Raymond James Conference

Sept 8, 2022

John B. Connerton

EVP & Chief Financial Officer

Dale M. McKim

EVP & Chief Risk Officer

This presentation includes "forward looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements include, but are not limited to, statements concerning future business, revenue and earnings. These statements are not historical facts or guarantees of future performance, events or results. There are risks, uncertainties and other factors that could cause the actual results of Evans Bancorp to differ materially from the results expressed or implied by such statements. Factors that may cause actual results to differ materially from those contemplated by such forward-looking statements include the impacts from COVID-19, competitive pressures among financial services companies, interest rate trends, general economic conditions, changes in legislation or regulatory requirements, effectiveness at achieving stated goals and strategies, and difficulties in achieving operating efficiencies. These risks and uncertainties are more fully described in Evans Bancorp’s Annual and Quarterly Reports filed with the Securities and Exchange Commission. Forward-looking statements speak only as of the date they are made. Evans Bancorp undertakes no obligation to publicly update or revise forward- looking information, whether as a result of new, updated information, future events or otherwise.

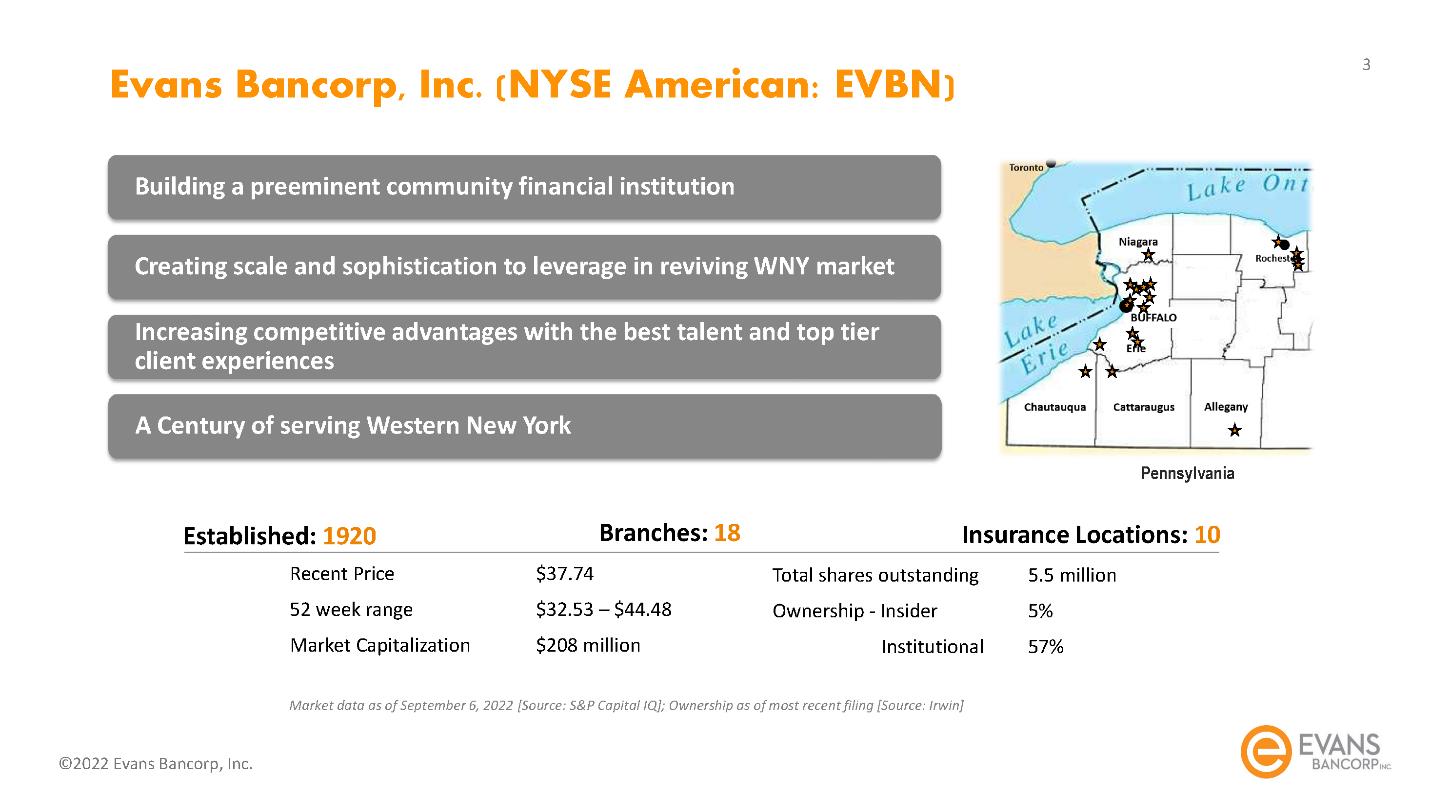

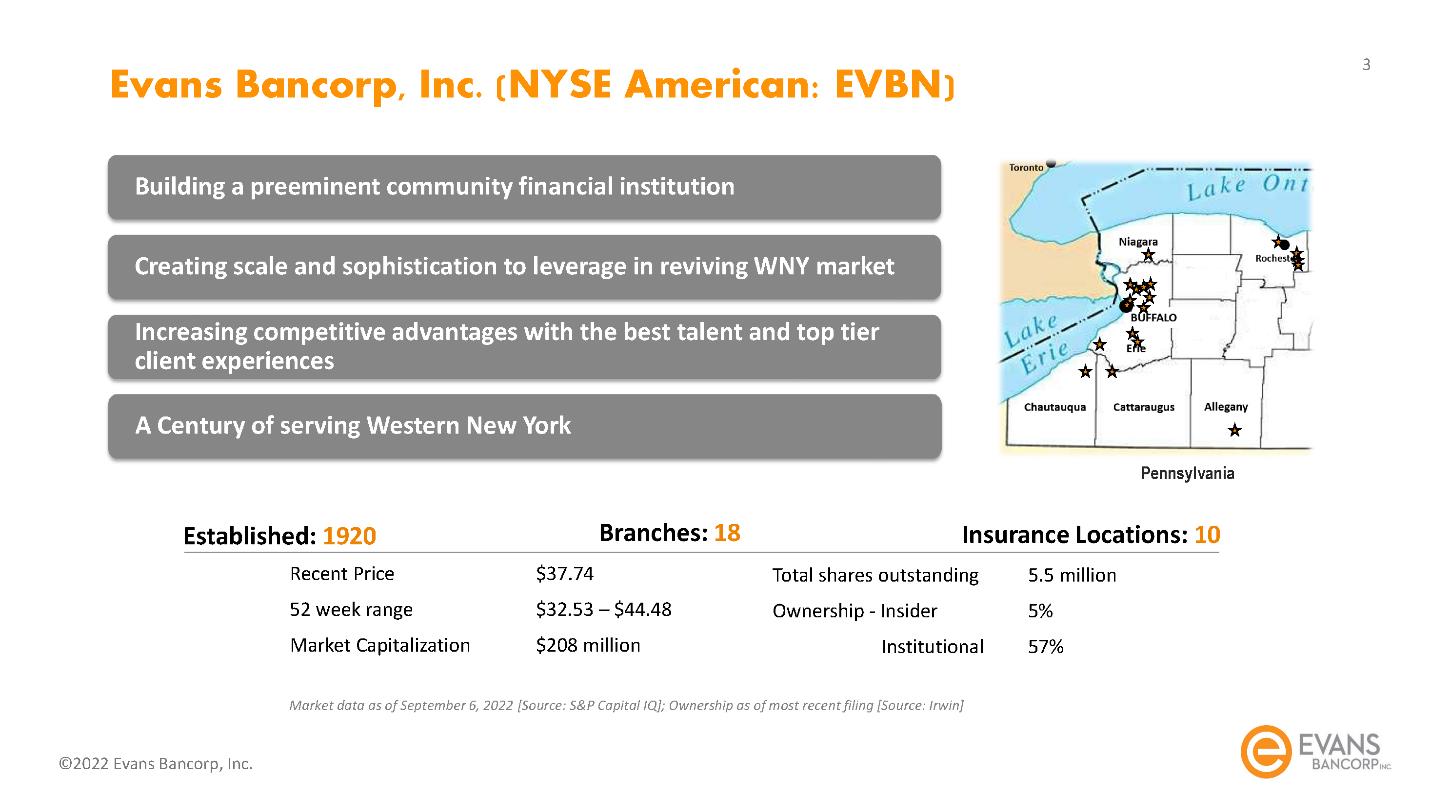

Evans Bancorp, Inc. (NYSE American: EVBN)

