriate box:

| [ ] | Preliminary Proxy Statement |

| [ ] | Confidential for Use of the Commission Only as permitted by Rule 14a-6(e)(2) |

| [X] | Definitive Proxy Statement |

| [ ] | Definitive Additional Materials |

| [ ] | Soliciting Material Pursuant to Rule 14a-11c or Rule 14a-12 |

| | Alpine Equity Trust | |

| (Name of Registrant as Specified in Its Charter) |

| |

| (Name of Person(s) Filing Proxy Statement) |

Payment of Filing Fee (Check the appropriate box):

[X] No fee required

[ ] Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11

| (1) | | Title of each class of securities to which transaction applies: |

| | | |

| (2) | | Aggregate number of securities to which transaction applies: |

| |

| (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11. (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

| (4) | | Proposed maximum aggregate value of transaction: |

| |

| (5) | | Total fee paid: |

[ ] Fee paid previously with preliminary materials.

[ ] Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

| (1) | | Amount previously paid: |

| | | |

| (2) | | Form, Schedule or Registration Statement No.: |

| (3) | | Filing Party: |

| |

| (4) | | Date Filed: |

EXPLANATORY NOTE

We are filing this Amendment #1 to the definitive proxy statement (the “Original Filing”) filed with the Securities and Exchange Commission on February 17, 2015 to reflect the correct proxy voting options of either by mail or by telephone (live operator). No other information, besides the voting options, has been changed. We will print and distribute to our shareholders this revised definitive proxy statement in lieu of the Original Filing.

ALPINE EQUITY TRUST Alpine Global Consumer Growth Fund |

c/o Boston Financial Data Services, Inc.

PO Box 8061

Boston, MA 02266

1-888-785-5578

February 17, 2015

Dear Shareholder:

The Special Meeting of Shareholders (the “Meeting”) of Alpine Global Consumer Growth Fund (the “Fund”), a series of Alpine Equity Trust, will be held on March 19, 2015 at 10:30 a.m. Eastern Time, at 2500 Westchester Avenue, Purchase, New York 10577. A Notice of the Special Meeting of Shareholders, Proxy Statement regarding the Meeting, proxy card for your vote, and postage prepaid envelope in which to return your proxy card are enclosed.

The matter on which you, as a shareholder of the Fund, are being asked to consider and vote is a Plan of Liquidation (the “Plan”) under which the assets of the Fund will be liquidated and all outstanding shares redeemed. The Board of Trustees (the “Board”) believes that this proposal is in the best interests of the Fund and its shareholders, and unanimously recommends that you vote “FOR” the Plan.

Detailed information about the proposal is contained in the enclosed materials. Please exercise your right to vote by completing, dating and signing the enclosed proxy card. A self-addressed, postage-paid envelope has been enclosed for your convenience. It is very important that you vote and that your voting instructions be received as soon as possible.

If you have any questions after considering the enclosed materials, please call 1-800-331-7543.

| | Alpine Equity Trust, on behalf of Alpine Global Consumer Growth Fund |

| | |

| | Respectfully, |

| | |

| | |

| | |

| | Samuel A. Lieber |

| | President |

ALPINE EQUITY TRUST

Alpine Global Consumer Growth Fund

NOTICE OF THE SPECIAL MEETING OF SHAREHOLDERS

February 17, 2015

To the Shareholders of Alpine Global Consumer Growth Fund:

NOTICE IS HEREBY GIVEN that the Special Meeting of Shareholders (the “Meeting”) of Alpine Global Consumer Growth Fund will be held on March 19, 2015 at 2500 Westchester Avenue, Purchase, New York 10577, beginning at 10:30 a.m. Eastern Time, for the following purposes:

