- EVBN Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Evans Bancorp (EVBN) DEF 14ADefinitive proxy

Filed: 24 Mar 20, 1:25pm

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant [×]Filed by a Party other than Registrant □

Check the appropriate box:

□Preliminary Proxy Statement

□Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

[×]Definitive Proxy Statement

□Definitive Additional Materials

□Soliciting Material Pursuant to §240.14a-12

EVANS BANCORP, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

[×]No fee required.

□Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1)Title of each class of securities to which transaction applies:

______________________________________________________________________________________________________

(2)Aggregate number of securities to which transaction applies:

______________________________________________________________________________________________________

(3)Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

______________________________________________________________________________________________________

(4)Proposed maximum aggregate value of transaction:

______________________________________________________________________________________________________

(5)Total fee paid:

______________________________________________________________________________________________________

□Fee paid previously with preliminary materials.

□Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(1)Amount Previously Paid:

______________________________________________________________________________________________________

(2)Form, Schedule, or Registration Statement No.:

______________________________________________________________________________________________________

(3)Filing Party:

______________________________________________________________________________________________________

(4)Date Filed:

______________________________________________________________________________________________________

March 24, 2020

March 24, 2020

To Our Shareholders:

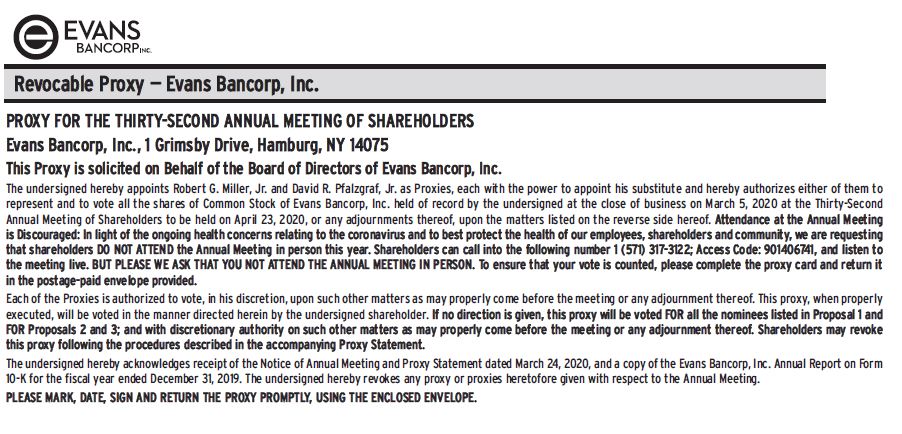

On behalf of the Board of Directors, I cordially invite you to attend the 2020 Annual Meeting of Shareholders of Evans Bancorp, Inc. The Annual Meeting this year will be held at Evans Bancorp, Inc., One Grimsby Drive, Hamburg, NY 14075, on Thursday, April 23, 2020 at 9:00 a.m. The formal Notice of the Annual Meeting is set forth on the following page.

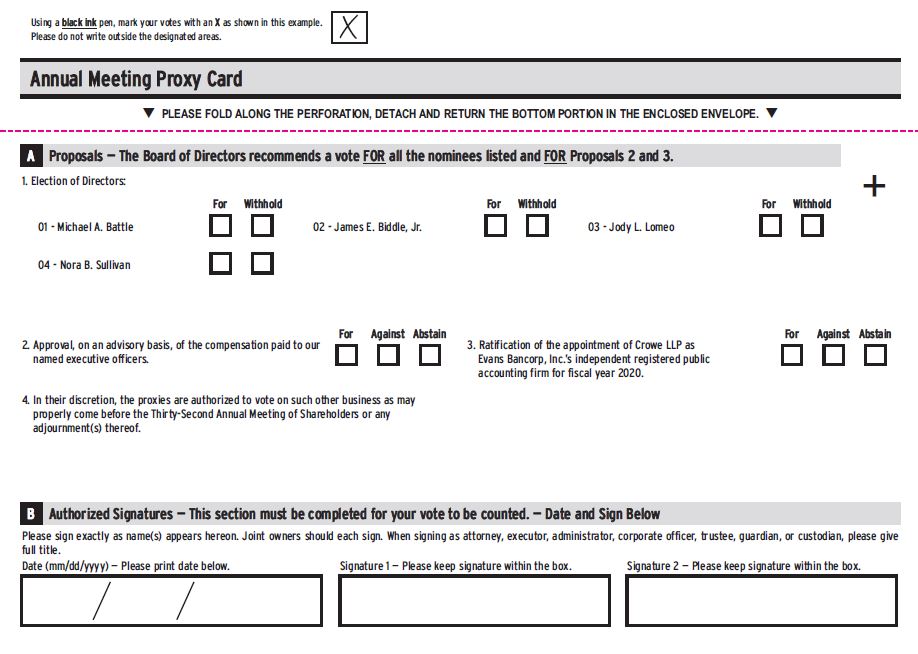

The enclosed Notice and Proxy Statement contain details concerning the business to come before the 2020 Annual Meeting. The Board of Directors of Evans Bancorp recommends a vote “FOR” the election of Michael A. Battle, James E. Biddle, Jr., Jody L. Lomeo, and Nora B. Sullivan for a three-year term. The Board of Directors of Evans Bancorp also recommends a vote “FOR” the approval, on an advisory basis, of the compensation paid to the Company’s named executive officers, and “FOR” ratification of the appointment of Crowe LLP as Evans Bancorp’s independent registered public accounting firm for fiscal year 2020.

To Vote:

Your vote is important, regardless of whether or not you attend the Annual Meeting in person. I urge you to sign, date, and return the enclosed proxy card in the postage-paid envelope provided as promptly as possible. In this way, you can be sure that your shares will be voted at the meeting. If you are voting “FOR” the election of the nominated directors, “FOR” the approval, on an advisory basis, of the compensation paid to the Company’s named executive officers, and “FOR” ratification of the appointment of Crowe LLP as Evans Bancorp, Inc.’s independent registered public accounting firm for fiscal year 2020, you need only date, sign and return the proxy card.

Voting is tabulated by an independent firm; therefore, to ensure that your vote is received in a timely manner, please mail the white proxy card in the envelope provided - do not return the proxy card to Evans Bancorp, Inc.

ATTENDANCE AT THE ANNUAL MEETING IS DISCOURAGED

In light of the ongoing health concerns relating to the coronavirus and to best protect the health of our employees, shareholders and community, we are requesting that shareholders DO NOT ATTEND the Annual Meeting in person this year. Shareholders can call into the following number 1 (571) 317-3122; Access Code: 901406741 and listen to the meeting live. BUT PLEASE WE ASK THAT YOU NOT ATTEND THE ANNUAL MEETING IN PERSON.

Thank you for your confidence and support.

Sincerely,

David J. Nasca

President and Chief Executive Officer

This page intentionally left blank

EVANS BANCORP, INC.

One Grimsby Drive

Hamburg, NY 14075

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

April 23, 2020

The Thirty-Second Annual Meeting of Shareholders of Evans Bancorp, Inc., a New York corporation (the "Company"), will be held on Thursday, April 23, 2020 at 9:00 a.m. at Evans Bancorp, Inc., One Grimsby Drive, Hamburg, NY, for the following purposes:

(1)To elect the four nominees named in the Proxy Statement as directors of the Company for a three-year term, each until the election and qualification of his or her successor.

(2)To approve, on an advisory basis, the compensation paid to the Company’s named executive officers.

(3)To ratify the appointment of Crowe LLP as the Company’s independent registered public accounting firm for fiscal year 2020.

(4)To act upon such other business as may properly come before the meeting or any adjournment thereof.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SHAREHOLDER MEETING TO BE HELD ON APRIL 23, 2020

The Company’s Proxy Statement and 2019 Annual Report, which includes the Company’s Annual Report on Form 10-K filed with the Securities and Exchange Commission, are available on the Company’s website at www.evansbancorp.com.

The Board of Directors has fixed the close of business on March 5, 2020 as the record date for the determination of shareholders entitled to notice of and to vote at the Annual Meeting.

A copy of the Company's Annual Report to Shareholders and Annual Report on Form 10-K for the Company’s 2019 fiscal year are enclosed for your reference.

Please complete and return the enclosed proxy card in the accompanying postage-paid, addressed envelope as soon as you have had an opportunity to review the attached Proxy Statement.