Evans Core Values

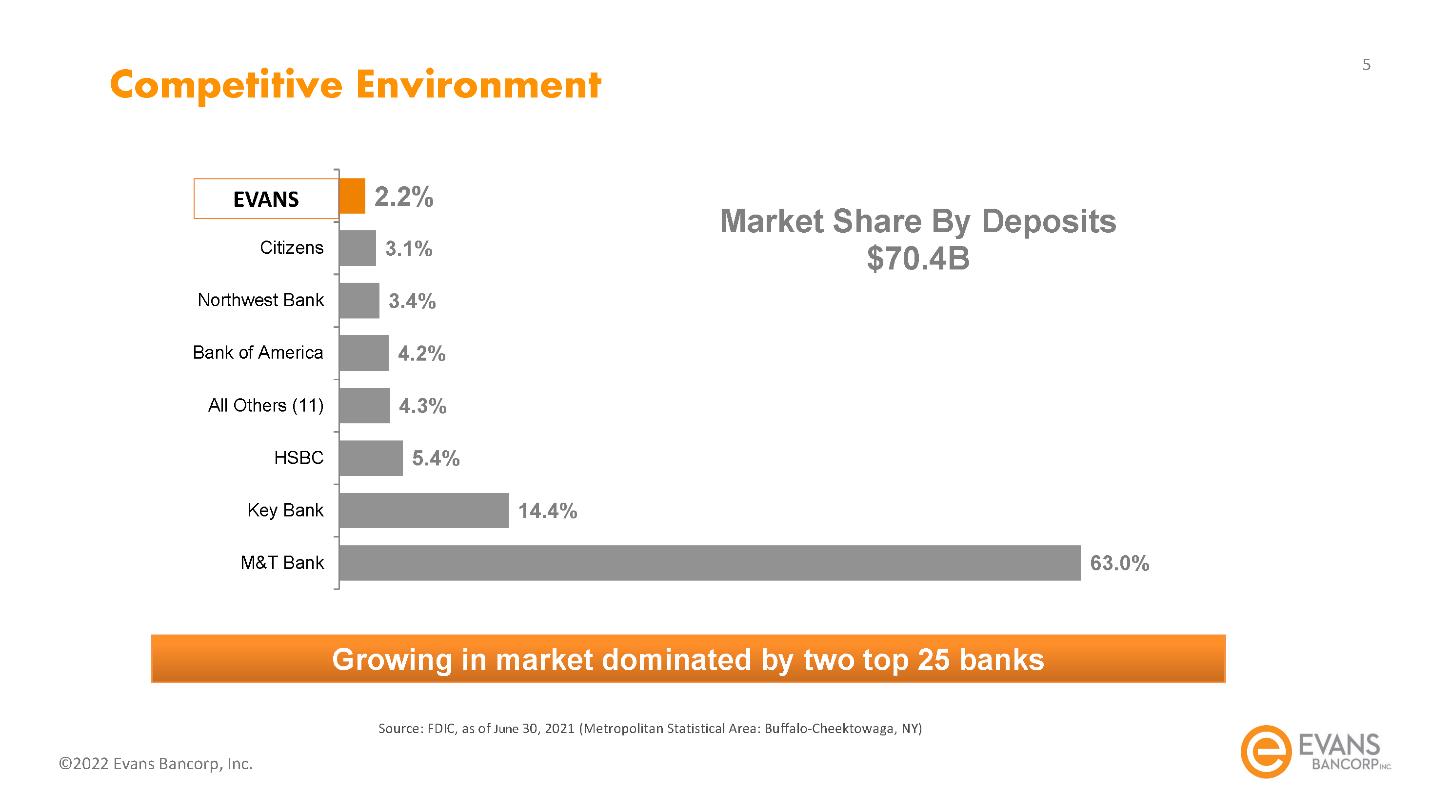

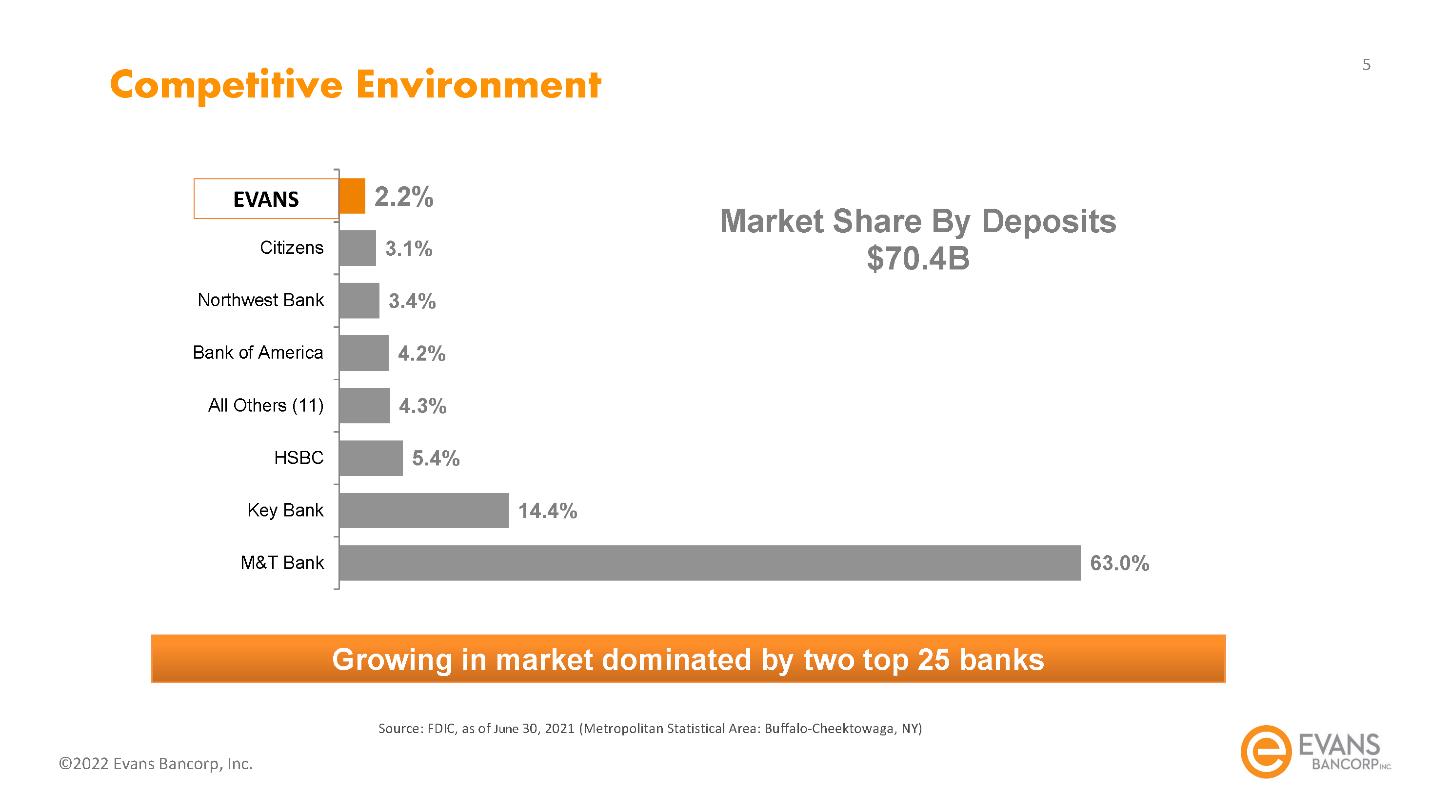

Competitive Environment

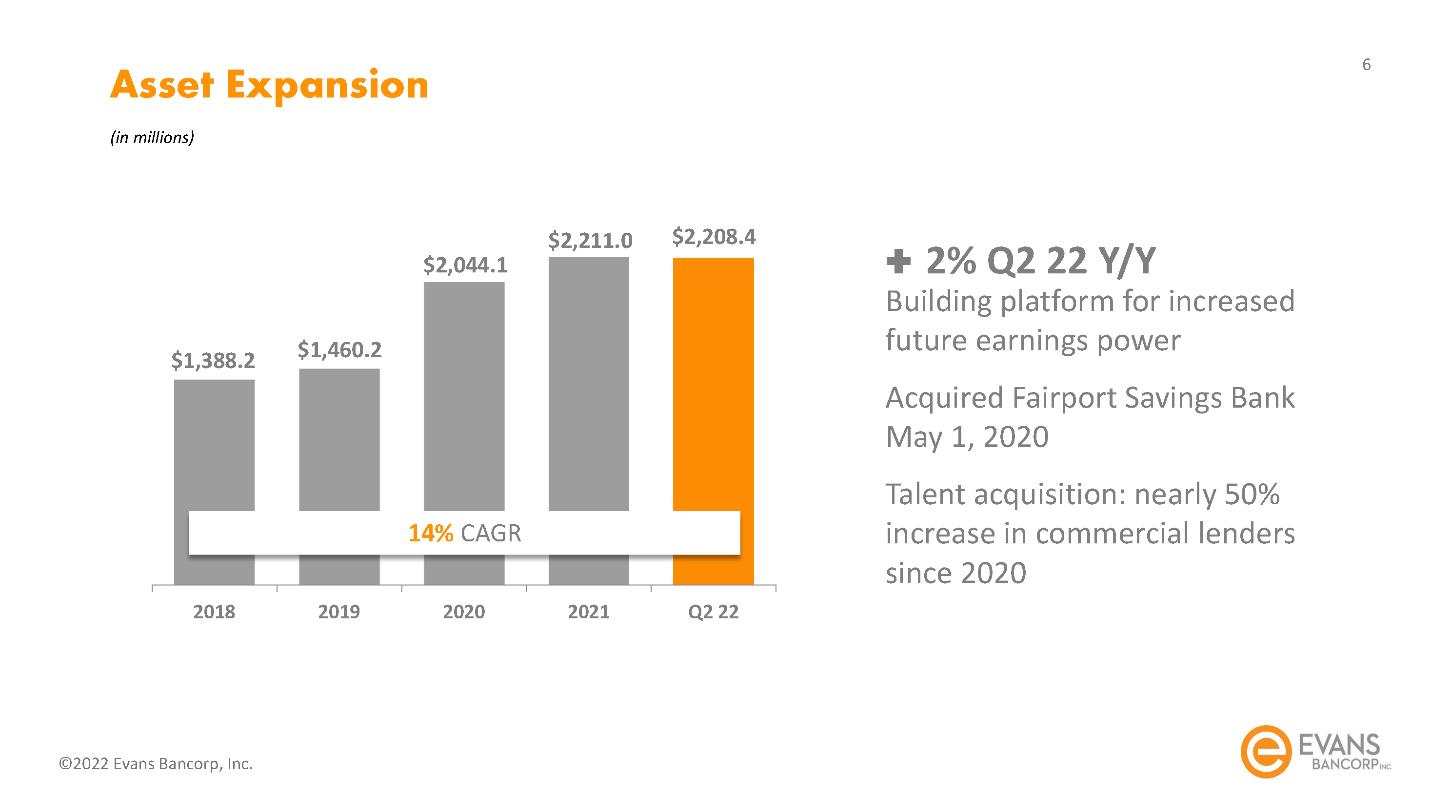

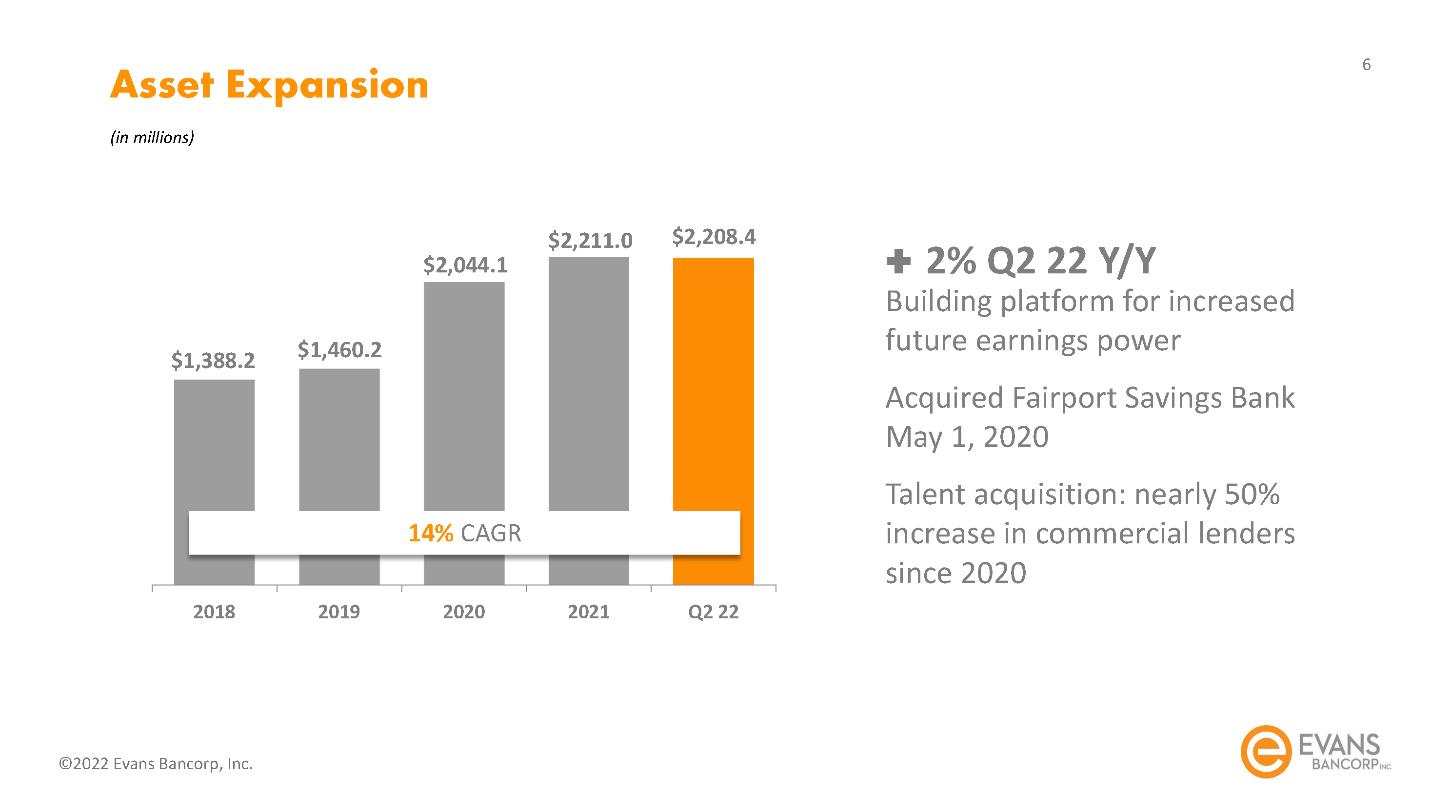