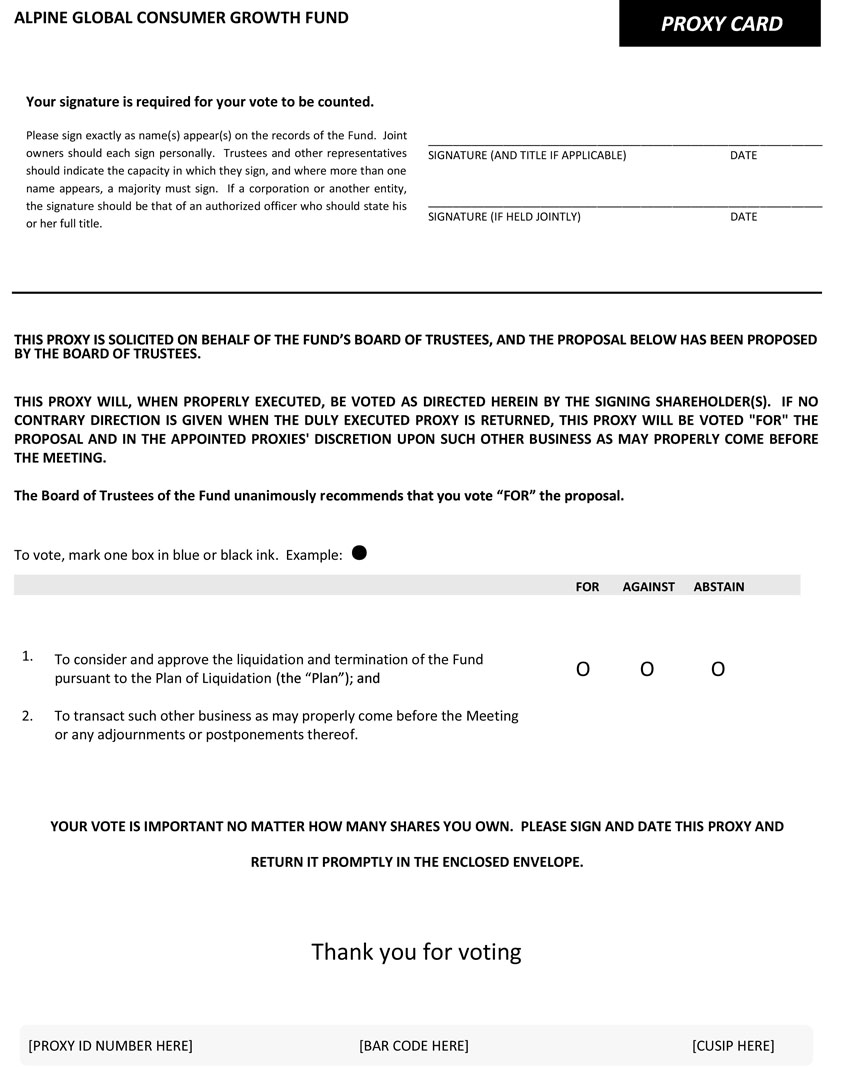

| | | 1. To consider and approve the liquidation and termination of the Fund pursuant to the Plan of Liquidation (the “Plan”); and 2. To transact such other business as may properly come before the Meeting or any adjournments or postponements thereof. |

The Board of Trustees (the “Board”) has fixed the close of business on January 7, 2015 as the record date for the determination of Shareholders entitled to notice of and to vote at the Meeting or any adjournments or postponements thereof.

You are cordially invited to attend the Meeting. Shareholders who do not expect to attend the Meeting in person are requested to vote by telephone or by completing, dating and signing the enclosed proxy card and returning it promptly in the envelope provided for that purpose. You may nevertheless vote in person at the Meeting if you choose to attend. The enclosed proxy is being solicited by the Board.

| | By order of the Board, |

| | |

| | |

| | |

| | Samuel A. Lieber |

| | President |

ALPINE EQUITY TRUST

Alpine Global Consumer Growth Fund

c/o Boston Financial Data Services, Inc.

PO Box 8061

Boston, MA 02266

1-888-785-5578

_______________

PROXY STATEMENT

_______________

INTRODUCTION

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Trustees (the “Board”) of Alpine Equity Trust (the “Trust”) on behalf of Alpine Global Consumer Growth Fund (the “Fund”) for use at the Special Meeting of Shareholders (the “Meeting”), to be held on March 19, 2015 at 2500 Westchester Avenue, Purchase, New York 10577, at 10:30 a.m. Eastern Time, and at any adjournments or postponements thereof.

This Proxy Statement and proxy card are being mailed to shareholders of record at the close of business on January 7, 2015 on or about February 17, 2015. Any shareholder giving a proxy has the power to revoke it prior to its exercise by submitting a superseding proxy by phone or mail following the process described on the proxy card or by submitting a notice of revocation to the Trust or in person at the Meeting. A proxy purporting to be executed by or on behalf of a shareholder shall be deemed valid unless challenged at or prior to its exercise, with the burden of proving invalidity resting on the challenger.