By Order of the Board of Directors

Michelle A. Baumgarden |

Secretary |

Hamburg, New York

Attendance at the Annual Meeting is Discouraged: In light of the ongoing health concerns relating to the coronavirus and to best protect the health of our employees, shareholders and community, we are requesting that shareholders DO NOT ATTEND the Annual Meeting in person this year. Shareholders can call into the following number 1 (571) 317-3122; Access Code: 901406741 and listen to the meeting live. BUT PLEASE WE ASK THAT YOU NOT ATTEND THE ANNUAL MEETING IN PERSON. To ensure that your vote is counted, please complete the white proxy card and return it in the postage-paid envelope provided.

EVANS BANCORP, INC.

One Grimsby Drive

Hamburg, NY 14075

PROXY STATEMENT

Dated March 24, 2020

For the Annual Meeting of Shareholders to be held April 23, 2020

GENERAL INFORMATION

This Proxy Statement is furnished to the shareholders of Evans Bancorp, Inc., a New York corporation (the "Company"), in connection with the solicitation of proxies for use at the Thirty-Second Annual Meeting of Shareholders (the "Annual Meeting") to be held at Evans Bancorp, Inc., One Grimsby Drive, Hamburg, NY, on Thursday, April 23, 2020 at 9:00 a.m. and at any adjournments thereof. To obtain directions to be able to attend our Annual Meeting and vote in person, please contact Michelle Baumgarden at (716) 926-2000.

Shares of common stock represented by a proxy in the form enclosed, properly executed, will be voted in the manner instructed, or if no instructions are indicated, “FOR” the election of director nominees named therein, “FOR” the approval, on an advisory basis, of the compensation paid to the Company’s named executive officers, and “FOR” ratification of the appointment of Crowe LLP as the Company’s independent registered public accounting firm for fiscal year 2020. The proxy given by the enclosed proxy card may be revoked at any time before it is voted by delivering to the Secretary of the Company a written revocation or a duly executed proxy bearing a later date or by attending the Annual Meeting and voting in person. Any shareholder of record may vote in person at the Annual Meeting, whether or not he or she has previously given a proxy. Attendance at the Annual Meeting will not have the effect of revoking a proxy unless you give proper written notice of revocation to the Secretary before the proxy is exercised or you vote by written ballot at the meeting. If you are a beneficial owner of shares held in street name and you wish to vote in person at the Annual Meeting, you must obtain a legal proxy from the organization that holds your shares.

The enclosed proxy is being solicited by the Board of Directors of the Company. The total cost of solicitation of proxies in connection with the Annual Meeting will be borne by the Company.This Proxy Statement and the enclosed proxy are first being mailed to shareholders on or about March 24, 2020.

The following proposals will be considered at the meeting:

Proposal I – To elect the four nominees named herein as directors of the Company to hold office for the term of three years.

Proposal II – To approve, on an advisory basis, the compensation paid to the Company’s named executive officers (“Say on Pay”).

Proposal III – To ratify the appointment of Crowe LLP as the Company’s independent registered public accounting firm for fiscal year 2020.

The Board of Directors of the Company unanimously recommends that you vote “FOR” election of the directors identified as nominees under Proposal I and “FOR” Proposals II and III.

Attendance at the Annual Meeting is Discouraged: In light of the ongoing health concerns relating to the coronavirus and to best protect the health of our employees, shareholders and community, we are requesting that shareholders DO NOT ATTEND the Annual Meeting in person this year. Shareholders can call into the following number 1 (571) 317-3122; Access Code: 901406741 and listen to the meeting live. BUT PLEASE WE ASK THAT YOU NOT ATTEND THE ANNUAL MEETING IN PERSON.

1

Voting Securities

Only holders of shares of common stock of record at the close of business on March 5, 2020 are entitled to notice of and to vote at the Annual Meeting and at all adjournments thereof. At the close of business on March 5, 2020, the Company had 4,942,802 shares of common stock outstanding. For all matters to be voted on at the Annual Meeting, holders of common stock are entitled to one vote per share.

A quorum of shareholders is necessary to hold a valid Annual Meeting. A majority of shares entitled to vote, present in person or represented by proxy, shall constitute a quorum for the transaction of business at the Annual Meeting. Broker non-votes and abstentions will be counted as being present or represented at the Annual Meeting for purposes of establishing a quorum. A broker non-vote occurs on an item when a broker is not permitted to vote on that item without timely instruction from the beneficial owner of the shares and no instruction is given.

Vote Required and Board Recommendations

|

|

|

|

|

|

| Proposal |

| Vote Required |

| Board Recommendation |

I. | Election of Directors |

| Plurality of the votes cast |

| “FOR” election of the nominated directors |

II | Advisory “Say-on-Pay” Vote |

| Majority of the votes cast |

| “FOR” the approval, on an advisory basis, of the compensation paid to our named executive officers |

III. | Ratification of Appointment of Independent Public Accounting Firm for 2020 |

| Majority of the votes cast |

| “FOR” ratification of the appointment of Crowe LLP |

Plurality Vote – Proposal I

Under New York law and the Company's bylaws, directors are elected by the affirmative vote, in person or by proxy, of a plurality of the votes cast at a meeting at which a quorum is present. Only votes actually cast will be counted for the purpose of determining whether a particular nominee received more votes than the persons, if any, nominated for the same seat on the Board of Directors. This means that, for Proposal I, the four director nominees identified in this Proxy Statement will be elected if they receive more affirmative votes than any other nominees.

Majority Vote – Proposals II and III

Proposals II and III must be approved by a majority of the votes cast at the Annual Meeting. This means that, in order for each of these proposals to be approved by the Company’s shareholders, the number of votes cast “For” a particular proposal must be greater than the number of votes cast “Against” that proposal.

Abstentions and Broker Non-Votes

If you hold your shares (i.e., they are registered) through a bank, broker or other nominee in “street name” but you do not provide the firm that holds your shares with your specific voting instructions, it will only be allowed to vote your shares on your behalf in its discretion on “routine” matters, but it cannot vote your shares in its discretion on your behalf on any “non-routine” matters. This result is known as a “broker non-vote”. Proposal I relating to the election of your Board’s nominees for Directors and Proposal II relating to Say on Pay are considered “non-routine” matters. Proposal III relating to the appointment of the Company’s independent auditors for fiscal year 2020 is considered a “routine” matter. While your broker will have discretionary authority to vote your uninstructed shares “for” or “against” or “abstaining” from voting on Proposal III, your broker will have no discretionary authority to vote your shares on Proposals I and II at the Annual Meeting. If you hold your shares in street name, please follow the voting instructions sent to you by your bank, broker or other nominee.

2

Abstentions and broker non-votes will be counted as present for purposes of determining the existence of a quorum at the Annual Meeting. However, broker non-votes will not be treated as votes “cast” at the Annual Meeting, and will have no effect on the outcome of any of the proposals to be considered at the Annual Meeting. Likewise, for Proposals I, II, and III, abstentions will not be treated as votes “cast” at the Annual Meeting, and will have no effect on the outcome of these Proposals.

Security Ownership of Management and Certain Beneficial Owners

The following table sets forth information, as of March 5, 2020, concerning:

Each person whom we know beneficially owns more than 5% of our common stock.

Each of our directors and nominees for the Board of Directors.

Each of our Named Executive Officers, as defined below under “Executive Compensation”.

All of our directors and executive officers as a group.