Asset Expansion

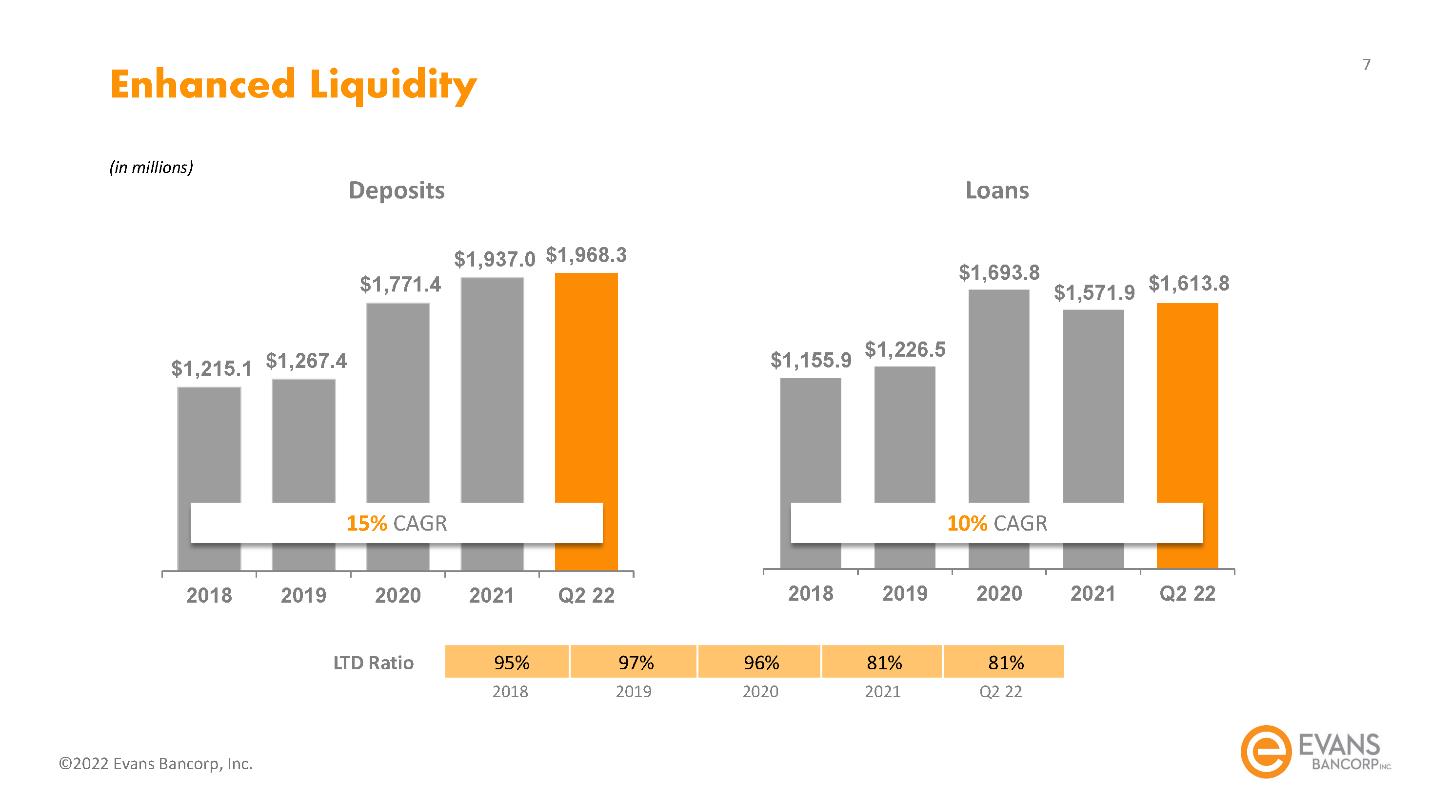

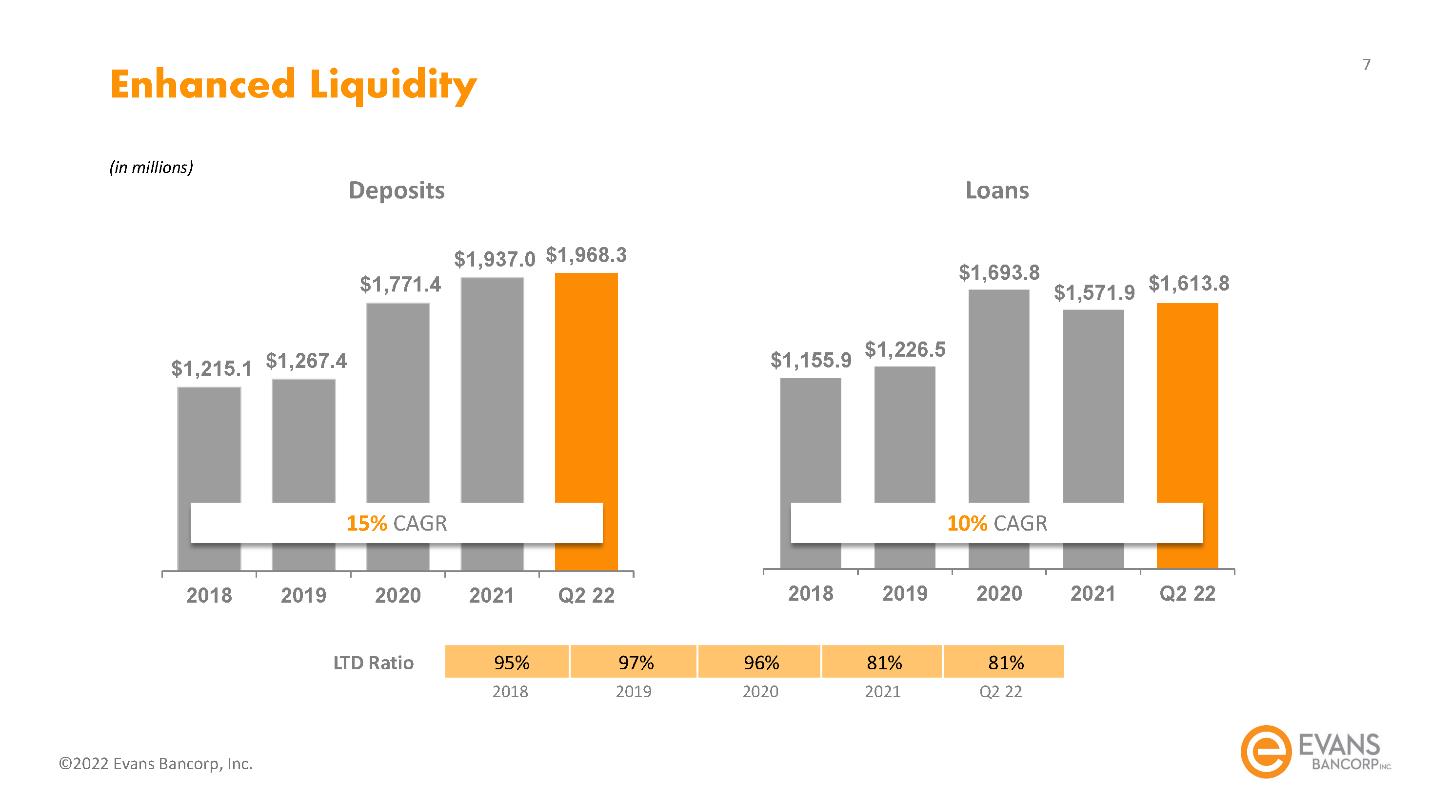

Enhanced Liquidity

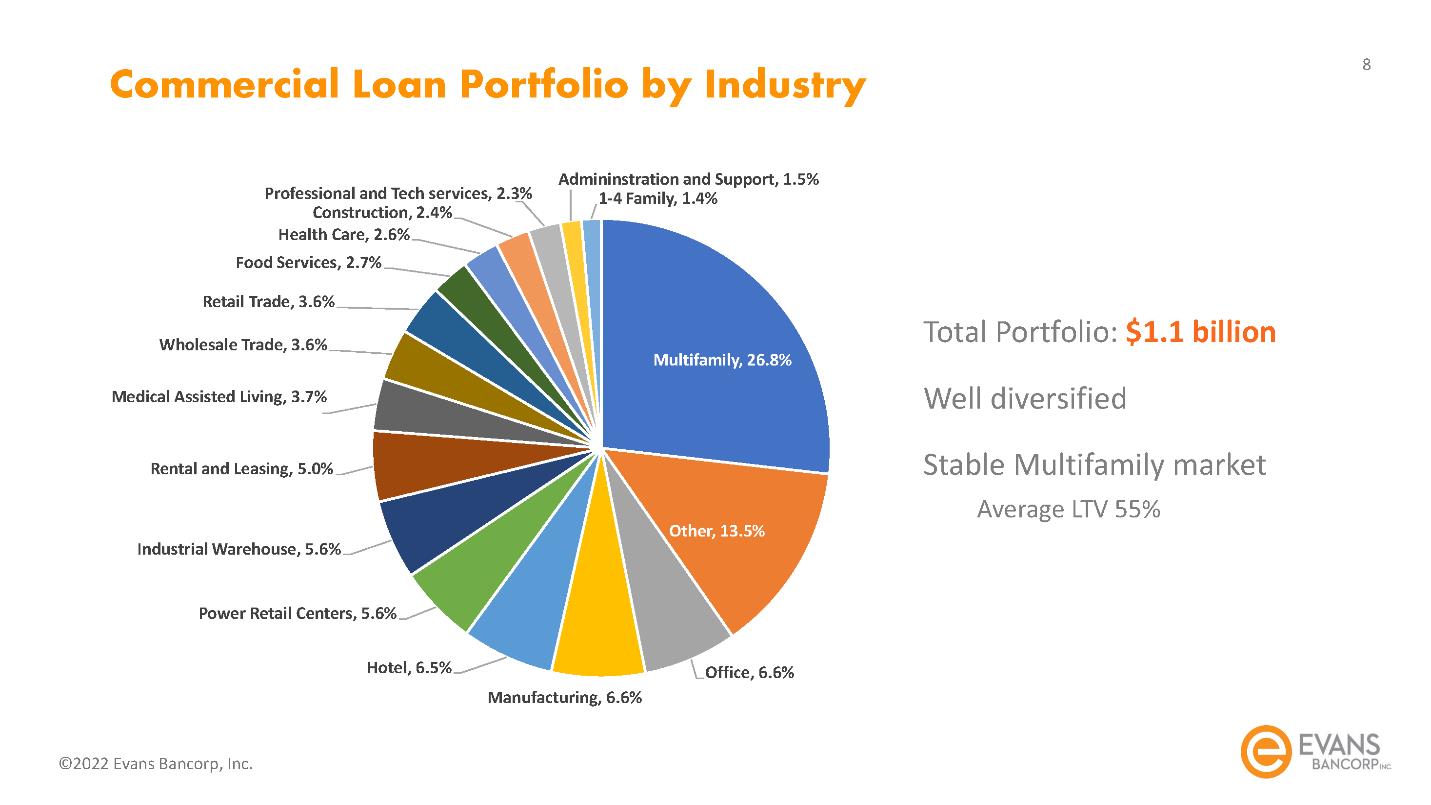

