Proxy Statement

June 9, 2014

Important Voting Information Inside

The Government Street Funds

The Government Street Equity Fund

The Government Street Mid-Cap Fund

The Alabama Tax Free Bond Fund

Series of Williamsburg Investment Trust

Please vote immediately!

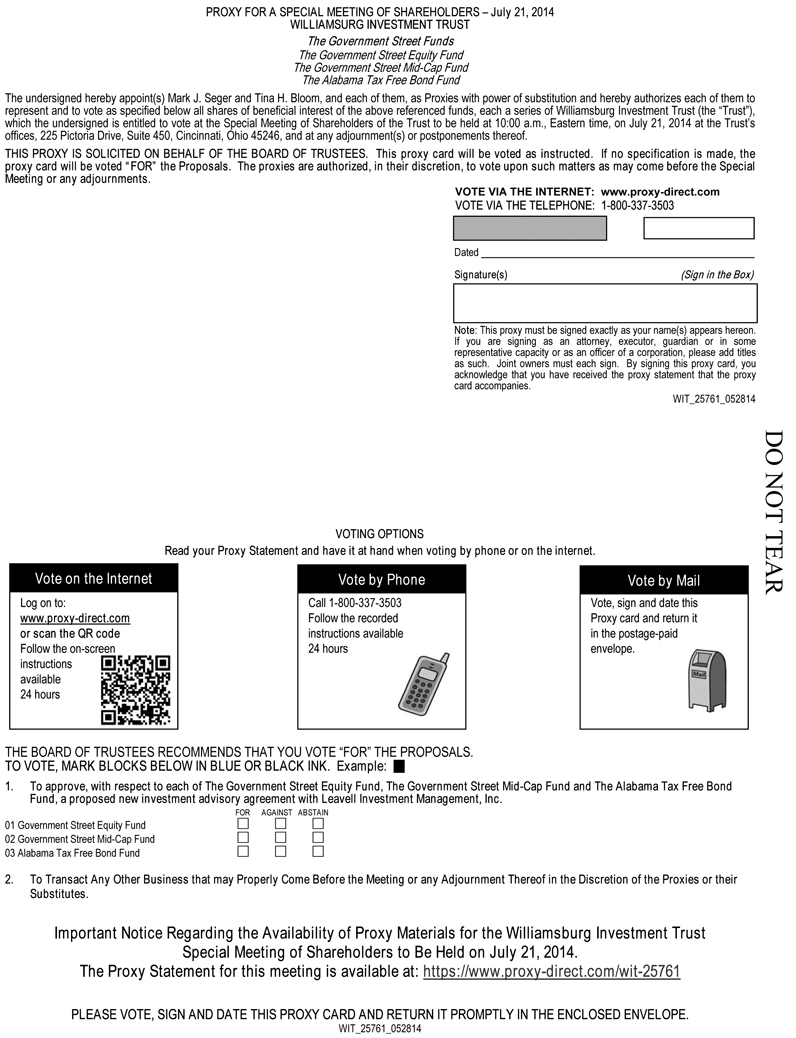

You can vote through the internet, by telephone, or by mail.

Details on voting can be found on your proxy card.

Williamsburg Investment Trust

225 Pictoria Drive, Suite 450

Cincinnati, Ohio 45246

SPECIAL MEETING OF SHAREHOLDERS OF

The Government Street Equity Fund

The Government Street Mid-Cap Fund

The Alabama Tax Free Bond Fund

Important Voting Information Inside

| Letter from the President | 1 |

| Notice of Special Meeting of Shareholders | 3 |

| Important Information to Help You Understand the Proposal | 4 |

| Proxy Statement | 7 |

| Proposal 1: | To approve, with respect to each of The Government Street Equity Fund, The Government Street Mid-Cap Fund and The Alabama Tax Free Bond Fund, a proposed new investment advisory agreement with Leavell Investment Management, Inc. | 8 |

| Proposal 2: | To transact any other business, not currently contemplated, that may properly come before the special meeting of shareholders or any adjournment thereof in the discretion of the proxies or their substitutes | 14 |

| Outstanding Shares and Voting Requirements | 15 |

| Additional Information on the Operation of the Funds | 16 |

| Other Matters | 17 |

| Exhibit A: | Form of the Proposed New Investment Advisory Agreement on behalf of The Government Street Equity Fund | 19 |

| Exhibit B: | Form of the Proposed New Investment Advisory Agreement on behalf of The Government Street Mid-Cap Fund | 25 |

| Exhibit C: | Form of the Proposed New Investment Advisory Agreement on behalf of The Alabama Tax Free Bond Fund | 31 |

THE GOVERNMENT STREET FUNDS

The Government Street Equity Fund

The Government Street Mid-Cap Fund

The Alabama Tax Free Bond Fund

Series of Williamsburg Investment Trust

June 9, 2014

Dear Shareholder:

You are cordially invited to attend a Special Meeting of Shareholders (the “Meeting”) of The Government Street Equity Fund, The Government Street Mid-Cap Fund and The Alabama Tax Free Bond Fund (individually a “Fund,” collectively, the “Funds”), to be held at 10:00 a.m., Eastern Time, on July 21, 2014 at the offices of the Trust’s transfer agent, Ultimus Fund Solutions, LLC, 225 Pictoria Drive, Suite 450, Cincinnati, Ohio 45246, to vote on the proposals listed below. Formal notice of the Meeting appears after this letter, followed by the Proxy Statement. We hope that you can attend the Meeting in person; however, we urge you in any event to vote your shares at your earliest convenience by telephone or through the Internet or by completing and returning the enclosed proxy in the envelope provided.

The Meeting is being held so that shareholders can vote on the following proposals:

| PROPOSAL 1. | To approve, with respect to each Fund, a proposed new investment advisory agreement by and between the Williamsburg Investment Trust (the “Trust”) and Leavell Investment Management, Inc. (the “Adviser”), under which the Adviser will continue to act as the investment adviser with respect to the assets of each Fund. |

| | |

| PROPOSAL 2. | To transact any other business, not currently contemplated, that may properly come before the Meeting or any adjournment thereof in the discretion of the proxies or their substitutes. |

Shareholders are being asked to approve new investment advisory agreements as a result of a planned change in the ownership structure of the Adviser (the “Transaction”). In the Transaction, the Adviser will replace its existing capital structure, which consists of two classes of common stock – one voting (Class A) and one non-voting (Class B) – with a single class of common stock with equal voting rights. The Adviser will raise capital by issuing new shares to several employees who are current Class B shareholders, as well as issuing shares to two employees who are not current shareholders of the Adviser. The effect of this recapitalization will be that no single shareholder of the Adviser will own more than 25% of the Adviser’s outstanding voting common stock (which is the ownership level which presumes control) and that all of the non-voting stock of the Adviser will be retired.

Under the Investment Company Act of 1940 (“the 1940 Act”), the Transaction may be deemed to constitute a “change in control” of the Adviser which would, when effected, cause each Fund’s investment advisory agreement presently in effect (the “Present Advisory Agreements”) to terminate. The 1940 Act and the Present Advisory Agreements require that we obtain from shareholders of each Fund approval of a new investment advisory agreement (the “New Advisory Agreements”) as a result of the presumed change in control and termination of the Present Advisory Agreements. Approval of the New Advisory Agreements will not change the rate at which the Funds pay advisory fees to the Adviser or the investment strategies and process currently being used to manage the Funds. The Trust’s Board of Trustees has approved each of the New Advisory Agreements and recommends that shareholders vote “FOR” approval of the New Advisory Agreements on behalf of the Funds.

Your vote is important regardless of the number of shares you own. In order to avoid the added cost of follow-up solicitations and possible adjournments, please take a few minutes to read the Proxy Statement and cast your vote. It is important that your vote be received no later than July 21, 2014.

In addition to voting by mail you may also vote either by telephone or through the Internet as follows:

| TO VOTE BY TELEPHONE: | | TO VOTE BY INTERNET: |

| 1) | Read the proxy statement and have the enclosed proxy card at hand | | 1) | Read the proxy statement and have the enclosed proxy card at hand |

| 2) | Call the toll-free number that appears on the enclosed proxy card and follow the simple instructions | | 2) | Go to the website that appears on the enclosed proxy card and follow the simple instructions |

We encourage you to vote by telephone or through the internet using the control number that appears on the enclosed proxy card. Use of telephone or internet voting will reduce the time and costs associated with this proxy solicitation. Whatever method you choose, please read the enclosed Proxy Statement carefully before voting.

