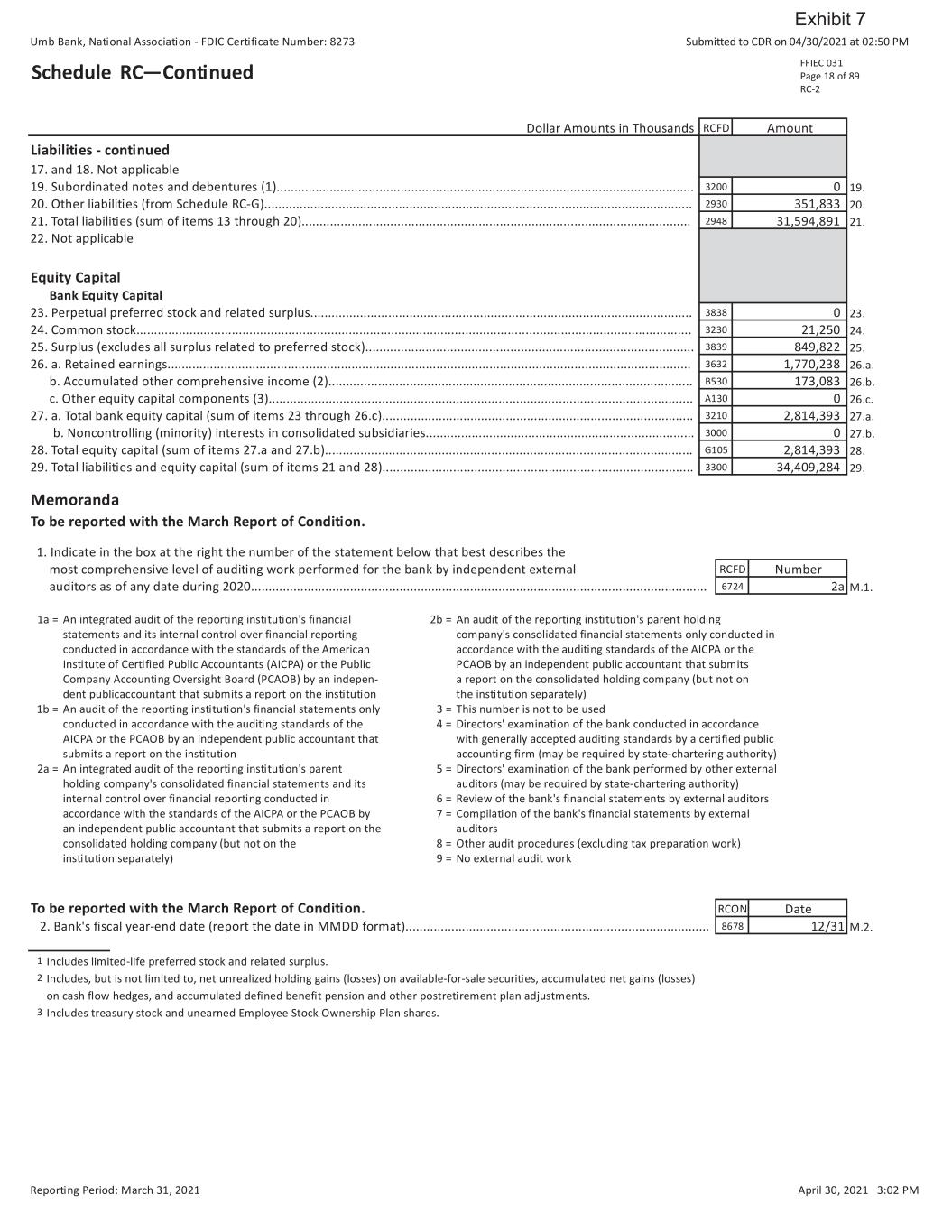

Umb Bank, National Association - FDIC Certificate Number: 8273 Submitted to CDR on 04/30/2021 at 02:50 PM Consolidated Report of Condition for Insured Banks and Savings Associations for March 31, 2021 All schedules are to be reported in thousands of dollars. Unless otherwise indicated, report the amount outstanding as of the last business day of the quarter. Schedule RC—Balance Sheet Dollar Amounts in Thousands Assets 1. Cash and balances due from depository institutions (from Schedule RC-A): 1.a. 1.b. 2. Securities: 2.a. 2.b. 2.c. 3. Federal funds sold and securities purchased under agreements to resell: 3.a. 3.b. 4. Loans and lease financing receivables (from Schedule RC-C): 4.a. 4.b. 4.c. 4.d. 5. 6. 7. 8. 9. 10. 11. 12. Liabilities 13. Deposits: a. In domestic offices (sum of totals of columns A and C from Schedule RC-E, Part I) 13.a. 13.a.1. 13.a.2. b. In foreign offices, Edge and Agreement subsidiaries, and IBFs (from Schedule RC-E, Part II) 13.b. 13.b.1. 13.b.2. 14. Federal funds purchased and securities sold under agreements to repurchase: 14.a. 14.b. 15. 16. 1 Includes cash items in process of collection and unposted debits. 2 Includes time certificates of deposit not held for trading. 3 Institutions that have adopted ASU 2016-13 should report in item 2.a amounts net of any applicable allowance for credit losses, and item 2.a should equal Schedule RC-B, item 8, column A, less Schedule RI-B, Part II, item 7, column B. 4 Item 2.c is to be completed by all institutions. See the instructions for this item and the Glossary entry for "Securities Activities" for further detail on accounting for investments in equity securities. 5 Includes all securities resale agreements, regardless of maturity. 6 Institutions that have adopted ASU 2016-13 should report in items 3.b and 11 amounts net of any applicable allowance for credit losses. 7 Institutions that have adopted ASU 2016-13 should report in item 4.c the allowance for credit losses on loans and leases. 8 Includes noninterest-bearing, demand, time, and savings deposits. 9 Report overnight Federal Home Loan Bank advances in Schedule RC, item 16, "Other borrowed money." 10 Includes all securities repurchase agreements, regardless of maturity. FFIEC 031 Page 17 of 89 RC-1 RCFD Amount a. Noninterest-bearing balances and currency and coin (1)......................................................................................... 0081 386,622 b. Interest-bearing balances (2).................................................................................................................................... 0071 3,830,763 a. Held-to-maturity securities (from Schedule RC-B, column A) (3)............................................................................. JJ34 1,039,711 b. Available-for-sale debt securities (from Schedule RC-B, column D)......................................................................... 