THE JAMESTOWN FUNDS

The Jamestown Balanced Fund

a series of

Williamsburg Investment Trust

1802 Bayberry Court, Suite 400

Richmond, Virginia 23226

Dear Shareholder:

We are writing to let you know about important developments involving The Jamestown Balanced Fund. Lowe, Brockenbrough & Company (“LB&C”), the investment advisor to the Jamestown Funds, after careful consideration, has proposed a tax-free reorganization of The Jamestown Balanced Fund into another series of the Trust, The Jamestown Equity Fund. Your fund’s current operating expenses are expected to be reduced following the reorganization since The Jamestown Equity Fund has a lower expense ratio than The Jamestown Balanced Fund. Moreover, shareholders will not pay any costs associated with the reorganization, which will be borne by LB&C. As a shareholder of The Jamestown Balanced Fund, you are being asked to vote on this proposal.

The reorganization is designed to achieve economies of scale by combining The Jamestown Balanced Fund with The Jamestown Equity Fund. On the date of the reorganization, your shares will automatically be converted into shares of The Jamestown Equity Fund, which has similar investment objectives, investment strategies and risk factors as The Jamestown Balanced Fund. In fact, all of the equity securities held by The Jamestown Balanced Fund are also held by The Jamestown Equity Fund. However, there are essential differences between the funds. Most importantly, The Jamestown Equity Fund does not offer any exposure to fixed income investments; instead, it invests primarily in a diversified portfolio of domestic equity securities. As a result, the net asset value of The Jamestown Equity Fund may fluctuate more due to changes in the stock market than that of The Jamestown Balanced Fund. Because the two funds do not have identical investment objectives and strategies, shareholders must consider if the resulting investment in The Jamestown Equity Fund is consistent with their investment objectives.

We believe the combination of the two series of the Trust will provide the opportunity for improved operating efficiencies as the fixed costs of operating a mutual fund can be spread over a larger pool of assets. As a result of the larger asset size of the combined fund, the projected expense ratio of The Jamestown Equity Fund is expected to be lower following the reorganization. Because the process used by LB&C to select equity investments in the Funds is substantially identical and the portfolio of equity securities held by each Fund is substantially the same (except for differences in proportions), the reorganization is designed to reduce product overlap in the Trust by combining The Jamestown Balanced Fund with The Jamestown Equity Fund. In addition, LB&C believes shareholders have the ability to obtain cost-effective, diversified fixed income exposure from investments other than The Jamestown Balanced Fund, such as through exchange-traded funds (“ETFs”), index funds or actively managed mutual funds. For these and other reasons, shareholders are expected to benefit from the reorganization.

On July 17, 2015 at 10:00 a.m., at the offices of Ultimus Fund Solutions, LLC, the Trust’s transfer agent, 225 Pictoria Drive, Suite 450, Cincinnati Ohio 45246, a Special Meeting of Shareholders will be held. The purpose of the meeting is to consider and approve an Agreement and Plan of Reorganization providing for the reorganization of The Jamestown Balanced Fund into The Jamestown Equity Fund. If the reorganization is approved and completed, you will become a shareholder of The Jamestown Equity Fund.

Formal notice of this Meeting appears in the enclosed Prospectus/Proxy Statement as well as a description of the proposed reorganization. The Agreement and Plan of Reorganization is attached as Appendix A to the Prospectus/Proxy Statement. The Board of Trustees believes that this transaction is in the best interests of shareholders of The Jamestown Balanced Fund and has unanimously recommended that shareholders vote “FOR” the proposal.

In connection with the reorganization you should note the following:

| · | The reorganization is intended to qualify as a tax-free transaction. As a condition to the closing of the reorganization, both funds will receive an opinion of legal counsel as to the tax-free nature of the reorganization for U.S. federal income tax purposes. |

| · | The value of the shares in The Jamestown Equity Fund you receive in the reorganization will equal the value of the shares you exchange from The Jamestown Balanced Fund |

| · | The reorganization is also expected to provide shareholders the opportunity to potentially benefit from economies of scale. |

The Board of Trustees of the Trust has fixed the close of business on June 12, 2015 as the record date for the Meeting. Shareholders of record on that date are entitled to notice of, and to vote at the Meeting. Your vote is important no matter how many shares you own. In addition to voting by mail, you may vote by telephone or through the Internet as follows:

| TO VOTE BY TELEPHONE: | TO VOTE BY INTERNET: |

| 1) | Read the Prospectus/Proxy Statement and have the enclosed proxy card at hand | 1) | Read the Prospectus/Proxy Statement and have the enclosed proxy card at hand |

| 2) | Call the toll-free number that appears on the enclosed proxy card and follow the simple instructions | 2) | Go to the website that appears on the enclosed proxy card and follow the simple instructions |

We encourage you to vote by telephone or through the internet using the control number that appears on the enclosed proxy card. Use of telephone or internet voting will reduce the time and costs associated with this proxy solicitation. Whichever method you choose, please read the enclosed Prospectus/Proxy Statement carefully before you vote.

If you have any questions after considering the enclosed materials, please call 1-866-738-1126. Please take this opportunity to vote. Thank you for your participation and for your continued support.

Respectfully,

Charles M. Caravati, III, CFA

President, The Jamestown Balanced Fund

NOTICE OF MEETING OF SHAREHOLDERS

TO BE HELD ON JULY 17, 2015

Williamsburg Investment Trust

The Jamestown Balanced Fund

To Shareholders of The Jamestown Balanced Fund:

NOTICE IS HEREBY GIVEN that a Special Meeting of Shareholders (the “Meeting”) of The Jamestown Balanced Fund, a series of Williamsburg Investment Trust (the “Trust”), will be held at 10:00 a.m. Eastern Time on July 17, 2015, at the offices of Ultimus Fund Solutions, LLC at 225 Pictoria Drive, Suite 450, Cincinnati, Ohio 45246, to consider and vote on the following:

1. Approval of the Agreement and Plan of Reorganization and related transactions that provide for the transfer of all of the assets of The Jamestown Balanced Fund to The Jamestown Equity Fund in exchange for shares of The Jamestown Equity Fund and the assumption by The Jamestown Equity Fund of the known liabilities of The Jamestown Balanced Fund, and the distribution of such shares to shareholders in complete liquidation of The Jamestown Balanced Fund, all as described in the attached Prospectus/Proxy Statement.

2. To transact any other business that may properly come before the Meeting or any postponement or adjournment thereof.

The proposed reorganization is described in the attached Prospectus/Proxy Statement. The Agreement and Plan of Reorganization is attached as Appendix A to the Prospectus/Proxy Statement.

The Board of Trustees of the Trust has fixed the close of business on June 12, 2015 as the record date for the Meeting. Shareholders of record on that date are entitled to notice of, and to vote at, the Meeting.

By Order of the Board of Trustees,

Charles M. Caravati, III, CFA

President

The Jamestown Balanced Fund

June 25, 2015

your vote is important. please vote by telephone or through the internet by following the instructions on your proxy card whether or not you plan to be present at the meeting. you may also vote by signing the enclosed proxy and returning it in the enclosed envelope. no postage is necessary if mailed in the united states. the proxy is revocable and will not affect your right to vote in person if you attend the meeting.

PROSPECTUS/PROXY STATEMENT

June 25 2015

Acquisition of tahe Assets and Liabilities of

The Jamestown Balanced Fund (JAMBX)

a series of

Williamsburg Investment Trust

1802 Bayberry Court, Suite 400

Richmond, Virginia 23226

(1-866-738-1126)

By and in Exchange for Shares of

The Jamestown Equity Fund (JAMEX)

a series of

Williamsburg Investment Trust

This Prospectus/Proxy Statement is being furnished to shareholders of The Jamestown Balanced Fund, a series of Williamsburg Investment Trust (the “Trust”), in connection with a Meeting of Shareholders of The Jamestown Balanced Fund (the “Meeting”) to be held at 10:00 a.m. Eastern Time on July 17, 2015, at the offices of the Trust’s transfer agent, Ultimus Fund Solutions, LLC, 225 Pictoria Drive, Suite 450, Cincinnati, Ohio 45246. At the Meeting, shareholders of The Jamestown Balanced Fund will be asked to approve an Agreement and Plan of Reorganization, pursuant to which The Jamestown Balanced Fund will be reorganized into The Jamestown Equity Fund (the “Reorganization”). The Jamestown Balanced Fund and The Jamestown Equity Fund are referred to herein collectively as the “Funds” and individually as a “Fund.”

TABLE OF CONTENTS

| I. | GENERAL INFORMATION | 5 |

| II. | INTRODUCTION | 6 |

| III. | QUESTIONS AND ANSWERS REGARDING THE REORGANIZATION | 7 |

| IV. | PROPOSAL: REORGANIZATION OF THE JAMESTOWN BALANCED FUND INTO THE JAMESTOWN EQUITY FUND | 15 |

| V. | OTHER INFORMATION | 19 |

| VI. | VOTING INFORMATION | 20 |

| VII. | FINANCIAL STATEMENTS AND EXPERTS | 22 |

| VIII. | LEGAL MATTERS | 23 |

| IX. | INFORMATION FILED WITH THE SEC | 22 |

| APPENDIX A: AGREEMENT AND PLAN OF REORGANIZATION | 24 |

| APPENDIX B: PRINCIPAL INVESTMENT STRATEGIES OF THE FUNDS | 37 |

| APPENDIX C: PRINCIPAL RISKS OF INVESTING IN THE FUNDS | 39 |

This Prospectus/Proxy Statement concisely sets forth information you should know before voting on the following proposal:

| Proposal - To be Voted on by Shareholders of The Jamestown Balanced Fund |

| Approval of the Agreement and Plan of Reorganization and related transactions that provide for the transfer of all of the assets of The Jamestown Balanced Fund to The Jamestown Equity Fund in exchange for shares of The Jamestown Equity Fund and the assumption by The Jamestown Equity Fund of the known liabilities of The Jamestown Balanced Fund, and the distribution of such shares to shareholders in complete liquidation of The Jamestown Balanced Fund, all as described in this Prospectus/Proxy Statement. |

Please read this Prospectus/Proxy Statement carefully and keep it for future reference. This Prospectus/Proxy Statement and related proxy materials are first being made available to shareholders on or about June 25, 2015. Shareholders of record as of the close of business on June 12, 2015 are entitled to vote at the Meeting and any adjournments thereof.