We appreciate your participation and prompt response in this matter and thank you for your continued support. If you have any questions after considering the enclosed materials, please call 1-866-738-1125.

| | Sincerely, |

| | |

| | Thomas W. Leavell President, The Government Street Funds |

WILLIAMSBURG INVESTMENT TRUST

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS OF

The Government Street Equity Fund

The Government Street Mid-Cap Fund

The Alabama Tax Free Bond Fund

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to be Held at 10:00 a.m., Eastern time, on July 21, 2014. The Proxy Statement is available at www.leavellinvestments.com/governmentstreetfunds.html or by calling the Funds at 1-866-738-1125.

To the Shareholders of The Government Street Equity Fund, The Government Street Mid-Cap Fund and The Alabama Tax Free Bond Fund:

NOTICE IS HEREBY GIVEN that a Special Meeting of Shareholders (the “Meeting”) of The Government Street Equity Fund, The Government Street Mid-Cap Fund and The Alabama Tax Free Bond Fund (each a “Fund”, and collectively the “Funds”) will be held at 10:00 a.m., Eastern time, on July 21, 2014 at the offices of the Trust’s transfer agent, Ultimus Fund Solutions, LLC, 225 Pictoria Drive, Suite 450, Cincinnati, Ohio 45246. The purpose of the Meeting is to consider and vote on the following matters:

| | 1. | To approve, with respect to each Fund, a proposed new investment advisory agreement by and between the Williamsburg Investment Trust and Leavell Investment Management, Inc. (the “Adviser”) under which the Adviser will continue to act as the investment adviser with respect to the assets of each Fund. |

| | 2. | To transact any other business, not currently contemplated, that may properly come before the Meeting or any adjournment thereof in the discretion of the proxies or their substitutes. |

Shareholders of record as of the close of business on May 23rd, 2014 will be entitled to notice of and to vote at the Meeting or any adjournment thereof. A Proxy Statement and proxy card solicited by the Funds are included herein.

Your vote is important to us. Thank you for taking the time to consider the proposals.

| | By order of the Board of Trustees, |

| |  |

| June 9, 2014 | Tina H. Bloom Secretary Williamsburg Investment Trust |

IMPORTANT Please vote by telephone or through the Internet by following the instructions on your proxy card, thus avoiding unnecessary expense and delay. You may also execute the enclosed proxy and return it promptly in the enclosed envelope. No postage is required if mailed in the United States. The proxy is revocable and will not affect your right to vote in person if you attend the Meeting. |

IMPORTANT INFORMATION TO HELP YOU UNDERSTAND THE PROPOSAL

While we encourage you to carefully read the entire text of the Proxy Statement, for your convenience we have provided answers to some of the most frequently asked questions and a brief summary of the proposal to be voted on by shareholders.

QUESTIONS AND ANSWERS

| Q: | What is happening? Why did I get this package of materials? |

| A: | A special meeting of shareholders of The Government Street Equity Fund, The Government Street Mid-Cap Fund and The Alabama Tax Free Bond Fund (individually a “Fund,” collectively, the “Funds”) is scheduled to be held at 10:00 a.m., Eastern time, on July 21, 2014. According to our records, you are a shareholder of record as of the Record Date for this meeting. |

| Q: | Why am I being asked to vote on a proposed new advisory agreement? |

| A: | Leavell Investment Management, Inc. (the “Adviser”) is undergoing a change in the ownership of the controlling interest of its voting common stock (the “Transaction”). In the Transaction, the Adviser will replace its existing capital structure, which consists of two classes of common stock – one voting (Class A) and one non-voting (Class B) – with a single class of common stock with equal voting rights. The Adviser will raise capital by issuing new shares to several employees who are current Class B shareholders, as well as issuing shares to two employees who are not current shareholders of the Adviser. The effect of this recapitalization will be that no single shareholder of the Adviser will own more than 25% of the Adviser’s outstanding voting common stock (which is the ownership level which presumes control) and all of the non-voting stock of the Adviser will be retired. Mr. Thomas W. Leavell, the founder and Chairman of the Board of the Adviser, currently owns 100% of the Adviser’s outstanding voting common stock. The 1940 Act provides that an owner of more than 25% of the outstanding voting securities of an entity, such as Mr. Leavell, is presumed to have a controlling interest in that entity. Because Mr. Leavell’s ownership interest in the Adviser is currently in excess of 25% and will be reduced to slightly less than 25% following the Transaction, the Transaction may be deemed to result in a change in control of the Adviser and, pursuant to relevant provisions of the 1940 Act, effectively terminate the investment advisory agreements for the Funds that are currently in effect (the “Present Advisory Agreements”). In order for the Adviser to continue to provide management services to the Funds following the Transaction, shareholders of each Fund are being asked to approve a new investment advisory agreement (the “New Advisory Agreements”) with the Adviser. As a shareholder of one or more of the Funds, you are entitled to vote on the New Advisory Agreement for each Fund in which you own shares. |

| Q: | How do the proposed New Advisory Agreements differ from the Present Advisory Agreements? |

| A: | The terms and conditions of the New Advisory Agreements are substantially identical to those of the Present Advisory Agreements and differ only with respect to the changes described below, none of which the Trust’s Board of Trustees deems material: |

| | 1) | A change in the effective date and the termination date; |

| | 2) | An update to reflect the current name of the Adviser; |

| | 3) | (The Government Street Equity Fund and The Government Street Mid-Cap Fund only.) A change in the applicable state law by which the New Advisory Agreements shall be governed, from the State of North Carolina to the State of Alabama. Management does not believe there would be any material implications to shareholders of The Government Street Equity Fund and The Government Street Mid-Cap Fund resulting from the change in the applicable state law by which the new advisory agreements would be governed; and |

| | 4) | Deletion of a reference to expense limitations previously imposed by certain states on mutual funds that are no longer in effect. |

| Q: | When would the New Advisory Agreements take effect? |

| A: | If approved by shareholders of each Fund, the New Advisory Agreements would take effect upon completion of the Transaction, which is expected to occur on or about August 1, 2014. |

| Q: | How will the Transaction affect the fees and daily portfolio management of the Funds? |

| A: | It is contemplated that the Transaction will not affect the operation of the Funds or the advisory fees charged to the Funds. Upon the approval of the New Advisory Agreements, Thomas W. Leavell will continue to manage the portfolio of The Government Street Equity Fund; Thomas W. Leavell, Timothy S. Healey, Richard E. Anthony, Jr. and Michael J. Hofto will continue to manage the portfolio of The Government Street Mid-Cap Fund; and Timothy S. Healy will continue to manage the portfolio of The Alabama Tax Free Bond Fund. |

| Q: | How does the Board of Trustees recommend that I vote? |

| A: | After careful consideration of the proposal, the Board of Trustees unanimously recommends that you vote FOR the proposal. The various factors that the Board of Trustees considered in making these determinations are described in the Proxy Statement. |

| Q: | What will happen if there are not enough votes to hold the Meeting? |

| A: | It is important that shareholders vote by telephone or Internet or complete and return signed proxy cards promptly, but no later than July 21, 2014, to ensure there is a quorum for the Meeting. You may be contacted by a representative of the Trust or the Adviser or a proxy solicitor, if we do not hear from you. If we have not received sufficient votes to have a quorum at the Meeting or have not received enough votes to approve the New Advisory Agreements, we may adjourn the Meeting to a later date so we can continue to seek more votes. |

| Q: | Whom should I call for additional information about the Proxy Statement? |

| A: | If you have any questions regarding the Proxy Statement or completing and returning your proxy card, please call 1-866-738-1125. |

WILLIAMSBURG INVESTMENT TRUST

SPECIAL MEETING OF SHAREHOLDERS OF

The Government Street Equity Fund

The Government Street Mid-Cap Fund

The Alabama Tax Free Bond Fund

To Be Held on July 21, 2014

This Proxy Statement is being furnished in connection with the solicitation of proxies by the Board of Trustees (the “Board of Trustees”) of Williamsburg Investment Trust (the “Trust”) for use at the Special Meeting of Shareholders (the “Meeting”) of three series of the Trust, The Government Street Equity Fund, The Government Street Mid-Cap Fund and The Alabama Tax Free Bond Fund (individually a “Fund,” collectively, the “Funds”), to be held at the offices of the Trust’s transfer agent, Ultimus Fund Solutions, LLC, 225 Pictoria Drive, Suite 450, Cincinnati, Ohio 45246 on July 21, 2014 or at any adjournment thereof. The principal business address of the Funds is 210 St. Joseph Street, Mobile, Alabama 36602.