1773 9,753,330 c. Equity securities with readily determinable fair values not held for trading (4)....................................................... JA22 101,801 a. Federal funds sold............................................................................................................................................ RCON B987 0 b. Securities purchased under agreements to resell (5,6)................................................................................... RCFD B989 1,629,813 RCFD a. Loans and leases held for sale.................................................................................................................................. 5369 10,275 b. Loans and leases held for investment............................................................................. B528 16,497,352 c. LESS: Allowance for loan and lease losses (7)................................................................. 3123 202,814 d. Loans and leases held for investment, net of allowance (item 4.b minus 4.c)......................................................... B529 16,294,538 5. Trading assets (from Schedule RC-D)........................................................................................................................... 3545 25,329 6. Premises and fixed assets (including capitalized leases).............................................................................................. 2145 220,435 7. Other real estate owned (from Schedule RC-M).......................................................................................................... 2150 4,740 8. Investments in unconsolidated subsidiaries and associated companies..................................................................... 2130 0 9. Direct and indirect investments in real estate ventures.............................................................................................. 3656 0 10. Intangible assets (from Schedule RC-M)...................................................................................................................... 2143 151,036 11. Other assets (from Schedule RC-F) (6)......................................................................................................................... 2160 960,891 12. Total assets (sum of items 1 through 11)..................................................................................................................... 2170 34,409,284 RCON 2200 28,483,240 (1) Noninterest-bearing (8).................................................................................... RCON 6631 11,806,864 (2) Interest-bearing................................................................................................ RCON 6636 16,676,376 RCFN 2200 0 (1) Noninterest-bearing......................................................................................... RCFN 6631 0 (2) Interest-bearing................................................................................................ RCFN 6636 0 a. Federal funds purchased in domestic offices (9).............................................................................................. RCON B993 217,301 