Additional information concerning each Fund and the Reorganization is contained in the documents described below, all of which have been filed with the Securities and Exchange Commission (“SEC”) and are hereby incorporated by reference into this Prospectus/Proxy Statement.

| Information about The Jamestown Balanced Fund and The Jamestown Equity Fund | How to Obtain this Information |

| Prospectus of The Jamestown Funds, dated August 1, 2014, as supplemented from time to time. | Copies are available upon request and without charge if you: Visit www.jamestownfunds.com on the Internet; or Write to The Jamestown Funds c/o Ultimus Fund Solutions, LLC P.O. Box 46707 Cincinnati, Ohio 45246; or Call 1-866-738-1126 |

| Statement of Additional Information of The Jamestown Funds, dated August 1, 2014, as supplemented from time to time. |

| Audited financial statements and related report of independent registered public accounting firm of The Jamestown Funds included in the Annual Report to Shareholders for the fiscal year ended March 31, 2015. |

| Unaudited financial statements of The Jamestown Funds included in the Semi-Annual Report to Shareholders for the period ended September 30, 2014. |

| Information about the Reorganization | How to Obtain this Information |

| Statement of Additional Information dated June 25, 2015 which relates to this Prospectus/Proxy Statement and the Reorganization. | Copies are available upon request and without charge if you: Visit www.jamestownfunds.com on the Internet; or Write to The Jamestown Funds c/o Ultimus Fund Solutions, LLC P.O. Box 46707 Cincinnati, Ohio 45246; or Call 1-866-738-1126 |

All of the foregoing Fund documents can be viewed online or downloaded from the EDGAR database without charge on the SEC’s Internet site at www.sec.gov. Shareholders can review and copy information about the Funds by visiting the SEC’s Public Reference Room in Washington, D.C. 20549-1520. Shareholders can obtain copies, upon payment of a duplicating fee, by sending an e-mail request to publicinfo@sec.gov or by writing the Public Reference Section Washington D.C., 20549-1520. Information on the operation of the Public Reference Room may be obtained by calling 1-202-551-8090.

THESE SECURITIES HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE SECURITIES AND EXCHANGE COMMISSION NOR HAS THE SECURITIES AND EXCHANGE COMMISSION PASSED UPON THE ACCURACY OR ADEQUACY OF THIS PROSPECTUS/PROXY STATEMENT. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

This Prospectus/Proxy Statement relates to the reorganization of The Jamestown Balanced Fund into The Jamestown Equity Fund. In the reorganization, all of the assets of The Jamestown Balanced Fund will be acquired by The Jamestown Equity Fund in exchange for shares of The Jamestown Equity Fund. Following shareholder approval, shares of The Jamestown Equity Fund will be distributed to the shareholders of The Jamestown Balanced Fund in accordance with their respective percentage ownership interests in The Jamestown Balanced Fund on the closing date, which is expected to be on or around July 28, 2015. The Jamestown Balanced Fund will then be terminated. These events, collectively, are referred to in this Prospectus/Proxy Statement as the “Reorganization.”

It is intended that, as a result of the proposed Reorganization, each of The Jamestown Balanced Fund’s shareholders will receive on a tax-free basis (for U.S. federal income tax purposes) a number of full and fractional shares of The Jamestown Equity Fund with an aggregate net asset value equal to the aggregate net asset value of the shares of The Jamestown Balanced Fund held by such shareholder immediately prior to the closing of the Reorganization.

Until the closing date, shareholders of The Jamestown Balanced Fund will continue to be able to redeem their shares at the next determined share price after receipt of a redemption request in proper form by Ultimus Fund Solutions, LLC, the Fund’s transfer agent (the “Transfer Agent”). (See “How to Redeem Shares” in The Jamestown Balanced Fund’s Prospectus dated August 1, 2014.) If the Reorganization is consummated, shareholders will be free to redeem shares of The Jamestown Equity Fund they receive in the transaction at the next determined share price after receipt of a redemption request in proper form by the Transfer Agent.

Shareholders of The Jamestown Balanced Fund are being asked to approve the Agreement and Plan of Reorganization. A copy of the Agreement and Plan of Reorganization is attached as Appendix A. By approving the Agreement and Plan of Reorganization, The Jamestown Balanced Fund’s shareholders are approving the Reorganization, which includes the liquidation and termination of The Jamestown Balanced Fund. The Agreement and Plan of Reorganization has been approved by the Board of Trustees of the Trust.

If The Jamestown Balanced Fund’s shareholders do not approve the Reorganization, the Board of Trustees of the Trust will consider what other action, if any, should be taken in the best interests of The Jamestown Balanced Fund and its shareholders. Possible alternatives to the Reorganization may include liquidating The Jamestown Balanced Fund or the continued operation of the Fund.

| III. | QUESTIONS AND ANSWERS REGARDING THE REORGANIZATION |

The following questions and answers provide an overview of key features of the proposed Reorganization. Please call 1-866-738-1126 with any questions about the Reorganization or this Prospectus/Proxy Statement generally or to obtain a copy of the prospectus and statement of additional information of the Funds.

| 1. | Why is the Reorganization being proposed? |

The Reorganization is being proposed in order to achieve operating efficiencies and lower operating expenses and to provide an opportunity for a more efficient investment management process. The Reorganization may benefit you by reducing operating expenses due to the spreading of fixed costs over a larger pool of assets. Your fund’s current operating expenses are expected to be reduced since The Jamestown Equity Fund has a lower expense ratio than The Jamestown Balanced Fund.

| 2. | How do the Trustees recommend that I vote? |

The Trustees of the Trust, including the Trustees who are not “interested persons,” as such term is defined in the Investment Company Act of 1940, as amended (the “1940 Act”), of the Trust (the “Independent Trustees"), have concluded that the Reorganization will be in the best interests of shareholders of The Jamestown Balanced Fund and that their interests will not be diluted as a result of the Reorganization. Before approving the Agreement and Plan of Reorganization, the Trustees considered the similarities in the investment objectives and principal investment strategies of The Jamestown Balanced Fund and The Jamestown Equity Fund, as well as the other potential benefits (i.e. lower operating expenses) of the Reorganization to shareholders of The Jamestown Balanced Fund. The Board of Trustees of the Trust believes that the completion of the proposed Reorganization will enable shareholders of The Jamestown Balanced Fund to benefit from, among other things:

| · | the fact that the expenses of The Jamestown Equity Fund are expected to be lower than the expenses of The Jamestown Balanced Fund; and |

| · | the potential to achieve operating efficiencies and economies of scale. |

After careful consideration, the Board of Trustees of the Trust determined that the proposed Reorganization is in the best interests of The Jamestown Balanced Fund and its shareholders. The Board strongly urges you to vote FOR approval of the Reorganization.

| 3. | How do the fees and expenses of The Jamestown Equity Fund compare to those of The Jamestown Balanced Fund, and what are they estimated to be following the Reorganization? |

As shown in the expense table below, the annual expense ratio of The Jamestown Equity Fund after the Reorganization is expected to be lower than the annual expense ratio of The Jamestown Balanced Fund. The advisory fees accrued by each Fund during the most recently completed fiscal year were at the rate of 0.65% of the Fund’s average daily net assets; however the advisory fee paid by The Jamestown Balanced Fund was equal to 0.59% of the Fund’s average daily net assets after voluntary fee waivers by Lowe, Brockenbrough & Company (“LB&C”). The following table shows the fees and expenses of each Fund for its most recently audited fiscal year as well as the pro forma fees and expenses for The Jamestown Equity Fund for its fiscal year ending March 31, 2016 assuming that the Reorganization occured on July 28, 2015. The examples following the table will help you compare the cost of investing in The Jamestown Balanced Fund with the estimated cost of investing in The Jamestown Equity Fund (based on the pro forma fees and expenses) after the Reorganization.

| FEES AND EXPENSES |

| Based on Fiscal Year Ended: | 3-31-15 | 3-31-15 | 3-31-16 |

| | The Jamestown Balanced Fund | The Jamestown Equity Fund | Pro Forma: The Jamestown Equity Fund |

Shareholder Fees (fees paid directly from your investment) | None | None | None |

| | | | |

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | | | |

| Management Fees | 0.65% | 0.65% | 0.65% |

| Service (12b-1) Fees | None | None | None |

| Other Expenses | 0.70% | 0.44% | 0.31% |

| Total Annual Fund Operating Expenses | 1.35% | 1.09% | 0.96% |

Expense Example. This example is intended to help you compare the cost of investing in The Jamestown Balanced Fund with the cost of investing in The Jamestown Equity Fund. The examples assume that you invest $10,000 for the time periods indicated. The examples also assume that your investment has a 5% return each year and that each Fund’s operating expenses remain the same. All expense information is based on the information set forth in the expense table above, including pro forma expense information for The Jamestown Equity Fund. Your actual costs may be higher or lower than those shown below.

| | The Jamestown Balanced Fund | The Jamestown Equity Fund | Pro Forma: The Jamestown Equity Fund |

| 1 Year | $137 | $111 | $98 |

| 3 Years | $428 | $347 | $306 |

| 5 Years | $739 | $601 | $531 |

| 10 Years | $1,624 | $1,329 | $1,178 |

4. How do the investment objectives and principal investment strategies of The Jamestown Balanced Fund compare to those of The Jamestown Equity Fund?

The Funds have similar investment objectives and principal investment strategies with respect to their equity investments. The investment objectives of The Jamestown Balanced Fund are long-term growth of capital and income. Capital protection and low volatility are important investment goals. The Jamestown Balanced Fund will normally hold at least 25% of its net assets and up to 75% of its net assets in fixed income securities and at least 25% of its net assets and up to 75% of its net assets in equity securities. The investment objective of The Jamestown Equity Fund is long-term growth of capital. Current income is incidental to this objective and may not be significant. Under normal circumstances, at least 80% of The Jamestown Equity Fund’s net assets (including the amount of any borrowings for investment purposes) will be invested in equity securities.

The Funds have substantially similar principal investment strategies with respect to their equity investments. The primary difference between the investment strategies of the Funds is that The Jamestown Balanced Fund seeks long-term growth of capital and income while The Jamestown Equity Fund seeks long-term growth of capital. The percentage of assets invested in equity and fixed income securities by The Jamestown Balanced Fund will vary from time to time based upon LB&C’s judgment of general market and economic conditions, trends in yields and interest rates and changes in fiscal or monetary policies. LB&C considers the goals of capital protection and low volatility when adjusting the Fund’s portfolio allocation between equity securities and fixed income securities. LB&C believes that, by utilizing these investment strategies, The Jamestown Balanced Fund’s net asset value may not rise as rapidly as the stock market (as represented by the S&P 500 Index) during rising market cycles, but would not suffer as great a decline as the S&P 500 Index during declining market cycles.