As described in more detail below, at the Meeting shareholders are being asked to consider the approval of new investment advisory agreements between the Trust, on behalf of each Fund, and Leavell Investment Management, Inc. (the “Adviser”) (Proposal 1).

A proxy, if properly executed, duly returned and not revoked, will be voted in accordance with the specifications therein. A proxy that is properly executed but has no voting instructions with respect to a proposal will be voted for that proposal. A shareholder may revoke a proxy at any time prior to use by filing with the Secretary of the Trust an instrument revoking the proxy, by submitting a proxy bearing a later date, or by attending and voting at the Meeting in person. This Proxy Statement and proxy card were first mailed to shareholders on or about June 18, 2014.

The Adviser will pay the cost of preparing, printing and mailing the enclosed proxy card(s) and Proxy Statement and all other costs incurred by the Funds in connection with the Transaction.

The Trust has retained Computershare Fund Services to solicit proxies for the Meeting which is responsible for printing proxy cards, mailing proxy material to shareholders, soliciting broker-dealer firms, custodians, nominees and fiduciaries, tabulating the returned proxies and performing other proxy solicitation services. The anticipated cost of these services is approximately $7,100 and such cost will be paid by the Adviser.

In addition to solicitation through the mail, proxies may be solicited by representatives of the Funds without cost to the Funds. Such solicitation may be by telephone, facsimile or otherwise. It is anticipated that broker-dealer firms, custodians, nominees, fiduciaries

and other financial institutions will be requested to forward proxy materials to beneficial owners and to obtain approval for the execution of proxies. Upon request, the Adviser will reimburse such persons or entities for the reasonable expenses incurred by them in connection with forwarding solicitation material to the beneficial owners of shares held of record by such persons.

| PROPOSAL 1: | TO APPROVE, WITH RESPECT TO EACH FUND, A PROPOSED NEW INVESTMENT ADVISORY AGREEMENT WITH LEAVELL INVESTMENT MANAGEMENT, INC. |

Mr. Thomas W. Leavell founded the Adviser in 1979 and has continuously owned 100% of the voting stock of the Adviser. In order to further expand the ownership of the Adviser, Mr. Leavell plans to transfer 75.1% of his ownership in the voting stock of the Adviser to key employees of the Adviser, thereby causing a change in the ownership of the controlling interest in the voting stock of the Adviser (the “Transaction”). The Investment Company Act of 1940 (the “1940 Act”) provides that an owner of more than 25% of the outstanding voting securities of an entity, such as Mr. Leavell, is presumed to have a controlling interest in that entity. Because Mr. Leavell’s ownership interest in the Adviser is currently in excess of 25% and will be reduced to slightly less than 25% following the Transaction, the Transaction may be deemed to result in a change in control of the Adviser and, pursuant to relevant provisions of the 1940 Act, effectively terminate the investment advisory agreements for the Funds in effect prior to the Transaction (the “Present Advisory Agreements”). In order for the Adviser to continue to provide management services to the Funds following the Transaction, shareholders of each Fund are being asked to vote on a proposed new investment advisory agreement between the Trust, on behalf of each Fund, and the Adviser (the “New Advisory Agreements”). As a shareholder of one or more of the Funds, you are entitled to vote on the New Advisory Agreement for each Fund in which you own shares.

The New Advisory Agreements

The Board of Trustees, including a majority of the Trustees who are not “interested persons,” as defined by the 1940 Act, of the Trust (the “Independent Trustees”), at a meeting held May 20, 2014, approved the New Advisory Agreements pursuant to which the Adviser will continue to provide investment management services to the Funds. The terms and conditions of the New Advisory Agreements are substantially identical in all material respects to the Present Advisory Agreements and differ only with respect to the changes described below, none of which the Trust’s Board of Trustees deems material:

| | 1) | A change in the effective date and the termination date; |

| | 2) | An update to reflect the current name of the Adviser; |

| | 3) | (The Government Street Equity Fund and The Government Street Mid-Cap Fund only). A change in the applicable state law by which the New Advisory Agreements shall be governed, from the State of North Carolina to the State of Alabama. Management does not believe there would be any material implications to shareholders of The Government Street Equity Fund and The Government Street Mid-Cap Fund resulting from the change in the applicable state law by which the new advisory agreements would be governed; and |

| | 4) | Deletion of a reference to expense limitations previously imposed by certain states on mutual funds that are no longer in effect. |

The New Advisory Agreements, if approved by shareholders, will replace the Present Advisory Agreements. Under the New Advisory Agreements, the Adviser will, subject to the supervision and control of the Board of Trustees, continue to be responsible for managing the investment and reinvestment of the Funds’ portfolio assets in securities, including buying, selling and trading in stocks, bonds and other investments, on behalf of the Funds, and establishing, maintaining and trading in brokerage accounts for and in the name of the Funds, all in accordance with the 1940 Act and any rules thereunder, and the investment objectives, policies and restrictions of each Fund. The Adviser will continue to pay all of the expenses incurred by it in connection with its investment advisory services provided to the Funds. The Funds will continue to pay all of the expenses relating to their operations, including brokerage fees and commissions, taxes, interest charges, the fees of the Adviser and the fees and expenses of the Funds’ administrator, transfer agent, fund accounting agent, chief compliance officer and custodian, legal and auditing expenses, expenses and fees related to registration and filing with the Securities and Exchange Commission and state regulatory authorities, costs of printing and mailing Prospectuses and shareholder reports to existing shareholders, fees and expenses of the Independent Trustees and other expenses. Fees paid to the Adviser under the New Advisory Agreements will be calculated at the same rate as the fees previously charged under the Present Advisory Agreements. The advisory fee paid by The Government Street Equity Fund is equal to 0.60% of the Fund’s average daily net assets on the first $100 million and 0.50% of such net assets in excess of $100 million. The advisory fee paid by The Government Street Mid-Cap Fund is equal to 0.75% of its average daily net assets. The advisory fee paid by The Alabama Tax Free Bond Fund is equal to 0.35% of its average daily net assets on the first $100 million and 0.25% of such net assets in excess of $100 million.

The New Advisory Agreements, like the Present Advisory Agreements, provide that the Adviser shall not be liable for any error of judgment, mistake of law or for any other loss whatsoever suffered by the Trust in connection with the performance of the Agreement, except a loss resulting from a breach of fiduciary duty with respect to the receipt of the compensation for services or a loss resulting from willful misfeasance, bad faith or gross negligence on the part of the Adviser in the performance of its duties or from reckless disregard by it of its obligations and duties under the Agreement.

Each New Advisory Agreement, if approved by shareholders, will remain in force for an initial term of two years, and from year to year thereafter, subject to annual approval by (a) the Board of Trustees or (2) a vote of a majority (as defined in the 1940 Act) of

the outstanding shares of the Fund. In either event, continuance of each New Advisory Agreement beyond the initial two year period must also be approved by a majority of the Independent Trustees, by a vote cast in person at a meeting called for the purpose of voting on the continuance. Each New Advisory Agreement may be terminated at any time, on 60 days’ written notice, without the payment of any penalty, by the Board of Trustees, by a vote of a majority of the outstanding voting shares of the Fund, or by the Adviser. Each New Advisory Agreement automatically terminates in the event of its assignment, as defined by the 1940 Act and the rules thereunder.

The New Advisory Agreements will become effective upon consummation of the Transaction. If shareholders of a Fund do not approve the New Advisory Agreement, the Trustees will consider other appropriate action in accordance with the 1940 Act. The form of each proposed New Advisory Agreement is attached hereto as Exhibits A, B and C. The descriptions of the New Advisory Agreements in this Proxy Statement are only summaries and are qualified in their entirety by reference to Exhibits A, B and C.