b. Securities sold under agreements to repurchase (10)..................................................................................... RCFD B995 2,542,517 15. Trading liabilities (from Schedule RC-D)............................................................................................................. RCFD 3548 0 16. Other borrowed money (includes mortgage indebtedness) (from Schedule RC-M).......................................... RCFD 3190 0 Reporting Period: March 31, 2021 April 30, 2021 3:02 PM Exhibit 7

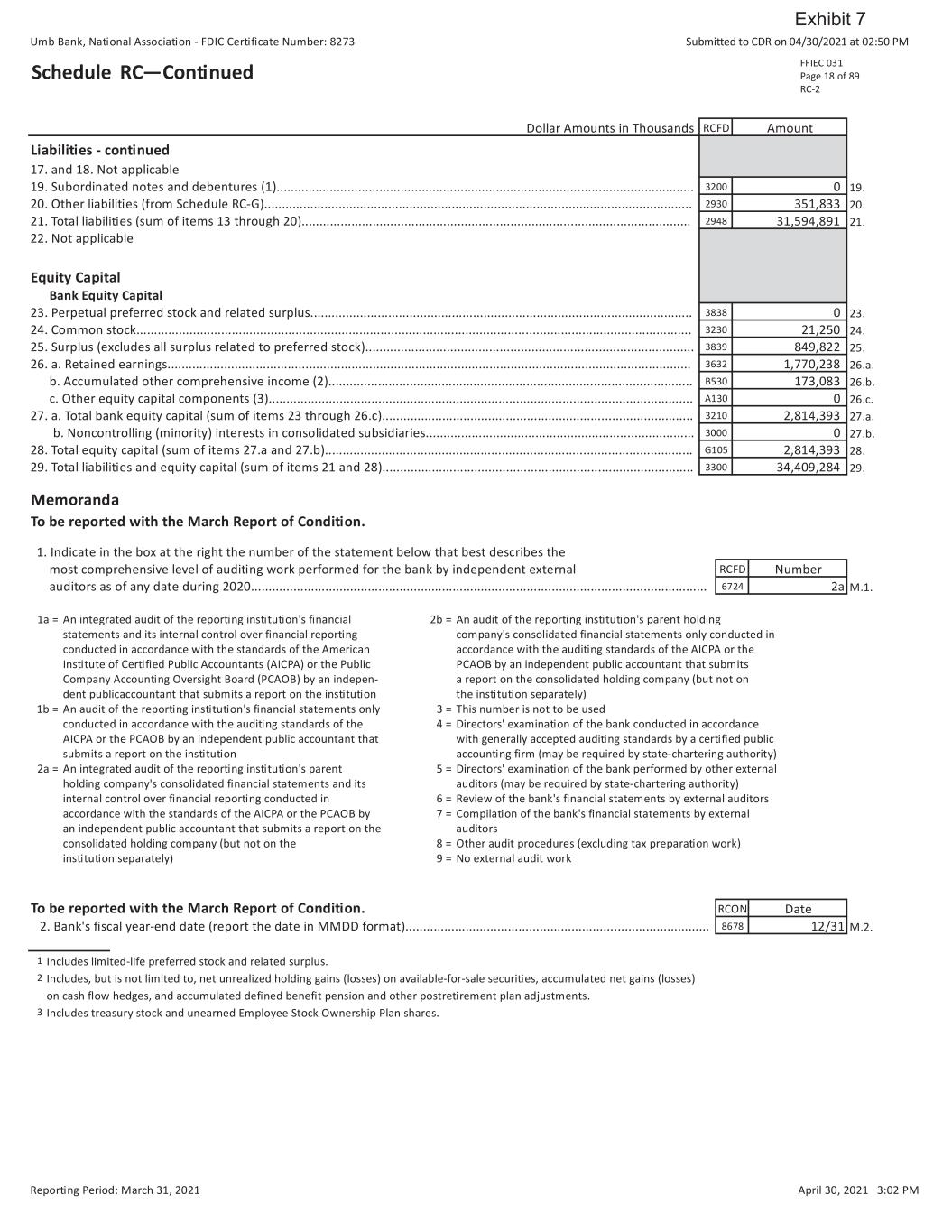

Umb Bank, National Association - FDIC Certificate Number: 8273 Submitted to CDR on 04/30/2021 at 02:50 PM Schedule RC—Continued Dollar Amounts in Thousands Liabilities - continued 17. and 18. Not applicable 19. 20. 21. 22. Not applicable Equity Capital Bank Equity Capital 23. 24. 25. 26.a. 26.b. 26.c. 27.a. 27.b. 28. 29. Memoranda To be reported with the March Report of Condition. 1. Indicate in the box at the right the number of the statement below that best describes the most comprehensive level of auditing work performed for the bank by independent external M.1. 1a = An integrated audit of the reporting institution's financial 2b = An audit of the reporting institution's parent holding statements and its internal control over financial reporting company's consolidated financial statements only conducted in conducted in accordance with the standards of the American accordance with the auditing standards of the AICPA or the Institute of Certified Public Accountants (AICPA) or the Public PCAOB by an independent public accountant that submits Company Accounting Oversight Board (PCAOB) by an indepen- a report on the consolidated holding company (but not on dent publicaccountant that submits a report on the institution the institution separately) 1b = An audit of the reporting institution's financial statements only 3 = This number is not to be used conducted in accordance with the auditing standards of the 4 = Directors' examination of the bank conducted in accordance AICPA or the PCAOB by an independent public accountant that with generally accepted auditing standards by a certified public submits a report on the institution accounting firm (may be required by state-chartering authority) 2a = An integrated audit of the reporting institution's parent 5 = Directors' examination of the bank performed by other external holding company's consolidated financial statements and its auditors (may be required by state-chartering authority) internal control over financial reporting conducted in 6 = Review of the bank's financial statements by external auditors accordance with the standards of the AICPA or the PCAOB by 7 = Compilation of the bank's financial statements by external an independent public accountant that submits a report on the auditors consolidated holding company (but not on the 8 = Other audit procedures (excluding tax preparation work) institution separately) 9 = No external audit work To be reported with the March Report of Condition. M.2. 