In order to transact business at the Meeting, a “quorum” must be present. Under the Trust’s By-Laws, a quorum is constituted by the presence in person or by proxy of shareholders representing a majority of the shares of the Fund issued and outstanding and entitled to vote on a matter.

Abstentions and broker non-votes (i.e., proxies from brokers or nominees indicating that they have not received instructions from the beneficial owners on an item for which the brokers or nominees do not have discretionary power to vote) will be treated as present for determining whether a quorum is present with respect to a particular matter. Abstentions and broker non-votes will not, however, be treated as votes cast at the Meeting.

The chairman of the Meeting shall have the power to adjourn the Meeting without further notice other than announcement at the Meeting. The Board of Trustees also has the power to postpone the Meeting to a later date and/or time in advance of the Meeting. Abstentions and broker non-votes will have the same effect at any adjourned or postponed meeting as noted above. Any business that might have been transacted at the Meeting may be transacted at any such adjourned or postponed session(s) at which a quorum is present.

Written notice of an adjournment of the Meeting, stating the place, date and hour thereof, shall be given to each shareholder entitled to vote thereat, at least ten (10) days prior to the Meeting, if the Meeting is adjourned to a date more than one hundred twenty (120) days after the original record date set for the Meeting.

The following proposal will be considered and acted upon at the Meeting: To approve the liquidation and termination of the Fund pursuant to the Plan of Liquidation (the “Plan”).

The Board of Trustees have fixed the close of business on January 7, 2015 as the record date for the determination of shareholders entitled to notice of and to vote at the Meeting and at any adjournments or postponements thereof. Shareholders on the record date will be entitled to one vote for each share held, with no shares having cumulative voting rights. As of the record date, the Fund had the following shares outstanding and entitled to vote at the Meeting:

| Name of Fund | Number of Shares Outstanding and Entitled to Vote |

| Alpine Equity Trust | Class A | Institutional Class |

| Alpine Global Consumer Growth Fund | 13,808 | 211,242 |

Management of the Trust knows of no item of business other than that mentioned in the Notice of the Special Meeting of Shareholders that will be presented for consideration at the Meeting.

The Trust will furnish, without charge, copies of its annual report for the fiscal year ended October 31, 2014 to any shareholder requesting such a report. Requests for an annual or semi-annual report should be made by contacting Alpine Funds c/o Boston Financial Data Services, Inc., PO Box 8061, Boston, MA 02266, by accessing the Fund’s website at www.alpinefunds.com or by calling 1-888-785-5578.

IMPORTANT INFORMATION

The Proxy Statement discusses important matters affecting the Fund. Please take the time to read the Proxy Statement, and then cast your vote. There are multiple ways to vote. Choose the method that is most convenient for you. To vote by telephone, follow the instructions provided on the proxy card. To vote by mail simply fill out the proxy card and return it in the enclosed postage-paid reply envelope. Please do not return your proxy card if you vote by telephone. To vote in person, attend the Meeting and cast your vote. The Meeting will be held at 2500 Westchester Avenue, Purchase, New York 10577. To obtain directions to the Meeting, please call 1-888-785-5578. Properly executed proxies will be voted as instructed on the proxy card. In the absence of such direction, executed proxies received prior to the Meeting or any adjournment thereof will be voted “FOR” the Proposal. Proxy holders may vote in their discretion with respect to any other matters properly coming before the Meeting.

PROPOSAL

APPROVAL OF THE LIQUIDATION OF THE FUND

At a meeting held on December 18, 2014, the Board, upon the recommendation of Alpine Woods Capital Investors, LLC (“Alpine”), determined that it would be in the best interest of the Fund’s shareholders if the Fund were liquidated in accordance with the Trust’s organizational documents and Massachusetts law. Accordingly, the Board approved the liquidation of the Fund pursuant to the Plan. A copy of the Plan is attached to this proxy statement as Appendix A.

The Plan provides for the liquidation of the Fund’s assets and the distribution to Fund shareholders of all of the proceeds of the liquidation. If the shareholders of the Fund approve the proposal, the Fund’s net proceeds (after deduction for all charges, taxes, expenses and liabilities of the Fund) will be distributed pro rata to all shareholders of record at the time of the distribution, which is expected to occur in the first quarter of 2015.