Beneficial ownership is determined under the rules of the Securities and Exchange Commission (the “SEC”) and generally includes voting or investment power with respect to our securities. Except as indicated in the footnotes to this table, the persons named in the table below have sole voting and investment power with respect to all shares of common stock beneficially owned. The number of shares beneficially owned by each person as of March 5, 2020 includes shares of common stock that such person has the right to acquire on or within 60 days after March 5, 2020 upon the exercise of vested stock options and also includes shares of restricted stock that are subject to forfeiture and transfer restrictions until the vesting date thereof. For each person or group included in the table below, percentage ownership is calculated by dividing the number of shares beneficially owned by such person, calculated as described in the previous sentence, by the sum of the 4,942,802 shares of common stock outstanding on March 5, 2020 plus the number of shares of common stock that such person or group has the right to acquire on or within 60 days after March 5, 2020. Beneficial ownership representing less than one percent is denoted with an asterisk "*".

|

|

|

|

Name of Beneficial Owner | Number of Shares Beneficially Owned |

| Percent of Class |

Directors, Director Nominees and Officers |

|

|

|

Michael A. Battle | 2,062 |

| * |

James E. Biddle, Jr. | 21,993 |

| * |

John B. Connerton (1) | 26,190 |

| * |

Jody L. Lomeo | 2,088 |

| * |

Robert G. Miller, Jr. (2) | 103,184 |

| 2.07% |

Kimberley A. Minkel | 1,513 |

| * |

David J. Nasca (3) | 124,259 |

| 2.49% |

Christina P. Orsi | 1,453 |

| * |

David R. Pfalzgraf, Jr. | 3,150 |

| * |

Michael J. Rogers | 5,605 |

| * |

Oliver Sommer | 3,281 |

| * |

Nora B. Sullivan | 3,638 |

| * |

Thomas H. Waring, Jr. (4) | 14,472 |

| * |

Aaron Whitehouse | 621 |

| * |

Lee C. Wortham | 14,148 |

| * |

Directors, director nominees and executive officers |

|

|

|

as a group; 15 persons (5) | 327,657 |

| 6.50% |

|

|

|

|

3

|

|

|

FJ Capital Management LLC (6) |

|

|

1313 Dolley Madison Blvd, Ste 306 | 485,663 | 9.83% |

McLean, VA 22101 |

|

|

|

|

|

Manulife Financial Corporation (7) |

|

|

200 Bloor Street East | 315,166 | 6.38% |

Toronto, Ontario, Canada M4W 1E5 |

|

|

|

|

|

PL Capital Advisors, LLC (8) |

|

|

750 Eleventh Street South, Suite 202 | 310,796 | 6.29% |

Naples, FL 34102 |

|

|

|

|

|

|

|

(1) | Includes 15,395 shares that Mr. Connerton may acquire by exercise of options exercisable on March 5, 2020 or within 60 days thereafter and 2,320 shares of restricted stock that are subject to forfeiture and transfer restrictions until the vesting date thereof. |

(2) | Includes 31,416 shares that Mr. Miller may acquire by exercise of options exercisable on March 5, 2020 or within 60 days thereafter and 2,893 shares of restricted stock that are subject to forfeiture and transfer restrictions until the vesting date thereof. |

(3) | Includes 2,344 shares owned jointly by Mr. Nasca and his wife, 552 shares owned by Mr. Nasca’s children, 52,173 shares that Mr. Nasca may acquire by exercise of options exercisable on March 5, 2020 or within 60 days thereafter and 6,238 shares of restricted stock that are subject to forfeiture and transfer restrictions until the vesting date thereof. |

(4) | Includes 1,129 shares held by Mr. Waring’s wife. |

(5) | Includes 101,786 shares that such persons may acquire by exercise of options exercisable on March 5, 2020 or within 60 days thereafter. |

(6) | Based on the most recently available Schedule 13G/A filed with the SEC on February 13, 2020. According to that report, the aggregate holdings consist of 450,920 shares held by Financial Opportunity Fund LLC and 6,600 shares held by Financial Opportunity Long/Short Fund LLC of which FJ Capital Management LLC (“FJ Capital) is the managing member and 28,143 shares held by a managed account that FJ Capital manages and of which FJ Capital is the managing member (reporting shared voting and dispositive power with respect to 485,663 shares) |

(7) | Based on the most recently available Schedule 13G/A filed with the SEC on February 12, 2020 on behalf of Manulife Financial Corporation (“MFC”) and MFC’s indirect, wholly-owned subsidiaries, Manulife Investment Management (US) LLC (“MIM (US)”), and Manulife Investment Management Limited ("MIML"). MIM (US) reported sole voting and dispositive power with respect to 315,166 shares, and MIML reported sole voting and dispositive power with respect to 3,348 shares. |

(8) | Based on the most recently available Schedule 13G/A filed with the SEC on February 14, 2020 on behalf of PL Capital Advisors, LLC, Richard J. Lashley, a managing member of PL Capital Advisors, and John W. Palmer, a managing member of PL Capital Advisors. According to the report PL Capital Advisors, Richard J. Lashley, and John W. Palmer reported shared voting and dispositive power with respect to 310,796 shares. |

4

Equity Compensation Plans. All equity compensation plans maintained by the Company were approved by the Company’s shareholders. Shown below is certain information as of December 31, 2019 concerning the shares of the Company’s common stock that may be issued under existing equity compensation plans.

|

|

|

|

|

|

|

|

|

Equity Compensation Plan Information | ||||||||

Equity Compensation Plans Approved by Security Holders |

| Number of securities to be issued upon exercise of outstanding options |

| Weighted-average exercise price of outstanding options |

| Number of securities remaining available for future issuance under equity compensation plans (1) | ||

Evans Bancorp, Inc. 2019 Long-Term Equity Incentive Plan |

|

| - |

|

| - |

| 313,429 |

Evans Bancorp, Inc. 2009 Long-Term Equity Incentive Plan |

|

| 215,560 |

| $ | 27.54 |

| - |

Evans Bancorp, Inc 2013 Employee Stock Purchase Plan |

|

| - |

|

| - |

| 92,411 |

Total |

|

| 215,560 |

| $ | 27.54 |

| 405,840 |

(1) This column excludes shares reflected under the column “Number of Securities to be issued upon exercise of outstanding options.”

DELINQUENT SECTION 16(a) REPORTS

Section 16(a) of the Securities Exchange Act of 1934 (the “Exchange Act”) requires the Company's officers and directors, and persons who beneficially own more than 10% of the Company's common stock, to file initial reports of ownership and reports of changes in ownership with the SEC. Officers, directors and greater than 10% beneficial owners are required by SEC regulations to furnish the Company with copies of all Section 16(a) forms they file.

Based solely on a review of the copies of such forms furnished to the Company and written representations from the Company's officers and directors, the Company believes that during or with respect to fiscal year 2019, all reports required by Section 16(a) of the Exchange Act were timely filed.

|

PROPOSAL I – ELECTION OF DIRECTORS |

The Company's bylaws provide for a classified board of directors, with three classes of directors, each nearly as equal in number as possible. Each class serves for a three-year term, and one class is elected each year. The Board of Directors is authorized by the Company's bylaws to fix from time to time, the number of directors that constitute the whole Board of Directors. The Board size has been set at thirteen members. The nominees for director at the 2020 Annual Meeting are: Michael A. Battle, James E. Biddle, Jr., Jody L. Lomeo, and Nora B. Sullivan, for terms to expire at the 2023 Annual Meeting and until their successors are duly elected and qualified.

The Board of Directors has no reason to believe that any nominee would be unable or unwilling to serve, if elected. In the event that any nominee for director becomes unavailable and a vacancy exists, it is intended that the Corporate Governance and Nominating Committee of the Board of Directors will recommend a substitute nominee for approval by the Board of Directors.

5

Required Vote

Under New York law and the Company’s bylaws, directors are elected by the affirmative vote, in person or by proxy, of a plurality of the votes cast at a meeting at which a quorum is present. Only votes actually cast will be counted for the purpose of determining whether a particular nominee received more votes than the persons, if any, nominated for the same seat on the Board of Directors. This means that, for Proposal I, the four director nominees identified in this Proxy Statement will be elected if they receive more affirmative votes than any other nominees. Votes to withhold in an uncontested election and broker non-votes will have no effect on the outcome of this vote.

Unless otherwise directed, the persons named in the proxy card intend to vote shares as to which proxies are received “FOR” the director nominees: Michael A. Battle, James E. Biddle, Jr., Jody L. Lomeo, and Nora B Sullivan.

THE COMPANY’S BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” EACH OF THE NOMINEES FOR ELECTION TO THE BOARD OF DIRECTORS.

INFORMATION REGARDING DIRECTORS, DIRECTOR NOMINEES

AND EXECUTIVE OFFICERS

The following tables set forth the names, ages, and positions of the director nominees, the directors continuing in office, and the executive officers of the Company:

Nominees for Director:

|

|

|

|

|

|

|

|

|

Name |

| Age |

| Position |

| Term to Expire |

| Independent* |

Michael A. Battle |

| 64 |

| Director |

| 2023 |

| Yes |

James E. Biddle, Jr. |

| 58 |

| Director |

| 2023 |

| Yes |

Jody L. Lomeo |

| 51 |

| Director |

| 2023 |

| Yes |

Nora B. Sullivan |

| 62 |

| Director |

| 2023 |

| Yes |

* Independence has been determined by the Company’s Board of Directors in accordance with the listing rules of NYSE American.