The Present Advisory Agreements

| | • | The Present Advisory Agreement on behalf of The Government Street Equity Fund is dated November 15, 2004, was initially approved by the Board of Trustees, including a majority of Independent Trustees, on August 17, 2004 and was last approved by the Board of Trustees on February 25, 2014. The Present Advisory Agreement was last approved by shareholders of The Government Street Equity Fund on November 15, 2004. During the fiscal year ended March 31, 2014, The Government Street Equity Fund paid the Adviser $528,710 in advisory fees under the Present Advisory Agreement. |

| | • | The Present Advisory Agreement on behalf of The Government Street Mid-Cap Fund is dated November 10, 2003, was initially approved by the Board of Trustees, including a majority of Independent Trustees, on November 10, 2003 and was last approved by the Board of Trustees on February 25, 2014. The Present Advisory Agreement was approved by the initial shareholder of The Government Street Mid-Cap Fund on November 17, 2003. During the fiscal year ended March 31, 2014, The Government Street Mid-Cap Fund paid the Adviser $378,612 in advisory fees under the Present Advisory Agreement. |

| | • | The Present Advisory Agreement on behalf of The Alabama Tax Free Bond Fund is dated November 15, 2004, was initially approved by the Board of Trustees, including a majority of the Independent Trustees, on August 17, 2004 and was last approved by the Board of Trustees on February 25, 2014. The Present Advisory Agreement was last approved by shareholders of The Alabama Tax Free Bond Fund on November 15, 2004. During the fiscal year ended March 31, 2014, The Alabama Tax Free Bond Fund paid the Adviser $80,402 in advisory fees (net of voluntary fee waivers) under the Present Advisory Agreement. There is no assurance that any fee waivers will continue in the future. |

Information About the Adviser

Leavell Investment Management, Inc. (the “Adviser”) was established in 1979 in Mobile, Alabama and has served as investment adviser to each Fund since inception. Today, the firm employs fifteen investment professionals, has an additional office in Birmingham, Alabama, and is one of the largest independent investment counseling firms in Alabama. The Adviser is privately owned and has no affiliation with any bank, broker, dealer, or other investment advisory firm. The Adviser provides a continuous program of supervision of each Fund’s assets, including the composition of its portfolio, and furnishes advice and recommendations with respect to investments, investment policies and the purchase and sale of securities. The Adviser is also responsible for the selection of broker-dealers through which each Fund executes portfolio transactions, subject to brokerage policies established by the Trustees, and provides certain executive personnel to the Funds. In addition to acting as the Funds’ investment adviser, the Adviser also provides investment advice to corporations, trusts, pension and profit sharing plans, other business and institutional accounts and individuals.

Information about the Transaction. As of the date of this Proxy Statement, the control person of the Adviser is Thomas W. Leavell, owning in the aggregate all of the outstanding voting common stock of the Adviser. As of the date of this Proxy Statement, certain employees of the Adviser own an interest in the non-voting common stock of the Adviser. In the Transaction, the Adviser will replace its existing capital structure, which consists of two classes of common stock – one voting (Class A) and one non-voting (Class B) – with a single class of common stock with equal voting rights. The Adviser will raise capital by issuing new shares to several employees who are current Class B shareholders, as well as issuing shares to two employees who are not current shareholders of the Adviser. The effect of this recapitalization will be that no single shareholder of the Adviser will own more than 25% of the Adviser’s outstanding voting common stock (which is the ownership level which presumes control) and all of the non-voting stock of the Adviser will be retired. Mr. Leavell will own slightly less than 25% of the outstanding voting common stock and eight other shareholders will have holdings of approximately 5% to 15%. Consequently, control of the Adviser will be vested in various combinations of shareholders acting collectively. The Transaction is expected to occur by August 1, 2014. The change in ownership will not result in a change in the operations of the Adviser or the persons responsible for the day-to-day management of the Funds.

Executive Officers and Directors of the Adviser. The following are the current executive officers and directors of the Adviser and their position with the Funds. The address of each officer and director is 210 Saint Joseph Street, Mobile, Alabama 36602, except as noted otherwise. No changes to the executive officers and directors of the Adviser or the officers of the Funds are being contemplated as a result of the Transaction.

| Name | Position with the Adviser | Position with the Funds |

| Thomas W. Leavell | Director | President |

| Andrew J. Grinstead | President | None |

| Margaret H. Alves | Vice President/Chief Compliance Officer | None |

| Janet R. Hayes | Vice President/Chief Operating Officer | None |

| Timothy S. Healey* | Vice President/Chief Investment Officer | Vice President |

| Michael J. Hofto | Vice President/Chief Financial Officer | None |

| Richard E. Anthony* | Vice President | None |

| Mary Shannon Hope | Vice President | Vice President |

| Richard M. Stimpson | Vice President | None |

| Michael C. Teel* | Vice President | None |

| John M. Williams* | Vice President | None |

| * | The address is 2712 18th Place South, Birmingham, Alabama 35209. |

Evaluation by the Board of Trustees

The Board of Trustees, including the Independent Trustees voting separately, reviewed and approved the New Advisory Agreements at an in-person meeting held on May 20, 2014. In making the determination to recommend approval of the New Advisory Agreements to shareholders of the Funds, the Board of Trustees considered all information the Trustees deemed reasonably necessary to evaluate the terms of the New Advisory Agreements and to determine that each New Advisory Agreement would be in the best interests of the Fund and its shareholders. The principal areas of review by the Trustees were the nature, extent and quality of the services provided by the Adviser and the reasonableness of the fees charged for those services. These matters were considered by the Independent Trustees consulting with experienced counsel for the Independent Trustees, who is independent of the Adviser. The Board of Trustees gave substantial weight to the Adviser’s representations that: (i) the responsibilities of the Adviser under the New Advisory Agreements are the same in all material respects as under the Present Advisory Agreements; (ii) the operations of the Adviser and the level or quality of advisory services provided to the Funds will not be materially affected as a result of the New Advisory Agreements; (iii) the same personnel of the Adviser who currently provide investment advisory services to the Funds will continue to do so upon approval of the New Advisory Agreements; (iv) the management fee payable by each Fund will be at the same rate as the compensation now payable by the Fund; and (v) the financial condition of the Adviser will not be adversely affected by the Transaction.

In addition, the Trustees considered the information they received when they approved the continuance of the Present Advisory Agreements at an in-person meeting held on February 25, 2014 and the information regarding the Adviser and each Fund’s performance they had been provided throughout the year at regular meetings of the Board of Trustees. Below is a discussion of the factors considered by the Board of Trustees along with the conclusions with respect thereto that formed the basis for the Board’s approvals of the New Advisory Agreements.

The Trustees’ evaluation of the quality of the Adviser’s services took into account their knowledge and experience gained through meetings with and reports of the Adviser’s senior management over the course of the preceding year. Both short-term and long-term investment performance of the Funds was considered. Each Fund’s performance was compared to its performance benchmark and to that of competitive funds with similar investment objectives. The Trustees also considered the scope and quality of the in-house capabilities of the Adviser and other resources dedicated to performing services for the Funds. The quality of administrative and other services, including the Adviser’s role in coordinating the activities of the Funds’ other service providers, were considered in light of the Funds’ compliance with investment policies and applicable laws and regulations and of related reports by management and the Funds’ independent public accounting firm in periodic meetings with the Trust’s Audit Committee. The Trustees also considered the business reputation of the Adviser, the qualifications of its key investment and compliance personnel, and its financial resources.

In reviewing the fees payable under the New Advisory Agreements, the Trustees compared the advisory fees and overall expense levels of each Fund with those of competitive funds with similar investment objectives. The Trustees considered information provided by the Adviser concerning the Adviser’s profitability with respect to each Fund, including the assumptions and methodology used in preparing the profitability information, in light of applicable case law relating to advisory fees. For these purposes, the Trustees took into account not only the fees paid by the Funds, but also so-called “fallout” benefits to the Adviser. The Trustees also considered the Adviser’s representations that all of the Funds’ portfolio trades were executed based on the best price and execution available, and that the Adviser does not participate in any soft dollar or directed brokerage arrangements. The Trustees further considered that the Adviser does not participate in any revenue sharing arrangements relating to the Funds. In evaluating the Funds’ advisory fees, the Trustees took into account the complexity and quality of the investment management of the Funds.

Based upon their review of this information, the Independent Trustees concluded that: (i) based upon the performance of The Government Street Equity Fund and The Government Street Mid-Cap Fund during the fiscal year ended March 31, 2014, as well as their longer term performance, the Adviser has provided quality services to those Funds; (ii) although the short-term and long-term performance of The Alabama Tax Free Bond Fund has lagged its benchmark index and the average returns for comparably managed funds, such Fund is managed in a conservative investment style and has satisfactorily met the goal of providing tax-exempt income with limited exposure to credit and maturity risks; (iii) the investment advisory fees payable to the Adviser by each Fund are competitive with

similarly managed funds, and the Independent Trustees believe the fees to be reasonable given the scope and quality of investment advisory services provided by the Adviser and other services provided to shareholders; (iv) the total operating expense ratio of each Fund is less than the average expense ratio for comparably managed funds, according to statistics derived from Morningstar, Inc.; (v) the Adviser’s voluntary commitment to cap overall operating expenses of The Alabama Tax Free Bond Fund through advisory fee waivers has enabled that Fund to further increase returns for shareholders; and (vi) the level of the Adviser’s profitability with respect to its management of the Funds is reasonable. Given the current size of the Funds and their expected growth, the Independent Trustees did not believe that at the present time it would be relevant to consider the extent to which economies of scale would be realized as the Funds grow, and whether fee levels reflect these economies of scale. The Independent Trustees also considered the “fallout” benefits to, and the profitability of, the Adviser with respect to the Funds, but given the amounts involved viewed these as secondary factors in connection with the evaluation of the reasonableness of the advisory fees paid by the Funds.