Shareholder approval of the Fund’s liquidation is required before the Fund can proceed with liquidation of its assets. For the reasons set out below, the Board has unanimously recommended that shareholders vote to approve this Proposal calling for the liquidation of the Fund.

Summary of Reasons for Liquidation

The Trustees believe, based upon the information provided by Alpine, that the liquidation of the Fund is in the best interests of the Fund and its shareholders for the following reasons:

| · | The Fund had net assets of approximately $2.81 million as of September 30, 2014; |

| · | In light of the recent performance record of the Fund, it is unlikely that the Fund will grow significantly from its current size; and |

| · | Possible alternatives to liquidation, including the merger of the Fund into another mutual fund, are not practical under the current circumstances and may not be advantageous to the Fund and its shareholders. |

Board Considerations

Alpine reviewed with the Board the performance and asset size of the Fund. Alpine has advised the Board that it does not anticipate, in the foreseeable future, that the Fund will grow significantly from its current size. With low asset levels and minimal prospects for future growth, the Fund is no longer viable and therefore Alpine has recommended to the Board that the Fund be liquidated.

The Board considered other alternatives for the Fund. Alpine reviewed with the Board whether merging the Fund with another series of the Trust or another individual fund would produce desirable results for shareholders. The Board discussed the relatively small size of the Fund, the time and effort, and expense required to effect such a transaction. The Board determined that any potential benefits to the Fund and its shareholders do not justify the costs involved with preparing the agreement and plan of reorganization and a Form N-14 prospectus/proxy statement and the other costs of holding a special shareholder meeting. The Board determined that there are no viable alternatives to liquidation.

Based on their consideration, analysis and evaluation of the above factors and Alpine’s recommendation, the Board (including the Board members who are not “interested persons” (the “Independent Trustees”) as defined in the Investment Company Act of 1940, as amended (the “1940 Act”)) concluded that the liquidation of the Fund is in the best interests of the Fund and its shareholders. The Board then adopted resolutions approving the Plan, declaring the proposed liquidation advisable and directing that it be submitted to the shareholders for consideration.

In the event that the shareholders do not approve the Plan, the Board will continue to search for other alternatives for the Fund, which could include resoliciting shareholders.

Plan of Liquidation

The Board has approved the Plan, which is effective upon approval by the Fund’s shareholders. The Plan is attached to this Proxy Statement as Appendix A and summarized below. This summary is qualified in its entirety by reference to the Plan.

| 1. | Adoption of the Plan. The Plan shall become effective upon its adoption and approval (the “Adoption Date”) by the affirmative vote of a “majority of the outstanding voting securities” of the Fund, as defined in the Declaration of Trust and the 1940 Act. The Plan provides that the Fund will cease to conduct business as soon as reasonably practicable following the Adoption Date. |

| 2. | Liquidating the Fund’s Assets. Within the period beginning on the Adoption Date and ending on the date of the final liquidating distribution of the Fund’s assets (the “Liquidation Period”), the Fund shall engage in such transactions as may be necessary or appropriate to effect the orderly sale or other disposition of the Fund’s assets. It is the intention of the Fund that all Fund property be liquidated as promptly as possible, but in such a manner as to maximize the proceeds of such liquidation and in the best interests of shareholders. |

| 3. | Distribution to Shareholders. Following the liquidation of the Fund’s assets, and after all charges, taxes, expenses and liabilities of the Fund have been paid or provided for, the liquidation proceeds will be distributed pro rata to all shareholders of record at the time of the distribution. |

| 4. | Amendment or Abandonment of the Plan. The Board has the authority to authorize such variations from, or amendments of, the provisions of the Plan as may be necessary or appropriate to give effect to the dissolution, winding up, liquidation and termination of the Fund and the distribution of the Fund property to shareholders in accordance with the purposes to be accomplished by this Plan. In addition, the Board may abandon this Plan by a majority vote of the Board at any time prior to the completion of the Liquidation Period. |

General Tax Consequences

Payment by the Fund of liquidation distributions to shareholders will be a taxable event. Shareholders will be viewed as having sold their Fund shares for an amount equal to the liquidation distribution(s) he or she receives. Each shareholder will recognize gain or loss in an amount equal to the difference between (a) the shareholder’s adjusted basis in the Fund shares, and (b) such liquidation distribution(s). The gain or loss will be capital gain or loss to the shareholder if the Fund shares were capital assets in the shareholder’s hands. Such gain or loss will generally be treated as long-term if the Fund shares were held for more than one year at the time of the liquidation distribution or as short-term if the Fund shares were held for one year or less.