Directors Continuing in Office and Executive Officers:

|

|

|

|

|

|

|

|

|

Name |

| Age |

| Position |

| Term Expires |

| Independent* |

Robert G. Miller, Jr. ** |

| 63 |

| Director |

| 2021 |

| No |

Kimberley A. Minkel |

| 54 |

| Director |

| 2021 |

| Yes |

David J. Nasca † |

| 62 |

| Director |

| 2022 |

| No |

|

|

|

| President and Chief Executive Officer of the |

|

|

|

|

|

|

|

| Company |

|

|

|

|

|

|

|

| President and Chief Executive Officer of |

|

|

|

|

|

|

|

| Evans Bank, N.A. |

|

|

|

|

Christina P. Orsi |

| 48 |

| Director |

| 2021 |

| Yes |

David R. Pfalzgraf, Jr. |

| 50 |

| Director |

| 2022 |

| Yes |

Michael J. Rogers |

| 62 |

| Director |

| 2021 |

| Yes |

Oliver H. Sommer |

| 52 |

| Director |

| 2021 |

| Yes |

Thomas H. Waring, Jr. |

| 62 |

| Director |

| 2022 |

| Yes |

Lee C. Wortham |

| 62 |

| Director |

| 2022 |

| Yes |

John B. Connerton † |

| 53 |

| Treasurer of the Company |

| --- |

| --- |

|

|

|

| Chief Financial Officer of Evans Bank, N.A. |

|

|

|

|

Aaron M. Whitehouse † |

| 49 |

| President of The Evans Agency, LLC |

| --- |

| --- |

† Executive Officer

* Independence has been determined by the Company’s Board of Directors in accordance with the listing rules of NYSE American.

**Mr. Miller, retired from the positions of Secretary of the Company, President of The Evans Agency, LLC, and Executive Vice President of Evans Bank, N.A. effective March 29, 2019. Mr. Miller continues to serve as a director of the Company.

6

Directors, Director Nominees and Executive Officer Information.

Set forth below are the biographies of (1) each of the nominees and continuing directors containing information regarding the person’s service as a director, business experience, director positions held currently or at any time during the last five years, and the experiences, qualifications, attributes or skills that caused the Board to determine that the person should serve as a director for the Company, and (2) the executive officers of the Company.

Nominees for Director

Mr. Battle has been a director of the Company since August 2016. He has been a partner of the Washington, DC office of Barnes & Thornburg LLP, specializing in white collar criminal defense, as a member of the firm’s Litigation Department since April 2016. Mr. Battle’s practice focuses on commercial and civil litigation, white collar criminal matters, and appeals. Prior to his role with Barnes & Thornburg, Mr. Battle was a senior partner of Schlam, Stone & Dolan LLP from 2010 – April 2016 and was a partner of Fulbright & Jaworski LLP from 2007 – 2010. He was Director of the Executive Office for United States Attorneys from 2005 – 2007, providing administrative oversight of all 93 United States Attorneys and serving as a liaison between the United States Attorneys and the Justice Department and other federal agencies. Mr. Battle served as United States Attorney with the United States Attorney’s Office, Western District of New York, from 2002 – 2005. From 1996 – 2002, he was appointed by Governor George Pataki (and subsequently elected) to serve as Judge for Erie County Family Court, providing rulings in thousands of family-law and matrimonial cases. Mr. Battle served as Attorney in Charge with the New York State Attorney’s Office, Buffalo Regional Office, from 1995 – 1996. He was the Assistant Federal Defender with the Federal Defender’s Office, Western New York, from 1992 – 1995 and Assistant United States Attorney with the United States Attorney’s Office, Western District of New York, from 1985 – 1992. Mr. Battle began his career as an Attorney with the Legal Aid Society of New York, Civil Division, from 1981 – 1985. We believe that Mr. Battle’s wide-ranging and extensive legal and governance experience make him a valuable member of our Board and its Enterprise Risk Committee and Corporate Governance and Nominating Committee.

Mr. Biddle has been a director of the Company since 2001. He has served as the Chairman and Treasurer of Mader Construction Co., Inc., since 2001. Mr. Biddle also has served as the Chief Financial Officer of Bullis Investors, LLC, since 2007. In addition, Mr. Biddle has served as the Vice President and Treasurer of Arric Corp., an environmental remediation company, since 1989. Mr. Biddle has extensive experience in the construction sector, an attribute that enables him to assist the Board in understanding the opportunities and risks of a large component of our loan portfolio. In addition, his experience as a treasurer provides the Board with skills in assessing risk and exercising diligence, which are functions relevant to his service on the Board’s Enterprise Risk Committee. We believe that Mr. Biddle’s work in the construction industry, his continuing executive experience, and his proven financial acumen make him a very valuable member of our Board and its Audit Committee and Enterprise Risk Committee.

Mr. Lomeo has been a director of the Company since April 2017. He has been the President and Chief Executive Officer of Kaleida Health, a healthcare provider in Western New York, since April of 2014 and served as interim CEO from January 2014 - February 2014. In addition to Kaleida Health, since 2014 he has served as the President and Chief Executive Officer of the Great Lakes Health System of Western New York, the parent organization responsible for integrating the clinical activities of Kaleida Health, Erie County Medical Center Corporation (ECMC), University at Buffalo and the Center for Hospice & Palliative Care. Mr. Lomeo served as CEO of ECMC from 2009 - 2014. We believe Mr. Lomeo’s significant executive experience and community leadership qualify him to serve as an integral member of our Board of Directors and its Corporate Governance and Nominating Committee and Human Resource and Compensation Committee.

Ms. Sullivan has been a director since 2013. She is President of Sullivan Capital Partners, LLC, a financial services company providing investment banking and consulting services to closely-held private businesses. Ms. Sullivan focuses on strategic planning, mergers and acquisitions, and governance matters. Prior to founding Sullivan Capital Partners in 2004, Ms. Sullivan worked for Citigroup Private Bank from 2000 to

7

2004, providing wealth management and private equity services to high net worth clients. From 1995 to 1999, Ms. Sullivan was Executive Vice President of Rand Capital Corporation, a publicly traded closed-end investment management company providing capital and managerial expertise to small and mid-size businesses. Ms. Sullivan began her career in the legal profession where she held various positions with significant legal responsibility and acquired a solid foundation in corporate related matters and business transactions. In 2015, Ms. Sullivan joined the board of directors of 22nd Century Group, Inc. a publicly traded company that is in the plant biotechnology industry and is a leader in tobacco harm reduction. She is currently and has been a member of the board of directors of several privately held businesses, working closely with fellow board members, management and ownership on strategic planning initiatives, developing exit strategies and implementing sound governance practices. We believe Ms. Sullivan’s unique combination of legal experience and financial services expertise qualifies her to serve on our Board of Directors, and as a member of the Board’s Audit Committee and Corporate Governance and Nominating Committee.

Directors Continuing in Office and Executive Officers

Mr. Miller has been a director of the Company since 2001. On March 29, 2019 Mr. Miller retired from the positions of Secretary of the Company, President of The Evans Agency, LLC (“TEA”), an indirect wholly-owned subsidiary of the Company, and Executive Vice President of Evans Bank, N.A (the “Bank”). Prior to retirement Mr. Miller served as the Secretary of the Company since April 2010, the President of TEA since 2000 and as Executive Vice President of Evans Bank, N.A. since December 2009. He also has served as the President of Evans National Financial Services, LLC, a wholly-owned subsidiary of the Company, since May 2002. Mr. Miller’s substantial experience in the financial services industry gives him a solid foundation from which to advise the Board with respect to financial service acquisition opportunities, and his experience overseeing a financial sales force provides him with a practical background on matters such as developing strategies to succeed in a highly competitive marketplace.

Ms. Minkel has been President and Executive Director of the Niagara Frontier Transportation Authority (“NFTA”) since 2010. Ms. Minkel is responsible for managing a transportation system including light rail, bus, paratransit, and two airports within Western New York. Ms. Minkel manages an annual $235 million operating and capital budget that provides efficient and professional transportation services while engaging with board members, over 1,600 employees, stakeholders, and the general public in a manner consistent with the needs of a diverse community. Before her role as President and Executive Director of the NFTA, Ms. Minkel served as Director of Risk, Health, Safety, and Environmental Quality for the NFTA. In this role, she provided functional leadership within the areas of risk management including loss control, environmental, and safety. We believe Ms. Minkel’s extensive executive experience and community leadership qualify her to serve on our Board of Directors and its Human Resource and Compensation Committee and Enterprise Risk Committee.