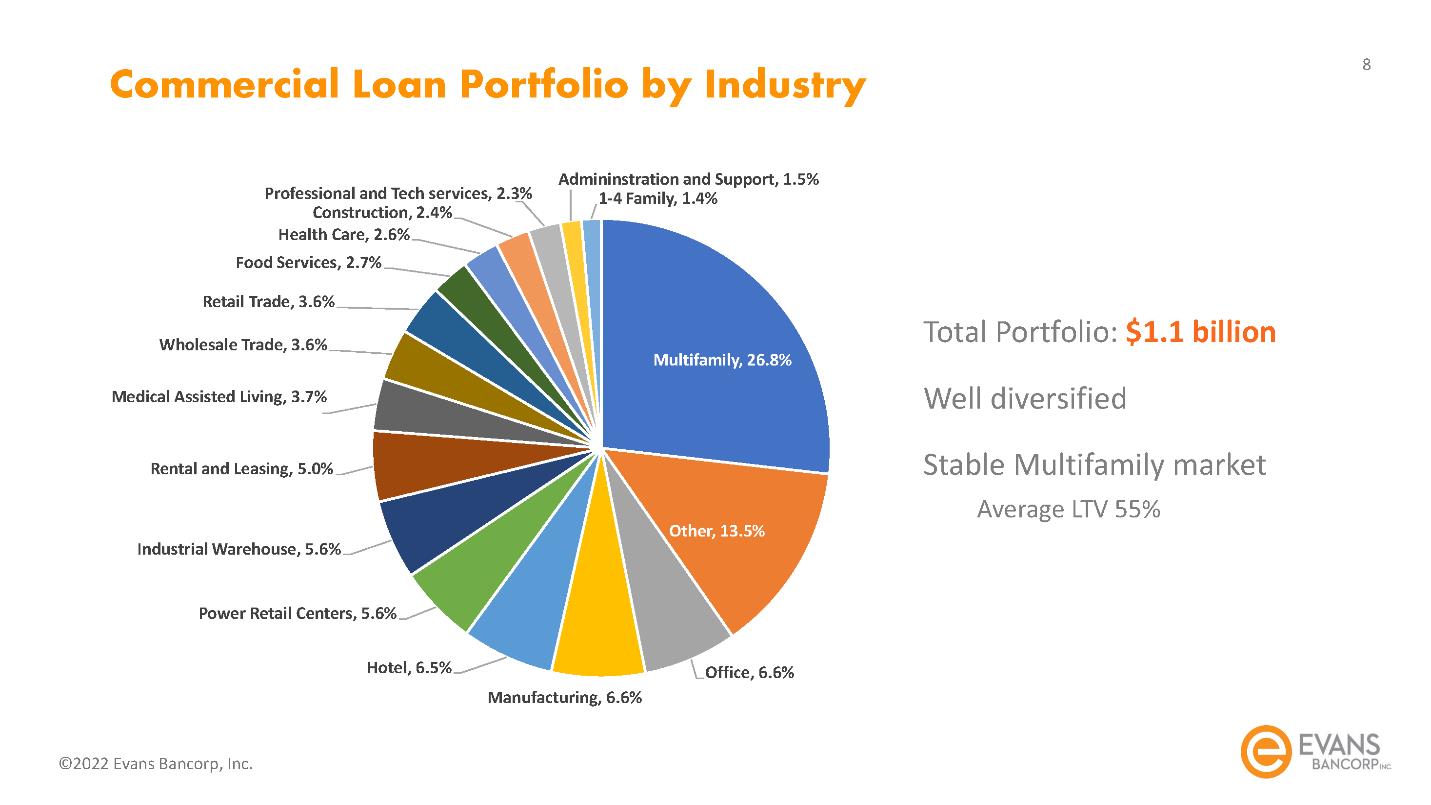

Commercial Loan Portfolio by Industry

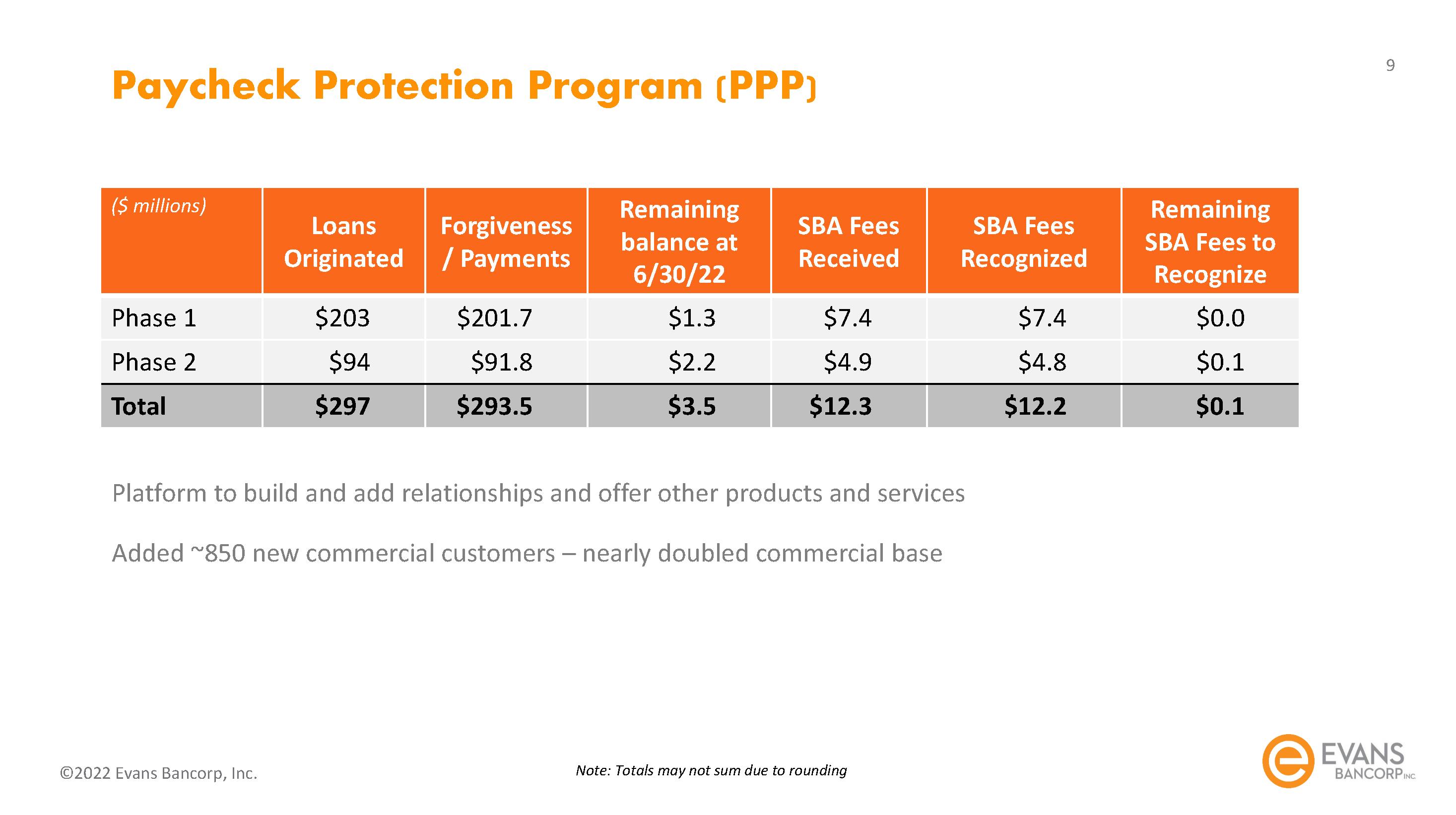

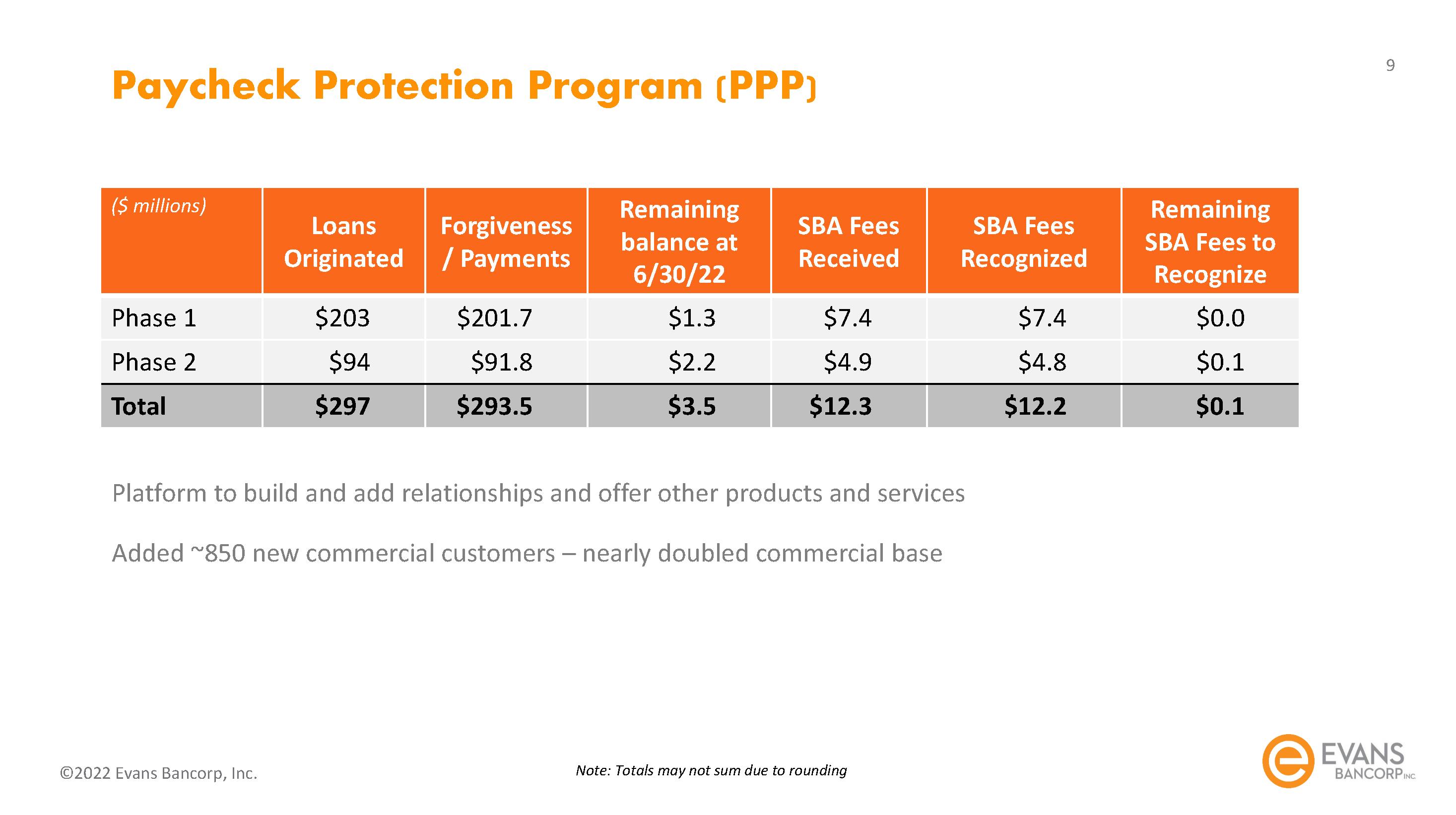

Paycheck Protection Program (PPP)