An Individual Retirement Account (an “IRA”) is generally not taxable on investment income and gain from the Fund (assuming that the IRA did not incur debt to finance its investment in the Fund). Accordingly, the receipt by an IRA of a liquidating distribution should not be a taxable event for the IRA. However, if the IRA beneficiary receives the liquidating distribution (as opposed to the IRA reinvesting the liquidating distribution), then the liquidating distribution may be taxable to the IRA beneficiary. An IRA beneficiary may roll the liquidating distribution into another IRA within sixty (60) days of the date of the distribution in order to avoid having to include the liquidating distribution in his or her taxable income for the year. IRA owners should promptly provide instructions to the Fund with respect to a rollover of the liquidating distribution. For more information, IRA owners should contact Alpine Funds c/o Boston Financial Data Services, Inc., PO Box 8061, Boston, MA 02266, or by calling 1-888-785-5578.

Shareholders should consult their tax advisors to determine the federal, state, and other income tax consequences of receiving the liquidating distribution with respect to their particular tax circumstances.

What vote is required to approve the proposed liquidation of the Fund?

Under the Trust’s Declaration of Trust, the liquidation of the Fund requires the affirmative vote of the lesser of: (1) 67% or more of the Fund’s shares represented at the meeting if the holders of more than 50% of the outstanding shares are present in person or by proxy; or (2) more than 50% of the Fund’s outstanding shares. Shareholders of all classes of the Fund vote together on the proposal affecting the Fund. You should be aware that the principals of the Investment Adviser, their family members and the Investment Adviser’s affiliates beneficially own and have voting authority over more than 50% of the Fund’s outstanding voting securities (as of January 7, 2015), and such shares are expected to be voted in favor of the Proposal, which will control the outcome of the vote. Shares of the Fund held by institutes and charitable trusts overseen by the principals of the Investment Adviser, but for which they do not maintain a beneficial ownership interest, will be voted in proportion to the total votes received from shareholders who are not principals of the Investment Adviser, their family members or affiliates of the Investment Adviser.

The Board of Trustees of the Fund, including the Fund’s Independent Trustees, recommends that shareholders of the Fund vote FOR the proposal.

If the Proposal is approved, the Fund will proceed to liquidate pursuant to the Plan, as described above. If the Proposal is not approved, the Board of Trustees will consider whether any other action is appropriate in the interests of the Fund’s shareholders.

GENERAL INFORMATION

MANAGEMENT AND OTHER SERVICE PROVIDERS

Investment Adviser

Alpine Woods Capital Investors, LLC, located at 2500 Westchester Avenue, Suite 215, Purchase, New York 10577, serves as the investment adviser to the Fund.

Administrator and Transfer Agent

State Street Bank and Trust Company (“State Street”), located at One Lincoln Street, Boston, Massachusetts 02111, serves as the administrator for the Fund pursuant to an administration agreement. State Street also serves as the Fund’s Custodian.

The Fund’s transfer and dividend disbursing agent is Boston Financial Data Services, Inc. (“BFDS”), 2000 Crown Colony Drive, Quincy, Massachusetts 02169.

Distributor

Quasar Distributors, LLC, located at 615 East Michigan Street, Milwaukee, Wisconsin 53202, serves as the distributor of the Fund’s shares pursuant to a Distribution Agreement with the Trust.

OTHER BUSINESS

The Board does not intend to present any other business at the Meeting. If, however, any other matters are properly brought before the Meeting, the persons named in the accompanying form of proxy will vote thereon in accordance with their judgment.

SUBMISSION OF SHAREHOLDER PROPOSALS

The Fund does not hold annual shareholder meetings.

Any shareholder intending to submit a proposal to be presented at a meeting of shareholders may transmit such proposal to the Trust (addressed to Alpine Equity Trust, c/o Andrew Pappert, Secretary of the Trust, Alpine Woods Capital Investors, LLC, 2500 Westchester Avenue, Suite 215, Purchase, New York 10577) to be received within a reasonable time before the solicitation of proxies for such meeting in order for such proposal to be considered for inclusion in that proxy statement relating to such meeting. Whether a proposal is included in a proxy statement will be determined in accordance with applicable federal and state law. The timely submission of a proposal does not guarantee its inclusion.