Mr. Nasca has been a director of the Company since 2006. Mr. Nasca also serves as the President and Chief Executive Officer of the Company and as President and Chief Executive Officer of the Bank. He has held the position of President of the Company and the Bank since 2006, and Chief Executive Officer of the Company and the Bank since 2007. Mr. Nasca served as Chief Operating Officer of LifeStage, LLC, a health care services startup company, from October 2005 to August 2006. From June 2004 to July 2005, Mr. Nasca served as Executive Vice President of Strategic Initiatives of First Niagara Financial Group. Mr. Nasca held the position of Executive Vice President, Consumer Banking Group, Central New York Regional Executive of First Niagara Financial Group from June 2002 through June 2004. From October 2000 to June 2002, Mr. Nasca served as President and CEO of Iroquois Financial, Inc. and Cayuga Bank which were wholly owned by First Niagara Financial Group. Mr. Nasca serves as President and CEO of the Company and the Bank pursuant to an employment agreement with the Company and the Bank. As President and CEO, Mr. Nasca provides our Board with information gained from hands-on management of our operations, identifying our near-term and long-term challenges and opportunities. The Board has determined that Mr. Nasca’s significant experience in the banking industry over the past 30 years, including operational, financial, and executive roles, as well as his unique perspective as leader of our management team, qualifies him for service as a member of our Board of Directors.

8

Ms. Orsi has been Associate Vice President of the Office of Economic Development for the University at Buffalo (“UB”) since 2015. In this role, Ms. Orsi leads UB’s Business and Entrepreneur Partnership with a focus on connecting business with UB faculty for collaboration on research and development; enabling business access to programs like START UP NY to help companies grow in New York State; and supporting the commercialization of faculty inventions to move the from idea to market. From 2007-2015, Ms. Orsi was the Executive Director of the Regional Economic Development Council and Regional Director for Western New York for the Empire State Development Corporation. In this role, Ms. Orsi provided strategic direction for the Regional Economic Development Council, established collaboration among diverse leaders throughout Buffalo Niagara, and led implementation of the Buffalo Billion Investment Strategy. We believe that Ms. Orsi’s extensive knowledge of economic development programs, private sector policy issues, and government agencies at the state, regional, and municipal levels qualify her to serve on our Board of Directors and its Audit Committee and its Human Resource and Compensation Committee.

Mr. Pfalzgraf has been a director of the Company since 2014. He has been a Managing Partner of Rupp, Baase, Pfalzgraf, Cunningham LLC, a law firm specializing in private business enterprises ranging from closely-held family businesses to multi-national corporations, since April 2000. Mr. Pfalzgraf leads the firm’s corporate practice group, working primarily with private business enterprises ranging from closely-held family businesses to multi-national corporations. He assists clients with all corporate needs including business formations, restructurings, mergers and acquisitions, financing and investment, development, labor and employment issues, and commercial transactions. Mr. Pfalzgraf’s extensive legal and business experience makes him a valuable member of our Board of Directors, to serve as Chairman of its Corporate Governance and Nominating Committee, and to serve as a member of the Human Resource and Compensation Committee.

Mr. Rogers has been a director of the Company since 2011. He is a certified public accountant in New York State and the managing member of a real estate development company, Oakgrove Development, LLC, a position he has held since 2009. Mr. Rogers was the Executive Vice President and Chief Financial Officer of Great Lakes Bancorp, Inc., the parent company of Greater Buffalo Savings Bank, from 2006 to 2008. From 2004 to 2006, Mr. Rogers worked as an independent consultant, principally on Sarbanes-Oxley initiatives and business rationalization reviews. Mr. Rogers worked at KPMG LLP, a leading accounting firm, from 1984 to 2004, serving as an audit partner from 1995 to 2004. In his role as an auditor at KPMG LLP, Mr. Rogers worked on several engagements for financial institutions, particularly banks. His many years of experience have provided Mr. Rogers with a very strong knowledge base on the banking industry. His previous roles as an audit partner, SEC reviewing partner, and CFO also demonstrate his high level of competence in the areas of finance and accounting in general, and SEC reporting in particular, qualify him to be our Audit Committee Chairman and a member of the Board’s Enterprise Risk Committee, and provide the Board an additional expert on these matters in an increasingly complex regulatory environment.

Mr. Sommer has been a director of the Company since April 2017 and has been Vice Chairman of the Board since April 2018. He has been a partner with The River Group, a management consulting firm assisting CEOs and senior executive transform their organizations and leaders in order to achieve strategic intent, since July 2013. His role includes leading the marketing, business development, practice development, client engagement management, infrastructure establishment, and recruiting efforts. Prior to his role with The River Group, Mr. Sommer was Executive Vice President, Corporate Development, with First Niagara Financial Group, Inc. (now part of KeyCorp.) from 2010 – 2013, providing financial services to individuals, families and businesses across Upstate New York, Pennsylvania, Connecticut and Massachusetts. Mr. Sommer was the President of Aston Associates / Aston Strategic Capital, a boutique advisory firm for financial institutions and their investors, from 2004 – 2010, and Managing Director from 1996 – 2003. We believe Mr. Sommer’s extensive experience in the financial services industry in a variety of roles, but in particular in corporate strategy and development, make him well-qualified to serve on our Board of Directors and to serve as Chairman of its Enterprise Risk Committee, and to serve as a member of the Corporate Governance and Nominating Committee.

Mr. Waring has been a director of the Company since 1998. He has owned and managed Waring Financial Group, a financial planning, insurance and financial services and sales firm since 1996. Waring Financial

9

Group was renamed GCW Risk and Benefit Solutions LLC in 2016. Mr. Waring is the majority member of GCW Capital, LLC, a fee only independent registered investment advisory entity formed in August 2014 and registered with the SEC. He has also been the managing member of Family & Business Directions, LLC, a fee-based consulting business serving family-held and closely-held business owners, their families, and key executives, since 2010. Mr. Waring’s financial services experience provides the Board with a deeper understanding of the products and services which the Company needs to provide in the marketplace to remain competitive, as well as the delivery of those products and services. Mr. Waring frequently advises high net worth individuals, family business owners and closely-held business owners. He is experienced in providing strategic planning and development advice, including designing and implementing executive and key employee benefits. We believe that Mr. Waring’s qualifications to serve on our Board of Directors, as Chairman of the Human Resource and Compensation Committee and as a member of the Board’s Corporate Governance and Nominating Committee include his extensive sales and marketing experience with a financial services company, as well as his executive leadership and management experience.

Mr. Wortham has been a director of the Company since 2011 and has served as Chairman since April 2018. He has been a Partner and COO at Barrantys LLC, a consultant and service provider to wealthy families and family offices, since 2007. Prior to his role with Barrantys, Mr. Wortham was an Executive Vice President of First Niagara Financial Group from 2005 to 2007, where his responsibilities included wealth management, risk management, and corporate marketing. From 1999 to 2005, Mr. Wortham was the Executive Vice President of Global Private Client Services, Product Development, and Central Operations for The Bank of New York. Mr. Wortham held several positions at Chase Manhattan Bank and Chemical Bank (currently JP Morgan Chase & Co.) from 1985 to 1999, including leading the Global Private Bank’s activities in Europe, the Middle East, and Africa while based in London, England. He started his career at M&T Bank in retail banking from 1980 to 1985. In 2018, Mr. Wortham joined the board of directors of Albany International Corp, a publicly traded global advanced textiles and materials processing company. Mr. Wortham’s extensive experience in the financial services industry makes him a valuable member of our Board, and its Audit, Human Resource and Compensation, Corporate Governance and Nominating, and Enterprise Risk Committees. His expertise has been valuable in helping the Board evaluate the Company’s strategies to diversify its product offerings and revenue streams as a growing and competitive financial institution.