No single factor was considered in isolation or to be determinative to the decision of the Trustees to approve the New Advisory Agreements and each Trustee weighed the various factors as he or she deemed appropriate. Rather the Trustees concluded, in light of a weighing and balancing of all factors considered, that approval of each New Advisory Agreement is in the best interests of each Fund and its shareholders. The Board of Trustees noted that the scope, quality, and nature of services to be provided by the Adviser, and the fees to be paid to the Adviser, under each of the New Advisory Agreements will be substantially identical to the scope, quality and nature of services provided, and fees paid, under each of the Present Advisory Agreements. After full consideration of the above factors as well as other factors, the Board of Trustees, with the Independent Trustees voting separately, unanimously concluded that approval of each of the New Advisory Agreements was in the best interest of the Funds and their shareholders and recommended approval of each of the New Advisory Agreements to the Funds’ shareholders.

The Board of Trustees recommends that shareholders of each Fund vote FOR the New Advisory Agreement on behalf of that Fund.

| PROPOSAL 2: | TO TRANSACT ANY OTHER BUSINESS, NOT CURRENTLY CONTEMPLATED, THAT MAY PROPERLY COME BEFORE THE MEETING OR ANY ADJOURNMENT THEREOF IN THE DISCRETION OF THE PROXIES OR THEIR SUBSTITUTES |

The proxy holders have no present intention of bringing any other matter before the Meeting other than the matters described herein or matters in connection with or for the purpose of effecting the same. Neither the proxy holders nor the Board of Trustees are aware of any matters which may be presented by others. If any other business shall properly come before the Meeting, the proxy holders intend to vote thereon in accordance with their best judgment.

OUTSTANDING SHARES AND VOTING REQUIREMENTS

Record Date. The Board of Trustees has fixed the close of business on May 23rd, 2014 (the “Record Date”) as the record date for determining shareholders of each of the Funds entitled to notice of and to vote at the Meeting or any adjournment thereof. As of the Record Date, there were 1,477,741.187 outstanding shares of beneficial interest of The Government Street Equity Fund, 2,516,124.025 outstanding shares of beneficial interest of The Government Street Mid-Cap Fund and 3,071,277.254 outstanding shares of beneficial interest of The Alabama Tax Free Bond Fund. Each share of a Fund is entitled to one vote, with proportionate voting for fractional shares.

5% Shareholders. As of the Record Date, the following shareholders owned of record more than 5% of the outstanding shares of the Funds. Accounts with an asterisk may be deemed to control a Fund by virtue of owning more than 25% of the outstanding shares. No other person owned of record and, according to information available to the Trust, no other person owned beneficially, 5% or more of the outstanding shares of the Funds on the Record Date.

| Name and Address of Record Owner | Percentage Ownership |

Charles Schwab & Co., Inc. 211 Main Street San Francisco, California 94105 | The Government Street Equity Fund – 82.98%* The Government Street Mid-Cap Fund – 85.09%* The Alabama Tax Free Bond Fund – 73.13%* |

National Financial Services LLC 248 East Capitol Street Jackson, Mississippi 39201 | The Government Street Mid-Cap Fund – 8.61% The Alabama Tax Free Bond Fund – 5.06% |

Quorum. A quorum is the number of shares legally required to be at a meeting in order to conduct business. If a quorum (more than 50% of the outstanding shares of the Fund) is represented at the meeting, the vote of a majority of the outstanding shares of the Fund is required to approve the Fund’s New Advisory Agreement (Proposal 1). The vote of a majority of the outstanding shares means the vote of the lesser of (1) 67% or more of the shares present or represented by proxy at the Meeting, if the holders of more than 50% of the outstanding shares are present or represented by proxy, or (2) more than 50% of the Fund’s outstanding shares. Proxies properly executed and marked with a negative vote or an abstention will be considered to be present at the Meeting for purposes of determining the existence of a quorum for the transaction of business. If the Meeting is called to order but a quorum for a Fund is not present at the Meeting, the persons named as proxies may vote those proxies that have been received with respect to adjournment of the Meeting to a later date. If a quorum for a Fund is present at the Meeting but sufficient votes to approve the proposal described herein are not received, the persons named as proxies may propose one or more adjournments of the Meeting to permit further solicitation of proxies. Any such adjournment will require the affirmative vote of a majority of those shares of a Fund represented at the Meeting in person or by proxy. The persons named

as proxies will vote those proxies received that voted in favor of a proposal in favor of such an adjournment and will vote those proxies received that voted against the proposal against any such adjournment.

Abstentions and “broker non-voters” are counted for purposes of determining whether a quorum is present but do not represent votes cast with respect to the proposal. “Broker non-votes” are shares held by a broker or nominee for whom an executed proxy is received by the Trust, but are not voted as to one or more proposals because instructions have not been received from the beneficial owners or persons entitled to vote and the broker or nominee does not have discretionary voting power. Notwithstanding the foregoing, “broker non-votes” will be excluded from the denominator of the calculation of the number of votes required to approve any proposal to adjourn the Meeting. Accordingly, abstentions and “broker non-votes” will effectively be a vote against the proposal, for which the required vote is a percentage of the outstanding voting shares and will have no effect on a vote for adjournment.

ADDITIONAL INFORMATION ON THE OPERATION OF THE FUNDS

Principal Underwriter

Ultimus Fund Distributors, LLC (the “Underwriter”) serves as the Funds’ principal underwriter and, as such, is the exclusive agent for distribution of the Funds’ shares. The Underwriter is obligated to sell shares of the Funds on a best efforts basis only against purchase orders for the shares. Shares of the Funds are offered to the public on a continuous basis. The Underwriter is located at 225 Pictoria Drive, Suite 450, Cincinnati Ohio 45246.

Administration and Other Services

Ultimus Fund Solutions, LLC (“Ultimus”) provides administrative services, accounting and pricing services, and transfer agent and shareholder services to the Funds. Ultimus also provides an individual to serve as Chief Compliance Officer of the Trust under the terms of a Compliance Consulting Agreement between the Trust and Ultimus. Ultimus is located at 225 Pictoria Drive, Suite 450, Cincinnati, Ohio 45246.

Independent Registered Public Accounting Firm

The Audit Committee and the Board of Trustees have selected Ernst & Young LLP, 1900 Scripps Center, 312 Walnut Street, Cincinnati, Ohio 45202, to serve as the Trust’s independent registered public accounting firm for the fiscal year ending March 31, 2015. Representatives of Ernst & Young LLP are not expected to be present at the Meeting although they will have an opportunity to attend and to make a statement, if they desire to do so. If representatives of Ernst & Young LLP are present at the Meeting, they will be available to respond to appropriate questions from shareholders.

| Fees Billed by Ernst & Young LLP to the Trust During the Previous Two Fiscal Years |

| Audit Fees | The aggregate fees billed for professional services rendered by Ernst & Young LLP for the audit of the annual financial statements of the Trust or for services that are normally provided by Ernst & Young LLP in connection with statutory and regulatory filings or engagements were $160,500 with respect to the fiscal year ended March 31, 2014 and $155,800 with respect to the fiscal year ended March 31, 2013. |

| Audit-Related Fees | No fees were billed in either of the last two fiscal years for assurance and related services by Ernst & Young LLP that are reasonably related to the performance of the audit of the Trust’s financial statements and are not reported as “Audit Fees” in the preceding paragraph. |

| Tax Fees | No fees were billed in either of the last two fiscal years for professional services rendered by Ernst & Young LLP for tax compliance, tax advice and tax planning. |

| All Other Fees | No fees were billed in either of the last two fiscal years for products and services provided by Ernst & Young LLP other than the services reported above. |

Aggregate Non-Audit Fees | No fees were billed in either of the last two fiscal years for non-audit services by Ernst & Young LLP rendered to the Trust and any entity controlling, controlled by, or under common control with the Trust that provides ongoing services to the Trust. |

Annual and Semi-Annual Reports

The Funds will furnish, without charge, a copy of their most recent annual report and most recent semi-annual report succeeding such annual report, if any, upon request. To request the annual or semi-annual report, please call us toll free at 1-866-738-1125, or write to Tina H. Bloom, Secretary, Williamsburg Investment Trust, P.O. Box 46707, Cincinnati, Ohio 45246-0707. The Funds’ most recent annual and semi-annual reports are available for download at www.leavellinvestments.com/governmentstreetfunds.html.