DELIVERY OF PROXY MATERIALS AND ANNUAL REPORTS

To avoid sending duplicate copies of materials to households, please note that only one annual or semi-annual report or proxy statement, as applicable, may be delivered to two or more shareholders of the Fund who share an address, unless the Fund has received instructions to the contrary. A shareholder may provide such instructions by contacting the Fund at the address or phone number listed below. A shareholder may obtain additional copies of the Notice of the Special Meeting of Shareholders, Proxy Statement and proxy card by accessing www.proxyonline.com/docs/awcgx.pdf or by calling 1-800-331-7543. Requests for an annual or semi-annual report should be made by contacting Alpine Funds c/o Boston Financial Data Services, Inc., PO Box 8061, Boston, MA 02266, by accessing the Fund’s website at www.alpinefunds.com or by calling 1-888-785-5578.

PROXY SOLICITATION

Proxies will be solicited by the Fund primarily via the internet and by phone or in some cases by mail. In addition, the Fund retained AST Fund Solutions, LLC to assist in the solicitation of proxies for a fee of approximately $1,000 plus reimbursement of expenses. The Investment Adviser will pay the costs of the proxy solicitation and the expenses incurred in connection with preparing, printing and mailing the Proxy Statement and its enclosures. Although it is not anticipated, the solicitation may also include telephone, facsimile, electronic or oral communications by certain officers of the Trust or employees of the Investment Adviser, or State Street, the Fund’s administrator, who will not be paid for these services. The Fund, the Investment Adviser or State Street may also request broker-dealer firms, custodians, nominees and fiduciaries to forward proxy materials to the beneficial owners of the shares of the Fund held of record by such persons. If requested, the Fund shall reimburse such broker-dealer firms, custodians, nominees and fiduciaries for their reasonable expenses incurred in connection with such proxy solicitation, including reasonable expenses in communicating with persons for whom they hold shares of the Fund.

ADJOURNMENTS/POSTPONEMENTS

In order to transact business at the Meeting, a “quorum” must be present. Under the Trust’s By-Laws, a quorum is constituted by the presence in person or by proxy of shareholders representing a majority of the shares of the Fund issued and outstanding and entitled to vote on a matter.

In the event a quorum is not present at the Meeting or in the event that that sufficient votes in favor of the proposal set forth in the Notice of this Meeting are not received by March 12, 2015, the persons named as proxies in the enclosed proxy may propose one or more adjournments of the Meeting to permit further solicitation of proxies. The Boards of Trustees may also postpone the Meeting in advance of such Meeting to a later date and/or time.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

Set forth in Appendix B is information with respect to persons who are registered as beneficial owners of more than 5% of any class of the Fund’s voting securities as of January 7, 2015.

| | By order of the Board, |

| | |

| | |

| | |

| | Samuel A. Lieber |

| | President |

February 17, 2015

APPENDIX A

PLAN OF LIQUIDATION AND TERMINATION

OF

ALPINE GLOBAL CONSUMER GROWTH FUND

This Plan of Liquidation and Termination (this “Plan”) is intended to accomplish the complete liquidation and termination of Alpine Global Consumer Growth Fund (the “Fund”), a series of Alpine Equity Trust, a Massachusetts business trust (the “Trust”), in accordance with applicable law and pursuant to the terms of the Declaration of Trust, dated October 26, 1988, as amended (the “Declaration of Trust”) and the Internal Revenue Code of 1986, as amended (the “Code”).

WHEREAS, the Board of Trustees (the “Board”), at a meeting held on December 18, 2014 has determined that it is in the best interests of the Fund and the shareholders of the Fund to liquidate and terminate the Fund; and

WHEREAS, the Board has adopted this Plan as the method of liquidating and terminating the Fund and directed that this Plan be submitted to shareholders of the Fund for approval in accordance with applicable law and the Declaration of Trust.

NOW, THEREFORE, the liquidation and termination of the Fund shall be carried out in the manner hereinafter set forth:

1. This Plan shall become effective upon its adoption and approval (the “Adoption Date”), at a meeting of shareholders called for the purpose of voting thereon, by the affirmative vote of a “majority of the outstanding voting securities” of the Fund, as defined in the Declaration of Trust and the Investment Company Act of 1940, as amended (the “1940 Act”).