Mr. Connerton was appointed Treasurer of the Company and Chief Financial Officer of the Bank on November 30, 2015. Prior to his appointment as Treasurer of the Company he had served as Principal Accounting Officer of the Company between 2002 and 2010 and again between 2013 and 2015. He has also served as Senior Vice President and Treasurer of the Bank since 2010. Prior to joining the Company, Mr. Connerton was a Senior Auditor specializing in auditing and consulting for banking, healthcare and manufacturing clients at Deloitte & Touche LLP.

Mr. Whitehouse was appointed President of The Evans Agency, LLC., a wholly owned subsidiary of Evans Bank, on September 1, 2019. Prior to his appointment as President, he served as Chief Operating Officer between 2018 and 2019. He joined the Company in 2018 when Evans acquired Richardson & Stout, Inc., an independent insurance agency he co-owned since 1998. He is currently responsible for the overall leadership and strategic direction of the agency which includes Property and Casualty functions, Employee Benefits, and Frontier Claims.

10

CORPORATE GOVERNANCE

Independence of Directors

A majority of the Board of Directors, and all members of the Audit, Human Resource and Compensation, and Corporate Governance and Nominating Committees, are independent, as affirmatively determined by the Board, consistent with the criteria established by NYSE American and as required by our bylaws.

The Board has conducted an annual review of director independence for all current nominees for election as directors and all continuing directors. During this review, the Board considered transactions and relationships during the prior year between each director or any member of his or her immediate family and the Company and its subsidiaries, affiliates and principal shareholders, including those of the type described below under “Transactions with Related Persons.” The Board also examined transactions and relationships between directors or their affiliates and members of senior management or their affiliates. The purpose of this review was to determine whether any such relationships or transactions were inconsistent with a determination that the director is independent.

��

As a result of this review, the Board affirmatively determined that the nominees Michael A. Battle, James E. Biddle, Jr., Jody L. Lomeo, and Nora B. Sullivan meet the Company’s standard of independence, as do the following continuing directors: Kimberley A. Minkel, Christina P. Orsi, David R. Pfalzgraf, Jr., Michael J. Rogers, Oliver H. Sommer, Thomas H. Waring, Jr., and Lee C. Wortham. As an executive officer of the Company, David J. Nasca has been determined not to be independent. As a previous executive officer of the Company, Robert G. Miller, Jr. has been determined not to be independent.

Leadership Structure. Lee C. Wortham has served as Chairman of the Company’s Board of Directors since April 2018. In his capacity as Chairman, Mr. Wortham chairs meetings of the Board and executive sessions of the Board, coordinates the activities of the other independent directors, and performs such other duties and responsibilities as the Board of Directors may determine. These duties also include chairing meetings of the Company’s shareholders, overseeing the preparation of agendas for meetings of the Board, keeping directors informed through the timely distribution of information and reports, maintaining contact with the Company’s CEO between meetings to stay current on developments and to determine when it may be appropriate to alert the Board to significant pending developments, serving as a liaison between independent directors and the CEO with respect to sensitive issues, and other matters.

We separated the positions of Chairman and CEO in 2001. While the separation of these positions is not required by our bylaws, we believe that it is the most appropriate leadership structure for us at this time. We believe that it is advantageous to separate the two positions in order to provide for independent director control over Board agenda and information flow, encourage open and lively communication between the independent directors and management, and to help balance the leadership of the Board.

Board of Directors Stock Ownership. Upon his or her first election or appointment to the Board of Directors, a new director must hold, or must obtain within 60 calendar days after such election or appointment, not less than $10,000 aggregate market value of the Company's common stock, based on the trailing 365-day average price. A new director has a period of 5 years from the beginning of such director’s term of office to obtain the required $50,000 aggregate market value of the Company’s common stock. The value of a new director’s qualifying shares at the beginning of his or her term in office will be determined as of the date purchased or the date on which the individual becomes a director, whichever value is greater. As of the date of this Proxy Statement, all directors are in compliance with the Board of Directors stock ownership requirements. Our Insider Trading Policy prohibits directors, officers and employees from engaging in any hedging or monetization transactions involving Evans Bancorp securities.

11

Oversight of Risk Management. In 2017, the Board of Directors established an Enterprise Risk Committee (“ERC”), which is responsible for overseeing and approving company-wide risk management practices throughout the Company, overseeing management’s risk assessment process and risk management infrastructure, reviewing management’s risk-management framework in the context of the Company’s size and business activities, and advising on risks that the Company may face. The ERC will review and discuss with management, at least annually, the Company’s risk governance structure and the Company’s risk management and risk assessment guidelines and policies regarding market, credit, operations, liquidity, funding, reputation, cybersecurity and franchise risk, and the Company’s risk tolerance. The ERC will review at least quarterly the major risk exposures of the Company and its business units against established risk management methodologies and targets. The Board’s role in the Company’s risk oversight process includes receiving reports, at least quarterly, from members of senior management on areas of material risk to the Company, including operational, financial, credit, liquidity, legal and regulatory, and strategic and reputational risks. The full Board (or the appropriate committee in the case of risks that are under the purview of a particular committee) receives these reports from the appropriate “risk owner” within the organization to enable it to understand our risk identification, risk management and risk mitigation strategies. When a committee receives the report, the chairman of the relevant committee reports on the discussion to the full Board during the committee reports portion of the next Board meeting. This enables the Board and its committees to coordinate the risk oversight role, particularly with respect to risk interrelationships. The Board’s role in the Company’s risk oversight process has not directly impacted its leadership structure.

Compensation Risk. The Human Resource and Compensation Committee considers risk and its influence on the Company's compensation programs. This Committee reviews each compensation element individually and in the aggregate to ensure that the overall compensation program provides a balanced perspective that ultimately aligns pay with performance while also ensuring bonus / incentive programs do not motivate inappropriate risk-taking. Equity award levels and practices are set to foster shared interests between management and shareholders, but are not considered by the Committee to be at levels that would drive inappropriate behavior. In the Committee's judgment, the compensation policies and practices of the Company do not give rise to material risks.

In addition, the Company is subject to guidance issued by the FDIC, the FRB and the OCC designed to ensure that incentive compensation arrangements at banking organizations appropriately tie rewards to longer-term performance and do not undermine the safety and soundness of the firm or create undue risks to the financial system. This guidance embodies three core principles, which are: (1) incentive compensation arrangements at a banking organization should provide employees incentives that appropriately balance risk and financial results in a manner that does not encourage employees to expose their organizations to imprudent risks; (2) these arrangements should be compatible with effective controls and risk management, and (3) these arrangements should be supported by strong corporate governance, including active and effective oversight by the organization’s board of directors. We believe that our incentive compensation programs are in compliance with this guidance.

Policy for Director Attendance at Annual Meeting. It is the policy of the Company that all directors be present at the Annual Meeting, barring unforeseen or extenuating circumstances. All directors who were then serving were present at the Company’s 2019 Annual Meeting, except for Michael A. Battle, Jody L. Lomeo, Kimberley A. Minkel, and Christina P. Orsi.

12

Shareholder Communications with the Board of Directors. Shareholders and other parties interested in communicating directly with the Company’s Board of Directors may do so by writing to the Evans Bancorp, Inc. Board of Directors, One Grimsby Drive, Hamburg, NY 14075. All correspondence received under this process is compiled and summarized by the Executive Assistant to the President and Chief Executive Officer of the Company and presented to the Board of Directors, in accordance with our Policy for Communication to the Board of Directors. Concerns relating to accounting, internal controls or auditing matters are handled in accordance with procedures established by the Audit Committee, as set forth in our Employee Complaint Procedure for Accounting and Auditing Matters. Each of these policies is available in the Governance Documents section of the Company’s website (www.evansbancorp.com), which can be found by clicking on “About Us”, then “Investor Relations”, then “Governance Documents” under the “Corporate Overview” tab.

Code of Ethics for Chief Executive Officer and Principal Financial Officers. The Company has a "Chief Executive Officer/Treasurer/Controller Code of Ethics," which is applicable to the Company’s principal executive officer, principal financial officer, and principal accounting officer. The "Chief Executive Officer/Treasurer/Controller Code of Ethics" is available in the Governance Documents section of the Company’s website (www.evansbancorp.com), which can be found by clicking on “About Us”, then “Investor Relations”, then “Governance Documents” under the “Corporate Overview” tab. The Company intends to post amendments to or waivers from its code of ethics at this location on its website.