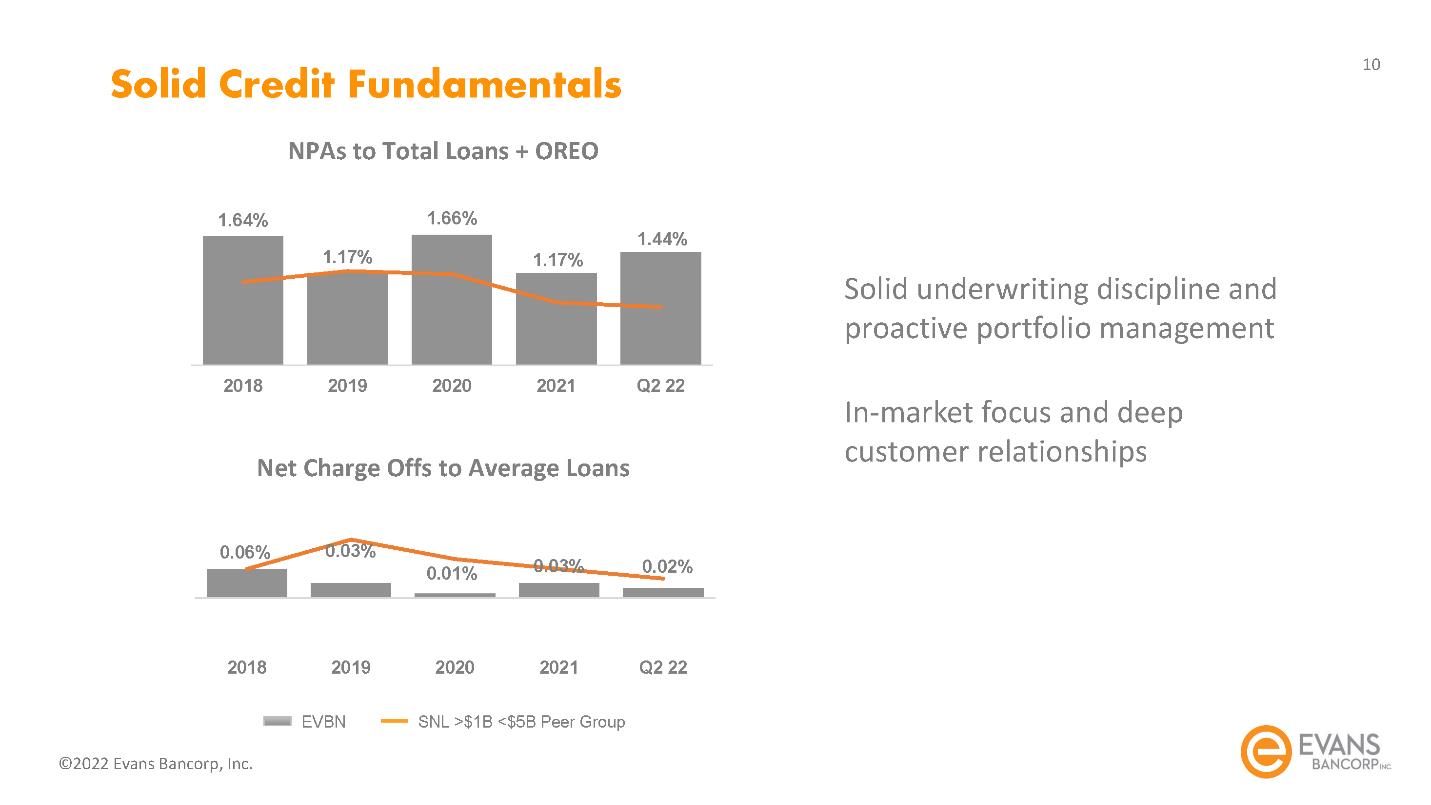

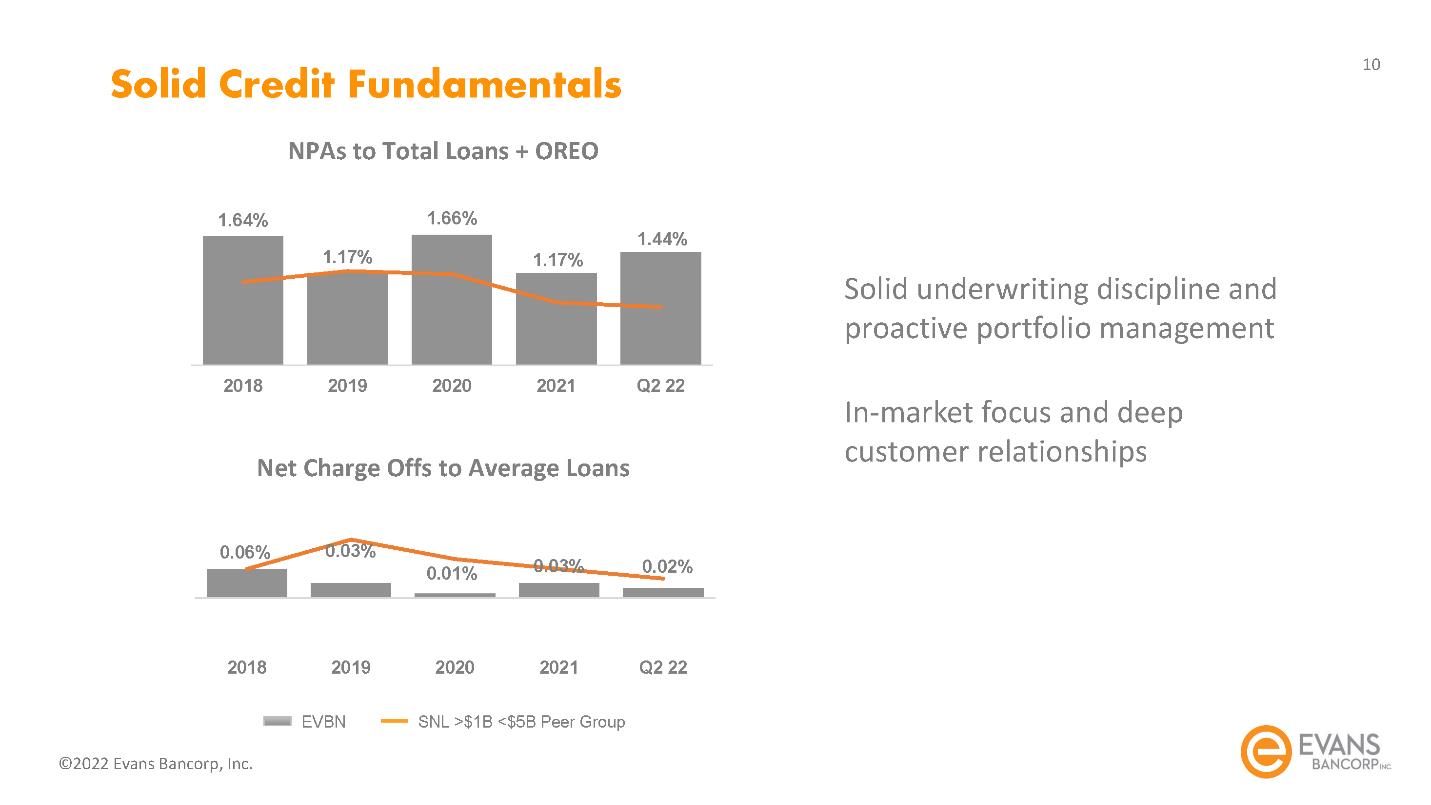

Solid Credit Fundamentals

Putting Excess Liquidity to Work

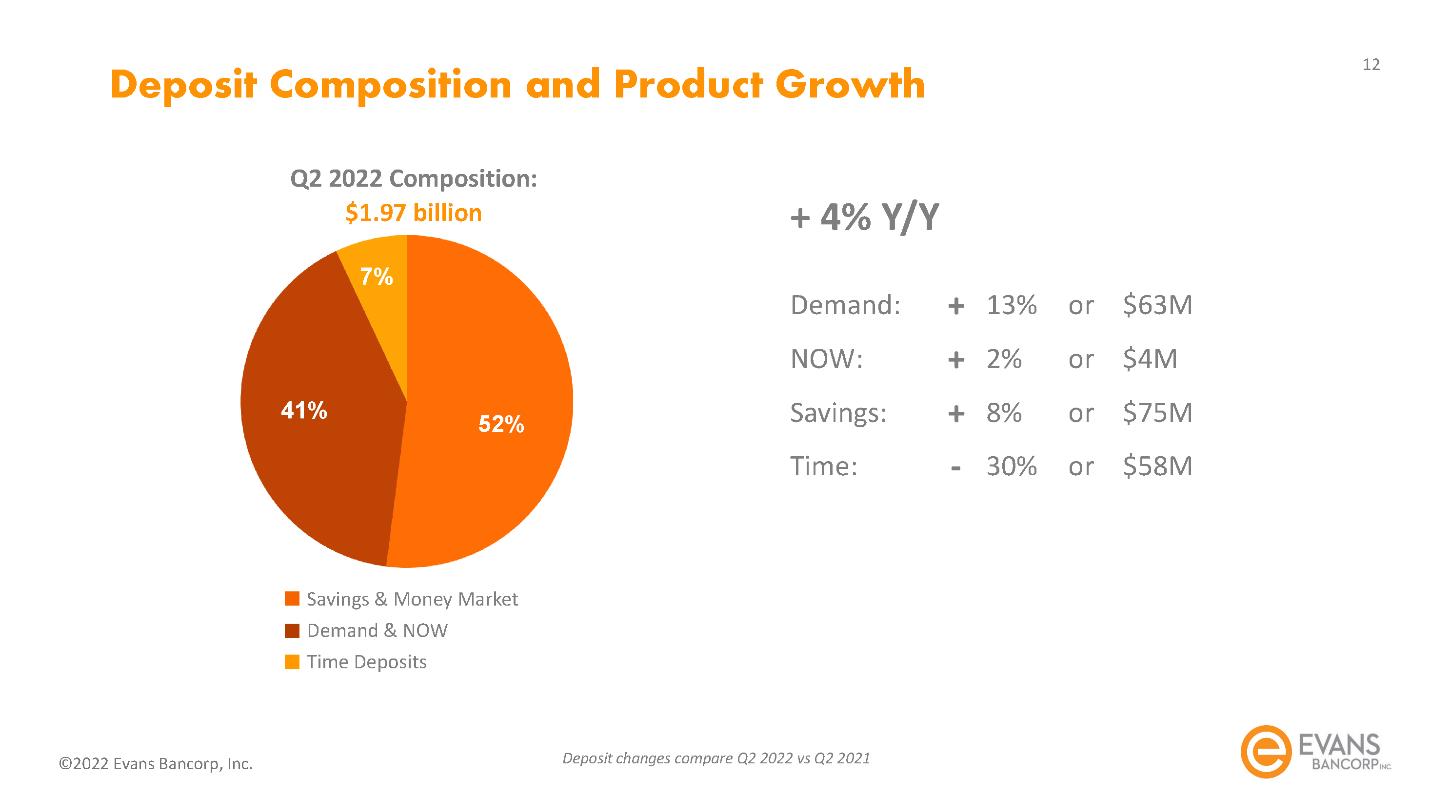

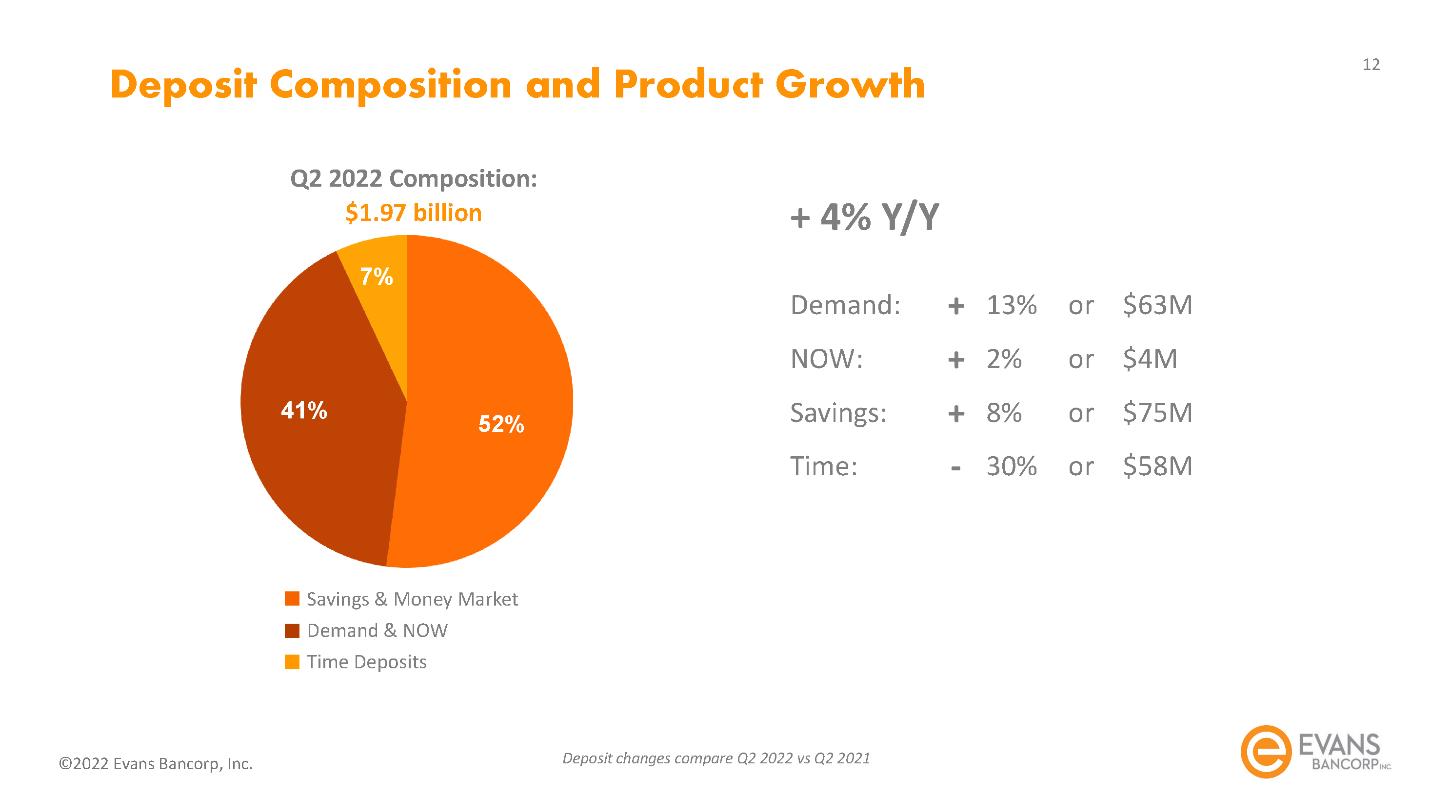

Deposit Composition and Product Growth

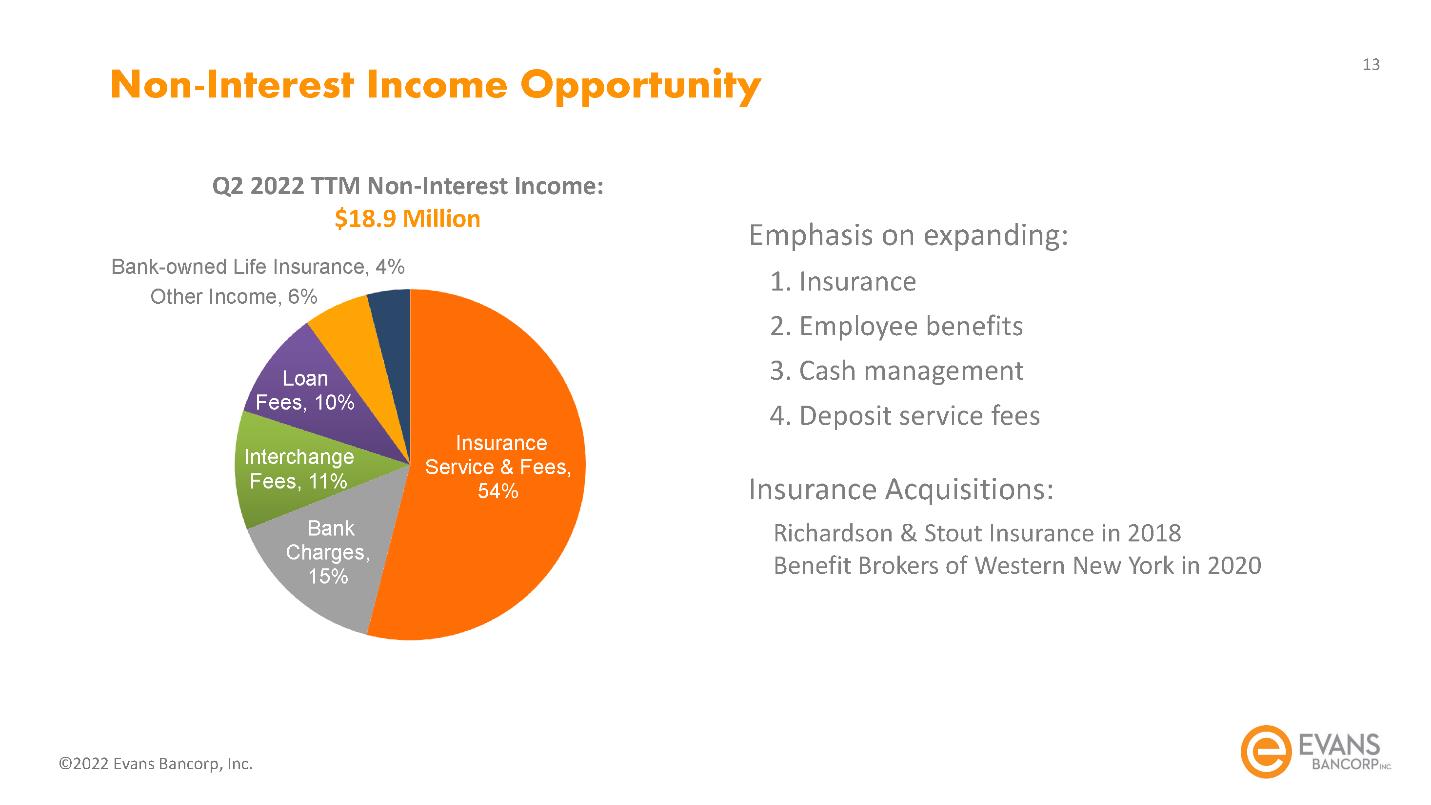

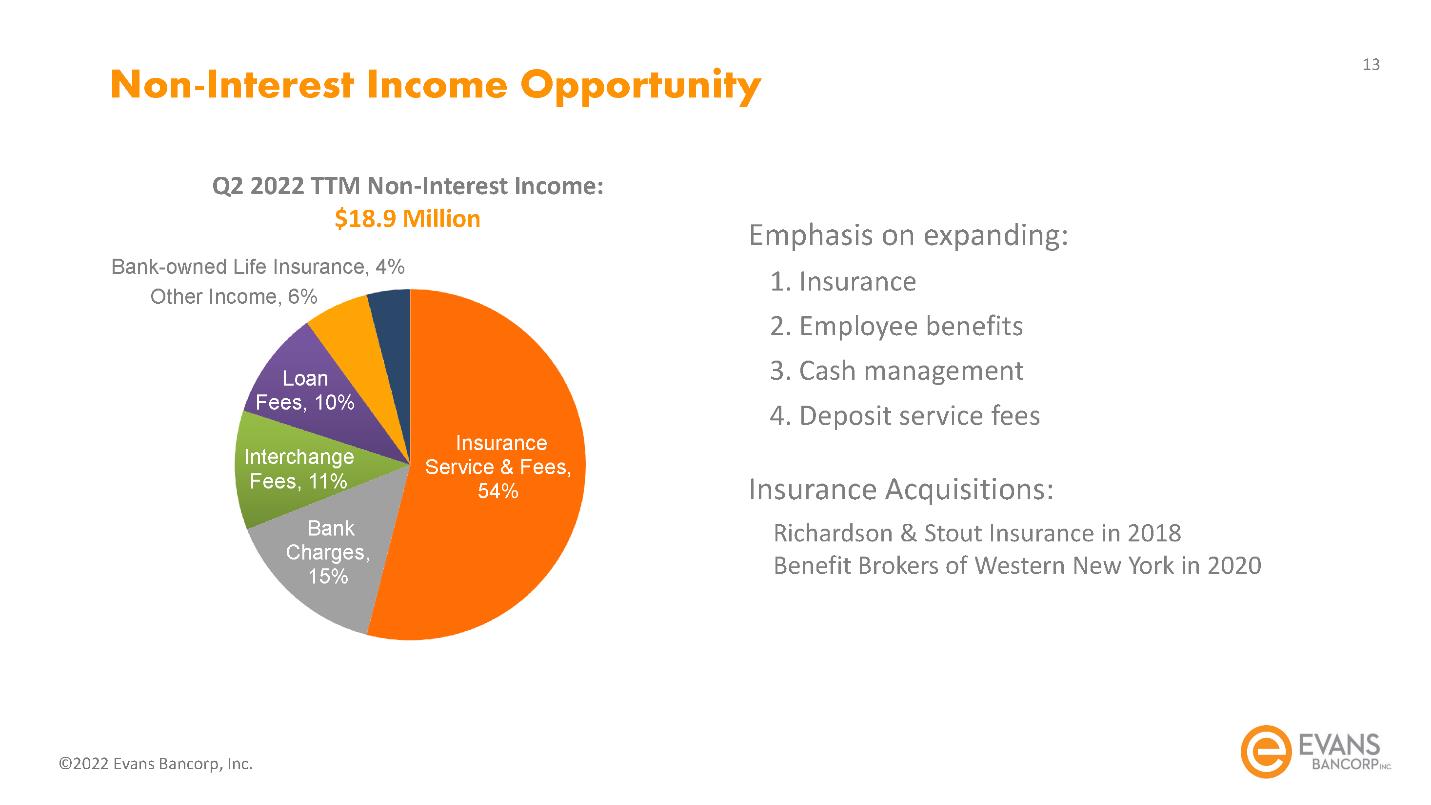

Non-Interest Income Opportunity

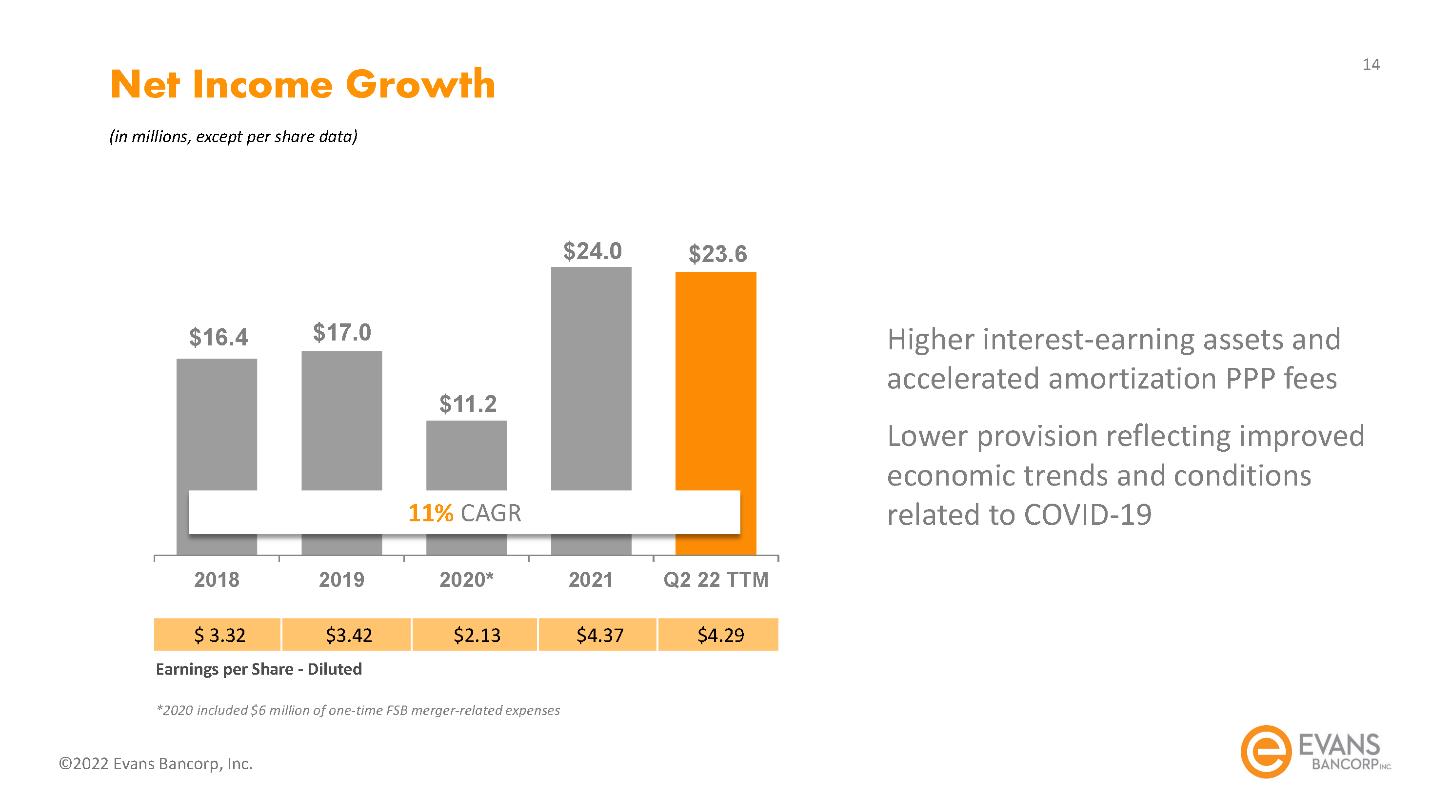

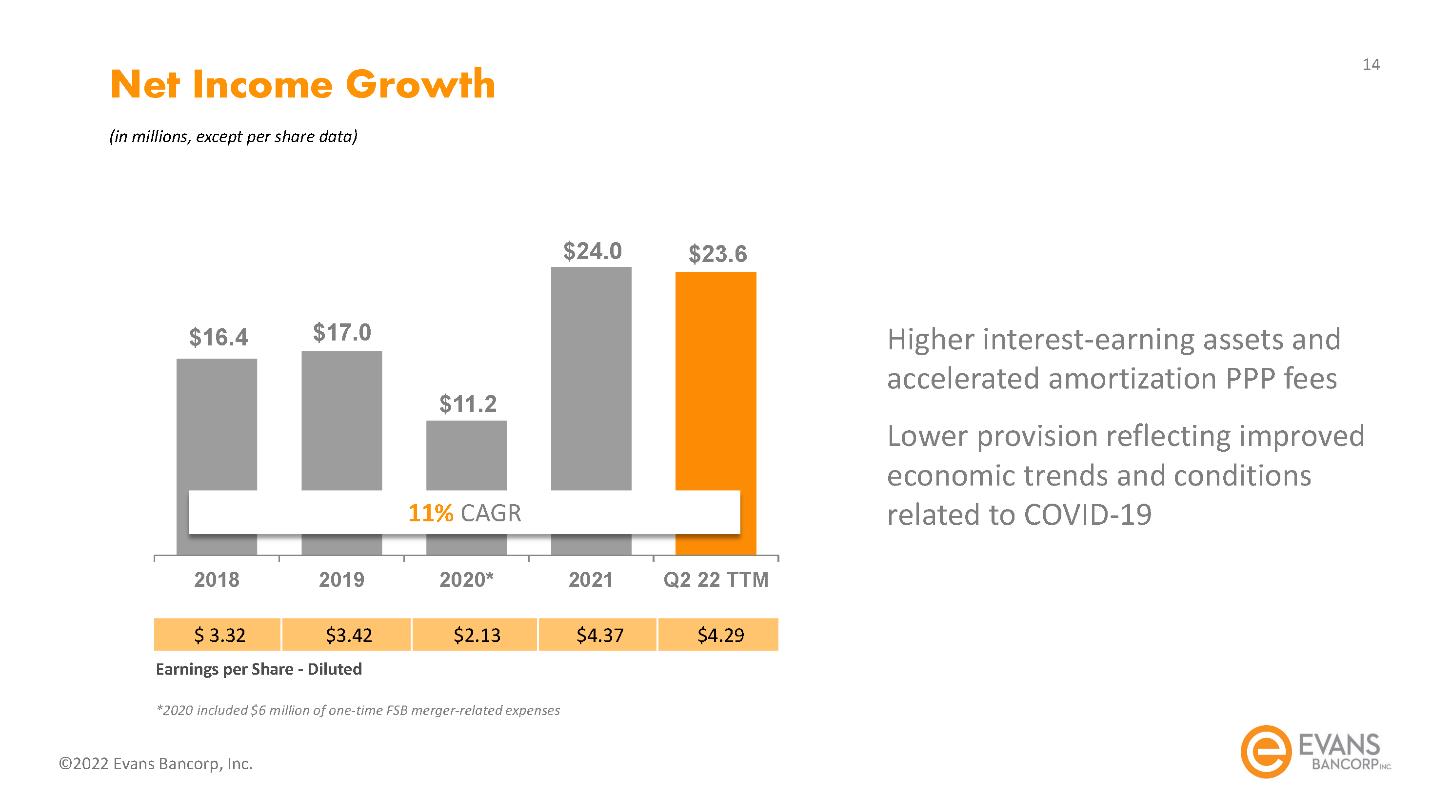

Net Income Growth

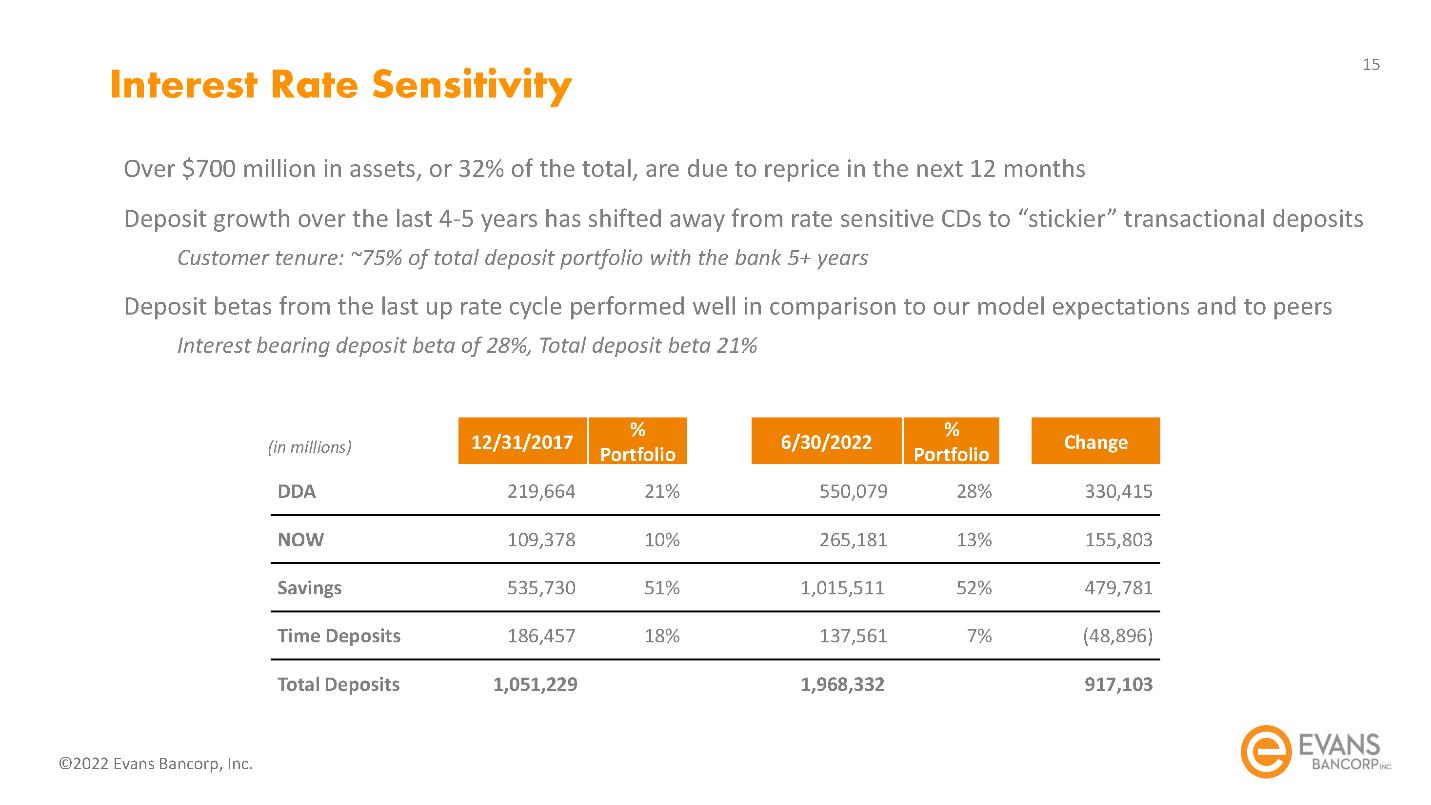

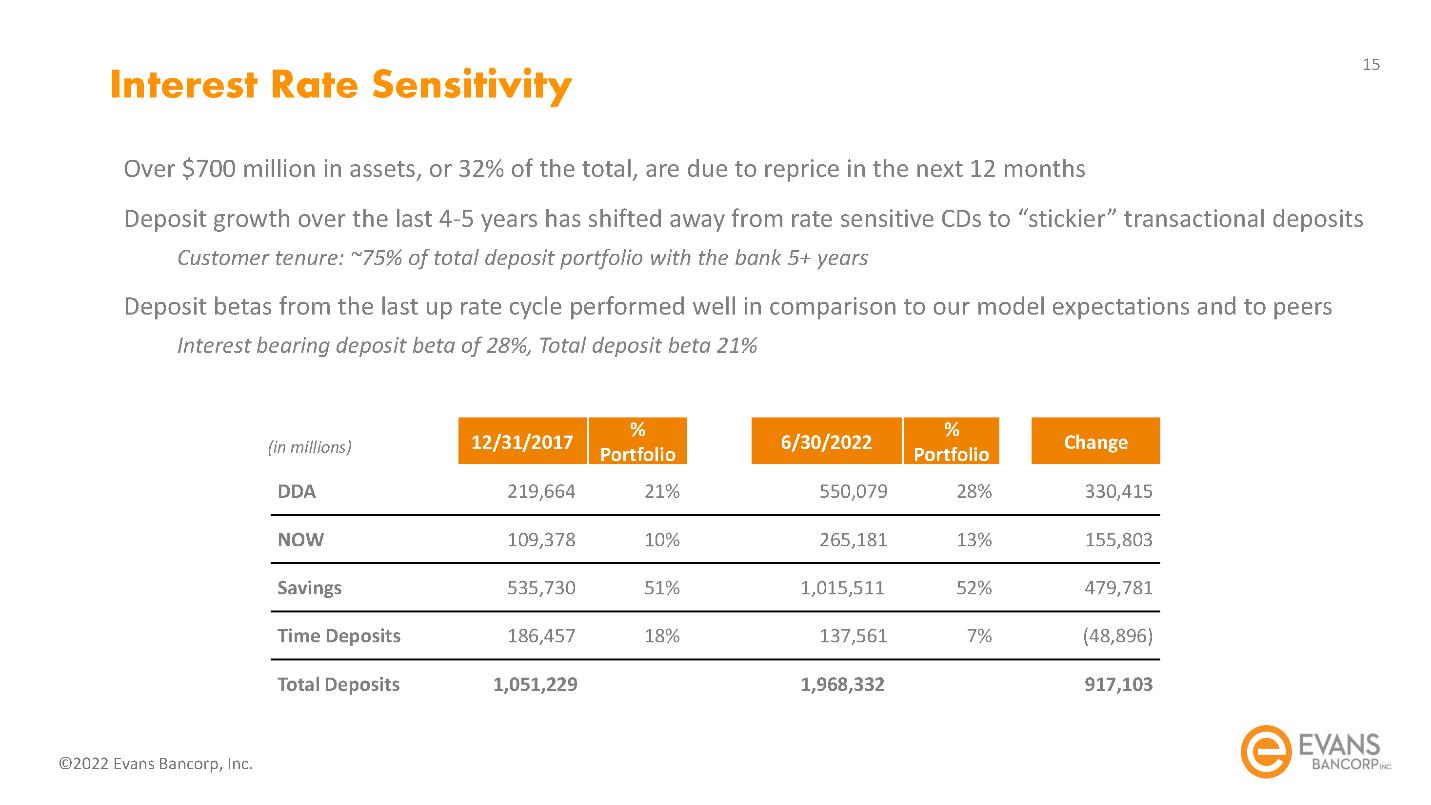

Interest Rate Sensitivity

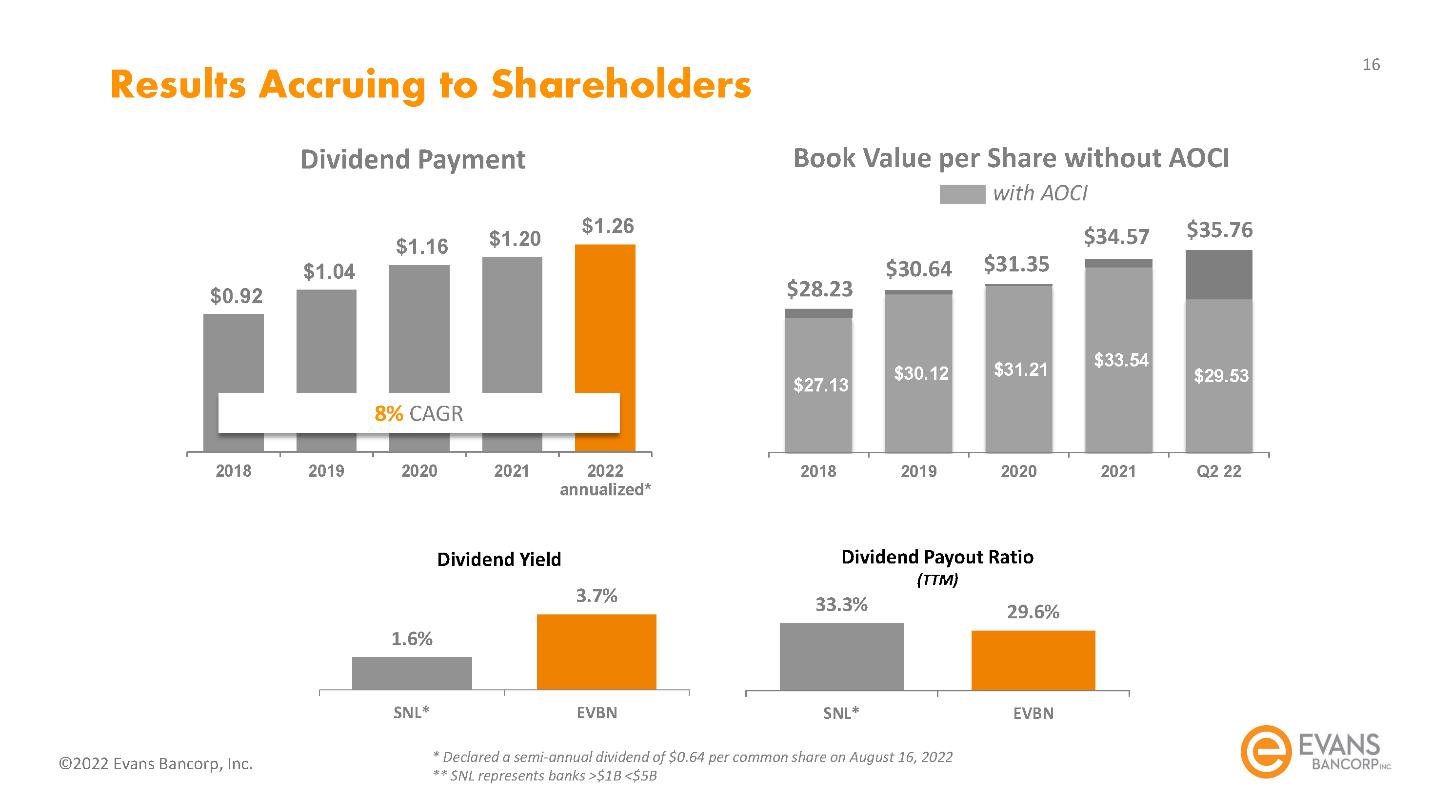

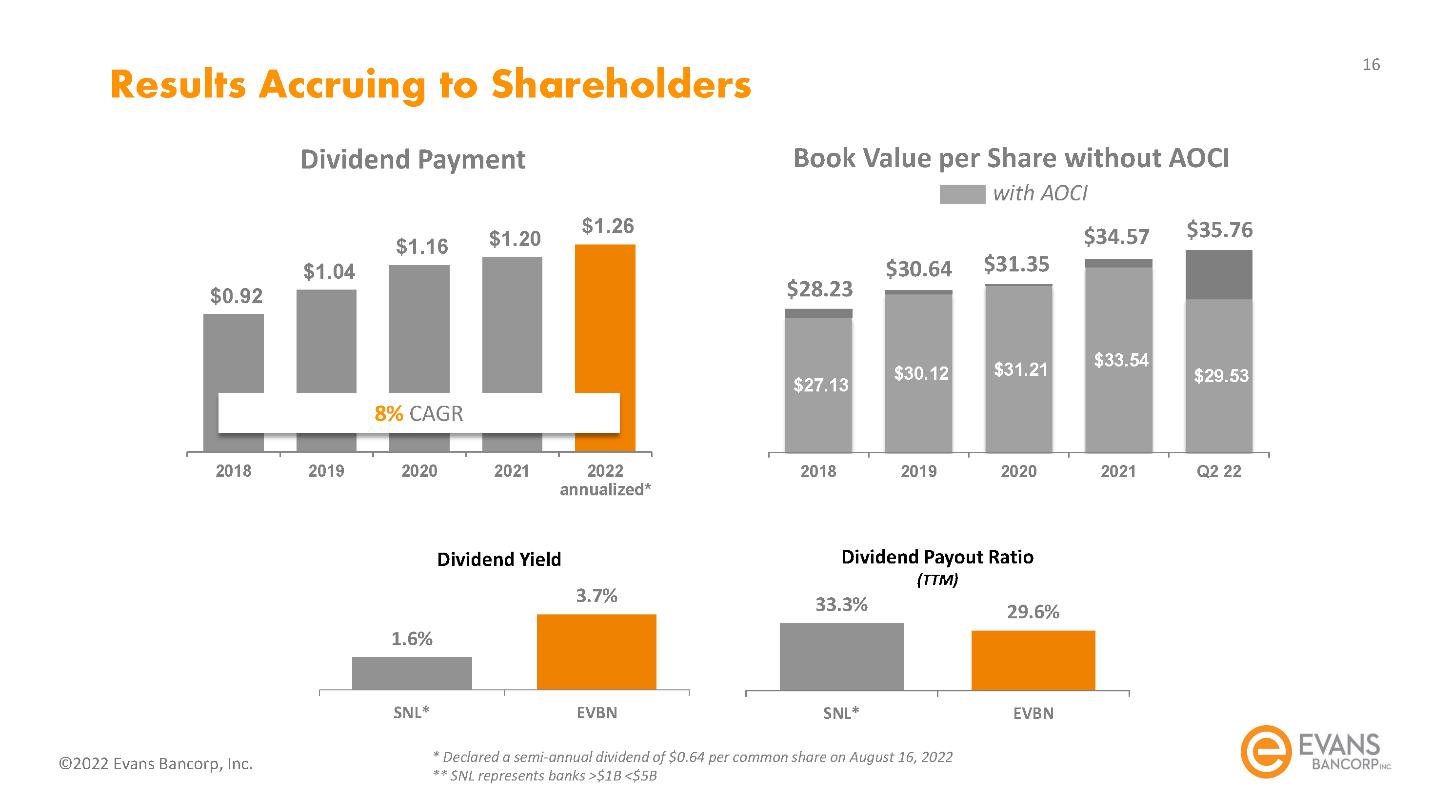

Results Accruing to Shareholders

Evans Strategic Objectives

Commercial:

Expect to achieve mid-single digit loan growth

Significant experience and talent were added to the Commercial Real Estate and Commercial & Industrial Teams in both Buffalo and Rochester, New York, expanding penetration in those markets and introducing new contacts and clients to Evans