1 Includes limited-life preferred stock and related surplus. 2 Includes, but is not limited to, net unrealized holding gains (losses) on available-for-sale securities, accumulated net gains (losses) on cash flow hedges, and accumulated defined benefit pension and other postretirement plan adjustments. 3 Includes treasury stock and unearned Employee Stock Ownership Plan shares. FFIEC 031 Page 18 of 89 RC-2 RCFD Amount 19. Subordinated notes and debentures (1)...................................................................................................................... 3200 0 20. Other liabilities (from Schedule RC-G)......................................................................................................................... 2930 351,833 21. Total liabilities (sum of items 13 through 20).............................................................................................................. 2948 31,594,891 23. Perpetual preferred stock and related surplus............................................................................................................ 3838 0 24. Common stock............................................................................................................................................................. 3230 21,250 25. Surplus (excludes all surplus related to preferred stock)............................................................................................. 3839 849,822 26. a. Retained earnings.................................................................................................................................................... 3632 1,770,238 b. Accumulated other comprehensive income (2)....................................................................................................... B530 173,083 c. Other equity capital components (3)........................................................................................................................ A130 0 27. a. Total bank equity capital (sum of items 23 through 26.c)........................................................................................ 3210 2,814,393 b. Noncontrolling (minority) interests in consolidated subsidiaries............................................................................ 3000 0 28. Total equity capital (sum of items 27.a and 27.b)........................................................................................................ G105 2,814,393 29. Total liabilities and equity capital (sum of items 21 and 28)........................................................................................ 3300 34,409,284 RCFD Number auditors as of any date during 2020................................................................................................................................. 6724 2a RCON Date 2. Bank's fiscal year-end date (report the date in MMDD format)...................................................................................... 8678 12/31 Reporting Period: March 31, 2021 April 30, 2021 3:02 PM Exhibit 7