Board Meetings and Attendance at Board of Director and Committee Meetings. The Company’s Board of Directors met fourteen times during fiscal 2019, including one strategic planning meeting. Each incumbent director, except Michael A. Battle, attended at least 75% of the aggregate of: (1) all meetings of the Company’s Board of Directors (held during the period for which he or she served as a director) and (2) all meetings held by the committees of the Company’s Board of Directors on which he or she served (during the periods that he or she served). Mr. Battle was unable to attend certain meetings of the Board of Directors and committees on which he served due to required business travel overseas. In an abundance of caution, the Company determined it was prudent for Mr. Battle to not participate in meetings via teleconference or video conference during these travel periods due to the risk of potential cyber security or proprietary risk.

Availability of Committee Charters and Other Corporate Governance Documents. Current copies of the written charters for the Audit Committee, the Human Resource and Compensation Committee, and the Corporate Governance and Nominating Committee, copies of the Company's "Chief Executive Officer/Treasurer/Controller Code of Ethics" and the "Code of Conduct," the "Policy for Communication to the Board of Directors," and the “Employee Complaint Procedure for Accounting and Auditing Matters” are available in the Governance Documents section of the Company's website (www.evansbancorp.com), which can be found by clicking on “About Us”, then “Investor Relations”, then “Governance Documents” under the “Corporate Overview” tab.

BOARD OF DIRECTOR COMMITTEES

The Company’s Board of Directors has four outstanding committees: the Audit Committee, the Corporate Governance and Nominating Committee, the Human Resource and Compensation Committee and the Enterprise Risk Committee. The members of each committee have been nominated by the Chairman of the Board of Directors and approved by the full Board. The names of the members of the Audit Committee, the Human Resource and Compensation Committee, and the Corporate Governance and Nominating Committee, together with a brief description of their functions, are set forth below.

Audit Committee:

|

|

Michael J. Rogers, Chairman | Nora B. Sullivan |

James E. Biddle, Jr. | Lee C. Wortham |

Christina P. Orsi |

|

13

The Audit Committee met five times during fiscal 2019. The Audit Committee is responsible for reviewing the financial information of the Company that will be provided to shareholders and others, overseeing the systems of internal controls which management and the Board of Directors have established, selecting and monitoring the performance of the Company’s independent auditors, and overseeing the Company’s audit and financial reporting processes. The Board of Directors has determined that James E. Biddle, Jr., Michael J. Rogers, Nora B. Sullivan and Lee C. Wortham each qualify as an “audit committee financial expert” as defined in Item 407(d) of Regulation S-K. Each member of the Audit Committee is an "independent director" in accordance with applicable NYSE American listing requirements, including the heightened independence requirements applicable to Audit Committee members, and Rule 10A-3(b)(1) under the Exchange Act. The Board of Directors has adopted an Audit Committee Charter, which is available in the Governance Documents section of the Company's website at www.evansbancorp.com, which can be found by clicking on “About Us”, then “Investor Relations”, then “Governance Documents” under the “Corporate Overview” tab.

Human Resource and Compensation Committee:

|

|

Thomas H. Waring, Jr., Chairman | David R. Pfalzgraf, Jr. |

Jody L. Lomeo | Christina P. Orsi |

Kimberley A. Minkel | Lee C. Wortham |

The Human Resource and Compensation Committee met five times during fiscal 2019. The Human Resource and Compensation Committee is responsible for administering the Company’s 2019 Long-Term Equity Incentive Plan and awarding new grants thereunder, for administering the Evans Excels Performance Incentive Plan, the Employee Stock Purchase Plan, the Executive Severance Plan, the SERP Plans (defined below), the Deferred Compensation Plan, and the Executive Incentive Retirement Plan, for making such determinations and recommendations as the Human Resource and Compensation Committee deems necessary or appropriate regarding the remuneration and benefits of employees of the Company and its subsidiaries, and, in addition, for reviewing with management the Compensation Discussion and Analysis and providing a report recommending to the Board of Directors whether the Compensation Discussion and Analysis should be included in the Proxy Statement.

The Human Resource and Compensation Committee has the authority to act on behalf of the Board of Directors in setting compensation policy, administering Board or shareholder approved compensation plans, approving benefit programs and making decisions for the Board with respect to compensation of senior management. Except as otherwise required by the applicable rules of the SEC or the NYSE American, the Human Resource and Compensation Committee may delegate any of its responsibilities to a subcommittee comprised of one or more members of the Human Resource and Compensation Committee, the Board or members of management. As discussed in more detail below under “Compensation Discussion and Analysis,” the Company’s executive officers may attend Human Resource and Compensation Committee meetings to present data and analysis and to make recommendations regarding compensation, benefit plans and promotions for executive officers other than the President and CEO. The Human Resource and Compensation Committee, on an annual basis, reviews and approves corporate goals and objectives relevant to CEO and other officer compensation, evaluates the performance of the CEO and the other executive officers in light of those goals and objectives, and determines and recommends compensation levels for the CEO and the other executive officers to the full Board of Directors based on this evaluation.

The Human Resource and Compensation Committee also has the authority to review and recommend to the full Board for approval director compensation, including board fees, committee fees and additional compensation, including awards of restricted stock and stock options.

14

In carrying out its duties, the Human Resource and Compensation Committee has the authority to retain, at the Company’s expense, to oversee the work of, and to terminate, a compensation consultant. The Human Resource and Compensation Committee also has the authority to retain independent counsel and other advisors at the Company’s expense. During 2019, the Human Resource and Compensation Committee engaged McLagan of Aon Plc (“McLagan”), an independent firm, to provide recommendations with respect to associate level short term incentive compensation plan design and advisement on CEO employment agreement trends and industry best practices for similar sized publicly held Community Banks. The material elements of the instructions given to the compensation consultant, and its recommendations, are discussed below under “Executive Compensation”.

The Human Resource and Compensation Committee reviews and re-approves, on an annual basis, its committee charter and the Company’s executive compensation philosophy, which is described in greater detail below. The Human Resource and Compensation Committee also conducts an annual self-assessment to confirm the Human Resource and Compensation Committee’s satisfactory completion of its responsibilities under its committee charter. As a result of its 2019 self-assessment, the Human Resource and Compensation Committee concluded that it was meeting its objectives as set forth in its committee charter.

The Board of Directors has determined that each of the members of the Human Resource and Compensation Committee is an “independent director,” in accordance with applicable NYSE American listing requirements, including the heightened independence requirements applicable to compensation committee members. The Board of Directors has adopted a Human Resource and Compensation Committee Charter, which is available on the Company’s website at www.evansbancorp.com, by clicking on “About Us”, then “Investor Relations”, then “Governance Documents” under the “Corporate Overview” tab.

Corporate Governance and Nominating Committee:

| |

David R. Pfalzgraf, Jr., Chairman | Thomas H. Waring, Jr. |

Nora B. Sullivan | Jody L. Lomeo |

Oliver H. Sommer | Michael A. Battle |

Lee C. Wortham |

|

The Corporate Governance and Nominating Committee met four times during fiscal 2019. Its purpose is to assist the Board in developing and implementing corporate governance guidelines for the Company, and to provide oversight of the corporate governance affairs of the Company, including strategic planning. It is also charged with the responsibility of identifying and recommending to the Board candidates for director nominees to be presented to the shareholders for their consideration at the Annual Meetings of Shareholders, and to fill vacancies on the Board of Directors. The director nominees for the Annual Meeting were selected by a majority of the independent directors of the full Board. The Board of Directors has determined that each of the members of the Corporate Governance and Nominating Committee is an "independent director," in accordance with applicable NYSE American listing requirements. The Board of Directors has adopted a Corporate Governance and Nominating Committee Charter, which is available in the Governance Documents section of the Company’s website at www.evansbancorp.com, which can be found by clicking on “About Us”, then “Investor Relations”, then “Governance Documents” under the “Corporate Overview” tab.