The average maturity of the fixed income portion of The Jamestown Balanced Fund’s portfolio will typically vary from 3 to 12 years and will be shifted to reflect LB&C’s assessment of changes in credit conditions, international currency markets, economic conditions, fiscal policy, monetary policy and political climate. The Jamestown Balanced Fund will normally hold at least 25% of its net assets and up to 75% of its net assets in fixed income securities and at least 25% of its net assets and up to 75% of its net assets in equity securities. As of March 31, 2015, 29.3% of the portfolio of The Jamestown Balanced Fund consisted of fixed income securities. After obtaining shareholder approval of the Reorganization, these fixed income securities will be sold by The Jamestown Balanced Fund prior to the consummation of the Reorganization. The securities that comprise the fixed income portion of The Jamestown Balanced Fund’s portfolio are expected to be sold during the period of July 17, 2015 to July 28, 2015. The Jamestown Balanced Fund will bear the cost of any brokerage fees and expenses incurred as a result of the sale of the Fund’s fixed income securities; however, we do not believe that any such costs and expenses will be incurred in selling the fixed income securities, although dealer markdowns may be incurred. It is also expected that capital gains of approximately $80,000 ($0.06 per share) will be generated by the sale of the fixed income securities, which will be distributed to shareholders of The Jamestown Balanced Fund immediately prior to the Reorganization.

The process used by LB&C to select equity investments for the Funds is substantially similar and the portfolio of equity securities held by each Fund is substantially the same, except for differences in proportions. LB&C seeks financially strong, relatively large companies that offer above average earnings and relatively modest valuations. LB&C uses a multi-factor screening process within a defined universe comprised of the stocks in the S&P 500 Index and the 50 largest capitalization stocks in the S&P 400 MidCap Index to select investments for each Fund. The process emphasizes securities with the most compelling earnings and valuation profiles based upon a variety of characteristics, including earnings momentum, earnings volatility, earnings estimate revisions, earnings surprises and price/earnings ratios.

As of March 31, 2015, common stocks comprised 65.1% of the portfolio of The Jamestown Balanced Fund and 93.4% of the portfolio of The Jamestown Equity Fund. As of March 31, 2015, the Funds had identical common stock holdings, although the amounts held varied, as The Jamestown Equity Fund had a larger position in each equity holding than The Jamestown Balanced Fund.

Although each Fund’s equity securities consist primarily of common stocks, each may invest a portion of its assets in other equity securities, including exchange-traded funds (“ETFs”), preferred stocks, convertible preferred stocks and convertible bonds that are rated at the time of purchase in the four highest grades assigned by a nationally recognized rating agency, or unrated securities determined by LB&C to be of comparable quality. As of March 31, 2015, each Fund held one identical ETF. The ETF comprised 1.4% of the portfolio of The Jamestown Balanced Fund and 2.0% of the portfolio of The Jamestown Equity Fund.

An equity security may be sold by the Funds when it no longer meets LB&C’s investment criteria, when there are more attractive investment opportunities or when the fundamentals of the issuer’s business or general market conditions have changed. For a description of each Fund’s portfolio investments, see the March 31, 2015 Annual Report for The Jamestown Funds.

For more information regarding the principal investment strategies of the Funds, see ”Principal Investment Strategies” in Appendix B.

| 5. | How do the risks of investing in The Jamestown Balanced Fund compare to the risks of investing in The Jamestown Equity Fund? |

Because the investment process for the selection of equity securities and the equity holdings as of March 31, 2015 are identical for each Fund (except for the proportions), they are both subject to the same risks associated with equity investments. The difference in risk characteristics between the Funds is that a portion of The Jamestown Balanced Fund’s portfolio consists of fixed income securities and is therefore subject to the risks associated with fixed income investments. The value of the fixed income securities held by The Jamestown Balanced Fund will fluctuate based on a variety of factors, including: interest rates, general bond market conditions, the maturity of the security and the creditworthiness of an issuer. The net asset value of The Jamestown Equity Fund may fluctuate more due to changes in the stock market than that of The Jamestown Balanced Fund. Because the two Funds do not have identical investment strategies, shareholders must consider if the resulting investment in The Jamestown Equity Fund is consistent with their investment objectives.

Each Fund is subject to the risk that you could lose all or a portion of the money you invest and there is no assurance that either Fund will achieve its investment objective(s). Upon redemption, an investment in either Fund may be worth less than its original cost. Each Fund, by itself, does not provide a complete investment program. Because the Funds are actively managed, they are subject to the risk that the investment strategies, techniques and risk analyses employed by LB&C may not produce the desired results. LB&C’s method of security selection may not be successful and could cause a Fund to underperform other funds with similar investment strategies. Also, because the Funds’ equity investment selections are chosen from a defined universe of the stocks in the S&P 500 Index and the 50 largest stocks in the S&P 400 MidCap Index, the Funds are subject to the risks of investing in larger capitalization companies. Larger capitalization companies may be unable to respond quickly to new competitive challenges, such as changes in technology and consumer tastes, and may not be able to attain the high growth rate of successful smaller companies, especially during extended periods of economic expansion.

For more information regarding the principal risks of the Funds, see ”Principal Risks” in Appendix C.