Residential:

Significantly expanded the mortgage team and plan to continue that expansion in 2022 and going forward

A more substantial mortgage program adds diversity to our revenue stream and complements our insurance agency and large and successful commercial banking business

EVANS INSURANCE AGENCY

Building out strong sales talent to further strengthen and competitively support existing business retention and new policy sales

Aligned to focus on advancing customer experience, operational efficiency and scalability

Leverage robotic process and workflow automation and evaluate opportunities to partner with financial technology providers as part of our overall digital transformation strategy

Goal to deliver strong and stable IT support for Bank growth

Talent and culture are true differentiators for Evans and key determinants for our success

Learning and development efforts, combined with consistent company and manager-led communication and programs, and focus on team empowerment and diversity

Concentrated heavily on preparing our team for the continuously changing environment and future technology enhancements

Evans seeks to meet its values and honor its promise as a community based financial institution

Continue to support community projects and contribute our resources and business expertise to programs and entities that enrich our community

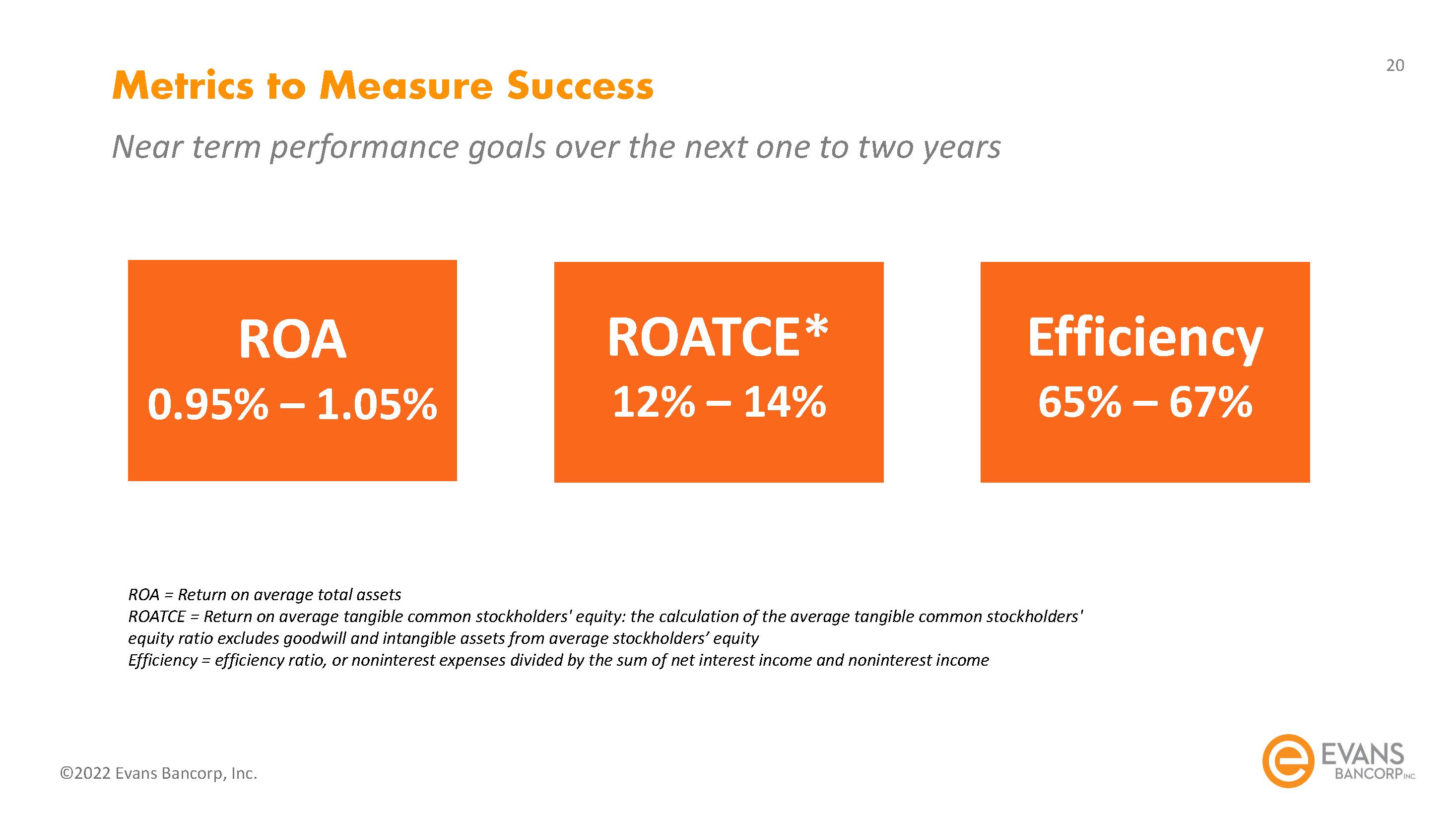

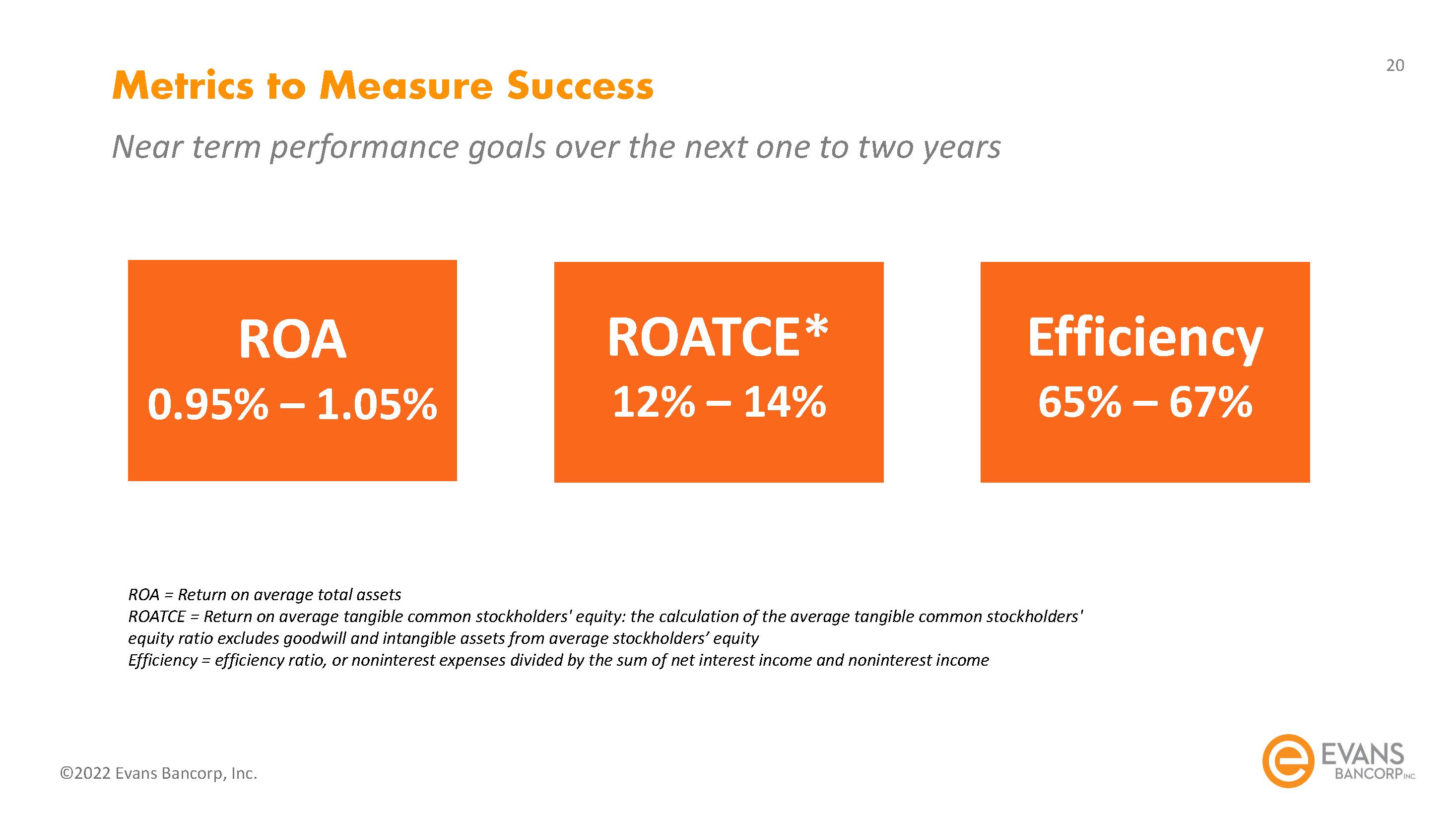

Metrics to Measure Success

ROA = Return on average total assets

ROATCE = Return on average tangible common stockholders' equity: the calculation of the average tangible common stockholders' equity ratio excludes goodwill and intangible assets from average stockholders’ equity

Efficiency = efficiency ratio, or noninterest expenses divided by the sum of net interest income and noninterest income

Investment Highlights

Strong and growing franchise in resurgent WNY

•Diverse revenue mix, strong operating fundamentals

•Core deposit and loan growth

•Lower-risk balance sheet with solid capital base

•Excess liquidity to support robust loan pipeline and investments to drive growth and earnings

Value creation with acquisition of FSB Bancorp

•Enhanced scale: leverages strength of Evans commercial bank and combined mortgage operation Created team and technology infrastructure to continue to gain market share Shareholder return orientation

Raymond James Conference

Sept 8, 2022

Supplemental

Community Partnerships

Management Team

David J. Nasca, President and Chief Executive Officer

John B. Connerton, EVP, Chief Financial Officer

Mary Ellen Frandina, EVP, Chief Administrative Officer

Dale M. McKim III, EVP, Chief Risk Officer

Kenneth D. Pawlak, EVP, Chief Commercial Banking Officer Nicholas J. Snyder, EVP, Retail Distribution and Corporate Operations Aaron M. Whitehouse, President, The Evans Agency, LLC

Jen Zorn, EVP, Chief Information Officer