The Company's bylaws set out the procedure to be followed by shareholders desiring to nominate directors for consideration at an annual meeting of shareholders. Under the Company's bylaws, shareholder director nominations must be submitted to the Secretary of the Company in writing not less than 14 days nor more than 50 days immediately preceding the date of the annual meeting. If less than 21 days’ notice of the annual meeting is given to shareholders, nominations must be mailed or delivered to the Secretary of the Company not later than the close of business on the seventh day following the day on which the notice of meeting was mailed. Such notification must contain the following information to the extent known by the notifying shareholder: (a) name and address of each proposed nominee; (b) the principal occupation of each proposed nominee; (c) the total number of shares of common stock of the Company that will be voted for

15

each proposed nominee; (d) the name and residence address of the notifying shareholder; and (e) the number of shares of common stock of the Company owned by the notifying shareholder. Candidates for nomination to the Board of Directors must meet criteria established from time to time by the Board of Directors or a duly authorized committee of the Board. Additionally, the Company's bylaws require that, in order to serve as a director of the Company, an individual must be less than 70 years of age. The Company’s bylaws provide that a Director who obtains the age of seventy (70) years old during his or her term as a Director may remain in office through the expiration of his or her term. Nominations not made in accordance with the bylaws of the Company may be disregarded by the presiding officer of the meeting, in his or her discretion, and upon his or her instruction, the inspectors of election may disregard all votes cast for each such nominee. However, in the event that any such nominee is nominated by more than one shareholder, the nomination shall be honored, and all votes cast in favor of such nominee shall be counted if at least one nomination for that person complies with the provisions of the bylaws of the Company.

The process whereby the Corporate Governance and Nominating Committee identifies director candidates may include identification of individuals well-known in the community in which the Company operates and individuals recommended to the Corporate Governance and Nominating Committee by current directors or officers who know those individuals through business or other professional relationships, as well as recommendations of individuals to the Corporate Governance and Nominating Committee by shareholders and customers. The Company has not historically received director candidate recommendations from its shareholders. However, the Corporate Governance and Nominating Committee will consider qualified nominees recommended by shareholders, and there is no difference in the manner in which the Corporate Governance and Nominating Committee will evaluate director candidates recommended by shareholders, as opposed to director candidates presented for consideration to the Corporate Governance and Nominating Committee by directors, officers or otherwise. The Corporate Governance and Nominating Committee, in conjunction with the CEO, maintains a list of potential director candidates based upon community reputation and contacts, record of accomplishments, and skill set. Additionally, the Corporate Governance and Nominating Committee reviews committee and Board assessments for competencies and needs and seeks to identify candidates that will assist in the continued development and enhancement of the Board of Directors. In its evaluation of prospective director candidates, the Corporate Governance and Nominating Committee considers an individual's independence (as defined in the listing rules of the NYSE American), as well as his or her skills and experience relative to the needs of the Company. Director candidates meet personally with the members of the Corporate Governance and Nominating Committee and are interviewed to determine their satisfaction of the criteria referred to above. Although the Company has no policy regarding diversity, the charter of the Corporate Governance and Nominating Committee provides that diversity is one of the criteria it may consider when selecting individuals to recommend for Board membership, together with independence, sound judgment, skill, integrity, willingness to make the required time commitment, understanding of financial statements and knowledge of and experience in the Company’s and its subsidiaries’ businesses, and the interplay of a candidate’s experience with the experience of other members of the Board of Directors.

DIRECTOR COMPENSATION

Director Compensation Philosophy. The Company’s director compensation program is designed to provide a compensation amount and structure that will attract and retain highly competent, skilled and engaged individuals for Board service. In order to ensure that its director compensation program remains competitive but appropriate, the Human Resource and Compensation Committee reviews director compensation, on an annual basis, against the same proxy peer group as that used in the review of executive compensation, as described below under “Executive Compensation – Compensation Discussion and Analysis – Role of Compensation Consultants. The desired total director compensation is at the 50th percentile of the proxy peer group and is delivered in both cash and equity. While many of the companies in our proxy peer group do not rely on equity compensation for their directors, the Human Resource and Compensation Committee believes that using a mix of cash and equity compensation aligns director compensation with long term shareholder value, while at the same time providing directors with an appropriate compensation for their service.

16

Director Fees. Each director of the Company also serves as a member of the Board of Directors of the Bank. Non-employee directors do not receive compensation for attending meetings of the Bank’s Board, but do receive committee meeting fees. It is the policy of the Board that employee directors are not paid for their service on the Company's or the Bank's Board of Directors in addition to their regular employee compensation.

During fiscal 2019:

Non-employee directors were paid a retainer at the rate of $1,458 in cash, payable on a monthly basis, and $1,458 per month in shares of restricted stock payable as a lump sum grant equal to $17,500 at the February board meeting. The number of shares of restricted stock awarded is calculated by dividing $17,500 by the closing price for a share of the Company’s common stock on the NYSE American on the date of grant. In February 2019, each non-employee director received a grant of 494 shares of restricted stock, at a grant date fair value of $35.45 per share, for service during 2019. In April of 2019, Mr. Miller received a grant of 364 shares of restricted stock at a grant date fair value of $36.05 for service as a non-employee director for the remainder of 2019. Each restricted stock grant vests 100% on the first anniversary of the grant date, subject to full acceleration of vesting upon an individual’s death, disability, retirement or involuntary termination in connection with a change in control of the Company. Vesting of restricted stock grants is accelerated on a pro-rated basis upon the individual’s resignation.

Non-employee directors were paid an annual cash retainer fee per committee as follows, with the fee paid over the course of the year in 12 equal monthly installments. In recognition of their heightened responsibilities, each committee chairperson is entitled to an annual retainer as described below. Members of the Enterprise Risk Committee did not receive an annual retainer and instead were paid per meeting attended, as set forth below.

· | Audit Committee: Chairperson $6,750, Member $3,750 |

· | Human Resources and Compensation Committee: Chairperson $4,750, Member $3,150 |

· | Corporate Governance and Nominating Committee: Chairperson $3,350, Member $2,150 |

· | Enterprise Risk Committee: Chairperson $800 per meeting, Member $600 per meeting |

Non-employee directors received $600 for attendance at a strategic planning meeting held outside of normal monthly Board meetings and regular committee meetings.

In addition to the annual service fee described above and Board meeting fees, the individual serving as Chairman of the Company’s Board of Directors and the Bank’s Board of Directors is entitled to receive an annual fee of $40,000. He or she does not receive committee meeting fees while serving as Chairman.

In addition to the annual service fee described above and Board and committee meeting fees, the individual serving as Vice Chairman of the Company’s Board of Directors and the Bank’s Board of Directors is entitled to receive an annual fee of $5,000.

17

Director Compensation. The following table provides information with regard to the compensation paid to the Company's non-employee directors for their service during the fiscal year ended December 31, 2019.

|

|

|

|

|

|

|

|

|

Name |

| Fees Earned or Paid in Cash |

| Stock Awards |

| Change in Pension Value and Non-qualified Deferred Compensation Earnings |

| Total |

Michael A. Battle |

| 27,008 |

| 17,512 |

| - |

| 44,520 |

James E. Biddle, Jr. |

| 31,012 |

| 17,512 |

| 10,499 |

| 59,023 |

Jody L. Lomeo |

| 23,319 |

| 17,512 |

| - |

| 40,831 |

Robert G. Miller, Jr. (5) |

| 19,725 |

| 13,122 |

|

|

| 32,847 |

Kimberley A. Minkel |

| 26,612 |

| 17,512 |

| - |

| 44,124 |

Christina P. Orsi |

| 25,599 |

| 17,512 |

| - |

| 43,111 |

David R. Pfalzgraf, Jr. |

| 24,482 |

| 17,512 |

| - |

| 41,994 |

Michael J. Rogers |

| 33,375 |

| 17,512 |

| - |

| 50,887 |

Oliver H. Sommer |

| 36,008 |

| 17,512 |

| - |

| 53,520 |

Nora B. Sullivan |

| 23,919 |

| 17,512 |

| - |

| 41,431 |

Thomas H. Waring, Jr. |

| 24,886 |

| 17,512 |

| 1,099 |

| 43,497 |

Lee C. Wortham |

| 57,500 |

| 17,512 |

| - |

| 75,012 |

(1)Includes the aggregate amount of the cash retainer, plus all committee and/or chairmanship fees and meeting fees paid to each director for service in 2019.

(2)Reflects the fair value of the awards at grant date, in accordance with FASB ASC Topic 718 for financial statement reporting purposes. For additional information as to the assumptions made in valuation, see Note 12 to the financial statements filed with the SEC in the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2019. Amounts shown in the table are based on the Company’s accounting expense for these awards, and do not necessarily correspond to the actual value that may be realized by the directors.

(3) The following reflects all equity awards granted to each director that were outstanding as of December 31, 2019:

|

|

|

|

|

|