| 6. | What is the performance record of the Funds? |

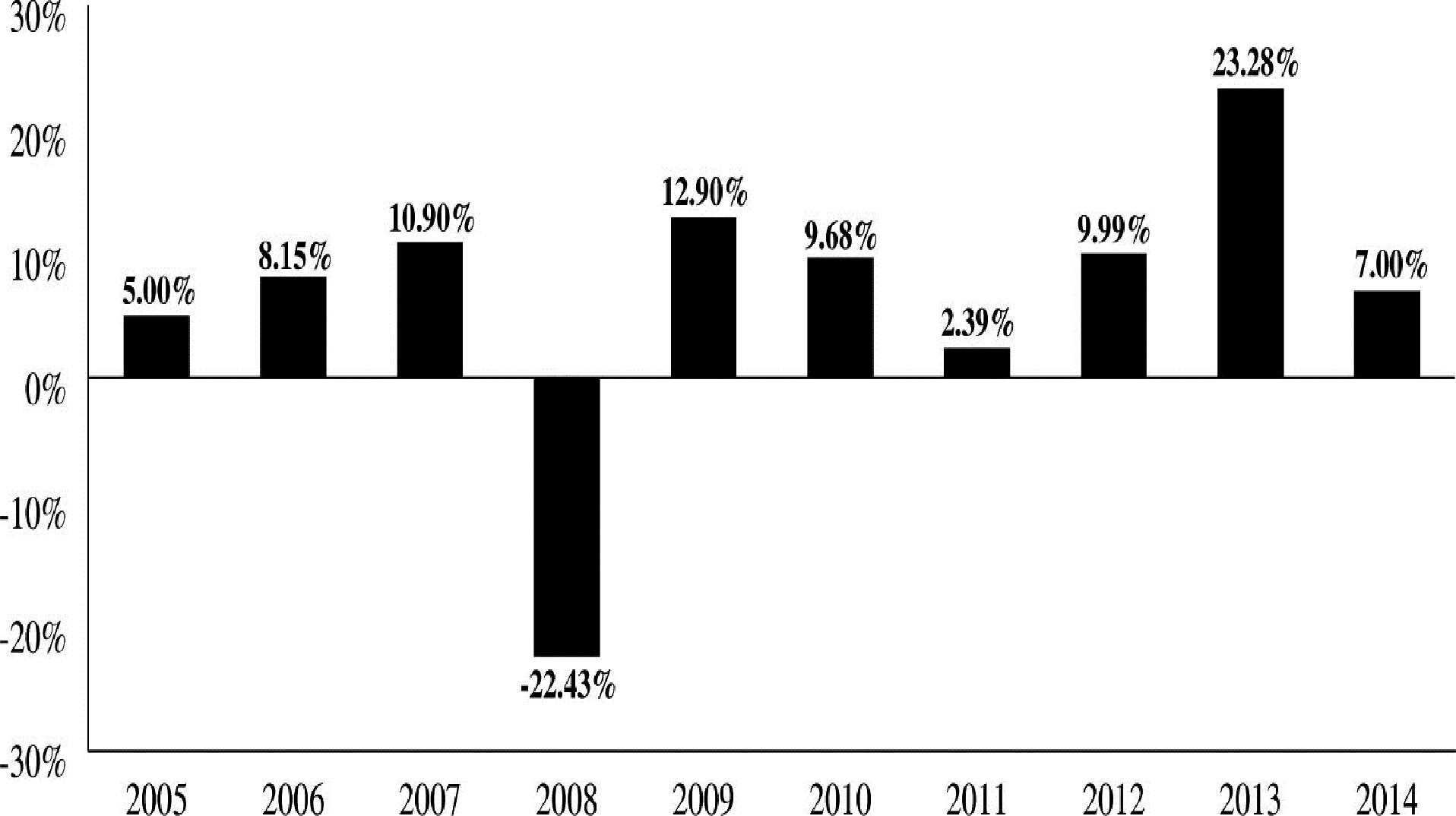

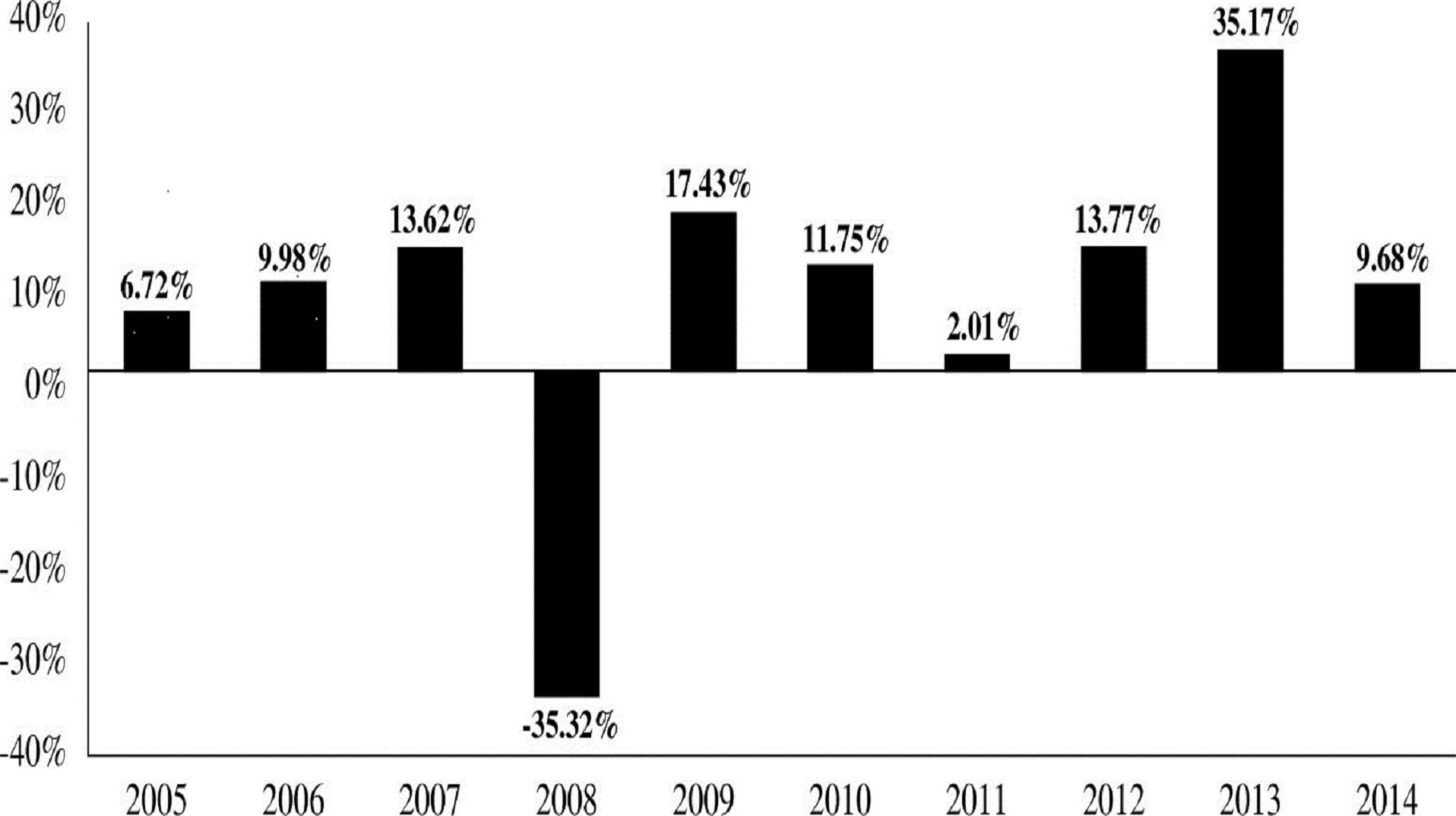

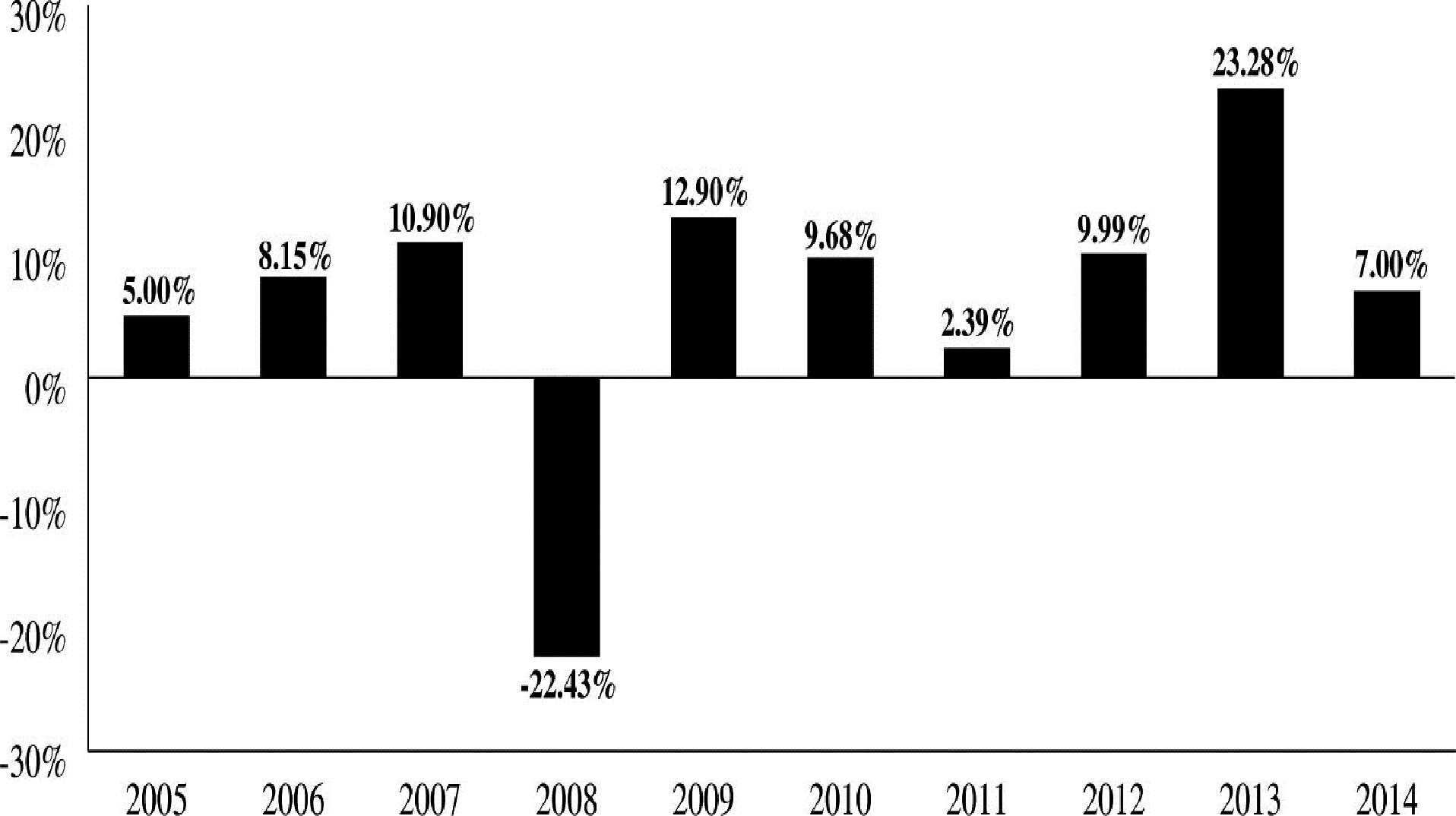

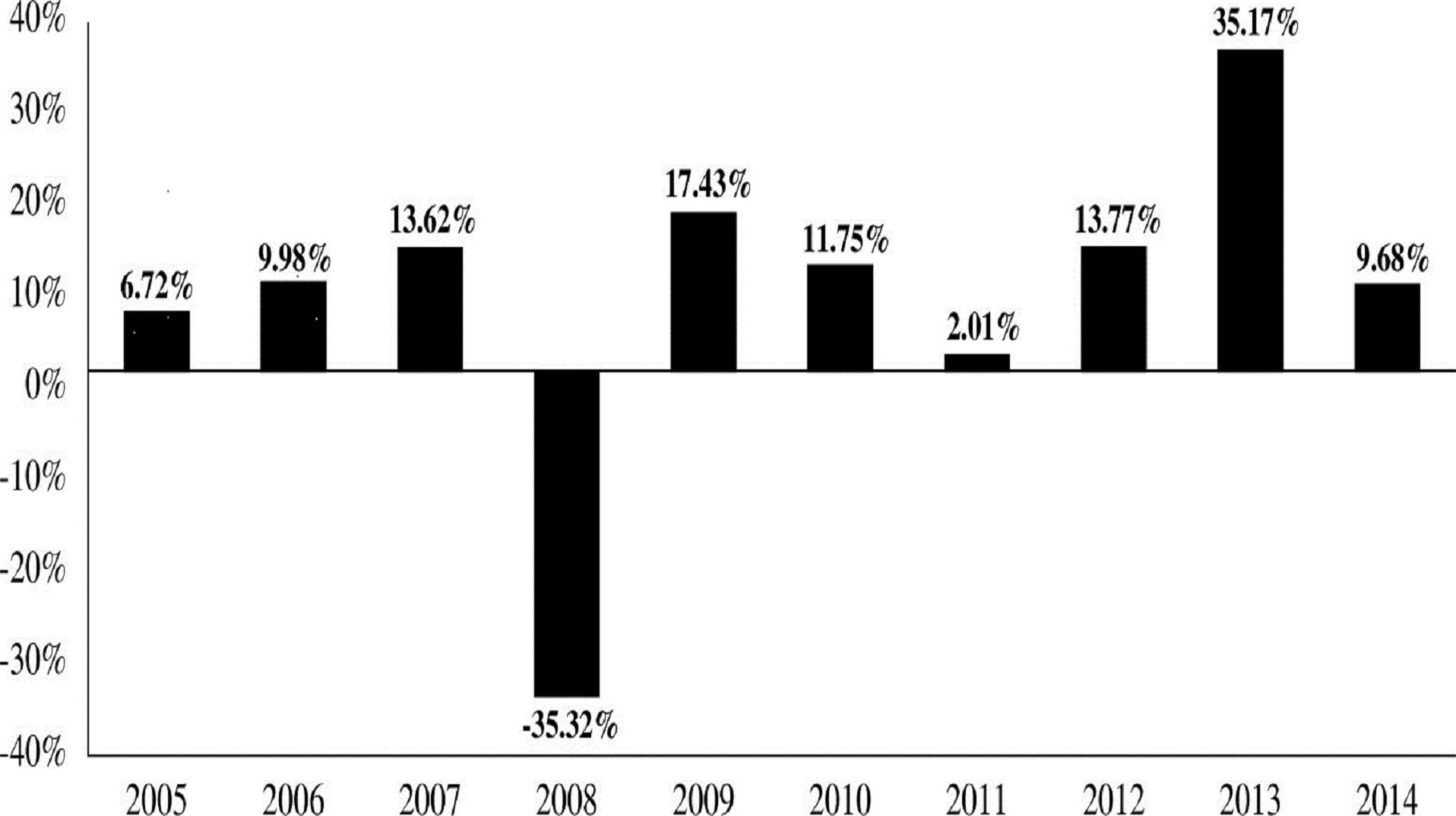

The following charts show the past performance record of each Fund for the past ten calendar years. The charts give you an indication of the risks and variability of investing in the Funds by showing how their performance has varied from year to year. Each Fund can also experience short-term performance swings as indicated in the high and low quarter information at the bottom of each chart. How a Fund has performed in the past is not necessarily an indication of how the Fund will perform in the future. Updated performance information, current to the most recent month-end, is available by calling 1-866-738-1126.