OTHER MATTERS

Shareholder Proposals

As a Massachusetts business trust, the Trust does not intend to, and is not required to hold annual meetings of shareholders, except under certain limited circumstances. The Board of Trustees does not believe a formal process for shareholders to send communications to the Board of Trustees is appropriate due to the infrequency of shareholder communications to the Board of Trustees. The Trust has not received any shareholder proposals to be considered for presentation at the Meeting. Under the proxy rules of the Securities and Exchange Commission, shareholder proposals may, under certain conditions, be included in the Trust’s proxy statement and proxy for a particular

meeting. Under these rules, proposals submitted for inclusion in the Trust’s proxy materials must be received by the Trust within a reasonable time before the solicitation is made. The fact that the Trust receives a shareholder proposal in a timely manner does not insure its inclusion in its proxy materials, because there are other requirements in the proxy rules relating to such inclusion. Annual meetings of shareholders of the Funds are not required as long as there is no particular requirement under the 1940 Act or the Declaration of Trust, which must be met by convening such a shareholder meeting. Any shareholder proposal should be sent to Tina H. Bloom, Secretary of the Trust, 225 Pictoria Drive, Suite 450, Cincinnati, Ohio 45246.

Shareholder Communications with Trustees

Shareholders who wish to communicate with the Board or individual Trustees should write to the Board or the particular Trustee in care of the Funds, at the offices of the Trust as set forth below. All communications will be forwarded directly to the Board or the individual Trustee. Shareholders also have an opportunity to communicate with the Board at shareholder meetings. The Trust does not have a policy requiring Trustees to attend shareholder meetings.

Proxy Delivery

The Trust may only send one proxy statement to shareholders who share the same address unless the Funds have received different instructions from one or more of the shareholders. The Funds will deliver promptly to a shareholder, upon oral or written request, a separate copy of the proxy statement to a shared address to which a single copy of this Proxy was delivered. By calling or writing the Funds, a shareholder may request separate copies of future proxy statements, or if the shareholder is receiving multiple copies of the proxy statement now, may request a single copy in the future. To request a paper or e-mail copy of the proxy statement or annual report at no charge, or to make any of the aforementioned requests, write to The Government Street Funds, P.O. Box 46707, Cincinnati, Ohio 45246-0707, or call the Funds toll-free at 1-866-738-1125 or e-mail the Funds at fundinfo@ultimusfundsolutions.com.

| | By order of the Board of Trustees, |

| |  |

| | Tina H. Bloom Secretary |

Date: June 9, 2014

Please complete, date and sign the enclosed Proxy and return it promptly in the enclosed reply envelope. NO POSTAGE IS REQUIRED IF MAILED IN THE UNITED STATES. You may also vote by telephone or through the Internet by following the instructions on your proxy card.

| EXHIBIT A: | FORM OF PROPOSED NEW INVESTMENT ADVISORY AGREEMENT ON BEHALF OF THE GOVERNMENT STREET EQUITY FUND |

INVESTMENT ADVISORY AGREEMENT

THIS AGREEMENT, entered into as of ___________, 2014, by and between The GOVERNMENT STREET EQUITY FUND of WILLIAMSBURG INVESTMENT TRUST, a Massachusetts Business Trust (the “Trust”), and Leavell Investment Management, Inc. an Alabama corporation (the “Adviser”), registered as an investment adviser under the Investment Advisers Act of 1940, as amended (the “Advisers Act”).

WHEREAS, the Trust is registered as a no-load, open-end management investment company of the series type under the Investment Company Act of 1940, as amended (the “1940 Act”); and

WHEREAS, the Trust desires to retain the Adviser to furnish investment advisory and administrative services to The Government Street Equity Fund series of the Trust, and the Adviser is willing to so furnish such services;

NOW THEREFORE, in consideration of the promises and mutual covenants herein contained, it is agreed between the parties hereto as follows:

| 1. | Appointment. The Trust hereby appoints the Adviser to act as investment adviser to The Government Street Equity Fund series of the Trust (the “Fund”) for the period and on the terms set forth in this Agreement. The Adviser accepts such appointment and agrees to furnish the services herein set forth, for the compensation herein provided. |

| 2. | Delivery of Documents. The Trust has furnished the Investment Adviser with copies properly certified or authenticated of each of the following: | |

| | (a) | The Trust’s Declaration of Trust, as filed with the State of Massachusetts (such Declaration, as presently in effect and as it shall from time to time be amended, is herein called the “Declaration”); |

| | (b) | The Trust’s By-Laws (such By-Laws, as presently in effect and as they shall from time to time be amended, are herein called the “By-Laws”); |

| | (c) | Resolutions of the Trust’s Board of Trustees authorizing this Agreement; |

| | (d) | The Trust’s Registration Statement on Form N-1A under the 1940 Act and under the Securities Act of 1933 as amended (the “1933 Act”), relating to shares of beneficial interest of the Trust (herein called the “Shares”) as filed with the Securities and Exchange Commission (“SEC”) and all amendments thereto; |

| | (e) | The Trust’s Prospectus (such Prospectus, as presently in effect and all amendments and supplements thereto are herein called the “Prospectus”). |

The Trust will furnish the Adviser from time to time with copies, properly certified or authenticated, of all amendments of or supplements to the foregoing at the same time as such documents are required to be filed with the SEC.

| 3. | Management. Subject to the supervision of the Trust’s Board of Trustees, the Adviser will provide a continuous investment program for the Fund, including investment research and management with respect to all securities, investments, cash and cash equivalents in the Fund. The Adviser will determine from time to time what securities and other investments will be purchased, retained or sold by the Fund. The Adviser will provide the services under this Agreement in accordance with the Fund’s investment objectives, policies and restrictions as stated in its Prospectus. The Adviser further agrees that it: |

| | (a) | Will conform its activities to all applicable Rules and Regulations of the Securities and Exchange Commission and will, in addition, conduct its activities under this Agreement in accordance with regulations of any other Federal and State agencies which may now or in the future have jurisdiction over its activities under this Agreement; |

| | (b) | Will place orders pursuant to its investment determinations for the Fund either directly with the issuer or with any broker or dealer. In placing orders with brokers or dealers, the Adviser will attempt to obtain the best net price and the most favorable execution of its orders. Consistent with this obligation, when the Adviser believes two or more brokers or dealers are comparable in price and execution, the Adviser may prefer: (i) brokers and dealers who provide the Fund with research advice and other services, or who recommend or sell Fund shares, and (ii) Brokers who are affiliated with the Trust or its Adviser(s), provided, however, that in no instance will portfolio securities be purchased from or sold to the Adviser or any affiliated person of the Adviser in principal transactions; |

| | (c) | Will provide certain executive personnel for the Trust as may be mutually agreed upon from time to time with the Board of Trustees, the salaries and expenses of such personnel to be borne by the Adviser unless otherwise mutually agreed upon; and |

| | (d) | Will provide, at its own cost, all office space, facilities and equipment necessary for the conduct of its advisory activities on behalf of the Trust. |

Notwithstanding the foregoing, the Adviser may obtain the services of an investment counselor or sub-advisor of its choice subject to the approval of the Board of Trustees. The cost of employing such counselor or sub-advisor will be paid by the Adviser and not by the Trust.

| 4. | Services Not Exclusive. The advisory services furnished by the Adviser hereunder are not to be deemed exclusive, and the Adviser shall be free to furnish similar services to others as long as its services under this Agreement are not impaired |

thereby provided, however, that without the written consent of the Trustees, the Adviser will not serve as investment adviser to any other investment company having a similar investment objective to that of the Fund.