2. The officers of the Fund (the “Authorized Officers”) shall have the responsibility, and are authorized and empowered, to take such actions under this Plan on or after the Adoption Date, as may be necessary or appropriate to implement this Plan and to oversee the complete liquidation and winding up of the Fund pursuant hereto.

3. Following the Adoption Date, the Fund shall undertake to:

(a) cease pursuing its investment objective;

(b) settle and close its business and wind up its affairs in an organized and deliberate manner, including notifying its service providers of the termination of their agreements with respect to the Fund;

(c) apply and distribute the proceeds of such liquidation in order to discharge or make reasonable provision for the Fund’s claims and obligations. If there are insufficient proceeds or assets, any claims or obligations of the Fund shall be paid or provided for according to their priority and, among claims and obligations of equal priority, ratably to the extent of proceeds or assets available therefor;

(d) (i) declare and pay dividends including, without limitation, liquidating distributions (all in such amounts and from such sources as determined by the Authorized Officers) on the outstanding shares, (ii) pay all previously declared dividends, if any, that remain unpaid, and (iii) classify and report the tax character of all such dividends and distributions, each only to the extent any assets or proceeds remain after paying or making reasonable payment for all claims or obligations of the Fund;

(e) hold the proceeds of the orderly liquidation of the Fund’s assets in cash or cash equivalents during the Liquidation Period (defined below);

(f) distribute any remaining property in cash or in kind or partly in each (after paying or adequately providing for the payment of all debts and liabilities of the Fund) among the shareholders of the Fund pro rata, only to the extent any assets or proceeds remain after paying or making reasonable payment for all claims or obligations of the Fund; and

(g) prepare, execute and file necessary or appropriate paperwork, if any, with the Commonwealth of Massachusetts, the United States Securities and Exchange Commission, and such other governmental or self-regulatory entities as may be required in connection with the termination of the Fund.

4. To assist in effecting the complete dissolution, liquidation, winding-up and termination of the Fund in accordance with applicable law, the Declaration of Trust and this Plan, the Authorized Officers are hereby authorized and empowered to delegate any of their duties and responsibilities, as such Authorized Officers deem appropriate, to any adviser, administrator, custodian, transfer agent, distributor or other service provider pursuant to its applicable service agreement with respect to the Fund.

5. Within the period beginning on the Adoption Date and ending on the date of the final liquidating distribution of the Fund’s assets (the “Liquidation Period”) as provided herein, the Fund’s investment adviser, or such other person or persons as the Authorized Officers shall determine, shall have the authority to engage in such transactions as may be necessary or appropriate to effect the orderly sale or other disposition of the Fund’s assets. It is the intention of the Fund that all Fund property be liquidated as promptly as possible, but in such a manner as to maximize the proceeds of such liquidation and in the best interests of shareholders. Accordingly, liquidation of Fund property may be deferred for a reasonable time as determined by the Authorized Officers in consultation with the Board.

6. After the Adoption Date, the Fund shall carry on no business except for the purpose of winding up its affairs, liquidating any and all property which is owned by or held for the account of the Fund, paying, discharging or making reasonable provision for the payment of all of the Fund’s claims, obligations and liabilities, whether accrued, contingent, conditional, unmatured, expected, unascertained or otherwise, and distributing the remaining Fund assets in complete distribution of the net assets of the Fund to the outstanding shareholders as provided in this Plan and the Declaration of Trust. Notwithstanding anything else set forth herein, the Fund may (a) hold its cash in high-quality, short-term investments to preserve the value of such cash (pending its distribution), such as, but not limited to, demand deposits, money market funds (including affiliated money market funds) or overnight “sweep” accounts, and (b) honor redemption requests if and as required under the 1940 Act and relevant exemptive relief.

7. Within the Liquidation Period, the Fund shall pay or discharge, or set aside cash, securities or other assets for the payment or discharge of, or to otherwise provide for, its claims, liabilities and obligations, including accrued, contingent, conditional, unmatured, expected, or unascertained claims, liabilities and obligations determined or otherwise reasonably estimated to be due either by an Authorized Officer or a court of competent jurisdiction, including among the foregoing, and without limiting the generality of the foregoing, administrative and investment advisory expenses, interest, penalties, taxes, assessments and public charges of every kind and nature.

(a) The proceeds of any liquidated Fund property shall be distributed to discharge the expenses of liquidation and the other liabilities of the Fund in the order of priorities stated in the Declaration of Trust and as may be required by applicable law.