| The Jamestown Balanced Fund (as of 12-31) | The Jamestown Equity Fund (as of 12-31) |

| | |

|  |

| Best Quarter | March 31, 2012 | 8.80% | Best Quarter | March 31, 2012 | 12.78% |

| Worst Quarter | December 31, 2008 | - 11.89% | Worst Quarter | December 31, 2008 | -20.50% |

| Average Annual Total Returns for Periods Ended December 31, 2014: |

| The Jamestown Balanced Fund | 1 Year | 5 Years | 10 Years |

| Return Before Taxes | 7.00% | 10.26% | 6.04% |

Return After Taxes on Distributions(1) | 4.22% | 8.89% | 4.63% |

Return After Taxes on Distributions and Sale of Fund Shares(1) | 6.03% | 8.04% | 4.71% |

Standard & Poor’s 500 Index (reflects no deduction for fees, expenses or taxes)(2) | 13.69% | 15.45% | 7.67% |

60% S&P 500 Index/40%Barclays Intermediate U.S. Government/Credit Index (reflects no deduction for fees, expenses or taxes)(3) | 9.43% | 10.78% | 6.52% |

| | | | |

| The Jamestown Equity Fund | 1 Year | 5 Years | 10 Years |

| Return Before Taxes | 9.68% | 13.97% | 6.89% |

Return After Taxes on Distributions(1) | 6.60% | 12.85% | 5.90% |

Return After Taxes on Distributions and Sale of Fund Shares(1) | 7.84% | 11.17% | 5.55% |

Standard & Poor’s 500 Index (reflects no deduction for fees, expenses or taxes)(2) | 13.69% | 15.45% | 7.67% |

| (1) | After-tax returns are calculated assuming the historical highest individual federal income and capital gains rates. “Return After Taxes on Distributions” assumes a continued investment in the Fund and shows the effect of taxes on Fund distributions. “Return After Taxes on Distributions and Sale of Fund Shares” assumes all shares were redeemed at the end of each measurement period and shows the effect of any taxable gain (or offsetting loss) on redemption, as well as the effects of taxes on Fund distributions. These after-tax returns do not reflect the impact of state and local taxes. After-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred programs, such as Individual Retirement Accounts (“IRAs”) or 401(k) plans. |

| (2) | The Standard & Poor’s 500 Index is an unmanaged index that measures the performance of the 500 largest U.S. companies listed on the New York Stock Exchange or NASDAQ. |

| (3) | The 60% S&P 500 Index/40%Barclays Intermediate U.S. Government/Credit Index is a blended index consisting of stocks in the S&P 500 Index and the Barclays Intermediate U.S. Government/Credit Index and is representative of a balanced portfolio consisting of both equity and fixed income securities. |

For a detailed discussion of the manner of calculating total return, please see the Funds’ Statement of Additional Information. Generally, the calculations of total return assume the reinvestment of all dividends and capital gains distributions on the reinvestment date and the deduction of all recurring expenses that were charged to shareholder accounts.

Important information about the Funds’ performance is also contained in the Letter to Shareholder section of The Jamestown Funds’ most recent annual report.

| 7. | Will I Be Able to Purchase, Exchange and Redeem Shares and Receive Distributions the Same Way? |

The Reorganization will not affect your right to purchase and redeem shares, to exchange shares and to receive distributions. After the Reorganization, you will be able to purchase additional shares, redeem shares, and receive distributions of The Jamestown Equity Fund in the same manner as you did for your shares of The Jamestown Balanced Fund before the Reorganization. The minimum initial investment in each Fund is $5,000 or $1,000 for tax deferred retirement accounts. The minimum additional investment in the Funds is $100 for participants in the automatic investment plan and these requirements will remain the same following the Reorganization.

After the Reorganization, shareholders who receive shares of The Jamestown Equity Fund in connection with the Reorganization will be able to purchase additional shares of The Jamestown Equity Fund, subject to the rights and restrictions currently in place for the Funds.

| 8. | Who will be the Investment Adviser and Portfolio Managers of The Jamestown Equity Fund after the Reorganization? |

Lowe, Brockenbrough & Company (“LB&C”) is the investment adviser to each of the Funds. LB&C is responsible for furnishing an investment program for the Funds, making the day-to-day investment decisions and arranging the execution of portfolio transactions. LB&C is located at 1802 Bayberry Court, Suite 400, Richmond, Virginia 23226 and has approximately $2.2 billion of assets under management as of March 31, 2015. The controlling shareholder of LB&C is Austin Brockenbrough, III who is a founding partner, Managing Director and Chairman of the Board of Directors of LB&C.

The co-portfolio managers for The Jamestown Balanced Fund are Charles M. Caravati, III, CFA, Lawrence B. Whitlock, Jr., CFA and Joseph A. Jennings, III, CFA. The co-portfolio managers for The Jamestown Equity Fund are Charles M. Caravati, III, CFA and Lawrence B. Whitlock, Jr. LB&C and the portfolio managers of The Jamestown Equity Fund will continue to manage The Jamestown Equity Fund in their same capacities following the Reorganization. Since Joseph A. Jennings, III, CFA was primarily responsible for managing the fixed-income portion of The Jamestown Balanced Fund, he will not be involved in the portfolio management of The Jamestown Equity Fund following the Reorganization.

The business experience of the portfolio managers for The Jamestown Equity Fund is described below:

· Charles M. Caravati, III, CFA, currently serves as Chief Investment Officer and a Managing Director of LB&C and has been with the firm since 1992. Mr. Caravati has been a co-portfolio manager of The Jamestown Equity Fund since August 2000. Mr. Caravati has a B.A. degree in History and Economics and an M.B.A. from the University of Virginia. He has earned a Chartered Financial Analyst designation and has 28 years of investment experience.

· Lawrence B. Whitlock, Jr., CFA, is a Managing Director of LB&C and has been with the firm since 1993. Mr. Whitlock has been a co-portfolio manager of The Jamestown Equity Fund since January 2002. Mr. Whitlock has a B.A. degree in History from the University of Richmond and an M.B.A. from Virginia Commonwealth University. He has earned a Chartered Financial Analyst designation and has 43 years of investment experience.

| 9. | How do the advisory fees of The Jamestown Balanced Fund compare to those of The Jamestown Equity Fund? |

The Funds have similar advisory fee rates and advisory fee structures, although there are differences in the fee breakpoints. The fee structure for The Jamestown Balanced Fund contains an additional fee breakpoint at $250 million of assets which could result in lower advisory fees payable by The Jamestown Balanced Fund if it reached that asset level. The advisory fee structure for The Jamestown Balanced Fund provides for payment of an investment advisory fee at the annual rate of 0.65% on the first $250 million of the average value of its daily net assets; 0.60% on the next $250 million of average daily net assets; and 0.55% on assets over $500 million. The advisory fee structure for The Jamestown Equity Fund provides for payment of an investment advisory fee at the annual rate of 0.65% on the first $500 million of the average value of its daily net assets; and 0.55% on assets over $500 million. LB&C currently is voluntarily waiving a portion of its investment advisory fees for The Jamestown Balanced Fund in an amount of $500 per month. LB&C will continue to waive its fees as necessary in order to maintain The Jamestown Balanced Fund's total operating expenses at their current level until the Reorganization. LB&C does not currently waive advisory fees for The Jamestown Equity Fund and has no current intention of doing so after the Reorganization. During the fiscal year ended March 31, 2015, The Jamestown Balanced Fund paid advisory fees (after voluntary fee waivers) equal to 0.59% of its average daily net assets and The Jamestown Equity Fund paid advisory fees equal to 0.65% of its average daily net assets.

| 10. | What shares of The Jamestown Equity Fund will shareholders of The Jamestown Balanced Fund receive if the Reorganization occurs? |

Shareholders of The Jamestown Balanced Fund will receive shares of The Jamestown Equity Fund in an amount equal to the aggregate net asset value of The Jamestown Balanced Fund shares exchanged therefor.

| 11. | What are the U.S. federal income tax consequences of the Reorganization? |

The Reorganization is intended to be a tax-free reorganization for U.S. federal income tax purposes. This means that neither The Jamestown Balanced Fund nor shareholders of The Jamestown Balanced Fund are expected to recognize a gain or loss directly as a result of the Reorganization. It should be noted, however, that The Jamestown Balanced Fund may make one or more distributions to shareholders prior to the closing of the Reorganization. Any such distribution generally will be taxable to shareholders as ordinary income or a capital gain.

The adjusted tax basis of The Jamestown Balanced Fund’s shares is expected to carry over to shareholders’ new shares in The Jamestown Equity Fund that are received in the Reorganization in exchange for those Jamestown Balanced Fund shares, and the holding period in the shares of The Jamestown Equity Fund received is expected to be determined by including the holding period of those Jamestown Balanced Fund shares, provided that the shareholder held those Jamestown Balanced Fund shares as capital assets on the date of the Reorganization.

At any time prior to the consummation of the Reorganization, a shareholder may redeem shares, resulting in recognition of gain or loss for U.S. federal income tax purposes if the shares are held in a taxable account. Please see “U.S. Federal Income Tax Consequences,” below for additional information.

| 12. | Who will pay the Expenses of the Reorganization? |

LB&C has agreed to pay all costs and expenses in connection with the Reorganization, which include the cost of preparing, printing and mailing this Prospectus/Proxy Statement and all other costs in connection with the Reorganization. Shareholders of The Jamestown Balanced Fund will not bear the costs of the Reorganization, except they will bear the cost of any brokerage fees and expenses incurred as a result of selling the fixed income securities held by The Jamestown Balanced Fund prior to the Reorganization; however, we do not believe that any such costs and expenses will be incurred in selling the fixed income securities, although dealer markdowns may be incurred. LB&C will pay all of the expenses of the Reorganization, even in the event the Reorganization is not consummated.

| IV. | PROPOSAL: REORGANIZATION OF THE JAMESTOWN BALANCED FUND INTO THE JAMESTOWN EQUITY FUND |

Introduction. This Prospectus/Proxy Statement is furnished in connection with the solicitation of proxies from shareholders of The Jamestown Balanced Fund by and on behalf of the Board of Trustees of the Trust for use at the Meeting.