| 5. | Books and Records. In compliance with the requirements of Rule 31a-3 under the 1940 Act, the Adviser hereby agrees that all records which it maintains for the benefit of the Trust are the property of the Trust and further agrees to surrender promptly to the Trust any of such records upon the Trust’s request. The Adviser further agrees to preserve for the periods prescribed by it pursuant to Rule 31a-2 under the 1940 Act the records required to be maintained by Rule 31a-1 under the Act that are not maintained by others on behalf of the Trust. |

| 6. | Expenses. During the term of this Agreement, the Adviser will pay all expenses incurred by it in connection with its investment advisory services pertaining to the Trust. In the event that there is no distribution plan under Rule 12b-1 of the 1940 Act in effect for the Fund, the Adviser will pay, out of the Adviser’s resources generated from sources other than fees received from the Trust, the entire cost of the promotion and sale of Fund shares. |

Notwithstanding the foregoing, the Trust shall pay the expenses and costs of the following:

| | (a) | Taxes, interest charges, and extraordinary expenses; |

| | (b) | Brokerage fees and commissions with regard to portfolio transactions of the Fund; |

| | (c) | Fees and expenses of the custodian of the Fund’s portfolio securities; |

| | (d) | Fees and expenses of the Fund’s administrative agent, the Fund’s transfer and shareholder servicing agent and the Fund’s accounting agent or, if the Trust performs any such services without an agent, the costs of the same; |

| | (e) | Auditing and legal expenses; |

| | (f) | Cost of maintenance of the Trust’s existence as a legal entity; |

| | (g) | Compensation of trustees who are not interested persons of the Adviser as that term is defined by law; |

| | (h) | Costs of Trust meetings; |

| | (i) | Federal and State registration or qualification fees and expenses; |

| | (j) | Costs of setting in type, printing and mailing Prospectuses, reports and notices to existing shareholders; |

| | (k) | The investment advisory fee payable to the Adviser, as provided in paragraph 7 herein; and |

| | (l) | Distribution expenses, but only in accordance with any Distribution Plan as and if approved by the shareholders of the Fund. |

| 7. | Compensation. For the services provided to the Fund and for the expenses assumed by the Adviser pursuant to this Agreement, the Trust will pay the Adviser and the Adviser will accept as full compensation an investment advisory fee, based upon the daily average net assets of the Fund, computed at the end of each month and payable within five (5) business days thereafter, according to the following schedule: |

| Net Assets | Annual Rate |

| First $100 Million | 0.60% |

| All over $100 Million | 0.50% |

| 8.(a) | Limitation of Liability. The Adviser shall not be liable for any error of judgment, mistake of law or for any other loss whatsoever suffered by the Trust in connection with the performance of this Agreement, except a loss resulting from a breach of fiduciary duty with respect to the receipt of the compensation for services or a loss resulting from willful misfeasance, bad faith or gross negligence on the part of the Adviser in the performance of its duties or from reckless disregard by it of its obligations and duties under this Agreement. |

| 8.(b) | Indemnification of Adviser. Subject to the limitations set forth in this Subsection 8(b), the Trust shall indemnify, defend and hold harmless (from the assets of the Fund or Funds to which the conduct in question relates) the Adviser against all loss, damage and liability, including but not limited to amounts paid in satisfaction of judgments, in compromise or as fines and penalties, and expenses, including reasonable accountants’ and counsel fees, incurred by the Adviser in connection with the defense or disposition of any action, suit or other proceeding, whether civil or criminal, before any court or administrative or legislative body, related to or resulting from this Agreement or the performance of services hereunder, except with respect to any matter as to which it has been determined that the loss, damage or liability is a direct result of (i) a breach of fiduciary duty with respect to the receipt of compensation for services; or (ii) willful misfeasance, bad faith or gross negligence on the part of the Adviser in the performance of its duties or from reckless disregard by it of its duties under this Agreement (either and both of the conduct described in clauses (i) and (ii) above being referred to hereinafter as “Disabling Conduct”). A determination that the Adviser is entitled to indemnification may be made by (i) a final decision on the merits by a court or other body before whom the proceeding was brought that the Adviser was not liable by reason of Disabling Conduct, (ii) dismissal of a court action or an administrative proceeding against the Adviser for insufficiency of evidence of Disabling Conduct, or (iii) a reasonable determination, based upon a review of the facts, that the Adviser was not liable by reason of Disabling Conduct by, (a) vote of a majority of a quorum of Trustees who are neither “interested persons” of the Trust as the quoted phrase is defined in Section 2(a)(19) of the 1940 Act nor parties to the action, suit or other proceeding on the same or similar grounds that is then or has been pending or threatened (such quorum of such Trustees being referred to hereinafter as the “Independent Trustees”), or (b) an independent legal counsel in a written opinion. Expenses, including accountants’ and counsel fees so incurred by the Adviser (but excluding amounts paid in satisfaction of judgments, in |

| | compromise or as fines or penalties), may be paid from time to time in advance of the final disposition of any such action, suit or proceeding; provided, that the Adviser shall have undertaken to repay the amounts so paid if it is ultimately determined that indemnification of such expenses is not authorized under this Subsection 8(b) and if (i) the Adviser shall have provided security for such undertaking, (ii) the Trust shall be insured against losses arising by reason of any lawful advances, or (iii) a majority of the Independent Trustees, or an independent legal counsel in a written opinion, shall have determined, based on a review of readily available facts (as opposed to a full trial-type inquiry), that there is reason to believe that the Adviser ultimately will be entitled to indemnification hereunder. |

| | As to any matter disposed of by a compromise payment by the Adviser referred to in this Subsection 8(b), pursuant to a consent decree or otherwise, no such indemnification either for said payment or for any other expenses shall be provided unless such indemnification shall be approved (i) by a majority of the Independent Trustees or (ii) by an independent legal counsel in a written opinion. Approval by the Independent Trustees pursuant to clause (i) shall not prevent the recovery from the Adviser of any amount paid to the Adviser in accordance with either of such clauses as indemnification of the Adviser is subsequently adjudicated by a court of competent jurisdiction not to have acted in good faith in the reasonable belief that the Adviser’s action was in or not opposed to the best interests of the Trust or to have been liable to the Trust or its Shareholders by reason of willful misfeasance, bad faith, gross negligence or reckless disregard of the duties involved in its conduct under the Agreement. |

| | The right of indemnification provided by this Subsection 8(b) shall not be exclusive of or affect any of the rights to which the Adviser may be entitled. Nothing contained in this Subsection 8(b) shall affect any rights to indemnification to which Trustees, officers or other personnel to which Trustees, officers or other personnel of the Trust, and other persons may be entitled by contract or otherwise under law, nor the power of the Trust to purchase and maintain liability insurance on behalf of any such person. |

| | The Board of Trustees of the Trust shall take all such action as may be necessary and appropriate to authorize the Trust hereunder to pay the indemnification required by this Subsection 8(b) including, without limitation, to the extent needed, to determine whether the Adviser is entitled to indemnification hereunder and the reasonable amount of any indemnity due it hereunder, or employ independent legal counsel for that purpose. |

| 8.(c) | The provisions contained in Section 8 shall survive the expiration or other termination of this Agreement, shall be deemed to include and protect the Adviser and its directors, officers, employees and agents and shall inure to the benefit of its/their respective successors, assigns and personal representatives. |

| 9. | Duration and Termination. This Agreement shall become effective on the date of its execution and, unless sooner terminated as provided herein, shall continue in effect for a period of two years. Thereafter, this Agreement shall be renewable for successive periods of one year each, provided such continuance is specifically approved annually: |

| | (a) | By the vote of a majority of those members of the Board of Trustees who are not parties to this Agreement or interested persons of any such party (as that term is defined in the 1940 Act), cast in person at a meeting called for the purpose of voting on such approval; and |

| | (b) | By vote of either the Board or a majority (as that term is defined in the 1940 Act) of the outstanding voting securities of the Fund. |

Notwithstanding the foregoing, this Agreement may be terminated by the Fund or by the Adviser at any time on sixty (60) days’ written notice, without the payment of any penalty, provided that termination by the Fund must be authorized either by vote of the Board of the Board of Trustees or by vote of a majority of the outstanding voting securities of the Fund. This Agreement will automatically terminate in the event of its assignment (as that term is defined in the 1940 Act).

| 10. | Amendment of this Agreement. No provision of this Agreement may be changed, waived, discharged or terminated orally, but only by a written instrument signed by the party against which enforcement of the change, waiver, discharge or termination is sought. No material amendment of this Agreement shall be effective until approved by vote of the holders of a majority of the Fund’s outstanding voting securities (as defined in the 1940 Act). |

| 11. | Miscellaneous. The captions of this Agreement are included for convenience of reference only and in no way define or limit any of the provisions hereof or otherwise affect their construction or effect. If any provision of this Agreement shall be held or made invalid by a court decision, statute, rule or otherwise, the remainder of the Agreement shall not be affected thereby. This Agreement shall be binding and shall inure to the benefit of the parties hereto and their respective successors. |

| 12. | Applicable Law. This Agreement shall be construed in accordance with, and governed by, the laws of the State of Alabama, provided, however, that nothing herein shall be construed as being inconsistent with the 1940 Act. |