(b) The Authorized Officers, in consultation with the Board, may establish a special reserve for the Fund at any time to ensure the Fund has sufficient assets to discharge any present or future liability, claim or obligation.

8. The Fund shall notify the appropriate parties, other than the shareholders of the Fund, of its impending dissolution and liquidation as soon as practicable after the date hereof, if such notice has not already been provided.

9. The Authorized Officers are authorized to approve such changes to the terms of any of the transactions referred to herein, and to interpret any of the provisions of this Plan. The Authorized Officers and the Board shall have authority to do or authorize any or all acts and things as they may consider necessary or desirable to carry out the purposes of effecting the complete dissolution, liquidation, winding up and termination of the Fund in accordance with applicable law, the Declaration of Trust and this Plan, including, without limitation, the execution, delivery and, as applicable, filing of all agreements, deeds, conveyances, assignments, certificates, documents, instruments, information returns, tax returns, forms and other papers that may be necessary or appropriate to implement this Plan or that may be required by the provisions of Massachusetts law, the Declaration of Trust, the 1940 Act, the Securities Act of 1933, as amended, the Securities Exchange Act of 1934, as amended, the Code, or other applicable laws. Subject to the provisions of Massachusetts law, the 1940 Act, the Declaration of Trust and this Plan, the Authorized Officers or the Board may also take such other actions as they or it determines are necessary or appropriate to facilitate the winding up of the Fund in an orderly and efficient manner. These actions may include the transfer of Fund property into a liquidating trust and the distribution of interests in the liquidating trust to shareholders and such other actions as the Authorized Officers, with the approval of the Board, determine to be in the best interests of shareholders. The Board shall have the authority to authorize such variations from, or amendments of, the provisions of this Plan as may be necessary or appropriate to give effect to the dissolution, winding up, liquidation and termination of the Fund and the distribution of the Fund property to shareholders in accordance with the purposes to be accomplished by this Plan.

10. The Board may abandon this Plan by a majority vote of the Board at any time prior to the completion of the Liquidation Period. Any Authorized Officer is hereby authorized to delay implementation of this Plan or any portion thereof if the officer determines that circumstances so warrant.

11. Upon completion of the Liquidation Period, (i) the Fund shall terminate and cease to be a separate series of the Trust, (ii) the Board and the Trust shall be discharged of any and all further liabilities and duties with respect to the Fund under the Declaration of Trust and (iii) the right, title and interest of all parties with respect to the Fund shall be cancelled and discharged.

12. The dissolution, liquidation, winding up and termination of the Fund, shall not cause the dissolution of the Trust or any other series thereof, and such dissolution, winding up, liquidation or termination of the Fund shall not affect the limitation of liability with respect to any other series of the Trust established in accordance with Massachusetts law.

APPENDIX B

To the knowledge of the Fund’s management, before the close of business on January 7, 2015, the following table sets forth each person (including any “group” as that term is used in Section 13(d) of the Securities Exchange Act of 1934, as amended), known to the Fund to be deemed the beneficial owner of more than five percent (5%) of the outstanding shares of the Fund:

Institutional Class

| Name and Address | % of Shares | Type of Ownership |

| | | |

| Samuel A. Lieber | 47.92% | Beneficial |

| c/o Alpine Woods Capital Investors, LLC | | |

| 2500 Westchester Avenue, Suite 215 | | |

| Purchase, NY 10577 | | |

| | | |

| Stephen A. Lieber | 23.96% | Beneficial |

| c/o Alpine Woods Capital Investors, LLC | | |

| 2500 Westchester Avenue, Suite 215 | | |

| Purchase, NY 10577 | | |

| | | |

| Constance E. Lieber | 23.96% | Beneficial |

| c/o Alpine Woods Capital Investors, LLC | | |

| 2500 Westchester Avenue, Suite 215 | | |

| Purchase, NY 10577 | | |

Class A

| Name and Address | % of Shares | Type of Ownership |

| | | |

| Alpine Woods Capital Investors, LLC | 81.07% | Record |

| 2500 Westchester Avenue, Suite 215 | | |

| Purchase, NY 10577 | | |

| | | |

| NFS FBO Dawn Leverett Trustee Charlotte Westberg Rev Trust | 18.93% | Record |

| 708 Inwood | | |

| Bryan, TX 77802 | | |