Terms of the Proposed Reorganization. Shareholders of The Jamestown Balanced Fund are being asked to vote for the approval of the Agreement and Plan of Reorganization. If approved by The Jamestown Balanced Fund’s shareholders, the Reorganization is expected to occur on or around July 28, 2015, or such other date as the parties may agree, under the Agreement and Plan of Reorganization (the “Closing Date”). If the Agreement and Plan of Reorganization is not approved by the shareholders of The Jamestown Balanced Fund, the Board of Trustees of the Trust will consider what other action, if any, should be taken in the best interests of The Jamestown Balanced Fund and its shareholders. Possible alternatives to the Reorganization may include liquidating The Jamestown Balanced Fund or the continued operation of the Fund.

The following is a brief summary of the principal terms of the Agreement and Plan of Reorganization. This summary is qualified in its entirety by the Agreement and Plan of Reorganization attached to this Prospectus/Proxy Statement as Appendix A. You should read Appendix A for a more complete understanding of the Agreement and Plan of Reorganization.

| · | The Jamestown Balanced Fund will transfer all of its assets and known liabilities to The Jamestown Equity Fund in exchange for shares of The Jamestown Equity Fund with an aggregate net asset value equal to the net asset value of the transferred assets and liabilities. |

| · | The assets and liabilities of The Jamestown Balanced Fund and The Jamestown Equity Fund will be valued as of the close of regular trading on the New York Stock Exchange on the business day immediately preceding the Closing Date, using the valuation policies and procedures of the Trust. |

| · | The shares of The Jamestown Equity Fund received by The Jamestown Balanced Fund will be distributed to the shareholders of The Jamestown Balanced Fund in an amount equal to the aggregate net asset value of The Jamestown Balanced Fund shares exchanged therefor, in full liquidation of The Jamestown Balanced Fund. |

| · | As part of the Reorganization, The Jamestown Balanced Fund’s affairs will be wound up, and The Jamestown Balanced Fund will be terminated under state law. |

The Reorganization requires approval by shareholders of The Jamestown Balanced Fund and satisfaction of a number of other conditions. The Reorganization may be terminated at any time under certain other circumstances.

The Jamestown Equity Fund Shares. If the Reorganization occurs, shareholders of The Jamestown Balanced Fund will receive shares of The Jamestown Equity Fund in an amount equal to the aggregate net asset value of The Jamestown Balanced Fund shares exchanged therefor. The Jamestown Equity Fund shares that a Jamestown Balanced Fund shareholder will receive will have the following characteristics:

| · | They will have an aggregate net asset value equal to the aggregate net asset value of a shareholder’s shares of The Jamestown Balanced Fund as of the business day before the closing of the Reorganization, as determined using the Trust’s valuation policies and procedures. |

| · | The procedures for purchasing and redeeming a shareholder’s shares will not change as a result of the Reorganization. |

| · | Shareholders will have voting and other rights the same as those they currently have, but as shareholders of The Jamestown Equity Fund. |

Factors Considered by the Board of Trustees of the Trust

The Reorganization will combine two series of the Trust having similar investment objectives and investment policies into one series and is designed to achieve operating efficiencies due to the spreading of fixed costs over a larger pool of assets. At a regular meeting held on May 19, 2015, all of the Trustees of the Trust, including the Independent Trustees, considered and approved the Reorganization. They determined that the Reorganization was in the best interests of existing shareholders of The Jamestown Balanced Fund and that their interests would not be diluted as a result of the transaction contemplated by the Reorganization.

Before approving the Agreement and Plan of Reorganization, the Trustees evaluated extensive information provide by management of the Trust and reviewed various factors about the Funds and the proposed Reorganization. The Trustees considered the relative asset size of The Jamestown Balanced Fund, including the benefits of combining the assets of The Jamestown Balanced Fund and The Jamestown Equity Fund to create a larger combined entity. As of March 31, 2015, the total assets of The Jamestown Balanced Fund were $18,254,172 and the total assets of The Jamestown Equity Fund were $29,595,936. If the Reorganization were completed as of that date, The Jamestown Equity Fund would have total assets of approximately $47,850,108.

The Trustees considered that the operating expenses of The Jamestown Equity Fund upon completion of the Reorganization are projected to be less than those of The Jamestown Balanced Fund. The Trustees considered the similarities of the Funds’ investment processes and investment portfolios, noting that as of March 31, 2015, the Funds had identical equity security holdings, though The Jamestown Equity Fund held a larger position in each equity security than The Jamestown Balanced Fund. The Trustees further considered the performance records of the Funds and noted that the annualized performance of The Jamestown Equity Fund for the 1-, 5-, 10- and 20-year periods ended March 31, 2015 was higher than that of The Jamestown Balanced Fund, which invests in both equity and fixed income securities.

In addition, the Trustees considered, among other things:

| · | The terms and conditions of the Reorganization; |

| · | The fact that the Reorganization would not result in the dilution of shareholders’ interests; |

| · | The expense ratios, fees and expenses of The Jamestown Balanced Fund and the anticipated expense ratios, fees and expenses of The Jamestown Equity Fund which are projected to be lower than The Jamestown Balanced Fund; |

| · | The comparative performance information, including the overall performance results of The Jamestown Equity Fund during the past 10 calendar years; |

| · | The investment objective and policies of each Fund; |

| · | The composition of each Fund’s portfolio and the ability of shareholders of The Jamestown Balanced Fund to obtain fixed-income exposure from investments other than The Jamestown Balanced Fund; |

| · | The investment personnel, expertise and resources of LB&C; |

| · | The fact that the Reorganization will provide continuity in the investment process for shareholders of The Jamestown Balanced Fund because LB&C is also the investment adviser for The Jamestown Equity Fund; |

| · | The fact that LB&C will bear all of the expenses incurred by The Jamestown Balanced Fund and The Jamestown Equity Fund in connection with the Reorganization; |

| · | The potential benefits to shareholders, including operating efficiencies that may be achieved from the Reorganization; |

| · | The fact that The Jamestown Equity Fund will assume all of the known liabilities of The Jamestown Balanced Fund; |

| · | The fact that the Reorganization is intended to be a tax-free transaction for U.S. federal income tax purposes; and |

| · | The fact that shareholders of The Jamestown Balanced Fund will continue to have the ability to redeem their shares prior to the Reorganization. |

After reviewing the foregoing factors, the Trustees of the Trust, in their business judgment, determined that the Reorganization is in the best interests of The Jamestown Balanced Fund’s shareholders. The Trustees of the Trust have also approved the Agreement and Plan of Reorganization on behalf of The Jamestown Equity Fund. A vote of shareholders of The Jamestown Equity Fund is not needed to approve the Reorganization.

U.S. Federal Income Tax Consequences

The Reorganization is intended to be a tax-free reorganization for U.S. federal income tax purposes. Sullivan & Worcester LLP, counsel to the Trust, will deliver to The Jamestown Equity Fund and The Jamestown Balanced Fund an opinion, and the closing of the Reorganization will be conditioned on receipt of such an opinion, substantially to the effect that, while the matter is not entirely free from doubt, on the basis of existing provisions of the Internal Revenue Code of 1986, as amended (the “Code”), the Treasury regulations promulgated thereunder, current administrative rules, pronouncements, and court decisions, for U.S. federal income tax purposes:

| · | The Reorganization will constitute a reorganization within the meaning of Section 368(a) of the Code, and The Jamestown Balanced Fund and The Jamestown Equity Fund will each be a “party to a reorganization” within the meaning of Section 368(b) of the Code; |

| · | Under Code Section 361, no gain or loss will be recognized by The Jamestown Balanced Fund (i) upon the transfer of its assets to The Jamestown Equity Fund in exchange for shares of The Jamestown Equity Fund and the assumption by The Jamestown Equity Fund of the known liabilities of The Jamestown Balanced Fund or (ii) upon the distribution of shares of The Jamestown Equity Fund by The Jamestown Balanced Fund to its shareholders in liquidation; |

| · | Under Code Section 354, no gain or loss will be recognized by shareholders of The Jamestown Balanced Fund upon the exchange of all of their Fund shares for shares of The Jamestown Equity Fund in the Reorganization; |

| · | Under Code Section 358, the aggregate tax basis of shares of The Jamestown Equity Fund to be received by each Jamestown Balanced Fund shareholder in exchange for his or her Fund shares in the Reorganization will be the same as the aggregate tax basis of The Jamestown Balanced Fund shares exchanged therefor; |

| · | Under Section 1223(1) of the Code, The Jamestown Balanced Fund shareholder’s holding period for shares of The Jamestown Equity Fund to be received pursuant to the Reorganization will be determined by including the holding period for The Jamestown Balanced Fund shares exchanged therefor, provided that the shareholder held those Fund shares as a capital asset on the date of the exchange; |

| · | Under Code Section 1032, no gain or loss will be recognized by The Jamestown Equity Fund upon receipt of the assets of The Jamestown Balanced Fund pursuant to the Reorganization in exchange for the assumption by The Jamestown Equity Fund of the known liabilities of The Jamestown Balanced Fund and issuance of shares of The Jamestown Equity Fund; |

| · | Under Code Section 362(b), the tax basis of the assets that The Jamestown Equity Fund acquires from The Jamestown Balanced Fund in the Reorganization will be the same as The Jamestown Balanced Fund’s tax basis of such assets immediately prior to such transfer; |

| · | Under Code Section 1223(2), the holding period for the assets that The Jamestown Equity Fund receives from The Jamestown Balanced Fund in the Reorganization will include the periods during which such assets were held by The Jamestown Balanced Fund; and |

| · | The Jamestown Equity Fund will succeed to and take into account all items of The Jamestown Balanced Fund described in Code Section 381(c) subject to the conditions and limitations specified in Code Sections 381, 382, 383, and 384 and the Treasury regulations thereunder. |

The Sullivan & Worcester LLP opinion will be based on certain factual certifications made by officers of the Trust and will also be based on customary assumptions. The opinion is not a guarantee that the tax consequences of the Reorganization will be as described above. There is no assurance that the Internal Revenue Service (“IRS”) or a court would agree with Sullivan & Worcester’s opinion. An opinion of counsel is not binding upon the IRS or the courts. If the Reorganization were consummated but did not qualify as a tax-free reorganization under the Code, a shareholder of The Jamestown Balanced Fund would recognize a taxable gain or loss equal to the difference between his or her tax basis in his or her Jamestown Balanced Fund shares and the fair market value of the shares of The Jamestown Equity Fund he or she received in the Reorganization.