IN WITNESS WHEREOF, the parties hereto have caused this instrument to be executed by their officers designated below as of the day and year first above written.

| ATTEST: | | WILLIAMSBURG INVESTMENT TRUST |

| By: | | | By: | |

| Title: | | | Title: | |

| ATTEST: | | LEAVELL INVESTMENT MANAGEMENT, INC. |

| By: | | | By: | |

| Title: | | | Title: | |

| EXHIBIT B: | FORM OF PROPOSED NEW INVESTMENT ADVISORY AGREEMENT ON BEHALF OF THE GOVERNMENT STREET MID-CAP FUND |

INVESTMENT ADVISORY AGREEMENT

THIS AGREEMENT, entered into as of ___________, 2014, by and between The GOVERNMENT STREET MID-CAP FUND of WILLIAMSBURG INVESTMENT TRUST, a Massachusetts Business Trust (the “Trust”), and Leavell Investment Management, Inc., an Alabama corporation (the “Adviser”), registered as an investment adviser under the Investment Advisers Act of 1940, as amended (the “Advisers Act”).

WHEREAS, the Trust is registered as a no-load, open-end management investment company of the series type under the Investment Company Act of 1940, as amended (the “1940 Act”); and

WHEREAS, the Trust desires to retain the Adviser to furnish investment advisory and administrative services to The Government Street Mid-Cap Fund series of the Trust, and the Adviser is willing to so furnish such services;

NOW THEREFORE, in consideration of the promises and mutual covenants herein contained, it is agreed between the parties hereto as follows:

| 1. | Appointment. The Trust hereby appoints the Adviser to act as investment adviser to The Government Street Mid-Cap Fund series of the Trust (the “Fund”) for the period and on the terms set forth in this Agreement. The Adviser accepts such appointment and agrees to furnish the services herein set forth, for the compensation herein provided. |

| 2. | Delivery of Documents. The Trust has furnished the Investment Adviser with copies properly certified or authenticated of each of the following: |

| | a. | The Trust’s Declaration of Trust, as filed with the State of Massachusetts (such Declaration, as presently in effect and as it shall from time to time be amended, is herein called the “Declaration”); |

| | b. | The Trust’s By-Laws (such By-Laws, as presently in effect and as they shall from time to time be amended, are herein called the “By-Laws”); |

| | c. | Resolutions of the Trust’s Board of Trustees authorizing this Agreement; |

| | d. | The Trust’s Registration Statement on Form N-1A under the 1940 Act and under the Securities Act of 1933 as amended (the “1933 Act”), relating to shares of beneficial interest of the Trust (herein called the “Shares”) as filed with the Securities and Exchange Commission (“SEC”) and all amendments thereto; |

| | e. | The Trust’s Prospectus (such Prospectus, as presently in effect and all amendments and supplements thereto are herein called the “Prospectus”). |

| | The Trust will furnish the Adviser from time to time with copies, properly certified or authenticated, of all amendments of or supplements to the foregoing at the same time as such documents are required to be filed with the SEC. |

| 3. | Management. Subject to the supervision of the Trust’s Board of Trustees, the Adviser will provide a continuous investment program for the Fund, including investment research and management with respect to all securities, investments, cash and cash equivalents in the Fund. The Adviser will determine from time to time what securities and other investments will be purchased, retained or sold by the Fund. The Adviser will provide the services under this Agreement in accordance with the Fund’s investment objectives, policies and restrictions as stated in its Prospectus. The Adviser further agrees that it: |

| | a. | Will conform its activities to all applicable Rules and Regulations of the Securities and Exchange Commission and will, in addition, conduct its activities under this Agreement in accordance with regulations of any other Federal and State agencies which may now or in the future have jurisdiction over its activities under this Agreement; |

| | b. | Will place orders pursuant to its investment determinations for the Fund either directly with the issuer or with any broker or dealer. In placing orders with brokers or dealers, the Adviser will attempt to obtain the best net price and the most favorable execution of its orders. Consistent with this obligation, when the Adviser believes two or more brokers or dealers are comparable in price and execution, the Adviser may prefer: (i) brokers and dealers who provide the Fund with research advice and other services, or who recommend or sell Fund shares, and (ii) Brokers who are affiliated with the Trust or its Adviser(s), provided, however, that in no instance will portfolio securities be purchased from or sold to the Adviser or any affiliated person of the Adviser in principal transactions; |

| | c. | Will provide certain executive personnel for the Trust as may be mutually agreed upon from time to time with the Board of Trustees, the salaries and expenses of such personnel to be borne by the Adviser unless otherwise mutually agreed upon; and |

| | d. | Will provide, at its own cost, all office space, facilities and equipment necessary for the conduct of its advisory activities on behalf of the Trust. |

Notwithstanding the foregoing, the Adviser may obtain the services of an investment counselor or sub-advisor of its choice subject to the approval of the Board of Trustees. The cost of employing such counselor or sub-advisor will be paid by the Adviser and not by the Trust.

| 4. | Services Not Exclusive. The advisory services furnished by the Adviser hereunder are not to be deemed exclusive, and the Adviser shall be free to furnish similar services to others as long as its services under this Agreement are not impaired |

thereby provided, however, that without the written consent of the Trustees, the Adviser will not serve as investment adviser to any other investment company having a similar investment objective to that of the Fund.

| 5. | Books and Records. In compliance with the requirements of Rule 31a-3 under the 1940 Act, the Adviser hereby agrees that all records which it maintains for the benefit of the Trust are the property of the Trust and further agrees to surrender promptly to the Trust any of such records upon the Trust’s request. The Adviser further agrees to preserve for the periods prescribed by it pursuant to Rule 31a-2 under the 1940 Act the records required to be maintained by Rule 31a-1 under the Act that are not maintained by others on behalf of the Trust. |

| 6. | Expenses. During the term of this Agreement, the Adviser will pay all expenses incurred by it in connection with its investment advisory services pertaining to the Trust. In the event that there is no distribution plan under Rule 12b-1 of the 1940 Act in effect for the Fund, the Adviser will pay, out of the Adviser’s resources generated from sources other than fees received from the Trust, the entire cost of the promotion and sale of Fund shares. |

| | Notwithstanding the foregoing, the Trust shall pay the expenses and costs of the following: |

| | a. | Taxes, interest charges, and extraordinary expenses; |

| | b. | Brokerage fees and commissions with regard to portfolio transactions of the Fund; |

| | c. | Fees and expenses of the custodian of the Fund’s portfolio securities; |

| | d. | Fees and expenses of the Fund’s administrative agent, the Fund’s transfer and shareholder servicing agent and the Fund’s accounting agent or, if the Trust performs any such services without an agent, the costs of the same; |

| | e. | Auditing and legal expenses; |

| | f. | Cost of maintenance of the Trust’s existence as a legal entity; |

| | g. | Compensation of trustees who are not interested persons of the Adviser as that term is defined by law; |

| | h. | Costs of Trust meetings; |

| | i. | Federal and State registration or qualification fees and expenses; |

| | j. | Costs of setting in type, printing and mailing Prospectuses, reports and notices to existing shareholders; |

| | k. | The investment advisory fee payable to the Adviser, as provided in paragraph 7 herein; and |

| | l. | Distribution expenses, but only in accordance with any Distribution Plan as and if approved by the shareholders of the Fund. |

| 7. | Compensation. For the services provided to the Fund and for the expenses assumed by the Adviser pursuant to this Agreement, the Trust will pay the Adviser and the Adviser will accept as full compensation an investment advisory fee, computed at the end of each month and payable within five (5) business days thereafter, at the annual rate of 0.75% of the Fund’s average daily net assets. |

| 8.(a) | Limitation of Liability. The Adviser shall not be liable for any error of judgment, mistake of law or for any other loss whatsoever suffered by the Trust in connection with the performance of this Agreement, except a loss resulting from a breach of fiduciary duty with respect to the receipt of the compensation for services or a loss resulting from willful misfeasance, bad faith or gross negligence on the part of the Adviser in the performance of its duties or from reckless disregard by it of its obligations and duties under this Agreement. |