Although the Reorganization is expected to be tax-free for shareholders, The Jamestown Balanced Fund may make one or more distributions to shareholders prior to the closing of the Reorganization. Any such distribution generally will be taxable to shareholders as ordinary income or a capital gain.

This description of the U.S. federal income tax consequences of the Reorganization is made without regard to the particular facts and circumstances of any shareholder. Shareholders are urged to consult their own tax advisors as to the specific consequences to them of the Reorganization, including the applicability and effect of state, local, non-U.S., and other tax laws.

Form of Organization. The Trust is an open-end management investment company registered with the SEC under the 1940 Act that continuously offers shares to the public. The Trust is organized as a Massachusetts business trust and is governed by its Agreement and Declaration of Trust, as amended, and its By-laws under applicable Massachusetts and federal laws. The Trust currently consists of twelve series, including the Funds. Each of The Jamestown Balanced Fund and The Jamestown Equity Fund is classified as a diversified fund.

Service Providers. The following table identifies certain of the service providers for the Funds, prior to and following the proposed Reorganization. The address of the Distributor is 225 Pictoria Drive, Suite 450, Cincinnati Ohio 45246.

| (Both Funds) | |

| Distributor: | Ultimus Fund Distributors, LLC |

| Transfer Agent and Administrator: | Ultimus Fund Solutions, LLC |

| Custodian: | U.S. Bank, N.A. |

| Independent Registered Public Accountant: | Ernst & Young LLP |

Financial Intermediary Compensation. If you purchase The Jamestown Equity Fund through a broker-dealer or other financial intermediary (such as a bank), the Fund and its related companies may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

Portfolio Turnover. Each Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over”) its portfolio. A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the expense example shown under “How do the Fees and Expenses of The Jamestown Equity Fund compare to those of The Jamestown Balanced Fund, and what are they estimated to be following the Reorganization?” affect each Fund’s performance. During the fiscal year ended March 31, 2015, the portfolio turnover rate was 25% for The Jamestown Balanced Fund and 29% for The Jamestown Equity Fund. The portfolio turnover rate of The Jamestown Equity Fund is not expected to exceed 100% annually.

Existing and Pro Forma Capitalization. The following table shows on an unaudited basis as of March 31, 2015: (i) the capitalization of The Jamestown Balanced Fund and The Jamestown Equity Fund and (ii) on an unaudited basis as of March 31, 2015, the pro forma capitalization of The Jamestown Equity Fund, as adjusted giving effect to the proposed Reorganization.

| | The Jamestown Balanced Fund | The Jamestown Equity Fund | Pro Forma Adjustments | The Jamestown Equity Fund Pro Forma Combined* |

| Net asset values | $ 18,254,172 | $ 29,595,936 | | $47,850,108 |

| Shares outstanding | 1,245,675 | 1,351,050 | (412,532)** | 2,184,193 |

| Net asset value per share | $ 14.65 | $ 21.91 | | $ 21.91 |

| * | Assumes the Reorganization was consummated on April 1, 2014 and is for information purposes only. |

| ** | To adjust for a tax-free exchange of shares of The Jamestown Balanced Fund for shares of The Jamestown Equity Fund. |

The capitalization of The Jamestown Balanced Fund, and consequently the pro forma capitalization of The Jamestown Equity Fund, is likely to be different at the effective time of the Reorganization as a result of market movements and daily share purchase and redemption activity, as well as the effects of other ongoing operations of The Jamestown Balanced Fund prior to the completion of the Reorganization.

THE BOARD OF TRUSTEES OF THE TRUST RECOMMENDS THAT SHAREHOLDERS OF THE JAMESTOWN BALANCED FUND APPROVE THE AGREEMENT AND PLAN OF REORGANIZATION.

Record Date. The Board of Trustees of Trust has fixed the close of business on June 12, 2015 (the “Record Date”) as the record date for the determination of shareholders entitled to notice of, and to vote at, the Meeting and at any postponements or adjournments thereof.

As of the Record Date, the number of outstanding shares of The Jamestown Balanced Fund entitled to vote was 1,135,452.257. All full shares are entitled to one vote, with proportional voting for fractional shares.

5% Shareholders. As of the Record Date, the Trustees and officers of the Trust owned 5.36% of the outstanding shares of The Jamestown Balanced Fund. As of the Record Date, the following shareholders owned of record five percent or more of The Jamestown Balanced Fund:

| Shareholder | % Ownership |

Jesse D. Bowles c/o LB&C 1802 Bayberry Court Richmond, Virginia 23226 | 9.28% |

Lawrence B. Schwartz c/o LB&C 1802 Bayberry Court Richmond, Virginia 23226 | 14.02% |

Charles Schwab & Co., Inc. Attn: Mutual Funds 211 Main Street San Francisco, California 94105 | 24.85% |

Required Vote for the Proposal

Quorum; Adjournments. A quorum is the number of shares legally required to be at a meeting in order to conduct business. The presence, in person or by proxy, of the holders of a majority of the outstanding shares of The Jamestown Balanced Fund entitled to vote is necessary to constitute a quorum at the Meeting. Proxies properly executed and marked with a negative vote or an abstention will be considered to be present at the Meeting for purposes of determining the existence of a quorum for the transaction of business. If the Meeting is called to order but a quorum is not present at the Meeting, the persons named as proxies may vote those proxies that have been received to adjourn the Meeting to a later date. If a quorum is present at the Meeting but sufficient votes to approve the Reorganization are not received, the persons named as proxies may propose one or more adjournments of the Meeting to permit further solicitation of proxies. Any such adjournment will require the affirmative vote of a majority of those shares represented at the Meeting in person or by proxy. The persons named as proxies will vote those proxies received that voted in favor of the Reorganization in favor of such an adjournment as to the Reorganization and will vote those proxies received that voted against the Reorganization against any such adjournment.

The vote of a majority of the outstanding shares of The Jamestown Balanced Fund entitled to vote is required to approve the Reorganization.

Abstentions and “broker non-votes” are counted for purposes of determining whether a quorum is present but do not represent votes cast with respect to the Reorganization. “Broker non-votes” are shares held by a broker or nominee for which an executed proxy is received by the Trust, but are not voted because instructions have not been received from the beneficial owners or persons entitled to vote and the broker or nominee does not have discretionary voting power. Accordingly, abstentions and “broker non-votes” will effectively be a vote against the Reorganization, for which the required vote is a percentage of the outstanding voting shares and will have no effect on a vote for adjournment.

The Trustees of the Trust intend to vote all of their shares in favor of the Reorganization. If shareholders of The Jamestown Balanced Fund do not approve the Reorganization, the Board of Trustees of the Trust may consider possible alternative arrangements in the best interests of The Jamestown Balanced Fund and its shareholders.

Voting Process. Shareholders can vote in either of the following ways:

| · | By mail, by filling out and returning the enclosed proxy card; |

| · | By automated telephone service (call the toll-free number listed on your proxy card); |

| · | By voting through the Internet (at the address listed on your proxy card); or |

| · | In person at the Meeting. |

The Internet and telephone voting procedures are designed to authenticate shareholder identities, to allow shareholders to give their voting instructions, and to confirm that shareholders’ instructions have been recorded properly. Proxies may be revoked at any time before they are voted either (i) by a written revocation received by the Secretary of the Trust, (ii) by properly executing a later-dated proxy, or (iii) by attending the Meeting and voting in person. If you choose to vote by mail and you are an individual account owner, please sign exactly as your name appears on the proxy card. Either owner of a joint account may sign the proxy card, but the signer’s name must exactly match the name that appears on the card.

Costs of Reorganization. LB&C has agreed to pay all costs and expenses in connection with the Reorganization, which include the cost of preparing, printing and mailing this Prospectus/Proxy Statement and all other costs in connection with the Reorganization. Shareholders of The Jamestown Balanced Fund will not bear the costs of the Reorganization, except they will bear the cost of any brokerage fees and expenses incurred as a result of selling the fixed income securities held by The Jamestown Balanced Fund prior to the Reorganization; however, we do not believe that any such costs and expenses will be incurred in selling the fixed income securities, although dealer markdowns may be incurred. LB&C will pay all of the expenses of the Reorganization, even in the event the Reorganization is not consummated.

The Trust has retained Computershare Fund Services to solicit proxies for the Meeting. Computershare is responsible for printing proxy cards, mailing proxy material to shareholders, soliciting broker-dealer firms, custodians, nominees and fiduciaries, tabulating the returned proxies and performing other proxy solicitation services. The anticipated cost of these services is approximately $2,540 and will be paid by LB&C.

Other Business. The Meeting has been called to transact any business that properly comes before it. The only business that management of The Jamestown Balanced Fund intends to present or knows that others will present is the Proposal to approve the Agreement and Plan of Reorganization. If any other matters properly come before the Meeting, and on all matters incidental to the conduct of the Meeting, the persons named as proxies intend to vote the proxies in accordance with their judgment, unless the Secretary of Trust has previously received written contrary instructions from the shareholder entitled to vote the shares.

| VII. | FINANCIAL STATEMENTS AND EXPERTS |

The Annual Report to Shareholders of the Trust relating to The Jamestown Funds for the year ended March 31, 2015, including the financial statements and financial highlights for periods indicated therein, audited by Ernst & Young LLP, independent registered public accounting firm, has been incorporated by reference herein in reliance on their report given on the authority of said firm as experts in accounting and auditing.

Certain legal matters concerning the issuance of shares of The Jamestown Equity Fund will be passed upon by Sullivan & Worcester LLP, counsel to the Trust.

| IX. | INFORMATION FILED WITH THE SEC |

Additional information about The Jamestown Equity Fund is included in the Statement of Additional Information dated June 25, 2015, relating to this Prospectus/Proxy Statement, which has been filed with the SEC under the Securities Act of 1933. A copy of the Statement of Additional Information relating to this Prospectus/Proxy Statement may be obtained without charge by calling 1-866-738-1126.

Proxy material, reports, proxy and information statements, registration statements and other information filed by the Trust can be inspected and copied (for a duplication fee) at the SEC’s public reference facilities located at 100 F Street, N.E., Washington, D.C. 20549, or at the SEC’s Midwest Regional Office (175 W. Jackson Boulevard, Suite 900, Chicago, IL 60604). You may obtain copies of this information, with payment of a duplication fee, by electronic request at the following e-mail address: publicinfo@sec.gov, or by writing the SEC’s Public Reference Branch, Office of Consumer Affairs and Informational Services, SEC, Washington, D.C. 20549 or by calling 1-202-551-8090. You may also access reports and other information about the Fund on the EDGAR database on the SEC’s Internet site at http://www.sec.gov.

APPENDIX A: AGREEMENT AND PLAN OF REORGANIZATION

THIS AGREEMENT AND PLAN OF REORGANIZATION (the “Agreement”) is made as of this 25th day of June, 2015, by and among Williamsburg Investment Trust, a Massachusetts business trust, with its principal place of business at 225 Pictoria Drive, Suite 450, Cincinnati, Ohio 44246 (the “Trust”), with respect to The Jamestown Equity Fund (the “Acquiring Fund”), and the Trust with respect to The Jamestown Balanced Fund (the “Acquired Fund”), and Lowe, Brockenbrough & Company, a Virginia corporation with its principal place of business at 1820 Bayberry Court, Richmond, Virginia 23226 (for purposes of Sections 9.1, 9.2 and 11.2 of the Agreement only).

This Agreement is intended to be and is adopted as a “plan of reorganization” within the meaning of the regulations under Section 368(a)(1)(F) of the United States Internal Revenue Code of 1986, as amended. The reorganization (the “Reorganization”) will consist of (i) the transfer of all of the assets of the Acquired Fund in exchange solely for shares of beneficial interest, having a par value of one cent ($0.01) per share, of the Acquiring Fund (the “Acquiring Fund Shares”); (ii) the assumption by the Acquiring Fund of all of the known liabilities of the Acquired Fund; and (iii) the distribution, after the Closing Date hereinafter referred to, of the Acquiring Fund Shares to the shareholders of the Acquired Fund in liquidation of the Acquired Fund as provided herein, all upon the terms and conditions hereinafter set forth in this Agreement.

WHEREAS, the Acquiring Fund is a separate series of the Trust, an open-end, registered investment company of the management type under the Investment Company Act of 1940, as amended (“1940 Act”);

WHEREAS, the Acquired Fund is a separate series of the Trust, an open-end, registered investment company of the management type under the 1940 Act and the Acquired Fund owns securities that generally are assets of the character in which the Acquiring Fund is permitted to invest;

WHEREAS, the Acquired Fund and the Acquiring Fund are authorized to issue their shares of beneficial interest;

WHEREAS, the Trustees of the Trust have determined that the transactions contemplated herein will be in the best interests of the Acquiring Fund and its shareholders and that the interests of the existing shareholders of the Acquiring Fund will not be diluted as a result of the transactions contemplated herein;

WHEREAS, the Trustees of the Trust have determined that the Acquired Fund should exchange all of its assets and known liabilities for Acquiring Fund Shares and that the interests of the existing shareholders of the Acquired Fund will not be diluted as a result of the transactions contemplated herein;

NOW, THEREFORE, in consideration of the premises and of the covenants and agreements hereinafter set forth, the parties hereto covenant and agree as follows:

ARTICLE I

TRANSFER OF ASSETS OF THE ACQUIRED FUND IN EXCHANGE FOR THE ACQUIRING FUND SHARES AND ASSUMPTION OF ACQUIRED FUND KNOWN LIABILITIES AND LIQUIDATION OF THE ACQUIRED FUND

1.1 THE EXCHANGE. Subject to the terms and conditions herein set forth and on the basis of the representations and warranties contained herein, the Acquired Fund agrees to transfer all of the Acquired Fund’s assets as set forth in paragraph 1.2 to the Acquiring Fund. The Acquiring Fund agrees in exchange for the Acquired Fund’s assets (i) to deliver to the Acquired Fund the number of Acquiring Fund Shares, including fractional Acquiring Fund Shares, computed in the manner and as of the time and date set forth in paragraphs 2.2 and 2.3; and (ii) to assume the known liabilities of the Acquired Fund, as set forth in paragraph 1.3. Such transactions shall take place on the Closing Date provided for in paragraph 3.1.

1.2 ASSETS TO BE ACQUIRED. The assets of the Acquired Fund to be acquired by the Acquiring Fund shall consist of all property, including, without limitation, all cash, securities, commodities, interests in futures and dividends or interest receivables, that is owned by the Acquired Fund and any deferred or prepaid expenses shown as an asset on the books of the Acquired Fund on the Closing Date.

The Acquired Fund has provided the Acquiring Fund with its most recent audited financial statements, which contain a list of all of the Acquired Fund’s assets as of the date thereof. The Acquired Fund hereby represents that as of the date of the execution of this Agreement there have been no material changes in its financial position as reflected in said financial statements other than those occurring in the ordinary course of its business in connection with the purchase and sale of securities and the payment of its normal operating expenses. The Acquired Fund reserves the right to sell any of such securities, but will not, without the prior written approval of the Acquiring Fund, acquire any additional securities other than securities of the type in which the Acquiring Fund is permitted to invest.

The Acquiring Fund will, within a reasonable time prior to the Closing Date, furnish the Acquired Fund with a list of the securities, if any, on the Acquired Fund’s list referred to in the second sentence of this paragraph that do not conform to the Acquiring Fund’s investment objectives, policies, and restrictions and the Acquired Fund will dispose of its fixed income securities and any other such securities prior to the Closing Date. The Acquired Fund will, within a reasonable period of time prior to the Closing Date, furnish the Acquiring Fund with a list of its portfolio securities and other investments. If it is determined that the Acquired Fund and the Acquiring Fund portfolios, when aggregated, would contain investments exceeding certain percentage limitations imposed upon the Acquiring Fund with respect to such investments, the Acquired Fund if requested by the Acquiring Fund will dispose of a sufficient amount of such investments as may be necessary to avoid violating such limitations as of the Closing Date. Notwithstanding the foregoing, nothing herein will require the Acquired Fund to dispose of any investments or securities if, in the reasonable judgment of the Acquired Fund, such disposition would violate the Acquired Fund’s fiduciary duty to its shareholders.

1.3 LIABILITIES TO BE ASSUMED. The Acquired Fund will endeavor to discharge all of its known liabilities and obligations prior to the Closing Date. The Acquiring Fund shall assume all of the Acquired Fund’s known liabilities and obligations reflected in the Acquired Fund’s net asset value as of the Closing Date.

1.4 LIQUIDATION AND DISTRIBUTION. On or as soon after the Closing Date as is conveniently practicable (the “Liquidation Date”),

(a) the Acquired Fund will liquidate and distribute pro rata to the Acquired Fund’s shareholders of record, determined as of the close of business on the Valuation Date, hereinafter referred to (the “Acquired Fund Shareholders”), the Acquiring Fund Shares received by the Acquired Fund pursuant to paragraph 1.1; and (b) the Acquired Fund will thereupon proceed to terminate as set forth in paragraph 1.8 below. Such liquidation and distribution will be accomplished by the transfer of the Acquiring Fund Shares then credited to the account of the Acquired Fund on the books of the Acquiring Fund to open accounts on the share records of the Acquiring Fund in the names of the Acquired Fund shareholders and representing the respective pro rata number of the Acquiring Fund Shares due such shareholders. All issued and outstanding shares of the Acquired Fund will simultaneously be canceled on the books of the Acquired Fund. The Acquiring Fund shall not issue certificates representing the Acquiring Fund Shares in connection with such exchange.

1.5 OWNERSHIP OF SHARES. Ownership of Acquiring Fund Shares will be shown on the books of the Acquiring Fund’s transfer agent. Shares of the Acquiring Fund will be issued in the manner described in the Prospectus/Proxy Statement which will be distributed to shareholders of the Acquired Fund as described in paragraph 4.1(o).

1.6 TRANSFER TAXES. Any transfer taxes payable upon issuance of the Acquiring Fund Shares in a name other than the registered holder of the Acquired Fund shares on the books of the Acquired Fund as of that time shall, as a condition of such issuance and transfer, be paid by the person to whom such Acquiring Fund Shares are to be issued and transferred.

1.7 REPORTING RESPONSIBILITY. Any reporting responsibility of the Acquired Fund is and shall remain the responsibility of the Acquired Fund up to and including the Closing Date and such later date on which the Acquired Fund is terminated.

1.8 TERMINATION. The Trust shall take all necessary and appropriate steps under applicable law to terminate the Acquired Fund promptly following the Closing Date and the making of all distributions pursuant to paragraph 1.4.

ARTICLE II

VALUATION

2.1 VALUATION OF ASSETS. The value of the Acquired Fund’s assets to be acquired by the Acquiring Fund hereunder shall be the value of such assets computed as of the close of business on the business day next preceding the Closing Date (such time and date being hereinafter called the “Valuation Date”), using the valuation procedures set forth in the Trust’s Agreement and Declaration of Trust (“Declaration of Trust”) and the Acquired Fund’s then current prospectus and statement of additional information or such other valuation procedures as shall be mutually agreed upon by the parties.

2.2 VALUATION OF SHARES. The net asset value per share of the Acquiring Fund Shares shall be the net asset value per share computed as of the close of business on the New York Stock Exchange on the Valuation Date, using the valuation procedures set forth in the Trust’s Declaration of Trust and the Acquiring Fund’s then current prospectus and statement of additional information.

2.3 SHARES TO BE ISSUED. The number of full and fractional Acquiring Fund Shares to be issued in exchange for the Acquired Fund’s assets shall be determined by multiplying the outstanding shares of the Acquired Fund by the ratio computed by dividing the net asset value per share of the Acquired Fund by the net asset value per share of the Acquiring Fund on the Valuation Date, determined in accordance with paragraph 2.2. Shares of the Acquiring Fund will be issued for shares of the Acquired Fund.

2.4 DETERMINATION OF VALUE. All computations of value of the Acquiring Fund shall be made by Ultimus Fund Solutions, LLC, the administrator of the Acquiring Fund and the Acquired Fund, in accordance with its regular practice in pricing the shares and assets of the Acquiring Fund and the Acquired Fund.

ARTICLE III

CLOSING AND CLOSING DATE

3.1 CLOSING DATE. The closing of the Reorganization (the “Closing”) shall take place on or about July 28, 2015 or such other date as the parties may agree to in writing (the “Closing Date”). All acts taking place at the Closing shall be deemed to take place simultaneously immediately prior to the opening of business on the Closing Date unless otherwise provided. The Closing shall be held as of 10:00 a.m. Eastern Time at the offices of Ultimus Fund Solutions, LLC, or at such other time and/or place as the parties may agree.